Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - INSITE VISION INC | Financial_Report.xls |

| EX-31.1 - EX-31.1 - INSITE VISION INC | d594582dex311.htm |

| EX-32.1 - EX-32.1 - INSITE VISION INC | d594582dex321.htm |

| EX-31.2 - EX-31.2 - INSITE VISION INC | d594582dex312.htm |

| 10-Q - FORM 10-Q - INSITE VISION INC | d594582d10q.htm |

| EX-32.2 - EX-32.2 - INSITE VISION INC | d594582dex322.htm |

Exhibit 10.1

AMENDMENT NO. 5

TO

MARINA VILLAGE OFFICE TECH LEASE

THIS AMENDMENT NO. 5 TO MARINA VILLAGE OFFICE TECH LEASE (this “Fifth Amendment”) is made and entered into as of May 31, 2013 (the “Effective Date”), by and between LEGACY PARTNERS I ALAMEDA, a Delaware limited liability company (“Landlord”), and INSITE VISION INCORPORATED, a Delaware corporation (“Tenant”).

R E C I T A L S :

A. Reference is hereby made to that certain Marina Village Industrial Gross Office Tech Lease dated as of September 1, 1996 (the “Original Lease”) between Alameda Real Estate Investments, a California limited partnership (“Alameda”) and Tenant, as amended by that certain: (i) Amendment No. 1 to Marina Village Office Tech Lease dated July 20, 2001 (the “First Amendment”) between Alameda and Tenant; (ii) Amendment No. 2 to Marina Village Office Tech Lease dated August 1, 2003 (the “Second Amendment”) between Alameda and Tenant; (iii) Amendment No. 3 to Marina Village Office Tech Lease dated November 21, 2006 (the “Third Amendment”) between Landlord (successor-in-interest to Alameda) and Tenant; and (iv) Amendment No. 4 to Marina Village Office Tech Lease dated April 1, 2007 (the “Fourth Amendment”) between Landlord and Tenant.

B. The Original Lease, as so amended, shall be referred to herein as the “Lease”.

C. Pursuant to the Lease, Tenant is currently leasing from Landlord the following (collectively, the “Existing Premises”): (i) that certain premises commonly known as Suites 100, 103 and 104, containing approximately 20,254 rentable square feet of space (collectively, the “Challenger Premises”) comprising the entire rentable area of that certain building addressed as 2020 Challenger Drive, Alameda, California (the “Challenger Building”); and (ii) that certain premises commonly known as Suite 100, containing approximately 18,869 rentable square feet of space (the “Existing Atlantic Premises”) located in that certain building addressed as 965 Atlantic Avenue, Alameda, California (the “Atlantic Building”). The Challenger Building and the Atlantic Building are sometimes collectively referred to herein as the “Building.” The Existing Premises are part of a multi-building commercial project known as “Marina Village” and located on an approximately 200-acre site on the estuary side of the island of Alameda (the “Project”).

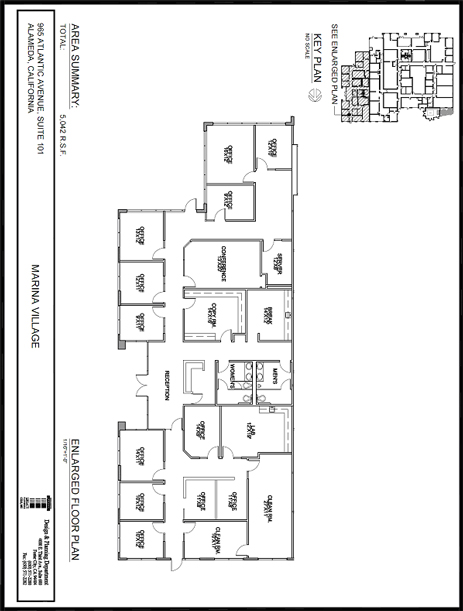

D. Landlord and Tenant now desire to amend the Lease to (i) extend the Extended Term (as defined in the Third Amendment) for the Existing Premises, (ii) expand the Existing Premises to include the certain premises (the “Atlantic Expansion Space”) containing approximately 5,042 rentable square feet of space within the Atlantic Building and comprising the balance of the rentable area of the Atlantic Building, as depicted on the floor plan attached hereto as Exhibit A, and (iii) modify various terms and provisions of the Lease, all as hereinafter provided.

-1-

E. All capitalized terms when used herein shall have the same meanings given such terms in the Lease unless expressly superseded by the terms of this Fifth Amendment.

NOW THEREFORE, in consideration of the foregoing recitals and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Extension of Extended Term. The Extended Term for the Existing Premises, which is currently scheduled to expire on December 31, 2013, is hereby extended until December 31, 2020, unless sooner terminated as provided in the Lease, as amended by this Fifth Amendment. Notwithstanding the scheduled date for expiration of the Extended Term provided in the previous sentence, the period from June 1, 2013 (the “Second Extended Term Commencement Date”) through and including December 31, 2020 (the “Second Extended Term Expiration Date”) is sometimes referred to herein as the “Second Extended Term”. All references to the term or the Extended Term in the Original Lease, as amended by this Fifth Amendment, shall mean the term of the Lease, as previously extended, or the Extended Term, in each case as further extended by this Fifth Amendment, including by the Option Term (as defined below), if Tenant properly and timely exercises its Extension Option (as defined below).

2. Existing Premises Base Rent.

2.1. Challenger Premises Base Rent. Notwithstanding anything in the Lease, as hereby amended, to the contrary, commencing on June 1, 2013 and ending on the Second Extended Term Expiration Date, the Base Rent payable by Tenant for the Challenger Premises shall be paid separate and apart from the Base Rent payable for the Existing Atlantic Premises and the Atlantic Expansion Space, and shall be as set forth in the following schedule:

| Period of Second Extended Term |

Annual Base Rent |

Monthly Installment of Base Rent |

Monthly Base Rental Rate per Rentable Square Foot of the Challenger Premises | |||

| 6/1/13-5/31/14 |

$230,895.60 | $19,241.30 | $0.95 | |||

| 6/1/14-5/31/15 |

$243,048.00 | $20,254.00 | $1.00 | |||

| 6/1/15-5/31/16 |

$255,200.40 | $21,266.70 | $1.05 | |||

| 6/1/16-5/31/17 |

$267,352.80 | $22,279.40 | $1.10 | |||

| 6/1/17-5/31/18 |

$279,505.20 | $23,292.10 | $1.15 | |||

| 6/1/18-5/31/19 |

$291,657.60 | $24,304.80 | $1.20 | |||

| 6/1/19-12/31/20 |

$303,810.00 | $25,317.50 | $1.25 |

-2-

2.2. Existing Atlantic Premises Base Rent. Notwithstanding anything in the Lease, as hereby amended, to the contrary, commencing on June 1, 2013 and ending on the Second Extended Term Expiration Date, the Base Rent payable by Tenant for the Existing Atlantic Premises shall be paid separate and apart from the Base Rent payable for the Atlantic Expansion Space and the Challenger Premises, and shall be as set forth in the following schedule:

| Period of Term |

Annual |

Monthly Installment of Base Rent |

Monthly Base Rental Rate per Rentable Square Foot of the Existing Atlantic Premises | |||

| 6/1/13-5/31/14 |

$344,170.56 | $28,680.88 | $1.52 | |||

| 6/1/14-5/31/15 |

$355,491.96 | $29,624.33 | $1.57 | |||

| 6/1/15-5/31/16 |

$366,813.36 | $30,567.78 | $1.62 | |||

| 6/1/16-5/31/17 |

$378,134.76 | $31,511.23 | $1.67 | |||

| 6/1/17-5/31/18 |

$389,456.16 | $32,454.68 | $1.72 | |||

| 6/1/18-5/31/19 |

$400,777.56 | $33,398.13 | $1.77 | |||

| 6/1/19-12/31/20 |

$412,098.96 | $34,341.58 | $1.82 |

3. Addition of Atlantic Expansion Space. Commencing upon the Atlantic Expansion Space Commencement Date (as defined in Section 4 below), the Existing Premises shall be expanded to include the Atlantic Expansion Space, thereby increasing the size of the Existing Premises to 44,165 rentable square feet (i.e., 18,869 rentable square feet in the Existing Atlantic Premises + 5,042 rentable square feet in the Atlantic Expansion Space + 20,254 rentable square feet in the Challenger Premises). The Atlantic Expansion Space shall be leased on the same terms and conditions set forth in the Lease, subject to the modifications set forth in this Fifth Amendment. Effective from and after the Atlantic Expansion Space Commencement Date, (i) the “Premises” shall mean the Existing Premises and the Atlantic Expansion Space, and (ii) the “Atlantic Premises” shall mean the Existing Atlantic Premises and the Atlantic Expansion Space.

4. Atlantic Expansion Space Commencement Date. For purposes of this Fifth Amendment, the term “Atlantic Expansion Space Commencement Date” shall mean the earlier of: (i) the date Tenant commences business operations in the Atlantic Expansion Space (meaning that Tenant is actually operating its business from the Atlantic Expansion Space, rather than preparing the Atlantic Expansion Space for its business and occupancy, even if such preparation involves having some of Tenant’s personnel in the Atlantic Expansion Space); and (ii) January 1, 2015. The term for the Atlantic Expansion Space (the “Atlantic Expansion Space Term”) shall commence on the Atlantic Expansion Space Commencement Date and expire coterminously with the Second Extended Term with respect to the Existing Premises on the Second Extended Term Expiration Date (i.e., December 31, 2020). The date that the Atlantic Expansion Space Commencement Date actually occurs shall be confirmed by the parties in writing in an Amendment No. 6 to Marina Village Office Tech Lease (“Amendment No. 6”), which Amendment No. 6 shall be in substantially the form of Exhibit C attached hereto. Amendment No. 6 shall be delivered by Landlord to Tenant after the Atlantic Expansion Space Commencement Date occurs, and Tenant shall execute and return such Amendment No. 6 to Landlord within five (5) business days after Tenant’s receipt thereof; provided, however, that if Amendment No. 6 is not factually correct, then Tenant shall make such changes as are necessary to make Amendment No. 6 factually correct and shall thereafter execute and return such corrected Amendment No. 6 to Landlord within such five (5) business day period and thereafter the dates set forth on such corrected Amendment No. 6 shall be conclusive and binding upon

-3-

Tenant and Landlord, unless Landlord, within five (5) business days following receipt of Tenant’s changes, sends a notice to Tenant rejecting Tenant’s changes, whereupon this procedure shall be repeated until the parties mutually agree upon the contents of Amendment No. 6. Failure of Tenant to execute and deliver to Landlord within such 5-business day period Amendment No. 6 submitted by Landlord or failure of Landlord to reject Tenant’s changes thereto within such 5-business day period, as applicable, shall constitute an acknowledgment by Tenant or Landlord (as applicable) that the statements included in Amendment No. 6 so submitted by Landlord or Tenant (as applicable) are true and correct, without exception, and binding upon Landlord and Tenant.

5. Atlantic Expansion Space Base Rent. During the Atlantic Expansion Space Term, the Base Rent payable by Tenant for the Atlantic Expansion Space shall be calculated separate and apart from the Base Rent payable for the Existing Premises (i.e., the Existing Atlantic Premises and the Challenger Premises), and shall be as set forth in the following schedule:

| Period of Atlantic Expansion |

Annual Base Rent |

Monthly Installment of Base Rent |

Monthly Base Rental Rate per Rentable Square Foot of the Atlantic Expansion Space | |||

| *Atlantic Expansion Space Commencement |

$91,966.08 | $7,663.84 | $1.52 | |||

| **6/1/14-5/31/15 |

$94,991.28 | $7,915.94 | $1.57 | |||

| 6/1/15-5/31/16 |

$98,016.48 | $8,168.04 | $1.62 | |||

| 6/1/16-5/31/17 |

$101,041.68 | $8,420.14 | $1.67 | |||

| 6/1/17-5/31/18 |

$104,066.88 | $8,672.24 | $1.72 | |||

| 6/1/18-5/31/19 |

$107,092.08 | $8,924.34 | $1.77 | |||

| 6/1/19-12/31/20 |

$110,117.28 | $9,176.44 | $1.82 |

| * | Not applicable if the Atlantic Expansion Space Commencement Date occurs after May 31, 2014. |

| ** | If the Atlantic Expansion Space Commencement Date occurs after June 1, 2014, payment of Base Rent at the applicable rental rate shown in the chart above shall commence on the actual Atlantic Expansion Space Commencement Date. |

-4-

6. Tenant’s Percentage Share. Due to the revised number of rentable square feet contained within the Premises (i.e., the Existing Premises and the Atlantic Expansion Space) as compared to the Existing Premises, from and after the Atlantic Expansion Space Commencement Date, the “Tenant’s Percentage Share” Section of the Basic Lease Information attached to the Original Lease (last amended by Section 7 of the Third Amendment) shall be deleted in its entirety and replaced with the following:

| “Tenant’s Percentage Share: | Atlantic Premises – 23,911 rsf/23,911 rsf = 100%

Challenger Premises – 20,254 rsf/20,254 = 100%” |

7. Condition of Premises; Landlord’s Work; Refurbishment Allowance.

7.1. Condition of Premises. Except as provided in Sections 7.2 and 7.3 below, and without limiting Landlord’s obligations under Paragraphs 7 and 8 of the Original Lease, as amended by this Fifth Amendment, (i) Landlord shall not be obligated to provide or pay for (or contribute any improvement or refurbishment allowance for) any improvements, work or services related to the improvement, remodeling or refurbishment of the Existing Premises and/or the Atlantic Expansion Space, and (ii) Tenant shall accept (A) the Existing Premises in its “AS IS” condition as of the Effective Date, and (B) the Atlantic Expansion Space in its “AS IS” condition as of the Effective Date and the Atlantic Expansion Space Commencement Date, except that Landlord shall ensure that the Atlantic Expansion Space is in broom-clean condition on the date Landlord delivers the Atlantic Expansion Space to Tenant. Notwithstanding the foregoing to the contrary, if (1) as of the Atlantic Expansion Space Commencement Date, the base, shell and core systems and equipment of the Atlantic Building which serve the Atlantic Expansion Space are not in good order, condition and repair, and (2) Tenant becomes aware thereof and delivers to Landlord written notice (the “Non-Compliance Notice”) of such base, shell and core systems and equipment not being in such condition described hereinabove on or before the date which is ninety (90) days after the Atlantic Expansion Space Commencement Date (the “Non-Compliance Outside Date”), then Tenant’s sole remedy shall be that Landlord shall, at Landlord’s sole cost and expense (which shall not be included in Operating Expenses), do that which is necessary to bring such base, shell and core systems and equipment of the Atlantic Building which serve the Atlantic Expansion Space in good order, condition and repair within a reasonable period of time after Landlord’s receipt of the Non-Compliance Notice. If Tenant fails to deliver the Non-Compliance Notice to Landlord on or prior to the Non-Compliance Outside Date, Landlord shall have no obligation to perform the work described hereinabove (but such release of such obligation shall not relieve Landlord of its other repair obligations under the Lease, as hereby amended, including, without limitation, Paragraph 8(b) of the Original Lease, as added by Section 9.4(a) below).

7.2. Landlord’s Work. In a good workmanlike manner and in accordance with all applicable laws, Landlord shall, at Landlord’s sole cost and expense, perform the following work using Building standard materials (collectively, “Landlord’s Work”): (i) with respect to the Atlantic Building, (A) modify the existing handicap access ramp on the exterior of the Atlantic Building as and to the extent necessary to correct any existing non-compliance of the ramp with applicable laws in effect as of the date of execution and delivery of this Fifth Amendment, (B) seal the cracks on the façade of the Atlantic Building at the entrance thereof to the extent existing as of the date of execution and delivery of this Fifth Amendment, (C) install a seismic actuated gas shutoff valve at the gas mains into the Atlantic Building, and (D) add a flexible pipe section to the fire sprinkler line outside the Atlantic Building for seismic concerns, similar to the sections added to other buildings in the Project including the Challenger Building; and (ii) with respect to the Challenger Building, install a seismic actuated gas shutoff valve at the gas mains into the Challenger Building. Tenant acknowledges that Landlord will be performing Landlord’s Work during Tenant’s occupancy of the Existing Premises under the Lease, as hereby

-5-

amended (and may be performing Landlord’s Work during Tenant’s occupancy of the Atlantic Expansion Space), and Tenant agrees that: (1) Tenant shall reasonably cooperate with Landlord and Landlord’s schedule of performance of Landlord’s Work during such occupancy so that Landlord may timely perform Landlord’s Work without unreasonable interference from Tenant (and in connection therewith, Landlord may cause Landlord’s Work to be performed during normal business hours as reasonably necessary to complete the same in a timely manner, without any obligation to pay overtime or other premiums); and (2) Tenant shall accept all reasonable inconveniences associated with the performance of Landlord’s Work and agrees that the performance of Landlord’s Work shall not constitute a constructive eviction of Tenant, nor entitle Tenant to any Rent abatement compensation (except as otherwise provided in Paragraph 7(d) of the Original Lease, as added by Section 9.3 below) or other damages from Landlord, nor subject Landlord to any liability, except for any injury to persons or damage to property (but not loss of business or other consequential damages) to the extent caused by Landlord’s negligence or willful misconduct and not insured or required to be insured by Tenant under the Lease, as hereby amended; provided, however, Landlord agrees to use commercially reasonable efforts to minimize unreasonable interference with Tenant’s use of and access to the Existing Premises (and following the Atlantic Expansion Space Commencement Date, the Atlantic Expansion Space, as the case may be) as a result of such Landlord’s Work.

7.3. Refurbishment Allowance.

(a) Refurbishment Allowance. Notwithstanding Section 7.1 above to the contrary, provided Tenant is not then in default under the Lease, as hereby amended, after expiration of all applicable notice and cure periods, Tenant shall be entitled to receive from Landlord a Refurbishment Allowance (as defined below) to help Tenant pay for the out-of-pocket costs actually incurred by Tenant during the applicable Refurbishment Allowance Availability Period (as defined below) for the design, permitting and construction of alterations to and refurbishment of the improvements in the Existing Premises and/or the Atlantic Expansion Space, which are made by or on behalf of Tenant during the applicable Refurbishment Allowance Availability Period and are permanently affixed to the Existing Premises and/or the Atlantic Expansion Space, including, without limitation, those certain alterations described in the “Scope of Work” attached hereto as Exhibit D (collectively, the “Refurbishment Work”). As used herein, the “Refurbishment Allowance” shall mean an amount up to, but not exceeding, (i) $1,104,125.00 (i.e., $25.00 per rentable square foot of the entire Existing Premises and the Atlantic Expansion Space) during the period from February 1, 2013 through and including May 31, 2014, and (ii) $220,825.00 (i.e., $5.00 per rentable square foot of the entire Existing Premises and the Atlantic Expansion Space) during the period from February 1, 2013 through and including November 30, 2015 (each period set forth in clauses (i) and (ii) hereinabove shall be referred to as a “Refurbishment Allowance Availability Period”). The construction and installation of the Refurbishment Work by Tenant shall be made in accordance with the terms of Paragraph 8(c) of the Original Lease (as amended by Paragraph 5 of the Addendum attached to the Original Lease), except that:

(i) all Refurbishment Work shall be subject to the mutual approval of the parties, including the mutual approval of all space plans, working

-6-

drawings and specifications therefor (collectively, the “Refurbishment Plans”) prepared by architects and engineers selected by Tenant (and reasonably approved by Landlord), at Tenant’s cost (which cost may be paid out of the Refurbishment Allowance);

(ii) Landlord has established specifications (the “Specifications”) for the Building standard components to be used in the construction of the Refurbishment Work (a copy of which Specifications are attached hereto as Exhibit B), and unless otherwise agreed to by Landlord, the Refurbishment Work shall comply with the Specifications;

(iii) the Refurbishment Work shall be performed by a general contractor selected by Tenant (the “Contractor”) pursuant to the following procedures: (A) Tenant will put the Refurbishment Plans out for competitive bid to at least three (3) licensed, bonded and insured general contractors designated by Tenant and approved by Landlord (one of which general contractors shall be Legacy Partners CDS, Inc., an affiliate of Landlord); (B) Tenant shall provide Landlord with copies of all of such bids of the bidding general contractors (which shall contain all major trade subcontractors’ bids incorporated therein), and a reconciliation shall be performed by Tenant to adjust inconsistent or incorrect assumptions so that a like-kind comparison can be made and the low bidder for the general contractor determined; and (C) Tenant shall select the Contractor from such bidding general contractors taking into account the following factors: (1) the bidding general contractor which provides the lowest bid; (2) the bidding general contractor’s experience and reputation in constructing systems and improvements for laboratory and office space; and (3) the quality of the proposed improvements and systems in such bidding general contractors’ bid; provided, however, if Tenant selects as the Contractor a bidding general contractor which is other than the bidding general contractor providing the lowest bid, then Landlord shall have the right to approve such Contractor, provided Landlord’s approval shall not be unreasonably withheld or delayed; and

(iv) Tenant shall not be required to remove any Refurbishment Work described in the “Scope of Work” attached hereto as Exhibit D upon the expiration or earlier termination of the Lease, as hereby amended.

(b) Disbursement of Refurbishment Allowance. Landlord shall disburse the Refurbishment Allowance to help Tenant pay for the costs of the design, construction, acquisition and installation of the Refurbishment Work actually incurred by Tenant (collectively, the “Refurbishment Costs”) during the applicable Refurbishment Allowance Availability Period, which Refurbishment Costs shall include a construction supervision and management fee payable to Landlord in an amount equal to three and one-half percent (3.5%) of the total Refurbishment Costs (the “CM Fee”); provided, however, no CM Fee shall be charged by Landlord as part of the Refurbishment Costs or otherwise if Legacy Partners CDS, Inc. is retained as the Contractor. Disbursements from the Refurbishment Allowance shall be made pursuant to this Section 7.3(b) on a progress payment basis as the Refurbishment Costs are incurred for the Refurbishment

-7-

Work (in all events prior to the expiration of the applicable Refurbishment Allowance Availability Period, subject to the limitations set forth hereinbelow), and after Landlord has received all of the following (collectively, the “Refurbishment Work Draw Documents”): (i) a request for payment of Tenant’s Contractor, in a commercially reasonable form, describing the portion of the Refurbishment Work which is the subject of such request for payment, and setting forth the amount of the Refurbishment Costs incurred in connection with the portion of the Refurbishment Work which is the subject of such request for payment; (ii) invoices which are, to Tenant’s knowledge, factually correct from all of Tenant’s Agents (as defined below) for labor and materials rendered in connection with such portion of the Refurbishment Work and included for payment in the applicable request for payment; and (iii) conditional executed mechanics’ lien waivers and releases from the Contractor and all subcontractors and other persons or entities performing such portion of the Refurbishment Work (collectively, “Tenant’s Agents”) which shall comply with the appropriate provisions of California Civil Code Section 8132 through 8138. Within thirty (30) days after Landlord’s receipt of the Refurbishment Work Draw Documents, Landlord shall deliver a check to Tenant made jointly payable to the Contractor and Tenant in payment of the lesser of (A) the amounts so requested by Tenant in the applicable Refurbishment Work Draw Documents, less a ten percent (10%) retention (the aggregate amount of such retentions to be known as the “Final Retention”), and (B) the balance of any remaining available portion of the Refurbishment Allowance (not including the Final Retention). If the CM Fee is applicable, then Landlord shall deduct the CM Fee from the Final Retention. Subject to the provisions of this Section 7.3(b), a check for the Final Retention (less the CM Fee, if applicable) payable jointly to Tenant and Contractor shall be delivered by Landlord to Tenant following the completion of all of the Refurbishment Work, as evidenced by Tenant’s delivery to Landlord of properly executed mechanics lien releases in compliance with both California Civil Code Section 8134 and either Section 8136 or Section 8138. In no event shall Landlord be obligated to make disbursements pursuant to this Section 7.3: (1) more often than once per month; (2) in a total amount which exceeds the Refurbishment Allowance; (3) before the commencement of the applicable Refurbishment Allowance Availability Period; (4) with respect to any Refurbishment Work Draw Documents delivered before or after the applicable Refurbishment Allowance Availability Period; and (5) notwithstanding anything to the contrary in this Section 7.3, if as of (x) May 31, 2014 (i.e., the expiration of the Refurbishment Allowance Availability Period pertaining to the portion of the Refurbishment Allowance totaling $1,104,125.00), all or any portion of such $1,104,125.00 amount is unused, such unused portion shall revert to Landlord and Tenant shall not be entitled to receive such unused portion of the Refurbishment Allowance), and (y) November 30, 2015 (i.e., the expiration of the Refurbishment Allowance Availability Period pertaining to the portion of the Refurbishment Allowance totaling $220,825.00), all or any portion of such $220,825.00 amount is unused, such unused portion shall revert to Landlord and Tenant shall not be entitled to receive such unused portion of the Refurbishment Allowance). In addition, Tenant shall not be entitled to receive in cash or as a credit against any rental or otherwise, any portion of the Refurbishment Allowance not used to pay for the Refurbishment Costs.

-8-

8. Option to Extend Second Extended Term. Section 10 of the Third Amendment is hereby deleted in its entirety and in lieu thereof, Landlord hereby grants to Tenant one (1) option (the “Extension Option”) to extend the term of the Lease (as hereby amended) for all, but not less than all, of the entire Premises (i.e., the Existing Premises and the Atlantic Expansion Space) (the “Renewal Premises”) for a period of five (5) years (“Option Term”) immediately following the expiration of the Second Extended Term and the Atlantic Expansion Space Term (i.e., the Option Term shall be for the period commencing on January 1, 2021 and ending on December 31, 2025), which Extension Option shall be exercisable only by written Exercise Notice (as defined below) delivered by Tenant to Landlord as provided below.

8.1. Option Rent. The annual Base Rent payable by Tenant during the Option Term (the “Option Rent”): (i) with respect to the Challenger Premises shall be equal to the greater of (A) the Challenger Floor Base Rent (as defined hereinbelow), and (B) the Challenger Fair Market Rental Rate (as defined hereinbelow); and (ii) with respect to the Atlantic Premises shall be equal to the greater of (A) the Atlantic Floor Base Rent (as defined hereinbelow), and (B) the Atlantic Fair Market Rental Rate (as defined hereinbelow). As used herein, (1) the “Challenger Floor Base Rent” shall mean an amount equal to the product of (x) $1.25, multiplied by (y) twelve (12), multiplied by (z) the number of rentable square feet in the Challenger Premises, which Challenger Floor Base Rent will be increased as of the first (1st) anniversary of the commencement date of the Option Term and each annual anniversary thereafter during the Option Term by three percent (3%) on a cumulative and compounded basis, and (2) the “Atlantic Floor Base Rent” shall mean an amount equal to the product of (x) $1.82, multiplied by (y) twelve (12), multiplied by (z) the number of rentable square feet in the Atlantic Premises, which Atlantic Floor Base Rent will be increased as of the first (1st) anniversary of the commencement date of the Option Term and each annual anniversary thereafter during the Option Term by three percent (3%) on a cumulative and compounded basis. As used herein, the “Challenger Fair Market Rental Rate” shall mean the annual base rent at which non-equity tenants, as of the commencement of the Option Term, will be leasing non-sublease space comparable in size, location and quality to the Challenger Premises for a comparable term, which comparable space is located in the other existing buildings in the Project which are office buildings, and in other single story office buildings in the Alameda Office Market that are of age and quality comparable to the Building (collectively, “Comparable Buildings”), taking into consideration all free rent and other out-of-pocket concessions generally being granted at such time for such comparable space for the Option Term (including, without limitation, any tenant improvement allowance provided for such comparable space, with the amount of such tenant improvement allowance to be provided for the Challenger Premises during the Option Term to be determined after taking into account the age, quality and layout of the tenant improvements in the Challenger Premises as of the commencement of the Option Term); provided, however, if Tenant does not deliver the Tangible Net Worth Documentation to Landlord with Tenant’s Interest Notice (as those terms are defined below), or if Landlord is not satisfied with Tenant’s Tangible Net Worth evidenced by the Tangible Net Worth Documentation delivered to Landlord, then the Challenger Fair Market Rental Rate shall mean the annual base rent at which non-equity tenants, as of the commencement of the Option Term, will be leasing non-sublease space comparable in size, location and quality to the Challenger Premises on an “as-is” basis for a comparable term, which comparable space is located in the Comparable Buildings (specifically excluding any free rent, tenant improvements, tenant improvement allowance or other rental concessions provided for such comparable space), and Landlord shall not be required to provide

-9-

any free rent, tenant improvements, tenant improvement allowance or other rental concessions for the Option Term. As used herein, the “Atlantic Fair Market Rental Rate” shall mean the annual base rent at which non-equity tenants, as of the commencement of the Option Term, will be leasing non-sublease space comparable in size, location and quality to the Atlantic Premises for a comparable term, which comparable space is located in the Comparable Buildings, taking into consideration all free rent and other out-of-pocket concessions generally being granted at such time for such comparable space for the Option Term (including, without limitation, any tenant improvement allowance provided for such comparable space, with the amount of such tenant improvement allowance to be provided for the Atlantic Premises during the Option Term to be determined after taking into account the age, quality and layout of the tenant improvements in the Atlantic Premises as of the commencement of the Option Term); provided, however, if Tenant does not deliver the Tangible Net Worth Documentation to Landlord with Tenant’s Interest Notice, or if Landlord is not satisfied with Tenant’s Tangible Net Worth evidenced by the Tangible Net Worth Documentation delivered to Landlord, then the Atlantic Fair Market Rental Rate shall mean the annual base rent at which non-equity tenants, as of the commencement of the Option Term, will be leasing non-sublease space comparable in size, location and quality to the Atlantic Premises on an “as-is” basis for a comparable term, which comparable space is located in the Comparable Buildings (specifically excluding any free rent, tenant improvements, tenant improvement allowance or other rental concessions provided for such comparable space), and Landlord shall not be required to provide any free rent, tenant improvements, tenant improvement allowance or other rental concessions for the Option Term. All other terms and conditions of the Lease, as hereby amended, shall apply throughout the Option Term; however, Tenant shall have no extension or renewal option beyond the Extension Option described in this Section 8.

8.2. Exercise of Option. The Extension Option shall be exercised by Tenant, if at all, only in the following manner: (i) Tenant shall deliver written notice (“Interest Notice”) to Landlord not before October 1, 2019 and not later than December 31, 2019 stating that Tenant may be interested in exercising the Extension Option, and together with the Interest Notice, Tenant may deliver evidence (collectively, the “Tangible Net Worth Documentation”) to Landlord of Tenant’s then-current tangible net worth and net income, in the aggregate, computed in accordance with generally accepted accounting principles, but excluding goodwill as an asset (collectively, “Tangible Net Worth”); (ii) Landlord, after receipt of Tenant’s Interest Notice, shall deliver written notice (the “Option Rent Notice”) to Tenant on or prior to January 31, 2020 setting forth Landlord’s determination of the Option Rent; and (iii) subject to Tenant’s right to object to the Challenger Fair Market Rental Rate and the Atlantic Fair Market Rental Rate as set forth in the next sentence, if Tenant wishes to exercise the Extension Option, Tenant shall, on or before March 31, 2020 (the “Exercise Date”), exercise the Extension Option by delivering written notice (“Exercise Notice”) thereof to Landlord. If Landlord determines in Landlord’s Option Rent Notice that the Option Rent for the Challenger Premises for the Option Term shall equal the Challenger Fair Market Rental Rate pursuant to Section 8.1(i)(B) above, and/or that the Option Rent for the Atlantic Premises for the Option Term shall equal the Atlantic Fair Market Rental Rate pursuant to Section 8.1(ii)(B) above, then concurrently with Tenant’s delivery of the Exercise Notice, Tenant may object, in writing, to Landlord’s determination of the Challenger Fair Market Rental Rate and/or the Atlantic Fair Market Rental Rate, as the case may be, for the Option Term set forth in the Option Rent Notice, in which event such Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, shall be determined

-10-

pursuant to Section 8.3 below. Tenant’s failure to deliver the Interest Notice or Exercise Notice on or before the applicable delivery dates therefor specified hereinabove shall be deemed to constitute Tenant’s waiver of the Extension Option. If Tenant timely delivers the Exercise Notice and does not affirmatively state therein that Tenant accepts Landlord’s determination of the Challenger Fair Market Rental Rate and/or the Atlantic Fair Market Rental Rate, as the case may be, set forth in the Option Rent Notice, then Tenant shall be deemed to have objected to Landlord’s determination of such Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, in which event such Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, shall be determined pursuant to Section 8.3 below. If Landlord determines in Landlord’s Option Rent Notice that the Option Rent for the Challenger Premises shall equal the Challenger Floor Base Rent pursuant to Section 8.1(i)(A) above and/or that the Option Rent for the Atlantic Premises shall equal the Atlantic Floor Base Rent pursuant to Section 8.1(ii)(A) above, as the case may be, such determination shall be final and conclusive, and the following provisions of Section 8.3 shall not apply with respect to such applicable determination.

8.3. Determination of Option Rent. If Landlord determines in Landlord’s Option Rent Notice that the Option Rent for the Challenger Premises for the Option Term shall equal the Challenger Fair Market Rental Rate pursuant to Section 8.1(i)(B) above and/or that the Option Rent for the Atlantic Premises for the Option Term shall equal the Atlantic Fair Market Rental Rate pursuant to Section 8.1(ii)(B) above, as the case may be, and Tenant timely and appropriately objects in writing pursuant to Section 8.2 above with respect to such Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, for the Option Term, then Landlord and Tenant shall attempt to agree upon such Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, using their good-faith efforts. If Landlord and Tenant fail to reach agreement by the date (the “Outside Agreement Date”) which is twenty (20) days following Tenant’s delivery of the Exercise Notice, then Tenant shall have the right, within two (2) business days after the Outside Agreement Date, to rescind the Exercise Notice for the Option Term by delivering written notice of such rescission (the “Rescission Notice”) to Landlord. If Tenant timely and properly delivers to Landlord the Rescission Notice for the Option Term pursuant to the foregoing, then (i) Tenant shall be deemed to have rescinded the Exercise Notice for the Option Term, (ii) the Extension Option shall be null and void as of the date Tenant delivered such Rescission Notice to Landlord, and (iii) Landlord and Tenant shall have no further liability to the other under this Section 8. Tenant’s failure to timely deliver the Rescission Notice shall be deemed to be Tenant’s election to proceed with the exercise of Tenant’s Extension Option for the Option Term and to have the Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, determined pursuant to the following provisions of this Section 8.3. If Tenant does not timely deliver the Rescission Notice, then each party shall submit to the other party a separate written determination of such Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, within ten (10) business days after the Outside Agreement Date, and such determinations shall be submitted to arbitration in accordance with the provisions of Sections 8.3(a) through (h) below. The failure of Tenant or Landlord to submit a written determination of such Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, within such ten (10) business day period shall conclusively be deemed to be such party’s approval of such Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, submitted within such ten (10) business day period by the other party.

-11-

(a) Landlord and Tenant shall each appoint one (1) arbitrator who shall by profession be a real estate leasing broker who shall have (i) been active over the ten (10) year period ending on the date of such appointment in the leasing of the Comparable Buildings, (ii) no financial interest in Landlord or Tenant, and (iii) not represented or employed or engaged the appointing party during such 10-year period. The determination of the arbitrators shall be limited solely to the issue of whether Landlord’s or Tenant’s submitted Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, is the closer to the actual Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, as determined by the arbitrators, taking into account the requirements with respect thereto set forth in Section 8.1 above. Each such arbitrator shall be appointed within fifteen (15) days after the Outside Agreement Date.

(b) The two (2) arbitrators so appointed shall, within fifteen (15) days after the date of the appointment of the last appointed arbitrator, agree upon and appoint a third arbitrator who shall be qualified under the same criteria set forth hereinabove for qualification of the initial two (2) arbitrators.

(c) The three (3) arbitrators shall, within thirty (30) days after the date of appointment of the third arbitrator, reach a decision as to which of Landlord’s or Tenant’s submitted Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, is closer to the actual Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, as the case may be, and shall select such closer determination as the Challenger Fair Market Rental Rate and/or Atlantic Fair Market Rental Rate, respectively, and notify Landlord and Tenant thereof.

(d) The decision of the majority of the three (3) arbitrators shall be binding upon Landlord and Tenant.

(e) If either Landlord or Tenant fails to appoint an arbitrator within the time period specified in Section 8.3(a) above, the arbitrator appointed by one of them shall reach the decision set forth in Section 8.3(c) above, notify Landlord and Tenant thereof, and such arbitrator’s decision shall be binding upon Landlord and Tenant.

(f) If the two (2) arbitrators fail to agree upon and appoint a third arbitrator, a third arbitrator shall be appointed by the Superior Court in and for the county of Alameda, California.

(g) Each party shall pay the fees and expenses of the arbitrator appointed by or on behalf of it, and each shall pay one-half of the fees and expenses of the third arbitrator, if any.

(h) In no event shall the applicable Option Rent selected by the arbitrator(s) pursuant to this Section 8.3 be less than the Challenger Floor Base Rent with respect to the Challenger Premises or the Atlantic Floor Base Rent with respect to the Atlantic Premises, as the case may be.

-12-

8.4. Default; Rights Personal. Notwithstanding the foregoing, at Landlord’s option, in addition to any other remedies available to Landlord under the Lease (as hereby amended), at law or in equity, the Extension Option shall not be deemed properly exercised if as of the date of delivery of the Exercise Notice by Tenant Tenant is in monetary or material non-monetary default under the Lease (as hereby amended) beyond all applicable notice and cure periods. Tenant’s Extension Option is personal to the original Tenant executing this Fifth Amendment (the “Original Tenant”) and any entity or person to which the Original Tenant’s entire interest in the Lease, as hereby amended, has been assigned pursuant to Section 12(j) of the Original Lease (each, an “Affiliate”) and may not be assigned or exercised, voluntarily or involuntarily, by or to, any person or entity other than the Original Tenant or such Affiliate assignee, as the case may be, and shall only be available to and exercisable by the Original Tenant or such Affiliate assignee, as the case may be, when the Original Tenant or such Affiliate assignee, as the case may be, is in actual and physical possession of the entire Renewal Premises.

9. Single-Tenant Building Modifications. As of (i) the Effective Date, Tenant leases the entire rentable square footage of the Challenger Building and is the sole tenant of the Challenger Building, and (ii) the Atlantic Expansion Space Commencement Date, Tenant shall lease the entire rentable square footage of the Atlantic Building and shall be the sole tenant in the Atlantic Building. Accordingly, the following modifications shall be made to the Lease (A) with respect to the Challenger Premises, effective from and after the Effective Date, and (B) with respect to the Atlantic Premises, effective from and after the Atlantic Expansion Space Commencement Date, and in connection therewith, during the period (1) from the Effective Date through and including the day before the Atlantic Expansion Space Commencement Date, all references in Sections 9.1 through 9.6 below to the “Premises” shall mean the Challenger Premises, only, and the “Building” shall mean the Challenger Building, only, and (2) from and after the Atlantic Expansion Space Commencement Date, all references in Sections 9.1 through 9.6 below to the “Premises” shall mean both the Challenger Premises and the Atlantic Premises, and the “Building” shall mean both the Challenger Building and the Atlantic Building (provided, however, paragraph Section 8(e) of the Original Lease [as added by Section 9.4(b) below] shall apply with respect to both the Challenger Building and the Atlantic Building from and after the Effective Date):

9.1. Gross-Up Provision. The fourth (4th) sentence of Paragraph 4(a) of the Original Lease (as replaced by Section 2 of the First Amendment), which provides for an adjustment of Operating Expenses to assume 95% occupancy of the Building, shall be deleted.

9.2. Janitorial Service. Landlord shall not be obligated to provide any janitorial services to the Premises or replace any light bulbs, lamps, starters and ballasts for lighting fixtures within the Premises. Tenant shall be solely responsible, at Tenant’s sole cost and expense, for (i) performing all janitorial services, trash removal and other cleaning of the Premises, and (ii) replacement of all light bulbs, lamps, starters and ballasts for lighting fixtures within the Premises, all as appropriate to maintain the Premises in a manner consistent with the age and quality of the Building and Project. Such services to be provided by Tenant shall be performed by contractors and pursuant to service contracts reasonably approved by Landlord. Landlord shall have the right to inspect the Premises upon reasonable notice to Tenant to confirm compliance with the terms of the Lease, as hereby amended.

-13-

9.3. Services. Paragraph 7 of the Original Lease (as amended by Paragraph 4 of the Addendum attached to the Original Lease) shall be deleted in its entirety and replaced with the following:

“7. Services.

a. Tenant’s Responsibility. Tenant shall be solely responsible, at its sole cost and expense, for the furnishing of all services and utilities to the Premises, including, but not limited to HVAC, electricity, water, telephone, telecommunications, cleaning, pest control, trash removal and security services (as well as maintenance and repairs of the Premises in accordance with the provisions of Paragraph 8(a) below and providing the janitorial and other services to the Premises as provided in Section 9.2 of that certain Amendment No. 5 to Marina Village Office Lease dated May 31, 2013 between Landlord and Tenant [the “Fifth Amendment”]). In connection with the foregoing, Tenant hereby agrees that (i) Landlord shall have absolutely no obligation to provide any such or other services or utilities to the Premises, it being agreed that this Lease is in the nature of a “single-tenant building” lease (although Landlord shall maintain and keep in service the existing utility connections located outside the Building and connected to the exterior of the Building as necessary for distribution of such utilities to the Premises by Tenant), (ii) Tenant shall contract directly with the applicable utility providers to provide all such utilities to the Premises, which utilities shall be separately metered, at Tenant’s cost, and (iii) Tenant shall pay for the cost of such utilities consumed at the Premises (and for all services provided to the Premises) directly to the applicable provider thereof. All such services and utilities for the Premises shall be provided in such a manner so as to maintain the Premises and the Building in a condition consistent with the age and quality of the Building and the Comparable Buildings, and if Tenant fails to do so, and such failure shall continue for fifteen (15) days after written notice from Landlord (which notice and cure period shall not be required in the event of an emergency), Landlord shall have the right to provide such services and/or such utilities and any charges or costs reasonably incurred by Landlord in connection therewith shall be deemed additional rent due and payable by Tenant within ten (10) days after receipt by Tenant of a written statement thereof from Landlord.

b. Overstandard Tenant Use. If Tenant shall use, or desire to use, electricity, water, HVAC or any other utilities for the Premises in quantities that exceed the capacity of the equipment supplying the same to the Building, then, subject to applicable law, and subject to Landlord’s approval, which shall not be unreasonably withheld, conditioned or delayed, Tenant shall, at Tenant’s sole cost and expense, install such supplemental equipment as may be reasonably required to provide such excess capacity.

c. Interruption of Use. Subject to Section 7(d) below, Tenant agrees that Landlord shall not be liable for damages, by abatement of rent or otherwise, for failure to furnish or delay in furnishing any utilities or services (including telephone and telecommunication services), or for any diminution in the quality or

-14-

quantity thereof, when such failure or delay or diminution is occasioned, in whole or in part, by necessary and/or elective repairs, replacements, or improvements (subject, however, to Section 7(d)(ii) below), by any strike, lockout or other labor trouble, by inability to secure electricity, gas, water, or other fuel at the Building or Project after reasonable effort to do so, by any accident or casualty whatsoever, by act or default of Tenant or other parties, or by any other cause; and such failures or delays or diminution shall never be deemed to constitute an eviction or disturbance of Tenant’s use and possession of the Premises or relieve Tenant from paying rent (except as otherwise provided in Section 7(d) below) or performing any of its obligations under this Lease. Furthermore, Landlord shall not be liable under any circumstances for a loss of, or injury to, property or for injury to, or interference with, Tenant’s business, including, without limitation, loss of profits, however occurring, through or in connection with or incidental to a failure to furnish any services or utilities to the Premises.

d. Special Abatement. If Tenant’s use of the Premises (or any portion thereof) is materially and adversely interfered with as a result of, and Tenant in fact does not use all or a portion of the Premises, as a result of, (i) Landlord’s failure to maintain and keep in service (whether due to Landlord’s negligence, misconduct or otherwise) the existing utility connections located outside the Building and connected to the exterior of the Building as necessary for distribution to the Premises by Tenant of those utilities that are part of the Tenant provided services and utilities in accordance with Paragraph 7(a) above, and/or (ii) Landlord’s elective (as opposed to necessary) repairs, replacements or improvements (in each case, an “Abatement Event”), then Tenant shall deliver written notice to Landlord of such Abatement Event (the “Abatement Event Notice”). If such Abatement Event continues for five (5) consecutive business days after Landlord’s receipt of the Abatement Event Notice (“Eligibility Period”), then Tenant’s obligation to pay Base Rent and Tenant’s Percentage Share of Operating Expenses and Property Taxes shall be abated or reduced, as the case may be, from and after the Eligibility Period and shall continue during such time that such Abatement Event continues to so materially and adversely interfere with Tenant’s use of (and as a result thereof Tenant does not use) all or any portion of the Premises, with such abatement to be in the proportion that the rentable square feet of the portion of the Premises so materially and adversely interfered with (and that Tenant does not use) bears to the total rentable square feet of the Premises. To the extent Tenant shall be entitled to abatement of Base Rent and Tenant’s Percentage Share of Operating Expenses and Property Taxes because of a damage or destruction pursuant to Paragraph 10 of this Lease (as amended by Paragraph 7 of the Addendum attached to this Lease and Section 9.5 of the Fifth Amendment) or a taking pursuant to Paragraph 11 of this Lease, then the Eligibility Period shall not be applicable.”

-15-

9.4. Maintenance, Repairs and Alterations. Paragraph 8 of the Original Lease shall be modified as follows:

(a) Paragraphs 8(a) and 8(b) of the Original Lease (as amended by Paragraph 5 of the Addendum attached to the Original Lease) shall be deleted in their entirety and replaced with the following:

“a. Tenant’s Repairs. Subject to Landlord’s repair obligations in Section 8(b) below, and except for any damage by casualty which is not Tenant’s obligation to repair pursuant to Paragraph 10 below, Tenant shall, at Tenant’s own expense, and with contractors reasonably acceptable to Landlord and subject to Tenant’s compliance with the following provisions of this Paragraph 8(a) and the provisions of Paragraph 8(c) below, keep the Building and every part thereof (except those portions of the Building which are Landlord’s obligation to maintain pursuant to Paragraph 8(b) below), including, without limitation, all tenant improvements, alterations, additions, equipment, restrooms, fixtures and furnishings therein (including all of the Building’s systems and equipment located within the Building and the HVAC equipment on the roof of the Building, subject, however, to Landlord’s obligations regarding replacement of such HVAC equipment as expressly provided below in Section 8(e)), all interior walls and wall coverings, doors, windows, glass, plate glass, ceilings, and skylights, in an order, repair and condition consistent with the age and quality of the Building and the Comparable Buildings. Such repair obligations shall include, without limitation, replacement of items as may be necessary to keep same in the condition required hereinabove (subject to Landlord’s replacement obligations set forth below in Section 8(e) below with respect to the Building’s HVAC equipment on the roof of the Building), notwithstanding that such replacements may be considered capital expenditures in accordance with accounting practices, and shall also include repairs of items above the ceiling, repairs of items below the floors (but not the floor slabs), and/or repairs of items within walls, such as, but not limited to, all plumbing and pipes for restrooms, the equipment providing distribution within the Building of the HVAC from the HVAC equipment on the roof, and the equipment providing distribution within the Building of all electricity and all other utilities required for the Premises (including all electrical panels in equipment rooms or elsewhere within the Building). Landlord shall have approval rights (in its sole but good faith discretion) with respect to repairs and/or replacements which may: (i) affect the roof and/or the HVAC equipment thereon; (ii) affect or consist of any of the structural components of the Building; (iii) adversely affect or consist of any of the Building’s systems and equipment; (iv) affect the exterior of the Building or any portion of the Project located outside of the Building, or can be seen from outside the Building; and/or (v) change the character of the Building as an office/laboratory building (any of such items set forth in clauses (i) through (v) hereinabove shall sometimes be referred to as the “Landlord’s Approval Items”). Tenant’s repair obligations set forth hereinabove shall include, without limitation, the obligation to promptly and adequately repair all damage to the Building and replace or repair all damaged or broken fixtures and appurtenances (subject, however, to the provisions of Paragraph 10 below regarding casualty damage to the Building); provided however, that if Tenant fails to commence such repairs within ten (10) business days after written notice from Landlord and thereafter diligently pursue such repairs to completion, Landlord

-16-

may, but need not, make such repairs and replacements, and Tenant shall pay Landlord the cost thereof, including a five percent (5%) administration fee sufficient to reimburse Landlord for all overhead, general conditions, fees and other costs or expenses arising from Landlord’s involvement with such repairs and replacements forthwith upon being billed for same. Tenant shall, at its own cost and expense, enter into regularly scheduled preventive maintenance/service contracts (and with maintenance contractors) reasonably approved by Landlord for the maintenance and service of all of the items listed above in this Paragraph 8(a) which Tenant is obligated to maintain. Tenant shall deliver to Landlord full and complete copies of all such contracts entered into by Tenant prior to entering into same. Notwithstanding any other provision herein to the contrary, Tenant may continue to use of the laboratory benches, casework, fume hoods and laminar flow hoods located in the Premises as of the Effective Date at no additional cost throughout the Second Extended Term, as the same may be further extended.

b. Landlord’s Repairs. Anything contained in Paragraph 8(a) above to the contrary notwithstanding, and subject to Paragraphs 10 and 11 of this Lease, Landlord shall maintain, as part of Operating Expenses, the following (collectively, “Landlord’s Repair Items”): (i) the common areas of the Project (including those systems and equipment located outside the Building but serving the Building, but excluding the HVAC equipment located on the roof of the Building, subject, however, to Landlord’s obligations regarding replacement of the HVAC equipment located on the roof of the Building provided in Section 8(e) below); (ii) the structural portions of the roof (including the roof membrane); (iii) the foundation and floor slabs of the Building; and (iv) the exterior walls and load-bearing portions of walls (excluding wall coverings, painting, glass and doors) of the Building; provided, however, to the extent such maintenance and repairs are caused by the act, neglect, fault of or omission of any duty by Tenant, its agents, employees, contractors, subtenants, licensees or invitees, Tenant shall pay directly to Landlord as additional rent (but not as part of Operating Expenses), the reasonable cost of such maintenance and repairs. Landlord shall not be liable for any failure to make any such repairs, or to perform any maintenance and there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of any repairs, alterations or improvements in or to any portion of the Project, Building or the Premises or in or to fixtures, appurtenances and equipment therein. Tenant hereby waives and releases its right to make repairs at Landlord’s expense under Sections 1941 and 1942 of the California Civil Code; or under any similar law, statute, or ordinance now or hereafter in effect.

In addition to the foregoing obligations, Landlord shall comply with all applicable laws (including, without limitation, the Americans With Disabilities Act of 1990 or any other applicable state or federal accessibility laws or regulations) relating to Landlord’s Repair Items. The cost of such compliance (other than the cost to correct any non-compliance of Landlord’s Repair Items with laws that exist as of the Effective Date of the Fifth Amendment [as defined

-17-

in the Fifth Amendment]) shall be included in Operating Expenses (provided, however, to the extent the cost of such compliance pertains to a capital improvement, such cost shall be amortized, including interest on the unamortized cost at a rate equal to Landlord’s cost of funds [the “Interest Rate”] in equal annual installments over the reasonable useful life of the applicable capital improvement as established by the manufacturer of the applicable capital improvement) Landlord shall provide reasonable evidence to Tenant of its cost of funds.”

(b) The following shall be added as new Section 8(e) of the Original Lease:

“(e) HVAC Equipment. Notwithstanding anything in this Section 8 to the contrary, if either party reasonably determines that the HVAC equipment located on the roof of the Building requires replacement instead of repairs, Landlord and Tenant shall negotiate in good faith to determine whether such replacements (instead of repairs) will be required to be performed. If repairs rather than replacements are required to be made, all repair costs with respect to the HVAC equipment on the roof of the Building shall be incurred by Tenant, at Tenant’s sole cost and expense; provided, however, if any required repairs are capital repairs (meaning, the aggregate cost thereof will exceed thirty-three percent (33%) or more of the replacement value of such repair item), then such capital repairs shall be performed by Landlord at Landlord’s sole cost and expense, provided further, however, (i) the cost of such capital repairs so paid by Landlord shall be amortized (including interest on the unamortized cost at the Interest Rate) in equal annual installments over the useful life of such repair item in accordance with standard real estate management and accounting practices consistently applied by Landlord, and shall be included in Operating Expenses, and (ii) if any such capital repairs are required due to the negligence or willful misconduct of Tenant or Tenant’s agents, employees, contractors, subtenants, licensees or invitees (including as a result of Tenant’s failure to perform its maintenance and repair obligations set forth in this Section 8), then such capital repairs shall be performed by Tenant at Tenant’s sole cost and expense. If it is determined by the parties that replacements of the HVAC equipment on the roof of the Building are required to be performed, such replacements shall be performed by Landlord at Landlord’s sole cost and expense; provided, however, that (A) the cost of such replacements so paid by Landlord shall be amortized (including interest on the unamortized cost at the Interest Rate) in equal annual installments over the useful life of such replacement as established by the manufacturer of such replacement, and shall be included in Operating Expenses, and (B) if any such replacements are required due to an act, omission or negligence of Tenant or Tenant’s agents, employees, contractors, subtenants, licensees or invitees (including as a result of Tenant’s failure to perform its maintenance and repair obligations set forth in this Section 8), then such replacements shall be performed by Tenant at Tenant’s sole cost and expense.”

-18-

9.5. Physical Damage Insurance on the Building. The following shall be added to the end of Section 9(a) of the Original Lease (as amended by Paragraph 6 of the Addendum attached to the Original Lease):

“In addition to any property damage insurance Tenant is required to maintain as provided hereinabove, Tenant shall procure Physical Damage Insurance covering all interior portions of the Building, including all improvements, alterations and additions now existing or hereafter made to the interior of the Building (including, without limitation, any Refurbishment Work [as defined in the Fifth Amendment], but specifically excluding Landlord’s Repair Items, and excluding the HVAC equipment located on the roof of the Building). Such insurance shall be written on the same basis and shall be maintained in the same manner as the property damage insurance pursuant to and in accordance with the terms and provisions hereinabove. Landlord shall maintain throughout the Second Extended Term (as the same may be further extended) broad form property damage insurance insuring Landlord’s Repair Items and the HVAC equipment located on the roof of the Building. Any damage that is covered by Landlord’s insurance (or that would have been covered if Landlord had maintained the insurance required to be maintained by it under this Lease), shall not be charged to Tenant either directly or as an Operating Expense.”

9.6. Damage or Destruction. Paragraph 10 of the Original Lease (as amended by Paragraph 7 of the Addendum attached to the Original Lease) shall be amended in the following respects:

(a) In the event of a damage to or destruction of the Building, Landlord shall not be obligated to repair or restore Tenant’s personal property in the Premises.

(b) If the cost of any repair by Landlord of any damage to any portion of the Building which is other than Landlord’s Repair Items exceeds the amount of insurance proceeds received by Landlord from Tenant’s insurance carrier, as assigned by Tenant, the cost of such repairs shall be paid by Tenant to Landlord prior to Landlord’s repair of the damage. Landlord agrees that if the HVAC equipment located on the roof of the Building is damaged as a result of a casualty, Landlord shall repair and/or replace such damaged HVAC equipment.

10. Miscellaneous Modifications. The Lease shall be modified as follows:

10.1. From and after the Effective Date, with respect to Paragraph 4(a) of the Original Lease (as replaced by Section 2 of the First Amendment):

(a) the following shall be added to the end of clause (1) thereof: “and/or the Project (subject to the immediately following sentence, as added by Section 10.1(c) of the Fifth Amendment), including, without limitation, (A) the cost of any capital improvements or other costs (I) which are intended as a labor-saving device or to effect other economies in the operation or maintenance of the Building (but not in

-19-

excess of the cost savings reasonably anticipated to result to Tenant therefrom), (II) made to the Building and/or the Project (subject to the immediately following sentence, as added by Section 10.1(c) of the Fifth Amendment) or any portion thereof that are required under any governmental law or regulation first enacted after the Effective Date of the Fifth Amendment, or (III) which are Conservation Costs, as defined below (but not in excess of the cost savings reasonably anticipated to result to Tenant therefrom); provided, however, that if any such cost described in (I), (II) or (III) above is a capital improvement, such cost shall be amortized (including interest on the unamortized cost at the Interest Rate) in equal annual installments over the reasonable useful life of the applicable capital improvement as established by the manufacturer of such capital improvement, (B) the costs and expenses of complying with, or participating in, conservation, recycling, sustainability, energy efficiency, waste reduction or other programs or practices implemented or enacted from time to time at the Building and/or Project, including, without limitation, in connection with any LEED (Leadership in Energy and Environmental Design) rating or compliance system or program, including that currently coordinated through the U.S. Green Building Council or Energy Star rating and/or compliance system or program (collectively, “Conservation Costs”) (but not in excess of the cost savings reasonably anticipated to result to Tenant therefrom), and (C) the costs of maintenance, repair, and/or operation of the parking lots, walkways and landscaping of the Project (subject to the immediately following sentence, as added by Section 10.1(c) of the Fifth Amendment).”

(b) the following shall be added to the end of clause (2) thereof: “and/or the Project (subject to the immediately following sentence, as added by Section 10.1(c) of the Fifth Amendment)”;

(c) the following shall be added after the third (3rd) sentence thereof: “Notwithstanding the foregoing to the contrary, certain of the Operating Expenses incurred in connection with the Project shall be reasonably and equitably shared among the Building and/or the other buildings in the Project.”; and

(d) clause (x) thereof shall be deleted and replaced with: “(x) costs of items considered capital improvements, capital repairs, capital replacements, and/or capital equipment, all as determined in accordance with generally accepted accounting principles, consistently applied, except for capital repairs, which shall be determined pursuant to Section 8(e) below, as added by Section 9.4(b) of the Fifth Amendment, except as expressly permitted in clause (1) hereinabove.”

10.2. From and after the Effective Date, the following shall be added as new Section 8(d) of the Original Lease:

“(d) Removal of Tenant Property by Tenant. Upon the expiration or any earlier termination of this Lease, Tenant shall quit and surrender possession of the Premises to Landlord in as good order and condition as when Tenant took possession and as thereafter improved by Landlord and/or Tenant, reasonable wear and tear and repairs which are specifically made the responsibility of Landlord under this Lease excepted. Upon such

-20-

expiration or termination, Tenant shall, without expense to Landlord, remove or cause to be removed from the Premises all furniture, equipment, free-standing cabinet work, trade fixtures and other articles of personal property owned by Tenant or installed or placed by Tenant at its expense in the Premises, and all debris and rubbish, and such similar articles of any other persons claiming under Tenant, and Tenant shall repair at its own expense all damage to the Premises and Building resulting from such removal. Notwithstanding any other provision of this Lease to the contrary, Tenant shall have no obligation to remove any (i) improvements existing in the Premises as of the Effective Date of the Fifth Amendment, (ii) any Refurbishment Work described in the “Scope of Work” attached hereto as Exhibit D, or (iii) telephone, data and other cabling and wiring (including any cabling and wiring associated with the Wi-Fi Network, if any) installed or caused to be installed by Tenant in the Premises at any time. Upon the expiration or any earlier termination of this Lease, Tenant shall have the right, but not the obligation (unless such specialized improvement was previously designated by Landlord to be removed pursuant to Section 8(c) above), to remove from the Premises any specialized improvements paid for and installed by Tenant in the Premises from Tenant’s own funds so long as Tenant repairs at its own expense all damage to the Premises and Building resulting from such removal.”

10.3. From and after the Effective Date, with respect to Section 16(c) of the Original Lease, the phrase “or sell” shall be added after the word “refinance” therein, and the phrase “lender” set forth two (2) times therein shall be deleted and replaced with: “lender and/or prospective purchaser, as the case may be”.

10.4. From and after the Effective Date, the following shall be added to the end of the penultimate sentence of Section 17 of the Original Lease: “and Tenant’s right to quiet possession of the premises shall not be disturbed by such purchaser at the foreclosure sale, grantee under the deed in lieu of foreclosure or ground lessor, as the case may be, so long Tenant is not in default under this Lease and so long as Tenant shall pay the rent and observe and perform all of the provisions of this Lease, unless this Lease is otherwise terminated pursuant to its terms.”

10.5. From and after June 1, 2013, Section 9 of the Third Amendment shall be deleted in its entirety and of no further force or effect.

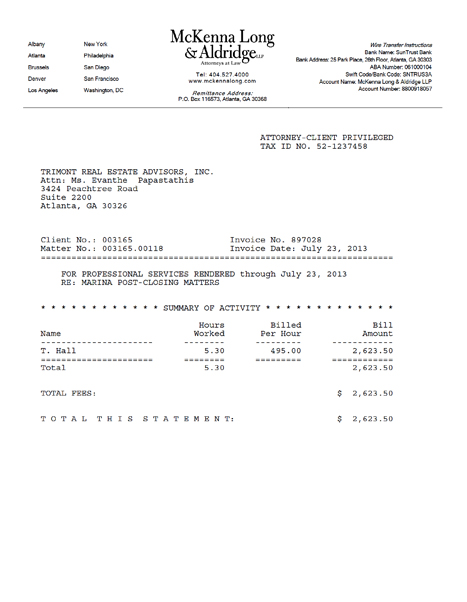

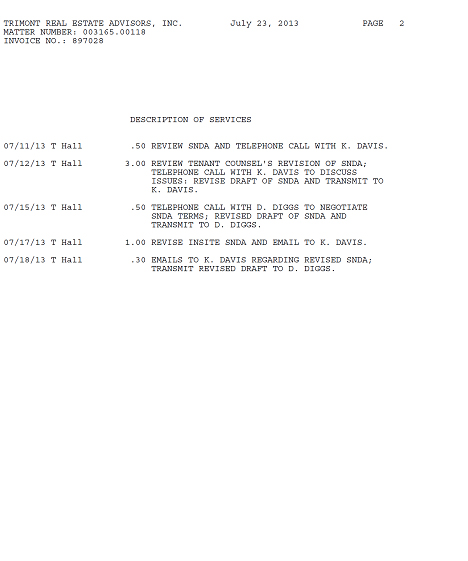

11. SNDA. Tenant hereby acknowledges that as of the Effective Date there is a deed of trust encumbering, and in force against, the Building in favor of U.S BANK, N.A AS SUCCESSOR IN INTEREST TO WELLS FARGO BANK, N.A , as Trustee for the registered holders of J.P. MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES CORP., Commercial Mortgage Pass-Through Certificates, Series 2006-FL2 (the “Current Lender”). Simultaneously with Tenant’s execution of this Fifth Amendment, Landlord, Tenant and Current Lender shall sign, notarize and deliver a subordination, non-disturbance and attornment agreement substantially in the form of Exhibit E attached hereto (the “Current SNDA”). The

-21-

fees and costs charged to Landlord by the Lender in connection with the Current SNDA are set forth on Exhibit F attached hereto; Tenant shall pay for $1,123.50 of such costs and fees within thirty (30) days after the mutual execution and delivery of this Fifth Amendment and Landlord shall pay for $1,500.00 of such costs and fees.

12. California Accessibility Disclosure. For purposes of Section 1938 of the California Civil Code, Landlord hereby discloses to Tenant, and Tenant hereby acknowledges, that the Existing Premises and the Atlantic Expansion Space have not undergone inspection by a Certified Access Specialist (CASp).

13. Brokers. Tenant represents and warrants to Landlord that Tenant has not dealt with any broker in connection with this Fifth Amendment except for Kidder Matthews, representing Tenant (the “Broker”), and insofar as Tenant knows, no other broker negotiated or participated in the negotiations of this Fifth Amendment or is entitled to any commission in connection herewith. Landlord shall pay the brokerage commissions owing to the Broker in connection with this Fifth Amendment pursuant to the terms of a separate written agreement between Landlord and the Broker. Each party agrees to indemnify, defend, protect and hold the other party harmless from and against any and all Claims with respect to any leasing commission or equivalent compensation alleged to be owing on account of the indemnifying party’s dealings with any real estate broker or agent in connection with this Fifth Amendment other than the Broker. The terms of this Section 11 shall survive the expiration or earlier termination of the Lease (as hereby amended).

14. Successors and Assigns. Subject to any provisions of the Lease (as hereby amended) restricting assigning or subletting by Tenant and subject to the provisions for the transfer of Landlord’s interest, the Lease (as hereby amended) shall bind the parties, their successors and assigns.

15. No Further Modification. Except as set forth in this Fifth Amendment, all of the terms and provisions of the Lease shall remain unmodified and in full force and effect.

16. Counterparts. This Fifth Amendment may be executed in multiple counterparts, each of which is to be deemed original for all purposes, but all of which together shall constitute one and the same instrument.

[SIGNATURES APPEAR ON THE FOLLOWING PAGE]

-22-

IN WITNESS WHEREOF, the parties have caused this Fifth Amendment to be duly executed by their duly authorized representatives as of the date first above written.

| LANDLORD: | LEGACY PARTNERS I ALAMEDA, LLC, | |||

| a Delaware limited liability company, | ||||

| Owner | ||||

| By: Legacy Partners Commercial, L.P., a California limited partnership, as Property Manager and Agent for Owner | ||||

| By: Legacy Partners Commercial, Inc., | ||||

| its General Partner | ||||

|

By: /s/ Hanna Eyal Name: Hanna Eyal Its: Senior Vice President DRE #01178811 BL DRE #01464134 |

| TENANT: | INSITE VISION INCORPORATED, a Delaware corporation | |||||

| By: | /s/ Louis Drapeau | |||||

| Name: Louis Drapeau | ||||||

| Title: VP, Chief Financial Officer | ||||||

| By: |

| |||||

| Name: | ||||||

| Title: | ||||||

-23-

EXHIBIT A

DEPICTION OF ATLANTIC EXPANSION SPACE

[Attached].

EXHIBIT A

-1-

EXHIBIT A

-2-

EXHIBIT B

SPECIFICATIONS

PARTITIONS

| A. | DEMISING PARTITION AND CORRIDOR WALLS |

| 1. | 3-5/8” (or match existing)- 20 gauge metal studs—24” on center maximum from floor to ceiling grid. (Provide backing for cabinet as required). |

| 2. | 5/8” Type ‘X’ gypsum wallboard one layer each side of studs, fire taped only. |

| 3. | Height from floor to ceiling grid. |

| 4. | Seismic bracing per code. |

| 5. | Two rows of continuous acoustical sealant—bottom tracks. R-11 batt type fiberglass insulation between studs. |

Note:

| • | All partitions to be paint finished on smooth surfaces GA-214, level 5 smoothness. |

| • | One hour rated walls where required based on occupancy group. |

| • | All interior 1-hour corridors to be tunnel construction in compliance with UBC requirements for one-hour fire rated assembly. |

| B. | TYPICAL INTERIOR PARTITION (Non rated) |

| 1. | 3-5/8” (or match existing)—25 gauge metal studs—24” on center maximum. (provide backing for wall mounted cabinetry or equipment as required). |

| 2. | 5/8” Type ‘X’ gypsum wallboard one layer each side of studs. |

| 3. | Height from floor to ceiling grid—approximately 9’-0” or 10’-0” based on structure cost at all floors; regular ceiling tiles must be scribed. |

| 4. | Seismic bracing per code. |

| 5. | All exterior corners with corner beads. All exposed edges finished with metal trim. |

Note:

| • | All partitions to be paint finished on smooth surfaces GA-214, level 5 smoothness. |

| • | Partitions must connect to building mullions or walls. Mechanical fasteners to mullions shall not be allowed. |

| C. | PERIMETER DRYWALL (at office areas) |

| 1. | 2-1/2”—25 gauge metal studs 24” on center to 6” above suspended ceiling (or as required by Title-24 for full height envelope, refer to demising wall specification. |

| 2. | 5/8” Type ‘X’ gypsum wallboard one layer on one side. |

| 3. | Height—floor slab to 6” above ceiling grid. |

| 4. | All exterior corners with corner beads. |

Note:

| • | All partitions to be paint finished on smooth surfaces GA-214, level 5 smoothness. |

| D. | COLUMN FURRING |

| 1. | 5/8” Type ‘X’ gypsum wallboard, one layer on 2 1/2” – 25 gauge metal studs, UNO. |

EXHIBIT B

-1-

| 2. | Height—floor slab to 2” above ceiling grid. |

| 3. | All exterior corners with corner beads. |

Note:

| • | All partitions to be paint finished on smooth surfaces GA-214, level 5 smoothness. |

| E. | INSULATION |

| 1. | Insulation at all perimeter walls and roof per specifications. |

| 2. | All common area walls including corridor, conference, copy rooms and lunch room to receive R-11 within partition cavity and four feet on either side of partition over ceiling at demising wall (if not full height). |

| F. | FIRE BLOCKING |

| 1. | 2-1/2” 20 Gauge metal studs. |

| 2. | 5/8” gypsum wallboard one layer on one side. |