Attached files

| file | filename |

|---|---|

| EX-32.01 - EXHIBIT 32.01 - Hondo Minerals Corp | hmnc1112form10kaexh32_01.htm |

| EX-31.02 - EXHIBIT 31.02 - Hondo Minerals Corp | hmnc1112form10kaexh31_02.htm |

| EX-32.02 - EXHIBIT 32.02 - Hondo Minerals Corp | hmnc1112form10kaexh32_02.htm |

| EX-31.01 - EXHIBIT 31.01 - Hondo Minerals Corp | hmnc1112form10kaexh31_01.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 5

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2012

Commission File No. 000-54326

Hondo Minerals Corporation

(Exact name of registrant as specified in its charter)

| Nevada | 26-1240056 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

15303 N. Dallas Parkway, Suite 1050

Addison, Texas 75001

(Address of principal executive offices, zip code)

(214) 444-7444

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ☐ No ☑

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting Company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting Company ☑ |

| (Do not check if a smaller | |||

| reporting Company) |

Indicate by check mark whether the registrant is a shell Company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of July 31, 2012 was $60,008,628 based upon the price of $1.50 at which the common stock was last sold as of the last business day of the most recently completed second fiscal quarter, multiplied by the approximate number of shares of common stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an “affiliate” of the registrant for purposes of the federal securities laws. Our common stock is traded in the over-the-counter market and quoted on the Over-The-Counter Bulletin Board under the symbol (“HMNC”).

As of October 5, 2012, the registrant’s outstanding stock consisted of 83,730,667 common shares.

EXPLANATORY NOTE

This Amendment No. 5 on Form 10-K/A amends the Company’s Annual Report on Form 10-K for the year ended July 31, 2012, as filed with the Securities and Exchange Commission (the “SEC”) on November 9, 2012 (the “Original Filing”) and Amendments No. 1, 2, 3 and 4 to the Original Filing as filed with the SEC on December 21, 2012, August 20, 2013, September 24, 2013 and October 16, 2013, respectively.

The purpose of this Amendment No. 5 on Form 10-K/A is to respond to certain comments received from the Staff of the SEC. For convenience and ease of reference, the Company is filing this Form 10-K/A in its entirety with all applicable changes and unless otherwise stated, all information contained in this amendment is as of November 9, 2012, the filing date of the Original Filing. Except as stated herein, this Form 10-K/A does not reflect events or transactions occurring after such filing date or modify or update those disclosures in the original Form 10-K that may have been affected by events or transactions occurring subsequent to such filing date.

HONDO MINERALS CORPORATION

TABLE OF CONTENTS

| Page No. | ||

| PART I | ||

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 17 |

| Item 1B. | Unresolved Staff Comments | 17 |

| Item 2. | Properties | 17 |

| Item 3. | Legal Proceedings | 17 |

| Item 4. | Mine Safety Disclosures | 17 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 18 |

| Item 6. | Selected Financial Data | 18 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 20 |

| Item 8. | Financial Statements and Supplementary Data | 21 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 22 |

| Item 9A. | Controls and Procedures | 22 |

| Item 9B. | Other Information | 23 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 24 |

| Item 11. | Executive Compensation | 26 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 27 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 28 |

| Item 14. | Principal Accounting Fees and Services | 28 |

| PART IV | ||

| Item 15. | Exhibits and Financial Statement Schedules | 29 |

| Signatures | 29 |

FORWARD-LOOKING STATEMENTS

This Amended Annual Report on Form 10-K/A of Hondo Minerals Corporation, a Nevada corporation, contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms and other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things: the volatility of minerals prices, the possibility that exploration efforts will not yield economically recoverable quantities of minerals, accidents and other risks associated with mineral exploration and development activities, the risk that the Company will encounter unanticipated geological factors, the Company’s need for and ability to obtain additional financing, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration and development plans, the exercise of the approximately 72.8% control the Company’s two officers and directors collectively hold of the Company’s voting securities, other factors over which we have little or no control; and other factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

Our management has included projections and estimates in this Form 10-K/A, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the SEC or otherwise publicly available. The Company is currently an exploration stage company and will continue to be an exploration stage company until we have established mineral reserves (defined herein). However, limited work has been performed and there is no assurance that a commercially viable mineral deposit exists on any of our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined. Internal and third party verification of our processing methods and properties have not been performed and all work is exploratory in nature. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

All references in this Form 10-K/A to the “Company”, “Hondo”, “we”, “us,” or “our” are to Hondo Minerals Corporation, unless otherwise specified.

PART I

ITEM 1. BUSINESS

I. ORGANIZATION WITHIN THE LAST FIVE YEARS

We are a forward-thinking, innovative and dynamic mining Company with headquarters in Addison, Texas. We were incorporated under the laws of the State of Nevada on September 25, 2007. We are engaged in the acquisition of mines, mining claims, and mining real estate in the United States, Canada and Mexico.

On February 8, 2011, Tycore Ventures, Inc., closed a transaction pursuant to that certain Share Exchange Agreement (the “Share Exchange Agreement”) with Hondo Minerals, Inc., a Nevada corporation (“HMI”) and the shareholders of HMI (the “HMI Shareholders”), whereby the Company acquired 100% of the outstanding shares of common stock of HMI (the “HMI Stock”) from HMI Shareholders. By agreement and after cancellations, Tycore exchanged 17,783,888 shares of its common stock for all of the issued and outstanding common shares of HMI. As a result of closing the transaction, HMI Shareholders then held approximately 76% of the Company’s issued and outstanding common stock. Thereafter, Tycore Ventures, Inc. changed its corporate name to Hondo Minerals Corporation.

The Company is currently an exploration stage company and will continue to be an exploration stage company until we have established mineral reserves. However, limited work has been performed and there is no assurance that a commercially viable mineral deposit exists on any of our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined. Internal and third party verification of our processing methods and properties have not been performed and all work is exploratory in nature.

II. GLOSSARY

The following defined technical geological terms (or variations thereof) are used in our Annual Report:

Term Definition

| Amphibole | Any of a large group of structurally similar hydrated double silicate minerals, such as hornblende, containing various combinations of sodium, calcium, magnesium, iron, and aluminum. |

| Andesite | Medium to dark coloured vesicular volcanic rocks, mostly fine grained with typically porphyric texture. |

| Anticline | A ridge or ridge-shaped fold of stratified rock in which the strata slope downward from the crest. |

| Aplite | Light-colored and fine-grained granitic rock consisting chiefly of quartz and feldspars. |

| Aresenopyrite | Metallic silver-white to steel gray mineral. The most common arsenic mineral and principal mineralized material of arsenic; occurs in many sulfide mineralized material deposits, particularly those containing lead, silver, and gold. |

| Assay | The testing of a metal or mineralized material to determine its ingredients and quality. |

| Batholith | A very large igneous intrusion extending deep in the Earth's crust. |

| Bedrock | A deposit of solid rock that is typically buried beneath soil and other broken or unconsolidated material. |

| Biotite | A black, dark brown, or greenish black micaceous mineral. |

| Breccia | A coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix |

| Calcite | A mineral composed of calcium carbonate (CaCO3). |

| Cenozoic | Relating to or denoting the most recent era, following the Mesozoic era and comprising the Tertiary and Quaternary periods. The Cenozoic period covers the period from approximately 65.5 million years ago to the present day. |

| Chalcopyrite | A mineral, a sulfide of copper and iron. |

| 3 |

| Chlorite | A generally green or black secondary mineral, often formed by metamorphic alteration of primary dark rock minerals that appears as a spot of green and resembles mica. |

| Clastic | Denoting rocks composed of broken pieces of older rocks. |

| Cretaceous | Of, relating to, or denoting the last period of the Mesozoic era, between the Jurassic and Tertiary periods. The Cretaceous period lasted from about 146 million to 65 million years ago. |

| Crystal | A piece of a homogeneous solid substance having a naturally geometrically regular form with symmetrically arranged plane faces. |

| Crystalline | Of, relating to, or composed of crystals. |

| Development Stage | Includes all issuers engaged in the preparation of an established commercially minable deposit (reserves) for its extraction which are not in the production stage. |

| Diabase | Fine- to medium-grained, dark gray to black intrusive igneous rock. |

| Dike | A sheetlike body of igneous rock that cuts across layering or contacts in the rock into which it intrudes. |

| Dip | The angle that a rock unit, fault or other rock structure makes with a horizontal plane. Expressed as the angular difference between the horizontal plane and the structure. The angle is measured in a plane perpendicular to the strike of the rock structure. |

| Diorite | Coarse-grained, intrusive igneous rock that is intermediate in composition between granite and gabbro. |

| Dore | Unrefined gold and silver bullion bars. |

| Electrowinning | Process used to remove metal ions from liquid solutions. Most often used to recover precious metals. |

| Exploration Stage | Includes all issuers engaged in the search for mineral deposit (reserves) which are not in either the development or production stage. |

| Extrusive Rock | Igneous rocks which form by the crystallization of magma at the surface of the Earth. |

| Facies | The character of a rock expressed by its formation, composition, and fossil content. |

| Fault | A fracture or fracture zone in rock along which movement has occurred. |

| Feldspar | Any of a group of abundant rock-forming minerals occurring principally in igneous, plutonic, and some metamorphic rocks, and consisting of silicates of aluminum with potassium, sodium, calcium, and, rarely, barium. |

| Fissure | A long, narrow opening in a rock, made by cracking or splitting. |

| Foliation | The set of layers visible in many metamorphic rocks as a result of the flattening and stretching of mineral grains during metamorphism. |

| Gabbro | A dark, coarse-grained plutonic rock of crystalline texture. |

| Galena | A bluish, gray, or black mineral of metallic appearance, consisting of lead sulfide. |

| Gneiss | A metamorphic rock with a banded or foliated structure, typically coarse-grained. |

| Gouge | A layer of soft, earthy or clayey material along the wall of a vein. |

| Halide | Minerals formed by combining a metal with one of the five halogen elements. |

| Hornblende | A green to black amphibolic mineral formed in the late stages of cooling in igneous rock. |

| Horse-tailing | Gradual splitting. |

| Hydrothermal | Of, relating to, or denoting the action of heated water in the Earth’s crust. |

| 4 |

| Igneous | Relating to or involving volcanic processes. |

| Intrusive Rock | Igneous rocks which form by the crystallization of magma at a depth within the Earth. |

| Jurassic | Of, relating to, or denoting the second period of the Mesozoic era, between the Triassic and Cretaceous periods. The Jurassic period lasted from about 208 million to 146 million years ago. |

| Lamprophyre | Any of a group of dark gray to black intrusive igneous rocks that generally occur as dikes. |

| Lode | A mineral deposit in solid rock. |

| Mafic | A term used to describe an igneous rock that has a large percentage of dark-colored minerals such as amphibole, pyroxene and olivine. Also used in reference to the magmas from which these rocks crystallize. Mafic rocks are generally rich in iron and magnesium. |

| Matrix | The solid matter in which a fossil or crystal is embedded. |

| Mesothermal | A mineral deposit formed at moderate temperature and pressure, in and along fissures or other openings in rocks, by deposition at intermediate depths, from hydrothermal fluids. |

| Mesozoic | Of, relating to, or denoting the era between the Paleozoic and Cenozoic eras, comprising the Triassic, Jurassic and Cretaceous periods. The Mesozoic period lasted from about 252 million to 66 million years ago. |

| Metallurgy | Domain of materials science that studies the physical and chemical behavior of metallic elements, their intermetallic compounds, and their mixtures, which are called alloys. It is also the technology of metals: the way in which science is applied to their practical use. |

| Metamorphic Rock | Rock that has undergone a change from its original form due to changes in temperature, pressure or chemical alteration. |

| Mica | A shiny silicate mineral with a layered structure, found as minute scales in granite and other rocks, or as crystals. |

| Mineral Reserve | That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. | |

1) Proven (Measured) Reserves. Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well- established. | ||

2) Probable (Indicated) Reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| Mineralization | The concentration of metals and their chemical compounds within a body of rock. |

| Outcrop | A segment of bedrock exposed to the atmosphere. |

| Paleozoic | Of, relating to, or denoting the era between the Precambrian era and the Mesozoic era. The Paleozoic era lasted from about 570 million to 245 million years ago. |

| Pegmatitic | A coarsely crystalline granite or other igneous rock with crystals several centimeters in length. |

| Porphyry | A heterogeneous rock characterized by the presence of crystals in a relatively finer- grained matrix. |

| 5 |

| Precambrian | Noting or pertaining to the earliest era of earth history, ending 570 million years ago, during which the earth's crust formed and life first appeared in the seas. |

| Production Stage | Includes all issuers engaged in the exploitation of a mineral deposit (reserve). |

| Pyrite | A common mineral that consists of iron disulfide, has a pale brass-yellow color and metallic luster. |

| Pulverize | To reduce (as by crushing or grinding) to very small particles (as in fine powder or dust). |

| Quartz | A mineral whose composition is silicon dioxide. A crystalline form of silica. |

| Quaternary | Period of time covering approximately the last two million years up to the present day. |

| Rhyolite | A pale fine-grained volcanic rock of granitic composition. |

| Schist | A coarse-grained metamorphic rock that consists of layers of different minerals. |

| Shear | A strain produced by pressure in the structure of a substance, when its layers are laterally shifted in relation to each other. |

| Shear Zone | Zone composed of rocks that are more highly strained than rocks adjacent to the zone. |

| Silica | A hard, unreactive, colorless compound, SiO2, that occurs as the mineral quartz. |

| Silicate | Any of the many minerals consisting of silica combined with metal oxides, forming a major component of the rocks of the earth's crust. |

| Stock | Discordant igneous intrusion having a surface exposure of less than 40 square miles (100 km2), differing from batholiths only in being smaller. |

| Strain | A change in the volume or shape of a rock mass in response to stress. |

| Stratum (Plural: Strata) | Layer of rock or soil with internally consistent characteristics that distinguishes it from contiguous layers. |

| Striation | One of multiple scratches or minute lines, generally parallel, inscribed on a rock surface by a geologic agent, i.e., glaciers, streams, or faulting. |

Strike

| The direction of the line formed by the intersection of a fault, bed, or other planar feature and a horizontal plane. Strike indicates the attitude or position of linear structural features such as faults, beds, joints, and folds. |

| Sulfide Mineral | Any member of a group of compounds of sulfur with one or more metals. Most of the sulfides are simple structurally, exhibit high symmetry in their crystal forms, and have many of the properties of metals, including metallic lustre and electrical conductivity. |

| Tertiary | Relating to the first period of the Cenozoic era, about 65 to 1.64 million years ago. |

Trenching | The removal of overburden to expose the underlying bedrock. |

| Trend | The direction of the line formed by the intersection of a fault, bed, or other planar feature and a horizontal plane. Strike indicates the attitude or position of linear structural features such as faults, beds, joints, and folds. |

| Triassic | Of, relating to, or denoting the earliest period of the Mesozoic era. The Triassic period lasted about 245 million to 208 million years ago. |

| Vein | An occurrence of mineralized material with an irregular development in length, width and depth usually from an intrusion of igneous rock. |

| Vesicles | A small cavity formed in volcanic rock by entrapment of a gas bubble during solidification. |

| Volcanic | Characteristic of, pertaining to, situated in or upon, formed in, or derived from volcanoes. |

| 6 |

III. PRINCIPAL PROJECTS

Our portfolio of assets include: the Tennessee Mine in the Wallapai Mining District near Chloride, Mohave County, Arizona; the Schuylkill Mine in the Wallapai Mining District near Chloride, Mohave County, Arizona (adjacent to the Tennessee Mine); as well as several additional mining claims located in Arizona, Nevada, Utah, and Colorado. Refer to Exhibit 99.2 for a complete list and description of all of our properties. On an ongoing basis, the Company will evaluate our exploration portfolio to determine ways to increase the value of our properties.

At this stage of our business, the Tennessee Mine and Schuylkill Mine are our principal exploration properties and our other properties are not material. At the Tennessee Mine, the focus is the processing of the one million ton tailings pile at the mouth of the mine. At the Schuylkill Mine, there are no processing or exploration activities being carried out and no future plans to carry out such activities. The Company is currently an exploration stage company and will continue to be an exploration stage company until we have established mineral reserves. However, limited work has been performed and there is no assurance that a commercially viable mineral deposit exists on any of our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined. Internal and third party verification of our processing methods and properties have not been performed and all work is exploratory in nature.

(a) Location and Access to Properties

The Tennessee/Schuylkill properties are located in the Wallapai Mining District of the Cerbat Mountain Range northeast of Kingman, Arizona. The District is about 10 miles long and 4 miles wide, trending NW obliquely across the Cerbat Range. There are about 225 mines, plus an estimated 1,000 shallow pits, shafts, and prospects in the District. The Tennessee/Schuylkill properties are located in premier silver regions.

We are able to access the Tennessee Mine and Schuylkill Mine by highways and paved roads and use trucks to travel to and from these properties. We do not utilize railroads to access the properties. We use generators to power our facilities at the Tennessee Mine and use line power from a local service provider to provide lighting on the properties. We provide our own water to the properties from three water wells that we have drilled.

(b) Acquisition, Mineral Rights and Additional Information

The Company purchased the Tennessee Mine and the Schuylkill Mine together on November 15, 2007 pursuant to an Asset Purchase Agreement and has full ownership of both claims. Both claims are patented, exploration, lode mining claims. Our mineral rights on the Tennessee Mine and Schuylkill Mine include the mineral and surface rights. Our rights are perpetual unless and until we sell our claims and there are no conditions that must be met to retain our rights on these claims, other than the annual payment of applicable taxes. There are no underlying agreements or royalties to be paid in regard to these claims.

Additional identifying information regarding the Tennessee Mine and Schuylkill Mine is as follows:

| Property Name | State and County | Township, Range & Section | Claim Number | Expiration of Claims | Date of Purchase | Area of Claim in Acres |

| Tennessee Lode & Great Lead Lode Mining Claims | State of Arizona, Mohave County | 24N, 18W, 3 | 308-04-013 | Perpetual | 11/15/2007 | 34.14 |

| Schuylkill Lode Mining Claim | State of Arizona, Mohave County | 24N, 18W, 34 | 340-10-009 | Perpetual | 11/15/2007 | 4.95 |

(c) Rock Formations and Mineralization

Rocks on the Tennesssee/Schuylkill properties consist of Precambrian crystalline rocks, chiefly of granitic composition, cut by large masses of Mesozoic granite. Dikes are scattered throughout the area. Some are parallel to the prominent northwest-trending system of veins, but others trend in various directions. Remnants of volcanic rocks of probable tertiary and quaternary age are around the margins of the Cerbat Range but are not present in the District proper.

The Precambrian rocks consist of a complex of amphibolite, hornblende schist, biotite schist, chlorite schist, diorite gneiss, granite and associated pegmatitic bodies, granite gneiss, schistose granite, granitic schist, and garnetiferous schist. Granite and amphibolite are the most widespread types, and the granite is predominant.

The amphibolites, which is one of the oldest rocks in the area, is a dark green to black, fine to medium-grained rock commonly epitomized and cut by granite pegmatite intrusions. It is widely distributed throughout the area but is particularly conspicuous near Chloride and in the low hills between Cerbat Canyon and Mineral Park Wash.

| 7 |

The Precambrian granites are represented by many types of bodies. Some of the bodies are distinct and separate intrusions but others are probably differentiation facies. Typically, the rock is light grey, medium-grained, gneissic granite containing a small amount of mafic minerals, chiefly biotite. Weathered surfaces are usually light buff, less commonly reddish-brown.

Chloride, which is in the central part of the District, is where a large granite stock has intruded the Precambrian granites, gneisses, and schists. Its age is tentatively assigned to late Jurassic or early Cretaceus, the same as the batholiths of California and western Nevada. The granite is essentially medium-grained, slightly porphyritic, and intensely altered, although there are many facies of fine or coarse-grained granite, granite porphyry, porphyritic granite, and granite pegmatite. Numerous small stocks and irregular bodies of greenish-black gabbro and associated diabase dikes occur most commonly in the southern part of the district. These are probably differentiation facies of the granite stock. Mineralizing solutions that formed the veins in the district are believed to be genetically related to the late Mesozoic granite intrusion.

Dikes of many different compositions are widespread. In thickness, they range from a few inches to 300 feet. Some extend along strike for only a hundred feet or less whereas others, notably the rhyolites, extend for long distances. The most abundant dike rocks are granite pegmatites of both Precambrian and late Mesozoic age, and dikes formed from them are usually narrow and of short lateral extent. Aplites are not common. Other dike rocks, some of which are abundant locally, include lamprophyre, andesite, diabase, porphyritic granite, granite porphyry, and rhyolite, and are probably differentiation products of the late Mesozoic intrusion.

The structure of the rocks is complex. Gneissic and schistose structures are common; the prevailing schistosity strikes NE with steep dips either NW or SE. Large and small folds, generally with NE trends, are common. The most predominant fold is near Chloride where the outcrop pattern of the amphibolite indicates a northeast-plunging anticline. Prominent joint systems, sheeting, and small shear zones, commonly with NW strikes, are abundant. Faulting is widespread and is usually well expressed by a prominent system of northwest-trending fault fissures in which many of the later veins are located. The dips of the fissures are generally steep, and NE dips predominate. In places, the fault fissures are in conjugate systems. The fissures show much branching and in a few places, considerable horse-tailing. Gouge and breccia, as well as numerous tear faults in the walls, are present along some fault fissures. The direction of the striations along the walls of the faults is nearly horizontal in places, but a greater number of striations show dips ranging from horizontal to parallel with the dip of the steep fault surface.

Deposits are mesothermal veins of prevailing northwestward strike and steep dip. Their gangue is quartz, in many places shattered and re-cemented by later calcite. The primary minerals are common sulfides of iron, lead, zinc and silver. Gold occurs locally in the sulfide zones. Oxidized zones contain secondary lead minerals, native silver, gold and silver chloride.

(d) History of the Tennessee Mine and Schuylkill Mine

The Tennessee/Schuylkill properties include two historic underground mines operated until 1947. The Tennessee Mine operated from the late 1800’s until 1947 producing lead, zinc, gold and silver. The Tennessee Mine was at one time the largest producing silver mine in Arizona and the southwestern United States.

(e) Previous Work Completed and Present Condition of the Claims

The Tennessee/Schuylkill properties are without known reserves and all activities carried out on such properties are exploratory in nature. However, limited work has been performed and there is no assurance that a commercially viable mineral deposit exists on these properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined. Internal and third party verification of our processing methods and properties have not been performed and all work is exploratory in nature.

Since early 2010, the Company has been building and developing a plant on the Tennessee Mine designed to process precious and base metals in the Tennessee and Schuylkill Mines. A more detailed description of the plant is described herein under Section III(f) entitled, “Equipment, Infrastructure and Other Facilities.”

In mid-July 2012, the Company began processing tailings from the Tennessee Mine; however, the Company has yet to realize any revenues from those operations. During the last half of July 2012, the Company processed approximately 125 tons of tailings and produced 94 carbon cells of metals that have yet to be evaluated.

As of the date of this Report, the Company is focused on processing the tailings and there is no exploration activity being conducted at the Tennessee Mine. There are no future detailed plans to conduct exploration on the property. Accordingly, the Company has not prepared any exploration programs, timetables or budgets and has not identified any parties to carry out exploration work. As the Company is not currently conducting any exploration activities and has no future detailed plans to conduct exploration on the Tennessee Mine, we have not established Quality Assurance/Quality Control protocols. Internal and third party verification of our processing methods and properties have not been performed and all work performed is exploratory in nature. As of July 31, 2012, the total costs incurred by the Company on the Tennessee Mine are $13,757,798. At this time, the Company cannot determine its future costs.

| 8 |

Figure 1. Examples of Float from Lode Veins

Figure 2. Close Up of a Silver Vein at the Tennessee Mine.

Figure 3. Projection of Silver Vein Extending to the Top of the Mountain.

(f) Equipment, Infrastructure and Other Facilities

In November 2011, the Company completed construction of its first commercial scale extraction plant to process the one million ton tailings pile present at the Tennessee Mine in Chloride, Arizona. At that time the Company intended to extract gold, silver, zinc, lead, and other metals that it believed to be present in the pile. The Company took delivery, installed, tested, and began operating all equipment necessary for commercial scale processing of the ELeach™ (hereinafter, “ELeach”) step of the extraction process. Leaching vats were modified to remove agitators and add aeration systems to improve the consistency of the leaching process. The Company was able to leach four ton batches at that time. The Company took delivery of production scale ELeach solvent generators, and installed and fine-tuned them. Each generator can produce 200 liters/minute of the high pH electrolyzed water that is the key technical innovation of the ELeach process. Two machines were delivered from Innovative Designs and Technology (Japan), at a cost of over $250,000 each. The Company expects the generators to be fully installed and operational in December 2012. Until the large generators are operational, the Company is using its small lab-scale solvent generators (4 liters/minute) to test and refine the leaching process step.

| 9 |

At that time, the Company ordered, and was awaiting delivery of, the production scale electroplating systems known as RenoCells. Electroplating is a standard process to remove metals from the pregnant solution created by the leaching process step. Electrical current is applied to a conductor, which causes the metal to precipitate on the conductor. The conductor is then burned away to leave metal.

The RenoCell is a proprietary machine which performs electroplating on a carbon mesh. The Company is using the RenoCell rather than traditional electroplating systems because of the RenoCell’s ability to electroplate in a three dimensional environment, which increases efficiency. Until volume RenoCells were installed, the Company extracted metal in very small batches with its lab-scale system.

The Company experienced substantial delays in the delivery and implementation of the RenoCell system. However, as of June 7, 2012, the Company had finally received and installed its 24 Bank RenoCell system and other extraction equipment and testing has begun on the entire processing circuit for initial activities. During the period of the delay, the Company doubled its potential processing capacity with the installation of the additional equipment and can currently process 50 tons/day. During the last half of July 2012, the Company processed approximately 125 tons of tailings and produced 94 carbon cells of metals that have yet to be evaluated. As of the date of this Report, none of the metals that have been processed from the Tennessee Mine are of commercial quality and none have been sold.

In 2012 the Company also completed its on-site, self-contained laboratory in Chloride. The final equipment installed included two spectrometers as well as traditional assay equipment. With the lab fully outfitted, the Company was able to replicate its proprietary ELeach extraction process on a small scale, which enabled quick testing of proposed process improvements. The spectrometers enabled technicians to closely monitor the extraction process, test optimization strategies on-site, and research prospective properties with in-house assay work.

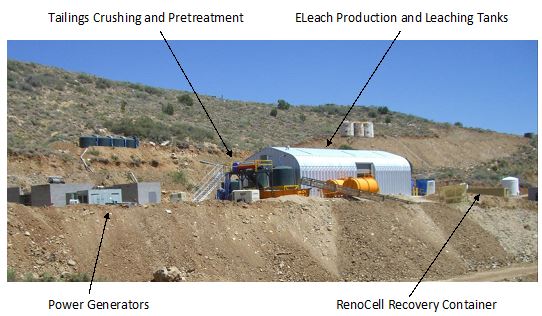

The facilities at the Tennessee Mine are continually expanding. Figure 4 identifies the key facilities installed, as of June 14, 2012, to implement processing of precious metals. Shown in Figure 5 is the laboratory facility located in the town of Chloride, AZ. As of the date of this Report, the Company’s processing plant and equipment is technologically modern and is in excellent condition. There are no subsurface improvements on the Tennessee Mine.

Figure 4. Key Facilities at the Tennessee Site

Figure 5. Hondo Laboratory Located in Chloride, Arizona.

| 10 |

IV. PROCESSING METHODS

We take a different approach from typical industry practices in that we are committed towards finding more efficient and more environmentally friendly mining processes than what is typical in the industry. For example, the usual approach in the industry is to do extensive sampling of the mining site to get enough assays to determine the precious metal content of the site. The weakness of this approach is that it can have substantial costs and can require a company to expend a significant portion of its financial resources. Because the Company is forward-thinking, innovative and dynamic in its approach to mining processes, the Company’s approach to sampling differs from typical industry practices.

For instance, with regard to processing at the Tennessee Mine, the typical and historical values of mine dumps and tailings at the Tennessee Mine have been based primarily on free milling mineralized materials and free gold, silver, and other base metals found in tailings. Samplings in the past did not focus on the values in the concentrated metal sulfides which are present in the tailings. Prior to the 1980s, an economic way to process metal sulfide mineralized materials did not exist. Thus, these types of mineralized materials were discarded with the mine tailings. Developments in the 1980s by pioneers such as Dr. Richard F. Hewlett and others brought new leaching methods and technologies to this field, such as the processing of Nevada’s Carlin Trend. The Company, with its knowledge of how to process metal sulfides of this nature, incorporated this knowledge as one of the core constituencies of its business development plans. The Company was aware that historically, halide leaching was a costly process, but was open to the possibility that advances in this technology might exist. We employ revolutionary new technologies to recover metals from mineralized material concentrates and mine tailings. Among these technologies are the “ELeach Processing” and “Aqua-Regia Processing,” and “RenoCell Processing.” With the advent of these new processing methods, such as the ELeach process, the Company is now able to process tailings to recover metals. The Company has also licensed the ELeach process.

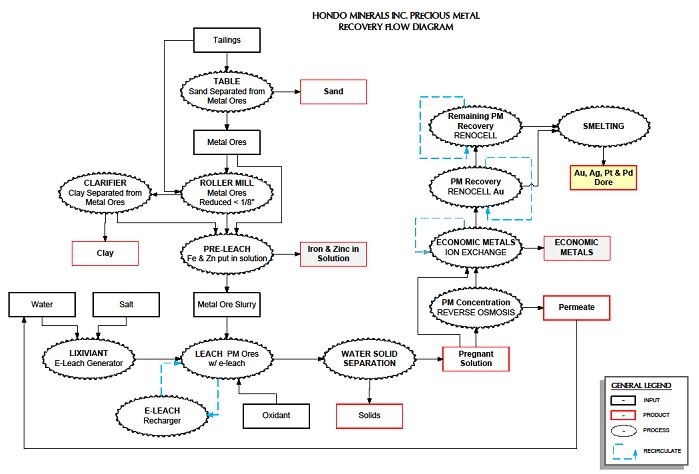

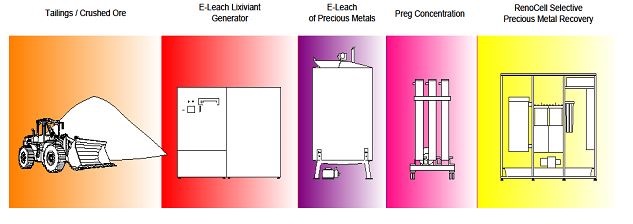

An overall flow diagram of the processing of precious metal at the Hondo site is shown in Figure 6. A simplified illustrated version is shown in Figure 7.

| 11 |

Figure 6. Flow Diagram of the Processes Involved in the Processing of Precious Metal at the Tennessee Mine

SULFIDE ENTWINED PM LEACH &

SELECTIVE PRECIOUS METAL RECOVERY

Basic Steps - Process Flow Diagram

Figure 7. Basic Steps in the Hondo Mining Process

| 12 |

(a) ELeach Process

ELeach is an environmentally friendly medium and technique that has been developed for recovering metals from mineralized material concentrates and mine tailings. ELeach has also been successfully applied to recovering metals and deleterious metals from toxic materials such as Coal Combustion Products (CCP). ELeach is currently in a patent pending/Patent Cooperation Treaty status.

Current precious metal recovery techniques often involve the use of strong chemicals, such as cyanide and corrosive acids, that are expensive to use onsite and are environmentally questionable. The disposal of CCP has also become a problem because of regulatory issues concerning heavy metals.

ELeach is produced through an on-site generator which enhances mixed oxidants in source water and then integrated as a leachant based upon its unique interaction with different elemental groups. ELeach optimizes specific chemical parameters such as pH, Oxidation Reduction Potential (ORP) and free halides while additional oxidizing agents are added when dictated by the mineralized material being leached.

ELeach can be used to replace or enhance the expensive, highly-regulated and environmentally-challenging chemicals that must be shipped to and stored at the site. For some cases such as gold sulfide mineralized material, where cyanide meets its challenges, ELeach has been successfully used to recover gold (ELeach leaches 20-60 times faster than cyanide). For mineralized material leaching applications where cyanide was previously used, ELeach can be used to neutralize the residual cyanide. ELeach and its process not only accelerates the gold and silver leaching processes, but also leaches out the platinum group metals that are not soluble in cyanide.

ELeach is not used for the liberation of free gold but is used to leach mineralized materials and high grade concentrates of fine gold and free gold in a microscopic state.

The benefits of ELeach are as follows:

1. Onsite processing (see Figure 4).

2. User, environmental, storage, transportation and disposition safety.

3. Cost effectiveness.

4. Exponentially effective over cyanide.

As each mineralized material bears a unique and individualized finger print, a proprietary ELeach is created for each mineralized material and for each mining process.

(b) Aqua-Regia Processing

Aqua-Regia is the use of chemical corrosives and oxidizers to remove precious metals from mineralized materials and suspend them in solution to be processed in final refining. Washed or scrubbed mineralized material is dissolved in a solution of hydrochloric acid (HCL) and nitric acid (HNO3), and heated to dissolve and release gold (Au) and silver (Ag) carried in sulfides.

Solution put through this processing is then filtered and a trade specific mix is then added to remove all Au and Ag content for final refining.

(c) RenoCell Process

The RenoCell Technology, provided by Renovare, has been developed to provide superior, low-cost, high performance solutions for the removal of metals from process and waste waters in the metal plating, microelectronics, mining and related industries. RenoCells are compact and modular, and are based on a unique electrochemical technology that utilizes a patented three-dimensional cathode design to reduce metal concentrations in process and wastewater to sub-ppm range with the lowest cost of ownership. The net result is that the RenoCell can achieve much lower final metal ion concentrations using far less energy. A specific example of how Renovare’s electrowinning technology improves the recovery of gold is detailed in a Renovare Technical Bulletin available on Renovare’s website located at http://www.renovare.com, under the heading “Reviewing the Operation of Gold Electrowinning Cells.”

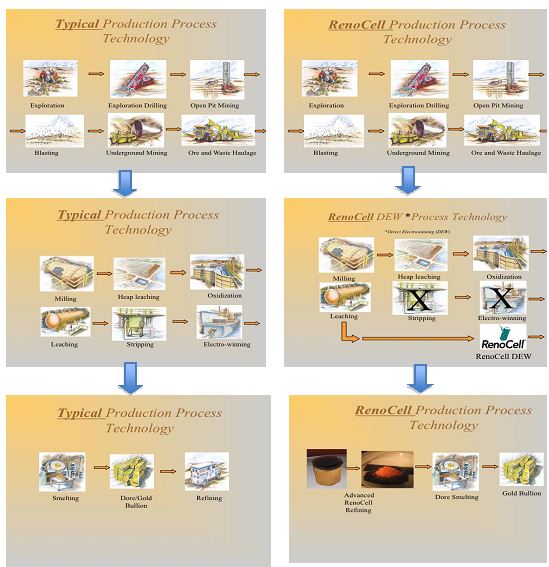

Figure 8 illustrates the advantages of the RenoCell technology over conventional mining processes. Figure 9 is a picture of a 40 foot container at the Tennessee Mine site that is outfitted with RenoCells capable of full scale recovery of precious metals from leachant produced by the installed full scale ELeach systems. The facility in Figure 9 is capable of full scale recovery of precious metals from leachant produced by the installed full scale ELeach systems.

| 13 |

Figure 8. Comparison of Typical versus RenoCell Mining Production Process Technology.

Figure 9. RenoCell Processing Facility Installed in a 40 Foot Container at the Tennessee Mine Site

| 14 |

V. ANALYSIS OF THE COMPANY’S MATERIALS

A metallurgical assay is a compositional analysis of a mineralized material, metal or alloy. For centuries, the fire assay (cupellation) has been the accepted assay technique for precious metals, however the fire assay process is time consuming and complex (as of the date of this Report, we have not performed any fire assays). Sample preparation of mineralized material from the mine involves crushing, splitting and pulverizing. Since the original mineralized material sample may be large (100’s of pounds), an accepted method is used to get a representative sample for testing (usually 30 grams). The precious metal content of mineralized material is commonly quoted in ounces (oz) per ton. Actually, the correct weight of the mineralized material sample varies depending on the units used for ounces and ton (it’s 29.166 for troy ounces per short ton, see www.edumine.com/Xtoolkit/XconTool/convert.htm).

Newer methods of determining the chemical composition of mineralized material are based on mass spectrometry (such as Inductively Coupled Plasma – Atomic Emission Spectroscopy, Inductively Coupled Plasma - Mass Spectrometry (“ICP-MS”) and x-ray diffraction (XRD). The results of these tests are usually reported in parts per billion (ppb) or parts per million (ppm). For example, 1 ppm corresponds to 0.001grams/1000 grams and can be expressed as 1 mg/kg or 1 mg/L.

Hondo has established a laboratory in Chloride that is capable of processing the mine tailings to the desired mesh size, selecting 30 gram (Assay Ton) samples in accordance with industry practices, leaching the sample in beakers of ELeach, and analyzing the resultant leachant for 72 elements using ICP-MS. The ICP-MS machine (Thermo Fisher Scientific iCAP 6300/6500) is calibrated to the manufacture’s specifications on a daily basis to insure accurate readings. If the machine is not calibrated (or will not calibrate), it will not operate. The calibration methods used by the lab are in alignment with the calibration methods used by independent third party assay laboratories such as ACME Labs.

As of the date of this Report, the Company is focused on processing the tailings and there is no exploration activity being conducted at the Tennessee Mine. The Company will continue to be an exploration stage company until we have established mineral reserves. However, limited work has been performed and there is no assurance that a commercially viable mineral deposit exists on any of our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined. Internal and third party verification of our processing methods and properties have not been performed and all work is exploratory in nature.

VI. RECENT DEVELOPMENTS

On September 29, 2011 the Company released a progress report announcing that the Company intends to list its shares on the American Stock Exchange as soon as practical. A listing involves satisfying a number of regulatory requirements, including SEC filings, capital adequacy, and minimum levels of trading volume and price. There is no guarantee that the Company will be able to meet these requirements and achieve the listing. The Company continues to evaluate potential investment banking relationships to assist in implementing strategies to achieve the listing, as well as increase liquidity and research coverage.

On December 12, 2011, Skip Headen resigned from all corporate offices with the Company. Mr. Headen still served as an Independent Director for the Company. The resignation did not involve any disagreement with the Company.

On December 12, 2011, the Board appointed Chris Larson as Chief Financial Officer, Secretary and as a Member of the Board of Directors of the Company.

On January 5, 2012 the Company announced preliminary success with its processing facility at the Tennessee Mine. The Company processed pregnant leached solutions (PLS) using its exclusive ELeach process. If the material being leached in the ELeach solution contained metals, a chemical reaction occurred. Once the chemical reaction began to subside or slow down and became relatively stable, we knew that the leaching was complete or near complete and that metals were now contained in the solution. The focus of our work was to test the efficacy of and to improve the leaching process itself, accordingly, the quantity and type of metals contained in each solution that we processed is unknown.

Metal was extracted from the PLS using its Renocell electroplating systems. The Company filled two of its Renocells with metals and dried the Renocells, the final step in preparation for metal extraction.

On March 8, 2012, the Company announced that it had begun using its proprietary ELeach extraction technology to evaluate several mining company’s resources. The initial executed agreements represent the first success in the Company’s expanded business model, which contemplates supplying its proprietary extraction technology to mine operators under joint ventures or licensing arrangements. To date, ELeach has only been used at the Tennessee Mine.

During the nine months ended April 30, 2012 the Company sold 4,089,400 shares of its common stock at $.50 per unit for net proceeds of $2,044,700. A unit consists of one share of common stock at a par value of $.001, a warrant to purchase one share of common stock at $2.00 per share, and a warrant to purchase one share of common stock at $3.00 per share.

| 15 |

During the month of April 2012, the Company received $1,000,000 cash proceeds through a senior loan agreement. In connection with the $1,000,000 senior loan payable were one million Class ‘G’ warrants and one million Class ‘H’ warrants. The Class ‘G’ warrants have an exercise price of $0.50, while the Class ‘H’ warrants have an exercise price of $0.75; both classes of warrant may be exercisable for the purchase of three shares of the Company’s common stock. All unexercised warrants expire on April 30, 2014. These warrants were valued at $415,856 using the Black-Scholes-Merton Valuation Model with the stock price on the date of the grant at either $0.43 for warrants associated to the senior loan dated April 26, 2012, or $0.35 for warrants associated to the senior loan dated April 30, 2012. The expected volatility was calculated at 76.06%, while the risk-free rate-of-return of 0.26% was based on a two-year Nominal Treasury constant maturity

Subsequent to the quarter ended April 30, 2012, the Company received an additional $250,000 cash proceeds through the senior loan agreement, also with warrants attached.

As of July 31, 2012 the Company had issued an aggregate of 11,716,880 shares of common stock, par value $0.001 per share to Ironridge Global IV, Ltd. (“Ironridge”) necessary to perfect the settlement of $1,648,544.39 in bona fide accounts payable of the Company. The stipulated settlement effectively ended the litigation and we do not anticipate future litigation with Ironridge Global IV, Ltd. unless we must defend or assert our rights in law or equity under the terms of the settlement.

VII. EMPLOYEES

As of the date of this Report, Hondo has 4 employees. However, Hondo pays an independent contractor that has 38 full-time employees working at the Tennessee Mine and tailings pile. Hondo may use third-party consultants to assist in the completion of various projects. Third-parties are instrumental to keep the development of projects on time and on budget. Management expects to continue to use consultants, attorneys, and accountants as necessary.

VIII. EXECUTIVE OFFICES

Executive offices are located at 15303 N. Dallas Parkway, Suite 1050 Addison, Texas 75001.

| 16 |

ITEM 1A. RISK FACTORS

As a “smaller reporting Company,” as defined in Rule 12b-2 of the Exchange Act, Hondo is not required to provide the information called for by this Item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Current business address is 15303 N. Dallas Parkway, Suite 1050, Addison, Texas 75001. Telephone number is (214) 444-7444.

Hondo believe this space is adequate for its current needs. In addition to the business address, there are also interests stated in the mining locations discussed herein.

ITEM 3. LEGAL PROCEEDINGS

From time to time, the Company may become subject to various legal proceedings that are incidental to the ordinary conduct of its business. Although the Company cannot accurately predict the amount of any liability that may ultimately arise with respect to any of these matters, it makes provision for potential liabilities when it deems them probable and reasonably estimable. These provisions are based on current information and legal advice and may be adjusted from time to time according to developments.

On October 26, 2012, Ironridge filed an Ex Parte Application to enforce a provision of the Stipulated Settlement entered into with the Company on April 18, 2012. Ironridge moved for an order requiring the Company to issue additional shares to Ironridge in addition to the Settlement Shares already issued. The Company vehemently opposed enforcement of the Stipulated Settlement in open court on October 30, 2012. However, the Court ordered that Plaintiff prepare a Proposed Order and Judgment in accordance with the Stipulated Settlement and submit the documents for the Court’s approval. Upon receiving Plaintiff’s Proposed Order and Judgment, the Company filed an opposition to the entry of Plaintiff’s Proposed Order and Judgment on November 3, 2012 as contrary to public policy, unconscionable and void. The Company plans to continue to aggressively defend any judgment entered on the Stipulated Settlement, zealously oppose payment of the additional shares to Ironridge and will not fail to assert the Company’s legal and equitable rights in any court of law. A judgment has yet to be entered on the matter.

On May 25, 2011, John Theodore Anderson (“Plaintiff”) filed a Complaint against the Company in the United States District Court, District of Nevada. The Plaintiff alleged a breach of contract and sought money damages against the Company. On August 8, 2011, a judgment was entered in favor of Hondo Minerals, Inc., William R. Miertschin, Richard M. Hewitt, Advanced Natural Tech. Services, Rhena Drury, Ivan Webb, Wild Quail Resources, Inc. against Plaintiff, John Theodore Anderson. Mr. Anderson appealed the decision. On October 18, 2011, Mr. Anderson’s appeal was denied and the judgment against Mr. Anderson was affirmed.

Other than the foregoing, we know of no material, existing or pending legal proceedings against our Company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFETY DISCLOSURES

The safety and health of all employees is our highest priority. Management believes that safety and health considerations are integral to, and compatible with, all other functions in the organization and that proper safety and health management will enhance processing and reduce costs. Our approach towards the health and safety of our workforce is to continuously improve performance through implementing robust management systems and providing adequate training and safety incentives.

Our objective is zero work place injuries and occupational illnesses. We measure progress toward achieving our objective against regularly established benchmarks, including measuring company-wide Total Recordable Incident Rates (TRIR). During the fiscal year ended July 31, 2012, our TRIR (including contractors) was 3 per 200,000 man-hours worked, compared to the preliminary metal mining sector industry average reported by the U.S. Mine Safety and Health Administration (MSHA) for 2011 of 2.29 per 200,000 man-hours worked. We strive to substantially reduce our TRIR during the upcoming year.

Refer to Exhibit 95.1 for mine safety disclosures required in accordance with Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

| 17 |

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Beginning March, 2011, our common stock was quoted on the OTC Bulletin Board under the symbol “HMNC.OB.” Because we are quoted on the OTC Bulletin Board, our common stock may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if it were listed on a national securities exchange. The OTC Bulletin Board prices are quotations, which reflect inter-dealer prices without retail mark-up, mark-down, or commissions and may not represent actual transactions.

The following table sets forth the low and high closing sales prices of shares of our common stock, as reported by the OTC Bulletin Board:

| BID PRICE PER SHARE | ||||||||

| HIGH | LOW | |||||||

| Three Months Ended April 30, 2011 | 1.01 | 2.03 | ||||||

| Three Months Ended July 31, 2011 | $ | 3.87 | $ | 2.02 | ||||

| Three Months Ended October 31, 2011 | $ | 2.29 | $ | 1.40 | ||||

| Three Months Ended January 31, 2012 | $ | 2.04 | $ | 1.30 | ||||

| Three Months Ended April 30, 2012 | $ | 1.67 | $ | 0.48 | ||||

| Three Months Ended July 31, 2012 | $ | .52 | $ | .16 | ||||

HOLDERS

As of the date of this Report, there were approximately 1,414 holders of record of common stock.

DIVIDENDS

Historically, Hondo has not paid any dividends to the holders of common stock and Hondo does not expect to pay any such dividends in the foreseeable future as Hondo expects to retain our future earnings for use in the operation and expansion of its business.

RECENT SALES OF UNREGISTERED SECURITIES

For recent sales other than previously reported, please see notes to financial statements included herewith in Note 7.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Hondo has not established any compensation plans under which equity securities are authorized for issuance.

PURCHASES OF EQUITY SECURITIES BY THE REGISTRANT AND AFFILIATED PURCHASERS

Hondo did not purchase any shares of common stock or other securities during the year ended July 31, 2012.

ITEM 6. SELECTED FINANCIAL DATA

At July 31, 2012, we had total assets of $14,049,298, compared to total assets of $10,182,646 at July 31, 2011. We had cash of $22,118 at July 31, 2012. Total liabilities at July 31, 2012 were $1,207,409 compared to total liabilities of $308,325 at July 31, 2011. Total liabilities as of July 31, 2012 were comprised primarily of payables and accrued expenses. Total shareholders’ equity was $14,049,298 at July 31, 2012, compared to $9,874,321 at July 31, 2011. Components of the change in shareholders’ equity related to sales and to sales and issuances of common stock and net losses during the period.

OPERATING ACTIVITIES

We have not generated positive cash flows from operating activities. For the year ended July 31, 2012, net cash flows used in operating activities were ($1,575,308), compared to net cash flows used in operating activities for the year ended July 31, 2011 of $35,264.

INVESTING ACTIVITIES

For the year ended July 31, 2012, net cash flows used in investing activities were ($4,046,008). Net cash flows used in investing activities were ($4,950,854) for the year ended July 31, 2011. Net cash for both periods was primarily used in building of mining plant.

FINANCING ACTIVITIES

We have financed our operations primarily through advancements or the issuance of equity and debt instruments. For the years ended July 31, 2012 and July 31, 2011, we generated $3,591,386 and $6,957,000 from financing activities, respectively.

| 18 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS

Hondo has generated no revenues since inception and has incurred $7,275,101 in operating expenses for the year ended July 31, 2012. These expenses were comprised of $1,151,435 in officers and directors’ fees; $4,197,433 in professional fees and $847,634 in corporate, general and administrative costs for the year ended July 31, 2012. We incurred operating expenses of $1,768,472 for the year ended July 31, 2011. The net loss for the year ended July 31, 2012 was $(7,423,912). The following table provides selected financial data about the Company for the years ended July 31, 2012 and 2011.

| Balance Sheet Data | July 31, 2011 | July 31, 2012 | ||||||

| Cash and Cash Equivalents | $ | 2,052,048 | $ | 22,118 | ||||

| Total Assets | $ | 10,182,646 | $ | 14,049,298 | ||||

| Total Liabilities | $ | 308,325 | $ | 3,825,063 | ||||

| Shareholders’ Equity (Deficit) | $ | 9,874,321 | $ | 10,224,225 | ||||

LIQUIDITY AND CAPITAL RESOURCES

As of July 31, 2012, the Company’s cash balance was $22,118 compared to $2,052,048 as of July 31, 2011. Hondo may not have sufficient cash on hand to continue its mining activities and to fund ongoing operational expenses beyond 12 months.

Hondo will need to raise funds in the future to fund possible acquisitions or further processing of mineralized materials. Additional funding will likely come from equity financing from the sale of common stock. If successful in completing an equity financing, existing shareholders will experience dilution of their interest in the Company. Hondo does not have any financing arranged and cannot provide investors with any assurance that we will be able to raise additional funding from the sale of common stock. There are no assurances that Hondo will be able to achieve further sales of common stock or any other form of additional financing.

Additional issuances of equity or convertible debt securities will result in dilution to our current shareholders. Such securities might have rights, preferences or privileges senior to our common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to take advantage of prospective new business endeavors or opportunities, which could significantly and materially restrict our business operations.

PLAN OF OPERATION

In 2011, Hondo constructed a pilot processing plant and completed the installation of lab facilities and saw a movement from a construction mode to full processing mode through the first half of 2012. Hondo will continue to expand upon mining activities and opportunities not only at the Tennessee/Schuylkill facility, but at other properties acquired throughout the year.

Currently, the research and development teams and the construction and installation personnel are finalizing Hondo’s facilities at the Tennessee Mine that will carry the Company into processing. Early trial runs of the pilot facility have returned favorable results for processing mineralized materials that may exceed previously planned capabilities.

The objectives of our current year end program will be:

(A) Step into full processing at the pilot facility.

(B) Begin 24-hour tailings processing.

(C) Start excavations of known deposits.

(D) Begin design of automated facility.

(E) Complete testing of all acquired properties.

OFF-BALANCE SHEET ARRANGEMENTS

None.

| 19 |

ITEM 7A. QUANTITIATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Critical Accounting Policies

We have adopted various accounting policies that govern the application of accounting principles generally accepted in the United States "GAAP". We describe our significant accounting policies in the notes to our audited financial statements as of July 31, 2012.

Some of the accounting policies involve significant judgments and assumptions by us that have a material impact on the carrying value of our assets and liabilities. We consider these accounting policies to be critical accounting policies. The judgment and assumptions we use are based on historical experience and other factors that we believe to be reasonable under the circumstances. Because of the nature of the judgments and assumptions we make, actual results could differ from these judgments and estimates and could materially affect the carrying values of our assets and liabilities and our results of operations.

The following is a summary of the more significant judgmental estimates and complex accounting principles, which represent our critical accounting policies.

Property, Plant and Equipment

Depreciation of property, plant and equipment is on a straight line basis beginning at the time it is placed in service, based on the following estimated useful lives:

| Years | ||||

| Machinery and equipment | 3-15 | |||

| Furniture and fixtures | 3-10 | |||

| Engineering equipment | 5-12 | |||

Leasehold improvements are depreciated at the lesser of the remaining term of the lease or the life of the asset (generally three to five years).

Expenditures for major renewals and betterments that extend the useful lives of property and equipment are capitalized. Expenditures for maintenance and repairs are charged to expense as incurred. Equipment has not been placed into service as of July 31, 2012.

Environmental Regulations

Our operations are subject to local, state and federal laws and regulations governing environmental quality and pollution control. To date, our compliance with these regulations has had no material effect on our operations, capital, earnings, or competitive position, and the cost of such compliance has not been material. We are unable to assess or predict at this time what effect additional regulations or legislation could have on our activities.

Securities Exchange Act of 1934 Reports

We maintain an Internet website at the following address: hondominerals.com. The contents of the website are not incorporated into this Form 10-K/A or into our other filings with the SEC. The Company makes available on or through our Internet website certain reports and amendments to those reports that are filed or furnished to the Securities and Exchange Commission (“SEC”) pursuant to Section 13(a) or 15(d) of the Exchange Act. These include annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and beneficial ownership reports on Forms 3, 4 and 5. This information is available on our website free of charge as soon as reasonably practicable after we electronically file the information with, or furnish it to, the SEC.

| 20 |

ITEM 8. FINANCIAL STATEMENTS

HONDO MINERALS CORPORATION

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

| Consolidated Financial Statements | Page | |

| Report of Independent Registered Public Accounting Firm | F-1 | |

| Consolidated Balance Sheets as of July 31, 2012 (Restated) and July 31, 2011. | F-2 | |

| Consolidated Statements of Operations for the years ended July 31, 2012 (Restated) and 2011 | F-3 | |

| Consolidated Statements of Stockholders’ Equity for the years ended July 31, 2012 (Restated) and 2011. | F-4 | |

| Consolidated Statements of Cash Flows for the years ended July 31, 2012 (Restated) and 2011. | F-5 | |

| Notes to Consolidated Financial Statements (Restated) | F-7 |

| 21 |

K W C O, P C

Certified Public Accountants

| 1931 East 37th Street, Suite 7 | 2626 Royal Circle | |

| Odessa, Texas 79762 | Kingwood, Texas 77339 | |

| (432) 363-0067 | (281) 359-7224 | |

| Fax (432) 363-0376 | Fax (281) 359-7112 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Hondo Minerals Corporation

Scottsdale, AZ 85259

We have audited the accompanying consolidated balance sheets of Hondo Minerals Corporation as of July 31, 2012 and 2011, and the related consolidated statements of operations, stockholders' equity, and cash flows for each of the years in the two-year period ended July 31, 2012. Hondo Minerals Corporation’s management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Hondo Minerals Corporation as of July 31, 2012 and 2011, and the results of its consolidated operations and its consolidated cash flows for the two-year period ended July 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has limited cash, no revenues, and limited capital resources raising substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ KWCO, PC

KWCO, PC

Odessa, Texas

October 26, 2012, except for Notes 9 and 11,

as to which the date is December 20, 2012

| F-1 |

Hondo Minerals Corporation

CONSOLIDATED BALANCE SHEETS

July 31, 2012 and 2011

| July 31, 2012 | July 31, 2011 | |||||||

| (Restated) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 22,118 | $ | 2,052,048 | ||||

| Prepaid assets | 32,402 | 59,386 | ||||||

| Total Current Assets | 54,520 | 2,111,434 | ||||||

| Properties, Equipment, and Buildings: | ||||||||

| Vehicles | 67,183 | 67,183 | ||||||

| Office equipment | 226,986 | 56,428 | ||||||

| Mining equipment | 6,249,238 | 4,129,601 | ||||||

| Plant and buildings | 4,904,272 | 1,539,387 | ||||||

| Land and mineral properties, net of $920,000 allowance for | ||||||||

| impairment | 2,574,318 | 2,278,513 | ||||||

| Accumulated depreciation | (37,213 | ) | — | |||||

| Total Properties, Equipment, and Buildings | 13,984,784 | 8,071,112 | ||||||

| Other Assets | 9,994 | 100 | ||||||

| TOTAL ASSETS | $ | 14,049,298 | $ | 10,182,646 | ||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Senior loan payable, net of $403,071 debt discount | $ | 846,929 | $ | — | ||||

| Promissory notes payable | 125,000 | — | ||||||

| Note payable - related party | 21,686 | — | ||||||

| Accounts payable and accrued liabilities | 112,531 | 293,066 | ||||||

| Accounts payable - related parties | 101,263 | 15,259 | ||||||

| Total Current Liabilities | 1,207,409 | 308,325 | ||||||

| Common Stock Liability | 1,668,554 | — | ||||||

| Derivative Liability | 949,110 | — | ||||||

| Total Liabilities | 3,825,073 | 308,325 | ||||||

| Shareholders' Equity: | ||||||||

| Common stock, $0.001 par value, 200,000,000 shares authorized | ||||||||

| 82,546,170 and 57,711,390 shares issued and outstanding at | ||||||||

| July 31, 2012 and 2011, respectively | 82,546 | 57,711 | ||||||

| Additional paid-in capital | 20,969,828 | 13,220,847 | ||||||

| Treasury stock, at cost | (12,921 | ) | (12,921 | ) | ||||

| Accumulated (deficit) | (10,815,228 | ) | (3,391,316 | ) | ||||

| Total Shareholders' Equity | 10,224,225 | 9,874,321 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 14,049,298 | $ | 10,182,646 | ||||

The accompanying notes are an integral part of these financial statements.

| F-2 |

Hondo Minerals Corporation

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Years ended July 31, 2012 and 2011

| 2012 | 2011 | |||||||

| (Restated) | ||||||||

| Revenue | ||||||||

| Mineral Sales | $ | — | $ | — | ||||

| Cost of Revenue | 129,489 | — | ||||||

| Gross Loss | (129,489 | ) | — | |||||

| Operating Expenses | ||||||||

| Officers' and directors' fees | 1,151,435 | 761,050 | ||||||

| Professional fees | 4,197,433 | 707,774 | ||||||

| Derivative Expense | 949,110 | — | ||||||

| General and administrative | 847,634 | 299,648 | ||||||

| Total Operating Expenses | 7,145,612 | 1,768,472 | ||||||

| Loss from Operations | (7,275,101 | ) | (1,768,472 | ) | ||||

| Other Income (Expense) | ||||||||

| Other income | 18,183 | 15,930 | ||||||

| Interest expense | (166,994 | ) | (28,548 | ) | ||||

| Net (Loss) | $ | (7,423,912 | ) | $ | (1,781,090 | ) | ||

| (Loss) per share | ||||||||

| Basic and fully diluted: | ||||||||

| Weighted average number of shares outstanding | 66,424,837 | 41,352,159 | ||||||

| (Loss) per share | $ | (0.11 | ) | $ | (0.04 | ) | ||

The accompanying notes are an integral part of these financial statements.

| F-3 |

Hondo Minerals Corporation

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

For the Years Ended July 31, 2012 and 2011

| Additional | ||||||||||||||||||||||||

| Common Stock | Treasury | Paid in | Retained | |||||||||||||||||||||

| Shares | Amount | Stock | Capital | (Deficit) | Total | |||||||||||||||||||

| Balance, July 31, 2010 | 28,509,140 | $ | 28,509 | $ | (12,921 | ) | $ | 3,454,560 | $ | (1,610,226 | ) | $ | 1,859,922 | |||||||||||

| Shares issued for officers' and directors' fees | 2,546,500 | 2,546 | — | 758,504 | — | 761,050 | ||||||||||||||||||

| Shares issued for services | 796,750 | 797 | — | 374,278 | — | 375,075 | ||||||||||||||||||

| Shares issued for services-related party | 193,000 | 193 | — | 84,807 | — | 85,000 | ||||||||||||||||||

| Donated management services | — | — | — | 3,000 | — | 3,000 | ||||||||||||||||||

| Shares issued for interest--related party | 537,250 | 537 | — | 26,325 | — | 26,862 | ||||||||||||||||||

| Shares issued for payment of short-term loans-- | ||||||||||||||||||||||||

| related party | 7,855,000 | 7,855 | — | 384,896 | — | 392,751 | ||||||||||||||||||

| Shares issued for payment of short-term loans | 50,000 | 50 | — | 2,450 | — | 2,500 | ||||||||||||||||||

| Shares issued for acquisition of mining | ||||||||||||||||||||||||

| equipment and buildings | 3,163,500 | 3,164 | — | 1,189,087 | — | 1,192,251 | ||||||||||||||||||

| Shares issued in private placement | 14,060,250 | 14,060 | — | 6,942,940 | — | 6,957,000 | ||||||||||||||||||

| Net (loss) | — | — | — | — | (1,781,090 | ) | (1,781,090 | ) | ||||||||||||||||

| Balance, July 31, 2011 | 57,711,390 | 57,711 | (12,921 | ) | 13,220,847 | (3,391,316 | ) | 9,874,321 | ||||||||||||||||

| Shares issued for officers' and directors' fees | 3,477,000 | 3,477 | — | 1,147,958 | — | 1,151,435 | ||||||||||||||||||

| Shares issued for services-related party | 330,000 | 330 | — | 164,670 | — | 165,000 | ||||||||||||||||||