Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HUDSON VALLEY HOLDING CORP | d627739d8k.htm |

Metro New York’s

Premier Business Bank

Seizing Tomorrow’s Opportunities

While Maintaining Our Core Fundamentals

November 2013

Exhibit 99.1 |

1

Safe Harbor Statement

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of

1995: This presentation contains various forward-looking statements with respect to

earnings, credit quality and other financial and business matters within the

meaning of the Private Securities Litigation Reform Act of 1995. These

forward-statements can be identified by words such as “expects,” “anticipates,” “intends,”

“believes,” “estimates,” “predicts” and words of similar

import. The Company cautions that these forward-looking statements are subject to numerous

assumptions, risks and uncertainties, and that statements relating to future periods

are subject to uncertainty because of the increased likelihood of changes in

underlying factors and assumptions. Actual results could differ materially from

forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by

such forward-looking statements, include, but are not limited to, statements

regarding: (a) the OCC and other bank regulators may require us to further modify or

change our mix of assets, including our concentration in certain types of loans,

or require us to take further remedial actions; (b) our inability to deploy our excess cash, reduce our expenses and improve our operating leverage and

efficiency; (c) our inability to pay quarterly cash dividends to shareholders in

light of our earnings, the current and future economic environment, Federal

Reserve Board guidance, our Bank’s capital plan and other regulatory requirements

applicable to Hudson Valley or Hudson Valley Bank; (d) the possibility that we

may need to raise additional capital in the future and our ability to raise such capital on terms that are favorable to us; (e) further increases in our non-

performing loans and allowance for loan losses; (f) ineffectiveness in managing our

commercial real estate portfolio; (g) lower than expected future performance of

our investment portfolio; (h) a lack of opportunities for growth, plans for expansion (including opening new branches) and increased or unexpected

competition in attracting and retaining customers; (i) continued poor economic

conditions generally and in our market area in particular, which may adversely

affect the ability of borrowers to repay their loans and the value of real property or

other property held as collateral for such loans; (j) lower than expected demand

for our products and services; (k) possible impairment of our goodwill and other intangible assets; (l) our inability to manage interest rate risk; (m)

increased expense and burdens resulting from the regulatory environment in which we

operate and our inability to comply with existing and future regulatory

requirements; (n) our inability to maintain regulatory capital above the minimum levels

Hudson Valley Bank has set as its minimum capital levels in its capital plan

provided to the OCC, or such higher capital levels as may be required; (o) proposed legislative and regulatory action may adversely affect us and the

financial services industry; (p) future increased Federal Deposit Insurance

Corporation, or FDIC, special assessments or changes to regular assessments; (q)

potential liabilities under federal and state environmental laws; (r) regulatory

limitations on dividends payable by Hudson Valley or Hudson Valley Bank .

For a more detailed discussion of these factors, see the Risk Factors discussion in the

Company’s most recent Annual Report on Form 10-K, and subsequent

Quarterly Reports on Form 10-Q. The forward-looking statements included in this

presentation are made only as of the date hereof and the Company undertakes no

obligation to update or revise any of its forward-looking statements.

Unless otherwise noted, information presented is from Company sources. |

2

Hudson Valley’s Business Model

•

Commercial bank focused on small and middle market businesses, professional service

firms

and

their

principals

–

they

view

us

as

their

“private

bankers”

•

Niche businesses synergistically compliment each other to form the core of HVB’s

business model

•

Relationship

Focus

--

high

quality

banking

products

and

exceptional

personal

service

General

Business

Attorneys

Not-For-

Profits

Trusts

Focus on

Targeted

Niche

Segments

Property

Managers

Municipal-

ities

Real Estate

Developers |

3

NOT A TRADITIONAL RETAIL COMMUNITY BANK

•

A

“Community

Business

Bank”

founded

to

focus

on

small

and

middle

market

commercial

customers and their principals

•

Focus on targeted niche businesses, entrepreneurs and professional service firms with

high deposit transaction volume throughout the Metro New York area

•

Low-cost, core deposits = foundation of customer relationships

•

We

sell

service,

with

a

strong

commitment

to

acting

as

a

“private

bank”

to

our

niche

commercial

customers

WE LEND WHERE WE LIVE

•

Providing

prudent,

conservatively

underwritten

loans

in

our

home

market

•

Stable and deep management team has extensive in-market experience and is highly

accessible to customers

•

Unique Metro NYC market allows for competitive positioning with high-touch service

and significant opportunities for growth

A Differentiated Business Model |

4

Our Mission is Unchanged

OUR METRO NYC SMALL-

AND MID-SIZED COMMERCIAL CUSTOMERS

REMAIN OUR FOUNDATION AND OUR PRIORITY

•

What changes is the number and diversity of products offered to serve them

OBJECTIVE IS TO GAIN COMPETITIVE ADVANTAGE WHILE MAINTAINING

COMPLIANCE

•

More nimble in adapting to new environments, products, and competitors

•

More effectively serve our niche markets with an even broader array of customized

products that meet their needs |

5

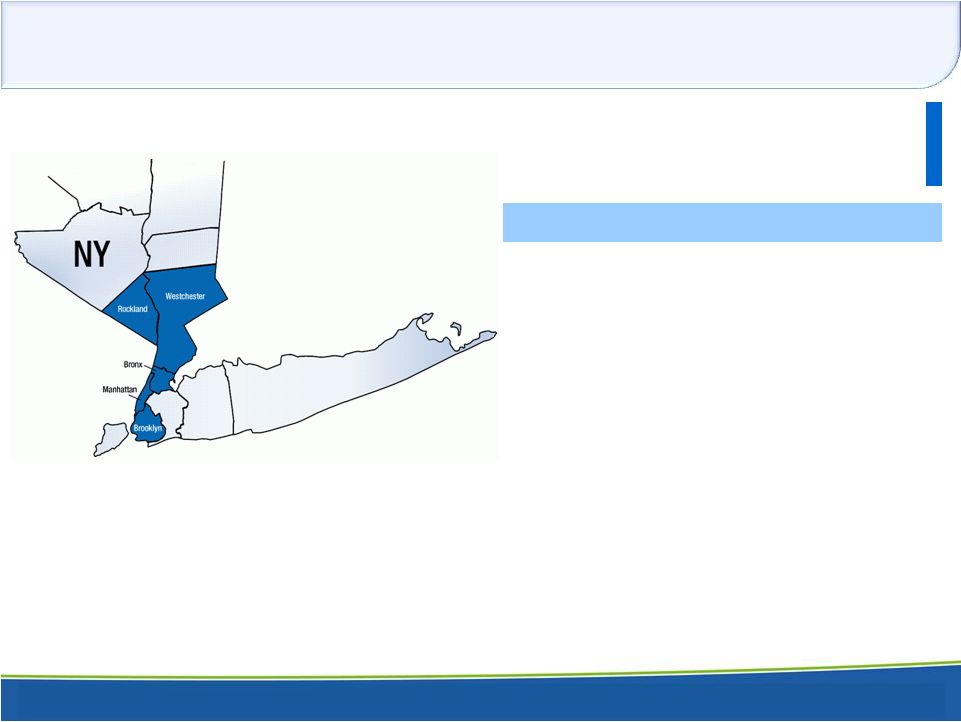

Metro New York Franchise

•

$3 billion commercial bank with 28 branches throughout Westchester, Rockland, the

Bronx, Manhattan and Brooklyn in New York •

Largest bank headquartered in Westchester County

•

Historic growth achieved by taking share from larger national bank competitors

•

There are more than 32,000 small and middle market companies with revenues of $1

million or more in this market Branch Network - County Level

Deposits

Branches

(1)

US $000s

New York State

Westchester

17

1,883,059

New York (Manhattan)

4

354,392

Bronx

4

232,442

Rockland

2

86,556

Kings (Brooklyn)

1

11,122

(1) 6

Connecticut

branches

are

excluded

and

closed

July-2013

and

2

New

York

branches

consolidated

into

other

branch

locations

in

September-

2013

Source: SNL Financial; deposit data as of 06/30/2013; branch count and map as of

09/30/2013 |

6

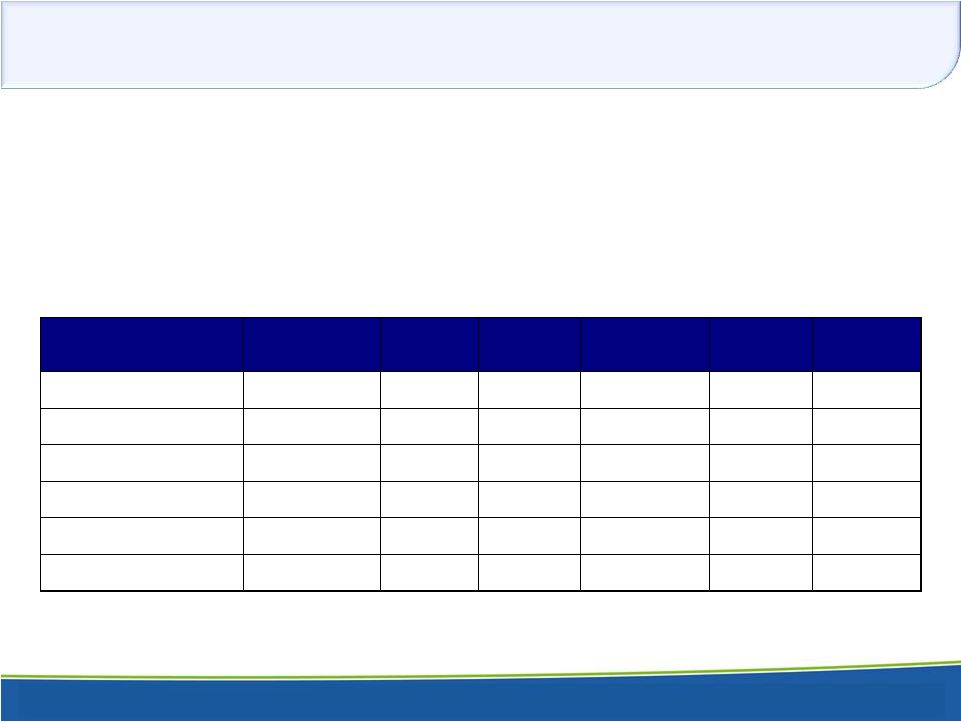

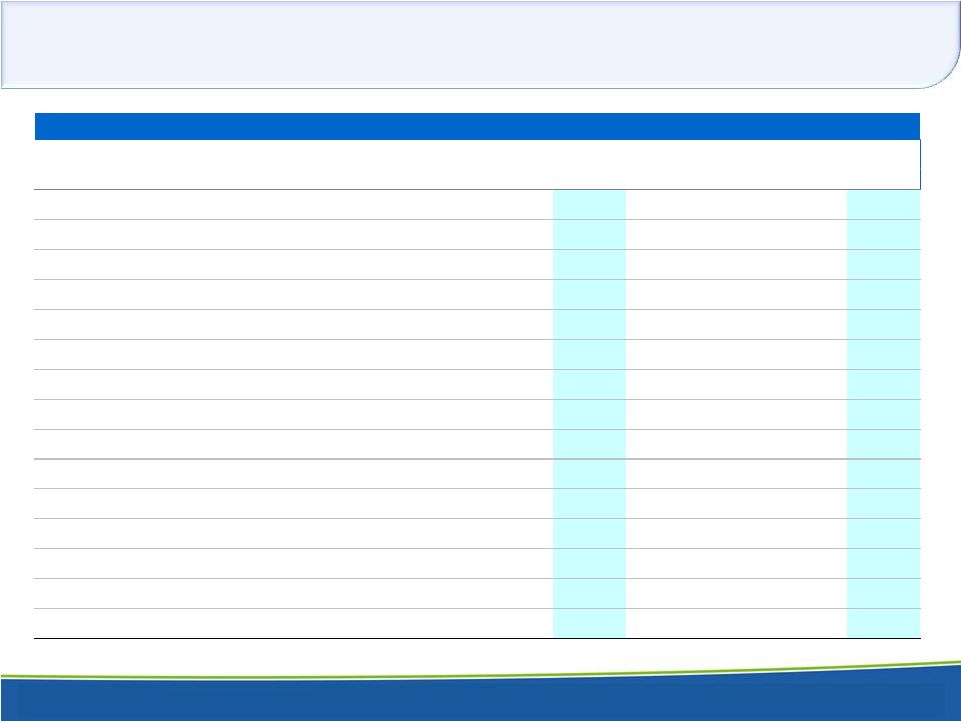

Summary Financial Highlights

3.70%

64.34%

0.97%

9.86%

8.7%

VS.

PEERS:

(1)

Excludes income from loan sales.

Peers = Median of US-based, publicly traded commercial banks with assets between

$1-$5 billion as of September 30, 2013. (Dollars in thousands, except per share

amounts) 2012

2012 (1)

2013

Net Interest Income

$80,919

$80,919

$63,327

Non Interest Income

$29,496

$13,561

$12,587

Non Interest Expense

$61,945

$61,945

$60,975

Net Income

$26,108

$16,751

$9,633

Diluted Earnings Per Share

$1.33

$0.85

$0.49

Dividends Per Share

$0.54

$0.54

$0.18

Net Interest Margin

4.09%

4.09%

3.07%

Return on Average Equity

12.03%

7.72%

4.41%

Return on Average Assets

1.23%

0.79%

0.44%

Efficiency Ratio

64.17%

64.17%

79.08%

Tangible Common Equity Ratio

9.2%

9.2%

8.9%

Average Assets

$2,838,448

$2,838,448

$2,937,766

Average Net Loans

$1,692,823

$1,692,823

$1,427,552

Average Deposits

$2,454,881

$2,454,881

$2,573,237

Average Stockholders' Equity

$289,345

$289,345

$291,315

Nine Months Ended September 30 |

7

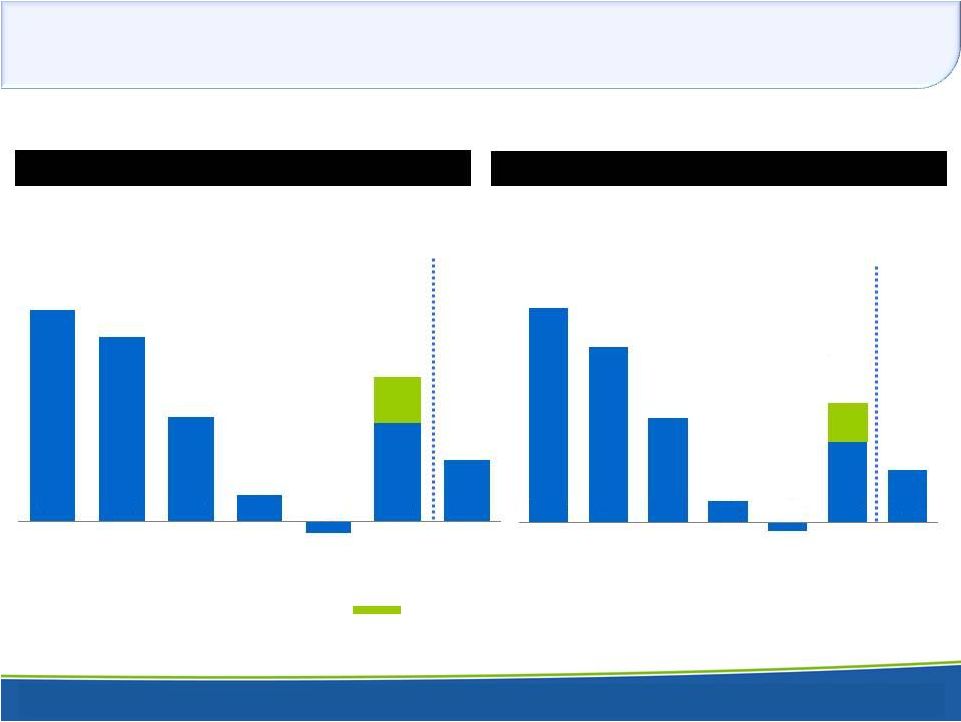

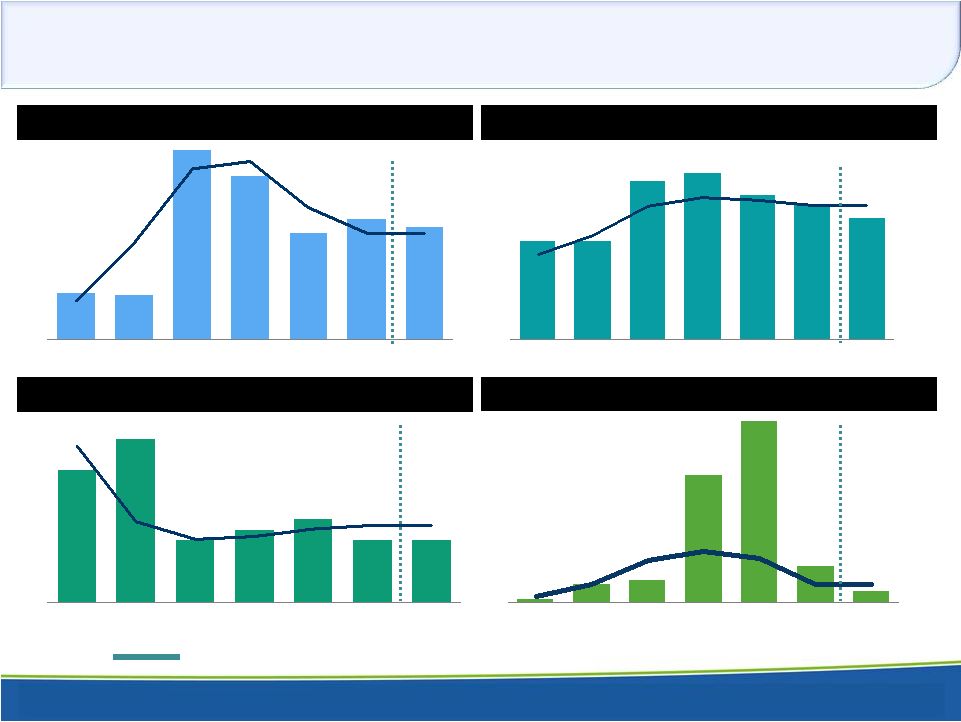

Historical Profitability

RETURN ON AVERAGE

ASSETS % RETURN ON AVERAGE EQUITY % Income from loan

sale 1.02

10.05

1.49

1.30

0.74

0.18

0.70

0.44

-0.08

2007

2008

2009

2010

2011

2012

2013 YTD

18.00

14.76

8.74

6.82

4.41

1.75

-0.72

2007

2008

2009

2010

2011

2012

2013 YTD |

8

Historical Profitability

Income from loan sale

$2.78

$1.49

$3.64

$3.84

$3.31

$2.58

$2.91

$1.97

$0.75

2007

2008

2009

2010

2011

2012

2013 YTD

$2.31

$2.06

$1.24

$0.26

$1.01

($0.11)

$0.49

2007

2008

2009

2010

2011

2012

2013 YTD

Pre-Tax

Pre-Provision

Diluted

Earnings

per

Share

is

a

Non-GAAP

measure.

See

Appendix

slide

44

for

reconciliation

PRE

-TAX PRE

-PROVISION

DILUTED

EARNINGS PER

SHARE

SHARE

*

DILUTED

EARNINGS PER |

9

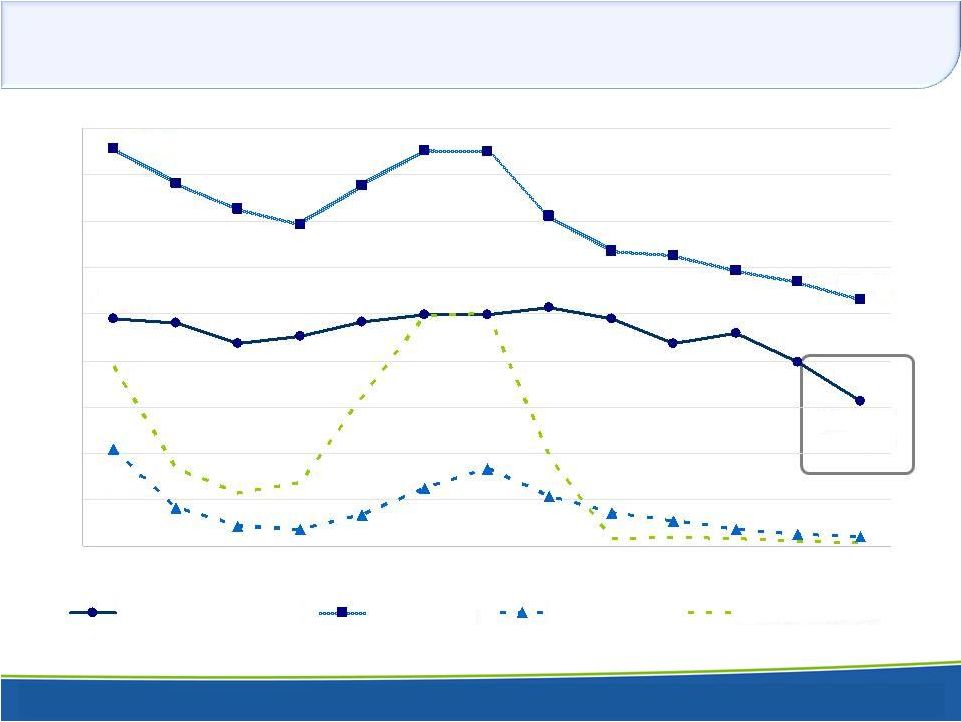

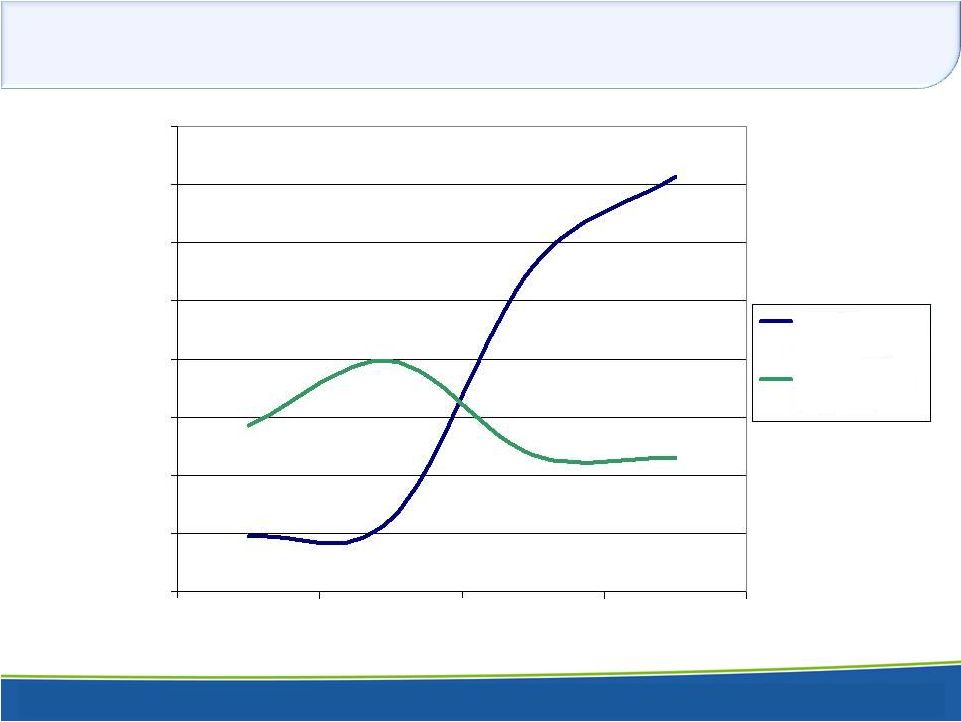

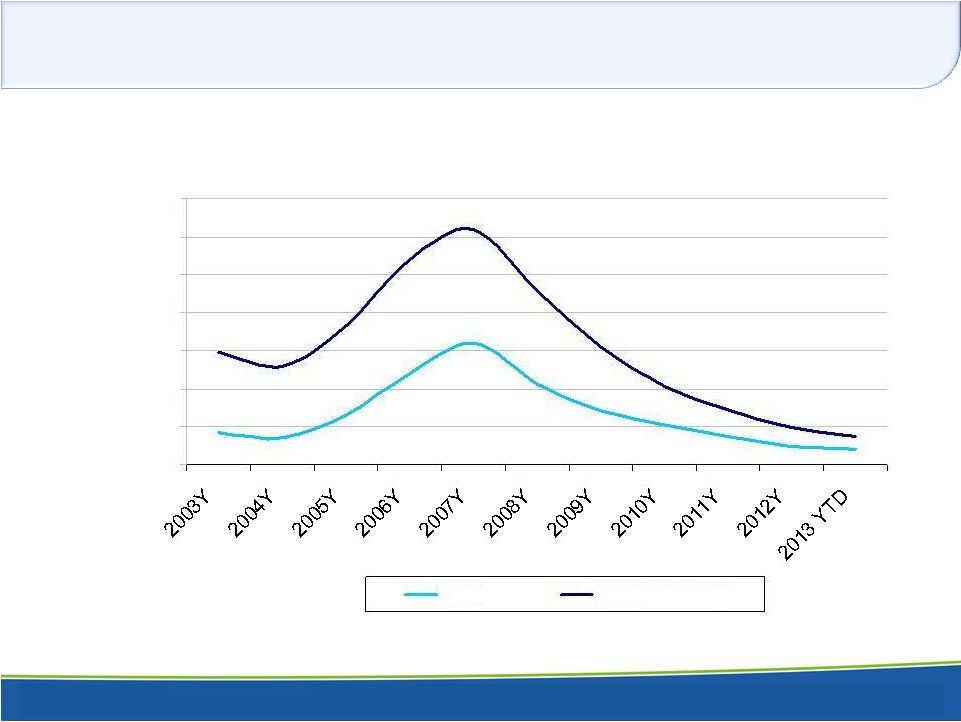

Net Interest Margin

VS. 3.58%

PEERS

(1,2)

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013Q3

3.13%

4.89%

5.31%

8.57%

0.19%

2.08%

Net Interest Margin (FTE)

Yield on Loans

Cost of Deposits

Federal Funds Rate

(1)

Fully tax equivalent basis.

(2)

Peers = Median of US-based, publicly traded commercial banks with assets

between $1-$5 billion as of September 30, 2013. |

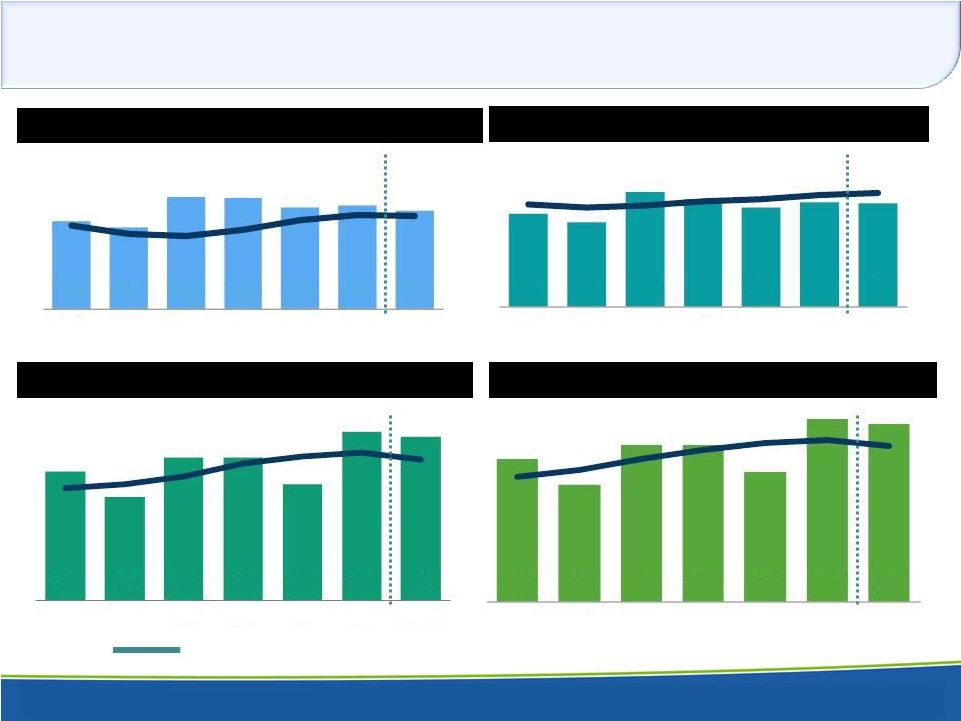

10

Strong Capital Position

TANGIBLE

COMMON

EQUITY

/

TANGIBLE

ASSETS

%

LEVERAGE

RATIO

%

TIER

1

RISK

BASED

CAPITAL

RATIO

%

TOTAL

RISK

BASED

CAPITAL

RATIO

%

Median of US-based, publicly traded commercial banks with assets between $1-$5

billion as of September 30, 2013. 7.9

7.3

10.1

10.0

9.1

9.3

8.9

2007

2008

2009

2010

2011

2012

2013 YTD

8.3

7.5

10.2

9.6

8.8

9.3

9.2

2007

2008

2009

2010

2011

2012

2013 YTD

12.6

10.1

13.9

13.9

11.3

16.5

15.9

2007

2008

2009

2010

2011

2012

2013 YTD

13.8

11.3

15.2

15.2

12.6

17.7

17.2

2007

2008

2009

2010

2011

2012

2013 YTD |

11

Summary –

Why HVB is Different

•

“Private Bank”

model emphasizes selling service over products

•

Value of service relationship outweighs price sensitivity in HVB’s

highly specialized, targeted niche customer segments

•

Loyal depositors trust HVB with their operating cash management

needs,

providing

a

stable

source

of

low-cost

deposits

–

and

an

opportunity for future business |

12

Growth Strategy

ORGANIC GROWTH IS OUR STRENGTH

•

We

have

been

successful

in

going

to

market

in

a

very

focused

way

in

the

highly

competitive

Metro NYC commercial banking market

–

Larger bank M&A in the market provides opportunities to acquire new customers and

new talent with intact books of business

•

Referrals and reputation for service have historically generated

profitable, controlled growth

in customers

•

Always seeking to grow sources of fee revenue

–

A.R. Schmeidler acquisition in 2004 is a good example of investing in a niche business

with strong fee generating capabilities

•

Breadth

and

depth

of

niche

business

markets

in

Metro

NYC

provide

unusually

high

growth

opportunities compared to other areas of the U.S.

•

Opportunistic and targeted M&A could supplement organic growth in the future,

particularly in fee income |

13

HOW DO WE DO IT?

•

Weekly reporting from branches about significant customer activity

–

Reporting provides market and customer intelligence

–

Reported to Chairman, President, EVPs, key managers

–

Outlines loan/deposit/customer opportunities

–

Highlights significant accomplishments from the week

•

Reporting to the Board on Relationships at Risk

–

Raises

executive

awareness

–

NO

SURPRISES

–

Flat corporate structure means highest-level executives know the

customers and can personally reach out

Institutional Attention to Relationships |

14

Relationship Management = Differentiation

•

Hiring the right people to manage and service relationships

•

All

3,600

Relationships

assigned

to

an

Officer

–

approximately

2/3rds

assigned

to

a

Relationship Manager (RM)

–

Relationships are measured on total balances, not just loan balances

–

Depositors receive high-touch personalized service just like borrowers

•

Branch

Managers

have

the

other

1/3rd

assigned

to

them

and

“co-manage”

all

RM

assigned relationships

•

Branch Managers and Relationship Managers have very good, cooperative

relationships

•

Branches responsible for daily servicing and providing an exceptional customer

banking experience

•

Relationship Managers provide ongoing professional skill, communication and any

necessary decision making |

15

Leveraging Relationships for Additional Business

RELATIONSHIP MANAGEMENT DEEP DIVE INITIATIVE

•

Objective:

Ongoing

annual

Structured,

joint

(Branch

Manager/RM)

review

and meeting with all relationships to

–

Review existing business

–

Seek additional business

–

Ask for referrals

•

The Private Banking and Middle Market Model (versus the Retail banking

approach) |

16

Liquidity Deployment and Portfolio Diversity

•

Primarily in our metro New York markets

•

Enhancing and complementing small-

and mid-sized commercial

banking customer focus

•

Additional opportunities outside CRE

•

Possible initiatives include:

–

Additional asset purchases

–

Loan participations

–

Diversification |

17

Liquidity Deployment: In-Market Participations

•

Build on longstanding CRE-participation experience with new

opportunities

–

Continue to underwrite both the borrower and the lead lender

•

Some examples

–

New large-regional bank relationship

•

Participations on upper middle market and large corporate C&I

–

New peer-bank relationship

•

Receivables financing

•

Mortgage warehouse financing

•

Other non-CRE lending |

18

Liquidity Deployment: Diversifying Offering

•

New products for our niche commercial customers and their owners, principals and

managers

•

Focused on metro New York

•

Some examples

–

Equipment leasing

•

Excellent opportunities for deals sized from $250,000 to $5 million

•

Categories including building equipment (e.g. HVAC), business, office,

medical, dental and light industrial equipment

–

Jumbo residential mortgage and home equity products complementing

commercial

•

For existing commercial customer owners, principals and managers, a

broader array of competitive residential options than previously

•

For prospective customers, a whole new line of products at our bankers’

disposal to develop new commercial relationships

•

No retail marketing or advertising |

19

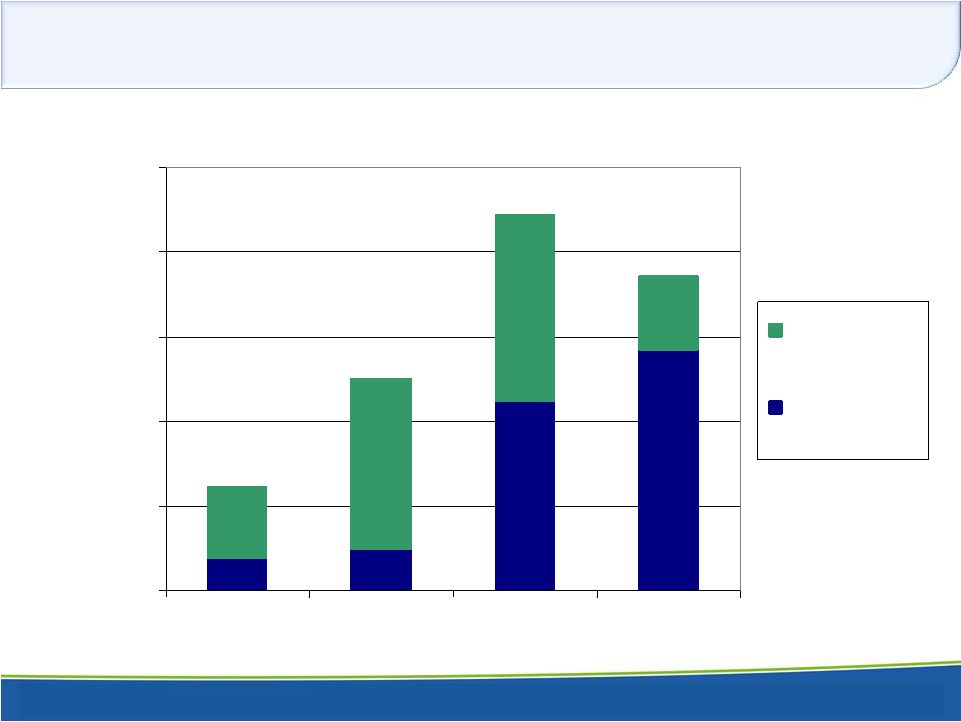

Liquidity Deployment

$-

$50,000,000

$100,000,000

$150,000,000

$200,000,000

$250,000,000

2012 Q4

2013 Q1

2013 Q2

2013 Q3

Investment

Purchases

Loan Originations

& Purchases |

20

Redeployment Aimed at Balance Sheet Efficiency

Diversifying by simultaneously implementing three approaches

1.Asset

purchases

–

CURRENT

•

$78.5

Million

in

Residential

ARMs

purchased

in

3Q13

•

Evaluating others

2.Loan

participations

with

other

institutions

–

NEAR

TERM

•

Building on HVB’s longstanding CRE-participation experience by leveraging

other institutions’ expertise and infrastructure for C&I and

residential lending 3.Building

internal

ability

to

originate,

underwrite

and

service

non-CRE

credits

–

NEAR

&

LONG

TERM

•

Focus is new products for longstanding niche business and industry targets in metro

NYC New commercial lending including equipment leases, lines of credit, term

loans, ABL, etc. Complementary

jumbo

mortgage

and

HELOC

products

for

RMs

to

offer

commercial-account

principals

All while continuing to leverage historic strength in CRE underwriting to capitalize on

solid demand from quality CRE credits |

21

Loan Originations and Payoffs

$-

$20,000,000

$40,000,000

$60,000,000

$80,000,000

$100,000,000

$120,000,000

$140,000,000

$160,000,000

2012 Q4

2013 Q1

2013 Q2

2013 YTD

Loan Originations

& Purchases

Loan Payoffs &

Paydowns |

22

Successful Measures to Manage Concentrations

MEASURES TO MANAGE CONCENTRATIONS

•

Effective risk management process

•

Active pipeline management process

•

Commitment to developing non-CRE lines of business

•

Participate with in-market financial institutions to reduce CRE

exposure while maintaining strategic relationships

•

In

3Q13

purchased

$78.5

million

in

residential

ARMs

supported

by

in-market collateral

CONCENTRATION

MEASURES Q1-13

Q2-13

Q3-13

TARGET

CRE

%

of

Risk

Based

Capital

333.7%

326.6%

327.7%

< 400%

Classified

Assets

%

of

Tier

1

Capital

&

ALLL

35.3%

30.8%

29.1%

< 25% |

23

Asset Quality Measures Strengthen Balance Sheet

Median of US-based, publicly traded commercial banks with assets between $1-$5

billion as of September 30, 2013. 1.33

1.33

2.13

2.25

1.95

1.81

1.64

2007

2008

2009

2010

2011

2012

2013 YTD

0.07

0.39

0.47

2.70

3.85

0.77

0.23

2007

2008

2009

2010

2011

2012

2013 YTD

0.46

0.44

1.90

1.64

1.07

1.20

1.12

2007

2008

2009

2010

2011

2012

2013 YTD

162

200

76

89

103

76

76

2007

2008

2009

2010

2011

2012

2013 YTD

NONACCRUAL

LOANS / TOTAL ASSETS %

LOAN

LOSS RESERVE / GROSS LOANS %

LOAN

LOSS RESERVE / NONACCRUAL LOANS %

NET

CHARGEOFFS / AVERAGE NET LOANS % |

24

Recent Successes

OCC AGREEMENT TERMINATED

•

October 2013, agreement terminated following regular annual examination

DISCIPLINED EXECUTION

•

Unwavering focus on strategy for diversifying balance sheet

•

Implemented ERM platform suitable for $10-$15 billion-asset bank

PRUDENT LIQUIDITY DEPLOYMENT CONTINUES

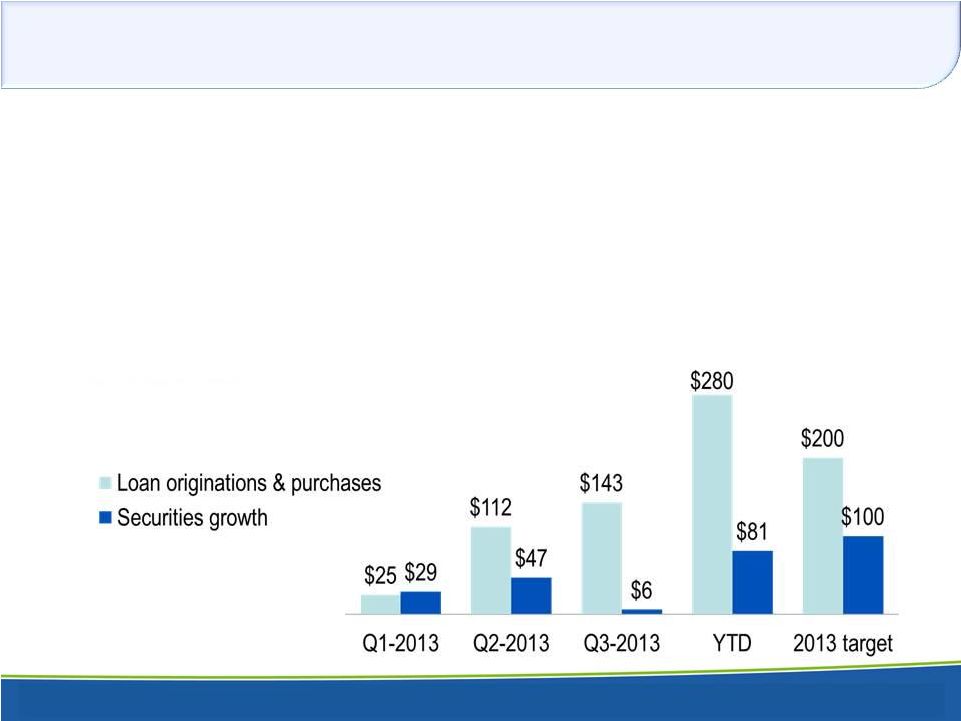

($ millions) |

25

Asset Based Lending

•

Diversifies and improves risk profile of overall portfolio

•

Provide a growing array of products and services in demand by

small-

and mid-sized commercial customers and prospects in metro

NYC and beyond

•

Addition

of

veteran

ABL

team

builds

on

long

record

of

attracting

top

talent from national/multinational banks

•

Mark

Fagnani

–

Wachovia,

Wells

Fargo,

First

Union,

Congress

Financial

•

Kenneth

Murphy

–

Transportation

Alliance

Bank,

Transamerica,

Fleet

•

Richard

Lampack

–

Wells

Fargo,

Wachovia |

26

Core Deposits –

The Jewel of the Franchise

Low Cost, Dependable Source of Funding

How we Identify, Maintain and Grow Them! |

27

Institutional Attention to Relationships

HOW DO WE DO IT?

•

Business managed by relationship profitability rather than volume of accounts

–

Very different from traditional retail banking models

•

“Relationship

Status”

reflects

achievement

of

a

profitability

hurdle

•

“Resumes”

for each actively maintained relationship

–

i.e. how the business came into the Bank; who their key service

providers are (attorney, accountant, insurance broker, etc.); how they

like to be entertained

–

Who really makes the banking decision in each relationship

•

Recognize that the core deposit is a key source of value for both our clients and

for Hudson Valley –

value proposition is mutually beneficial for the clients we

target |

28

Marketing for Core Deposits

HOW WE IDENTIFY, SECURE AND GROW THEM!

•

Marketing

to

the

right

business

segments

–

large

deposits,

low

activity,

not

as

rate sensitive

•

Marketing “relationship”

and “service”

versus interest rate

•

Utilizing testimonials and recommendations of current customers

–

Ongoing

calling

–

10,200

documented

calls

in

2012

and

6,179

in

the

first 9 months of 2013

–

Calls made to prospective individuals/businesses that have recently

interacted with a Hudson Valley RM or client |

2012

HVB

HVB

Peers

(2)

Core Deposits / Total Deposits

(1)

96%

97%

88%

Non Interest Bearing/Total Deps

39%

37%

21%

Deposits / Total Funding

98%

99%

92%

Loans / Deposits Ratio

(3)

58%

58%

80%

Cost of Total Deposits

25 bp

19 bp

37 bp

Deposit Metrics

2013

Period

Ended

-

September

30,

29

A Core Deposit Driven Franchise

(1)

Core Deposits defined as total deposits less time deposits >$100,000.

(2)

Peers = Median of US-based, publicly traded commercial banks with assets between

$1-$5 billion as of September 30, 2013. (3)

Represents Net Loans to Deposits |

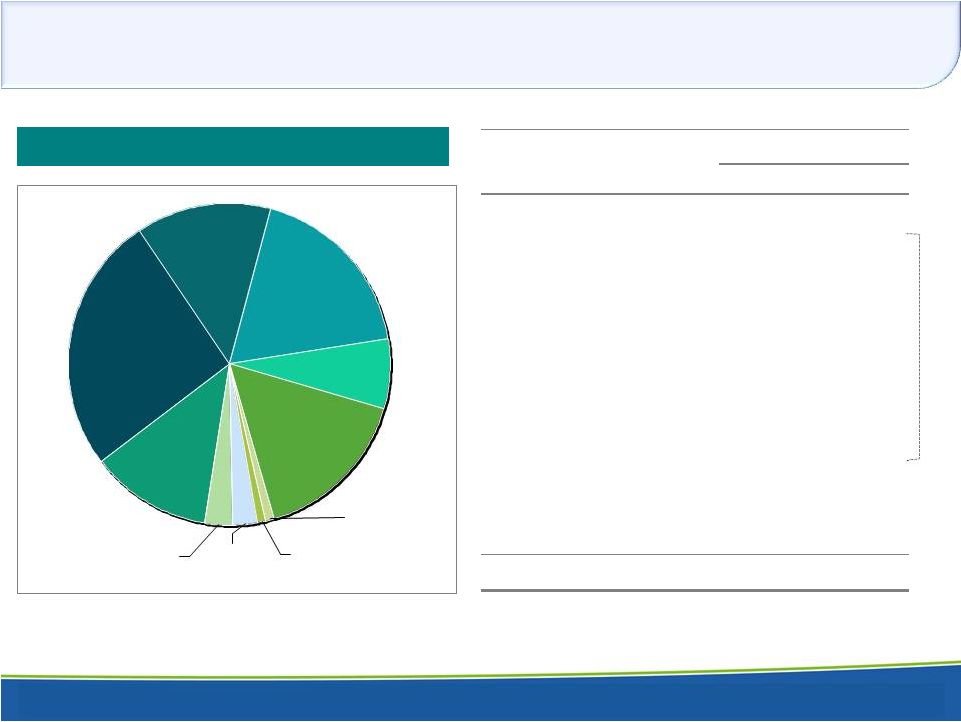

30

A Core Deposit Driven Franchise

DEPOSIT COMPOSITION –

September 30, 2013

CORE FUNDING

(1)

Net loans excluding loans held-for-sale.

(2)

Core Deposits defined as total deposits less time deposits >$100,000.

TOTAL DEPOSITS -

2,665

$

Million

Money

Market,

35%

Demand,

37%

Savings, 5%

Time > $100m,

3%

Time < $100m,

1%

Checking with

Interest, 19%

71%

58%

89%

97%

50%

60%

70%

80%

90%

100%

2007

2008

2009

2010

2011

2012

2013

Loan/Dep Ratio

Core/Total Deposits

(2)

(1) |

31

HVB Funding

Advantage

Peers = Median of US-based, publicly traded commercial banks with assets between

$1-$5 billion as of September 30, 2013. Cost of Deposits

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

HVB

National Peers |

32

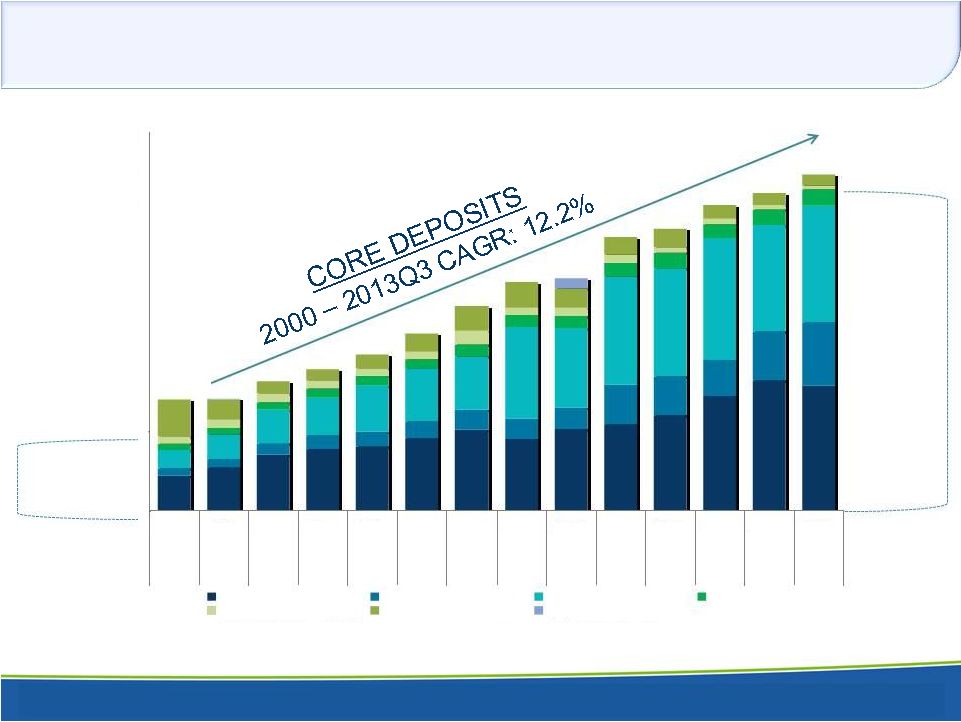

Deposit Growth Drives Long-Term Profitability

67.2%

CORE

DEPOSITS

(1)

96.8%

CORE

DEPOSITS

(1)

VS.

88.9% FOR

PEERS

(2)

$0

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

$2,500

$2,750

$3,000

$880

$888

$1,027

$1,125

$1,235

$1,408

$1,626

$1,813

$1,839

$2,173

$2,234

$2,425

$2,520

$2,665

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Sep

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Demand Deposits

Checking with Interest

Money Market Accounts

Savings Accounts

Time Deposits < $100m

Time Deposits > $100m

Brokered Deposits

(1)

Core

deposits

defined

as

total

deposits

less

time

deposits

>

$100,000

and

brokered

deposits.

December

2006

Includes

approximately

$127

million

of

deposits

as

part

of

New

York

National

Bank

acquisition

(2)

Peers

=

Median

of

US-based,

publicly

traded

commercial

banks

with

assets

between

$1-$5

billion

as

of

September

30,

2013. |

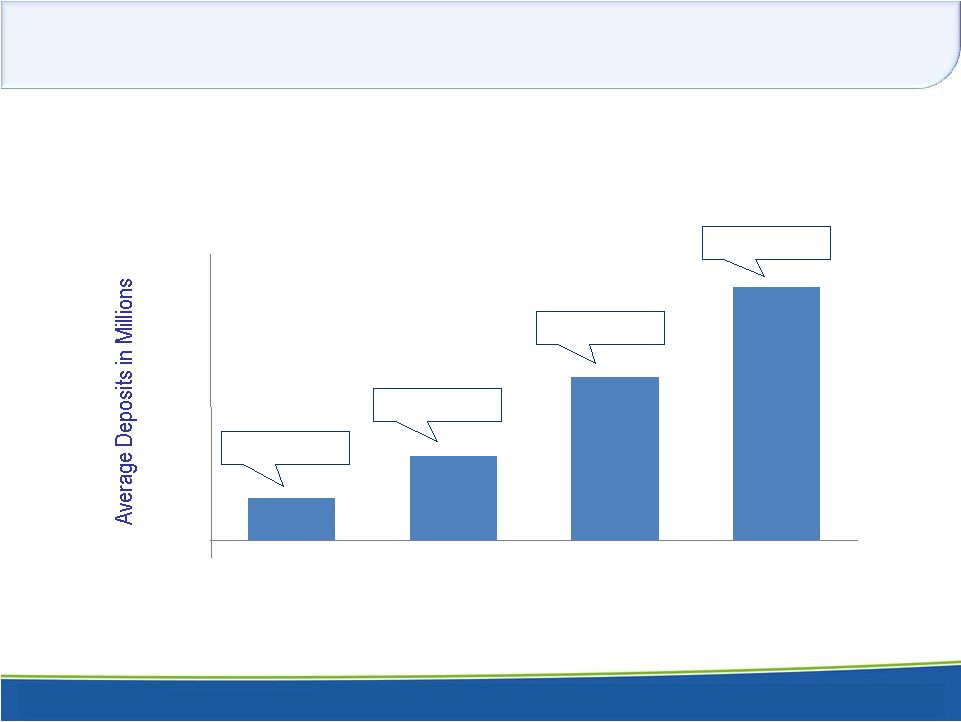

33

Branch Network –

Local Service & Execution

•

Low-cost branch infrastructure supports core deposit franchise

•

Branch value grows with age –

deeper penetration into existing relationships and new referrals

increase deposits per branch over time

7 Branches

11 Branches

(2)

(1)

6 Connecticut branches excluded closed July-2013

(2)

2 New York branches were consolidated June -2013

7 Branches

3 Branches

September

2013

YTD

Avg

Deposit

Balances

per

Branch

(1)

$21.8

$43.5

$85.5

$132.3

-$10

$10

$30

$50

$70

$90

$110

$130

$150

< 5 Yrs

5-10 Yrs

10-20 Yrs

> 20 Yrs

Age of Branch |

34

Key Takeaways

HISTORIC DIFFERENTIATING QUALITIES REMAIN OUR STRENGTH

•

Low-cost core deposit base = source of stable funding for future growth

•

Efficient mindset is in our DNA

•

“Private Bank”

approach wins and retains customers

AN INCREASINGLY NIMBLE AND SOPHISTICATED BANK

•

Ahead

of

the

curve

in

adopting

best

practices

typically

reserved

for

$10-$25

billion

banks

•

Increased sophistication = heightened competitive edge

•

Developing diversified lending skills as a strategic and tactical focus

USING ENHANCED OPERATIONAL EFFECTIVENESS TO OUR ADVANTAGE

•

Quicker reaction to customers’

needs

•

Quicker reaction to regulatory and market changes

•

Quicker ability to diversify lending sources and maximize capital allocation

–

Results in: Quicker ability to grow shareholder returns |

35

THANK YOU

THANK YOU

FOR YOUR INTEREST IN

FOR YOUR INTEREST IN

HUDSON VALLEY HOLDING

HUDSON VALLEY HOLDING

CORP.

CORP. |

36

Ticker: HVB

www.hudsonvalleybank.com

APPENDIX

APPENDIX

FINANCIAL DETAIL AND NON-GAAP

FINANCIAL DETAIL AND NON-GAAP

RECONCILIATION

RECONCILIATION |

37

New York Metro Market Profile

DEMOGRAPHICS

•

Along with being rich in deposits and HVB’s niche businesses, the market also has

very favorable demographics

Consumer Demographics (1)

Manhattan /

NY

Brooklyn

Bronx

Westchester

Rockland

Total

Population

1,585,873

2,504,700

1,385,108

949,113

311,687

19,378,102

Housing Units (2)

847,090

1,000,293

511,896

370,821

104,057

8,108,103

Home ownership rate

22.8%

30.3%

20.7%

62.7%

71.0%

55.2%

Persons per household, 2006-

2010

2.09

2.68

2.79

2.64

3.02

2.59

Median household income 2006-

2010

$64,971

$43,567

$34,264

$79,619

$82,534

$55,603

Median Income Per Capita

$59,149

$23,605

$17,575

$47,814

$34,304

$30,948

Unemployment Rate (3)

8.7%

9.6%

12.0%

6.2%

6.2%

7.6%

Business Demographics (4)

Revenues: < $1 million

132,064

83,131

28,992

52,991

16,425

313,603

Revenues: $1 million - $5 million

13,081

3,993

1,381

3,073

887

22,415

Revenue: > $5 million

6,542

1,108

462

1,212

260

9,584

Revenue: Not reported

17,521

8,580

4,279

5,397

1,613

37,390

Total Business Entities

169,208

96,812

35,114

62,673

19,185

382,992

(1)

2010 US Census Quick Facts by State|County

(2) A housing unit is defined as a house, an apartment, a mobile home, a group of

rooms, or a single room that is occupied

County unemployment rates as of August, 2013 Bureau of Labor Statistics

(4)

Hoovers|D&B

(3) |

38

New York Metro Market Profile

NICHE BUSINESSES

•

Just as this market is deposit rich, it is also rich with HVB’s targeted niche

businesses •

We have leading market share among Westchester attorneys and property managers

•

High growth potential in all other segments and counties, each with HVB market share

currently <2% 1 –

Dunn & Bradstreet Market Data based on Primary & Secondary NAICS

codes DATA DEMONSTRATES TREMENDOUS UNTAPPED ORGANIC GROWTH POTENTIAL IN HVB’S

CORE NICHE MARKETS Segment

Manhattan /

NY

Brooklyn

Bronx

Westchester

Rockland

Total

Attorney

9,036

1,756

533

2,217

557

14,099

Not for Profit

7,278

8,196

3,210

3,261

1,334

23,279

Real Estate Investors

4,053

1,216

559

917

220

6,965

Property Managers

5,069

3,059

1,222

1,843

490

11,683

Municipalities

77

409

277

525

186

1,474

Sub-Total

25,513

14,636

5,801

8,763

2,787

57,500

HVB NICHE BUSINESS BY COUNTY

(1) |

39

Client Retention

RELATIONSHIPS

ARE

NOT

BUILT

OVERNIGHT

–

IT

TAKES

TIME

•The

wait

is

worth

it

–

the

value

of

the

relationship

generally

increases

over

time

DISTRIBUTION OF STRATEGIC CLIENT

RELATIONSHIPS (AS OF SEPTEMBER 30, 2013)

SEGMENT

% <2 YEARS

TENURE

% 2 TO 5

YEARS

TENURE

% 5 TO 10

YEARS

TENURE

% > 10 YEARS

TENURE

Attorney

5%

29%

30%

36%

Not-for-Profit

7%

29%

19%

46%

Property Managers /

Real Estate Investors

14%

36%

15%

34%

Municipalities

7%

25%

14%

55%

General Business

8%

26%

21%

46% |

40

Strength in Diversified Commercial Lending

80%

LOAN COMPOSITION –September 30, 2013

Loan Balances

In Millions

2012

2013

REAL ESTATE

C&D - RESIDENTIAL

$48

$41

C&D - NON RESIDENTIAL

43

42

OWNER OCCUPIED CRE

195

191

NON-OWNER OCCUPIED CRE

389

408

MULTIFAMILY LOANS

209

215

1-4 FAMILY MORTGAGE

214

289

HOME EQUITY

109

107

COMMERCIAL & INDUSTRIAL

266

255

CONSUMER

20

15

LEASE FINANCING

14

12

OTHER

3

2

TOTAL (1)

$1,510

$1,577

Sept 30

(1)

Total is gross of unearned income.

C&D -

RESIDENTIAL

3%

CONSUMER

1%

C&D

-

NON

RESIDENTIAL

3%

LEASE

FINANCING

1%

HOME EQUITY

7%

1-4 FAMILY

MORTGAGE

18%

MULTIFAMILY

LOANS

14%

NON-OWNER

OCCUPIED

CRE

25%

OWNER

OCCUPIED

CRE

12%

COMMERCIAL

& INDUSTRIAL

16% |

41

HVB General Business Average Loan = $503,361

Businesses in Market > 382,992

> $193 BILLION LENDING OPPORTUNITY

Market Potential Example

AS OF SEPTEMBER 30, 2013

SEGMENT

% OF STRATEGIC

CLIENT

RELATIONSHIPS

% OF

TOTAL BANK

DEPOSITS

AVERAGE

DEPOSITS PER

STRATEGIC CLIENT

RELATIONSHIP

(IN THOUSANDS)

% OF STRATEGIC

CLIENT

RELATIONSHIPS

WITH LOANS

Attorney

29%

19%

$783

28%

Not-for-Profit

18%

15%

$949

38%

Property

Managers/Real Estate

Investors

17%

24%

$1,693

60%

Municipalities

2%

9%

$5,417

7%

General Business

34%

23%

$810

49%

TOTAL / AVERAGE

100%

89%

$1,065 |

42

Quarterly Summary Financial Highlights

(a)

Excludes income from loan sales.

Dollars in thousands, except per share amounts

Q4 2011

Q1 2012 (a)

Q1 2012

Q2 2012

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013

Net Interest Income

$30,739

$31,296

$31,296

$25,508

$24,115

$22,410

$21,246

$21,068

$21,013

Non Interest Income

$4,136

$4,419

$20,354

$4,789

$4,353

$4,346

$4,517

$3,881

$4,189

Non Interest Expense

$18,967

$20,876

$20,876

$21,034

$20,035

$20,593

$19,611

$19,818

$21,546

Net Income (Loss)

($22,901)

$8,656

$18,013

$4,961

$3,134

$3,073

$3,651

$3,487

$2,495

Net Interest Margin

4.60%

4.75%

4.75%

3.93%

3.60%

3.28%

3.18%

3.06%

2.99%

Diluted Earnings (Loss) Per Share

($1.17)

$0.44

$0.92

$0.25

$0.16

$0.16

$0.18

$0.18

$0.13

Dividends Per Share

$0.18

$0.18

$0.18

$0.18

$0.18

$0.18

$0.06

$0.06

$0.06

Return on Average Equity

-30.07%

12.20%

25.51%

6.72%

4.32%

4.18%

5.02%

4.75%

3.45%

Return on Average Assets

-3.19%

1.21%

2.53%

0.71%

0.44%

0.43%

0.51%

0.47%

0.33%

Efficiency Ratio

52.79%

56.81%

56.81%

68.06%

69.33%

75.73%

74.97%

78.12%

84.24%

Tangible Common Equity Ratio

9.1%

9.6%

9.6%

9.6%

9.2%

9.3%

9.6%

9.0%

8.9%

Average Assets

$2,867,304

$2,845,223

$2,845,223

$2,795,090

$2,874,634

$2,883,086

$2,859,443

$2,949,423

$3,002,857

Average Net Loans

$2,028,587

$1,997,391

$1,997,391

$1,577,190

$1,505,942

$1,467,153

$1,422,132

$1,409,875

$1,450,338

Average Deposits

$2,463,056

$2,466,159

$2,466,159

$2,408,726

$2,489,378

$2,514,818

$2,493,021

$2,586,583

$2,638,509

Average Stockholders' Equity

$304,624

$282,459

$282,459

$295,378

$290,189

$293,886

$290,950

$293,616

$289,395

Earnings |

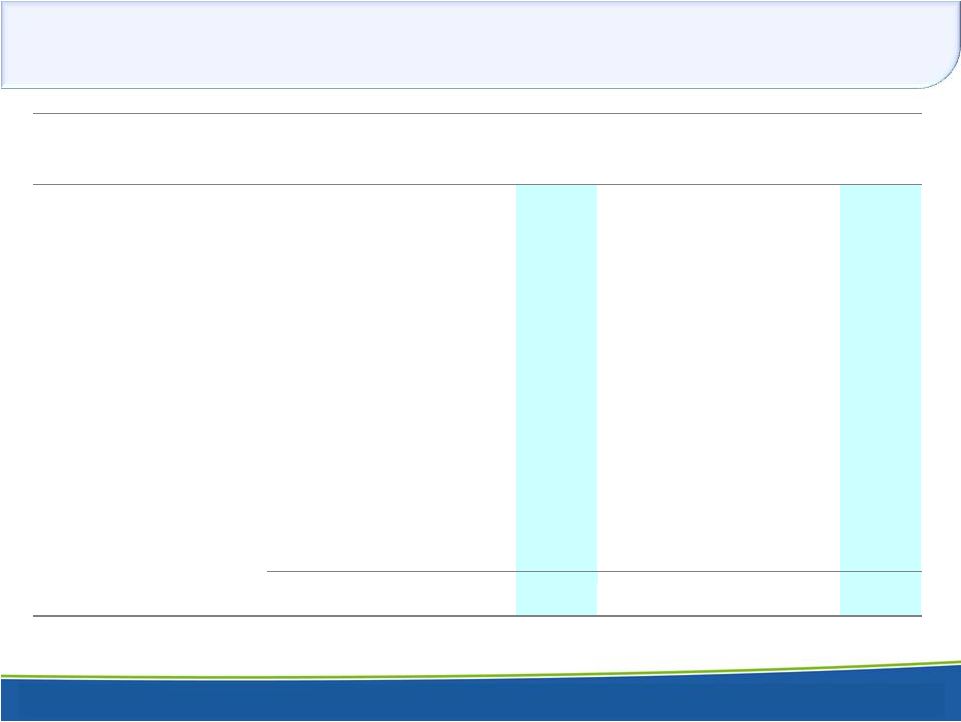

43

Quarterly Loan Balances

(1)

Total is gross of unearned income.

Dollars in Millions

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

REAL ESTATE

C&D - RESIDENTIAL

53

51

53

48

34

27

35

41

C&D - NON RESIDENTIAL

57

56

43

43

41

43

37

42

OWNER OCCUPIED CRE

244

256

229

195

181

177

186

191

NON-OWNER OCCUPIED CRE

447

449

405

389

369

399

408

408

MULTIFAMILY LOANS

228

225

213

209

196

195

196

215

1-4 FAMILY MORTGAGE

175

232

237

214

216

189

222

289

HOME EQUITY

113

111

109

109

110

106

107

107

COMMERCIAL & INDUSTRIAL

219

222

231

266

289

250

261

255

CONSUMER

27

27

19

20

19

17

16

15

LEASE FINANCING

12

15

14

14

14

11

10

12

OTHER

0

1

3

3

3

1

2

2

TOTAL (1)

$1,575

$1,645

$1,557

$1,510

$1,472

$1,415

$1,480

$1,577

Period Ending |

44

Non-GAAP Reconciliation

Excluding

Loan Sale

in thousands except share and per share

numbers

2007

2008

2009

2010

2011

2012(a)

2012(a,b)

2013

Net Income as reported

34,483

$

30,877

$

19,012

$

5,113

$

(2,137)

$

29,181

$

19,824

$

9,633

$

Income attributable to participating

shares as reported

-

-

-

-

-

(85)

(57)

(136)

Net Income attributable to common

shares as reported

34,483

$

30,877

$

19,012

$

5,113

$

(2,137)

$

29,096

$

19,766

$

9,497

$

Net Income as reported

34,483

$

30,877

$

19,012

$

5,113

$

(2,137)

$

29,181

$

19,824

$

9,633

$

Exclude:

Income Tax (1)

18,259

15,646

7,310

(1,406)

(5,413)

16,945

10,367

3,478

Provision for Loan Loss (2)

1,470

11,025

24,306

46,527

64,154

8,507

8,507

1,828

Income attributable to participating

shares (3)

-

-

-

-

-

(158)

(112)

(211)

Pre-tax, Pre-provision Earnings

54,212

$

57,548

$

50,628

$

50,234

$

56,605

$

54,474

$

38,586

$

14,729

$

Weighted Average Diluted common

shares

14,906,752

14,973,866

15,307,674

19,455,971

19,462,055

19,545,037

19,545,037

19,581,238

Diluted Earnings per Share as reported

2.31

$

2.06

$

1.24

$

0.26

$

(0.11)

$

1.49

$

1.01

$

0.49

$

Effects of (1) and (2) above

1.33

$

1.78

2.07

2.32

3.02

1.30

0.96

0.27

Pre-Tax, Pre-Provision Diluted Earnings

per Common Share

3.64

$

3.84

$

3.31

$

2.58

$

2.91

$

2.79

$

1.97

$

0.75

$

Tangible Equity Ratio:

Total Stockholders' Equity:

As reported

203,687

$

207,500

$

293,678

$

289,917

$

277,562

$

290,971

$

290,971

$

290,702

$

Less: Goodwill and other intangible

assets

20,296

25,040

27,118

26,296

25,493

24,745

24,745

24,602

Tangible stockholders' equity

183,391

$

182,460

$

266,560

$

263,621

$

252,069

$

266,226

$

266,226

$

266,100

$

Total Assets:

As reported

2,330,748

$

2,540,890

$

2,665,556

$

2,669,033

$

2,797,670

$

2,891,246

$

2,891,246

$

3,021,520

$

Less: Goodwill and other intangible

assets

20,296

25,040

27,118

26,296

25,493

24,745

24,745

24,602

Tangible assets

2,310,452

$

2,515,850

$

2,638,438

$

2,642,737

$

2,772,177

$

2,866,501

$

2,866,501

$

2,996,918

$

Tangible equity ratio

7.9%

7.3%

10.1%

10.0%

9.1%

9.3%

9.3%

8.9%

(a) Year Ended Dec 31,

2012

(b) The loan sale in the first quarter of 2012 resulted in a gross gain of

$15,935. Related income taxes totaled $6,578. |

THANK

YOU FOR YOUR INTEREST IN THANK YOU FOR YOUR INTEREST IN

HUDSON VALLEY HOLDING CORP.

HUDSON VALLEY HOLDING CORP.

Ticker: HVB

www.hudsonvalleybank.com

November 2013 |