Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Air Transport Services Group, Inc. | a2013form8kcovernov13inves.htm |

0 Stephens Fall Conference Nov. 13, 2013 Joe Hete President & CEO Quint Turner Chief Financial Officer Boeing 767-200 Freighters Boeing 767-300 Freighters Boeing 757-200 Freighters Boeing 757-200 Combis The World’s Largest Integrated Source of Midsize Freighter Aircraft, ACMI Airlift and Related Services

Safe Harbor Statement Except for historical information contained herein, the matters discussed in this presentation contain forward-looking statements that involve risks and uncertainties. There are a number of important factors that could cause Air Transport Services Group's ("ATSG's") actual results to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, changes in market demand for our assets and services, the costs and timing associated with the modification and certification testing of Boeing 757 aircraft, the timing associated with the deployment of aircraft to customers, achievement of the benefits we anticipated from the merger of two of our airline businesses, our operating airlines' ability to maintain on-time service and control costs, and other factors that are contained from time to time in ATSG's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this presentation and should not place undue reliance on ATSG's forward-looking statements. These forward-looking statements were based on information, plans and estimates as of the date of this presentation. ATSG undertakes no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. 1

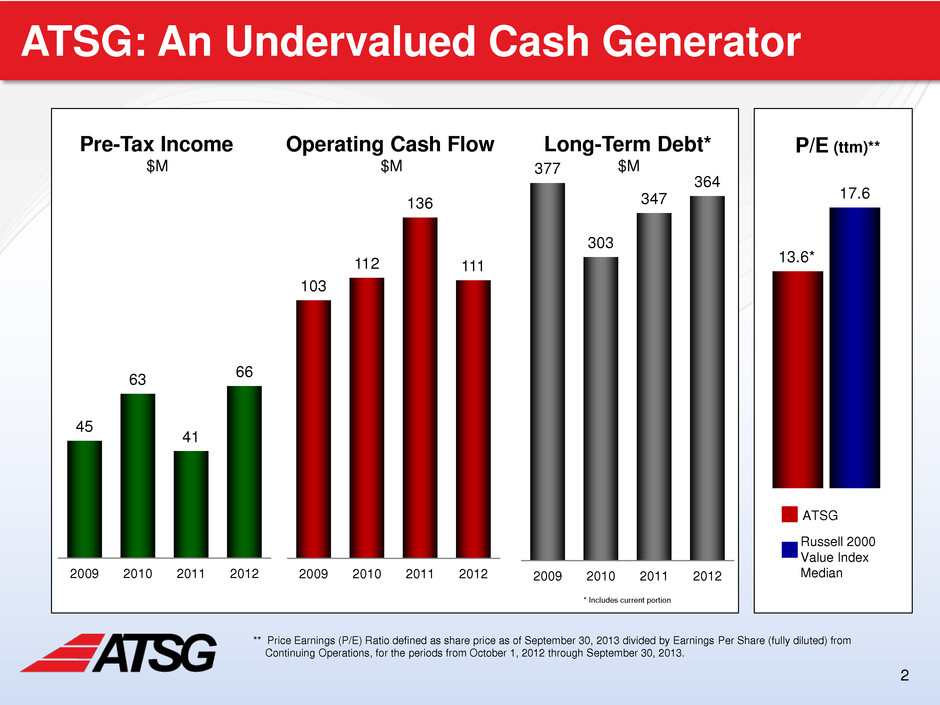

2 ATSG: An Undervalued Cash Generator 13.6* 17.6 103 112 136 111 2009 2010 2011 2012 Operating Cash Flow $M P/E (ttm)** ATSG Russell 2000 Value Index Median 45 63 41 66 2009 2010 2011 2012 Pre-Tax Income $M 377 303 347 364 2009 2010 2011 2012 Long-Term Debt* $M * Includes current portion ** Price Earnings (P/E) Ratio defined as share price as of September 30, 2013 divided by Earnings Per Share (fully diluted) from Continuing Operations, for the periods from October 1, 2012 through September 30, 2013.

3 Unique Business Model, Leverage-Lite Differentiated Business Model With Global Leadership Lessor and operator of world’s largest fleet of converted medium widebody Boeing 767 freighters Long-term relationships with global logistics leader DHL, plus U.S. Military, USPS, TNT Provide full spectrum of air transport services throughout the world: Dry leasing, ACMI (wet leasing), maintenance, and technical, fuel management and logistics services Favorable Industry Positioning Midsize freighters are essential ‘spoke’ components for global cargo networks, and flexible primary option for regional carriers 757 and 767 are industry’s preferred replacements for older freighters in the 40-60 ton class More than three times the fleet size of next largest ACMI operator in midsize market Strong Financial Characteristics and Performance Low 2.5x leverage, with minimal off-balance sheet liabilities or growth capital commitments Strong free cash flow outlook Not projected to pay cash federal income taxes until 2016 Disciplined capital allocation against established ROIC hurdles

4 ATSG at a Glance Business Description Dry leases 767 and 757 freighters to ATSG airlines and external customers Access to engine maintenance and component services External customers include DHL, Amerijet, CargoJet, RIO, First Air Provides 767 ACMI and CMI services Customers include DHL, TNT, U.S. Military, Aeromexico Provides 767, 757 freighter and 757 Combi ACMI services Customers include DHL, U.S. Military Operating and leasing solutions that leverage entire ATSG portfolio and other solution partners for bundled, turn-key cargo airline solutions Heavy & line maintenance, component overhaul, engineering and manufacturing Customers include major airlines, private operators Contracted sort management services for USPS Logistic support services A C M I B u sines s e s Dr y L e a sin g S u p p o rt S e rv ic e s

5 ATSG Strategy – It Starts With The Lease Dry leasing of midsized freighter aircraft is the foundation of ATSG’s unique capital allocation model and business strategy ▌ Cargo Aircraft Management (CAM) purchases passenger aircraft, manages extensive modification and upgrade process ▌ Aircraft offered for dry lease at market rates to yield 10%+ unlevered ROIC ▌ Dry leases typically have 5-7 year term; customers assume operating risk ▌ ATSG subsidiary airlines compete with third-party lessees for access to assets ▌ Incremental returns from maintenance and other custom services

6 ATSG Strategy – ACMI or CMI Operations We crew, maintain and insure our aircraft types for incremental (CMI) or package (A+CMI) price ▌ABX Air and ATI provide ACMI services for cargo transport companies worldwide ▌Customer accepts fuel-price risk ▌ACMI generates incremental operating return above market lease rates ▌CMI services available for customer aircraft – incremental return without capital investment

7 ATSG Strategy – Customized Support The world’s only source of complete turnkey solutions for customers seeking midsized freighter air network services Airborne Maintenance & Engineering Services ▌ Heavy & line maintenance, component overhaul, engineering, manufacturing ▌ Customers include major airlines, private operators ▌ Expanding hangar facilities to serve more 3rd party fleets LGSTX Services, Inc. ▌ Equipment leasing, and equipment/facility maintenance ▌ Customers: major airlines, regional airports ▌ Logistics support services ▌ Sort management services for USPS Logistics Maintenance

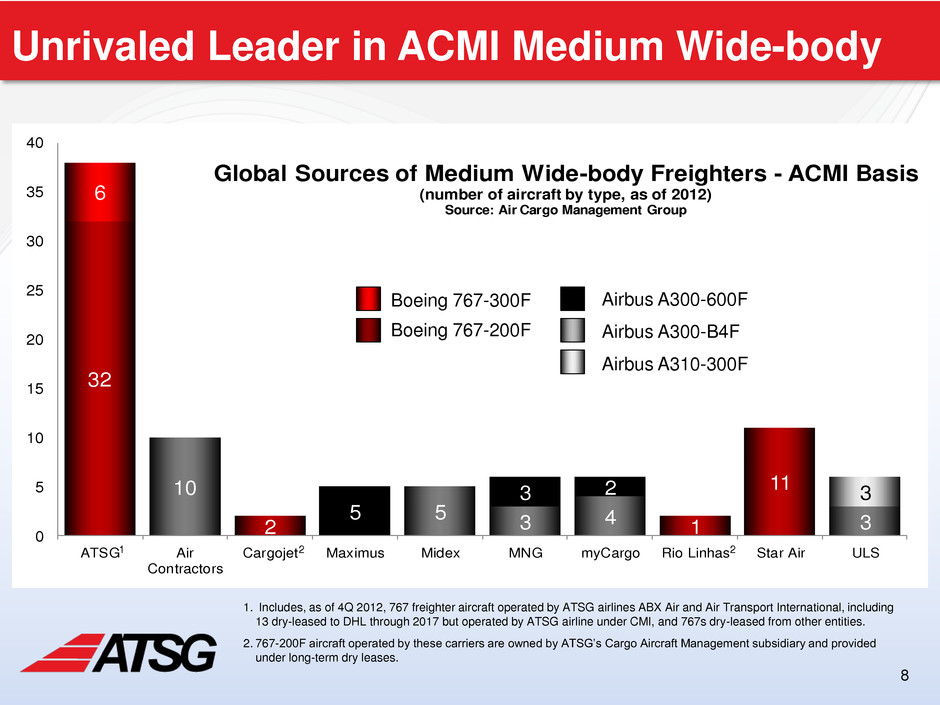

8 32 2 1 11 6 10 5 3 4 3 5 3 2 3 0 5 10 15 20 25 30 35 40 ATSG Air Contractors Cargojet Maximus Midex MNG myCargo Rio Linhas Star Air ULS Global Sources of Medium Wide-body Freighters - ACMI Basis (number of aircraft by type, as of 2012) Source: Air Cargo Management Group Unrivaled Leader in ACMI Medium Wide-body 1. Includes, as of 4Q 2012, 767 freighter aircraft operated by ATSG airlines ABX Air and Air Transport International, including 13 dry-leased to DHL through 2017 but operated by ATSG airline under CMI, and 767s dry-leased from other entities. 2. 767-200F aircraft operated by these carriers are owned by ATSG’s Cargo Aircraft Management subsidiary and provided under long-term dry leases. Boeing 767-300F Boeing 767-200F Airbus A300-600F Airbus A300-B4F Airbus A310-300F 1 2 2

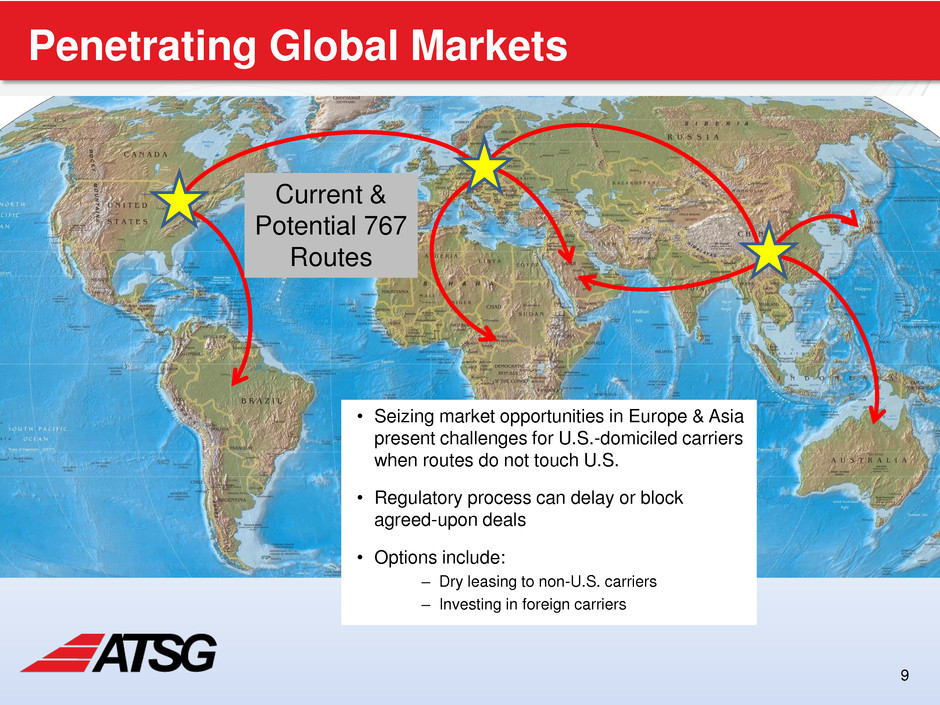

9 Penetrating Global Markets • Seizing market opportunities in Europe & Asia present challenges for U.S.-domiciled carriers when routes do not touch U.S. • Regulatory process can delay or block agreed-upon deals • Options include: – Dry leasing to non-U.S. carriers – Investing in foreign carriers Current & Potential 767 Routes

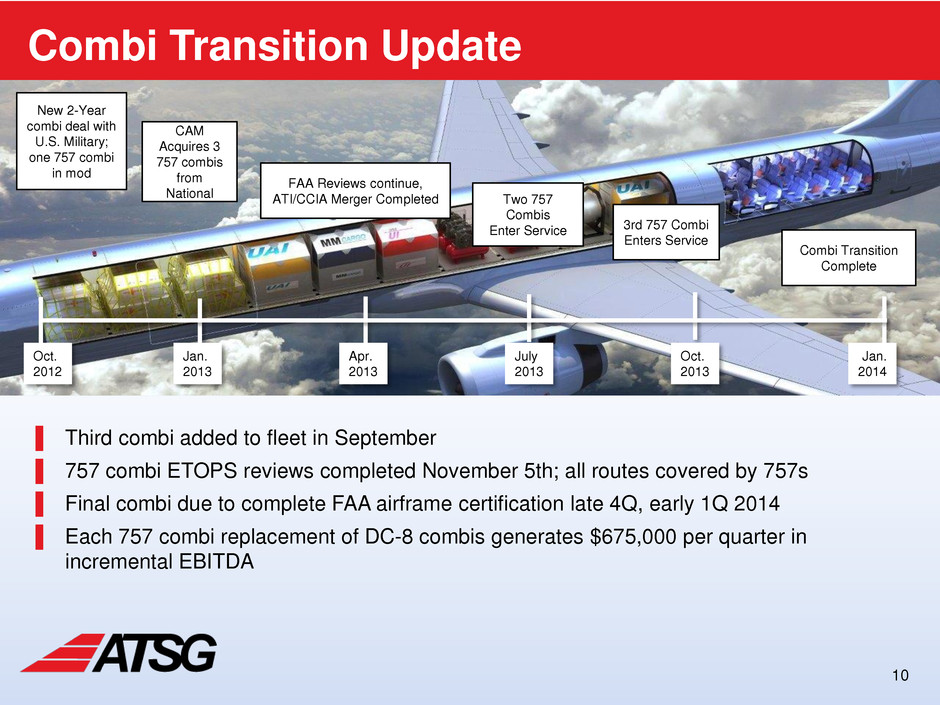

10 Combi Transition Update New 2-Year combi deal with U.S. Military; one 757 combi in mod CAM Acquires 3 757 combis from National FAA Reviews continue, ATI/CCIA Merger Completed Two 757 Combis Enter Service 3rd 757 Combi Enters Service Combi Transition Complete Oct. 2012 Jan. 2014 Jan. 2013 Apr. 2013 July 2013 Oct. 2013 ▌ Third combi added to fleet in September ▌ 757 combi ETOPS reviews completed November 5th; all routes covered by 757s ▌ Final combi due to complete FAA airframe certification late 4Q, early 1Q 2014 ▌ Each 757 combi replacement of DC-8 combis generates $675,000 per quarter in incremental EBITDA

11 ATSG Investment Strategy 767 freighter fleet yields unlevered base ROICs above 10%; incremental return potential driven by complementary services Base Dry Lease Only (A) Dry Lease + Crew + Maint. (A+CMI) Dry Lease + Maintenance (A+M) Projected Dry Lease EBIT Incremental EBIT to Dry Lease Only Total Unlevered ROIC $77 - 83 - - $77 - 83 $77 - 83 $4 - 16 $16 - 19 Note: Illustration based on current average investment costs to acquire & convert comparable 767 passenger aircraft to freighter configuration. Cost to acquire and convert ATSG’s owned and in-service 767 freighter fleet (thirty-six 200s and five 300s) at current market prices: approximately $775 million. ($ in millions) ATSG 767 Freighter Fleet Return Opportunities or or 12.5 - 13.5% 10.8 - 13.1% 10.3 - 11.0%

12 3Q12 2Q13 3Q13 Revenues 3Q12 2Q13 3Q13 Adj. EBITDA* Quarterly Results ▌ Sequential-quarter gains in revenues, earnings, EBITDA, 2Q to 3Q ▌ ACMI Services revenues up, operating loss down vs. 2Q ▌ 3Q expenses down more than $7 million vs. year ago, including: ▌ $3 million salaries, wages & benefits ▌ $2 million maintenance ▌ $3 million travel, landing & ramp, insurance $40 $43 Strong 3Q13 Returns from Leasing, DHL Support, Offset by ATI Shortfall $M $M $M * Non-GAAP metric. See table at end of this presentation for reconciliation to nearest GAAP results $139 $154 3Q12 2Q13 3Q13 Pre-tax Income $11 $19 ($M, except ratios) 12/31/2012 9/30/2013 Cash & Cash Equivalents $ 15.4 $ 16.9 Total Debt 364.5 391.9 EBITDA* 165.0 157.2 (ttm) Adjusted EBITDA* 163.2 155.9 (ttm) Debt Oblig./Adjusted EBITDA Ratio* 2.2 2.5 $141 $12 $36

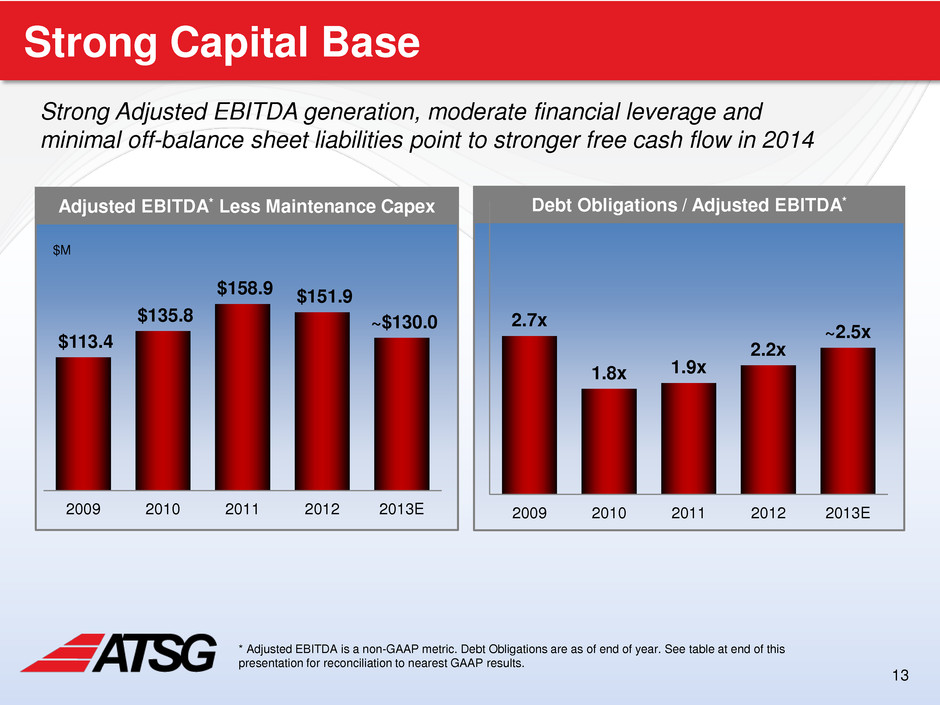

13 Strong Capital Base Strong Adjusted EBITDA generation, moderate financial leverage and minimal off-balance sheet liabilities point to stronger free cash flow in 2014 $113.4 $135.8 $158.9 $151.9 ~$130.0 2009 2010 2011 2012 2013E Debt Obligations / Adjusted EBITDA* Adjusted EBITDA* Less Maintenance Capex * Adjusted EBITDA is a non-GAAP metric. Debt Obligations are as of end of year. See table at end of this presentation for reconciliation to nearest GAAP results. $M 2.7x 1.8x 1.9x 2.2x ~2.5x 2009 2010 2011 2012 2013E

14 2014 – Expanding Free Cash Flow Creates Options Free Cash Flow Options Growth Investments Debt Replacement Share Buybacks

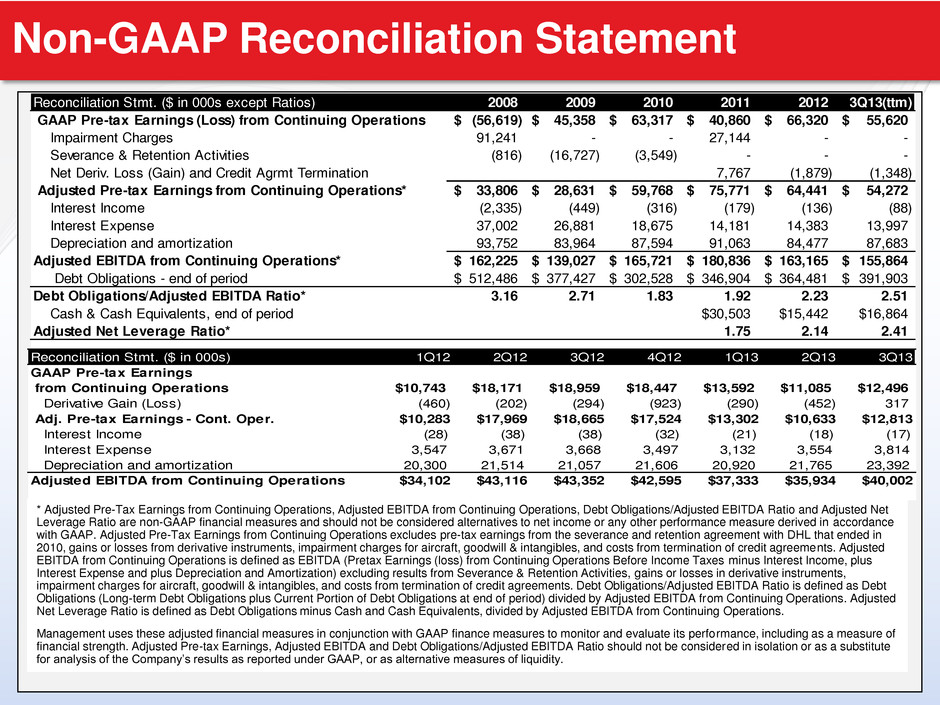

15 Non-GAAP Reconciliation Statement * Adjusted Pre-Tax Earnings from Continuing Operations, Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio and Adjusted Net Leverage Ratio are non-GAAP financial measures and should not be considered alternatives to net income or any other performance measure derived in accordance with GAAP. Adjusted Pre-Tax Earnings from Continuing Operations excludes pre-tax earnings from the severance and retention agreement with DHL that ended in 2010, gains or losses from derivative instruments, impairment charges for aircraft, goodwill & intangibles, and costs from termination of credit agreements. Adjusted EBITDA from Continuing Operations is defined as EBITDA (Pretax Earnings (loss) from Continuing Operations Before Income Taxes minus Interest Income, plus Interest Expense and plus Depreciation and Amortization) excluding results from Severance & Retention Activities, gains or losses in derivative instruments, impairment charges for aircraft, goodwill & intangibles, and costs from termination of credit agreements. Debt Obligations/Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations at end of period) divided by Adjusted EBITDA from Continuing Operations. Adjusted Net Leverage Ratio is defined as Debt Obligations minus Cash and Cash Equivalents, divided by Adjusted EBITDA from Continuing Operations. Management uses these adjusted financial measures in conjunction with GAAP finance measures to monitor and evaluate its performance, including as a measure of financial strength. Adjusted Pre-tax Earnings, Adjusted EBITDA and Debt Obligations/Adjusted EBITDA Ratio should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP, or as alternative measures of liquidity. 2008 2009 2010 2011 2012 3Q13(ttm) (56,619)$ 45,358$ 63,317$ 40,860$ 66,320$ 55,620$ Impairment Charges 91,241 - - 27,144 - - Severance & Retention Activities (816) (16,727) (3,549) - - - Net Deriv. Loss (Gain) and Credit Agrmt Termination 7,767 (1,879) (1,348) 33,806$ 28,631$ 59,768$ 75,771$ 64,441$ 54,272$ Interest Income (2,335) (449) (316) (179) (136) (88) Interest Expense 37,002 26,881 18,675 14,181 14,383 13,997 Depreciation and amortization 93,752 83,964 87,594 91,063 84,477 87,683 162,225$ 139,027$ 165,721$ 180,836$ 163,165$ 155,864$ 512,486$ 377,427$ 302,528$ 346,904$ 364,481$ 391,903$ 3.16 2.71 1.83 1.92 2.23 2.51 Cash & Cash Equivalents, end of period $30,503 $15,442 $16,864 Adjusted Net Leverage Ratio* 1.75 2.14 2.41 Reconciliation Stmt. ($ in 000s except Ratios) Debt Obligations/Adjusted EBITDA Ratio* GAAP Pre-tax Earnings (Loss) from Continuing Operations Adjusted EBITDA from Continuing Operations* Debt Obligations - end of period Adjusted Pre-tax Earnings from Continuing Operations* 1Q12 2Q12 3Q12 4Q12 1Q 3 2Q13 3Q13 $10,743 $18,171 $18,959 $18,447 $13,592 $11,085 $12,496 Derivative Gain (Loss) (460) (202) (294) (923) (290) (452) 317 $10,283 $17,969 $18,665 $17,524 $13,302 $10,633 $12,813 Interest Income (28) (38) (38) (32) (21) (18) (17) Interest Expense 3,547 3,671 3,668 3,497 3,132 3,554 3,814 Depreciation and amortization 20,300 21,514 21,057 21,606 20,920 21,765 23,392 $34,102 $43,116 $43,352 $42,595 $37,333 $35,934 $40,002 GAAP Pre-tax Earnings Reconciliation Stmt. ($ in 000s) Adjusted EBITDA from Continuing Operations from Continuing Operations Adj. Pre-tax Earnings - Cont. Oper.