Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON CORP | d623892d8k.htm |

Edison Electric Institute

Financial Conference

November 11 –

12, 2013

Exhibit 99.1 |

1

Cautionary Statements Regarding Forward-Looking Information

This presentation contains certain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, that are

subject to risks and uncertainties. The factors that could cause actual

results to differ materially from the forward-looking statements

made by Exelon Corporation, Commonwealth Edison Company, PECO Energy

Company, Baltimore Gas and Electric Company and Exelon

Generation Company, LLC (Registrants) include those factors discussed herein,

as well as the items discussed in (1) Exelon’s 2012 Annual

Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations and (c) ITEM 8. Financial Statements and

Supplementary Data: Note 19; (2) Exelon’s Third Quarter 2013 Quarterly

Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk

Factors; (b) Part 1, Financial Information, ITEM 2. Management’s

Discussion and Analysis of Financial Condition and Results of Operations

and (c) Part I, Financial Information, ITEM 1. Financial Statements:

Note 18; and (3) other factors discussed in filings with the SEC by the

Registrants. Readers are cautioned not to place undue reliance on these

forward- looking statements, which apply only as of the date of this

presentation. None of the Registrants undertakes any obligation to

publicly release any revision to its forward- looking statements to

reflect events or circumstances after the date of this

presentation.

2013 EEI Conference |

2

While we believe in market recovery, we are not waiting for it and are taking

actions to improve our value

The current trends in the

industry…

…

are continuing to create

a challenging

environment…

…

and Exelon is

responding…

…while monitoring the

power markets for

recovery.

Increasing natural gas production

Expanding renewable capacity

Growing demand response and energy efficiency

Low natural gas and power prices

Low load growth

Lack of volatility

Asset optimization and rationalization

Leverage business model to identify and invest in growth areas

Manage costs and improve efficiencies

Advocate for policies that enable well-functioning competitive markets and

create value for shareholders

Full impact of coal retirements is not currently reflected in the forward

markets Significant number of coal plants need additional controls to

comply with MATS Forward market implied heat rates are trading at a

discount to the spot market Upside in both forward and spot markets as

current heat rates move higher 2013 EEI Conference

2

Setting the Context |

3

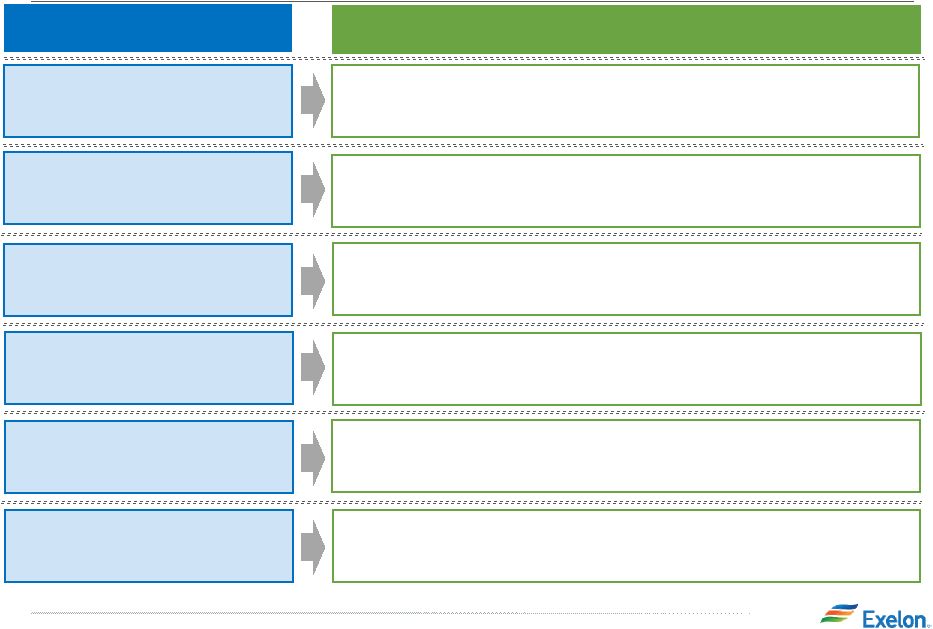

Exelon’s Strategic Response to the Current Environment

We are biased towards action while we leverage our competencies and strengths

to influence our financial future

Asset Optimization

Growth Investments

Cost Management

Utilities

Invest $15 billion across the

planning period

Upgrade aging infrastructure

Invest in infrastructure and new

technologies

Provide stable earnings growth

ExGen

Invest in renewables and

expand footprint in the natural

gas business to diversify

Maintain retail pricing discipline

Bolster presence in core regions

Research and invest in

emerging technologies

Review

Solutions

from

All

Angles

Infrastructure

Commercial

Policy

Legal

Scenarios for Optimization

Cost and productivity

enhancement

Operations improvement

Transmission

PPAs

Sale

Retirement

Our Record

Record of managing costs

$550 million in merger

synergies

Reduced 2013 ExGen O&M by

$150 million

CENG annual projected

synergies of $50-70 million

(1)

Continued Focus

Expand cost management

efforts

Efficiency gains through

productivity and technology

enhancements

Share best practices across the

utilities

(1)

At 100% ownership, Exelon share is 50%

2013 EEI Conference |

4

Advocating for Public Policy to Enhance Customer and

Shareholder Value

PJM:

Engaged in stakeholder process

regarding PJM reliance on

planned resources

Minimum Offer Price Rule

(MOPR) Reform

Demand Response Reforms

ERCOT:

•

Resource adequacy

New England:

•

Energy and capacity market

reforms

RGGI:

•

New Model Rule

Oppose Subsidized Generation:

IL: Defeated Taylorsville Energy

Project Subsidy legislation

MA: Opposed Footprint Power

Subsidy legislation

NJ: Won LCAPP Court decision

Infrastructure & Ratemaking

Improvements:

IL: Energy Infrastructure and

Modernization Legislation

(Senate Bill 9)

MD/PA: Policies to speed

recovery for gas and

infrastructure investments

Market Policy

Federal Policy

State Policy

Regulatory / Policy Actions

Subsidies:

Leading voice against extension

of the Production Tax Credit and

other electric generation

subsidies

EPA Regulations:

Mercury and Air Toxics

Standards (MATS)

Greenhouse gases (new and

existing sources)

316(b)

2013 EEI Conference |

5

Investing in a Stronger Future

Utility Investment

Operating Excellence

Asset Optimization

Portfolio Management

Strong Balance Sheet

Significant infrastructure and technology enhancements under

regulatory structures that allow a fair rate of return.

Generating fleet will continue unwavering focus on world class

performance.

Disciplined

fleet

evaluation

will

drive

strategic

decisions

to

unlock

value,

improve cash flow and grow earnings.

Enhance the value of our portfolio through implementation of our

fundamental view and disciplined retail pricing.

Solid

financial

footing

and

investment

grade

credit

rating

will

allow

us

to

grow in challenging times.

Core Strength

Strategic Focus and Actions

Well-Crafted Public Policies

Advocate for policies that strengthen competitive markets, limit

subsidies and enhance the value of clean generation.

2013 EEI Conference |

Financial Update

*

*

*

*

* |

7

2013 Operating Earnings Guidance

2013 Prior Guidance

(prior to 3Q earnings call)

$2.35 -

$2.65

(1)

$1.40 -

$1.60

$0.35 -

$0.45

$0.35 -

$0.45

$0.15 -

$0.25

ExGen

ComEd

PECO

BGE

(1)

Earnings guidance for OpCos may not add up to consolidated EPS guidance. Refer to slide 15 for a list of adjustments from GAAP EPS to adjusted (non-GAAP) operating EPS.

Key Drivers of Change in

Full-Year Guidance

•

Strong YTD earnings

through Q3

•

Lower than expected ExGen

gross margin largely offset

by O&M savings

•

Delay of AVSR project

•

Lower storm costs at

utilities

2013 EEI Conference

2013 Revised Guidance

(disclosed at 3Q earnings call)

$2.40 -

$2.60

(1)

$1.40 -

$1.50

$0.45 -

$0.50

$0.40 -

$0.45

$0.20 -

$0.25

ExGen

ComEd

PECO

BGE |

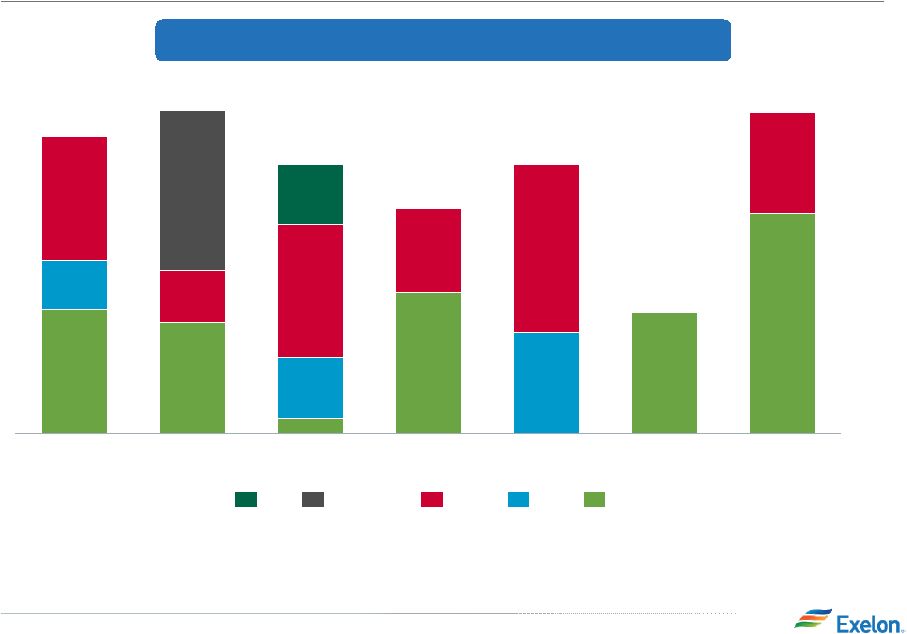

Capital Expenditure Expectations

75

100

100

25

50

25

125

100

75

50

25

50

25

75

150

2,075

750

1,050

100

2015

2,350

875

950

200

2014

2,400

900

900

150

2016

2013

2,725

950

1,000

25

500

150

Base Capex

Nuclear Fuel

Fukushima Response

(2)

MD Commitments

Wind

Solar

Upstream Gas

Nuclear Uprates

1,400

575

200

450

1,725

850

225

300

2014

3,025

1,650

700

225

450

2013

2,625

2016

2,950

1,750

725

250

225

2015

3,100

Electric Distribution

Electric Transmission

Gas Delivery

Smart Grid/Smart Meter

Exelon Utilities

Exelon

Generation

(1)

(in $M)

(in $M)

8

2013 EEI Conference

(1)

Excludes CENG

(2)

Fukushima Response spend excludes Salem, which is included in Base CapEx

|

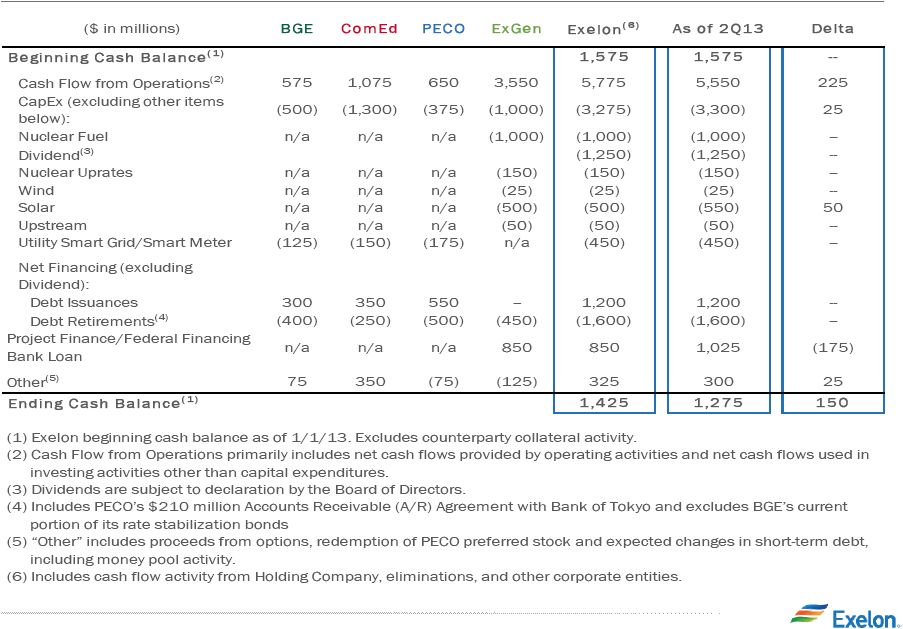

2013 Projected Sources and Uses of Cash

9

2013 EEI Conference |

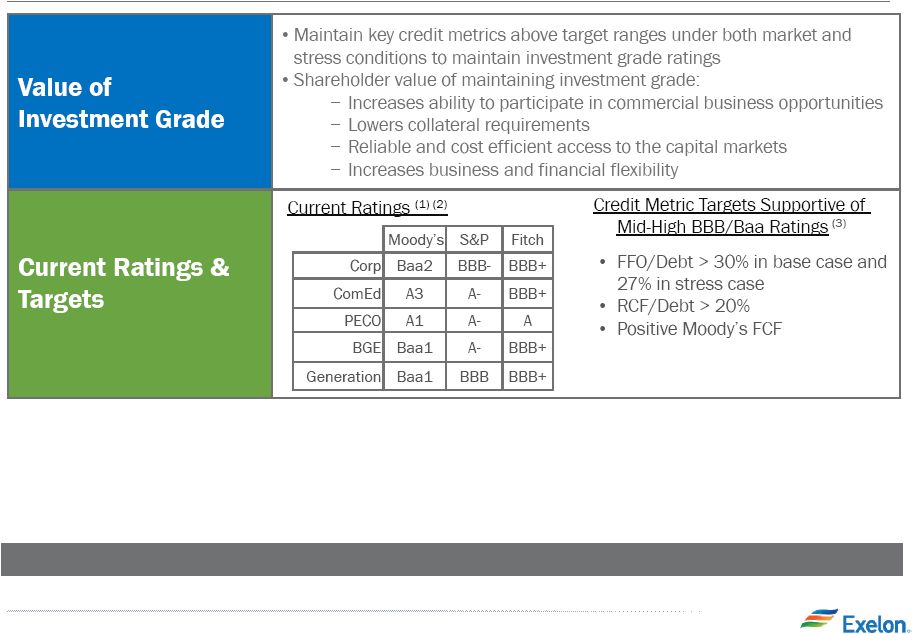

Commitment to Investment Grade

Exelon remains committed to maintaining investment grade ratings

(1)

Current senior unsecured ratings for Exelon, Exelon Generation and BGE and

senior secured ratings for ComEd and PECO as of September 25,

2013. (2)

All

ratings

at

S&P

and

Moody’s

have

a

stable

outlook.

On

August

23rd,

BGE

was

upgraded

one

notch

to

A-

as

part

of

S&P’s

annual

review. All other entities were affirmed. Additionally, on February 8th,

Fitch affirmed all ratings for Exelon and subs and placed ComEd on

positive outlook. (3)

Credit metric target ranges are for ExGen and include the debt obligations of

Exelon Corp. 10

2013 EEI Conference |

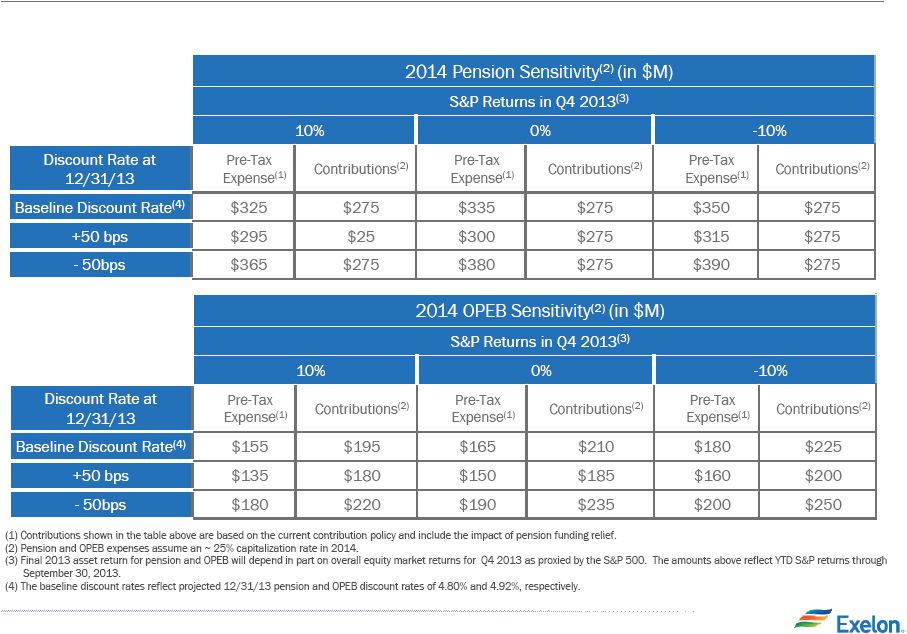

Pension and OPEB Forecast

Current Forecast:

•

The table below provides the combined company’s forecasted 2014 and 2015

pension and OPEB expense and contributions

11

2013 EEI Conference |

2014 Pension and OPEB Sensitivities

12

2013 EEI Conference

•

Tables below provide sensitivities for the combined company’s 2014 pension

and OPEB expense and contributions

(1)

under various discount rate and S&P 500 asset return scenarios

|

13

Additional 2013 ExGen and CENG Modeling

(1)

ExGen

amounts

for

O&M,

TOTI

and

Depreciation

&

Amortization

exclude

the

impacts

of

CENG.

CENG

impact

is

reflected

in

“Equity

earnings

of

unconsolidated

affiliates”

in

the

Income

Statement.

(2)

ExGen O&M excludes P&L neutral decommissioning costs and the

impact from O&M related to entities consolidated solely as a result of the application of FIN 46R.

(3)

TOTI excludes gross receipts tax for retail.

(4)

ExGen Depreciation & Amortization excludes the impact of P&L neutral

decommissioning. (5)

The CENG model inputs are intended to support Exelon’s guidance range and

do not represent CENG’s final estimates. 2013 EEI Conference

P&L Item

2013 Estimate

ExGen

Model

Inputs

(1)

O&M

(2)

$4,275M

Taxes Other Than Income (TOTI)

(3)

$300M

Depreciation & Amortization

(4)

$825M

Interest Expense

$350M

CENG

Model

Inputs

(at

ownership)

(5)

Gross Margin

Included in ExGen Disclosures

O&M/TOTI

$400M -

$450M

Depreciation & Amortization/Accretion of Asset

Retirement Obligations

$100M -

$150M

Capital Expenditures

$75M -

$125M

Nuclear Fuel Capital Expenditures

$100M -

$150M |

Debt Maturity Schedule

(in $M)

Debt Maturity Profile

(1)

(2014-2020)

14

2013 EEI Conference

(1)

As of 9/30/13

(2)

Includes $550M in 2015 and 2020 of inter-company loan agreements between

Exelon and Exelon Generation that mirror the terms and amounts of the third party

obligations of Exelon.

500

840

2017

2020

1,600

1,100

1,340

2019

2018

600

500

1,125

700

425

2016

1,342

77

300

665

300

2015

1,610

550

260

800

2014

1,482

615

250

617

Exelon Corp

BGE

ExGen

(2)

PECO

ComEd |

GAAP to Operating Adjustments

15

2013 EEI Conference |

Exelon Utilities

*

*

*

*

*

* |

17

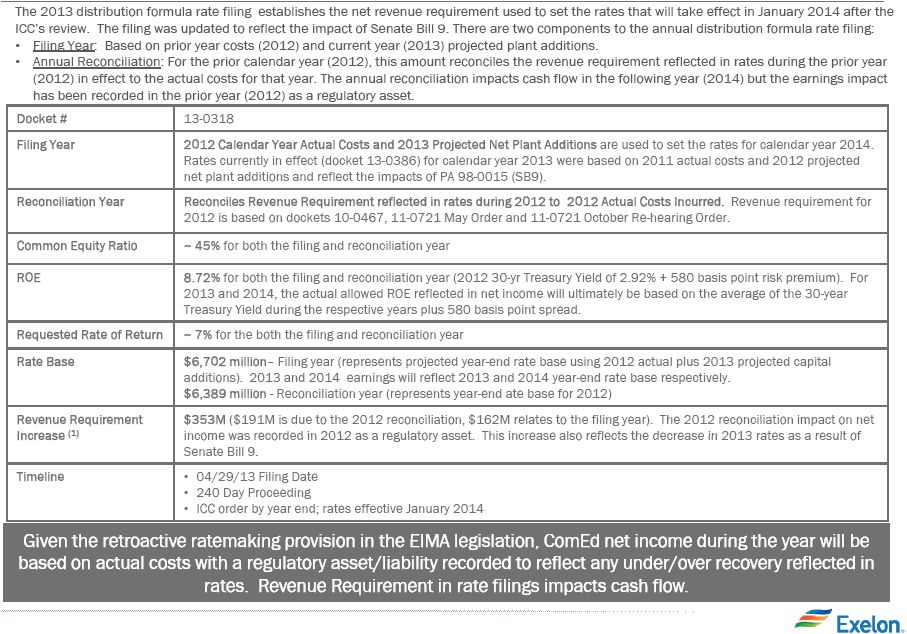

ComEd April 2013 Distribution Formula Rate Updated Filing

2013 EEI Conference |

18

BGE Rate Case

2013 EEI Conference

Rate Case Request

Electric

Gas

Docket #

9326

Test Year

August 2012 –

July 2013

Common Equity Ratio

51.1%

Requested Returns

ROE: 10.5%; ROR: 7.87%

ROE: 10.35%; ROR: 7.79%

Rate Base

$2.8B

$1.0B

Revenue Requirement Increase

$82.6M

$24.4M

Proposed Distribution Price

Increase as % of overall bill

2%

3%

Timeline

•

5/17/13: BGE filed application with the MDPSC seeking increases in gas &

electric distribution base rates •

8/5/13: Staff/Intervenors file direct testimony

•

8/23/13: Update 8 months actual/4 month estimated test period data with actuals

for last 4 months (March -

July 2013)

•

9/17/13: BGE and staff/intervenors file rebuttal testimony

•

10/3/13: Staff/Intervenors and BGE file surrebuttal testimony

•

10/18/13 –

10/29/13: Hearings

•

11/12/13: Initial Briefs

•

11/22/13: Reply Briefs

•

12/13/13: Final Order

•

New rates are in effect shortly after the final order

|

19

ComEd Load

2013 EEI Conference

Weather-Normalized Load YoY Growth

Economic

Forecast

of

Drivers

that

Influence

Load

2013E

0.1%

-0.6%

-0.5%

-0.3%

1.2%

2012

-0.3%

0.2%

-0.6%

-0.1%

2.1%

GMP

Large C&I

Small C&I

Residential

All Customers

Driver or

Indicator

2014 Outlook

Gross Metro

Product (GMP)

2.2% growth in GMP reflects overall better

economic conditions than the slow growth in

2013 (Manufacturing and Professional Business

Services employment accelerate in 2014)

Employment

1.4% increase in total employment is expected

for 2014, which is consistent with the past three

years

Manufacturing

Manufacturing employment is expected to grow

1.4% in 2014. This is a significant improvement

over the 0.7% growth in 2012 and the 0.4%

growth in 2013

Households

Household formations are expected to increase

0.4% in 2014. This is a slight improvement over

the 0.3% realized in the past couple of years

Energy

Efficiency

Continued expansion of EE program expected to

reduce usage in 2014 by approximately 1.2%

Notes: 2012 data is not adjusted for leap year. Source of 2014 economic

outlook data is Global Insight (July 2013). Moderate growth economy and

energy efficiency initiatives will continue to impact load growth

|

20

PECO Load

Weather-Normalized Load YoY Growth

Economic

Forecast

of

Drivers

that

Influence

Load

2013E

-2.4%

1.7%

-0.2%

0.2%

1.0%

2012

-2.7%

-2.3%

-1.7%

-2.2%

1.5%

GMP

Large C&I

Small C&I

Residential

All Customers

Driver or Indicator

2014 Outlook

Gross Metro

Product (GMP)

GMP projected to grow at 2.1% for 2014,

vs. pre-recession average of 2.5%

Resident

Employment

Resident Employment outlook is 1.0% in

2014 vs. 0.8% in 2013

Manufacturing

Employment

Manufacturing employment is expected to

grow at 1.1%. Philadelphia has had

negative growth from 2000 to 2013

Households

Household growth is expected to be 0.7%,

strongest growth since 2010

Energy Efficiency

Deemed Energy Efficiency impact

forecasted to be ~1% reduction in usage

in 2014

Moderately strong economic recovery will drive sales in 2014, but this will be

partially offset by on-going energy efficiency initiatives

2013 EEI Conference

Notes: 2012 data is not adjusted for leap year. Source of 2013 economic

outlook data is Global Insight (August 2013) |

21

BGE Load

Weather-Normalized Load YoY Growth

Economic

Forecast

of

Drivers

that

Influence

Load

2013E

-3.6%

1.4%

-1.1%

1.8%

2012

-0.2%

-2.8%

-2.1%

-1.5%

GMP

Large C&I

Small C&I

Residential

All Customers

2014 Outlook

Gross Metro

Product (GMP)

GMP is projected to grow at 2.4% for

2014.

Employment

1.4% growth projected. BGE’s decoupled

non-rate case revenue growth is primarily

driven by customer growth. The main

driver for customer growth is employment.

Manufacturing

Manufacturing employment is expected to

be fairly flat to 2013 levels in 2014

Households

Household growth is projected to be

0.9%, the same as 2013.

Energy Efficiency

Continued expansion of EE programs will

partially offset growth seen due to

improvements in economic conditions.

2014 is expected to be another transition year for the Baltimore

economy with

continued slow to moderate growth

Notes: 2012 Data is not adjusted for leap year. Source of 2014 economic

outlook data is Global Insight (August 2013). 1.4%

2.5%

2013 EEI Conference

Driver or Indicator |

22

Exelon Utilities: Rate Base

(1)

and ROE Targets

Continued investment in Utilities will provide stable earnings growth

($ in billions)

2013E

$5.4

$3.5

$0.7

$1.1

$1.3

2016E

$4.0

$0.8

$6.1

2015E

$5.9

$3.9

$0.7

$1.3

2014E

$5.7

$3.8

$0.7

$1.2

Electric Distribution

Electric Transmission

Gas Delivery

2014E

$9.5

$7.2

$2.3

2013E

$8.7

$6.6

$2.1

2016E

2015E

$10.7

$7.9

$2.9

$11.6

$3.1

$8.5

Distribution

Transmission

$3.1

$5.1

$3.0

$0.8

$1.2

2014E

$4.8

$3.0

$0.7

$1.2

2013E

$4.6

$2.9

$0.6

$1.1

$0.9

2016E

$5.3

$1.3

2015E

Electric Distribution

Electric Transmission

Gas Delivery

(1)

ComEd and PECO rate base represents end-of-year; and BGE rate base

represents a trailing 13-month average. Numbers may not add

due to rounding. (2)

Equity component for distribution rates will be the actual capital structure

adjusted for goodwill.

(3)

Earned ROE will reflect the weighted average of 11.5% allowed transmission ROE

and distribution ROE resulting from 30-year Treasury plus 580 basis

points for each calendar year. 2013 EEI Conference

(4)

Per MDPSC merger commitment, BGE is precluded from paying dividends through

2014. Per MDPSC orders, BGE cannot pay out a dividend to its parent

company if said dividend would cause BGE’s equity ratio to fall

below 48%. |

23

Capital Expenditures

($ in millions)

$275

$25

$75

$100

2014E

$625

$300

$175

$50

$100

2013E

$550

2016E

$425

$250

$75

$100

2015E

$475

$225

$175

$50

$100

Electric Distribution

Smart Meter/Smart Grid

(1)

Electric Transmission

Gas Delivery

2015E

$2,025

$1,150

$275

$600

2014E

$1,775

$1,050

$175

$550

2013E

$1,450

$850

$150

$450

2016E

$1,925

$225

$500

$1,200

2015E

$600

$300

$175

$125

2014E

$625

$150

$150

$300

$300

$100

$100

$125

2013E

$625

$300

$100

$100

$125

2016E

$600

(1)

Smart Meter/Smart Grid CapEx net of proceeds from U.S. Department of Energy

(DOE) grant. For BGE, includes CapEx from Smart Energy Savers program of ~$10M per year.

2013 EEI Conference |

24

Regulatory Schedule

4Q13

1Q14

2Q14

3Q14

2014 formula rate

case filing (by

5/15/14)

ComEd Distribution

Formula Rate

Illinois Power

Agency

Procurement

ComEd

Transmission Rate

Update

2014 formula rate case

filing (by 5/15/14);

rates effective June

2014 thru May 2015

2014 formula rate case

filing final order (by

12/31/14); rates

effective 1/2/15 –

12/31/15

4Q14

BGE Distribution Rates

PECO Supply

Procurement

BGE Transmission Rate

Update

2014 formula rate case

filing (by 5/15/14);

rates effective June

2014 thru May 2015

MDPSC Order expected

December 13, 2013

BGE Supply

Procurement

Regular procurement

event (January)

Regular procurement

event (April and June)

Potential Electric and

Gas DSIC Filing

PECO Distribution

Filing

13-0318 final order

(by 12/25); rates

effective 1/2/14 –

12/31/14

DSP II Procurement

(January)

DSP II Procurement

(September)

Regular

procurement event

(October)

Regular

procurement event

(October)

IPA proposed procurement events in April and September

2013 EEI Conference |

*

* |

26

Commercial Business Overview

Scale, Scope and Flexibility Across the Energy Value Chain

Development and

exploration of natural gas

and liquids properties

12 assets in

seven states

~255 BCFe of proved

Reserves

(1)

Leading merchant power

generation portfolio in the

U.S.

~35 GW of owned

generation capacity

(2)

Clean portfolio, well

positioned for evolving

regulatory requirements

Industry-leading wholesale

and retail sales and

marketing platform

~150 TWh of load and

~410 BCF of gas delivered

(3)

~ 1 million residential and

100,000 business and

public sector customers

One of the largest and most

experienced Energy

Management providers

~2,000 MW of Load

Response under contract

(4)

Over 4,000 energy savings

projects implemented

across the U.S.

Benefiting from scale, scope and flexibility across the value chain

(1) Estimated

proved

reserves

as

of

12/31/2012.

Includes

Natural

Gas

(NG),

NG

Liquids

(NGL)

and

Oil.

NGL

and

Oil

are

converted

to

BCFe

at

a

ratio

of

6:1.

(2) Total owned generation capacity as of 9/30/2013.

(3) Expected for 2013 as of 9/30/2013. Electric load and gas includes fixed

price and indexed products. (4) Load Response estimate as of

9/30/2013. 2013 EEI Conference |

New York

New England

ERCOT

MidAtlantic

27

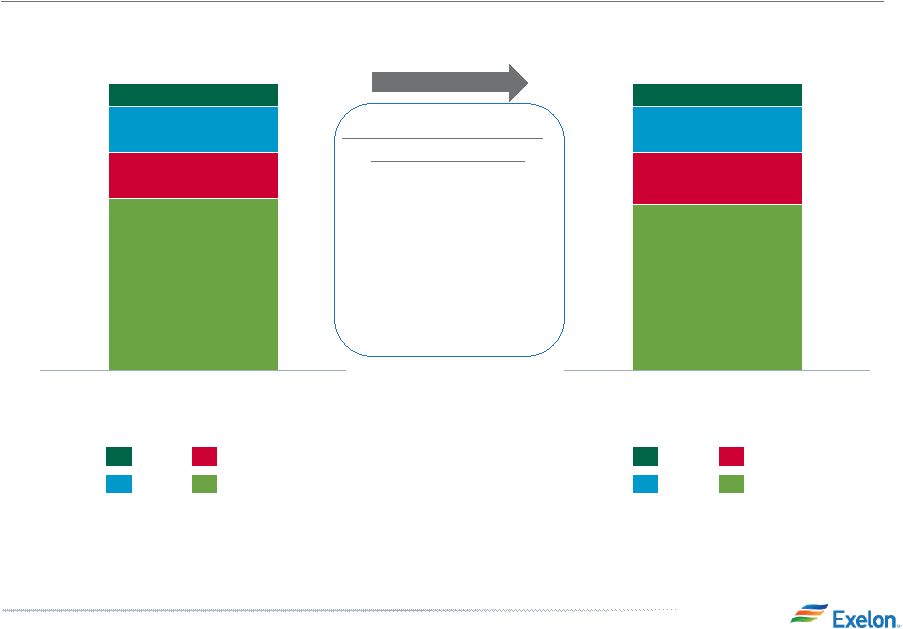

Generation and Load Match

The combination establishes an industry-leading platform with regional

diversification of the generation fleet and customer-facing load

business Generation Capacity, Expected Generation and Expected Load

2014 in TWh

(1,2)

Expected Load

Expected Generation

Generation

capacity:

2013 EEI Conference

Peaking

Intermediate

Baseload

Renewables

(1)

Owned and contracted generation capacity converted from MW to MWh assuming 100%

capacity factor for all technology types, except for renewable capacity which is shown at estimated capacity factor.

(2)

Expected generation and load shown in the chart above will not tie out with

load volume and ExGen disclosures. Load shown above does not include indexed products and generation reflects a net

owned and contracted position. Estimates as of 9/30/2013.

South/West/

Canada

MidWest |

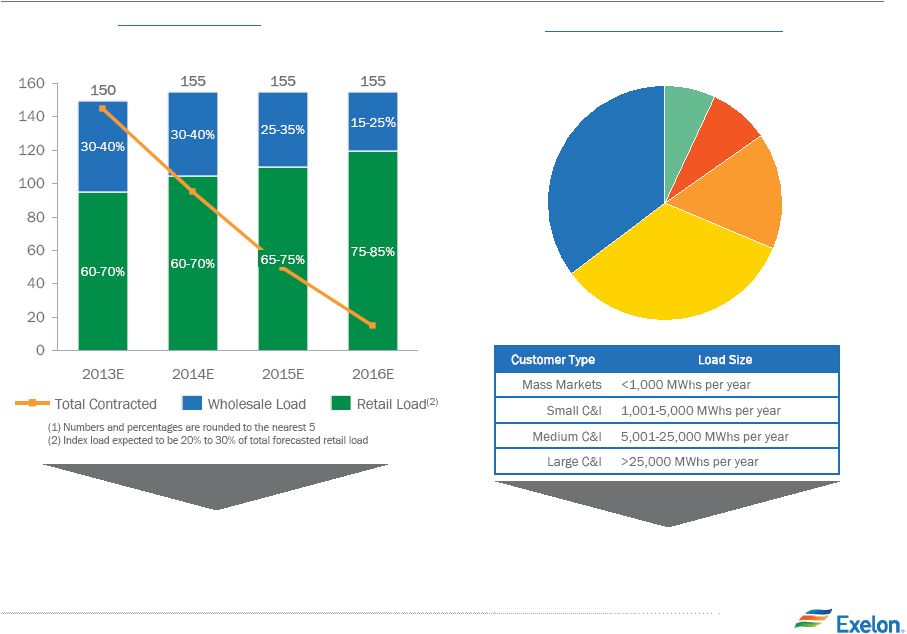

28

Electric Load Serving Business: Growth Target

Commercial Load

(1)

2013 –

2016 TWh

8%

Load Split by Customer Class

(2013 TWh)

Focus on disciplined pricing and

maximizing margin potential through

all channels to market

A diverse set of customers enhances

margin opportunities from a sales and

portfolio management standpoint

33%

Wholesale

35%

Large C&I

Medium C&I

16%

Small C&I

8%

Mass Markets

7%

C&I = Commercial & Industrial

2013 EEI Conference |

29

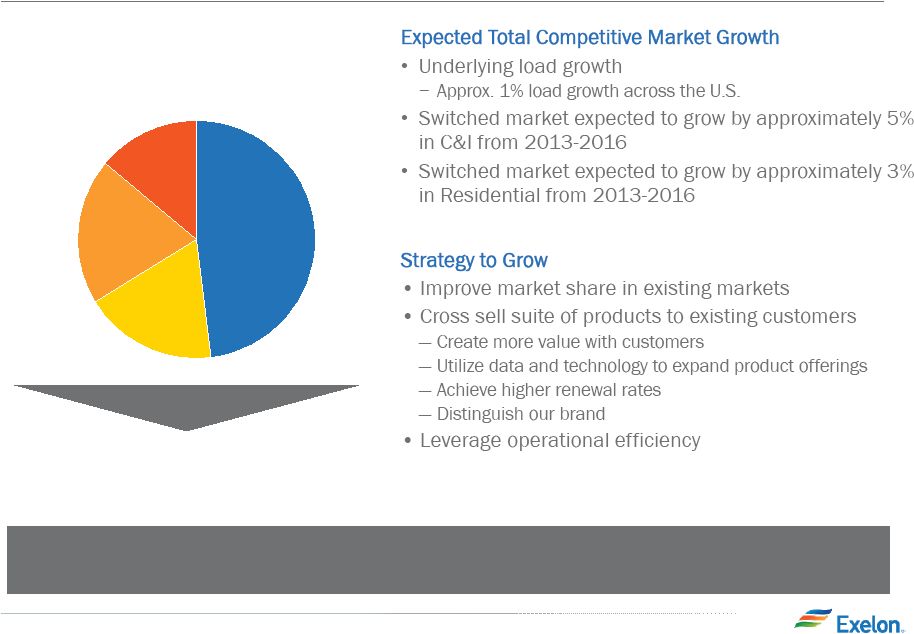

Electric Load Serving Business: Strategy

Constellation is well positioned in a U.S. market where capacity

available for

competitive supply has room to grow

Total U.S. Power Market in 2013

Estimated Load ~ 3,700 TWh

(1)

(1) Source: EIA, KEMA and internal estimates.

Through retail and wholesale channels, Constellation

currently serves 150 TWhs, or approximately 4%, of total

U.S. power demand

18%

Eligible Non-Switched

14%

Eligible Switched

20%

Muni/Co-Op Market

Other

Ineligible

48%

2013 EEI Conference |

Capacity Markets

30

2013 EEI Conference |

31

Retail and Wholesale Gas

(1)

Estimate as of 9/30/2013.

Retail Gas

Portfolio Size:

•

410 Bcf expected to be served in 2013 with

moderate growth thereafter

•

Month by month renewals, with high retention

rates

Market Potential:

•

All states are competitive markets with an

estimated total market size of 15,000 Bcf, of

which 7,500 Bcf is currently switched

Growth Strategy and Objectives:

•

Looking to grow Northeast gas markets as well

as ONEOK territories

Wholesale Gas

Portfolio Size:

•

8 Bcf wholesale storage

•

450,000 MMBtu’s per day of term transport

•

Over 1 Bcf/day of plant supply

•

~4Bcf/day of NG flows to meet growing

customer business, asset optimization, and

plant supply

Growth Strategy and Objectives:

•

Continue to expand wholesale presence to

complement power assets

•

Increase market knowledge of regional and

basis transport information to assist power

forecasting

•

Continue to expand physically based customer

business

•

Continue to grow NG asset portfolio that

complements customer business & plant supply

requirements

2013 EEI Conference |

32

(1)

Oil/NGL conversion to gas is 6:1.

(2)

Constellation does not operate any of its properties.

Note: E&P = Exploration and Production

(3)

12/31/12 Year end reserves excluding Eagle Ford

(4)

Net daily production as of Q2 2013 excluding Eagle Ford

Upstream E&P Assets

2013 EEI Conference |

2013 EEI Conference

33

Energy Price Upside -

NIHub

We continue to believe there is $4 of upside in NiHub energy prices in

2015/2016 driven by several factors including compliance with

environmental regulations $31.00

$30.50

$31.25

$33.07

$4.21

$4.10

$3.91

2011

2012

2013

2014

2015

2016

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

$5.50

$6.00

$36.00

$34.00

$32.00

$30.00

$28.00

$26.00

$24.00

$30.25

$3.68

$2.75

$28.95

$3.99

Realized

Forward

Key Drivers

•

Year over year increases in fuel prices

•

Current and future coal retirements

•

Higher variable unit costs due to MATS

•

Modest load growth

•

Offset by new generation (gas and renewable)

Other factors (not included)

•

Demand Response energy bidding

•

Increased variable costs due to RGGI

•

Scarcity pricing

NG-NYMEX

NIHub Upside

NIHub ATC |

34

Exelon Generation Disclosures

September 30, 2013

(As disclosed in Third Quarter 2013 Earnings materials)

2013 EEI Conference |

35

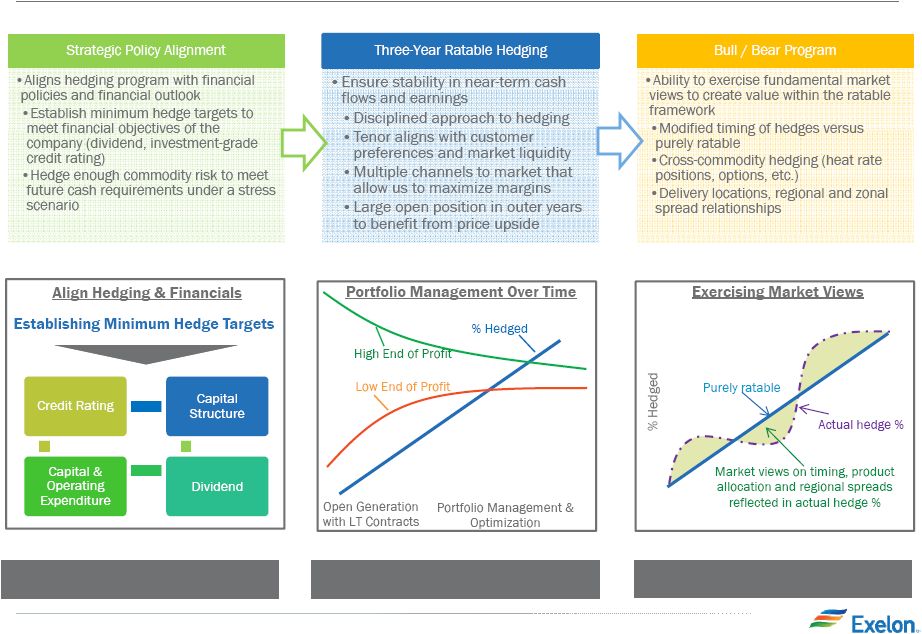

Portfolio Management Strategy

Protect Balance Sheet

Ensure Earnings Stability

Create Value

2013 EEI Conference |

36

Components of Gross Margin Categories

Gross margin linked to power production and sales

Gross margin from

other business activities

2013 EEI Conference |

37

ExGen Disclosures

2013 EEI Conference

Gross Margin Category ($M)

(1,2)

2013

2014

2015

2016

Open

Gross

Margin

(including

South,

West

&

Canada

hedged

GM)

(3)

$5,600

$5,650

$5,800

$5,800

Mark

to

Market

of

Hedges

(3,4)

$1,700

$900

$450

$250

Power

New

Business

/

To

Go

$50

$500

$750

$750

Non-Power

Margins

Executed

(5)

$400

$200

$100

$100

Non-Power

New

Business

/

To

Go

(5)

$200

$400

$500

$500

Total

Gross

Margin

$7,950

$7,650

$7,600

$7,400

Reference Prices

(6)

2013

2014

2015

2016

Henry Hub Natural Gas ($/MMbtu)

$3.65

$3.86

$4.06

$4.17

Midwest: NiHub ATC prices ($/MWh)

$31.18

$30.25

$30.47

$30.99

Mid-Atlantic: PJM-W ATC prices ($/MWh)

$37.58

$37.19

$37.53

$38.13

ERCOT-N ATC Spark Spread ($/MWh)

HSC Gas, 7.2HR, $2.50 VOM

$1.09

$6.30

$8.18

$7.13

New York: NY Zone A ($/MWh)

$37.07

$35.54

$35.70

$36.07

New England: Mass Hub ATC Spark Spread($/MWh)

ALQN Gas, 7.5HR, $0.50 VOM

$3.70

$4.88

$3.69

$2.33 |

38

ExGen Disclosures

Generation and Hedges

2013

2014

2015

2016

Exp. Gen (GWh)

(1)

214,700

215,500

209,400

211,000

Midwest

97,200

96,900

96,400

97,400

Mid-Atlantic

(2)

74,500

73,600

70,100

71,400

ERCOT

13,200

17,800

19,600

19,400

New York

(2)

14,000

12,500

9,300

9,300

New England

15,800

14,700

14,000

13,500

% of Expected Generation Hedged

(3)

97-100%

84-87%

48-51%

19-22%

Midwest

97-100%

85-88%

47-50%

16-19%

Mid-Atlantic

(2)

97-100%

90-93%

56-59%

21-24%

ERCOT

92-95%

81-84%

39-42%

31-34%

New York

(2)

98-101%

87-90%

54-57%

19-22%

New England

95-98%

49-52%

22-25%

7-10%

Effective Realized Energy Price ($/MWh)

(4)

Midwest

$37.00

$33.50

$33.00

$34.00

Mid-Atlantic

(2)

$49.00

$45.00

$45.00

$49.00

ERCOT

(5)

$24.00

$11.00

$9.50

$6.50

New York

(2)

$32.00

$37.00

$42.50

$39.50

New England

(5)

$6.00

$3.50

$2.00

$5.50

2013 EEI Conference |

39

ExGen Hedged Gross Margin Sensitivities

Gross Margin Sensitivities (With Existing Hedges)

(1, 2,3)

2013

2014

2015

2016

Henry Hub Natural Gas ($/MMbtu)

+ $1/MMbtu

$10

$110

$370

$575

-

$1/MMbtu

$0

$(45)

$(305)

$(550)

NiHub ATC Energy Price

+ $5/MWh

$0

$65

$325

$450

-

$5/MWh

$0

$(60)

$(325)

$(450)

PJM-W ATC Energy Price

+ $5/MWh

$0

$35

$175

$290

-

$5/MWh

$0

$(35)

$(170)

$(280)

NYPP Zone A ATC Energy Price

+ $5/MWh

$0

$5

$20

$35

-

$5/MWh

$0

$(10)

$(20)

$(35)

Nuclear Capacity Factor

+/-

1%

+/-

$10

+/-

$40

+/-

$45

+/-

$45

2013 EEI Conference |

40

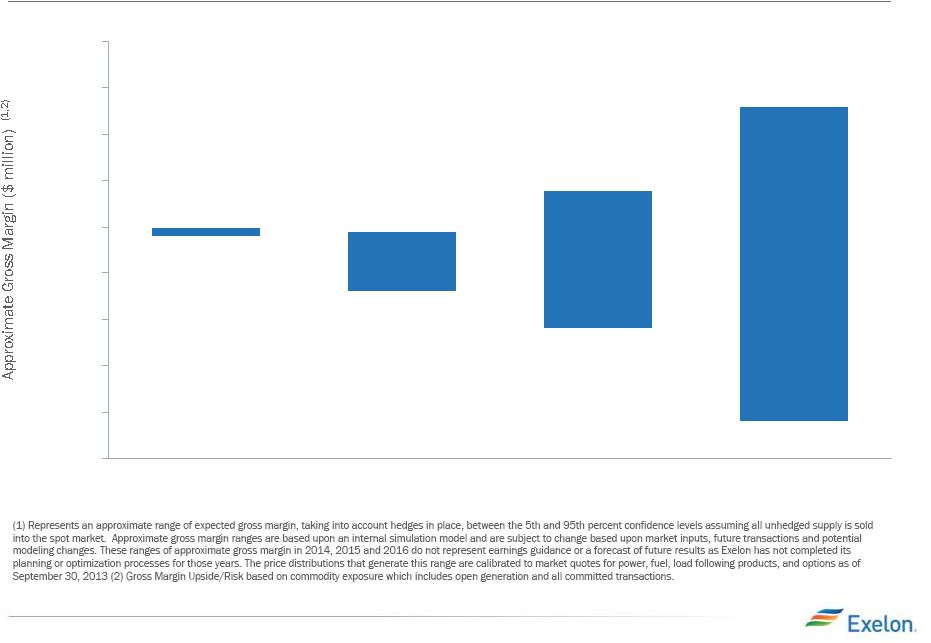

Exelon Generation Hedged Gross Margin Upside/Risk

5,500

6,000

6,500

7,000

7,500

8,000

8,500

9,000

9,500

10,000

2016

2015

2014

2013

$9,300

$8,400

$7,950

$8,000

$7,900

$7,300

2013 EEI Conference

$6,900

$5,900 |

Row

Item

Midwest

Mid-

Atlantic

ERCOT

New York

New

England

South,

West &

Canada

(A)

Start with fleet-wide open gross margin

$5.65 billion

(B)

Expected Generation (TWh)

96.9

73.6

17.8

12.5

14.7

(C)

Hedge % (assuming mid-point of range)

86.5%

91.5%

82.5%

88.5%

50.5%

(D=B*C)

Hedged Volume (TWh)

83.8

67.3

14.7

11.1

7.4

(E)

Effective Realized Energy Price ($/MWh)

$33.50

$45.00

$11.00

$37.00

$3.50

(F)

Reference Price ($/MWh)

$30.25

$37.19

$6.30

$35.54

$4.88

(G=E-F)

Difference ($/MWh)

$3.25

$7.81

$4.70

$1.46

$(1.38)

(H=D*G)

Mark-to-market value of hedges ($ million)

(1)

$275 million

$525 million

$70 million

$15 million

$(10) million

(I=A+H)

Hedged Gross Margin ($ million)

$6,550 million

(J)

Power New Business / To Go ($ million)

$500 million

(K)

Non-Power Margins Executed ($ million)

$200 million

(L)

Non-

Power New Business / To Go ($ million)

$400 million

(N=I+J+K+L)

Total Gross Margin

$7,650 million

41

Illustrative Example of Modeling Exelon

Generation

2014 Gross Margin

(1) Mark-to-market rounded to the nearest $5 million.

2013 EEI Conference |

42

Constellation Energy Nuclear Group (CENG) Background

As

a

result

of

Exelon’s

equity

interest

in

CENG,

CENG

gross

margins

and

earnings

are

reflected

in

ExGen

disclosures

and

other

financial

statements.

The

following

is

information

related

to

PPA

contracts

between

CENG

and

3

rd

parties

and

the

PPA

between

CENG

and

its

equity

parents.

2013 EEI Conference |

43

Constellation

Energy

Nuclear

Group

(CENG)

Background

2013 EEI Conference |

Generation

*

*

*

*

* |

Exelon Generation Fleet

A clean and diverse portfolio that is well positioned for environmental upside

from EPA regulations

(1)

Total owned generation capacity as of 9/30/2013. Nuclear capacity

reflects EXC ownership of CENG and Salem. 45

National Scope

•

Power generation assets in 20 states and

Canada

•

Low-cost generation capacity provides

unparalleled leverage to rising commodity

prices

Large and Diverse

•

35 GW of diverse generation

(1)

–

19 GW of Nuclear

–

10 GW of Gas

–

2 GW of Hydro

–

2 GW of Oil

–

1 GW of Coal

–

1 GW of Wind/Solar/Other

Clean

•

One of nation’s cleanest fleets as

measured by CO2, SO2 and NOx intensity

•

Less than 5% of generation capacity will

require capital expenditures to comply

with Air Toxic rules

2013 EEI Conference |

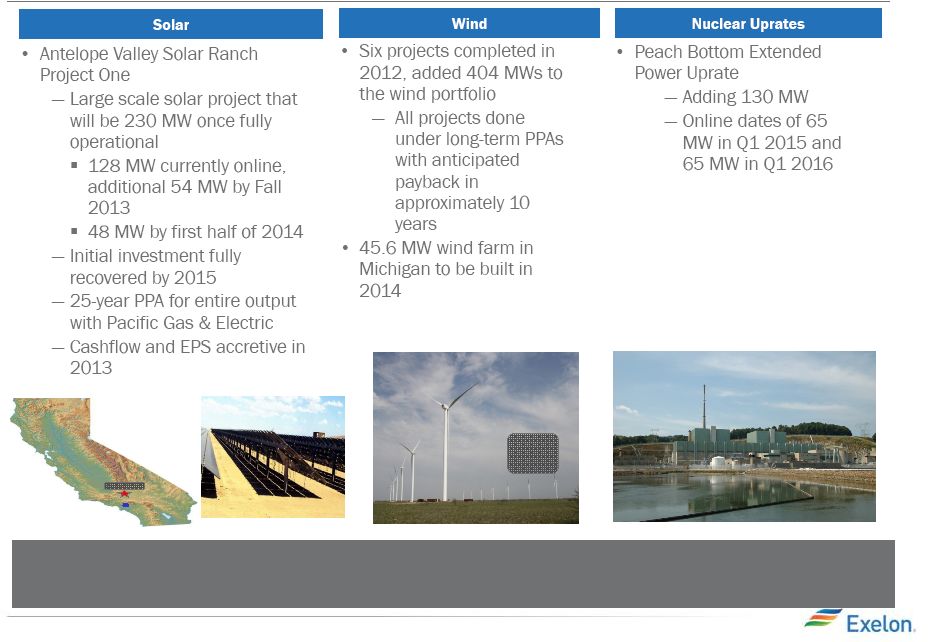

Executing on Generation Development and Growth Projects

Expanding the contracted renewable portfolio of Solar and Wind while adding

incremental MWs to our existing nuclear fleet

46

Los Angeles

AVSR 1

Wildcat

Wind

2013 EEI Conference |

Exelon Nuclear Fleet Overview (including CENG and Salem)

(1)

Operating license renewal process takes approximately 4-5 years from

commencement until completion of NRC review. (2)

The date for loss of full core reserve identifies when the on-site storage

pool will no longer have sufficient space to receive a full complement of fuel from the reactor core. Dry cask storage will be in operation at those sites prior to losing full core discharge

capacity in their on-site storage pools.

(3)

On December 8, 2010, Exelon announced that it will permanently cease generation

operations at Oyster Creek by December 31, 2019. Oyster Creek’s

current NRC license expires in 2029. (4)

Exelon Generation has a 50.01% ownership interest in CENG (Constellation Energy

Nuclear Group, LLC). Electricite de France SA (EDF) has a 49.99% ownership interest in CENG.

47

2013 EEI Conference |

48

1,208

1,169

1,104

(1)

Exelon fleet averages exclude Salem and CENG

(2)

Source: 2012 Electric Utility Cost Group (EUCG) survey. Includes

Fuel Cost plus Direct O&M divided by net generation.

(3)

Source:

Platts

Nuclear

News,

Nuclear

Energy

Institute

and

Energy

Information

Administration

(Department

of

Energy).

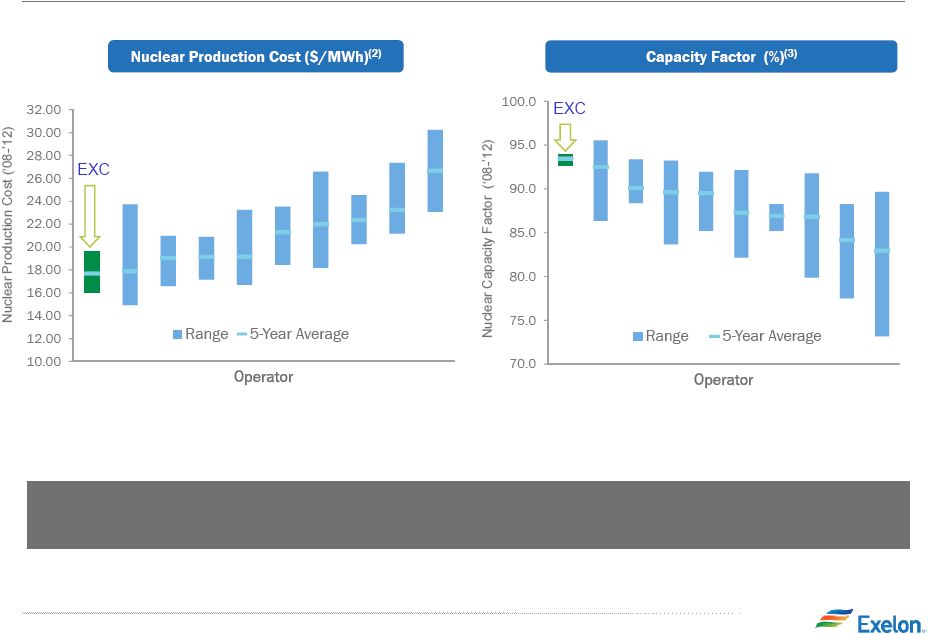

World Class Nuclear Operator

(1)

Among major nuclear plant fleet operators, Exelon is consistently one of the

lowest-cost and most efficient producers of electricity in the

nation 2013 EEI Conference |

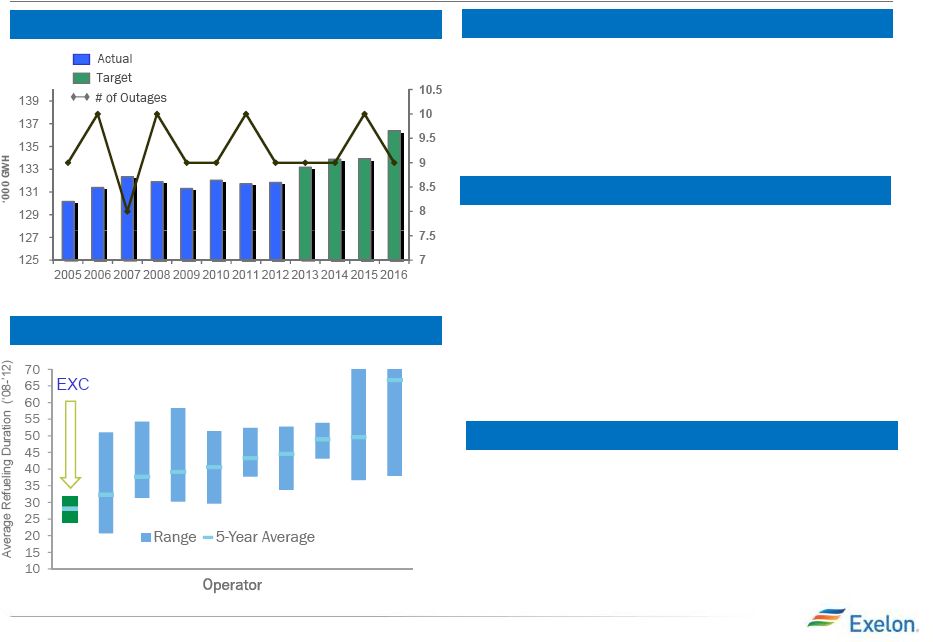

Nuclear Output and Refueling Outages

Fleet Average Refueling Outage Duration (Days)

(1)

31%

36%

14%

14%

Nuclear Output

(1)

(1) Net nuclear generation data at ownership excluding

Salem and CENG. 2016 includes

Clinton Refueling Only outage of shortened duration. 49

Nuclear Refueling Cycle

•

All Exelon owned units on a 24 month cycle

except for Braidwood U1/U2, Byron U1/U2 and

Salem U1/U2, which are on 18 month cycles

•

Starting in 2015 Clinton is on annual cycles

2013 Refueling Outage Impact

•

10 planned refueling outages, including 1 at

Salem

•

Exelon completed 4 refueling outages in the

Spring with an average duration of 24 days

•

Salem completed 1 refueling outage in the

Spring

•

5 Exelon planned Fall refueling outages

(Braidwood 1, Peach Bottom 3, Clinton, Three

Mile Island and Dresden 2)

(1) Exelon fleet averages exclude Salem and CENG.

2013 EEI Conference

2014 Refueling Outage Impact

•

11 planned refueling outages, including 2 at

Salem

•

5 Exelon planned Spring refueling outages and

4 planned Fall refueling outages

•

1 Salem planned Spring refueling outage and 1

planned Fall refueling outage |

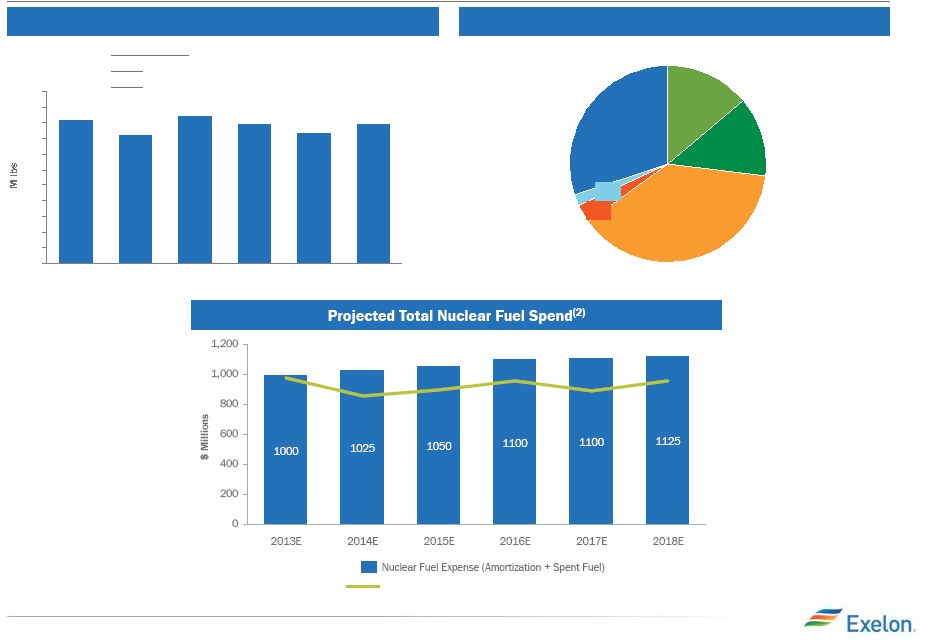

Nuclear Fuel Costs

(1)

Projected Exelon (100%) Uranium Demand

Components of Fuel Expense in 2013

2013 –

2016: 100% hedged in volume

2017:

~80% hedged in volume

2018:

~50% hedged in volume

2

1

0

11

10

9

8

7

6

5

4

3

2018E

2017E

2016E

2015E

2014E

2013

Enrichment

30%

Tax/Interest

2%

Conversion

3%

Uranium

38%

Nuclear Waste

13%

Fabrication

14%

(1)

All charts exclude Salem and CENG.

(2)

At ownership, excluding Salem and CENG. Excludes costs reimbursed under the

settlement agreement with the DOE. 50

Nuclear Fuel Capex

2013 EEI Conference |

Constellation Energy Nuclear Group (CENG)

Operating Services Agreement

51

•

Agreements

signed

between

Exelon

and

EDF,

with

expected

close

in

2014

(first

quarter

or early second quarter)

•

Nuclear Operating services agreement

•

Integrate CENG and their 3 plants into Exelon Nuclear with transfer of

operating licenses •

Utilize Exelon Nuclear Management Model to improve plant performance

•

Leverage

scale

and

obtain

cost

efficiencies

of

running

a

larger,

integrated

fleet

•

Expect cost synergies of $50-$70M at 100% ownership

•

Loan to CENG and distributions to EDF/Exelon Generation

•

Exelon Generation $400M loan to CENG at 5.25% annual interest rate

•

CENG $400M special distribution to EDF

•

Exelon Generation to receive preferred distributions from CENG’s available

cash flows until loan is fully repaid

•

Exelon Generation also to receive aggregate distributions of $400M plus a

return of 8.5% per annum from the date of the special dividend

•

Option provision for EDF to sell its 49.99% interest in CENG to Exelon

Generation •

Exercisable from January 2016 to June 2022, priced at fair market value

•

Indemnify EDF in the event of a future nuclear incident (as defined in the Price

Anderson Act) in connection with the CENG nuclear plants or their

operations •

Given Exelon’s size and past performance, no material impact to

premiums Leverages Exelon’s best-in-class operations, scale

and low-cost fleet to add value 2013 EEI Conference

|