Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Wendy's Co | d622804d8k.htm |

Third

Quarter 2013 Conference Call

November 7, 2013

©

2013 Oldemark LLC

Exhibit 99.1 |

JOHN

BARKER Chief Communications

Officer

2

©

2013 Oldemark LLC |

Today’s Agenda

CEO Overview

Emil Brolick

Financial Update

Q&A

3

Todd

Penegor |

4

Forward-Looking Statements and Non-GAAP Financial Measures

This presentation, and certain information that management may discuss in connection with

this presentation, contains certain statements that are not historical facts,

including information concerning possible or assumed future results of our

operations. Those statements constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995 (The “Reform

Act”). For all forward-looking statements, we claim the protection of the safe

harbor for forward-looking statements contained in the Reform Act. Many

important factors could affect our future results and could cause those results to differ materially

from those expressed in or implied by our forward-looking statements. Such factors,

all of which are difficult or impossible to predict accurately, and many of which

are beyond our control, include but are not limited to those identified under the

caption “Forward-Looking Statements” in our news release issued on

November 7, 2013 and in the “Special Note Regarding Forward-Looking Statements and

Projections” and “Risk Factors” sections of our most recent Form 10-K

/ Form 10-Qs.

In addition, this presentation and certain information management may discuss in

connection with this presentation reference non-GAAP financial measures, such

as adjusted earnings before interest, taxes, depreciation and amortization, or

adjusted EBITDA, and adjusted earnings per share. Adjusted EBITDA and adjusted

earnings per share exclude certain expenses, net of certain benefits. Reconciliations of

non-GAAP financial measures to the most directly comparable GAAP financial measures

are provided in the Appendix to this presentation, and are included in our news

release issued on November 7, 2013 and posted on www.aboutwendys.com. |

EMIL

BROLICK President & CEO

5

5

©

2013 Oldemark LLC |

©

2013 Oldemark LLC

SYSTEM OPTIMIZATION

PROCEEDING AS PLANNED

CONFIDENT IN 4Q; RAISING

2013 EARNINGS OUTLOOK

BRAND TRANSFORMATION

MOMENTUM CONTINUES

STRONG QUARTER OF SALES

AND EARNINGS GROWTH

6

IMAGE ACTIVATION

PROGRESSING |

Adjusted

EBITDA* $98.7 mil

vs. $84.5 mil

Adjusted EPS*

$0.08 vs.

$0.02

N.A. Rest. Margin

15.6% vs. 13.9%

Co.-Op. SSS

3.2% vs. 2.7%

7

Q3 2013 Highlights

2013

2012

*See reconciliation of Adjusted EBITDA and Adjusted EPS in the appendix.

+17%

+$0.06

5.9%

2-year

+170bps |

8

HIGH

LOW

FUNCTIONAL

EMOTIONAL

BRAND VISION

NEW

QSRs

TRADITIONAL

QSRs

EXPERIENCE |

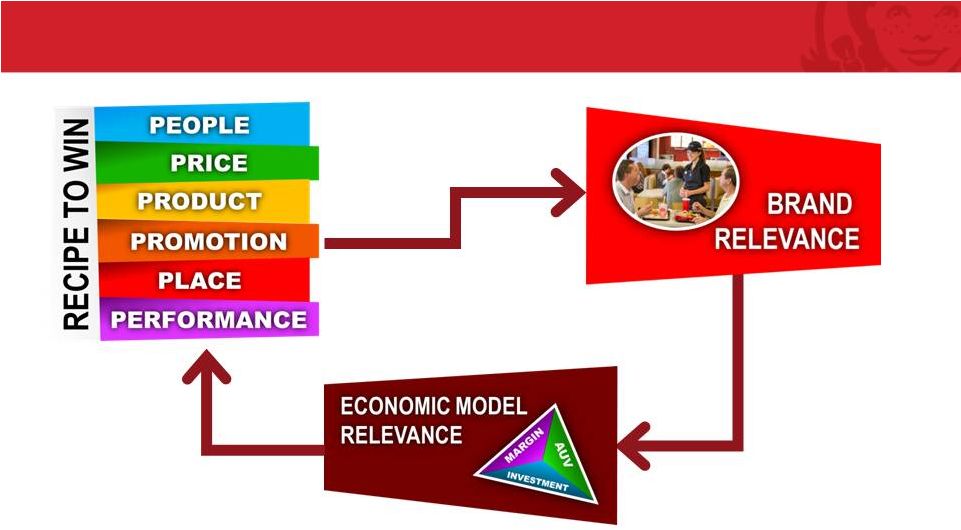

PRODUCT

Play a different game

PRICE

New QSR Quality at QSR Price

PROMOTION

Strategically driven, tactically brilliant

PEOPLE

5-Star Performers

PERFORMANCE

Keeping the brand promise

PLACE

The complete brand experience

9

THE RECIPE TO WIN |

10

Regaining Heritage of Product Innovation |

11 |

12

PREMIUM

PRICE / VALUE

Executing the High-Low Strategy |

13 |

14

Ultimate source of differentiation |

wendys.com

LinkedIn

Ultimate source of differentiation |

16

Source: QSR Magazine’s 2013 Drive-Thru Performance Study

Fastest Drive-Thru in QSR

134

158

181

189

198

204

218

Average Drive

-

Thru Time in Seconds |

17

IMAGE ACTIVATION

New QSR Experience |

SYSTEM

OPTIMIZATION Selling 425 Restaurants to Franchisees

SHAREHOLDER VALUE

EFFICIENCY

OPERATIONAL EFFECTIVENESS

GROWTH |

•

Completed sale of 118 restaurants through Nov. 7, 2013

•

New and existing franchisees

•

Strong operators with proven success

•

Strong financially and well-capitalized

•

Growth mindset –

commitment to Image Activation and new restaurant

development

•

Demonstrated commitment to customer service

SYSTEM OPTIMIZATION PROGRESS |

20

Brand Relevance Drives Economic Model Relevance |

©

2013 Oldemark LLC

TODD PENEGOR

Chief Financial Officer

21 |

Image

Activation Continues to Evolve 22

Core Remodel Costs*

* Does not include deferred maintenance

$1,200

$800

$650

$550

2011

2014 |

STANDARD DESIGN

IMAGE ACTIVATION

New QSR Experience |

Expect

System Optimization to Produce Higher Quality Earnings

24

Royalties

$25 M

Rent

$20 M

G&A

$30 M

EBITDA Lost

EBITDA Gained

=

* Estimates based on Company’s current outlook.

Restaurant

EBITDA

$75 M |

25

Q3 2013 Highlights

N.A. Company Restaurant

Margin +170 bps

Q3 2013 15.6%

Q3 2012 13.9%

N.A. Company Restaurant

Margin +170 bps

Q3 2013 15.6%

Q3 2012 13.9%

Q3 2013 North America

Same-Store Sales

1-Year

2-Year

Company-Operated

Franchise

3.1%

6.0%

3.2%

5.9% |

26

Q3 2013 Financial Summary

Q3

2013

Q3

2012

%

Change

Sales

558.0

$

558.3

$

-0.1%

Franchise revenues

82.8

78.0

6.2%

Total revenues

640.8

$

636.3

$

0.7%

Adjusted EBITDA*

98.7

$

84.5

$

16.8%

($ in millions)

(Unaudited)

*See reconciliation of Adjusted EBITDA in the appendix.

|

27

Q3 2013 Financial Summary

Q3

2013

Q3

2012

$

Change

Adjusted EPS*

0.08

$

0.02

$

0.06

$

Reported EPS

(0.00)

$

(0.07)

$

0.07

$

(Unaudited)

*See reconciliation of Adjusted EPS in the appendix.

|

Solid

Four Quarters Earnings 28

2013

2012

Q4

Q1

Q2

Adjusted EBITDA

Adjusted EPS

Q3

$98.7*

Actual

Prior Year

% Change

$102.1

$77.3

$95.9

$84.5

$89.1

$63.9

$80.9

+17%

+15%

+21%

+19%

$0.08*

Actual

Prior Year

% Change

$0.08

$0.03

$0.09

$0.02

$0.05

$0.01

$0.04

+300%

+60%

+200%

+125%

* See reconciliation of Adjusted EBITDA and Adjusted EPS in the appendix.

|

29

YTD 2013 Cash Flow Highlights

($ in millions)

YTD 2013

YTD 2012

Cash flow from operations

252.7

$

124.6

$

Capital expenditures

130.8

126.3

Beginning cash balance

453.4

$

475.2

$

Change in cash

60.1

(21.6)

Ending cash balance

513.4

$

453.6

$ |

30

Selected Balance Sheet Highlights

($ in millions)

Cash

513

$

Senior Debt

1,429

$

Capital Leases and Other Debt

43

Total Debt

1,472

$

TTM Adjusted EBITDA

374

$

Total Debt / TTM Adjusted EBITDA

3.9x

Net Debt / TTM Adjusted EBITDA

2.6x

Sept. 29, 2013 |

Raising

2013 Outlook Estimates based on Company’s current outlook.

31

Adjusted EBITDA:

Approximately $365 million

Adjusted EPS:

Approximately $0.25 |

2013

Outlook Estimates based on Company’s current outlook.

32

•

Adjusted EBITDA of approximately $365 million

•

Adjusted EPS of approximately $0.25

•

SSS of approximately 2.0 percent

•

Restaurant margin of 15.0 percent

•

25 Company IA openings & 100 Company IA reimages

•

Expect to make incremental fourth-quarter investments to drive growth

•

As a result, project fourth-quarter Adjusted EBITDA to decline approximately 10

percent. |

©

2013 Oldemark LLC

SYSTEM OPTIMIZATION

DRIVING IMPROVED EARNINGS

QUALITY

HIGH-QUALITY Q3 DRIVEN BY

SSS GROWTH

33

SOLID MOMENTUM; RAISING

2013 EARNINGS OUTLOOK

CONFIDENT IN LONG-TERM

OUTLOOK |

©

2013 Oldemark LLC

JOHN BARKER

Chief Communications

Officer

34 |

©

2013 Oldemark LLC

MEG NOLLEN

Senior Vice President

Strategy and Investor

Relations

35 |

2013

Events Nov. 13: Image Activation tour in Dublin (host: Stephens)

2014 Events

Jan. 13: ICR Conference –

Preliminary 2013 Earnings and

2014 Guidance

36

Investor Relations Calendar |

Q&A

37 |

Appendix

38 |

Reconciliation of Adjusted EBITDA from Continuing Operations

to Net (Loss) Income Attributable to The Wendy's Company

39

(In Thousands)

(Unaudited)

Three Months

Nine Months

2013

2012

2013

2012

Adjusted EBITDA from continuing operations

$ 98,737

$ 84,491

$ 278,122

$ 237,445

Less:

Depreciation and amortization

(44,325)

(41,878)

(134,841)

(110,136)

Impairment of long-lived assets

(5,327)

-

(5,327)

(7,781)

Facilities action charges, net

(22,275)

(11,430)

(31,690)

(27,561)

Costs associated with closed restaurants in other operating

(income) expense, net

-

-

-

(1,477)

Operating profit

26,810

31,183

106,264

90,490

Interest expense

(15,620)

(21,566)

(55,548)

(77,803)

Loss on early extinguishment of debt

-

(49,881)

(21,019)

(75,076)

Investment income and other income (expense), net

2,273

900

50

30,471

Income (loss) from continuing operations before income taxes

and noncontrolling interests

13,463

(39,364)

29,747

(31,918)

(Provision for) benefit from income taxes

(15,625)

12,672

(17,774)

14,467

(Loss) income from continuing operations

(2,162)

(26,692)

11,973

(17,451)

Discontinued operations:

Income from discontinued operations, net of income taxes

-

784

-

784

Loss on disposal of discontined operations, net of income taxes

-

(254)

-

(254)

Net income from discontinued operations

-

530

-

530

Net (loss) income

(2,162)

(26,162)

11,973

(16,921)

Net loss (income) attributable to noncontrolling

interests 223

-

445

(2,384)

Net (loss) income attributable to The Wendy's Company

$ (1,939)

$ (26,162)

$ 12,418

$ (19,305)

|

40

Reconciliation of Adjusted Income and Adjusted Earnings Per Share from

Continuing Operations to Net (Loss) Income and Earnings Per Share

Attributable to The Wendy's Company

(a)

Adjusted earnings per share amounts for the three months ended September 29, 2013 and

the three and nine months ended September 30, 2012, include the dilutive effect of stock

options and restricted shares, which were excluded from the reported number of shares

used to calculate basic and diluted loss per share, as the impact would have been anti-dilutive.

Included above is a reconciliation of the number of shares used to calculate adjusted

earnings per share amounts.

(In Thousands Except Per Share Amounts)

(Unaudited)

Per share

(a)

Per share

(a)

Per share

Per share

(a)

Adjusted income and adjusted earnings per share from continuing operations

30,254

$

0.08

$

9,119

$

0.02

$

75,132

$

0.19

$

31,687

$

0.08

$

(Less) plus:

Facilities action charges, net

(24,990)

(0.06)

(7,066)

(0.02)

(30,875)

(0.08)

(17,038)

(0.04)

Depreciation of assets that will be replaced as part of the Image Activation

initiative (3,591)

(0.01)

-

-

(15,312)

(0.04)

-

-

Loss on early extinguishment of debt

-

-

(30,926)

(0.08)

(13,137)

(0.03)

(46,547)

(0.12)

Impairment of long-lived assets

(3,332)

(0.01)

-

-

(3,332)

(0.01)

(4,801)

(0.02)

(Loss) gain on sale of investment, net

(503)

(0.00)

-

-

(503)

(0.00)

17,978

0.05

Benefits of prior years' tax matters

-

-

2,181

0.01

-

-

2,181

0.01

Costs associated with closed restaurants in other operating (income) expense,

net -

-

-

-

-

-

(911)

(0.00)

Total adjustments

(32,416)

(0.08)

(35,811)

(0.09)

(63,159)

(0.16)

(49,138)

(0.12)

(Loss) income from continuing operations

(2,162)

(0.00)

(26,692)

(0.07)

11,973

0.03

(17,451)

(0.04)

Net income from discontinued operations

-

-

530

0.00

-

-

530

0.00

Net (loss) income

(2,162)

(0.00)

(26,162)

(0.07)

11,973

0.03

(16,921)

(0.04)

Net loss (income) attributable to noncontrolling interests

223

0.00

-

-

445

0.00

(2,384)

(0.01)

Net (loss) income and earnings per share attributable to The Wendy's Company

(1,939)

$

(0.00)

$

(26,162)

$

(0.07)

$

12,418

$

0.03

$

(19,305)

$

(0.05)

$

Reported number of shares used to calculate diluted (loss) income per

share 392,579

390,406

398,101

390,028

Plus: Dilutive effect of stock options and restricted shares

8,145

1,514

-

1,946

Adjusted number of shares used to calculate adjusted earnings per share

400,724

391,920

398,101

391,974

2013

2012

2013

2012

Three Months

Nine Months |