Attached files

| file | filename |

|---|---|

| 8-K - OPEXA THERAPEUTICS, INC. 8-K - Acer Therapeutics Inc. | a50746443.htm |

| EX-99.1 - EXHIBIT 99.1 - Acer Therapeutics Inc. | a50746443ex99_1.htm |

Exhibit 99.2

Slide: 1

Slide: 2 Title: Forward-Looking Statements Other Placeholder: This earnings presentation contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements made during this presentation, other than statements of historical fact, constitute "forward-looking statements." The words "expects," "believes," "anticipates," "estimates," “enables,” "may," "could," "intends," “positions,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements do not constitute guarantees of future performance. Investors are cautioned that statements which are not strictly historical statements, including, without limitation, statements regarding current or future financial payments, returns, royalties, performance and position, management’s strategy, plans and objectives for future operations, plans and objectives for product development, plans and objectives for present and future clinical trials and results of such trials, plans and objectives for regulatory approval, litigation, intellectual property, product development, manufacturing plans and performance, and management’s initiatives and strategies, and the financing and development of the Company's product candidate, Tcelna (imilecleucel-T), constitute forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These risks and uncertainties include, but are not limited to, risks associated with: market conditions; our capital position; our ability to compete with larger, better financed pharmaceutical and biotechnology companies; new approaches to the treatment of our targeted diseases; our expectation of incurring continued losses; our uncertainty of developing a marketable product; our ability to raise additional capital to continue our development programs (including to undertake and complete any ongoing or further clinical studies for Tcelna), including in this regard our ability to satisfy various conditions required to access the financing potentially available under the purchase agreements with Lincoln Park Capital Fund, LLC (“Lincoln Park”) (such as the minimum closing price for our common stock and the requirement for an ongoing trading market for our stock); our ability to raise additional capital through the sale of shares of our common stock under the purchase agreements with Lincoln Park or under our at-the-market (ATM) facility; our ability to maintain compliance with NASDAQ listing standards; the success of our clinical trials (including the Phase IIb trial for Tcelna in secondary progressive MS which, depending upon results, may determine whether Ares Trading SA (“Merck”) elects to exercise its option for an exclusive license to Tcelna for the treatment of MS (the “Option”)); whether Merck exercises its Option and, if so, whether we receive any development or commercialization milestone payments or royalties from Merck pursuant to the Option; our dependence (if Merck exercises its Option) on the resources and abilities of Merck for the further development of Tcelna; the efficacy of Tcelna for any particular indication, such as for relapsing remitting MS or secondary progressive MS; our ability to develop and commercialize products; our ability to obtain required regulatory approvals; our compliance with all Food and Drug Administration regulations; our ability to obtain, maintain and protect intellectual property rights (including for Tcelna); the risk of litigation regarding our intellectual property rights or the rights of third parties; the success of third party development and commercialization efforts with respect to products covered by intellectual property rights that we may license or transfer; our limited manufacturing capabilities; our dependence on third-party manufacturers; our ability to hire and retain skilled personnel; our volatile stock price; and other risks detailed in our filings with the SEC. These forward-looking statements speak only as of the date made. We assume no obligation or undertaking to update any forward-looking statements to reflect any changes in expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. You should, however, review additional disclosures we make in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC. Other Placeholder: 2

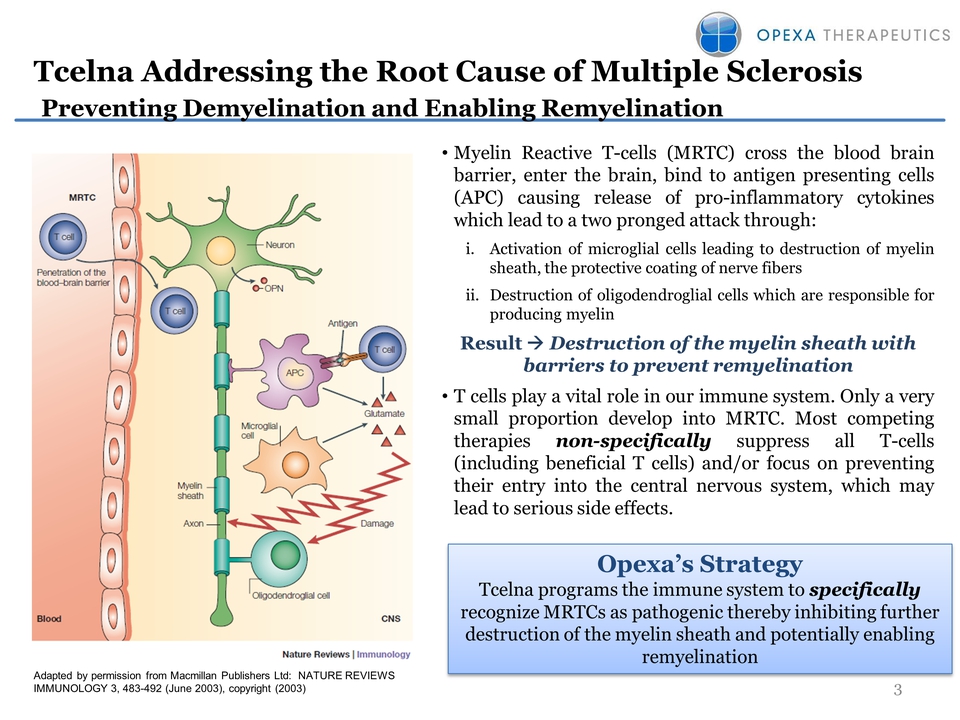

Slide: 3 Title: Tcelna Addressing the Root Cause of Multiple Sclerosis Preventing Demyelination and Enabling Remyelination Myelin Reactive T-cells (MRTC) cross the blood brain barrier, enter the brain, bind to antigen presenting cells (APC) causing release of pro-inflammatory cytokines which lead to a two pronged attack through: Activation of microglial cells leading to destruction of myelin sheath, the protective coating of nerve fibersDestruction of oligodendroglial cells which are responsible for producing myelinResult ? Destruction of the myelin sheath with barriers to prevent remyelinationT cells play a vital role in our immune system. Only a very small proportion develop into MRTC. Most competing therapies non-specifically suppress all T-cells (including beneficial T cells) and/or focus on preventing their entry into the central nervous system, which may lead to serious side effects. Opexa’s Strategy Tcelna programs the immune system to specifically recognize MRTCs as pathogenic thereby inhibiting further destruction of the myelin sheath and potentially enabling remyelination Adapted by permission from Macmillan Publishers Ltd: NATURE REVIEWS IMMUNOLOGY 3, 483-492 (June 2003), copyright (2003) Other Placeholder: 3

Slide: 4 Title: Abili-T : Landmark trial in SPMS Other Placeholder: Abili-T Phase IIb clinical trial in SPMS is ongoingDouble-blind, 1:1 randomized, placebo-controlledTwo annual courses of personalized therapyInclusion criteria: Secondary Progressive MS with EDSS of 3 to 6100 patients enrolled as of November 6, 2013Immune Monitoring program conducted on a blinded basisFast Track designation granted by FDA for Tcelna in SPMS180 Patients expected to be enrolledSPMS populationApproximately 33 sites in USA and CanadaPrimary EndpointWhole-brain atrophySecondary EndpointsSustained progression measured by EDSSTime to sustained progressionChange in EDSS, etc.Other Placeholder: 4

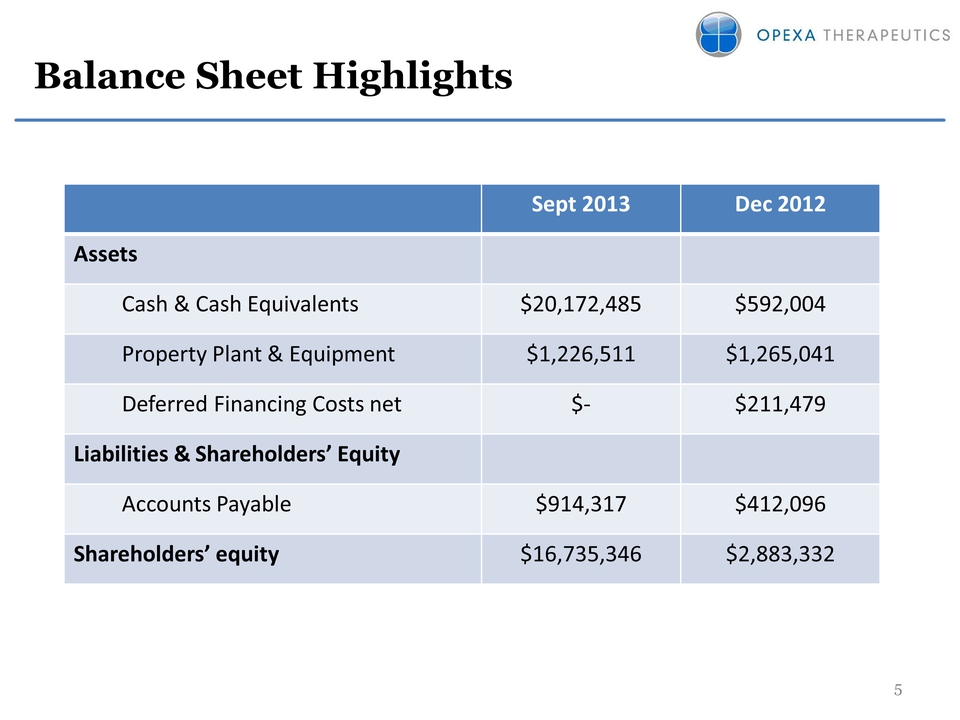

Slide: 5 Other Placeholder: 5 Title: Balance Sheet Highlights Sept 2013 Dec 2012 Assets Cash & Cash Equivalents $20,172,485 $592,004 Property Plant & Equipment $1,226,511 $1,265,041 Deferred Financing Costs net $‐ $211,479 Liabilities & Shareholders’ Equity Accounts Payable $914,317 $412,096 Shareholders’ equity $16,735,346 $2,883,332

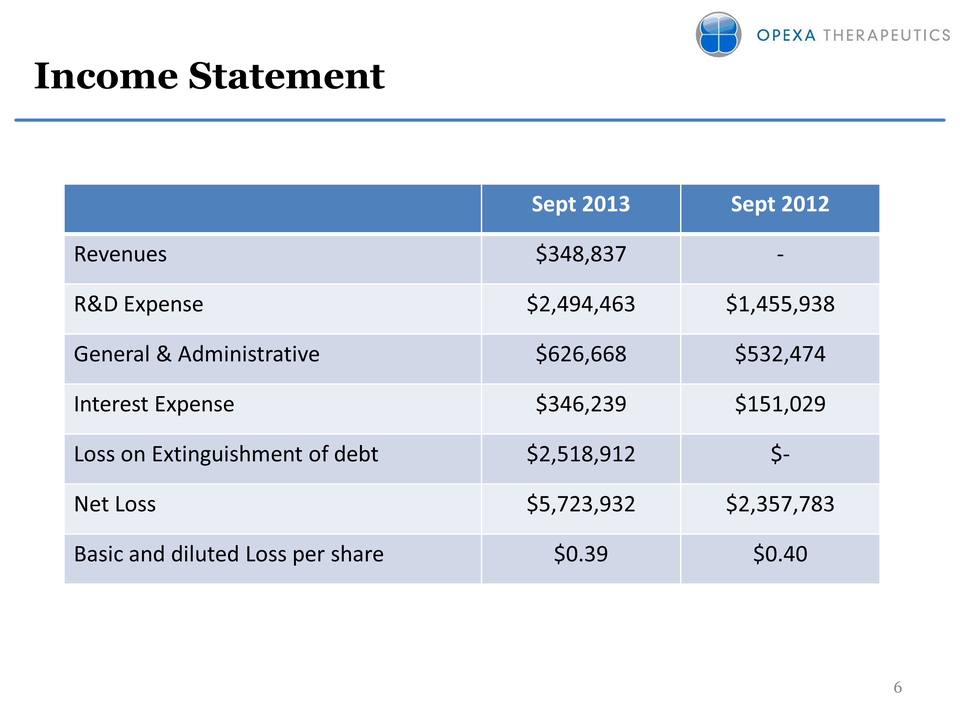

Slide: 6 Other Placeholder: 6 Title: Income Statement Sept 2013 Sept 2012 Revenues $348,837 ‐ R&D Expense $2,494,463 $1,455,938 General & Administrative $626,668 $532,474 Interest Expense $346,239 $151,029 Loss on Extinguishment of debt $2,518,912 $‐ Net Loss $5,723,932 $2,357,783 Basic and diluted Loss per share $0.39 $0.40

Slide: 7 Title: Investment Thesis Other Placeholder: T-cell platform company with Fast Track designation in SPMSStrong Intellectual property with 50 issued patents Esteemed Scientific Advisory Board Precision Immunotherapy potentially optimizes benefit-risk profileTargeting an unmet medical need in a potentially substantial marketOption Agreement with Merck Serono, a strong commercial partnerReplacement value of company is multiples of present market capAttractive potential risk-reward profile for long term/value investorsGoal-oriented management team focused on value creation Other Placeholder: 7