Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIFTH THIRD BANCORP | d623756d8k.htm |

©

Fifth Third Bank | All Rights Reserved

BancAnalysts Association of Boston

Conference

Tayfun Tuzun

Executive Vice President & Chief Financial Officer

November 7, 2013

Please refer to earnings release dated October 17, 2013 and 10-Q dated

November 6, 2013 for further information.

Exhibit 99.1 |

2

Well-positioned in current environment

©

Fifth Third Bank | All Rights Reserved

Disciplined

expense control

Traditional

banking focus

consistent with

direction of

financial reform

Strong levels of

profitability

Broad-based

credit

improvements

Exceed fully

phased-in Basel

III capital

standards today

Well-established

franchise in key

markets

Organic growth

success

Continued

investments to

maintain and

enhance

revenue-

generation |

Earnings per diluted share of $0.47 up 24% from prior year

—

3Q13 included $85MM of pre-tax gains on the sale of Vantiv shares and a

positive $6MM Vantiv warrant valuation

Return on assets of 1.4% (or 1.2% ex-Vantiv) and return on average tangible

common equity¹

of 14.7% (or 12.6% ex-Vantiv)

Pre-provision net revenue¹

up 15% from prior year (fees up 7%; expenses down 5%)

Maintained momentum with strong 3Q results

1

Non-GAAP measure; see Reg. G reconciliation in appendix.

2

Capital ratios presented under current U.S. capital regulations.

The pro forma Basel III Tier I common equity ratio is management’s estimate based upon

its current interpretation of recent prospective regulatory capital requirements

approved in July 2013. 3

Not including any potential future incremental repurchases of common shares in the amount of

any after-tax gains from the sale of Vantiv, Inc. stock. Optimizing retail

distribution strategy and prioritizing key segments within consumer

bank

—

Consumer deposit fees up 17%; credit card balances up 8% from 3Q12

Segment and industry specialization in mid-corporate, energy, and healthcare

within commercial bank

Investment and retirement focus driving 12% growth in retail brokerage and 10%

growth in private client fees within investment advisors business

Strong capital ratios²

—

Tier 1 common ratio¹

9.9%, Basel III pro forma estimate¹

of ~9.5%; reflect benefit

of conversion of Series G preferred stock

Tangible book value per share¹

of $13.09 up 8% from 3Q12

~$600MM of remaining repurchase capacity³

approved under 2013 CCAR plan

3

©

Fifth Third Bank | All Rights Reserved

Strong

Profitability

Executing on

Strategic

Plans

Prudent

Capital

Management |

4

©

Fifth Third Bank | All Rights Reserved

NII results reflect continued moderate NIM

pressure offset by balance sheet growth

1

Estimate; funding (DDAs + interest-bearing liabilities); liabilities attributed

to fixed or floating using terms and expected beta Fixed / Floating

Portfolio Interest-Earning

Assets

Funding

Fixed

~55-60%

Loans

49%

Loans

32%

Investment

Portfolio 4%

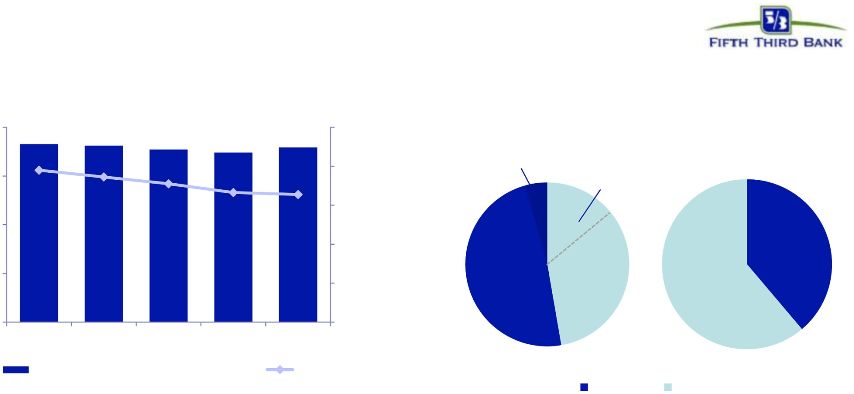

NII and NIM (FTE)

($MM)

3.56%

3.49%

3.42%

3.33%

3.31%

$450

$550

$650

$750

$850

$950

2.0%

2.5%

3.0%

3.5%

4.0%

3Q12

4Q12

1Q13

2Q13

3Q13

Net Interest Income (right axis)

NIM

$907

$903

$893

$885

$898

Fixed

47%

Floating

53%

Investment

Portfolio

15%

Floating

~40-45%

Floating

Fixed

1

•

Sequential increase in NII due to higher balances and yields in investment

securities, lower interest expense, and the benefit of an extra day in the

quarter, partially offset by the effects of loan repricing, lower balances of

held-for-sale loans, and the 2Q13 maturity of interest rate floors

•

Changed composition and size of investment portfolio in 3Q13; expect benefit to NII

in future quarters •

New origination spreads remain tight (reflects increased level of competition, impact

of better credit, and overall relationship profitability targets)

•

Increase in short-term LIBOR rates key driver for long-term upside on NII and

NIM •

Coupons on new fixed rate loan originations continue to converge with portfolio avg. coupons (~40%

of loan book is fixed)

|

5

©

Fifth Third Bank | All Rights Reserved

Strengthened deposit profile

and increased value proposition to customers

Average core deposit balances ($B)

Deposit growth benefited

from focus on

full customer relationship

$86.9

$81.7

Simplified deposit products

•

Straightforward, easy to use

accounts

•

Reduced complexity

•

Elimination of certain fees

•

Total relationship earns better

rates and lower costs

•

Compatible with Fifth Third’s

strategic direction and the new

regulatory landscape

•

Fully converted 2.1 million

households as of the end of the

second quarter

Cost of funds

0.48%

0.47% 0.42% 0.40%

0.38%

0.51%

0.47% 0.44% 0.41%

0.39%

FITB

Peer avg.

Source: SNL Financial. Peer average includes: BBT, CMA, HBAN, KEY, MTB, PNC, RF,

STI, USB, WFC, and ZION. $77.5

$80.2

$80.9

$81.7

$83.2

3Q12

4Q12

1Q13

2Q13

3Q13

Transaction deposits

Other time deposits |

6

©

Fifth Third Bank | All Rights Reserved

Deposit momentum delivering franchise value

Naples

Source: FDIC, SNL Financial.

Note: branches included are full service retail / brick and mortar; data excludes

headquarters branches with over $250 million in deposits ($500MM for Chicago CBSA).

Cincinnati affiliate

#1 market share (22% or $10.6B

of FITB footprint deposits) and

Fifth Third’s largest affiliate

market; home of our corporate

headquarters

Western Michigan and Northwestern Ohio affiliates

#1 market shares (17% and 18% of FITB footprint deposits,

respectively); incl. Grand Rapids, MI and Toledo, OH

Chicago affiliate

Fifth Third’s second largest affiliate market;

strongest affiliate deposit growth in footprint

vs. 2012; significant expansion through Old

Kent acquisition in 2000

•

Deposit growth in 15 of 18

affiliates

–

Top 3 deposit share in

7 affiliates

–

Deposit growth

outperforming market

in 14 affiliates

•

Fifth Third grew deposit

market share in 78% of

affiliates

Strong market share in mature Midwest markets;

Southeast markets remain key focus area and source of future growth.

North Carolina affiliate

#4 market share in Charlotte;

Entered market through First

Charter acquisition in 2008

Florida region

5.4% increase in deposits vs. 2012,

strongest regional growth market |

7

©

Fifth Third Bank | All Rights Reserved

Strong loan growth,

ample opportunities for ongoing growth

Loan balances ($B)

Loan composition (EOP HFI)

48% C&I / lease

10% Commercial real estate

Commercial

25% Resi. mtg. / home equity

14% Auto

3% Card / other

Consumer

•

Solid loan growth with

disciplined lending standards

•

C&I and residential mortgage

balance growth more than

offset run-off in both home

equity and commercial real

estate loans

$83.1

$87.2

$82.9

$83.9

$85.9

$86.7

$87.3

3Q12

4Q12

1Q13

2Q13

3Q13

EOP loans HFI

Avg loans HFI

©

Fifth Third Bank | All Rights Reserved

7 |

Commercial loans –

C&I driving growth

•

Continued run-off in CRE portfolio has

impacted overall loan growth

•

Commercial construction balances are

showing accelerating growth

–

+1%, +3%, and +11% in 1Q13, 2Q13,

and 3Q13, respectively

•

Expect CRE portfolio to contribute to

overall loan growth in future

–

Growth focused primarily on

multi-family and industrial sectors

Source: SNL Financial and Company Reports. Peer average includes: BBT, CMA, HBAN,

KEY, MTB, PNC, RF, STI, USB, WFC, and ZION. BBT & ZION exclude

government guaranteed loans.

1

Presented on a yearly weighted average basis; Excluding held-for-sale

loans. 2

Presented on an average basis; Excluding held-for-sale loans.

•

Growth driven by investments in mid-corporate

segment ($500MM to $2B in revenue) and industry

specializations (i.e. Healthcare and Energy)

•

Loan utilization at record low level

($ in billions)

$10.3

$9.1

$9.3

$9.7

$9.9

+7%

+16%

+15%

Peer average: 26%

$40

$35

$30

$25

$20

$15

$10

28.0

32.4

37.4

3Q11

3Q12

3Q13

44%

32%

31%

30%

29%

27%

25%

21%

21%

21%

18%

13%

CMA

STI

FITB

HBAN

PNC

KEY

RF

ZION

BBT

MTB

USB

WFC

$10

$8

$6

$4

$2

$0

0.7

0.7

0.7

0.7

0.8

3Q12

4Q12

1Q13

2Q13

3Q13

Commercial Mortgage ($B)

Commercial Construction ($B)

©

Fifth Third Bank | All Rights Reserved

8

C&I Portfolio YTD growth

1

CRE balance trend

2

3Q13 C&I Loans / Average Assets

2

9.6

9.2

9.0

8.6

8.3 |

Growth

opportunities in consumer loans •

5 consecutive quarters of average growth

•

Sequential and yearly growth driven by

stronger cross sell activity and account

growth

•

Significant cross-sell opportunity remains

•

Continued innovation in card products

designed to fit customers’

needs (i.e.

DUO, Access 360)

•

DUO Card balance per active account up

34% from prior year

1

Presented on an average basis; excluding held-for-sale loans.

2

Presented on an end of period basis; excluding held-for-sale loans.

•

Represents 14% of total loans

•

5

largest

bank

originator

of

indirect

auto loans

•

Expanded footprint from 36 to 45 states

•

Careful margin management to

optimize volume/return levels

•

High quality portfolio with ~760 average

FICO

Automobile

balances

2

($B)

Automobile

Credit

Card

Credit

card

balances

1

($B)

# Purchase Active Cards

th

$9.0

$10.7

$11.6

$11.9

$12.1

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

3Q09

3Q10

3Q11

3Q12

3Q13

In Footprint

Out of Footprint

47%

53%

57%

60%

62%

47%

53%

43%

40%

38%

$1.5

$1.6

$1.7

$1.8

$1.9

$2.0

$2.1

$2.2

3Q12

4Q12

1Q13

2Q13

3Q13

Mortgage

34%

Home

equity

26%

Auto

33%

Credit

card

6%

Other

consumer

1%

3Q12

3Q13

All Other

DUO Card

Consumer loan portfolio

1

9

©

Fifth Third Bank | All Rights Reserved |

10

©

Fifth Third Bank | All Rights Reserved

Mortgage banking results

1

Gain-on-sale margin represents gains on all loans originated for

sale. Note: numbers may not sum due to rounding

Mortgage Banking Net Revenue ($MM)

$233

$200

$258

$220

$121

Mortgage originations

and gain-on-sale

margin

1

•

Purchase originations of $2.0B, strongest

absolute level and highest relative to total

originations since 2Q11; key focus area near-term

•

3Q13 mortgage components

–

Origination fees and gains on loan sales down

50% due to lower gain-on-sale margins and

lower origination volumes

–

Lower gains-on-sale partially offset MSR

valuation adjustments of positive $23 million

•

Expect lower mortgage gain-on-sale revenue on

lower volume as higher mortgage rates persist and

competitive pressure on industry margins remains

high

•

Managing expenses in line with reduction in

revenue, 3Q13 mortgage-related expenses down

$25MM

–

elimination of overtime and contract work

–

some reduction in full-time employee costs

–

lower incentive compensation due to lower

origination volumes

•

Potential for better mortgage servicing results as

rates increase

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

5.0%

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

3Q12

4Q12

1Q13

2Q13

3Q13

Originations for sale

Originations HFI

Margin

($B)

$7.5B

record

1

226

239

169

150

74

62

64

61

62

63

(48)

(52)

(53)

(51)

(39)

(40)

7

42

73

23

3Q12

4Q12

1Q13

2Q13

3Q13

Orig fees and gains on loan sales

Gross servicing fees

Servicing rights amortization

MSR valuation adjustments

% purchase 26%

21% 14% 24% 43%

% refinance 74%

79% 86% 76% 57% |

11

©

Fifth Third Bank | All Rights Reserved

Strong revenue and profit generation

3Q13 returns strong relative to peers

ROAA

ROATCE

•

Business mix provides higher than average

diversity between spread and fee revenues

•

Relatively strong margin and fee income

contribution drive strong profitability despite

interest rate environment

3Q13 PPNR

/ Average Assets

Source:

SNL

Financial

and

Company

Reports.

Data

as

of

3Q13.

Peer

median

includes:

BBT,

CMA,

HBAN,

KEY,

MTB,

PNC,

RF,

STI,

USB,

WFC,

and

ZION.

PPNR

and

ROATCE

are

Non-GAAP

measures.

See

Reg.

G

reconciliation

in

appendix.

1

Annualized;

excludes

securities

gains

/

losses

for

FITB

and

peers.

STI

also

excludes

$323MM

of

legal

expense,

$96MM

allowance

for

servicing

assets,

and

$63MM

addition

to

repurchase

reserve.

2

See Page 18 in the Appendix for adjustments.

Peer median 1.8%

2.1% /

1.9%

2

Significant purchase

accounting

benefit

14.7%

1.35%

Adjusted

As reported

NII

3Q13 fee income as % of revenue

Fee income

45%

55%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

USB

WFC

MTB

FITB

PNC

BBT

HBAN

STI

RF

KEY

CMA

ZION

13.5%

13.2%

FITB

Peer Median

1.24%

1.22%

FITB

Peer Median

1

2 |

12

©

Fifth Third Bank | All Rights Reserved

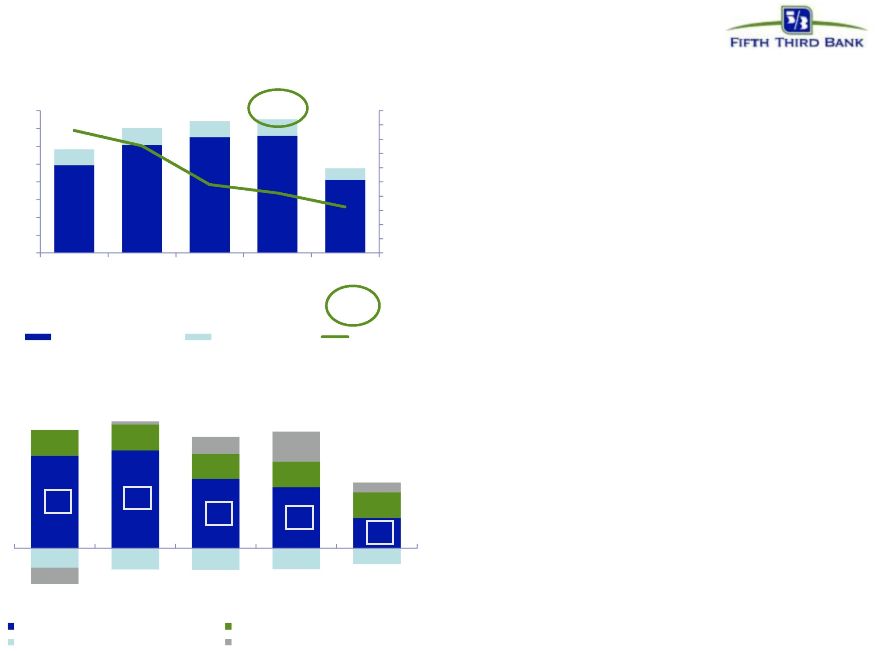

•

Long-term target for mid-50% efficiency

ratio in normalized environment

–

Potential benefit of higher interest

rates in future

–

Current level reflects below-capacity

balance sheet and lower revenue than

we expect to generate in the future

Disciplined expense management

Expense trend ($MM)

Managing expenses carefully in response to revenue environment;

continuous process of expense evaluation

Efficiency ratio trend

Reported expense

$1,006

$1,163

$978

$1,035

$959

Significant

items

impacting

expenses :

Benefit

$5

--

$9

$2

$16

Detriment

($59)

($176)

($12)

($61)

($40)

Adjusted Expense

$952

$987

$975

$976

$935

1

$600

$700

$800

$900

$1,000

$1,100

$1,200

3Q12

4Q12

1Q13

2Q13

3Q13

64%

65%

60%

53%

59%

60%

60%

62%

60%

61%

Adjusted

Efficiency Ratio

1

1

Significant

items

listed

on

page

18

in

the

appendix

under

“Adjustments

to

remove

(benefit)

/

detriment

in

noninterest

expense.”

3Q13

also

included

a

$15

million

reduction

in the mortgage representation and warranty reserve; 2Q13, 4Q12,

and 3Q12 also included mortgage repurchase reserve builds of $9 million, $26

million, and $24 million, respectively related to additional guidance

received from Freddie Mac. These impacts are reflected in “Credit-related items in noninterest expense”.

3Q12

4Q12

1Q13

2Q13

3Q13 |

13

Strong asset quality and coverage

Continued

decline

in

problem

assets

and

corresponding

decline

in

charge-offs

combined with strong reserves on an absolute and relative basis

3Q13 coverage ratios

strong relative to peers

Fifth Third

Peer Median

$112

Net charge-offs ($MM)

$109

$156

$147

NCO ratio

0.75%

0.70%

0.63%

0.51%

0.49%

$133

Nonperforming assets ($MM)

$1,210

$1,150

$1,014

$1,446

$1,286

$1,750

$1,500

$1,250

$1,000

$750

$500

$250

$0

334

356

382

403

429

3Q12

4Q12

1Q13

2Q13

3Q13

Commercial

Consumer

1,017

883

828

794

680

$175

$150

$125

$100

$75

$50

$25

$0

65

67

79

91

94

3Q12

4Q12

1Q13

2Q13

3Q13

Commercial

Consumer

62

56

54

45

44

160%

218%

165%

355%

152%

320%

Reserves / NPLs

Reserves / NPAs

Reserves / Annualized YTD

NCOs

©

Fifth Third Bank | All Rights Reserved

1.73%

1.49%

1.41%

1.32%

1.16%

NPA ratio |

14

©

Fifth Third Bank | All Rights Reserved

Strong capital position and capital generation

support ability to return capital to shareholders

Very strong capital

levels support balance

sheet growth and

higher returns to

shareholders.

~$1.9 billion in capital returned to common shareholders

(7 quarters through 9/30/13)

$175MM

Vantiv-related

repurchases

$600MM

other

repurchases

$421MM

dividends

$539MM

repurchases

$207MM

dividends

~$600MM

remaining

capacity for

repurchases

1

Not including any potential future incremental repurchases of common shares in the

amount of any after-tax gains from the sale of Vantiv, Inc. stock. 2

Included $157MM of repurchases related to after-tax gains from the sale of

Vantiv, Inc. stock. 3

Non-GAAP measure; see Reg. G reconciliation in Appendix. Capital ratios

presented under current U.S. capital regulations. The pro forma Basel III Tier I common equity

ratio is management’s estimate based upon its current interpretation of recent

prospective regulatory capital requirements approved in July 2013. 9.5%

9.9%

3Q13 Tier 1

common ratio

(Basel I)

3Q13 Tier 1

common ratio

(Basel III)

Relative to 5.0% unofficial CCAR

supervisory reference minimum

Relative

to

2015

Basel

III

minimum

of

4.5% and 2019 Basel III buffered

minimum of 7.0%

(5 Quarters)

(through 2 Quarters)

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2012 CCAR

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2013 CCAR

3

3

1

2

|

15

Well-positioned for the future

•

Cash currently sufficient to satisfy all fixed obligations in a stressed

environment for approximately 2 years (debt maturities, common and preferred

dividends, interest and other expenses) without accessing capital markets; relying on dividends from

subsidiaries or any other discretionary actions

•

~9.5%

pro

forma

Basel

III

Tier

1

common

capital

ratio

1

under

recent

prospective

regulatory

capital

requirements

•

Strong returns to shareholders through dividends and share repurchases, additional

capacity from capital generation Superior capital and liquidity position

•

NCO

ratio

lowest

reported

in

more

than

6

years;

delinquencies

at

historically

low

levels

•

Very low relative exposure to areas of concern, e.g. European financials, mortgage

repurchase risk •

Traditional commercial banking franchise built on customer-oriented localized

operating model •

Strong market share in key markets with focus on further improving density

•

Fee income ~45% of total revenue

Diversified traditional banking platform

•

PPNR remained strong throughout the credit cycle

•

Solid returns on both assets and equity, with or without gains related to our

Vantiv holding •

Disciplined expense management

Industry leader in earnings power

1

Non-GAAP measure; see Reg. G reconciliation in Appendix. Capital ratios

presented under current U.S. capital regulations. The pro forma Basel III Tier I common

equity ratio is management’s estimate based upon its current interpretation of

recent prospective regulatory capital requirements approved in July 2013.

©

Fifth Third Bank | All Rights Reserved

Credit

trends

reflective

of

excellent

asset

quality

with

further

opportunity

for

improvement |

16

©

Fifth Third Bank | All Rights Reserved

This report contains statements that we believe are “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule

3b-6 promulgated thereunder. These statements relate to our financial condition, results

of operations, plans, objectives, future performance or business. They usually can be

identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is

anticipated,” “estimate,” “forecast,” “projected,”

“intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,”

“objective,” “continue,” “remain,” or similar expressions, or

future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,”

or similar verbs. You should not place undue reliance on these statements, as they are

subject to risks and uncertainties, including but not limited to the risk factors set

forth in our most recent Annual Report on Form 10-K. When considering these forward-looking statements, you

should keep in mind these risks and uncertainties, as well as any cautionary statements we

may make. Moreover, you should treat these statements as speaking only as of the date

they are made and based only on information then actually known to us.

There are a number of important factors that could cause future results to differ materially

from historical performance and these forward- looking statements. Factors that

might cause such a difference include, but are not limited to: (1) general economic conditions and weakening

in the economy, specifically the real estate market, either nationally or in the states in

which Fifth Third, one or more acquired entities and/or the combined company do

business, are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other

hostilities may disrupt or increase volatility in securities markets or other economic

conditions; (4) changes in the interest rate environment reduce interest margins; (5)

prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s

ability to maintain required capital levels and adequate sources of funding and liquidity;

(7) maintaining capital requirements may limit Fifth Third’s operations and

potential growth; (8) changes and trends in capital markets; (9) problems encountered by larger or similar financial

institutions may adversely affect the banking industry and/or Fifth Third; (10) competitive

pressures among depository institutions increase significantly; (11) effects of

critical accounting policies and judgments; (12) changes in accounting policies or procedures as may be required

by the Financial Accounting Standards Board (FASB) or other regulatory agencies; (13)

legislative or regulatory changes or actions, or significant litigation, adversely

affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth

Third, one or more acquired entities and/or the combined company are engaged, including the

Dodd-Frank Wall Street Reform and Consumer Protection Act; (14) ability to

maintain favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16) ability to attract

and retain key personnel; (17) ability to receive dividends from its subsidiaries; (18)

potentially dilutive effect of future acquisitions on current shareholders’

ownership of Fifth Third; (19) effects of accounting or financial results of one or more acquired entities; (20) difficulties from the

separation of or the results of operations of Vantiv, LLC; (21) loss of income from any sale

or potential sale of businesses that could have an adverse effect on Fifth

Third’s earnings and future growth; (22) ability to secure confidential information and deliver products and services

through the use of computer systems and telecommunications networks; and (23) the impact of

reputational risk created by these developments on such matters as business

generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could

cause actual results to be significantly different from those expressed or implied by these forward-looking

statements.

Cautionary statement |

©

Fifth Third Bank | All Rights Reserved

Appendix |

18

Pre-tax

pre-provision

earnings

1

1

Non-GAAP measure; see Reg. G reconciliation on following pages.

2

Prior quarters include similar adjustments.

3

See

Slide

7

and

Slide

8

of

earnings

presentation

dated

10/17/13

for

detailed

breakout

of

credit-related

items.

4

There

are

limitations

on

the

usefulness

of

credit-adjusted

PPNR,

including

the

significant

degree

to

which

changes

in

credit

and

fair

value

are

integral,

recurring

components

of

the

Bancorp’s

core

operations

as

a

financial

institution.

This

measure

has

been

included

herein

to

facilitate

a

greater

understanding

of

the

Bancorp’s

financial

condition.

Note:

3Q13

also

included

a

$15

million

reduction

in

the

mortgage

representation

and

warranty

reserve;

2Q13,

4Q12,

and

3Q12

also

included

mortgage

repurchase

reserve

builds of $9 million, $26 million, and $24 million, respectively, related to additional

guidance received from Freddie Mac. These impacts are reflected in “Credit-related items in

noninterest expense”

listed above.

PPNR of $655MM up 15%; Adjusted PPNR of $603MM up 1% from 3Q12.

PPNR reconciliation

$800

$700

$600

$500

$400

$300

$200

$100

$0

3Q12

4Q12

1Q13

2Q13

3Q13

59

68

24

14

13

10

6

35

16

5

600

640

605

632

603

$568

$616

$653

$905

$655

PPNR

Credit-related items in noninterest expense

Credit-related items in noninterest income

Adjusted PPNR

($ in millions)

3Q12

4Q12

1Q13

2Q13

3Q13

Income before income taxes (U.S. GAAP) (a)

$503

$540

$591

$841

$605

Add: Provision expense (U.S. GAAP) (b)

65

76

62

64

51

PPNR (a) + (b)

$568

$616

$653

$905

$655

Adjustments

to

remove

(benefit)

/

detriment

2

:

In

noninterest

income:

Gain from sales of Vantiv shares

-

(157)

-

(242)

(85)

Vantiv warrant & puts

16

19

(34)

(76)

(6)

Valuation of 2009 Visa total return swap

1

15

7

5

2

Sale of certain Fifth Third funds

(13)

-

(7)

-

-

BOLI settlement

-

-

-

(10)

-

Securities (gains) / losses

(2)

(2)

(17)

-

(2)

In

noninterest

expense:

Debt extinguishment (gains) / losses

26

134

-

-

-

Severance expense

2

3

3

1

5

Sale of certain Fifth Third funds

2

-

-

-

-

Large bank assessment fees

-

-

-

-

5

Gain on sale of affordable housing investments

(5)

-

(9)

(2)

(1)

Additions to litigation reserves

5

13

9

51

30

Adjusted PPNR

$600

$640

$605

$632

$603

Credit-related

items

3

:

In noninterest income

14

13

10

6

5

In noninterest expense

59

68

24

35

16

Credit-adjusted

PPNR

4

$673

$721

$639

$673

$624

©

Fifth Third Bank | All Rights Reserved

PPNR trend |

Available and

contingent borrowing capacity (3Q13): –

FHLB ~$9B available, ~$11B total

–

Federal Reserve ~$28B

Holding Company cash at 9/30/13: $1.9B

Cash currently sufficient to satisfy all fixed

obligations in a stressed environment for over

2 years (debt maturities, common and

preferred dividends, interest and other

expenses) without accessing capital markets;

relying on dividends from subsidiaries or any

other discretionary actions

Holding company unsecured debt maturities ($MM)

Bank

unsecured

debt

maturities

($MM

–

excl.

Brokered

CDs)

Heavily core funded

Strong liquidity profile

S-T

wholesale

9%

19

©

Fifth Third Bank | All Rights Reserved

$1,250

$500

$500

$2,312

$1,458

$62

$500

$700

$600

2013

2014

2015

2016

2017

2018

2019 on

2017

2013

2014

2015

2016

2018

2019 on

Fifth Third Bancorp

Fifth Third Capital Trust (Bancorp)

L-T debt

6%

Equity

12%

Other

liabilities

4%

S-T

borrowings

3%

Non-Core

Deposits

6%

Foreign

Office

1%

Consumer

time

3%

Savings

MMDA

22%

Interest

checking

19%

Demand

24% |

20

©

Fifth Third Bank | All Rights Reserved

Capital management philosophy

1

Subject to Board of Directors and regulatory approval

Organic growth opportunities

•

Support growth of core banking franchise

•

Continued loan growth despite sluggish

economy

Strategic opportunities

•

Prudently evaluate opportunities to increase

density of franchise via disciplined

acquisitions or selective de novos

•

Expect future acquisition opportunities

although activity likely to remain muted in

near-term

•

Attain top 3 market position in 65% of

markets or more longer term

Dividends

•

As previously indicated, target levels more

consistent with Fed’s near-term payout ratio

guidance of 30%

•

Strong levels of profitability would support

higher dividend than current level

•

Quarterly dividend increased to $0.12 in 2Q13

Repurchases / Redemptions

Consistent and prudent capital management philosophy

Capital Retention / Deployment

Capital Return

•

Common share repurchases to limit / manage growth of

excess capital levels

•

2013 CCAR included:

–

Potential repurchase of ~$1.2B in common stock

(including repurchases related to already realized

Vantiv gains)

o

Repurchased $539MM of common shares in

2Q13

–

Potential issuance of $1.05B in preferred stock

o

$593MM of preferred stock issued in 2Q13

–

Conversion of $398MM in 8.5% convertible preferred

stock into ~35.5MM common shares –

July 2013

•

Ability to repurchase shares in amount equal to any

future after-tax gains on sale of Vantiv shares

1

1

1 |

21

©

Fifth Third Bank | All Rights Reserved

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

September

June

March

December

September

2013

2013

2013

2012

2012

Income before income taxes (U.S. GAAP)

$604

$841

$591

$540

$503

Add:

Provision expense (U.S. GAAP)

51

64

62

76

65

Pre-provision net revenue (a)

655

905

653

616

568

Net income available to common shareholders (U.S. GAAP)

421

582

413

390

354

Add:

Intangible amortization, net of tax

1

1

1

2

2

Tangible net

income available to common shareholders 422

583

414

392

356

Tangible net income available to common

shareholders (annualized) (b) 1,674

2,338

1,679

1,559

1,416

Average Bancorp shareholders' equity (U.S. GAAP)

14,440

14,221

13,779

13,855

13,887

Less:

Average preferred stock

(593)

(717)

(398)

(398)

(398)

Average goodwill

(2,416)

(2,416)

(2,416)

(2,417)

(2,417)

Average intangible assets

(22)

(24)

(26)

(28)

(31)

Average tangible common equity

(c) 11,409

11,064

10,939

11,012

11,041

Total Bancorp shareholders' equity (U.S. GAAP)

14,641

14,239

13,882

13,716

13,718

Less:

Preferred stock

(593)

(991)

(398)

(398)

(398)

Goodwill

(2,416)

(2,416)

(2,416)

(2,416)

(2,417)

Intangible assets

(21)

(23)

(25)

(27)

(30)

Tangible common equity, including

unrealized gains / losses (d) 11,611

10,809

11,043

10,875

10,873

Less: Accumulated other comprehensive income / loss

(218)

(149)

(333)

(375)

(468)

Tangible common equity, excluding unrealized gains /

losses (e) 11,393

10,660

10,710

10,500

10,405

Total assets (U.S. GAAP)

125,673

123,360

121,382

121,894

117,483

Less:

Goodwill

(2,416)

(2,416)

(2,416)

(2,416)

(2,417)

Intangible assets

(21)

(23)

(25)

(27)

(30)

Tangible assets, including

unrealized gains / losses (f) 123,236

120,921

118,941

119,451

115,036

Less: Accumulated other comprehensive income / loss, before tax

(335)

(229)

(512)

(577)

(720)

Tangible assets, excluding unrealized gains / losses

(g) 122,901

120,692

118,429

118,874

114,316

Common shares outstanding (h)

887

851

875

882

897

Ratios:

Return on average tangible common equity (b) / (c)

14.7%

21.1%

15.4%

14.1%

12.8%

Tangible common equity (excluding unrealized gains/losses) (e) / (g)

9.27%

8.83%

9.03%

8.83%

9.10%

Tangible common equity (including unrealized gains/losses) (d) / (f)

9.42%

8.94%

9.28%

9.10%

9.45%

Tangible book value per share (d) / (h)

13.09

12.69

12.62

12.33

12.12

For the Three Months Ended |

22

Regulation G Non-GAAP reconciliation

Fifth Third Bancorp and Subsidiaries

Regulation G Non-GAAP Reconcilation

$ and shares in millions

(unaudited)

September

June

March

December

September

2013

2013

2013

2012

2012

Total Bancorp shareholders' equity (U.S. GAAP)

$14,641

$14,239

$13,882

$13,716

$13,718

Goodwill and certain other intangibles

(2,492)

(2,496)

(2,504)

(2,499)

(2,504)

Unrealized gains

(218)

(149)

(333)

(375)

(468)

Qualifying trust preferred securities

810

810

810

810

810

Other

21

22

23

33

38

Tier I capital

12,762

12,426

11,878

11,685

11,594

Less:

Preferred stock

(593)

(991)

(398)

(398)

(398)

Qualifying trust preferred securities

(810)

(810)

(810)

(810)

(810)

Qualifying noncontrolling interest in consolidated subsidiaries

(39)

(38)

(38)

(48)

(51)

Tier I common equity (a)

11,320

10,587

10,632

10,429

10,335

Risk-weighted

assets

1

(b)

114,544

112,285

109,626

109,699

106,858

Ratio:

Tier I common equity (a) / (b)

9.88%

9.43%

9.70%

9.51%

9.67%

Basel III -

Estimated Tier 1 common equity ratio

September

June

2013

2013

Tier 1 common equity (Basel I)

$11,320

$10,587

Add:

$88

$86

Estimated Tier 1 common equity under final Basel III rules without AOCI (opt out)(c)

$11,408

$10,673

Add:

Adjustment

related

to

AOCI

3

$218

$149

Estimated Tier 1 common equity under final Basel III rules with AOCI (non opt out)(d)

$11,626

$10,822

Estimated

risk-weighted

assets

under

final

Basel

III

rules

4

(e)

120,447

117,366

Estimated

Tier

1

common

equity

ratio

under

final

Basel

III

rules

(opt

out)

(c)

/

(e)

9.47%

9.09%

Estimated

Tier

1

common

equity

ratio

under

final

Basel

III

rules

(non

opt

out)

(d)

/

(e)

9.65%

9.22%

1

2

3

4

Adjustments

related

to

capital

components

include

MSRs

and

deferred

tax

assets

subject

to

threshold

limitations

and

deferred

tax

liabilities

related

to

intangible

assets,

which

were

deductions

to capital under Basel I capital rules.

Under final Basel III rules, non-advanced approach banks are permitted to make a

one-time election to opt out of the requirement to include AOCI in Tier I common equity.

For the Three Months Ended

Under the banking agencies’

risk-based capital guidelines, assets and credit equivalent amounts of derivatives and

off-balance sheet exposures are assigned to broad risk categories. The aggregate

dollar amount in each risk category is multiplied by the associated risk weight of the category. The resulting weighted values are added together, along with the measure

for market risk, resulting in the Bancorp’s total risk-weighted assets.

Key differences under Basel III in the calculation of risk-weighted assets compared to

Basel I include: (1) Risk weighting for commitments under 1 year; (2) Higher risk weighting

for exposures to securitizations, past due loans, foreign banks and certain commercial real

estate; (3) Higher risk weighting for MSRs and deferred tax assets that are under certain

thresholds as a percent of Tier I capital;

and

(4)

Derivatives

are

differentiated between

exchange

clearing

and

over-the-counter

and

the

50%

risk-weight

cap

is

removed.

©

Fifth Third Bank | All Rights Reserved

Adjustment

related

to

capital components

2 |