Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL HOME LOAN MORTGAGE CORP | d620722d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - FEDERAL HOME LOAN MORTGAGE CORP | d620722dex991.htm |

Third

Quarter 2013 Financial Results

Supplement

November 7, 2013

Exhibit 99.2 |

2

Table of contents

Business Results

Credit Supplement

3 -

Quarterly Financial Results

20 -

National Home Prices

4 -

Comprehensive Income (Loss)

21 -

State-by-State Home Prices: June 2006 to September 2013

5 -

Senior Preferred Stock Purchase Agreement with Treasury

22 -

State-by-State Home Prices: September 2012 to September 2013

6 -

Treasury Draw Requests and Dividend Payments

23 -

Mortgage Market and Freddie Mac Serious Delinquency Rates

7 -

Total Equity and Senior Preferred Stock Activity

24 -

8 -

Single-Family Guarantee Fees Charged on New Acquisitions

25 -

9 -

Loan Loss Reserves

26 -

10 -

27 -

11 -

28 -

12 -

29 -

13 -

30 -

14 -

31 -

15 -

32 -

Multifamily Portfolio Composition

16 -

33 -

Multifamily New Business Volume by State

17 -

34 -

Multifamily Mortgage Portfolio UPB Concentration by State

18 -

35 -

Multifamily Mortgage Portfolio by Attribute

36 -

Multifamily Mortgage Portfolio by Attribute, Continued

37 -

Multifamily Market and Freddie Mac Delinquency Rates

Loan Purpose of Single-Family Credit Guarantee Portfolio

Purchases

Credit Quality of Single-Family Credit Guarantee Portfolio Purchases

Single-Family Credit Guarantee Portfolio Characteristics

Single-Family 3Q 2013 Credit Losses and REO by Region and State

Single-Family Credit Profile by Book Year and Product Feature

Single-Family Serious Delinquency Rates by State and Region

Aging of Single-Family Seriously Delinquent Loans by Judicial and

Non-Judicial States

Real Estate Owned

Single-Family Cumulative Foreclosure Transfer and Short Sale

Rates by Book Year

Market Liquidity Provided

Single-Family Refinance Activity

Performance of Single-Family Modified Loans

Single-Family Loan Modifications

Single-Family Loan Workouts

Administrative Expenses

Repurchase Requests

Purchase Agreement Portfolio Limits |

3

Quarterly financial results

Line 12:

Pre-tax income increased in 3Q13 primarily

due to:

Line 6:

Gains on securities in the company’s

mortgage-related investments portfolio, gains on

multifamily mortgages loans and settlement

proceeds related to private label securities

litigation.

Line 4:

A shift from derivative gains in 2Q13 to

derivative losses in 3Q13 as long-term interest

rates increased less during 3Q13 as compared

to 2Q13.

Line 13:

Income tax benefit in 3Q13 includes a benefit

for federal income taxes of $23.9 billion that resulted

from the company’s conclusion to release the valuation

allowance against its net deferred tax assets.

($ Billions)

3Q 2013

vs

2Q 2013

3Q 2013

2Q 2013

1

Net interest income

$4.1

$4.3

$0.1

2

Benefit for credit losses

0.6

1.1

0.5

3

Net interest income after benefit for credit losses

4.8

5.4

0.6

Non-interest income (loss)

4

Derivative gains (losses)

1.4

(0.1)

(1.4)

5

Net impairment of available-for-sale securities

recognized in earnings

(0.0)

(0.1)

(0.1)

6

Other non-interest income (loss)

(0.6)

1.9

2.5

7

Non-interest income

0.7

1.7

1.0

Non-interest expense

8

Total administrative expenses

(0.4)

(0.5)

(0.0)

9

Real estate owned operations income

0.1

0.1

(0.0)

10

Other expenses

(0.2)

(0.2)

(0.0)

11

Non-interest expense

(0.5)

(0.6)

(0.1)

12

Pre-tax income

4.9

6.5

1.6

13

Income tax benefit

0.0

24.0

23.9

14

Net income

5.0

30.5

25.5

15

Total other comprehensive income (loss),

net of taxes

(0.6)

(0.0)

0.6

16

Comprehensive income

$4.4

$30.4

$26.1

Partially offset by: |

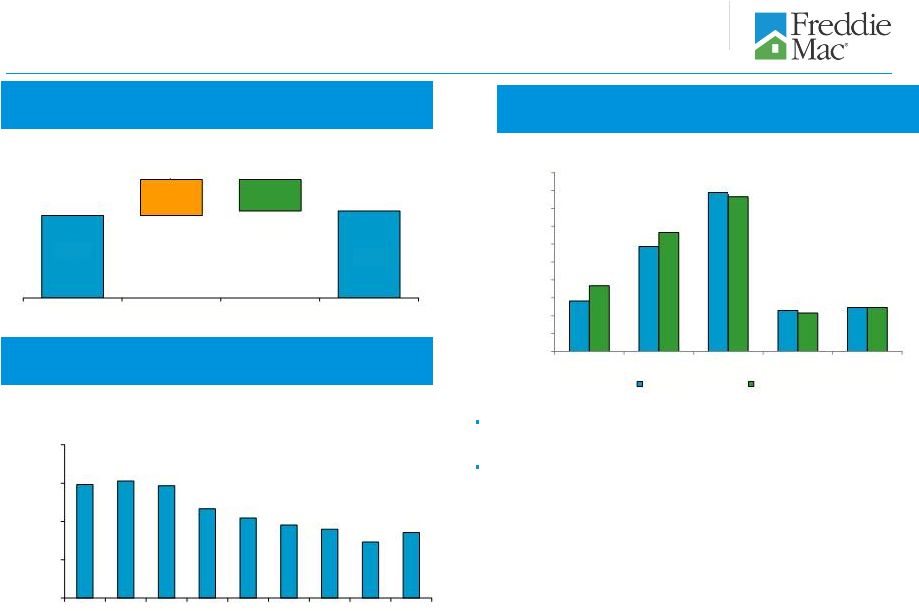

4

Comprehensive income (loss)

1

Consists of the after-tax changes in: (a) the unrealized gains and losses on

available-for-sale securities; (b) the effective portion of derivatives previously designated as cash flow

hedges; and (c) defined benefit plans.

A

B

C = A + B

(10)

(5)

0

5

10

15

20

25

30

35

3Q

2011

4Q

2011

1Q

2012

2Q

2012

3Q

2012

4Q

2012

1Q

2013

2Q

2013

3Q

2013

$ Billions

Net income (loss)

Comprehensive income (loss)

Includes

$23.9 billion

benefit from

releasing the

valuation

allowance on

deferred tax

assets

1

Total

other

comprehensive

income

(loss),

net

of

taxes |

Senior

Preferred Stock Purchase Agreement with Treasury

Senior

preferred

stock

outstanding

and

held

by

Treasury

remained

$72.3

billion

at

September 30, 2013.

1

Dividend payments do not reduce prior Treasury draws.

Any future draws will increase the balance of senior preferred stock

outstanding. Since entering conservatorship in September 2008, Freddie Mac

has: Received cumulative draws of $71.3 billion from Treasury. No draws

have been requested for the past six quarters; last draw request was $19

million for first quarter 2012.

Freddie Mac’s net worth was $33.4 billion at September 30, 2013. As a

result: Dividend obligation to Treasury will be $30.4 billion in

December 2013. Aggregate cash dividends paid to Treasury will

total $71.345 billion including the December dividend obligation, versus

cumulative cash draws of $71.336 billion received from Treasury through

September 30, 2013. The amount of remaining Treasury funding currently

available to Freddie Mac under the Purchase Agreement is $140.5

billion. Any future draws will reduce this amount. 5

1

Senior preferred stock outstanding of $72.3 billion at September 30, 2013 includes cumulative draws of

$71.3 billion plus the initial liquidation preference of $1 billion. |

Dividend Payment to Treasury

Draw Request from Treasury

6

Treasury draw requests and dividend payments

1

2

Data as of September 30, 2013.

3

Amount does not include the December 2013 dividend obligation of $30.4 billion.

4

Annual amounts represent the total draws requested based on Freddie Mac’s

quarterly net deficits for the periods presented. Draw requests are funded in the subsequent quarter

(e.g., $19 million draw request for 1Q 2012 was funded in 2Q 2012).

5

Represents quarterly cash dividends paid by Freddie Mac to Treasury during the

periods presented. Through December 31, 2012, Treasury was entitled to receive cumulative

quarterly cash dividends at the annual rate of 10% per year on the liquidation

preference of the senior preferred stock. However, the fixed dividend rate was replaced with a net

worth sweep dividend payment beginning in the first quarter of 2013. See the

company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2013 for more

information.

$ Billions

5

4

2, 3

2

Draws From Treasury

Dividend Payments to Treasury

$44.6

$6.1

$13.0

$7.6

$0.02

$0.0

2008

2009

2010

2011

2012

YTD

3Q 2013

$0.2

$4.1

$5.7

$6.5

$7.2

$17.2

2008

2009

2010

2011

2012

YTD

3Q 2013

($ Billions)

Cumulative

Total

Dividend Payments as of 9/30/13

$40.909

4Q 2013 Dividend Obligation

$30.436

Total Dividend Payments

$71.345

($ Billions)

Cumulative

Total

$1.000

Treasury Draws

$71.336

Total Senior Preferred Stock

Outstanding

$72.336

The initial $1 billion liquidation preference of senior preferred stock was issued to Treasury in

September 2008 as consideration for Treasury’s funding commitment. The company

received no cash proceeds as a result of issuing this initial $1 billion liquidation preference of senior preferred stock.

|

7

Total equity and Senior Preferred Stock activity

1

See the company’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2013 for a description of the company’s dividend obligation to Treasury.

2

Includes the initial liquidation preference of Freddie Mac’s senior preferred

stock of $1.0 billion. ($ Billions)

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

1

Beginning

balance

-

Total

equity

/

GAAP

net

worth

$1.1

$4.9

$8.8

$10.0

$7.4

2

Capital draw funded by Treasury

-

-

-

-

-

3

Net income

2.9

4.5

4.6

5.0

30.5

4

Total other comprehensive income (loss), net of taxes

2.7

1.3

2.4

(0.6)

(0.0)

5

Comprehensive income

5.6

5.7

7.0

4.4

30.4

6

Dividends paid to Treasury

(1.8)

(1.8)

(5.8)

(7.0)

(4.4)

7

Other

-

-

-

-

-

8

Ending

balance

-

Total

equity / GAAP

net

worth

1

$4.9

$8.8

$10.0

$7.4

$33.4

9

Aggregate

liquidation

preference

of

the

senior

preferred

stock

2

$72.3

$72.3

$72.3

$72.3

$72.3

10

Remaining senior preferred stock funding beginning in 2013

N/A

N/A

$140.5

$140.5

$140.5 |

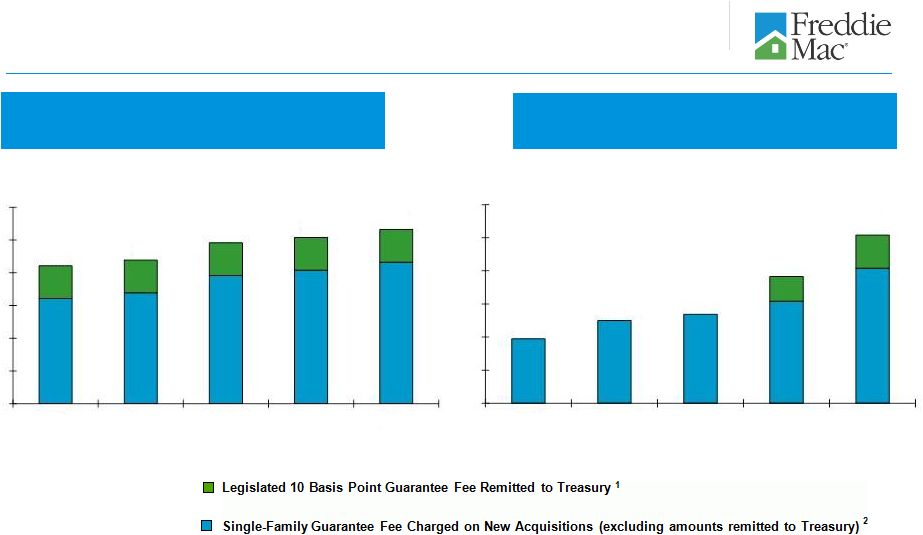

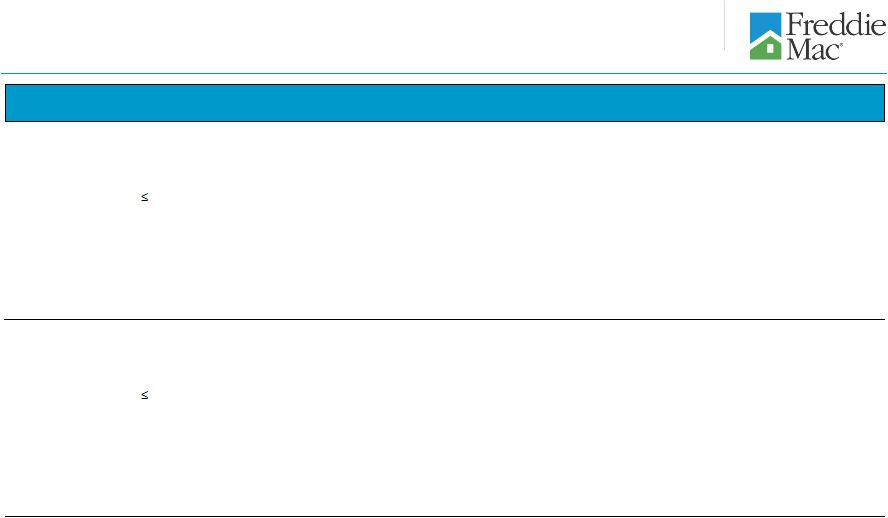

8

Single-family guarantee fees charged on new

acquisitions

1

2

Quarterly

In Basis Points, Annualized

Annual

In Basis Points

1

42

44

49

51

53

0

10

20

30

40

50

60

3Q

2012

4Q

2012

1Q

2013

2Q

2013

3Q

2013

20

25

27

38

51

0

10

20

30

40

50

60

2009

2010

2011

2012

YTD 2013

Represents the estimated rate of management and guarantee fees for new acquisitions during the period

assuming amortization of delivery fees using the estimated life of the related loans rather

than the original contractual maturity date of the related loans. Also includes the effect of pricing adjustments that are based on the relative

performance of our PCs compared to comparable Fannie Mae securities.

Effective April 1, 2012, guarantee fees charged on single-family loans sold to Freddie Mac were

increased by 10 basis points. Under the Temporary Payroll Tax Cut Continuation Act of

2011, Freddie Mac is required to remit the proceeds from this increase to Treasury. Given the April 1, 2012 effective date, the impact of the increase on

average guarantee fees for full-year 2012 was 7.5 basis points.

|

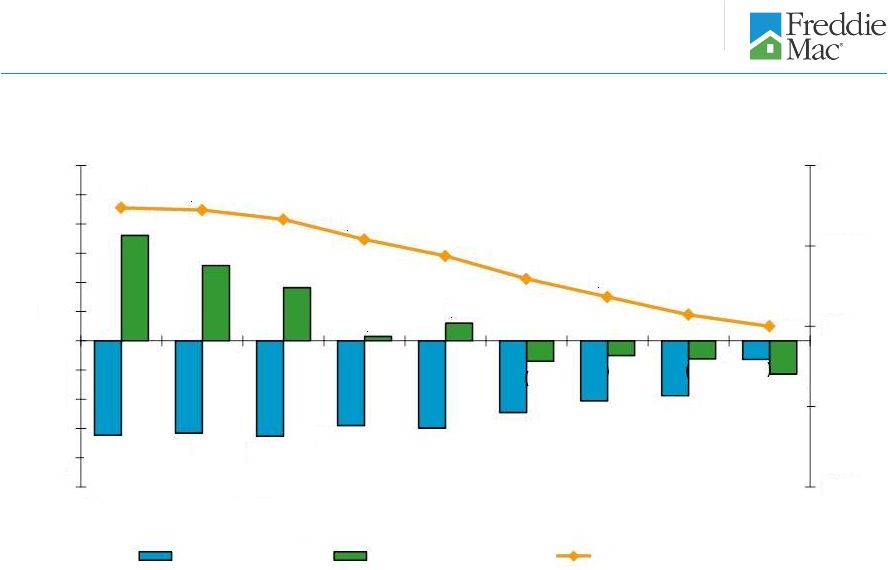

9

Loan loss reserves

1

1

Includes amounts related to certain loans purchased under financial guarantees and

reflected within other expenses on the company’s consolidated statements of comprehensive

income.

2

Consists of the allowance for loan losses and the reserve for guarantee losses.

2

($3.2)

($3.2)

($3.3)

($2.9)

($3.0)

($2.5)

($2.1)

($1.9)

($0.6)

$3.6

$2.6

$1.8

$0.2

$0.6

($0.7)

($0.5)

($0.6)

($1.1)

$39.7

$39.5

$38.3

$35.8

$33.8

$30.9

$28.6

$26.4

$25.0

$5.0

$15.0

$25.0

$35.0

$45.0

($5.0)

($4.0)

($3.0)

($2.0)

($1.0)

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

Period End Balances

$ Billions

$ Billions

Net Charge-offs

Provision (Benefit)

Loan Loss Reserves |

10

Real

estate

owned

Property Inventory

3Q 2013 Activity

Geographic Distribution

Based on Number of Properties in Inventory

Historical Trend

Ending Property Inventory

1

Includes single-family and multifamily REO. Multifamily ending property

inventory was 5 properties as of June 30, 2013 and 1 property as of September 30, 2013.

2

Region designation: West (AK, AZ, CA, GU, HI, ID, MT, NV, OR, UT, WA); Northeast

(CT, DE, DC, MA, ME, MD, NH, NJ, NY, PA, RI, VT, VA, WV); Southeast (AL, FL, GA, KY, MS,

NC, PR, SC, TN, VI); North Central (IL, IN, IA, MI, MN, ND, OH, SD, WI); and

Southwest (AR, CO, KS, LA, MO, NE, NM, OK, TX, WY).

((Number of Properties)

In 3Q13, REO inventory increased as foreclosure activity increased in judicial

states and disposition activity moderated.

The North Central region comprised 37 percent of our REO property inventory

at September 30, 2013. This region generally has experienced more

challenging

economic

conditions,

and

includes

a

number

of

states

with

longer

foreclosure timelines due to the local laws and foreclosure process in the

region. Seven of the nine states in the North Central region require a

judicial foreclosure process. Foreclosures generally take longer to

complete in states where judicial foreclosures (those conducted under the

supervision of a court) are required than in states where non-judicial

foreclosures are permitted. 44,628

47,120

19,441

(16,949)

6/30/13

Inventory

Acquisitions

Dispositions

9/30/13

Inventory

60k

45k

61k

59k

53k

51k

49k

48k

47k

30,000

40,000

50,000

60,000

70,000

3Q

2011

4Q

2011

1Q

2012

2Q

2012

3Q

2012

4Q

2012

1Q

2013

2Q

2013

3Q

2013

Number of

Properties

6k

12k

18k

5k

5k

7k

13k

17k

4k

5k

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

Northeast

Southeast

North Central

Southwest

West

Number of

Properties

6/30/2013

9/30/2013

1

2 |

11

Market liquidity provided

Number of Families Freddie Mac

Helped

to

Own

or

Rent

a

Home

1

In Thousands

Purchase and Issuance Volume

2, 3

(Single-Family and Multifamily)

$ Billions

1

For the periods presented, a borrower may be counted more than once if the company

purchased more than one loan (purchase or refinance mortgage) relating to the same

borrower.

2

Includes cash purchases of single-family and multifamily mortgage loans,

issuances of Freddie Mac mortgage-related securities through the company’s guarantor swap program,

issuances of other guarantee commitments and purchases of non-Freddie Mac

mortgage-related securities. 3

In the first quarter of 2013, Freddie Mac made certain changes to more closely

align the presentation of the company’s single-family and multifamily securitization activities. As a

result, the purchase and issuance volumes for all prior periods have been revised

to conform with the current period presentation. 2,480

2,089

1,830

2,472

2,011

600

755

723

743

545

0

500

1,000

1,500

2,000

2,500

3,000

2009

2010

2011

2012

YTD

2013

3Q

2012

4Q

2012

1Q

2013

2Q

2013

3Q

2013

$546

$406

$349

$456

$382

$110

$140

$138

$138

$106

0

100

200

300

400

500

600

2009

2010

2011

2012

YTD

2013

3Q

2012

4Q

2012

1Q

2013

2Q

2013

3Q

2013

Number

of

Families

Freddie

Mac

Helped

to

Own

or

Rent

a

Home

1

(In Thousands)

Refinance borrowers (includes HARP)

Purchase borrowers

Multifamily rental units

Freddie Mac Purchase and Issuance Volume

2

Cumulative Totals

Since 2009

10,882

$2.1 Trillion

7,492

1,898

1,492 |

12

Single-family

refinance

activity

1

1

Consists of all single-family refinance mortgage loans that the company either

purchased or guaranteed during the period, including those associated with other guarantee commitments and

Other Guarantee Transactions.

2

Some

loans

have

multiple

borrowers,

but

the

company

has

counted

them

as

one

borrower

for

this

purpose.

For

the

periods

presented,

a

borrower

may

be

counted

more

than

once

if

the

company purchased more than one refinance loan relating to the same borrower.

3

The relief refinance mortgage initiative is Freddie Mac’s implementation of

the Home Affordable Refinance Program (HARP). Under the program, the company allows eligible borrowers who

have mortgages with high current LTV ratios to refinance their mortgages without

obtaining new mortgage insurance in excess of what was already in place. HARP is targeted at borrowers

with current LTV ratios above 80%; however, Freddie Mac’s program also allows

borrowers with LTV ratios at or below 80% to participate. 2009

2010

2011

2012

1Q

2013

2Q

2013

3Q

2013

Cumulative

Total

Number of Borrowers

2

(In

Thousands)

Other Refinance

1,595

947

740

996

343

308

190

5,119

Relief Refinance -

LTV 80%

83

324

268

253

84

89

61

1,162

Relief Refinance -

LTV > 80% to 100% (HARP)

3

72

166

126

191

52

54

38

699

Relief Refinance -

LTV > 100% to 125% (HARP)

3

14

43

59

144

37

36

24

357

Relief Refinance -

LTV > 125% (HARP)

3

0

0

0

99

24

20

12

155

Total Number of Borrowers

1,764

1,480

1,193

1,683

540

507

325

7,492

$

Volume

(In

Billions)

Other Refinance

$345

$200

$168

$228

$78

$68

$42

$1,129

Relief Refinance -

LTV 80%

$15

$58

$42

$36

$11

$12

$9

$183

Relief Refinance -

LTV > 80% to 100% (HARP)

3

$17

$38

$27

$37

$10

$10

$6

$145

Relief Refinance -

LTV > 100% to 125% (HARP)

3

$3

$10

$13

$30

$7

$7

$5

$75

Relief Refinance -

LTV > 125% (HARP)

3

$0

$0

$0

$20

$5

$3

$2

$30

Total $ Volume

$380

$306

$250

$351

$111

$100

$64

$1,562 |

Repayment plans

13

Loan modifications

Forbearance agreements

Short sales and deed-in-lieu of foreclosure transactions

Single-family loan workouts

Home Retention Actions

1

Foreclosure Alternatives

1

133

275

45

208

43

46

1

These categories are not mutually exclusive and a borrower in one category may also

be included within another category in the same period. For the periods presented,

borrowers helped through home retention actions in each period may subsequently

lose their home through foreclosure or a short sale or deed-in-lieu transaction.

41

169

41

128

Number of Families Avoiding Foreclosure

1

(In Thousands)

Families Retaining Homes

Cumulative Totals Since

2009

913

8 out of every 10

0

30

60

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

Number of Loans

(000)

0

50

100

150

200

250

300

2009

2010

2011

2012

YTD

2013

Number of Loans

(000) |

No change in terms

Term extension

Reduction of contractual interest rate, and in certain cases,

term extension

Rate reduction, term extension and principal forbearance

2

14

Single-family loan modifications

Single-family Loan Modifications

(HAMP and non-HAMP)

1

65

170

109

21

20

21

70

19

21

60

1

Includes completed loan modifications under HAMP and under the company’s other modification

programs. Excludes those loan modification activities for which the borrower has started

the required process, but the modification has not been made permanent or effective, such as loans in a modification trial

period.

2

Principal forbearance is a change to a loan’s terms to designate a portion of the principal as

non-interest bearing and non-amortizing.

0

10

20

30

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

Number of

Loans

(000)

0

40

80

120

160

200

2009

2010

2011

2012

YTD

2013

Number of

Loans

(000) |

15

Quarterly Percentages of Modified Single-Family Loans

(HAMP and non-HAMP)

1

Performance of single-family modified loans

1

2

Represents the percentage of loans that are current and performing (no payment is 30 days or more past

due) or have been paid in full. Excludes loans in modification trial periods. Loan modifications are recognized as completed in the quarterly period in which the servicer

has reported the modification as effective and the agreement has been accepted by the company.

For loans that have been remodified (e.g., where a borrower has received a new modification after defaulting on the prior modification) the rates reflect the status of

each modification separately. For example, in the case of a remodified loan where the borrower is

performing, the previous modification would be presented as being in default in the applicable

period.

Time Since Modification

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3 to 5 months

81%

86%

85%

87%

84%

85%

86%

85%

6 to 8 months

79%

80%

80%

83%

82%

81%

81%

N/A

9 to 11 months

75%

75%

77%

81%

78%

78%

N/A

N/A

12 to 14 months

71%

73%

76%

78%

76%

N/A

N/A

N/A

15 to 17 months

69%

73%

74%

77%

N/A

N/A

N/A

N/A

18 to 20 months

69%

71%

73%

N/A

N/A

N/A

N/A

N/A

21 to 23 months

67%

70%

N/A

N/A

N/A

N/A

N/A

N/A

24 to 26 months

67%

N/A

N/A

N/A

N/A

N/A

N/A

N/A

% Current and Performing

Quarter

of

Loan

Modification

Completion

2 |

16

1

The amount the company expects to collect on outstanding requests is significantly

less than the unpaid principal balance (UPB) of the loans subject to repurchase requests primarily

because many of these requests are likely to be satisfied by reimbursement of the

company’s realized credit losses by seller/servicers, or rescinded in the course of the contractual appeals

process. Based on historical loss experience and the fact that many of these

loans are covered by credit enhancements (e.g., mortgage insurance), Freddie Mac expects the actual credit

losses experienced by the company should it fail to collect on these repurchase

requests to also be less than the UPB of the loans. 2

Approximately $0.6 billion of the total amount of repurchase requests outstanding

at September 30, 2013 were issued due to mortgage insurance rescission or mortgage insurance claim

denial.

3

Repurchase requests outstanding more than four months include repurchase requests

for which appeals were pending. 4

Requests collected are based on the UPB of the loans associated with the repurchase

request, which in many cases is more than the amount of payments received for reimbursement of

losses for requests associated with foreclosed mortgage loans, negotiated

settlements and other alternative remedies. Includes $0.9 billion in the nine months ended September 30, 2013

related to agreements with certain seller/servicers to release specified loans with

certain repurchase obligations in exchange for one-time cash payments.

5

Year-to-date September 30, 2013, repurchase requests related to $4.4

billion of UPB of loans were cancelled, primarily as a result of the servicer providing missing documentation or a

successful appeal of the request. In addition, requests cancelled includes

$0.2 billion of other items that affect the UPB of the loan while the repurchase request is outstanding, such as a

change in UPB due to payments made on the loan, as well as requests deemed

uncollectible due to the insolvency or other failure of the counterparty.

Repurchase requests

Trend in Repurchase Requests Outstanding

YTD September 2013 Repurchase Request Activity

$ Billions

2

3

5

4

$3.6

$4.2

$3.8

$2.7

$3.0

$3.4

20%

20%

34%

39%

41%

31%

0

5

10

15

20

25

30

35

40

45

50

0

1

2

3

4

5

6

12/31/2008

12/31/2009

12/31/2010

12/31/2011

12/31/2012

Percent

(%)

UPB

$ Billions

Outstanding repurchase requests

Requests outstanding more than 4 months

$3.0

$3.4

$8.3

($3.4)

($4.6)

UPB of

outstanding

requests at

12/31/2012

New Requests

Issued

Requests

Collected

Requests

Cancelled

UPB of

outstanding

requests at

9/30/2013

9/30/2013

1 |

17

Administrative expenses

Annual

Quarterly

$1,685

$1,597

$1,506

$1,561

$1,331

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2009

2010

2011

2012

YTD

2013

$ Millions

$401

$422

$432

$444

$455

0

200

400

600

3Q

2012

4Q

2012

1Q

2013

2Q

2013

3Q

2013

$ Millions |

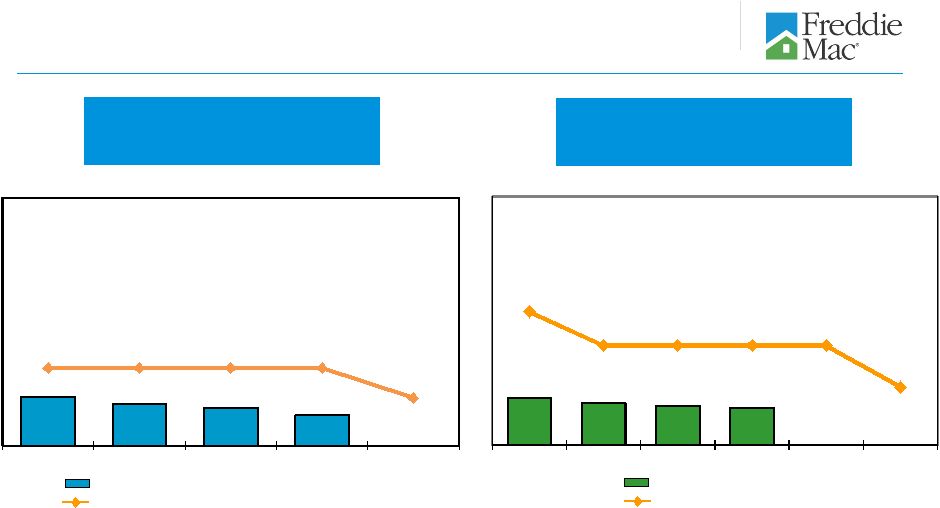

Mortgage-related investments portfolio ending balance

Mortgage-related investments portfolio limit

18

Purchase Agreement portfolio limits

Indebtedness

1, 3

($ Billions)

Mortgage Assets

1, 2

($ Billions)

1

The

company’s

Purchase

Agreement

with

Treasury

limits

the

amount

of

mortgage

assets

the

company

can

own

and

indebtedness

it

can

incur.

Under

the Purchase Agreement,

mortgage assets and indebtedness are calculated without giving effect to the

January 1, 2010 change in the accounting guidance related to the transfer of financial assets and

consolidation of variable interest entities (VIEs). See the company’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2013 for more information.

2

Represents the unpaid principal balance (UPB) of the company’s

mortgage-related investments portfolio. The company discloses its mortgage assets on this basis monthly in its

Monthly Volume Summary reports, which are available on its Web site and in Current

Reports on Form 8-K filed with the Securities and Exchange Commission (SEC).

3

Represents the par value of the company’s unsecured short-term and

long-term debt securities issued to third parties to fund its business activities. The company discloses its

indebtedness on

this

basis

monthly

in

its

Monthly

Volume

Summary

reports,

which

are

available

on

its

Web

site

and

in

Current

Reports

on

Form

8-K

filed

with

the

SEC.

4

Limit under the Purchase Agreement, as amended on August 17, 2012.

Indebtedness limit

Total debt outstanding

4

4

4

4

$558

$534

$521

$498

$650

$650

$650

$650

$553

12/31/2012

3/31/2013

6/30/2013

9/30/2013

12/31/2013

$552

$535

$526

$520

$874.8

$780

$780

$780

$780

$663

12/31/2012

3/31/2013

6/30/2013

9/30/2013

12/31/2013

1/1/2014 |

19

Credit

Supplement |

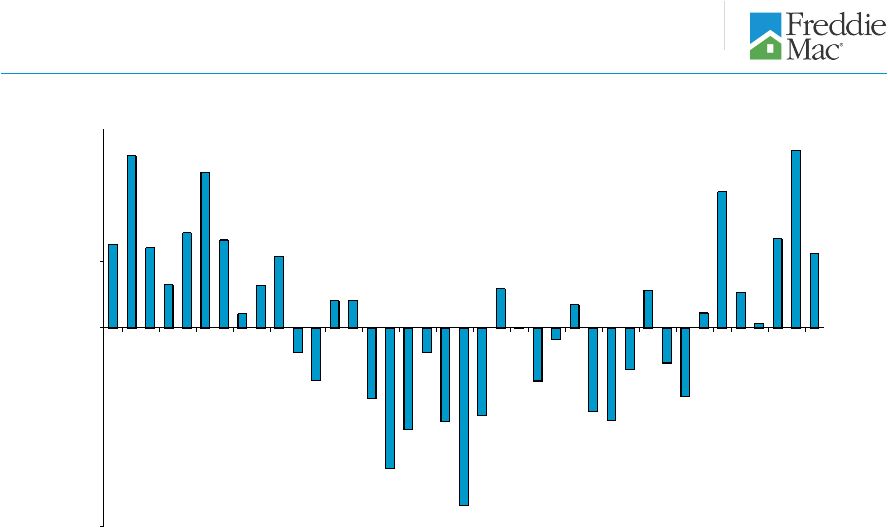

1

Source: Freddie Mac.

20

National home prices have experienced a cumulative

decline of 14% since June 2006

1

2.5

5.2

2.4

1.3

2.9

4.7

2.7

0.4

1.3

2.2

(0.8)

(1.6)

0.8

0.8

(2.1)

(4.3)

(3.1)

(0.7)

(2.8)

(5.4)

(2.6)

1.2

(0.0)

(1.6)

(0.4)

0.7

(2.5)

(2.8)

(1.2)

1.1

(1.1)

(2.1)

0.4

4.1

1.1

0.1

2.7

5.4

2.2

(6)

(4)

(2)

0

2

4

6

1Q

2004

3Q

2004

1Q

2005

3Q

2005

1Q

2006

3Q

2006

1Q

2007

3Q

2007

1Q

2008

3Q

2008

1Q

2009

3Q

2009

1Q

2010

3Q

2010

1Q

2011

3Q

2011

1Q

2012

3Q

2012

1Q

2013

3Q

2013

Percent

(%)

National home prices use the Freddie Mac House Price Index for the U.S., which is a

value-weighted average of the state indexes where the value weights are based on Freddie

Mac’s single-family credit guarantee portfolio. Other indices of home prices may have

different results, as they are determined using different pools of mortgage loans and

calculated under different conventions than Freddie Mac’s. The Freddie Mac House Price

Index for the U.S. is a non-seasonally adjusted monthly series; quarterly growth rates are

calculated as a 3-month change based on the final month of each quarter. Seasonal factors

typically result in stronger house-price appreciation during the second and third

quarters. Historical quarterly growth rates change as new data becomes available. Values for the

most recent periods typically see the largest changes. Cumulative decline calculated as

the percent change from June 2006 to September 2013.

-

-

-

- |

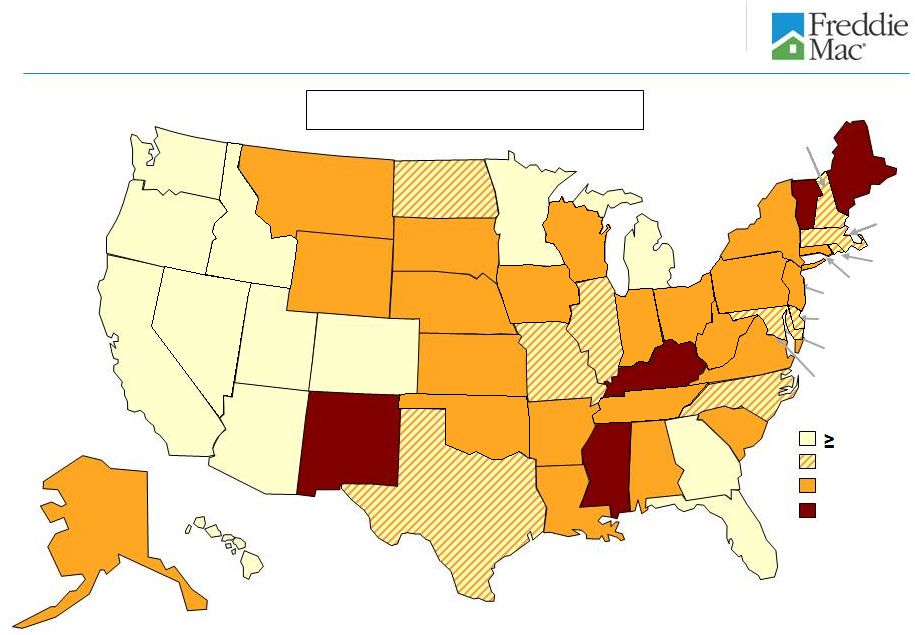

Home

Price Performance By State June

2006

to

September

2013

1

United States -14%

1

Source: Freddie Mac

21

-7%

AL

8%

AK

0%

-11 to -1%

-21%

-20 to -12%

-2%

AR

-29%

AZ

-23%

CA

6%

CO

CT -18%

DC 23%

DE -14%

-36%

FL

-16%

GA

0%

HI

3%

IA

-11%

ID

-22%

IL

-2%

IN

2%

KS

KY -1%

3%

LA

-11%

-20%

-10%

ME

-20%

MI

-13%

MN

-10%

MO

-6%

MS

2%

MT

NC -4%

38%

ND

3%

NE

-11%

NM

-42%

NV

-9%

NY

-12%

OH

8%

OK

-12%

OR

-6%

PA

RI -25%

-7%

SC

11%

SD

TN -2%

15%

TX

0%

UT

-12%

VA

-3%

VT

-13%

WA

-12%

WI

5%

WV

9%

WY

NH

MA

MD

NJ -21%

The Freddie Mac House Price Index for the U.S. is a value-weighted average of the state indexes

where the value weights are based on Freddie Mac’s single-family credit guarantee

portfolio. Other indices of home prices may have different results, as they are determined using different pools of mortgage loans and calculated under different

conventions. The Freddie Mac House Price Index for the U.S. is a non-seasonally adjusted monthly

series. -17% |

5%

AL

5%

AK

10%

7 to 9%

0 to 3%

4 to 6%

4%

AR

17%

AZ

23%

CA

11%

CO

CT 4%

DC 13%

DE 7%

14%

FL

14%

GA

13%

HI

5%

IA

14%

ID

9%

IL

5%

IN

5%

KS

KY 3%

5%

LA

7%

3%

ME

14%

MI

11%

MN

7%

MO

3%

MS

6%

MT

NC 7%

8%

ND

5%

NE

NJ 4%

2%

NM

30%

NV

4%

NY

5%

OH

4%

OK

14%

OR

4%

PA

RI 8%

6%

SC

6%

SD

TN 6%

9%

TX

13%

UT

6%

VA

12%

WA

6%

WI

6%

WV

6%

WY

8%

2%

VT

8%

MD

MA

NH

Home Price Performance By State

September 2012 to September 2013

1

United States 11%

1

The Freddie Mac House Price Index for the U.S. is a value-weighted average of

the state indexes where the value weights are based on Freddie Mac’s single-family credit

guarantee portfolio. Other indices of home prices may have different results, as

they are determined using different pools of mortgage loans and calculated under different

conventions.

The

Freddie

Mac

House

Price

Index

for

the

U.S.

is

a

non-seasonally

adjusted

monthly

series.

Source: Freddie Mac

22 |

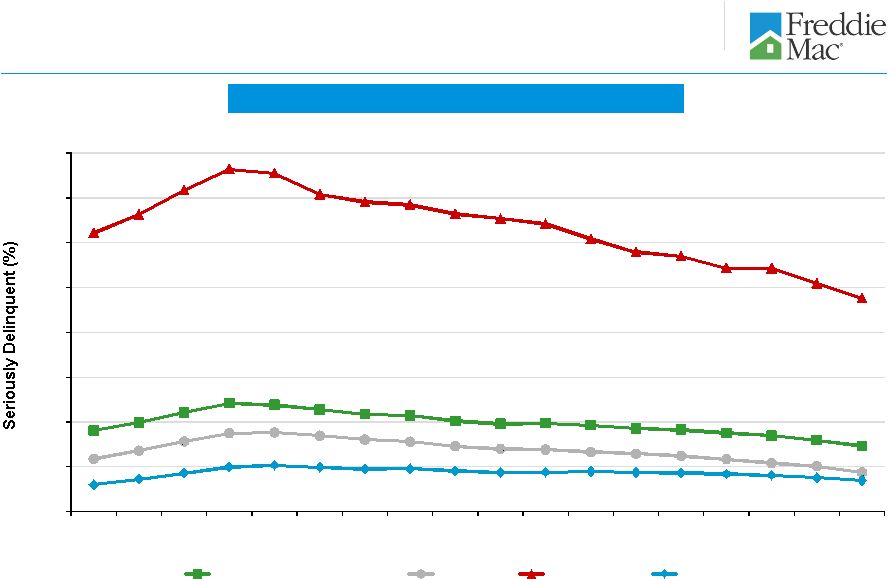

23

Single-family Serious Delinquency Rates

Mortgage market and Freddie Mac serious delinquency

rates

0

4

8

12

16

20

24

28

32

Mar-

09

Jun-

09

Sep-

09

Dec-

09

Mar-

10

Jun-

10

Sep-

10

Dec-

10

Mar-

11

Jun-

11

Sep-

11

Dec-

11

Mar-

12

Jun-

12

Sep-

12

Dec-

12

Mar-

13

Jun-

13

Total Mortgage Market

Prime

Subprime

Freddie Mac

19.05%

5.88%

2.79%

3.50%

1

1

1

2

Source: National Delinquency Survey from the Mortgage Bankers Association. Categories represent

first lien single-family loans. Data is not yet available for the third quarter of 2013.

See “MD&A – RISK MANAGEMENT – Credit Risk – Mortgage Credit Risk –

Single-Family Mortgage Credit Risk – Credit Performance – Delinquencies” in Freddie Mac’s Form 10-K for

the year ended December 31, 2012, for information about the company’s reported delinquency

rates. The single-family serious delinquency rate at September 30, 2013 was 2.58%.

1

2 |

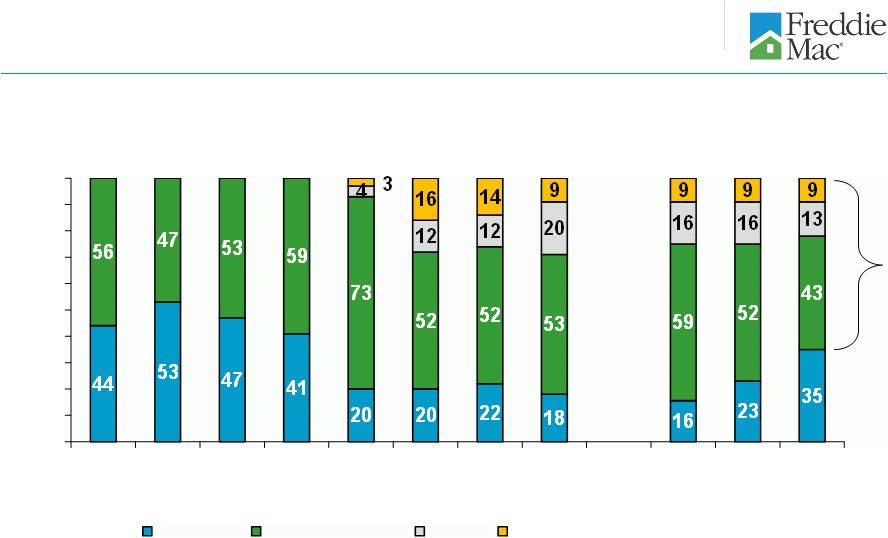

24

Loan purpose of single-family credit guarantee

portfolio purchases

1

The relief refinance mortgage initiative is Freddie Mac’s implementation of

the Home Affordable Refinance Program (HARP). Under the program, the company allows eligible

borrowers who have mortgages with high current LTV ratios to refinance their

mortgages without obtaining new mortgage insurance in excess of what was already in place. HARP is

targeted at borrowers with current LTV ratios above 80%; however, Freddie

Mac’s relief refinance initiative also allows borrowers with LTV ratios at or below 80% to participate.

1

1

0

10

20

30

40

50

60

70

80

90

100

2005

2006

2007

2008

2009

2010

2011

2012

1Q

2013

2Q

2013

3Q

2013

Percent

(%)

Purchase

Other Refinance

HARP

Relief Refinance (Non-HARP)

65% |

25

Credit quality of single-family credit guarantee

portfolio purchases

2009

2010

2011

2012

1Q

2013

2Q

2013

3Q

2013

Weighted Average Original LTV Ratio

1

Relief refinance (includes HARP)

80%

77%

77%

97%

93%

91%

89%

All other

66%

67%

67%

68%

68%

70%

72%

Total purchases

67%

70%

70%

76%

74%

75%

76%

Weighted Average Credit Score

2

Relief refinance (includes HARP)

738

747

744

740

731

729

723

All other

757

758

759

762

760

757

754

Total purchases

756

755

755

756

753

750

747

2009

2010

2011

2012

1Q

2013

2Q

2013

3Q

2013

Purchase of Relief Refinance Mortgages > 80% LTV (HARP loans)

$ Billions

$19.6

$47.9

$39.7

$86.9

$21.5

$20.3

$13.2

% of single-family credit guarantee portfolio purchases

4%

12%

12%

20%

16%

16%

13%

3

1

2

3

Original LTV ratios are calculated as the unpaid principal balance (UPB) of the mortgage Freddie Mac

guarantees including the credit-enhanced portion, divided by the lesser of the appraised

value of the property at the time of mortgage origination or the mortgage borrower’s purchase price. Second liens not owned or guaranteed by Freddie Mac are excluded

from the LTV ratio calculation. The existence of a second lien mortgage reduces the

borrower’s equity in the home and, therefore, can increase the risk of default.

Credit score data is based on FICO scores at the time of origination and may not be indicative of the

borrowers’ creditworthiness at September 30, 2013. FICO scores can range between

approximately 300 to 850 points. HARP is the portion of the company’s relief refinance initiative targeted at borrowers with

current LTV ratios above 80%. In April 2013, HARP was extended to December 31, 2015.

|

26

Single-family 3Q 2013 credit losses and REO

by region and state

1

Based on the unpaid principal balance (UPB) of the single-family credit

guarantee portfolio at September 30, 2013. 2

UPB amounts exclude $435 million of Other Guarantee Transactions since these

securities are backed by non-Freddie Mac issued securities for which loan characteristic data

was not available.

3

Based on the number of loans that are three monthly payments or more past due or in

the process of foreclosure. 4

Based

on

the

UPB

of

loans

at

the

time

of

REO

acquisition.

5

Consist

of

the

aggregate

amount

of

charge-offs,

net

of

recoveries,

and

REO

operations

(income)

expense

for

3Q

2013.

6

Region designation: West (AK, AZ, CA, GU, HI, ID, MT, NV, OR, UT, WA); Northeast

(CT, DE, DC, MA, ME, MD, NH, NJ, NY, PA, RI, VT, VA, WV); Southeast (AL, FL, GA, KY, MS,

NC, PR, SC, TN, VI); North Central (IL, IN, IA, MI, MN, ND, OH, SD, WI); and

Southwest (AR, CO, KS, LA, MO, NE, NM, OK, TX, WY). 7

States presented are those with the highest credit losses during the three months

ended September 30, 2013. ($ Billions)

% of Total

UPB

2

($ Millions)

% of Total

Serious

Delinquency

Rate

3

(%)

3Q 2013

Acquisitions

($ Millions)

REO

Inventory

($ Millions)

% of Total

Inventory

($ Millions)

% of Total

Region

6

1

West

$462

28%

$9,991

21%

1.94%

$458

$1,030

14%

($21)

(4%)

2

Northeast

430

26

16,641

35

3.39%

588

1,323

18

136

24

3

North Central

292

18

6,149

13

1.93%

687

2,320

32

168

30

4

Southeast

274

17

11,906

25

3.78%

990

2,025

28

285

51

5

Southwest

194

11

2,616

6

1.44%

201

558

8

(4)

(1)

6

Total

$1,652

100%

$47,303

100%

2.58%

$2,924

$7,256

100%

$564

100%

7

7

Florida

$93

6%

$8,252

18%

7.26%

$618

$1,239

17%

246

44%

8

Illinois

83

5

2,975

6

3.05%

290

907

12

131

23

9

Washington

55

3

1,628

3

2.68%

97

213

3

29

5

10

Maryland

51

3

1,871

4

3.48%

206

409

6

70

12

11

Ohio

47

3

932

2

2.16%

101

295

4

38

7

12

All other

1,323

80

31,645

67

2.17%

1,612

4,193

58

50

9

13

Total

$1,652

100%

$47,303

100%

2.58%

$2,924

$7,256

100%

$564

100%

Total Portfolio UPB

Credit

Losses

(Gains)

5

REO Acquisitions & Balance

4

Seriously Delinquent Loans

1

State |

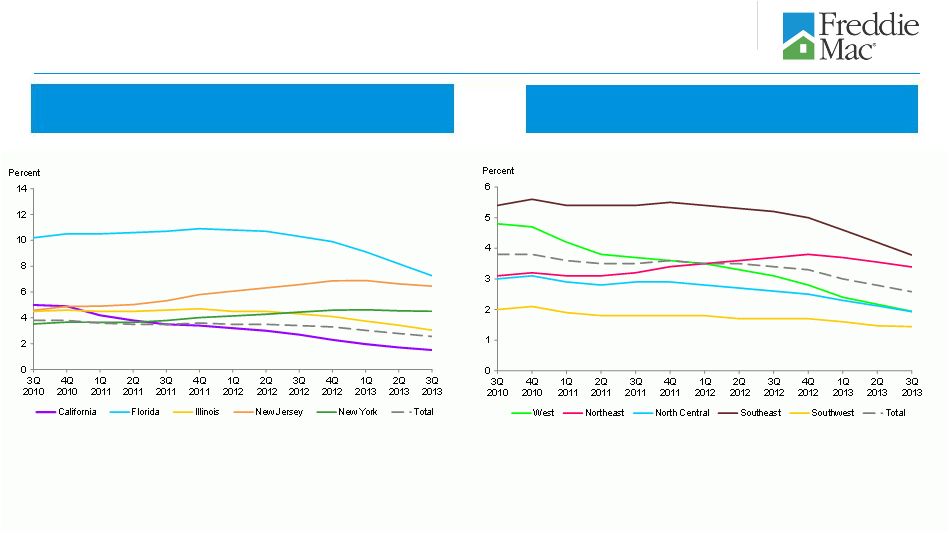

1.5%

Single-family serious delinquency rates by state and

region

27

Single-family Serious Delinquency Rates

By State

1,2

Single-family Serious Delinquency Rates

By Region

1,3

2

States presented are those with the highest number of seriously delinquent loans as

of September 30, 2013. 3

Region designation: West (AK, AZ, CA, GU, HI, ID, MT, NV, OR, UT, WA); Northeast

(CT, DE, DC, MA, ME, MD, NH, NJ, NY, PA, RI, VT, VA, WV); Southeast

(AL,

FL,

GA,

KY,

MS,

NC,

PR,

SC,

TN,

VI);

North

Central

(IL,

IN,

IA,

MI,

MN,

ND,

OH,

SD,

WI);

and

Southwest

(AR,

CO,

KS,

LA,

MO,

NE,

NM,

OK,

TX,

WY).

1.4%

1.9%

1.9%

2.6%

3.4%

3.8%

7.3%

6.5%

2.6%

3.1%

4.5%

1

Based on the number of loans that are three monthly payments or more past due or in the process

of foreclosure. See “MD&A – RISK MANAGEMENT – Credit Risk – Mortgage

Credit Risk – Single-Family Mortgage Credit Risk – Credit Performance – Delinquencies” in Freddie Mac’s Form 10-K for the year ended

December 31, 2012, for information about the company’s reported delinquency rates. |

Aging

of single-family seriously delinquent loans by judicial and

non-judicial states 28

1

# of Seriously

Delinquent

Loans

Percent

# of Seriously

Delinquent

Loans

Percent

# of Seriously

Delinquent

Loans

Percent

Judicial

Review

States

Less than or equal to 1 year

82,458

22%

64,772

22%

60,943

22%

More than 1 year and less than or equal to 2 years

54,525

15%

39,054

13%

33,756

12%

More than 2 years

77,122

21%

71,789

24%

67,306

25%

Non-Judicial States

1

Less than or equal to 1 year

94,059

26%

72,185

24%

66,405

25%

More than 1 year and less than or equal to 2 years

33,838

9%

25,360

9%

22,063

8%

More than 2 years

24,158

7%

24,133

8%

22,998

8%

Combined

Less than or equal to 1 year

176,517

48%

136,957

46%

127,348

47%

More than 1 year and less than or equal to 2 years

88,363

24%

64,414

22%

55,819

20%

More than 2 years

101,280

28%

95,922

32%

90,304

33%

Total

366,160

100%

297,293

100%

273,471

100%

As of 9/30/2012

2

As of 6/30/2013

As of 9/30/2013

1

1

2

Excludes loans underlying single-family Other Guarantee Transactions since the geographic

information is not available to us for these loans. As of September 30, 2013, the states

and territories classified as having a judicial foreclosure process consist of: CT, DE, FL, HI, IA, IL, IN, KS, KY, LA, ME, ND, NE,

NJ, NM, NY, OH, OK, PA, PR, SC, SD, VI, VT and WI. All other states are classified as having a

non-judicial foreclosure process. Judicial foreclosures are those conducted under the

supervision of a court. Prior periods revised to reflect changes made in second quarter 2013 to

states and territories classified as having a judicial foreclosure process. |

29

Single-family

credit

guarantee

portfolio

characteristics

1

Option

FICO

FICO

Original

LTV

FICO < 620 &

Original

Attribute

Alt-A²

Interest-only

3

ARM

< 620

4

620 -

659

4

> 90%

LTV > 90%

4

1

UPB $ Billions

$1,652

$60

$37

$7

$49

$97

$252

$13

2

Percent of Total Portfolio

100%

4%

2%

0%

3%

6%

15%

1%

3

Average UPB per loan

$154,101

$154,152

$226,775

$200,975

$126,148

$132,680

$169,261

$135,900

4

Fixed Rate (% of total portfolio)

94%

63%

19%

0%

95%

93%

98%

98%

5

Owner Occupied

90%

82%

81%

76%

95%

94%

91%

96%

6

Original Loan-to-Value (OLTV)

74%

73%

74%

71%

81%

80%

107%

106%

7

OLTV > 90%

15%

4%

3%

2%

26%

23%

100%

100%

8

Current Loan-to-Value (CLTV)

70%

89%

95%

89%

84%

81%

100%

103%

9

CLTV > 90%

18%

48%

56%

45%

38%

34%

64%

69%

10

CLTV > 100%

11%

35%

40%

32%

26%

23%

38%

50%

11

CLTV > 110%

7%

24%

26%

22%

18%

15%

24%

34%

12

Average FICO Score

4

739

711

718

711

585

643

725

583

13

FICO < 620

4

3%

5%

3%

4%

100%

0%

5%

100%

Book Year

5

14

2013

18%

0%

0%

0%

9%

10%

21%

14%

15

2012

24%

0%

0%

0%

10%

10%

34%

22%

16

2011

11%

0%

0%

0%

5%

5%

11%

7%

17

2010

11%

0%

1%

0%

5%

6%

10%

6%

18

2009

9%

0%

1%

0%

4%

5%

5%

4%

19

2008

3%

7%

9%

0%

6%

6%

2%

3%

20

2007

5%

30%

35%

2%

19%

15%

6%

17%

21

2006

4%

27%

28%

11%

11%

11%

2%

6%

22

2005

5%

20%

21%

58%

9%

11%

2%

4%

23

2004 and prior

10%

16%

5%

29%

22%

21%

7%

17%

24

% of Loans with Credit Enhancement

13%

12%

9%

15%

23%

20%

49%

55%

25

% Seriously Delinquent

6

2.58%

10.74%

13.49%

13.25%

10.41%

7.56%

3.45%

10.12%

Total Portfolio

as of

September 30, 2013

Note: Individual categories are not mutually exclusive, and therefore are not additive across columns. 1

Portfolio characteristics are based on the unpaid principal balance (UPB) of the single-family

credit guarantee portfolio. Approximately $1 billion in UPB for Other Guarantee

Transactions is included in total UPB and percentage seriously delinquent but not included in the

calculation of other statistics since these securities are backed by non-Freddie Mac issued

securities for which loan characteristic data was not available.

2

For a description of Alt-A, see the “Glossary” in the company’s Quarterly Report on

Form 10-Q for the quarter ended September 30, 2013.

3

Beginning September 1, 2010, the company fully discontinued purchases of interest-only loans.

4

Represents the FICO score of the borrower at loan origination. The company estimates that less

than 1% of loans within the portfolio are missing origination FICO scores and as such are

excluded.

5

Indicates year of loan origination. Calculated based on the loans remaining in the portfolio as of

September 30, 2013, rather than all loans originally guaranteed by the company and originated

in the respective year. Each Book Year category represents the percentage of loans referenced in line 1 of the same vertical column.

6

Based on the number of loans that are three monthly payments or more past due or in the process of

foreclosure. |

30

Single-family credit profile by book year and product

feature

1

Attribute

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004 and

prior

1

UPB $ Billions

$1,652

$296

$388

$183

$185

$148

$54

$89

$67

$76

$166

2

Original Loan-to-Value (OLTV)

74%

75%

78%

72%

72%

71%

74%

77%

75%

73%

72%

3

OLTV > 90%

15%

18%

22%

15%

14%

9%

10%

16%

9%

7%

11%

4

Current Loan-to-Value (CLTV)

70%

74%

70%

63%

64%

65%

81%

97%

94%

80%

51%

5

CLTV > 100%

11%

9%

9%

3%

3%

3%

18%

42%

38%

20%

3%

6

CLTV > 110%

7%

6%

6%

1%

1%

1%

9%

29%

26%

13%

2%

7

Average FICO Score

3

739

749

754

751

750

748

715

696

702

709

712

8

FICO < 620

3

3%

1%

1%

1%

1%

1%

5%

11%

8%

6%

7%

9

Adjustable-rate

6%

4%

4%

6%

3%

1%

7%

11%

18%

21%

11%

10

Interest-only

4

2%

0%

0%

0%

0%

0%

7%

15%

16%

10%

1%

11

Investor

6%

8%

6%

5%

4%

3%

8%

7%

6%

5%

5%

12

Condo

8%

8%

6%

6%

6%

7%

11%

11%

12%

11%

8%

Geography

5

13

Florida

6%

5%

5%

4%

4%

4%

8%

10%

12%

11%

8%

14

Illinois

5%

5%

5%

5%

6%

5%

5%

4%

5%

5%

5%

15

Maryland

3%

3%

3%

3%

3%

3%

3%

4%

3%

3%

2%

16

Ohio

3%

3%

3%

3%

3%

3%

1%

2%

2%

3%

4%

17

Washington

3%

3%

3%

4%

4%

4%

4%

3%

3%

3%

2%

18

All other

80%

81%

81%

81%

80%

81%

79%

77%

75%

75%

79%

19

% of Loans with Credit Enhancement

13%

16%

13%

10%

8%

8%

24%

25%

14%

12%

11%

20

% Seriously Delinquent

6

2.58%

0.02%

0.15%

0.37%

0.63%

1.05%

7.05%

11.73%

10.61%

6.86%

3.29%

Total Portfolio

as of

September 30, 2013

Book Year

2

1

Portfolio characteristics are based on the unpaid principal balance (UPB) of the single-family

credit guarantee portfolio. Approximately $1 billion in UPB for Other Guarantee Transactions is

included in total UPB and percentage seriously delinquent but not included in the calculation of other

statistics since these securities are backed by non-Freddie Mac issued securities for which

loan characteristic data was not available.

2

Indicates year of loan origination. Calculated based on the loans remaining in the portfolio as of

September 30, 2013, rather than all loans originally guaranteed by the company and originated

in the respective year.

3

Represents the average of the borrowers’ FICO scores at origination. The company estimates

that less than 1% of loans within the portfolio are missing FICO scores and as such are

excluded.

4

Beginning September 1, 2010, the company fully discontinued purchases of interest-only loans.

5

States presented are those with the highest percentage of the company’s single-family credit

losses during the three months ended September 30, 2013.

6

Based on the number of loans that are three monthly payments or more past due or in the process of

foreclosure. |

31

Single-family cumulative foreclosure transfer and

short sale rates

1

by book year

2007

2006

2005

2004

2003

2008

2009

2010

2011

2013

1

Rates are calculated for each year of origination as the number of loans that have proceeded to

foreclosure transfer or short sale and resulted in a credit loss, excluding any subsequent

recoveries, divided by the number of loans originated in that year that were acquired in the company’s single-family credit guarantee portfolio. Includes Other Guarantee

Transactions where loan characteristic data is available.

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

11.00%

12.00%

Yr1

Q1

Yr1

Q3

Yr2

Q1

Yr2

Q3

Yr3

Q1

Yr3

Q3

Yr4

Q1

Yr4

Q3

Yr5

Q1

Yr5

Q3

Yr6

Q1

Yr6

Q3

Yr7

Q1

Yr7

Q3

Yr8

Q1

Yr8

Q3

Yr9

Q1

Yr9

Q3

Yr10

Q1

Yr10

Q3

Yr11

Q1

Yr11

Q3

Quarter Post Origination

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2012 |

32

Total Multifamily (MF) Portfolio

Multifamily portfolio composition

$172

$135

$154

$164

$169

$177

$180

0

20

40

60

80

100

120

140

160

180

200

12/31/2007

12/31/2008

12/31/2009

12/31/2010

12/31/2011

12/31/2012

9/30/2013

MF loan portfolio

MF investment securities portfolio

MF guarantee portfolio

UPB

$ Billions |

Multifamily

new

business

volume

by

state

1

(%)

AL

0.8%

AK

0.0%

> 5%

> 3% -

5%

1%

> 1% -

3%

MF New Business Volume $18.8B

Nine Months Ended September 30, 2013

AR

0.1%

AZ

3.4%

CA

15.6%

CO

2.8%

CT

0.7%

DC

0.2%

DE

0.4%

FL

9.7%

GA

5.3%

HI

<0.1%

IA

0.2%

ID

0.1%

IL

2.6%

IN

0.6%

KS

0.3%

KY

0.3%

LA

0.1%

MD

3.1%

ME

<0.1%

MI

1.5%

MN

0.5%

MO

0.8%

MS

0.1%

MT

0.0%

NC

2.5%

ND

<0.1%

NE

0.4%

NJ

5.6%

NM

0.1%

NV

0.8%

NY

8.0%

OH

1.5%

OK

0.3%

OR

1.3%

PA

3.7%

RI

0.4%

SC

0.3%

SD

0.0%

TN

0.5%

TX

13.0%

UT

1.1%

VA

6.7%

VT

0.0%

WA

3.0%

WI

0.4%

WV

0.0%

WY

<0.1%

NH

0.1%

33

MA 0.9%

1

Based on the unpaid principal balance (UPB) of the multifamily loan purchases and issuance of

other guarantee commitments. Percentages shown above are rounded to the nearest tenth of

a percent although classifications are based on unrounded figures. |

Multifamily mortgage portfolio UPB concentration by

state

1

MF Mortgage Portfolio $132.1B

2

As of September 30, 2013

34

1

Based on the unpaid principal balance (UPB) of unsecuritized mortgage loans, other

guarantee commitments, and collateral underlying both Freddie Mac guaranteed mortgage-

related securities and related unguaranteed K Certificates. Percentages shown above

are rounded to the nearest tenth of a percent although classifications are based on unrounded

figures.

2

Consists of the UPB of unsecuritized multifamily loans, other guarantee

commitments, and guaranteed Freddie Mac mortgage-related securities. Excludes the UPB associated with

unguaranteed K Certificates.

AL

0.9%

AK

0.0%

AR

0.3%

AZ

2.4%

CA

16.4%

CO

3.0%

CT

0.9%

DC

0.7%

DE

0.2%

FL

7.1%

GA

4.6%

HI

0.2%

IA

0.2%

ID

0.1%

IL

2.5%

IN

0.6%

KS

0.8%

KY

0.5%

LA

0.7%

MA 1.9%

ME

<0.1%

MI

1.0%

MN

1.2%

MO

1.1%

MS

0.4%

MT

<0.1%

NC

2.8%

ND

0.1%

NE

0.5%

NJ

2.8%

NM

0.3%

NV

1.1%

NY

8.5%

OH

1.9%

OK

0.5%

OR

0.8%

PA

2.5%

RI

0.2%

SC

1.0%

SD

0.1%

TN

1.3%

TX

12.5%

UT

0.6%

VA

5.4%

VT

0.0%

WA

3.3%

WI

0.6%

WV

0.1%

WY

<0.1%

NH

0.2%

5%

2% -

5%

1%

1%

-

2% |

35

Multifamily

mortgage

portfolio

by

attribute

1

1

Based

on

the

unpaid

principal

balance

(UPB)

of

the

multifamily

mortgage

portfolio.

2

Based

on

the

UPB

of

mortgages

two

monthly

payments

or

more

past

due

or

in

the

process

of

foreclosure.

3

4

Presents the six states with the highest UPB at September 30, 2013.

Year of Acquisition or Guarantee

3

1

2004 and prior

$10.4

0.26%

$7.6

0.06%

$6.5

0.03%

2

2005

6.7

0.56

6.0

-

5.8

-

3

2006

10.1

0.27

9.2

-

8.9

-

4

2007

19.3

0.96

16.1

0.53

15.8

0.29

5

2008

18.0

0.34

15.0

0.11

14.1

0.15

6

2009

12.8

-

11.8

-

11.5

-

7

2010

12.2

-

11.5

0.08

11.4

-

8

2011

17.4

-

16.6

-

16.4

-

9

2012

18.3

-

24.5

-

24.1

-

10

2013

N/A

N/A

13.5

-

17.6

-

Total

$125.2

0.27%

$131.8

0.09%

$132.1

0.05%

Maturity Dates

11

2013

$5.1

0.50%

$1.1

1.02%

$0.5

1.73%

12

2014

6.9

0.69

4.3

-

3.4

-

13

2015

10.3

0.19

8.7

-

7.8

-

14

2016

13.6

0.01

12.4

-

11.9

0.04

15

2017

10.7

0.38

10.5

0.45

10.4

0.17

16

Beyond 2017

78.6

0.26

94.8

0.06

98.1

0.04

Total

$125.2

0.27%

$131.8

0.09%

$132.1

0.05%

Geography

4

17

California

$21.3

0.24%

$21.5

0.04%

$21.9

-%

18

Texas

15.5

0.46

16.2

0.13

16.3

0.04

19

New York

10.2

0.09

11.3

0.09

11.3

0.09

20

Florida

8.2

0.04

9.2

-

9.3

-

21

Virginia

6.5

-

7.1

0.35

7.1

-

22

Maryland

6.5

-

6.8

-

6.8

-

23

All other states

57.0

0.36

59.7

0.09

59.4

0.09

Total

$125.2

0.27%

$131.8

0.09%

$132.1

0.05%

UPB

($ Billions)

September 30, 2013

UPB

($ Billions)

Delinquency

Rate

2

(%)

June 30, 2013

Delinquency

Rate

2

(%)

September 30, 2012

Delinquency

Rate

2

(%)

UPB

($ Billions)

Based

on

either:

(a)

the

year

of

acquisition,

for

loans

recorded

on

the

company’s

consolidated

balance

sheets;

or

(b)

the

year

that

the

company

issued

its

guarantee,

for

the

remaining loans in its multifamily mortgage portfolio.

|

36

Multifamily

mortgage

portfolio

by

attribute,

continued

1

Based

on

the

unpaid

principal

balance

(UPB)

of

the

multifamily

mortgage

portfolio.

2

Based on the UPB of mortgages two monthly payments or more past due or in the

process of foreclosure. 3

Current Loan Size

1

> $25M

$46.3

0.12%

$49.9

0.05%

$50.8

-

%

2

> $5M & <= $25M

69.6

0.36

73.0

0.09

72.4

0.07

3

> $3M & <= $5M

5.9

0.35

5.8

0.22

5.8

0.23

4

> $750K & <= $3M

3.2

0.40

2.9

0.46

2.9

0.23

5

<= $750K

0.2

0.62

0.2

0.38

0.2

0.45

6

Total

$125.2

0.27%

$131.8

0.09%

$132.1

0.05%

Legal Structure

7

Unsecuritized Loans

$80.3

0.16%

$69.4

0.04%

$64.9

0.05%

8

Freddie Mac mortgage-related securities

35.4

0.49

53.1

0.17

58.1

0.07

9

Other guarantee commitments

9.5

0.40

9.3

-

9.1

-

10

Total

$125.2

0.27%

$131.8

0.09%

$132.1

0.05%

Credit Enhancement

11

Credit Enhanced

$42.7

0.45%

$59.3

0.15%

$64.1

0.06%

12

Non-Credit Enhanced

82.5

0.18

72.5

0.04

68.0

0.05

13

Total

$125.2

0.27%

$131.8

0.09%

$132.1

0.05%

Other

14

Original LTV > 80%

$6.2

2.75%

$5.5

0.51%

$5.2

0.33%

15

Original DSCR below 1.10

3

$2.7

3.18%

$2.1

0.91%

$2.0

0.30%

September 30, 2013

UPB

($ Billions)

Delinquency

Rate

2

(%)

June 30, 2013

Delinquency

Rate

2

(%)

September 30, 2012

Delinquency

Rate

2

(%)

UPB

($ Billions)

UPB

($ Billions)

1

DSCR –

Debt Service Coverage Ratio –

is an indicator of future credit performance for multifamily loans. DSCR estimates

a multifamily borrower’s ability to service its mortgage obligation

using the secured property’s cash flow, after deducting non-mortgage expenses from income. The higher the DSCR, the more

likely

a

multifamily

borrower

will

be

able

to

continue

servicing

its

mortgage

obligation. |

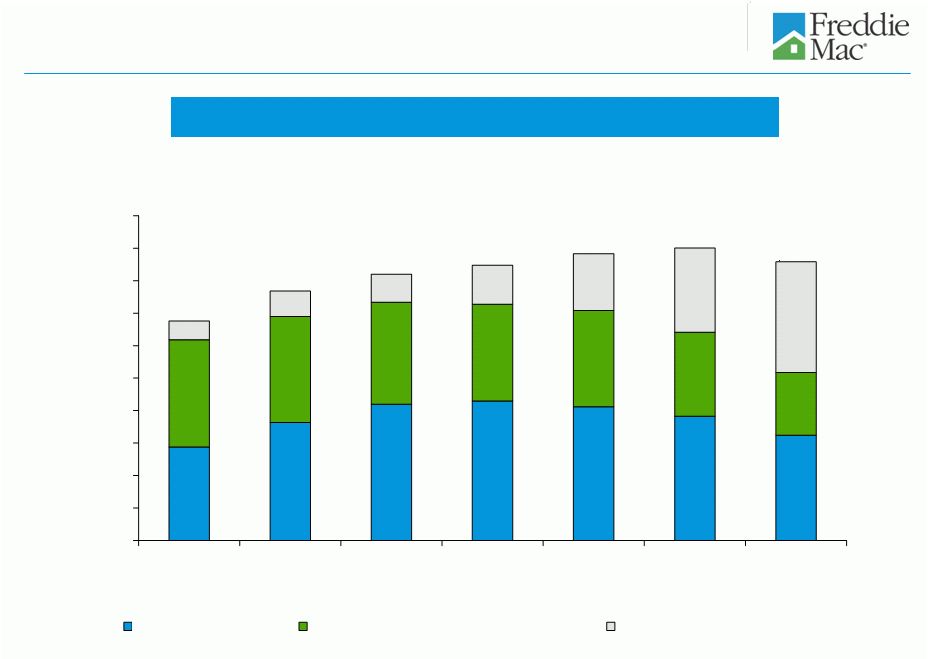

0.00%

Multifamily market and Freddie Mac delinquency rates

Percent

1

37

7.38%

1.13%

0.09%

1

Freddie Mac (60+ day)

FDIC Insured Institutions (90+ day)

MF CMBS Market (60+ day)

ACLI Investment Bulletin (60+ day)

See “MD&A – RISK MANAGEMENT – Credit Risk – Mortgage Credit Risk –

Multifamily Mortgage Credit Risk ” in Freddie Mac’s Form 10-K for the year ended December 31,

2012, for information about the company’s reported multifamily delinquency rate. The

multifamily delinquency rate at September 30, 2013 was 0.05%.

Source: Freddie Mac, FDIC Quarterly Banking Profile, TREPP (CMBS multifamily 60+ delinquency rate,

excluding REOs), American Council of Life Insurers (ACLI). Non-Freddie Mac data is not

yet available for the third quarter of 2013. |

38

Safe Harbor Statements

Freddie Mac obligations

Freddie Mac’s securities are obligations of Freddie Mac only. The securities,

including any interest or return of discount on the securities, are not

guaranteed by and are not debts or obligations of the United States or any federal agency or instrumentality other than Freddie

Mac.

No offer or solicitation of securities

This

presentation

includes

information

related

to,

or

referenced

in

the

offering

documentation

for,

certain

Freddie

Mac

securities,

including offering circulars and related supplements and agreements. Freddie Mac

securities may not be eligible for offer or sale in certain

jurisdictions

or

to

certain

persons.

This

information

is

provided

for

your

general

information

only,

is

current

only

as

of

its

specified

date and does not constitute an offer to sell or a solicitation of an offer to buy

securities. The information does not constitute a sufficient basis

for

making

a

decision

with

respect

to

the

purchase

or

sale

of

any

security.

All

information

regarding

or

relating

to

Freddie

Mac

securities

is

qualified

in

its

entirety

by

the

relevant

offering

circular

and

any

related

supplements.

Investors

should

review

the

relevant

offering circular and any related supplements before making a decision with respect

to the purchase or sale of any security. In addition, before purchasing any

security, please consult your legal and financial advisors for information about and analysis of the security, its

risks and its suitability as an investment in your particular circumstances.

Forward-looking statements

Freddie Mac's presentations may contain forward-looking statements, which may

include statements pertaining to the conservatorship, the company’s

current expectations and objectives for its efforts under the MHA Program, the servicing alignment initiative and other

programs to assist the U.S. residential mortgage market, future business plans,

liquidity, capital management, economic and market conditions and trends,

market share, the effect of legislative and regulatory developments, implementation of new accounting guidance,

credit

losses,

internal

control

remediation

efforts,

and

results

of

operations

and

financial

condition

on

a

GAAP,

Segment

Earnings

and

fair value basis. Forward-looking statements involve known and unknown risks

and uncertainties, some of which are beyond the company’s control.

Management’s expectations for the company’s future necessarily involve a number of assumptions, judgments and

estimates, and various factors, including changes in market conditions, liquidity,

mortgage-to-debt option-adjusted spread, credit outlook, actions

by FHFA, Treasury, the Federal Reserve, the SEC, HUD, other federal agencies, the Administration and Congress, and the

impacts of legislation or regulations and new or amended accounting guidance, could

cause actual results to differ materially from these expectations. These

assumptions, judgments, estimates and factors are discussed in the company’s Annual Report on Form 10-K for

the year ended December 31, 2012, Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2013, June 30, 2013 and September 30, 2013 and

Current Reports on Form 8-K, which are available on the Investor Relations page of the company’s Web site at

www.FreddieMac.com/investors and the SEC’s Web site at www.sec.gov. The

company undertakes no obligation to update forward- looking statements it

makes to reflect events or circumstances after the date of this presentation. |