Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMARIN CORP PLC\UK | d624041d8k.htm |

Exhibit 99.1

Amarin Reports Third Quarter 2013 Financial Results

and Provides Update on Operations

- Amarin pursuing reinstatement of Special Protocol Assessment agreement for ANCHOR study -

BEDMINSTER, N.J., and DUBLIN, Ireland, November 7, 2013 — Amarin Corporation plc (Nasdaq: AMRN), a late stage biopharmaceutical company focused on the commercialization and development of therapeutics to improve cardiovascular health, today announced financial results for Q3, the quarter ended September 30, 2013, and provided an update on company operations.

Key Amarin accomplishments and setbacks since June 30, 2013 include:

| • | Recognized $8.4 million in product revenue from Vascepa® sales in Q3, the second full quarter of Vascepa sales, as compared to $5.5 million in Q2 |

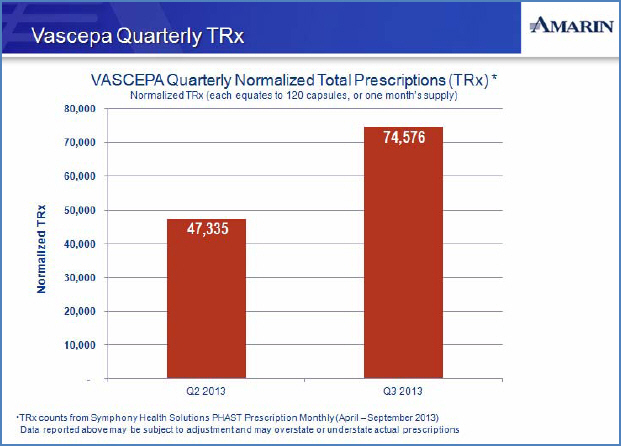

| • | Normalized prescriptions, based upon data from Symphony Health, increased by 58% in Q3 to 74,576 from 47,335 in Q2 |

| • | Improved formulary access by increasing number of lives covered with Tier 2 status to 92 million with over 200 million lives covered on formulary overall |

| • | Increased the number of physicians prescribing Vascepa to over 13,000 |

| • | Surpassed 6,000 patients enrolled in the REDUCE-IT cardiovascular outcomes trial in which the mean and median baseline triglyceride, or TG, levels in patients participating in the study to date are >200 mg/dL, a level which is intentionally higher than studied in recently conducted outcomes trials of other prescription lipid modifying therapies |

| • | Increased patents issued or allowed in the United States to 37, adding 10 in Q3, which include multiple claims directed at the administration of pure EPA to lower triglycerides with or without statin therapy (26 year-to-date), all but two of the 37 have patent terms extending into 2030, with more than 30 additional patent applications being prosecuted in the United States alone |

| • | Completed an equity financing resulting in approximately $121.2 million in net proceeds helping to provide an improved financial foundation for the company |

| • | Reduced worldwide staffing by half in October to reduce costs and better match the operational size of Amarin for commercialization of the current indication for Vascepa following a negative recommendation (2 to 9 vote) from an FDA advisory committee on the pending ANCHOR sNDA |

“We continue to witness the growth of awareness, Tier 2 managed care conversions, and prescription volume for Vascepa, seeing an increase of 58% in normalized TRxs from Q2 to Q3 of this year,” said Joseph Zakrzewski, Chairman and Chief Executive Officer of Amarin. “We believe our dedicated and talented employees will be able to continue to grow our commercial business. We also believe that the efficacy and safety profile of Vascepa for its approved indication reflects a unique and favorably differentiated product which is well positioned to help clinicians provide improved care to their patients.”

1

Commenting on the FDA’s recently expressed position that the results from the ACCORD-Lipid, AIM-HIGH, and HPS2-THRIVE trials fail to support the hypothesis that a TG-lowering drug significantly reduces the risk for cardiovascular (CV) events among statin-treated patients and that such results constitute a new substantial scientific issue, Steven B. Ketchum, Ph.D., President of Research and Development of Amarin provided, “We intend to continue to work vigorously in support of improved patient care and labeling of Vascepa for the ANCHOR indication. Toward that end, we have submitted to the FDA all materials needed to appeal the FDA rescission of the ANCHOR Special Protocol Assessment, or SPA, agreement and have begun the formal appeal process with FDA. We believe that had the FDA advisory committee been asked to vote on the indication supported by the SPA agreement for ANCHOR and by the ANCHOR results submitted in our sNDA, the outcome would have favored Vascepa approval.” Amarin plans on today’s conference call to further discuss this appeal and Amarin’s perspective on why the ANCHOR indication should be approved.

Operational update

Commercialization update

Vascepa is being marketed as an adjunct to diet to reduce triglyceride levels in adult patients with severe (>500 mg/dL) hypertriglyceridemia, the MARINE indication. The quarter ended September 30, 2013 represents the second full quarter of Vascepa sales following its launch by Amarin’s direct sales force on January 28, 2013. The number of clinicians prescribing Vascepa continues to increase with now over 13,000 prescribers. Continued expansion of Tier 2 coverage is expected to support further sales growth. In October, as previously announced, Amarin reduced its worldwide workforce by half. This included a reduction of the company’s U.S. sales team to approximately 150 members, including approximately 130 sales representatives. While in doing so Amarin is no longer directly detailing Vascepa in certain lower potential geographies, the territories of our existing team covers the majority of Vascepa prescription volume and growth since its launch earlier this year. Amarin believes that sales will continue to grow for Vascepa and that Vascepa is well differentiated in this market based on its safety profile, which is comparable to placebo, and on its spectrum of demonstrated lipid benefit at 4 g/day, including statistically significant reductions in TGs, Apo B, VLDL-C, and non-HDL-C, with no increase in LDL-C, also known as bad cholesterol.

2

Vascepa additional indication

In parallel with marketing Vascepa for the MARINE indication, Amarin is vigorously pursuing FDA approval of Vascepa for the ANCHOR indication, a second indication as an adjunct to diet and exercise for adult patients with mixed dyslipidemia who despite optimized statin therapy have TG levels between 200 and 499 mg/dL.

As previously announced, in a clinical trial of the use of Vascepa in the ANCHOR indication, Vascepa demonstrated statistically significant reductions in a broad spectrum of lipid and inflammatory markers, on top of optimized statin therapy, including significant reduction in LDL-C compared to placebo. The FDA held an advisory committee meeting on October 16, 2013 regarding the ANCHOR indication and had previously assigned a PDUFA action date of December 20, 2013 for this sNDA.

Last week, the FDA informed Amarin that it rescinded the ANCHOR SPA agreement because the FDA has determined that a substantial scientific issue essential to determining the effectiveness of Vascepa in the studied population was identified after testing began. Specifically, consistent with discussion at the advisory committee meeting, the FDA cited results from the ACCORD-Lipid and AIM-HIGH outcome trials, as well as the publicly presented results from the HPS2-THRIVE outcome trial, which the FDA stated fail to support the hypothesis that a triglyceride-lowering drug significantly reduces the risk for cardiovascular events among statin-treated patients with mixed dyslipidemia and residually high serum triglyceride levels (200-499 mg/dL).

3

Amarin plans to continue to pursue approval of the ANCHOR indication vigorously. Amarin has submitted to the FDA all materials needed to appeal the FDA rescission of the ANCHOR SPA agreement and has begun the formal appeal process with FDA. The company is being encouraged in these efforts by many clinicians who want to see approval of the ANCHOR indication. Based on planned discussions with the FDA, Amarin will assess its options with respect to the ANCHOR sNDA and the extent to which Amarin should continue its other clinical trials, including the ongoing REDUCE-IT outcomes trial.

Vascepa exclusivity update

Amarin continues to make significant progress in its effort to expand patent protection for Vascepa and now has 37 patents issued or allowed in the United States with over 30 additional U.S. patent applications being prosecuted. This patent portfolio includes claims directed at Vascepa’s pharmaceutical composition and methods of use for the MARINE indication, ANCHOR indication and other potential uses of Vascepa. Amarin is also pursuing patent applications related to Vascepa in multiple jurisdictions outside the United States. In May 2013, the European Patent Office granted a patent directed at the use of Vascepa based on the results from the MARINE trial. All but two of the granted patents in the United States have expiry dates extending into 2030 and the majority of U.S. patent applications, if and when allowed, are anticipated to have expiry dates in or beyond 2030. Patent protection for Vascepa is augmented by protection provided by trade secrets, existing manufacturing barriers to entry and anticipated three- or five-year regulatory exclusivity.

REDUCE-IT and other Vascepa-related clinical development

Enrollment for the REDUCE-IT outcomes trial of Vascepa continues at over 450 sites spanning 11 countries. In Q3 of this year enrollment for the REDUCE-IT trial surpassed 6,000 patients. As previously reported, the mean and median baseline triglyceride levels for patients participating to date in the REDUCE-IT cardiovascular outcomes study has been confirmed to be >200 mg/dL. As intended, these are higher baseline TG levels than levels studied in other recent outcomes trials of other lipid modifying therapies. Results of the REDUCE-IT study will not be available until a specified number of cardiovascular events have been observed. Based on current expectations, unless feedback from pending discussion with the FDA regarding the ANCHOR sNDA results in modification or termination of the REDUCE-IT study, results of this blinded study are anticipated in 2017. Amarin estimates that over $100 million is required to complete this study. While Amarin remains scientifically committed to continuing the REDUCE-IT study, Amarin anticipates that the trial may be difficult to complete without the expected revenues from the previously anticipated ANCHOR indication.

Financial update

Amarin reported cash and cash equivalents on-hand of $225.9 million at September 30, 2013. On July 12, 2013, Amarin completed a public offering resulting in net proceeds to Amarin of approximately $121.2 million, after deducting the company’s portion of estimated offering expenses.

Net product revenues for the three and nine months ended September 30, 2013 were $8.4 million and $16.2 million, as compared to no revenues in the corresponding periods of 2012 and as compared to revenue of $5.5 million for the three months ended June 30,

4

2013. In accordance with U.S. Generally Accepted Accounting Principles (US GAAP), and consistent with previously reported revenue results, until the company has more operating history with the commercialization of Vascepa, it is recognizing revenue based not on its sales to wholesalers but based on the resale of Vascepa for the purpose of filling prescriptions. For the nine months ended September 30, 2013, the net value of Vascepa sold to wholesalers was $17.8 million, and, as a result, in addition to $16.2 million in recognized revenue, Amarin recorded deferred revenue of $1.6 million at September 30, 2013. Cash collections from the sale of Vascepa in the quarter ended September 30, 2013 were approximately $9.1 million for a total of $18.5 million collected from wholesalers since the launch of Vascepa.

Consistent with industry practice, the net price of Vascepa for the three and nine months ended September 30, 2013 reflects deductions for costs of Amarin’s co-payment rebate card program and customary payor rebates and allowances. The net price also includes adjustments for other customary amounts as well as the deduction of one-time discounts paid to wholesalers to stock Vascepa in advance of Vascepa’s launch in January 2013, which discounted stock was principally sold during the first half of 2013.

Cost of goods sold for the three and nine months ended September 30, 2013 was $3.7 million and $7.8 million, respectively. Gross margin improved to 56% in Q3 2013 from 48% and 45% in Q2 and Q1, respectively, which was primarily driven by lower unit cost API purchases. Average gross margin was 52% for the nine months ended September 30, 2013. The majority of Vascepa capsules included in cost of goods sold for the nine months ended September 30, 2013 included API sourced from a single API supplier. Amarin’s purchases of API from this supplier in 2012 and 2013 are at higher cost per kilogram than expected future purchases from this supplier. The unusually high cost of goods, as a percentage of revenue, is attributable to a number of things including the geographic location of our suppliers, exchange rate exposures and lower volume and less favorable economic terms than those with other API suppliers. Amarin expects steady state gross margin as a percentage of product revenues to continue to increase over time into the sixties and seventies and, with significantly higher API purchase volumes potentially into the low eighties in the longer term.

Under U.S. GAAP, Amarin reported a net loss of $48.9 million in Q3 2013, or basic and diluted loss per share of $0.29. This net loss included $4.3 million in non-cash, share-based compensation expense, $0.3 million in non-cash, warrant compensation expense, and a $1.4 million loss on the change in the fair value of derivatives. In Q3 2012, GAAP net loss was $26.4 million, or basic and diluted loss per share of $0.18, and included $4.6 million in non-cash share-based compensation expense, $1.2 million in non-cash warrant compensation income, and a $16.5 million non-cash gain on the change in the fair value of derivatives.

For the nine months ended September 30, 2013, Amarin reported a net loss of $150.8 million, or basic and diluted loss per share of $0.96. This net loss included $14.2 million in non-cash share-based compensation expense, $1.2 million in non-cash warrant compensation income, and a $21.1 million gain on the change in the fair value of derivatives. For the nine months ended September 30, 2012, GAAP net loss was $168.6 million, or basic and diluted loss per share of $1.19, and included $13.3 million in non-cash share-based compensation expense, $3.0 million in non-cash warrant compensation expense, and a $68.7 million loss on the change in the fair value of derivatives.

5

Excluding non-cash gains or losses for share-based compensation, warrant compensation and change in value of derivatives, non-GAAP adjusted net loss was $43.0 million for Q3 2013, or non-GAAP adjusted basic and diluted loss per share of $0.25, as compared to non-GAAP adjusted net loss of $39.4 million, or non-GAAP adjusted basic and diluted loss per share of $0.26 for the same period in 2012. Adjusted net loss was $158.8 million for the nine months ended September 30, 2013, or non-GAAP adjusted basic and diluted loss per share of $1.01, as compared to non-GAAP adjusted net loss of $83.6 million, or non-GAAP adjusted basic and diluted loss per share of $0.59 for the same period in 2012.

Amarin reported cash and cash equivalents decreased in aggregate by $34.3 million from December 31, 2012 as compared to September 30, 2013. Net cash outflows from operations were $157.2 million for the nine months ended September 30, 2013. Net cash outflows from operations for the three months ended September 30, 2013 were $44.9 million as compared to $52.8 million in net cash outflows from operations for the three months ended June 30, 2013, representing a net decrease of $7.9 million. As a result of the headcount reductions in October 2013 and additional anticipated reductions in spend, Amarin expects that it will experience continued reductions in quarterly net cash outflows from operations with future quarterly cash outflows below the results of the third quarter. Amarin estimates that during 2014 that operating activities will result in a net use of cash of less than $80 million.

During the nine months ended September 30, 2013, net cash outflows included approximately $71.3 million in sales and marketing related expenses in conjunction with the initial commercial launch of Vascepa, approximately $34.2 million of expenses in support of the REDUCE-IT cardiovascular outcomes study inclusive of clinical trial materials and approximately $20.4 million for Vascepa API, purchased in conjunction with the buildup of commercial supply and for clinical trial material.

Amarin’s liabilities as of September 30, 2013, excluding the fair value of the non-cash warrant derivative liability, totaled approximately $272.0 million, which includes $145.3 million for the carrying value of exchangeable debt and $87.3 million for the carrying value of the hybrid debt financing that we entered into in December 2012.

As of September 30, 2013, Amarin had approximately 172.6 million American Depository Shares (ADSs) and ordinary shares outstanding as well as approximately 9.8 million, and 10.9 million equivalent shares underlying warrants and stock options, respectively, at average exercise prices of $1.44 and $7.32, respectively, and 0.8 million equivalent shares underlying restricted or deferred stock units. In addition, $150 million in exchangeable senior notes issued in January 2012 are exchangeable into an aggregate of 17.0 million ADSs (based on an initial exchange price of approximately $8.81 per ADS), subject to certain specified conditions. The notes accrue interest at an annual rate of 3.5%, payable semiannually in arrears on January 15 and July 15. The notes will mature on January 15, 2032, unless earlier repurchased or redeemed by the company or exchanged by the holders. In conjunction with Amarin’s financing in July 2013, Amarin issued 21.7 million additional ADSs, which are included in the total outstanding shares above.

Amarin’s operational priorities

The current operational priorities of Amarin are:

| • | Increasing revenues from sales of Vascepa |

6

| • | Continuing managed care migration coverage from Tier 3 to Tier 2 |

| • | Continuing discussions with the FDA and vigorously pursuing approval of Vascepa for the ANCHOR indication; PDUFA date of December 20, 2013 |

Conference call and webcast information

Amarin will host a conference call at 4:30 p.m. ET (8:30 p.m. UTC/GMT) today, November 7, 2013. The conference call can be heard live via the investor relations section of the company’s website at www.amarincorp.com, or via telephone by dialing 877-407-8033 within the United States or 201-689-8033 from outside the United States. A replay of the call will be made available for a period of two weeks following the conference call. To hear a replay of the call, dial 877-660-6853 (inside the United States) or 201-612-7415 (outside the United States). A replay of the call will also be available through the company’s website shortly after the call. For both dial-in numbers please use conference ID 100291.

Use of non-GAAP adjusted financial information

Included in this press release and the conference call referenced above are non-GAAP adjusted financial information as defined by U.S. Securities and Exchange Commission Regulation G. The GAAP financial measure most directly comparable to each non-GAAP adjusted financial measure used or discussed, and a reconciliation of the differences between each non-GAAP adjusted financial measure and the comparable GAAP financial measure, are included in this press release after the condensed consolidated financial statements.

Non-GAAP adjusted net loss was derived by taking GAAP net loss and adjusting it for non-cash gains or losses for share-based compensation, warrant compensation, and change in value of derivatives. Management believes that these non-GAAP adjusted measures provide investors with a better understanding of the company’s historical results from its core business operations. While management believes that these non-GAAP adjusted financial measures provide useful supplemental information to investors regarding the underlying performance of the company’s business operations, investors are reminded to consider these non-GAAP measures in addition to, and not as a substitute for, financial performance measures prepared in accordance with GAAP. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP. In addition, it should be noted that these non-GAAP financial measures may be different from non-GAAP measures used by other companies, and management may utilize other measures to illustrate performance in the future.

About Amarin

Amarin Corporation plc is a biopharmaceutical company focused on the commercialization and development of therapeutics to improve cardiovascular health. Amarin’s product development program leverages its extensive experience in lipid science and the potential therapeutic benefits of polyunsaturated fatty acids. Vascepa® (icosapent ethyl), Amarin’s first FDA approved product, is a patented, ultra pure omega-3 fatty acid product comprising not less than 96% EPA. For more information about Vascepa visit www.vascepa.com. For more information about Amarin visit www.amarincorp.com.

7

About Vascepa® (icosapent ethyl) capsules

Vascepa® (icosapent ethyl) capsules, known in scientific literature as AMR101, is a highly pure-EPA omega-3 prescription product in a 1 gram capsule.

Indications and Usage

| • | Vascepa (icosapent ethyl) is indicated as an adjunct to diet to reduce triglyceride (TG) levels in adult patients with severe (>500 mg/dL) hypertriglyceridemia. |

| • | The effect of Vascepa on the risk for pancreatitis and cardiovascular mortality and morbidity in patients with severe hypertriglyceridemia has not been determined. |

Important Safety Information for Vascepa

| • | Vascepa is contraindicated in patients with known hypersensitivity (e.g., anaphylactic reaction) to Vascepa or any of its components and should be used with caution in patients with known hypersensitivity to fish and/or shellfish. |

| • | The most common reported adverse reaction (incidence >2% and greater than placebo) was arthralgia (2.3% for Vascepa, 1.0% for placebo). |

FULL VASCEPA PRESCRIBING INFORMATION CAN BE FOUND AT WWW.VASCEPA.COM.

Forward-looking statements

This press release contains forward-looking statements, including statements about the commercial launch of Vascepa, including the number of total prescriptions to date and the potential for future growth, expectations for revenue growth, product awareness, receptivity of clinicians to and patient experience with Vascepa; expectations regarding managed care coverage migration from Tier 3 to Tier 2 and continued growth in Tier 2 coverage; the pricing terms of commercial supply for Vascepa; expectations regarding gross margins and cost of goods sold (COGS); the timing and outcome of FDA decisions regarding Amarin’s sNDA for the ANCHOR indication and regulatory exclusivity; the efficacy, safety and therapeutic benefits of Vascepa; the ability of Amarin to continue the REDUCE-IT study in light of company resources and other factors; Amarin’s ability to obtain sufficient patent protection and regulatory exclusivity for its product and product candidates, maintain trade secrets, and take advantage of existing manufacturing barriers to entry; continued enrollment of patients in Amarin’s REDUCE-IT cardiovascular outcomes study; continued publication of study data; and continued assessment of collaboration prospects for commercialization of Vascepa. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. In particular, as disclosed in its previous filings with the U.S. Securities and Exchange Commission, Amarin’s ability to effectively commercialize Vascepa will depend in part on its ability to create market demand for Vascepa through education, marketing and sales activities, to achieve market acceptance of Vascepa, to receive adequate levels of reimbursement from third-party payers, to develop and maintain a consistent source of

8

commercial supply at a competitive price, and to obtain and maintain patent protection and regulatory exclusivity. Among the factors that could cause actual results to differ materially from those described or projected herein include the following: uncertainties associated generally with research and development, clinical trials and related regulatory approvals; the risk that Special Protocol Assessment agreements with the FDA are not a guarantee that FDA will approve a product candidate upon submission; the risk associated with the FDA’s recent rescinding of the ANCHOR SPA; the risk that FDA will follow the negative recommendation of the advisory committee ; the risk that the recent reductions in expenses will not be sufficient or will hurt sales; the risk that the FDA may not complete its review of the ANCHOR sNDA by the PDUFA action date or grant new chemical entity regulatory exclusivity to Vascepa; the risk that historical REDUCE-IT clinical trial enrollment and randomization rates may not be predictive of future results and related cost may increase beyond expectations; the risk that patent applications may not result in issued patents, trade secrets may not be maintained and that circumstances that create manufacturing barriers to entry may not last; the risk that Amarin may not enter into a collaboration agreement for the commercialization of Vascepa in the ANCHOR indication under favorable terms or at all or market the ANCHOR indication successfully on its own; and the risk that publications of scientific data may not accept proposals to publish Vascepa data. A further list and description of these risks, uncertainties and other risks associated with an investment in Amarin can be found in Amarin’s filings with the U.S. Securities and Exchange Commission, including its most recent Quarterly Report on Form 10-Q. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Amarin undertakes no obligation to update or revise the information contained in this press release, whether as a result of new information, future events or circumstances or otherwise.

Vascepa has been approved for use by the FDA as an adjunct to diet to reduce triglyceride levels in adult patients with severe (>500 mg/dL) hypertriglyceridemia. Vascepa is under various stages of development for potential use in other indications that have not been approved by the FDA. Nothing in this press release should be construed as marketing the use of Vascepa in any indication that has not been approved by the FDA.

Important information regarding prescriptions data and product revenue

The historical prescription data provided in this press release is based on data published by a third party as of October 15, 2013. Although Amarin believes these data are prepared on a period to period basis in a manner that is generally consistent and that such results are indicative of current prescription trends, these data are based on estimates and should not be relied upon as definitive. These data may overstate or understate actual prescriptions. Based on other data available to Amarin and the history of such third-party prescription estimates in the early stages of launch of other new pharmaceutical products, Amarin believes that the trends provided by this information can be useful to gauge current prescription levels. Amarin commenced its commercial launch of Vascepa on January 28, 2013. Accordingly, there is a very limited amount of information available at this time to determine the actual number of total prescriptions for Vascepa. Amarin believes that investors should view these data with caution, as data for this single and limited period may not be representative of a trend consistent with the results presented or otherwise predictive of future results. Seasonal fluctuations in pharmaceutical sales, for example, may affect future prescription trends of Vascepa as could change in prescriber sentiment and other factors. Amarin believes investors should consider its results during this quarter together with its

9

results over several future quarters, or longer, before making an assessment about potential future performance. The commercial launch of a new pharmaceutical product is a complex undertaking, and Amarin’s ability to effectively and profitably launch Vascepa will depend in part on its ability to generate market demand for Vascepa through education, marketing and sales activities, its ability to achieve market acceptance of Vascepa, its ability to generate product revenue and its ability to receive adequate levels of reimbursement from third-party payers. See “Risk Factors—Risks Related to the Commercialization and Development of Vascepa” included in Part II, Item 1A. Risk Factors in Amarin’s most recent Quarterly Report on Form 10-Q.

Availability of other information about Amarin

Investors and others should note that we communicate with our investors and the public using our company website (www.amarincorp.com), our investor relations website (http://www.amarincorp.com/investor-splash.html), including but not limited to investor presentations and investor FAQs, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that we post on these channels and websites could be deemed to be material information. As a result, we encourage investors, the media, and others interested in Amarin to review the information that we post on these channels, including our investor relations website, on a regular basis. This list of channels may be updated from time to time on our investor relations website and may include social media channels. The contents of our website or these channels, or any other website that may be accessed from our website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933.

Amarin contact information:

Joseph Bruno

Investor Relations and Corporate Communications

Amarin Corporation

In U.S.: +1 (908) 719-1315

investor.relations@amarincorp.com

10

CONSOLIDATED BALANCE SHEET DATA

(U.S. GAAP)

Unaudited

| September 30, 2013 |

December 31, 2012 |

|||||||

| (in thousands) | ||||||||

| ASSETS | ||||||||

| Current Assets: |

||||||||

| Cash and cash equivalents |

$ | 225,885 | $ | 260,242 | ||||

| Restricted cash |

1,400 | — | ||||||

| Accounts receivable |

3,721 | — | ||||||

| Inventory, net |

27,083 | 21,262 | ||||||

| Deferred tax asset |

936 | 937 | ||||||

| Other current assets |

3,537 | 3,253 | ||||||

|

|

|

|

|

|||||

| Total current assets |

$ | 262,562 | $ | 285,694 | ||||

| Property, plant and equipment, net |

646 | 811 | ||||||

| Deferred tax asset |

14,433 | 8,044 | ||||||

| Other non-current assets |

5,335 | 4,951 | ||||||

| Intangible asset, net |

10,870 | 11,355 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 293,846 | $ | 310,855 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current Liabilities: |

||||||||

| Accounts payable |

$ | 6,233 | $ | 17,458 | ||||

| Accrued interest payable |

10,901 | 2,520 | ||||||

| Deferred revenue |

1,617 | — | ||||||

| Accrued expenses and other liabilities |

12,548 | 5,224 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

$ | 31,299 | $ | 25,202 | ||||

|

|

|

|

|

|||||

| Long-Term Liabilities: |

||||||||

| Warrant derivative liability |

39,598 | 54,854 | ||||||

| Exchangeable senior notes |

145,316 | 134,250 | ||||||

| Long-term debt |

87,319 | 85,153 | ||||||

| Long-term debt redemption feature |

7,200 | 14,577 | ||||||

| Other long-term liabilities |

811 | 816 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

$ | 311,543 | $ | 314,852 | ||||

|

|

|

|

|

|||||

| Stockholders’ Deficit: |

||||||||

| Common stock |

141,455 | 124,597 | ||||||

| Additional paid-in capital |

739,524 | 619,266 | ||||||

| Treasury stock |

(217 | ) | (217 | ) | ||||

| Accumulated deficit |

(898,459 | ) | (747,643 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ deficit |

$ | (17,697 | ) | $ | (3,997 | ) | ||

|

|

|

|

|

|||||

| Total Liabilities and Stockholders’ Deficit |

$ | 293,846 | $ | 310,855 | ||||

|

|

|

|

|

|||||

11

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

(U.S. GAAP)

Unaudited

| Three Months Ended September 30 (in thousands, except per share amounts) |

Nine Months Ended September 30 (in thousands, except per share amounts) |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Product revenues |

$ | 8,403 | $ | — | $ | 16,245 | $ | — | ||||||||

| OPERATING EXPENSES: |

||||||||||||||||

| Cost of goods sold |

3,682 | — | 7,813 | — | ||||||||||||

| Research and development (1) |

16,821 | 20,913 | 56,148 | 39,735 | ||||||||||||

| Selling, general and administrative (1) |

28,274 | 13,397 | 101,502 | 41,059 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

48,777 | 34,310 | 165,463 | 80,794 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

(40,374 | ) | (34,310 | ) | (149,218 | ) | (80,794 | ) | ||||||||

| (Loss) gain on change in fair value of derivative liabilities (2) |

(1,402 | ) | 16,454 | 21,059 | (68,686 | ) | ||||||||||

| Interest expense, net |

(8,441 | ) | (4,570 | ) | (26,646 | ) | (12,838 | ) | ||||||||

| Other (expense) income, net |

(302 | ) | (427 | ) | (838 | ) | (411 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations before taxes |

(50,519 | ) | (22,853 | ) | (155,643 | ) | (162,729 | ) | ||||||||

| Benefit from (provision for) income taxes |

1,635 | (3,573 | ) | 4,827 | (5,888 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (48,884 | ) | $ | (26,426 | ) | $ | (150,816 | ) | $ | (168,617 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss per share: |

||||||||||||||||

| Basic and diluted |

$ | (0.29 | ) | $ | (0.18 | ) | $ | (0.96 | ) | $ | (1.19 | ) | ||||

| Weighted average shares: |

||||||||||||||||

| Basic and diluted |

170,187 | 149,200 | 157,105 | 141,947 | ||||||||||||

| (1) | A substantial portion of Amarin’s selling, general and administrative costs represents non-cash warrant based compensation to former officers. Excluding non-cash stock and warrant based compensation, research and development expenses were $16,231 and $19,943 for the three months ending September 30, 2013 and 2012, respectively and selling, general and administrative expenses were $24,333 and $10,926, respectively, for the same periods. |

| (2) | Non-cash gains and losses result from changes in the fair value of a warrant derivative liability, a long-term debt redemption feature and foreign exchange contracts. |

12

The following is a reconciliation of the non-GAAP financial measures used by Amarin to describe its financial results determined in accordance with United States generally accepted accounting principles (GAAP). An explanation of these measures is also included under the heading “Use of non-GAAP adjusted financial information” above.

RECONCILIATION OF NON-GAAP LIABILITIES

Unaudited

| (in thousands) | September 30, 2013 |

December 31, 2012 |

||||||

| Current Liabilities: |

||||||||

| Accounts payable |

$ | 6,233 | $ | 17,458 | ||||

| Accrued interest payable |

10,901 | 2,520 | ||||||

| Deferred revenue |

1,617 | — | ||||||

| Accrued expenses and other liabilities |

12,548 | 5,224 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

$ | 31,299 | $ | 25,202 | ||||

|

|

|

|

|

|||||

| Long-Term Liabilities: |

||||||||

| Warrant derivative liability |

39,598 | 54,854 | ||||||

| Exchangeable senior notes |

145,316 | 134,250 | ||||||

| Long-term debt |

87,319 | 85,153 | ||||||

| Long-term debt redemption feature |

7,200 | 14,577 | ||||||

| Other long-term liabilities |

811 | 816 | ||||||

|

|

|

|

|

|||||

| Total liabilities – GAAP |

$ | 311,543 | $ | 314,852 | ||||

|

|

|

|

|

|||||

| Warrant derivative liability |

(39,598 | ) | (54,854 | ) | ||||

|

|

|

|

|

|||||

| Total liabilities – non GAAP |

$ | 271,945 | $ | 259,998 | ||||

|

|

|

|

|

|||||

RECONCILIATION OF NON-GAAP NET LOSS

Unaudited

| Three Months Ended September 30 (in thousands, except per share amounts) |

Nine Months Ended September 30 (in thousands, except per share amounts) |

|||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Net loss for EPS1 – GAAP |

$ | (48,884 | ) | $ | (26,426 | ) | $ | (150,816 | ) | $ | (168,617 | ) | ||||

| Share based compensation expense |

4,255 | 4,635 | 14,218 | 13,344 | ||||||||||||

| Warrant compensation expense (income) |

276 | (1,194 | ) | (1,179 | ) | 3,037 | ||||||||||

| Loss (gain) on change in fair value of derivatives |

1,402 | (16,454 | ) | (21,059 | ) | 68,686 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted net loss for EPS1 – non GAAP |

(42,951 | ) | (39,439 | ) | (158,836 | ) | (83,550 | ) | ||||||||

| 1 basic and diluted |

||||||||||||||||

| Loss per share: |

||||||||||||||||

| Basic and diluted EPS – non GAAP |

$ | (0.25 | ) | $ | (0.26 | ) | $ | (1.01 | ) | $ | (0.59 | ) | ||||

| Weighted average shares: |

||||||||||||||||

| Basic and diluted |

170,187 | 149,200 | 157,105 | 141,947 | ||||||||||||

13