Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FNB CORP/PA/ | d623388d8k.htm |

F.N.B. Corporation

Third Quarter 2013

Investor Presentation

Guggenheim Partners –

New York, NY

November 6, 2013

Exhibit 99.1 |

Cautionary Statement Regarding Forward-Looking Information

and Non-GAAP Financial Information

2

This presentation and the reports F.N.B. Corporation files with the Securities and Exchange Commission

often contain “forward-looking statements” relating to present or future

trends or factors affecting the banking industry and, specifically, the financial operations, markets and

products of F.N.B. Corporation. These forward-looking statements involve certain risks and

uncertainties. There are a number of important factors that could cause F.N.B.

Corporation’s future results to differ materially from historical performance or projected performance. These factors

include, but are not limited to: (1) a significant increase in competitive pressures among financial

institutions; (2) changes in the interest rate environment that may reduce interest margins;

(3) changes in prepayment speeds, loan sale volumes, charge-offs and loan loss provisions; (4)

general economic conditions; (5) various monetary and fiscal policies and regulations of the U.S.

government that may adversely affect the businesses in which F.N.B. Corporation is engaged; (6)

technological issues which may adversely affect F.N.B. Corporation’s financial operations

or customers; (7) changes in the securities markets; (8) risk factors mentioned in the reports and

registration statements F.N.B. Corporation files with the Securities and Exchange Commission;

(9) housing prices; (10) job market; (11) consumer confidence and spending habits; (12) estimates

of fair value of certain F.N.B. Corporation assets and liabilities; (13) transaction risks associated

with the pending merger of BCSB Bancorp, Inc., and integration challenges related to the

recently completed mergers with PVF Capital Corp. and Annapolis Bancorp, Inc. and the difficulties

encountered in expanding into a new market and (14) the effects of current, pending and future

legislation, regulation and regulatory actions. F.N.B. Corporation undertakes no

obligation to revise these forward-looking statements or to reflect events or circumstances after the date of this

presentation.

To supplement its consolidated financial statements presented in accordance with Generally Accepted

Accounting Principles (GAAP), the Corporation provides additional measures of operating

results, net income and earnings per share (EPS) adjusted to exclude certain costs, expenses,

and gains and losses. The Corporation believes that these non-GAAP financial measures are appropriate to enhance the

understanding of its past performance as well as prospects for its future performance. In the

event of such a disclosure or release, the Securities and Exchange Commission’s Regulation

G requires: (i) the presentation of the most directly comparable financial measure calculated and

presented in accordance with GAAP and (ii) a reconciliation of the differences between the

non-GAAP financial measure presented and the most directly comparable financial measure

calculated and presented in accordance with GAAP.

The Appendix to this presentation contains non-GAAP financial measures used by the Corporation to

provide information useful to investors in understanding the Corporation's operating

performance and trends, and facilitate comparisons with the performance of the Corporation's peers.

While the Corporation believes that these non-GAAP financial measures are useful in evaluating the

Corporation, the information should be considered supplemental in nature and not as a

substitute for or superior to the relevant financial information prepared in accordance with GAAP.

The non-GAAP financial measures used by the Corporation may differ from the non-GAAP financial

measures other financial institutions use to measure their results of operations. This

information should be reviewed in conjunction with the Corporation’s financial results disclosed on

October 17, 2013 and in its periodic filings with the Securities and Exchange Commission. |

Important Information About the Pending Mergers

3

Merger

of

F.N.B.

and

BCSB

Bancorp.

In

connection

with

the

proposed

merger

between

F.N.B.

and

BCSB

Bancorp,

a

definitive

proxy

statement

of

BCSB

Bancorp and prospectus of F.N.B. will be filed with the SEC. SHAREHOLDERS OF

BCSB BANCORP, INC. ARE URGED TO READ THE DEFINITIVE PROXY

STATEMENT/PROSPECTUS

AND

ANY

OTHER

RELEVANT

DOCUMENTS

THAT

ARE

FILED

WITH

THE

SEC,

AS

WELL

AS

ANY

AMENDMENTS

OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. F.N.B. and BCSB Bancorp and certain of their directors and

executive officers may be deemed to be participants in the solicitation of proxies from BCSB

Bancorp

shareholders

in

connection

with

the

proposed

merger.

Information

concerning

such

participants’

ownership

of

BCSB

Bancorp

common

stock

will

be

set forth in the definitive proxy statement/prospectus.

Where to Find Additional Information. A free copy of the definitive proxy

statement/prospectus for each pending merger (when it is available), as well as other

documents containing information about F.N.B. Corporation and BCSB Bancorp, Inc.,

may be obtained at the SEC’s Internet site (http://www.sec.gov). In

addition, investors and security holders may obtain free copies of the documents

that F.N.B. and BCSB Bancorp have filed with the SEC by contacting the

following persons at each corporation:

F.N.B.:

James

G.

Orie,

Chief

Legal

Officer,

F.N.B.

Corporation,

One

F.N.B.

Boulevard,

Hermitage,

PA

16148,

telephone:

(724)

983-3317

BCSB

Bancorp:

Joseph

J.

Bouffard,

President

and

Chief

Executive

Officer,

BCSB

Bancorp,

Inc.,

4111

East

Joppa

Road,

Baltimore,

MD

21236,

telephone:

(410) 256-5000 |

4

F.N.B. Corporation

Key Investment Considerations

About F.N.B. Corporation

Experienced Leadership Team

Reposition and Reinvest Strategy Drives Growth

Strong Operating Trends |

Key

Investment Considerations 5

Consistent Strategy Focused on Long-Term Perspective

Achieved organic growth throughout the recent economic cycle, largely driven by

growth in loans and low-cost deposits Consistent and high-quality

operating results Continuous investments in People, Process, Products and

Productivity Maintain lower-risk profile with significant investments

in enterprise-wide risk management Strong culture focused on people,

talent management, cross-sell and sophisticated product offerings Proven

success achieving top market position in major markets and across footprint

Proven ability to compete effectively against much larger peers

Disciplined acquisition and expansion strategy focused on organic growth

potential Long-term investment thesis centered on efficient capital

management and generating shareholder value Attractive relative valuation

with consistent and supported P/TBV, modest P/E and strong dividend yield KEY INVESTMENT

CONSIDERATIONS – Differentiating Factors |

About F.N.B. Corporation

6

(1) Pro-forma for the recently completed PVFC acquisition, which closed October 12, 2013

with assets of approximately $0.7 billion, loans of $0.5 billion, deposits of $0.6

billion and 16 banking locations and the pending acquisition of BCSB Bancorp, expected to close 1Q14 with assets of approximately $0.6

billion, loans of $0.3 billion, deposits of $0.6 billion and 16 banking locations (2) SNL

Financial, Pro-forma for PVFC & BCSB, excludes custodian bank; (3) As of

November 1, 2013

Fourth Largest

Pennsylvania-Based Bank

Positioned for Sustained Growth

Consistent, Strong Operating Results

Operating Strategy

Assets:$14.1 billion

(1)

Loans:$9.6 billion

(1)

Deposits:$11.8 billion

(1)

Banking locations:282

(1)

Consumer finance locations:72

Attractive and expanding footprint: PA/OH/MD/WV: Banking locations span 56

counties and four states

(1)

Leading market position (Pro-Forma)

(2)

#3 market share in the Pittsburgh MSA

#10 market share in the Baltimore MSA

#6 overall market position for all counties of operation

Top quartile profitability performance

Deliver consistent, solid results

Industry-leading, consistent loan growth through recent economic cycle

Strong

performance:3-year

total

shareholder

return

of

73%

(3)

Reposition

and

reinvest

for

sustained

growth;

maintain

low

risk

profile

Reposition and reinvest for sustained growth

Maintain disciplined expense control

Expanding market share potential and growth opportunities

Maintain low-risk profile |

Years of

Banking

Experience

Joined FNB

Prior Experience

President and CEO

Vincent J. Delie, Jr.

26

2005

National City

President, First National Bank

John C. Williams, Jr.

42

2008

Huntington

National City

Mellon Bank

Chief Financial Officer

Vincent J. Calabrese, Jr.

25

2007

People’s United

Chief Credit Officer

Gary L. Guerrieri

27

2002

FNB

Promistar

Experienced Leadership Team

7

Experienced and respected executive management team has guided FNB through the cycle

|

Reposition and Reinvest Strategy

8

Talent Management

Geographic Segmentation

Sales Management/Cross-Sell

Product Development

Branch Optimization

Electronic Delivery Investment

Utilize Acquisitions to Enhance Growth

Opportunities

Proven ability to attract talent

Consistent, strong operating results

Revenue growth

Consistent organic loan growth

Continued organic transaction deposit growth

Attractive market position

Expanded market share potential via entry and

expansion in attractive markets

Strong 3-year total shareholder return

Strategic Focus Drives Long-Term Growth and Performance

Actions

Results |

Reposition

and

Reinvest

–

Actions

Drive

Long-Term

Performance

9

2009

2010

2011

2012

2013 YTD

PEOPLE

Talent Management

Strengthened team through key

hires; Continuous team

development

Attract, retain, develop best talent

Geographic Segmentation

Regional model

Regional

Realignment

Created 5

&

6

Regions

PROCESS

Sales Management/Cross Sell

Proprietary sales management

system developed and

implemented: Balanced

scorecards, cross-functional

alignment

Consumer

Banking

Scorecards

Consumer Banking Refinement/Daily Monitoring

Continued

Utilization

Commercial

Banking Sales

Management

Expansion to additional lines of

business

Private Banking,

Insurance,

Wealth

Management

PRODUCT

Product Development

Deepened product set and niche

areas allow FNB to successfully

compete with larger banks and

gain share

Private Banking

Capital Markets

Online and mobile banking investment

/implementation –

Online banking enhancements, mobile

banking and app

Online/mobile

banking

infrastructure

complete with

mobile remote

deposit capture

and online

budgeting tools

Asset Based

Lending

Small Business

Realignment

Treasury

Management

PRODUCTIVITY

Branch Optimization

Continuous evolution of branch

network to optimize profitability

and growth prospects

De-Novo Expansion 11 Locations

Consolidate 2

Locations

Consolidate 6

Locations

Consolidate 37

Locations

Consolidate 6

Locations

Acquisitions

Opportunistically expand

presence in attractive markets

CB&T

Parkvale

ANNB Closed 4/13

PVFC Closed 10/13

BCSB 1Q14

th

th |

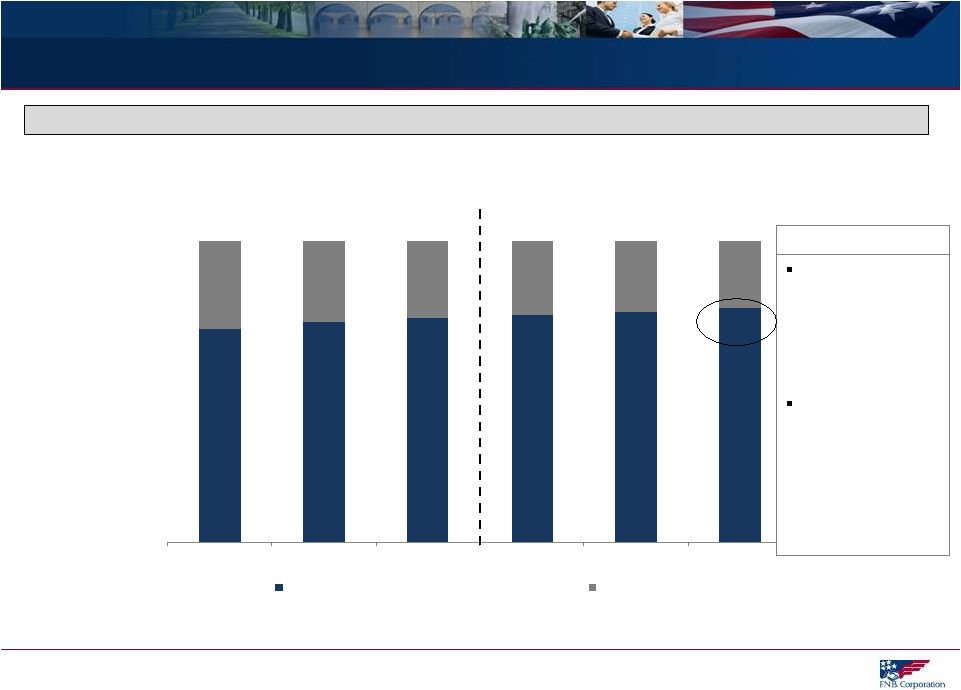

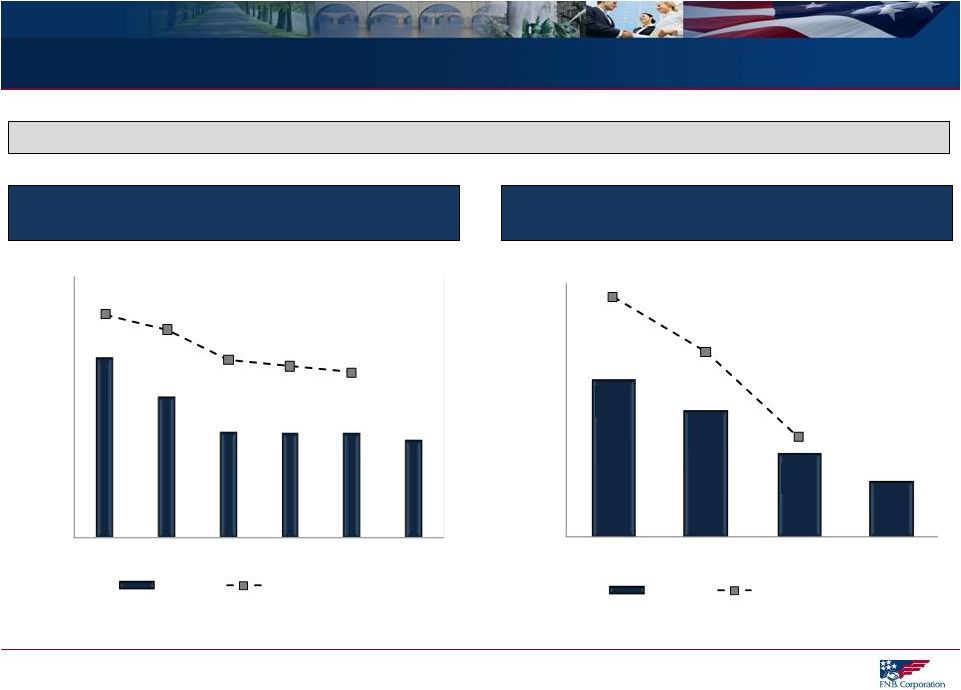

Consistent Loan and Transaction Deposit Growth

10

(1) Organic balances exclude initial respective balances acquired upon transaction close for

ANNB (4/2013), PVSA (1/2012) and CBT (1/2011) Consistent Growth in Loans and

Transaction Deposits Loans

(Quarterly, In Billions)

Transaction Deposits and Customer Repos

(Quarterly, In Billions)

$8.7

$8.0

$6.8

$6.0

$7.1

$6.7

$6.4

3Q13

4Q12

4Q11

4Q10

Total

Organic

$8.0

$7.4

$5.8

$5.2

$6.5

$6.3

$5.5

3Q13

4Q12

4Q11

4Q10

Total

Organic

CAGR 4Q10 –

3Q13

Total

17.3%

Organic

(1)

8.9%

CAGR 4Q10 –

3Q13

Total

14.4%

Organic

(1)

6.3% |

Transaction

Deposit

Growth

-

Strengthened

Funding

Mix

11

(1) Based on period-end balances

Consistent Transaction Deposit Growth Results in Strengthened Deposit Mix

Total Transaction Deposits and Customer Repos Mix

78%

77%

75%

74%

73%

71%

22%

23%

25%

26%

27%

29%

9/30/2013

6/30/2013

3/31/2013

12/31/2012

12/31/2011

12/31/2010

Transaction Deposits and Customer Repos

Time Deposits

Transaction

deposits and

customer repos =

78% of total

deposits and

customer repos

Strong growth in

average non-

interest bearing

deposits of $131.8

million, or 27.5%

annualized,

resulted in further

strengthened mix

3Q13 |

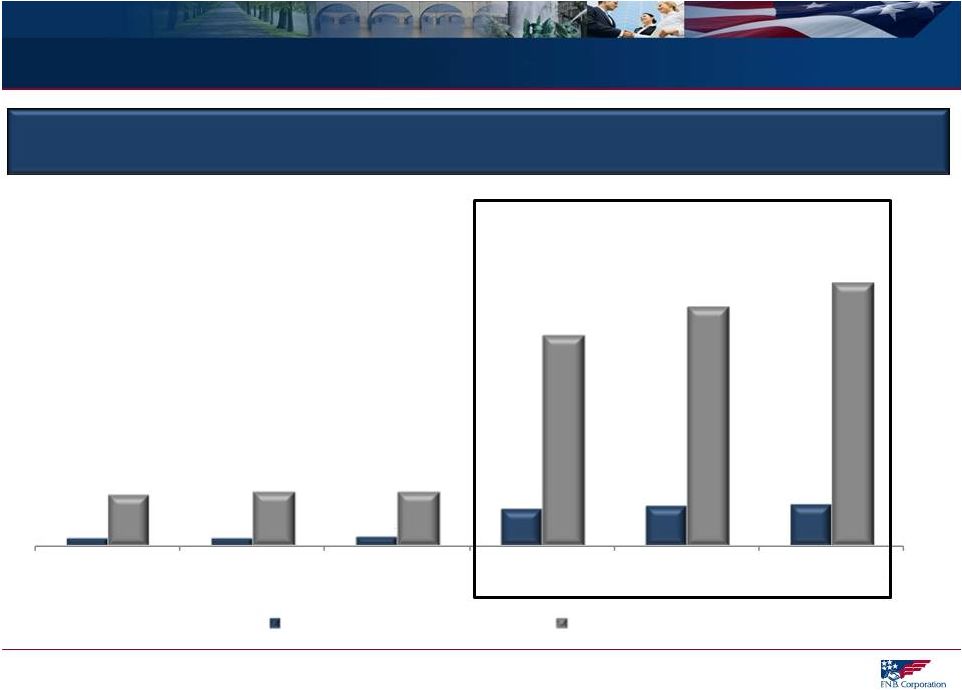

Peer Leading ROTA and ROTE

12

Return on tangible assets and return on tangible equity are non-GAAP measures and FNB ROTE

and ROTA exclude merger costs, refer to Appendix for GAAP to Non-GAAP

Reconciliation details. Peer data per SNL Financial. ROTA and ROTE

Exceed Peer Results 1.08%

1.08%

1.12%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1Q13

2Q13

3Q13

FNB

Peer Group Median

Return on Average Tangible Assets

Return on Average Tangible Equity

17.46%

17.33%

18.33%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

1Q13

2Q13

3Q13

FNB

Peer Group Median |

High-Quality Earnings

13

(1) At respective period-end. FNB levels represents allowance for loan losses to

total originated loans. Peer data per SNL Financial and based on availability.

FNB Continues to Deliver High-Quality Earnings

Provision for Loan Losses as % of Net Charge-Offs ($)

FNB provision for loan losses exceeds net charge-offs to

support consistent, solid loan growth results

Allowance for Loan Losses/Total Loans (%)

(1)

FNB allowance for loan losses to total loans (originated

portfolio) has remained relatively stable

133%

134%

113%

61%

75%

9/30/2013 YTD

6/30/2013 YTD

2012

FNB

Peer Group Median

1.34

1.35

1.39

1.25

1.34

1.47

9/30/2013

6/30/2013

12/31/2012

FNB

Peer Group Median |

Market Position

Top Overall and MSA Market Position

Regional Alignment

Presence in Major Markets

Significant Commercial Prospects

14 |

FNB’s model utilizes six regions, including three in top 30 MSA markets,

with each having a regional headquarters housing cross-functional teams.

FNB

Banking

Footprint

-

Regional

Alignment

15

Source: SNL Financial, Pro-Forma for PVFC and BCSB

Baltimore MSA

Pittsburgh MSA

Cleveland MSA

PVFC Target

Completion

October 2013

ANNB Completed

4/6/2013 &

BCSB Completed

10/12/13

Cleveland

Hermitage

Erie

State College

Harrisburg

Philadelphia

Scranton

WV

OH

PA

NY

MD

Baltimore

Pittsburgh

Top 30 MSA Presence

MSA

Population

Baltimore,

MD

2.7 million

#20 MSA

Pittsburgh,

PA

2.4 million

#22 MSA

Cleveland,

OH

2.1 million

#29 MSA |

Top

Overall Market Position 16

Source:

SNL

Financial,

deposit

data

as

of

June

30,

2013,

pro-forma

as

of

October

21,

2013,

excludes

custodial

bank.

FNB Pennsylvania Counties of Operation

Rank

Institution

Branch

Count

Total Market

Deposits

($ 000)

Total

Market

Share

(%)

1

PNC Financial Services

399

58,855,363

35.3

2

Royal Bank of Scotland

202

10,073,477

6.4

3

F.N.B. Corporation

224

8,884,922

5.6

4

M&T Bank Corp.

141

7,393,569

4.7

5

Wells Fargo & Co.

65

4,905,156

3.1

6

First Commonwealth

99

4,225,821

2.7

7

Banco Santander

72

4,056,694

2.6

8

Dollar Bank

37

3,556,646

2.2

9

Susquehanna Bancshares

80

3,105,908

2.0

10

First Niagara Financial

73

3,060,621

1.9

Total (1-138)

2,449

158,109,555

100.0

FNB All Counties of Operation

Rank

Institution

Branch

Count

Total Market

Deposits

($ 000)

Total

Market

Share

(%)

1

PNC Financial Services

515

70,806,498

24.2

2

M&T Bank Corp.

247

21,368,411

7..3

3

Bank of America

91

15,886,192

5.4

4

Royal Bank of Scotland

289

14,902,081

5.1

5

KeyCorp

98

12,538,370

4.3

6

F.N.B. Corporation

281

10,995,883

3.8

7

Wells Fargo & Co

124

10,776,383

3.7

8

Huntington

224

10,569,758

3.6

9

FirstMerit Corp.

104

6,941,093

2.4

10

TFS Financial

22

5,950,561

2.0

Total (1-233)

4,346

292,676,461

100.0

FNB

holds

the

#3

overall

retail

market

position

for

Pennsylvania

counties

of

operation

and

#6

position

for

all

counties |

17

Source: SNL Financial, deposit data as of June 30, 2013, pro-forma as of October 22,

2013, excludes custodial bank (Pittsburgh MSA). All Other MSA’s represent

MSA’s with FNB presence excluding Pittsburgh, Cleveland and Baltimore MSA’s.

Baltimore-Towson, MD MSA

Rank

Institution

Total Deposits

($000)

Market

Share (%)

1

Bank of America Corp.

16,078,490

25.1

2

M&T Bank Corp.

14,292,887

22.3

3

PNC Financial Services Group Inc.

6,789,660

10.6

4

Wells Fargo & Co.

6,049,235

9.5

5

BB&T Corp.

3,909,353

6.1

6

SunTrust Banks Inc.

2,094,589

3.3

7

Susquehanna Bancshares Inc.

1,258,598

2.0

8

First Mariner Bancorp

1,109,454

1.7

9

Capital One Financial Corp.

976,432

1.5

10

F.N.B. Corporation

914,733

1.4

Cleveland-Elyria-Mentor, OH MSA

Rank

Institution

Total Deposits

($000)

Market

Share (%)

1

KeyCorp

11,363,682

21.8

2

PNC Financial Services Group Inc.

6,382,510

12.2

3

TFS Financial Corp. (MHC)

5,425,587

10.4

4

Huntington Bancshares Inc.

4,261,126

8.2

5

Royal Bank of Scotland Group Plc

4,104,874

7.9

6

FirstMerit Corp.

3,522,009

6.8

7

Fifth Third Bancorp

3,384,743

6.5

8

JPMorgan Chase & Co.

2,939,452

5.6

9

U.S. Bancorp

2,032,321

3.9

10

Dollar Bank Federal Savings Bank

1,701,264

3.3

14

F.N.B. Corporation

623,947

1.2

Pittsburgh, PA MSA

Rank

Institution

Total Deposits

($000)

Market

Share (%)

1

PNC Financial Services Group Inc.

47,062,720

56.5

2

Royal Bank of Scotland Group Plc

7,129,530

8.6

3

F.N.B. Corporation

3,867,847

4.6

4

Dollar Bank Federal Savings Bank

3,556,646

4.3

5

First Niagara Financial Group Inc.

2,762,262

3.3

6

Huntington Bancshares Inc.

2,512,422

3.0

7

First Commonwealth Financial Corp.

2,465,101

3.0

8

TriState Capital Holdings Inc.

1,940,243

2.3

9

S&T Bancorp Inc.

1,685,131

2.0

10

Northwest Bancshares Inc.

1,045,914

1.3

All Other FNB MSA's (excludes Pittsburgh, Baltimore, Cleveland)

Rank

Institution

Total Deposits

($000)

Market

Share (%)

1

PNC Financial Services Group Inc.

11,180,309

11.7

2

M&T Bank Corp.

7,288,461

7.6

3

F.N.B. Corporation

5,175,196

5.4

4

Wells Fargo & Co.

4,861,113

5.1

5

Banco Santander SA

4,056,694

4.2

6

Huntington Bancshares Inc.

3,875,653

4.0

7

Royal Bank of Scotland Group Plc

3,667,677

3.8

8

FirstMerit Corp.

3,419,084

3.6

9

Susquehanna Bancshares Inc.

2,947,480

3.1

10

JPMorgan Chase & Co.

2,631,476

2.7

MSA Market Share - Proven Success, Opportunity For Growth Established MSA Markets –

Proven Success, Leading Share Position Achieved

Recent Expansion MSA Markets – Opportunity for Growth

|

Population

Rank

MSA

(000's)

#1

#2

#3

1

New York

(1)

19,567

JPM

BofA

Citi

2

Los Angeles

12,829

BofA

Wells Fargo

Mitsubishi UFJ

3

Chicago

9,461

JPM

BMO

BofA

4

Dallas

6,426

BofA

JPM

Wells Fargo

5

Philadelphia

5,965

BofA

Capital One

TD

6

Houston

5,920

JPM

Wells Fargo

BofA

7

Washington

(1)

5,636

Wells Fargo

Capital One

BofA

8

Miami

5,565

Wells Fargo

BofA

Citi

9

Atlanta

5,287

SunTrust

Wells Fargo

BofA

10

Boston

(1)

4,552

BofA

RBS

Banco Santander

11

San Francisco

4,335

BofA

Wells Fargo

Citi

12

Detroit

4,296

JPM

Comerica

BofA

13

Riverside

4,225

BofA

Wells Fargo

JPM

14

Phoenix

4,193

JPM

Wells Fargo

BofA

15

Seattle

3,440

BofA

Wells Fargo

U.S. Bancorp

16

Minneapolis

3,349

Wells Fargo

U.S. Bancorp

TCF

17

San Diego

3,095

Wells Fargo

Mitsubishi UFJ

BofA

18

St. Louis

(1)

2,788

U.S. Bancorp

BofA

Commerce

19

Tampa

(1)

2,783

BofA

Wells Fargo

SunTrust

20

Baltimore

2,710

BofA

M&T

PNC

21

Denver

2,543

Wells Fargo

JPM

FirstBank

22

Pittsburgh

(1)

2,356

PNC

RBS

23

Portland

2,226

BofA

U.S. Bancorp

Wells Fargo

24

Charlotte

2,217

BofA

Wells Fargo

BB&T

25

Sacramento

2,149

Wells Fargo

BofA

U.S. Bancorp

Top 3 Banks in MSA by Deposit Market Share

Unique #3 Position in a Major Market

18

Source: MSA population per U.S. Census Bureau 2010 data; Deposit market share per SNL

Financial as of June 30, 2013, pro-forma as of October 22, 2013 (1) Excludes

custodial bank F.N.B. Corporation

FNB is uniquely

positioned as

one of only very

few community

banks to hold a

Top 3 deposit

market rank in

one of the

nation’s 25

largest

metropolitan

statistical areas. |

Significant Commercial Prospects

19

Note: Above metrics at the MSA level

(1)

Data per U.S. Census Bureau

(2)

Data per Hoover’s as of October 21, 2013

Significant Commercial Prospects Concentrated in Pittsburgh, Baltimore &

Cleveland Opportunity to Leverage Core Competency and Drive Sustained Organic

Growth (1)

(2)

Strong Concentration of Commercial Prospects

Over 175,000 Total Businesses

(1)

1,904

1,987

2,094

8,857

9,621

10,106

12,851

13,345

13,410

52,149

59,240

65,169

Youngstown MSA

Scranton MSA

Harrisburg MSA

Cleveland MSA

Pittsburgh MSA

Baltimore MSA

# of Business with Revenue >$1M

Total Businesses |

20

Acquisition Strategy

Disciplined and Consistent Strategy

Significant Expansion

Enhanced Organic Growth Prospects |

Acquisition

Strategy 21

Disciplined and Consistent Acquisition Strategy

Strategy

Disciplined identification and focus on markets that offer potential to

leverage core competencies and growth opportunities

Criteria

Create shareholder value

Meet strategic vision

Fit culturally

Evaluation

Targeted financial and capital recoupment hurdles

Proficient and experienced due diligence team

Extensive and detailed due diligence process

Execution

Superior post-acquisition execution

Execute FNB’s proven, scalable, business model

Proven success assimilating FNB’s strong sales culture

Experienced Acquirer

12th bank acquisition since 2002 announced June 2013 (BCSB)

Fourth consecutive acquisition in a major MSA

Five acquisitions since 2010

Ten acquisitions since 2005

Execution

Execution

Criteria

Criteria

Evaluation

Evaluation

Strategy

Strategy |

22

Baltimore, MD MSA

Annapolis Bancorp, Inc -

Closed April 6, 2013

BCSB Bancorp, Inc. -

Target close February, 2014

Talent established

Team and leadership in place

Presence anchored

Downtown Baltimore headquarters announced

Performance tracking well

Loan production on target, pipelines healthy

Sales management processes fully deployed

Cleveland, Ohio MSA

PVF Capital Corp. –

Closed October 12, 2013

Team and leadership in place

Downtown Cleveland headquarters announced

Sales management process deployed

BCSB Locations

FNB Locations (including ANNB)

PVFC Locations

Continued Positive Progress Integrating Acquisitions

Team and Leadership Established

Regional Headquarters in Both Markets Announced

Results Tracking Well

Cleveland

Baltimore

Pittsburgh

Performance goals established

Presence anchored

Talent established

Recent Acquisitions – Positioning for Sustained Organic Growth |

Expanded Franchise = Enhanced Organic Growth Prospects

23

Note: Market population and market businesses represent current metrics based on respective

FNB MSA presence Data per FNB, SNL Financial and/or U.S. Census Bureau

(Businesses) Acquisition-

Related

Expansion in

Higher Growth

Markets

Enhances

Organic Growth

Opportunities

In Millions |

24

Strong Operating Results

3Q13 Highlights and Trends |

3Q13 Financial Highlights –

Quarterly Trends

25

Current

Quarter

3Q13

Prior

Quarter

2Q13

Prior Year

Quarter

3Q12

Operating

Earnings

(1)

Net income ($ millions)

$32.2

$30.1

$29.9

Earnings per diluted share

$0.22

$0.21

$0.21

Profitability

Performance

ROTE

(1)

18.33%

17.33%

18.57%

ROTA

(1)

1.12%

1.08%

1.12%

Net interest margin

3.64%

3.63%

3.70%

Efficiency ratio

59.7%

58.6%

57.4%

Strong

Balance Sheet

Trends

(2)

Total loan growth

9.3%

5.6%

4.7%

Commercial loan growth

4.2%

5.8%

5.0%

Consumer loan growth

25.3%

11.8%

12.0%

Transaction

deposits

and

customer

repo

growth

(3)

7.0%

7.4%

8.7%

(1) Non-GAAP measure, refer to Appendix for GAAP to Non-GAAP Reconciliation details;

(2) Average, annualized linked quarter organic growth results. Organic growth

results exclude balances acquired in the ANNB acquisition 2Q13; (3) Total deposits excluding time deposits

|

Balance Sheet Highlights

26

Average Balances,

$ in Millions

3Q13

Linked-Quarter

Growth

(1)

3Q13 Highlights

Balance

$

%

Securities

$2,275

-$20.7

-3.6%

Strong balance sheet growth, with continued

momentum growing loans and transaction

deposits

Growth in average total loans of $200.2 million

or 9.3% annualized

Growth in average transaction deposits and

customer repurchase agreements of $138.6

million or 7.0% annualized

Transaction deposit growth further enhanced

attractive deposit mix

Total loans

$8,730

$200.2

9.3%

Commercial loans

$4,783

$49.6

4.2%

Consumer

loans

(2)

$2,860

$171.5

25.3%

Residential mortgage loans

$1,043

-$22.2

-8.3%

Earning assets

$11,048

$161.6

5.9%

Total deposits and customer repos

$10,403

$68.9

2.6%

Transaction

deposits

and

customer

repos

(3)

$8,011

$138.6

7.0%

Time deposits

$2,392

-$69.7

-11.2%

(1) % growth annualized; (2) Includes Direct Installment, Indirect Installment and Consumer

LOC portfolios; (3) Excludes time deposits; (4) Period-end as of September 30,

2013 Growth driven by strong growth in

average non-interest bearing deposits

of $131.8 million or 27.5% annualized

Lower cost, relationship-based

transaction deposits and customer repurchase agreements

represent 78% of total

deposits and customer repurchase agreements compared to

74% at September 30, 2012

(4)

|

Net

Interest Margin Trends 27

Net Interest Margin Trends

Relatively stable core net interest margin

The net interest margin has benefited from the consistent growth

in loans and transaction deposits

Active net interest management through Pricing Committee and Asset/Liability Committee

effective through focused efforts on managing interest rate risk strategy and margin

preservation 3Q13

net

interest

income

(FTE)

totaled

$101.0

million,

growing

$2.5

million,

or

2.6%,

linked

quarter,

and

$5.7

million,

or

5.9%,

compared to the prior year quarter

3.64%

3.63%

3.66%

3.66%

3.70%

2.00%

2.25%

2.50%

2.75%

3.00%

3.25%

3.50%

3.75%

4.00%

3Q13

2Q13

1Q13

4Q12

3Q12

Core Net Interest Margin

Accretable Yield Benefit |

Asset Quality Results

(1)

28

$ in Thousands

3Q13

2Q13

3Q12

3Q13 Highlights

NPL’s+OREO/Total loans+OREO

1.49%

1.59%

1.69%

Total delinquency

1.44%

1.44%

1.66%

Provision for loan losses

(2)

$7,280

$7,903

$8,429

Net charge-offs (NCO’s)

(2)

$5,507

$7,325

$7,362

NCO’s/Total average loans

(2)

0.25%

0.34%

0.37%

NCO’s/Total average originated loans

0.26%

0.33%

0.42%

Allowance for loan losses/

Total loans

1.34%

1.35%

1.43%

Allowance for loan losses/

Total non-performing loans

127.37%

121.68%

120.23%

Solid

performance

with

metrics

remaining

at

good,

consistent

levels

Net charge-offs very low at 0.26% annualized

for the originated portfolio

Provision for loan losses of $7.3 million

exceeds net charge-offs in support of the

strong loan growth

Reserve position consistent with prior quarter

levels

NPL’s+OREO/Total loans +OREO improved

from the prior quarter and the year-ago quarter

Delinquency remained stable compared to the

prior quarter and improved from the year-ago

quarter

(1)

Metrics shown are originated portfolio metrics unless noted as a total portfolio metric.

“Originated portfolio” or “Originated loans” excludes loans

acquired at fair value and accounted for in accordance with ASC 805 (effective January 1,

2009), as the risk of credit loss has been considered by virtue of the

Corporation’s estimate of fair value.

(2)

Total portfolio metric

|

Asset Quality Trends

29

NCO’s

Originated

Loans/

Total

Originated

Loans

(1)(3)

NPL’s+OREO/

Total

Originated

Loans+OREO

(1)(2)

Asset Quality Trends Compare Favorably to Peer Results

2.74%

2.15%

1.60%

1.59%

1.59%

1.49%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

2010

2011

2012

1Q13

2Q13

3Q13

FNB

Peer Group Median

0.77%

0.62%

0.41%

0.27%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

FY 2010

FY 2011

FY 2012

YTD 2013

FNB

Peer Group Median

Peer data per SNL Financial, refer to Appendix for peer listing; (1) Metrics shown are

originated portfolio. “Originated portfolio” or “Originated loans”

excludes loans acquired at fair value and accounted for in accordance with ASC 805 (effective January 1, 2009), as the risk of credit loss has

been considered by virtue of the Corporation’s estimate of fair value; (2) Based on

balances at quarter end for each period presented; (3) Full year or quarterly results

annualized. |

Capital Position

30

Capital Position as of September 30, 2013

(1)

(1) Regulatory risked-based ratios estimated as of September 30, 2013.

12.1%

10.6%

8.4%

6.1%

12.1%

10.6%

8.4%

6.1%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

Total Risk-Based

Tier One

Leverage

Tangible Common Equity

June 30, 2013

September 30, 2013 |

31

Investment Thesis

Long-Term Investment Thesis |

Long-Term Investment Thesis -

Return Focused

32

Long-Term Investment Thesis

Targeted EPS Growth

5-6%

Targeted Dividend Yield

(Targeted Payout Ratio 60-70%)

4-6%

Implied Total Shareholder Return

9-12%

FNB’s long-term investment thesis reflects a commitment to efficient capital management

and creating value for our shareholders |

Operating Results Outperform Peers

33

ROTE

(1)

Efficiency Ratio

Net Interest Margin

Net Charge

Offs to Average Loans

-

The above represents full-year 2010, 2011, 2012 and/or quarterly, year-to-date

results where noted. Refer to Supplemental Information for peer group listing.

(1) Operating results, refer to Supplemental Information for details

|

Consistent Operating Results

34

FNB = 85% Percentile

FNB = 94% Percentile

Data per FNB and/or SNL Financial

Refer to Supplemental Information for peer listing

FNB’s ability to deliver consistent operating results exceeds peer results

0.00%

0.05%

0.10%

0.15%

0.20%

0.25%

2013 Peer Median

FNB

ROAA Volatility

0.000%

0.005%

0.010%

0.015%

0.020%

0.025%

0.030%

0.035%

0.040%

0.045%

0.050%

2013 Peer Median

FNB

Revenue/Avg Assets Volatility

FNB and Peer Volatility (Standard Deviation 1Q10 – 3Q13)

|

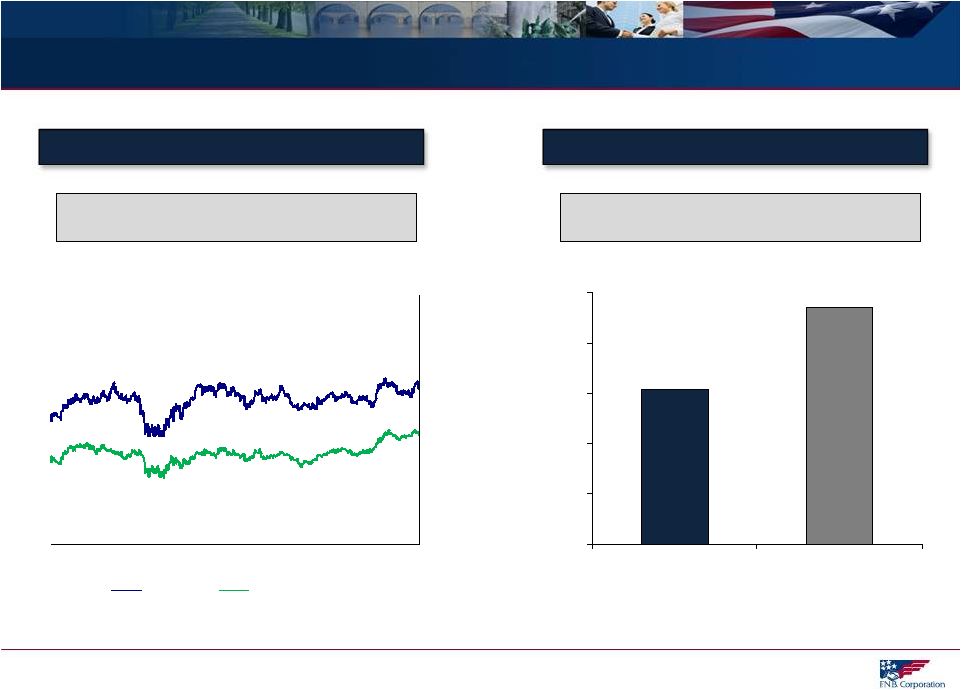

Attractive P/E Valuation Highlights Potential Upside

Market data per SNL Financial as of November 1, 2013. Refer to Supplemental Information

for regional peer listing. 35

Consistent premium to peers based on price

to tangible book value per share

FNB currently reflects an attractive

valuation based on future earnings

0.00x

0.50x

1.00x

1.50x

2.00x

2.50x

3.00x

3.50x

4.00x

11/01/10

11/01/11

11/01/12

11/01/13

FNB

2013 Group Peer Median

14.54x

15.36x

13.00x

13.50x

14.00x

14.50x

15.00x

15.50x

FNB

2013 Peer Median

Historical Price / TBV Per Share (x)

Price / 2014 EPS Estimate (x) |

36

Transaction Overview

Successfully raised $151.2 million through a combination of common equity (4.7 million shares,

$54.5 million net proceeds, including over-allotment option exercised) and

preferred equity (4.0 million shares, $96.7 million net proceeds). Proactive Capital

Management Action Supports future growth opportunities and proactively positions F.N.B.

for Basel III implementation , including the redemption of

certain trust preferred securities

Demonstrated track record of robust loan growth (17 consecutive quarters of organic

growth) Positions FNB to redeem $131.5mm of existing trust preferred securities at a

weighted average cost of 4.33%² and

potential repayment of BCSB’s $16.5mm of trust preferred securities upon anticipated

closing of pending acquisition

Adds $151mm of fully Basel III-compliant capital to support future balance sheet

growth Strengthens/improves quality of capital under Basel III; Tier 1 common improves

~50bps to 9.1% Current rate environment presented opportunity to access permanent

capital at historically attractive levels Use of proceeds consistent with FNB’s

proactive and efficient capital management strategy Reported and Pro-Forma Capital

Ratios as of September 30, 2013³ 12.1%

12.2%

Total risk-based capital

Tier 1 leverage

TCE / TA

8.4%

8.5%

6.1%

6.5%

Tier 1 :

10.6%

Tier 1 :

10.7%

Tier 1

common

Non-

common

Tier 1

Tier 2

8.6%

9.1%

2.0%

1.6%

1.5%

1.5%

As Reported

Pro forma

As Reported

Pro forma

As Reported

Pro forma

¹Under Basel III Final rules, if a depository institution holding company under $15

billion makes an acquisition and the resulting organization has total consolidated assets of $15 billion or more, its non-

qualifying capital instruments also will be subject to the phase-out schedule (25%

includable in Tier 1 in 2015 and 0% includable in Tier 1 in 2016); ² Weighted average cost of redeemed trust preferred

securities assumes 3 month LIBOR of 0.24%; ³ Pro forma capital ratios do not include

impacts from PVF Capital and BCSB transactions; capital ratios shown on a Basel I basis

October 2013 Capital Actions – Proactive Capital Management 1

|

37

Supplemental Information |

38

Supplemental Information Index

Diversified Loan Portfolio

Deposits and Customer Repurchase Agreements

Investment Portfolio

Loan Risk Profile

Marcellus and Utica Shale Exposure

Regency Finance Company Profile

Regional Peer Group Listing

GAAP to Non-GAAP Reconciliation

Third Quarter 2013 Earnings Release (October 17, 2013) |

Diversified Loan Portfolio

39

Note: Balance, CAGR and % of Portfolio based on period-end balances

9/30/2013

CAGR

% of Portfolio

($ in millions)

Balance

12/08-

9/30/13

12/31/08

9/30/13

C&I

$1,755

13.9%

16%

20%

CRE: Non-Owner Occupied

1,555

11.4%

16%

17%

CRE: Owner Occupied

1,317

5.9%

17%

15%

Commercial Leases

142

32.7%

1%

2%

Total Commercial

$4,769

10.9%

50%

54%

Consumer Home Equity

2,042

11.6%

21%

23%

Residential Mortgage

987

12.0%

10%

11%

Indirect

624

4.4%

9%

7%

Other

192

4.5%

3%

2%

Regency

175

2.2%

2%

2%

Florida

49

-31.4%

5%

<1%

Total Loan Portfolio

$8,837

9.2%

100%

100%

Well diversified portfolio

Strong growth results driven by commercial loan growth

$8.8 Billion Loan Portfolio

September 30, 2013

C&I + Owner Occupied CRE =

35% of Total Loan Portfolio

Commercial &

Industrial 20%

Consumer

Home Equity

23%

Residential

Mortgage 11%

Other 2%

Regency 2%

Florida 0%

Commercial

Leases 2%

CRE: Non

Owner

Occupied 17%

CRE: Owner

Occupied 15%

Indirect 7% |

Deposits and Customer Repurchase Agreements

40

Note: Balance, CAGR and % of Portfolio based on period-end balances; (1) Transaction

deposits include savings, NOW, MMDA and non-interest bearing deposits; (2) December

31, 2008 through September 30, 2013 9/30/2013

CAGR

Mix %

($ in millions)

Balance

12/08-

9/13

12/31/08

9/30/13

Savings, NOW, MMDA

$4,981

12.8%

44%

47%

Time Deposits

2,360

0.4%

36%

22%

Non-Interest Bearing

2,116

19.2%

14%

20%

Customer Repos

1,101

22.8%

6%

11%

Total Deposits and

Customer Repo Agreements

$10,558

10.9%

100%

100%

Transaction Deposits

(1)

and

Customer Repo Agreements

$8,198

15.4%

64%

78%

Loans to Deposits and Customer Repo Agreements Ratio =

84% at September 30, 2013

New client acquisition and relationship-based focus reflected in favorable deposit

mix –

15.4% average growth for transaction deposits and customer repo agreements

(2)

–

78% of total deposits and customer repo agreements are transaction-based deposits

(1)

$10.6 Billion Deposits and

Customer Repo Agreements

September 30, 2013

Non-Interest

Bearing 20%

Savings, NOW,

MMDA 47%

Customer

Repos 11%

Time Deposits

22% |

%

Ratings

($ in millions

(1)

)

Portfolio

Investment %

Agency MBS

$878

37%

AAA

100%

CMO Agency

831

35%

AAA

100%

Agency Senior Notes

376

16%

AAA

100%

Municipals

153

7%

AAA

AA

A

BBB

2%

50%

47%

1%

Trust Preferred

(2)

35

1%

BBB

BB

B

CCC

Ca

C

5%

13%

12%

8%

2%

60%

Short Term

49

2%

AAA

100%

CMO Private Label

9

1%

AA

A

BBB

BB

23%

12%

34%

31%

Corporate

10

1%

A

100%

Bank Stocks

2

-

Non-Rated

Commercial MBS

2

-

AAA

100%

US Treasury

1

-

AAA

100%

Total Investment Portfolio

$2,346

100%

Investment Portfolio

41

(1) Amounts reflect GAAP; (2) Original cost of $ 104 million, adjusted cost of $43 million,

fair value of $35 million Highly Rated $2.3 Billion Investment Portfolio

September 30, 2013

Ratings

Composition

AAA, 91.2%

AA, 3.3%

A, 3.5%

BBB,BB,B

Non-

Rated

Available for

Sale, 49%

Held to

Maturity, 51%

CCC,CC,Ca,C

2%

–

Highly rated with an average rating of AA and 99%

of the portfolio rated A or better

–

General obligation bonds = 99.0% of portfolio

–

78.0% from municipalities located throughout

Pennsylvania

Relatively low duration of 3.4

Portfolio comprised of 49% AFS and 51% HTM

Municipal bond portfolio

95% of total portfolio rated AA or better, 98% rated A

or

better |

42

Loan Risk Profile

(1)

Originated portfolio metric

$ in millions

Balance

9/30/2013

% of Loans

NPL's/Loans

(1)

YTD Net Charge-

Offs/Loans

(1)

Total Past

Due/Loans

(1)

Commercial and Industrial

$1,755

19.9%

0.48%

0.22%

0.75%

CRE: Non-Owner Occupied

1,555

17.6%

1.04%

0.24%

1.25%

CRE: Owner Occupied

1,317

14.9%

2.02%

0.08%

2.32%

Home Equity and Other Consumer

2,181

24.7%

0.48%

0.20%

0.88%

Residential Mortgage

987

11.2%

1.22%

0.11%

2.63%

Indirect Consumer

624

7.1%

0.16%

0.35%

1.00%

Regency Finance

175

2.0%

4.09%

3.72%

3.75%

Commercial Leases

142

1.6%

0.55%

0.16%

1.14%

Florida

49

0.6%

22.14%

-2.17%

22.14%

Other

53

0.6%

0.00%

2.31%

0.11%

Total

$8,837

100.0%

1.05%

0.27%

1.44% |

Marcellus and Utica Shale Exposure

43

(1)

Sources: www.marcellus.psu.edu, retrieved May 3, 2013; (2) www.dnr.state.oh.us, retrieved June

5, 2013; (3) Sterne Agee June 7, 2010 and FBR Capital Markets, March 2, 2011.

Ohio

FNB PA/OH Banking Locations

Pennsylvania

Ohio

FNB is well-positioned in the Marcellus Shale and Utica

Shale regions with a Pennsylvania footprint that closely

aligns with the Marcellus Shale concentration and

exposure to the Utica Shale region in Ohio.

FNB has been noted by analysts as being one of the

best geographically positioned banks to benefit from

the Marcellus Shale.

(3)

Ohio Utica Shale

(2)

FNB branch map per SNL Financial |

Marcellus and Utica Shale FNB Strategic Focus

44

Opportunity for FNB relates to potential indirect and induced economic benefits across

footprint Direct Effect:

Oil and Gas

Directly associated with the extraction, processing and delivery

of the gas

Drilling, extraction and support activities

Indirect Effect:

Supply Chain

Provides goods and services to the energy industry

e.g.: Iron and steel, transportation, commodity traders,

heavy equipment, surveyors, utilities, rig parts, attorneys,

real estate, machinery manufacturers, etc.

Induced Benefit:

Consumption

Resulting benefit to industries and individuals from positive

direct and indirect effects

e.g.: Higher education, travel, housing, food and drink,

entertainment, utilities, etc.

FNB

Strategic Focus:

Supply Chain and

Consumption |

Consumer

finance

business

with

over

80

years

of

consumer

lending

experience

Credit quality: 3Q13 YTD net charge-offs to average loans of 3.71%

Returns: 3Q13 YTD: ROA 3.89%, ROE 42.00%, ROTE 47.16%

Regency Finance Company Profile

(1)

Return on average tangible common equity (ROTCE) is calculated by dividing net

income less amortization of intangibles by average common equity less

average intangibles. 45

72 Locations

Spanning Four

States

Regency Finance Company

$175 Million Loan Portfolio

86% of Real Estate Loans are First Mortgages

60%

26%

14%

Direct

Real Estate

Sales Finance

Ohio

Kentucky

Tennessee

Pennsylvania |

Regional Peer Group Listing

46

Ticker

Institution

Ticker

Institution

ASBC

Associated Bancorp

ONB

Old National Bancorp

AF

Astoria Financial Corporation

PVTB

Private Bancorp, Inc.

CBSH

Commerce Bancshares, Inc.

SUSQ

Susquehanna Bancshares, Inc.

FMER

First Merit Corp.

UMBF

UMB Financial Corp.

FULT

Fulton Financial Corporation

VLY

Valley National Bancorp

MBFI

MB Financial, Inc

WBS

Webster Financial Corporation

NPBC

National Penn Bancshares, Inc.

WTFC

Wintrust Financial Corporation |

GAAP to Non-GAAP Reconciliation

47

Operating: Earnings, Return on Avg Tangible Equity, Return on Avg Tangible

Assets September 30, 2013

June 30, 2013

March 31, 2013

September 30, 2012

2012

2011

2010

Operating net income

Net income

$31,634

$29,193

$28,538

$30,743

$110,410

$87,047

$74,652

Add: Merger and severance costs, net of tax

593

1,915

229

57

5,203

3,238

402

Add: Litigation settlement accrual, net of tax

-

-

-

-

1,950

-

-

Add: Branch consolidation costs, net of tax

-

-

-

-

1,214

-

-

Less: Gain on extinguishment of debt, net of tax

-

(1,013)

-

-

-

-

-

Less: Gain on sale of building, net of tax

-

-

-

(942)

(942)

-

-

Less: One-time pension expense credit

-

-

-

-

-

-

(6,853)

Operating net income

$32,227

$30,095

$28,767

$29,858

$117,835

$90,285

$68,201

Operating diluted earnings per share

Diluted earnings per share

$0.22

$0.20

$0.20

$0.22

$0.79

$0.70

$0.65

Add: Merger and severance costs, net of tax

0.00

0.02

0.00

0.00

0.04

0.02

0.00

Add: Litigation settlement accrual, net of tax

-

-

-

-

0.01

-

-

Add: Branch consolidation costs, net of tax

-

-

-

-

0.01

-

-

Less: Gain on extinguishment of debt, net of tax

-

(0.01)

-

-

-

-

-

Less: Gain on sale of building

-

-

-

(0.01)

(0.01)

-

-

Less: One-time pension expense credit

-

-

-

-

-

-

(0.05)

Operating diluted earnings per share

$0.22

$0.21

$0.20

$0.21

$0.84

$0.72

$0.60

Operating return on average tangible equity

Operating net income (annualized)

$127,858

$120,706

$116,668

$118,784

$117,835

$90,285

$68,201

Amortization of intangibles, net of tax (annualized)

5,455

5,538

5,237

5,798

5,938

4,698

4,364

$133,313

$126,244

$121,904

$124,582

$123,773

$94,983

$72,565

Average shareholders' equity

$1,475,751

$1,473,945

$1,410,827

$1,385,282

$1,376,493

$1,181,941

$1,057,732

Less: Average intangible assets

748,592

745,458

712,466

714,501

717,031

599,851

564,448

Average tangible equity

$727,159

$728,487

$698,361

$670,781

$659,462

$582,089

$493,284

Operating return on average tangible equity

18.33%

17.33%

17.46%

18.57%

18.77%

16.32%

14.71%

Operating return on average tangible assets

Operating net income (annualized)

$127,858

$120,706

$116,668

$118,784

$117,834

$90,285

$68,201

Amortization of intangibles, net of tax (annualized)

5,455

5,538

5,237

5,798

5,938

4,698

4,364

$133,313

$126,244

$121,904

$124,582

$123,772

$94,983

$72,565

Average total assets

$12,615,338

$12,470,029

$12,004,759

$11,842,204

$11,782,821

$9,871,164

$8,906,734

Less: Average intangible assets

748,592

745,458

712,466

714,501

717,031

599,851

564,448

Average tangible assets

11,866,746

$

11,724,570

$

11,292,292

$

11,127,704

$

11,065,789

$

9,271,313

$

8,342,286

$

Operating return on average tangible assets

1.12%

1.08%

1.08%

1.12%

1.12%

1.02%

0.87%

For the Quarter Ended

For the Year Ended |