Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TWO HARBORS INVESTMENT CORP. | a8kq32013earningsrelease.htm |

| EX-99.1 - TWO HARBORS INVESTMENT CORP. REPORTS THIRD QUARTER 2013 FINANCIAL RESULTS - TWO HARBORS INVESTMENT CORP. | q3-2013earningspressrelease.htm |

Two Harbors Investment Corp. Third Quarter 2013 Earnings Call November 6, 2013

Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2012, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to, higher than expected operating costs, changes in prepayment speeds of mortgages underlying our residential mortgage-backed securities, the rates of default or decreased recovery on the mortgages underlying our non-Agency securities, failure to recover credit losses in our portfolio, changes in interest rates and the market value of our assets, the availability of financing, the availability of target assets at attractive prices, our ability to manage various operational risks associated with our business, our ability to maintain our REIT qualification, limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940, the impact of new legislation or regulatory changes on our operations, the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process, our ability to acquire mortgage loans or securitize the mortgage loans we acquire, our involvement in securitization transactions, the timing and profitability of our securitization transactions, the risks associated with our securitization transactions, our ability to acquire mortgage servicing rights, the impact of new or modified government mortgage refinance or principal reduction programs, unanticipated changes in overall market and economic conditions, and our exposure to claims and litigation, including litigation arising from our involvement in securitization transactions. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. 2 Safe Harbor Statement

Executive Summary 3 Third Quarter Results – Focus on Book Value Preservation Portfolio positioned defensively to protect book value from potentially rising interest rates and wider mortgage spreads. Reported book value of $10.35 per diluted common share and declared a dividend of $0.28 per share. Generated Comprehensive Income of $54 million, or $0.15 per diluted weighted average common share. Comprehensive Income for the nine months ended September 30, 2013 was $156 million, a return on average equity of 5.4%, or $0.45 per diluted weighted average share. Generated Core Earnings of $68 million, or $0.19 per diluted weighted average common share. Repurchased approximately 1.5 million shares under share repurchase program, which was accretive to book value. Approximately 65,000 warrants were exercised in the third quarter with 4.1 million warrants remaining. The warrants expire at 5:00 pm EST on November 7, 2013.

Progress on New Investment Initiatives 4 Mortgage Servicing Rights (MSRs) We made significant progress toward allocating capital to MSRs through: ― Two-year flow sale agreement with PHH Mortgage Corporation acquiring MSRs on newly originated residential mortgage loans ― Acquiring two small bulk MSR portfolios in July 2013 ― Advanced discussions with potential MSR sellers that are likely to result in substantial additional investments in the near-term Mortgage Loan Conduit and Securitization Completed Agate Bay Mortgage Trust 2013-1, a prime jumbo securitization, the first using our own depositor Continued progress to build our originator network as we make progress towards the creation of an industry-leading prime jumbo mortgage conduit

Monitoring Key Macroeconomic Factors 5 (1) Source: CoreLogic Home Price Index rolling 12-month change as of August 31, 2013. Interest Rates Interest rates were relatively unchanged but highly volatile in the quarter. We were positioned defensively against a rise in interest rates and wider mortgage spreads. Employment While unemployment remains high, job creation in recent quarters indicates improvements in the economy. Unemployment is a meaningful determinant of probability of default on a mortgage loan. Home Prices The U.S. housing market continues to perform well, with the CoreLogic Home Price Index +12.4%(1) on a rolling 12-month basis. Improving housing prices are good for our non-Agency portfolio. Policy Considerations: New Federal Reserve Chair Future of Federal Reserve’s Quantitative Easing plan GSE reform Potential new FHFA Director Final Qualified Mortgage (QM) and proposed Qualified Residential Mortgage (QRM) rules

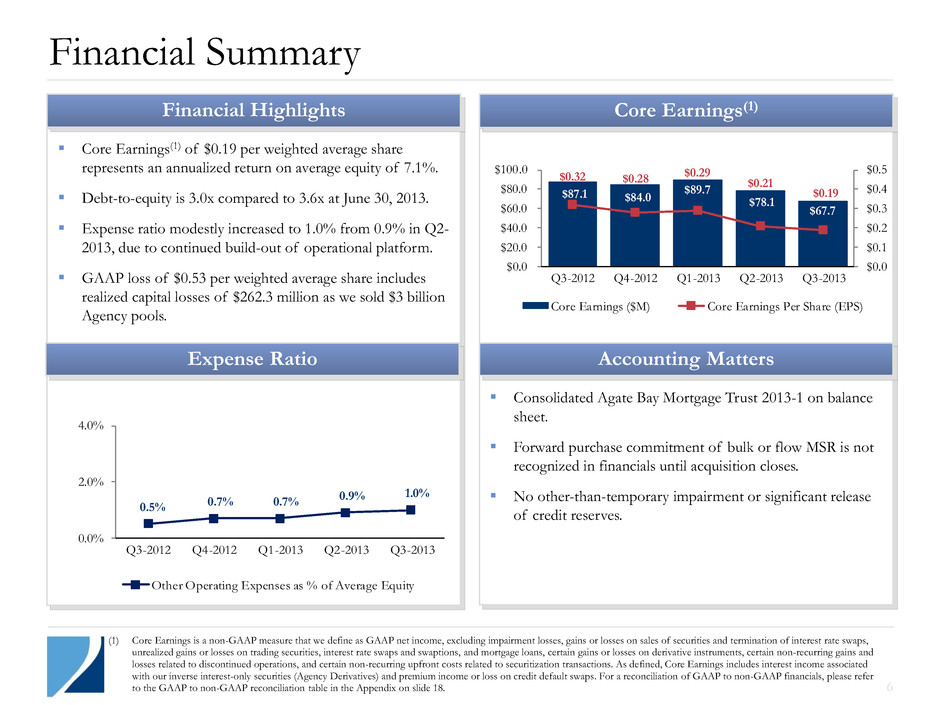

110 110 Financial Summary Financial Highlights Core Earnings(1) Expense Ratio Core Earnings(1) of $0.19 per weighted average share represents an annualized return on average equity of 7.1%. Debt-to-equity is 3.0x compared to 3.6x at June 30, 2013. Expense ratio modestly increased to 1.0% from 0.9% in Q2- 2013, due to continued build-out of operational platform. GAAP loss of $0.53 per weighted average share includes realized capital losses of $262.3 million as we sold $3 billion Agency pools. $87.1 $84.0 $89.7 $78.1 $67.7 $0.32 $0.28 $0.29 $0.21 $0.19 $0.0 $0.1 $0.2 $0.3 $0.4 $0.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Core Earnings ($M) Core Earnings Per Share (EPS) 0.5% 0.7% 0.7% 0.9% 1.0% 0.0% 2.0% 4.0% Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Other Operating Expenses as % of Average Equity (1) Core Earnings is a non-GAAP measure that we define as GAAP net income, excluding impairment losses, gains or losses on sales of securities and termination of interest rate swaps, unrealized gains or losses on trading securities, interest rate swaps and swaptions, and mortgage loans, certain gains or losses on derivative instruments, certain non-recurring gains and losses related to discontinued operations, and certain non-recurring upfront costs related to securitization transactions. As defined, Core Earnings includes interest income associated with our inverse interest-only securities (Agency Derivatives) and premium income or loss on credit default swaps. For a reconciliation of GAAP to non-GAAP financials, please refer to the GAAP to non-GAAP reconciliation table in the Appendix on slide 18. Accounting Matters Consolidated Agate Bay Mortgage Trust 2013-1 on balance sheet. Forward purchase commitment of bulk or flow MSR is not recognized in financials until acquisition closes. No other-than-temporary impairment or significant release of credit reserves. 6

Book Value 7 Book Value Q3-2013 Book Value ($M) Q3-2013 Book Value per Share Year-to-date 2013(2) Book Value ($M) Year-to-date 2013(2) Book Value per Share Beginning Stockholders’ equity – basic $3,834.1 $10.48 $3,450.6 $11.55 GAAP Net Income: Core Earnings, net of tax 67.7 235.5 Realized gains and losses, net of tax (112.4) (78.8) Unrealized mark-to-market gains and losses, net of tax (148.9) 179.7 Discontinued operations 0.9 3.3 Other comprehensive income (loss) 246.8 (183.7) Dividend declaration (102.0) (675.7)(3) Other (0.5) 0.5 Balance before capital transactions $3,785.7 $2,931.4 Issuance of common stock, net of offering costs 0.1 763.3 Repurchase of common stock (13.4) (23.9) Proceeds from issuance of common stock through warrant exercise 0.7 102.3 Ending Stockholders’ equity – basic $3,773.1 10.36 $3,773.1 10.36 Warrants outstanding(1) - (0.01) - (0.01) Ending Stockholders’ equity – diluted $3,773.1 $10.35 $3,773.1 $10.35 (1) Using the treasury stock method, 0.1 million shares would be considered outstanding and dilutive to book value per share at September 30, 2013. (2) Year-to-date time period is December 31, 2012 through September 30, 2013. (3) Includes the special dividend of Silver Bay common stock of $343.5 million. Year-to-date cash dividend per common share of $0.91 or $332.2 million, which is approximately 97% of our year-to-date taxable income Year-to-date Comprehensive Income of $156 million; includes Q3-2013 Comprehensive Income of $54 million Year-to-date accretive share repurchases of 2.45 million shares

Diverse Agency Counterparties(2) Financing Profile 8 High-Quality Non-Agency Counterparties(3) We continue to ladder repo maturities, and average 76 days to maturity. We had 24 counterparties at quarter-end. As of today, substantially all of our repo maturities have been rolled past year-end. The majority of non-Agency repo is held with counterparties having a credit default swap (CDS) spread of <150, indicating low overall counterparty risk profile. Approximately 56% of our Agency repo is with counterparties based in North America and 52% of our non- Agency repo is with counterparties based in North America. (1) As of September 30, 2013. (2) Reflects the counterparty percentage of our outstanding repurchase agreements for our Agency portfolio. (3) Reflects the CDS Spread for our non-Agency portfolio repo counterparties. (1) 39.6% 59.3% 1.1% CDS Spread ≤ 100 CDS Spread 101 to 150 CDS Spread 150+ 13.2% 11.2% 9.8% 9.7% 7.8% 7.0% 6.8% 6.7% 6.4% 5.4% 3.3% 2.9% 2.3% 2.3% 1.8% 1.5% 1.2% 0.7%

110 Significant outperformance vs. benchmark indices year-to-date as a result of prudent risk management Defensive portfolio positioning in Q3-2013 led to modest return in the quarter Yields increased due to a larger allocation to non- Agencies Portfolio Performance Summary Three Months Ended June 30, 2013 September 30, 2013 Agency Non- Agency Aggregate Portfolio Agency Non- Agency Aggregate Portfolio Annualized Yield(1) 2.7% 9.1% 3.7% Cost of repurchase agreements (0.5%) (2.3%) (0.7%) Cost of interest rate swaps & swaptions (0.6%) - (0.5%) Cost of financing (1.1%) (2.3%) (1.2%) Net interest spread 1.6% 6.8% 2.5% 9 Benchmark Indices(2) 110 3.1% 2.9% 2.9% 2.7% 2.8% 9.6% 9.5% 9.2% 9.1% 9.0% 4.2% 4.0% 4.0% 3.7% 4.0% 0.0% 4.0% 8.0% 12.0% Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Agency RMBS Non-Agency RMBS Aggregate Portfolio (1) Agency yield includes impact of Agency Derivatives. Interest income on Agency Derivatives was $2.3 million and $3.6 million for the second quarter of 2013 and the third quarter of 2013, respectively. (2) Source for benchmark indices: Bloomberg. (3) See Appendix page 14 for calculation of third quarter 2013 return on book value. Performance Highlights Annualized Yields by Portfolio(1) Net Interest Spread Three Months Ended June 30, 2013 September 30, 2013 Agency Non- Agency Aggregate Portfolio Agency Non- Agency Aggregate Portfolio Annualized Yield(1) 2.7% 9.1% 3.7% 2.8% 9.0% 4.0% st f re urc ase agree ts (0. ) (2. ) (0. ) (0.5%) (2.2%) (0.7%) Cost of interest rate swaps & swaptions (0.6%) - (0.5%) (0.5%) (0.6%) (0.5%) Cost of financing (1.1%) (2.3%) (1.2%) (1.0%) (2.8%) (1.2%) Net interest spread 1.6% 6.8% 2.5% 1.8% 6.2% 2.8% Sector Three Months ended September 30, 2013 Nine months ended September 30, 2013 Agency Strategy: Barclays US MBS Fixed Rate Index vs. duration-matched swap at 6:1 leverage 4.7% (8.8%) Credit: ABX 06-2 AAA 4.5% 9.8% Proxy for 50% Agency and 50% Non- Agency Strategy 4.6% 0.5% Two Harbors’ Return on Book Value(3) 1.5% 6.3%

110 110 Portfolio Composition 10 (1) Home Equity Conversion Mortgage loans (HECMs) are loans that allow the homeowner to convert home equity into cash collateralized by the value of their home. (2) Includes Agency Derivatives (IIOs) of $223.7 million. (3) “Rates” category includes Agency securities and MSR. (4) “Credit” category includes non-Agency securities, prime jumbo loans, net economic interest in securitization trusts and CSLs. Highlights Targeted Capital Allocation Capital allocation at September 30, 2013 was 54% Rates(3) and 46% Credit(4) Opportunistically purchased $1 billion of Agency ARMs Rates category includes Agency securities and MSR, and Credit category includes non-Agency securities, prime jumbo loans, net economic interest in securitization trusts and CSLs As of September 30, 2013 $13.6B Portfolio $ Millions Rates(3) $9.9B Credit(4) $3.7B 30-Year Fixed $5,884 15-Year Fixed $76 HECM(1) $1,819 Other-Fixed $661 IOs and IIOs(2) $494 Hybrid ARMs $1,008 Mezzanine $525 Senior $2,421 Portfolio Composition Other $284 CSLs $440 50% 60% 60% 55% 55% 52% 52% 57% 53% 52% 54% 54% 50% 40% 40% 45% 45% 48% 44% 36% 37% 38% 46% 46% 4% 7% 10% 10% 0% 10% 20% 30% 40% 50% 60% 70% Rates Credit Residential Real Properties (3) (4) MSRs $16

110 (1.1%) (1.8%) 0.1% 9.9% (1.2%) (10%) (6%) (2%) 2% 6% 10%Key Portfolio Metrics Portfolio Metrics Q2-2013 Q3-2013 Agency Weighted average 3-month CPR(3) 8.7% 8.7% Weighted average cost basis(4) $108.0 $108.0 Non-Agency Weighted average 3-month CPR 4.0% 4.0% Weighted average cost basis(4) $52.2 $52.2 Change in equity value for +100bps change in interest rates(2) 9.9% 9.9% Debt-to-Equity(5) 3.6x 3.6x 11 110 Low implied debt-to-equity ratio of 3.2x at September 30th vs. 2.9x at June 30th(1) Currently maintain low Agency basis risk exposure Non-Agency speeds very favorable as fundamentals have improved (1) Implied debt-to-equity is calculated after including net long or short TBA position. As of September 30, 2013 and June 30, 2013, the net TBA position was long $857 million and short $2.7 billion notional, respectively. (2) Represents estimated percentage change in equity value for theoretical +100 bps parallel shift in interest rates. Change in equity value is total net asset change. (3) Agency weighted average 3-month Constant Prepayment Rate (CPR) includes derivatives. (4) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, total non-Agency RMBS excluding the company’s non-Agency IO portfolio would have been $49.22 at September 30, 2013. (5) Debt-to-equity is defined as total borrowings to fund RMBS, mortgage loans held-for-sale and Agency Derivatives divided by total equity. Curtailed large net short position Greatly reduced swaps, swaptions and short TBAs during the quarter Portfolio Metrics BV Exposure to +100 bps Change in Rates(2) Hedging Strategy Q2-2012 Q1-2013 Q4-2012 Q3-2012 Q3-2013 Portfolio Metrics Q2-2013 Q3-2013 Agency Weighted average 3-month CPR(3) 8.7% 8.7% Weighted average cost basis(4) $108.0 $108.1 Non-Agency Weighted average 3-month CPR 4.0% 4.8% Weighted average cost basis(4) $52.2 $52.6 Change in equity value for +100 bps change in interest rates(2) 9.9% (1.2%) Debt-to-Equity(5) 3.6x 3.0x

Mortgage Servicing Rights (MSRs) 12 Flow agreement with PHH Mortgage Corporation to acquire MSRs Right to acquire MSRs on at least 50% of eligible new Fannie Mae and Ginnie Mae mortgage loans, subject to quarterly pricing Subservicing agreement with PHH Mortgage Corporation to provide ongoing servicing of the underlying mortgage loans Two-year term Closed on two small bulk transactions in July 2013 Potential for other significant investments in the near-term Natural interest rate and mortgage basis hedge for our portfolio Current supply/demand dynamics make it opportune time to enter market

Mortgage Loan Conduit and Securitization 13 Completed a prime jumbo securitization using our own depositor Agate Bay Mortgage Trust 2013-1, a $434 million securitization of prime jumbo loans Ongoing progress building out originator platform Approximately 30 originators in various stages of approval Ability to source prime jumbo loans as well as other products, creating mutually beneficial relationships with originator partners Our goal is to generate attractive credit investments for our portfolio while providing capital to the U.S. mortgage market Robust mortgage acquisition process and infrastructure will allow us to control and manage loans we purchase and securitize, including credit and servicing oversight

14 Appendix

Return on Book Value Return on book value Q3-2013(1) (Per diluted share amounts, except for percentage) Book value at September 30, 2013 ($) $10.35 Book value at June 30, 2013 10.47 Decrease in book value (0.12) Dividend declared in Q3-2013 0.28 Return on book value Q3-2013 ($) $0.16 Return on book value Q3-2013 (%) 1.5% 15 (1) Diluted shares outstanding at end of period, which includes the effect of dilutive outstanding warrants determined using the treasury stock method, are used as the denominator for book value per share calculation. (2) Includes Silver Bay common stock distribution amounting to $1.01 per share. Return on book value as of September 30, 2013(1) (Per diluted share amounts, except for percentage) Book value at September 30, 2013 ($) $10.35 Book value at December 31, 2012 11.54 Decrease in book value (1.19) Dividends declared in 2013(2) 1.92 Return on book value at September 30, 2013 ($) $0.73 Return on book value at September 30, 2013 (%) 6.3%

Operating Performance 16 110 110 $524.4 $185.4 $248.0 ($146.1) $54.0 70.2% 21.6% 26.9% (14.2%) 5.7% -50% 0% 50% 100% ($300) $0 $300 $600 Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Comprehensive Income ($M) Comprehensive Income ROAE (%) (1) Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the relevant quarter. (2) Diluted shares outstanding at end of period, which includes the effect of dilutive outstanding warrants determined using the treasury stock method, are used as the denominator for book value per share calculation. (3) Includes cash dividend of $0.32 per share and Silver Bay common stock distribution amounting to $1.01 per share. (4) Dividend yield based on cash dividend of $0.32 per share only. Does not include Silver Bay common stock distribution, which amounted to $1.01 per share. Book Value and Dividend(1) per Share(2) GAAP Net Income Comprehensive Income Dividends(1) $26.8 $189.3 $143.7 $388.6 ($192.7) $0.10 $0.64 $0.47 $1.06 ($0.53) -$1.00 -$0.50 $0.00 $0.50 $1.00 $1.50 $(300) $(200) $(100) $- $100 $200 $300 $400 Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 GAAP Net Income ($M) GAAP EPS ($) $0.36 $0.55 $0.32 $0.31 $0.28 12.3% 19.9% 10.2%(4) 12.1% 11.5% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Dividend per Share ($) Dividend Yield (%) $11.44 $11.54 $11.19 $10.47 $10.35 $0.36 $0.55 $1.33(3) $0.31 $0.28 $8.00 $10.00 $12.00 Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Book Value ($) Dividend declared ($)

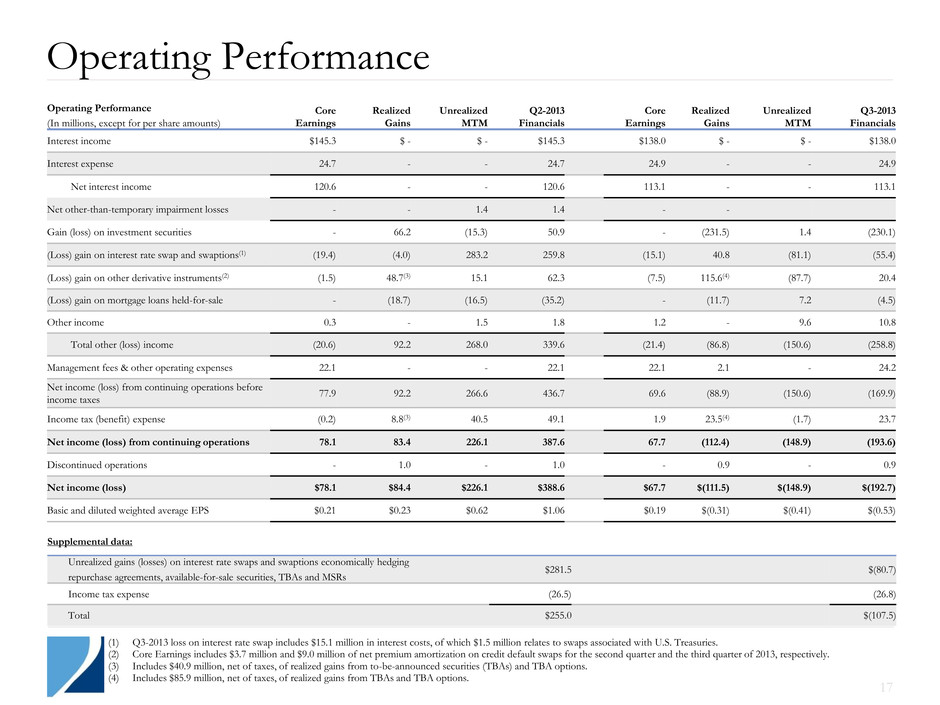

Operating Performance 17 (1) Q3-2013 loss on interest rate swap includes $15.1 million in interest costs, of which $1.5 million relates to swaps associated with U.S. Treasuries. (2) Core Earnings includes $3.7 million and $9.0 million of net premium amortization on credit default swaps for the second quarter and the third quarter of 2013, respectively. (3) Includes $40.9 million, net of taxes, of realized gains from to-be-announced securities (TBAs) and TBA options. (4) Includes $85.9 million, net of taxes, of realized gains from TBAs and TBA options. Operating Performance (In millions, except for per share amounts) Core Earnings Realized Gains Unrealized MTM Q2-2013 Financials Core Earnings Realized Gains Unrealized MTM Q3-2013 Financials Interest income $145.3 $ - $ - $145.3 $138.0 $ - $ - $138.0 Interest expense 24.7 - - 24.7 24.9 - - 24.9 Net interest income 120.6 - - 120.6 113.1 - - 113.1 Net other-than-temporary impairment losses - - 1.4 1.4 - - Gain (loss) on investment securities - 66.2 (15.3) 50.9 - (231.5) 1.4 (230.1) (Loss) gain on interest rate swap and swaptions(1) (19.4) (4.0) 283.2 259.8 (15.1) 40.8 (81.1) (55.4) (Loss) gain on other derivative instruments(2) (1.5) 48.7(3) 15.1 62.3 (7.5) 115.6(4) (87.7) 20.4 (Loss) gain on mortgage loans held-for-sale - (18.7) (16.5) (35.2) - (11.7) 7.2 (4.5) Other income 0.3 - 1.5 1.8 1.2 - 9.6 10.8 Total other (loss) income (20.6) 92.2 268.0 339.6 (21.4) (86.8) (150.6) (258.8) Management fees & other operating expenses 22.1 - - 22.1 22.1 2.1 - 24.2 Net income (loss) from continuing operations before income taxes 77.9 92.2 266.6 436.7 69.6 (88.9) (150.6) (169.9) Income tax (benefit) expense (0.2) 8.8(3) 40.5 49.1 1.9 23.5(4) (1.7) 23.7 Net income (loss) from continuing operations 78.1 83.4 226.1 387.6 67.7 (112.4) (148.9) (193.6) Discontinued operations - 1.0 - 1.0 - 0.9 - 0.9 Net income (loss) $78.1 $84.4 $226.1 $388.6 $67.7 $(111.5) $(148.9) $(192.7) Basic and diluted weighted average EPS $0.21 $0.23 $0.62 $1.06 $0.19 $(0.31) $(0.41) $(0.53) Supplemental data: Unrealized gains (losses) on interest rate swaps and swaptions economically hedging repurchase agreements, available-for-sale securities, TBAs and MSRs $281.5 $(80.7) Income tax expense (26.5) (26.8) Total $255.0 $(107.5)

Operating Performance 18 Three Months Ended September 30, 2013 Reconciliation of GAAP to non-GAAP Information Core Earnings: Net (loss) income attributable to common stockholders $ (192,728) Adjustments for non-core earnings: Loss (gain) on sale of securities and mortgage loans, net of tax 240,223 Unrealized (gain) loss on trading securities, equity securities and mortgage loans held-for-sale, net of tax (5,675) Other-than-temporary impairment loss, net of tax - Realized (gain) loss on termination or expiration of swaps and swaptions, net of tax (52,944) Unrealized loss (gain), net of tax, on interest rate swap and swaptions economically hedging repurchase agreements, TBAs, MSRs and available-for-sale securities 107,466 Unrealized loss (gain), net of tax, on interest rate swap economically hedging trading securities 258 (Gain) loss on other derivative instruments, net of tax (19,876) Unrealized gain on financing securitizations (8,774) Unrealized gain, net of tax, on mortgage servicing rights (832) Securitization deal costs 1,402 (Income) loss from discontinued operations (871) Core Earnings $ 67,649 Weighted average shares outstanding - Basic 365,057,767 Weighted average shares outstanding - Diluted 365,166,992 Core Earnings per weighted average share outstanding - Diluted $ 0.19 (1) Unaudited. Dollars in thousands, except per share data. (1)

Portfolio Metrics 19 110 Portfolio Yield Realized Q2-2013 At June 30, 2013 Realized Q3-2013 At September 30, 2013 Annualized yield(1) 3.7% 3.8% 4.0% 4.1% Agency(1) 2.7% 2.8% 2.8% 2.9% Non-Agency 9.1% 9.1% 9.0% 9.0% Cost of financing(2) 1.2% 1.2% 1.2% 1.2% Net interest spread 2.5% 2.6% 2.8% 2.9% Portfolio Metrics Q2-2013 Q3-2013 Agency Weighted average 3-month CPR 8.7% 8.7% Weighted average cost basis(3) $108.0 $108.1 Non-Agency Weighted average 3-month CPR 4.0% 4.8% Weighted average cost basis(3) $52.2 $52.6 Change in equity value for +100bps change in interest rates(4) 9.9% (1.2%) Debt-to-Equity(5) 3.6x 3.0x Portfolio Yields and Metrics 110 Agency RMBS CPR Non-Agency RMBS CPR 3.0% 3.2% 2.6% 4.0% 4.8% 0.0% 5.0% 10.0% 15.0% 20.0% Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Non-Agency RMBS CPR 6.0% 6.6% 7.0% 8.7% 8.7% 0.0% 5.0% 10.0% 15.0% 20.0% Q3-2012 Q4-2012 Q1-2013 Q2-2013 Q3-2013 Agency RMBS CPR (1) Agency yield includes impact of Agency Derivatives. Interest income on Agency Derivatives was $2.3 million and $1.5 million for the second quarter of 2013 and the third quarter of 2013, respectively. (2) Cost of financing RMBS includes interest spread expense associated with the portfolio’s interest rate swaps of $18.1 million and $22.1 million for the second quarter of 2013 and the third quarter of 2013, respectively. Interest spread expense increased cost of financing RMBS by 0.5% in both the second and third quarters of 2013. (3) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, total non-Agency RMBS excluding the company’s non-Agency interest-only portfolio would have been $49.22 at September 30, 2013. (4) Represents range of the percentage change in equity value for + 100 bps change in interest rates. Change in equity value is portfolio value change adjusted for leverage. (5) Debt-to-equity is defined as total borrowings to fund RMBS, mortgage loans held-for-sale and Agency Derivatives divided by total equity.

110 110 Financing and Hedging Strategy Swaps Maturities Notional Amounts ($M) Average Fixed Pay Rate Average Receive Rate Average Maturity (Years) 2014 $ 900 0.318% 0.269% 0.29 2015 4,000 0.386% 0.270% 1.28 2016 2,650 0.579% 0.263% 2.42 2017 4,225 0.888% 0.263% 3.62 2018 and after 2,325 1.294% 0.259% 5.52 $ 14,100 0.718% 0.265% 2.83 Option Underlying Swap Swaption Expiration Cost ($M) Fair Value ($M) Average Months to Expiration Notional Amount ($M) Average Pay Rate Average Receive Rate Average Term (Years) Payer < 6 Months $ - $ - - $ - - 3M Libor - Payer ≥ 6 Months 229.9 313.4 41.79 6,400 4.23% 3M Libor 9.1 Total Payer $ 229.9 $ 313.4 41.79 $ 6,400 4.23% 3M Libor 9.1 Receiver < 6 Months $ (7.4) $ - 0.10 $ (1,170) 3M Libor 3.11% 10.0 Receiver ≥ 6 Months (81.2) (75.5) 45.02 (800) 3M Libor 3.44% 10.0 Total Receiver $ (88.6) $ (75.5) 45.02 $ (1,970) 3M Libor 3.24% 10.0 20 (1) As of September 30, 2013. (2) Notional amounts do not include $1.0 billion of notional interest rate swaps economically hedging our trading securities and $2.5 billion of notional interest rate swaps economically hedging our TBA contracts and MSRs. (3) Does not include repurchase agreements collateralized by U.S. Treasuries of $1.0 billion and mortgage loans held for sale of $16.2 million. Interest Rate Swaps(2) Financing Interest Rate Swaptions Repurchase Agreements: RMBS and Agency Derivatives(3) Amount ($M) Percent (%) Within 30 days $2,911 26% 30 to 59 days 4,731 42% 60 to 89 days 89 1% 90 to 119 days 1,567 14% 120 to 364 days 1,642 15% One year and over 200 2% $11,140 (1)

Agency Securities as of September 30, 2013 Par Value (M) Market Value (M) % of Agency Portfolio Amortized Cost Basis (M) Weighted Average Coupon Weighted Average Age (Months) 30-Year Fixed 3.0-3.5% $736 $749 7.5% $783 3.5% 16 4.0-4.5% 3,942 4,166 41.9% 4,281 4.1% 16 ≥ 5.0% 877 969 9.8% 953 5.6% 57 $5,555 $5,884 59.2% $6,017 4.3% 23 15-Year Fixed 3.0-3.5% $70 $73 0.8% $69 3.0% 35 4.0-4.5% 2 2 0.0% 2 4.0% 40 ≥ 5.0% 1 1 0.0% 1 6.0% 102 $73 $76 0.8% $72 3.1% 35 HECM $1,655 $1,819 18.3% $1,769 4.7% 23 Hybrid ARMs 992 1,008 10.1% 999 2.5% 20 Other-Fixed 605 661 6.6% 655 4.7% 59 IOs and IIOs 4,808 494(1) 5.0% 515 4.2% 63 Total $13,688 $9,942 100.0% $10,027 4.2% 27 21 (1) Represents the market value of $270.6 million of IOs and $223.7 million of Agency Derivatives.

22 Non-Agency Securities as of September 30, 2013 Senior Bonds Mezzanine Bonds Total P&I Bonds Portfolio Characteristics Carrying Value ($M) $2,421 $525 $2,946 % of Non-Agency Portfolio 82.2% 17.8% 100.0% Average Purchase Price(1) $51.20 $59.21 $52.63 Average Coupon 1.8% 1.6% 1.7% Collateral Attributes Average Loan Age (months) 84 97 86 Average Loan Size ($K) $258 $193 $247 Average Original Loan-to-Value 74.1% 73.0% 73.9% Average Original FICO(2) 611 644 617 Current Performance 60+ Day Delinquencies 33.8% 27.3% 32.6% Average Credit Enhancement(3) 11.2% 23.2% 13.4% 3-Month CPR(4) 4.2% 7.1% 4.8% (1) Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, the average purchase price for senior, mezzanine and total non-Agency RMBS, excluding our non-Agency interest-only portfolio, would have been $47.81, $56.51 and $49.22, respectively. (2) FICO represents a mortgage industry accepted credit score of a borrower, which was developed by Fair Isaac Corporation. (3) Average credit enhancement remaining on our non-Agency RMBS portfolio, which is the average amount of protection available to absorb future credit losses due to defaults on the underlying collateral. (4) 3-Month CPR is reflective of the prepayment speed on the underlying securitization; however, it does not necessarily indicate the proceeds received on our investment tranche. Proceeds received for each security are dependent on the position of the individual security within the structure of each deal.

Agency: Vintage & Prepayment Protection Q2-2013 Q3-2013 High LTV (predominately MHA)(1) 26% 24% HECM 15% 18% $85K Max Pools(2) 20% 14% 2006 & subsequent vintages – Premium and IOs 8% 14% Low FICO(3) 6% 7% 2006 & subsequent vintages – Discount 2% 7% Seasoned (2005 and prior vintages) 5% 6% Other Low Loan Balance Pools(4) 14% 5% Prepayment Protected 4% 5% Portfolio Composition as of September 30, 2013 23 Implicit or Explicit Prepayment Protection Non-Agency: Loan Type Q2-2013 Q3-2013 Sub-Prime 87% 86% Option-ARM 7% 7% Alt-A 4% 4% Prime 2% 3% (1) Securities collateralized by loans with greater than or equal to 80% loan-to-value ratio (LTV). High LTV pools are predominately Making Homeownership Affordable (MHA) pools. MHA pools consist of borrowers who have refinanced through the HARP. (2) Securities collateralized by loans of less than or equal to $85K. (3) Securities collateralized by loans held by lower credit borrowers as defined by FICO. (4) Securities collateralized by loans of less than or equal to $175K, but more than $85K.