Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Panache Beverage, Inc. | wdka_8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - Panache Beverage, Inc. | wdka_ex21.htm |

| EX-10.2 - FIRST AMENDMENT TO AMENDED AND RESTATED - Panache Beverage, Inc. | wdka_ex102.htm |

EXHIBIT 10.1

SECOND AMENDMENT TO AMENDED AND RESTATED LOAN AGREEMENT

This SECOND AMENDMENT TO AMENDED AND RESTATED LOAN AGREEMENT (the “Agreement”) is made effective as of this 29th day of October, 2013 (the “Effective Date”), by and between PANACHE BEVERAGE INC., a Delaware Corporation, as successor in interest by merger to Panache Beverage, Inc., a Florida corporation, sometimes hereafter referred to as “Panache Delaware”), ALIBI NYC, LLC, a New York limited liability company (“Alibi”), PANACHE USA, LLC, a New York limited liability company (“Panache USA”), ALCHEMY INTERNATIONAL, LLC, a New York limited liability company (“Alchemy”), MIS BEVERAGE HOLDINGS, LLC, a New York limited liability company (“MIS”), JAMES DALE (“Dale”), AGATA PODEDWORNY (“Podedworny”), SJOERD DE JONG (“De Jong”) and PANACHE DISTILLERY, LLC, a Florida limited liability company (“Panache Distillery”) (Alibi, Panache USA, Alchemy, MIS, Dale, Podedworny, De Jong and Panache Distillery are sometimes hereafter collectively referred to as the “Related Parties”; AND CONSILIUM CORPORATE RECOVERY MASTER FUND, LLC a limited company existing under the laws of the Caymen Islands ( the “ Lender”).

WITNESSETH

(A) On or about October 29, 2013, Panache Beverage, Inc., a Florida corporation (hereinafter sometimes referred to as the “Borrower” or “Panache Florida”), merged with and into and was succeeded by Panache Beverage, Inc., a Delaware corporation (hereinafter referred to herein as “Panache Delaware”) (the “Merger”). The Merger was accomplished in connection with the Florida Business Corporation Act and the Delaware General Corporation law. By operation of law, upon the effectiveness of the Merger, Panache Florida ceased to exist as a separate entity and Panache Delaware, as the surviving corporation of the Merger possesses all the rights, privileges, immunities and franchises, of both a public and private nature, of each of the constituent corporations and became responsible and liable for all of the liabilities and obligations of each of the constituent corporations. Pursuant to the Agreement and Plan of Merger, Panache Delaware is authorized to issue 100 million shares of common stock, $0.001 par value per share (the “Common Stock”), and shareholders of Panache Florida have exchanged on a one for one basis their shares of common stock with those issued by Panache Delaware. In addition Panache Delaware has authorized 10,000,000 shares of Preferred Stock, $0.001 par value per share (the “Preferred Stock”).

1

(B) Panache Florida has heretofore executed and delivered to Lender certain loan documents described below (hereafter the “Loan Documents”):

(i) a Promissory Note payable to the Lender, dated as of December 21, 2012, in the principal amount of Two Million One Hundred Thousand ($2,100,000.00) Dollars (the “$2,100,000 Note”, and together with the security and loan documents entered into in connection therewith, the “$2,100,000 Loan”);

(ii) a Promissory Note payable to the Lender in the amount of Four Million ($4,000,000.00) Dollars, dated as of May 9, 2013 (the “ $4,000,000 Note”, and together with the security and loan documents entered into in connection therewith, the “$4,100,000 Loan”);

(iii) a term loan agreement, dated as of December 21, 2012, by and among Panache Florida, Lender, Dale, Podedworny, De Jong and MIS (the “Original Loan Agreement”), which Original Loan Agreement has been modified by that certain Amended and Restated Loan Agreement, dated May 9, 2013 (the “Amended and Restated Loan Agreement”), which includes all parties as aforedescribed in the Original Loan Agreement, plus an additional party; to wit, Panache Distillery, and that certain First Amendment to said Amended and Restated Loan Agreement, dated as of September 4, 2013 (the “First Amendment”). The original Loan Agreement, the Amended and Restated Loan Agreement and First Amendment are collectively referred to herein as the “Amended Loan Agreement” and set forth the rights and obligations with respect to the $4,000,000 Loan and the $2,100,000 Loan, each as defined below (collectively the “Loans”);

2

(iv) a UCC-1 financing statement evidencing the security interest granted in the “ Collateral” as that term is referenced in the Amended Loan Agreement;

(v) as additional security for the obligations under the $2,100,000.00 Note and the Original Loan Agreement, Dale, Podedworny, MIS, Alchemy and De Jong have previously executed Stock Pledge Agreements (the “Trademark Pledges”), dated as of December 21, 2012, which pledge of shares represents approximately 68% of all currently issued and outstanding shares of Common Stock in Panache Florida and which stock entitle the holders (until a default occurs) to 68% of the voting interest and 68% of entitlements to dividends and shareholder distributions;

(vi) Dale, Podedworny and Borrower have previously executed Pledge and Security Agreements, dated as of December 21, 2012, wherein they have pledged their respective interest in Panache USA, LLC, Panache, LLC, Alibi NYC, LLC (“Alibi”) and Alchemy, LLC (“Alchemy”);

(vii) Alibi and Panache LLC have previously executed Trademark Security Agreements in which they have pledged their interest in certain trademarks to Lender in connection with the $2,100,000.00 Loan and which agreements have been amended and restated on May 19, 2013 and are being amended as of even date. In addition, Alibi, Alchemy, Borrower, and Panache LLC have each previously executed a Trademark Assignment and Security Agreement as security for the $2,100,000 Loan which has been amended and restated to include reference to the $4,000,000 Loan and will be further amended to reference this Amendment as well as the September 4, 2013 Amendment;

(viii) Alchemy, Panache LLC and Alibi have previously executed a Limited Guaranty in favor of the Lender as security for the $2,100,000.00 Loan;

3

(ix) Panache has executed an Amended and Restated Pledge Agreement pledging all their right, title and interest in and to Panache Distillery, as well as other assets.

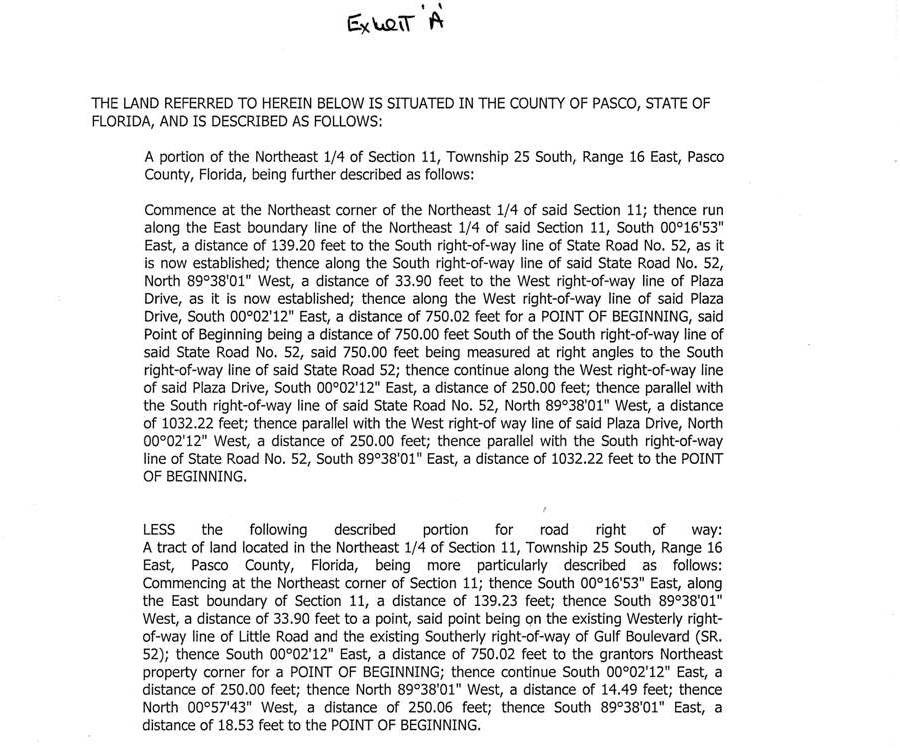

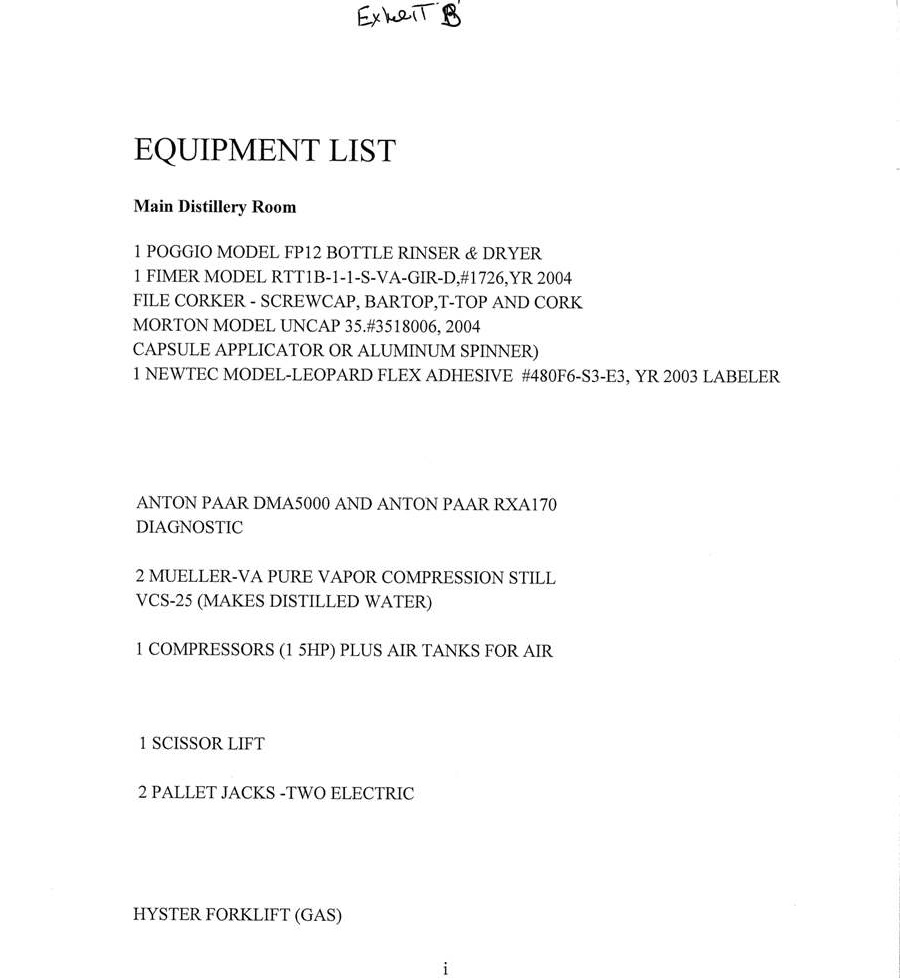

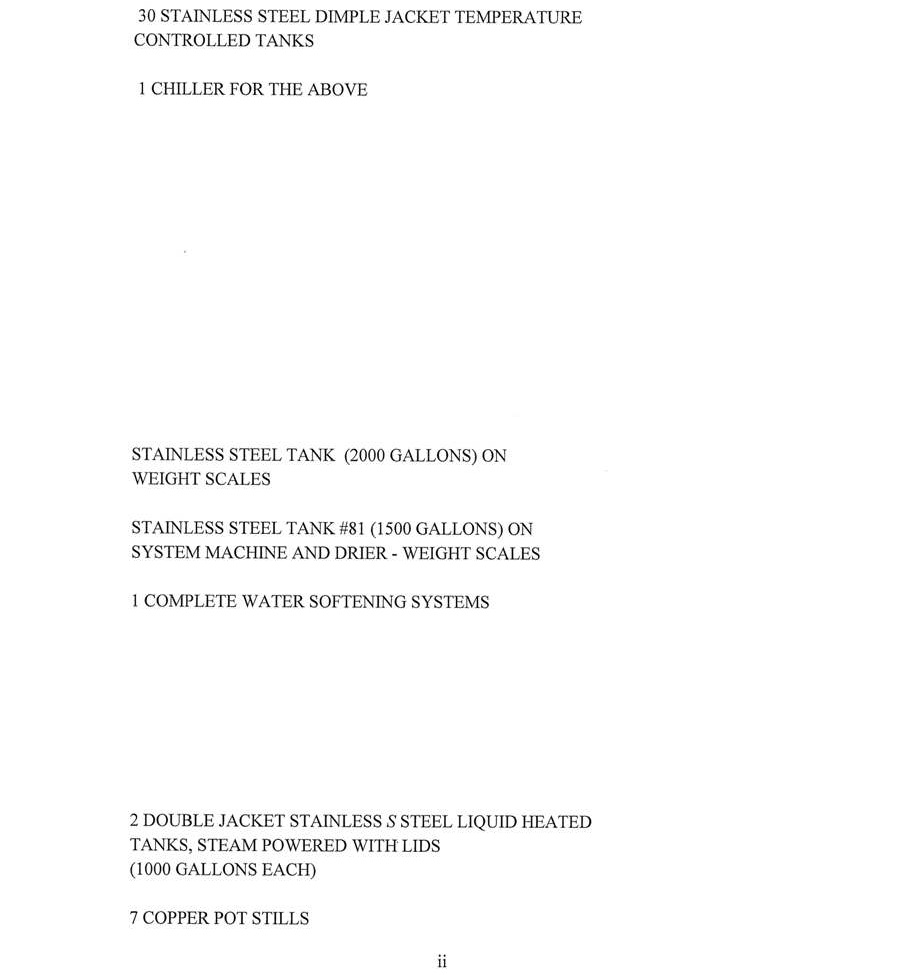

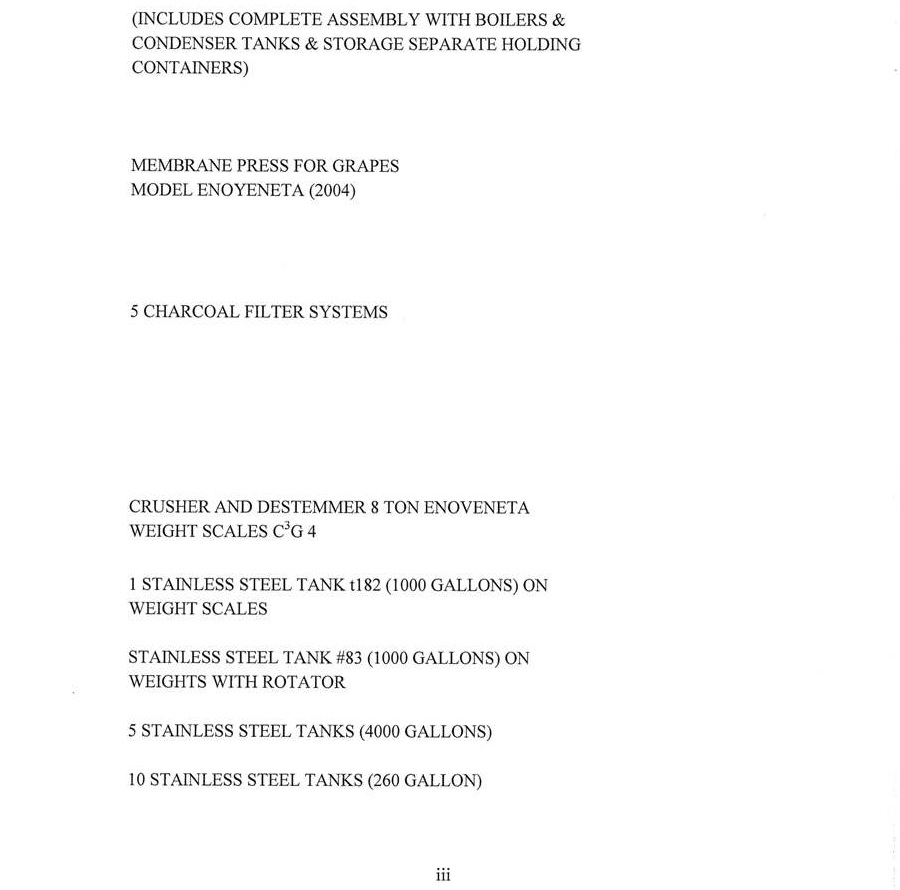

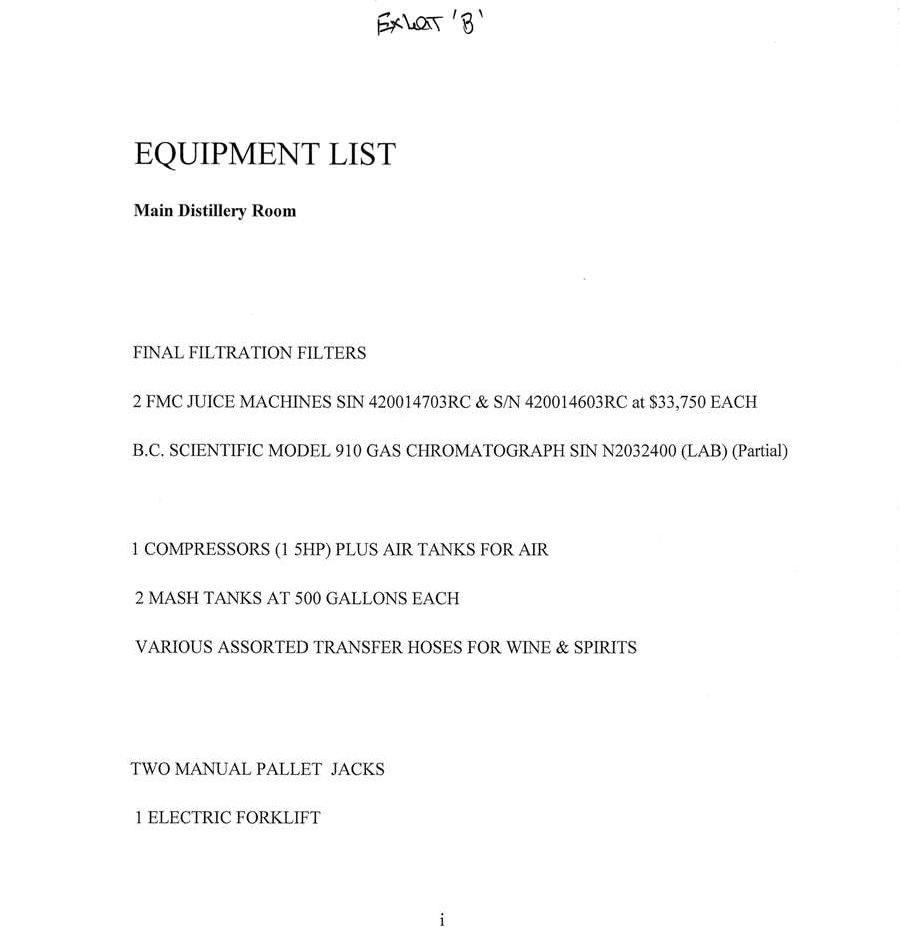

(x) Panache Distillery has previously granted a second mortgage lien on realty described on Exhibit “A” (the “Second Mortgage”) and a lien on the personal property described on the UCC-1 financing statement attached hereto as Exhibit “B” (the “Distillery UCC-1”) in favor of the Lender securing the $4,000,000.00 Loan and the $2,100,000.00 Loan (Sometimes collectively referred to herein as the “Loans”), which Lender has not yet recorded;

(xi) Panache Distillery has previously executed a Pledge and Security Agreement pledging the assignment of depository agreement and operating account with respect to all proceeds which have been unfunded with respect to the $4,000,000.00 Loan;

(xii) Panache Distillery has previously executed its Corporate Guaranty guarantying both the Loans; and

(xiii) An Omnibus Modification Agreement, dated May 9, 2013, by and among Borrower, Dale, Podedworny, MIS, De Jong, Panache USA, Alibi, Alchemy, Panache Distillery and Lender amending all of the aforesaid loan documents and providing for them to be cross defaulted and cross collateralized.

(C) The purpose of this Agreement is to acknowledge the Merger of Panache Florida with and into Panache Delaware and to reconfirm that all of the Loan Documents as aforedescribed, plus any other ancillary documents issued on connection with the consummation of said loans, are all in full force and effect and for all purposes hereafter Panache Delaware shall serve as the Borrower under said loan documentation in the place and stead of the now defunct Panache Florida other matters as set forth below.

NOW THEREFORE, in consideration of Ten Dollars ($10.00) and other mutual considerations, the receipt and sufficiency which are acknowledged, the parties by their execution hereof agree as follows:

4

1. Recitals. All Recitals as contained above are incorporated herein and are deemed to be true and correct in all respects.

2. Reaffirmation. Panache Delaware, as successor by merger to Panache Florida, is reconfirmed as the “Borrower” under the Loan Documents as aforedescribed and any ancillary documents issued in connection therewith and for all purposes thereafter shall be deemed to be the Borrower under said Loan Documents and ancillary documents, all of which are deemed amended, restated and reconfirmed. The Related Parties confirm their obligations under the Loan Documents and ancillary documents and agree that their obligations under said Loan Documents (including but not limited to any guaranty and/or pledge agreement) are in full force and effect and that no defenses exist to the enforcement thereof nor, to their knowledge, is there any state of facts in existence which over time would give rise to a defense.

3. Share Certificates. Dale, De Jong, MIS and Podedworny (the “Pledgee`s) hold share certificates in Panache Delaware totaling 19,900,000, representing approximately 74% of said authorized issued stock in Panache Delaware. Borrower certifies that pursuant to its reorganization documents the existing certificates will not be replaced and will continue in existence and continue to evidence the holder’s interest in Panache Delaware. At Lender’s request, Borrower and Pledgees will assist Lender in obtaining new share certificates to substitute for the existing certificates. The existing share certificates for each of the Pledgee`s are delineated hereafter:

|

Number of

Shares

|

Share

Certificate No.

|

||||||||

| (a) | JamesDale | 2,460,000 | #333 | ||||||

| 10,440,000 | #234 | ||||||||

| (b) | Agata Podedworny | 4,000,000 | #235 | ||||||

| (c) | Sjoerd De Jong | 1,000,000 | #237 | ||||||

| (d) | MIS Beverage Holdings, LLC | 2,000,000 | #236 | ||||||

5

4. Trademark Pledges. Trademark Pledges as afore described in subparagraph B (vii) are reconfirmed and cover the trademarks delineated on Exhibit “C” appended hereto. Since the filing of said Trademark Pledges, two new trademarks have been issued and filed by Panache LLC and are described on Exhibit “C-1” and are to be collaterally assigned to Lender pursuant to new Trademark Assignment and Security Agreements of Panache LLC of even date herewith and will be recorded in the appropriate public records to reflect a collateral assignment as said Trademarks to the Lender as security for the Loans.

5. UCC-1 Financing Statements. A UCC-3 Financing Statement will be filed in the State of Florida and a new UCC-1 Financing Statement will be filed in the State of Delaware upon effectiveness of the Merger to reflect the fact that Panache Florida has merged into Panache Delaware.

6. Lender Consent to Loan Covenants. Lender hereby consents to the Merger and hereby consents to and/or waives compliance with all applicable Loan Covenants contained in the Amended Loan Agreement that could be deemed to relate to the Merger and the transactions contemplated by it, including, but not limited to, Sections 6.1, 7.3, 7.8, 7.10, 7.12, 7.15 and 7.17 of the Amended Loan Agreement.

7. Waiver and Release of Claims. Borrower and Related Parties on the one hand, or Lender on the other, each hereby acknowledge, agree and affirm that they do not possess any claims, defenses, offsets, recoupment, or counterclaims of any kind or nature against the other or arising out of or relating to the Loans or any other Loan Documents securing the same evidenced or secured thereby or any collateral for the Loans, or the enforcement thereof (collectively the “Claims”), nor do Borrower or Related Parties on the one hand, or Lender on the other, now have knowledge of any facts that would or might give rise to any Claims. Each of the parties hereto hereby unconditionally, irrevocably, and unequivocally waive and fully release any and all such Claims arising out of facts or circumstances existing on or before the execution of this instrument, provided this release shall not release Lender or Borrower from liability for breach of this Agreement. In no event shall either party be liable to the other(s), and each of the parties hereto hereby waive, release and agree not to sue for any special, indirect, punitive, exemplary, or consequential damages suffered by them in connection with, or arising out of, or in any way related to the Loan Documents existing as of the date hereof, including, without limiting the generality of the foregoing, lost profits and each of the parties hereto waive all claims for punitive, exemplary, or consequential damages.

6

8. Miscellaneous.

a. Florida law shall govern the interpretation and the enforceability of this document.

b If any form of security granted to the Lender is deemed to be of no force and effect, it shall have no effect on other loan documentation executed as of December 21, 2012, May 9, 2013, September 4, 2013 or other loan documentation of even date herewith.

c. All other terms and conditions of the aforedescribed loan documentation not in conflict herewith are hereby deemed to be reaffirmed and in full force and effect.

d. This instrument may be signed in one or more counterparts, each of which shall be deemed to be an original, and all of which taken together shall constitute one and the same agreement (and all signatures need not appear on anyone counterpart). In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page were an original thereof. This Agreement shall become effective when one or more counterparts has been signed and delivered by each of the parties hereto.

Signature pages to follow

7

IN WITNESS WHEREOF, the undersigned parties have executed this document in one or more counterparts effective as of the date and year first above written.

|

CONSILIUM CORPORATE RECOVERY MASTER FUND, LTD.,

a Florida limited partnership

|

PANACHE BEVERAGE, INC.,

a Delaware corporation

|

||||

| By: |

/S/ CHARLES T. CASSEL, III

|

By: |

/S/ AGATA PODEDWORNY

|

||

| Name: |

Charles T. Cassel, III

|

Name: |

Agata Podedworny

|

||

| Title: |

Authorized Person

|

Title: |

Secretary

|

||

| JOINED INTO BY: | PANACHE DISTILLERY, LLC, a | ||||

| Florida limited liability company | |||||

| By: | /S/ JAMES DALE | By: | /S/ AGATA PODEDWORNY | ||

| JAMES DALE |

Name:

|

Agata Podedworny | |||

|

Title:

|

Manager

|

||||

| By: | /S/ AGATA PODEDWORNY | ||||

| AGATA PODEDWORNY | |||||

| By: | /S/ SJOERD DE JONG | ||||

| SJOERD DE JONG | |||||

|

MIS BEVERAGE HOLDINGS, LLC,

a New York limited liability company

|

ALCHEMY INTERNATIONAL, LLC,

a New York limited liability company

|

||||

| By: | /S/ MARIA GORDON | By: | /S/ AGATA PODEDWORNY | ||

|

Name:

|

Maria Gordon

|

Name:

|

Agata Podedworny

|

||

|

Title:

|

Manager

|

Title:

|

Manager | ||

|

ALIBI NYC, LLC,

a New York limited liability company

|

|||||

| By: | /S/ AGATA PODEDWORNY | ||||

|

Name:

|

Agata Podedworny | ||||

| Title: |

Manager

|

||||

|

|

|||||

|

PANACHE USA, LLC,

a New York limited liability company

|

|||||

| By: | /S/ AGATA PODEDWORNY | ||||

|

Name:

|

Agata Podedworny

|

||||

|

Title:

|

Manager

|

||||

8

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF BROWARD | ) |

The foregoing instrument was acknowledged before me this 19th day of September, 2013 by Charles T. Cassel, III, as authorized person of CONSILIUM COROPRATE RECOVERY MASTER FUND, LTD., a Florida limited partnership, on behalf of the partnership. He/She is personally known to me or has produced _______________ as identification.

|

|

By:

|

/S/ MARIA C. NOVICK | |

| NOTARY PUBLIC, State of Florida | |||

| Print Name: Maria C. Novick | |||

| Title: _______________ | |||

| Commission No.: EE 053763 |

My Commission Expires: March 25, 2015

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by James Dale who is personally known to me or has produced _________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

My Commission Expires: June 8, 2016

9

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by Agata Podedworny who is personally known to me or who has produced _________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by Sjoerd De Jong who is personally known to me or who has produced _________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

My Commission Expires: June 8, 2016

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by Maria Gordon, as Manager of MIS BEVERAGE HOLDINGS, LLC, a Florida limited partnership, on behalf of the partnership. He/She is personally known to me or has produced _____________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

My Commission Expires: June 8, 2016

10

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by Agata Podedworny, as Secretary of PANACHE BEVERAGE, INC., a Delaware corporation, on behalf of the corporation. He/She is personally known to me or has produced _____________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

My Commission Expires: June 8, 2016

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by Agata Podedworny as Manager of PANACHE DISTILLERY, LLC, a Florida limited liability company, on behalf of the company. He/She is personally known to me or has produced _____________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

My Commission Expires: June 8, 2016

11

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by Agata Podedworny as Manager of ALCHEMY INTERNATIONAL, LLC, a New York limited liability company, on behalf of the company. He/She is personally known to me or has produced _____________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

My Commission Expires: June 8, 2016

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by Agata Podedworny as Manager of ALIBI NYC, LLC, a New York limited liability company, on behalf of the company. He/She is personally known to me or has produced _____________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

My Commission Expires: June 8, 2016

12

| STATE OF FLORIDA | ) | |

| ) | SS: | |

| COUNTY OF MIAMI DADE | ) |

The foregoing instrument was acknowledged before me this 29th day of October, 2013 by Agata Podedworny as Manager of PANACHE USA, LLC, a New York limited liability company, on behalf of the company. He/She is personally known to me or has produced _____________________ as identification.

|

|

By:

|

/S/ IAN GRUTMAN | |

| NOTARY PUBLIC, State of Florida | |||

|

Print Name: Ian Grutman

|

|||

|

Commission No.: EE 185194

|

My Commission Expires: June 8, 2016

13