Attached files

| file | filename |

|---|---|

| 8-K - Rowl, Inc. | overnear8k100413.htm |

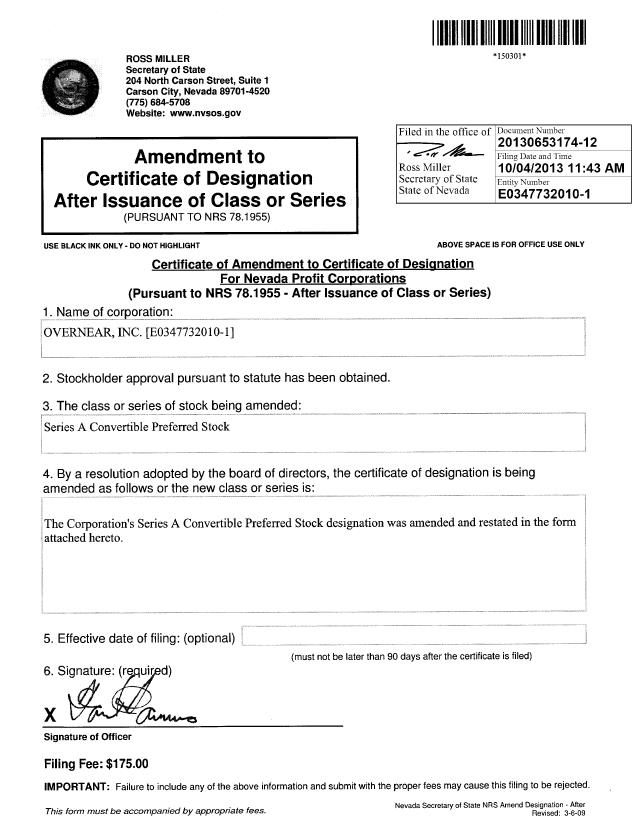

AMENDED AND RESTATED

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES A CONVERTIBLE PREFERRED STOCK

OF

OVERNEAR, INC.

(Pursuant to Section 78.1955 of the Nevada Revised Statutes)

Pursuant to Section 78.1955 of the Nevada Revised Statutes, Overnear, Inc., a corporation organized and existing under the Nevada Revised Statutes (the "Corporation"),

DOES HEREBY CERTIFY that pursuant to the authority conferred upon (a) the Board of Directors by the Articles of Incorporation, as amended, of the Corporation, and pursuant to Section 78.1955 of the Nevada Revised Statutes, all of the members of the Board of Directors, at a meeting of the Board of Directors held on October 4, 2013 (which meeting and approval is conclusively established by the signature of the Chief Executive Officer and Co-Chairman of the Board of Directors below), and (b) shareholders holding over 66% of the Corporation’s Series A Convertible Preferred Stock, by a written consent of such Series A Convertible Preferred Stock shareholders on or around August 26, 2013, duly adopted resolutions providing for the amendment and restatement of the Corporation’s Series A Convertible Preferred Stock designation originally filed with the Secretary of State of Nevada on November 9, 2012, which resolution is and reads as follows:

RESOLVED, that a series of the preferred stock, par value $0.001 per share, of the Corporation be, and it hereby is, established; and

FURTHER RESOLVED, that the series of preferred stock of the Corporation be, and it hereby is, given the distinctive designation of "Series A Preferred Stock" or “Series A Preferred”; and

FURTHER RESOLVED, that the Series A Preferred Stock shall consist of 18,000,000 shares; and

RESOLVED, that the Series A Preferred Stock shall have the powers and preferences, and the relative, participating, optional and other rights, and the qualifications, limitations, and restrictions thereon set forth below (the “Designation” or the “Certificate of Designations”):

1. Dividends. The holders of Series A Preferred Stock shall be entitled to receive, if, when and as declared by the Board, out of any funds legally available therefore (or, alternatively, out of the Corporation’s authorized but unissued shares of the Corporation’s common stock, $0.001 par value per share (the “Common Stock”), valued at its per share fair market value as determined in good faith by the Board of Directors) dividends at an annual rate of 8% of the Original Purchase Price (as defined below) of the Series A Preferred Stock for each outstanding share of Series A Preferred Stock (as adjusted for combinations, consolidations, subdivisions or stock splits with respect to such shares) held by each such holder (the “Dividends”). Such dividends shall rank (i) senior to the Common Stock or any new class or series of stock of the Corporation that by its terms ranks junior to the Series A Preferred Stock, or that does not provide for any terms for seniority (collectively, “Series A Junior Dividend Securities”) (ii) on a parity with any new class or series of stock of the Corporation that by its terms ranks on a parity with the Series A Preferred Stock as to payment of dividends (“Series A Parity Dividend Securities”) and (iii) junior to any new class of stock of the Corporation that by its terms ranks senior to the Series A Preferred Stock with respect to dividends.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 1 of 13

In the event dividends are paid to the holders of Series A Preferred Stock that are less than the full amounts to which such holders are entitled pursuant to this Section 1, such holders shall share pro rata in the total amount of dividends paid according to the respective amounts due each such holder if such dividends were paid in full. The right to such dividends on the Series A Preferred Stock shall not be cumulative, and no right shall accrue to holders of Series A Preferred Stock by reason of the fact that dividends are not declared or paid in any prior year.

No dividend shall be paid or declared on any Series A Junior Dividend Securities or Series A Parity Dividend Securities (other than dividends payable in Common Stock for which an adjustment is made pursuant to Section 4(f) hereof), unless a dividend, payable in the same consideration and manner, is simultaneously paid or declared, as the case may be, on each share of Series A Preferred Stock in an amount determined as set forth above. For purposes hereof, the term “dividends” shall include any pro rata distribution by the Corporation, out of funds of the Corporation legally available therefore, of cash, property, securities (including, but not limited to, rights, warrants or options) or other property or assets to the holders of capital stock of the Corporation, whether or not paid out of capital, surplus or earnings.

Prior to declaring any dividend or making any distribution on or with respect to shares of any Series A Junior Dividend Securities or Series A Parity Dividend Securities, the Corporation shall take all prior corporate action necessary to authorize the issuance of any securities that are issuable as a dividend or distribution in respect of the Series A Preferred Stock.

For purposes hereof, the Original Purchase Price of the Series A Preferred Stock shall mean $0.25.

2. Liquidation Preference.

(a) In the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary, the holders of the Series A Preferred Stock shall be entitled to receive the amount of $0.50 per share (as adjusted for any stock splits or combinations of the Series A Preferred Stock, stock dividends paid in and on Series A Preferred Stock, or recapitalizations or any similar transactions that have the effect of increasing or decreasing the number of shares represented by each outstanding share of Series A Preferred Stock) then held by them, with fractional cents being rounded to nearest whole cent (with one-half cent being rounded upward), both prior and in preference to any distribution of any of the assets or surplus funds of the Corporation to the holders of the Common Stock or to any new class or series of stock of the Corporation that by its terms ranks junior to the Series A Preferred Stock, or that does not provide any terms for seniority, as to distribution of assets upon liquidation, dissolution or winding up (collectively, “Series A Junior Liquidation Securities”) plus all declared but unpaid dividends on each such share (“Liquidation Payment”). If upon the occurrence of such event, the assets and funds thus distributed among the holders of the Series A Preferred Stock shall be insufficient to permit the payment to such holders of the full preferential amount, then the entire assets and funds of the Corporation legally available for distribution shall be distributed ratably among the holders of the Series A Preferred Stock in proportion to the preferential amount each such holder is otherwise entitled to receive.

(b) After payment has been made to (i) the holders of the Series A Preferred Stock of the full amounts to which they shall be entitled as aforesaid and (ii) the holders of any equity securities of the Corporation that by its terms ranks on a parity with the Series A Preferred Stock as to distribution of assets upon liquidation, dissolution or winding up, (collectively, “Series A Parity Liquidation Securities”), the entire remaining assets and funds of the Corporation legally available for distribution, if any, shall be distributed pro rata among the holders of Series A Junior Liquidation Securities, the Series A Preferred Stock and the Series A Parity Liquidation Securities (if any) in proportion to their respective holdings of the issued and outstanding shares of the Corporation, on an as-converted basis, calculated as of the date immediately prior to the date fixed for determination of stockholders entitled to receive such distribution.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 2 of 13

(c) For purposes of this Subsection 2, a liquidation, dissolution or winding up of the Corporation shall be deemed to be occasioned by, or to include (unless the holders of at least a majority of the Series A Preferred Stock then outstanding shall determine otherwise), (i) the acquisition of the Corporation by another entity by means of any transaction or series of related transactions (including, without limitation, any reorganization, merger or consolidation) that results in the transfer of more than 50% of the outstanding voting power of the Corporation; or (ii) a sale, lease or other disposition of all or substantially all the assets of the Corporation (including, for purposes of this section, intellectual property rights which, in the aggregate, constitute substantially all of the Corporation’s material assets).

(d) In any of such events described in Subsection 2(c) above, if the consideration received is other than cash, its value will be deemed its fair market value as determined in good faith by the Board of Directors.

Any securities shall be valued as follows:

(A) Securities not subject to investment letters or other similar restrictions on free marketability covered by (B) below:

(1) If traded on a national securities exchange or through the Nasdaq Stock Market, the value shall be deemed to be the average of the closing prices of the securities on such quotation system over the thirty (30) day period ending three (3) days prior to the closing;

(2) If actively traded over-the-counter, the value shall be deemed to be the average of the closing bid or sale prices (whichever is applicable) over the thirty (30) day period ending three (3) days prior to the closing; and

(3) If there is no active public market, the value shall be the fair market value thereof, as determined in good faith by the Board.

(B) The method of valuation of securities subject to investment letters or other restrictions on free marketability (other than restrictions arising solely by virtue of a stockholder's status as an affiliate or former affiliate) shall be to make an appropriate discount from the market value determined as above in (A)(1), (2) or (3) to reflect the approximate fair market value thereof, as determined by the Board in good faith.

(e) Liquidation Notice. Prior to any liquidation pursuant to this Section 2, the Corporation shall mail, postage prepaid, written notice thereof (the “Liquidation Notice”) 10 days prior to any liquidation, to each holder of record of the Series A Preferred Stock whose shares are to be redeemed, at such holder’s post office address last shown on the records of the Corporation. Each such Liquidation Notice shall state:

(i) The date on which liquidation is to occur (the “Liquidation Date”), which date shall be no less than ten (10) days after the Corporation’s mailing of the Liquidation Notice, and the Liquidation Price;

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 3 of 13

(ii) The number of shares of Series A Preferred Stock held by the holder that the Corporation shall liquidate on the Liquidation Date specified in the Liquidation Notice; and

(iv) That the holder is to surrender to the Corporation, in the manner and at the place designated, his or its certificate or certificates representing the shares of Series A Preferred Stock to be redeemed.

3. Voting Rights.

(a) Each share of Series A Preferred Stock issued and outstanding shall be entitled to the number of votes equal to the number of shares of Common Stock into which such share of Series A Preferred Stock could be converted by the holder in accordance with the terms of this Certificate at the record date for determination of the stockholders entitled to vote or consent on such matters, such votes or consents to be counted together with all other shares of stock of the Corporation having general voting power and not separately as a class (except as otherwise expressly provided herein or as required by law). Holders of Series A Preferred Stock shall be entitled to notice of any stockholders’ meeting or consent in accordance with the By-laws of the Corporation. Fractional votes shall not, however, be permitted and any fractional voting rights resulting from the above formula (after aggregating all shares into which shares of Series A Preferred Stock held by each holder could be converted) shall be rounded to a nearest whole number (with one-half being rounded upward).

(b) In addition to any other rights provided by law, for so long as any Series A Preferred Stock remain outstanding, the consent of the holders of at least 66% of the outstanding Series A Preferred Stock, voting as a separate class, shall be required for any action to (i) effect a sale of all or substantially all of the Corporation’s assets or enter into any transaction which results in the holders of the Corporation’s capital stock prior to the transaction owning less than 50% of the voting power of the Corporation’s capital stock after the transaction, (ii) effect a reclassification or recapitalization of the outstanding capital stock of the Corporation, (iii) redeem shares of Preferred Stock or Common Stock (excluding shares of Common Stock repurchased from employees, officers, directors, consultants or other persons performing services for the Corporation pursuant to agreements under which the Corporation has the option to repurchase such shares at cost upon the occurrence of certain events, such as the termination of employment), (iv) effect a liquidation, dissolution, recapitalization or reorganization of the Corporation or enter into any license that has the same economic effect as a liquidation of the Corporation, (v) creation (by reclassification or otherwise) or issuance of any new class or series of capital stock with rights, preferences or privileges that are pari passu or senior to the Series A Preferred Stock, or (vi) amend or repeal any provision of, or add any provision to, the Corporation’s Articles of Incorporation or Bylaws to alter or change the rights, preferences or privileges of the Series A Preferred or increase or decrease the number of authorized shares of Series A Preferred.

4. Conversion. The Series A Preferred Stock shall have conversion rights as follows (the “Conversion Rights”):

(a) Right to Convert. The Series A Preferred Stock shall only be convertible, and shall convert, as provided in Subsections 4(b) and (c) hereof.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 4 of 13

(b) Voluntary Conversion. Each share of Series A Preferred Stock shall be convertible, at the option of the holder thereof, at any time after the date of issuance of such share at the office of the Corporation or any transfer agent for the Series A Preferred Stock without payment of any additional consideration. Each share of Series A Preferred Stock shall be convertible into such number of fully paid and non-assessable shares of Common Stock as is determined by dividing the Original Purchase Price of the Series A Preferred Stock by the Series A Preferred Conversion Price (as defined below), subject to adjustments in effect at the time of conversion as provided below (the “Conversion Ratio”). The conversion price for the Series A Preferred Stock shall initially be the Original Purchase Price of the Series A Preferred Stock with respect to each share of Series A Preferred Stock (the “Series A Preferred Conversion Price”). As of the date of the adoption of this Certificate, the Original Purchase Price of Series A Preferred Stock is $0.25 per share, therefore, the Series A Preferred Conversion Price for the Series A Preferred Stock is $0.25. Accordingly, as of the date hereof, each share of Series A Preferred Stock shall convert into one share of Common Stock, with the foregoing being subject to further adjustment as set forth below. Before any holder of Series A Preferred Stock shall be entitled to convert the same into shares of Common Stock, such holder shall surrender the certificate or certificates thereof, duly endorsed, at the office of the Corporation or of any transfer agent for such stock, and, in the event of voluntarily conversion pursuant to Subsection 4(b), shall give written notice to the Corporation at such office that he elects to convert the same and shall state therein the name or names in which he wishes the certificate or certificates for shares of Common Stock to be issued. The Corporation shall, as soon as practicable thereafter, issue and deliver at such office to such holder of Series A Preferred Stock, a certificate or certificates for the number of shares of Common Stock to which such holder shall be entitled as aforesaid. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of surrender of the shares of Series A Preferred Stock to be converted, and the person or persons entitled to receive the shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record holder or holders of such shares of Common Stock on such date. If the conversion is in connection with an underwritten offering of securities pursuant to the Act, the conversion may, at the option of any holder tendering Series A Preferred Stock for conversion, be conditioned upon the closing with the underwriters of the sale of securities pursuant to such offering, in which event the persons entitled to receive the Common Stock upon the conversion of the Series A Preferred Stock shall not be deemed to have converted such Series A Preferred Stock until immediately prior to the closing of such sale of securities.

(c) Corporation Conversion. The Corporation shall have the right in its sole option, at any time, to convert all of the outstanding Series A Preferred Stock shares of the Corporation into shares of the Corporation’s Common Stock (the “Corporation Conversion Right”). Upon the exercise by the Corporation of the Corporation Conversion Right, and the delivery to the holders of written notice of the exercise of such right by the Corporation (the “Corporation Conversion Notice”), each share of Series A Preferred Stock, shall automatically and without any required action by any holder, be converted into that number of fully-paid, non-assessable shares of Common Stock as determined by dividing the Original Purchase Price for the Series A Preferred Stock by $0.24271844660 (the “Company Conversion Price” and together with the Series A Preferred Conversion Price, as applicable, the “Conversion Price”).

(1) The Corporation is not required to receive any confirmation that such Corporation Conversion Notice was received by any holder, but instead assuming such Corporation Conversion Notice was sent to the address which the Corporation then has on record for such holder, the Corporation Conversion Notice shall be treated as received by the holder for all purposes on the third (3rd) Business Day following the date such notice was sent by the Corporation (the “Corporation Conversion Notice Reception Date”). Within ten (10) Business Days following the Corporation Conversion Notice Reception Date, the Corporation shall issue to each holder all shares of Common Stock which such holder is due in connection with the Corporation Conversion Right (the “Corporation Conversion Shares”) and promptly deliver such Corporation Conversion Shares to the address of holder which the Corporation then has on record (the “Delivery”). The Corporation Conversion Shares issuable in connection with a Corporation Conversion Right shall be fully-paid, non-assessable shares of Common Stock. Unless the holder provides a valid opinion from an attorney stating that such Corporation Conversion Shares can be issued free of restrictive legend, which shall be determined by the Corporation in its sole discretion, prior to the issuance date of such Corporation Conversion Shares, such Corporation Conversion Shares shall be issued as Restricted Shares. “Business Day” means a day in which a majority of the banks in the State of California in the United States of America are open for business. “Restricted Shares” means shares of the Corporation’s Common Stock which are restricted from being transferred by the holder thereof unless the transfer is effected in compliance with the Securities Act of 1933, as amended and applicable state securities laws.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 5 of 13

(2) The issuance and Delivery by the Corporation of the Corporation Conversion Shares shall fully discharge the Corporation from any and all further obligations under the Series A Preferred Stock and shall automatically, and without any required action by the Corporation or the holder, result in the cancellation, termination and invalidation of any outstanding Series A Preferred Stock and certificates evidencing such Series A Preferred Stock held by holder or his, her or its assigns and shall fully discharge any and all requirement for the Corporation to pay any Dividends, which Preferred Stock shall cease accruing Dividends upon the exercise of the Corporation Conversion Right.

(3) The Corporation and/or the Corporation’s Transfer Agent shall be authorized to take whatever action necessary, if any, following the issuance and Delivery of the Corporation Conversion Shares to reflect the cancellation of the Series A Preferred Stock subject to the Corporation Conversion Right, which shall not require the approval and/or consent of any holder or the return to the Corporation of any certificates evidencing Series A Convertible Preferred Stock (a “Cancellation”).

(4) Notwithstanding the above, each holder shall, whenever and as reasonably requested by the Corporation and the Transfer Agent, at its sole cost and expense, do, execute, acknowledge and deliver any and all such other and further acts, deeds, assignments, transfers, conveyances, confirmations, powers of attorney and any instruments of further assurance, approvals and consents as the Corporation or the Transfer Agent may reasonably require in order to complete, insure and perfect the Cancellation (including, but not limited to delivering the Series A Preferred Stock Stock certificates, if requested), if such may be reasonably required by the Corporation and/or the Corporation’s Transfer Agent.

(5) In the event that the Delivery of any Corporation Conversion Shares is unsuccessful and/or any holder fails to accept such Corporation Conversion Shares, such Corporation Conversion Shares shall be held by the Corporation and/or the Transfer Agent in trust and shall be released to such holder upon reasonable evidence to the Corporation or the Transfer Agent that such holder is the legal owner of such Corporation Conversion Shares, provided that the holder’s failure to accept such Corporation Conversion Shares and/or the Corporation’s inability to Deliver such shares shall in no event effect the validity of the Cancellation.

(e) [Intentionally Removed.]

(e) Adjustments to Conversion Price for Certain Diluting Issues.

(i) Special Definitions. For purposes of this Subsection 4(e)(i), the following definitions apply:

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 6 of 13

(A) “Options” shall mean rights, options, or warrants to subscribe for, purchase or otherwise acquire either Common Stock or Convertible Securities (defined below).

(B) “Original Issue Date” shall mean the date on which a share of Series A Preferred Stock was first issued.

(C) “Convertible Securities” shall mean any evidences of indebtedness, shares (other than Common Stock and Series A Preferred Stock) or other securities convertible into or exchangeable for Common Stock.

(D) “Additional Shares of Common Stock” shall mean any shares of the capital stock of the Corporation, whether now authorized or not, and rights, options or warrants to purchase such shares, and securities of any type whatsoever that are, or may become, convertible into such shares; provided that the term “Additional Shares of Common Stock” does not include shares of Common Stock issued: (1) upon conversion of Series A Preferred Stock; (2) pursuant to the exercise, exchange or conversion of Options or Convertible Securities or other common stock purchase rights issued (or to be issued) to employees, officers or directors of, or consultants, counsel or advisors to, or any strategic ally of or investor in, the Corporation pursuant to any stock purchase or stock option plan or other arrangement approved by the Board of Directors; (3) pursuant to the exercise of options, warrants or any convertible debt outstanding as of the date of the final closing date of the sale of Series A Preferred Stock (“Final Closing Date”); (4) in connection with the acquisition of all or part of another entity by stock acquisition, merger, consolidation or other reorganization, or by the purchase of all or part of the assets of such other entity (including securities issued to persons formerly employed by such other entity and subsequently hired by the Corporation or an affiliate of the Corporation and to any brokers or finders in connection therewith) where the Corporation or its stockholders own more than fifty percent (50%) of the voting power of the acquired, surviving, combined or successor company; (5) to financial institutions, strategic or institutional investors or bona fide commercial partners, or lessors in connection with credit arrangements, equipment financings or similar transactions approved by the Board of Directors, but shall not include a transaction in which the Corporation is issuing securities primarily for the purpose of raising capital or to an entity whose primary business is investing in securities; (6) as a dividend or other distribution on the Series A Preferred Stock; (7) upon the exercise of any warrants issued to any placement agent or its designees in connection with the placement of the Series A Preferred Stock; and (8) any right, option or warrant to acquire any securities convertible into the securities excluded from the definition of Additional Shares of Common Stock pursuant to subsections (1) through (8) above.

(ii) No Adjustment of Conversion Price. Notwithstanding anything to the contrary, no adjustment of the Conversion Price shall be made in respect of the issuance of Additional Shares of Common Stock unless the consideration per share (determined pursuant to Subsection 4(e)(iv) hereof) for an Additional Share of Common Stock issued or deemed to be issued by the Corporation is at least $0.01 less than the Conversion Price in effect on the date of and immediately prior to such issue; provided that any adjustment in an amount less than $0.01 per share shall be carried forward and taken into account in any subsequent adjustment.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 7 of 13

(iii) Deemed Issue of Additional Shares of Common Stock. In the event the Corporation at any time or from time to time after the Original Issue Date shall issue any Options (except for Options issued pursuant to Subsection 4(e)(i)(D) herein) or Convertible Securities or shall fix a record date for the determination of holders of any class of securities entitled to receive any such Options or Convertible Securities, then the maximum number of shares (as set forth in the instrument relating thereto without regard to any provisions contained therein for a subsequent adjustment of such number) of Common Stock issuable upon the exercise of such Options or, in the case of Convertible Securities and Options therefor, the conversion or exchange of such Convertible Securities, shall be deemed to be Additional Shares of Common Stock issued as of the time of such issue or, in case such a record date shall have been fixed, as of the close of business on such record date, provided that in any such case in which Additional Shares of Common Stock are deemed to be issued:

(A) no further adjustment in the Conversion Price shall be made upon the subsequent issue of Convertible Securities or shares of Common Stock upon the exercise of such Options or conversion or exchange of such Convertible Securities;

(B) if such Options or Convertible Securities by their terms provide, with the passage of time or otherwise, for any increase in the consideration payable to the Corporation, or decrease in the number of shares of Common Stock issuable, upon the exercise, conversion or exchange thereof, the Conversion Price computed upon the original issue thereof (or upon the occurrence of a record date with respect thereto), and any subsequent adjustments based thereon, shall, upon any such increase or decrease becoming effective, be recomputed to reflect such increase or decrease insofar as it affects such Options or the rights of conversion or exchange under such Convertible Securities; and

(C) no readjustment pursuant to clause (B) above shall have the effect of increasing the Conversion Price to an amount which exceeds the lower of (1) the Conversion Price on the original adjustment date, or (2) the Conversion Price that would have resulted from any issuance of Additional Shares of Common Stock between the original adjustment date and such readjustment date.

(iv) Adjustment of Conversion Price Upon Issuance of Additional Shares of Common Stock. In the event the Corporation, at any time after the Original Issue Date shall issue Additional Shares of Common Stock, without consideration or for a consideration per share at least $0.01 per share less than the Conversion Price in effect on the date of and immediately prior to such issue, then and in such event, the Conversion Price shall be reduced, concurrently with such issue, to a price equal to the consideration per share received by the Corporation for such issue or deemed issue of the Additional Shares of Common Stock; provided that if such issuance or deemed issuance was without consideration, then the Corporation shall be deemed to have received an aggregate of $0.01 of consideration for all such Additional Shares of Common Stock issued or deemed to be issued. For the purposes of adjusting the Conversion Price, the issue of Additional Shares of Common Stock issued at the same price at two or more closings held within thirty (30) days of each other shall be aggregated and shall be treated as one issue of Additional Shares of Common Stock occurring on the earliest date on which such securities were issued.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 8 of 13

(v) Determination of Consideration. For purposes of this Subsection 4(e), the consideration received by the Corporation for the issue of any Additional Shares of Common Stock shall be computed as follows:

(A) insofar as it consists of cash, be computed at the aggregate amount of cash received by the Corporation excluding amounts paid or payable for accrued interest or accrued dividends;

(B) insofar as it consists of property other than cash, be computed at the fair value thereof at the time of such issue, as determined in good faith by the Board; and

(C) in the event Additional Shares of Common Stock are issued together with other shares or securities or other assets of the Corporation (“Related Securities”) for consideration which covers both, be the proportion of such consideration so received, computed as provided in Subsections 4(e)(v)(A) and 4(e)(v)(B) above, as determined in good faith by the Board of Directors, based on the actual consideration paid for the Additional Shares of Common Stock less the fair market value of the Related Securities.

(D) The consideration per share received by the Corporation for Additional Shares of Common Stock deemed to have been issued pursuant to Section 4(e)(iii), relating to Options and Convertible Securities, shall be determined by dividing (x) the total amount, if any, received or receivable by the Corporation as consideration for the issue of such Options or Convertible Securities, plus the minimum aggregate amount of additional consideration (as set forth in the instruments relating thereto, without regard to any provision contained therein for a subsequent adjustment of such consideration) payable to the Corporation upon the exercise of such Options or the conversion or exchange of such Convertible Securities, or in the case of Options for Convertible Securities, the exercise of such Options for Convertible Securities and the conversion or exchange of such Convertible Securities, by (y) the maximum number of shares of Common Stock (as set forth in the instruments relating thereto, without regard to any provision contained therein for a subsequent adjustment of such number) issuable upon the exercise of such Options or the conversion or exchange of such Convertible Securities.

(f) (i) Adjustments for Combinations or Subdivisions of Common Stock. In the event that at any time after the date the Series A Preferred Stock is first issued, the outstanding shares of Common Stock shall be subdivided (by forward stock split, stock dividend or other like occurrence) into a greater number of shares of Common Stock, and no equivalent subdivision or increase is made with respect to the Series A Preferred Stock, the Conversion Price then in effect shall, concurrently with the effectiveness of such subdivision or other increase, be proportionately decreased. In the event that the outstanding shares of Common Stock shall be combined or consolidated into a lesser number of shares of Common Stock (by reverse split or otherwise), and no equivalent combination or consolidation is made with respect to the Series A Preferred Stock, the Conversion Price then in effect shall, concurrently with the effectiveness of such combination or consolidation, be proportionately increased.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 9 of 13

(ii) Adjustments for Stock Dividends and Other Distributions. If the Corporation at any time pays a dividend, with respect to its Common Stock only, payable in shares of Common Stock or rights to purchase shares of Common Stock, without any comparable payment or distribution to the holders of Series A Preferred Stock, then the Conversion Price shall be proportionally reduced as at the date the Corporation fixes as a record date for the purpose of receiving such dividend (or if no such record date is fixed, as at the date of such payment) to that price determined by multiplying the applicable Conversion Price in effect immediately prior to such record date (or if no record date is fixed then immediately prior to such payment) by a fraction (x) the numerator of which shall be the total number of shares of Common Stock outstanding and those issuable with respect to other securities or rights convertible into, or entitling the holder thereof to receive directly or indirectly, additional shares of Common Stock (“Common Stock Equivalents”), prior to the payment of such dividend, and (y) the denominator of which shall be the total number of shares of Common Stock outstanding and those issuable with respect to such shares of Common Stock Equivalents immediately after the payment of such dividend (plus, in the event that the Corporation paid cash for fractional shares, the number of additional shares which would have been outstanding had the Corporation issued fractional shares in connection with such dividend). In the event the Corporation at any time or from time to time makes, or fixes a record date for the determination of holders of Common Stock entitled to receive any distribution (excluding any repurchases of securities by the Corporation not made on a pro rata basis from all holders of any class of the Corporation's securities) payable in property or in securities of the Corporation other than shares of Common Stock, and other than as otherwise adjusted in this Section 4 or as provided in Section 1, then and in each such event the holders of Preferred Stock shall receive at the time of such distribution, the amount of property or the number of securities of the Corporation that they would have received had their Preferred Stock been converted into Common Stock on the date of such event.

(iii) Adjustments for Reclassification, Exchange and Substitution. If any capital reorganization or reclassification of the capital stock of the Corporation (other than as a result of a stock dividend, subdivision or combination of shares or any other event described in Sections 4(f)(1) or 4(f)(ii) (a “Corporate Change”) shall be effected in such a way that holders of Common Stock shall be entitled to receive capital stock, other securities or property with respect to or in exchange for Common Stock, then, as a condition of such Corporate Change, lawful and adequate provisions shall be made whereby each holder of a share or shares of Series A Preferred Stock shall, upon conversion, receive such kind and shares of capital stock, other securities or property as may be issued or payable with respect to or in exchange for the number of shares of such Common Stock into which the Series A Preferred Stock held at the time of such Corporate Change shall have been convertible. In the event of any Corporate Change, appropriate adjustment shall be made in the application of the provisions herein set forth with respect to the rights and interests thereafter of the holders of the Series A Preferred Stock, to the end that the provisions set forth herein shall thereafter be applicable, as nearly as reasonably may be, in relation to any shares of capital stock, other securities or property thereafter receivable upon conversion of the Series A Preferred Stock. The Corporation shall not effect any Corporate Change unless, prior to the consummation of such Corporate Change, the successor or combined corporation (if other than the Corporation) or the acquiring corporation, by written instrument, undertakes the obligations of the Corporation described in the first sentence of this Section 4(f)(iii) and assumes the obligation to deliver to each holder of Series A Preferred Stock such shares of capital stock, other securities or property that the holder is entitled to receive in accordance with this Section 4(f)(iii).

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 10 of 13

(g) No Impairment. The Corporation will not, by amendment of its Articles of Incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation but will at all times in good faith assist in the carrying out of all the provisions of this Section 4 and in the taking of all such action as may be necessary or appropriate in order to protect the Conversion Rights of the holders of the Series A Preferred Stock against impairment.

(h) Issue Taxes. The Corporation shall pay any and all issue and other taxes that may be payable in respect of any issue or delivery of shares of Common Stock on conversion of shares of Series A Preferred Stock pursuant hereto; provided, however, that the Corporation shall not be obligated to pay any transfer taxes resulting from any transfer requested by any holder in connection with any such conversion.

(i) Reservation of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock, solely for the purpose of effecting the conversion of the shares of the Series A Preferred Stock, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of the Series A Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Series A Preferred Stock, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to this Certificate.

(j) Fractional Shares. No fractional share shall be issued upon the conversion of any share or shares of Series A Preferred Stock. All shares of Common Stock (including fractions thereof) issuable upon conversion of more than one share of Series A Preferred Stock by a holder thereof shall be aggregated for purposes of determining whether the conversion would result in the issuance of any fractional share. If, after the aforementioned aggregation, the conversion would result in the issuance of a fraction of a share of Common Stock, the Corporation shall, in lieu of issuing any fractional share, issue such applicable holder an additional share of Common Stock.

(k) Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment of the Conversion Price pursuant to this Section 4, the Corporation at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof and furnish to each holder of Preferred Stock a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, upon the written request at any time of any holder of Series A Preferred Stock, furnish or cause to be furnished to such holder a like certificate setting forth (i) such adjustments and readjustments, (ii) the Conversion Price, at the time in effect, and (iii) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of the Series A Preferred Stock.

(l) Notices of Record Date. Subject to Section 3(b) above, in the event that the Corporation shall propose at any time:

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 11 of 13

(a) to declare any dividend or distribution upon its Common Stock, whether in cash, property, stock or other securities, whether or not a regular cash dividend and whether or not out of earnings or earned surplus;

(b) to offer for subscription pro rata to the holders of any class or series of its stock any additional shares of stock of any class or series or other rights;

(c) to effect any reclassification or capitalization of its Common Stock outstanding involving a change in the Common Stock; or

(d) to merge or consolidate with or into any other Corporation, or sell, lease or convey all or substantially all its property or business, or to liquidate, dissolve or wind up,

Then, in connection with each such event, the Corporation shall send to the holders of Series A Preferred Stock:

(1) in the case of the matters referred to in (a) and (b) above, at least twenty (20) days' prior written notice of the date on which a record shall be taken for such dividend, distribution or subscription rights (and specifying the date on which the holders of Common Stock shall be entitled thereto) or for determining rights to vote in respect of the matters referred to in (a) and (b) above; and

(2) in the case of the matters referred to in (c) and (d) above, at least thirty (30) days' prior written notice of the date when the same shall take place (and specifying the date on which the holders of Common Stock shall be entitled to exchange their Common Stock for securities or other property deliverable upon the occurrence of such event).

Each such written notice shall be delivered personally or given by first class mail, postage prepaid, addressed to the holders of the Series A Preferred Stock at the address for each such holder as shown on the books of the Corporation.

5. Redemption. The Series A Preferred Stock shall not be redeemable by the Corporation.

6. Amendment. Subject to Section 3(b)(vi), any term relating to the Series A Preferred Stock may be amended and the observance of any term relating to the Series A Preferred Stock may be waived (either generally or in a particular instance and either retroactively or prospectively) only with the vote or written consent of holders of at least a majority of the shares of the Series A Preferred Stock then outstanding. Any amendment or waiver so effected shall be binding upon the Corporation and any and all holders of shares of Series A Preferred Stock.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 12 of 13

7. Miscellaneous.

|

(a)

|

The headings of the various sections and subsections of this Certificate of Designation are for convenience of reference only and shall not affect the interpretation of any of the provisions of this Certificate of Designation.

|

|

(b)

|

Whenever possible, each provision of this Certificate of Designation shall be interpreted in a manner as to be effective and valid under applicable law and public policy. If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions of this Certificate of Designation. No provision herein set forth shall be deemed dependent upon any other provision unless so expressed herein. If a court of competent jurisdiction should determine that a provision of this Certificate of Designation would be valid or enforceable if a period of time were extended or shortened, then such court may make such change as shall be necessary to render the provision in question effective and valid under applicable law.

|

|

(c)

|

Except as may otherwise be required by law, the shares of the Preferred Stock shall not have any powers, designations, preferences or other special rights, other than those specifically set forth in this Certificate of Designations.

|

|

(d)

|

Shares of the Series A Preferred Stock converted into Common Stock shall be retired and canceled and shall have the status of authorized but unissued shares of Preferred Stock of the Corporation undesignated as to series and may with any and all other authorized but unissued shares of Preferred Stock of the Corporation be designated or redesignated and issued or reissued, as the case may be, as part of any series of Preferred Stock of the Corporation.

|

|

(e)

|

With respect to any notice to a holder required to be provided hereunder, such notice shall be mailed to the registered address of such holder, and neither failure to mail such notice, nor any defect therein or in the mailing thereof, to any particular holder shall affect the sufficiency of the notice or the validity of the proceedings referred to in such notice with respect to the other holders or affect the legality or validity of any redemption, conversion, distribution, rights, warrant, reclassification, consolidation, merger, conveyance, transfer, dissolution, liquidation, winding-up or other action, or the vote upon any action with respect to which the holders are entitled to vote. All notice periods referred to herein shall commence on the date of the mailing of the applicable notice. Any notice which was mailed in the manner herein provided shall be conclusively presumed to have been duly given whether or not the holder receives the notice.

|

IN WITNESS WHEREOF, this Amended and Restated Certificate of Designation of Preferences, Rights and Limitations of the Corporation’s Series A Convertible Preferred Stock is executed on behalf of the Corporation by the Co-Chairman of the Board of Directors and Chief Executive Officer of the Corporation this 4th day of October 2013.

Amended and Restated Designation of

Series A Convertible Preferred Stock of

Overnear, Inc.

Page 13 of 13