Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - ARX Gold Corp | arx_10ka2-ex3101.htm |

| EX-32 - CERTIFICATION - ARX Gold Corp | arx_10ka2-ex3200.htm |

| EX-32.2 - CERTIFICATION - ARX Gold Corp | arx_10ka2-ex3102.htm |

| 10-K/A - AMENDMENT NO. 2 TO FORM 10-K - ARX Gold Corp | arx_10ka2.htm |

Exhibit 10.3

Definitive Feasibility Study

ARX Gold Corporation

For mining project located in

Wide Bay Burnett Region,

Queensland, Australia

March 2013

| 1 |

To,

Attn Mr Brian Smith

ARX Resources Corp.

Level 13 - 40 Creek St. 130309-CH-ARXGC-2-L001

Brisbane,

Queensland,

4000

Report prepared by

COCCIARDI HOLDINGS PTY LTD

Unit 4, 2 Fiveways Boulevard

Keysborough, Victoria 3173, Australia

Phone: +61 3 9798 2633

Fax: +61 3 9798 2422

Peter Cocciardi,

Director.

Peterc@cocciardi.com.au

Effective Dated: 9th March 2013

| 2 |

|

COCCIARDI HOLDINGS PTY LTD Unit 4, 2 Fiveways Boulevard Keysborough, Victoria 3173, Australia Phone: +61 3 9798 2633 Fax: +61 3 9798 2422 http://www.cocciardi.com.au/ |

To,

Attn Mr Biran Smith

ARX Gold Corporation 130309-CH-ARXGC-2-L001

Level 13 - 40 Creek St.

Brisbane,

Queensland,

4000

Dear Sir,

ARX GOLD CORPORATION

GOLD PROJECTS IN THE WIDE BAY BURNETT REGION,

QUEENSLAND, AUSTRALIA

| • | These statements are based on ARX Gold Corps’ current plans and expectations and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be different from any further results, performance and achievements expressed or implied by these statements. |

| • | The information provided in this documents is available for the assistance only of ARX Gold Corp’ and is not intended to be and must not be taken alone as the basis for an investment decision. Where required, any potential investor should make further investigations as it deems necessary to arrive at an independent evaluation of the project. In regards to this overview summary, there has been no consultation of legal counsel and financial, accounting, regulatory and tax advisors to determine the consequences of any proposal for the project. |

| 3 |

| • | The report is to be read and its use must be in conjunction with the following disclaimer: CHPL do not accept any liability to any individual, organization or company and takes no responsibility for any loss or damage arising from the use of this report information data or assumptions contained. Achievability of life of mine plans, project plans, budgets and forecasts are inherently uncertain. Consequently actual results may be significantly more or less favorable. This report includes technical information, which assumes historical accuracy of data, and future prospective results, which may be subjective. We retain the right to change and or modify conclusions as further information becomes available. CHPL assumes no liability for the accuracy of the information provided within this report. |

| • | The report on the project, referred to, as the ARX Gold Corporation Project does not address potential corporate structure, individual interests or avenues for new participants in the project. I have been informed that ARX Gold Corporation is the intended holding company for Arx Springs Pte Ltd, Singapore which owns two subsidiary companies ARX Springs Pty Ltd, Australia and ARX Pacific Resources Pty Ltd, Australia. It also includes financial evaluations and analyses as provided by external parties with significant experience in these areas. References to ARX Gold Corporation Project are made to provide an overview and summary. Hereinafter, the company shall also be referred to as "ARX Gold Corp". |

Sincerely,

COCCIARDI HOLDINGS PTY LTD

Peter Cocciardi

MANAGING DIRECTOR

| 4 |

TABLE OF CONTENTS

| Executive Summary | 7 |

| Introduction | 7 |

| About the Project | 7 |

| Current Status of the Project | 7 |

| Satellite images of ARX Gold Corporation Project Sites | 8 |

| Financial Analysis Summary | 9 |

| Important Risks and Opportunities | 10 |

| Conclusions and Recommendations | 11 |

| Main Report | 12 |

| Introduction | 12 |

| History of the Area | 13 |

| Tenure | 19 |

| Permits/ Bonds | 19 |

| Ownership and Permits | 20 |

| About Riverstone Resources | 21 |

| Terms of the Agreement with Riverstone | 23 |

| Application of BRI Microfine Technology | 23 |

| Terms of the Sub-License between BRI and the Project | 25 |

| Local Characteristics | 26 |

| Geology & Resource | 26 |

| Preliminary Operations | 29 |

| Plant & Treatment of Stockpile | 30 |

| Access | 31 |

| Accommodation | 32 |

| Plant Site | 32 |

| Tailings | 32 |

| 5 |

| Water | 32 |

| Power | 33 |

| Site Buildings | 33 |

| Mobile Equipment | 33 |

| Communications | 33 |

| Rehabilitation | 34 |

| Infrastructure Summary | 34 |

| Financial | 35 |

| Capital Cost Summary | 35 |

| Production Data | 37 |

| Economic Evaluation | 38 |

| Valuation Methodology | 38 |

| Royalties | 38 |

| Taxation | 38 |

| Cash Flows | 39 |

| Net Present Values and Sensitivities | 40 |

| NPV Sensitivity – Single Parameter Analysis | 40 |

| NPV Sensitivity – Twin Parameter Analysis | 41 |

| Payback | 42 |

| Important Risks and Opportunities | 42 |

| Interpretation and Conclusions | 42 |

| Recommendations | 42 |

| Appendix 1: Assay Reports | 43 |

| References | 77 |

| Date and Signature | 77 |

| Report Distribution Record | 77 |

| 6 |

Executive Summary

Introduction

ARX Gold Corporation wishes to evaluate a proposed mining project with Australian interests in a mining property in the Wide Bay Burnett Region in central Queensland. We have been engaged by ARX Gold Corp to update information for this project. The project can be operated in stages however for the purpose of this report there is not a significant difference in referring to the project as a whole.

About the Project

The ARX Gold Corp Gold Project (gold project) is located about 25 km East of Eidsvold in the Wide Bay Burnett Region of Queensland. The project site is situated at Coonambula on Cheltenham Road, (nearest town is Eidsvold) within a quarry and extractive industries operation. The project site is referred to as the ARX Springs Site.

The ARX Springs site is located on the first stage of this extraction site. The ARX Pacific Resources site is located in the second stage. The staging of the extractive operations does not impose onerous conditions on proposed mining and processing production by ARX Gold Corp.

The deposit is described as alluvial grade sand and gravel resource with a varying depth of resource and for Phase 1 (ARX Springs) the project is contained within a continuous surface area of 600 ha and for phase 2 (ARX Pacific Resources) the project is contained within a continuous surface area 1000 ha. Average depth of resources estimated from extensive drilling is at between 15 m to 20 m. For the sake of this report we have assumed a conservative 12.5m average depth over the project site resulting in an estimated 200,000,000 cu metres of treatable material.

The total resource is estimated to be between 300,000,000 tonnes and 320,000,000 tonnes of treatable material. The estimated recovery is based on assumptions of average low-grade recovery using BRI Microfine process at an average of only 1.8 gpt giving a targeted recovery of between 16,000,000 ounces and 18,000,000 ounces of gold from the current resource area. This targeted recovery is dependent upon operational factors once the project is in production and the consistent average recovery of the targeted yield.

Current Status of the Project

| • | The ARX Springs project is ready to start the construction phase and quickly move into production. We have verified with relevant agencies on the required permits and licenses and the required permits are in place for production to commence subject to specific building permits in relation to the construction of the processing plant. |

| • | Ownership: Riverstone Resources Pty Ltd is the extractive Industries license holder and has provided exclusive treatment farm-in agreements for mining to ARX Springs Pty Ltd and ARX Pacific Resources Pty Ltd. |

| • | Environmental, planning and local permits are issued and current. |

| • | Treatment rights have been granted specifically utilising existing mining license. |

| • | Technology sub license for BRI Microfine process has been signed. |

| • | Permits are in place with further requirement of mining plan and mining license application. |

| • | Additional survey of the specific surface area of the project is to be initiated. |

| • | A Joint application toward securing additional mining licence as expansion of existing permits. |

| 7 |

Satellite images of ARX Corp Gold Project Sites

| 8 |

Financial Analysis Summary

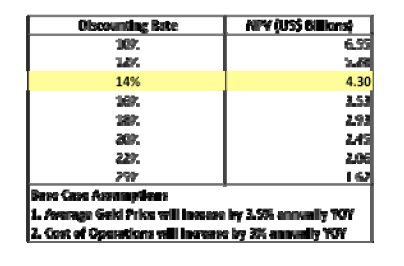

The ARX Gold Corp Gold Project feasibility study uses discounted cash flow techniques to determine a Net Present Value (‘NPV’) for the Project in real terms. The NPV is derived after royalties and tax, is ungeared and based on real cash flows. The effective date of the financial evaluation is March 1, 2012.

The Life of Mine (LOM) is 20 years, which includes an initial two- yea r design and construction phase and subsequent capacity expansion over the next 8 years. The Gold prices used to develop the base case in the financial model are based on the current market price of gold and reasonable estimates of market prices in the future. Included is a detailed sensitivity analysis to test the various parameters for both revenue and costs.

| 9 |

The NPV (14%) in real terms amounts to US$ 4.29 billion. Payback on capital is 3.5 years (2.5 years following commissioning). Total capital expenditure over the construction period is US$ 400 million with a peak funding requirement of US$ 60 million each in years 9 and 10.

Project sensitivities to revenue, capital and operating costs are shown in the following tables in the report. The base case sensitivity analysis of the variation in NPV at various discounting rates is shown below

Base Case Sensitivity Analysis (variation in NPV at various discount rates)

Important Risks and Opportunities

The project assessment indicated certain risks and opportunities, which should be evaluated in further detail by ARX Gold Corp in order to assess the complete returns on the project. The key risks and opportunities are:

Risks

| • | Delay in establishing the initial production plant and consequently the financial impact on the project; |

| • | Decline in global demand of gold and consequent decrease in prices; |

| • | Increase in the costs of operations of the project by 10% or more on annual basis thereby affecting the margins; |

| • | The BRI Microfine process has not yet been commercially deployed on any project and during the process of developing the initial production plant and deploying the process, there could be unexpected issues and concerns arising out of the deployment of the process. This could delay the project commencement unless alternative processing methods are planned as contingencies; |

Opportunities

| • | The BRI Microfine process has the potential to derive significant improvements in yield from the tailings at the project site. The upside from any potential increase in yield will have significant positive impact on the project returns; |

| • | The Master Agreement in place with Riverstone Resources provides for a total treatment area of 2500 hectares. The phase 1 and 2 as part of this report is for a total area of 1600 hectares and hence there is scope to include a significant additional area as part of the project in future (57.50% of the total area under phase 1 and 2 is the possible additional area for treatment) |

| 10 |

Conclusions and Recommendations

CHPL concludes that ARX Gold Corp Gold Project fulfils financing requirements in terms of payback period (less than 5 years), required returns (>15% real) and that the risk of returning a negative NPV is considered low especially because the yield assumed at 1.8gpt is a conservative assumption. Any possible increases in costs or capital required or drop in commodity prices can be managed with this yield. The possibility of getting better yields is a potential but ARX Gold Corporation should retain conservative assumptions of yield in assessment of the financial viability of the project.

Further, the microfine process adopted for this project is not capital intensive by its very nature and the production plant to be constructed is a modular design. This allows for a higher degree of flexibility to control the capital expansion in accordance with the change in market dynamics such as gold prices and increased costs. Hence, the likelihood of a negative NPV on the project is very low.

CHPL recommends that ARX Gold Corporation progress the project to the detailed design and implementation phase. The various risks and opportunities identified should be closely monitored during the detail design and implementation phase, to take advantage of any further possible optimization.

| 11 |

Main Report

Introduction

The ARX Gold Corp Gold Project is located about 25 km east of Eidsvold in the Wide Bay Burnett Region of Queensland. The project site is situated at Coonambula on Cheltenham Road, (nearest town is Eidsvold) within a quarry and extractive industries operation.

The extractive industries operation has commenced. The project sites are located on the first and second stages of this extraction site, which is located in proximity to an additional extended mining lease area. The staging of the extractive operations does not impose onerous conditions on proposed mining and processing production by ARX Gold Corporation.

The deposit at the sites can be described as alluvial grade sand and gravel resource with a varying depth of resource and for Phase 1 (Arx Springs) the project is contained within a continuous surface area of 600 ha and for phase 2 (Arx Pacific Resources) the project is contained within a continuous surface area 1000 ha. Average depth of resources estimated from extensive drilling is at between 15 m to 20 m.

| 12 |

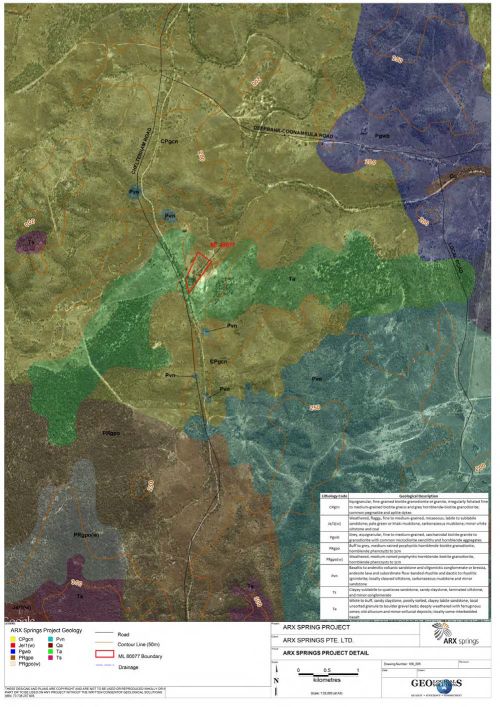

Overlay Image of Project site.

The project site is a tertiary glacial till deposit and the recoverable grade is contained within paleo channels of alluvial sand, gravel and conglomerate associated with gravel beds of old alluvium and minor alluvial deposits. The tertiary glacial till deposit is composed of white to buff, poorly sorted, clayey sandstone, local unsorted granule to boulder gravel beds and the sands associated with the gravel beds.

History of the Area

Gold has historically been found, worked and extracted from the material in vicinity of the project. The mineral interest in this area dates back to the 1880s. The early geological reports identified a tertiary glacial till that extends extensively in the area of the project site. It is within this glacial till that the majority of the alluvial deposits occur and the surveys have indicated the presence of gold.

Gold was discovered in the area in 1888. Production from the nearby St John's Creek field between 1888 and 1937 yielded 313 kg from 15,669 t of ore (19.976gpt). Peak production was achieved in 1890 when 98.35 kg of gold was obtained from 7574 t of ore (12.985gpt). There has been no activity since 1937 reported. The first gold production recorded from the Hungry Hill Creek McKonkeys Creek area was in 1889. The field was worked intermittently until 1901, the total recorded production of 23.32 kg of gold from 938 t of ore (24.861gpt). No records of production from alluvial workings have been found.

| 13 |

A number of shafts were dug which yielded widely varying results. The water accumulating at the bottom of shafts generally defeated the mining.

The shafts are identified by various names, MacPherson's shaft, PC shaft, Harvey's shaft, Capers claim and Gully shaft. Subsequent reports indicated that these older workings were not at the deepest part of the lead. Reports indicated in most places there are two channels at the bottom of the lead both containing gold. Gold was detected at most points close to the bottom of the lead and stream and surface examination confirmed the presence of gold.

The water table exists between 20 feet and 40 feet from the surface. Old sampling of dumps around old shafts show gold that was at least 10 divt per tonne. Sampling of undisturbed shallow ground also showed similar grades. Early miners would not have worked the large numbers of shafts at the depth they did unless they were getting something like 1 ounce to the tonne. Admittedly, this could have been in small pockets.

| 14 |

Overlay Image of Shape of Paleo Channel

You can clearly see the Paleochannel extending through all stages of the project.

Antimony has also been produced from the project site surrounds. Since 1876 the deposits have been worked intermittently. In the period 1953 to 1954, 23.6 t of antimony concentrate was produced from 111.8 t of ore. This area has been known previously under many identities: Spring Gully, McKonkeys Creek, Macpherson’s diggings, PC claim and so forth. Historically the Queensland government geologist William H Rand undertook a geological survey in 1901 over the Eidsvold goldfield and mapped locations, which indicated mineral deposits where the project site today exists. Geological survey was conducted in 1969, which indicated the existence of alluvial gold deposits in and around the vicinity of the project site. Further surveys have been undertaking more recently, Batstone and Cardno in 1984 and Morris and Savory in 1990. Kelly in 1979 conducted a review report of the 1969 survey.

Early prospecting established the presence of an auriferous alluvial lead. Gold was extracted from the old workings by former mining operations in limited amounts but in variable grades up to 5 ounces per tonne. Preliminary surface examination has historically confirmed the presence of gold in the lead. Extensive drilling operations confirmed the presence of two deep channels within the area. Owing to an abundance of clay, which caused severe analytical difficulties the early drilling, was completed without obtaining critical assays. The early analytical techniques at that stage (1969) closely matched systems that were then available for production and it was assumed that production difficulties might be expected.

| 15 |

The ARX Gold Corp Gold Project site and area has a history of intermittent working by small-scale mining and various private operators. The area has been subject to a number of previous investigations and has included reports by Rands (1897, 1901), Saint Smith (1926), Ball (1931) and Denmead (1943). Much of the previous investigations referred to the mining conducted in the area. Previous literature reported that some 51t of ore averaging 27 g per tonne from shafts up to 25 m deep in this area were worked. The best grades were apparently in coarse wash near the base of alluvial sands. Water from the water table discouraged much mining.

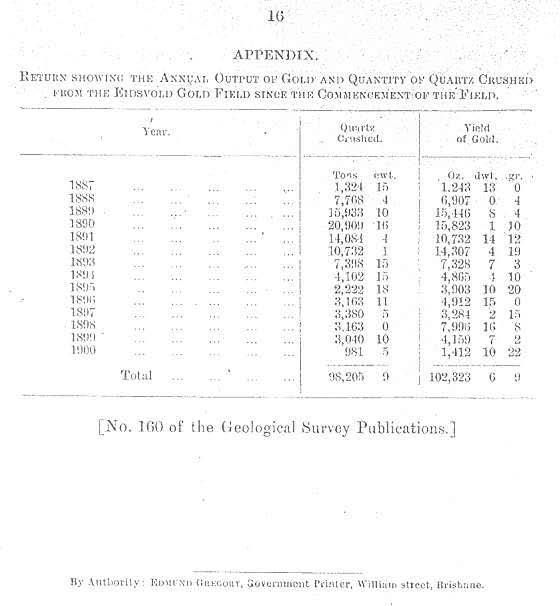

William Rands report of 1901 showing results from 1887 through to 1900.

Total recovery of 102,323 ounces from 98,205 tonnes of ore.

| 16 |

Extracts from the Mining Maps of the Site

| 17 |

| 18 |

There is a long history of small-scale working and exploration on the property and surrounding areas and although reports are available on previous work those reports have not allowed the full potential of the property to be understood. Gold has been detected and recovered since the 1880s however in small disconnected independent operations. Attempts to evaluate the area by larger prospective operations/ companies found gold in low levels and based on the lower gold price before the last decade usually concluded the area and the project site was sub economic.

However three factors now appear to work to ARX Gold Corporations advantage and allow the project to be operated as a low-level long-term project. Firstly the site has been amalgamated into a large continuous area available for treatment so offering volume of the resource and the ability to target low average per tonne grade. Secondly the use of the microfine process increases the viability, as it is one treatment that can target the low micron sized sandy alluvial material where 92% of the potential gold is likely to be found. Thirdly the sustained increase in the price of gold over recent years has made the operation viable.

Tenure

The current project area is approximately 1600 ha. The tenure of the ARX Gold Corp Gold Project is based on a mining lease; extractive industries permit, farm-in style treatment agreements with exclusive licences for the expected life of mine term to treat the anticipated resource.

The mining lease is current until 2014 and it allows immediate production processing work subject to notification to the Queensland Department of Environment and Resource Management. The anticipation is that it will be renewed for a further five years in the ordinary course of business. The extractive industries permit covers all areas of the project. Exclusive treatment agreements have now been signed for the use of the mining licence to treat the project area. Licences have been granted to operating companies on an exclusive basis to mine process and treat for minerals.

The extractive industry licence holder has contracted with ARX Springs Pty Ltd to expand the area of the mining lease in a joint application for additional mining lease grants as an overlay of the existing extractive industries permit. The joint applications will be in the names of Riverstone Resources Pty Ltd, ARX Springs Pty Ltd and ARX Pacific Resources Pty Ltd and will follow standard industry practices and procedures.

Permits/ Bonds

On application for extended mining leases the Queensland Mines Department will assess an increase in the current bond for rehabilitation purposes. There is no reason known to Riverstone Resources or ARX Springs why the bond will not be assessed according to current guidelines and the actual amount of the bond while not yet known is covered by reasonable forward provisions.

The mineral extraction and mining rights will be an overlay of the permits owned by Riverstone Resources. Those permits are in place and allow the extraction of sand, gravel and minerals to an area known as Coonambula Sand Operation.

The sand and gravel operation is forecast to have a production life of 80 years. From the underlying extraction rights Riverstone Resources has granted mining rights for the anticipated life mine terms for all minerals to ARX Springs Pty Ltd and ARX Pacific Resources Pty Ltd. Riverstone Resources will indefinitely operate a sand and gravel operation and in so doing deliver to ARX Springs Pty Ltd screened crushed material for treatment.

| 19 |

As the operation increases in size it is anticipated that primary earthmoving operations will be undertaken by ARX Springs as an expansion of the Riverstone Resources operation. There is no hard rock mining or underground mining involved. There is no need for blasting. There is no requirement for hard rock drilling, sampling or test work.

The relationship between Riverstone Resources and ARX Springs Pty Ltd/ARX Pacific Resources Pty Ltd is one of a Farm-in exclusive treatment rights and licensed mine and with Riverstone Resources operating its own sand and gravel business, there are cost savings to ARX in the supply to it of raw material for processing as part of the relationship. Riverstone Resources is compensated by the payment of royalty on gold extracted.

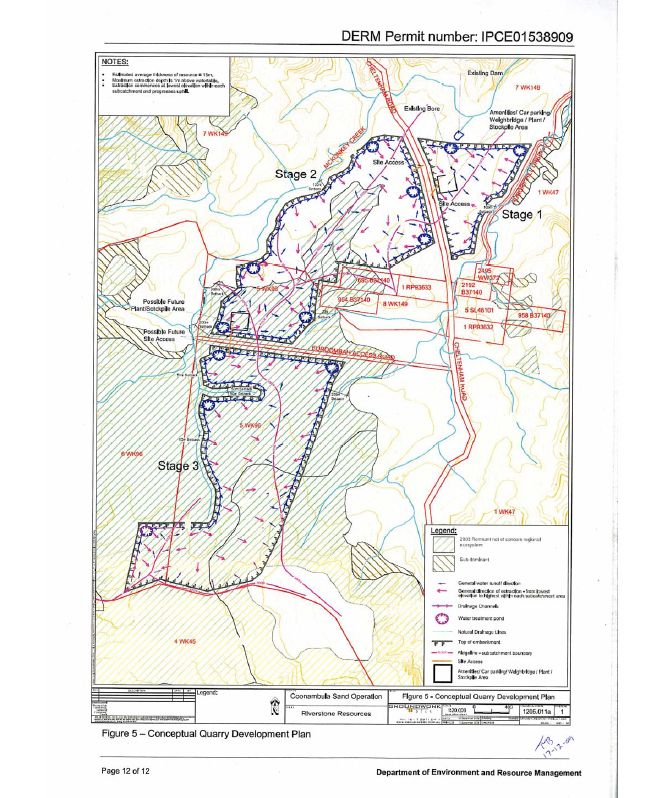

Overlay Image of Extractive Operation & Mineral Area

Ownership and Permits

The ARX Gold Corp Gold Project site is within a large area in total and the resource of this mine site is part of a larger deposit with similar geology. The land upon which the mine site is located comprises a total area in Lot 7, Crown Plan WK96, County of Wicklow, Parish of Boolgal, Title reference 487184; lot 5, Crown Plan WK96, County of Wicklow, Parish of Cheltenham, Title reference 50205095, Lot 6, Crown Plan WK96, County of Wicklow, Parish of Cheltenham, Title reference 50221359, Lot 8, Crown Plan WK149, County of Wicklow, Parish of Boolgal, Title reference 17487185. There is a long history of historical mining rights and licenses granted by the Queensland mines Department in respect of previous workings. The owner is confident that there will be no problems in securing additional mining rights. There is no vegetation, environmental, heritage, and historical, aboriginal or cultural impediments to treatment operations at the mine site.

| 20 |

About Riverstone Resources

Riverstone Resources Pty Ltd is a privately limited liability company, which was primarily established to generate a new supply of river-gravel and decorative stone to the building, and landscape industries in and around Queensland with some export potential also investigated.

Riverstone Resources Pty Ltd and its consultant Mr Bob Lewers worked closely together since early 2008 in establishing extraction rights for sand and river-gravel from some 2500Ha surrounding a Mining lease owned by Riverstone Resources Pty Ltd. His experience in sand & gravel extraction as well as mineral exploration is immense as Bob Lewers is a protégé of the Farley & Lewers company, a well- known Australian quarrying, concrete manufacturing and mining company that were market leaders in the 50's, 60's and 70's throughout NSW and southern Queensland. Bob Lewers has been interested in the subject site and surrounding areas as a source of both precious metals and gravel for over 30 years. The current Managing Director and founder of Riverstone Resources Pty Ltd was previously Managing Director of Coloundra Sand & Gravel a medium sized (30 employees) private company operating in the sand and gravel supply business in South East Queensland for many years.

Riverstone Resources Pty Ltd has obtained all the required permits to operate both for its business and to provide treatment agreements for the mineral extraction. Riverstone Resources Pty Ltd has obtained government planning and development authority and conditions granted with reasons in case No 1789 0f 2011, extraction and environment permits Environmental Authority IPCE01538909 dated 30 June 2009 issued by the State of Queensland Department Environment Resource Management for the extractive industries business and mineral extraction business, a Mining Lease ML 80077, the Environmental Authorities for Mining Lease ML 80077 dated 28 August 2009 and Extractive Industries permit No 175-09 dated 21 September 2011. A copy of the plan approved in DERM permit IPCE01538909 is included.

Riverstone Resources Pty Ltd has consolidated the area, which contains the Arx Springs project so combined extractive operations, and mining operations can be conducted side by side. The management of Arx Springs Pty Ltd, Arx Pacific Resources Pty Ltd and Riverstone Resources Pty Ltd enjoy a good working relationship.

| 21 |

| 22 |

Terms of the Agreement with Riverstone

Riverstone Resources Pty Ltd and Arx Springs Pty Ltd have signed tribute Treatment agreements. The treatment agreements provide exclusive rights to the project for extracting minerals from the mining operations. It contains a license and is subject to royalty payments payable to Riverstone Resources Pty Ltd. The grant of license of mineral extraction rights is for a term until the resource of the project is fully treated or the 25th annual anniversary (March 2037) from the date of agreement to treat.

The company also has the right to occupy and utilise the land until the resource of the project is fully treated or the 25th annual anniversary from the date of its agreement, whichever is the earlier. There is provision in the agreement to extend the term of occupation of the land upon notice, if the resource is not fully treated within 25 years.

The approvals and permits attached to the ARX Springs project are to be utilised freely and in accordance with the tribute treatment agreement. The approvals and permits are available to Celframe ARX Resources Corp Gold Project for use in its business on the project site area. The tribute treatment agreement provides for use of current permits and future and additional permits and approvals to be obtained within the ordinary scope of the development of the treatment operation. Those approvals and permits cover planning, environmental, landowner, local government, business operations, extraction rights, exploration and mining permits, mineral treatment extraction rights, work plans, rehabilitation plans and bonds, roads, power and water.

The company has the right to transport material extracted from the resource of the project to an adjacent property for treatment using a proposed production, processing plant. The land the company is to occupy and the adjacent property share a common boundary and share free access between and over the areas. Vehicle access to the nearest public road is provided for and will be constructed within the scope of the mining work plan. The adjacent property is subject to a treatment agreement between Riverstone Resources Pty Ltd and Arx Pacific Resources Pty Ltd. The treatment agreement has similar terms to the Arx Springs Treatment agreement. The Arx Pacific Resources agreement covers the use of the current permits and mining license, is an exclusive right and license and allows immediate start of mining and processing operations.

Application of BRI Microfine Technology

A report in 1984 on behalf CSR Ltd provided summary information about the area in which the project site is situated. The report refers to the known placer gold deposits occur at the base of a sedimentary sequence of probable Jurassic age. The gold occurs in a mature pebble conglomerate. There is indication that the material ore deposits from which the project has been drawn occurs in a paleo channel where working from the West to East there is a greater volume of coarse gravels overlain by finer sentiments in the West while to the east, there is a significantly less coarse material and a far greater volume of fine sediments in place. There are suggestions of a significant difference in the environment of the deposits of the material probably affected by a tertiary drainage.

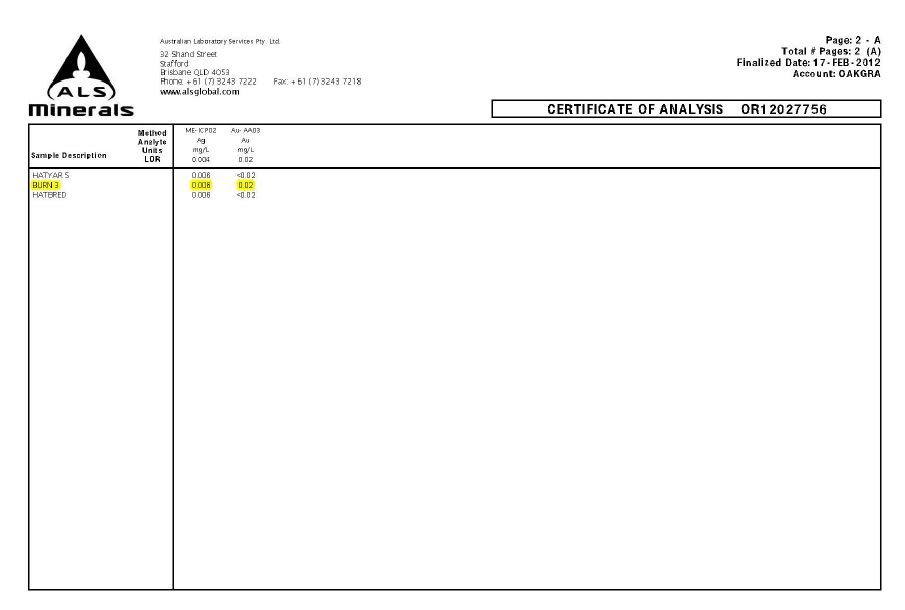

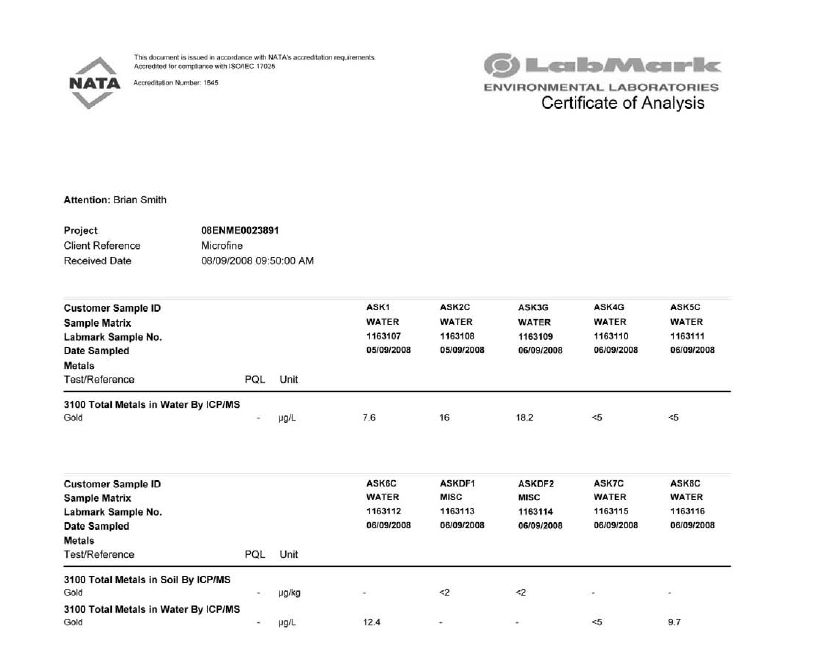

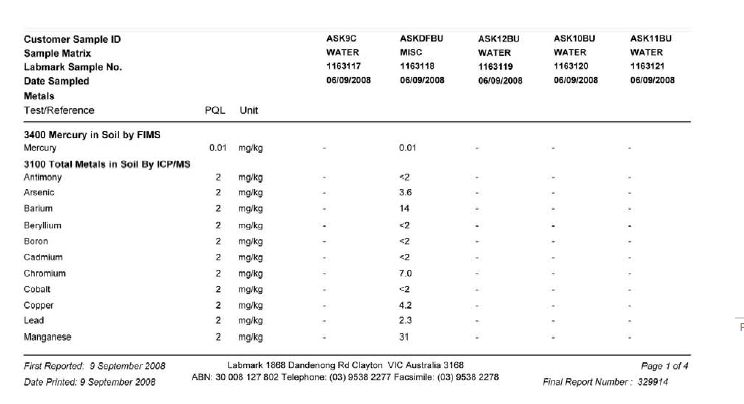

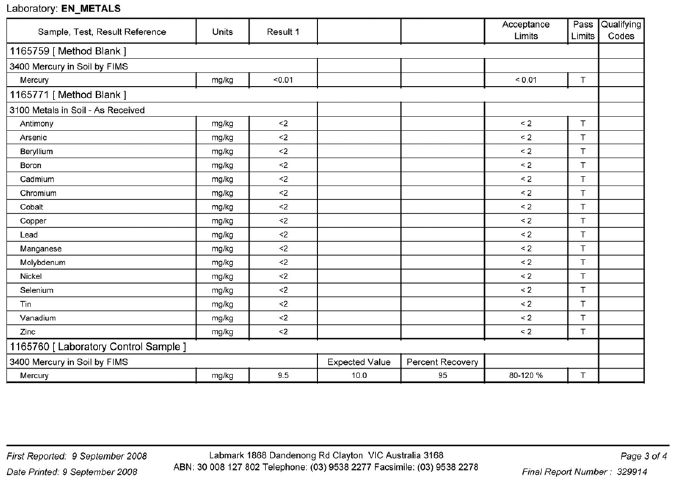

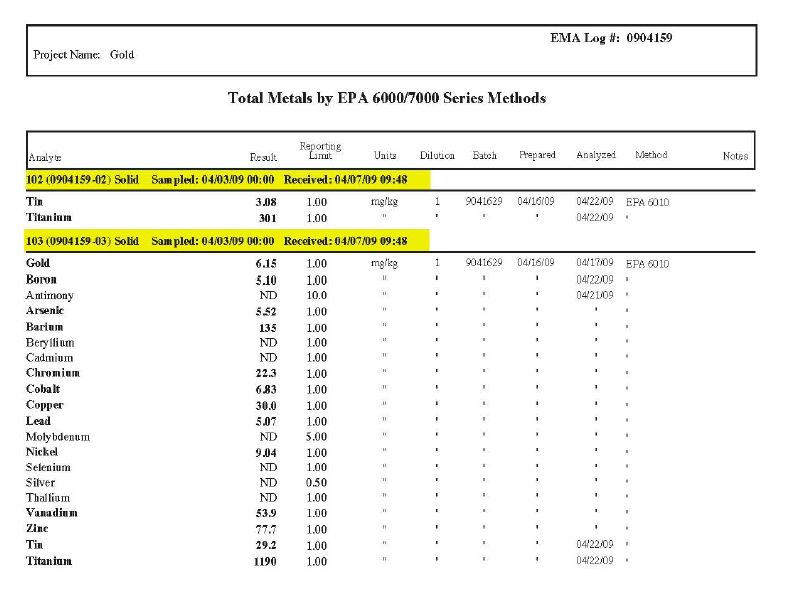

In recent times with development work and the establishment of the extractive industries operation various samples have been taken from in and around the project site area mainly for petrological analysis. Whilst the stone testing was being conducted, samples were also taken and submitted for testing (gold) to three separate labs.

| 23 |

The conventional assays, which resulted from the submission to the labs, show mineral concentration that match with historical archive results relating to this area. The BRI Microfine process has consistently produced superior results than the conventional assays.

Testing of the sand and gravel of samples taken from the ARX Springs Project and the surrounding geological material has shown the BRI Microfine process can recover gold from the project resource. The basis of a potential productive mine operation is twofold, firstly the BRI Microfine process can obtain moderately better results than historical mining on the site notwithstanding it is a low grade alluvial sand deposit and secondly the recent sustained increase in the price of gold. A large-scale mining operation, albeit at low recovery grades, in current times is potentially feasible as the BRI Microfine process may lift recovery from sub economic levels when compared to previous assessments and the price of gold may sustain profitable operations.

The definition of the BRI Microfine process and technology is broadly as an enhanced chemical leaching process which has been shown to concentrate gold, particularly in a Microfine state, from concentrates, ores, tailings, solutions and other friable or pulverized materials even when conventional methods of assay do not disclose the presence of gold and metals or do not disclose the extent of the presence of gold and metals.

Microfine technology is still a relatively new technology process to recover gold and other precious metals that exist in a Microfine form. The BRI Microfine technology aims to recover gold, silver and platinum by processing material at the Microfine level in many cases from existing tailings dumps. Treatment processing is a leaching style mining operation using the BRI Microfine Technology for the treatment of tailings ore. The ore body can be an alluvial source and need not have prior processing. While tailings denote an ore body having appearance of pulverized low micron material whether it be alluvial source, reprocessed or crushed ore it can include alluvial sands.

Independent assessments have been conducted by numerous parties over decades are recited below, Extensive sampling and drilling has been undertaken on the material on the project site and its surrounds. Although there is some disagreement the number of the geological reports referring to this area and sites recommended (when the reports were done) that it was not economically viable to mine the area commercially as the mineral concentration although definitely existing was not noted as overly outstanding. However, in one of the reports of investigation in the area on alluvial material it was noted that the 92.6% of the gold occurred in the -5 mm size material.

Sample testing produced an observation that gold particles appear to be highly uniform in size and screening indicated that some 92% of the gold was contained in the -30-mesh fraction. It is this size material (as a by-product of the extractive industry operation) which is targeted by the Microfine process. The highest gold values recorded in the previous investigations seem to be recorded in a coarse clayey basal wash material and it is intended that the Microfine process by its ability to obtain the gold in coarse clayey material will obtain economic grade.

The extractive industries operation means that the project is not a stand-alone mine and will be able to treat the low micron size material produced from the extractive industries operation and from its own screening and movement of material. The increase in the gold price since all of the previous investigations were undertaken indicates that an economic recovery can be made from what is a low- grade alluvial deposit.

| 24 |

In many cases the estimates of grade were low to uneconomic based on the then prevailing technology for recovering of fine gold from alluvial sands. Microfine technology has tested samples from the total deposit from which the area of this resource is derived and the grade that has been assessed by the Microfine test work is 1 .80 gpt to 2.10 gpt. There are no records of recent gold sales from this property. The historical information contained in reports from the government geologist and seven other independent geologists confirms recovery of gold and antimony.

Samples were taken and submitted to a USA based laboratory with instructions to ascertain assay of gold without allowing for the gold assays to be affected by the abundance of clay component in the sand and gravel samples. The assay results were good, all above the target grade for the project and twice the assay result exceeded 15 g per tonne.

There has been a recent assessment of the project by its owner in his project development and all legal and business matters were successfully completed for the start-up of the sand and gravel component of the extractive industries project. The geology observed on the property during site visits is similar to the geology observed in areas in close proximity to the project. The surface and wildcat drilling gravels are similar in nature to ones observed nearby. The sand and gravel component extends extensively in the north and south direction kilometres either side of the property there is no observable reason why successful alluvial goldmining cannot take place.

Recent inspections vindicated that the historical more recent mining activities have been based on the principle where the mining was blind and it was not based on a mining plan where definable grade block models existed. Many of the previous workings potholes and the gold bearing trenches were not identified in indicated on plans. However, based on test work current observations in available data the area is prospective.

The Assay reports are included in Appendix 1 at the end of this report.

Terms of the SubLicense between BRI and the Project

A technology Sub License has been signed between BRI Microfine Pty Ltd and Arx Springs Pty Ltd. In summary the sub license agreement is a contractual right permitting Arx Springs Pty Ltd and Arx Pacific Resources Pty Ltd exclusive rights to operate a Licensed Business with the utilisation of the Technology for the purpose of recovering gold from friable, or pulverised earth and operate microfine production plants at the site at Arx Springs Wide Bay Queensland.

It is a grant of the use of the technology for the Arx Springs Project. It is exclusive sub license and is limited to the project only. The technology sub license covers the project and is not limited by any term, as it is available at the project site for as long as the resource exists and can be treated. BRI provides the technology, operating management of the plant, operation security and the design build delivery and commissioning of plant and equipment.

For these operations BRI will provide the operating systems, facility management systems and software. During operations BRI will provide technical and operational support and personnel for LOM. At the end of the treatment of the project resource BRI will oversee the dismantling of the plant and equipment.

| 25 |

Local Characteristics

Climate: the area lies within a temperate region with the average rainfall is around 700 mm. approximately 67% falls in the summer months. Normal mean temperature is approximately 25°C. Vegetation; a major portion of the area has been at least partially cleared the more densely vegetated areas being confined to a few hills. Most of the areas covered by low grasses and eucalyptus.

Topography: the topography is generally a low medium relief, which consists of gently undulating hills and plains.

Land use: for beef cattle grazing horse racing and grain growing are the main industries within the area.

Geology & Resource

The project site is a tertiary glacial till deposit and the recoverable grade is contained within paleo channels of alluvial sand, gravel and conglomerate associated with gravel beds of old alluvium and minor alluvial deposits. The tertiary glacial till deposit is composed of white to buff, poorly sorted, clayey sandstone, local unsorted granule to boulder gravel beds and the sands associated with the gravel beds.

| 26 |

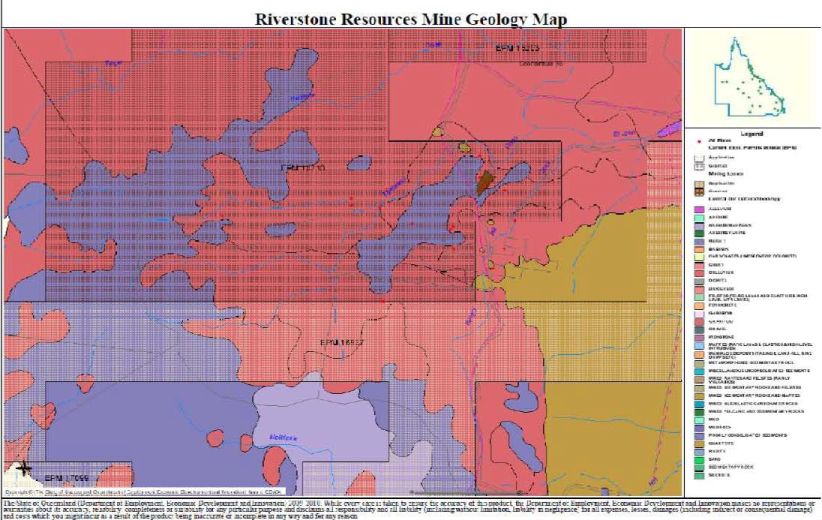

The general characteristics of the area are shown in the table marked Lithology Code in the map.

| 27 |

Numerous geological reports exist which identify that the area has been of interest as a potential source of alluvial mineralisation since the turn of the century. A literature review on the area indicates existence of precious metals and heavy minerals (predominantly gold/antimony, ilmenite, rutile, and zircon) in this area. Minor resources have been historically exploited (indicated by the appearance of many mining leases) in and around this area. A significant degree of interest exists in the exploration potential of the area.

The project site and the mining lease covers a section of Carboniferous Permian Granitoids (Coonambulla Granodiorite and Cheltenham Adamelite ) in the north of the lease area whilst in the south, a series of tertiary glacial till paleo channels host the majority of recorded mineralisation on site. The granitoids are basement to the tertiary alluvium in the area. The maximum-recorded thickness of the alluvial channel is 28 m however it varies significantly in both thickness and lateral extent (800 m to 1500 m). Mineralisation within the placer leads is in the form of ultrafine -5 um-alluvial gold slightly coarser heavy mineral also occurring generally between the -50 um and -150 um fraction. The map illustrates the regional geology of the area and also displays known occurrences of mineralisation. It should be noted that if blind or deep leads within the placer can be identified and delineated then this enrichment could quickly and significant upgrade the quantum of a resource on the mining lease area and the project site.

| 28 |

Preliminary Operations

Riverstone Resources has commenced operations on the site and has begun stockpiling materials for treatment by the ARX Gold Corp Gold Project. Sufficient stockpile has been produced and exists for three months operation of the pilot production plant to be installed. Stockpiling will continue during the construction period of pilot production plant, the initial 10 t per hour processing plant and construction of the first 100 t per hour commercial plant. It is anticipated that by the time of the commissioning of the 10 t per hour initial production plant the stockpile of treated material available to ARX Gold Corp will provide 4 to 6 months of resource available for treatment processing. The topography of the project area is relatively benign and is flat with slightly undulating hills. Riverstone Resources operations confirm the area is conducive to the use of earthmoving equipment. The project sites topography does not represent any major infrastructure or construction obstacles.

The actual mining will consist of earthmoving activities within the paleo channel of Coonambula sand operation. Most of the mining in the sense of obtaining the material for treatment and processing will consist of operations with moderate sized, low risk earthmoving equipment. Some of the equipment is already on site and commissioned and assessments have been made performance of the resource material to loading screening and crushing. No difficulties in loading, screening and crushing the material is anticipated based on the work carried out to date.

First mining of the target resource will occur at local creek level with loaders operating to create working face and long narrow strikes into resource sands away from the creek toward Cheltenham Road.

| 29 |

Open pit extraction of resource is not required for the first 2 to 3 years of production. It may not be required at any time during the life of the mine. However, it is an unknown. Should open pit mining be most efficient method a pit design will be modelled by engineers and plans lodged with the Queensland Mines Department. The design and work plan utilising open pit will conform to the mining and environmental regulations of the Queensland Mines Department. Open pit mining may require reassessment of the bond however it is considered low risk and will not occur in the first three years of operations. Any open pit work will not be extensive as the resource targeted is found in a long paleo channel, which varies in widths with an average depth of 20 m, and an adopted average by ARX is 12.5 m. Sample drilling has logged maximum depth at 35 m in some spots.

The first useful production resource will be obtained by working long strikes in a narrow band and keeping a consistent depth along the strike. Once the first earthmoving strikes have been established the loaders will widen the working face. Loaders will transfer to dump trucks for delivery to the extractive sand, gravel plant for crushing screening and processing.

Plant & Treatment of Stockpile

Stockpile material for treatment by the ARX Springs project will be accumulated next to the extractive industries sand & gravel plant. Stock stockpile material will be handled by the ARX Springs project using a lift loader and conveyor and will follow the design, build, supply, install and commissioning of a series of conveyors and associated feed hoppers for an alluvial sand wash plant.

The purpose of these conveyors is to deliver the Alluvial sand to the process plant and take the wash sand and deposit this into (waste) stockpiles. This will be in preparation for backfill loading to extraction areas. The proposed conveyor systems will feed 10 separate process production lines with an average of 10 tons per hour per production line, with each production line 15 meters apart. Therefore the conveyor feed system will need to accommodate this. Initially the plant will process a total of 100 tons per hour via ten process production lines. These 10 production lines will ultimately increase to 30 production lines, and then the process plant will produce a total output of 300 tons per hour.

The 10tph production lines are a constant process line and are simply replicated to increase overall production. The system being delivered must be capable of dealing with this expansion in production without the need for significant upgrade. The proposed sand conveying system is required to be a covered type conveyor with associated access and maintenance walkways. The site is reasonably flat with only slight undulations.

Location of the proposed process production plant will be nearby to existing sand stockpile but may ultimately be up to 100 metres away from a stockpile location. Various Alluvial sand stockpiles will be situated within a 1 square kilometre project site. The proposed process production plant will treat this alluvial sand taken from the stockpiles. The new stockpile of processed sand will be within 100m of the process plant.

Plant construction will follow the path of off-site assembly; build and test of each plant section in a progressive step up in production capacity. Planned modules will be constructed in discrete operating units; however the overall design allows each unit to work independently as modules. Processing plant will start with a pilot production and 10 t per hour capacity operation. Once commissioned the 10 t per two further modules will expand hour plant module each time until 100 t per hour capacity is achieved. The overall design allows modules to be built from then on at 20 t per hour capacity.

| 30 |

The process plant itself is being designed as an isolated, largely self-contained element that can be replicated as required. The entire process plant will be enclosed within large portal steel shed. This structure will be fully reusable and can be replicated at various locations throughout the site. These sheds will be approx 180m long with a span of approx 60metres.

Its main purpose is to provide protection from the elements for the operators and a heighted level of security over the process. The process will be fully enclosed and therefore unable to be viewed without security clearance. They will contain some laboratory facilities and secure gold room.

The material required to feed the processing plant will be delivered from the stock pile via conveyors, the material will then be processed, then delivered onto another set of conveys and stockpiled ready for drying and delivery back into the site from where it was initially extracted.

As the current process allows for retreatment of the material, a conveyor system allowing for this will be incorporated into the stockpiling conveyor systems. This will allow material requiring processing to be delivered directly from the initial stockpile or from the treated stockpile as required.

The conveyor systems will be let on a design and construct basis. The supplier will be required to provide the design, fabrication, installation, and commissioning and possibly ongoing maintenance of the conveyor systems as part of their contract. This system will incorporate a recovery pit and reclaim conveyor (or similar). The contract will incorporate both incentives and penalties for the handling of the sand thereby, as much as is practical, ensuring the processing capacities and associated timelines. The material will be fed onto the main conveyor system for distribution to the various process lines. The material will ultimately be fed onto each of the process feed lines. These process lines will be nominally 15 meters apart and approx 50 metres long.

The process plant is being designed to allow expansion of capacity of each process line from the initial 10 tph up to 30tph. This will allow the initial plant to commence processing 100tph but quickly move up to 300 tph as design refinements within the process are developed. Modular expansion of the process lines is aimed at lifting the total plant production to approx 450-500tph. It is simply a matter of replicating the entire plant to achieve a plant with 900tph – 1000tph capacity each at multiple locations within the project site.

Access

Access to the site is easy and does not present difficulties for delivery of equipment during construction phase or operation phase. Main roads in Queensland have provided permits for the use of roadways by heavy vehicles. Access within the site is easily constructed on the surface of the project area using loaders and earthmoving equipment utilised in mining.

An upgrade of roads is not acquired for construction and operations traffic. If it is required (and the probability is very low) a gravel airstrip can be constructed on the project site as well as a helipad for personnel transfers and secure air transport. However the townships of Eidsvold and Mundubbera are close by and there are mostly all-weather roads in the area. It is considered more likely that the personnel will transfer to and from the project site on a daily basis.

| 31 |

Accommodation

There is no need to build an accommodation village or overnight accommodation other than for security staff.

Plant Site

The plant site will be located on the site of the existing extractive industries operation. An initial area of 20000 m² has been set-aside in the mining lease for the construction of the initial processing plant. The plant site will not be constrained by mine waste, as tailings will not be a significant cost or operational issue. The site will be moderately levelled and presents very little difficulty with the advantage of the flat topography. Drains will isolate the plant site from run-off for diversion around the plant. Within the plant area, drainage will be collected and recovered to the process.

Tailings

A tailings facility is not required. Microfine processing allows the waste to be stockpiled on site and after a short time to allow for monitoring and drying, the waste will be returned to the extraction areas as backfill. The stockpiling can occur in bunded (with soil) secure low-level indents in the surface area of the project site. The stockpile areas will have diversion drains constructed to minimise capture of rainfall in the stockpile areas. There is sufficient area on the project site to allow process material to be dried by natural weather.

Prior to return to the extraction areas quality tests will be conducted to ensure the mineral content of the material complies with Mines Department regulations. It is a feature of the microfine process that's the resource material may be treated more than once, and as such the handling of the material both during the process and at completion of the process will be conducted in similar methods to the stockpiling of sand and gravel with the use of movable conveyors and lifters.

Water

Perennial streams and local groundwater can supply the project’s water needs. There is ample evidence numerous small underground streams existing between the surface area and the actual water table. Groundwater use will not involve the local water table.

The Coonambula area overall is a significant catchment area with well-developed streams creeks and rivers and groundwater can therefore be developed from surface water leakage, groundwater storage and groundwater through flow and the local streams.

In years one to three of plant operation the average water demand for the project is estimated to be easily accommodated by the local streams and will be augmented by an initial water feed dam to be constructed in the initial construction phase. Once full-scale commercial operations are established, it is not anticipated there will be any significant risk to operations from the supply of water from the local area around the project site.

Stormwater runoff from undisturbed areas of the plant site will be allowed to run into local creeks, through diversion channels and sediment control structures if necessary. Rainfall onto bunded areas will be recovered by the sump pumps and used in the process. Rainfall onto other plant areas will flow into a secure event pond and returned to the process, as it may be contaminated with chemicals or ore spillage.

| 32 |

Power

Power will be generated for the operations by diesel generator sets at 11 kV to meet the expected maximum demands. Power can be supplied by transportable equipment and it will 4 years into the operations before a permanent power installation may be required. Any boreholes will have a separate generator and a stand-by generator will be located at the plant area.

Site Buildings

Wherever practical, flat-pack type buildings will be used, imported in containers and assembled on site. This construction method will be used for the laboratory, administration and training facility. Larger facilities such as the workshop and warehouse will be made up of stacked shipping containers, with roofing over the enclosed spaces and concrete floors as required. The containers will be used as stores and offices. Specialised buildings such as the plant control rooms and laboratory will be prefabricated in shipping containers and brought to site fully assembled.

Staff and office rooms will likewise be prefabricated and pre-wired inside shipping containers, with the wiring tested in the factory before despatch, to minimise site work. The main processing plant will be fully enclosed inside a large weather resistant building providing security and protection for operating systems and to allow operations to be conducted 24/ 6 with 20 hours per day and 4 hours per day allocated for maintenance. Lighting and safety procedures will also be more easily installed within a large building envelope.

Mobile Equipment

In addition to the mining fleet, four 4WD vehicles will be provided for use by the treatment plant and administration department to transfer staff around the site. An ambulance will be provided. A 5 t truck with hoists will be provided to carry light freight to and from site.

Other equipment to be provided to the operations include a mobile crane, portable stand-by generators and lighting towers, diesel welders and HDPE pipe fusion welder, an Integrated tool carrier / forklift for reagent bag handling and a small FEL / Bobcat for plant clean-up.

Four-diesel storage tanks will provide approximately two weeks supplies for the mine and power station. The facility will be bunded with unloading pumps, light vehicle and heavy vehicle rapid fill bowsers. Mining trucks will refuel at the plant site, but a service truck will refuel other mining equipment and remote generators. Transfer pumps will be used to supply the plant diesel generator set day tanks. During construction, two additional 2 kL storage bladders will supplement the existing 2 kL tank, until such time as the permanent fuel storage tanks can be constructed.

Communications

The existing satellite service for voice and data will be used until a new expanded system can be installed for use during construction and later for operations. A two-way radio system will be installed at the site, covering the mine operations and extending to a solar powered transmitter tower will be installed on a convenient hill and the system will provide additional security for the area. Vehicles travelling between off site and the site will be equipped with mobile telephones for safety reasons. Within the plant, additional security will be provided around the gold room.

| 33 |

Rehabilitation

At the end of the mine life, major items of process equipment and mining plant will be sold. Structures will be dismantled and the construction materials sold for use in other projects. Waste dumps will be battered during operation to conform to typical slopes in the land and all extraction areas then vacant will be backfilled. Seepage bores will be monitored for several years after closure to ensure that no drainage problems from returned material arise.

The mine operation will work with its waste material to back fill extraction areas as part of the ongoing operations. It is intended that constantly returning material to extraction areas will aim for efficient handling and transport and at end of LOM the task of rehabilitation will be simplified. The work plans to be lodged and approved by Queensland Government Mines Department will contain all rehabilitation requirements and it is expected the requirements can be managed.

Infrastructure Summary

The infrastructure in the district is good and the area is readily accessible by well-maintained tarmac then sand and gravel roads. Telecommunications equipment has been installed. Access within the site will be over widened and packed farm tracks. Electricity will need to be supplied by on site local transportable power generation. There is adequate water for domestic and agricultural purposes and sufficient water to commence mining operations. Large-scale mining operations may require pumping from local water table, utilising boreholes that would require government approval. The planning and environmental permits allow borehole pumping to be part of a mining work plans.

| 34 |

Financial

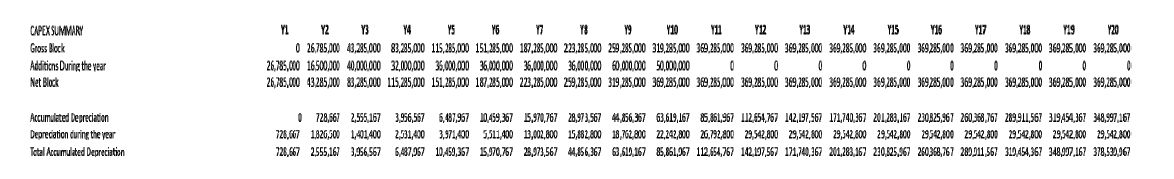

Capital Cost Summary

The capital expenditure summary over the first two years (initial design and construction phase) is shown in the table below, with sustaining capital for capacity expansion shown in the subsequent table.

| 35 |

Table Capital Cost After initial Design and Construction Phase (Refer to NPV Sheet)

Table Capacity Build Up

| 36 |

Production Data

The data of production planned during the design and construction phase (Y1 and 2), capacities build up phase (Y3-10) and operating phase (Y11-20) is shown in the table below:

Direct Cost and Plant Operating Costs

| 37 |

Economic Evaluation

Valuation Methodology

Valuation of the project is by using Discounted Cash Flow (“DCF”) techniques to determine a Net Present Value (“NPV”) for the Project in real terms. The NPV is derived from post royalties and tax, pre-debt real cash flows. The cash flows extracted from the Financial Model (“FM”) are presented in real terms using the Technical Parameters (“TP”), commodity price and macro- economic projections. To accommodate taxation a nominal financial model has been populated and the final free cash flow has been de-escalated to real terms prior to discounting.

To populate the nominal financial model the commodity prices have been escalated over the LoM by US$ inflation which is estimated to be 3.5% per annum. All capital and operating costs have been escalated from Month 1 to the end of the LoM by inflation, which is estimated to be 3% per annum.

The timing of the cash flow has been adjusted to take into consideration the effects of revenue delay. The project valuation is based on a zero starting balance with respect to unredeemed capital expenditure.

The FM is based on calendar years running from June to May. The FM commences on 1 June 2012. The LoM is 20 years, consisting of 10 years of full capacity production and 10 years of production during capacity build-up.

Royalties

Royalties have been deducted from the operating margin as per the terms agreed to in the Royalty Agreement with Riverstone Resources:

| 1. | On the first 100 ha of surface area of the project mined – 19% of the gross revenue earned by the project |

| 2. | Subsequent to the first 100 ha of surface area of the project mined – 15% of the gross revenue earned by the project |

Taxation

Company tax has been deducted from profits at a rate of 30% in line with the Australian corporate tax rate. Taxable income is determined from operating profit less depreciation.

| 38 |

Cash Flows

Table below presents the post-tax real cash flows for the Project. Each period reflects the calendar year from June to May. The valuations are derived from the projected cash flows commencing in June 2012.

| 39 |

Net Present Values and Sensitivities

Based on the real cash flows calculated in the FM, CHPL has reported a DCF valuation, and performed single and double parameter sensitivity analyses to ascertain the impact of discount factors, commodity prices and total costs;

Net Present Values (“NPV”) for the project are presented. The NPV of the post-tax pre-finance nominal cash flows as derived from the FM compiled are presented here, as follows:

The variations in NPV with discount factors for the Project are presented in the following table. The discount factors are arranged from 10% to 25%. A rate of 14% is used to represent the NPV for the project and as a base case to compare sensitivity. The NPV for the Project, at a 14% discount rate, amounts to US$ 4.29 billion.

NPV Sensitivity – Single Parameter Analysis

The variations in NPV based on single parameter sensitivities for the Project are presented in the following table. For the single parameter sensitivity, we have kept the revenues of the LoM at an average of US$2525 per Oz based on an escalation of 3.5% per annum from the current base price of US$ 1600 per Oz. The single parameter is “Cost” and we have shown the impact of increase in costs on the NPV at various discounting rates. Our base cost escalation is assumed at 3% pa over the LoM.

| 40 |

NPV Sensitivity – Twin Parameter Analysis

The variations in NPV based on twin parameter sensitivities for the Project are presented in the following table. The parameters tested for sensitivity are “commodity price” and “cost” and we have presented the impact at various discounting rates.

From an analysis of the twin parameter sensitivity table above, the project has a very high sensitivity to a combination of falling gold prices and increase in costs of operations. If we were to factor drop in the commodity price combined with increase in costs, we will approach negative NPV scenarios if the twin affect of a 5% drop in price is combined with an approximate 10% annual increase in costs. While the risk of such a combined affect occurring is relatively medium-low, it could affect the viability of the project.

We have also evaluated a possible scenario of an increase/decrease in yield affecting the NPV at 14% discounting rate. The emphasis is to test the negative impact from a drop in actual yield from the recoveries from the estimated average of 1.8gpt. A scenario analysis in such a situation is exhibited in the table below and even at an average yield of 0.9gpt (50% discount to the 1.8gpt adopted yield) the NPV is US$2.07 billion.

| 41 |

Payback

The payback period is 3.5 years (including 1 year of design and construction) for a LoM of 20 years.

Important Risks and Opportunities

The project assessment indicated certain risks and opportunities, which should be evaluated in further detail by ARX Gold Corporation in order to assess the complete returns on the project. The key risks and opportunities are:

Risks

| • | Delay in establishing the initial production plant and consequently the financial impact on the project; |

| • | Decline in global demand of gold and consequent decrease in prices; |

| • | Increase in the costs of operations of the project by 10% or more on annual basis thereby affecting the margins; |

| • | The Microfine process has not yet been commercially deployed on any project and during the process of developing the initial production plant and deploying the process, there could be unexpected issues and concerns arising out of the deployment of the process. This could delay the project commencement unless alternative processing methods are planned as contingencies; |

Opportunities

| • | The Microfine process has the potential to derive significant improvements in yield from the tailings at the project site. The upside from any potential increase in yield will have significant positive impact on the project returns; |

| • | The Master Agreement in place with Riverstone Resources provides for a total treatment area of 2500 hectares. The phase 1 and 2 as part of this report is for a total area of 1600 hectares and hence there is scope to include a significant additional area as part of the project in future (57.50% of the total area under phase 1 and 2 is the possible additional area for treatment) |

Interpretation and Conclusions

The ARX Gold Project fulfils financing requirements in terms of payback period (less than 5 years), required returns (>15% real) and that the risk of returning a negative NPV is considered low especially because the yield assumed at 1.8gpt is an extremely conservative assumption. Any possible increases in costs or capital required or drop in commodity prices can be managed if the yield is even marginally higher. The possibility of getting better yields is good based on the test results from the site but we have retained conservative assumptions of yield in our assessment of the financial viability of the project.

Further, the microfine process adopted for this project is not capital intensive by its very nature and the production plant to be constructed is a modular design. This allows for a higher degree of flexibility to control the capital expansion in accordance with the change in market dynamics such as gold prices and increased costs. Hence, the likelihood of a negative NPV on the project is very low.

Recommendations

CHPL recommends that ARX Gold Corporation progress the project to the detailed design and implementation phase. The various risks and opportunities identified should be closely monitored during the detail design and implementation phase, to take advantage of any further possible optimization

| 42 |

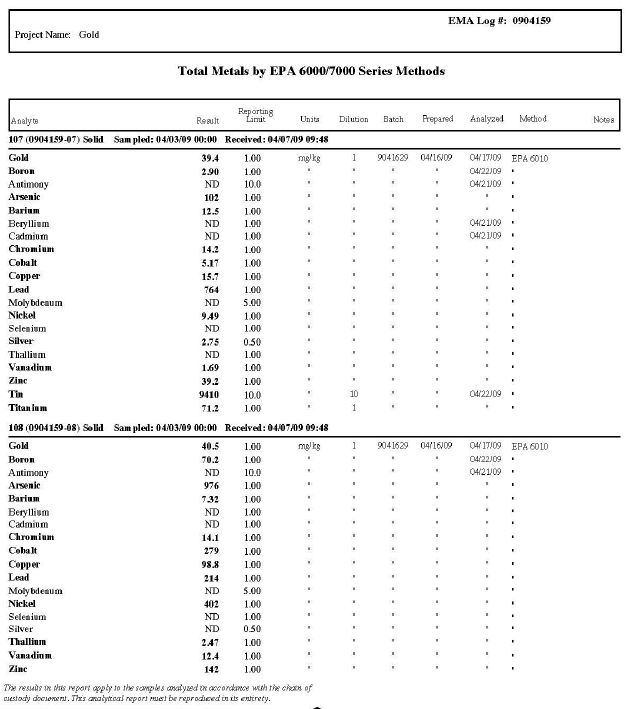

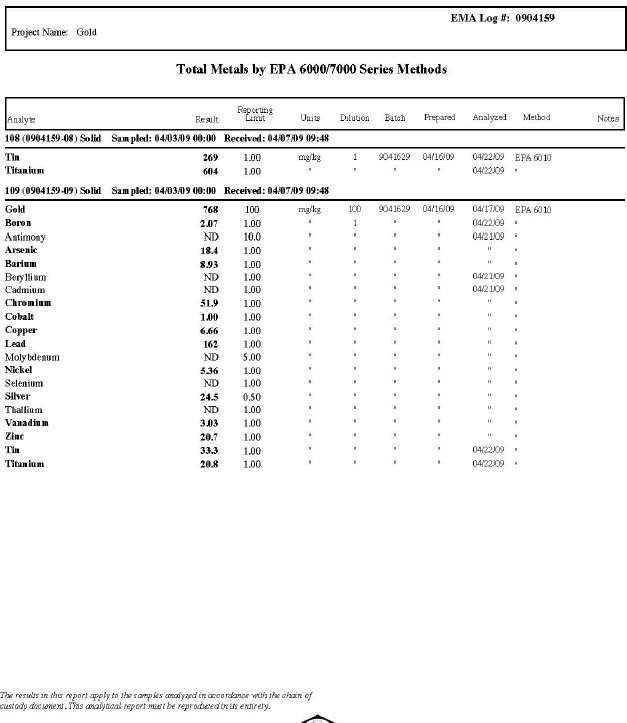

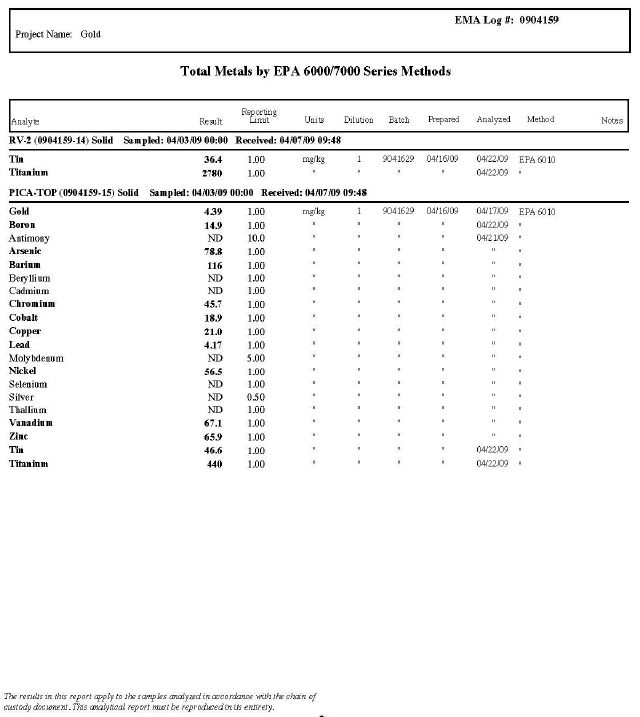

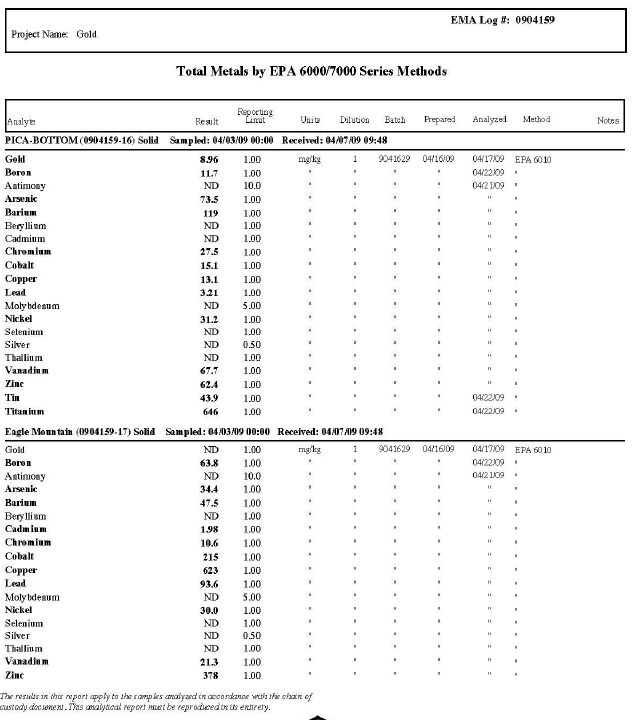

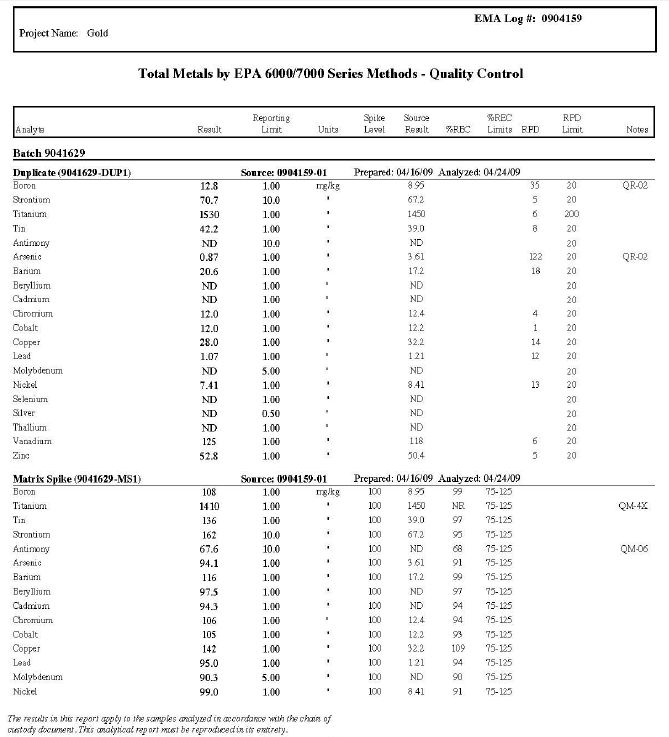

Appendix 1: Assay

Reports

| 43 |

| 44 |

| 45 |

| 46 |

| 47 |

| 48 |

| 49 |

| 50 |

| 51 |

| 52 |

| 53 |

Labmark Internal Quality Control Review

General

| 1. | Laboratory QC results for Method Blanks, Duplicates, Matrix Spikes, and Laboratory Control Samples are included in this QC report where applicable. Additional QC data may be available on request. |

| 2. | Matrix spike recoveries are calculated on an ‘As Received’ basis; the parent sample result is moisture corrected after the % recovery is determined. |

| 3. | Proficiency trial results are available upon request. |

| 4. | Actual PQLs are matrix dependant. Quotes PQLs may be raised where sample extracts are diluted due to interferences. |

| 5. | Results are uncorrected for matrix spike or surrogate recoveries. |

| 6. | Test samples are duplicated or spiked, are for this job only and are identified in the following QC report. |

| 7. | SVOC analyses on waters are performed on homogenized, unfiltered sample, unless noted otherwise. |

| 8. | When individual results are qualified in the body of a report, refer to the qualifier descriptions that follow. |

| 9. | Samples were analysed on an as received basis. |

| 10. | This report replaces any interim results previously issued. |

Holding Times

Please refer to “Sampling and Preservation Chart for Soils & Waters” for holding times (LM-FOR-ADM-020)

For samples received on the last day of holding time, notification of testing requirements should have been received at least 6 hours prior to sample receipt deadlines as stated on the Sample Receipt Acknowledgement.

If the Laboratory did not receive the information in the required timeframe, and regardless of any other integrity issues, suitability qualified results may still be reported.

Holding times apply from the date of sampling, therefore compliance to these may be outside the laboratory’s control.

**NOTE: pH duplicates are reported as a rant NOT as an RPD

Qualtity Control Results

| 54 |

| Sample Integrity | |

| Custody Seals Intact (if used) | N/A |

| Attempt to Chill was evident | No |

| Samples correctly preserved | Yes |

| Organic samples had Teflon liners | N/A |

| Samples received with Zero Headspace | N/A |

| Samples received within Holding Time | Yes |

| Some samples have been subcontracted | No |

| Authorized By | ||

| Carol Cawrse | Client Services Officer | |

| Mark Herbstreit | Senior Analyst - Metals | Accreditation Number: 1645 |

| Laboratory Manager | ||

| Anthony Crane | Operations Manager | /s/ Anthony Crane |

| Final Report | |

| - Indicates Not Requested | * Indicates NATA accreditation does not cover the performance of this service |

| 55 |

24 April 2009

EMA Log #” 0904159

Project Name: Gold

Enclosed are the results of analyses for samples received by the laboratory on 04/07/09 09:48. Samples were analyzed pursuant to client request utilizing EPA or other ELAP approved methodologies. I certify that this data is in compliance both technically and for completeness.

/s/ Dan Verdon

Dan Verdon

Laboratory Director

CA ELAP Certification #: 2564

4340 Viewridge Avenue, Suite A - San Diego, California 92123 - (858) 560-7717 - Fax (858) 560-7763

Analytical Chemistry Laboratory

| 56 |

| 57 |

| 58 |

| 59 |

| 60 |

| 61 |

| 62 |

| 63 |

| 64 |

| 65 |

| 66 |

| 67 |

| 68 |

| 69 |

| 70 |

| 71 |

| 72 |

| 73 |

Notes and Definitions

| QR-02 | The RPD result exceeded the QC limits due to non-homogeneity of sample. |

| QM-4X | The spike recovery was outside of the QC acceptance limits for the MS and/or MSD due to analyte concentration at 4 times or greater the spike concentration. The QC batch was accepted based on LCS and/or LCSD recoveries within the acceptance limits. |

| QM-06 | Due to noted non-homogeneity of the QC sample matrix, the MS/MSD did not provide reliable results for accuracy and precision. Sample results for the QC batch were accepted based on LCS/LCSD percent recoveries and RPD values. |

| QL-03 | The LCS recovery for this analyte was outside the QC criteria for this method. |

| QB-05 | This analyte was found in the method blank and is a suspected laboratory contaminent. |

| ND | Analyte NOT DETECTED at or above the reporting limit |

| NR | Not Reported |

| dty | Sample results reported on a dry weight basis |

| RPD | Relative Percent Difference |

| 74 |

| 75 |

| 76 |

References

ARX Pacific Resources Pty Ltd, ASIC Database Extract, 11 April 2012

ARX Springs Pty Ltd, ASIC Database Extract, 11 April 2012

BRI Microfine Pty Ltd, ASIC Database Extract, 11 April 2012

ARX Springs Pty Ltd and Riverstone Resources Pty Ltd, Various Tribute Agreements and Map

Areas, 6 March 2012/ 31st March 2012

BRI Microfine Pty Ltd and ARX Springs Pty Ltd, Technology Sub License Agreement

Environment Approvals for Extractive Industries, Extractive industries permit, EPA approvals for mining license and Mining License

ARX Springs NPV Certificate and NPV Valuation - ESA Pte Ltd, Singapore, Ref: CD/11-2011/034, 28 November 2011

Certificate of Analysis- LabMark Environmental Laboratories, Australia, 31 July 2008

Certificate of Analysis- EnviroMatric Analytical, Inc., USA, 24 April 2009

Certificate of Analysis- LabMark Environmental Laboratories, Australia, 31 September 2008

Certificate of Analysis- ALS Chemex, Australia, 19 January 2009 / 7 October 2011 / 17 February 2012 / 22 February 2012 / 23 February 2012

Date and Signature

Effective Date of Feasibility Study: 9th March 2013

Date of Signature: 9th March 2013

Signed by:

COCCIARDI HOLDINGS PTY LTD

| 77 |

Report Distribution Record

Complete this form and include it as the final page for each copy of the report produced.

This report is protected by copyright vested in ARX Springs Pty Ltd. It may not be reproduced or transmitted in any form or by any means whatsoever to any person without the written permission of the copyright holder, ARX Springs Pty Ltd.