Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - PORTLAND GENERAL ELECTRIC CO /OR/ | exhibit99120130930pressrel.htm |

| 8-K - FORM 8-K - PORTLAND GENERAL ELECTRIC CO /OR/ | form8-kfor20130930prandsli.htm |

Earnings Conference Call Third Quarter 2013 1 Exhibit 99.2

Cautionary Statement 2 Information Current as of November 1, 2013 Except as expressly noted, the information in this presentation is current as of November 1, 2013 — the date on which PGE filed its Quarterly Report on Form 10-Q for the quarter ended September 30, 2013 — and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update the presentation, except as may be required by law. Forward-Looking Statements Statements in this presentation that relate to future plans, objectives, expectations, performance, events and the like may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding earnings guidance, statements regarding future load, hydro conditions and operating and maintenance costs; statements concerning implementation of the Company’s Integrated Resource Plan and related future capital expenditures, statements concerning future compliance with regulations limiting emissions from generation facilities and the costs to achieve such compliance; statements regarding the outcome of any legal or regulatory proceeding; as well as other statements containing words such as “anticipates,” “believes,” “intends,” “estimates,” “promises,” “expects,” “should,” “conditioned upon,” and similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including the reductions in demand for electricity and the sale of excess energy during periods of low wholesale market prices; operational risks relating to the Company’s generation facilities, including hydro conditions, wind conditions, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric and energy markets conditions, which could affect the availability and cost of purchased power and fuel; changes in capital market conditions, which could affect the availability and cost of capital and result in delay or cancellation of capital projects; failure to complete projects on schedule and within budget, or the abandonment of capital projects, which could result in the Company’s inability to recover project costs; the outcome of various legal and regulatory proceedings; and general economic and financial market conditions. As a result, actual results may differ materially from those projected in the forward-looking statements. All forward-looking statements included in this presentation are based on information available to the Company on the date hereof and such statements speak only as of the date hereof. The Company assumes no obligation to update any such forward-looking statement. Prospective investors should also review the risks and uncertainties listed in the Company’s most recent Annual Report on Form 10-K and the Company’s reports on Forms 8-K and 10-Q filed with the United States Securities and Exchange Commission, including Management’s Discussion and Analysis of Financial Condition and Results of Operations and the risks described therein from time to time.

Leadership Presenting Today 3 Jim Lobdell Senior Vice President of Finance, CFO & Treasurer Jim Piro President & CEO

On Today’s Call 4 Growth Initiatives Regulatory Update Operational Update Economy and Customers Financial Update 2013 Outlook

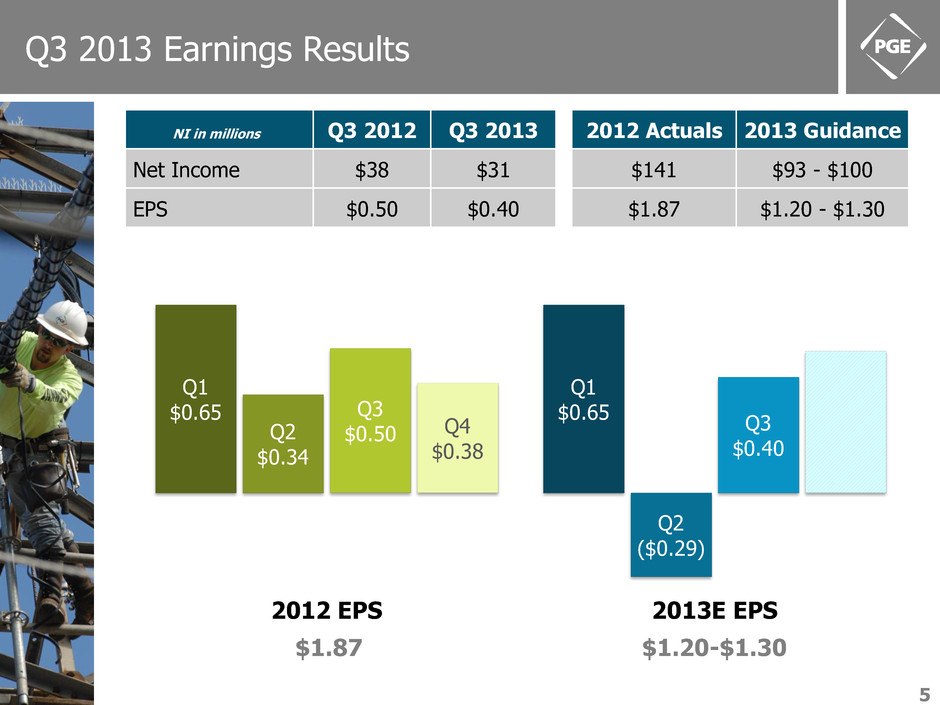

Q3 2013 Earnings Results Q1 $0.65 Q1 $0.65 Q2 $0.34 Q2 ($0.29) Q3 $0.50 Q3 $0.40 Q4 $0.38 2012 EPS 2013E EPS 5 NI in millions Q3 2012 Q3 2013 2012 Actuals 2013 Guidance Net Income $38 $31 $141 $93 - $100 EPS $0.50 $0.40 $1.87 $1.20 - $1.30 $1.87 $1.20-$1.30

Flexible Capacity Seasonal Capacity Project Name Port Westward Unit 2 Purchased Power Agreements with Iberdrola Project Location Clatskanie, OR 100 MW of winter capacity 100 MW of summer capacity Project Type PGE’s Benchmark Bid Capacity Fuel Technology 220 MW Natural Gas Wärtsilä Reciprocating Engines 12 18-MW units Estimated Capital Cost (excluding AFDC) $300 million Estimated In-Service Date Q1 2015 EPC / Supplier Contractor(s) Black & Veatch / Harder Mechanical & Wärtsilä Regulatory Recovery Method 2015 Test Year General Rate Case Potential Customer Price Impact 3-4% Strategic Initiatives: Capacity Resources 6 $165 $125 $10 2013 2014 2015 PW2 CapEx (in millions)

Strategic Initiatives: Renewable Resources 7 $110 $375 $15 2013 2014 2015 Tucannon River CapEx (in millions) Renewable Energy Project Name Tucannon River Wind Farm Project Location Columbia County, WA Project Type EPC Contract on Third Party Site Capacity Fuel Technology 267 MW Wind Project Siemens Turbines Estimated Capital Cost (excluding AFDC) $500 million Estimated In-Service Date First half of 2015 EPC / Supplier Contractor(s) Renewable Energy Service (RES) / Siemens Regulatory Recovery Method Renewable Adjustment Clause Filing/GRC Potential Customer Price Impact 3-4%

Strategic Initiatives: Baseload Resources 8 $125 $170 $110 $45 2013 2014 2015 2016 Carty CapEx (in millions) Baseload Energy Project Name Carty Generating Station Project Location Boardman, OR Project Type EPC Contract on Benchmark Site Capacity Fuel Technology 440 MW Natural Gas Mitsubishi CCGT Estimated Capital Cost (excluding AFDC) $450 million Estimated In-Service Date Mid-2016 EPC / Supplier Contractor(s) Abener Construction / Mitsubishi, Sargent & Lundy Regulatory Recovery Method 2016/2017 Test Year General Rate Case Potential Customer Price Impact 6-7%

Expected Rate Base and Capital Expenditures 9 $1.4B of Expected Increase in Rate Base (in millions) 2013 2014 2015 2016 2017 TOTAL Base Capital Spending(1) $320 $365 $315 $270 $245 $1,515 Port Westward Unit 2 $165 $125 $10 $300 Tucannon River Wind Farm $110 $375 $15 $500 Carty Generating Station $125 $170 $110 $45 $450 TOTAL $720 $1,035 $450 $315 $245 $2,765 (1) Includes ongoing capex and hydro relicensing as disclosed in the Q3 2013 Form 10-Q filed on November 1, 2013 Note: Amounts exclude AFDC debt and equity $3.1B $4.5B 2012 20172012 2017 8% CAGR Expected Capital Expenditures

General Rate Case: 2014 Test Year All issues settled with OPUC Staff and interveners Stipulation filed July 10, 2013: Return on Equity (ROE): 9.75% Capital Structure: 50% debt, 50% equity Rate base: $3.1 billion Stipulation filed September 23, 2013 Pension expense recovery of $19.5 million in 2014 New customer prices effective January 1, 2014 10 in millions Original Filing Request $105 UE 262 Non-Power Cost Stipulation $(42) Load Forecast Update (Revenue) $ 15 UE 266 Power Cost Update $(11) Revised revenue requirement increase $67

Operational Update – Plant Outages 11 in millions, PGE Share Boardman Colstrip Unit 4 Coyote Springs Date of Outage July 1 July 1 August 24 Actual/Expected Online Date July 31 Q1 2014 November 2013 Replacement Power Costs $4 $5-$6 $7-8

Economic Outlook & Customer Satisfaction 12 Growth in Operating Area Growth in PGE work order requests Unemployment rate of 6.8% in core operating area Employment growth in healthcare, hotels, and restaurants Manufacturing and high tech industries continue to expand Load growth forecast of approximately 1% in 2014 GRC

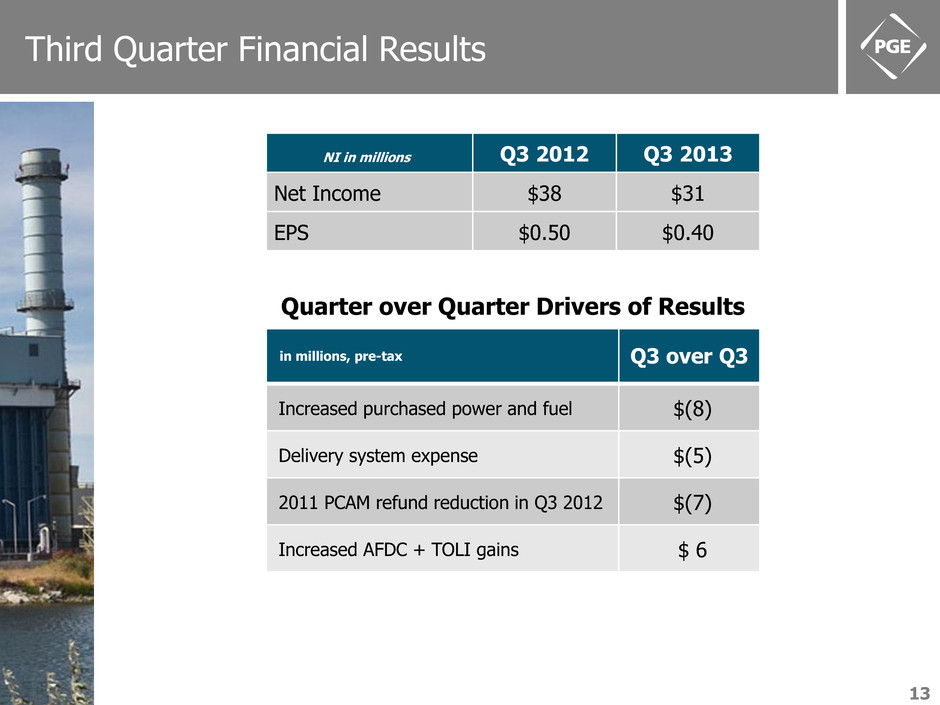

Third Quarter Financial Results Quarter over Quarter Drivers of Results 13 NI in millions Q3 2012 Q3 2013 Net Income $38 $31 EPS $0.50 $0.40 in millions, pre-tax Q3 over Q3 Increased purchased power and fuel $(8) Delivery system expense $(5) 2011 PCAM refund reduction in Q3 2012 $(7) Increased AFDC + TOLI gains $ 6

Total Revenues and Power Costs in millions Q3 2012 Q3 2013 YTD 2012 YTD 2013 Total Revenues $450 $435 $1,342 $1,311 Power Costs $182 $190 $533 $538 18% 16% 14% 9% 43% Q3 2012 Sources of Power Coal Natural Gas Hydro Wind Purchased Power 16% 21% 14% 9% 40% Q3 2013 Sources of Power 14

Operating Expenses 15 Interest Expense $27 $25 $82 $75 in millions Q3 2012 Q3 2013 YTD 2012 YTD 2013 Production & Distribution $49 $54 $153 $169 Administrative & General $50 $49 $160 $158 Total O&M $99 $103 $313 $327 Cascade Crossing Expense -- -- -- $52 Depreciation & Amortization $63 $62 $188 $186 Income Tax Expense $19 $4 $43 $10

Liquidity and Financing Senior Secured Senior Unsecured Outlook S&P A- BBB Stable Moody’s A2 Baa1 Stable Credit Ratings Total Liquidity as of 9/30/13 (in millions) Credit Facilities $752 Commercial Paper -- Letters of Credit $(56) Cash $91 Available $787 16 $69 $108 $68 $152 $81 $193 $85 2012 2013E Q4 Q3 Q2 Q1 Capital Expenditures (in millions) $710-$730 $303

2013 Earnings Guidance Progression 17 2/24/13 Original 2013 Earnings Guidance $1.85 - $2.00 5/1/13 Q1 2013 Earnings Call no change 6/3/13 Cascade Crossing project suspension Customer billing refund $(0.42) $(0.07) Guidance Revised Downward $1.35 - $1.50 8/2/13 Replacement power costs for coal plant outages $(0.10) Guidance Revised Downward $1.25 - $1.40 11/1/13 Replacement power costs for Coyote Springs $(0.05) 2013 Actual Guidance Revised Downward $1.20 - $1.30 11/1/13 Add back Cascade Crossing and customer billing impacts $0.49 2013 Adjusted Operating EPS Guidance $1.70 - $1.80 2013 Actual EPS Guidance: $1.20 - $1.30 per diluted share

18 2013 Earnings Guidance Assumptions 2013 EPS Guidance: $1.20 - $1.30 per share Weather-adjusted energy deliveries comparable to weather-adjusted 2012 O&M expense between $440 and $460 million D&A expense between $240 and $250 million Assumptions for FY 2013 Capital expenditures between $710 and $730 million Estimated replacement power costs of $16 - $18 million for plant outages