Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Houghton Mifflin Harcourt Co | d570278dex232.htm |

| EX-23.1 - EX-23.1 - Houghton Mifflin Harcourt Co | d570278dex231.htm |

| EX-5.1 - EX-5.1 - Houghton Mifflin Harcourt Co | d570278dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on November 1, 2013

Registration No. 333-190356

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Houghton Mifflin Harcourt Company

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2731 | 27-1566372 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

222 Berkeley Street

Boston, MA 02116

(617) 351-5000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William F. Bayers, Esq.

Executive Vice President, Secretary and General Counsel

Houghton Mifflin Harcourt Company

222 Berkeley Street

Boston, MA 02116

(617) 351-5000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| John C. Kennedy, Esq. David S. Huntington, Esq. Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, NY 10019-6064 (212) 373-3000 |

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Latham & Watkins LLP 885 Third Avenue New York, NY 10022-4834 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Calculation Of Registration Fee

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1)(2) |

Proposed Offering Price |

Proposed Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common stock, par value $0.01 per share |

20,987,500 | $16.00 | $335,800,000 | $44,012 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) of the Securities Act of 1933, as amended. |

| (2) | Includes the additional shares of common stock that the underwriters have the right to purchase from the selling stockholders. |

| (3) | The Registrant previously paid $13,640 of this amount in connection with the initial filing of this Registration Statement on August 2, 2013. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Dated November 1, 2013

18,250,000 Shares

Houghton Mifflin Harcourt Company

COMMON STOCK

This is an initial public offering of Houghton Mifflin Harcourt Company common stock.

The selling stockholders identified in this prospectus are offering all of the shares of common stock under this prospectus. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. We anticipate that the initial public offering price will be between $14.00 and $16.00 per share.

We have applied to list the common stock on the NASDAQ Global Select Market under the symbol “HMHC.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 14.

PRICE $ PER SHARE

| Price to Public | Underwriting Discounts and Commissions (1) |

|||||||

| Per Share |

$ | $ | ||||||

| Total |

$ | $ | ||||||

| (1) | We have agreed to pay all underwriting discounts and commissions applicable to the sale of the common stock and certain expenses of the selling stockholders incurred in connection with the sale. We refer you to “Underwriting” beginning on page 134 for additional information regarding underwriting compensation. |

The selling stockholders have granted the underwriters the option to purchase from them up to an additional 2,737,500 shares of common stock. We will not receive any proceeds from the sale of shares of our common stock pursuant to this option to purchase additional shares. To the extent that the underwriters’ option to purchase additional shares is exercised in part or in full, certain of the selling stockholders will sell an amount of shares that was determined based upon the elections by the selling stockholders, the number of shares being sold by each selling stockholder in this offering and the priority of sales under the terms of the Company’s investor rights agreement. See “Principal and Selling Stockholders” and “Underwriting.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock on or about , 2013.

| Goldman, Sachs & Co. | Morgan Stanley | |||||||

| Citigroup | Credit Suisse | Wells Fargo Securities | ||||||

| Blackstone Capital Markets | BMO Capital Markets | Piper Jaffray | Stifel | |||||||||||

| CastleOak Securities, L.P. | Ramirez & Co., Inc. | |||||||||

Prospectus dated , 2013

Table of Contents

| CURIOUS GEORGE, created by Margaret and H.A. Rey, is copyrighted and trademarked by Houghton Mifflin Harcourt Publishing Company. All Rights Reserved. Carmen Sandiego™ is a trademark of HMH Consumer Company. Data-Director™, Iowa Assessments™, and HMH Fuse™ are a trademark of Houghton Mifflin Harcourt Publishing Company. The Leadership and Learning Center® is a registered trademark of Advanced Learning Centers, Inc. © New Line Productions, Inc. All rights reserved. THE HOBBIT; AN UNEXPECTED JOURNEY and the names of the characters, items, events and places therein are trademarks of The Saul Zaentz Company d/b/a Middle-earth Enterprises under license to New Line Productions, Inc. HISTORY® and related logos are the property of A&E Television Networks (AETN)® Houghton Mifflin Harcourt Publishing Company. All rights reserved. Printed in the U.S.A. MS83978 |

Table of Contents

We, the selling stockholders and the underwriters have not authorized anyone to provide any information other than that contained in this prospectus or any free writing prospectus prepared by us or on our behalf or to which we have referred you. We can take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. We and the selling shareholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

As used in this prospectus, the terms “we,” “us,” “our,” “HMH” and the “Company” refer to Houghton Mifflin Harcourt Company, formerly known as HMH Holdings (Delaware), Inc., and its consolidated subsidiaries, unless otherwise expressly stated or the context otherwise requires.

Until , 2013 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

TRADEMARKS

This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

i

Table of Contents

STATEMENT REGARDING INDUSTRY AND MARKET DATA

We obtained the market, industry and competitive position data contained in this prospectus from our own internal data and estimates and a variety of third-party sources, including independent industry publications, government publications, reports by market research firms or other published independent sources. The third-party sources include The Condition of Education 2013, dated May 2013, by the National Center for Education Statistics (“NCES”); Digest of Education Statistics, 2011, dated May 2012, by the NCES; Public Elementary and Secondary School Student Enrollment and Staff Counts From the Common Core of Data: School Year 2010-11, dated April 2012, by the NCES; Projections of Education Statistics to 2021 (Fortieth Edition), dated January 2013, by the NCES; American Revolution 2.0: How Education Innovation is Going to Revitalize America and Transform the U.S. Economy, dated July 4, 2012, by GSV Asset Management; Statistical Abstract of the United States: 2012, dated January 2013, by the U.S. Census Bureau; “Early Learning: America’s Middle Class Promise Begins Early”, by the U.S. Department of Education; Evaluation of Evidence-Based Practices in Online Learning: A Meta-Analysis and Review of Online Learning Studies, dated September 2010, by the U.S. Department of Education; “Florida instructional materials adoption schedule for adoption years 2011-2012 through 2016-2017”, by the Florida Department of Education; “Curriculum Frameworks: Mathematics”, by the California Department of Education; “Instructional Materials 2013-2014 Adoption Bulletin”, by the Texas Education Agency; “Instructional Materials Adoption”, by the Association of American Publishers; “Population & Development: Global Population Patterns and Trends”, by the United Nations Educational, Scientific and Cultural Organization (UNESCO); “School enrollment, preprimary (% gross)”, by the World Bank, with data from the UNESCO Institute for Statistics; A Study of the Instructional Effectiveness of Go Math!: Report Number 399, dated March 2011, by the Educational Research Institute of America; and 2013 Q-Score Data, provided by Marketing Evaluations, Inc. We believe that each of these third-party sources is reliable. Our internal data and estimates, which we believe are true and accurate, are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions.

ii

Table of Contents

This summary highlights certain significant aspects of our business and this offering and is a summary of information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding whether to invest in our common stock. You should read this entire prospectus carefully, including the “Risk Factors” section and our consolidated financial statements and the notes to those statements included in this prospectus, before making an investment decision. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.”

Overview

Our mission is to change people’s lives by fostering passionate, curious learners. We believe that by combining world-class educational content, products and services with cutting edge technology, digital innovation and research, we can make learning and teaching more effective and engaging.

We are a leading global provider of education solutions, delivering content, technology, services and media to over 50 million students in over 150 countries worldwide. We deliver our offerings to both educational institutions and consumers around the world. In the United States, we are the leading provider of kindergarten through twelfth grade, or K-12, educational content by market share. We believe that nearly every current K-12 student in the United States has utilized our content during the course of his or her education. As a result, we believe that we have an established reputation with these students that is difficult for others to replicate and positions us to continue to provide our broader content and services to serve their lifelong learning needs. We believe our long-standing reputation and well-known brands enable us to capitalize on consumer and digital trends in the education market through our existing and developing channels. Furthermore, since 1832, we have published trade and reference materials, including adult and children’s fiction and non-fiction books that have won industry awards such as the Pulitzer Prize, Newbery and Caldecott medals and National Book Award, all of which are generally known.

According to GSV Asset Management, the market for education content, media and services related expenditures is around $4.6 trillion globally The K-12 market, which is the market we predominantly target, represents approximately 52% of these total expenditures. We believe our leadership position provides us with strong competitive advantages in this market. We have established relationships with educators, institutions, parents, students and life-long learners around the world that are founded on our education expertise, content and services that meet the evolving needs of our customers. Our portfolio of intellectual property spans educational, general interest, children’s and reference works, and has been developed by award-winning authors—including 8 Nobel Prize winners, 47 Pulitzer Prize winners and 13 National Book Award winners—and editors with expertise in learning and pedagogy. Our content includes characters and titles such as Curious George, Carmen Sandiego, The Oregon Trail, The Little Prince, The Lord of the Rings, Life of Pi, Webster’s New World Dictionary and Cliffs Notes that we believe are recognized in the United States and internationally. Through our network of over 300 sales professionals, we serve a growing list of institutional customers. We believe that our combination of established relationships, content portfolio, and sales team creates a competitive position that is difficult to replicate.

We sell our products and services across multiple platforms and distribution channels and are expanding our customer base beyond institutions, with an increasing focus on individual consumers who comprise a significant target audience of life-long learners. Leveraging our portfolio of content, including some of our children’s brands and titles that we believe are iconic and timeless such as Where in the World is Carmen Sandiego? and Curious George, we create interactive digital content, mobile apps and educational games, build websites and provide technology-based educational solutions. Based on the strength of our content portfolio and its adaptability across

1

Table of Contents

multiple distribution channels, we believe that we are also well positioned to expand into the early childhood development and global English language learning markets without significant additional costs associated with content development.

We believe we are a leader in transforming the traditional educational content and services landscape based on our market share, which is greater than 30%, and the size of our digital products portfolio, which includes approximately 34,000 titles. Our digital products portfolio, combined with our content development or distribution agreements with recognized technology leaders such as Apple, Samsung, Knewton and Kno, enables us to bring our next-generation learning solutions and media content to learners across substantially all platforms and devices. Additionally, we believe our technology and development capabilities allow us to enhance content engagement and effectiveness with embedded assessment, interactivity, personalization and adaptivity.

In addition to our comprehensive instructional materials, which are intended to provide a complete course of study in a subject for one or more grade levels, we provide testing and assessment solutions through our Riverside products. We also provide school improvement and professional development services through our Heinemann products and The Leadership and Learning Center that help teachers and administrators meet their academic objectives and regulatory mandates.

For the nine months ended September 30, 2013 and for the years ended December 31, 2012, 2011 and 2010, our total net sales were $1,079.7 million, $1,285.6 million, $1,295.3 million and $1,507.0 million, respectively. For the nine months ended September 30, 2013 and for the years ended December 31, 2012, 2011 and 2010, our net loss was $46.5 million, $87.1 million, $2,182.4 million and $819.5 million, respectively, and our Adjusted EBITDA, a non-GAAP measure, was $270.2 million, $319.8 million, $238.2 million and $440.7 million, respectively. For a reconciliation of Adjusted EBITDA to net loss, see “—Summary Historical Consolidated Financial and Other Information.”

Market Opportunity

Rising Global Demand for Education

We believe we are a leading provider in the global learning and educational content market based on our market share and are well positioned to take advantage of the continued growth expected to result as more countries transition to knowledge-based economies, global markets integrate, and consumption, especially in emerging markets, rises. In particular, we expect to primarily offer our English language education and instructional products in foreign countries. The global education sector is experiencing rising enrollments and increasing government and consumer spending driven by the close connection between levels of educational attainment, evolving standards, personal career prospects and economic growth. In particular, we believe that the educational markets in China, India, Brazil, Mexico and the Middle East are poised for growth. However, there can be no guarantee that the global educational markets will continue to rise or that we will be able to increase our market share in foreign countries or benefit from growth in these markets. In 2011, our international sales were $46.1 million lower than 2010 due to a tightening of credit terms with our distributors in the Middle East.

U.S. K-12 Market is Large and Growing

In the United States, which is our primary market today and in which we sell K-12 educational content to both public and private schools, the K-12 education sector represents one of the largest industry segments accounting for over $638 billion of expenditures, or about 4.4% of the 2011 U.S. gross domestic product as measured by the U.S. Department of Education’s National Center for Education Statistics (“NCES”) for the 2010-2011 school year. The instructional supplies and services component of this market was estimated to be approximately $30 billion in 2011 and is expected to continue growing as a result of several secular and cyclical factors. However, there can be no assurance that the U.S. K-12 market will grow. See “—Risks Associated with Our Business.”

2

Table of Contents

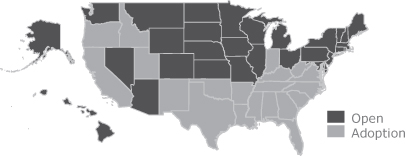

In addition to its size, the U.S. K-12 education market is highly decentralized and is characterized by complex content adoption processes. The sector is comprised of approximately 15,600 public school districts across the 50 states and 132,000 public and private elementary and secondary schools. We believe this market structure underscores the importance of scale and industry relationships and the need for broad, diverse coverage across states, districts and schools. Even while we believe certain initiatives in the education sector such as the Common Core State Standards, a set of shared math and literacy standards benchmarked to international standards, have increased standardization in K-12 education content, we believe significant state standard specific customization still exists, and we believe the need to address customization provides an ongoing need for companies in the sector to maintain relationships with individual state and district policymakers and expertise in state-varying academic standards.

Growth in the U.S. K-12 market for educational content and services will be driven by several factors. In the near term, total spend by institutions, which is largely dependent upon state and local funding, is increasing in the wake of the U.S. economic recovery. As tax revenues collected through income, sales and property taxes continue to rebound, institutional customers benefit from improved funding cycles. However, the U.S. economic recovery has been slower than anticipated and there can be no assurance that any further improvement will be significant.

Longer-term growth in the U.S. K-12 market is positively correlated with student enrollments. Compared to 55.0 million students in 2010, enrollments are expected to increase to over 58.0 million by the 2021 school year, according to NCES and the U.S. Census Bureau.

In addition, increased investment in areas of government policy focus is expected to further drive market growth. For example, President Obama has identified early childhood development as an important education initiative of his administration and has proposed a Preschool for All initiative, which has not been enacted yet, with a $75 billion budget over the next 10 years to increase access to high quality early childhood education.

Increasing Focus on Accountability and Student Outcomes

U.S. K-12 education has come under significant political scrutiny in recent years, due to a recognition of its importance to the U.S. society at large and concern over the perceived decline in U.S. student competitiveness relative to their international peers.

This political focus has generated significant new legislation and government initiatives over the last decade, beginning with No Child Left Behind, implemented in 2002, and continuing with Race to the Top and other programs enacted by the Department of Education (“DOE”) since 2009. These regulatory frameworks have mandated stricter accountability, higher standards and increased transparency in education, and states have been required to measure annual progress towards these standards and make results publicly available for the first time.

As a result of these more rigorous regulations and standards, schools and districts have increased their focus on acquiring high quality, proven content that is aligned with these standards and empowers educators to meet new requirements. Although this trend may lead to increases in spending by schools and districts, educational mandates and expenditures can also be affected by other factors, including the recent U.S. economic recession and budget cuts related to education, which could lead to lower spending.

Growing Shift Towards Digital Materials

The digitalization of education content and delivery is also driving a substantial shift in the education market. An increasing number of schools are utilizing digital content in their classrooms and implementing online or blended learning environments, which mix the use of print and digital educational materials in the

3

Table of Contents

classroom. Technologies are also being adapted for educational uses on the internet, mobile devices and through cloud-computing, which permits the sharing of digital files and programs among multiple computers or other devices at the same time through a virtual network. An analysis conducted by the DOE in 2009 that surveyed more than a thousand empirical studies of online learning found that, on average, students in online learning conditions performed modestly better than those receiving face-to-face instruction.

While the adoption of technology within the U.S. K-12 market may differ significantly across districts and states due to varying resources and infrastructure, most schools are seeking to implement more technology and are seeking partners to help them create effective digital learning environments. This presents opportunities for providers of instructional materials to broaden their existing relationships with institutional customers by offering content, service and technology solutions that meet these evolving needs.

In addition, as sales of digital educational materials grow as a percentage of the total market, the relatively lower development and distribution costs of digital content relative to print products are expected to enhance the operating margins of companies that create and distribute educational content.

Consumerization of Education

As education continues to increase in importance in the modern knowledge economy, individual consumers are increasingly supplementing their formal education with additional learning programs and services that enhance existing knowledge and skills. According to GSV Asset Management, the global English language learning market is forecast to grow from approximately $40 billion in 2013 to $80 billion by 2018. While there is no guarantee that we will be able to increase sales in this market, we believe that it represents an important opportunity for our company because we currently capture less than 1% of the global English language learning market.

Competitive Strengths

We believe we are a leader in our market based on our decades-long experience developing content and solutions and forming and maintaining long-term customer and industry relationships. We believe the following to be our key competitive strengths:

| • | High quality content portfolio. Our intellectual property portfolio is one of our most valuable and difficult to replicate assets and reflects multi-billion dollar investments over our history. Our portfolio spans education, general interest, children’s and reference works and includes content developed in collaboration with respected educational authors such as Irene Fountas, Gay Su Pinnell and Ed Berger and contains almost 500,000 separate International Standard Book Numbers, which are 10-digit numbers that uniquely identify books and book-like products. We leverage this content, which is backed by decades of research, to provide educational products and solutions that are developed to meet or exceed U.S. and global education standards and are relied upon daily by thousands of teachers, students, parents and lifelong learners. Our approach to creating and maintaining our content digitally enables us to provide products and solutions through device-agnostic, digital learning platforms in a variety of formats and allows us to create new solutions with minimal incremental investment. |

| • | Long-standing relationships with educators and other key education stakeholders. We believe our relationships with educators are an important source of competitive advantage and reflect our expertise in educational policy, content development and delivery of results-driven education solutions. Given the nature of the K-12 education market’s multi-year usage cycle, we believe that educators have little room for error in selecting programs for their schools and seek out relationships with established providers to minimize curriculum selection risk. Our sales force utilizes a strategic, consultative approach that involves |

4

Table of Contents

| stakeholders at every level of the decision-making process, from state legislators and school districts to school administrators and teachers. Our approach positions us to flexibly respond to schools’ and teachers’ needs, as demonstrated by our growing suite of professional services, which are focused on improving educational effectiveness at both the institutional and instructor levels. |

| • | Iconic brands with international recognition. Our brands include characters and titles that we believe are recognized in the United States and internationally, such as Curious George, Gossie and Gertie, Polar Express and Life of Pi, and which we believe resonate with students, teachers, educators and parents. We believe that nearly every school-aged child in the United States has used our curriculum as part of their education because we sell our educational products to approximately 13,850 public school districts and 14,600 private schools in the United States that collectively represent approximately 98% of student enrollments in the United States. Our comprehensive instructional materials reach 100% of the top 1,000 school districts in the United States. Recent Q score data, a measurement of the familiarity and appeal of a brand used in the United States, indicates that more mothers of children aged 2 to 11 are familiar with Curious George than Mickey Mouse. This combination of reach and recognition contributes to what we believe is a long-lasting relationship with consumers, who are introduced to our brands as children, use our educational products throughout their pre-K-12 school years, read our general interest titles as adults, and then purchase our content for their own children. We believe that we have a strong foundation upon which to further monetize our intellectual property across new media and channels, including websites, mobile applications, electronic books, otherwise known as e-books, and games. |

| • | Strategic relationships with industry and technology thought leaders. Our position as a leader in our market allows us to continually expand upon our strategic relationships with both industry and technology thought leaders. These relationships enable us to create innovative solutions that meet the evolving needs of the global education market. Our relationships and content development agreements, such as those with Knewton and Kno, allow us to leverage cutting-edge technologies that bring interactive, adaptive and personalized features to our content with new pricing and delivery models. Our relationships and content development agreements also provide us with exclusive content from popular or highly marketable providers, such as the History Channel, from which we integrate into our education solutions to further strengthen our appeal to customers. |

| • | Strong financial position and scalable business model. Our strong financial position is derived from our ability to generate significant cash flow from operating activities and the actions that we have taken over the past few years. For the years ended December 31, 2012 and 2011, we generated $104.8 million and $132.8 million of cash flow from operations, respectively. As a result of the economic recession, our significant indebtedness and other factors, we generated net losses for the nine months ended September 30, 2013 and for the years ended December 31, 2012, 2011 and 2010 of $46.5 million, $87.1 million, $2,182.4 million and $819.5 million, respectively, restructured our indebtedness in 2010 and entered bankruptcy in 2012. Our financial position was strengthened by our successful emergence from bankruptcy in June 2012, which reduced our outstanding indebtedness from approximately $3,142.2 million to $250.0 million. Also, since 2010, we have reduced our selling and administrative expenses by approximately $183.2 million while reducing headcount by 720 full time employees, or 18%. |

We believe that as we continue to monetize our content across newly developed channels and implement new revenue and pricing models, we will begin to realize even greater sales while incurring lower incremental costs, which will further improve our operating margins. In addition, as we distribute more of our content in digital formats, our operating margins will benefit from lower development and distribution costs relative to print products. Because of these factors, we believe our business model is scalable since we should be able to generate future revenue without materially increasing our costs as we believe our current infrastructure, warehousing and fulfillment capabilities can support increased sales. We believe our strong financial position provides the flexibility to continue to invest in new projects and pursue selective acquisitions.

5

Table of Contents

| • | Experienced, technology-focused and innovation-oriented management team. Our management team consists of industry leaders with a unique combination of technology-based backgrounds and relevant experience from prior positions at technology and media leaders such as IBM, Microsoft, Oracle, Peoplesoft, Texas Instruments and Thomson Reuters, among others. During their tenure, the team has demonstrated their execution capabilities by refocusing the Company to create a digitally-enabled content platform that has better positioned us for growth in a rapidly changing educational content environment. Additionally, the management team has realigned the Company’s sales force and reduced selling and administrative costs. We believe our management team has the skills necessary to maintain and build upon our position as a leader in the digital transformation of the industry. |

Strategies for Growth

Our growth strategies involve broadening our content and service offerings to meet the growing needs of an evolving educational landscape, acquiring new customers while simultaneously selling additional or more profitable products or services to existing customers and monetizing our existing assets across new channels and markets. We intend to pursue the following strategies to drive our future growth:

| • | Deepen penetration of existing educational markets by adapting and broadening our content and service offerings. We intend to invest in additional content, value-added services and digital offerings. These include support for school districts to govern and implement a digital learning environment, instructional leadership focused on Common Core State Standards and best practice teacher training. We offer our content on a wide variety of technology platforms and we continue to explore new, digitally enabled opportunities to reach a broader audience and cater to customer specific needs. We believe our well-known brands, schools’ use of our products to improve student performance and established relationships with educators will allow us to further penetrate existing markets and customers by offering innovative new products and services and will provide new opportunities for growth. |

| • | Expand into adjacent high-growth education markets. We intend to pursue a number of existing opportunities involving emerging and adjacent education segments by leveraging our expertise in content development and our competencies in addressing the educational needs of learners of all ages. We are designing our curricula with the goal of penetrating a diverse set of adjacent markets, which range from early childhood development to workforce re-entry for adults. We believe our existing products will allow us to address a broad array of customer needs with minimal incremental capital spending. |

| • | Grow our international presence and global footprint. Our international strategy leverages the success of and expertise derived from our core U.S. business and is intended to focus on international segments such as English language learning, a market that is estimated to grow to $80 billion by 2018, according to GSV Asset Management. In many countries, students seek English language learning content and the U.S. curriculum to eventually gain access to higher education in the United States or improved employment opportunities in their home market. In addition, a significant number of English speaking educational institutions require high quality, English language education and instructional materials. For the years ended December 31, 2012, 2011 and 2010, our international revenues as a percentage of total sales were 4.8%, 4.2% and 6.7%, respectively. We plan to continue building on our existing international footprint by targeting areas where demand for our English language offerings is high, including Brazil, China, India, Korea, Mexico, Philippines, and the Middle-Eastern Gulf States. |

| • | Further monetize our content by targeting new customers and channels. We intend to leverage our current portfolio to address a range of learning needs and appeal to more customers. As parents increasingly seek to improve their students’ scholastic achievement, and as cost effective alternatives for at-home educational enhancement proliferate, the market for online learning products is expected to grow substantially. Our online customers that use our various websites and learning management platforms will |

6

Table of Contents

| serve as the initial target market. We expect to derive future revenues from a variety of models including website advertising and sales of subscription-based learning applications, in addition to direct sales of physical materials and e-books to consumers. |

| • | Continue to pursue strategic acquisitions to extend our leadership position. Even though we do not currently have any plans for material acquisitions, we intend to complement our organic growth with highly selective acquisitions of content, technologies, solutions and businesses, targeted to enhance our ability to accelerate our strategic initiatives and capitalize on our strengths. Our strength, expertise and scale allows us to reduce time to market, enhance certain features or capabilities, and serve a broader audience for these acquired offerings. |

Risks Associated with Our Business

Our business is subject to numerous risks, which are highlighted in the section entitled “Risk Factors.” These risks represent challenges to the successful implementation of our strategy and the growth of our business. Some of these risks are:

| • | Our business and results of operations may be adversely affected by many factors outside of our control, including changes in federal, state and local education funding, general economic conditions and/or changes in the state procurement process. For example, state, local and municipal finances were and may continue to be adversely affected by the recent U.S. economic recession, which led to reduced spending on educational materials and impacted our business and results of operations, and many school districts receive a substantial amount of funding from the Federal government, which may be reduced as a result of the Federal sequester. There also can be no assurance that the U.S. K-12 market will grow. |

| • | Our operating results fluctuate on a seasonal and quarterly basis and our business is dependent on our results of operations for the third quarter. |

| • | Our business will be impacted by the rate of and state of technological change, including the digital evolution and other disruptive technologies, and the presence and development of open-sourced content could continue to increase, which could adversely affect our revenue. |

| • | Our history of operations includes periods of operating and net losses, and we may incur operating and net losses in the future. Our significant net losses and our significant amount of indebtedness led us to declare bankruptcy in 2012. |

| • | Our ability to enforce our intellectual property and proprietary rights may be limited, which may harm our competitive position and materially and adversely affect our business and results of operations. |

| • | A significant increase in operating costs and expenses could have a material adverse effect on our profitability. |

| • | There can be no guarantee that the global educational markets will continue to rise or that we will be able to increase our market share in foreign countries or benefit from growth in emerging markets. In addition, we may not be able to increase sales in the global English language learning market, which is an important part of our international growth strategy, because the market may not grow as we expect. |

For a discussion of these and other risks you should consider before making an investment in our common stock, see the section entitled “Risk Factors.”

Products and Services

Our products and services are organized under our two reportable segments: Education and Trade Publishing. The Education segment is our largest business, representing approximately 88%, 90% and 92% of our total net sales for the years ended December 31, 2012, 2011 and 2010, respectively.

7

Table of Contents

Education

Our Education segment provides educational products, technology platforms and services to meet the diverse needs of today’s classrooms. These products and services include print and digital content in the form of textbooks, digital courseware, instructional aids, educational assessment and intervention solutions, professional development and school reform services. We develop programs aligned to state standards and customized for specific state requests. In addition, our Education segment offers a wide range of standardized testing products targeting the assessment markets.

Our Education products consist of the following offerings:

| • | Comprehensive Curriculum. We develop comprehensive educational programs intended to provide a complete course of study in a subject, either at a single grade level or across multiple grade levels, and serve as the primary source of classroom instruction. The Comprehensive Curriculum portfolio is focused on subjects that consistently receive the highest priority from educators and educational policy makers, namely reading, literature/language arts, mathematics, science, world languages and social studies. |

| • | Supplemental Products. We develop products targeted at addressing struggling learners through comprehensive intervention solutions, products targeted at assisting English language learners and products providing incremental instruction in a particular subject area. Supplemental Products are used both as alternatives and as supplements to Comprehensive Curriculum programs. |

| • | Heinemann. Heinemann produces professional books and developmental resources aimed at empowering pre-K-12 teachers, our Benchmark Assessment System, which allows teachers to evaluate students’ reading levels three times a year, has displaced competing programs and is used by approximately 28% of K-12 schools, and our Leveled Literacy Intervention System, which is a supplementary intervention program for children struggling with reading and writing, and we believe, is used by approximately 38% of K-3 students. The author base includes some prominent experts in teaching, such as Irene Fountas and Gay Su Pinnell, who support the practice of other teachers through books, videos, workshops and classroom tools. |

| • | Professional Services/The Leadership and Learning Center. Through The Leadership and Learning Center, we provide consulting services to assist school districts in increasing accountability for improvement and offering professional development training, comprehensive services and school turnaround solutions. Our services include learning resources that are supported with professional development in classroom assessment, teacher effectiveness and high impact leadership, which have a measurable and sustainable impact on student achievement. |

| • | Riverside Assessment. Riverside Assessment products provide district and state level solutions focused on clinical, group and formative assessment tools and platform solutions. Clinical solutions provide psychological and special needs testing to assess intellectual, cognitive and behavioral development. |

| • | International. Our International products are educational solutions that are sold into global education markets predominantly to large English language schools in high growth territories primarily in Asia, the Pacific, the Middle East, Latin America, the Caribbean and Africa. In addition to our sales team, we have a global network of distributors in local markets around the world. |

Trade Publishing

Our Trade Publishing segment, established in 1832, develops, markets and sells consumer books in print and digital formats and licenses book rights to other publishers and electronic businesses in the United States and abroad. We offer an extensive library of general interest, adult and children’s and reference works that include well-known characters and brands and feature numerous Nobel and Pulitzer Prize winners and Newbery and Caldecott medal winners, including a 2012 Caldecott Honor winner.

8

Table of Contents

We are increasingly leveraging the strength of our Trade Publishing brands and characters, such as Curious George, together with our expertise in developing educational solutions, to further penetrate the large and growing consumer market for at-home educational products and services.

Corporate Information

Houghton Mifflin Harcourt Company, formerly known as HMH Holdings (Delaware), Inc., was incorporated under the laws of the State of Delaware on March 5, 2010. Our principal executive offices are located at 222 Berkeley Street, Boston, Massachusetts 02116. Our telephone number is (617) 351-5000. Our website is www.hmhco.com. Information contained on our website does not constitute a part of this prospectus. On October 22, 2013, we changed our name from “HMH Holdings (Delaware), Inc.” to “Houghton Mifflin Harcourt Company.”

Houghton Mifflin Harcourt Company, formerly known as HMH Holdings (Delaware), Inc., was incorporated on March 5, 2010 and established as the holding company of our legacy operating companies. On March 9, 2010, we completed a restructuring with our then-existing lenders and stockholders that exchanged approximately $4.0 billion of our outstanding indebtedness for equity. In addition, as part of the restructuring, we issued warrants to certain lenders and stockholders and raised new equity capital through a rights offering. Subsequently, in May 2012, we filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code. On June 22, 2012, we successfully emerged from bankruptcy as a reorganized company pursuant to a pre-packaged plan of reorganization. In connection with our emergence from bankruptcy, we issued all of the outstanding shares of our new common stock to our lenders in exchange for cancelling all of our outstanding secured indebtedness, and we issued warrants to purchase shares of our new common stock to our equityholders in exchange for cancelling all of our outstanding equity. For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 1 to our consolidated financial statements included elsewhere in this prospectus.

9

Table of Contents

THE OFFERING

The summary below describes the principal terms of this offering. The “Description of Capital Stock” section of this prospectus contains a more detailed description of the common stock.

| Common stock offered by us |

We are not selling any shares of common stock in this offering. |

| Common stock offered by the selling stockholders |

18,250,000 shares of common stock (20,987,500 shares if the underwriters exercise their option to purchase additional shares in full). |

| Common stock to be outstanding immediately after this offering |

Immediately after this offering, we will have 139,955,578 shares of common stock issued and outstanding. |

| Over-allotment option |

The selling stockholders have granted the underwriters the option to purchase up to an additional 2,737,500 shares of common stock within 30 days from the date of this prospectus. |

| Use of proceeds |

The selling stockholders will receive all of the proceeds from the sale of the common stock offered under this prospectus. Accordingly, we will not receive any proceeds from the sale of the common stock in this offering. |

| Dividend policy |

We do not intend to declare or pay any cash dividends on our common stock for the foreseeable future. See “Dividend Policy.” |

| Listing |

We have applied to list our common stock on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “HMHC.” |

| Risk factors |

Investing in our common stock involves substantial risks. See “Risk Factors” for a discussion of risks you should carefully consider before deciding whether to invest in our common stock. |

The number of shares of our common stock outstanding after this offering excludes 16,336,670 shares issuable pursuant to the HMH Holdings (Delaware), Inc. 2012 Management Incentive Plan (the “MIP”) as of September 30, 2013, including 12,434,118 shares that are subject to options granted pursuant to the MIP as of September 30, 2013 at a weighted average exercise price of $12.71 per share and 228,602 restricted stock units outstanding as of September 30, 2013, and excludes 7,368,422 shares of common stock that we may issue upon exercise of outstanding warrants as of September 30, 2013, with a weighted average exercise price of $21.14 per share. See “Executive Compensation.”

Except as otherwise indicated, all information in this prospectus:

| • | assumes the underwriters’ option to purchase additional shares will not be exercised; and |

| • | assumes an initial public offering price of $15.00 per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus); and |

| • | gives effect to a 2 for 1 stock split, which we refer to as the “Stock Split,” that occurred on October 22, 2013. |

10

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER INFORMATION

The following table summarizes the consolidated historical financial data of Houghton Mifflin Harcourt Company (Successor) and HMH Publishing Company (Predecessor) for the periods presented. We derived the consolidated historical financial data as of December 31, 2012 and 2011, for the years ended December 31, 2012 and 2011 (Successor) and for the periods March 10, 2010 to December 31, 2010 (Successor) and January 1, 2010 to March 9, 2010 (Predecessor) from the audited consolidated financial statements included elsewhere in this prospectus. We derived the consolidated historical financial data as of September 30, 2013 and for the nine months ended September 30, 2013 and 2012 from our unaudited consolidated interim financial statements included elsewhere in this prospectus. We derived the consolidated historical financial data as of September 30, 2012 from our unaudited consolidated interim financial statements not included in this prospectus. We have prepared our unaudited consolidated interim financial statements on the same basis as our audited consolidated financial statements and, in our opinion, have included all adjustments necessary to state fairly in all material respects our financial position and results of operations. Historical results for any prior period are not necessarily indicative of results to be expected in any future period, and results for any interim period are not necessarily indicative of results for a full fiscal year.

The data set forth in the following table should be read together with the sections of this prospectus entitled “Capitalization,” “Selected Historical Financial and Operating Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto included elsewhere in this prospectus.

| Successor | Predecessor | |||||||||||||||||||||||||

| (in thousands, except share and per share data) |

Nine Months Ended September 30, 2013 |

Nine Months Ended September 30, 2012 |

Year Ended December 31, | March 10, 2010 to December 31, 2010 |

January 1, 2010 to March 9, 2010 |

|||||||||||||||||||||

| 2012 | 2011 | |||||||||||||||||||||||||

| Operating Data: |

||||||||||||||||||||||||||

| Net sales |

$ | 1,079,735 | $ | 1,003,446 | $ | 1,285,641 | $ | 1,295,295 | $ | 1,397,142 | $ | 109,905 | ||||||||||||||

| Cost and expenses: |

||||||||||||||||||||||||||

| Cost of sales, excluding pre-publication and publishing rights amortization |

460,566 | 393,855 | 515,948 | 512,612 | 559,593 | 45,270 | ||||||||||||||||||||

| Publishing rights amortization (1) |

106,088 | 135,212 | 177,747 | 230,624 | 235,977 | 48,336 | ||||||||||||||||||||

| Pre-publication amortization (2) |

88,468 | 102,026 | 137,729 | 176,829 | 181,521 | 37,923 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cost of sales |

655,122 | 631,093 | 831,424 | 920,065 | 977,091 | 131,529 | ||||||||||||||||||||

| Selling and administrative |

420,295 | 419,862 | 533,462 | 638,023 | 597,628 | 119,039 | ||||||||||||||||||||

| Other intangible asset amortization |

16,087 | 39,753 | 54,815 | 67,372 | 57,601 | 2,006 | ||||||||||||||||||||

| Impairment charge for goodwill, intangible assets, pre-publication costs and fixed assets |

8,500 | — | 8,003 | 1,674,164 | 103,933 | 4,028 | ||||||||||||||||||||

| Severance and other charges (3) |

6,824 | 5,492 | 9,375 | 32,801 | (11,243 | ) | — | |||||||||||||||||||

| Gain on bargain purchase |

— | — | (30,751 | ) | — | — | — | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating loss |

(27,093 | ) | (92,754 | ) | (120,687 | ) | (2,037,130 | ) | (327,868 | ) | (146,697 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Other Income (expense): |

||||||||||||||||||||||||||

| Interest expense |

(16,626 | ) | (116,733 | ) | (123,197 | ) | (244,582 | ) | (258,174 | ) | (157,947 | ) | ||||||||||||||

| Other (loss) income, net |

— | — | — | — | (6 | ) | 9 | |||||||||||||||||||

| Loss on extinguishment of debt |

(598 | ) | — | — | — | — | — | |||||||||||||||||||

| Change in fair value of derivative instruments |

(229 | ) | 1,624 | 1,688 | (811 | ) | 90,250 | (7,361 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Loss before reorganization items and taxes |

(44,546 | ) | (207,863 | ) | (242,196 | ) | (2,282,523 | ) | (495,798 | ) | (311,996 | ) | ||||||||||||||

| Reorganization items, net (4) |

— | (156,894 | ) | (149,114 | ) | — | — | — | ||||||||||||||||||

| Income tax expense (benefit) |

1,989 | 1,966 | (5,943 | ) | (100,153 | ) | 11,929 | (220 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss |

$ | (46,535 | ) | $ | (52,935 | ) | $ | (87,139 | ) | $ | (2,182,370 | ) | $ | (507,727 | ) | $ | (311,776 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss per share from continuing operations - basic and diluted (5) |

$ | (0.33 | ) | $ | (0.13 | ) | $ | (0.26 | ) | $ | (3.85 | ) | $ | (0.90 | ) | $ | (100,572.90 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss per share attributable to common stockholders - basic and diluted (5) |

$ | (0.33 | ) | $ | (0.13 | ) | $ | (0.26 | ) | $ | (3.85 | ) | $ | (0.90 | ) | $ | (100,572.90 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Weighted average number of common shares used in net loss per share attributable to common stockholders - basic and diluted (5) |

139,918,392 | 408,654,442 | 340,918,128 | |

567,272,470 |

|

567,272,470 | 3,100 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

11

Table of Contents

| Successor | Predecessor | |||||||||||||||||||||||||

| Nine Months Ended September 30, 2013 |

Nine Months Ended September 30, 2012 |

Year Ended December 31, | March 10, 2010 to December 31, 2010 |

January 1, 2010 to March 9, 2010 |

||||||||||||||||||||||

| (in thousands) | 2012 | 2011 | ||||||||||||||||||||||||

| Balance Sheet Data (as of period end): |

||||||||||||||||||||||||||

| Cash, cash equivalents and short-term investments |

$ | 358,012 | $ | 374,895 | $ | 475,119 | $ | 413,610 | $ | 397,740 | ||||||||||||||||

| Working capital |

658,181 | 578,551 | 599,085 | 440,844 | 380,678 | |||||||||||||||||||||

| Total assets |

3,066,632 | 3,100,077 | 3,029,584 | 3,263,903 | 5,257,155 | |||||||||||||||||||||

| Debt (short-term and long-term) |

246,250 | 248,750 | 248,125 | 3,011,588 | 2,861,594 | |||||||||||||||||||||

| Stockholders’ equity (deficit) |

1,904,107 | 1,954,436 | 1,943,701 | (674,552 | ) | 1,517,828 | ||||||||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||||||||

| Operating activities |

46,293 | (56,264 | ) | 104,802 | 132,796 | 182,966 | $ | (41,296 | ) | |||||||||||||||||

| Investing activities |

(141,820 | ) | (213,438 | ) | (295,998 | ) | (195,300 | ) | (232,122 | ) | (25,616 | ) | ||||||||||||||

| Financing activities |

(1,875 | ) | 117,897 | 106,664 | 96,041 | 402,289 | (150 | ) | ||||||||||||||||||

| Other Data: |

||||||||||||||||||||||||||

| Capital expenditures: |

||||||||||||||||||||||||||

| Pre-publication capital expenditures (6) |

112,597 | 89,311 | 114,522 | 122,592 | 96,613 | 22,057 | ||||||||||||||||||||

| Other capital expenditures |

46,232 | 37,538 | 50,943 | 71,817 | 64,139 | 3,559 | ||||||||||||||||||||

| Pre-publication amortization |

88,468 | 102,026 | 137,729 | 176,829 | 181,521 | 37,923 | ||||||||||||||||||||

| Depreciation and intangible asset amortization |

166,494 | 215,971 | 290,693 | 356,388 | 342,227 | 61,242 | ||||||||||||||||||||

| Adjusted EBITDA (7) |

270,201 | 249,231 | 319,812 | 238,198 | 472,751 | (32,014 | ) | |||||||||||||||||||

| (1) | Publishing rights are intangible assets that allow us to publish and republish existing and future works as well as create new works based on previously published materials and are amortized on an accelerated basis over periods estimated to represent the useful life of the content. |

| (2) | We capitalize the art, prepress, manuscript and other costs incurred in the creation of the master copy of a book or other media and amortize such costs from the year of sale over five years on an accelerated basis. |

| (3) | Represents severance and real estate charges. The credit balance in 2010 relates to the reversal of certain charges recorded in prior periods due to a change in estimate. |

| (4) | Represents net gain associated with our Chapter 11 reorganization in 2012. |

| (5) | Gives retroactive effect to the Stock Split for all periods subsequent to our March 9, 2010 restructuring. |

| (6) | Represents capital expenditures for the art, prepress, manuscript and other costs incurred in the creation of the master copy of a book or other media. |

| (7) | Management believes that the presentation of Adjusted EBITDA provides useful information to investors regarding our results of operations because it assists both investors and management in analyzing and benchmarking the performance and value of our business. Adjusted EBITDA provides an indicator of general economic performance that is not affected by debt restructurings, fluctuations in interest rates or effective tax rates, or levels of depreciation or amortization. Accordingly, our management believes that this measurement is useful for comparing general operating performance from period to period. Furthermore, the agreements governing our indebtedness contain covenants and other tests based on Adjusted EBITDA. In addition, targets and positive trends in Adjusted EBITDA are used as performance measures and to determine certain compensation of management. Other companies may define Adjusted EBITDA differently and, as a result, our measure of Adjusted EBITDA may not be directly comparable to Adjusted EBITDA of other companies. Although we use Adjusted EBITDA as a financial measure to assess the performance of our business, the use of Adjusted EBITDA is limited because it does not include certain material costs, such as interest and taxes, necessary to operate our business. Adjusted EBITDA should be considered in addition to, and not as a substitute for, net earnings in accordance with GAAP as a measure of performance. Adjusted EBITDA is not intended to be a measure of liquidity or free cash flow for discretionary use. You are cautioned not to place undue reliance on Adjusted EBITDA. |

12

Table of Contents

The following table reconciles net loss to Adjusted EBITDA:

| Successor | Predecessor | |||||||||||||||||||||||||

| (in thousands) | Nine Months Ended September 30, 2013 |

Nine Months Ended September 30, 2012 |

Year Ended December 31, | March 10, 2010 to December 31, 2010 |

January 1, 2010 to March 9, 2010 |

|||||||||||||||||||||

| 2012 | 2011 | |||||||||||||||||||||||||

| Net loss |

$ | (46,535 | ) | $ | (52,935 | ) | $ | (87,139 | ) | $ | (2,182,370 | ) | $ | (507,727 | ) | $ | (311,776 | ) | ||||||||

| Interest expense |

16,626 | 116,733 | 123,197 | 244,582 | 258,174 | 157,947 | ||||||||||||||||||||

| Provision (benefit) for income taxes |

1,989 | 1,966 | (5,943 | ) | (100,153 | ) | 11,929 | (220 | ) | |||||||||||||||||

| Depreciation expense |

44,319 | 41,006 | 58,131 | 58,392 | 48,649 | 10,900 | ||||||||||||||||||||

| Amortization expense (a) |

210,643 | 276,991 | 370,291 | 474,825 | 475,099 | 88,265 | ||||||||||||||||||||

| Non-cash charges—stock compensation |

6,923 | 2,943 | 4,227 | 8,558 | 4,274 | 925 | ||||||||||||||||||||

| Non-cash charges—gain (loss) on foreign currency and interest hedge |

229 | (1,624 | ) | (1,688 | ) | 811 | (90,250 | ) | 7,361 | |||||||||||||||||

| Non-cash charges—asset impairment charges |

8,500 | — | 8,003 | 1,674,164 | 103,933 | 4,028 | ||||||||||||||||||||

| Purchase accounting adjustments (b) |

8,515 | 11,630 | (16,511 | ) | 22,732 | 113,182 | — | |||||||||||||||||||

| Fees, expenses or charges for equity offerings, debt or acquisitions |

5,819 | 267 | 267 | 3,839 | 1,513 | — | ||||||||||||||||||||

| Debt restructuring (c) |

— | — | — | — | 30,000 | 9,564 | ||||||||||||||||||||

| Restructuring (d) |

1,710 | 3,323 | 6,716 | — | — | — | ||||||||||||||||||||

| Severance, separation costs and facility closures (e) |

10,865 | 5,825 | 9,375 | 32,818 | 23,975 | 992 | ||||||||||||||||||||

| Reorganization items, net (f) |

— | (156,894 | ) | (149,114 | ) | — | — | — | ||||||||||||||||||

| Debt extinguishment loss |

598 | — | — | — | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted EBITDA |

$ | 270,201 | $ | 249,231 | $ | 319,812 | $ | 238,198 | $ | 472,751 | $ | (32,014 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (a) | Includes pre-publication amortization of $88,468 and $102,026 for the nine months ended September 30, 2013 and 2012, respectively, and $137,729 and $176,829 for the years ended December 31, 2012 and 2011, respectively, and $181,521 for the period from March 10, 2010 to December 31, 2010, and $37,923 for the period from January 1, 2010 to March 9, 2010. |

| (b) | Represents certain non-cash accounting adjustments, most significantly relating to deferred revenue and inventory costs, that we were required to record as a direct result of the March 9, 2010 restructuring and the acquisitions for the years ended December 31, 2012 and 2011 and the periods March 10, 2010 to December 31, 2010 and January 1, 2010 to March 9, 2010. |

| (c) | Represents fees paid and charged to operations relating to the March 9, 2010 debt restructuring. |

| (d) | Represents restructuring costs (other than severance and real estate) such as consulting and realignment. |

| (e) | Represents costs associated with restructuring. Included in such costs are severance, facility integration and vacancy of excess facilities. 2010 costs also include program integration and related inventory obsolescence and consulting costs. |

| (f) | Represents net gain associated with our Chapter 11 reorganization in 2012. |

13

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the following risks and all of the other information set forth in this prospectus before deciding whether to invest in our common stock. If any of the following risks actually occurs, our business, financial condition or results of operations would likely suffer. In such case, the trading price of our common stock would likely decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to Our Business and Our Industry

Our business and results of operations may be adversely affected by many factors outside of our control, including changes in federal, state and local education funding, general economic conditions and/or changes in the state procurement process.

The performance and growth of our U.S. educational comprehensive curriculum, supplemental and assessment businesses depend in part on federal and state education funding, which in turn is dependent on the robustness of state finances and the level of funding allocated to educational programs. State, local and municipal finances were and continue to be adversely affected by the recent U.S. economic recession and are affected by general economic conditions and factors outside of our control, as well as increasing costs and financial liabilities of under-funded public pension plans. In response to general economic conditions or budget shortfalls, states and districts may reduce educational spending to protect against existing or expected economic conditions or seek cost savings to mitigate budget deficits. Most public school districts, the primary customers for K-12 products and services, depend largely on state and local funding to purchase materials. In school districts in states that primarily rely on local tax proceeds, significant reductions in those proceeds for any reason can severely restrict district purchases of instructional materials. In districts and states that primarily rely on state funding for instructional materials, a reduction in state funds or loosening of restrictions on the use of those funds may reduce net sales. Additionally, many school districts receive substantial amounts through Federal education programs, funding for which may be reduced as a result of the Federal sequester.

Federal and/or state legislative changes can also affect the funding available for educational expenditure, which include the impact of education reform such as the reauthorization of the Elementary and Secondary Education Act (“ESEA”) and the implementation of Common Core State Standards. Existing programs and funding streams could be changed or eliminated in connection with legislation to reauthorize the ESEA and/or the federal appropriations process, in ways that could negatively affect demand and sources of funding for our products and services. Our business, results of operations and financial condition may be materially adversely affected by many factors outside of our control, including, but not limited to, delays in the timing of adoptions, changes in curricula and changes in student testing processes. There can be no assurances that states or districts will have sufficient funding to purchase our products and services, that we will win their business in our competitive marketplace or that schools or districts that have historically purchased our products and services will do so again in the future.

Similarly, changes in the state procurement process for textbooks, supplemental materials and student tests, particularly in adoption states, can also affect our markets and sales. A significant portion of our net sales is derived from sales of K-12 instructional materials pursuant to cyclical adoption schedules. Due to the revolving and staggered nature of state adoption schedules, sales of K-12 instructional materials have traditionally been cyclical, with some years offering more sales opportunities than others. In addition, changes in curricula and changes in the student testing processes can negatively affect our programs and therefore the size of our market in any given year.

For example, over the next few years, adoptions are scheduled in the primary subjects of reading, language arts and literature, social studies and mathematics in, among others, the states of Texas and Florida, two of the largest adoption states. The inability to succeed in these two states, or reductions in their anticipated funding

14

Table of Contents

levels, could materially and adversely affect net sales for the year of adoption and subsequent years. Allowing districts flexibility to use state funds previously dedicated exclusively to the purchase of instructional materials and other items such as technology hardware and training could adversely affect district expenditures on state-adopted instructional materials in the future.

Decreases in federal and state education funding and negative trends or changes in general economic conditions can have a material adverse effect on our business, results of operations and financial condition.

Introduction of new products, services or technologies could impact our profitability.

We operate in highly competitive markets that continue to change to adapt to customer needs. In order to maintain a competitive position, we must continue to invest in new content and new ways to deliver our products and services. These investments may not be profitable or may be less profitable than what we have experienced historically. In particular, in the context of our current focus on key digital opportunities, including e-books, the market is evolving and we may be unsuccessful in establishing ourselves as a significant competitor. New distribution channels, such as digital platforms, the internet, online retailers and delivery platforms (e.g., tablets and e-readers), present both threats and opportunities to our traditional publishing models, potentially impacting both sales volumes and pricing.

Our operating results fluctuate on a seasonal and quarterly basis and our business is dependent on our results of operations for the third quarter.

Our business is seasonal. For the year ended December 31, 2012, we derived approximately 88% of net sales from educational publishing in our Education segment. For sales of educational products, purchases typically are made primarily in the second and third quarters of the calendar year, in preparation for the beginning of the school year, though testing net sales are primarily generated in the second and fourth quarters. We typically realize a significant portion of net sales during the third quarter, making third-quarter results material to full-year performance. This sales seasonality affects operating cash flow from quarter to quarter. We normally incur a net cash deficit from all of our activities through the middle of the third quarter of the year. In addition, changes in our customers’ ordering patterns may impact the comparison of results in a quarter with the same quarter of the previous year, in a quarter with the consecutive quarter or a fiscal year with the prior fiscal year.

We may not be able to identify successful business models for generating sales of technology-enabled programs. Furthermore, customers’ expectations for the number and sophistication of technology-enabled programs that are given to them at no additional charge may increase, as may development costs.

The core curriculum elementary school, core curriculum secondary school and educational testing customers have become accustomed to being given technology-enabled products at no additional charge from publishers, such as us, as incentives to adopt programs and other products. The sophistication and expense of technology-enabled products continues to grow. Our profitability may decrease materially if we are unable to realize sales of these products, customers continue to expect/insist on an increasing number of technology-enabled materials of increasing quality being given to them, or costs of these products continue to rise.

Our business will be impacted by the rate of and state of technological change, including the digital evolution and other disruptive technologies, and the presence and development of open-sourced content could continue to increase, which could adversely affect our revenue.

The publishing industry has been impacted by the digitalization of content and proliferation of distribution channels, either over the internet, or via other electronic means, replacing traditional print formats. The digital migration brings the need for change in product distribution, consumers’ perception of value and the publisher’s position between retailers and authors. Such digitalization increases competitive threats both from large media

15

Table of Contents

players and from smaller businesses, online and mobile portals. If we are unable to adapt and transition to the move to digitalization at the rate of our competitors, our ability to effectively compete in the marketplace will be affected.

In recent years there have been initiatives by non-profit organizations such as the Gates Foundation and the Hewlett Foundation to develop educational content that can be “open sourced” and made available to educational institutions for free or nominal cost. To the extent that such open sourced content is developed and made available to educational customers and is competitive with our instructional materials, our sales opportunities and net sales could be adversely affected.

Technological changes and the availability of free or relatively inexpensive information and materials may also affect changes in consumer behavior and expectations. Public and private sources of free or relatively inexpensive information and lower pricing for digital products may reduce demand and impact the prices we can charge for our products and services. To the extent that technological changes and the availability of free or relatively inexpensive information and materials limit the prices we can charge or demand for our products and services, our business, financial position and results of operations may be materially adversely affected.

Changes in product distribution channels and/or customer bankruptcy may restrict our ability to grow and affect our profitability in our Trade Publishing segment.

New distribution channels such as digital formats, the internet, online retailers, growing delivery platforms (e.g., tablets and e-readers), combined with the concentration of retailer power, pose threats and provide opportunities to our traditional consumer publishing models in our Trade Publishing segment, potentially impacting both sales volumes and pricing. The economic slowdown combined with the trend to e-books has created contraction in the consumer books retail market that has increased the risk of bankruptcy of major retail customers. Additional bankruptcies of traditional “bricks and mortar” retailers of Trade Publishing could negatively affect our business, financial condition and results of operations.