Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JONES LANG LASALLE INC | a8kq3earningrelease.htm |

| EX-99.1 - EX-99.1 - JONES LANG LASALLE INC | exhibit991.htm |

Supplemental Information Third-Quarter Earnings Call 2013

Market & Financial Overview

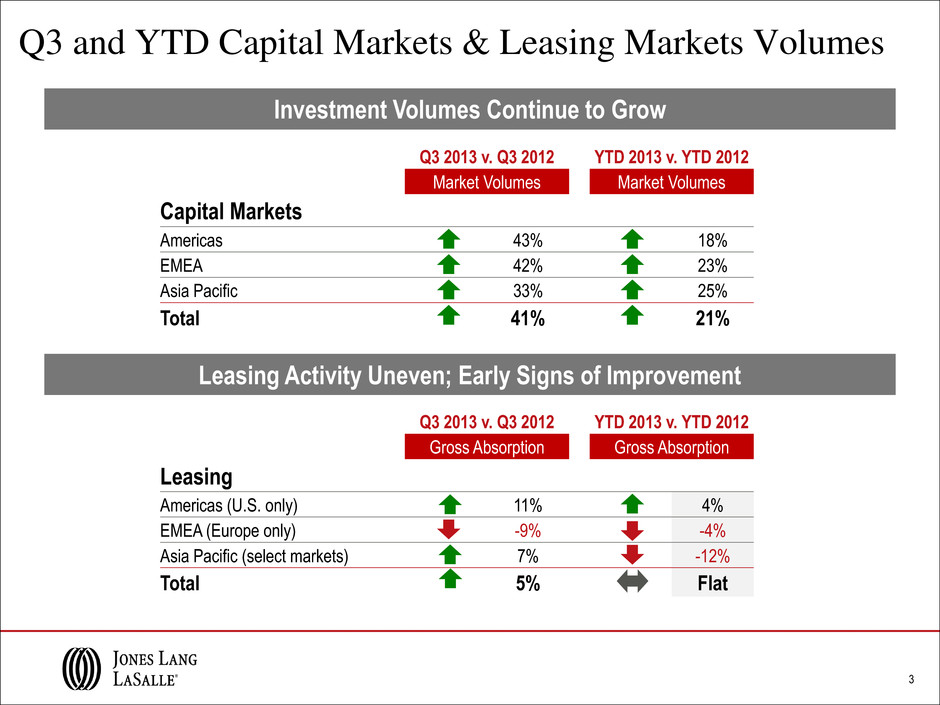

Q3 and YTD Capital Markets & Leasing Markets Volumes Q3 2013 v. Q3 2012 YTD 2013 v. YTD 2012 Gross Absorption Gross Absorption Leasing Americas (U.S. only) 11% 4% EMEA (Europe only) -9% -4% Asia Pacific (select markets) 7% -12% Total 5% Flat Q3 2013 v. Q3 2012 YTD 2013 v. YTD 2012 Market Volumes Market Volumes Capital Markets Americas 43% 18% EMEA 42% 23% Asia Pacific 33% 25% Total 41% 21% Leasing Activity Uneven; Early Signs of Improvement Investment Volumes Continue to Grow 3

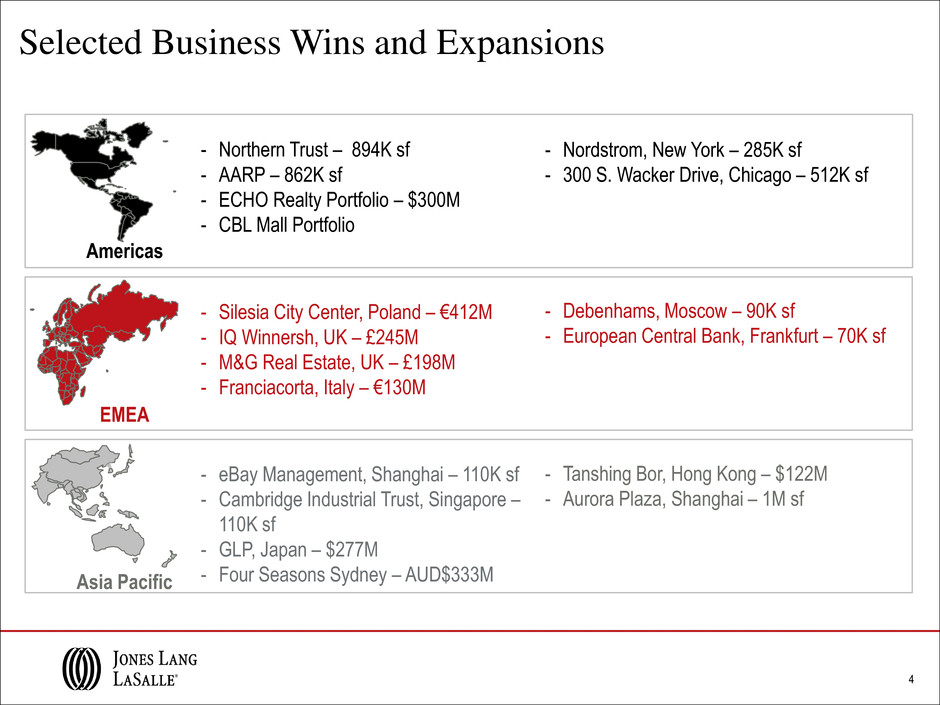

Selected Business Wins and Expansions 4 Americas EMEA Asia Pacific - Northern Trust – 894K sf - AARP – 862K sf - ECHO Realty Portfolio – $300M - CBL Mall Portfolio - Nordstrom, New York – 285K sf - 300 S. Wacker Drive, Chicago – 512K sf - Silesia City Center, Poland – €412M - IQ Winnersh, UK – £245M - M&G Real Estate, UK – £198M - Franciacorta, Italy – €130M - Debenhams, Moscow – 90K sf - European Central Bank, Frankfurt – 70K sf - eBay Management, Shanghai – 110K sf - Cambridge Industrial Trust, Singapore – 110K sf - GLP, Japan – $277M - Four Seasons Sydney – AUD$333M - Tanshing Bor, Hong Kong – $122M - Aurora Plaza, Shanghai – 1M sf

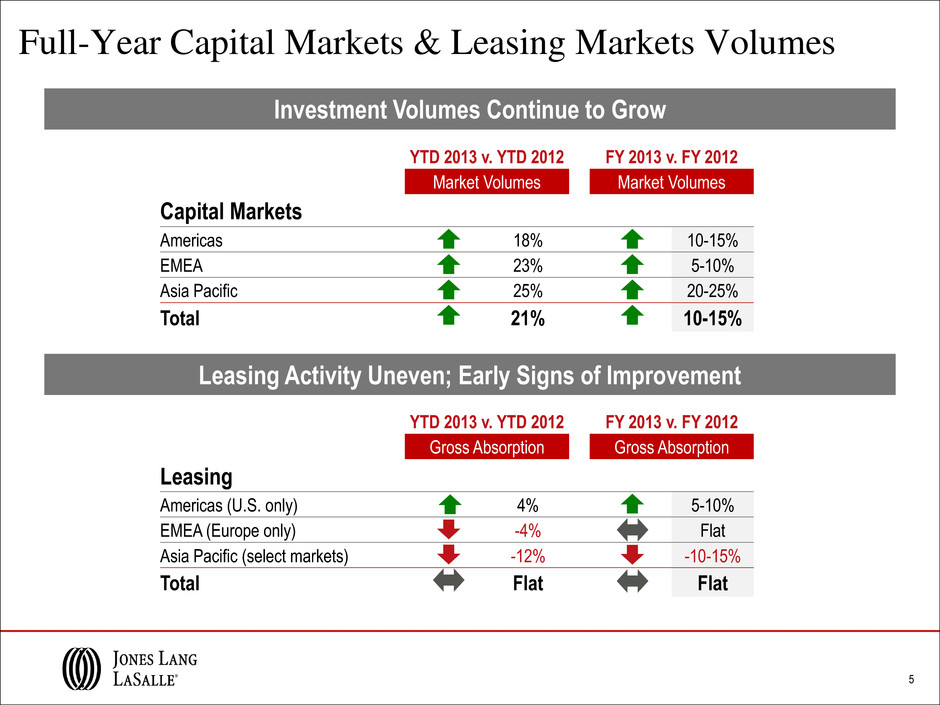

Full-Year Capital Markets & Leasing Markets Volumes YTD 2013 v. YTD 2012 FY 2013 v. FY 2012 Gross Absorption Gross Absorption Leasing Americas (U.S. only) 4% 5-10% EMEA (Europe only) -4% Flat Asia Pacific (select markets) -12% -10-15% Total Flat Flat YTD 2013 v. YTD 2012 FY 2013 v. FY 2012 Market Volumes Market Volumes Capital Markets Americas 18% 10-15% EMEA 23% 5-10% Asia Pacific 25% 20-25% Total 21% 10-15% Leasing Activity Uneven; Early Signs of Improvement Investment Volumes Continue to Grow 5

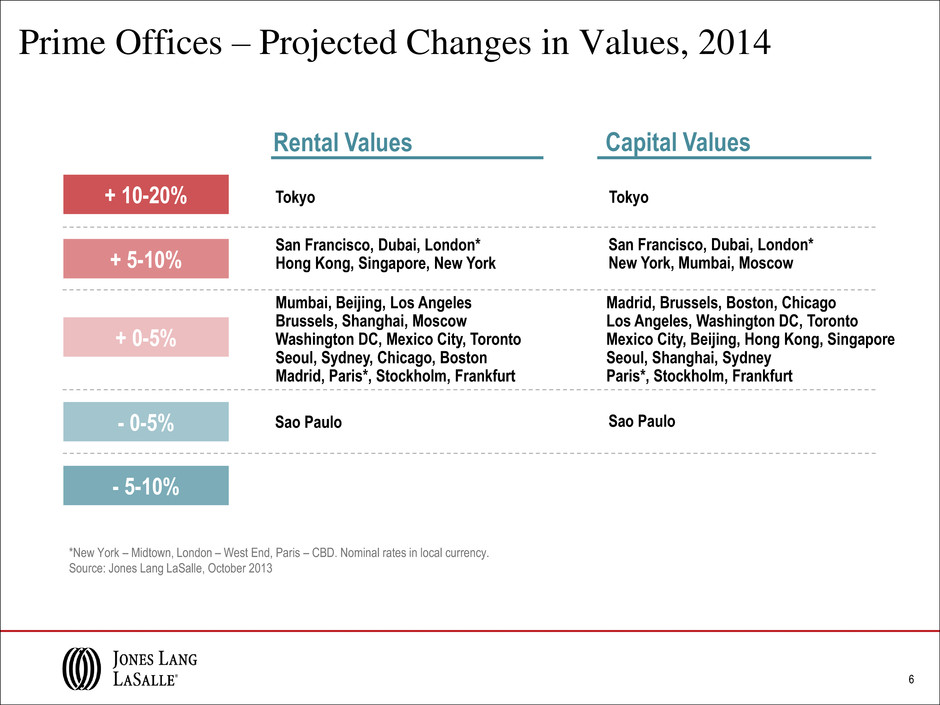

Prime Offices – Projected Changes in Values, 2014 6 + 10-20% + 5-10% + 0-5% - 0-5% - 5-10% San Francisco, Dubai, London* Hong Kong, Singapore, New York Mumbai, Beijing, Los Angeles Brussels, Shanghai, Moscow Washington DC, Mexico City, Toronto Seoul, Sydney, Chicago, Boston Madrid, Paris*, Stockholm, Frankfurt San Francisco, Dubai, London* New York, Mumbai, Moscow Sao Paulo Tokyo Sao Paulo Tokyo *New York – Midtown, London – West End, Paris – CBD. Nominal rates in local currency. Source: Jones Lang LaSalle, October 2013 Capital Values Rental Values Madrid, Brussels, Boston, Chicago Los Angeles, Washington DC, Toronto Mexico City, Beijing, Hong Kong, Singapore Seoul, Shanghai, Sydney Paris*, Stockholm, Frankfurt

Financial Information

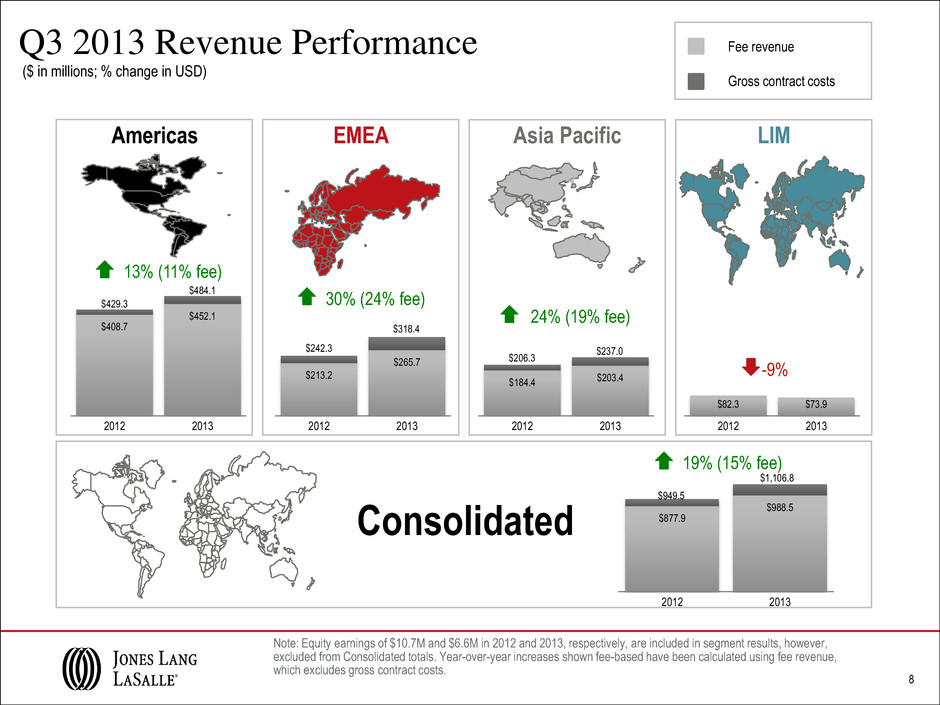

$82.3 $73.9 2012 2013 -9% $877.9 $988.5 2012 2013 $408.7 $452.1 2012 2013 8 Q3 2013 Revenue Performance Note: Equity earnings of $10.7M and $6.6M in 2012 and 2013, respectively, are included in segment results, however, excluded from Consolidated totals. Year-over-year increases shown fee-based have been calculated using fee revenue, which excludes gross contract costs. Americas EMEA Asia Pacific LIM Consolidated ($ in millions; % change in USD) 13% (11% fee) $184.4 $203.4 2012 2013 $213.2 $265.7 2012 2013 30% (24% fee) 24% (19% fee) 19% (15% fee) $484.1 $429.3 $318.4 $242.3 $237.0 $206.3 $949.5 Fee revenue Gross contract costs $1,106.8

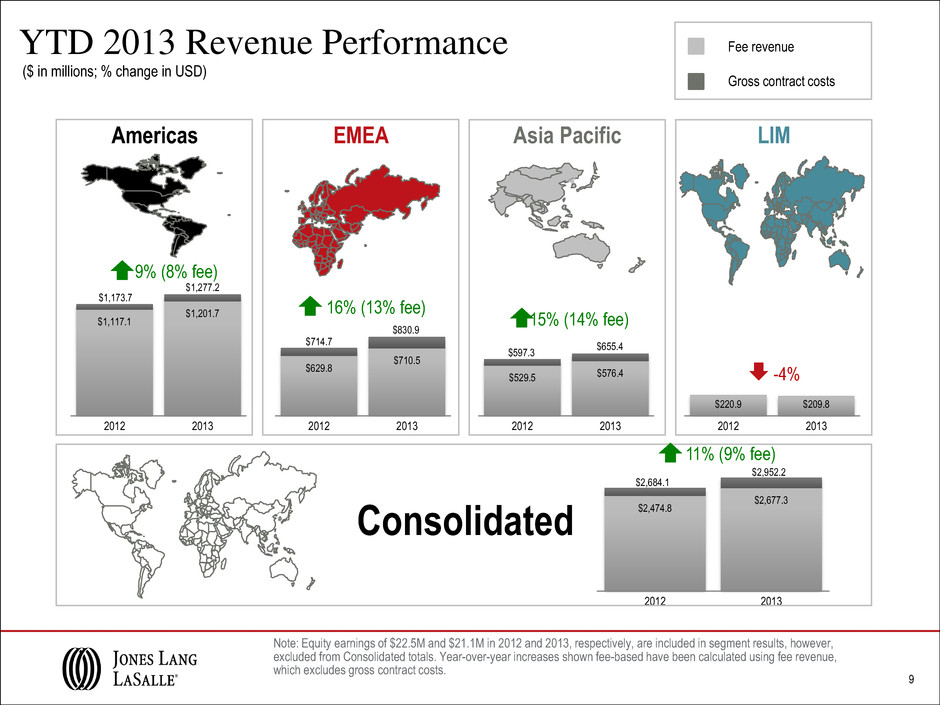

$2,474.8 $2,677.3 2012 2013 $1,117.1 $1,201.7 2012 2013 9 YTD 2013 Revenue Performance Americas EMEA Asia Pacific LIM Consolidated ($ in millions; % change in USD) 9% (8% fee) $529.5 $576.4 2012 2013 $220.9 $209.8 2012 2013 $629.8 $710.5 2012 2013 16% (13% fee) 15% (14% fee) -4% 11% (9% fee) $1,277.2 $1,173.7 $830.9 $714.7 $655.4 $597.3 $2,952.2 $2,684.1 Fee revenue Gross contract costs Note: Equity earnings of $22.5M and $21.1M in 2012 and 2013, respectively, are included in segment results, however, excluded from Consolidated totals. Year-over-year increases shown fee-based have been calculated using fee revenue, which excludes gross contract costs.

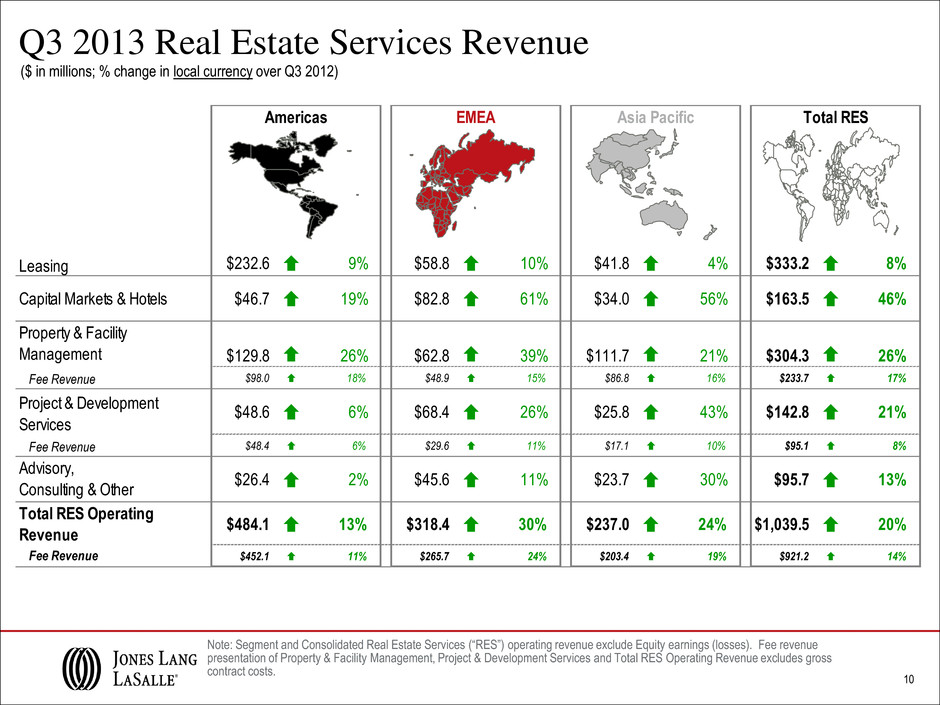

10 Q3 2013 Real Estate Services Revenue ($ in millions; % change in local currency over Q3 2012) Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $232.6 9% $58.8 10% $41.8 4% $333.2 8% Capital Markets & Hotels $46.7 19% $82.8 61% $34.0 56% $163.5 46% Property & Facility Management $129.8 26% $62.8 39% $111.7 21% $304.3 26% Fee Revenue $98.0 18% $48.9 15% $86.8 16% $233.7 17% Project & Development Services $48.6 6% $68.4 26% $25.8 43% $142.8 21% Fee Revenue $48.4 6% $29.6 11% $17.1 10% $95.1 8% Advisory, Consulting & Other $26.4 2% $45.6 11% $23.7 30% $95.7 13% Total RES Operating Revenue $484.1 13% $318.4 30% $237.0 24% $1,039.5 20% Fee Revenue $452.1 11% $265.7 24% $203.4 19% $921.2 14% Americas EMEA Asia Pacific Total RES

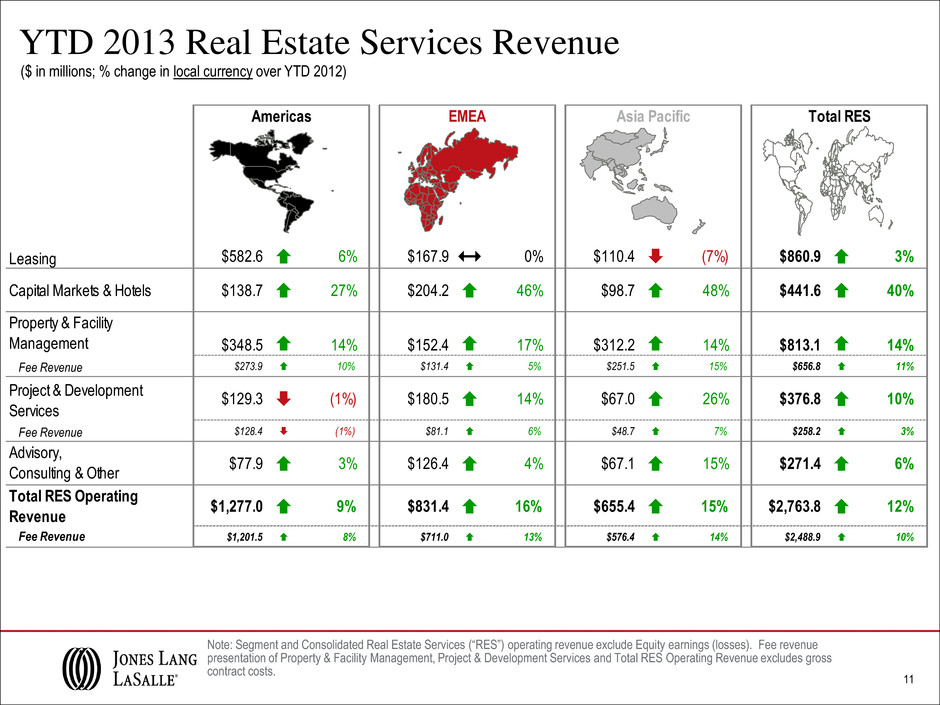

11 YTD 2013 Real Estate Services Revenue ($ in millions; % change in local currency over YTD 2012) Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $582.6 6% $167.9 1 0% $110.4 (7%) $860.9 3% Capital Markets & Hotels $138.7 27% $204.2 46% $98.7 48% $441.6 40% Property & Facility Management $348.5 14% $152.4 17% $312.2 14% $813.1 14% Fee Revenue $273.9 10% $131.4 5% $251.5 15% $656.8 11% Project & Development Services $129.3 (1%) $180.5 14% $67.0 26% $376.8 10% Fee Revenue $128.4 (1%) $81.1 6% $48.7 7% $258.2 3% Advisory, Consulting & Other $77.9 3% $126.4 4% $67.1 15% $271.4 6% Total RES Operating Revenue $1,277.0 9% $831.4 16% $655.4 15% $2,763.8 12% Fee Revenue $1,201.5 8% $711.0 13% $576.4 14% $2,488.9 10% Americas EMEA Asia Pacific Total RES

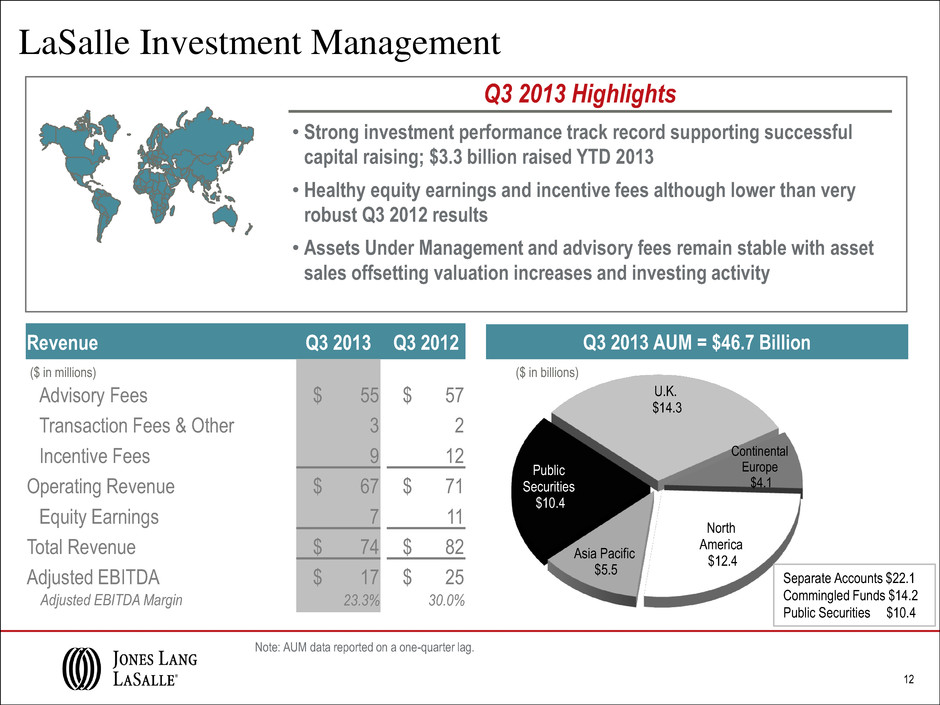

Q3 2013 Highlights LaSalle Investment Management Note: AUM data reported on a one-quarter lag. • Strong investment performance track record supporting successful capital raising; $3.3 billion raised YTD 2013 • Healthy equity earnings and incentive fees although lower than very robust Q3 2012 results • Assets Under Management and advisory fees remain stable with asset sales offsetting valuation increases and investing activity Q3 2013 AUM = $46.7 Billion U.K. $14.3 Continental Europe $4.1 North America $12.4 Asia Pacific $5.5 Public Securities $10.4 Revenue Q3 2013 Q3 2012 Advisory Fees $ 55 $ 57 Transaction Fees & Other 3 2 Incentive Fees 9 12 Operating Revenue $ 67 $ 71 Equity Earnings 7 11 Total Revenue $ 74 $ 82 Adjusted EBITDA $ 17 $ 25 Adjusted EBITDA Margin 23.3% 30.0% ($ in millions) Separate Accounts $22.1 Commingled Funds $14.2 Public Securities $10.4 ($ in billions) 12

Solid Balance Sheet Position Q3 2013 Highlights ($ in millions) 13 Q3 Q2 Q1 Q4 Balance Sheet 2013 2013 2013 2012 Cash and Cash Equivalents $ 120 $ 122 $ 133 $ 152 Short-Term Borrowings 35 51 38 32 Credit Facility 445 479 470 169 Net Bank Debt $ 360 $ 408 $ 375 $ 49 Long-Term Senior Notes 275 275 275 275 Deferred Business Acquisition Obligations 130 150 220 214 Total Net Debt $ 765 $ 833 $ 870 $ 538 • Investment grade balance sheet; Baa2 / BBB- (Stable) – Low debt cost: 3Q 2013 net interest expense of $9.6 million – Renewed bank credit facility; increased size to $1.2 billion with initial pricing at LIBOR + 1.25% • Healthy net debt position entering historically strong fourth quarter – Net debt reduction of $68 million during Q3; steady net debt reduction from seasonally high balance at Q1 • Q3 spending reflects ongoing business investment including M&A, co-investment and CapEx Q3 YTD 2013 Q3 YTD 2012 – Capital Expenditures $55 m $55 m – New M&A Payments $11 m $14 m – Deferred Acquisition Payments/Earn Outs $114 m $44 m – Co-Investment Distributions/Returns $14 m $55 m

Appendix

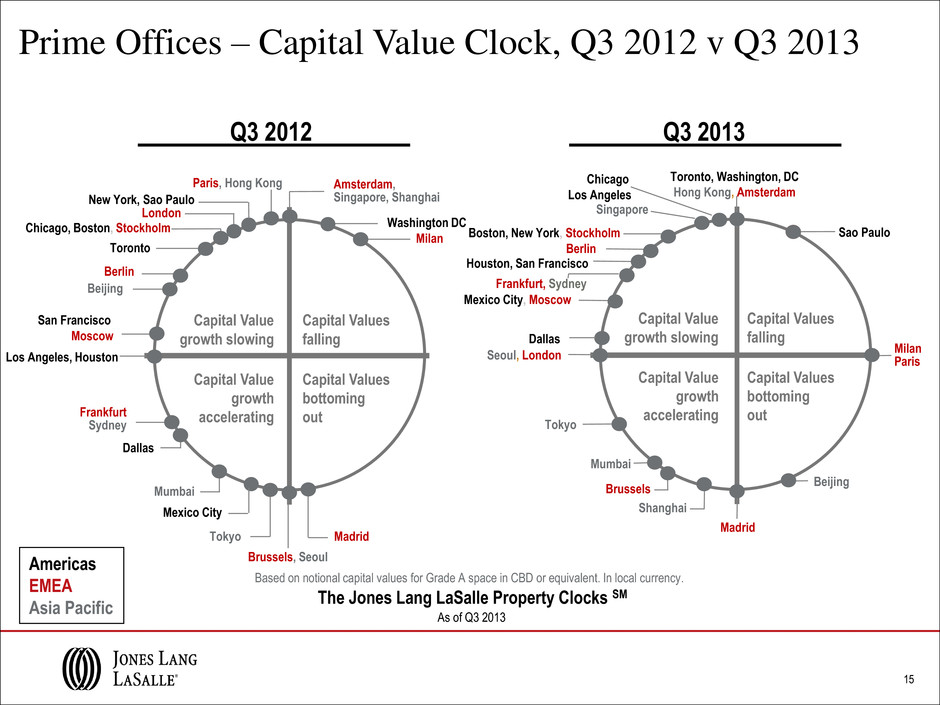

Capital Value growth slowing Capital Value growth accelerating 15 Prime Offices – Capital Value Clock, Q3 2012 v Q3 2013 Americas EMEA Asia Pacific Q3 2012 Q3 2013 As of Q3 2013 The Jones Lang LaSalle Property Clocks SM Milan Madrid Brussels, Seoul Paris, Hong Kong Amsterdam, Singapore, Shanghai New York, Sao Paulo Los Angeles, Houston Dallas Toronto Mexico City San Francisco Moscow Washington DC Chicago, Boston, Stockholm Frankfurt Sydney Berlin London Tokyo Mumbai Beijing Capital Value growth slowing Capital Value growth accelerating Capital Values bottoming out Capital Values falling Capital Values bottoming out Capital Values falling Toronto, Washington, DC Hong Kong, Amsterdam Sao Paulo Mexico City, Moscow Houston, San Francisco Chicago Los Angeles Boston, New York, Stockholm Dallas Seoul, London Tokyo Mumbai Madrid Beijing Milan Paris Brussels Frankfurt, Sydney Berlin Shanghai Singapore Based on notional capital values for Grade A space in CBD or equivalent. In local currency.

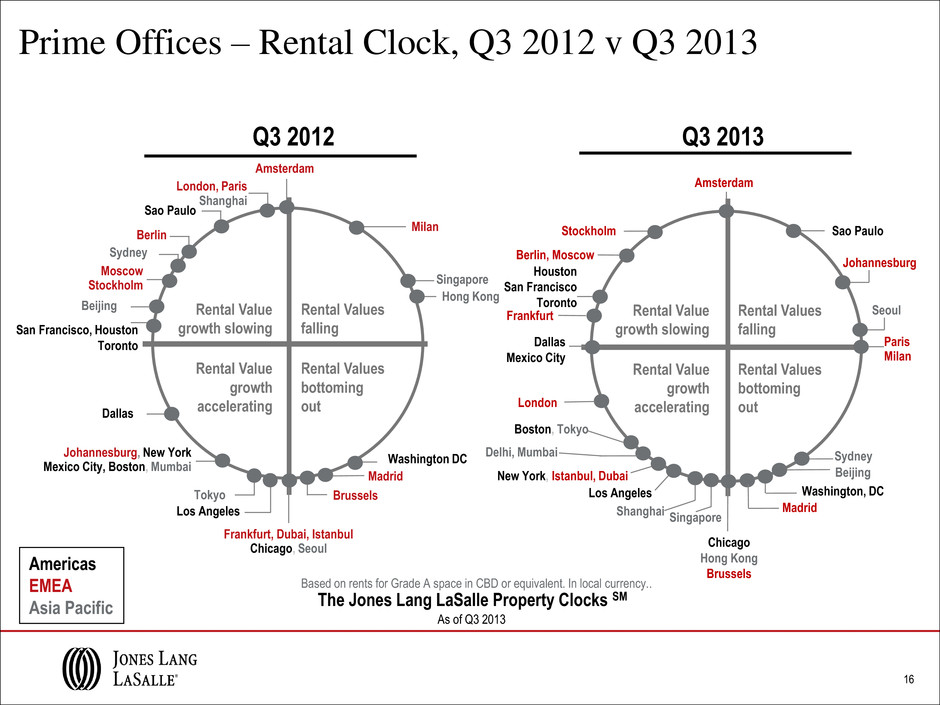

Rental Value growth accelerating Rental Value growth slowing 16 Prime Offices – Rental Clock, Q3 2012 v Q3 2013 As of Q3 2013 The Jones Lang LaSalle Property Clocks SM Americas EMEA Asia Pacific Q3 2012 Q3 2013 Madrid Johannesburg, New York Mexico City, Boston, Mumbai Frankfurt, Dubai, Istanbul Chicago, Seoul Amsterdam Milan Brussels Moscow Stockholm Berlin London, Paris Shanghai Dallas Washington DC Tokyo Sao Paulo Singapore Hong Kong Sydney Los Angeles Beijing Rental Value growth slowing Rental Value growth accelerating Rental Values bottoming out Rental Values falling Rental Values bottoming out Rental Values falling Houston San Francisco Toronto Boston, Tokyo Chicago Hong Kong Brussels New York, Istanbul, Dubai Los Angeles Washington, DC Sao Paulo Dallas Mexico City Delhi, Mumbai Shanghai Singapore Beijing Johannesburg Paris Milan Madrid London Frankfurt Berlin, Moscow Stockholm Amsterdam Sydney San Francisco, Houston Toronto Seoul Based on rents for Grade A space in CBD or equivalent. In local currency..

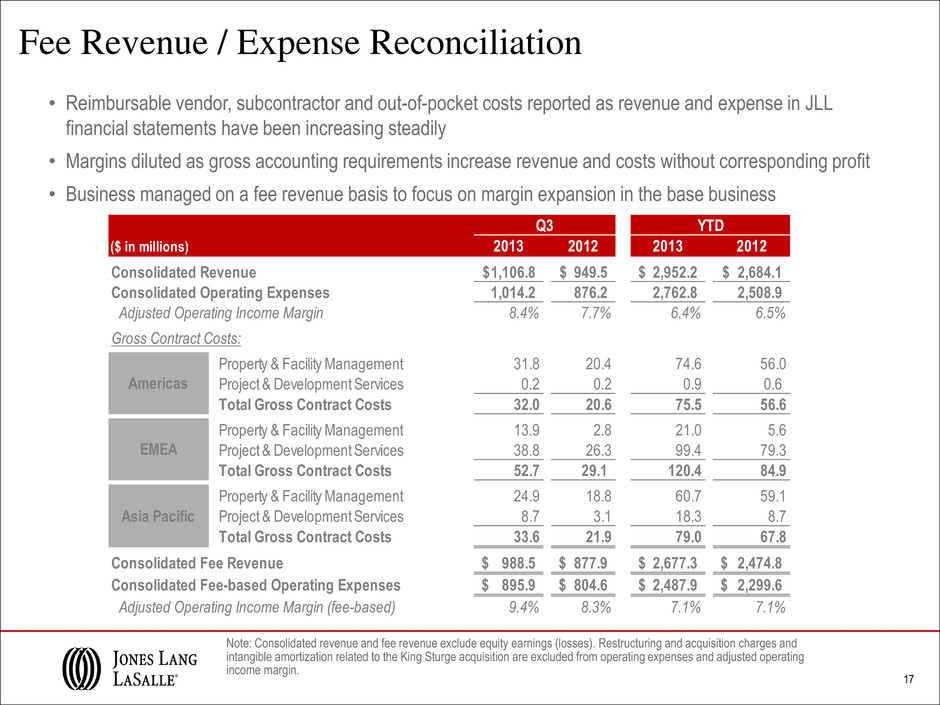

Fee Revenue / Expense Reconciliation Note: Consolidated revenue and fee revenue exclude equity earnings (losses). Restructuring and acquisition charges and intangible amortization related to the King Sturge acquisition are excluded from operating expenses and adjusted operating income margin. • Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue and expense in JLL financial statements have been increasing steadily • Margins diluted as gross accounting requirements increase revenue and costs without corresponding profit • Business managed on a fee revenue basis to focus on margin expansion in the base business ($ in millions) 2013 2012 2013 2012 Consolidated Revenue 1,106.8$ 949.5$ 2,952.2$ 2,684.1$ Consolidated Operating Expenses 1,014.2 876.2 2,762.8 2,508.9 Adjusted Operating Income Margin 8.4% 7.7% 6.4% 6.5% Gross Contract Costs: Property & Facility Management 31.8 20.4 74.6 56.0 Project & Development Services 0.2 0.2 0.9 0.6 Total Gross Contract Costs 32.0 20.6 75.5 56.6 Property & Facility Management 13.9 2.8 21.0 5.6 Project & Development Services 38.8 26.3 99.4 79.3 Total Gross Contract Costs 52.7 29.1 120.4 84.9 Property & Facility Management 24.9 18.8 60.7 59.1 Project & Development Services 8.7 3.1 18.3 8.7 Total Gross Contract Costs 33.6 21.9 79.0 67.8 Consolidated Fee Revenue 988.5$ 877.9$ 2,677.3$ 2,474.8$ Consolidated Fee-based Operating Expenses 895.9$ 804.6$ 2,487.9$ 2,299.6$ Adjusted Operating Income Margin (fee-based) 9.4% 8.3% 7.1% 7.1% A ia Pacific Americas EMEA Q3 YTD 17

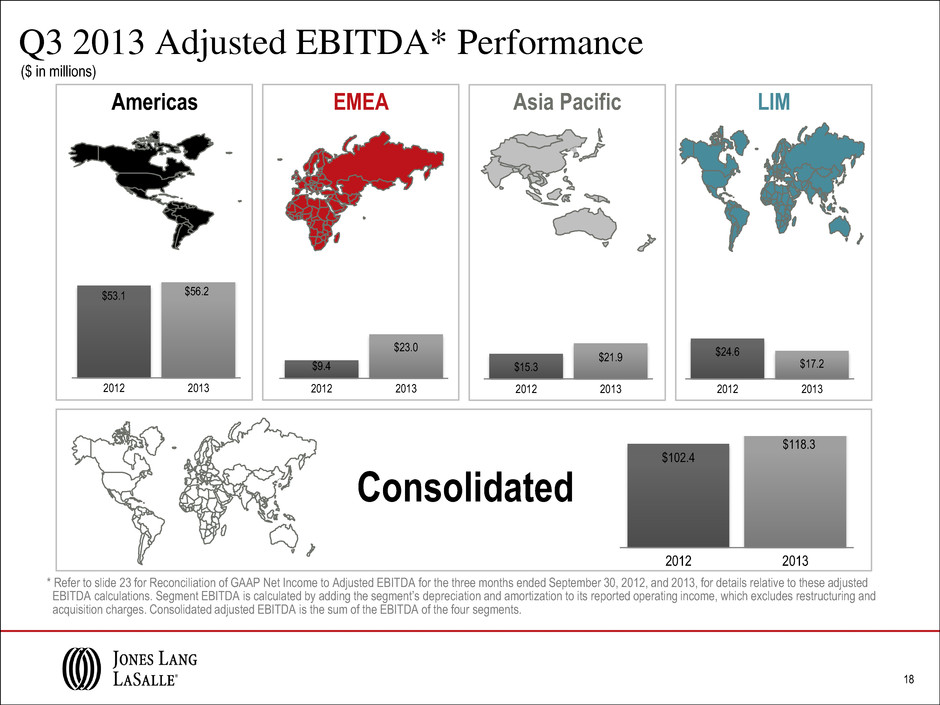

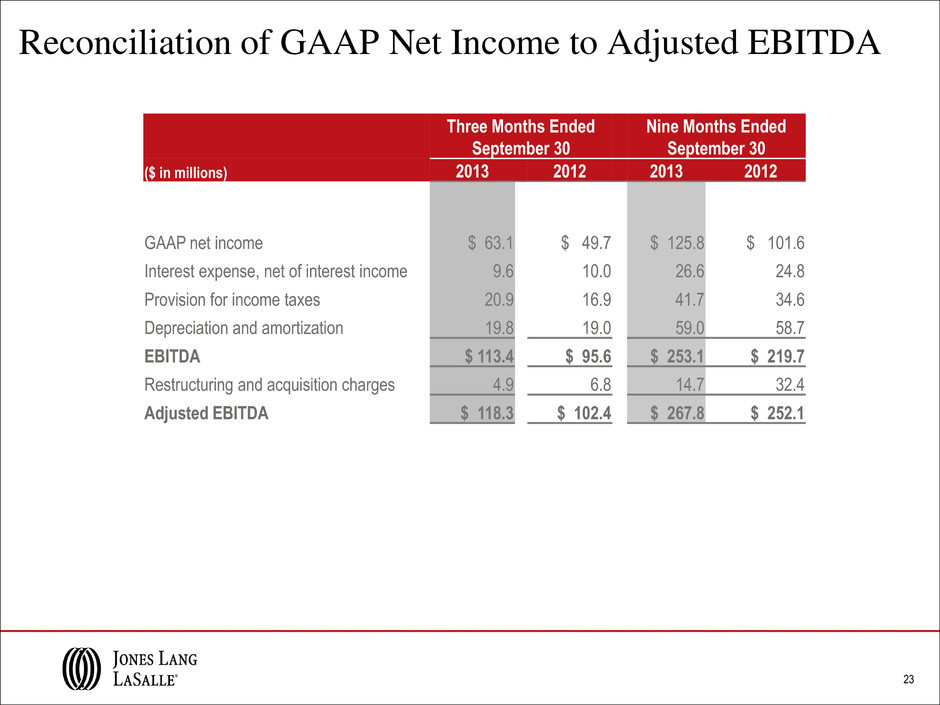

$53.1 2012 2013 18 Q3 2013 Adjusted EBITDA* Performance Americas EMEA Asia Pacific LIM Consolidated $102.4 2012 2013 $118.3 * Refer to slide 23 for Reconciliation of GAAP Net Income to Adjusted EBITDA for the three months ended September 30, 2012, and 2013, for details relative to these adjusted EBITDA calculations. Segment EBITDA is calculated by adding the segment’s depreciation and amortization to its reported operating income, which excludes restructuring and acquisition charges. Consolidated adjusted EBITDA is the sum of the EBITDA of the four segments. ($ in millions) $15.3 $21.9 2012 2013 $24.6 $17.2 2012 2013 $9.4 $23.0 2012 2013 $56.2

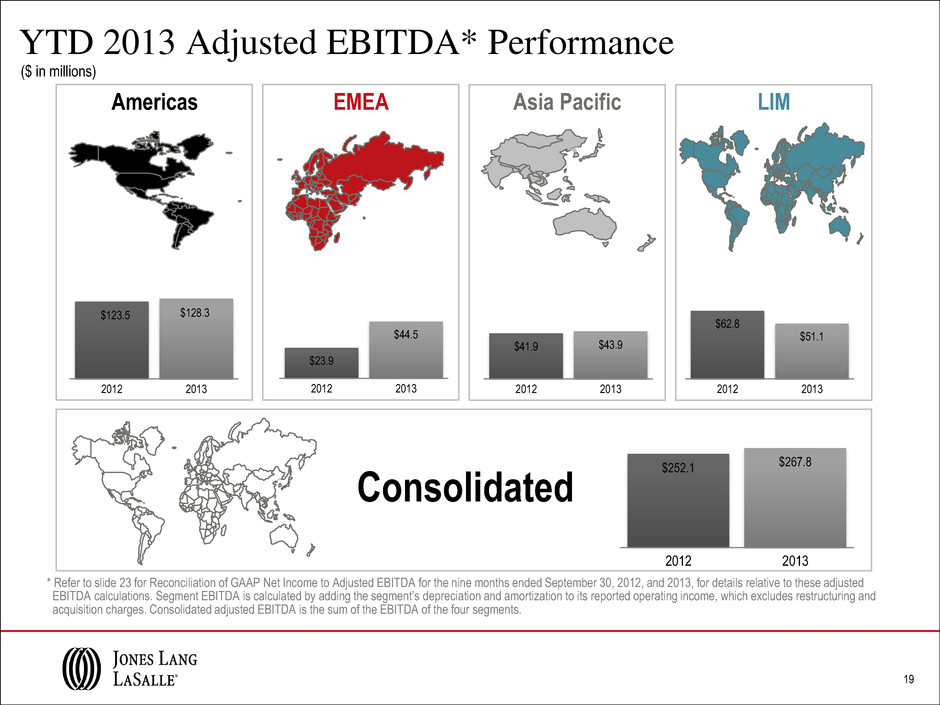

19 YTD 2013 Adjusted EBITDA* Performance Americas EMEA Asia Pacific LIM Consolidated $252.1 $267.8 2012 2013 * Refer to slide 23 for Reconciliation of GAAP Net Income to Adjusted EBITDA for the nine months ended September 30, 2012, and 2013, for details relative to these adjusted EBITDA calculations. Segment EBITDA is calculated by adding the segment’s depreciation and amortization to its reported operating income, which excludes restructuring and acquisition charges. Consolidated adjusted EBITDA is the sum of the EBITDA of the four segments. ($ in millions) $41.9 $43.9 2012 2013 $62.8 $51.1 2012 2013 $23.9 $44.5 2012 20132012 2013 $123.5 $128.3

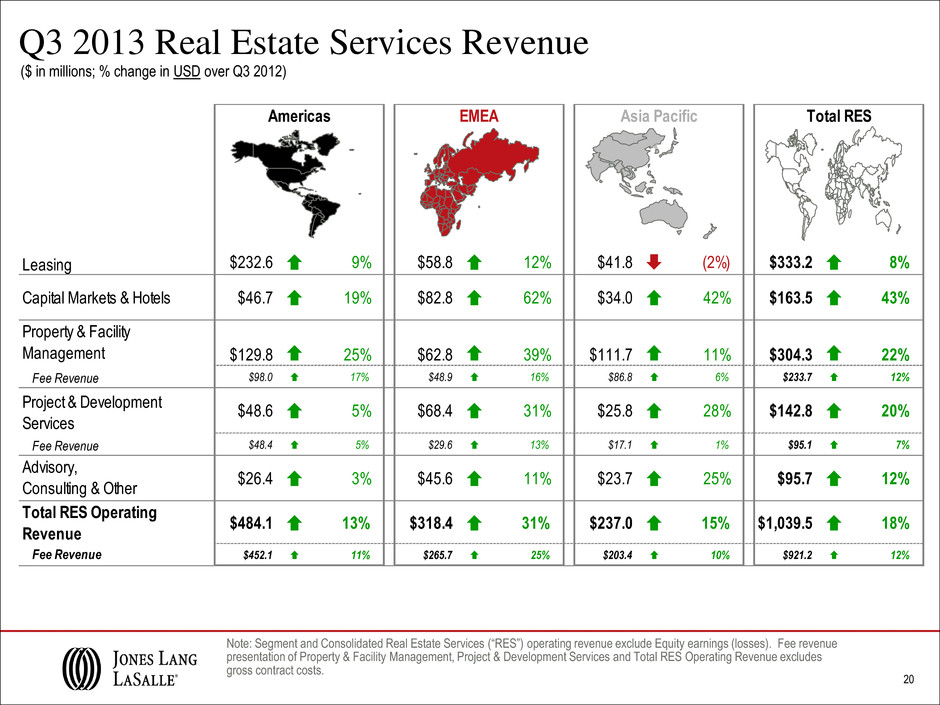

20 Q3 2013 Real Estate Services Revenue ($ in millions; % change in USD over Q3 2012) Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $232.6 9% $58.8 12% $41.8 (2%) $333.2 8% Capital Markets & Hotels $46.7 19% $82.8 62% $34.0 42% $163.5 43% Property & Facility Management $129.8 25% $62.8 39% $111.7 11% $304.3 22% Fee Revenue $98.0 17% $48.9 16% $86.8 6% $233.7 12% Project & Development Services $48.6 5% $68.4 31% $25.8 28% $142.8 20% Fee Revenue $48.4 5% $29.6 13% $17.1 1% $95.1 7% Ad isory, Consulting & Other $26.4 3% $45.6 11% $23.7 25% $95.7 12% Total RES Operating Revenue $484.1 13% $318.4 31% $237.0 15% $1,039.5 18% Fee Revenue $452.1 11% $265.7 25% $203.4 10% $921.2 12% Americas EMEA Asia Pacific Total RES

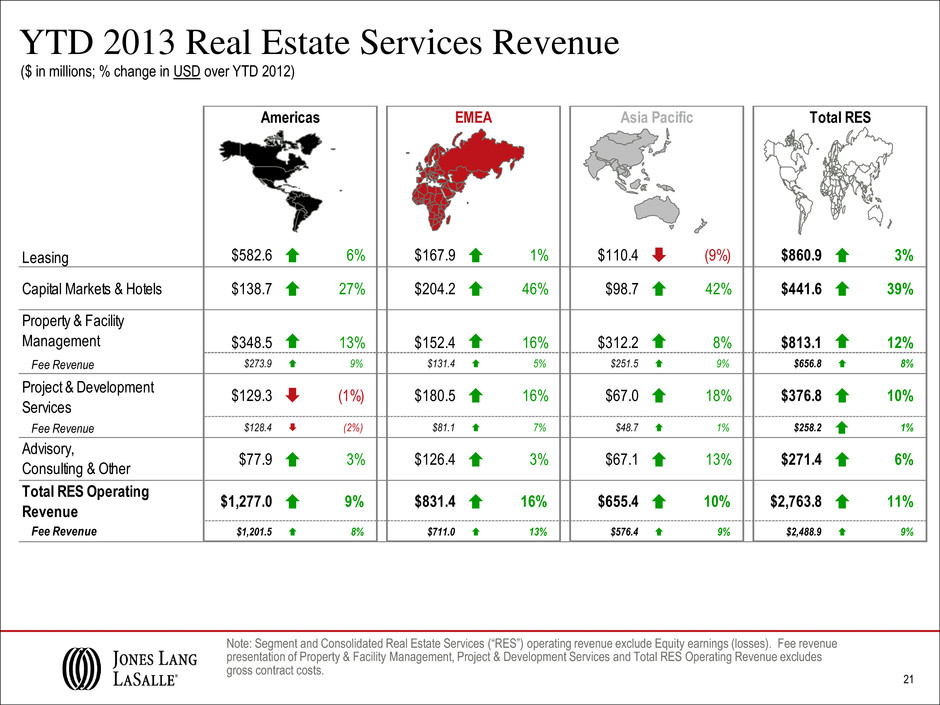

21 YTD 2013 Real Estate Services Revenue ($ in millions; % change in USD over YTD 2012) Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Leasing $582.6 6% $167.9 1% $110.4 (9%) $860.9 3% Capital Markets & Hotels $138.7 27% $204.2 46% $98.7 42% $441.6 39% Property & Facility Management $348.5 13% $152.4 16% $312.2 8% $813.1 12% Fee Revenue $273.9 9% $131.4 5% $251.5 9% $656.8 8% Project & Development Services $129.3 (1%) $180.5 16% $67.0 18% $376.8 10% Fee Revenue $128.4 (2%) $81.1 7% $48.7 1% $258.2 1% Advisory, Consulting & Other $77.9 3% $126.4 3% $67.1 13% $271.4 6% Total RES Operating Revenue $1,277.0 9% $831.4 16% $655.4 10% $2,763.8 11% Fee Revenue $1,201.5 8% $711.0 13% $576.4 9% $2,488.9 9% Americas EMEA Asia Pacific Total RES

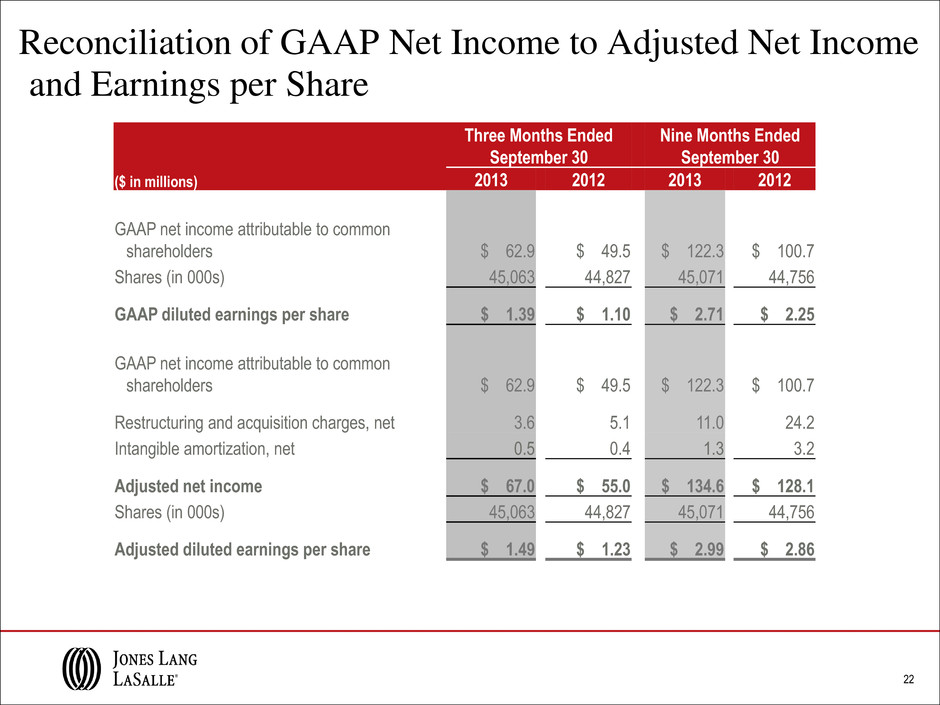

22 Reconciliation of GAAP Net Income to Adjusted Net Income Three Months Ended September 30 Nine Months Ended September 30 ($ in millions) 2013 2012 2013 2012 GAAP net income attributable to common shareholders $ 62.9 $ 49.5 $ 122.3 $ 100.7 Shares (in 000s) 45,063 44,827 45,071 44,756 GAAP diluted earnings per share $ 1.39 $ 1.10 $ 2.71 $ 2.25 GAAP net income attributable to common shareholders $ 62.9 $ 49.5 $ 122.3 $ 100.7 Restructuring and acquisition charges, net 3.6 5.1 11.0 24.2 Intangible amortization, net 0.5 0.4 1.3 3.2 Adjusted net income $ 67.0 $ 55.0 $ 134.6 $ 128.1 Shares (in 000s) 45,063 44,827 45,071 44,756 Adjusted diluted earnings per share $ 1.49 $ 1.23 $ 2.99 $ 2.86 and Earnings per Share

23 Reconciliation of GAAP Net Income to Adjusted EBITDA Three Months Ended September 30 Nine Months Ended September 30 ($ in millions) 2013 2012 2013 2012 GAAP net income $ 63.1 $ 49.7 $ 125.8 $ 101.6 Interest expense, net of interest income 9.6 10.0 26.6 24.8 Provision for income taxes 20.9 16.9 41.7 34.6 Depreciation and amortization 19.8 19.0 59.0 58.7 EBITDA $ 113.4 $ 95.6 $ 253.1 $ 219.7 Restructuring and acquisition charges 4.9 6.8 14.7 32.4 Adjusted EBITDA $ 118.3 $ 102.4 $ 267.8 $ 252.1