Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SAVIENT PHARMACEUTICALS INC | d620429d8k.htm |

Exhibit 99.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

|

|

x | |||

| : | ||||

| In re: | : | Chapter 11 | ||

| : | ||||

| SAVIENT PHARMACEUTICALS, INC., | : | Case No. 13-12680 (MFW) | ||

| et al., | : | |||

| : | Jointly Administered | |||

| Debtors.1 | : | |||

| : | ||||

|

|

x |

NOTICE OF FILING OF INITIAL MONTHLY OPERATING REPORT

PLEASE TAKE NOTICE that the debtors and debtors in possession in the above-captioned jointly administered bankruptcy cases (collectively, the “Debtors”) filed today the Initial Monthly Operating Report, a copy of which is attached hereto as Exhibit A.

Dated: Wilmington, Delaware

October 29, 2013

| SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP |

| /s/ Dain A. De Souza |

| Anthony W. Clark (I.D. No. 2051) |

| Dain A. De Souza (I.D. No. 5737) |

| One Rodney Square |

| P.O. Box 636 |

| Wilmington, Delaware 19899-0636 |

| Telephone: (302) 651-3000 |

| Fax: (302) 651-3001 |

| - and - |

| 1 | The Debtors and the last four digits of their respective taxpayer identification numbers are as follows: Savient Pharmaceuticals, Inc. (3811), Savient Pharma Holdings, Inc. (0701). The address of the Debtors’ corporate headquarters is 400 Crossing Boulevard, 3rd Floor, Bridgewater, New Jersey 08807. |

Docket No. 94

Date Filed: 10/29/13

| Kenneth S. Ziman |

| David M. Turetsky |

| Four Times Square |

| New York, New York 10036-6522 |

| Telephone: (212) 735-3000 |

| Fax: (212) 735-2000 |

| Proposed Counsel for Debtors and Debtors in Possession |

2

EXHIBIT A

3

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| Savient Pharmaceuticals, Inc. et al | Case No. 13-12680 (MFW) | |

| Debtor |

INITIAL MONTHLY OPERATING REPORT

File report and attachments with Court and submit copy to United States Trustee within 15 days after order for relief.

Certificates of insurance must name United States Trustee as a party to be notified in the event of policy cancellation. Bank accounts and checks must bear the name of the debtor, the case number, and the designation “Debtor in Possession.” Examples of acceptable evidence of Debtor in Possession Bank accounts include voided checks, copy of bank deposit agreement/certificate of authority, signature card, and/or corporate checking resolution.

| REQUIRED DOCUMENTS |

Document Attached |

Explanation Attached | ||

| 12-Month Cash Flow Projection (Form IR-1) |

Exhibit 1 | 13-week cash flow budget | ||

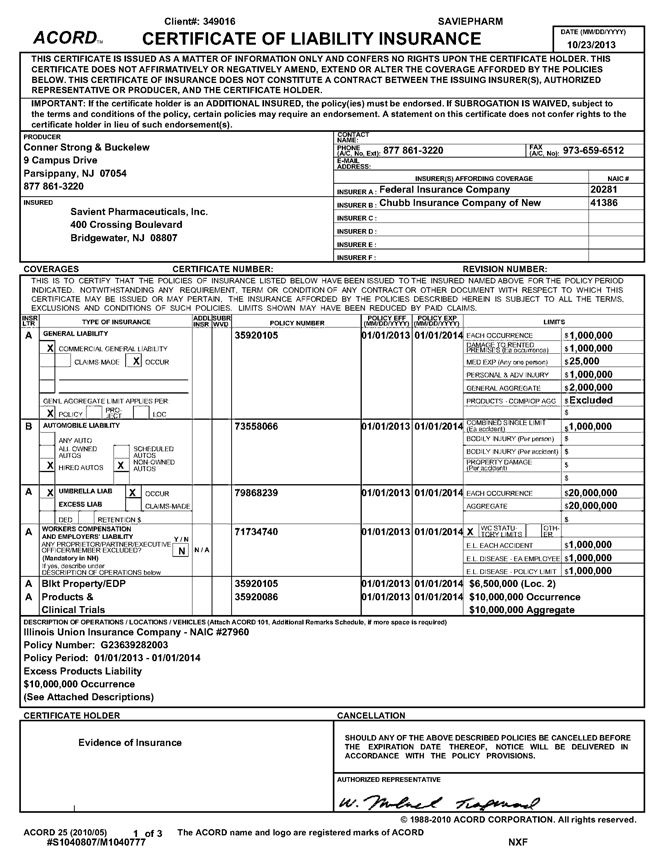

| Certificates of Insurance: |

||||

| Workers Compensation |

Exhibit 2 | Certificates of Insurance | ||

| Property |

||||

| General Liability |

||||

| Vehicle |

||||

| Other: |

||||

| Identify areas of self-insurance w/liability caps |

||||

| Evidence of Debtor in Possession Bank Accounts |

||||

| Tax Escrow Account |

Exhibit 3 | Interim Cash Management Order | ||

| General Operating Account |

||||

| Money Market Account pursuant to Local Rule 4001-3 for the District of Delaware only. Refer to: |

||||

| http://www.deb.uscourts.gov/ |

||||

| Other: |

||||

| Retainers Paid (Form IR-2) |

Exhibit 4 |

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the documents attached are true and correct to the best of my knowledge and belief.

|

|

| |||

| Signature of Debtor | Date | |||

|

|

| |||

| Signature of Joint Debtor | Date | |||

| /s/ John Hamill |

October 29, 2013 | |||

| Signature of Authorized Individual* | Date | |||

| John Hamill Printed Name of Authorized Individual |

Co-President and Chief Financial Officer Title of Authorized Individual | |||

| * | Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. |

FORM IR

(4/07)

EXHIBIT 1

13-WEEK BUDGET

| Week | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | TOTAL | ||||||||||||||||||||||||||||||||||||||||||

| Est. | Est. | Est. | Est. | Est. | Est. | Est. | Est. | Est. | Est. | Est. | Est. | Est. | ||||||||||||||||||||||||||||||||||||||||||||

| W/E | W/E | W/E | W/E | W/E | W/E | W/E | W/E | W/E | W/E | W/E | W/E | W/E | ||||||||||||||||||||||||||||||||||||||||||||

| 10/18/13 | 10/25/13 | 11/01/13 | 11/08/13 | 11/15/13 | 11/22/13 | 11/29/13 | 12/06/13 | 12/13/13 | 12/20/13 | 12/27/13 | 01/03/14 | 01/10/14 | ||||||||||||||||||||||||||||||||||||||||||||

| Beginning Cash Balance |

$ | 27,744 | $ | 27,983 | $ | 28,222 | $ | 27,996 | $ | 27,720 | $ | 26,756 | $ | 26,843 | $ | 26,011 | $ | 25,669 | $ | 25,978 | $ | 25,293 | $ | 25,684 | $ | 26,070 | $ | 27,744 | ||||||||||||||||||||||||||||

| Total Cash Collections |

$ | 500 | $ | 525 | $ | 500 | $ | 525 | $ | 500 | $ | 525 | $ | 580 | $ | 500 | $ | 500 | $ | 525 | $ | 400 | $ | 400 | $ | 400 | $ | 6,380 | ||||||||||||||||||||||||||||

| Disbursements: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payroll Related |

— | (2 | ) | (565 | ) | (200 | ) | (1,256 | ) | — | (567 | ) | (550 | ) | — | — | — | — | — | (3,140 | ) | |||||||||||||||||||||||||||||||||||

| Concur |

(50 | ) | (50 | ) | (50 | ) | (50 | ) | (50 | ) | (50 | ) | (50 | ) | (25 | ) | — | — | — | — | — | (375 | ) | |||||||||||||||||||||||||||||||||

| Board Fees |

— | — | — | — | — | — | — | — | (105 | ) | — | — | — | — | (105 | ) | ||||||||||||||||||||||||||||||||||||||||

| Royalty Payments |

— | — | — | — | — | — | (495 | ) | — | — | — | — | — | — | (495 | ) | ||||||||||||||||||||||||||||||||||||||||

| Distribution Fees |

(11 | ) | (11 | ) | (11 | ) | (11 | ) | (11 | ) | (11 | ) | (11 | ) | (11 | ) | — | — | — | — | — | (88 | ) | |||||||||||||||||||||||||||||||||

| Taxes |

— | — | — | — | — | — | (19 | ) | — | — | — | — | — | — | (19 | ) | ||||||||||||||||||||||||||||||||||||||||

| Rent |

— | (123 | ) | — | — | — | — | (123 | ) | — | — | — | — | — | — | (246 | ) | |||||||||||||||||||||||||||||||||||||||

| Other (1) |

(200 | ) | (100 | ) | (100 | ) | (540 | ) | (147 | ) | (147 | ) | (147 | ) | (247 | ) | — | — | — | — | — | (1,628 | ) | |||||||||||||||||||||||||||||||||

| Restructuring Costs |

— | — | — | — | — | (230 | ) | — | (9 | ) | (86 | ) | (1,210 | ) | (9 | ) | (14 | ) | (14 | ) | (1,572 | ) | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Total Disbursements |

($ | 261 | ) | ($ | 286 | ) | ($ | 726 | ) | ($ | 801 | ) | ($ | 1,464 | ) | ($ | 438 | ) | ($ | 1,412 | ) | ($ | 842 | ) | ($ | 191 | ) | ($ | 1,210 | ) | ($ | 9 | ) | ($ | 14 | ) | ($ | 14 | ) | ($ | 7,668 | ) | ||||||||||||||

| Net Change in Cash |

$ | 239 | $ | 239 | ($ | 226 | ) | ($ | 276 | ) | ($ | 964 | ) | $ | 87 | ($ | 832 | ) | ($ | 342 | ) | $ | 309 | ($ | 685 | ) | $ | 391 | $ | 386 | $ | 386 | ($ | 1,288 | ) | |||||||||||||||||||||

| Ending Cash Balance |

$ | 27,983 | $ | 28,222 | $ | 27,996 | $ | 27,720 | $ | 26,756 | $ | 26,843 | $ | 26,011 | $ | 25,669 | $ | 25,978 | $ | 25,293 | $ | 25,684 | $ | 26,070 | $ | 26,456 | $ | 26,456 | ||||||||||||||||||||||||||||

Note: Amounts do not reflect the proposed Cash Payment and certain other proposed adequate protection payments.

| (1) | Includes all other accounts payable related expenses relating to operations of the Company. These expenses include selling, marketing, clinical R&D, regulatory, cost of goods sold and administrative costs. |

ACCRUAL BUDGET

| ACCRUAL BUDGET | ||||||||||||||||||||||||||||||||||||

| Oct-13 | Nov-13 | Dec-13 | Jan-14 | Feb-14 | Mar-14 | Apr-14 | May-14 | Total | ||||||||||||||||||||||||||||

| Company Advisors: |

||||||||||||||||||||||||||||||||||||

| Skadden |

$ | 1.90 | $ | 1.00 | $ | 0.25 | — | — | — | — | — | $ | 3.15 | |||||||||||||||||||||||

| Lazard |

0.15 | 0.15 | 2.19 | — | — | — | — | — | 2.49 | |||||||||||||||||||||||||||

| Cole Schotz |

0.18 | 0.25 | 0.45 | 0.25 | 0.28 | 0.21 | 0.26 | 0.13 | 2.00 | |||||||||||||||||||||||||||

| Deloitte |

0.04 | 0.08 | 0.04 | — | — | — | — | — | 0.16 | |||||||||||||||||||||||||||

| Kramer Levin |

0.10 | 0.13 | 0.09 | — | — | — | — | — | 0.31 | |||||||||||||||||||||||||||

| Joelle Frank |

0.03 | 0.05 | 0.03 | — | — | — | — | — | 0.10 | |||||||||||||||||||||||||||

| GCG (Claims Agent) |

0.39 | 0.08 | 0.10 | 0.08 | 0.14 | 0.08 | 0.10 | 0.03 | 0.98 | |||||||||||||||||||||||||||

| Subtotal Company Advisors |

$ | 2.78 | $ | 1.73 | $ | 3.14 | $ | 0.33 | $ | 0.41 | $ | 0.29 | $ | 0.36 | $ | 0.16 | $ | 9.18 | ||||||||||||||||||

| Secured Lender Advisor: |

||||||||||||||||||||||||||||||||||||

| Paul, Weiss |

$ | 0.40 | $ | 0.40 | $ | 0.40 | $ | 0.10 | $ | 0.10 | $ | 0.10 | $ | 0.10 | $ | 0.08 | $ | 1.68 | ||||||||||||||||||

| Subtotal Secured Lender Advisor |

$ | 0.40 | $ | 0.40 | $ | 0.40 | $ | 0.10 | $ | 0.10 | $ | 0.10 | $ | 0.10 | $ | 0.08 | $ | 1.68 | ||||||||||||||||||

| UCC Advisors: |

||||||||||||||||||||||||||||||||||||

| Legal Advisor (TBD) |

— | $ | 0.05 | $ | 0.03 | — | — | — | — | — | $ | 0.08 | ||||||||||||||||||||||||

| Financial Advisor (TBD) |

— | 0.05 | 0.03 | — | — | — | — | — | 0.08 | |||||||||||||||||||||||||||

| Subtotal UCC Advisors |

$ | 0.00 | $ | 0.10 | $ | 0.05 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.15 | ||||||||||||||||||

| Other Expenses: |

||||||||||||||||||||||||||||||||||||

| Court and U.S. Trustee Fees |

$ | 0.03 | $ | 0.03 | $ | 0.04 | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.01 | $ | 0.12 | ||||||||||||||||||

| Operational Wind-Down Expenses |

— | — | 0.03 | 0.06 | 0.06 | 0.04 | 0.04 | 0.04 | 0.27 | |||||||||||||||||||||||||||

| Liquidating Trust |

— | — | — | — | — | 0.20 | — | — | 0.20 | |||||||||||||||||||||||||||

| Employee-Related Costs (after-sale) |

0.08 | — | 1.14 | — | — | — | — | — | 1.22 | |||||||||||||||||||||||||||

| Contingency and Expenses |

0.31 | 0.34 | 0.55 | 0.07 | 0.09 | 0.09 | 0.08 | 0.04 | 1.57 | |||||||||||||||||||||||||||

| Subtotal Other |

$ | 0.42 | $ | 0.36 | $ | 1.76 | $ | 0.14 | $ | 0.15 | $ | 0.34 | $ | 0.12 | $ | 0.09 | $ | 3.38 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

$ | 3.59 | $ | 2.59 | $ | 5.34 | $ | 0.57 | $ | 0.66 | $ | 0.73 | $ | 0.58 | $ | 0.32 | $ | 14.39 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Note: | For purposes of measuring fees and expenses against the amounts set forth in this Accrual Budget, the amounts set forth in this Accrual Budget are estimated accruals, not cash payments, with the excess of accrual over actual for any month (or months) to be carried over into and increase the subsequent month’s Budget. |

| Note: | Amounts do not reflect the proposed Cash Payment and certain other proposed adequate protection payments. |

EXHIBIT 2

DESCRIPTIONS (Continued from Page 1)

$10,000,000 Aggregate

Navigators Specialty Insurance Company - NAIC #36056

Policy Number: NY13LEX630148NC

Policy Period: 01/01/2013 - 01/01/2014

Excess Products Liability

$10,000,000 Occurrence

$10,000,000 Aggregate

Gemini Insurance Company - NAIC #10833

Policy Number: EX108613

Policy Period: 01/01/2013 - 01/01/2014

Excess Products Liability

$10,000,000 Occurrence

$10,000,000 Aggregate

Ironshore Specialty Insurance Company

Policy Number: 001127302

Policy Period: 01/01/2013 - 01/01/2014

Excess Products Liability

$10,000,000 Occurrence

$10,000,000 Aggregate

Catlin Insurance Company (UK) Ltd.

Policy Number: LO1307459

Policy Period: 01/01/2013 - 01/01/2014

Excess Products Liability

$5,000,000 Occurrence

$5,000,000 Aggregate

National Union Fire Insurance Company Pittsburgh - NAIC #19445

Policy Number: 016400181

Policy Period: 02/01/2013 - 01/01/2014

Employment Practices Liability

Limit of Liability: $3,000,000

Liberty Surplus Insurance Corporation - NAIC #10725

Policy Number: TVENY100466113

Policy Period: 01/01/2013 - 01/01/2014

Pollution Legal Liability

Aggregate Limit: $1,000,000

Lloyd’s of London

Policy Number: MC2144/WC2144

Policy Period: 01/01/2013 - 01/01/2014

Transit/Ocean Cargo

Vessel/Air/Land Conveyance: $10,000,000

Federal Insurance Company - NAIC #20281

Policy Number: 8212-18-45

Policy Period: 01/01/2013 - 01/01/2014

Fiduciary Liability/Crime/Kidnap & Ransom

Each Claim Limit: $5,000,000 Kidnap/Ransom: $2,000,000

Each Policy Period: $5,000,000

ACE American Insurance Company - NAIC #22667

Policy Number: ADDN04831445

Policy Period: 01/01/2013 - 01/01/2014

SAGITTA 25.3 (2010/05) 2 of 3

#S 1040807/M 1040777

DESCRIPTIONS (Continued from Page 1)

Travel Accident

Aggregate Limit: $1,500,000 (Maximum Benefit)

Great Northern Insurance Company (Chubb) - NAIC #20303

Policy Number: 2178-69-72

Policy Period: 01/01/2013 - 01/01/2014

Foreign Property - Israel

Property Damage: $1,500,000

Business Interruption/EE & R&DI: $3,000,000

Underwriters At Lloyds - NAIC #32727

Policy Number: B128410422W13

Policy Period: 03/11/2013 - 03/11/2014

Terrorism/Property - Israel

Limit of Liability: $7,250,000

“Notice Party”

Office of The United States Trustee

Attn: Mark Kenney

844 King Street, Suite 2207

Lockbox 35

Wilmington, DE 19801

Phone: (302) 573-6491

Facsimile: (302) 573-6497

SAGITTA 25.3 (2010/05) 3 of 3

#S 1040807/M 1040777

EXHIBIT 3

Case 13-12680-MFW Doc 35 Filed 10/16/13 Page 1 of 8

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

|

|

x | |||

| : | ||||

| In re: | : | Chapter 11 | ||

| : | ||||

| SAVIENT PHARMACEUTICALS, INC., | : | Case No. 13-12680 (MFW) | ||

| et al., | : | |||

| : | Jointly Administered | |||

| Debtors.1 | : | |||

| : | ||||

|

|

x | Related Docket No. 5 |

INTERIM ORDER PURSUANT TO 11 U.S.C. §§ 105(a), 345, 363 AND 503(b), FED. R.

BANKR. P. 6003 AND 6004, AND DEL. BANKR. L.R. 2015-2 AND 4001-3 (I)

AUTHORIZING (A) THE CONTINUED USE OF EXISTING CASH MANAGEMENT

SYSTEM, BANK ACCOUNTS, BUSINESS FORMS, AND DEPOSIT AND

INVESTMENT PRACTICES; (B) PAYMENT OF RELATED PREPETITION

OBLIGATIONS AND (C) A WAIVER OF CERTAIN OPERATING GUIDELINES

RELATING TO BANK ACCOUNTS; (II) AUTHORIZING CONTINUED

ENGAGEMENT IN INTERCOMPANY TRANSACTIONS; AND (III) ACCORDING

ADMINISTRATIVE EXPENSE PRIORITY STATUS TO

ALL POSTPETITION INTERCOMPANY CLAIMS

Upon the motion (the “Motion”)2 of the Debtors for an interim order (the “Order”), pursuant to sections 105(a), 345, 363 and 503(b) of the Bankruptcy Code, Bankruptcy Rules 6003 and 6004, and Local Bankruptcy Rules 2015-2 and 4001-3, (i) authorizing, but not directing (a) the continued use of the Debtors’ existing cash management system, bank accounts, business forms, and deposit and investment practices under the cash management system; (b) payment of related prepetition obligations and (c) to the extent inconsistent with such practices, a waiver of investment and deposit requirements of Bankruptcy Code section 345(b) and the U.S.

| 1 | The Debtors and the last four digits of their respective taxpayer identification numbers are as follows: Savient Pharmaceuticals, Inc. (3811), Savient Pharma Holdings, Inc. (0701). The address of the Debtors’ corporate headquarters is 400 Crossing Boulevard, 3rd Floor, Bridgewater, New Jersey 08807. |

| 2 | Capitalized terms not otherwise defined herein shall have the meanings ascribed to such terms in the Motion or the First Day Declaration. |

Case 13-12680-MFW Doc 35 Filed 10/16/13 Page 2 of 8

Trustee Guidelines; (ii) authorizing the Debtors to continue engaging in intercompany transactions in the ordinary course of business; and (iii) according administrative expense priority status to postpetition intercompany claims; and upon the First Day Declaration; and due and sufficient notice of the Motion having been given under the particular circumstances; and it appearing that no other or further notice need be provided; and it appearing that the relief requested by the Motion is in the best interests of the Debtors, their estates, their creditors and other parties in interest; and after due deliberation thereon and good and sufficient cause appearing therefor, it is hereby,

ORDERED, ADJUDGED AND DECREED that:

1. The Motion is GRANTED on an interim basis as set forth herein.

2. The final hearing on this Motion is set for Nov. 13, 2013 at 9:30 am/p.m. (prevailing Eastern Time). Any

objections or responses to entry of the proposed Final Order shall be filed and served upon (i) the Debtors, Savient Pharmaceuticals, Inc., 400 Crossing Boulevard, 3rd Floor, Bridgewater, New Jersey, 08807 (Attn: Philip Yachmetz),

(ii) proposed counsel for the Debtors, Skadden, Arps, Slate, Meagher & Flom LLP, Four Times Square, New York, New York 10036-6522 (Attn: Kenneth S. Ziman and David M. Turetsky); (iii) proposed counsel for the Debtors, Skadden Arps

Slate Meagher & Flom LLP, One Rodney Square, 920 North King Street, Wilmington, Delaware 19801 (Attention: Anthony W. Clark), (iv) counsel to the Unofficial Committee of Senior Secured Noteholders, Paul, Weiss, Rifkind,

Wharton & Garrison LLP, 1285 Avenue of the Americas, New York, New York 10019-6064, (Attn: Andrew N. Rosenberg, Elizabeth McColm and Jacob A. Adlerstein) and Young, Conaway, Stargatt & Taylor LLP, Rodney Square, 1000 North King

Street, Wilmington, Delaware 19801 (Attn: Pauline K. Morgan) and (v) the U.S. Trustee, so as to be received by 4:00 p.m. (prevailing Eastern Time) no later than seven (7) days prior to the final hearing.

2

Case 13-12680-MFW Doc 35 Filed 10/16/13 Page 3 of 8

3. Pursuant to sections 105 and 363 of the Bankruptcy Code, the Debtors, in their discretion, are authorized, but not directed, to (i) designate, maintain and continue to use any and all of their Bank Accounts in existence as of the Petition Date, with the same account numbers, including the accounts identified in Exhibit A annexed hereto, and need not comply with certain operating guidelines relating to bank accounts set forth in the U.S. Trustee Guidelines; (ii) close existing accounts; (iii) open new accounts; and (iv) treat the Bank Accounts for all purposes as accounts of the Debtors in their capacity as debtors in possession; provided, however, that the Debtors are only authorized to open new bank accounts (a) after providing notice to the U.S. Trustee, the Unofficial Committee of Senior Secured Noteholders and any official committee appointed in the Chapter 11 Cases; (b) with a bank that (x) is organized under the laws of the United States of America or any state therein, (y) is insured by the FDIC, and (z) is an authorized depository in the District of Delaware or has executed, or is willing to immediately execute, a Uniform Depository Agreement with the Office of the United States Trustee for the District of Delaware; (c) that are designated “Debtor in Possession” accounts by the relevant bank and (d) subject to the terms and conditions of the Cash Collateral Order.

4. The relief granted in the Order is extended to any new bank account opened by the Debtors, in accordance with the provisions of this Order, after the date hereof, which account shall be deemed a Bank Account, and to the bank at which such account is opened.

5. To the extent the Debtors close bank accounts, they shall provide notice to the U.S. Trustee, the Unofficial Committee of Senior Secured Noteholders and any official committee appointed in the Chapter 11 Cases.

3

Case 13-12680-MFW Doc 35 Filed 10/16/13 Page 4 of 8

6. The Debtors shall not make any intercompany transfers to non-debtor affiliates absent further order of the Court.

7. Within fifteen (15) days from the date of entry of the Order, the Debtors shall (a) contact each of the Debtors’ Banks; (b) provide the Debtors’ Banks with each of the Debtors’ employer identification numbers; and (c) identify each of their accounts held at the Debtors’ Banks as being held by a debtor in possession.

8. The Debtors are authorized, but not directed, to continue to use their existing Business Forms without alteration or change and without the designation “Debtor in Possession” imprinted upon them; provided, however, that upon depletion of the Debtors’ check stock, the Debtors will obtain new check stock bearing the designation “Debtor in Possession.”

9. The Debtors are authorized to continue to use their existing Cash Management System. The Debtors may, in the ordinary course of business, transfer funds into, out of, and through the Cash Management System in accordance with the Debtors’ prepetition practices. In connection with the ongoing utilization of their Cash Management System, the Debtors shall continue to maintain records with respect to all transfers of cash so that all transactions may be readily ascertained, traced, and recorded properly. Except as otherwise set forth herein, the Debtors are further authorized to implement any changes to the Cash Management System that they deem appropriate in their discretion, subject to the terms and conditions of the Cash Collateral Order.

10. The requirements of the U.S. Trustee Guidelines that the Debtors close all existing bank accounts and open new debtor in possession accounts are hereby waived. Further, the requirements of the U.S. Trustee Guidelines that the Debtors establish specific bank accounts for tax payments are hereby waived.

4

Case 13-12680-MFW Doc 35 Filed 10/16/13 Page 5 of 8

11. The Bank Accounts are deemed debtor in possession accounts. Subject to the Cash Collateral Order, the Debtors are authorized, but not directed, to maintain and use the Bank Accounts in the same manner and with the same account numbers, styles and document forms as those employed prior to the Petition Date, including, without limitation: (a) to deposit funds in, and withdraw funds from, the Bank Accounts by all usual means, including checks, wire transfers and other debits; (b) to pay postpetition ordinary course bank fees in connection with the Bank Accounts; (c) to perform their obligations under the documents and agreements governing the Bank Accounts; and (d) to treat the Bank Accounts for all purposes as accounts of the Debtors in their capacities as debtors in possession.

12. After the Petition Date, and subject to the terms of the Order, the Debtors’ Banks are authorized and directed to continue to administer the Bank Accounts as such accounts were maintained prepetition, without interruption and in the usual and ordinary course, and to debit the Debtors’ Bank Accounts in the ordinary course of business without the need for further order of this Court for: (a) all checks drawn on the Bank Accounts which were cashed at the Debtors’ Banks’ counters or exchanged for cashier’s checks by the payees thereof prior to the Petition Date; and (b) all undisputed prepetition amounts outstanding as of the date hereof, if any, owed to the Debtors’ Banks as service charges for the maintenance of the Debtors’ Cash Management System.

13. Notwithstanding anything in this Order to the contrary, no checks, drafts, wires or electronic fund transfers (excluding any electronic fund transfers that the Debtors’ Banks are obligated to settle), or other items presented, issued, or drawn on the Bank Accounts prior to the Petition Date shall be honored, unless (a) authorized by order of this Court; (b) not otherwise

5

Case 13-12680-MFW Doc 35 Filed 10/16/13 Page 6 of 8

prohibited by a “stop payment” request timely received by the Debtors’ Banks from the Debtors; and (c) supported by sufficient funds in the Bank Account in question.

14. Subject to the provisions of the Order, the Debtors’ Banks are authorized and directed to honor all disbursements of the Debtors from the Bank Accounts dated subsequent to the Petition Date to the extent of sufficient available funds.

15. The Debtors’ Banks are further authorized and directed to (a) honor the Debtors’ directions with respect to the opening or closing of any Bank Account and (b) accept and hold, or invest, the Debtors’ funds in accordance with the Debtors’ instructions; provided that the Debtors’ Banks shall not have any liability to any party for relying on such representations.

16. The Debtors are authorized to continue engaging in Intercompany Transactions in connection with the Cash Management System in the ordinary course of business and subject to the Cash Collateral Order, including increasing the amount of the Intercompany Note. The Intercompany Claims arising postpetition relating to the Intercompany Transactions shall have administrative expense priority status pursuant to section 503(b) of the Bankruptcy Code.

17. The requirements of section 345 of the Bankruptcy Code shall be waived with respect to the Bank Accounts and any other accounts of the Debtors with the banks; provided, however, that the Debtors shall comply with Local Bankruptcy Rule 4001-3 within sixty (60) days of entry of the Order.

18. The Debtors shall serve a copy of the Order on the Debtors’ Banks within five (5) business days of the entry of the Order, and upon any bank at which the Debtors open a new bank account, immediately upon the opening of such new account.

6

Case 13-12680-MFW Doc 35 Filed 10/16/13 Page 7 of 8

19. To the extent applicable, the Court finds and determines that the requirements of Bankruptcy Rule 6003 are satisfied and that the relief requested is necessary to avoid immediate and irreparable harm.

20. Notwithstanding Bankruptcy Rule 6004(h), the Order shall be effective and enforceable immediately upon entry hereof.

21. To the extent any other order is entered by this Court directing the Debtors’ Banks to honor checks, drafts, automated clearing house transfers, or other electronic funds transfers or any other withdrawals made, drawn, or issued in payment of prepetition claims, the obligation to honor such items shall be subject to the Order.

22. Notwithstanding anything to the contrary contained herein, any payment to be made, or authorization contained, hereunder will be subject to the requirements imposed on the Debtors under the Cash Collateral Order, including any budget approved in connection therewith; provided that the Banks shall be authorized to rely on the Debtors’ representations that any requests for payments or transfers made by the Debtors to the Banks with respect to the Bank Accounts is consistent with the Cash Collateral Order.

23. The requirements set forth in Local Bankruptcy Rule 9013-l(b) are satisfied by the contents of the Motion.

24. The Debtors are authorized and empowered to take all actions necessary to implement the relief granted in this Order.

7

Case 13-12680-MFW Doc 35 Filed 10/16/13 Page 8 of 8

25. This Court shall retain jurisdiction with respect to all matters arising from or related to the implementation or interpretation of this Order.

Dated: Wilmington, Delaware

Oct. 16, 2013

| /s/ Mary F. Walrath |

| Honorable Mary F. Walrath |

| UNITED STATES BANKRUPTCY JUDGE |

8

Case 13-12680-MFW Doc 35-1 Filed 10/16/13 Page 1 of 1

EXHIBIT A

Debtors’ Bank Accounts

| Bank |

Account Number |

Account Holder |

Description | |||

| PNC Bank, N.A. 500 First Avenue, 5th Pittsburgh, PA 15219 |

XXX-XXX-5687 | Savient Pharmaceuticals, Inc. | Operating Account | |||

| XXX-XXX-6418 | Savient Pharma Holdings, Inc. | Operating Account | ||||

| Fidelity Capital Markets 200 Seaport Boulevard Z2H Boston, MA 02210 |

XXX-XX0159 | Savient Pharmaceuticals, Inc. | Money Market Account | |||

| XXX-XX0175 | Savient Pharma Holdings, Inc. | Money Market Account | ||||

| Wells Fargo Advisors 401 S. Tryon Street Charlotte, NC 28202-1934 |

XXXX-9201 | Savient Pharmaceuticals, Inc. | Money Market Account and Certificates of Deposit Account | |||

EXHIBIT 4

Case No. 13-12680 (MFW)

In re Savient Pharmaceuticals, Inc.

SCHEDULE OF RETAINERS PAID TO PROFESSIONALS

| Check |

Amount Applied | |||||||||||||||||

| Payee |

Date |

Number |

Name of Payor |

Amount | to Date | Balance | ||||||||||||

| Arnold & Porter (UK) LLP1 |

10/11/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 50,000.00 | $ | — | $ | 50,000.00 | |||||||||

| Cole Schotz Meisel Forman & Leonard, P.A. |

3/20/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 75,000.00 | $ | — | $ | 75,000.00 | |||||||||

| Joele Frank, Wilkinson Brimmer |

10/3/2013 | 67536 | Savient Pharmaceuticals, Inc. | $ | 30,000.00 | $ | — | $ | 30,000.00 | |||||||||

| Kramer, Levin, Naftalis & Frankel, LLP |

10/2/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 55,000.00 | $ | — | $ | 55,000.00 | |||||||||

| Paul, Weiss, Rifkind,Wharton & Garrison LLP |

5/31/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 150,000.00 | $ | — | $ | 150,000.00 | |||||||||

| Skadden, Arps, Slate, Meagher & Flom LLP |

3/25/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 750,000.00 | $ | 539,314.00 | $ | 210,686.00 | |||||||||

| Skadden, Arps, Slate, Meagher & Flom LLP |

8/5/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 400,000.00 | $ | — | $ | 400,000.00 | |||||||||

| Skadden, Arps, Slate, Meagher & Flom LLP2 |

9/25/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 500,000.00 | $ | — | $ | 500,000.00 | |||||||||

| The Garden City Group, Inc. |

3/28/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 380,000.00 | $ | 355,000.00 | $ | 25,000.00 | |||||||||

| Young Conaway Stargatt & Taylor, LLP |

10/9/2013 | Wire Transfer | Savient Pharmaceuticals, Inc. | $ | 25,000.00 | $ | — | $ | 25,000.00 | |||||||||

| 1 | While included on this Schedule, the amount paid is “money on account” |

| 2 | With amounts applied to the Skadden Retainer, at no time did Skadden hold a Retainer exceeding $1.5 million. |

Form IR-2

(4/07)