Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - Noranda Aluminum Holding CORP | a2013q3earningsreleaseform.htm |

| EX-99.3 - EXHIBIT 99.3 DIVIDEND RELEASE - Noranda Aluminum Holding CORP | a2013q3dividendreleaseexhi.htm |

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - Noranda Aluminum Holding CORP | a2013q3earningsreleaseexhi.htm |

3rd Quarter 2013 Earnings Conference Call Noranda Aluminum Holding Corp October 30, 2013 10:00 AM Eastern / 9:00 AM Central Exhibit 99.2

The presentation and comments made by Noranda’s management on the quarterly conference call contain “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements about future, not past, events and involve certain important risks and uncertainties, any of which could cause the Company’s actual results to differ materially from those expressed in forward-looking statements, including, without limitation: the cyclical nature of the aluminum industry and fluctuating commodity prices, which cause variability in earnings and cash flows; a downturn in general economic conditions, including changes in interest rates, as well as a downturn in the end-use markets for certain of the Company’s products; fluctuations in the relative cost of certain raw materials and energy compared to the price of primary aluminum and aluminum rolled products; the effects of competition in Noranda’s business lines; Noranda’s ability to retain customers, a substantial number of which do not have long-term contractual arrangements with the Company; the ability to fulfill the business’ substantial capital investment needs; labor relations (i.e. disruptions, strikes or work stoppages) and labor costs; unexpected issues arising in connection with Noranda’s operations outside of the United States; the ability to retain key management personnel; and Noranda’s expectations with respect to its acquisition activity, or difficulties encountered in connection with acquisitions, dispositions or similar transactions. Forward-looking statements contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “anticipates” or similar expressions that relate to Noranda’s strategy, plans or intentions. All statements Noranda makes relating to its estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to the Company’s expectations regarding future industry trends are forward-looking statements. Noranda undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs. For a discussion of additional risks and uncertainties that may affect the future results of Noranda, please see the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Forward-Looking Statements 2

Ove rv ie w Key Takeaways • We delivered solid 3Q financial results, with positive cash flow despite seasonal peak power rates and lower LME prices • We are taking actions to improve our operating results and liquidity; expecting cash flow breakeven for 2H-13, productivity targets are $225 million for 2014-2016 • Our liquidity and our debt profile, stable operations and transformational improvement plans support our ability to create value across the cycle • Our outlook supports our previously communicated key operating metrics for 2013, with a stable demand and input cost environment for 2014 Financial Highlights • Cash from operating activities—$26.1 million • Total segment profit—$11.0 million • Primary aluminum shipments—149 million pounds • Liquidity(1)—$184 million o No funds drawn under the Incremental ABL at quarter-end o No funded-debt maturities until 2019 3rd Quarter 2013 Financial Highlights 3 (1) Liquidity includes $120 million available borrowing capacity under the revolving credit facility plus $64 million cash

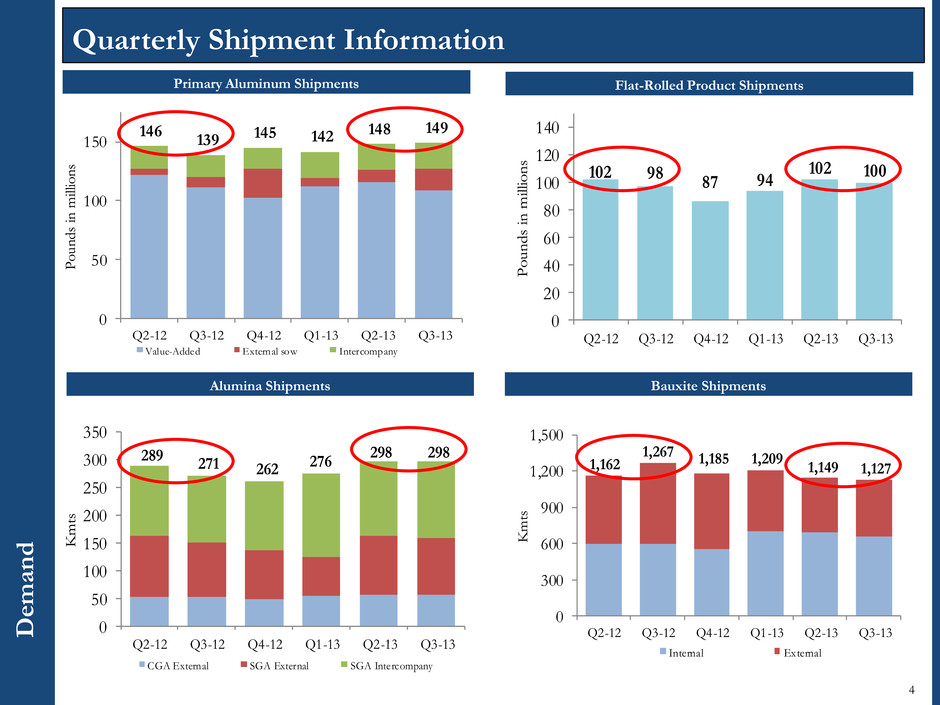

289 271 262 276 298 298 0 50 100 150 200 250 300 350 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13 K m ts CGA External SGA External SGA Intercompany 102 98 87 94 102 100 0 20 40 60 80 100 120 140 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13 Po un ds in m illi on s Primary Aluminum Shipments Bauxite Shipments 4 Quarterly Shipment Information Flat-Rolled Product Shipments 146 139 145 142 148 149 5 100 150 Q2-12 Q3-12 Q4-12 Q -13 Q2-13 Q -13 Po un ds in m illi on s Value-Added External sow Intercompany Alumina Shipments 1,162 1,267 1,185 1,209 1,149 1,127 0 300 600 90 1,200 1,500 Q2-12 Q3- 2 Q4-12 Q1-1 Q2-13 Q3-13 K m ts Internal ExternalD e man d

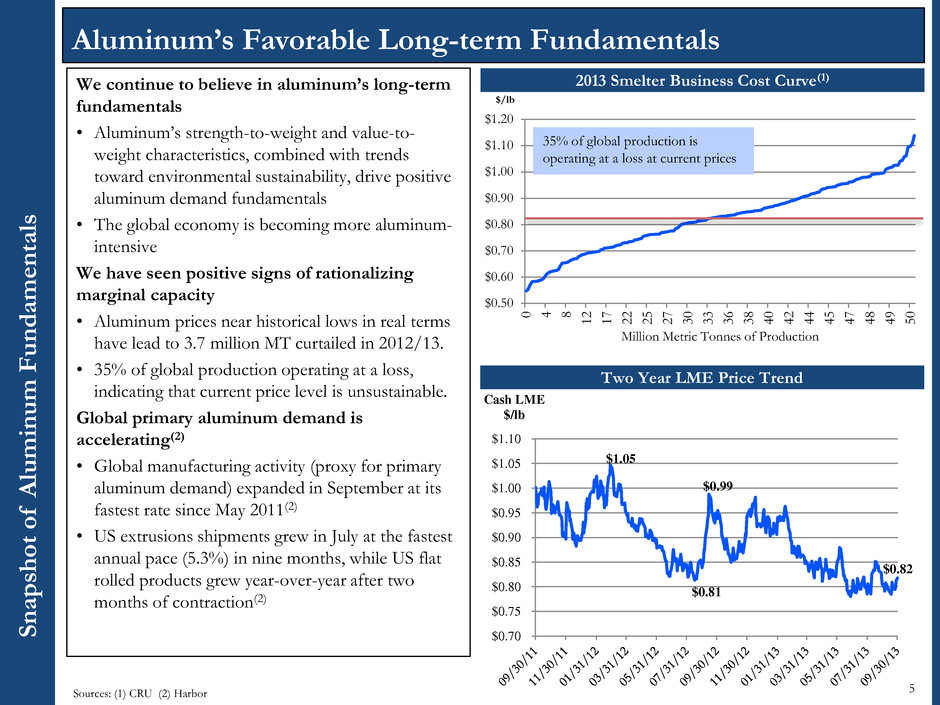

We continue to believe in aluminum’s long-term fundamentals • Aluminum’s strength-to-weight and value-to- weight characteristics, combined with trends toward environmental sustainability, drive positive aluminum demand fundamentals • The global economy is becoming more aluminum- intensive We have seen positive signs of rationalizing marginal capacity • Aluminum prices near historical lows in real terms have lead to 3.7 million MT curtailed in 2012/13. • 35% of global production operating at a loss, indicating that current price level is unsustainable. Global primary aluminum demand is accelerating(2) • Global manufacturing activity (proxy for primary aluminum demand) expanded in September at its fastest rate since May 2011(2) • US extrusions shipments grew in July at the fastest annual pace (5.3%) in nine months, while US flat rolled products grew year-over-year after two months of contraction(2) Aluminum’s Favorable Long-term Fundamentals Sna p shot o f Alumi n um Fundam e nta ls 5 Sources: (1) CRU (2) Harbor Year-over-Year LME Trends $0.50 $0.60 $0.70 $0.80 $0.90 $1.00 $1.10 $1.20 0 4 8 1 2 1 7 2 2 2 5 2 7 3 0 3 3 3 6 3 8 4 0 4 2 4 4 4 5 4 7 4 8 4 9 5 0 $/lb Million Metric Tonnes of Production 35% of global production is operating at a loss at current prices 2013 Smelter Business Cost Curve(1) $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 4/ 1 4/ 8 4/1 5 4/2 2 4/2 9 5/ 6 5/1 3 5/2 0 5/2 7 6/ 3 6/1 0 6/1 7 6/2 4 7/ 1 7/ 8 7/1 5 7/2 2 7/2 9 8/ 5 8/1 2 8/1 9 8/2 6 9/ 2 9/ 9 9/1 6 9/2 3 9/3 0 2013 2012 Average Prices 4/1 to 9/30: 2012 = $0.89/lb; 2013 = $0.82/lb $1.05 $0.81 $0.99 $0.82 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 Cash LME $/lb Two Year LME Price Trend

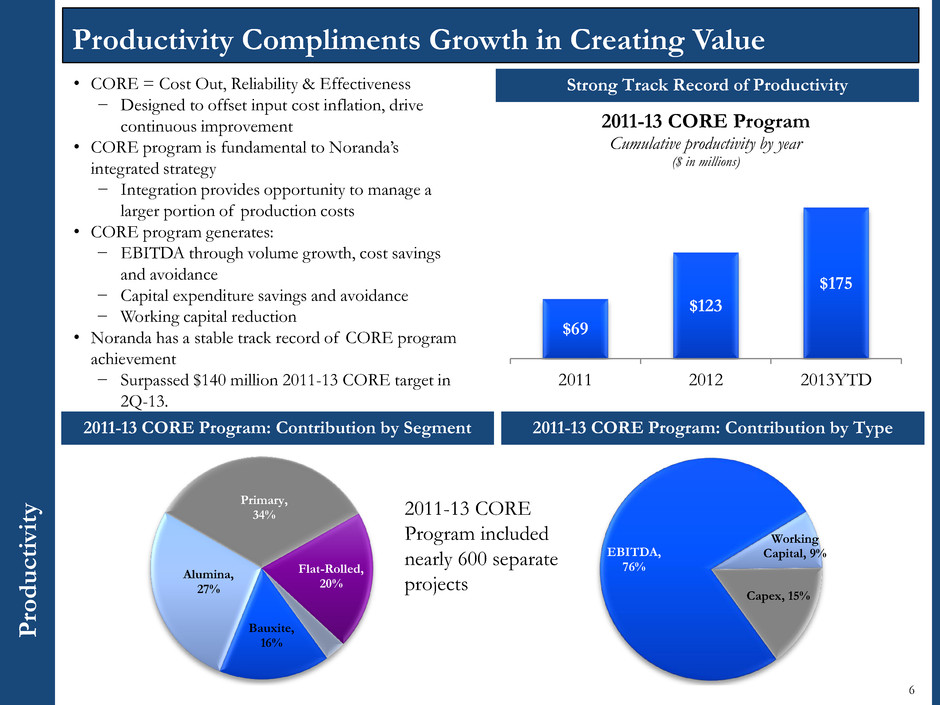

Productivity Compliments Growth in Creating Value P rodu c ti v it y 6 Strong Track Record of Productivity 2011-13 CORE Program: Contribution by Type • CORE = Cost Out, Reliability & Effectiveness − Designed to offset input cost inflation, drive continuous improvement • CORE program is fundamental to Noranda’s integrated strategy − Integration provides opportunity to manage a larger portion of production costs • CORE program generates: − EBITDA through volume growth, cost savings and avoidance − Capital expenditure savings and avoidance − Working capital reduction • Noranda has a stable track record of CORE program achievement − Surpassed $140 million 2011-13 CORE target in 2Q-13. EBITDA, 76% Working Capital, 9% Capex, 15% $69 $123 $175 2011 2012 2013YTD 2011-13 CORE Program Cumulative productivity by year ($ in millions) 2011-13 CORE Program: Contribution by Segment Bauxite, 16% Alumina, 27% Primary, 34% Flat-Rolled, 20% 2011-13 CORE Program included nearly 600 separate projects

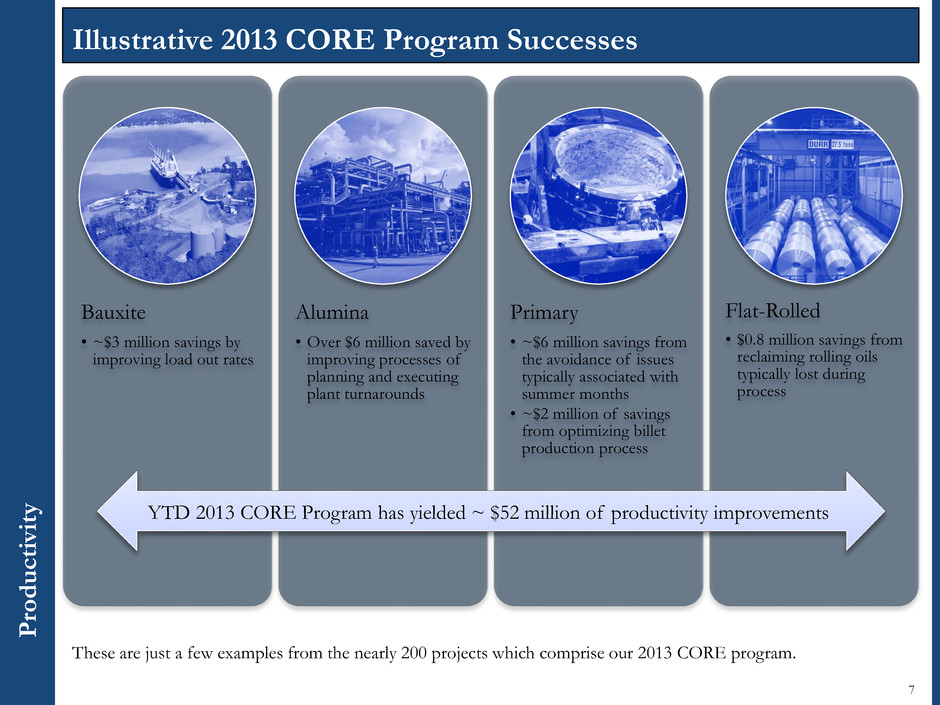

Illustrative 2013 CORE Program Successes P rodu c ti v it y 7 Bauxite • ~$3 million savings by improving load out rates Alumina • Over $6 million saved by improving processes of planning and executing plant turnarounds Primary • ~$6 million savings from the avoidance of issues typically associated with summer months • ~$2 million of savings from optimizing billet production process Flat-Rolled • $0.8 million savings from reclaiming rolling oils typically lost during process YTD 2013 CORE Program has yielded ~ $52 million of productivity improvements These are just a few examples from the nearly 200 projects which comprise our 2013 CORE program.

Productivity and Liquidity Improvement Program P rodu c ti v it y & Liquidi ty P rese rv atio n 8 • Evaluate effectiveness & efficiency of organizational structure • Includes review of comp & benefits Functional streamlining • Improve usage rates and eliminate cost activities at each step in value-chain Production Processes • Identify alternative sources, more favorable pricing for key inputs Strategic Sourcing • Grow capacity by improving utilization & de-bottlenecking • Improve operational predictability Reliability & Effectiveness Key 2014-16 CORE Program Tenets 2014-16 CORE Program – Contribution by Type • 2014-16 CORE program targets $225 million in productivity − Builds on success of a CORE program that since 2009 has created over $295 million of productivity − Includes portfolio of traditional small and medium sized projects −Also includes certain more transformational initiatives −Collectively, these projects will enhance our profitability and cash flow and create significant shareholder value EBITDA, 95% Working Capital, 3% Capex, 5% Estimate

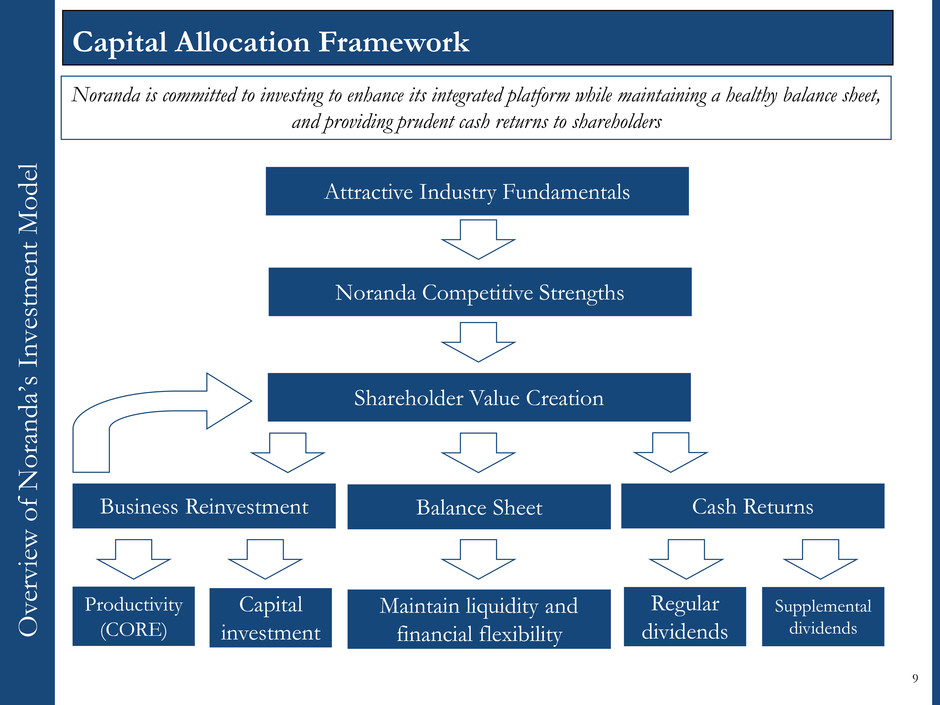

Overview of Nora nda’s Investm en t M odel Capital Allocation Framework 9 Attractive Industry Fundamentals Noranda Competitive Strengths Shareholder Value Creation Business Reinvestment Cash Returns Regular dividends Supplemental dividends Productivity (CORE) Capital investment Balance Sheet Maintain liquidity and financial flexibility Noranda is committed to investing to enhance its integrated platform while maintaining a healthy balance sheet, and providing prudent cash returns to shareholders

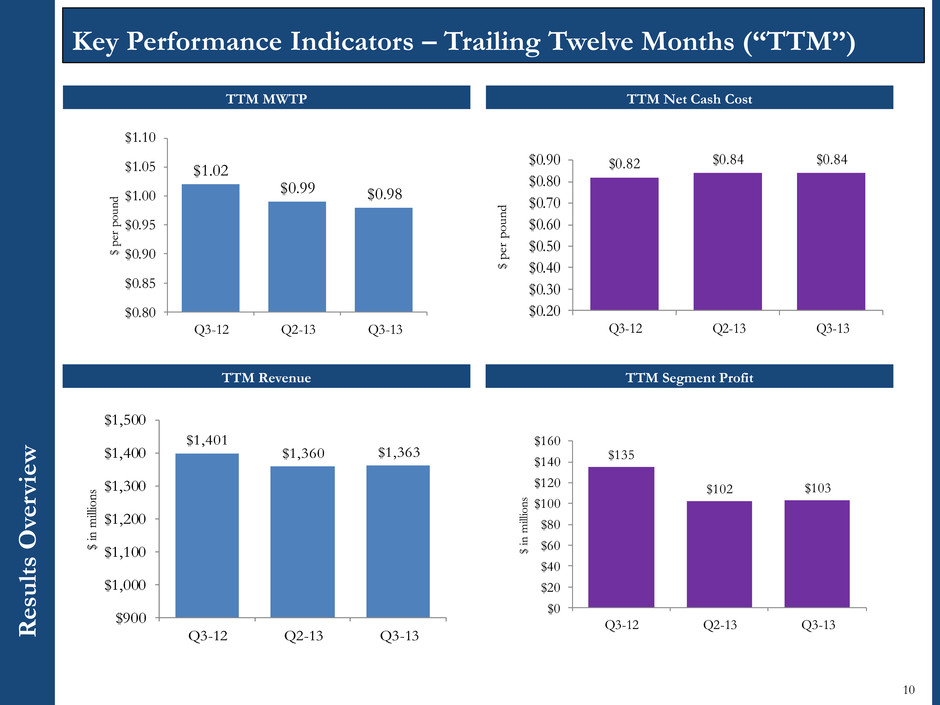

R esu lts O ve rv ie w TTM MWTP $1.02 $0.99 $0.98 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 Q3-12 Q2-13 Q3-13 $ pe r p ou nd TTM Revenue TTM Net Cash Cost $135 $102 $103 $0 $20 $40 $60 $80 $100 $120 $140 $160 Q3-12 Q2-13 Q3-13 $ i n m illi on s Key Performance Indicators – Trailing Twelve Months (“TTM”) 10 $0.82 $0.84 $0.84 0.20 0.30 0.40 $0.50 $0.60 $0.70 $0.80 $0.90 Q3-12 Q2-13 Q3-13 $ p er p ou nd TTM Segment Profit $1,4 1 $1,360 $1,363 $900 $1,000 $1,100 1,2 0 1,300 $1,400 $1,500 Q3-12 2-13 Q3-13 $ i n m illi on s

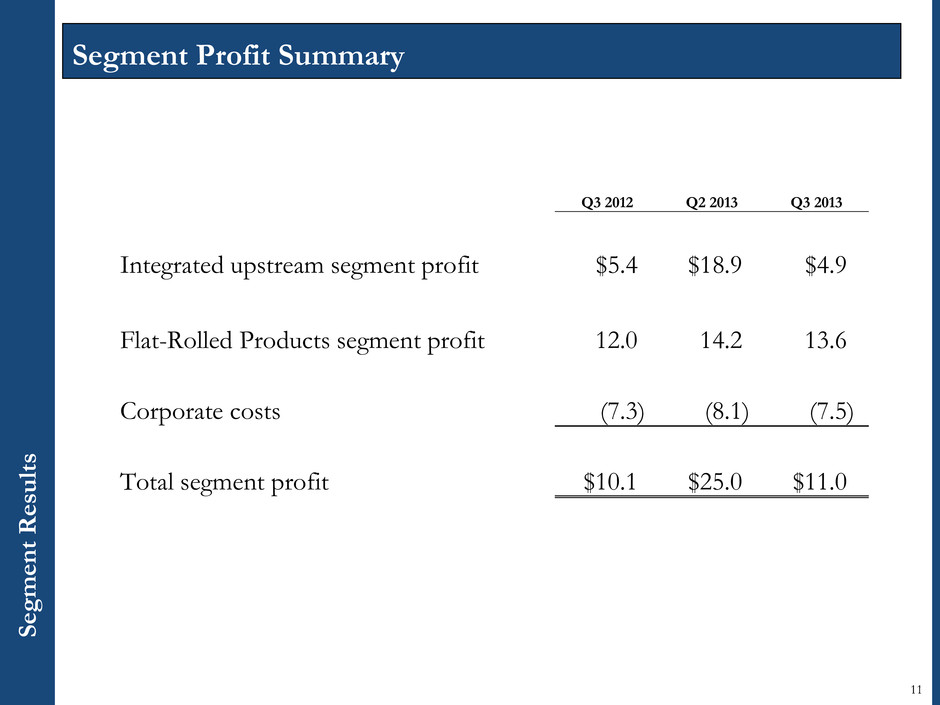

Se g men t R esu lt s 11 Segment Profit Summary Q3 2012 Q2 2013 Q3 2013 Integrated upstream segment profit $5.4 $18.9 $4.9 Flat-Rolled Products segment profit 12.0 14.2 13.6 Corporate costs (7.3) (8.1) (7.5) Total segment profit $10.1 $25.0 $11.0

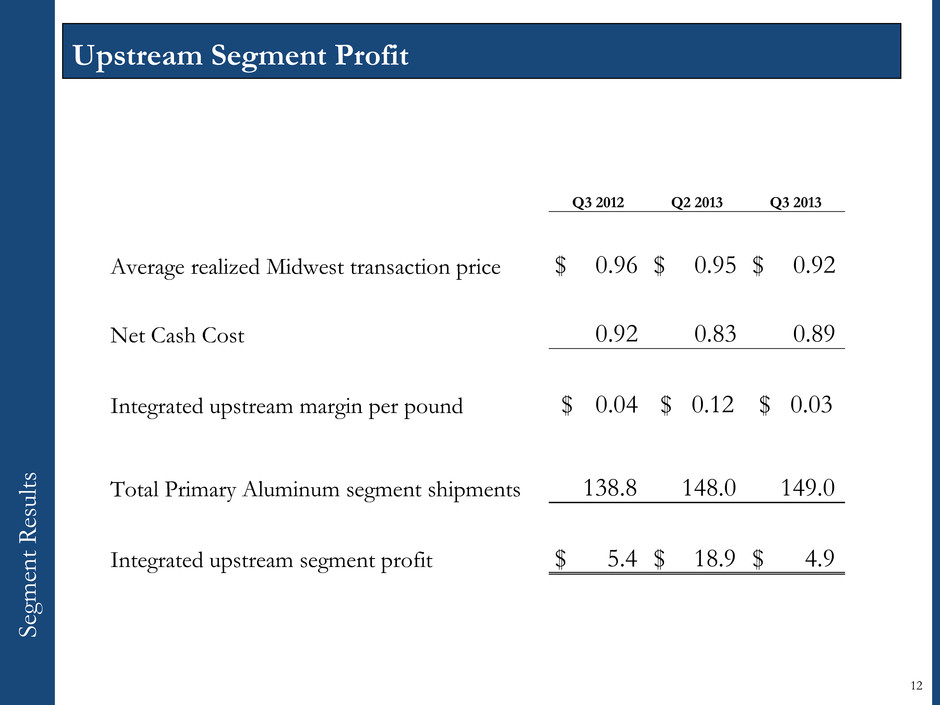

12 Upstream Segment Profit Q3 2012 Q2 2013 Q3 2013 Average realized Midwest transaction price $ 0.96 $ 0.95 $ 0.92 Net Cash Cost 0.92 0.83 0.89 Integrated upstream margin per pound $ 0.04 $ 0.12 $ 0.03 Total Primary Aluminum segment shipments 138.8 148.0 149.0 Integrated upstream segment profit $ 5.4 $ 18.9 $ 4.9 Se gm ent R es u lt s

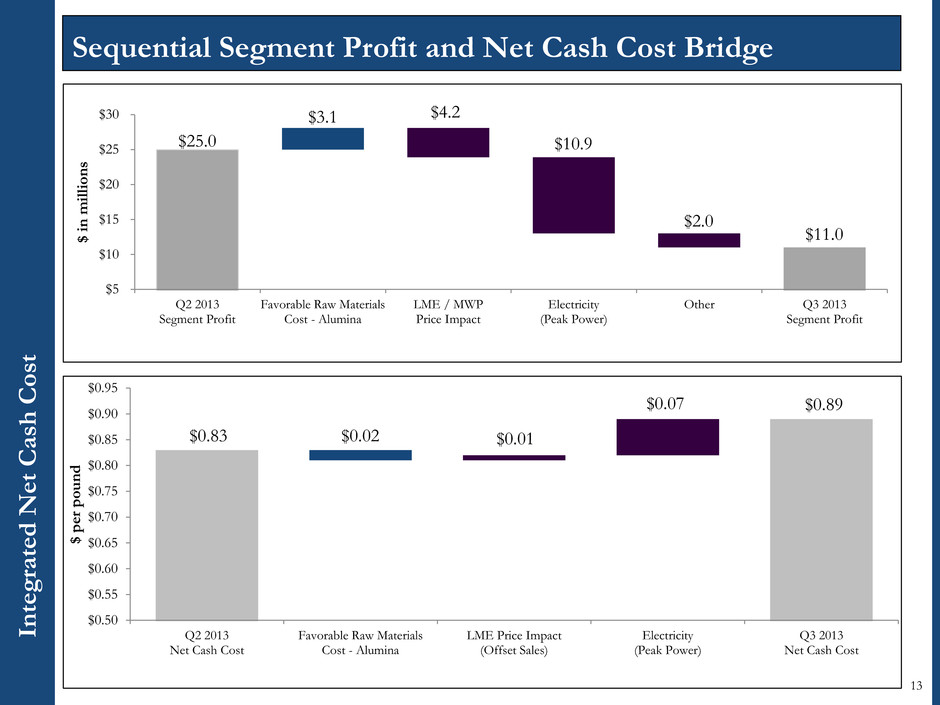

In te g ra te d Net Cash Cos t 13 Sequential Segment Profit and Net Cash Cost Bridge $0.89 $0.02 $0.01 $0.07 $0.83 $0.50 $0.55 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 Q2 2013 Net Cash Cost Favorable Raw Materials Cost - Alumina LME Price Impact (Offset Sales) Electricity (Peak Power) Q3 2013 Net Cash Cost $ pe r p o u n d $11.0 $4.2 $10.9 $2.0 $3.1 $25.0 $5 $10 $15 $20 $25 $30 Q2 2013 Segment Profit Favorable Raw Materials Cost - Alumina LME / MWP Price Impact Electricity (Peak Power) Other Q3 2013 Segment Profit $ in m illi o n s

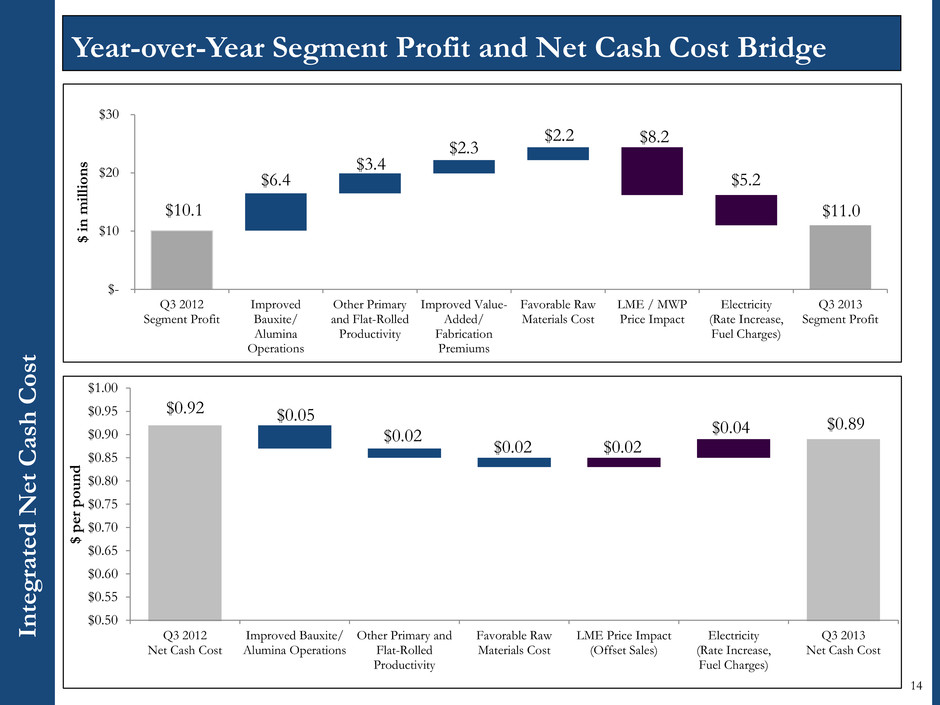

In te g ra te d Net Cash Cos t 14 Year-over-Year Segment Profit and Net Cash Cost Bridge $0.89 $0.05 $0.02 $0.02 $0.02 $0.04 $0.92 $0.50 $0.55 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 Q3 2012 Net Cash Cost Improved Bauxite/ Alumina Operations Other Primary and Flat-Rolled Productivity Favorable Raw Materials Cost LME Price Impact (Offset Sales) Electricity (Rate Increase, Fuel Charges) Q3 2013 Net Cash Cost $ pe r p o u n d $11.0 $8.2 $5.2 $6.4 $3.4 $2.3 $2.2 $10.1 $- $10 $20 $30 Q3 2012 Segment Profit Improved Bauxite/ Alumina Operations Other Primary and Flat-Rolled Productivity Improved Value- Added/ Fabrication Premiums Favorable Raw Materials Cost LME / MWP Price Impact Electricity (Rate Increase, Fuel Charges) Q3 2013 Segment Profit $ in m illi o n s

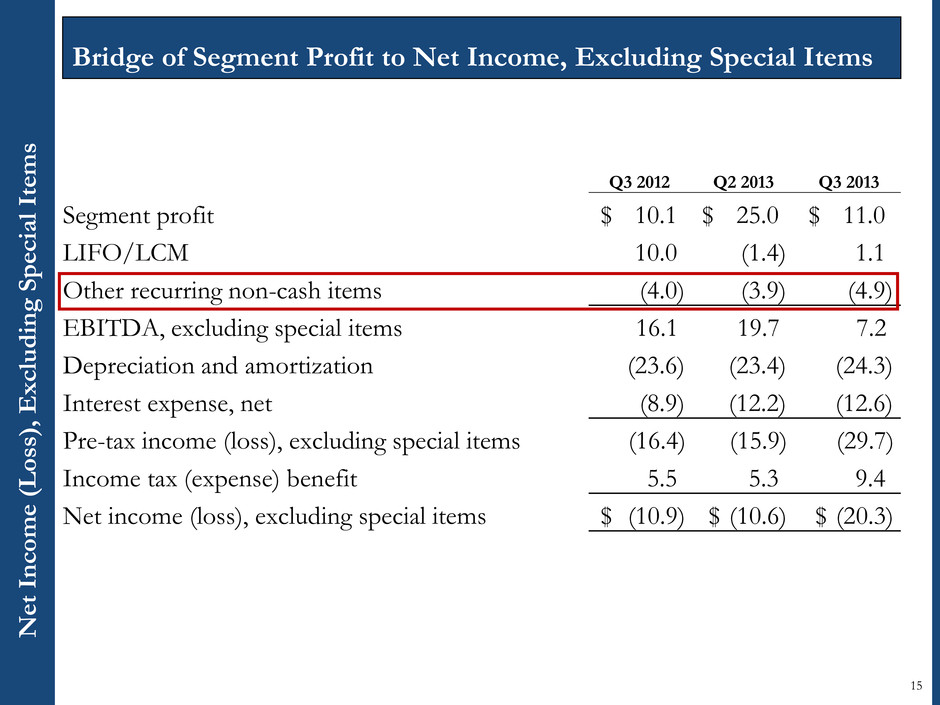

Ne t In c ome (Los s) , E x c ludin g Sp e cia l It e m s 15 Bridge of Segment Profit to Net Income, Excluding Special Items Q3 2012 Q2 2013 Q3 2013 Segment profit $ 10.1 $ 25.0 $ 11.0 LIFO/LCM 10.0 (1.4) 1.1 Other recurring non-cash items (4.0) (3.9) (4.9) EBITDA, excluding special items 16.1 19.7 7.2 Depreciation and amortization (23.6) (23.4) (24.3) Interest expense, net (8.9) (12.2) (12.6) Pre-tax income (loss), excluding special items (16.4) (15.9) (29.7) Income tax (expense) benefit 5.5 5.3 9.4 Net income (loss), excluding special items $ (10.9) $ (10.6) $ (20.3)

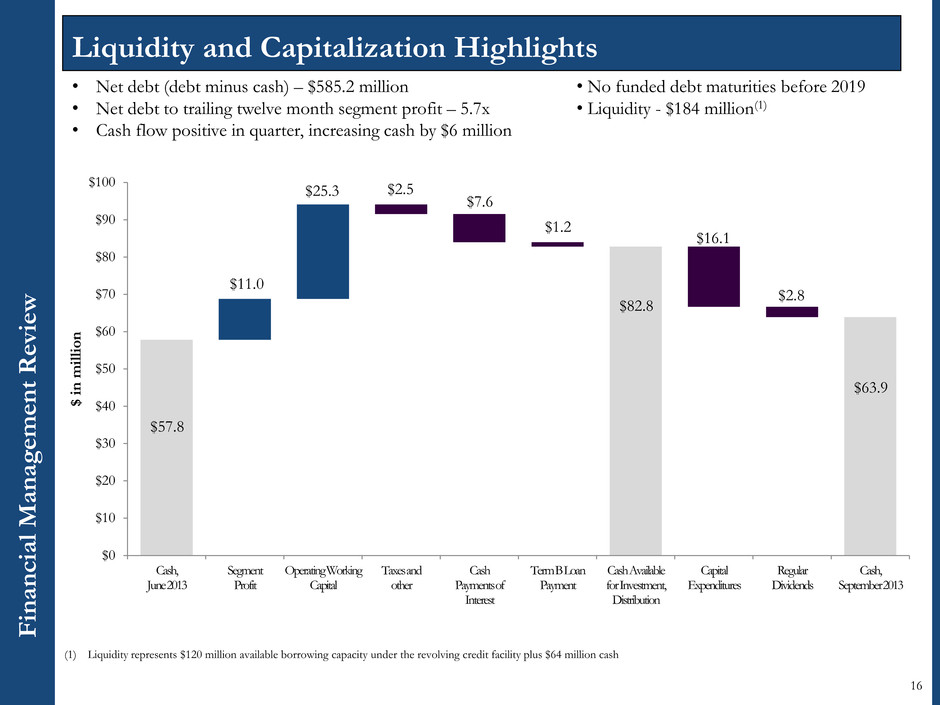

Financia l Mana g em e nt Revie w 16 Liquidity and Capitalization Highlights $2.5 $7.6 $1.2 $16.1 $2.8 $11.0 $25.3 $57.8 $82.8 $63.9 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Cash, June 2013 Segment Profit Operating Working Capital Taxesand other Cash Payments of Interest Term B Loan Payment Cash Available for Investment, Distribution Capital Expenditures Regular Dividends Cash, September 2013 $ in m illi o n (1) Liquidity represents $120 million available borrowing capacity under the revolving credit facility plus $64 million cash • Net debt (debt minus cash) – $585.2 million • Net debt to trailing twelve month segment profit – 5.7x • Cash flow positive in quarter, increasing cash by $6 million • No funded debt maturities before 2019 • Liquidity - $184 million(1)

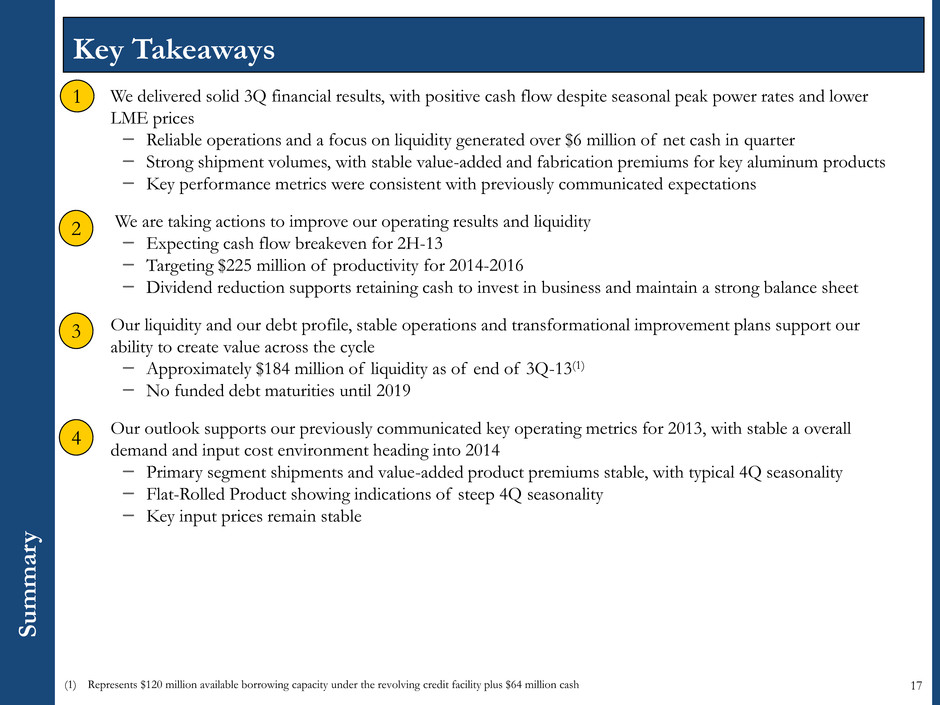

We delivered solid 3Q financial results, with positive cash flow despite seasonal peak power rates and lower LME prices – Reliable operations and a focus on liquidity generated over $6 million of net cash in quarter – Strong shipment volumes, with stable value-added and fabrication premiums for key aluminum products – Key performance metrics were consistent with previously communicated expectations We are taking actions to improve our operating results and liquidity – Expecting cash flow breakeven for 2H-13 – Targeting $225 million of productivity for 2014-2016 – Dividend reduction supports retaining cash to invest in business and maintain a strong balance sheet Our liquidity and our debt profile, stable operations and transformational improvement plans support our ability to create value across the cycle – Approximately $184 million of liquidity as of end of 3Q-13(1) – No funded debt maturities until 2019 Our outlook supports our previously communicated key operating metrics for 2013, with stable a overall demand and input cost environment heading into 2014 – Primary segment shipments and value-added product premiums stable, with typical 4Q seasonality – Flat-Rolled Product showing indications of steep 4Q seasonality – Key input prices remain stable Key Takeaways 17 1 2 Summa ry 3 4 (1) Represents $120 million available borrowing capacity under the revolving credit facility plus $64 million cash

Non-GAAP Measure: Disclaimer No n -GA A P M ea sure: Disclaim er This presentation contains non-GAAP financial measures as defined by SEC rules. We believe these measures are helpful to investors in measuring our financial performance and comparing our performance to our peers. However, our non-GAAP financial measures may not be comparable to similarly titled non- GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for U.S. GAAP financial measures. To the extent we disclose any non-GAAP financial measures, a reconciliation of each measure to the most directly comparable U.S. GAAP measure is available in the Press Release included as an exhibit to the Current Report on Form 8-K to which this presentation is also an exhibit. As such, this presentation should be read in conjunction with our Press Release. 18