Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Cooper-Standard Holdings Inc. | d620680dex991.htm |

| 8-K - 8-K - Cooper-Standard Holdings Inc. | d620680d8k.htm |

|

DRIVE

FOR PROFITABLE

GROWTH

Investor Day

October 30, 2013 |

TOP 30 / TOP 5

Today’s Presentation

-

Glenn Dong, Vice President and Treasurer

-

Jeff Edwards, Chairman and Chief Executive Officer

-

Keith Stephenson, Executive Vice President and Chief Operating Officer

-

Allen Campbell, Executive Vice President and Chief Financial Officer

•

Welcome and Introductions

•

Cooper Standard Overview and Strategic Direction

•

Avenues for Growth

•

Financial Overview and Guidance

3 |

TOP 30 / TOP 5

Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of U.S.

federal securities laws, and we intend that such forward-looking statements be subject to

the safe harbor created thereby. We make forward-looking statements in this presentation and may make such statements

in future filings with the SEC. We may also make forward-looking statements in our press releases

or other public or stockholder communications. These forward-looking statements include

statements concerning our plans, objectives, goals, strategies, future events, future revenue or

performance, capital expenditures, financing needs, plans or intentions relating to acquisitions,

business trends, and other information that is not historical information. When used in this

presentation, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,”

“forecasts,” or future or conditional verbs, such as “will,” “should,”

“could,” or “may,” and variations of such words or similar expressions are intended

to identify forward-looking statements. All forward-looking statements, including, without

limitation, management’s examination of historical operating trends and data are based

upon our current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good

faith and we believe there is a reasonable basis for them. However, no assurances can be made that

these expectations, beliefs and projections will be achieved. Forward-looking statements

are not guarantees of future performance and are subject to significant risks and uncertainties that may

cause actual results or achievements to be materially different from the future results or

achievements expressed or implied by the forward-looking statements. There are a number of

risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in

this presentation. Important factors that could cause our actual results to differ materially

from the forward-looking statements we make herein include, but are not limited to:

cyclicality of the automotive industry with the possibility of further material contractions in automotive sales and

production effecting the viability of our customers and financial condition of our customers; global

economic uncertainty, particularly in Europe; loss of large customers or significant platforms;

supply shortages; escalating pricing pressures and decline of volume requirements from our customers; our

ability to meet significant increases in demand; availability and increasing volatility in cost of raw

materials or manufactured components; our ability to continue to compete successfully in the

highly competitive automotive parts industry; risks associated with our non-U.S. operations; foreign currency

exchange rate fluctuations; our ability to control the operations of joint ventures for our benefit;

the effectiveness of our lean manufacturing and other cost savings plans; product liability and

warranty and recall claims that may be brought against us; work stoppages or other labor conditions; natural

disasters; our ability attract and retain key personnel; our ability to meet our customers’ needs

for new and improved products in a timely manner or cost-effective basis; the possibility

that our acquisition strategy may not be successful; our legal rights to our intellectual property portfolio;

environmental and other regulations; legal proceedings or commercial and contractual disputes that we

may be involved in; the possible volatility of our annual effective tax rate; our ability to

generate sufficient cash to service our indebtedness, and obtain future financing; our underfunded pension

plans; significant changes in discount rates and the actual return on pension assets; the possibility

of future impairment charges to our goodwill and long-lived assets; and operating and

financial restrictions imposed on us by our bond indentures and credit agreement.

There may be other factors that may cause our actual results to differ materially from the

forward-looking statements. All forward-looking statements attributable to us or

persons acting on our behalf apply only as of the date of this presentation and are expressly qualified in their entirety by the

cautionary statements included herein. We undertake no obligation to update or revise

forward-looking statements to reflect events or circumstances that arise after the date

made or to reflect the occurrence of unanticipated events.

4 |

Jeff

Edwards Chairman and Chief

Executive Officer

5 |

Allen Campbell

Executive Vice President

& CFO

Presenting Team and Regional Presidents

Keith Stephenson

Executive Vice President

& COO

Song Min Lee

President, Asia Pacific

Fernando de Miguel

President, Europe

Bill Pumphrey

President, North America

Jeff Edwards

Chairman and CEO

TOP 30 / TOP 5

6 |

TOP 30 / TOP 5

Corporate Vice Presidents in Attendance

Helen T Yantz

Vice President &

Corporate Controller

Glenn Dong

Vice President & Treasurer

Sharon Wenzl

Vice President, Corporate

Communications

Tim Hefferon

Vice President & General

Counsel

7 |

8

Company Snapshot

1

Automotive News

2

Does not include approximately $400 M in unconsolidated JV

revenue Product Business Units:

Sealing & Trim

Fuel & Brake Delivery

Fluid Transfer

Thermal & Emissions

Anti-Vibration

8

TOP 30 / TOP 5

Headquarters:

Novi, MI

Established:

1960

Employees:

22,000

Global Suppliers:

Rank 69

1

Global Footprint:

75+ in 19 Countries

7 Design / Engineering Centers

Equity Ticker:

NYSE: CPS

Financial:

2012 revenue: $2.88B

2

2013 E revenue: $3,050 -

$3,075M

Customers:

81% Direct OEM

19% Tiers / Other |

9

Cooper Standard’s Journey

2004

Divestment

2005 –

2008

Expansion

2008 –

2011

Survival

2011 -

2013

Recovery

2014 and Beyond

Growth

Divested from Cooper Tire & Rubber Company

SEC Registrant

TOP 30 / TOP 5

9 |

TOP 30 / TOP 5

Cooper Standard’s Journey

2004

Divestment

2005 –

2008

Expansion

2008 –

2011

Survival

2011 -

2013

Recovery

2014 and Beyond

Growth

Strategic Acquisitions:

•

Metzeler

Automotive

Profiles

-

Sealing

•

ITT

-

Fluid

Handling

•

ACH -

Fuel Rail

•

Gates

Corp.

Automotive

-

Fluid

Transfer

Systems

10 |

TOP 30 / TOP 5

Cooper Standard’s Journey

Global economic / auto industry downturn

Managed for near-term

Downsized engineering & overhead

Tempered capital spending

Restructured debt

2004

Divestment

2005 –

2008

Expansion

2008 –

2011

Survival

2011 -

2013

Recovery

2014 and Beyond

Growth

11 |

TOP 30 / TOP 5

Cooper Standard’s Journey

2004

Divestment

2005 –

2008

Expansion

2008 –

2011

Survival

2011 -

2013

Recovery

2014 and Beyond

Growth

Rebuilding capabilities and adding management talent

Expanding in Romania, Brazil, India and Thailand

Entering Serbia and Restructuring European Footprint

Rebuilding and re-staffing plants and functions

Investing in IT infrastructure

12 |

Cooper

Standard’s Journey 2004

Divestment

2005

–

2008

Expansion

2008

–

2011

Survival

2011

-

2013

Recovery

2014 and Beyond

Growth

Focusing business for profitable growth

Tripling our investment in innovation

Creating world-class manufacturing operations

Growing Asia and other expanding markets

Doubling the size of the Company by 2020

TOP 30 / TOP 5

13 |

Extensive Product Portfolio

*Global Market Share Booz & Company

Static Systems

Glass Run

Channels

Waist belts

Encapsulation

Day Light Systems

Dynamic Systems

On Body Seals

On Door Seals

Convertible

Occupant

Detection

Systems (ODS)

Trim Systems

Appliqués

Bright trim

Garnish moldings

Decorative

interior trim

Specialty Elastomer

#1

Globally

Fuel Lines

Brake Lines

Bundles

Fuel Rails

Tank Lines

#2

Globally

North

American

Leader

Fluid Delivery

Hoses

Sensors

Connectors

Quick-Connects

Engine Tubes

Transmission Oil

Cooler (TOC)

TOC Lines

TOC Modules

AC Lines / Bundles

Power Management

Power Steering

Lines

Convertible Lines

Cabin Tilt Lines

Sealing & Trim

Systems

17%*

Fuel & Brake Delivery

Systems

11%*

Fluid Transfer

Systems

5%*

TOP 30 / TOP 5

14 |

Revenue is

Growing $1,945.3

Global Sales

15

TOP 30 / TOP 5

$2,414.1

$2,853.5

$2,880.9

$3,050 –

$3,075

$98.3

$282.3

$312.2

$409.7

$435 –

$450

Non-Consolidated JVs

CS Sales

2009

2010

2011

2012

2013

E

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000 |

16

TOP 30 / TOP 5

Sales are Diversifying

includes non-consolidated JV sales

2004

Sales

2012

Sales

Ford

GM

Chrysler

37%

22%

16%

5%

3%

10%

24%

18%

12%

4%

7%

6%

13%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100% |

17

TOP 30 / TOP 5

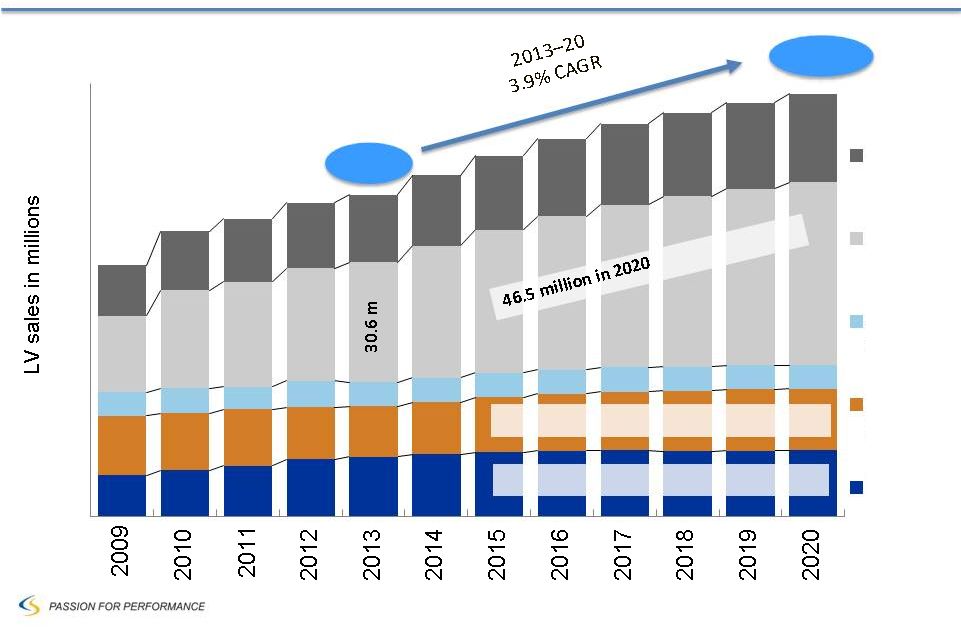

Global Automotive Industry Growth

Source: IHS

Global volume

to exceed

105 million

vehicles by

2020

•

China: greatest global growth from 2015 –

2020; positioned to

be #1 light vehicle market +30 million vehicles

•

India: poised to produce more than 5 million vehicles by 2020

•

Continued strong growth of other developing countries:

Indonesia, Thailand, Mexico, Turkey and Argentina

•

Europe:

to

recover

in

2015

–

2017

•

North America: modest growth aided by global vehicle platforms

•

Top 10 global platforms expected to account for about 20% of

world volume |

18

TOP 30 / TOP 5

Cooper Standard Products Well Represented

on Global Platforms 2013

#6 GM

Tahoe/Yukon/

Escalade

#2 Ford

Explorer

#19 Ford

Fusion/Mondeo/MKZ

#1 Ford

F-150

#5 GM

LaCrosse / Malibu

#8 Chrysler

200 Mid -

Size CUV

#16 Chrysler

Dodge

Challenger/Charger

#7 PSA

Picasso/C3

#15 Fiat

Giulietta / Dart

#3 Ford

Fiesta / Fusion

#4 Ford

Focus/Escape

#11 GM

Cruze/Volt/Astra

#9 Chrysler

Ram

#13 Volvo

S60/V70

#10 PSA

408 / C4

#20 Chrysler

Jeep Wrangler

#17 VW

Jetta

#18 Chrysler

Town &Country/

Dodge Caravan

#14 Ford

F-Series Super Duty

#12 GM

Silverado/Sierra

Denotes Global Platform

Cooper Standard Products are Consistently on the Top Selling Global Platforms

*While the Volvo models on this platform are not global, the platform

when viewed in total is (includes Ford, Mazda, Tata, and Geely models)

|

19

TOP 30 / TOP 5

Sealing & Trim Systems

Fluid Transfer Systems

Fuel & Brake Systems

2020E

2012

2020E

2012

2020E

2012

% represents compound annual growth rate

The Cooper Standard Vision

Growth platforms 2012-2020:

Drive for Profitable Growth

Top 30 -

Top 5 *

*Non-consolidated sales

$1.8B

$0.4B

$0.6B

>10% |

20

TOP 30 / TOP 5

Cooper Standard is Aligned with and

Well-Positioned to Capitalize on Industry Trends

2. Long-term Growth in Emerging Markets

4. Trend Toward Global Platforms

3. North America and Europe Market Recovery

1. Capture China Growth

5. Innovation

Avenues for Profitable Growth

6. Capture Strategic M&A Opportunities |

21

Keith Stephenson

Executive Vice President and

Chief Operating Officer |

22

TOP 30 / TOP 5

Avenues for Profitable Growth:

Long-term Growth in Emerging Markets

Brazil

India

China

Production (million)

Source: September 2013 IHS volumes

3.2

3.9

4.6

CAGR: 4.0%

3.2

4.5

6.7

CAGR: 7.7%

30.0

14.7

24.2

CAGR: 7.4% |

23

TOP 30 / TOP 5

Avenues for Profitable Growth:

North America and Europe Market Recovery

North America

Production (million)

Source: September 2013 IHS volumes

11.9

17.4

18.2

CAGR: 4.3%

19.0

20.4

23.2

CAGR: 1.9%

Europe |

24

TOP 30 / TOP 5

Global

Footprint Evolution

2008 |

25

TOP 30 / TOP 5

Global

Footprint Evolution

2013

Expansion

•

Opened two new plants in Brazil

•

Added two plants in NA via

acquisition

•

Launching new JV plant in Mexico

Consolidation

•

Closed Bowling Green, OH plant

Expansion

•

Established plant in Romania

•

Expanded Poland facilities

•

Opening Serbia plant 1Q 2014

Consolidation

•

Closed plants in France, Spain and

Belgium

Expansion

•

Added plant in China via acquisition

•

Added plant in Thailand via JV

•

Opening two facilities in India

•

Expanding two plants in China

Consolidation

•

Downsizing in Korea

Asia

Europe

Americas |

26

TOP 30 / TOP 5

•

Industry leading line-up of sealing products

–

Alternative materials for weight reduction and

recyclability

•

Value added trim, encapsulation and SafeSeal™

technology

–

Enhanced appearance, safety and increased

content per vehicle

•

Complete range of fluid transfer systems

Introduction of alternative materials

New generation of coatings and connectors

to improve product life

Development of smart systems

Avenues for Profitable Growth:

New Technology and Product Development |

27

TOP 30 / TOP 5

Innovation is a Core Capability:

–

Internal and external idea generation

–

Detailed gate review designed for “Fast-to-Fail /

Fast-to-Win” –

Formal go-to-market plans

Cooper Standard’s Unique Innovation Process is a Key Differentiator

Avenues for Profitable Growth:

New Technology and Product Development

Established separate organization dedicated to “skip-generation”

technologies/products; radical change

Global team of product / materials / process innovators

Structured process designed for deep and quick investigation,

development & commercialization |

28

Avenues for Profitable Growth:

Disciplined M&A Strategy Drives In-Organic Growth

•

Demonstrated competency with integrating into Cooper Standard and

realizing synergies

M&A Process Tied to Company Strategy

•

Constantly identifying and evaluating opportunities to accelerate

strategy |

29

TOP 30 / TOP 5

Building Worldwide Capabilities

Program Management

Global launch process

Product Engineering

Standardizing product specifications / launching low cost engineering center

Innovation Management

Developing

“skip

generation”

technology

Purchasing

Effectively leveraging scale

IT Systems

IT / business systems (SAP, PLM and HRIS)

Best Business Practices

Global operating system and standardization |

30

Allen Campbell

Executive Vice President and

Chief Financial Officer |

31

TOP 30 / TOP 5

Source: IHS AutoInsight

Global Light Vehicle Sales Outlook

By Region

0

20

40

60

80

100

Others

BRIC

Japan/

Korea

Western

Europe

US

81.9

15.6 million in 2020

16.7 million in 2020

106.7 |

TOP 30 / TOP 5

32

Market Dynamics

Prospects for North American Output

Source: IHS Automotive Light Vehicle Production Forecast

11 years

15.8

17.2

15.1

8.6

15.4

5 years

0

4

8

12

16

20

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Others

German 3

Asian 4

Fiat

Ford

GM |

33

TOP 30 / TOP 5

Year-to-Date 2013 Performance

Note: Numbers subject to rounding

$ USD Millions, except EPS / %

Year-to-Date

2012

2013

Sales

$2,183.8

$2,296.3

Gross Profit

339.2

367.6

% Margin

15.5%

16.0%

SGA

206.4

220.8

Operating Profit

105.4

127.5

% Margin

4.8%

5.6%

Net Income

$ 110.3

$ 66.3

Adjusted EBITDA

227.1

228.7

% Margin

10.4%

10.0% |

34

TOP 30 / TOP 5

Year-to-Date 2013 Revenue Up 5.2 %

$ USD Millions

Note: Numbers

subject to rounding

$302

$335

$132

$146

$170

$189

Unconsolidated JV Revenue

$2,184

$1,139

$781

$107

$156

$2,296

$1,192

$806

$139

$160

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

Consolidated

North America

Europe

South America

Asia Pacific

2012 YTD Cooper Standard Revenue

2013 YTD Cooper Standard Revenue |

35

TOP 30 / TOP 5

Cash Flow and Liquidity as of September 30, 2013

Liquidity

Cash Balance as of Sep 30, 2013

ABL Revolver

Letters of Credit

Total Liquidity

Note: Numbers subject to rounding

$ 119.2

150.0

(26.4)

$ 242.8

($ USD Millions) |

36

TOP 30 / TOP 5

Capital Structure

as of September 30, 2013

(1) Before OID and underwriting fees

Cash & equivalents

$119.2

Total Debt

Capital leases & other

33.0

Revolving Credit Facility

-

Total Secured Debt

33.0

Senior Unsecured Notes

450.0

Holdco PIK Toggle Notes

(1)

200.0

Total Debt

683.0

Convertible Preferred Stock

103.6

Equity

496.7

Total Capitalization

$ 1,402.5 |

37

TOP 30 / TOP 5

2013 Guidance

Key Assumptions:

North American production

16.2 million

Europe (including Russia) production

19.0 million

Average full year exchange rate

$1.32/Euro

$3,050 -

$3,075

$ USD Millions

$ USD Millions

$ USD Millions

$ USD Millions

*Guidance

Capital Expenditures

Cash Restructuring

Cash Taxes

Revenues

2009A

2010A

2011A

2012A

2013*

2009A

2010A

2011A

2012A

2013*

2009A

2010A

2011A

2012A

2013*

2009A

2010A

2011A

2012A

2013*

$1,945

$2,414

$2,854

$2,881

$46

$77

$108

$131

$180-$190

$43

$19

$27

$43

$20-$25

($1)

$11

$21

$18

$5-$10 |

38

TOP 30 / TOP 5

Investment Highlights

NYSE: CPS

Advantaged global footprint and

strong track record of

operating performance

Free

cash

flow

supports

investment in

expansion,

innovation,

M&A

Long-standing customer

relationships

Significant growth available by

product, customer, geography

Superior innovation and

engineering capabilities

Management team focused on

profitable growth

Drive for Profitable Growth

Top 30 -

Top 5 |

39

Appendix |

40

TOP 30 / TOP 5

EBITDA

and

Adjusted

EBITDA

Reconciliation

–

2009

2009

Net Loss

$(356.1)

Income tax benefit

(55.7)

EBITDA

$(233.7)

Restructuring

32.4

Adjusted EBITDA

$ 176.5

Interest expense, net of interest income

64.3

Depreciation and amortization

113.8

Bond repurchase

(9.1)

Foreign exchange gains

(4.0)

Reorganization / Fresh Start/ Impairment

EBITDA excl. Reorg & Impairment

147.2

380.9

Reorganization related fees

7.7

Other

0.9

Stock based compensation

1.4

($ USD Millions) |

41

TOP 30 / TOP 5

EBITDA

and

Adjusted

EBITDA

Reconciliation

–

2010

and

2011

2010

2011

Net income

$ 320.3

$ 102.8

Income tax expense

45.0

EBITDA

$ 537.2

$ 288.2

Restructuring

6.4

32.3

Adjusted EBITDA

$ 276.5

$ 324.1

20.8

Interest expense, net of interest income

69.5

40.5

Depreciation and amortization

102.4

124.1

Stock based compensation

6.6

Other / foreign exchange

21.6

10.8

(7.9)

Reorganization / Fresh Start

--

Inventory write-up

8.1

0.7

EBITDA excl. Reorganization

288.2

233.8

(303.4)

($ USD Millions) |

42

TOP 30 / TOP 5

EBITDA and Adjusted EBITDA Reconciliation –

2012

($ USD Millions)

(1)

Includes cash and non-cash restructuring.

(2)

(3)

Non-cash stock amortization expense and non-cash stock option expense for grants issued at

emergence from bankruptcy. (4)

Impairment charges related to goodwill ($2.8 million) and fixed assets ($7.3 million)

(5)

Executive compensation for retired CEO and recruiting costs related to search for new CEO

(6)

Noncontrolling interest deferred tax valuation reversal

Note: Numbers subject to rounding

Three Months Ended

Twelve

Months

Ended

Mar 31,

2012

Jun 30,

2012

Sep 30,

2012

Dec 31,

2012

Dec 31,

2012

Net income (loss)

$ 23.8

$ 77.3

$ 11.6

$ (9.9)

$ 102.8

Income tax expense (benefit)

8.1

(46.2)

5.4

1.2

(31.5)

Interest expense, net of interest income

11.2

10.8

11.3

11.5

44.8

Depreciation and amortization

31.6

30.5

29.1

31.5

122.7

EBITDA

$ 74.7

$ 72.4

$ 57.4

$ 34.3

$ 238.8

Restructuring

(1)

6.1

(0.5)

10.2

13.0

28.8

Noncontrolling interest restructuring

(2)

(0.3)

-

(0.2)

(2.5)

(3.0)

Stock-based compensation

(3)

2.7

2.2

2.4

2.5

9.8

Impairment charges

(4)

-

-

-

10.1

10.1

Payment to former CEO and transition cost

(5)

-

-

-

11.5

11.5

Noncontrolling deferred tax valuation reversal

(6)

-

-

-

2.0

2.0

Adjusted EBITDA

$ 83.2

$ 74.1

$ 69.8

$ 70.9

$ 298.0

Sales

765.3

734.5

684.0

697.1

2,880.9

Adjusted EBITDA as a percent of Sales

10.9%

10.1%

10.2%

10.2%

10.3%

Proportionate share of restructuring costs related to FMEA joint venture.

|

43

TOP 30 / TOP 5

Net Leverage Ratio and Adj. EBITDA % Margin

as of September 30, 2013

($ USD Millions)

(1)

Includes noncash restructuring.

(2)

Proportionate share of restructuring costs related to Cooper Standard France joint

venture. (3)

Non-cash stock amortization expense and non-cash stock option expense for grants

issued at time of the Company's 2010 reorganization. (4)

Impairment charges related to goodwill ($2.8 million) and fixed assets ($7.3 million)

(5)

Executive compensation for retired CEO and costs related to search for new CEO

(6)

Noncontrolling interest deferred tax valuation reversal

(7)

Write-up of inventory to fair value for the Jyco acquisition

(8)

Costs incurred in relation to the Jyco acquisition

Three Months Ended

Twelve Months

Ended

Dec 31, 2012

Mar 31, 2013

Jun 30, 2013

Sep 30, 2013

Sep 30, 2013

Net income (loss)

$ (9.9)

$ 20.7

$ 27.4

$ 20.6

$ 58.8

Income tax expense

1.2

7.9

12.2

4.5

25.8

Interest expense, net of interest income

11.5

11.2

13.6

15.2

51.5

Depreciation and amortization

31.5

29.8

28.2

25.2

114.7

EBITDA

$ 34.3

$ 69.6

$ 81.4

$ 65.5

$ 250.8

Restructuring

13.0

4.8

1.0

1.9

20.7

Noncontrolling interest restructuring

(2.5)

(0.7)

(0.1)

-

(3.3)

Stock-based compensation

2.5

2.7

0.5

1.1

6.8

Impairment charges

10.1

-

-

-

10.1

Payment to former CEO and transition cost

11.5

-

-

-

11.5

2.0

-

-

-

2.0

Inventory write-up

-

-

-

0.3

0.3

Acquisition costs

-

-

-

0.7

0.7

Other

-

0.3

(0.3)

-

-

Adjusted EBITDA

$ 70.9

$ 76.7

$ 82.5

$ 69.5

$ 299.6

Net Leverage

Debt payable within one year

30.3

Long-term debt

649.0

Less: cash and cash equivalents

(119.2)

Net Leverage

$ 560.1

Net Leverage Ratio

1.9

Sales

$ 697.1

$ 747.6

$ 784.7

$ 764.1

$ 2,993.5

Adjusted EBITDA as a percent of Sales

10.2%

10.3%

10.5%

9.1%

10.0%

Note: Numbers subject to rounding

(1)

(2)

(3)

(4)

(5)

(7)

(8)

Noncontrolling deferred tax valuation reversal

(6) |

44

TOP 30 / TOP 5

LTM EBITDA and Adjusted EBITDA Reconciliation

as of September 30, 2012

Note: Numbers subject to rounding

(1)

Includes cash and noncash restructuring.

(2)

Proportionate share of restructuring costs related to Cooper Standard France joint

venture. (3)

Non-cash stock amortization expense and non-cash stock option expense for

grants issued at time of the Company’s 2010 reorganization. (4)

Costs related to corporate development activities.

($ USD Millions)

Three Months Ended

Twelve

Months

Ended

Dec 31,

2011

Mar 31,

2012

Jun 30,

2012

Sep 30,

2012

Sep 30,

2012

Net income

$ 23.2

$ 23.8

$ 77.3

$ 11.6

$ 135.9

Income tax expense (benefit)

(6.0)

8.1

(46.2)

5.4

(38.7)

Interest expense, net of interest income

10.3

11.2

10.8

11.3

43.6

Depreciation and amortization

32.1

31.6

30.5

29.1

123.3

EBITDA

$ 59.6

$ 74.7

$ 72.4

$ 57.4

$ 264.1

Restructuring

(1)

4.1

6.1

(0.5)

10.2

19.9

Noncontrolling interest restructuring

(2)

(0.9)

(0.3)

-

(0.2)

(1.4)

Stock-based compensation

(3)

2.5

2.7

2.2

2.4

9.8

Other

(4)

1.3

-

-

-

1.3

Adjusted EBITDA

$ 66.6

$ 83.2

$ 74.1

$ 69.8

$ 293.7

Sales

$ 695.7

$ 765.3

$ 734.5

$ 684.0

$ 2,879.5

Adjusted EBITDA as a percent of Sales

10.2% |

45

TOP 30 / TOP 5

EBITDA and Adjusted EBITDA –

Nine Months Ended September 30, 2013

Note: Numbers subject to rounding

(1)

Includes noncash restructuring.

(2)

Proportionate share of restructuring costs related to Cooper Standard France joint

venture. (3)

Non-cash stock amortization expense and non-cash stock option expense for grants

issued at time of the Company’s 2010 reorganization. (4)

Write-up of inventory to fair value for the Jyco acquisition

(5)

Costs incurred in relation to the Jyco acquisition

($ USD Millions)

Three Months Ended

Nine Months

Ended

Mar 31,

Jun 31,

Sep 30,

Sep 30,

2013

2013

2013

2013

Net income

$ 20.7

$ 27.4

$ 20.6

$ 68.7

Income tax expense

7.9

12.2

4.5

24.6

Interest expense, net of interest income

11.2

13.6

15.2

40.0

Depreciation and amortization

29.8

28.2

25.2

83.2

EBITDA

$ 69.6

$ 65.5

$ 216.5

Restructuring

(1)

4.8

1.0

1.9

7.7

Noncontrolling

interest restructuring

(2)

(0.7)

(0.1)

-

(0.8)

Stock-based compensation

(3)

2.7

0.5

1.1

4.3

Inventory write-

up

(4)

-

-

0.3

0.3

Acquisition costs

(5)

-

-

0.7

0.7

Others

0.3

(0.3)

-

-

Adjusted EBITDA

$ 76.7

$ 82.5

$ 69.5

$ 228.7

Sales

747.6

784.7

764.1

2,296.3

Adjusted EBITDA as a percent of Sales

10.3%

10.5%

9.1%

10.0%

$ 81.4 |

46

TOP 30 / TOP 5

EBITDA and Adjusted EBITDA –

Nine Months Ended September 30, 2012

Note: Numbers subject to rounding

(1)

Includes cash and noncash restructuring.

(2)

Proportionate share of restructuring costs related to Cooper Standard France joint

venture. (3)

Non-cash stock amortization expense and non-cash stock option expense for grants

issued at time of the Company’s 2010 reorganization. ($ USD Millions)

Three Months Ended

Nine Months

Ended

Mar 31,

Jun 31,

Sep 30,

Sep 30,

2012

2012

2012

2012

Net income

$ 23.8

$ 77.3

$ 11.6

$ 112.7

Income tax expense (benefit)

8.1

(46.2)

5.4

(32.8)

Interest expense, net of interest income

11.2

10.8

11.3

33.3

Depreciation and amortization

31.6

30.5

29.1

91.2

EBITDA

74.7

72.4

57.4

204.4

Restructuring

(1)

6.1

(0.5)

10.2

15.8

Noncontrolling

interest restructuring

(2)

(0.3)

-

(0.2)

(0.5)

Stock-based compensation

(3)

2.7

2.2

2.4

7.4

Adjusted EBITDA

$ 83.2

$ 74.1

$ 69.8

$ 227.1

Sales

$ 765.3

$ 734.5

$ 684.0

$ 2,183.8

Adjusted EBITDA as a percent of Sales

10.9%

10.1%

10.2%

10.4% |