Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Xylem Inc. | d616973dex991.htm |

| 8-K - FORM 8-K - Xylem Inc. | d616973d8k.htm |

XYLEM

INC. Q3 2013 EARNINGS RELEASE

OCTOBER 29, 2013

Exhibit 99.2 |

XYLEM PROPRIETARY / CONFIDENTIAL

FORWARD-LOOKING STATEMENTS

This

document

contains

information

that

may

constitute

“forward-looking

statements.”

Forward-looking

statements

by

their

nature

address

matters

that

are,

to

different

degrees,

uncertain.

Generally,

the

words

“anticipate,”

“estimate,”

“expect,”

“project,”

“intend,”

“plan,”

“believe,”

“target”

and

similar

expressions

identify

forward-looking

statements,

which

generally

are

not

historical

in

nature.

However,

the

absence

of

these

words

or

similar

expressions

does

not

mean

that

a

statement

is

not

forward-looking.

These

forward-looking

statements

include,

but

are

not

limited

to,

statements

about

the

separation

of

Xylem

Inc.

(the

“Company”)

from

ITT

Corporation

in

2011,

capitalization

of

the

Company,

future

strategic

plans

and

other

statements

that

describe

the

Company’s

business

strategy,

outlook,

objectives,

plans,

intentions

or

goals,

and

any

discussion

of

future

operating

or

financial

performance.

All

statements

that

address

operating

performance,

events

or

developments

that

we

expect

or

anticipate

will

occur

in

the

future

—

including

statements

relating

to

orders,

revenues,

operating

margins

and

earnings

per

share

growth,

and

statements

expressing

general

views

about

future

operating

results

—

are

forward-looking

statements.

Caution

should

be

taken

not

to

place

undue

reliance

on

any

such

forward-looking

statements

because

they

involve

risks,

uncertainties

and

other

factors

that

could

cause

actual

results

to

differ

materially

from

those

expressed

or

implied

in,

or

reasonably

inferred

from,

such

statements.

The

Company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-

looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise,

except

as

required

by

law.

In

addition,

forward-looking

statements

are

subject

to

certain

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

the

Company’s

historical

experience

and

our

present

expectations

or

projections.

These

risks

and

uncertainties

include,

but

are

not

limited

to,

those

set

forth

in

Item

1A

of

our

Annual

Report

on

Form

10-K,

and

those

described

from

time

to

time

in

subsequent

reports

filed

with

the

Securities

and

Exchange

Commission.

2

Q3 2013 EARNINGS RELEASE |

XYLEM PROPRIETARY / CONFIDENTIAL

3

Q3’13 BUSINESS UPDATE

Q3 2013 EARNINGS RELEASE

GAINING TRACTION & BUILDING MOMENTUM

Strong 3rd Quarter Performance

Return

to

Organic

Revenue*

Growth

(+1%);

Organic

Orders*

(+6%)

…

Solid Backlog

Operating

Margin

*

of

13.5%

(Up

60

Bps),

With

Strong

Incremental

Performance

EPS*

$0.49

Up

11%

…

Raising

Full

Year

Guidance

Enhancing

Shareholder

Returns

…

Deploying

Capital

into

Share

Repurchases

Looking Ahead –

Next Steps

Improving

Emerging

Markets

Conditions,

U.S.

Stable

&

Europe

Better

Than

Expected

Prioritizing

Initiatives

&

Driving

Productivity

Focused

on

Execution

&

Accountability

to

Provide

for

Better

Visibility

Identifying

Actions

to

Drive

Stronger

2014

Performance

Committed

to

Long-Term

Strategy

&

Financial

Targets

* See appendix for non-GAAP reconciliations |

XYLEM PROPRIETARY / CONFIDENTIAL

4

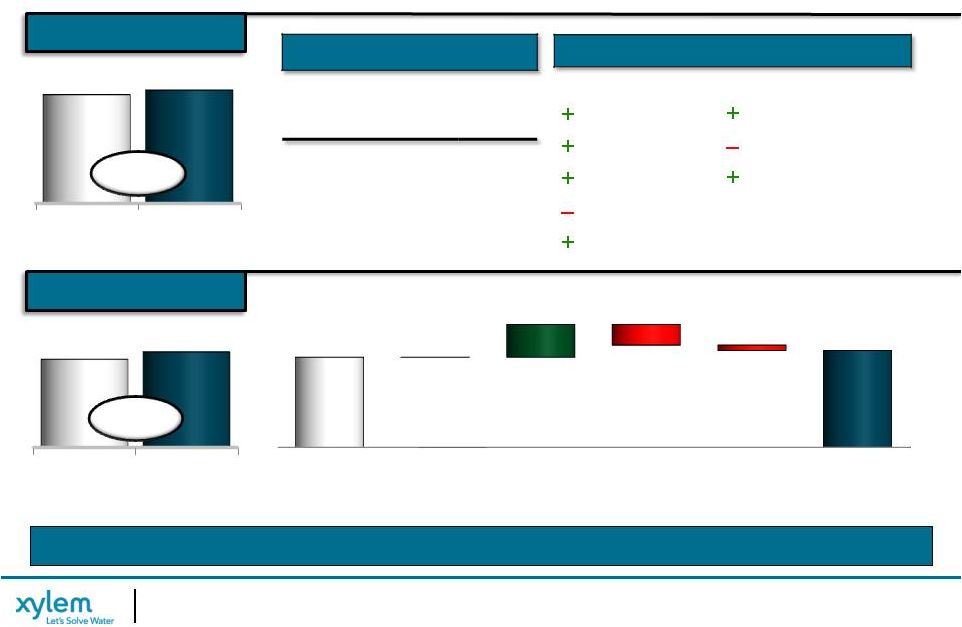

Q3’13 XYLEM PERFORMANCE

+4%

(Dollars, In Millions)

(Dollars, In Millions)

* See appendix for non-GAAP reconciliations

STRONG OPERATING PERFORMANCE

STRONG OPERATING PERFORMANCE

Q3 GROWTH

Q3 GROWTH

Organic

+1%

Acquisitions

+2%

Constant

Currency

+4%

+

Double-Digit Growth

in Eastern Europe &

Asia Pac (China Up

Over 40%)

Q3'12

Op Margin*

Volume,

Mix, & Other

Cost

Reductions &

Price

Material,

Labor,

& OH

Inflation

FX/Acq

Q3'13

Op Margin*

12.9%

13.5%

0.0%

2.1%

0.5%

3.2%

Q3'12

Q3'13

931

965

Q3'12

Q3'13

120

130

+8%

Q3 2013 EARNINGS RELEASE

OPERATING INCOME*

OPERATING INCOME*

REVENUE

REVENUE

ORGANIC PERFORMANCE

By End Market

By Geography

Industrial

Europe

Public Utility

U.S.

Commercial

Emerging Markets

Residential

Agriculture

Price -

0.3%

FX

-0.1%

Vol/Other

+0.4%

Euro HQ

-0.2%

Pension

-0.2%

(Note Rounding Impacts Sum Total) |

XYLEM PROPRIETARY / CONFIDENTIAL

5

Q3’13 XYLEM PERFORMANCE

Q3 2013 EARNINGS RELEASE

EPS*

* See appendix for non-GAAP reconciliations

STRONG PERFORMANCE ON MODEST REVENUE GROWTH

+

Organic Revenue Growth

+

Strong Incremental Margins

Driven by Productivity & Strict

Cost Management

+

Restructuring Savings $0.03

+

European Realignment $0.01

–

Unfavorable Mix/Price $0.02

–

Pension/1x Separation

Headwind $0.01

+11%

Adjusted

Q3'12 EPS

Adjusted

Q3'13 EPS

$0.44

$0.49 |

XYLEM PROPRIETARY / CONFIDENTIAL

6

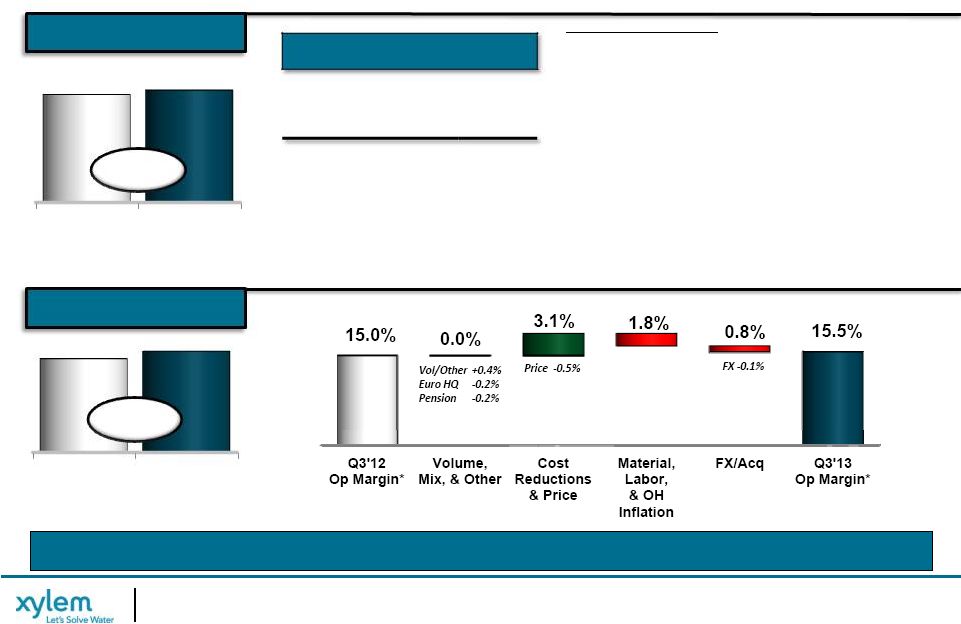

Q3’13 WATER INFRASTRUCTURE PERFORMANCE

Q3 2013 EARNINGS RELEASE

OPERATING INCOME*

+4%

(Dollars, In Millions)

(Dollars, In Millions)

REVENUE

* See appendix for non-GAAP reconciliations

ORGANIC GROWTH & COST ACTIONS DRIVING IMPROVED PERFORMANCE

(Organic Performance)

Transport

+2%;

Treatment

-2%;

Test

Flat

+

Europe

Up

Low

Single

Digits

+

Transport

North/Central

Strength

…

South

Weak

–

Treatment

…

PY

Biogas

&

UK

Projects

Compare

–

U.S.

Down

1%

–

Treatment

…

Project

Delays,

Funding

Constraints

=

Transport

Flat

…

Dewatering

Up

MSD

(Sandy,

Fracking),

Offset

by

Capex

Decline

+

Emerging

Markets

Up

High

Single

Digits

+

Asia

Pac

(China

Up

Over

30%)

+

Eastern

Europe

(Capex

Projects,

Russia

Share

Gains)

Q3 GROWTH

Organic

+1%

Acquisitions

+4%

Constant

Currency

+5%

Q3'12

Q3'13

595

619

Q3'12

Q3'13

89

96

+8% |

XYLEM PROPRIETARY / CONFIDENTIAL

7

Q3’13 APPLIED WATER PERFORMANCE

Q3 2013 EARNINGS RELEASE

OPERATING INCOME*

+3%

(Dollars, In Millions)

(Dollars, In Millions)

REVENUE

* See appendix for non-GAAP reconciliations

STRONG

EMERGING

MARKETS

PERFORMANCE

…

MIX

DRIVES

MARGIN

DECLINE

(Organic Performance)

Building Svcs +1%; Ind’l Water +2%; Irrigation +2%

+

Emerging Markets Up Double-Digits

+

China Exceptionally Strong …

Industrial Water

Projects (Offshore O&G Fire Pump Projects) &

Commercial Building Market Share Gains

+

U.S. Commercial (Timing/Promotions) & Agriculture

(Favorable Weather Conditions)

–

U.S. Residential Slowing …

Southern Europe Weak

–

Continued U.S Industrial Weakness

Q3 GROWTH

Organic

+2%

Acquisition

0%

Constant

Currency

+2%

Q3'12

Q3'13

350

Q3'12

Q3'13

44

44

Flat

360

Vol/Other

-0.8%

Euro HQ

-0.3%

Pension

-0.3% |

XYLEM PROPRIETARY / CONFIDENTIAL

8

Q3 2013 EARNINGS RELEASE

XYLEM FINANCIAL POSITION

* See Appendix for Non-GAAP Reconciliations

September 30, 2013

Cash

394

Debt

1,202

Net Debt

808

Shareholders’

Equity

2,158

Net Capital

2,966

Net Debt to Net Capital

27%

CAPITAL SUMMARY

•

Strong Cash Position

•

Enhancing Shareholder Returns …

Deployed $107M in Dividends &

Repurchases vs. $58M in YTD‘12

•

Free Cash Flow Decline Driven by

Lower Income, Higher

Restructuring Payments, &

Unfavorable Working Capital

(Dollars, In Millions)

Cash

Dec. 2012

Operating

Activities

& Other

Dividends

& Share

Repurchases

Acquisitions

& Capex

Cash

Sept. 2013

504

394

107

172

169

69

325

SEPT.

2013

U.S.

International

Q3'12

YTD

Q3'13

YTD

171

72

CASH DRIVERS

CASH DRIVERS

FREE CASH FLOW *

FREE CASH FLOW *

CASH BALANCE

CASH BALANCE

(GEOGRAPHIC)

(GEOGRAPHIC)

(Dollars, In Millions)

(Dollars, In Millions)

(Dollars, In Millions)

FCF%

73%

45% |

XYLEM PROPRIETARY / CONFIDENTIAL

9

Q3 2013 EARNINGS RELEASE

XYLEM GUIDANCE UPDATE

FOCUSED EXECUTION DRIVING PERFORMANCE …

RAISING FULL YEAR EXPECTATIONS

* See appendix for non-GAAP reconciliations

FY REVENUE

FY EPS*

3.7B

3.8B

3.8B

$1.45

$1.63

$1.63

•

Internal Growth Initiatives & Improved Market Conditions

Drive Top Line Revision

-

Europe Stabilizing, U.S. Stable, Emerging Markets

Continue to Grow

-

Solid Backlog of $752M …

$470M Shippable Up 2%

•

Focused Execution & Disciplined Cost Management Drives

Solid Operating Performance

-

On Track to Deliver Full Year Restructuring Savings;

Incremental Actions Identified

Mid -

Point

Mid -

Point

Previous

Guidance

Current

Outlook

Previous

Guidance

Current

Outlook

Implied 4Q Revenue $965M; EPS* $0.51

•

European Realignment Delivers Benefits As

Previously Expected

• |

XYLEM PROPRIETARY / CONFIDENTIAL

10

Q3 2013 EARNINGS RELEASE

2013 Full Year

Financial Outlook

Growth

2013E vs. 2012

Xylem Consolidated

~$3,770

~ -1%

~ -2%

2%

-1%

Water Infrastructure

~$2,405

~ -1%

~ -3%

3%

-1%

Applied Water

~$1,430

Flat

Flat

Flat

Flat

Segment Margin *

13.1% to 13.3%

-120 bps to -100 bps

Operating Margin *

11.5% to 11.8%

-140 bps to -110 bps

EPS *

$1.60 to $1.65

$1.63 Mid-Point

Free Cash Flow

Conversion

~90%

Restructuring Pmts, Realignment Capex, & 1x Spin

Capex

Guidance Assumptions:

Operating Tax Rate

~21%

4Q Tax Rate of 21%

Share Count

~186.0

4Q Assumption ~185.0

Restructuring &

Realignment Costs *

~$65 to $80

‘13 Net Cost Savings $14 to $15; Realignment Cost

$25-$30

2013 FINANCIAL GUIDANCE SUMMARY

* See appendix for non-GAAP reconciliations

(Dollars In Millions, Except per Share Data)

Organic

Acquisition

FX

Total Growth

(Mid-Point)

Revenue |

XYLEM PROPRIETARY / CONFIDENTIAL

11

Q3 2013 EARNINGS RELEASE

XYLEM 3Q EARNINGS SUMMARY

Strong 3 Quarter Performance …

Raising 2013 Guidance

Enhancing Shareholder Returns …

Deploying Capital into Share

Repurchases

Prioritizing Initiatives & Driving Productivity

Focused on Execution & Accountability to Provide for Better Visibility

Identifying Actions to Drive Stronger 2014 Performance

Committed to Long-Term Strategy & Financial Targets

rd |

XYLEM PROPRIETARY / CONFIDENTIAL

12

Q3 2013 EARNINGS RELEASE

NON-GAAP MEASURES

Management

views

key

performance

indicators

including

revenue,

gross

margins,

segment

operating

income

and

margins,

orders

growth,

free cash

flow,

working

capital,

and

backlog,

among

others.

In

addition,

we

consider

certain

measures

to

be

useful

to

management

and

investors

evaluating

our

operating

performance

for

the

periods

presented,

and

provide

a

tool

for

evaluating

our

ongoing

operations,

liquidity

and

management

of

assets.

This

information

can

assist

investors

in

assessing

our

financial

performance

and

measures

our

ability

to

generate

capital

for

deployment

among

competing

strategic

alternatives

and

initiatives.

These

metrics,

however,

are

not

measures

of

financial

performance

under

GAAP

and

should

not

be

considered

a

substitute

for

revenue,

operating

income,

net

income,

earnings

per

share

(basic

and

diluted)

or

net

cash

from

operations

as

determined

in

accordance

with

GAAP.

We

consider

the

following

non-GAAP

measures,

which

may

not

be

comparable

to

similarly

titled

measures

reported

by

other

companies,

to

be

key

performance

indicators:

“Organic

revenue”

and

“Organic

orders”

defined

as

revenue

and

orders,

respectively,

excluding

the

impact

of

foreign

currency

fluctuations,

intercompany

transactions,

and

contributions

from

acquisitions

and

divestitures.

Divestitures

include

sales

of

portions

of

our

business

that

did

not

meet

the

criteria

for

classification

as

a

discontinued

operation

or

insignificant

portions

of

our

business

that

we

did

not

classify

as

a

discontinued

operation.

The

period-over-period

change

resulting

from

foreign

currency

fluctuations

assumes

no

change

in

exchange

rates

from

the

prior

period.

“Constant

currency”

defined

as

financial

results

adjusted

for

currency

translation

impacts

by

translating

current

period

and

prior

period

activity

using

the

same

currency

conversion

rate.

This

approach

is

used

for

countries

whose

functional

currency

is

not

the

U.S.

dollar.

“EBITDA”

defined

as

earnings

before

interest,

taxes,

depreciation,

amortization

expense,

and

share-based

compensation.

“Adjusted

EBITDA”

reflects

the

adjustment

to

EBITDA

to

exclude

for

non-recurring

separation

costs

associated

with

the

Xylem

spin-off

from

ITT

Corporation

as

well

as

non-recurring

restructuring

and

realignment

costs.

“Adjusted

Operating

Income,”

“

Adjusted

Segment

Operating

Income,”

and

“Adjusted EPS”

defined

as

operating

income

and

earnings

per

share,

adjusted

to

exclude

non-recurring

separation

costs

associated

with

the

Xylem

spin-off

from

ITT Corporation,

non-recurring

restructuring

and

realignment

costs

and

tax-related

special

items.

“Normalized

EPS”

defined

as

adjusted

earnings

per

share,

as

well

as

adjustments

to

reflect

the

incremental

current

period

amount

of

interest

expense

and

stand

alone

costs

in

the

prior

comparable

period.

“Free

Cash

Flow”

defined

as

net

cash

from

operating

activities,

as

reported

in

the

Statement

of

Cash

Flow,

less

capital

expenditures

as

well

as

adjustments

for

other

significant

items

that

impact

current

results

which

management

believes

are

not

related

to

our

ongoing

operations

and

performance.

Our

definition

of

free

cash

flows

does

not

consider

non-discretionary

cash

payments,

such

as

debt.

“Realignment

costs”

defined

as

non-recurring

costs

not

included

in

restructuring

costs

that

are

incurred

as

part

of

actions

taken

to

reposition

our

business,

including

items

such

as

professional

fees,

relocation,

travel

and

other

costs.

“Special

charges”

defined

as

costs

incurred

by

the

Company

associated

with

the

settlement

of

legal

proceedings

with

Xylem

Group

LLC,

as

well

as

certain

costs

incurred

for

the

change

in

chief

executive

officer

made

during

the

third

quarter

of

2013. |

XYLEM PROPRIETARY / CONFIDENTIAL

13

Q3 2013 EARNINGS RELEASE

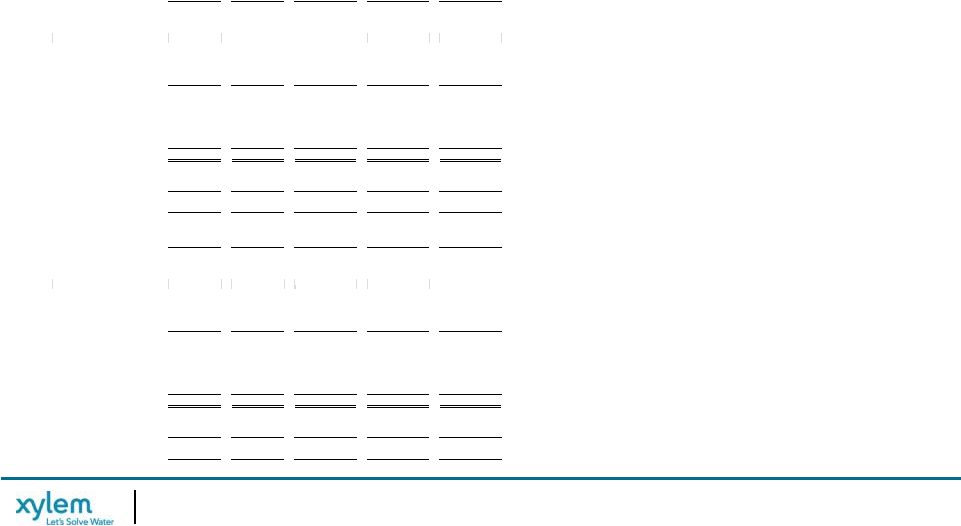

NON-GAAP RECONCILIATION:

ORGANIC & CONSTANT CURRENCY REVENUE GROWTH

Constant Currency

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

(H) = (F -

C) / A

Change

% Change

Change

% Change

Revenue

Revenue

2013 v. 2012

2013 v. 2012

FX Contribution

Eliminations

Adj. 2013 v. 2012

Adj. 2013 v. 2012

2013

2012

Nine Months Ended September 30

Xylem Inc.

2,804

2,822

(18)

-1%

(67)

(2)

-

(87)

-3%

-1%

Water Infrastructure

1,766

1,788

(22)

-1%

(67)

2

1

(86)

-5%

-1%

Applied Water

1,086

1,078

8

1%

-

(5)

(4)

(1)

0%

0%

Quarter Ended September 30

Xylem Inc.

965

931

34

4%

(21)

-

-

13

1%

4%

Water Infrastructure

619

595

24

4%

(21)

3

1

7

1%

5%

Applied Water

360

350

10

3%

-

(4)

-

6

2%

2%

Quarter Ended June 30

Xylem Inc.

960

966

(6)

-1%

(23)

(4)

-

(33)

-3%

-1%

Water Infrastructure

596

609

(13)

-2%

(23)

(2)

-

(38)

-6%

-2%

Applied Water

381

373

8

2%

-

(1)

(2)

5

1%

1%

Quarter Ended March 31

Xylem Inc.

879

925

(46)

-5%

(23)

2

-

(67)

-7%

-5%

Water Infrastructure

551

584

(33)

-6%

(23)

1

-

(55)

-9%

-5%

Applied Water

345

355

(10)

-3%

-

-

(2)

(12)

-3%

-3%

Note: Due to rounding the sum of segment amounts may not agree to Xylem totals.

Acquisitions /

Divestitures

Reported vs. Organic & Constant Currency Revenue

($ Millions)

(As Reported -

GAAP)

(As Adjusted -

Organic) |

XYLEM PROPRIETARY / CONFIDENTIAL

14

Q3 2013 EARNINGS RELEASE

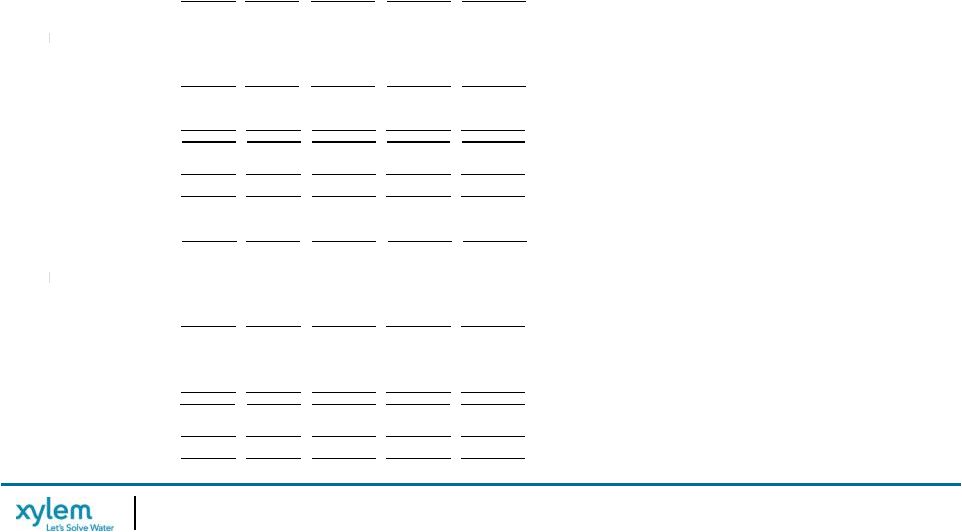

NON-GAAP RECONCILIATION:

ORGANIC & CONSTANT CURRENCY ORDER GROWTH

Constant Currency

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

(H) = (F -

C) / A

Change

% Change

Change

% Change

Orders

Orders

2013 v. 2012

2013 v. 2012

FX Contribution

Eliminations

Adj. 2013 v. 2012

Adj. 2013 v. 2012

2013

2012

Nine Months Ended September 30

Xylem Inc.

2,926

2,856

70

2%

(71)

1

-

-

0%

2%

Water Infrastructure

1,865

1,819

46

3%

(71)

4

-

(21)

-1%

3%

Applied Water

1,111

1,086

25

2%

-

(4)

1

22

2%

2%

Quarter Ended September 30

Xylem Inc.

955

882

73

8%

(20)

1

-

54

6%

8%

Water Infrastructure

617

564

53

9%

(20)

3

-

36

6%

10%

Applied Water

355

334

21

6%

-

(3)

1

19

6%

6%

Quarter Ended June 30

Xylem Inc.

1,009

970

39

4%

(25)

(2)

-

12

1%

4%

Water Infrastructure

647

617

30

5%

(25)

(1)

-

4

1%

5%

Applied Water

378

370

8

2%

-

(1)

1

8

2%

2%

Quarter Ended March 31

Xylem Inc.

962

1,004

(42)

-4%

(26)

2

-

(66)

-7%

-4%

Water Infrastructure

601

638

(37)

-6%

(26)

2

-

(61)

-10%

-5%

Applied Water

378

382

(4)

-1%

-

-

(1)

(5)

-1%

-1%

Note: Due to rounding the sum of segment amounts may not agree to Xylem totals.

Acquisitions /

Divestitures

Reported vs. Organic & Constant Currency Order Growth

($ Millions)

(As Reported -

GAAP)

(As Adjusted -

Organic) |

XYLEM PROPRIETARY / CONFIDENTIAL

15

Q3 2013 EARNINGS RELEASE

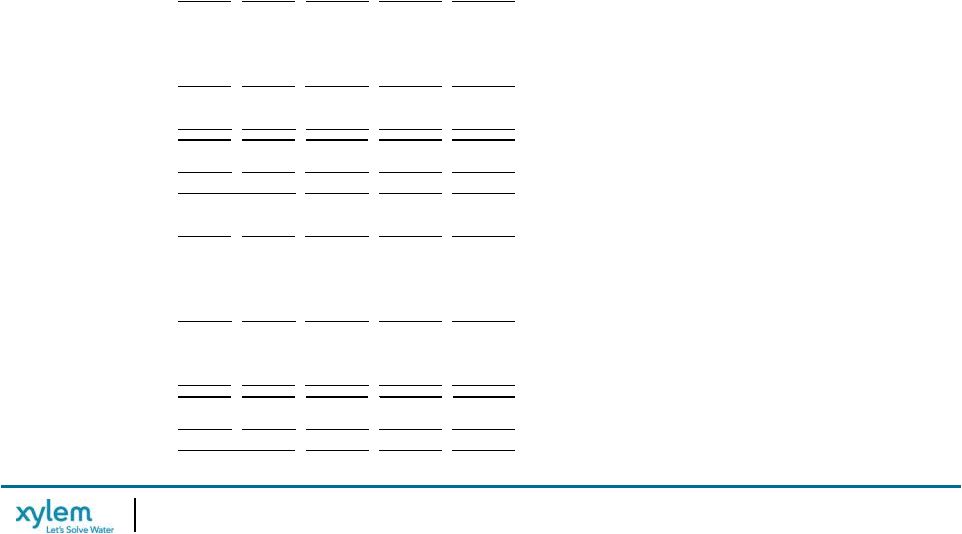

NON-GAAP RECONCILIATION:

ADJUSTED DILUTED EPS

Q3 2012

Q3 2013

As Reported

Adjustments

Adjusted

As Reported

Adjustments

Adjusted

Total Revenue

931

931

965

965

Operating Income

111

9

a

120

98

32

c

130

Operating Margin

11.9%

12.9%

10.2%

13.5%

Interest Expense

(14)

(14)

(14)

(14)

Other Non-Operating Income (Expense)

3

3

(1)

(1)

Income before Taxes

100

9

109

83

32

115

Provision for Income Taxes

(28)

2

b

(26)

(10)

(13)

d

(23)

Net Income

72

11

83

73

19

92

Diluted Shares

186.3

186.3

186.0

186.0

Diluted EPS

0.38

$

0.06

$

0.44

$

0.39

$

0.10

$

0.49

$

Q3 YTD 2012

Q3 YTD 2013

As Reported

Adjustments

Adjusted

As Reported

Adjustments

Adjusted

Total Revenue

2,822

2,822

2,804

2,804

Operating Income

339

20

a

359

234

72

c

306

Operating Margin

12.0%

12.7%

8.3%

10.9%

Interest Expense

(41)

(41)

(41)

(41)

Other Non-Operating Income (Expense)

1

1

(2)

(2)

Income before Taxes

299

20

319

191

72

263

Provision for Income Taxes

(75)

(2)

b

(77)

(31)

(24)

d

(55)

Net Income

224

18

242

160

48

208

Diluted Shares

186.2

186.2

186.2

186.2

Diluted EPS

1.20

$

0.09

$

1.29

$

0.86

$

0.26

$

1.12

$

a

One-time separation costs and restructuring & realignment costs

b

Net tax impact of separation costs, restructuring & realignment costs and special tax

items c

Restructuring & realignment costs and special charges

d

Net tax impact of restructuring & realignment costs, special charges and special tax

items ($ Millions, except per share amounts) |

XYLEM PROPRIETARY / CONFIDENTIAL

16

Q3 2013 EARNINGS RELEASE

NON-GAAP RECONCILIATION:

ADJ. OPERATING INCOME AND MARGIN

Q3

Q3 YTD

'13

'12

'13

'12

Total Revenue

• Total Xylem

965

931

2,804

2,822

• Water Infrastructure

619

595

1,766

1,788

• Applied Water

360

350

1,086

1,078

Operating Income

• Total Xylem

98

111

234

339

• Water Infrastructure

88

85

171

253

• Applied Water

40

43

125

135

Operating Margin

• Total Xylem

10.2%

11.9%

8.3%

12.0%

• Water Infrastructure

14.2%

14.3%

9.7%

14.1%

• Applied Water

11.1%

12.3%

11.5%

12.5%

Separation Costs

• Total Xylem

-

4

-

15

• Water Infrastructure

-

-

-

3

• Applied Water

-

1

-

2

Special Charges

• Total Xylem

20

-

20

-

• Water Infrastructure

-

-

-

-

• Applied Water

-

-

-

-

Restructuring & Realignment Costs

• Total Xylem

12

5

52

5

• Water Infrastructure

8

4

40

4

• Applied Water

4

-

12

-

Adjusted Operating Income*

• Total Xylem

130

120

306

359

• Water Infrastructure

96

89

211

260

• Applied Water

44

44

137

137

Adjusted Operating Margin*

• Total Xylem

13.5%

12.9%

10.9%

12.7%

• Water Infrastructure

15.5%

15.0%

11.9%

14.5%

• Applied Water

12.2%

12.6%

12.6%

12.7%

($ Millions)

*Adjusted Operating Income excludes restructuring & realignment costs and special charges

in 2013 and excludes restructuring & realignment costs and non-recurring

separation costs in 2012. |

XYLEM PROPRIETARY / CONFIDENTIAL

17

Q3 2013 EARNINGS RELEASE

NON-GAAP RECONCILIATION:

FREE CASH FLOW

2013

2012

Net Cash - Operating Activities

163

$

230

$

Capital Expenditures

(91)

(81)

Free Cash Flow, including separation costs

72

149

Cash Paid for Separation Costs (incl. Capex)

-

22

Free Cash Flow, excluding separation costs*

72

$

171

$

Net Income

160

224

Separation Costs, net of tax (incl. tax friction)

-

11

Net Income, excluding separation costs*

160

$

235

$

Free Cash Flow Conversion

45%

73%

* Separation costs are not excluded in 2013

Net Cash - Operating Activities vs. Free Cash Flow

($ Millions)

Nine Months Ended |

XYLEM PROPRIETARY / CONFIDENTIAL

18

Q3 2013 EARNINGS RELEASE

NON-GAAP RECONCILIATION:

XYLEM EBITDA & ADJ. EBITDA

Q1

Q2

Q3

Q4

Total

Pre-Tax Income

51

57

83

191

Interest Expense (Income), net

12

13

14

39

Depreciation

25

24

23

72

Amortization

12

13

13

38

Stock Compensation

6

6

9

21

EBITDA

106

113

142

361

Restructuring & Realignment

12

28

12

52

Special Charges

-

-

20

20

Adjusted EBITDA

118

141

174

433

Revenue

879

960

965

2,804

Adjusted EBITDA Margin

13.4%

14.7%

18.0%

15.4%

Q1

Q2

Q3

Q4

Total

Pre-Tax Income

84

115

100

89

388

Interest Expense (Income), net

13

13

12

13

51

Depreciation

23

21

24

26

94

Amortization

11

12

12

13

48

Stock Compensation

5

5

6

6

22

EBITDA

136

166

154

147

603

Separation Costs

5

6

4

7

22

Restructuring & Realignment

-

-

5

19

24

Adjusted EBITDA

141

172

163

173

649

Revenue

925

966

931

969

3,791

Adjusted EBITDA Margin

15.2%

17.8%

17.5%

17.9%

17.1%

2012

EBITDA and Adjusted EBITDA by Quarter

($ Millions)

2013 |

XYLEM PROPRIETARY / CONFIDENTIAL

19

Q3 2013 EARNINGS RELEASE

NON-GAAP RECONCILIATION:

WATER INFRASTRUCTURE EBITDA & ADJ. EBITDA

Q1

Q2

Q3

Q4

Total

Pre-Tax Income

42

43

87

172

Interest Expense (Income), net

-

(1)

-

(1)

Depreciation

19

17

16

52

Amortization

9

11

11

31

Stock Compensation

1

1

1

3

EBITDA

71

71

115

257

Restructuring & Realignment

10

22

8

40

Adjusted EBITDA

81

93

123

297

Revenue

551

596

619

1,766

Adjusted EBITDA Margin

14.7%

15.6%

19.9%

16.8%

Q1

Q2

Q3

Q4

Total

Pre-Tax Income

75

93

86

88

342

Interest Expense (Income), net

-

-

(1)

-

(1)

Depreciation

16

15

17

20

68

Amortization

10

9

10

10

39

Stock Compensation

1

1

3

-

5

EBITDA

102

118

115

118

453

Separation Costs

2

1

-

1

4

Restructuring & Realignment

-

-

4

15

19

Adjusted EBITDA

104

119

119

134

476

Revenue

584

609

595

637

2,425

Adjusted EBITDA Margin

17.8%

19.5%

20.0%

21.0%

19.6%

2012

2013

($ Millions) |

XYLEM PROPRIETARY / CONFIDENTIAL

20

Q3 2013 EARNINGS RELEASE

NON-GAAP RECONCILIATION:

APPLIED WATER EBITDA & ADJ. EBITDA

Q1

Q2

Q3

Q4

Total

Pre-Tax Income

40

45

40

125

Interest, net

-

-

-

-

Depreciation

6

5

6

17

Amortization

2

1

1

4

Stock

Compensation 1

-

1

2

EBITDA

49

51

48

148

Restructuring &

Realignment 2

6

4

12

Adjusted EBITDA

51

57

52

160

Revenue

345

381

360

1,086

Adjusted EBITDA Margin

14.8%

15.0%

14.4%

14.7%

Q1

Q2

Q3

Q4

Total

Pre-Tax Income

40

52

43

35

170

Interest, net

-

-

-

-

-

Depreciation

6

6

6

5

23

Amortization

1

1

1

2

5

Stock

Compensation 1

-

2

(1)

2

EBITDA

48

59

52

41

200

Separation Costs

1

-

1

-

2

Restructuring & Realignment

-

-

-

5

5

Adjusted

EBITDA 49

59

53

46

207

Revenue

355

373

350

346

1,424

Adjusted EBITDA Margin

13.8%

15.8%

15.1%

13.3%

14.5%

2012

2013

($ Millions) |

XYLEM PROPRIETARY / CONFIDENTIAL

21

Q3 2013 EARNINGS RELEASE

NON-GAAP RECONCILIATION:

GUIDANCE

Illustration of Mid Point Guidance

2013 Guidance

FY '12

FY '13

As Reported

Adjustments

Adjusted

As Projected

Adjustments

Adjusted

Total Revenue

3,791

3,791

3,770

3,770

Segment Operating Income

512

30

a

542

425

73

c

498

Segment Operating Margin

13.5%

14.3%

11.3%

13.2%

Corporate Expense

69

(16)

b

53

78

(20)

d

58

Operating Income

443

46

489

347

93

440

Operating Margin

11.7%

12.9%

9.2%

11.7%

Interest Expense

(55)

(55)

(55)

(55)

Other Non-Operating Income (Expense)

-

-

(3)

(3)

Income before Taxes

388

46

434

289

93

382

Provision for Income Taxes

(91)

(13)

e

(104)

(48)

(32)

e

(80)

Net Income

297

33

330

241

61

302

Diluted Shares

186.2

186.2

186.0

186.0

Diluted EPS

1.59

$

0.18

$

1.77

$

1.30

$

0.33

$

1.63

$

Guidance

($ Millions, except per share amounts)

a

b

c

d

e

Restructuring and realignment costs incurred at the segment level

Special charges incurred at the corporate level

Net tax impact of above items, plus the addition of special tax items

One-time separation, restructuring and realignment costs incurred at the segment

level One-time separation, restructuring and realignment costs incurred at the corporate

level |

XYLEM PROPRIETARY / CONFIDENTIAL

22

Q3 2013 EARNINGS RELEASE

NON-GAAP RECONCILIATION:

ADJUSTED OPERATING INCOME

Mid Point Guidance

2008

2009

2010

2011

2012

2013E

Revenue

3,291

2,849

3,202

3,803

3,791

3,770

Operating Income

315

276

388

395

443

347

Operating Margin

9.6%

9.7%

12.1%

10.4%

11.7%

9.2%

Restructuring, Realignment & Special Charges

41

31

15

-

24

93

Separation Costs*

-

-

-

87

22

-

Adjusted Operating Income

356

307

403

482

489

440

Adjusted Operating Margin

10.8%

10.8%

12.6%

12.7%

12.9%

11.7%

Standalone Costs

-

-

-

5

28

-

Adj. Operating Income, excl. Standalone

Costs 356

307

403

487

517

440

Adjusted Operating Margin, excl.

Standalone Costs 10.8%

10.8%

12.6%

12.8%

13.6%

11.7%

* 2013 separation costs are not excluded from adjusted operating income.

($ Millions) |