Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Scio Diamond Technology Corp | a13-23075_18k.htm |

Exhibit 99.1

|

|

Created by Nature, Perfected by Science. www.sciodiamond.com October 2013 OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Safe Harbor Agreement & Disclosure This presentation contains forward-looking statements that are based on the beliefs of Scio Diamond’s management and reflect Scio’s current expectations and projections about future results, performance, prospects and opportunities. Scio has tried to identify these statements by using words such as “anticipate,” believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “potential,” “should,” “will,” “will be,” “would” and similar expressions, but this is not an exclusive way of identifying such statements. Investors are cautioned that all forward-looking statements contained herein speak only as of the date of this presentation and involve risks and uncertainties that could cause Scio’s actual results, performance and achievements to differ materially from those expressed in these forward-looking statements, including, without limitation, the impact of the current challenging global economic conditions and recent financial crisis; the development of the market for cultured diamonds; competition; Scio’s ability to raise the capital required for research, product development, operations and marketing; anticipated dependence on material customers and material suppliers. For a detailed discussion of factors that could affect Scio’s future operating results, investors should see disclosures under “Risk Factors” in the company’s applicable filings with the US Securities and Exchange Commission. These factors should be considered carefully and investors should not rely on any forward-looking statements contained herein, or that may be made elsewhere from time to time by Scio or on Scio’s behalf. Scio undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law. OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Key Facts Symbol OTCBB: SCIO Price as of 9/30/2013 $0.40 Price (52-week range) $0.15 - $2.75 Daily Volume (90-day average) 18,426 Market Capitalization $19.31M Shares Outstanding 48.26M Debt at 6/30/2013 $0.94M Cash at 6/30/2013 $0.61M Enterprise Value $19.64M Corporate Headquarters Greenville, South Carolina Full-Time Employees (9/30/2013) 11 Accounting Firm Cherry Bekaert LLP Significant intellectual property portfolio: 24 US patents, 8 foreign patents 15 US and 10 foreign patent applications in process OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

What We Do Scio manufactures diamond that is “real diamond” Scio employs a patent-protected Chemical Vapor Deposition (CVD) process that produces high-quality, single crystal diamond in a controlled laboratory setting Scio produced diamond has chemical, physical and optical properties identical to mined diamonds Scio’s manufacturing process enables it to produce high quality, high purity single-crystal diamond that is colorless, near colorless and fancy colored Scio’s proprietary technology offers the flexibility to produce lab-grown diamond in size, color, specification and quality combinations that are very rare in nature OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Executives of Scio & Key Advisors Executives of Scio Diamond Technology Corp. Michael McMahon, Chief Executive Officer brings 35 years of executive experience in operations and business development of Fortune 100 companies such as Fluor and Jacobs Engineering. Throughout his career he was responsible for over $19 billion of engineering, construction, startup and commissioning of facilities worldwide primarily serving clients in the high tech industry, DoE, and DoD. He has successfully led project turnarounds, business development, process controls and improvements, startups, joint ventures, mergers and acquisitions, and profit improvement initiatives. Mr. McMahon has a BS from the University of Cincinnati. Jonathan Pfohl, Chief Financial Officer brings more than 25 years of leadership experience in the wireless industry, including roles as CEO of Wireless Express; CFO of Main Street Broadband; CFO of Movida Cellular; and VP, Finance of AirGate PCS, Inc. He has broad and deep experience in funding, planning, SEC reporting, business development and expense control for small to mid-sized companies. Mr. Pfohl has a BS-Management and an MBA-Finance from the State University of New York at Buffalo. Board Member & Inventor of Diamond Technology Dr. Robert C. Linares brings extensive and diverse experience in the field of crystal growth technologies, having held positions with Bell Laboratories, Perkin Elmer, M/A-COM (now part of Tyco Electronics) and Spectrum Technology, Inc., a company he founded and was sold to NERCO Advanced Materials (NYSE: NER). Dr. Linares holds a doctorate in chemical engineering as well as a master’s in business administration. OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Chemical Vapor Deposition (CVD) Chemical Vapor Deposition(CVD), well understood technology that is widely employed in the electronics and materials industries, is a process that is used to produce solid materials that are high-purity and high-performance in quality. Scio patented CVD Single Crystal > 1 mm thick Lowers stress in the crystal lattice which leads to great strength and hardness for industrial use. Produces low nitrogen Type IIa crystals (colorless/near colorless) – less than 3% of all mined diamonds qualify as Type II a diamond Scio has designed proprietary reactors that produce 7 to 10 times more diamond than competitors. Expected breakeven on capital investment per reactor is less than 18 months. Scio CVD vs. HPHT/Microwave CVD (competitor processes) Growth of Scio CVD can be monitored and controlled during growth cycle Scio CVD has greater thickness potential because of its single growth process Scio diamond surface area potential is significantly greater than HPHT Highest rate of productive growth in the world per reactor. OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

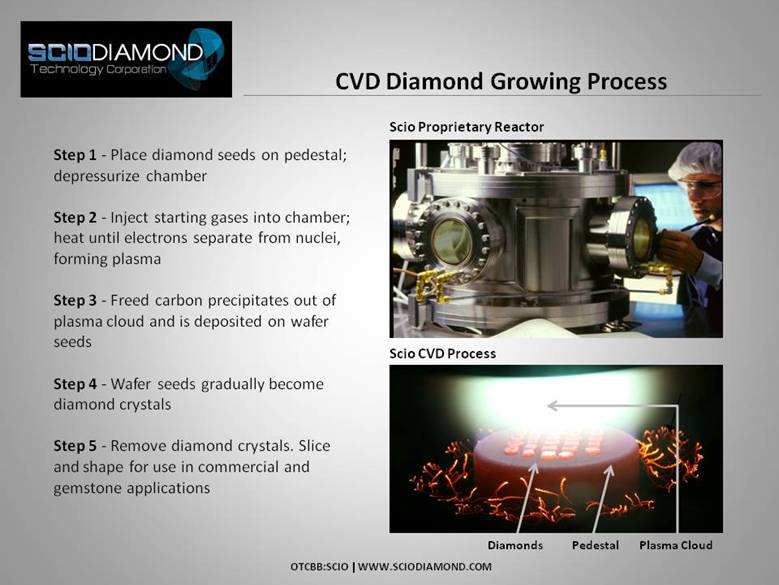

CVD Diamond Growing Process Plasma Cloud Diamonds Pedestal Scio Proprietary Reactor Scio CVD Process Step 1 - Place diamond seeds on pedestal; depressurize chamber Step 2 - Inject starting gases into chamber; heat until electrons separate from nuclei, forming plasma Step 3 - Freed carbon precipitates out of plasma cloud and is deposited on wafer seeds Step 4 - Wafer seeds gradually become diamond crystals Step 5 - Remove diamond crystals. Slice and shape for use in commercial and gemstone applications OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Opportunities – Gemstone & Industrial Gemstone Opportunities Scio-created gemstones are real diamond Grown in a environmentally clean reactor instead of the earth-mined Features of Scio-created diamond gemstones Perfection and Scalability – stones of same size and color Colorless, yellow and Pink diamond capability Environmentally friendly alternative to earth-mined diamonds No “conflict diamond” concerns Gem market is rapidly developing and estimated at $15-$20B Industrial Applications Current Applications - Precision Cutting Signed production deal for cutter blades with a South Korean tool manufacturer that has been in business for 20+ years Other vendors have placed orders for water jet and cutting tool applications. Future Applications Semiconductor Substrate / Quantum Computing / “Diamond Chip” Scalpel – Laser Scalpel Molecular Resolution MRI Water Purification High Power Laser & Other Defense and Energy Applications OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Strategic Opportunities Technology Licensing Cooperative Ownership Production Expansion OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Gemstone Joint Venture in China Scio announced definitive agreement for joint venture to produce Type IIA, single crystal CVD Diamond in China on September 17, 2013 targeting a specific gemstone market opportunity. Partners have 75 years combined experience in gemstone industry in distribution and technology processes Initially target of 100 reactors operational by summer 2014. Capacity to expand to 400 with 24 months Scio provides technology and intellectual property in exchange for 30% equity interest and licensing fees. No Scio capital requirements with partners provide funding and associated technology. Venture affirms acceptance of technology platform and Scio’s ability to mass produce quality diamond OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Technology Licensing Offshore opportunities for licensing technology to 3rd party manufacturers in exchange for licensing revenue: One time flat fee for limited rights to IP On-going royalties based on revenue produced Per machine licensing fees based on machines in production Sale of Scio reactors/technology OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Cooperative Ownership Offshore opportunities to license technology for ownership interests in production joint venture. One time flat fee for limited rights to IP On-going royalties based on revenue of product produced Per machine licensing fees based on machines in production Sale of Scio reactors/technology OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Production Expansion Strategic plan to expand growing platform to 4” technology and to expand capacity to 60 reactors total. Potential funding from strategic with dedicated production for partner: 4” growing technology is being tested that will result in 70% increase in growing capacity Expansion to 60 growers will increase revenue potential by 600% Strategic partners potentially funding a portion of expansion capacity with dedicated production. Provides for competitive fixed gross margins and lower incremental cost of expansion Limited need for incremental overhead expenditures as revenue increases, enhancing overall cash flow margins. OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

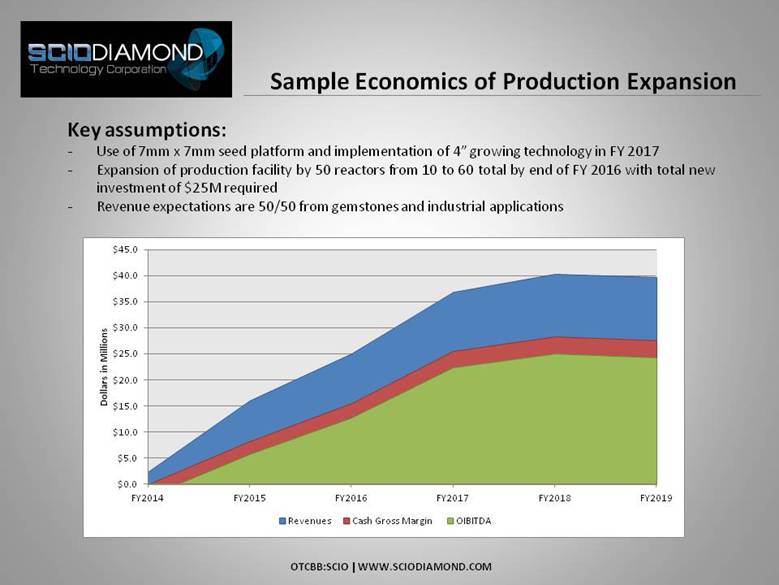

Sample Economics of Production Expansion Key assumptions: Use of 7mm x 7mm seed platform and implementation of 4” growing technology in FY 2017 Expansion of production facility by 50 reactors from 10 to 60 total by end of FY 2016 with total new investment of $25M required Revenue expectations are 50/50 from gemstones and industrial applications OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

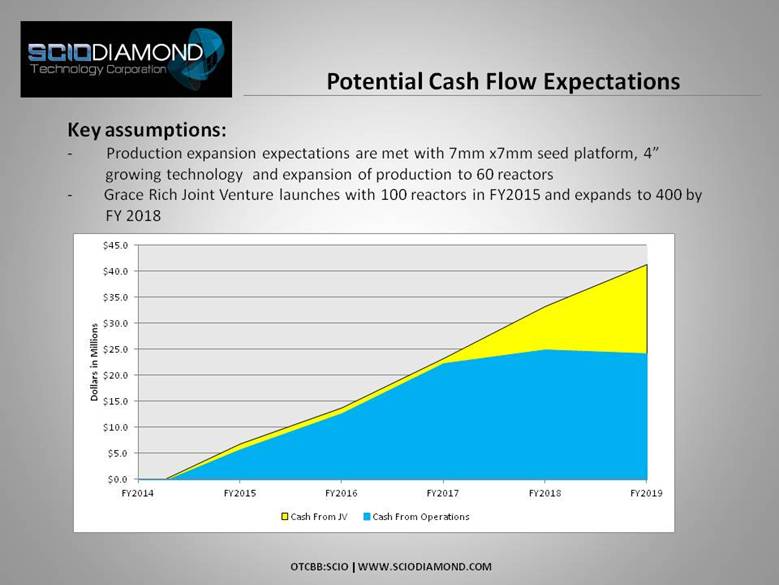

Potential Cash Flow Expectations Key assumptions: Production expansion expectations are met with 7mm x7mm seed platform, 4” growing technology and expansion of production to 60 reactors Grace Rich Joint Venture launches with 100 reactors in FY2015 and expands to 400 by FY 2018 OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Summary Continue development of sustainable commercial applications for mass production of high quality single crystal diamond targeting industrial and gemstone markets Accelerating production capacity by advancing seed size from 4mm to 7mm, an increase of 110%; next phase of production expansion is 4” reactor technology with additional 70% increase in production capacity Seeking to expand production capacity in South Carolina by initially doubling growers to 20 and ultimately expanding to 60 total Exploring strategic technology licensing opportunities High gross margins and incremental revenue flows to bottom line Looking to exploit expanding gemstone opportunities Long term objective is to be the world leader in the production of high-value added diamond material OTCBB:SCIO | WWW.SCIODIAMOND.COM |

|

|

Created by Nature, Perfected by Science.TM Greenville South Carolina Headquarters 411 University Ridge Road, Greenville, SC 29601 (864) 751-4880 www.sciodiamond.com |