Attached files

| file | filename |

|---|---|

| EX-8.1 - EX-8.1 - CHC Group Ltd. | d590709dex81.htm |

| EX-24.2 - EX-24.2 - CHC Group Ltd. | d590709dex242.htm |

| EX-23.1 - EX-23.1 - CHC Group Ltd. | d590709dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on October 25, 2013

Registration No. 333-191268

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHC Group Ltd.

(Exact name of Registrant as specified in its charter)

| Cayman Islands | 4522 | 98-0587405 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

CHC Group Ltd.

c/o Heli-One Canada Inc.

4740 Agar Drive

Richmond, BC V7B 1A3, Canada

(604) 276-7500

(Address, including zip code, and telephone number, of registrants’ principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 590-9070

(Name, address, including zip code and telephone number, including area code, of agent for service)

Please send copies of all communications to:

| Louis Lehot Michael Tenta Cooley LLP 3175 Hanover Street Palo Alto, California 94304-1130 (650) 843-5949 (650) 843-5636 |

Joshua Ford Bonnie Ryan Bekkerus Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 (212) 455-2000 |

Michael O’Neill SVP, Chief Legal Officer Russ Hill VP, Deputy General Counsel and Corporate Secretary CHC Group Ltd. 4740 Agar Drive Richmond, BC V7B 1A3, Canada (604) 276-7500 |

Michael E. Michetti Scott R. Saks Joel M. Simon Paul Hastings LLP 75 East 55th Street New York, NY 10022 212-318-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement of which this prospectus is a part and which is filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities nor does it solicit an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated October 25, 2013

PROSPECTUS

Ordinary Shares

CHC Group Ltd.

CHC Group Ltd. is offering of its ordinary shares. This is our initial public offering and no public market currently exists for our ordinary shares. We anticipate that the initial public offering price will be between $ and $ per share.

After the completion of this offering, funds affiliated with First Reserve Management, L.P., or First Reserve, will continue to own a majority of the voting power of ordinary shares eligible to vote in the election of our directors. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of The New York Stock Exchange, or the NYSE.

We intend to apply to list our ordinary shares on the NYSE under the symbol “HELI”.

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 20.

PRICE $ PER SHARE

| Price to Public |

Underwriting Discounts |

Proceeds to us(1) |

||||||||||

| Per Share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting.” |

To the extent that the underwriters sell more than ordinary shares, the underwriters have the option to purchase up to an additional ordinary shares from us at the initial public offering price less the underwriting discount.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares to purchasers on or about , 2013.

| J.P. Morgan | Barclays | |

UBS Investment Bank

, 2013

Table of Contents

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the U.S. Securities and Exchange Commission, or the SEC. Neither we, nor the underwriters, have authorized anyone to provide additional information or information different from those contained in this prospectus or in any free writing prospectuses filed with the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our ordinary shares only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our ordinary shares. Our business, financial condition, results of operations, and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit our initial public offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our ordinary shares and the distribution of this prospectus outside of the United States.

Table of Contents

MARKET, INDUSTRY AND OTHER DATA

The market data and other statistical information (such as the size of certain markets and our position and the position of our competitors within these markets, oil and gas production and market information) used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources, including reports from Spears & Associates, or Spears, U.S. Energy Information Administration, International Energy Agency, or IEA, and PFC Energy. Some market data and statistical information are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. We believe that these external sources and estimates are reliable, but have not independently verified them.

The audited consolidated financial statements of the CHC Group Ltd. (the “Successor,” the “Company,” “we,” “us” or “our”), consist of the Successor’s consolidated balance sheets as of April 30, 2012 and 2013 and the Successor’s consolidated statements of operations, comprehensive income (loss), changes in shareholder’s equity and cash flows for the years ended April 30, 2011, 2012, and 2013. CHC Group Ltd. was incorporated on July 3, 2008 under the Cayman Islands Companies Law whose sole purpose was to acquire CHC Helicopter Corporation (the “Predecessor”). The Company completed its acquisition of the Predecessor on September 16, 2008 and has included the results of operations and cash flows of the entity formerly known as CHC Helicopter Corporation from September 16, 2008 to April 30, 2009 in its unaudited consolidated financial statements for the fiscal year ended April 30, 2009, which are not included in this prospectus. Our results of operations also include organizational expenses and losses related to the acquisition, as it was not previously operating in the helicopter transportation services industry from May 1, 2008 up to the date of the acquisition. The acquisition of CHC Helicopter Corporation was accounted for using the purchase method of accounting. The application of the purchase method of accounting requires the allocation of the acquisition purchase price to the tangible and intangible assets acquired, and liabilities assumed, based on their respective fair values as of the date of the acquisition. As a result, the assets and liabilities acquired from the Predecessor on the date of acquisition are recorded at fair values, and these became the Successor’s cost basis. Accordingly, the Predecessor period from May 1, 2008 to September 15, 2008 and the Successor period from May 1, 2008 to April 30, 2009 have a different basis of accounting. The Predecessor adopted the U.S. dollar as its reporting currency on May 1, 2008. As such, historical figures previously reported in Canadian dollars have been translated into U.S. dollars using the current rate method. Under this method, the statement of operations and cash flow statement items have been translated into U.S. dollars using the rates in effect at the date of the transactions. Assets and liabilities have been translated using the exchange rate in effect at the balance sheet date. The Predecessor applied this method retrospectively to all activity that commenced May 1, 2004. Equity balances which arose prior to May 1, 2004 have been translated to the reporting currency at the exchange rate in effect on May 1, 2004.

CHC Helicopter and the CHC Helicopter logo are trademarks of CHC Capital (Barbados) Ltd., a wholly owned subsidiary of CHC Group Ltd. All other trademarks and service marks appearing in this prospectus are the property of their respective holders. All rights reserved. The absence of a trademark or service mark or logo from this prospectus does not constitute a waiver of trademark or other intellectual property rights of CHC Group Ltd., its subsidiaries, affiliates, licensors or any other persons.

ii

Table of Contents

This summary highlights some of the information contained in this prospectus, but does not contain all of the information that may be important to you. You should read this entire prospectus and the documents to which we refer you before making an investment decision. You should carefully consider the information set forth under “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes included elsewhere in this prospectus. Where applicable, we have assumed an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus). Unless otherwise indicated, the information presented in this prospectus assumes that the underwriters’ option to purchase additional ordinary shares is not exercised.

Unless the context otherwise requires, references in this prospectus to “Company,” “CHC,” “we,” “us” and “our” refer to CHC Group Ltd., a Cayman Islands exempted company, and its subsidiaries. Our fiscal year ends on April 30, and we refer to fiscal years based on the end of such period (the fiscal year ended April 30, 2013 is referred to as “fiscal 2013”). Certain operational terms used in this prospectus are defined under the heading “Glossary.”

CHC HELICOPTER

Overview

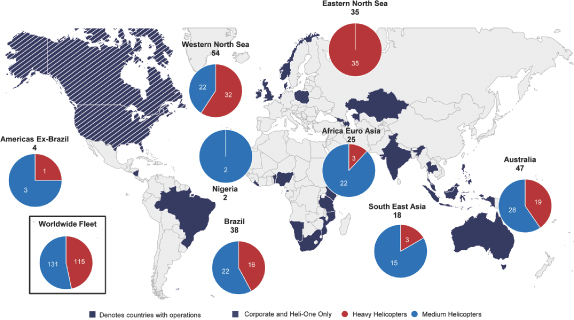

We are the world’s largest commercial operator of helicopters based on revenue of $1.7 billion in fiscal 2013. We are also the world’s largest commercial operator of heavy and medium helicopters based on our fleet of 246 heavy and medium helicopters as of July 31, 2013. With bases on six continents, we are one of only two global commercial helicopter service providers to the offshore oil and gas industry. Our mission is to provide the highest level of service in the industry, which we believe will enable our customers to go further, do more and come home safely. Through our 60 years of experience providing helicopter services, we believe our brand and reputation have become associated with safe and reliable transportation and mission-critical logistics solutions. Our fleet of heavy and medium helicopters, global capabilities and reputation for safety position us to capitalize on anticipated increases in ultra-deepwater and deepwater drilling and production spending by our major, national and independent oil and gas company customers.

Our helicopters are primarily used to facilitate large, long-distance crew changes on offshore production facilities and drilling rigs. We also provide search and rescue services, or SAR, and emergency medical services, or EMS, to government agencies. We maintain a presence in most major offshore oil and gas markets through a network of approximately 70 bases with operations in approximately 30 countries, more than any other commercial helicopter service provider in the world. We cover this expansive and diverse geography with a technologically advanced fleet of 246 helicopters and the expertise to serve customers in ultra-deepwater and deepwater locations. To secure and maintain operating certificates in the many jurisdictions in which we provide helicopter services, we must meet stringent and diverse regulatory standards across multiple jurisdictions, and have an established track record in obtaining and maintaining certificates as well as working with regulators and local partners.

We generate the majority of our oil and gas customer Helicopter Services revenue from contracts tied to our customers’ offshore production operations, which have long-term transportation requirements. A substantial portion of our remaining oil and gas customer Helicopter Services revenue comes from transporting personnel to and from offshore drilling rigs, and we believe this capability allows us to take advantage of expansion in the global ultra-deepwater rig fleet. Approximately 71% to 75% of our revenue under these contracts was attributable to fixed monthly charges for the fiscal years ended April 30, 2011, 2012 and 2013.

1

Table of Contents

We also provide maintenance, repair and overhaul, or MRO, services through our Heli-One business to both our own Helicopter Services segment and to third-party customers. Our MRO capabilities enable us to perform heavy structural repairs, and maintain, overhaul and test helicopters and helicopter components globally across various helicopter types. We believe our in-house MRO operations through our Heli-One business enable us to manage our supply chain and maintain our fleet more efficiently, thereby increasing the availability of our helicopters and reducing our overall cost of maintenance. In addition, we are the largest provider of these services (excluding original equipment manufacturers, or OEMs), which allows us to provide our Heli-One customers with comprehensive MRO services across multiple helicopter types and families. Our MRO services include complete maintenance outsourcing solutions, parts sales and distribution, engineering services, design services and logistics support.

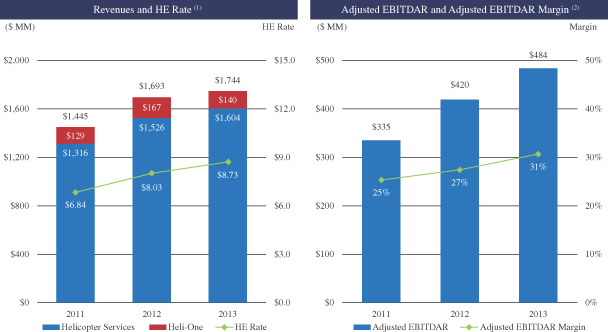

We conduct our business through two operating segments: Helicopter Services for flying operations and Heli-One for MRO services. The following charts show our revenue generated by segment, our Heavy Equivalent, or HE Rate, our Adjusted EBITDAR and our Adjusted EBITDAR margin, for each of the fiscal years ended April 30, 2011, 2012 and 2013:

| (1) | HE Rate is the third-party operating revenue from our Helicopter Services segment excluding reimbursable revenue divided by a weighted average factor corresponding to the number of heavy and medium helicopters in our fleet. Our heavy and medium helicopters, including owned and leased, are weighted at 100% and 50%, respectively, to arrive at a single HE count, excluding helicopters expected to be retired from our fleet. |

| (2) | Adjusted EBITDAR margin is calculated as Adjusted EBITDAR divided by total revenue less reimbursable revenue. Cost reimbursements from customers are recorded as reimbursable revenue with the related reimbursement expense in direct costs. |

For an explanation of how we calculate Adjusted EBITDAR and a reconciliation to net loss, see “—Summary Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations— Key Financial and Operating Metrics.”

2

Table of Contents

We have incurred net losses in the past five years, including approximately $67.1 million, $96.2 million, $116.5 million and $35.7 million in the last three fiscal years ended April 30, 2011, 2012 and 2013, and the three months ended July 31, 2013, respectively, and on a cumulative basis since our inception. Our net losses during this five-year period have resulted from a number of factors, including non-cash impairments of goodwill and other assets totaling $903.3 million and interest charges related to substantial leverage incurred to acquire additional helicopters and grow our business.

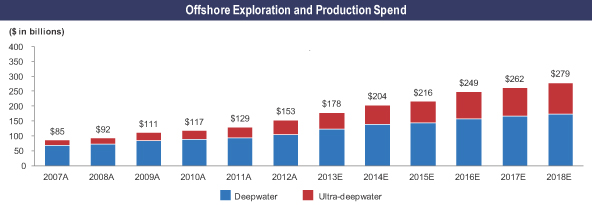

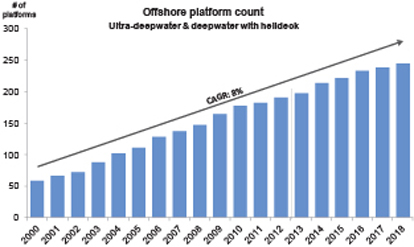

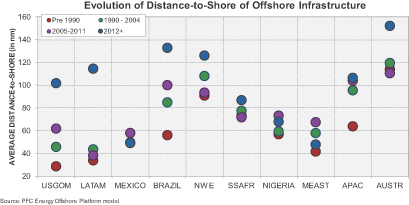

Our Market Opportunity

We believe trends in the offshore oil and gas industry will positively affect the market and demand for our helicopter services. As the major, national and independent oil and gas companies seek to replace reserves and grow production, we believe they will continue to explore for, develop and produce oil and gas from deeper waters and at locations that are further offshore, which requires more complex transportation and logistics services. According to PFC Energy, the number of oil and gas platforms that are accessible by helicopter in ultra-deepwater and deepwater locations has more than doubled in the past ten years, and the distance from shore has been increasing. Oil and gas companies are also adopting increasingly complex offshore oilfield services and solutions that require more personnel to operate. Additionally, regulatory bodies are increasing their own oversight functions and crews are being rotated on and off at periodic intervals. We believe these factors will drive an increase in the number of personnel needing to be transported to and from offshore facilities. Helicopter service is the most efficient and often the only viable or permitted form of transportation in many of these jurisdictions due to the distance from shore of the platforms and environmental conditions offshore, particularly in the North Sea, where a sea-faring vessel may take a substantially longer time to cover the same distance and in significantly less comfortable conditions, with greater logistical risks of transporting workers from vessel to platform.

We believe that the adoption of more complex services on ultra-deepwater and deepwater installations, increased regulatory oversight of these installations and more frequent rotation of increasingly larger crews at regular intervals will further drive customer demand for heavy and medium helicopters, which comprise all of our fleet. Based on our experience, heavy and medium helicopters are favored by customers with ultra-deepwater and deepwater transportation needs due to their greater range, passenger capacity, comfort, enhanced passenger safety systems and ability to fly under a variety of conditions. In recent years, in our experience, the demand for new commercial medium and heavy helicopters has outpaced their supply, a trend we believe will continue. As a result, we expect the market dynamics for our helicopter services to remain strong. Furthermore, we believe that our size and scale afford us greater operational and commercial flexibility when purchasing new helicopters and helicopter parts, allowing us to continue to grow our business in response to market opportunities.

Based on our experience operating in the industry, the market for MRO services is highly fragmented. We believe we are the only independent non-OEM provider of MRO services with a global footprint. Moreover, we believe our status as the largest commercial operator that purchases heavy and medium helicopters has positioned us to obtain licenses from all of the major manufacturers to conduct a full range of MRO services across a wide array of models of helicopters used in our industry. We believe that our geographic reach, combined with the related licenses, offers us a significant opportunity to grow our Heli-One business with our third-party customers. As demand for helicopter services grows in conjunction with growth in ultra-deepwater and deepwater drilling and production, we expect that a corresponding increase in flying hours should lead to greater demand for MRO services.

Our Operations

We conduct operations in approximately 30 countries through a network of approximately 70 bases on six continents, including a new global operations center located in Irving, Texas. We believe our global operations center is the first of its kind in our industry, allowing us to centrally coordinate flight schedules, pilot rostering,

3

Table of Contents

training, fleet management and maintenance from a single location. Representatives from helicopter manufacturers work on-site at our global operations center alongside our own employees to resolve maintenance issues and return helicopters to service. Our global operations center leverages new information technology systems to promulgate best-in-class practices and procedures throughout our company.

We assist our customers with logistics solutions to manage rotation of their crews, as many of our offshore oil and gas customers are required by law and collective labor agreements to change crews every seven to 14 days. For the 12 months ended July 31, 2013, we operated approximately 87,000 flights worldwide, carrying in excess of one million passengers. As offshore operators have moved further from shore and become more remote, crews have grown larger and taken on functions that previously relied on shore based support. To accommodate the change out of larger crews, a helicopter would have to make multiple trips or several helicopters would have to be used. Computerized logistics systems in our global operations center help us provide seamless coordination between our regional bases and our customers, matching customer needs with helicopters, engineer and pilot availability which enables efficient crew changes, while maintaining compliance with relevant regulations. In addition, we have advanced systems in place to monitor and maintain equipment. In the event a helicopter requires unforeseen repairs or replacement of parts, we have the ability to provide immediate support to ground personnel to make a repair as well as a dedicated team available to identify the most efficient manner to source any replacement parts. Since October 2012, this infrastructure, and these processes, have enabled us to save approximately 24 aircraft on ground, or AOG, days per month, for a savings of approximately $300,000 per month. We believe that our global operations center, combined with our expertise in crew logistics and equipment availability as well as our robust compliance programs, allow us to offer superior and differentiated service to our customers.

Our MRO operations are conducted through our Heli-One business, which provides quality and cost control for maintenance, repair, and overhaul of our own fleet as well as comprehensive outsourced MRO services to third-party customers. We maintain four principal Heli-One centers for our global MRO operations, including Delta, British Columbia (Canada), Fort Collins, Colorado (USA), Rzeszow (Poland) and Stavanger (Norway). We maintain a strategic inventory of spare parts, providing us the ability to respond quickly and efficiently to unplanned maintenance events. We believe our focus on speed and efficiency allows us to provide better service at lower cost. Approximately 28% and 34% of our third-party Heli-One revenue in the 2012 and 2013 fiscal years, respectively, was derived from “power by the hour” contracts, where the customer pays a ratable monthly charge, typically based on the number of hours flown, for all scheduled and un-scheduled maintenance.

Safety and Regulatory Compliance

We strive to exceed the stringent safety and performance audit standards set by aviation regulatory bodies and our customers. We have established an in-house flight safety group that is responsible for our compliance with safety standards within our organization, standardizing base operating procedures, compliance with government regulations and customer requirements, and educating and training our flight crews. Over the five year period ended September 1, 2013, according to our safety records we had a rolling average of 0.37 accidents per 100,000 flight hours, a much lower than average rate reported for civilian twin engine helicopters and an even smaller fraction of the rate reported for offshore helicopter operations generally, per industry reports. We also host a highly regarded annual international safety summit attended by our customers, manufacturers, competitors and regulators, which is a manifestation of our commitment to safe operations.

A key to maintaining our strong safety record is having a highly qualified and experienced workforce. Our pilots average in excess of 3,000 flight hours of experience, and many of them carry endorsements to operate more than one type of helicopter. Our mechanics are highly experienced and receive ongoing training from helicopter manufacturers.

4

Table of Contents

In addition to safety regulations, most of the countries in which we conduct flying operations have laws, with typically complex requirements, that require commercial operators to hold either or both an operating license and an air operator certificate, or AOC. We believe our track record of safety and experience working with regulators will enhance our ability to obtain needed licenses/certificates as we continue to grow.

Our Fleet

Helicopters are generally classified as light (3 to 7 passengers), medium (8 to 15 passengers) and heavy (16 to 26 passengers). We believe heavy and medium helicopters are favored by our customers and are best suited for crew change transportation services on oil and gas production facilities and drilling rigs due to their greater range, higher passenger capacity, enhanced passenger safety systems and ability to fly under a broader variety of conditions than light helicopters. In addition, heavy and medium helicopters have twin engines and typically two pilots, making them safer for longer flights. As a result, larger helicopters generally command higher pricing and earn higher margins compared to smaller helicopters.

We operate the largest fleet of heavy and medium commercial helicopters serving the offshore oil and gas industry, with 246 heavy and medium helicopters as of July 31, 2013. Our fleet is comprised purely of heavy and medium helicopters, which we believe optimally positions us to respond to opportunities in the high growth ultra-deepwater and deepwater market. Over the last eight years, we have modernized and expanded our fleet significantly, and we continue to invest to meet customer demand for newer heavy and medium helicopters. We have strong longstanding operating relationships with the four major OEMs, Eurocopter, Sikorsky, AgustaWestland and Bell, and have helicopters manufactured by each of them in our fleet. This diversity ensures that we are not overly reliant on any one model or manufacturer, while still giving our fleet critical mass across various helicopter types, resulting in fleet management, maintenance and training efficiencies.

The model life cycle for helicopters spans multiple decades. Individual components, which represent a large majority of a helicopter’s value, are frequently replaced to meet regulatory requirements or safety standards. In addition, there is an active secondary market for helicopters supported by independent appraisers and valuation experts.

As of July 31, 2013, our fleet had an appraised market value of approximately $2.95 billion, consisting of $2.03 billion of value attributable to heavy helicopters and $920 million of value attributable to medium helicopters. As of July 31, 2013, the average age of our fleet was 12 years and the weighted average age of our fleet was seven years based on appraised market value. Our calculation of the weighted average age of our fleet takes into account each helicopter’s appraised value, while the average age of our fleet is calculated as the arithmetic mean in which each helicopter contributes equally to the overall average age of our fleet. If the age of two helicopters were equal, the helicopter with higher appraised value would have a greater impact on the weighted average age. The Eurocopter EC225, Sikorsky S92A, AgustaWestland AW139 and Sikorsky S76C++, which have been the core part of our capital investment program in recent years, represent 75% of our total fleet value.

5

Table of Contents

The table below provides a detailed summary of our fleet as of July 31, 2013:

| Helicopter Type |

Total | Cruise Speed (kts) |

Approximate Range (nmi) |

Passenger Capacity |

Maximum Weight (lbs) |

|||||||||||||||

| Heavy: |

||||||||||||||||||||

| Sikorsky S92A |

37 | 145 | 400 | 19 | 26,500 | |||||||||||||||

| Eurocopter EC225 |

30 | 145 | 400 | 19 | 24,250 | |||||||||||||||

| Eurocopter AS332 L, L1, and L2 |

43 | 130-140 | 250-350 | 17-19 | 18,000-20,500 | |||||||||||||||

| Sikorsky S61N |

5 | N/A | 1 | N/A | 1 | N/A | 1 | N/A | 1 | |||||||||||

| Total Heavy |

115 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| Medium: |

||||||||||||||||||||

| Agusta AW139 |

39 | 145 | 280 | 12-15 | 15,000 | |||||||||||||||

| Sikorsky S76C++ |

23 | 145 | 220 | 12 | 11,700 | |||||||||||||||

| Sikorsky S76C+ |

22 | 145 | 175 | 12 | 11,700 | |||||||||||||||

| Sikorsky S76A/B/C |

22 | 135 | 110-130 | 12 | 10,800-11,700 | |||||||||||||||

| Bell 412 |

11 | 125 | 135 | 13 | 11,900 | |||||||||||||||

| Eurocopter AS365 Series |

9 | 120-145 | 80 | 11 | 9,500 | |||||||||||||||

| Eurocopter EC135/145/155 |

5 | N/A | 2 | N/A | 2 | N/A | 2 | N/A | 2 | |||||||||||

| Total Medium |

131 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Helicopters |

246 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| (1) | SAR only |

| (2) | EMS only |

As of July 31, 2013, we had committed to purchase 28 new helicopters with total required expenditures of approximately $701.0 million. We intend to enter into leases for these helicopters or purchase them outright upon delivery from the manufacturer. Additionally, as of July 31, 2013, we had the option to purchase 13 helicopters which, if exercised, would be a total of 41 helicopter commitments. Subsequent to July 31, 2013, we entered into a commitment to acquire nine additional heavy helicopters from Sikorsky, with an option to purchase an additional 15 helicopters from them, and a commitment to purchase $100.0 million of heavy helicopters from Eurocopter.

6

Table of Contents

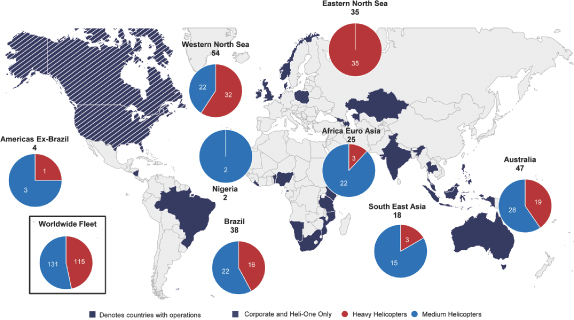

The following map illustrates the geographic distribution of our helicopters as of July 31, 2013 and countries in which we operated over the prior 12 months:

Note: Fleet count as of July 31, 2013. Worldwide fleet includes 23 helicopters held for fleet retirement.

Customers and Contracts

Our current oil and gas customer base is comprised of major, national and independent oil and gas companies. These customers generally enter into multi-year contracts for our services. The majority of our customer contracts provide for revenues based on fixed-monthly charges and hourly flight rates. In addition, our contracts generally require the customer to either provide or to be charged for fuel, which significantly limits our operational exposure to volatility in fuel costs.

Our contracts with offshore oil and gas customers are typically for periods of four to five years, and normally carry extension options of one to five years. Our contracts with government agencies for SAR and EMS services are typically for periods of eight to ten years, and we believe government agencies will increasingly look to outsource this function. Based on our experience, we believe that contracts are awarded based on a number of factors, including technical capability, operational effectiveness, price, strength of relationships, availability of fleet types and other technical mission requirements, quality of customer service and the safety record of the helicopter service provider. We believe that maintaining a strong safety record is imperative for our customers, and that our safety record and safety culture at all levels of our organization are key to maintaining and growing our business.

Longer-term contracts are ordinarily awarded through competitive bidding processes. An incumbent operator commonly has a competitive advantage when pursuing future business with that customer because of its relationship with the customer, knowledge of operating site characteristics, pre-existing investment in support infrastructure and demonstrated ability to meet defined service-level requirements. Also, customers often prefer to avoid start-up costs associated with switching to another operator. Over the past 12 months, we have retained approximately 94% of offshore oil and gas customer contracts that were up for renewal or extension.

7

Table of Contents

Our key customers include many leading oil and gas companies around the world. The following table sets out our top ten customers based on revenue for our fiscal year ended April 30, 2013 and geographic regions served. Our top two customers for the year ended April 30, 2013 were Statoil and Petrobras, accounting for 14% of our revenues each. No other single customer accounted for more than 10% of our revenues during this period.

| Geographic regions served by CHC | ||||||||||||

| Company |

Credit rating |

North Sea | Brazil | Australia | SE Asia | Africa Euro Asia | ||||||

|

|

A2 / A |

— | — | — | ||||||||

|

|

Aa1 / AA |

— | — | — | ||||||||

|

|

A1 / A |

— | — | — | ||||||||

|

|

A3 / A- |

— | — | |||||||||

|

|

N/A |

— | ||||||||||

|

|

A3 / BBB |

— | — | |||||||||

|

|

Aa1 / AA |

— | — | — | — | |||||||

|

|

Aa2 / AA- |

— | — | |||||||||

|

|

Aa1 / AA- |

— | — | — | ||||||||

|

|

Baa1/BBB+ |

— | ||||||||||

For our fiscal year ended April 30, 2013, the customers in the table above constituted approximately 60% of our total revenues.

The largest customer of our Heli-One segment is our Helicopter Services segment. Our Heli-One contracts with third parties include military, coast guard, parapublic and other governmental organizations, and other helicopter operators. Revenues can be earned for services provided individually or, in many cases, as part of multi-year, complete maintenance outsourcing agreements.

Competitive Strengths

We believe that we possess the following competitive strengths, which will enable us to continue to grow our business globally:

| • | The world’s largest new generation fleet of heavy and medium helicopters. We are the world’s largest commercial operator of helicopters based on revenue of $1.7 billion in fiscal 2013. We are also the world’s largest commercial operator of heavy and medium helicopters based on our fleet of 246 heavy and medium helicopters as of July 31, 2013. Our premium fleet has enabled us to establish a prominent position as a helicopter services provider to the fast-growing ultra-deepwater and deepwater markets. Our fleet includes some of the newest and most advanced civilian helicopters, including the Eurocopter EC225, Sikorsky S92A, AgustaWestland AW139 and Sikorsky S76C++, which together represent 75% of our total fleet value and which we believe helps us attract and retain highly experienced pilots and maintenance engineers. We have modernized and expanded our fleet significantly over the last eight years, and we continue to invest to meet customer demand. As of July 31, 2013, we have plans to acquire 28 new heavy and medium helicopters, with delivery dates between fiscal 2014 and 2017, and options to acquire an additional 13 heavy and medium helicopters. The size of our fleet and diversity across multiple helicopter types enables us to meet the varied operational requirements of our customers. |

8

Table of Contents

| • | Largest global footprint servicing the offshore oil and gas market. We are the most globally diverse participant in our industry, with operations in approximately 30 countries. Our broad geographic coverage and experience entering new markets enables us to respond quickly and efficiently to new business opportunities, by leveraging our knowledge of, and experience with, international safety standards, local market regulations and customs. Additionally, our multi-national footprint and scale allow us to secure contracts and global framework agreements where our largest customers are seeking helicopter operators that can provide one standard of service in many locations around the world. |

| • | Strong long-term relationships with leading oil and gas producers. We believe we have strong relationships with our top ten customers, which include Statoil, Petrobras, BP, Shell, Total, ENI and other oil and gas producers, many of which we have continuously served for over a decade. We establish relationships with our customers at both the regional and global level, which positions us to grow our business as our customers grow. We believe this enables us to better understand our customers’ growth objectives and positions us to participate in contract tenders. Our strong customer relationships and track record of performance have allowed us to achieve a 94% retention rate on contract renewals and extensions and a 64% win rate on all contract tenders over the 12 month period through August 2013. |

| • | Safety record and reputation. We have implemented a single safety management system worldwide and continue to meet or exceed the stringent safety and performance audits conducted by our customers. Over the past five years, according to industry reports and our safety records, we had a rolling average of 0.37 accidents per 100,000 flight hours for our twin engine helicopters, compared to a 2007 industry average of 0.8 accidents for twin engine helicopters and 1.8 accidents for offshore helicopter operations generally. Our pilots average in excess of 3,000 hours of flight experience, and many of them carry endorsements to operate more than one type of helicopter. Our mechanics are highly experienced and receive ongoing training from helicopter manufacturers. We also host a highly regarded annual international safety summit attended by our customers, manufacturers, competitors and regulators, which is a manifestation of our commitment to safe operations. |

| • | Our innovative transformation initiatives are driving standardization, efficiencies and cost savings. For the past three years, we have implemented a comprehensive review of our operations and organizational structure through our transformation initiatives, with the goal of consolidating, strengthening and standardizing our capabilities, tools, processes and systems globally, while lowering overhead costs. We recently designed and launched our global operations center and implemented new information technology, or IT, systems across our operations to drive highly integrated processes, including fleet management, flight scheduling, maintenance and supply chain, which we believe allow us to offer superior and differentiated services to our customers and our personnel in the field. |

| • | Only global commercial helicopter operator with in-house MRO operations through Heli-One. Our Heli-One division is the market leader in helicopter MRO services by a non-OEM. Our Heli-One segment enhances the quality control and cost competitiveness of our maintenance processes, and improves the flight availability of our fleet. We have the capability to service and support multiple models from all the major OEMs including Eurocopter, Sikorsky, AgustaWestland and Bell, which allows us to offer a comprehensive outsourced maintenance solution to other helicopter operators, and to diversify our revenue stream. |

| • | Experienced management team. Our chief executive officer and senior executives have extensive experience at CHC managing our helicopter services business and Heli-One business and with managing major, international public corporations focused on technology, IT services and operational excellence. We believe our management’s breadth of experience, equity ownership and incentive plans align their objectives with those of our shareholders. |

9

Table of Contents

Our Business Strategy

Our goal is to enhance our leadership position and create value for our shareholders by consistently and efficiently providing safe, reliable value-added services to our customers while maximizing our return on assets, earnings and cash flow. To achieve this goal, we intend to focus on the following key strategies:

| • | Achieve the highest levels of safety and performance. Our overall strategy is deeply rooted in a foundation of safety. We will continue to build on our highly safety-conscious culture where the safety of our passengers and employees is embedded in everything we do. We will invest in technology, processes, training and talent to continuously improve our capabilities to enable us to achieve the highest level of safety performance and standards. |

| • | Continue to apply a disciplined, returns-based approach to evaluating growth opportunities. We have implemented a rigorous, financial returns-based approach throughout our organization that is fundamental to how we evaluate growth opportunities. Our centralized decision-making framework is critical to ensuring that our clearly defined return thresholds are applied in all key investment-making decisions, such as setting contract terms, pursuing expansion into new regions and acquiring new helicopters. This disciplined and coordinated methodology of pursuing the highest risk-adjusted growth opportunities will continue to drive our expansion strategy and enable us to make rational capital investment decisions and maximize our returns as we continue to grow. |

| • | Continue to invest in our fleet of heavy and medium helicopters to meet customer demand and maximize our long-term financial returns. We will continue to upgrade our fleet and optimize our fleet size and mix to reflect the latest technologies and larger helicopters demanded by our customers, while selectively divesting older helicopters. We will continue to manage our fleet to provide optimum service to the growing ultra-deepwater and deepwater markets, where larger helicopters are preferred by our customers for their reliability, comfort and efficiency. The demand for helicopter services combined with continued constraints on new helicopter supply will allow us to focus our investments in our fleet on opportunities with the highest strategic and financial value. We believe our global fleet management strategy allows us to deploy our assets to our most attractive opportunities worldwide. |

| • | Expand our operations in high growth markets. We have existing operations in what we believe are some of the highest growth markets for helicopter services, such as Brazil and Australia. We intend to continue to grow in these regions as we believe the demand for our services continues to grow. We will also continuously evaluate entry into new markets with high projected growth rates which are often characterized by isolated locations and greater operating distances from shore. We have a track record of successfully entering new markets, which requires experienced pilots and expertise in assessing risks, obtaining permits, partnering with local businesses, working with regulators and establishing new flight bases. We believe our customers recognize the importance of our track record as well as our standardized and globally-integrated operational support, maintenance and IT systems, and our ability to realize operational efficiencies across numerous and often remote jurisdictions. We believe that owning the world’s largest fleet of heavy and medium helicopters positions us to continue to grow our business in high growth ultra-deepwater and deepwater markets. |

| • | Leverage the differentiated attributes of our Heli-One segment to expand the depth and global reach of our Heli-One platform. According to industry sources, we are the largest non-OEM MRO vendor servicing the industry today and we believe that our Heli-One segment provides us with a competitive and differentiating advantage. The breadth of services we provide and our operational scale has enabled us to establish unique supply chain management expertise that we will leverage to provide superior service levels to our customers. We will capitalize upon our access to key OEM licenses to bolster our strategic inventories and to improve the level of integration with our own internal operations, as well as to expand our third-party revenues. We will seek to grow our third-party Heli-One business, as we believe it offers an opportunity to generate attractive returns on limited incremental capital investment. |

10

Table of Contents

| Given the fragmented nature of the global MRO market, we will also pursue targeted strategic acquisitions to enhance our position in key regions or markets and to capture new, unique service offerings for our customers. |

| • | Utilize knowledge and enterprise management systems to hone our customer service. We seek to build a customer-centric culture responsive to our customers’ unique requirements. As part of our operational transformation efforts and investment in IT systems, we have expanded our capabilities to measure and report key performance metrics that are most critical to our customers. Our commercial and customer support teams maintain a regular dialogue across multiple disciplines within our customers’ organizations to share these performance metrics as well as to discuss our customers’ future plans. This enables us to better understand our customers’ needs and how well we are addressing them. We believe that developing and maintaining such a deep understanding of our customers’ requirements enables us to provide superior customer-centric services and ideally positions us to grow with our customers as they expand their operations. |

| • | Continue to implement innovative transformation initiatives to pursue industry leading operating efficiency and superior returns. We believe innovation is core to our culture. We believe we are the first in the industry to establish a global, in-house MRO capability through Heli-One and a global operations center, and to implement innovative IT platforms to standardize global processes. We have established leadership in innovative transformation as a firmwide mindset with the goal of continuously improving operating efficiency, identifying cost savings and enhancing returns. |

Recent Developments

Following an incident in October 2012 that led to the temporary industry-wide suspension of all over water passenger flights with Eurocopter EC225 helicopters, we commenced in July 2013 the phased re-introduction of our EC225 helicopters to full service. We expect to return to service virtually all of our EC225 helicopters before the end of our second fiscal quarter ending October 31, 2013.

On August 23, 2013, one of our Eurocopter AS332L2 heavy helicopters was involved in an accident near Sumburgh in the Shetland Isles, United Kingdom. Authorities subsequently confirmed four fatalities and multiple injuries among the 16 passengers and two crew members on board. The cause of the accident is not yet known and full investigations are being carried out in conjunction with the U.K. Air Accident Investigation Branch, or UK AAIB, and Police Scotland.

Despite engineering and operating differences between the AS332L2, AS332L, AS332L1 and EC225 helicopters, for a limited period, we voluntarily canceled all our flights worldwide on those helicopter types (except for those involved in life-saving missions), out of respect for our work force and those of our customers, and to evaluate any implications associated with the accident.

Within a week of the incident, after consultation with our principal regulators, customers, union representatives and industry groups, and based on findings that there was no evidence to support a continuation of our temporary voluntary suspension and, on recommendations to return to active service all variants of these helicopter types, we resumed commercial passenger flights to and from offshore oil and gas installations, including in the UK. We have now resumed normal operations with all of these helicopter types worldwide.

On October 18, 2013, the UK AAIB issued its latest special bulletin about its investigation on the causes of the accident. (See http://www.aaib.gov.uk/publications/special_bulletins/s72013as332l2superpumagwnsb.cfm). Neither the foregoing website nor the information contained on the website nor the report accessible through such website shall be deemed incorporated into, and neither shall be a part of, this prospectus or the registration statement of which it forms a part. In the special bulletin, the UK AAIB confirmed that, to date, the wreckage examination and analysis of recorded data as well as information from interviews of people involved in the accident have not found any evidence of a technical fault that could have been causal to the accident. The investigations by the UK AAIB and Police Scotland are not complete and are ongoing.

11

Table of Contents

It is too early to determine the extent of the impact of the accident on our results of operations or financial condition based on information currently available.

Summary Risk Factors

An investment in our ordinary shares involves a number of risks, including changes in economic and oil and gas industry conditions, competition and other material factors, that could materially affect our business, financial condition and results of operations, and cause the trading price of our ordinary shares to decline. Some of the significant challenges and risks include the following:

| • | we have a history of net losses; |

| • | our level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in our business and place us at a competitive disadvantage; |

| • | many of the markets in which we operate are highly competitive, which may result in a loss of market share or a decrease in revenue or profit margins; |

| • | we rely on a limited number of large offshore helicopter support contracts with a limited number of customers, and if any of these are terminated early or not renewed, our revenues could decline; |

| • | operating helicopters involves a degree of inherent risk and we are exposed to the risk of losses from safety incidents; |

| • | failure to mitigate potential losses through a robust safety management and insurance coverage program, our financial condition would be jeopardized in the event of a safety or other hazardous incident; |

| • | failure to maintain standards of acceptable safety performance could have an adverse impact on our ability to attract and retain customers and could adversely impact our reputation, operations and financial performance; |

| • | our operations are subject to extensive regulations which could increase our costs and adversely affect us; |

| • | we derive significant revenue from non-wholly owned entities, which, if we develop problems with the other owners of such non-wholly owned entities, could adversely affect our financial condition and results of operations; |

| • | our operations may suffer due to political and economic uncertainty; and |

| • | we are controlled by our financial sponsor, which might have interests that conflict with ours and the interests of our other shareholders. |

Our Financial Sponsor

Prior to this offering, funds affiliated with First Reserve, our financial sponsor, owned and controlled, directly or indirectly, approximately 98.7% of our outstanding equity interests. Immediately following the completion of this offering, funds affiliated with First Reserve will own an approximate % indirect economic and voting interest in us through 6922767 Holding (Cayman) Inc. (“CHC Cayman”), which will own approximately % of our outstanding ordinary shares (or % if the underwriters’ option to purchase additional shares is exercised in full). These percentage ownership levels could change in the future.

Founded in 1983, First Reserve is an investment firm with over $23 billion of capital raised since inception. First Reserve makes both private equity and infrastructure investments throughout the energy value chain. For 30 years, it has invested solely in the global energy industry, utilizing its broad base of specialized energy industry knowledge as a competitive advantage. First Reserve invests strategically across a wide range of industry sectors, developing a portfolio that is diversified across the energy value chain, backing talented management teams and creating value by building companies.

12

Table of Contents

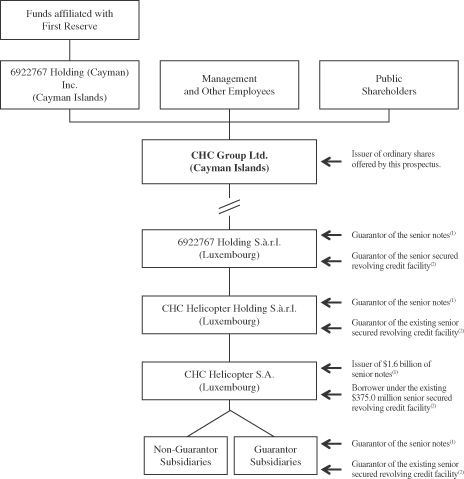

Our Organizational Structure

The following chart shows a summary of our capital structure as of July 31, 2013, as adjusted, for this offering and the use of proceeds therefrom.

| (1) | On October 4, 2010, our subsidiary CHC Helicopter S.A. issued $1.1 billion aggregate principal amount of 9.250% Senior Secured Notes due 2020, or the senior secured notes, at an issue price of 98.399%. On October 5, 2012, CHC Helicopter S.A. issued an additional $200.0 million aggregate principal amount of senior secured notes at an issue price of 101%. On May 13, 2013, CHC Helicopter S.A. issued $300.0 million aggregate principal amount of 9.375% Senior Notes due 2021, or the senior unsecured notes, and, together with the senior secured notes, the senior notes, at par. |

| (2) | As of July 31, 2013, there were no borrowings outstanding under our existing senior secured revolving credit facility and $53.6 million letters of credit were issued and outstanding thereunder. Our existing senior secured revolving credit facility currently matures in 2015. See “Use of Proceeds.” We intend to enter into a new senior secured revolving credit facility concurrently with the consummation of this offering. See “Description of Indebtedness.” |

13

Table of Contents

Corporate Information

CHC Group Ltd., formerly known as FR Horizon Holding (Cayman) Inc., was incorporated in the Cayman Islands on July 3, 2008 and changed its name by way of special shareholder resolution dated September 12, 2013 to CHC Group Ltd. CHC Group Ltd.’s registered office is located at c/o Intertrust Corporate Services (Cayman) Ltd., 190 Elgin Avenue, George Town, Grand Cayman, KY1-9005, Cayman Islands.

We have entered into agreements with Heli-One Canada Inc. and Heli-One American Support, LLC to provide certain management services, subject to authority limits as determined by our board of directors and set out in such agreements. The corporate headquarters of Heli-One Canada Inc.’s offices is located at 4740 Agar Drive, Richmond, British Columbia, V7B 1A3 Canada and our telephone number at that location is (604) 276-7500.

Our website is located at www.chc.ca. Information contained on, or that can be accessed through, our website shall not be deemed incorporated into and is not a part of this prospectus or the registration statement of which it forms a part.

14

Table of Contents

The Offering

| Ordinary shares offered by us |

ordinary shares (or ordinary shares if the underwriters exercise their option to purchase additional ordinary shares in full). |

| Ordinary shares to be outstanding immediately after this offering |

ordinary shares (or ordinary shares if the underwriters exercise their option to purchase additional ordinary shares in full). |

| Use of proceeds |

We estimate that our net proceeds from the sale of the ordinary shares that we are offering will be approximately $ million, assuming an initial public offering price of $ per share, which represents the midpoint of the price range set forth on the cover page of this prospectus, and after deducting underwriting discounts and estimated offering expenses payable by us. We intend to use approximately $134 million of the net proceeds from this offering to redeem 10% of the aggregate principal amount of our senior secured notes at 103% of the principal amount, plus accrued and unpaid interest, if any, and to repay borrowings under our existing senior secured revolving credit facility, with any remaining proceeds to be used for general corporate purposes. See “Use of Proceeds.” |

| Dividend policy |

We do not intend to pay cash dividends on our ordinary shares for the foreseeable future. See “Dividend Policy.” |

| Proposed NYSE symbol |

“HELI”. |

In this prospectus, unless otherwise indicated, the number of ordinary shares outstanding and the other information based thereon is based on the number of ordinary shares outstanding at , 2013 and does not reflect:

| • | ordinary shares issuable upon the exercise of the underwriters’ option to purchase additional ordinary shares from us; or |

| • | ordinary shares issuable pursuant to our 2013 Omnibus Incentive Plan, or the 2013 Incentive Plan. |

15

Table of Contents

Summary Historical Consolidated Financial Data

The following table shows our summary historical consolidated financial data, for the periods and as of the dates indicated. The summary statement of operations and cash flow data for the years ended April 30, 2011, 2012 and 2013 and the balance sheet data as of April 30, 2012 and 2013 are derived from our audited consolidated financial statements and related notes for the respective periods included elsewhere in this prospectus. The balance sheet data as of April 30, 2011 are derived from our unaudited consolidated financial statements, not included in this prospectus.

The summary statement of operations and cash flow data for the three months ended July 31, 2012 and 2013 and balance sheet data as of July 31, 2013 are derived from our unaudited interim consolidated financial statements and related notes for the respective periods included elsewhere in this prospectus. The balance sheet data as of July 31, 2012 are derived from our unaudited interim consolidated financial statements for the period not included in this prospectus. In the opinion of management, our unaudited interim consolidated financial data reflects all adjustments (consisting of normal and recurring adjustments) considered necessary to fairly present our financial position for the periods presented. The results of operations for the three month periods are not necessarily indicative of the results that may be expected for the full year.

The summary financial data presented below is qualified in its entirety by reference to, and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| As at and for the year ended April 30, | As at and for the three months ended July 31, |

|||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| Operating data: | (in thousands of U.S. dollars) |

|||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Operating revenue |

$ | 1,321,036 | $ | 1,525,795 | $ | 1,578,309 | $ | 374,027 | $ | 373,059 | ||||||||||

| Reimbursable revenue |

124,424 | 166,744 | 165,538 | 42,042 | 41,872 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

1,445,460 | 1,692,539 | 1,743,847 | 416,069 | 414,931 | |||||||||||||||

| Direct costs(i) |

(1,047,532 | ) | (1,205,740 | ) | (1,190,101 | ) | (297,657 | ) | (287,827 | ) | ||||||||||

| Earnings from equity accounted investees |

2,159 | 2,844 | 4,718 | 1,012 | 2,391 | |||||||||||||||

| General and administration costs |

(64,867 | ) | (70,108 | ) | (74,113 | ) | (18,556 | ) | (18,116 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDAR(ii) |

335,220 | 419,535 | 484,351 | 100,868 | 111,379 | |||||||||||||||

| Helicopter lease and associated costs(i) |

(164,828 | ) | (176,685 | ) | (201,736 | ) | (48,430 | ) | (55,279 | ) | ||||||||||

| Depreciation |

(99,625 | ) | (112,967 | ) | (131,926 | ) | (28,310 | ) | (32,057 | ) | ||||||||||

| Restructuring costs |

(4,751 | ) | (22,511 | ) | (10,976 | ) | (1,930 | ) | — | |||||||||||

| Asset impairments(iii) |

(29,403 | ) | (17,651 | ) | (29,981 | ) | (6,559 | ) | (7,324 | ) | ||||||||||

| Gain (loss) on disposal of assets |

7,193 | 8,169 | (15,483 | ) | (1,591 | ) | (1,122 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

43,806 | 97,890 | 94,249 | 14,048 | 15,597 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Financing charges(iv) |

(140,565 | ) | (129,778 | ) | (157,311 | ) | (45,372 | ) | (45,972 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from continuing operations before income tax |

(96,759 | ) | (31,888 | ) | (63,062 | ) | (31,324 | ) | (30,375 | ) | ||||||||||

| Income tax recovery (expense) |

32,833 | (48,225 | ) | (54,452 | ) | (1,281 | ) | (5,308 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from continuing operations |

(63,926 | ) | (80,113 | ) | (117,514 | ) | (32,605 | ) | (35,683 | ) | ||||||||||

| Earnings (loss) from discontinued operations, net of tax |

(3,202 | ) | (16,107 | ) | 1,025 | 345 | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (67,128 | ) | $ | (96,220 | ) | $ | (116,489 | ) | $ | (32,260 | ) | $ | (35,683 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

16

Table of Contents

| As at and for the years ended April 30, | As at and for the three months ended July 31, |

|||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| (in thousands of U.S. dollars) |

||||||||||||||||||||

| Net earnings (loss) attributable to: |

||||||||||||||||||||

| Net earnings (loss) attributable to controlling interest |

$ | (72,197 | ) | $ | (108,642 | ) | $ | (119,436 | ) | $ | (33,128 | ) | $ | (38,331 | ) | |||||

| Net earnings attributable to non-controlling interest |

5,069 | 12,422 | 2,947 | 868 | 2,648 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (67,128 | ) | $ | (96,220 | ) | $ | (116,489 | ) | $ | (32,260 | ) | $ | (35,683 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per ordinary share attributable to controlling interest—basic and diluted: |

||||||||||||||||||||

| Continuing operations |

(0.04 | ) | (0.05 | ) | (0.06 | ) | (0.02 | ) | (0.02 | ) | ||||||||||

| Discontinued operations |

— | (0.01 | ) | — | — | — | ||||||||||||||

| Net loss per ordinary share |

(0.04 | ) | (0.06 | ) | (0.06 | ) | (0.02 | ) | (0.02 | ) | ||||||||||

| Weighted average number of ordinary stock outstanding—basic and diluted |

1,760,779,361 | 1,807,957,443 | 1,860,779,361 | 1,860,779,361 | 1,860,779,361 | |||||||||||||||

| Pro forma net earnings (loss) per ordinary share attributable to controlling interest—basic and diluted: |

||||||||||||||||||||

| Continuing operations |

||||||||||||||||||||

| Discontinued operations |

||||||||||||||||||||

| Net loss per ordinary share (v) |

||||||||||||||||||||

| Pro forma weighted average number of ordinary stock outstanding – basic and diluted (v) |

||||||||||||||||||||

| Balance sheet data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 69,020 | $ | 55,639 | $ | 123,801 | $ | 57,157 | $ | 114,655 | ||||||||||

| Total assets |

2,790,236 | 2,717,143 | 2,893,768 | 2,702,071 | 2,931,049 | |||||||||||||||

| Total long-term debt and capital lease obligations(vi) |

1,291,486 | 1,287,080 | 1,477,225 | 1,357,185 | 1,656,580 | |||||||||||||||

| Total liabilities |

2,041,535 | 2,054,558 | 2,388,349 | 2,103,008 | 2,488,890 | |||||||||||||||

| Capital stock |

1,580,307 | 1,680,307 | 1,680,307 | 1,680,307 | 1,680,307 | |||||||||||||||

| Shareholders’ equity |

745,614 | 660,910 | 513,681 | 594,764 | 448,365 | |||||||||||||||

| Other financial information: |

||||||||||||||||||||

| Adjusted EBITDAR margin(ii) |

25 | % | 27 | % | 31 | % | 27 | % | 30 | % | ||||||||||

| Adjusted net loss(vii) |

$ | (53,459 | ) | $ | (83,177 | ) | $ | (59,237 | ) | $ | (11,611 | ) | $ | (28,914 | ) | |||||

| HE Rate(viii) |

$ | 6,842 | $ | 8,034 | $ | 8,730 | $ | 2,157 | $ | 2,052 | ||||||||||

| (i) | Direct costs above excludes helicopter lease and associated costs. These costs are combined in the consolidated statement of operations, which are included in the unaudited interim consolidated financial statements and the audited annual consolidated financial statements included elsewhere in this prospectus. |

| (ii) | Adjusted EBITDAR is a non-GAAP measure that is defined as earnings (loss) before interest, taxes, depreciation, amortization and helicopter lease and associated costs or total revenue plus earnings from equity accounted investees, less direct costs excluding helicopter lease and associated costs less general and administration costs. Adjusted EBITDAR also excludes restructuring costs, asset impairments, gain (loss) |

17

Table of Contents

| on disposal of assets and goodwill impairment, if any. These items are significant components to understanding and assessing financial performance and liquidity. Adjusted EBITDAR margin is calculated as Adjusted EBITDAR divided by total revenue less reimbursable revenue. Cost reimbursements from customers are recorded as reimbursable revenue with the related reimbursement expense in direct costs. See our “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operating Metrics” for a further discussion of this non-GAAP measure. Additional information about our Adjusted EBITDAR, including a reconciliation of this measure to our consolidated financial statements, is also provided in Note 19 of our unaudited interim consolidated financial statements for the three months ended July 31, 2012 and 2013 and Note 27 of our audited annual consolidated financial statements for the years ended April 30, 2011, 2012 and 2013, each of which are included elsewhere in this prospectus. See below for our calculation of Adjusted EBITDAR Margin. |

| For the years ended April 30, |

For the three months ended July 31, |

|||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| Adjusted EBITDAR |

$ | 335,220 | $ | 419,535 | $ | 484,351 | $ | 100,868 | $ | 111,379 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues less reimbursable revenue |

$ | 1,321,036 | $ | 1,525,795 | $ | 1,578,309 | $ | 374,027 | $ | 373,059 | ||||||||||

| Adjusted EBITDAR Margin |

25 | % | 27 | % | 31 | % | 27 | % | 30 | % | ||||||||||

| (iii) | Asset impairments includes impairment of assets held for sale, impairment of assets held for use, impairment of receivables and residual value guarantees and impairment of intangible assets if any. |

| (iv) | Financing charges includes interest on long-term debt, foreign exchange gain (loss) and other financing charges (income). Other financing charges includes amortization of deferred financing costs, net gain (loss) on the fair value of derivative financial instruments, interest income and expense and the other items set forth in Note 10 to our unaudited interim consolidated financial statements for the three months ended July 31, 2012 and 2013 and Note 16 to our audited annual consolidated financial statements for the years ended April 30, 2011, 2012 and 2013, each of which are included elsewhere in this prospectus. |

| (v) | Both pro forma net earnings (loss) per ordinary share attributable to controlling interest and pro forma weighted average number of ordinary stock outstanding give effect to (i) the application of $ million of the estimated net proceeds from the issue of ordinary shares by us in this offering to redeem 10% of the aggregate principal amount of our senior secured notes at 103% of the principal amount, plus accrued and unpaid interest, if any, totalling $ , and to repay borrowings of $ under our existing senior secured revolving credit facility as if the offering and those transactions had occurred on May 1, 2012 and May 1, 2013 for the fiscal and interim periods, respectively; and (ii) the issuance of ordinary shares in this offering (excluding the additional ordinary shares that may be issued by us in this offering pursuant to the underwriters’ option to purchase additional ordinary shares). This assumes net proceeds of this offering of $ million, assuming the shares are offered at $ per share, the midpoint of the price range set forth on the cover of this prospectus, after deducting the underwriting discount and estimated offering expenses. |

| (vi) | Total long-term debt and capital lease obligations is presented net of the discount and includes the premium on our senior notes and excludes a facility secured by accounts receivables. As of July 31, 2013, the facility secured by accounts receivables had a balance of $45.5 million. See Note 2(a)(ii) to our unaudited interim consolidated financial statements for the three months ended July 31, 2012 and 2013 and Note 4(a)(ii) to our audited annual consolidated financial statements, each of which are included elsewhere in this prospectus. |

18

Table of Contents

| (vii) | Adjusted net loss is a non-GAAP measure that has not been prepared in accordance with generally accepted accounting principles, or GAAP, and has not been audited or reviewed by our independent auditors. This financial measure is therefore considered a non-GAAP financial measure. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Summary Results of Operations” for a discussion of this non-GAAP financial measure. A description of the adjustments to and reconciliations of this non-GAAP financial measure to the most comparable GAAP financial measure is as follows: |

| For the years ended April 30, |

For the three months ended July 31, |

|||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| Adjusted net loss |

$ | (53,459 | ) | $ | (83,177 | ) | $ | (59,237 | ) | $ | (11,611 | ) | $ | (28,914 | ) | |||||

| Asset impairments |

(29,403 | ) | (17,651 | ) | (29,981 | ) | (6,559 | ) | (7,324 | ) | ||||||||||

| Gain (loss) on disposal of assets |

7,193 | 8,169 | (15,483 | ) | (1,591 | ) | (1,122 | ) | ||||||||||||

| Foreign exchange gain (loss) |

17,891 | 1,819 | (11,383 | ) | (7,345 | ) | (13,087 | ) | ||||||||||||

| Unrealized gain (loss) on derivatives |

(9,350 | ) | (5,380 | ) | (405 | ) | (5,154 | ) | 14,764 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (67,128 | ) | $ | (96,220 | ) | $ | (116,489 | ) | $ | (32,260 | ) | $ | (35,683 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (viii) | HE Rate is the third-party operating revenue from the Helicopter Services segment excluding reimbursable revenue divided by a weighted average factor corresponding to the number of heavy and medium helicopters in our fleet. Our heavy and medium helicopters, including owned and leased, are weighted as 100% and 50%, respectively, to arrive at a single HE count, excluding helicopters expected to be retired from our fleet. See below for our calculation of this non-GAAP measure and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a further discussion of this non-GAAP measure. |

| For the years ended April 30, | For the three months ended July 31, |

|||||||||||||||||||

| 2011 | 2012 | 2013 | 2012 | 2013 | ||||||||||||||||

| Helicopter Services Operating Revenue |

$ | 1,316,238 | $ | 1,526,060 | $ | 1,603,403 | $ | 391,523 | $ | 387,302 | ||||||||||

| Less: Reimbursable revenues |

(124,424 | ) | (166,744 | ) | (165,538 | ) | (42,042 | ) | (41,872 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Helicopter Services Revenue (excluding reimbursable revenues) |

$ | 1,191,814 | $ | 1,359,316 | $ | 1,437,865 | $ | 349,481 | $ | 345,430 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Helicopter Services Revenue (excluding reimbursable revenues) |

$ | 1,191,814 | $ | 1,359,316 | $ | 1,437,865 | $ | 349,481 | $ | 345,430 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Heavy Equivalent (HE) |

174.2 | 169.2 | 164.7 | 162.0 | 168.3 | |||||||||||||||

| HE Rate |

$ | 6,842 | $ | 8,034 | $ | 8,730 | $ | 2,157 | $ | 2,052 | ||||||||||

19

Table of Contents

Investing in our ordinary shares involves a number of risks. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the consolidated financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest in our ordinary shares. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of many factors, including the considerations described below and elsewhere in this prospectus. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Net Losses and Our Indebtedness

We have a history of net losses.

We have incurred net losses in the past five years, including approximately $67.1 million, $96.2 million, $116.5 million and $35.7 million in the last three fiscal years ended April 30, 2011, 2012 and 2013, and the three months ended July 31, 2013, respectively, and on a cumulative basis since our inception. Our net losses during this five-year period have resulted from a number of factors, including non-cash impairments of goodwill and other assets totaling $903.3 million and interest charges related to substantial leverage incurred to acquire additional helicopters and grow our business. We may continue to incur net losses in the future and we cannot assure you that we will achieve or sustain profitability, or that we will continue to generate sufficient cash flow and liquidity through access to the capital markets to meet our debt and interest obligations as and when they become due.