Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FRANKLIN RESOURCES INC | form8kq4fy13.htm |

| EX-99.1 - PRESS RELEASE - FRANKLIN RESOURCES INC | exhibit991q42013.htm |

FRANKLIN RESOURCES, INC. Franklin Resources, Inc. Preliminary Fourth Quarter and Fiscal Year Results October 24, 2013 Exhibit 99.2

FRANKLIN RESOURCES, INC. Forward-Looking Statements The financial results in this presentation are preliminary. Statements in this presentation regarding Franklin Resources, Inc. (“Franklin”) and its subsidiaries, which are not historical facts, are "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. When used in this presentation, words or phrases generally written in the future tense and/or preceded by words such as “will,” “may,” “could,” “expect,” “believe,” “anticipate,” “intend,” “plan,” “seek,” “estimate,” “preliminary” or other similar words are forward-looking statements. Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. We caution you therefore against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. These and other risks, uncertainties and other important factors are described in more detail in Franklin’s recent filings with the U.S. Securities and Exchange Commission, including, without limitation, in Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations in Franklin’s Annual Report on Form 10-K for the fiscal year ended September 30, 2012 and Franklin’s subsequent Quarterly Reports on Form 10-Q: (1) volatility and disruption of the capital and credit markets, and adverse changes in the global economy, may significantly affect our results of operations and may put pressure on our financial results; (2) the amount and mix of our assets under management (“AUM”) are subject to significant fluctuations; (3) we are subject to extensive and complex, overlapping and frequently changing rules, regulations and legal interpretations; (4) regulatory and legislative actions and reforms have made the regulatory environment in which we operate more costly and future actions and reforms could adversely impact our AUM, increase costs and negatively impact our profitability and future financial results; (5) failure to comply with the laws, rules or regulations in any of the non-U.S. jurisdictions in which we operate could result in substantial harm to our reputation and results of operations; (6) changes in tax laws or exposure to additional income tax liabilities could have a material impact on our financial condition, results of operations and liquidity; (7) any significant limitation, failure or security breach of our information and cyber security infrastructure, software applications, technology or other systems that are critical to our operations could constrain our operations; (8) our business operations are complex and a failure to properly perform operational tasks or the misrepresentation of our products and services, or the termination of investment management agreements representing a significant portion of our AUM, could have an adverse effect on our revenues and income; (9) we face risks, and corresponding potential costs and expenses, associated with conducting operations and growing our business in numerous countries; (10) we depend on key personnel and our financial performance could be negatively affected by the loss of their services; (11) strong competition from numerous and sometimes larger companies with competing offerings and products could limit or reduce sales of our products, potentially resulting in a decline in our market share, revenues and income; (12) changes in the third-party distribution and sales channels on which we depend could reduce our income and hinder our growth; (13) our increasing focus on international markets as a source of investments and sales of investment products subjects us to increased exchange rate and other risks in connection with our revenues and income generated overseas; (14) harm to our reputation or poor investment performance of our products could reduce the level of our AUM or affect our sales, potentially negatively impacting our revenues and income; (15) our future results are dependent upon maintaining an appropriate level of expenses, which is subject to fluctuation; (16) our ability to successfully integrate widely varied business lines can be impeded by systems and other technological limitations; (17) our inability to successfully recover should we experience a disaster or other business continuity problem could cause material financial loss, loss of human capital, regulatory actions, reputational harm, or legal liability; (18) certain of the portfolios we manage, including our emerging market portfolios, are vulnerable to significant market-specific political, economic or other risks, any of which may negatively impact our revenues and income; (19) regulatory and governmental examinations and/or investigations, litigation and the legal risks associated with our business, could adversely impact our AUM, increase costs and negatively impact our profitability and/or our future financial results; (20) our ability to meet cash needs depends upon certain factors, including the market value of our assets, operating cash flows and our perceived creditworthiness; (21) our business could be negatively affected if we or our banking subsidiaries fail to satisfy regulatory and supervisory standards; and (22) we are dependent on the earnings of our subsidiaries. Any forward-looking statement made by us in this presentation speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. The information in this presentation is provided solely in connection with this presentation, and is not directed toward existing or potential investment advisory clients or fund shareholders. 2

FRANKLIN RESOURCES, INC. Audio Commentary and Conference Call Details Pre-recorded audio commentary on the results from Franklin Resources, Inc.’s Chairman, CEO and President Greg Johnson, CFO and Executive Vice President Ken Lewis and Executive Vice President of Global Advisory Services Vijay Advani will be available today at approximately 8:30 a.m. Eastern Time. They will also lead a live teleconference today at 10:30 a.m. Eastern Time to answer questions of a material nature. Analysts and investors are encouraged to review the Company’s recent filings with the U.S. Securities and Exchange Commission and to contact Investor Relations before the live teleconference for any clarifications or questions related to the earnings release, this presentation or the pre-recorded audio commentary. Access to the pre-recorded audio commentary and accompanying slides are available at franklinresources.com. The pre-recorded audio commentary can also be accessed by dialing (888) 843-7419 in the U.S. and Canada or (630) 652-3042 internationally using access code 35835349, any time through November 23, 2013. Access to the live teleconference will be available at franklinresources.com or by dialing (800) 446-2782 in the U.S. and Canada or (847) 413-3235 internationally. A replay of the call can also be accessed by calling (888) 843-7419 in the U.S. and Canada or (630) 652-3042 internationally using access code 35835373, after 1:00 p.m. Eastern Time on October 24, 2013 through November 23, 2013. Questions regarding the pre-recorded audio commentary or live teleconference should be directed to Franklin Resources, Inc., Investor Relations at (650) 312- 4091 or Media Relations at (650) 312-2245. 3

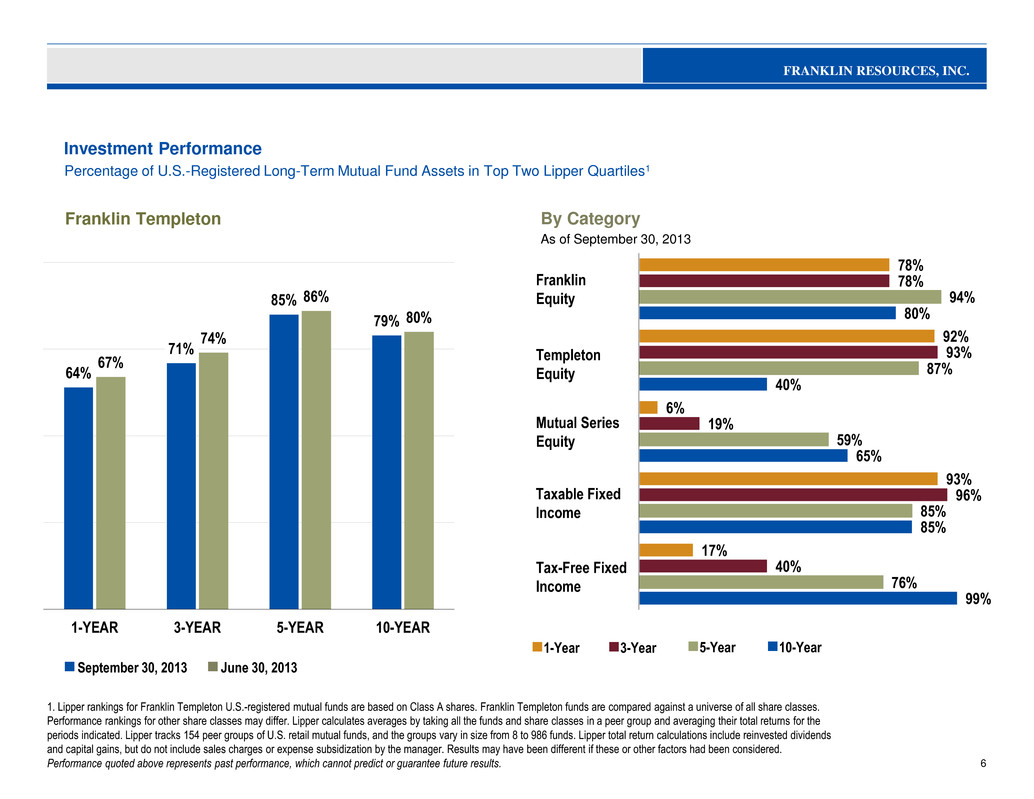

FRANKLIN RESOURCES, INC. Highlights • The fourth quarter capped off another record year of operating results with revenues, operating income and net income reaching all-time highs. • Equity and hybrid net new flows improved to $5.6 billion, due to steadily increasing sales, which grew 33% from the prior year, and net exchanges from fixed income funds. This was offset by weaker global and tax- free fixed income flows. • Templeton global equity performance continues to improve, with approximately 90% of assets ranked in the top two quartiles versus its peer group for the 1-, 3-, and 5-year periods, and returned to positive flows. 4

FRANKLIN RESOURCES, INC. Investment Performance

FRANKLIN RESOURCES, INC. 64% 71% 85% 79% 67% 74% 86% 80% 1-YEAR 3-YEAR 5-YEAR 10-YEAR Investment Performance Franklin Templeton 6 By Category As of September 30, 2013 1. Lipper rankings for Franklin Templeton U.S.-registered mutual funds are based on Class A shares. Franklin Templeton funds are compared against a universe of all share classes. Performance rankings for other share classes may differ. Lipper calculates averages by taking all the funds and share classes in a peer group and averaging their total returns for the periods indicated. Lipper tracks 154 peer groups of U.S. retail mutual funds, and the groups vary in size from 8 to 986 funds. Lipper total return calculations include reinvested dividends and capital gains, but do not include sales charges or expense subsidization by the manager. Results may have been different if these or other factors had been considered. Performance quoted above represents past performance, which cannot predict or guarantee future results. September 30, 2013 June 30, 2013 Percentage of U.S.-Registered Long-Term Mutual Fund Assets in Top Two Lipper Quartiles1 Franklin Equity Taxable Fixed Income Mutual Series Equity Templeton Equity Tax-Free Fixed Income 10-Year 5-Year 3-Year 1-Year 78% 92% 6% 93% 17% 78% 93% 19% 96% 40% 94% 87% 59% 85% 76% 80% 40% 65% 85% 99%

FRANKLIN RESOURCES, INC. Assets Under Management and Flows

FRANKLIN RESOURCES, INC. Assets Under Management End of Period 8 Simple Monthly Average (in US$ billions, for the three months ended) 749.9 781.8 823.7 815.0 844.7 9/12 12/12 3/13 6/13 9/13 726.7 763.6 807.3 833.2 827.8 9/12 12/12 3/13 6/13 9/13

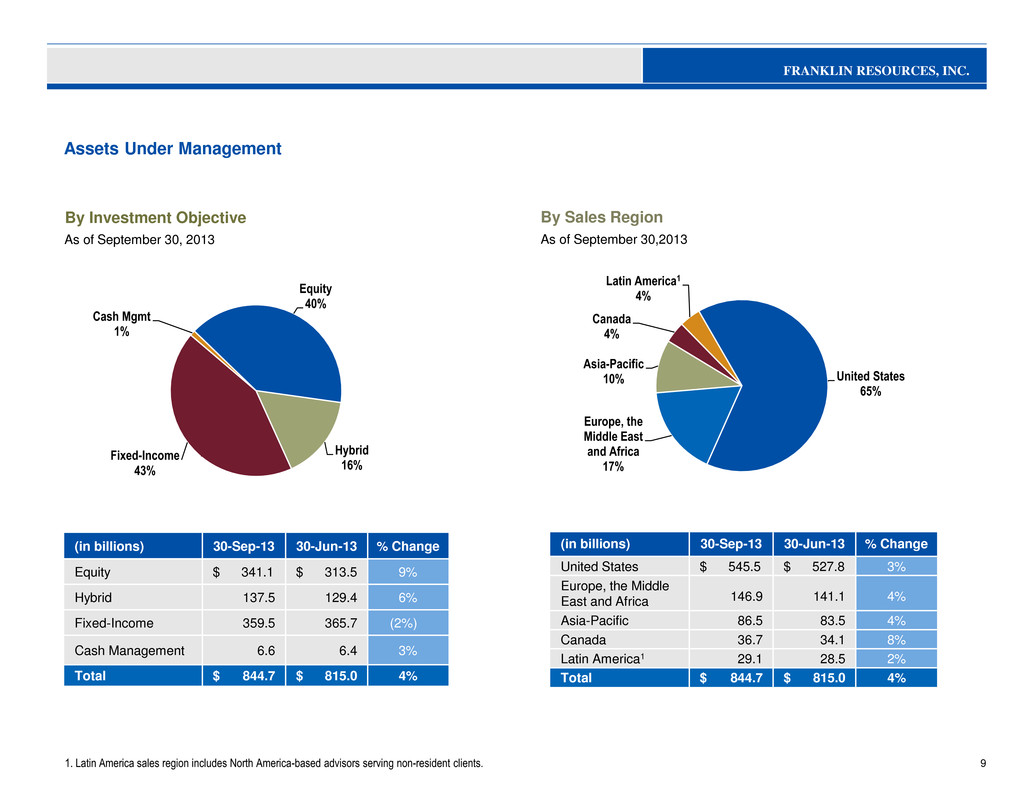

FRANKLIN RESOURCES, INC. United States 65% Europe, the Middle East and Africa 17% Asia-Pacific 10% Canada 4% Latin America1 4% Equity 40% Hybrid 16% Fixed-Income 43% Cash Mgmt 1% Assets Under Management By Investment Objective 9 By Sales Region As of September 30, 2013 As of September 30,2013 1. Latin America sales region includes North America-based advisors serving non-resident clients. (in billions) 30-Sep-13 30-Jun-13 % Change Equity $ 341.1 $ 313.5 9% Hybrid 137.5 129.4 6% Fixed-Income 359.5 365.7 (2%) Cash Management 6.6 6.4 3% Total $ 844.7 $ 815.0 4% (in billions) 30-Sep-13 30-Jun-13 % Change United States $ 545.5 $ 527.8 3% Europe, the Middle East and Africa 146.9 141.1 4% Asia-Pacific 86.5 83.5 4% Canada 36.7 34.1 8% Latin America1 29.1 28.5 2% Total $ 844.7 $ 815.0 4%

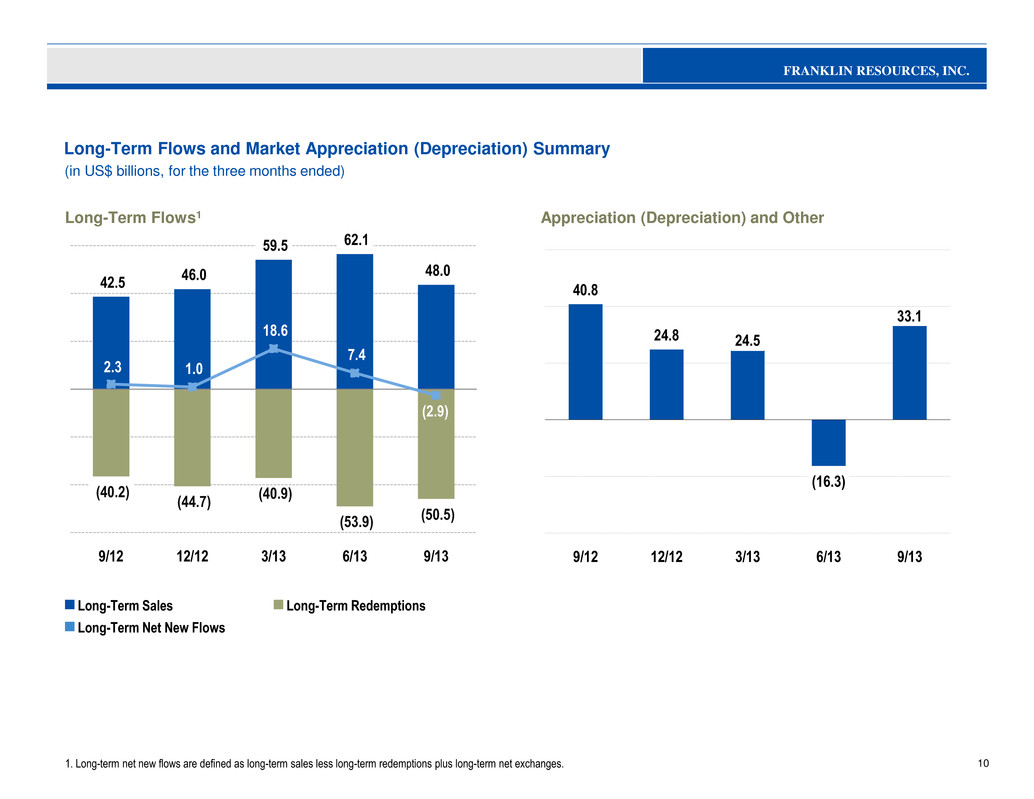

FRANKLIN RESOURCES, INC. 40.8 24.8 24.5 (16.3) 33.1 9/12 12/12 3/13 6/13 9/13 Long-Term Flows and Market Appreciation (Depreciation) Summary 10 (in US$ billions, for the three months ended) Appreciation (Depreciation) and Other 1. Long-term net new flows are defined as long-term sales less long-term redemptions plus long-term net exchanges. Long-Term Net New Flows Long-Term Sales Long-Term Redemptions Long-Term Flows1 42.5 46.0 59.5 62.1 48.0 (40.2) (44.7) (40.9) (53.9) (50.5) 2.3 1.0 18.6 7.4 (2.9) 9/12 12/12 3/13 6/13 9/13

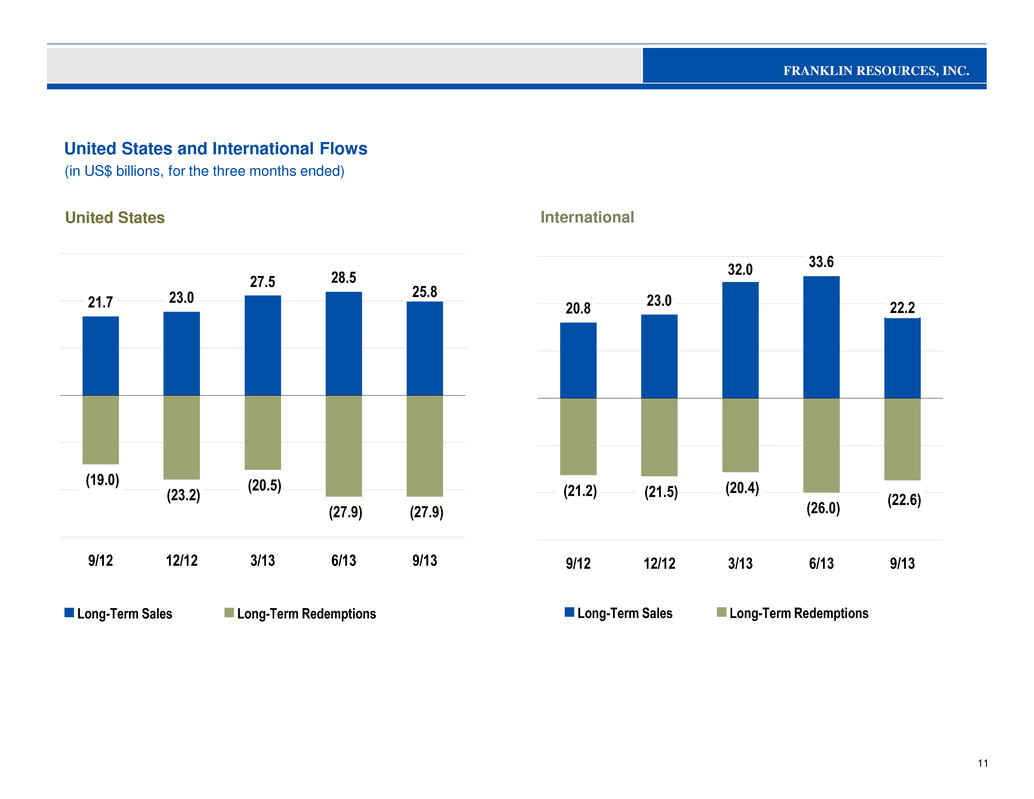

FRANKLIN RESOURCES, INC. United States and International Flows United States 11 (in US$ billions, for the three months ended) International Long-Term Sales Long-Term Redemptions Long-Term Sales Long-Term Redemptions 21.7 23.0 27.5 28.5 25.8 (19.0) (23.2) (20.5) (27.9) (27.9) 9/12 12/12 3/13 6/13 9/13 20.8 23.0 32.0 33.6 22.2 (21.2) (21.5) (20.4) (26.0) (22.6) 9/12 12/12 3/13 6/13 9/13

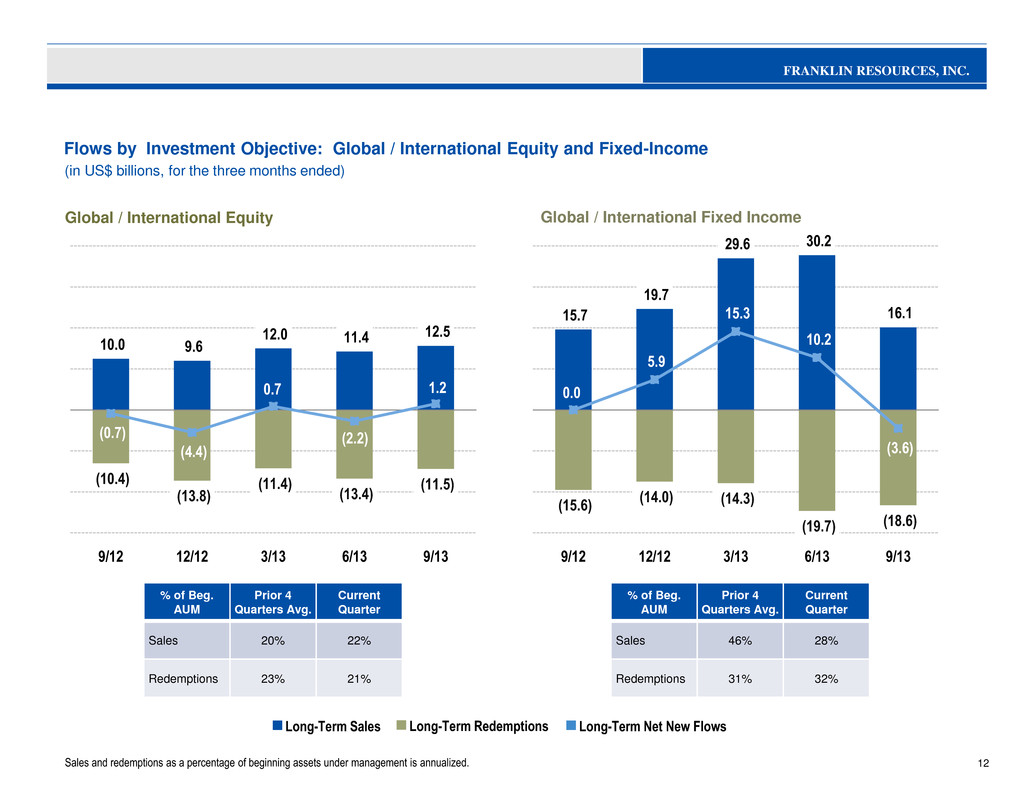

FRANKLIN RESOURCES, INC. 15.7 19.7 29.6 30.2 16.1 (15.6) (14.0) (14.3) (19.7) (18.6) 0.0 5.9 15.3 10.2 (3.6) 9/12 12/12 3/13 6/13 9/13 10.0 9.6 12.0 11.4 12.5 (10.4) (13.8) (11.4) (13.4) (11.5) (0.7) (4.4) 0.7 (2.2) 1.2 9/12 12/12 3/13 6/13 9/13 Flows by Investment Objective: Global / International Equity and Fixed-Income (in US$ billions, for the three months ended) 12 Sales and redemptions as a percentage of beginning assets under management is annualized. % of Beg. AUM Prior 4 Quarters Avg. Current Quarter Sales 46% 28% Redemptions 31% 32% Long-Term Net New Flows Long-Term Sales Long-Term Redemptions Global / International Equity Global / International Fixed Income % of Beg. AUM Prior 4 Quarters Avg. Current Quarter Sales 20% 22% Redemptions 23% 21%

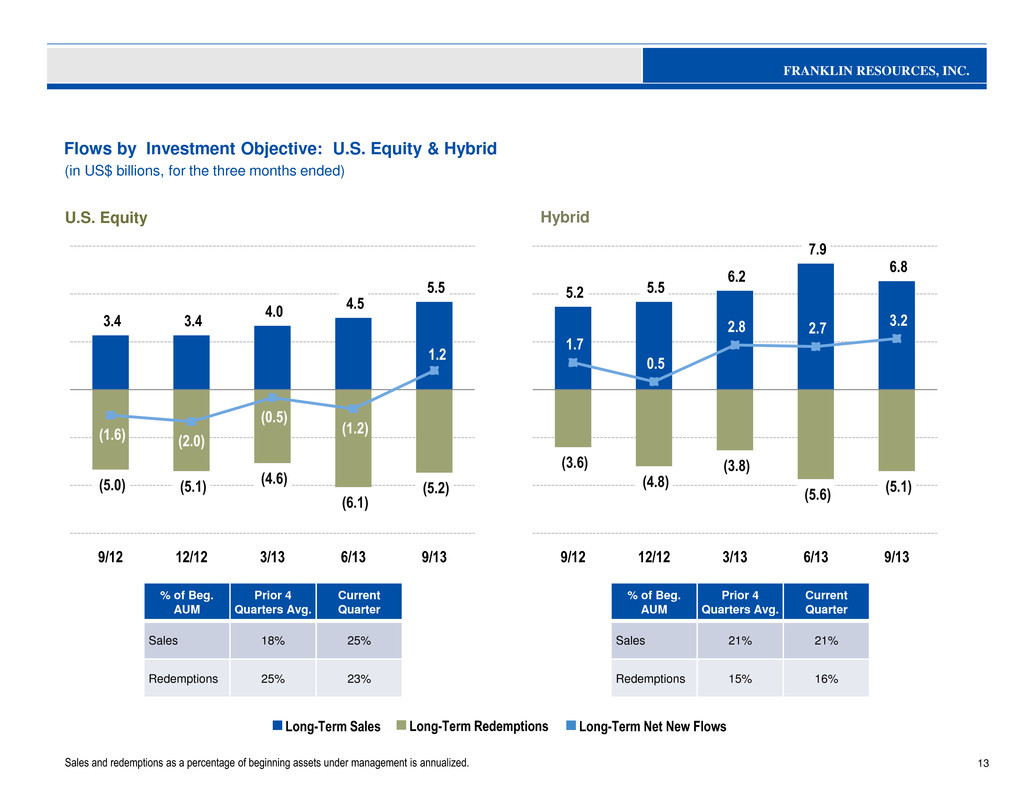

FRANKLIN RESOURCES, INC. Flows by Investment Objective: U.S. Equity & Hybrid (in US$ billions, for the three months ended) 13 Sales and redemptions as a percentage of beginning assets under management is annualized. % of Beg. AUM Prior 4 Quarters Avg. Current Quarter Sales 21% 21% Redemptions 15% 16% Long-Term Net New Flows Long-Term Sales Long-Term Redemptions U.S. Equity % of Beg. AUM Prior 4 Quarters Avg. Current Quarter Sales 18% 25% Redemptions 25% 23% 3.4 3.4 4.0 4.5 5.5 (5.0) (5.1) (4.6) (6.1) (5.2) (1.6) (2.0) (0.5) (1.2) 1.2 9/12 12/12 3/13 6/13 9/13 5.2 5.5 6.2 7.9 6.8 (3.6) (4.8) (3.8) (5.6) (5.1) 1.7 0.5 2.8 2.7 3.2 9/12 12/12 3/13 6/13 9/13 Hybrid

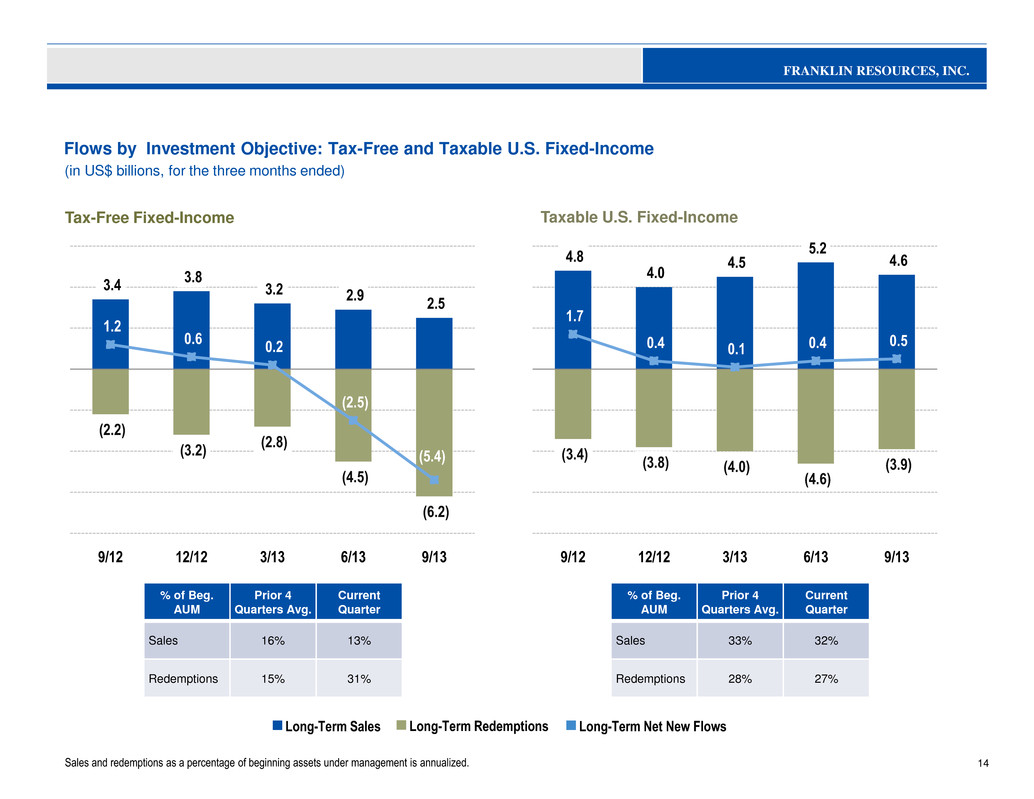

FRANKLIN RESOURCES, INC. Flows by Investment Objective: Tax-Free and Taxable U.S. Fixed-Income (in US$ billions, for the three months ended) 14 Sales and redemptions as a percentage of beginning assets under management is annualized. % of Beg. AUM Prior 4 Quarters Avg. Current Quarter Sales 33% 32% Redemptions 28% 27% Long-Term Net New Flows Long-Term Sales Long-Term Redemptions Tax-Free Fixed-Income % of Beg. AUM Prior 4 Quarters Avg. Current Quarter Sales 16% 13% Redemptions 15% 31% Taxable U.S. Fixed-Income 3.4 3.8 3.2 2.9 2.5 (2.2) (3.2) (2.8) (4.5) (6.2) 1.2 0.6 0.2 (2.5) (5.4) 9/12 12/12 3/13 6/13 9/13 4.8 4.0 4.5 5.2 4.6 (3.4) (3.8) (4.0) (4.6) (3.9) 1.7 0.4 0.1 0.4 0.5 9/12 12/12 3/13 6/13 9/13

FRANKLIN RESOURCES, INC. Operating Results and Capital Management

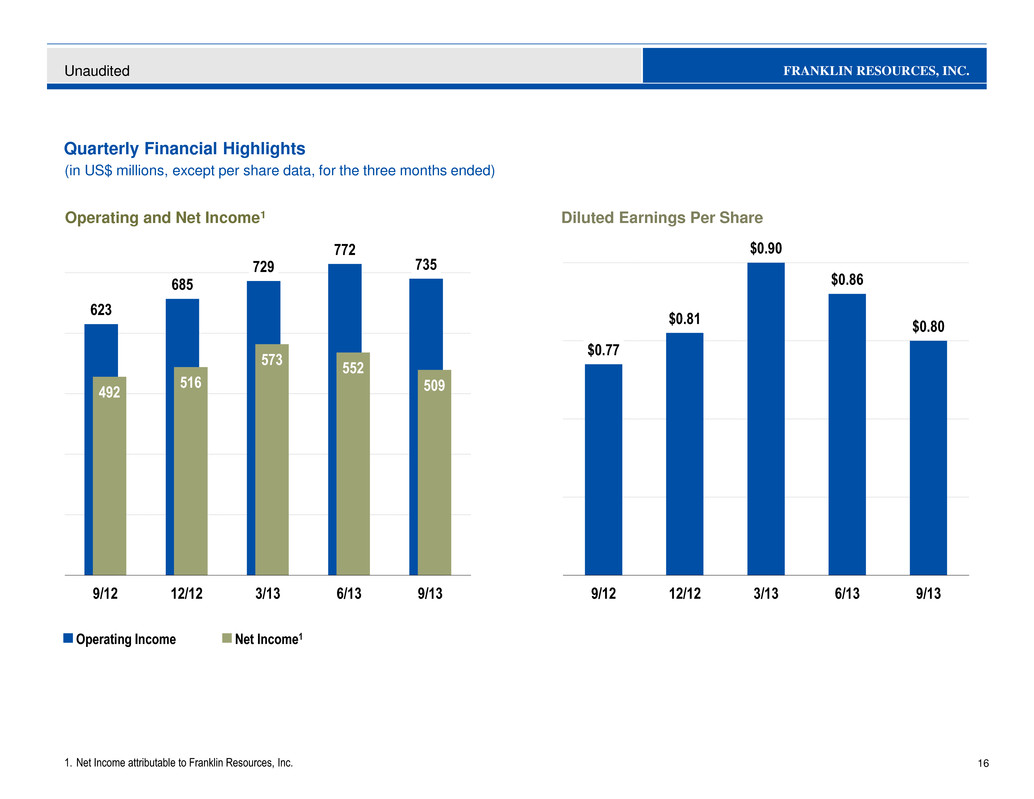

FRANKLIN RESOURCES, INC. Quarterly Financial Highlights Operating and Net Income1 16 Unaudited Diluted Earnings Per Share (in US$ millions, except per share data, for the three months ended) 1. Net Income attributable to Franklin Resources, Inc. Operating Income Net Income1 623 685 729 772 735 492 516 573 552 509 9/12 12/12 3/13 6/13 9/13 $0.77 $0.81 $0.90 $0.86 $0.80 9/12 12/12 3/13 6/13 9/13

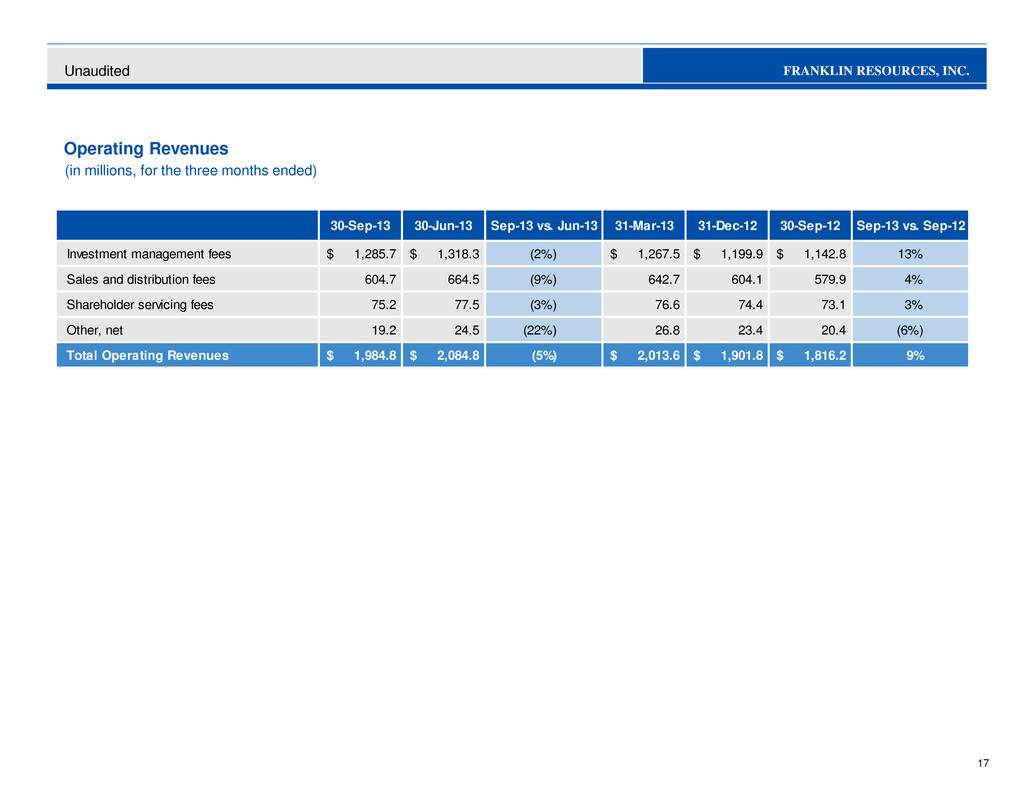

FRANKLIN RESOURCES, INC. Operating Revenues (in millions, for the three months ended) 17 Unaudited 30-Sep-13 30-Jun-13 Sep-13 vs. Jun-13 31-Mar-13 31-Dec-12 30-Sep-12 Sep-13 vs. Sep-12 Investment management fees 1,285.7$ 1,318.3$ (2%) 1,267.5$ 1,199.9$ 1,142.8$ 13% Sales and distribution fees 604.7 664.5 (9%) 642.7 604.1 579.9 4% Shareholder servicing fees 75.2 77.5 (3%) 76.6 74.4 73.1 3% Other, net 19.2 24.5 (22%) 26.8 23.4 20.4 (6%) Total Operating Revenues 1,984.8$ 2,084.8$ (5%) 2,013.6$ 1,901.8$ 1,816.2$ 9%

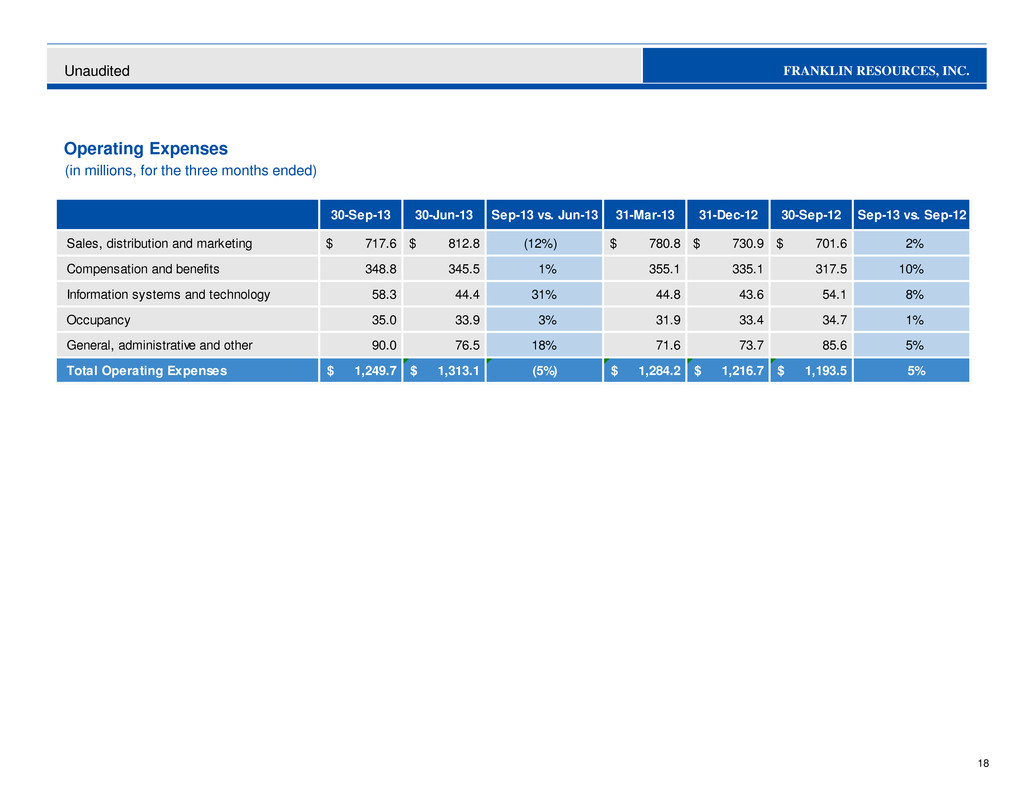

FRANKLIN RESOURCES, INC. Operating Expenses (in millions, for the three months ended) 18 Unaudited 30-Sep-13 30-Jun-13 Sep-13 vs. Jun-13 31-Mar-13 31-Dec-12 30-Sep-12 Sep-13 vs. Sep-12 Sales, distribution and marketing 717.6$ 812.8$ (12%) 780.8$ 730.9$ 701.6$ 2% C mpensation and benefits 348.8 345.5 1% 355.1 335.1 317.5 10% Information systems and technology 58.3 44.4 31% 44.8 43.6 54.1 8% Occupancy 35.0 33.9 3% 31.9 33.4 34.7 1% General, administrative and other 90.0 76.5 18% 71.6 73.7 85.6 5% Total Operating Expenses 1,249.7$ 1,313.1$ (5%) 1,284.2$ 1,216.7$ 1,193.5$ 5%

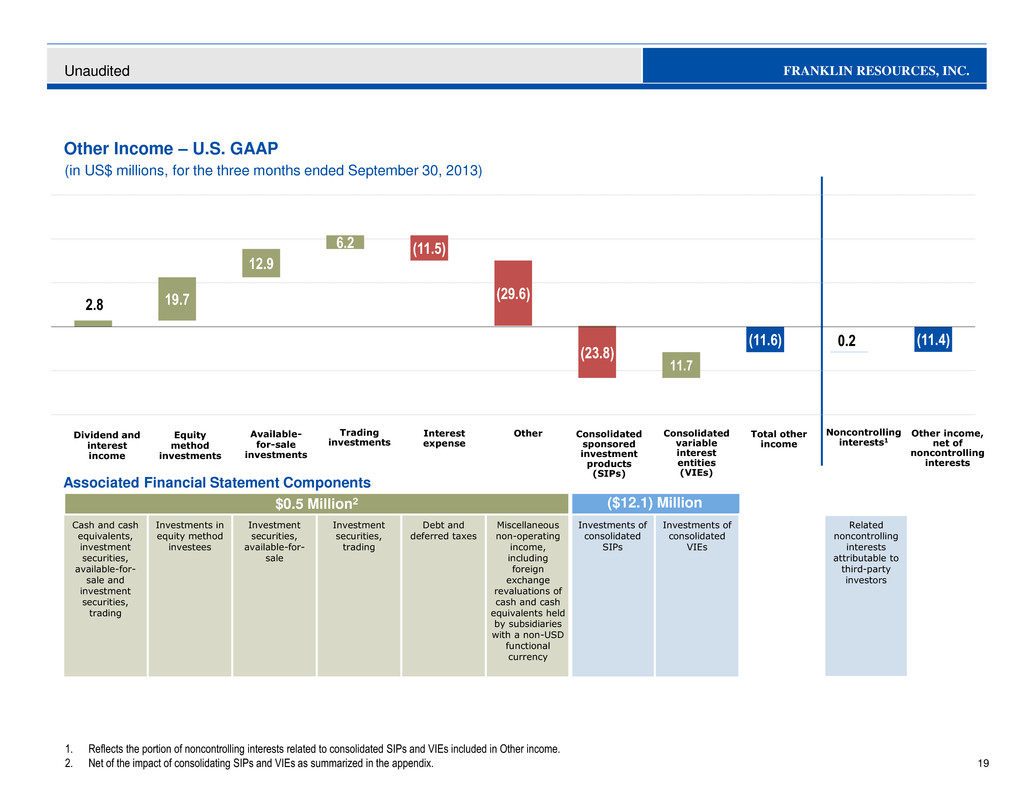

FRANKLIN RESOURCES, INC. Associated Financial Statement Components $0.5 Million2 ($12.1) Million Cash and cash equivalents, investment securities, available-for- sale and investment securities, trading Investments in equity method investees Investment securities, available-for- sale Investment securities, trading Debt and deferred taxes Miscellaneous non-operating income, including foreign exchange revaluations of cash and cash equivalents held by subsidiaries with a non-USD functional currency Investments of consolidated SIPs Investments of consolidated VIEs Related noncontrolling interests attributable to third-party investors Other Income – U.S. GAAP (in US$ millions, for the three months ended September 30, 2013) 19 1. Reflects the portion of noncontrolling interests related to consolidated SIPs and VIEs included in Other income. 2. Net of the impact of consolidating SIPs and VIEs as summarized in the appendix. Unaudited Dividend and interest income Equity method investments Available- for-sale investments Trading investments Interest expense Other Consolidated sponsored investment products (SIPs) Consolidated variable interest entities (VIEs) Total other income Noncontrolling interests1 Other income, net of noncontrolling interests 2.8 19.7 12.9 6.2 (11.5) (29.6) (23.8) 11.7 (11.6) 0.2 (11.4)

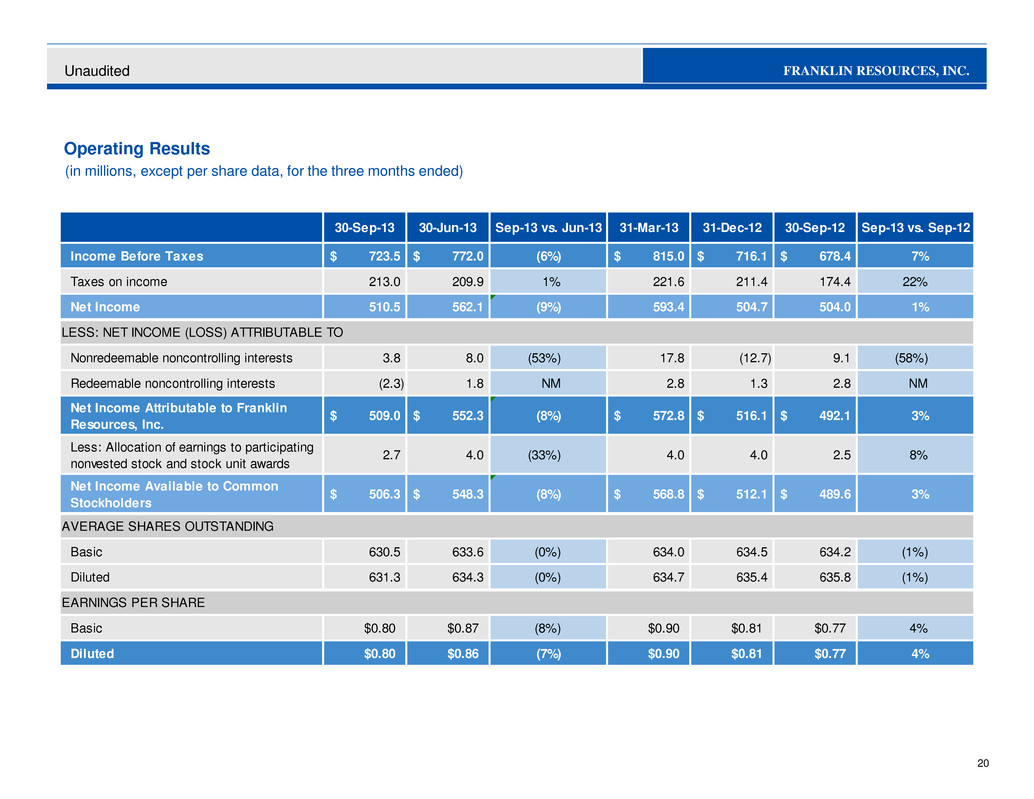

FRANKLIN RESOURCES, INC. Operating Results (in millions, except per share data, for the three months ended) 20 Unaudited 30-Sep-13 30-Jun-13 Sep-13 vs. Jun-13 31-Mar-13 31-Dec-12 30-Sep-12 Sep-13 vs. Sep-12 Income Before Taxes 723.5$ 772.0$ (6%) 815.0$ 716.1$ 678.4$ 7% Taxes on income 213.0 209.9 1% 221.6 211.4 174.4 22% Net Income 510.5 562.1 (9%) 593.4 504.7 504.0 1% LESS: NET INCOME (LOSS) ATTRIBUTABLE TO Nonredeemable noncontrolling interests 3.8 8.0 (53%) 17.8 (12.7) 9.1 (58%) Redeemable noncontrolling interests (2.3) 1.8 NM 2.8 1.3 2.8 NM Net Income Attributable to Franklin Resources, Inc. 509.0$ 552.3$ (8%) 572.8$ 516.1$ 492.1$ 3% Less: Allocation of earnings to participating nonvested stock and stock unit awards 2.7 4.0 (33%) 4.0 4.0 2.5 8% Net Income Available to Common Stockholders 506.3$ 548.3$ (8%) 568.8$ 512.1$ 489.6$ 3% AVERAGE SHARES OUTSTANDING Basic 630.5 633.6 (0%) 634.0 634.5 634.2 (1%) Diluted 631.3 634.3 (0%) 634.7 635.4 635.8 (1%) EARNINGS PER SHARE Basic $0.80 $0.87 (8%) $0.90 $0.81 $0.77 4% Diluted $0.80 $0.86 (7%) $0.90 $0.81 $0.77 4%

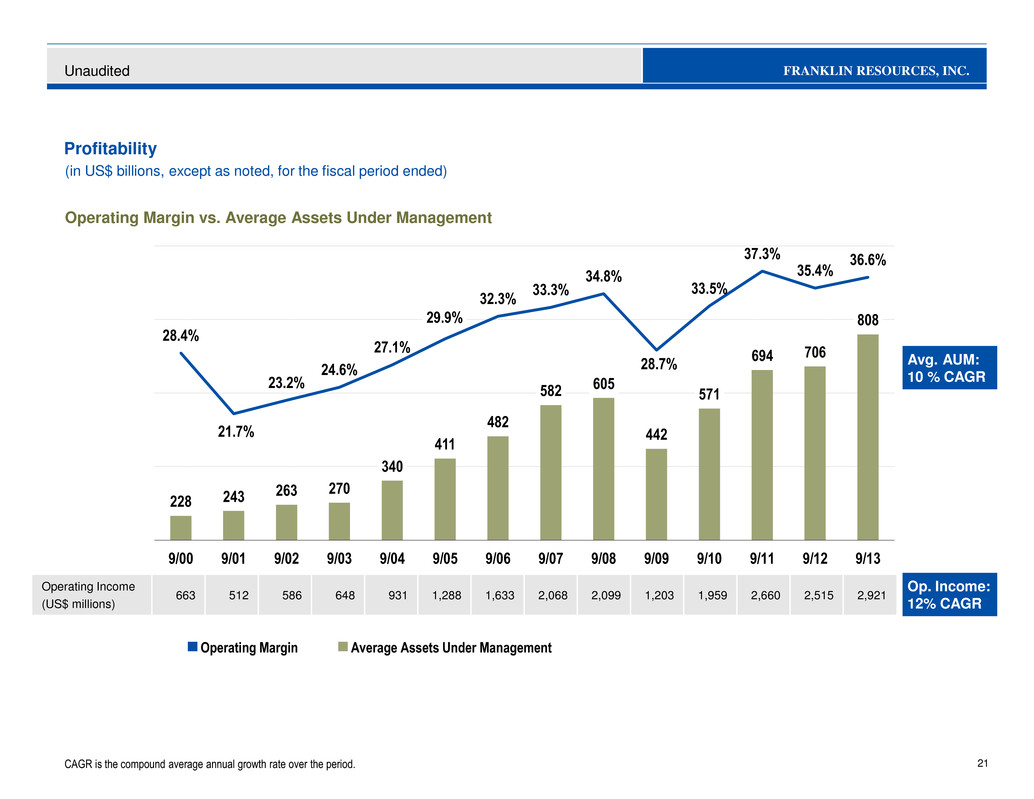

FRANKLIN RESOURCES, INC. Profitability Operating Margin vs. Average Assets Under Management 21 (in US$ billions, except as noted, for the fiscal period ended) Unaudited Operating Margin Average Assets Under Management Operating Income (US$ millions) 663 512 586 648 931 1,288 1,633 2,068 2,099 1,203 1,959 2,660 2,515 2,921 CAGR is the compound average annual growth rate over the period. Avg. AUM: 10 % CAGR Op. Income: 12% CAGR 228 243 263 270 340 411 482 582 605 442 571 694 706 808 28.4% 21.7% 23.2% 24.6% 27.1% 29.9% 32.3% 33.3% 34.8% 28.7% 33.5% 37.3% 35.4% 36.6% 9/00 9/01 9/02 9/03 9/04 9/05 9/06 9/07 9/08 9/09 9/10 9/11 9/12 9/13

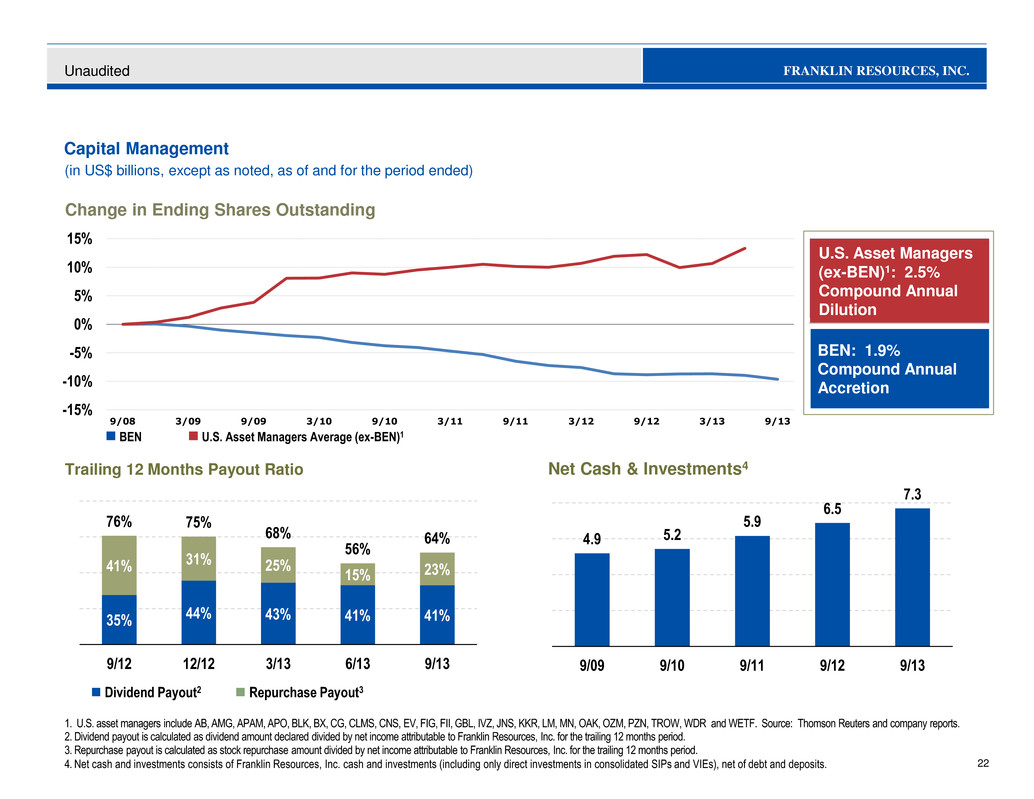

FRANKLIN RESOURCES, INC. Capital Management 22 (in US$ billions, except as noted, as of and for the period ended) 1. U.S. asset managers include AB, AMG, APAM, APO, BLK, BX, CG, CLMS, CNS, EV, FIG, FII, GBL, IVZ, JNS, KKR, LM, MN, OAK, OZM, PZN, TROW, WDR and WETF. Source: Thomson Reuters and company reports. 2. Dividend payout is calculated as dividend amount declared divided by net income attributable to Franklin Resources, Inc. for the trailing 12 months period. 3. Repurchase payout is calculated as stock repurchase amount divided by net income attributable to Franklin Resources, Inc. for the trailing 12 months period. 4. Net cash and investments consists of Franklin Resources, Inc. cash and investments (including only direct investments in consolidated SIPs and VIEs), net of debt and deposits. Unaudited Change in Ending Shares Outstanding Trailing 12 Months Payout Ratio Net Cash & Investments4 BEN U.S. Asset Managers Average (ex-BEN)1 U.S. Asset Managers (ex-BEN)1: 2.5% Compound Annual Dilution Dividend Payout2 Repurchase Payout3 BEN: 1.9% Compound Annual Accretion -15% -10% -5% 0% 5% 10% 15% 9/08 3/09 9/09 3/10 9/10 3/11 9/11 3/12 9/12 3/13 9/13 35% 44% 43% 41% 41% 41% 31% 25% 15% 23% 76% 75% 68% 56% 64% 9/12 12/12 3/13 6/13 9/13 4.9 5.2 5.9 6.5 7.3 9/09 9/10 9/11 9/12 9/13

FRANKLIN RESOURCES, INC. Appendix

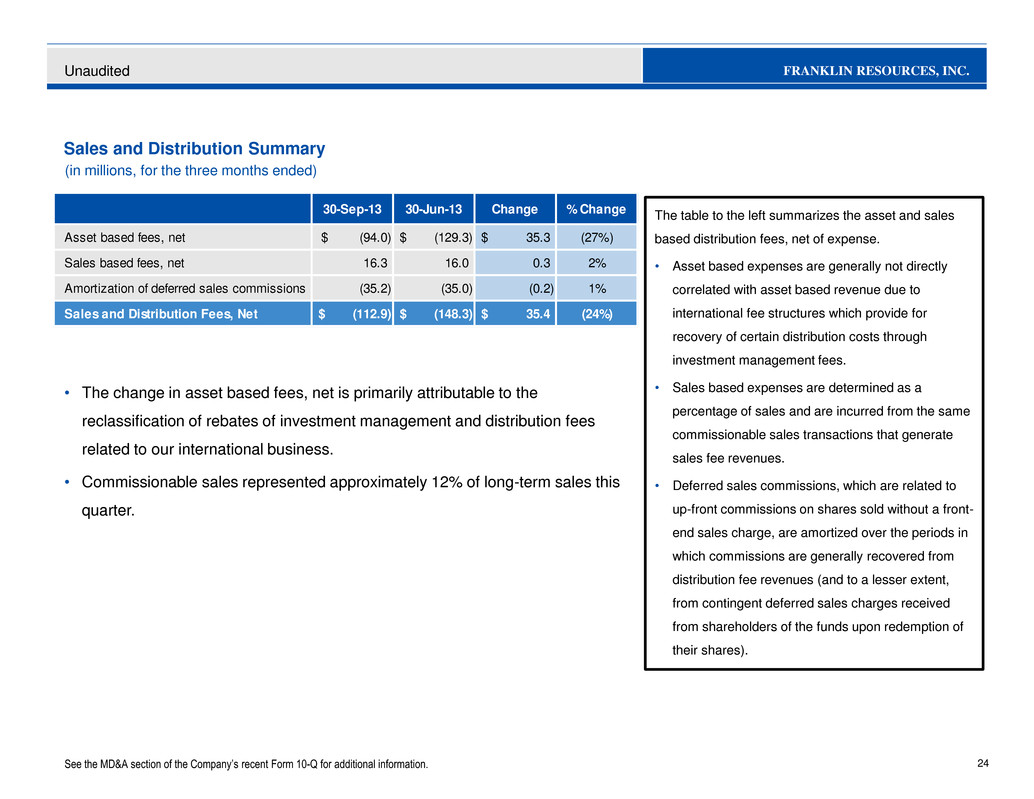

FRANKLIN RESOURCES, INC. Sales and Distribution Summary 24 (in millions, for the three months ended) Unaudited The table to the left summarizes the asset and sales based distribution fees, net of expense. • Asset based expenses are generally not directly correlated with asset based revenue due to international fee structures which provide for recovery of certain distribution costs through investment management fees. • Sales based expenses are determined as a percentage of sales and are incurred from the same commissionable sales transactions that generate sales fee revenues. • Deferred sales commissions, which are related to up-front commissions on shares sold without a front- end sales charge, are amortized over the periods in which commissions are generally recovered from distribution fee revenues (and to a lesser extent, from contingent deferred sales charges received from shareholders of the funds upon redemption of their shares). See the MD&A section of the Company’s recent Form 10-Q for additional information. • The change in asset based fees, net is primarily attributable to the reclassification of rebates of investment management and distribution fees related to our international business. • Commissionable sales represented approximately 12% of long-term sales this quarter. 30-Sep-13 30-Jun-13 Change % Change Asset based fees, net (94.0)$ (129.3)$ 35.3$ (27%) Sales based fee , t 16.3 16.0 0.3 2% Amortization of d f r e sales commissions (35.2) (35.0) (0.2) 1% Sales and Distribut on Fees, Net (112.9)$ (148.3)$ 35.4$ (24%)

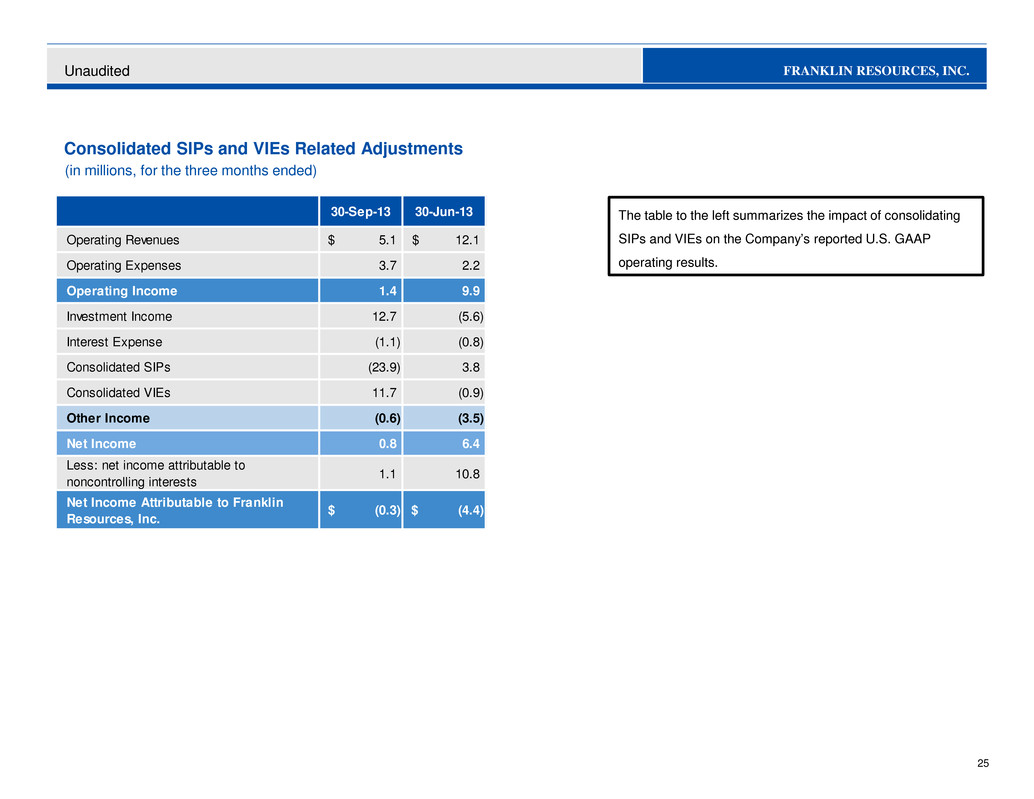

FRANKLIN RESOURCES, INC. Consolidated SIPs and VIEs Related Adjustments 25 (in millions, for the three months ended) Unaudited The table to the left summarizes the impact of consolidating SIPs and VIEs on the Company’s reported U.S. GAAP operating results. 30-Sep-13 30-Jun-13 Operating Revenues 5.1$ 12.1$ Operating Expenses 3.7 2.2 Operating Income 1.4 9.9 Investment Income 12.7 (5.6) Interest Expense (1.1) (0.8) Consolidated SIPs (23.9) 3.8 Consolidated VIEs 11.7 (0.9) Other Inco e (0.6) (3.5) Net Income 0.8 6.4 Less: net income attributable to noncontrolling interests 1.1 10.8 Net Income Attributable to Franklin Resources, Inc. (0.3)$ (4.4)$