Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MOLEX INC | d615944d8k.htm |

| EX-99.1 - EX-99.1 - MOLEX INC | d615944dex991.htm |

Exhibit 99.2

Exhibit 99.2

FY14 Q1 Conference Call

October 23, 2013

Forward-Looking Statement

Page 1

Statements in this release that are not historical are forward-looking and are subject to various risks and uncertainties that could cause actual results to vary materially from those stated. Words such as

“expect,” “anticipate,” “outlook,” “forecast,” “could,” “project,” “intend,” “plan,” “continue,” “believe,” “seek,” “estimate,” “should,” “may,” “assume,” “potential,” variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are based on currently available information. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Respective risks, uncertainties and assumptions that could affect the outcome or results of operations are described in Part 1, Item 1A of our Annual Report on Form 10-K for the year ended June 30, 2013, which is incorporated by reference and in other reports that Molex files or furnishes with the Securities and Exchange Commission. Among other risks and uncertainties, there can be no guarantee that the pending merger with Koch Industries, Inc. will be completed, or if it is completed, the time frame in which it will be completed. The pending merger is subject to the satisfaction of certain conditions contained in the Merger Agreement. Pursuing the pending merger could disrupt certain of our current plans, operations, business, and employee relationships. We have based our forward-looking statements on our management’s beliefs and assumptions based on information available to management at the time the statements are made. We caution you that actual outcomes and results may differ materially from what is expressed, implied, or forecast by our forward-looking statements. Reference is made in particular to forward-looking statements regarding growth strategies, industry trends, global economic conditions, success of customers, cost of raw materials, value of inventory, currency exchange rates, labor costs, protection of intellectual property, cost reduction initiatives, acquisition synergies, manufacturing strategies, product development introduction and sales, regulatory changes, competitive strengths, natural disasters, unauthorized access to data, government investigations and outcomes of legal proceedings. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this report, whether as a result of new information, future events, changes in assumptions, or otherwise.

Non-GAAP Financial Measures

Page 2

In Molex Incorporated’s (“Molex” or the “Company”) conference call on October 23, 2013 regarding the Company’s financial results for the fiscal quarter and the following slides, Molex may refer to non-GAAP financial measures to describe earnings for such periods excluding the items referenced in the relevant slides used during this conference call. This is in addition to disclosing the most directly comparable measure for such periods determined in accordance with generally accepted accounting principles, or GAAP. Molex believes that these non-GAAP financial measures provide useful information to investors because they provide information about the estimated financial performance of Molex’s ongoing business and provide for greater transparency of supplemental information used by management in its financial and operational decision-making. These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

Investors are encouraged to review the relevant slides reconciling the non-GAAP financial measures intended to be used in the conference call to the most comparable GAAP measure.

FY14 Q1 Summary

Page 3

Exceeded revenue guidance

Auto, mobile and telecom exceeded expectations

Strong margin expansion

Higher revenue and production

Favorable product mix

Lower material costs

Merger update

Annual Stockholders Meeting November 15, 2013

Waiting on regulatory approvals

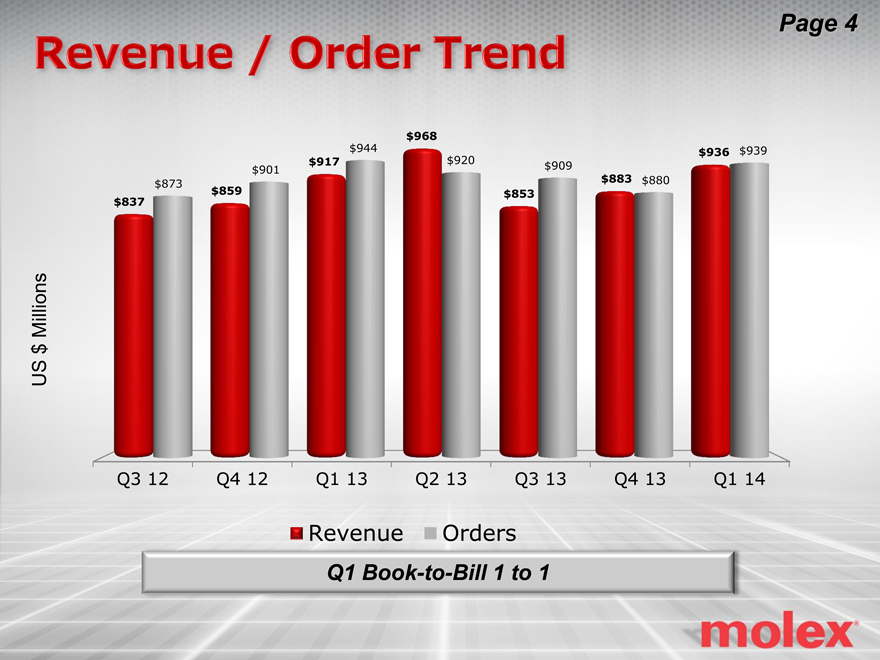

Revenue / Order Trend

Page 4

$968

$944 $936 $939

$901 $917 $920 $909

$873 $883 $880

$837 $859 $853

Millions

$

US

Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14

Revenue Orders

Q1 Book-to-Bill 1 to 1

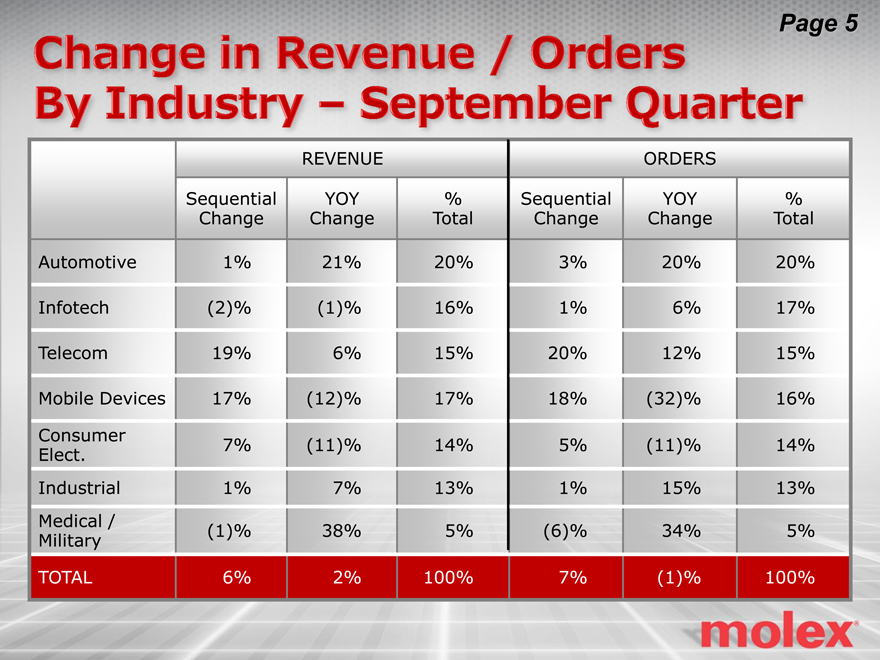

Change in Revenue / Orders By Industry – September Quarter

Page 5

REVENUE ORDERS

Sequential YOY % Sequential YOY %

Change Change Total Change Change Total

Automotive 1% 21% 20% 3% 20% 20%

Infotech (2)% (1)% 16% 1% 6% 17%

Telecom 19% 6% 15% 20% 12% 15%

Mobile Devices 17% (12)% 17% 18% (32)% 16%

Consumer 7% (11)% 14% 5% (11)% 14%

Elect.

Industrial 1% 7% 13% 1% 15% 13%

Medical / (1)% 38% 5% (6)% 34% 5%

Military

TOTAL 6% 2% 100% 7% (1)% 100%

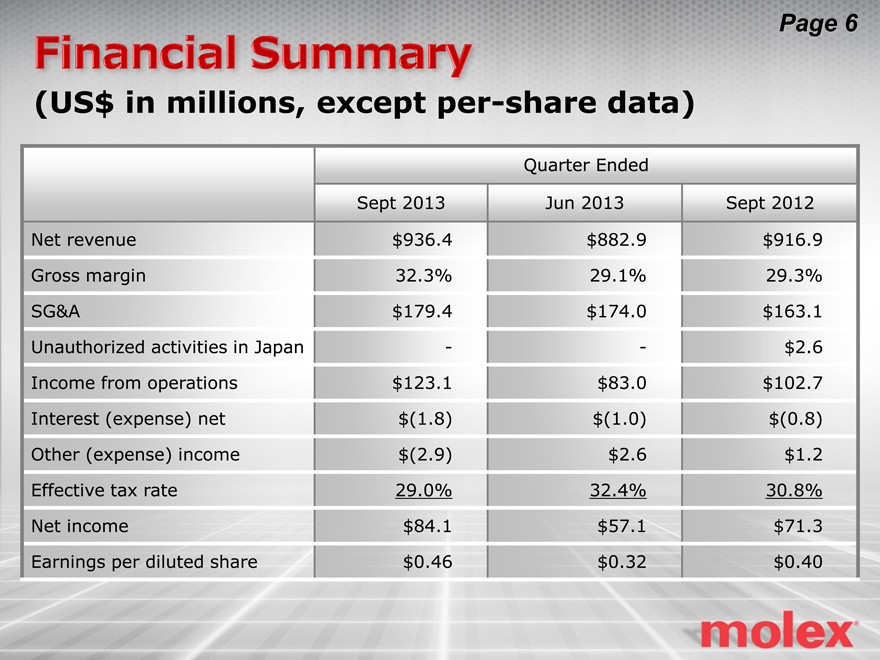

Page 6

Financial Summary

(US$ in millions, except per-share data)

Quarter Ended

Sept 2013 Jun 2013 Sept 2012

Net revenue $936.4 $882.9 $916.9

Gross margin 32.3% 29.1% 29.3%

SG&A $179.4 $174.0 $163.1

Unauthorized activities in Japan- - $2.6

Income from operations $123.1 $83.0 $102.7

Interest (expense) net $(1.8) $(1.0) $(0.8)

Other (expense) income $(2.9) $2.6 $1.2

Effective tax rate 29.0% 32.4% 30.8%

Net income $84.1 $57.1 $71.3

Earnings per diluted share $0.46 $0.32 $0.40

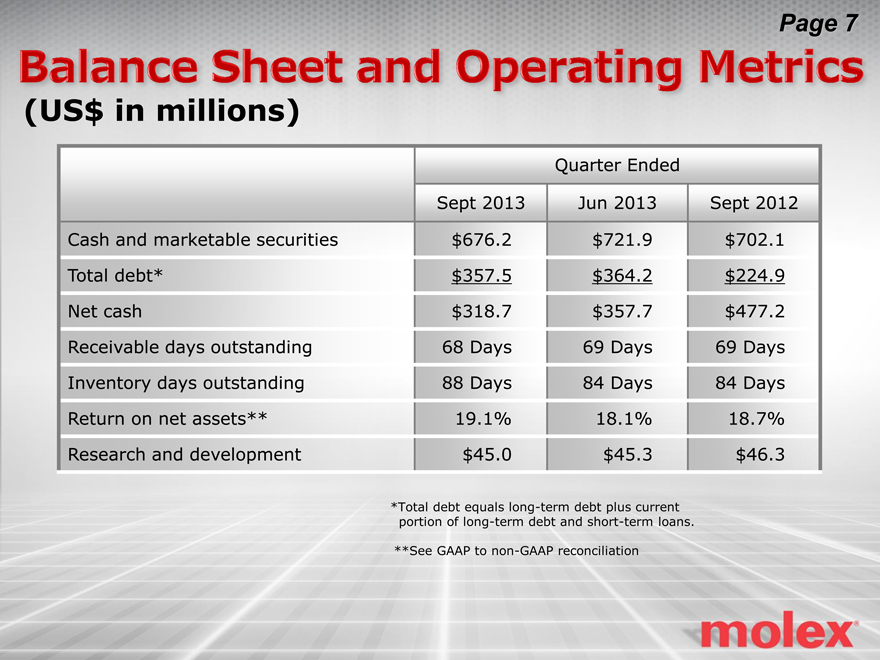

Page 7

Balance Sheet and Operating Metrics

(US$ in millions)

Quarter Ended

Sept 2013 Jun 2013 Sept 2012

Cash and marketable securities $676.2 $721.9 $702.1

Total debt* $357.5 $364.2 $224.9

Net cash $318.7 $357.7 $477.2

Receivable days outstanding 68 Days 69 Days 69 Days

Inventory days outstanding 88 Days 84 Days 84 Days

Return on net assets** 19.1% 18.1% 18.7%

Research and development $45.0 $45.3 $46.3

*Total debt equals long-term debt plus current

portion of long-term debt and short-term loans.

**See GAAP to non-GAAP reconciliation

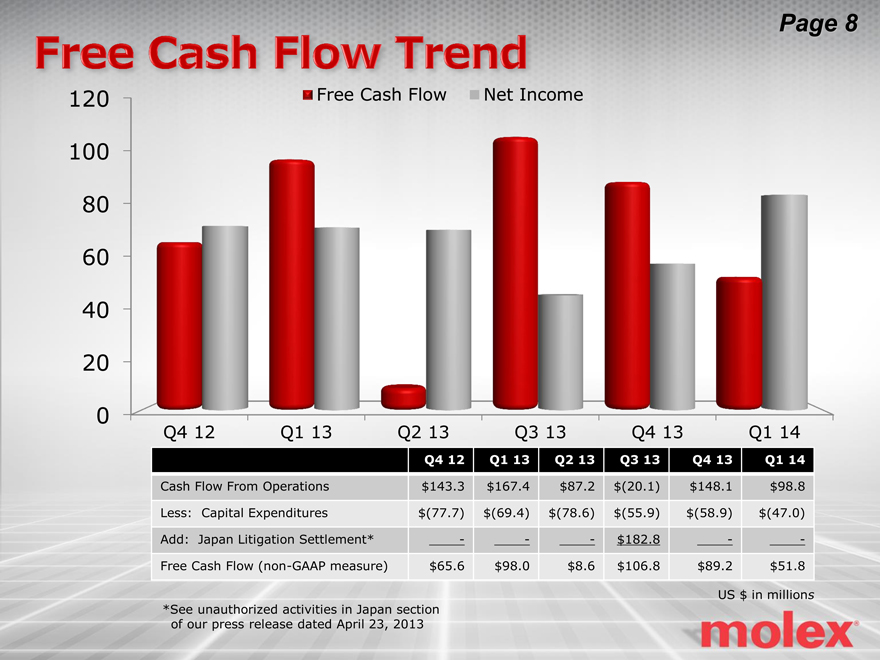

Page 8

Free Cash Flow Trend

120 Free Cash Flow Net Income

100

80

60

40

20

0

Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14

Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14

Cash Flow From Operations $143.3 $167.4 $87.2 $(20.1) $148.1 $98.8

Less: Capital Expenditures $(77.7) $(69.4) $(78.6) $(55.9) $(58.9) $(47.0)

Add: Japan Litigation Settlement* ——— $182.8 — -

Free Cash Flow (non-GAAP measure) $65.6 $98.0 $8.6 $106.8 $89.2 $51.8

US $ in millions

*See unauthorized activities in Japan section of our press release dated April 23, 2013

molex®

one company a world of innovation

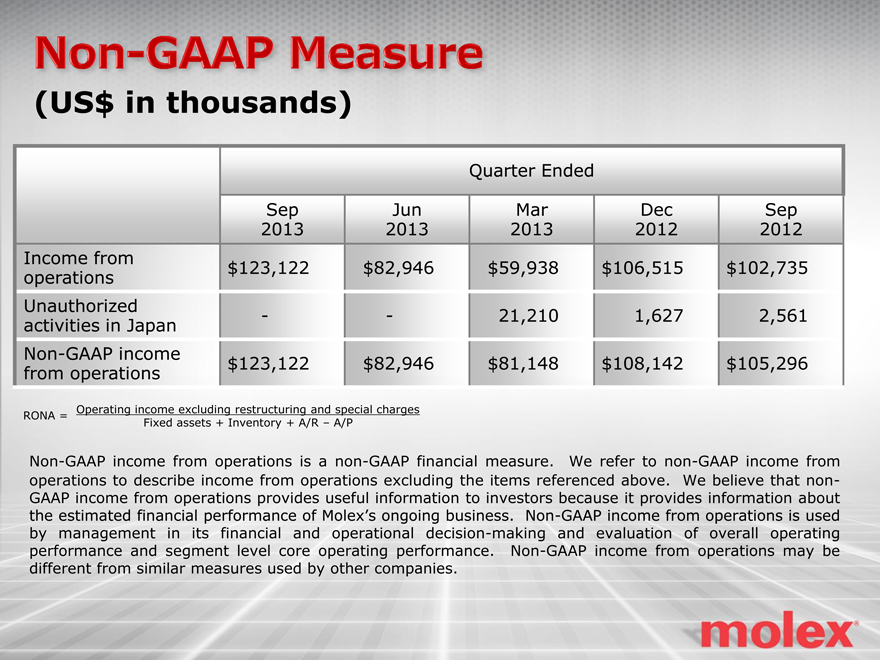

Non-GAAP Measure

(US$ in thousands)

Quarter Ended

Sep Jun Mar Dec Sep

2013 2013 2013 2012 2012

Income from $ 123,122 $ 82,946 $ 59,938 $ 106,515 $ 102,735

operations

Unauthorized – – 21,210 1,627 2,561

activities in Japan

Non-GAAP income $ 123,122 $ 82,946 $ 81,148 $ 108,142 $ 105,296

from operations

Operating income excluding restructuring and special charges RONA = Fixed assets + Inventory + A/R - A/P

Non-GAAP income from operations is a non-GAAP financial measure. We refer to non-GAAP income from operations to describe income from operations excluding the items referenced above. We believe that non-GAAP income from operations provides useful information to investors because it provides information about the estimated financial performance of Molex’s ongoing business. Non-GAAP income from operations is used by management in its financial and operational decision-making and evaluation of overall operating performance and segment level core operating performance. Non-GAAP income from operations may be different from similar measures used by other companies.

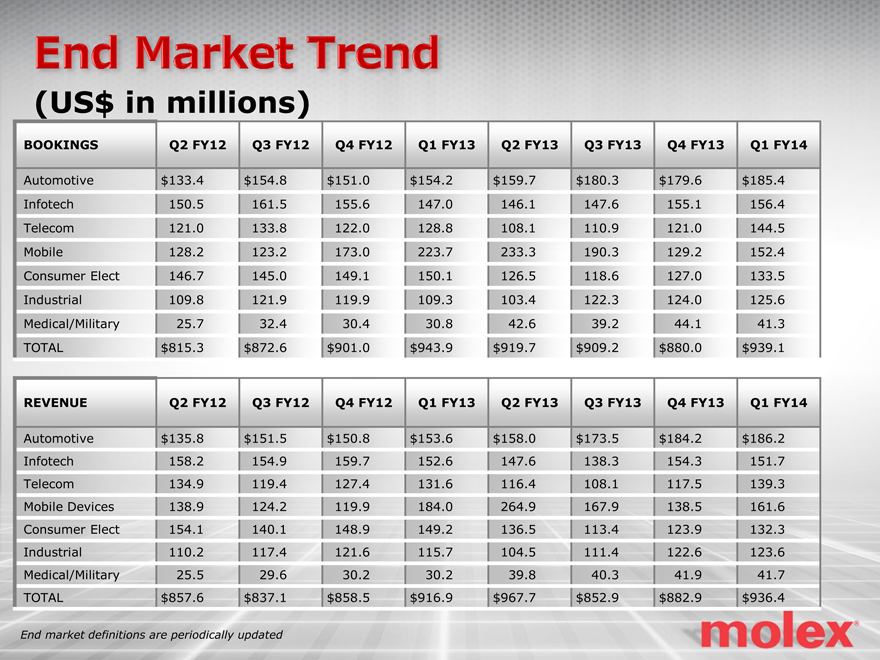

End Market Trend

(US$ in millions)

BOOKINGS Q2 FY12 Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14

Automotive $133.4 $154.8 $151.0 $154.2 $159.7 $180.3 $179.6 $185.4

Infotech 150.5 161.5 155.6 147.0 146.1 147.6 155.1 156.4

Telecom 121.0 133.8 122.0 128.8 108.1 110.9 121.0 144.5

Mobile 128.2 123.2 173.0 223.7 233.3 190.3 129.2 152.4

Consumer Elect 146.7 145.0 149.1 150.1 126.5 118.6 127.0 133.5

Industrial 109.8 121.9 119.9 109.3 103.4 122.3 124.0 125.6

Medical/Military 25.7 32.4 30.4 30.8 42.6 39.2 44.1 41.3

TOTAL $815.3 $872.6 $901.0 $943.9 $919.7 $909.2 $880.0 $939.1

REVENUE Q2 FY12 Q3 FY12 Q4 FY12 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY13 Q1 FY14

Automotive $135.8 $151.5 $150.8 $153.6 $158.0 $173.5 $184.2 $186.2

Infotech 158.2 154.9 159.7 152.6 147.6 138.3 154.3 151.7

Telecom 134.9 119.4 127.4 131.6 116.4 108.1 117.5 139.3

Mobile Devices 138.9 124.2 119.9 184.0 264.9 167.9 138.5 161.6

Consumer Elect 154.1 140.1 148.9 149.2 136.5 113.4 123.9 132.3

Industrial 110.2 117.4 121.6 115.7 104.5 111.4 122.6 123.6

Medical/Military 25.5 29.6 30.2 30.2 39.8 40.3 41.9 41.7

TOTAL $857.6 $837.1 $858.5 $916.9 $967.7 $852.9 $882.9 $936.4

End market definitions are periodically updated