Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | d613907d8k.htm |

| EX-99.1 - EX-99.1 - ASSOCIATED BANC-CORP | d613907dex991.htm |

ASSOCIATED BANC-CORP

3Q 2013 EARNINGS PRESENTATION

OCTOBER 17, 2013

Exhibit 99.2 |

FORWARD-LOOKING STATEMENTS

Important note regarding forward-looking statements:

Statements

made

in

this

presentation

which

are

not

purely

historical

are

forward-looking

statements,

as

defined

in

the

Private

Securities

Litigation

Reform

Act

of

1995.

This

includes

any

statements

regarding

management’s

plans,

objectives,

or

goals

for

future

operations,

products

or

services,

and

forecasts

of

its

revenues,

earnings,

or

other

measures

of

performance.

Such forward-

looking

statements

may

be

identified

by

the

use

of

words

such

as

“believe”,

“expect”,

“anticipate”,

“plan”,

“estimate”,

“should”,

“will”,

“intend”,

“outlook”,

or

similar

expressions.

Forward-

looking

statements

are

based

on

current

management

expectations

and,

by

their

nature,

are

subject

to

risks

and

uncertainties.

Actual

results

may

differ

materially

from

those

contained

in

the

forward-looking

statements.

Factors

which

may

cause

actual

results

to

differ

materially

from

those

contained

in

such

forward-looking

statements

include

those

identified

in

the

Company’s

most

recent

Form

10-K

and

subsequent

SEC

filings.

Such

factors

are

incorporated

herein

by

reference.

1 |

HIGHLIGHTS

2

Solid Earnings Despite Mortgage Banking Income Headwinds

Net Income

&

ROT1CE

Balance Sheet

Net Interest Income

&

Net Interest Margin

•

Average

loans

of

$15.7

billion

were

flat

to

the

second

quarter

–

Commercial

and

Residential

Mortgage

loans

up

1%

from

the

second

quarter

–

Home

Equity

and

Installment

loans

continued

to

shrink

QoQ

•

Net interest income of $161 million was up slightly from the second quarter

–

Net interest margin of 3.13% compared to 3.16% in the prior quarter

Capital

•

Quarterly dividend of $0.08/share

•

Repurchased 1.8 million shares of stock during the third quarter

–

October

4

th

–

repurchased

additional

1.8

million

shares

in

accelerated

program

•

Capital

ratios

remain

very

strong

with

a

Tier

1

common

equity

ratio

of

11.64%

Noninterest Income

& Expense

•

Noninterest income of $71 million was down $13 million from the second

quarter –

Mortgage banking income of $4 million, down $16 million from second quarter

–

Core fee based income up $3 million from prior quarter

•

Noninterest expense of $164 million was down $6 million from prior quarter

•

Net

income

available

to

common

shareholders

of

$44

million

or

$0.27

per

share

•

YTD

Return

on

Tier

1

Common

Equity

of

9.8%,

compared

to

9.4%

for

YTD

2012

•

Average

deposits

of

$17.6

billion

were

up

3%

from

the

second

quarter |

LOAN

PORTFOLIO COMPOSITION 3

Average Loans of $15.7 billion for Third Quarter 2013

3Q 2013 Average Net Loan Change

Loan Mix –

3Q 2013 (Average)

Average Quarterly Loans ($ in billions)

Peak Average Loans (1Q 2009) $16.4 billion |

GROWING

NET INTEREST INCOME WHILE MARGIN COMPRESSES

4

Yield on Interest-earning Assets

Cost of Interest-bearing Liabilities

Net Interest Income & Net Interest Margin

($ in millions) |

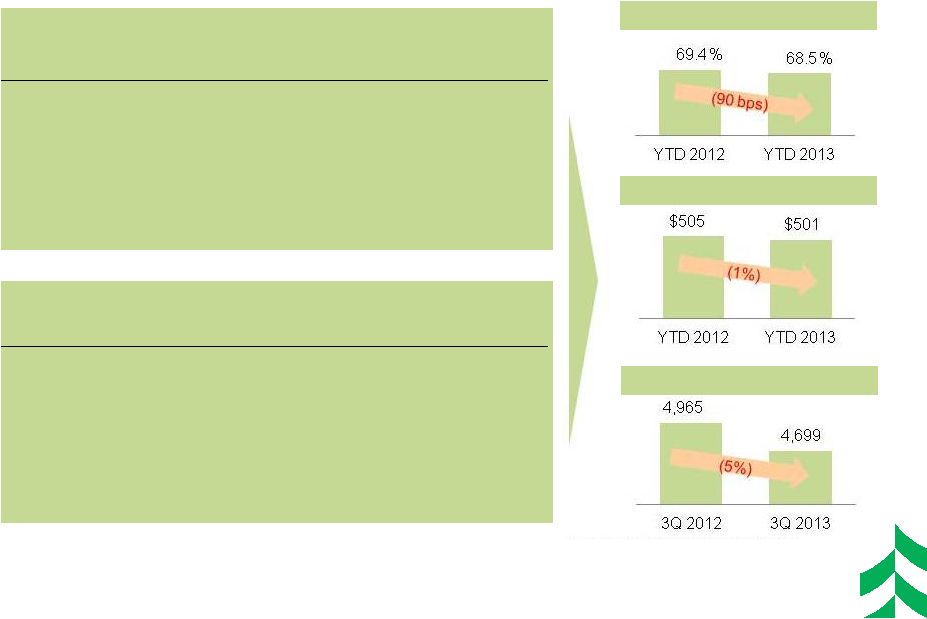

NONINTEREST INCOME AND EXPENSE

5

FTE

2

Trend

1

–

Efficiency ratio =

Noninterest

expense,

excluding

amortization

of

intangibles,

divided

by

sum

of

taxable

equivalent

net

interest

income

plus

noninterest

income,

excluding

investment

securities

gains,

net,

and

asset

gains,

net.

This

is

a

non-GAAP

financial

measure. Please refer to the appendix and our press release tables for a

reconciliation of this and other non-GAAP items. 2

–

FTE

= Full Time Equivalent Employees

Noninterest Income -

$71 mm in 3Q, down $13 mm from 2Q

Mortgage

Banking

•

Lower gains and volumes

Insurance

Revenue

•

Normalized revenue

compared to prior quarter

Asset Gain/Loss

•

Sale of real estate

Noninterest Expense -

$164 mm in 3Q, down $6 mm from 2Q

Personnel

Expense

Losses other

than Loans

•

Favorable resolution of

legal matter

Legal & Prof.

Fees

•

BSA consultant expense

ending

•

FTE reductions

Efficiency Ratio

1

Trend

3Q Var

Key Driver(s)

3Q Var

Key Driver(s)

($16 mm)

$2 mm

$2 mm

$2 mm

$2 mm

$3 mm

Expense Trend ($ in mm) |

IMPROVEMENT IN CREDIT QUALITY INDICATORS

($ IN MILLIONS)

6 |

STRONG

CAPITAL PROFILE & SUSTAINED EARNINGS

•

Current capital levels are well in excess

of “well-capitalized”

regulatory

benchmarks

–

Existing capital levels are already

above Basel III capital levels

7

Tier 1 Common Equity Ratio

Net Income Available to Common & ROT1CE

Net Income Available

to Common

($ in millions)

Return on Tier 1

Common Equity |

FOCUS ON

EFFICIENCY INITIATIVES 8

Support Service

Consolidation

Branch

Optimization

•

Consolidating several support functions from La Crosse into

more central locations

•

Streamlining consumer and mortgage loan processing operations

in reaction to current and anticipated loan demand slowdown

•

Consolidating 8 additional branches in Wisconsin and Illinois

•

Distribution optimization based on branch locations, transaction

trends, strategic fit, and branch profitability and RAROC analysis

•

Customer usage patterns and preferences are evolving

On October 10, we announced actions to refine our presence within our footprint,

gain efficiencies, and position ourselves for the future.

|

RECONCILIATION AND DEFINITIONS OF

NON-GAAP ITEMS

9

YTD 2013

YTD 2012

3Q 2013

2Q 2013

1Q 2013

4Q 2012

3Q 2012

Efficiency Ratio Reconciliation:

Efficiency ratio (1)

70.11%

72.65%

71.10%

69.54%

69.74%

73.71%

72.81%

Taxable equivalent adjustment

(1.44)

(1.62)

(1.49)

(1.39)

(1.46)

(1.57)

(1.61)

Asset gains (losses), net

0.26

(1.16)

0.58

(0.01)

0.24

(0.06)

(0.98)

Other intangible amortization

(0.42)

(0.44)

(0.44)

(0.41)

(0.42)

(0.43)

(0.43)

Efficiency ratio, fully taxable equivalent (1)

68.51%

69.43%

69.75%

67.73%

68.10%

71.65%

69.79%

(1)

Efficiency

ratio

is

defined

by

the

Federal

Reserve

guidance

as

noninterest

expense

divided

by

the

sum

of

net

interest

income

plus

noninterest

income,

excluding

investment

securities

gains

/

losses,

net.

Efficiency

ratio,

fully

taxable

equivalent,

is

noninterest

expense,

excluding

other

intangible

amortization,

divided

by

the

sum

of

taxable

equivalent

net

interest

income

plus

noninterest

income,

excluding

investment

securities

gains

/

losses,

net

and

asset

gains

/

losses,

net.

This

efficiency

ratio

is

presented

on

a

taxable

equivalent

basis,

which

adjusts

net

interest

income

for

the

tax-favored

status

of

certain

loans

and

investment

securities.

Management

believes

this

measure

to

be

the

preferred

industry

measurement

of

net

interest

income

as

it

enhances

the

comparability

of

net

interest

income

arising

from

taxable

and

tax-exempt

sources

and it

excludes

certain

specific

revenue

items

(such

as

investment

securities

gains

/

losses,

net

and

asset

gains

/

losses,

net).

Definition

of

Tier

1

Common

Equity:

Common

Equity

Tier

1

(CET1),

a

non-GAAP

financial

measure,

is

used

by

banking

regulators,

investors

and

analysts

to

assess

and

compare

the

quality

and

composition

of

our

capital

with

the

capital

of

other

financial

services

companies.

Management

uses

Tier

1

common

equity,

along

with

other

capital

measures,

to

assess

and

monitor

our

capital

position.

Common

Equity

Tier

1

is

Tier

1

capital

excluding

qualifying

perpetual

preferred

stock

and

qualifying

trust

preferred

securities. |