Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d605302d8k.htm |

| EX-99.1 - EX-99.1 - PNC FINANCIAL SERVICES GROUP, INC. | d605302dex991.htm |

The PNC

Financial Services Group, Inc. Third Quarter 2013

Earnings Conference Call

October 16, 2013

Exhibit 99.2 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This

presentation

includes

“snapshot”

information

about

PNC

used

by

way

of

illustration.

It

is

not

intended

as

a

full

business

or

financial

review

and

should

be

viewed

in

the

context

of

all

of

the

information

made

available

by

PNC

in

its

SEC

filings.

The

presentation

also

contains

forward-looking

statements

regarding

our

outlook

for

earnings,

revenues,

expenses,

capital

levels

and

ratios,

liquidity

levels,

asset

levels,

asset

quality,

financial

position,

and

other

matters

regarding

or

affecting

PNC

and

its

future

business

and

operations.

Forward-looking

statements

are

necessarily

subject

to

numerous

assumptions,

risks

and

uncertainties,

which

change

over

time.

The

forward-looking

statements

in

this

presentation

are

qualified

by

the

factors

affecting

forward-looking

statements

identified

in

the

more

detailed

Cautionary

Statement

included

in

the

Appendix,

which

is

included

in

the

version

of

the

presentation

materials

posted

on

our

corporate

website

at

www.pnc.com/investorevents,

and

in

our

SEC

filings.

We

provide

greater

detail

regarding

these

as

well

as

other

factors

in

our

2012

Form

10-K

and

our

2013

Form

10-Qs,

including

in

the

Risk

Factors

and

Risk

Management

sections

and

in

the

Legal

Proceedings

and

Commitments

and

Guarantees

Notes

of

the

Notes

To

Consolidated

Financial

Statements

in

those

reports,

and

in

our

subsequent

SEC

filings.

Our

forward-looking

statements

may

also

be

subject

to

other

risks

and

uncertainties,

including

those

we

may

discuss

in

this

presentation

or

in

SEC

filings,

accessible

on

the

SEC’s

website

at

www.sec.gov

and

on

PNC’s

corporate

website

at

www.pnc.com/secfilings.

We

have

included

web

addresses

in

this

presentation

as

inactive

textual

references

only.

Information

on

those

websites

is

not

part

of

this

presentation.

Future

events

or

circumstances

may

change

our

outlook

and

may

also

affect

the

nature

of

the

assumptions,

risks

and

uncertainties

to

which

our

forward-looking

statements

are

subject.

Forward-looking

statements

in

this

presentation

speak

only

as

of

the

date

of

this

presentation.

We

do

not

assume

any

duty

and

do

not

undertake

to

update

those

statements.

Actual

results

or

future

events

could

differ,

possibly

materially,

from

those

anticipated

in

forward-looking

statements,

as

well

as

from

historical

performance.

In

this

presentation,

we

may

sometimes

refer

to

adjusted

results

to

help

illustrate

the

impact

of

certain

types

of

items,

such

as

provisions

for

residential

mortgage

repurchase

obligations,

gains

on

sales

of

a

portion

of

our

VISA

shares,

non-cash

charges

related

to

redemptions

of

trust

preferred

securities,

expenses

for

residential

mortgage

foreclosure-related

matters,

and

integration

costs.

This

information

supplements

our

results

as

reported

in

accordance

with

GAAP

and

should

not

be

viewed

in

isolation

from,

or

as

a

substitute

for,

our

GAAP

results.

We

believe

that

this

additional

information

and

the

reconciliations

we

provide

may

be

useful

to

investors,

analysts,

regulators

and

others

to

help

evaluate

the

impact

of

these

respective

items

on

our

operations.

We

may

also

provide

information

on

the

components

of

net

interest

income

(purchase

accounting

accretion

and

the

core

remainder),

on

the

impact

of

purchase

accounting

accretion

on

net

interest

margin,

core

net

interest

margin

(net

interest

margin

less

(annualized

purchase

accounting

accretion

divided

by

average

interest-earning

assets)),

on

pretax

pre-provision

earnings

(total

revenue

less

noninterest

expense),

and

on

tangible

book

value

per

share

(calculated

as

book

value

per

share

less

total

intangible

assets,

other

than

servicing

rights,

per

share).

Where

applicable,

we

provide

GAAP

reconciliations

for

such

additional

information,

including

in

the

slides,

the

Appendix

and/or

other

slides

and

materials

on

our

corporate

website

at

www.pnc.com/investorevents

and

in

our

SEC

filings.

In

certain

discussions,

we

may

also

provide

information

on

yields

and

margins

for

all

interest-earning

assets

calculated

using

net

interest

income

on

a

taxable-equivalent

basis

by

increasing

the

interest

income

earned

on

tax-exempt

assets

to

make

it

fully

equivalent

to

interest

income

earned

on

taxable

investments.

We

believe

this

adjustment

may

be

useful

when

comparing

yields

and

margins

for

all

earning

assets.

We

may

also

use

annualized,

proforma,

estimated

or

third

party

numbers

for

illustrative

or

comparative

purposes

only.

These

may

not

reflect

actual

results.

This presentation may also include discussion of other non-GAAP financial measures, which,

to the extent not so qualified therein or in the Appendix, is qualified by GAAP

reconciliation information available on our corporate website at www.pnc.com under “About PNC–Investor Relations.” |

3

3Q13 Highlights

Financial performance: Net income of $1.0 billion; Diluted EPS

of $1.79; ROAA of 1.36%

Stronger capital position

Grew commercial and consumer loans

Maintained expense discipline

Continued improvement in overall credit quality

Demonstrated progress on strategic priorities

YTD performance highlights

PNC Is Well-Positioned to Continue to Create Shareholder Value.

|

4

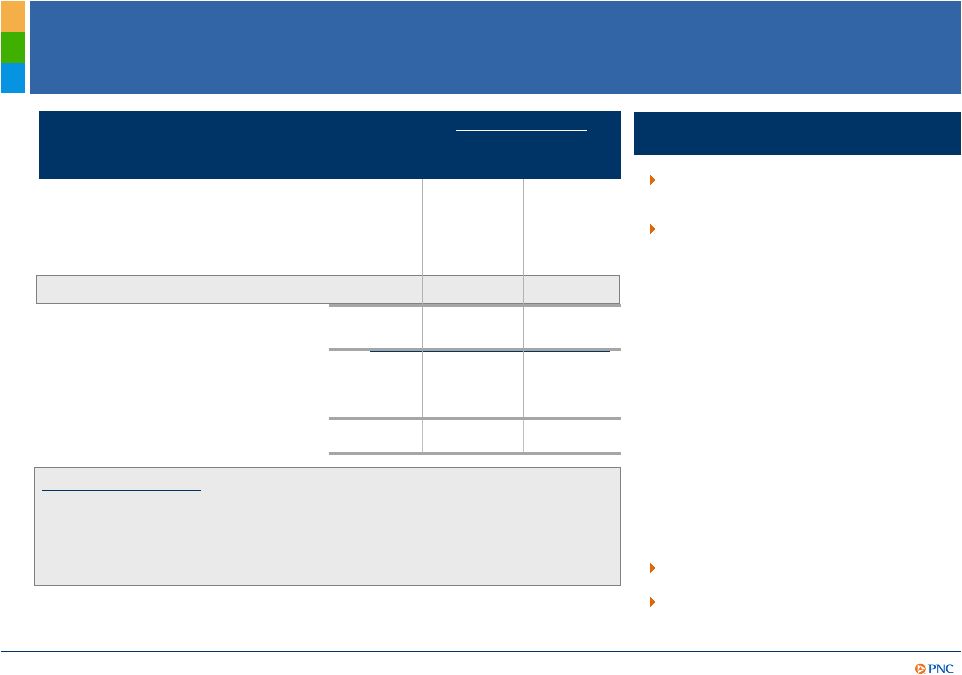

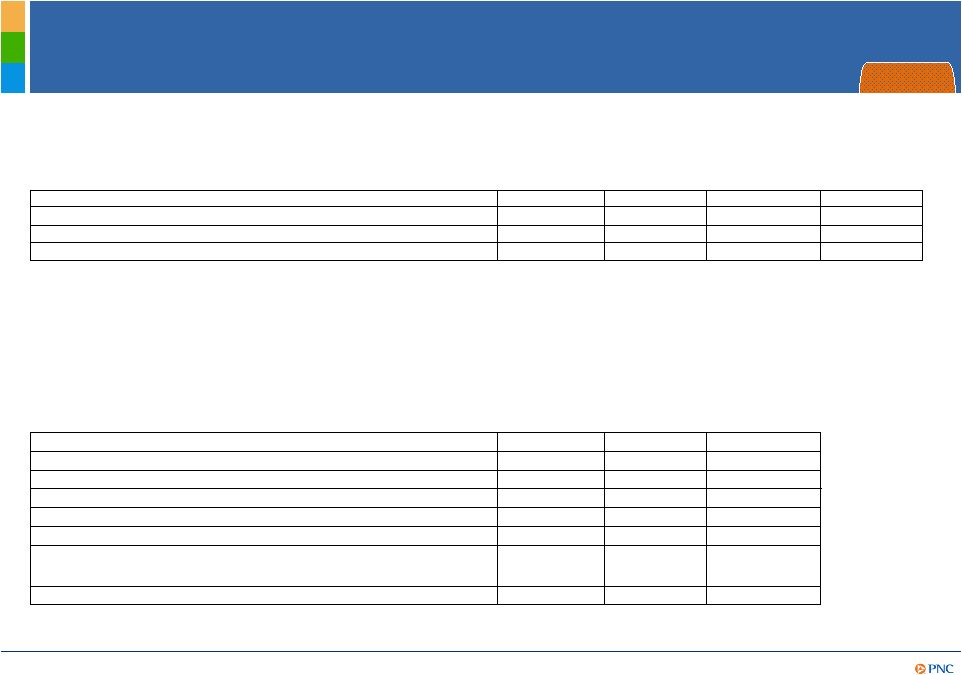

Continued Loan Growth and Capital Improvement

Investment securities stable

from end of 2Q13

Loans

increased $3.1 billion

within commercial and

consumer lending

Total deposits grew $3.8 billion

Stronger capital position

(1)

Estimated as of September 30, 2013. (2)

See Note A in the Appendix for further details. (3) PNC’s pro forma Basel III Tier 1

common capital ratio was estimated without benefit of phase-ins. See

Estimated Pro forma Basel III Tier 1 Common Capital and related information in the

Appendix for further details. (4) Pro forma Basel III Tier 1 common capital ratio estimate not

provided in 3Q12. Linked quarter highlights

% change from:

Category (billions)

Sep. 30,

2013

Jun. 30,

2013

Sep. 30,

2012

Investment securities

$57

(0.3%)

(8.8%)

Total commercial lending

$114

1.0%

8.8%

Total consumer lending

79

2.5%

2.3%

Total loans

$193

1.6%

6.0%

Total assets

$309

1.4%

2.6%

Transaction deposits

182

3.5%

8.0%

Total deposits

$216

1.8%

4.8%

Total shareholders’

equity

$41

2.1%

6.3%

Capital ratios

(1)

:

Basel I Tier 1 common capital

ratio

(2)

10.4%

10.1%

9.5%

Pro forma Basel III Tier 1

common capital ratio

(3)

8.6%

8.2%

*

(4)

Balances at period-end

–

Commercial lending

increased $1.2 billion

largely as a result of

commercial real estate and

to a lesser extent other

specialty lending businesses

–

Consumer lending grew

$1.9 billion primarily due to

automobile, home equity,

credit cards and purchased

residential real estate loans

partially offset by paydowns

of education loans |

5

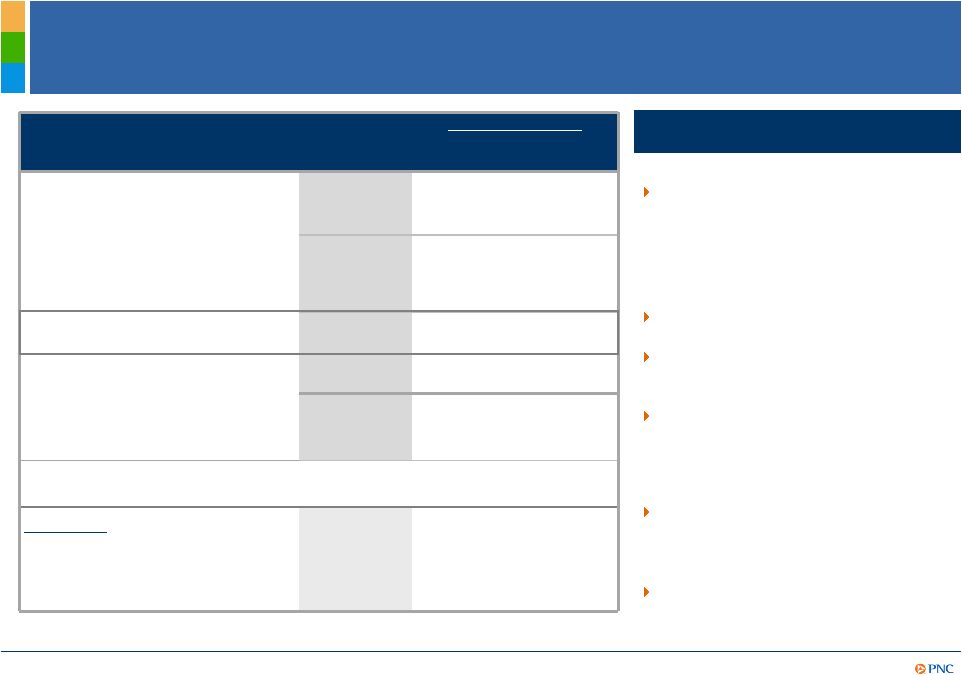

Lower Revenues and Improved Credit Quality

Impacted Profitability and Returns

Highlights

Revenue declined 4% driven by:

Decline in expense reflected

focused expense management

Pretax pre-provision earnings

(1)

decreased 8% primarily due to

lower noninterest income

Credit costs declined as overall

credit trends continued to

improve, but at a slower pace

$ change from:

(millions)

3Q13

2Q13

3Q12

Net interest income

$2,234

($24)

($165)

Noninterest income

1,686

(120)

(3)

Total revenue

$3,920

($144)

($168)

Noninterest expense

($2,424)

$11

$226

Pretax pre-provision

earnings

(1)

$1,496

($133)

$58

Provision

(137)

20

91

Pretax earnings

(2)

1,359

(113)

149

Net income

$1,039

($84)

$114

Returns

ROAA

(3)

1.36%

1.49%

1.23%

ROACE

(3)

10.50%

11.81%

10.15%

(1),(2),(3) See Notes B, C and D respectively in the Appendix for additional details. (4) See

Reconcilement section of the Appendix. YTD:

Pretax pre-provision earnings

(1)(4)

increased 27% primarily due to

noninterest income growth of 20%

and expense decline of 6%

ROAA and ROACE increased to

1.40% and 11.00%

Linked

quarter:

–

Decline in NII

–

Lower noninterest income

primarily due to impact of

higher asset sales and

valuations in 2Q13 |

6

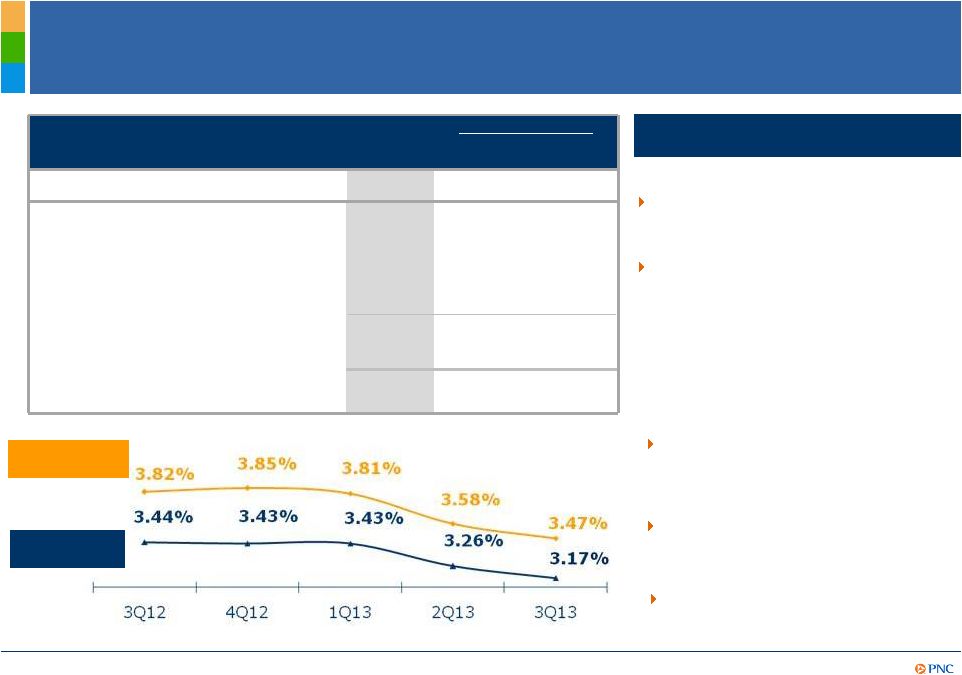

Net Interest Income Highlights

(1) Core net interest income (Core NII) is total net interest income (NII), as reported, less

related purchase accounting accretion (scheduled and excess cash recoveries). (2) See

Note E in Appendix for further details. (3) Net interest margin less (annualized

PAA/average interest-earning assets). See Reconcilement in Appendix.

Core NII

(1)

$2,035

($19)

($119)

Scheduled accretion

173

(20)

(51)

Excess cash recoveries

(2)

26

15

5

Total purchase accounting

accretion (PAA)

199

(5)

(46)

Total NII

$2,234

($24)

($165)

Highlights

Linked quarter:

Prior year quarter:

Average interest-earning assets

increased

1.4% primarily due to

average loan growth of 1.0%

NII decline of 1%

Average interest-earning assets

growth

of 3% driven by average

loan growth of 5% offset by decline

in investment securities balances

Core NII

(1)

decreased primarily due

to decline in asset yields

NII declined 5% primarily due to

lower yields and declining PAA

YTD:

$ change from:

(billions)

3Q13

2Q13

3Q12

Average interest-earning assets

$260

$4

$7

Net interest

Margin(NIM)

Core NIM

(3)

(millions)

–

Further spread compression

partially offset by loan growth

–

Lower scheduled accretion

partially offset by higher excess

cash recoveries on purchased

impaired loans |

7

Diversified Businesses Drove Fee Income

Highlights

(1) Asset management includes the Asset Management Group and BlackRock. (2) Commercial

mortgage servicing rights valuation adjustments, net of economic hedge (CMSR) and

credit valuations related to customer-initiated hedging activities (CVA). (3) See

Reconcilement section of the Appendix.

Noninterest income decreased 7%

primarily due to:

Fee income grew 1% primarily driven by

Deposit and Consumer services as well

as improvement in residential mortgage

repurchase obligations provision and

higher net hedging gains on RMSR

Noninterest income to total revenue of

43%

Linked quarter:

$ change from:

(millions)

3Q13

2Q13

3Q12

Asset management

(1)

$330

($10)

$25

Consumer services

316

2

28

Corporate services

306

(20)

11

Residential mortgage

199

32

(28)

Deposit service charges

156

9

4

Fee income

$1,307

$13

$40

Net gains on sales of securities

less net OTTI

19

(38)

3

Gain on VISA sales

85

2

(52)

Other

275

(97)

6

Total noninterest income

$1,686

($120)

($3)

Prior Year Quarter:

Stable noninterest income largely

reflects strong fee income growth

including lower provision for

residential mortgage repurchase

obligations

YTD:

Fee income increased 19% or 5%

excluding provision for residential

mortgage

repurchase

obligations

(3)

–

Impact of higher asset sales and

valuations

(2)

in 2Q13

–

Decline in residential mortgage

loan sales revenue |

8

Disciplined Expense Management While Investing for

Growth

$ change from:

(millions)

3Q13

2Q13

3Q12

Adjusted for specified items

(1)

:

Personnel

$1,181

($5)

$8

Occupancy

205

(1)

(2)

Equipment

194

5

10

Marketing

68

1

6

Other

728

(26)

(113)

Noninterest expense, adjusted

for TPS charges and Other

specified items

(1)

$2,376

($26)

($91)

Trust preferred securities

redemption-related charges

27

(3)

(68)

Other specified items

21

18

(67)

Total noninterest expense

$2,424

($11)

($226)

Efficiency ratio

(3)

62%

60%

65%

Efficiency ratio, adjusted

(3,4)

61%

59%

62%

Noninterest expense decline

reflects continued focus on

expense management

Achieved $700 million

CIP

(2)

target

Highlights

Linked quarter:

(1)

Specified

items

are

trust

preferred

securities

redemption-related

charges

and

Other

specified

items.

Other

specified

items

are

residential

mortgage

foreclosure-related

matters

and

integration

costs.

See

Reconcilement

section

of

the

Appendix

for

impact

of

each

specified

item

on

each

category

of

noninterest

expense,

where

applicable.

(2)

CIP

refers

to

PNC’s

Continuous

Improvement

Program.

(3)

See

Note

F

in

the

Appendix.

(4)

Efficiency

ratio

adjusted

for

integration

costs

and

trust

preferred

securities

redemption-related

charges

in

each

quarter

where

applicable.

See

Reconcilement

section

of

the

Appendix.

Prior Year Quarter:

Noninterest expense decline of

9% largely reflects lower trust

preferred securities redemption

charges, lower integration costs

and the benefit of our continuous

improvement efforts

YTD:

Noninterest expense down 6% |

9

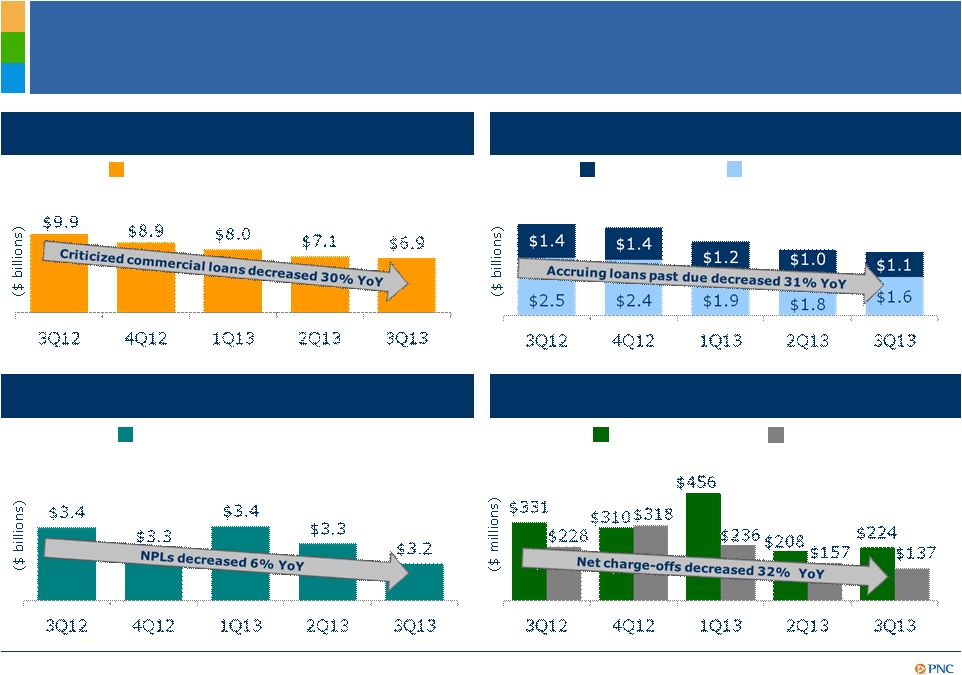

Overall Credit Quality Continued to Improve

Nonperforming

loans

(2,4)

Provision and net charge-offs

Criticized commercial loans

30-89 Days

90 Days +

Accruing

loans

past

due

(2,3)

As

of

quarter

end

except

net

charge-offs

and

provision,

which

are

for

the

quarter.

(1)

Criticized

loans

are

ones

that

we

consider

“special

mention,”

“substandard’”

or

“doubtful”.

(2)

Loans

acquired

from

National

City

or

RBC

Bank

(USA)

that

were

impaired

are

not

included

as

they

were

recorded

at

estimated

fair

value

when

acquired

and

are

currently

considered

performing

loans

due

to

the

accretion

of

interest

in

purchase

accounting.

(3)

Includes

loans

that

are

government

guaranteed/insured,

primarily

residential

mortgages.

These

loans

totaled

$2.0

billion

in

3Q13.

(4)

Does

not

include

loans

held

for

sale

or

foreclosed

and

other

assets.

Excludes

certain

government

insured

or

guaranteed

loans

and

loans

accounted

for

under

the

fair

value

option.

Criticized

Commercial

loans

(1)

Total nonperforming loans

Provision

Net charge-offs |

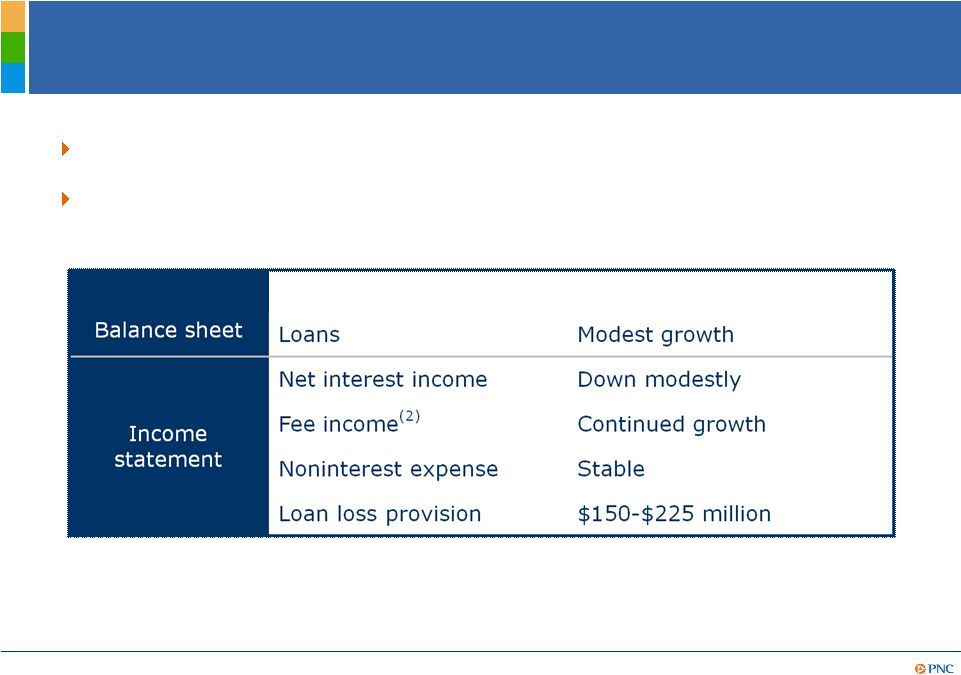

10

Outlook

(1)

–

4Q13 vs. 3Q13

(1)

Refer

to

Cautionary

Statement

in

the

Appendix,

including

economic

and

other

assumptions.

Does

not

take

into

account

impact

of

potential

legal

and

regulatory

contingencies

or

the

potential

impacts

of

the

Congress

failing

to

timely

raise

the

Federal

debt

ceiling.

(2)

Fee

income

refers

to

Noninterest

income

in

the

following

categories:

asset

management,

consumer

services,

corporate

services,

residential

mortgage,

and

service

charges

on

deposits.

Revenue to increase in 2013 compared to 2012

Expectation for 4Q13 vs. 3Q13: |

11

Cautionary Statement Regarding Forward-Looking

Information

Appendix

This

presentation

includes

“snapshot”

information

about

PNC

used

by

way

of

illustration

and

is

not

intended

as

a

full

business

or

financial

review.

It

should

not

be viewed

in

isolation

but

rather

in

the

context

of

all

of

the

information

made

available

by

PNC

in

its

SEC

filings.

We

also

make

statements

in

this

presentation,

and

we

may

from

time

to

time

make

other

statements,

regarding

our

outlook

for

earnings,

revenues,

expenses,

capital

levels

and

ratios,

liquidity

levels,

asset

levels,

asset

quality,

financial

position,

and

other

matters

regarding

or

affecting

PNC

and

its

future

business

and

operations

that

are

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act.

Forward-looking

statements

are

typically

identified

by

words

such

as

“believe,”

“plan,”

“expect,”

“anticipate,”

“see,”

“look,”

“intend,”

“outlook,”

“project,”

“forecast,”

“estimate,”

“goal,”

“will,”

“should”

and

other

similar words

and

expressions.

Forward-looking

statements

are

subject

to

numerous

assumptions,

risks

and

uncertainties,

which

change

over

time.

Forward-looking

statements

speak

only

as

of

the

date

made.

We

do

not

assume

any

duty

and

do

not

undertake

to

update

forward-looking

statements.

Actual

results

or

future

events

could

differ,

possibly

materially,

from

those

anticipated

in

forward-looking

statements,

as

well

as

from

historical

performance.

Our forward-looking statements are subject to the following principal risks and

uncertainties. •Our businesses, financial results and balance sheet

values are affected by business and economic conditions, including the following:

•Changes in interest rates and valuations in debt, equity and other financial

markets. •Disruptions in the liquidity and other functioning of U.S. and

global financial markets. •The

impact

on

financial

markets

and

the

economy

of

any

changes

in

the

credit

ratings

of

U.S.

Treasury

obligations

and

other

U.S.

government-backed

debt,

as

well

as

issues

surrounding

the

level

of

U.S.

and

European

government

debt

and

concerns

regarding

the

creditworthiness

of

certain

sovereign

governments,

supranationals

and

financial

institutions

in

Europe.

•Actions

by

the

Federal

Reserve,

U.S.

Treasury

and

other

government

agencies,

including

those

that

impact

money

supply

and

market

interest

rates.

•Changes in customers’, suppliers’

and other counterparties’

performance and creditworthiness.

•Slowing or reversal of the current moderate U.S. economic expansion.

•Continued effects of aftermath of recessionary conditions and uneven spread

of positive impacts of recovery on the economy and our counterparties, including

adverse impacts on levels of unemployment, loan utilization rates, delinquencies,

defaults and counterparty ability to meet credit and other obligations.

•Changes in customer preferences and behavior, whether due to changing

business and economic conditions, legislative and regulatory initiatives, or other

factors.

•Our

forward-looking

financial

statements

are

subject

to

the

risk

that

economic

and

financial

market

conditions

will

be

substantially

different

than

we

are

currently

expecting.

These

statements

are

based

on

our

current

view

that

the

moderate

U.S.

economic

expansion

will

persist,

despite

drags

from

Federal

fiscal

restraint,

the partial

Federal

government

shutdown

will

not

continue

for

an

extended

period

of

time,

and

short-term

interest

rates

will

remain

very

low

but

bond

yields

will

remain elevated

in

the

second

half

of

2013.

These

forward-looking

statements

also

do

not,

unless

otherwise

indicated,

take

into

account

the

impact

of

potential

legal

and

regulatory

contingencies

or

the

potential

impacts

of

the

Congress

failing

to

timely

raise

the

Federal

debt

ceiling. |

12

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•PNC’s ability to take certain capital actions, including paying dividends and any plans to increase common stock dividends,

repurchase common stock under

current or future programs, or issue or redeem preferred stock or other regulatory capital instruments, is subject to

the review of such proposed actions by the Federal Reserve as part of PNC’s comprehensive

capital plan for the applicable period in connection

with

the

regulators’

Comprehensive

Capital

Analysis

and

Review

(CCAR)

process

and

to

the

acceptance

of

such

capital

plan

and

non-objection to such capital actions by the Federal Reserve

•PNC’s regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms

of final capital regulations then in effect (particularly those implementing the Basel Capital

Accords), and management actions affecting the composition

of

PNC’s

balance

sheet.

In

addition,

PNC’s

ability

to

determine,

evaluate

and

forecast

regulatory

capital

ratios,

and

to

take

actions (such as capital distributions) based on actual or forecasted capital ratios, will be

dependent on the ongoing development, validation and regulatory approval of related

models. •Legal

and

regulatory

developments

could

have

an

impact

on

our

ability

to

operate

our

businesses,

financial

condition,

results

of

operations,

competitive

position,

reputation,

or

pursuit

of

attractive

acquisition

opportunities.

Reputational

impacts

could

affect

matters

such

as

business

generation

and

retention,

liquidity,

funding,

and

ability

to

attract

and

retain

management.

These

developments

could

include:

•Changes resulting from legislative and

regulatory reforms, including major reform of the regulatory oversight structure of the

financial services industry and changes to laws and regulations involving tax, pension,

bankruptcy, consumer protection, and other industry aspects, and changes in accounting

policies and principles. We will be impacted by extensive reforms provided for in the

Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank

Act”) and otherwise growing out of the recent financial crisis, the precise

nature, extent and timing of which, and their impact on us, remains uncertain.

•Changes to regulations governing bank

capital and liquidity standards, including due to the Dodd-Frank Act and to Basel-related

initiatives.

•Unfavorable resolution of legal

proceedings or other claims and regulatory and other governmental investigations or other inquiries.

In

addition

to

matters

relating

to

PNC’s

business

and

activities,

such

matters

may

include

proceedings,

claims,

investigations,

or

inquiries relating to pre-acquisition business and activities of acquired companies, such

as National City. These matters may result in monetary judgments or settlements

or other remedies, including fines, penalties, restitution or alterations in our business

practices, and in additional expenses and collateral costs, and may cause reputational harm to

PNC. •Results of the regulatory

examination and supervision process, including our failure to satisfy requirements of agreements with

governmental agencies.

•Impact

on

business

and

operating

results

of

any

costs

associated

with

obtaining

rights

in

intellectual

property

claimed

by

others

and of adequacy of our intellectual property protection in general.

|

13

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•Business and operating results are affected by our ability to identify and effectively

manage risks inherent in our businesses, including, where

appropriate,

through

effective

use

of

third-party

insurance,

derivatives,

and

capital

management

techniques,

and

to

meet

evolving

regulatory capital standards. In particular, our results currently depend on our ability

to manage elevated levels of impaired assets. •Business

and

operating

results

also

include

impacts

relating

to

our

equity

interest

in

BlackRock,

Inc.

and

rely

to

a

significant

extent

on

information provided to us by BlackRock. Risks and uncertainties that could affect

BlackRock are discussed in more detail by BlackRock in its SEC filings.

•We grow our business in part by acquiring from time to time other financial services

companies, financial services assets and related deposits and other liabilities.

Acquisition risks and uncertainties include those presented by the nature of the business acquired, including

in some cases those associated with our entry into new businesses or new geographic or other

markets and risks resulting from our inexperience in those new areas, as well as risks

and uncertainties related to the acquisition transactions themselves, regulatory issues, and

the integration of the acquired businesses into PNC after closing.

•Competition can have an impact on customer acquisition, growth and retention and on

credit spreads and product pricing, which can affect market share, deposits and

revenues. Industry restructuring in the current environment could also impact our business and financial

performance

through

changes

in

counterparty

creditworthiness

and

performance

and

in

the

competitive

and

regulatory

landscape.

Our

ability to anticipate and respond to technological changes can also impact our ability to

respond to customer needs and meet competitive demands.

•Business and operating results can also be affected by widespread natural and other

disasters, dislocations, terrorist activities or international hostilities through

impacts on the economy and financial markets generally or on us or our counterparties specifically.

We provide greater detail regarding these as well as other factors in our 2012 Form 10-K

and our first and second quarter 2013 Form 10- Qs,

including

in

the

Risk

Factors

and

Risk

Management

sections

and

the

Legal

Proceedings

and

Commitments

and

Guarantees

Notes

of

the

Notes

To

Consolidated

Financial

Statements

in

those

reports,

and

in

our

subsequent

SEC

filings.

Our

forward-looking

statements

may

also

be subject to other risks and uncertainties, including those we may discuss elsewhere in this

presentation or in SEC filings, accessible on the SEC’s website at www.sec.gov and

on our corporate website at www.pnc.com/secfilings. We have included these web addresses as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this

document.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are

used for illustrative or comparative purposes

only

and

may

not

reflect

actual

results.

Any

consensus

earnings

estimates

are

calculated

based

on

the

earnings

projections

made

by analysts who cover that company. The analysts’

opinions, estimates or forecasts (and therefore the consensus earnings estimates) are

theirs alone, are not those of PNC or its management, and may not reflect PNC’s or other

company’s actual or anticipated results. |

14

Notes

Appendix

Explanatory Notes

(A) Basel I Tier 1 common capital ratio is period-end Basel I Tier 1 common capital

divided by period-end Basel I risk-weighted assets.

(E) Excess cash recoveries represent cash payments from customers that exceeded the recorded

investment of the designated impaired loans.

(C) Pretax earnings is income before income taxes and noncontrolling interests.

(F) Efficiency ratio calculated as noninterest expense divided by total revenue.

(B) Pretax pre-provision earnings is defined as total revenue less noninterest expense. We

believe that pretax pre-provision earnings, a non-GAAP measure, is useful as a

tool to help evaluate the ability to provide for credit costs through operations. (D)

ROAA is Return on Average Assets and ROACE is Return on Average Common Shareholders' Equity. |

15

Estimated Pro forma Basel III Tier I Common Capital

Appendix

Basel I Tier 1 Common Capital Ratio

Dollars in millions

Sept. 30, 2013 (a)

June 30, 2013

December 31, 2012

Sept. 30, 2012

Basel I Tier 1 common capital

$27,543

$26,668

$24,951

$24,382

Basel I risk-weighted assets

265,708

264,750

260,847

257,297

Basel I Tier 1 common capital ratio

10.4%

10.1%

9.6%

9.5%

(a) Estimated as of September 30, 2013.

Estimated Pro forma Basel III Tier 1 Common Capital Ratio (b)

Dollars in millions

Sept. 30, 2013

June 30, 2013

December 31, 2012

Basel I Tier 1 common capital

$27,543

$26,668

$24,951

Less regulatory capital adjustments:

Basel III quantitative limits

(2,049)

(2,224)

(2,330)

Accumulated other comprehensive income (a)

(231)

(241)

276

All other adjustments

(274)

(283)

(396)

Estimated Basel III Tier 1 common capital

$24,989

$23,920

$22,501

Estimated Basel III risk-weighted assets

289,695

290,838

301,006

Pro forma Basel III Tier 1 common capital ratio

8.6%

8.2%

7.5%

(a) Represents net adjustments related to accumulated other comprehensive income for available

for sale securities and pension and other postretirement benefit plans. (b) Pro forma

Basel III Tier 1 common capital ratio estimate not provided in 3Q12. We provide

information below regarding PNC’s pro forma fully phased-in Basel III Tier 1 common capital ratio and how it differs from the Basel I

Tier 1 common capital ratio. This Basel III ratio, which is calculated using PNC's estimated

risk-weighted assets under the Basel III advanced approaches, will replace the

current Basel I ratio for this regulatory metric when PNC exits the parallel run qualification phase. The Federal

Reserve Board announced final rules implementing Basel III on July 2, 2013. Our estimate of

Basel III capital information set forth below is based on our understanding of the

final Basel III rules. Tier 1 common capital as defined under the Basel III rules

differs materially from Basel I. For example, under Basel III, significant common stock

investments in unconsolidated financial institutions, mortgage servicing rights and deferred tax assets must be deducted from capital to the

extent they individually exceed 10%, or in the aggregate exceed 15%, of the institution's

adjusted Tier 1 common capital. Also, Basel I regulatory capital excludes certain other

comprehensive income related to both available for sale securities and pension and other

postretirement plans, whereas under Basel III these items are a component of PNC's capital.

Basel III risk-weighted assets were estimated under the advanced approaches

included in the Basel III rules and application of Basel II.5, and reflect credit, market and operational risk.

PNC utilizes this capital ratio estimate to assess its Basel III capital position (without the

benefit of phase-ins), including comparison to similar estimates made by other

financial institutions. This Basel III capital estimate is likely to be impacted by any additional regulatory guidance,

continued analysis by PNC as to the application of the rules to PNC, and the ongoing

evolution, validation and regulatory approval of PNC's models integral to the

calculation of advanced approaches risk-weighted assets. |

16

Non-GAAP to GAAP Reconcilement

Appendix

$ in millions

Sept. 30, 2013

Jun. 30, 2013

Mar. 31, 2013

Dec. 31, 2012

Sep. 30, 2012

Net interest margin, as reported

3.47%

3.58%

3.81%

3.85%

3.82%

Purchase accounting accretion (1)

$199

$204

$249

$273

$245

Purchase accounting accretion, if annualized

$790

$818

$1,010

$1,086

$975

Avg. interest earning assets

$259,606

$256,102

$256,180

$253,643

$252,606

Annualized purchase accounting accretion/Avg. interest-earning assets

0.30%

0.32%

0.38%

0.42%

0.38%

Core net interest margin (2)

3.17%

3.26%

3.43%

3.43%

3.44%

For the three months ended

(1) Purchase accounting accretion is scheduled purchase accounting accretion plus cash

recoveries. (2)

PNC

believes

that

core

net

interest

margin,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

impact

of

purchase

accounting

accretion

on

net interest margin. The adjustment represents annualized purchase accounting accretion

divided by average interest-earning assets. $ in millions

Sept. 30, 2013

Sept. 30, 2012

% Change

Net interest income

$6,881

$7,216

-5%

Noninterest income

$5,058

$4,227

20%

Total revenue

$11,939

$11,443

4%

Noninterest expense

($7,254)

($7,753)

-6%

Pretax pre-provision earnings (1)

$4,685

$3,690

27%

Net income

$3,166

$2,282

39%

(1) PNC believes that pretax, pre-provision earnings, a non-GAAP measure, is useful as

a tool to help evaluate the ability to provide for credit costs

through operations. For

the nine months ended |

17

Non-GAAP to GAAP Reconcilement

Appendix

$ in millions

Sept. 30, 2013

Jun. 30, 2013

Sept. 30, 2012

Total revenue, as reported

$3,920

$4,064

$4,088

Total noninterest expense, as reported

$2,424

$2,435

$2,650

Efficiency ratio, as reported

62%

60%

65%

Total revenue, as reported

$3,920

$4,064

$4,088

Total noninterest expense, as reported

$2,424

$2,435

$2,650

Adjustments:

Integration costs

-

-

(35)

Total noninterest expense, as adjusted

$2,397

$2,405

$2,520

Efficiency ratio, as adjusted

61%

59%

62%

* Efficiency ratio calculated as noninterest expense divided by total revenue

For the three months ended

Noncash charges for unamortized discounts related to

redemption of trust preferred securities

(27)

(30)

(95)

$ in millions

Sept. 30, 2013

Sept. 30, 2012

% change

Asset management

$978

$867

Consumer services

$926

$842

Corporate services

$909

$817

Residential mortgage

$600

$284

Deposit service charges

$439

$423

Total fee income, as reported

$3,852

$3,233

19%

Provision for residential mortgage repurchase obligations

($71)

($507)

Fee income, adjusted for provision for residential mortgage repurchase obligations

$3,923

$3,740

5%

For

the nine months ended |

18

Non-GAAP to GAAP Reconcilement

Appendix

In millions

Sept. 30, 2013

Jun. 30, 2013

Sept. 30, 2012

Personnel, as reported

$1,181

$1,186

$1,171

Integration costs

2

Personnel, as adjusted

$1,181

$1,186

$1,173

Occupancy, as reported

$205

$206

$212

Integration costs

(5)

Occupancy, as adjusted

$205

$206

$207

Equipment, as reported

$194

$189

$185

Integration costs

(1)

Equipment, as adjusted

$194

$189

$184

Marketing, as reported

$68

$67

$74

Integration costs

(12)

Marketing, as adjusted

$68

$67

$62

Other, as reported

$776

$787

$1,008

Residential mortgage foreclosure-related matters

(21)

(3)

(53)

TPS redemption-related charges

(27)

(30)

(95)

Integration costs

-

-

(19)

Other, as adjusted

$728

$754

$841

Noninterest expense, adjusted for specified items

$2,376

$2,402

$2,467

Specified items -

Total

48

33

183

Total noninterest expense

$2,424

$2,435

$2,650

For the quarter ended |