Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KEYCORP /NEW/ | d611847d8k.htm |

| EX-99.1 - EX-99.1 - KEYCORP /NEW/ | d611847dex991.htm |

| EX-99.3 - EX-99.3 - KEYCORP /NEW/ | d611847dex993.htm |

| KeyCorp

Third Quarter 2013 Earnings Review

October 16, 2013

Beth E. Mooney

Chairman and

Chief Executive Officer

Don Kimble

Chief Financial Officer

Exhibit 99.2 |

| 2

FORWARD-LOOKING STATEMENTS AND ADDITIONAL

INFORMATION DISCLOSURE

This presentation contains forward-looking statements, including statements

about our financial condition, results of operations, asset quality trends,

capital

levels

and

profitability.

Forward-looking

statements

can

often

be

identified

by

words

such

as

“outlook,”

“goal,”

“objective,”

“plan,”

“expect,”

“anticipate,”

“intend,”

“project,”

“believe,”

or “estimate.”

Forward-looking statements represent management’s current expectations

and forecasts regarding future events. If underlying assumptions prove to be

inaccurate or unknown risks or uncertainties arise, actual results could vary

materially from these projections or expectations. Risks and uncertainties

include but are not limited to: (1) continued strain on the global financial markets; (2) the slow progress of the U.S. economic

recovery; changes in trade, monetary and fiscal policies; (3) our ability to

anticipate interest rate changes correctly and manage interest rate risk; (4)

changes

in

local,

regional

and

international

business,

economic

or

political

conditions;

(5)

regulatory

initiatives

in

the

U.S.,

including

the

Dodd-Frank

Act, subjecting us to new and more stringent regulatory requirements; (6) the

increase in unemployment or deterioration in real estate asset values or

their failure to recover for an extended period of time; (7) adverse changes in

credit quality trends; (8) our ability to determine accurate values of

certain assets and liabilities; (9) adverse behaviors in securities, public debt,

and capital markets ; (10) unanticipated changes in our liquidity position,

including but not limited to, changes in the cost of liquidity, our ability to

enter the financial markets and to secure alternative funding sources; (11) the

soundness

of

other

financial

institutions;

(12)

our

ability

to

satisfy

new

capital

and

liquidity

standards

such

as

those

imposed

by

the

Dodd-Frank

Act

and

those

adopted

by

the

Basel

Committee;

(13)

our

ability

to

receive

dividends

from

our

subsidiary,

KeyBank;

(14)

downgrades

in

our

credit

ratings

and the credit ratings of KeyBank; (15) our ability to timely and effectively

implement our strategic initiatives; (16) operational or risk management

failures; breaches of security or failures of our technology systems due to

technological or other factors and cybersecurity threats; (17) the occurrence

of natural or man-made disasters or conflicts or terrorist attacks; (18) the

adequacy of our risk management programs; (19) adverse judicial

proceedings;

(20)

increased

competitive

pressure

due

to

industry

consolidation;

(21)

our

ability

to

attract

and

retain

talented

executives

and

employees, to effectively sell additional products or services to new or existing

customers, and to manage our reputational risks; and (22) unanticipated

adverse effects of acquisitions and dispositions of assets or businesses. We

provide greater detail regarding these factors in our 2012 Form 10-K and subsequent filings, which are available online at www.key.com/ir and

www.sec.gov. Forward looking statements speak only as of the date they are made and

Key does not undertake any obligation to update the forward- looking

statements to reflect new information or future events. This

presentation

also

includes

certain

Non-GAAP

financial

measures

related

to

“tangible

common

equity,”

“Tier

1

common

equity,”

“pre-provision

net

revenue,”

“cash efficiency ratio,”

and “adjusted cash efficiency ratio.”

Management believes these ratios may assist investors, analysts

and regulators

in analyzing Key’s financials. Although Key has procedures in place to ensure

that these measures are calculated using the appropriate GAAP or

regulatory

components,

they

have

limitations

as

analytical

tools

and

should

not

be

considered

in

isolation,

or

as

a

substitute

for

analysis

of

results

under GAAP. For more information on these calculations and to view the

reconciliations to the most comparable GAAP measures, please refer to the

Appendix to this presentation or our most recent earnings press release, which

is accessible at www.key.com/ir. |

3

Grew average loans 5% from the prior year, driven by CF&A up 11%

Linked quarter average total loans up 4.4% annualized

Increased investment banking & debt placement fees; 4 quarter

rolling average up 29%

from prior year Completed CRE servicing acquisition (now #3 primary, #5 CMBS

special servicer in the U.S.)

Achieved expense target, with $207 million in annualized savings

Incurred charges of $41 million during 3Q13 related to efficiency initiative

(incl. pension settlement)

Consolidated 8 branches in 3Q13; 65 total from launch of efficiency initiative

Improve

Efficiency

Repurchased $198 million of common shares during 3Q13

Completed Victory divestiture on July 31; after-tax net gain of $92 million in

discontinued operations

Committed to capital priorities: organic growth, dividends, repurchases,

opportunistic growth

Optimize and

Grow

Revenue

Investor Highlights –

3Q13

Execution of strategy and differentiated business model driving results

Effectively

Manage

Capital |

4

Financial Review |

5

Financial Highlights

TE = Taxable equivalent, EOP = End of Period

(a)

From continuing operations

(b)

Year-over-year average balance growth

(c)

From consolidated operations

(d)

9-30-13 ratios are estimated

(e)

Non-GAAP measure: see Appendix for reconciliation

(f)

Efficiency initiative charges include pension settlement in 3Q13

Metrics

3Q13

2Q13

1Q13

4Q12

3Q12

EPS –

assuming dilution

$ .25

$ .21

$ .21

$ .20

$ .22

Cash efficiency ratio

(e)

67.5

%

69.1

%

66.0

%

69.0

%

64.1

%

Adj. cash efficiency ratio (ex. initiative charges

)

63.6

65.4

64.5

67.5

63.3

Net interest margin (TE)

3.11

3.13

3.24

3.37

3.23

Return on average total assets

1.12

.95

.99

.96

1.06

Total loans and leases

5

%

7

%

6

%

7

%

6

%

CF&A loans

11

14

16

21

24

Deposits (excl. foreign deposits)

5

8

7

7

7

Tier 1 common equity

(d), (e)

11.1

%

11.2

%

11.4

%

11.4

%

11.3

%

Tier 1 risk-based capital

(d)

11.9

11.9

12.2

12.2

12.1

Tangible common equity to tangible assets

(e)

9.9

10.0

10.2

10.2

10.4

NCOs to average loans

.28

%

.34

%

.38

%

.44

%

.86

%

NPLs to EOP portfolio loans

1.01

1.23

1.24

1.28

1.27

Allowance for loan losses to EOP loans

1.62

1.65

1.70

1.68

1.73

Financial

Performance

(a)

Balance

Sheet

Growth

(a),

(b)

Capital

(c)

Asset

Quality

(a)

(e)

(f) |

6

3Q13 Significant Items

$ in millions, except per share amounts

Pre-tax

After-tax

EPS

(a)

Continuing operations

Leveraged lease terminations

(b)

$ 15

$ 15

$ .02

Net interest income: $(8) million; Net interest margin: (4) bps;

Noninterest income: $23 million

Efficiency initiative charges (incl. pension settlement)

$ (41)

$ (26)

$ (.03)

Total continuing operations

$ (26)

$ (11)

$ (.01)

Discontinued operations

Victory divestiture

$ 146

$ 92

$ .10

Education lending trust fair value adjustment

$ (77)

$ (48)

$ (.05)

Total discontinued operations

$ 69

$ 44

$ .05

(a)

EPS may not foot due to rounding

(b)

Excludes the total tax impact of leveraged lease terminations of $13

million, or $.01 per common share |

7

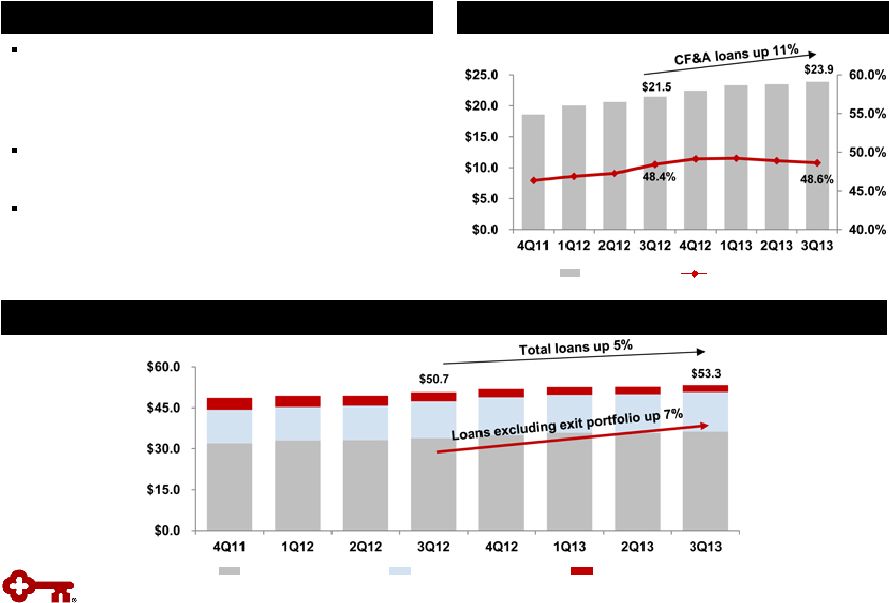

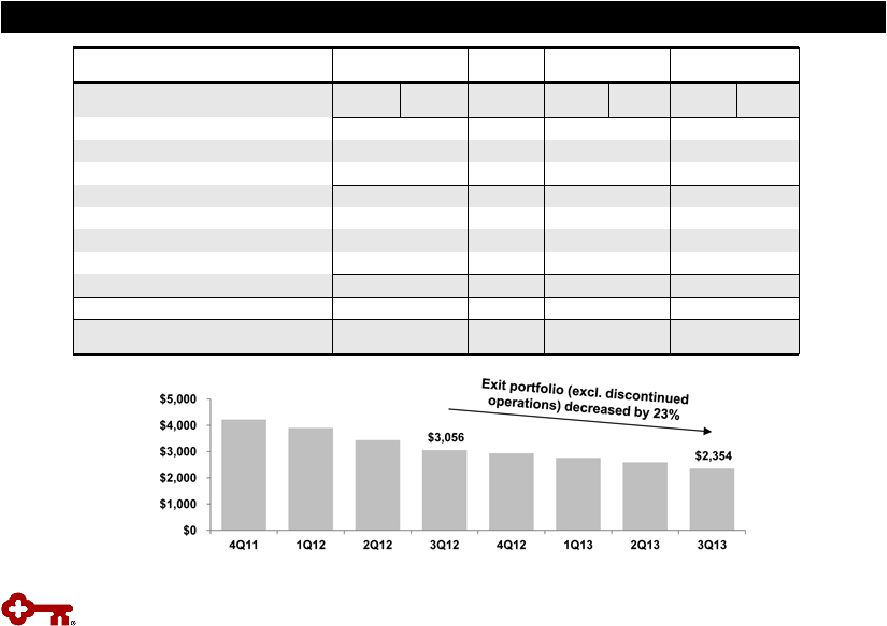

Average loan growth from prior year driven by

CF&A up 11%

–

Loan growth benefitted from distinctive

business model and client expansion

Average loans up 7% from prior year, excluding

the exit portfolio

High quality new loan originations: consistent with

moderate risk profile

Loan Growth

$ in billions

Highlights

Average Commercial, Financial & Agricultural Loans

CF&A loans

Utilization rate

Average Loans

Exit Portfolios

Home Equity & Other

Total Commercial

$ in billions |

8

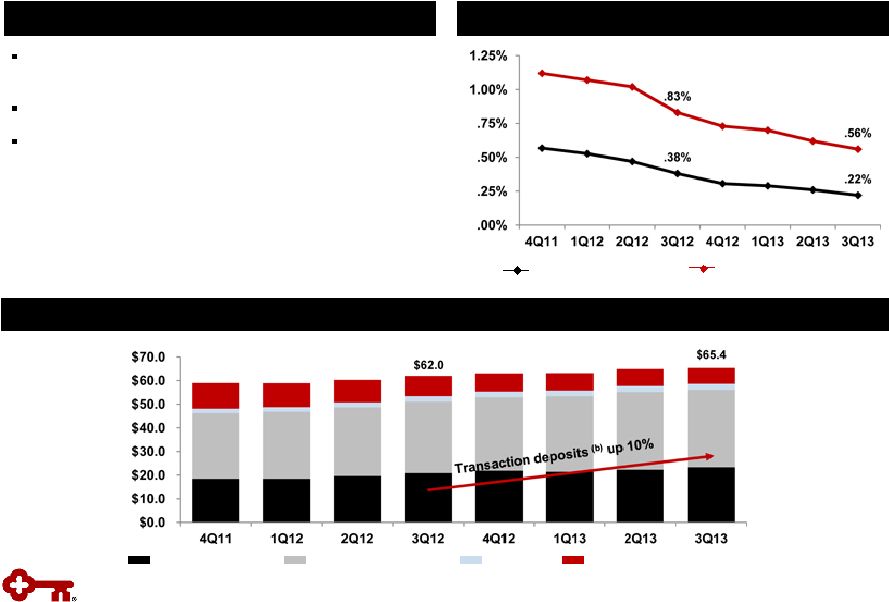

Improving Deposit Mix

Highlights

Funding Cost

Overall funding cost continues to improve, with

total deposit cost declining to 22 bps

Transaction deposit balances up 10% from 3Q12

Total CD maturities and average cost

–

2013 Q4: $1.6 billion at .78%

–

2014: $3.4 billion at 1.37%

–

2015 & beyond: $1.5 billion at 1.97%

Average

Deposits

(a)

$ in billions

(a)

Excludes deposits in foreign office

(b)

Transaction deposits include noninterest-bearing, and NOW and MMDA

Cost of total deposits

(a)

Interest-bearing liability cost

CDs and other time deposits

Savings

Noninterest-bearing

NOW and MMDA |

9

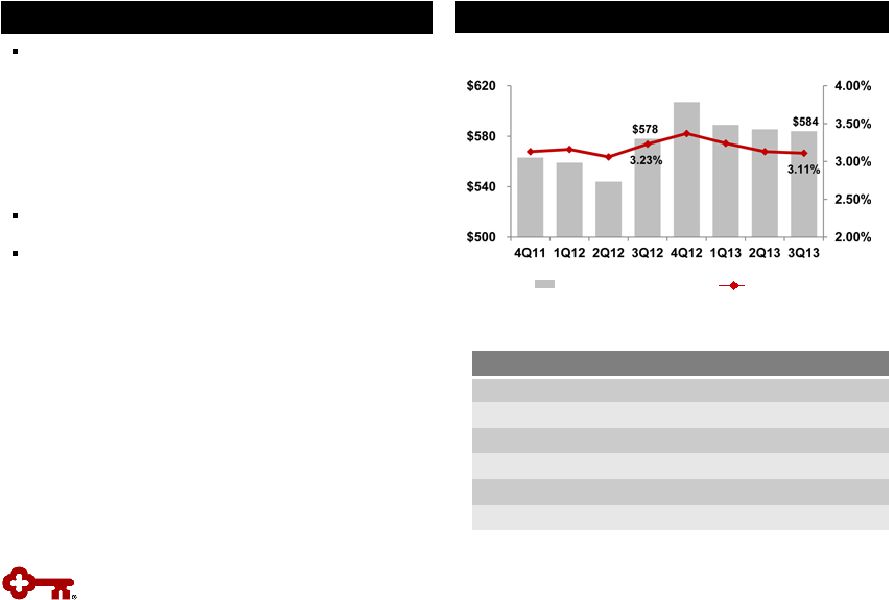

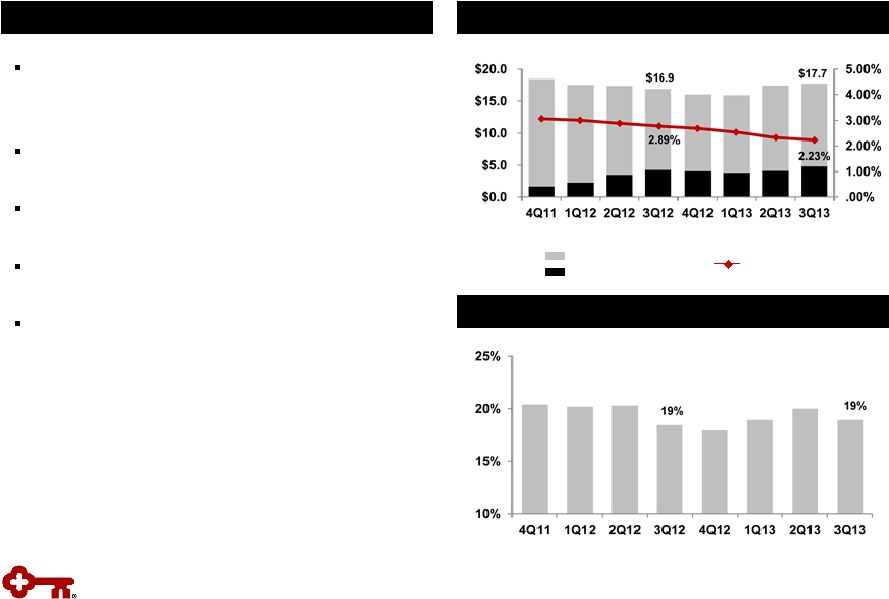

Net Interest Income and Margin

TE = Taxable equivalent

Continuing Operations

Highlights

Net Interest Income (TE) & Net Interest Margin (TE) Trend

Net interest income increased 1% from prior year

and down slightly from prior quarter

–

Early termination of leveraged leases reduced

net interest income by $13 MM in 3Q12 and by

$8 MM in 3Q13

–

Excl. impact of leveraged leases, net interest

income is up 4% from prior quarter annualized

Net interest margin down 2 bps from prior quarter

Maintaining moderate asset sensitive position

–

Naturally asset sensitive balance sheet:

approximately 70% of loans variable rate

–

High quality investment portfolio with average

life of 3.8 years

–

Flexibility to quickly adjust interest rate risk

position through use of swaps

NIM Change (bps):

vs. 2Q13

Leveraged lease terminations

(.04)

Loan yield, mix and fees

(.04)

Interest rate risk management / swaps

(.02)

Liquidity / securities

.02

Funding cost

.06

Total Change

(.02)

Net interest income (TE)

NIM (TE)

$ in millions |

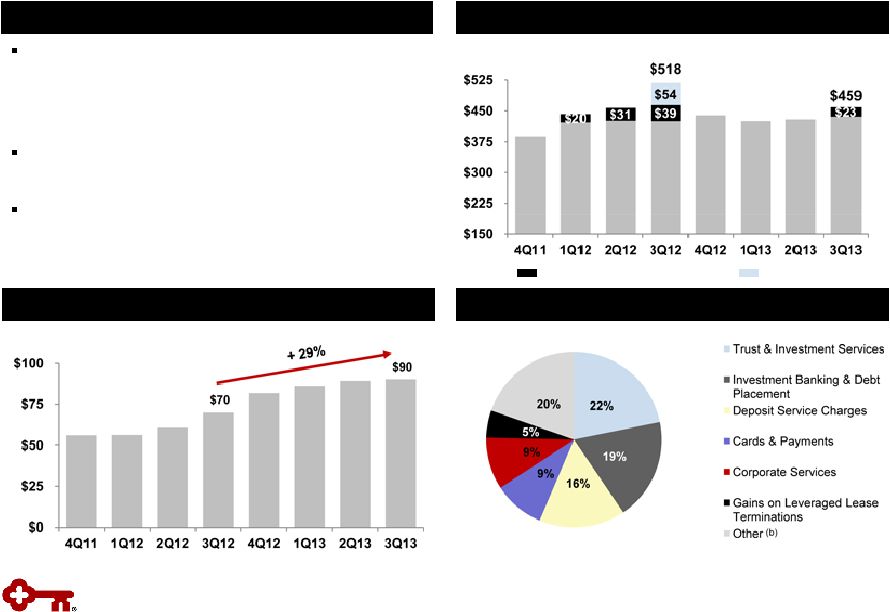

10

Noninterest Income

TE = Taxable equivalent

Continuing Operations

Highlights

Noninterest Income

Continued strength in core fee income categories

–

Excl. gains from TruPS and leveraged leases

(a)

,

noninterest income is up 3% from prior year and

up 7% from prior quarter annualized

Investment banking and debt placement fees, up

29% from prior year on a rolling four quarter avg.

Broad-based components of noninterest income

strengthen revenue diversity

Investment Banking & Debt Placement Fees

3Q13

Noninterest Income Components

Rolling Four Quarter Average

$ in millions

$ in millions

(a)

Excludes gains from the redemption of trust preferred securities

amounting to $54MM in 3Q12 and gains resulting from the early termination

of leveraged leases amounting to $39 MM in 3Q12 and $23 MM in 3Q13

(b)

Other includes corporate-owned life insurance, principal investing, mortgage

servicing revenue, etc. Leveraged lease termination gains

TruPS gains |

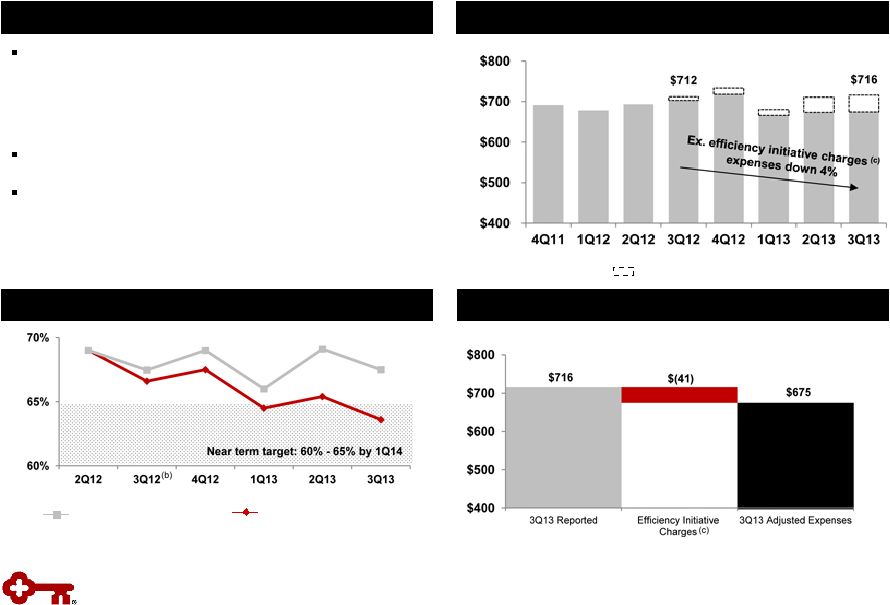

$

in millions 11

Focused Expense Management

Noninterest Expense

$ in millions

Highlights

Noninterest Expense

(a)

Non-GAAP measures: see Appendix for reconciliation

(b)

Excludes one-time gains of $54 million related to the redemption of trust

preferred securities (c)

Efficiency initiative charges includes pension settlement in 3Q13

Efficiency Ratio

(a)

Adjusted cash efficiency ratio

(ex. efficiency initiative charges )

Cash efficiency ratio

Efficiency initiative charges

(c)

(c)

Achieved expense target, with $207

million

in savings

–

3Q13 expense included $41 million related to

efficiency initiative

(c)

Focused on further efficiency improvements

Expenses excluding pension and efficiency charges:

–

Down 4% from prior year

–

Relatively flat to prior quarter due to increased

marketing spend in 3Q13 |

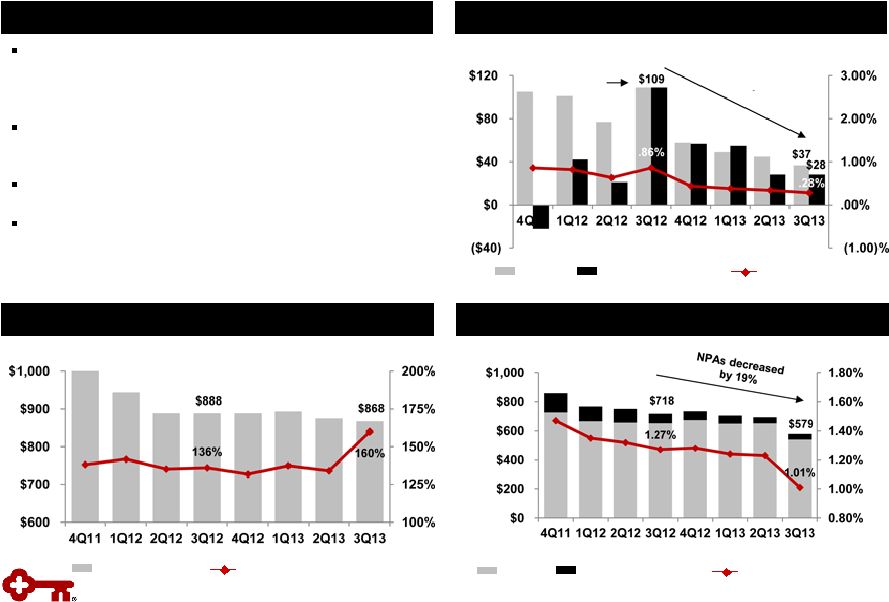

12

Nonperforming Assets

Net Charge-offs & Provision for Loan and Lease Losses

NPLs

NPLs to period-end loans

NCOs

Provision for loan and

lease losses

NCOs to average loans

$ in millions

$ in millions

NPLs held for sale,

OREO & other NPAs

Continued Improvement in Asset Quality

Highlights

Net loan charge-offs decreased 66% from 3Q12 to

$37MM, or 28 bps of average loans (down 42%

excluding impact of updated regulatory guidance)

3Q13 commercial loan net charge-offs were $5MM

or 5 bps of average loans

Gross recoveries up $12MM or 41% from 2Q13

Net charge-offs expected to be within or below

targeted range

Allowance for Loan and Lease Losses

Allowance for loan and

lease losses to NPLs

Allowance for loan

and lease losses

$ in millions

NCOs decreased

by 66%

Includes $45MM for

updated regulatory

guidance |

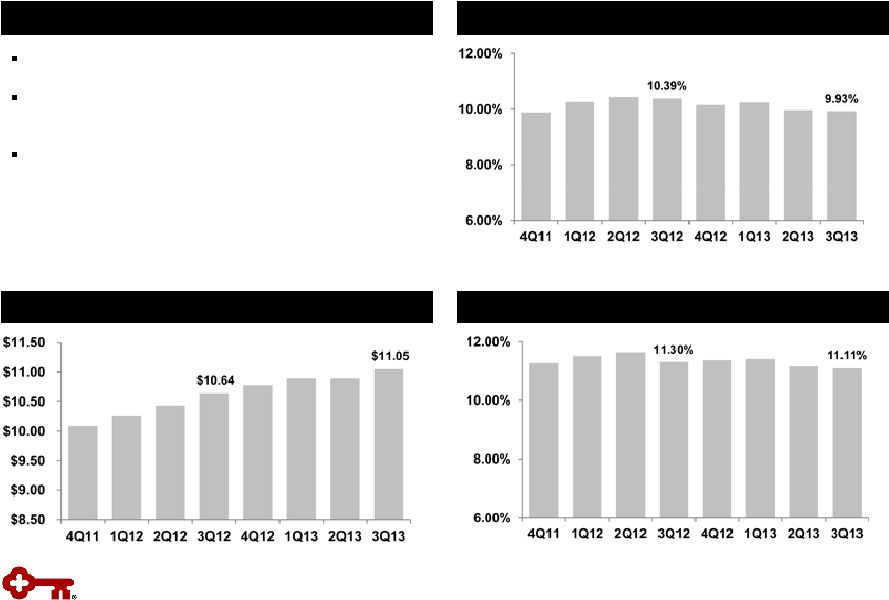

13

Disciplined execution of capital plan

Repurchased $198 million in common shares

during 3Q13

Estimated Tier 1 common equity ratio under the

Regulatory Capital Rules of 10.6%

(a), (b)

Tier 1 Common Equity

(b), (c)

Tangible Common Equity to Tangible Assets

(b)

Strong Capital Ratios

Highlights

Book Value per Share

(a)

Based upon September 30, 2013 pro forma analysis; see Appendix for further

detail (b)

Non-GAAP measure: see Appendix for reconciliations

(c)

9-30-13 ratio is estimated |

14

Outlook and Expectations

Loans

•

Mid-single digit average balance growth

NIM

•

Relatively stable to the 3Q13 level over the next few quarters

•

Potential downward pressure, dependent upon level of liquidity

Revenue

•

Net interest income relatively stable in 2H13

•

Continued strength in fee income businesses

Expense

•

$680 -

$700 million for 4Q13, including one-time charges

Efficiency

•

60% -

65% cash efficiency

NCOs / Provision

•

Within or below targeted range of 40 –

60 bps of average loans

•

Provision near the level of net charge-offs

Capital

•

Remaining share repurchase authority of $187 million over the next

two quarters |

15

Appendix |

16

(a)

Continuing operations, unless otherwise note

(b)

Represents period-end consolidated total loans and loans held for sale

(excluding education loans in the securitization trusts) divided by

period-end consolidated total deposits (excluding deposits in foreign office)

(c)

Excludes intangible asset amortization; Non-GAAP measure: see Appendix for

reconciliation (d)

Efficiency initiative charges include pension settlement

Progress on Targets for Success

KEY Business

Model

KEY Metrics

(a)

KEY

3Q13

KEY

2Q13

Targets

Action Plans

Efficient balance

sheet

Loan to deposit ratio

(b)

84%

84%

90-100%

Use integrated model to grow relationships

and loans

Improve deposit mix

Maintaining

moderate risk

profile

NCOs to average loans

.28%

.34%

40-60 bps

Focus on relationship clients

Exit noncore portfolios

Limit concentrations

Focus on risk-adjusted returns

Provision to average

loans

.21%

.21%

Growing high

quality, diverse

revenue streams

Net interest margin

3.11%

3.13%

>3.50%

Improve funding mix

Focus on risk-adjusted returns

Grow client relationships

Capitalize on Key’s total client solutions and

cross-selling capabilities

Noninterest income

to total revenue

44%

42%

>40%

Creating positive

operating

leverage

Cash efficiency ratio

(c)

68%

69%

60-65%

Improve efficiency and effectiveness

Better utilize technology

Change cost base to more variable from

fixed

Adj. cash efficiency ratio

(ex. efficiency initiative

charges

(d)

)

(c)

64%

65%

Executing our

strategies

Return on average

assets

1.12%

.95%

1.00-1.25%

Execute our client insight-driven

relationship model

Focus on operating leverage

Improved funding mix with lower cost core

deposits |

17

Average Total Investment Securities

Highlights

Average AFS securities

$ in billions

High Quality Investment Portfolio

Portfolio composed of Agency or GSE backed

CMOs: Fannie, Freddie & GNMA

–

No private label MBS or financial paper

Average portfolio life at 9/30/13 of 3.8 years

compared to 3.2 years at 6/30/13

Unrealized net gain of $3 million on available-for-

sale securities portfolio at 9/30/13

Securities cash flows of $1.3 billion in 3Q13

and $1.5 billion in 2Q13

Yields on purchases were 67 bps lower than

3Q13 maturities

Securities to Total Assets

(b)

(a) Yield is calculated on the basis of amortized cost

(b) Includes end of period held-to-maturity and

available-for-sale securities Average yield

(a)

Average HTM securities |

18

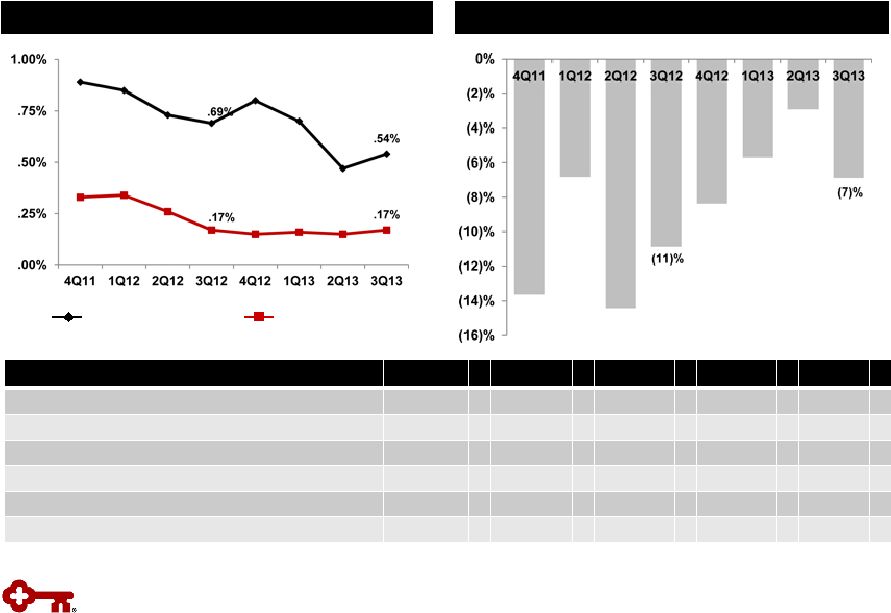

Asset Quality Trends

Quarterly Change in Criticized Outstandings

(a)

Delinquencies to Period-end Total Loans

(a)

Loan and lease outstandings

(b)

From continuing operations

30 –

89 days delinquent

90+ days delinquent

Metric

(b)

3Q13

2Q13

1Q13

4Q12

3Q12

Delinquencies to EOP total loans: 30-89 days

.54

%

.47

%

.70

%

.80

%

.69

%

Delinquencies to EOP total loans: 90+ days

.17

.15

.16

.15

.17

NPLs to EOP portfolio loans

1.01

1.23

1.24

1.28

1.27

NPAs to EOP portfolio loans + OREO + Other NPAs

1.08

1.30

1.34

1.39

1.39

Allowance for loan losses to period-end loans

1.62

1.65

1.70

1.68

1.73

Allowance for loan losses to NPLs

160.4

134.4

137.4

131.8

136.0

Continuing Operations

Continuing Operations |

19

Period-

end

loans

Average

loans

Net loan

charge-offs

Net loan

charge-offs

(b)

/

average loans

(%)

Nonperforming

loans

(c)

Ending

allowance

(d)

Allowance /

period-end

loans

(d)

(%)

Allowance /

NPLs

(%)

9/30/13

3Q13

3Q13

2Q13

3Q13

2Q13

9/30/13

6/30/13

9/30/13

9/30/13

9/30/13

Commercial, financial and agricultural

(a)

$24,317

$23,864

$ 4

$ 8

.07

.14

$ 102

$ 146

$

370 1.52

362.75

Commercial real estate:

Commercial Mortgage

7,544

7,575

(8)

(2)

(.42)

(.11)

58

106

172

2.28

296.55

Construction

1,058

1,073

(6)

1

(2.22)

.38

17

26

36

3.40

211.76

Commercial lease financing

4,550

4,633

15

(2)

1.28

(.17)

22

14

64

1.41

290.91

Real estate

–

residential mortgage

2,198

2,193

2

4

.36

.74

98

94

35

1.59

35.71

Home equity:

Key Community Bank

10,285

10,247

12

14

.46

.56

198

205

82

.80

41.41

Other

353

364

2

5

2.18

5.16

13

16

14

3.97

107.69

Consumer other

–

Key Community Bank

1,440

1,435

7

5

1.94

1.44

2

3

27

1.88

N/M

Credit cards

698

700

8

6

4.53

3.45

4

11

34

4.87

850.00

Consumer other:

Marine

1,083

1,120

1

5

.35

1.66

25

30

31

2.86

124.00

Other

71

67

-

1

-

5.42

2

1

3

4.23

150.00

Continuing total

(e)

$53,597

$53,271

$ 37

$ 45

.28

.34

$ 541

$ 652

$

868 1.62

160.44

Discontinued operations

4,738

4,905

9

7

1.36

1.04

23

19

38

.80

165.22

Consolidated total

$58,335

$58,176

$46

$ 52

.33

.38

$ 564

$ 671

$

906 1.55

160.64

Credit Quality by Portfolio

Credit Quality

(a)

9-30-13

ending

loan

balances

include

$96

million

of

commercial

credit

card

balances;

9-30-13

average

loan

balances

include

$96

million

of

assets

from commercial credit cards

(b)

Net loan charge-off amounts are annualized in calculation. NCO ratios for

discontinued operations and consolidated Key exclude education loans in the

securitization trusts since valued at fair-market value (c)

9-30-13 and 6-30-13 NPL amounts exclude $18 million and $19

million respectively of purchased credit impaired loans acquired in July 2012.

(d) 9-30-13 allowance by portfolio is estimated.

Allowance/period loans ratios for discontinued operations and consolidated Key exclude education

loans in the securitization trusts since valued at fair-market value

(e) 9-30-13 ending loan balances include purchased loans of $176

million of which $18 million were purchased credit impaired $ in millions

N/M = Not Meaningful |

Vintage (% of Loans)

Loan

Balances

Average Loan

Size ($)

Average

FICO

Average

LTV

(a)

% of Loans

LTV>90%

2012 and

later

2011

2010

2009

2008 and

prior

Home equity loans and lines

First lien

$

16

$

23,209

744

35

%

.4

%

-

-

1%

1%

98

%

Second lien

337

23,003

729

82

32.5

-

-

-

-

100

Total home equity loans and lines

$

353

23,013

729

80

31.0

-

-

-

-

100

Nonaccrual loans

First lien

$

1

$

24,247

729

33

%

-

-

-

-

-

100

%

Second lien

12

24,712

702

82

35.1

%

-

-

-

-

100

Total home equity nonaccrual loans

$

13

24,685

703

80

33.0

-

-

-

-

100

Exit Portfolio -

Home Equity

Third quarter net charge-offs

$

2 -

-

-

-

100

%

Net loan charge-offs to average loans

2.18

%

Vintage (% of Loans)

Loan

Balances

Average Loan

Size ($)

Average

FICO

Average

LTV

(a)

% of Loans

LTV>90%

2012 and

later

2011

2010

2009

2008 and

prior

Home equity loans and lines

First lien

$ 5,932

$

67,691

765

67

%

.6

%

40

%

6%

4

%

4

%

46%

Second lien

4,353

47,569

760

76

3.2

25

6

4

4

61

Total home equity loans and lines

$

10,285

57,525

763

71

1.8

33

6

4

4

53

Nonaccrual loans

First lien

$

108

$

58,708

713

73

%

.4%

2

%

3%

3

%

5

%

87%

Second lien

90

48,922

711

78

2.0

-

2

2

4

92

Total home equity nonaccrual loans

$

198

53,794

712

75

1.1

1

2

3

5

89

Community Bank -

Home Equity

Third quarter net charge-offs

$

12

-

3%

-

4

%

93%

Net loan charge-offs to average loans

.46

%

20

(a)

Average LTVs are at origination. Current average LTVs for Community Bank total

home equity loans and lines is approximately 74%, which compares to 75% at

the end of the second quarter 2013. Community Bank –

Home Equity

Exit Portfolio –

Home Equity

$ in millions, except average loan size

Home Equity Loans –

9/30/13

$ in millions, except average loan size |

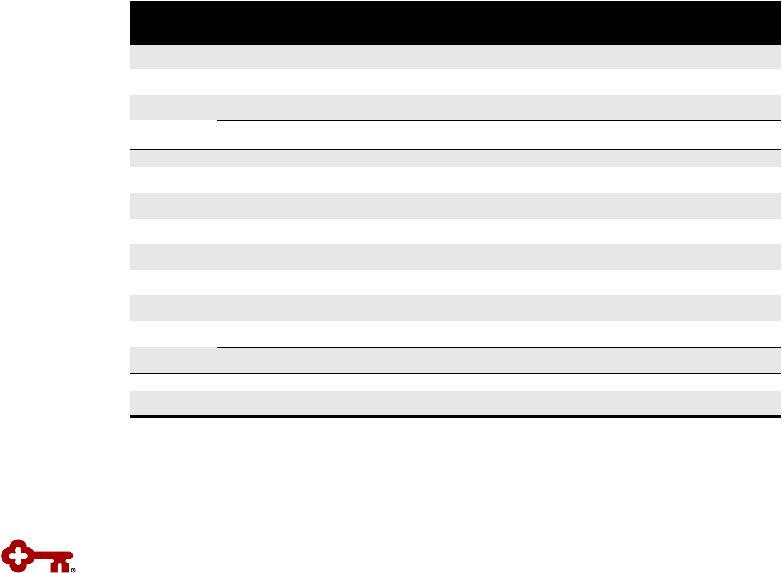

Balance Outstanding

Change

Net Loan Charge-offs

Balance on

Nonperforming Status

9-30-13

6-30-13

9-30-13

vs.

6-30-13

3Q13

(c)

2Q13

(c)

9-30-13

6-30-13

Residential properties –

homebuilder

$ 26

$ 26

-

-

$ 1

$ 8

$ 8

Marine and RV floor plan

25

28

$ (3)

-

-

6

7

Commercial lease financing

(a)

796

931

(135)

$ (2)

(2)

1

1

Total commercial loans

847

985

(138)

(2)

(1)

15

16

Home equity –

Other

353

375

(22)

2

5

14

16

Marine

1,083

1,160

(77)

1

5

25

31

RV and other consumer

71

69

2

-

1

2

-

Total consumer loans

1,507

1,604

(97)

3

11

41

47

Total exit loans in loan portfolio

$ 2,354

$ 2,589

$ (235)

$ 1

$ 10

$ 56

$ 63

Discontinued operations –

education lending

business (not included in exit loans above)

(b)

$ 4,738

$ 4,992

$ (254)

$ 9

$ 7

$ 23

$ 19

21

$ in millions

(a)

Includes (1) the business aviation, commercial vehicle, office products,

construction and industrial leases; (2) Canadian lease financing portfolios;

and (3) all remaining balances related to lease in, lease out; sale in, lease out;

service contract leases; and qualified technological equipment leases (b)

Includes loans in Key’s consolidated education loan securitization

trusts (c)

Credit amounts indicate recoveries exceeded charge-offs

$ in millions

Exit Loan Portfolio

Exit Loan Portfolio |

Three months ended

9-30-13

6-30-13

9-30-12

Tangible common equity to tangible assets at period end

Key shareholders’

equity (GAAP)

$

10,206

$

10,229

$

10,251

Less:

Intangible assets

(a)

1,017

1,021

1,031

Preferred Stock, Series A

(b)

282

282

291

Tangible common equity (non-GAAP)

$

8,907

$

8,926

$

8,929

Total assets (GAAP)

$

90,708

$

90,639

$

86,950

Less:

Intangible assets

(a)

1,017

1,021

1,031

Tangible assets (non-GAAP)

$

89,691

$

89,618

$

85,919

Tangible common equity to tangible assets ratio (non-GAAP)

9.93

%

9.96

%

10.39

%

Tier 1 common equity at period end

Key shareholders' equity (GAAP)

$

10,206

$

10,229

$

10,251

Qualifying capital securities

339

339

339

Less:

Goodwill

979

979

979

Accumulated other comprehensive income (loss)

(c)

(409)

(359)

(109)

Other assets

(d)

97

101

121

Total Tier 1 capital (regulatory)

9,878

9,847

9,599

Less:

Qualifying capital securities

339

339

339

Preferred Stock, Series A

(b)

282

282

291

Total Tier 1 common equity (non-GAAP)

$

9,257

$

9,226

$

8,969

Net risk-weighted assets (regulatory)

(d), (e)

$

83,335

$

82,528

$

79,363

Tier 1 common equity ratio (non-GAAP)

(e)

11.11

%

11.18

%

11.30

%

Pre-provision net revenue

Net interest income (GAAP)

$

578

$

581

$

572

Plus:

Taxable-equivalent adjustment

6

5

6

Noninterest income (GAAP)

459

429

518

Less:

Noninterest expense (GAAP)

716

711

712

Pre-provision net revenue from continuing operations (non-GAAP)

$

327

$

304

$

384

GAAP to Non-GAAP Reconciliation

22

$ in millions

(a)

Three months ended September 30, 2013, June 30, 2013, and September 30, 2012

exclude $99 million, $107 million, and $130 million, respectively, of

period end purchased credit card receivable intangible assets (b)

Net of capital surplus for the three months ended September 30, 2013 and June 30,

2013 (c)

Includes net unrealized gains or losses on securities available for sale (except

for net unrealized losses on marketable equity securities), net gains or

losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined benefit and other

postretirement plans

(d)

Other assets deducted from Tier 1 capital and net risk-weighted assets consist

of disallowed intangible assets (excluding goodwill) and deductible

portions of nonfinancial equity investments. There were no disallowed deferred tax assets at 9-30-13, 6-30-13, and 9-30-12

(e)

9-30-13 amount is estimated |

GAAP

to Non-GAAP Reconciliation (continued) $ in millions

23

(a)

Three months ended September 30, 2013, June 30, 2013, and September 30, 2012

exclude $103 million, $110 million and $86 million, respectively, of

average ending purchased credit card receivable intangible assets

Three months ended

9-30-13

6-30-13

9-30-12

Average tangible common equity

Average Key shareholders' equity (GAAP)

$

10,237

$

10,314

$

10,222

Less:

Intangible assets (average)

(a)

1,019

1,023

1,026

Preferred Stock, Series A (average)

291

291

291

Average tangible common equity (non-GAAP)

$

8,927

$

9,000

$

8,905

Return on average tangible common equity from continuing operations

Net income (loss) from continuing operations attributable to Key

common shareholders

(GAAP)

$

229

$

193

$

211

Average tangible common equity (non-GAAP)

8,927

9,000

8,905

Return on average tangible common equity from continuing operations

(non-GAAP) 10.18

%

8.60

%

9.43

%

Return on average tangible common equity consolidated

Net income (loss) attributable to Key common shareholders (GAAP)

$

266

$

198

$

214

Average tangible common equity (non-GAAP)

8,927

9,000

8,905

Return on average tangible common equity consolidated (non-GAAP)

11.82

%

8.82

%

9.56

%

Cash efficiency ratio

Noninterest expense (GAAP)

$

716

$

711

$

712

Less:

Intangible asset amortization on credit cards (GAAP)

8

7

6

Other intangible asset amortization (GAAP)

4

3

3

Adjusted noninterest expense (non-GAAP)

$

704

$

701

$

703

Net interest income (GAAP)

$

578

$

581

$

572

Plus:

Taxable-equivalent adjustment

6

5

6

Noninterest income (GAAP)

459

429

518

Total taxable-equivalent revenue (non-GAAP)

$

1,043

$

1,015

$

1,096

Cash efficiency ratio (non-GAAP)

67.5

%

69.1

%

64.1

%

Adjusted cash efficiency ratio

Adjusted noninterest expense (non-GAAP)

$

704

$

701

$

703

Less:

Efficiency initiative and pension settlement charges (non-GAAP)

41

37

9

Net adjusted noninterest expense (non-GAAP)

$

663

$

664

$

694

Total taxable-equivalent revenue (non-GAAP)

$

1,043

$

1,015

$

1,096

Adjusted cash efficiency ratio (non-GAAP)

63.6

%

65.4

%

63.3

% |

Tier 1

Common Equity Under the Regulatory Capital Rules, Incorporating Basel III

Guidance (estimated) (a)

KeyCorp & Subsidiaries

24

$ in billions

Quarter ended

Sept. 30, 2013

Tier 1 common equity under current regulatory rules

$

9.3 Adjustments from current regulatory rules

to the Regulatory Capital Rules: Deferred tax assets and PCCRs

(b)

(.1)

Tier 1 common equity anticipated under the Regulatory Capital Rules

(c)

$

9.1 Total risk-weighted

assets under current regulatory rules

$

83.3 Adjustments from current regulatory rules to the

Regulatory Capital Rules: Loan commitments <1 year

.5

Past Due Loans

.2

Mortgage servicing assets

(d)

.6

Deferred tax assets

(d)

.2

Other

1.5

Total risk-weighted assets anticipated under the Regulatory Capital

Rules

$

86.3 Tier 1 common equity ratio under the Regulatory Capital

Rules 10.6

%

(a)

Tier

1

common

equity

is

a

non-generally

accepted

accounting

principle

(GAAP)

financial

measure

that

is

used

by

investors,

analysis

and

bank

regulatory agencies to assess the capital position of financial services

companies; management reviews Tier 1 common equity along with other

measures of capital as part of its financial analyses

(b)

Includes the deferred tax asset subject to future taxable income

for realization, primarily tax credit carryforwards as well as the deductible

portion of purchased credit card receivables

(c)

The

anticipated

amount

of

regulatory

capital

and

risk-weighted

assets

is

based

upon

the

federal

banking

agencies’

Regulatory

Capital

Rules

(as

fully phased-in on January 1, 2019); Key is subject to the Regulatory

Capital Rules under the “standardized approach”

(d)

Item is included in the 10%/15% exceptions bucket calculation and is

risk-weighted at 250% Table may not foot due to rounding

|