Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2013 | |

| ☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from [ ] to [ ] | |

| Commission file number 000-54334 | ||

| UAN Power Corp. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 27-0155619 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 102 North Avenue, Mount Clemens, Michigan | 48043 | |

| (Address of principal executive offices) | (Zip Code) | |

| Registrant's telephone number, including area code: (586) 530-5605 | ||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered | |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

| Common Stock, $0.00001 par value per share | |

| (Title of class) | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. | |

| Yes ☐ No ☒ | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act | |

| Yes ☐ No ☒ | |

| Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. | |

| Yes ☒ No ☐ | |

| 1 |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☒ No ☐

The aggregate market value of Common Stock held by non-affiliates of the Registrant on June 30, 2013 was $Nil based on a $Nil average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

78,273,000 common shares as of September 25, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

None.

| 2 |

UAN Power Corp.

Annual Report on Form 10-K

For the Fiscal Year Ended June 30, 2013

Table of Contents

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 9 |

| Item 1B. | Unresolved Staff Comments | 9 |

| Item 2. | Properties | 9 |

| Item 3. | Legal Proceedings | 10 |

| Item 4. | Mine Safety Disclosures | 10 |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 10 |

| Item 6. | Selected Financial Data | 10 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 10 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 18 |

| Item 8. | Financial Statements and Supplementary Data | 18 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 37 |

| Item 9A. | Controls and Procedures | 37 |

| Item 9B. | Other Information | 38 |

| Item 10. | Directors, Executive Officers and Corporate Governance | 38 |

| Item 11. | Executive Compensation | 43 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 44 |

| Item 13. | Certain Relationships And Related Transactions, And Director Independence | 45 |

| Item 14. | Principal Accounting Fees And Services | 47 |

| Item 15. | Exhibits, Financial Statement Schedules | 47 |

| 3 |

PART I

| Item 1. | Business |

FORWARD-LOOKING STATEMENTS

This annual report contains certain forward-looking statements. All statements other than statements of historical fact are "forward-looking statements" for purposes of these provisions, including any projections of earnings, revenues, or other financial items; any statements of the plans, strategies, and objectives of management for future operation; any statements concerning proposed new products, services, or developments; any statements regarding future economic conditions or performance; statements of belief; and any statement of assumptions underlying any of the foregoing. Such forward-looking statements are subject to inherent risks and uncertainties, and actual results could differ materially from those anticipated by the forward-looking statements.

These forward-looking statements involve significant risks and uncertainties, including, but not limited to, the following: competition, promotional costs and the risk of declining revenues. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of a number of factors. These forward-looking statements are made as of the date of this filing, and we assume no obligation to update such forward-looking statements. The following discusses our financial condition and results of operations based upon our unaudited financial statements which have been prepared in conformity with accounting principles generally accepted in the United States. It should be read in conjunction with our financial statements and the notes thereto included elsewhere herein.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our consolidated financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States Dollars (US$) and all references to "common shares" refer to the common shares in our capital stock.

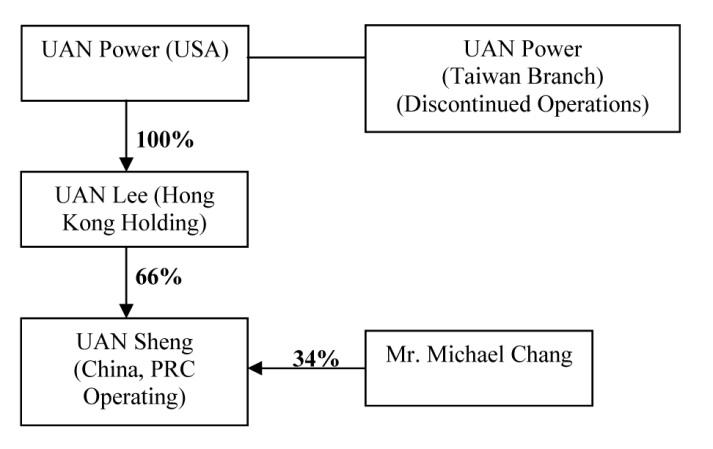

As used in this annual report, the terms “we”, “us”, “our” and “our company” mean UAN Power Corp., and our subsidiaries UAN Lee Agricultural Technology Holding Limited, a Hong Kong company, and UAN Sheng Agricultural Technology Development Limited Company, a People’s Republic of China company, unless otherwise indicated.

Overview

Our company was originally incorporated in the State of Nevada on May 8, 2009. We completed a reincorporation of our company in Delaware under the name UAN Power Corp. on November 14, 2011.

Our company was originally organized to seek opportunities to manage income producing commercial and residential real estate properties in Florida and the southeastern region of the United States.

On May 23, 2011, our company and our principal shareholders, including David Dreslin, our former president, chief financial officer and treasurer, entered into a stock purchase agreement resulting in a change in control of our company. Pursuant to that agreement, Wan-Fang Liu, Yuan-Hao Chang and Pei-Chi Yang purchased an aggregate of 77,775,000 outstanding shares of our company’s common stock, par value $0.00001, from those principal shareholders for an aggregate purchase price of $200,000. On May 23, 2011, we entered into a further agreement with Wan-Fang Liu, pursuant to which 48,275,000 shares of the common stock purchased by Ms. Liu were immediately returned to our company in consideration of the payment of $1.00. These shares were subsequently sold in a private placement for a purchase price of $0.01 per share and aggregate gross proceeds of $482,750 on July 25, 2011.

| 4 |

Immediately prior to the completion of the stock purchase and cancellation described above, Mr. Dreslin, who owned 59,925,000 shares, or approximately 77% of the common stock of our company, was the largest shareholder of our company. Upon completion of these transactions, Ms. Liu owned 27,500,000 shares, or approximately 91.7% of the common stock, and became the largest shareholder of our company.

Concurrent with the change of control of our company that occurred on May 23, 2011, we abandoned our real estate business plan in order to seek the acquisition of an operating business by merger, share exchange, asset acquisition or other business combination.

In August 2011, we entered into a technology license and technology transfer agreement, under which we licensed the rights to develop, manufacture, market, sell and import products which incorporate or rely upon certain “Triops” technologies and processes in Taiwan, the People’s Republic of China, the United States, Japan and Korea, in exchange for a one-time licensing fee of $100,000. Triops are prehistoric creatures also known as dinosaur shrimp that are brought to life by adding water to eggs that are in suspended animation. In connection with the license, we also entered into a tenancy agreement under which we leased space in Taiwan for a two-year period. The tenancy agreement requires rental payments of approximately $5,000 per month. In addition, we provided the landlord with a deposit of $13,800 upon the execution of the lease.

In September 2011, we entered into a sales agency agreement related to the Triops technology and purchased $99,850 of leasehold improvements associated with the tenancy agreement described above.

In December 2011, we established a Taiwan branch of UAN Power Corp.

On May 16, 2012, we entered into a joint venture agreement with Mr. Yuan-Hao Chang, a shareholder of our company, under which we intended to develop, own and operate an agricultural business in the People’s Republic of China. We intend to rely on Mr. Chang’s experience and knowledge in organic fertilizers and farming to plant and grow various fruits in China, and to harvest and sell the produced crops and goods for a profit.

On May 31, 2012, we entered into a term promissory note with certain shareholders and/or directors of the Company for the principal sum of $350,000 with a maturity date of May 31, 2017. The note may be paid in full or in part at the option of our company at any time prior to the maturity date without penalty, with interest accrued as at the date of prepayment. The note bears interest at 4.00% per annum and shall be computed on the basis of a year of 360 days for the number of days actually elapsed.

On July 2, 2012, UAN Sheng (Fujian) Agricultural Technology Development Limited Company (“UAN Sheng”), a company established by the board of directors of our company, entered into a renting agreement with Jianyang City Construction Supervision Team Masha (“Jianyang Construction”) whereby Jianyang Construction has agreed to lease a business location (gross area of 170.661 m2) to UAN Sheng for a term of six years. The store location is Room 204, No. 2 Building, 342 West Marsha Street, Culture Plaza Masha Town, Jianyang City. The monthly rent for the location is RMB¥26000 which must be paid on a quarterly basis, pursuant to the terms of the renting agreement.

Effective July 3, 2012, our subsidiary, UAN Sheng, and UAN Lee Agricultural Technology Holding Limited, entered into a partnership agreement with Jianyang City Jinxiong Agricultural and Forestry Professional Cooperative (“Jinxiong”) to develop technology in the Greater China Region for the cultivation of tropical peach trees in Masha Town, Taiwan and to promote tropical peaches as the region’s major agricultural product (the “Proposition”).

Pursuant to the terms of the Proposition, UAN Sheng will provide tree species and personnel to undertake the anticipated tree cultivation. The property, provided by Jinxiong, consists of 300 acres of agricultural land located in Liutian Village, Masha Town, Jianyan City, Fujian Province. UAN Sheng will acquire 70% of the Proposition’s earnings and Jinxiong will acquire the remaining 30% of the Proposition’s earnings, after tax deductions. In addition, the taxes allocated on the Proposition will be distributed pro-rated to the interests of each party, as UAN Sheng will be responsible for 70% of the taxes due and Jinxiong will be responsible for the remaining 30% of the taxes due. Furthermore, both parties will each acquire 50% of the government agricultural subsidiary.

| 5 |

On July 7, 2012, UAN Sheng entered into a transfer agreement with Guifang Chen, whereby Guifang Chen has agreed to transfer a factory building and land use rights on a property in the city of Jianyang. Guifang Chen shall transfer to UAN Sheng the use and rights of 7.53 acres of land located in Liangdong Village, Shuishang Xian, Masha Town, Jianyang City and all current factory equipment, effective July 9, 2012 and until December 31, 2046. Guifang Chen will be compensated an aggregate of RMB¥650,000 by UAN Sheng, which includes a deposit of RMB¥200,000 to be paid upon execution of the transfer agreement and the balance was paid in one payment in July, 2012. As per the terms of the transfer agreement, UAN Sheng will be responsible for the all taxes and fees related to the transfer.

On August 8, 2012, UAN Sheng, entered into a leasing agreement with Yongliang Yang, whereby Yang has agreed to lease a property for residential use to UAN Sheng for a period of 12 months, effective August 10, 2012. The property, of approximately 119.48 m2, is located at No. 818 South Jiahe, Tongyou Street, Jianyang City, Fujian Province and is bound by a monthly payment of RMB¥200. The lease agreement has not been extended and Uan Sheng does not intend to extend the lease agreement.

In conjunction with the partnership agreement, on October 18, 2012, UAN Sheng entered into a concession agreement with Lin Changbin, whereas UAN Sheng has agreed to lease from Lin Changbin the rights to a property of 300 acres, containing approximately 8,800 pear trees, in Erlian Shan of Zhuzhou Village, from October 18, 2012 to December 31, 2025. Pursuant to the terms of the concession agreement, UAN Sheng will pay a sapling fee of an aggregate of RMB¥500,000 to Lin Changbin which includes a deposit of RMB¥100,000 paid immediately upon signing of the concession agreement and the balance was paid in one payment in October, 2012.

In November 2012, we discontinued our limited business operations in Taiwan where we had entered into a Technology Licensing & Transfer Agreement to obtain the rights to develop, manufacture, market, sell and import products which incorporate or rely upon certain “Triops” technologies and processes in Taiwan, The People’s Republic of China, the United States, Japan and Korea. Concurrent with the discontinuation of our business operations in Taiwan, we liquidated all assets related to that business. In accordance with the applicable accounting guidance for the ceased operations, the results of the Taiwan Business are presented as discontinued operations and, as such, have been excluded from both continuing operations and segment results for all periods presented in this annual report.

On December 1, 2012, we entered into a convertible promissory note with Yuan-Hao Chang for the principal sum of $157,691 with a maturity date of December 1, 2017. The note may be paid in full or in part at the option of our company at any time prior to the maturity date without penalty, with interest accrued as at the date of prepayment. The note bears interest at 4.00% per annum and shall be computed on the basis of a year of 360 days for the number of days actually elapsed. On December 1, 2013, the aggregate outstanding principal and all unpaid accrued interest due under the note shall automatically be converted into a number of units of common shares of our company equal to the aggregate outstanding principal and unpaid accrued interest, divided by $0.02. No fractional units will be issued in connection with any conversion. Fractional units will be rounded to the nearest whole number.

On December 31, 2012, we entered into a global amendment to the term promissory notes dated May 31, 2012 with each of the Note Holders. The amendment provides for the conversion of the aggregate outstanding principal and all unpaid accrued interest due under the notes into a number of units of common shares of our company equal to the aggregate outstanding principal and unpaid accrued interest, divided by $0.02. No fractional units will be issued in connection with any conversion. Fractional units will be rounded to the nearest whole number.

As of June 30, 2013 and the date of this report, our company, through our 66% owned subsidiary, UAN Sheng Agricultural Technology Development Limited Company, is focused on the development of our tropical peach agriculture business in China. Our management is also seeking and assessing other opportunities to create shareholder value on an ongoing basis, whether by acquisition, joint-venture, business combination, or otherwise.

| 6 |

As at the date of this Annual Report, we have nominal operations, no foreseeable prospect of revenue, and remain in the development stage. There is substantial doubt about our ability to continue as a going concern because we will be required to obtain additional capital to continue our operations. If adequate capital cannot be obtained on a timely basis and on satisfactory terms, our operations will be materially negatively impacted. There can be no assurance that we will be able to raise additional capital, on terms favorable to us or at all.

Our Operating Strategy

Our current plan of operation is to develop, own, and operate an agricultural business. We have not yet generated revenues from our planned agricultural operations and remain in the development stage.

Concurrently with the development of our agricultural business, we are actively seeking to acquire one or more target companies or businesses seeking the perceived advantages of being a publicly held corporation. We will continue to identify, research and negotiate the purchase of businesses that our management deems to be in the best interest of our shareholders. Our company’s principal business objective for the next 12 months and beyond will be to achieve long-term growth through a combination with one or more businesses rather than immediate, short-term earnings. Our company will not restrict its potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business. We cannot assure you that we will be able to locate an appropriate target business or that we will be able to engage in a business combination with a target business on favorable terms.

The analysis of new business opportunities will be undertaken by or under the supervision of the officers and directors of our company. Although we have licensed the rights related to the “Triops” technologies and have entered into the agricultural joint venture agreement, each as described above, as of this date, our company has not entered into any definitive acquisition or merger agreement with any party through which our company may acquire an existing operating company or business. Our company has unrestricted flexibility in seeking, analyzing and participating in potential business opportunities. In its efforts to analyze potential acquisition targets, our company will consider the following factors, among others:

| (a) | Potential for growth, indicated by new technology, anticipated market expansion or new products; |

| (b) | Competitive position as compared to other firms of similar size and experience within the industry segment as well as within the industry as a whole; |

| (c) | Strength and diversity of management, either in place or scheduled for recruitment; |

| (d) | Capital requirements and anticipated availability of required funds, to be provided by our company or from operations, through the sale of additional securities, through joint ventures or similar arrangements or from other sources; |

| (e) | The cost of participation by our company as compared to the perceived tangible and intangible values and potentials; |

| (f) | The extent to which the business opportunity can be advanced; and |

| (g) | The accessibility of required management expertise, personnel, raw materials, services, professional assistance and other required items. |

In applying the foregoing criteria, no one of which will be controlling, management will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available data. Business opportunities may occur in many different industries, and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. Due to our company's limited capital available for investigation, our company may not discover or adequately evaluate adverse facts about the opportunity to be acquired.

| 7 |

Competition

We expect that our agricultural business in China will face competition from a vast number of concerns ranging from small family farms to large state-run enterprises. Many of these competitors and potential competitors are well established and have greater resources and experience than we do. There can be no assurance that we will be able to compete successfully with existing or new competitors or that our agricultural business will be successful.

In identifying, evaluating and selecting any additional target business, we may encounter intense competition from other entities having a business objective similar to ours. There are numerous “public shell” companies either actively or passively seeking operating businesses with which to merge in addition to a large number of “blank check” companies formed and capitalized specifically to acquire operating businesses. In addition, we are subject to competition from other established operating companies looking to expand their operations through the acquisition of a target business. Many of these entities are well established and have extensive experience identifying and effecting business combinations directly or through affiliates. Many of these competitors possess greater technical, human and other resources than us and our financial resources will be relatively limited when contrasted with those of many of these competitors. Our ability to compete in acquiring certain sizable target businesses is limited by our available financial resources. This inherent competitive limitation gives others an advantage in pursuing the acquisition of a target business. Further, our outstanding shares and potential future dilution may not be viewed favorably by certain target businesses.

Any of these factors may place us at a competitive disadvantage in successfully negotiating a business combination. Our management believes, however, that our status as a public entity and potential access to the United States public equity markets may give us a competitive advantage over privately-held entities with a business objective similar to ours to acquire a target business on favorable terms.

If we succeed in effecting a business combination, there will be, in all likelihood, intense competition from competitors of the target business. Many of our target business’ competitors are likely to be significantly larger and have far greater financial and other resources than we will. Some of these competitors may be divisions or subsidiaries of large, diversified companies that have access to financial resources of their respective parent companies. Our target business may not be able to compete effectively with these companies or maintain them as customers while competing with them on other projects. In addition, it is likely that our target business will face significant competition from smaller companies that have specialized capabilities in similar areas. We cannot accurately predict how our target business’ competitive position may be affected by changing economic conditions, customer requirements or technical developments. We cannot assure you that, subsequent to a business combination, we will have the resources to compete effectively.

Current Operations

On May 16, 2012, UAN Power entered into a joint venture agreement with Mr. Yuan-Hao Chang, a shareholder of UAN Power, to develop, own and operate an agricultural business in China, PRC (the “Joint Venture”). UAN Power will rely on Mr. Chang’s experience and knowledge in organic fertilizers and farming to plant and grow various fruits ( namely tropical peaches), in China, and to harvest and sell the produced crops and goods for a profit.

On July 2, 2012, UAN Power (through its director and UAN Lee) and Mr. Chang established UAN Sheng Agricultural Technology Development Limited Company (“UAN Sheng”) in China, PRC. As at October 11, 2012, both parties have completed their initial capital contribution to UAN Sheng pursuant to the Joint Venture agreement. Our company contributed $320,000 to the joint venture. However, we have not yet begun operations or generated any revenue from this business. There can be no assurance that we will generate any revenues from this joint venture.

| 8 |

Employees

Our company currently has 10 employees, our chief financial officer is located in Taiwan and , six employees are located in China in addition to our chief executive officer, who is located in the United States. None of these employees are covered by a collective bargaining agreement, and management considers its relations with its employees to be good. Our company also relies on the services of independent consultants.

| Item 1A. | Risk Factors |

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| Item 1B. | Unresolved Staff Comments |

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| Item 2. | Properties |

Our business office is located at 102 North Avenue, Mt. Clemens, Michigan 48043. Our previous office space was provided to us without charge by an entity owned by family members of our chief executive officer.

We entered into a month to month lease for our new office space starting December 2012 for $200 a month. We do not anticipate that we will require any additional premises in the foreseeable future. Our telephone number is (586) 530-5605.

On July 7, 2012, we entered into a transfer agreement with Guifang Chen, whereby Guifang Chen transferred a factory building and land use rights on a property in the city of Jianyang. Guifang Chen transferred to us the use and rights of 7.53 acres of land located in Liangdong Village, Shuishang Xian, Masha Town, Jianyang City and all current factory equipment, effective July 9, 2012 and until December 31, 2046. Guifang Chen is compensated an aggregate of RMB¥650,000 by us, which includes a deposit of RMB¥200,000 was paid upon execution of the transfer agreement and the remaining balance was paid in one payment in July, 2012. As per the terms of the transfer agreement, we will be responsible for the all taxes and fees related to the transfer.

On August 8, 2012, we entered into a leasing agreement with Yongliang Yang, whereby Yang has agreed to lease a property for residential use to us for a period of 12 months, effective August 10, 2012. The property, of approximately 119.48 m2, is located at No. 818 South Jiahe, Tongyou Street, Jianyang City, Fujian Province and is bound by a monthly payment of RMB¥200. The lease agreement has not been extended and Uan Sheng does not intend to extend the lease agreement.

On October 18, 2012, we entered into a concession agreement with Lin Changbin, whereas we has agreed to lease from Lin Changbin the rights to a property of 300 acres, containing approximately 8,800 pear trees, in Erlian Shan of Zhuzhou Village, from October 18, 2012 to December 31, 2025. Pursuant to the terms of the concession agreement, we will pay a sapling fee of an aggregate of RMB¥500,000 to Lin Changbin which includes a deposit of RMB¥100,000 paid immediately upon signing of the concession agreement and the balance was paid in one payment in October, 2012.

| Item 3. | Legal Proceedings |

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

| 9 |

| Item 4. | Mine Safety Disclosures |

Not applicable.

PART II

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is quoted on the OTC Bulletin Board under the symbol "UPOW". As of September 25, 2013 there have been no trades of our common stock.

Our shares are issued in registered form. Empire Stock Transfer Inc., 1859 Whitney Mesa Drive, Henderson, NV, 89014 (telephone: (702) 818-5898), (facsimile: (702) 974-1444), is the registrar and transfer agent for our common shares.

Holders

On September 25, 2013, the shareholder’s list showed 28 registered shareholders and 78,273,000 common shares outstanding.

Dividend Policy

To date, we have not paid dividends on shares of our common stock and we do not expect to declare or pay dividends on shares of our common stock in the foreseeable future. The payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by our board of directors.

Securities Authorized For Issuance Under Equity Compensation Plans

Our company does not have any equity compensation plans or any individual compensation arrangements with respect to its common stock or preferred stock. The issuance of any of our common or preferred stock is within the discretion of our board of directors, which has the power to issue any or all of our authorized but unissued shares without stockholder approval.

Recent Sales of Unregistered Securities and Use of Proceeds

We did not sell any equity securities which were not registered under the Securities Act during our fiscal year ended June 30, 2013.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fiscal year ended June 30, 2013.-

| Item 6. | Selected Financial Data |

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

The following plan of operations provides information that management believes is relevant to an assessment and understanding of our financial condition and results of operations. The discussion should be read along with our financial statements and notes thereto. This discussion includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words such as “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project” and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

| 10 |

Limited Operating History

We have an extremely limited operating history and have generated no significant independent financial history. Our business plan changed significantly in May 2011, and we have not demonstrated that we will be able to execute that plan. We cannot guarantee that our existing ventures or our efforts to identify and acquire one or more target companies or businesses as described above will be successful. Our business is subject to all of the risks inherent in development-stage enterprises, including limited capital resources and possible rejection of our business model.

Future financing may not be available to us on acceptable terms or at all. If financing is not available or is not available on satisfactory terms, we may be unable to continue our operations. Any equity financing that may be available will result in dilution of the interests of our existing shareholders.

Results of Operations

For the years ended June 30, 2013 and June 30, 2012

| Year Ended | ||||||||

| June 30, | ||||||||

| 2013 | 2012 | |||||||

| Revenue | $ | Nil | $ | Nil | ||||

| Cost of Sales | $ | Nil | $ | Nil | ||||

| Operating Expenses | $ | 425,715 | $ | 199,808 | ||||

| Interest Expense | $ | 17,556 | $ | 1,167 | ||||

| Other Income | $ | (7,517 | ) | $ | Nil | |||

| Exchange (Gain) / Loss | $ | 6,483 | $ | Nil | ||||

| Government Subsidy | $ | (7,966 | ) | $ | Nil | |||

| Loss (gain) from discontinued operations, net of tax | $ | 136,110 | $ | 51,416 | ||||

| Net Income (Loss) | $ | (570,381 | ) | $ | (252,390 | ) | ||

We realized revenues of $Nil for the years ended June 30, 2013 and 2012.

Expenses

| Year Ended | ||||||||

| June 30, | ||||||||

| 2013 | 2012 | |||||||

| Professional and Consulting fees – Related party | $ | 52,950 | $ | 41,500 | ||||

| Professional fees | $ | 88,694 | $ | 139,635 | ||||

| General and administrative expenses | $ | 284,071 | $ | 27,989 | ||||

Operating expenses for year ended June 30, 2013 increased by $225,907 or approximately 113.06% compared to operating expenses for year ended June 30, 2012, primarily as a result of increases in professional and consulting fees – related party and general and administrative expenses. Our company commenced operations of our agricultural business in China in July 2012 where we incurred wages and salaries expenses of $132,673, travel expenses of $77,485 and other general and administrative expenses of $73,913 .

During the fiscal year ended June 30, 2013, we had no revenue. Expenses for the year totaled $425,715 resulting in a net loss of $570,381. Operating expenses consisted of professional and consulting fees-related party of $52,950, professional fees of $88,694 and general and administrative expenses of $284,071.

| 11 |

Liquidity and Capital Resources

Working Capital

| At | At | |||||||

| June 30, | June 30, | |||||||

| 2013 | 2012 | |||||||

| Current Assets | $ | 522,646 | $ | 415,260 | ||||

| Current Liabilities | $ | 426,356 | $ | 60,393 | ||||

| Working Capital | $ | 96,290 | $ | 354,867 | ||||

Cash Flows

| Year Ended | ||||||||

| June 30, | ||||||||

| 2013 | 2012 | |||||||

| Net Cash provided by (used in) Operating Activities | $ | (841,385 | ) | $ | (171,194 | ) | ||

| Net Cash provided by (used in) Investing Activities | $ | 14,203 | $ | (519,746 | ) | |||

| Net Cash provided by (used in) Financing Activities | $ | 804,048 | $ | 753,596 | ||||

| Net Increase (Decrease) in Cash | $ | (22,943 | ) | $ | 87,614 | |||

As of June 30, 2013, we had a cash balance of $18,316, total assets of $841,437, and total liabilities of $934,047, as compared to a cash balance of $41,501, total assets of $570,325 and total liabilities of $410,393 as of June 30, 2012. Our working capital at June 30, 2013 was $96,290, as compared to a working capital of $354,867 at June 30, 2012.

Our company’s operations have been funded through an equity financing and a series of debt transactions, primarily with shareholders, directors, and officers of our company. These related party debt transactions have operated as informal lines of credit since the inception of our company, and related parties have extended credit as needed which our company has repaid at its convenience. We anticipate that we will incur operating losses in the foreseeable future and we believe we will need additional cash to support our daily operations while we are attempting to execute our business plan and produce revenues. If our related parties are unable or unwilling to provide additional capital, we would likely require financing from third parties. There can be no assurance that any additional financing will be available to us, on terms we believe to be favorable or at all. The inability to obtain additional capital would have a material adverse effect on our operations and financial condition and could force us to curtail or discontinue operations entirely and/or file for protection under bankruptcy laws.

On May 31, 2012, three of our shareholders and directors loaned us an aggregate of $350,000. These loans are represented by term promissory notes which are payable on May 31, 2017 and bear interest at the rate of 4% per annum. We advanced $319,896 of those loans as initial capital for the establishment of a new business venture.

In July 2011, we completed a private placement financing resulting in proceeds of $465,506 (net of expenses). From time to time our officers and shareholders have advanced money to our company as working capital. For the years ended June 30, 2013 and 2012, net cash provided by financing activities was $804,048 and $735,596, respectively.

Operating Activities

During the fiscal years ended June 30, 2013 and 2012, we used $841,385 and $171,194 in operating activities, respectively. The increase in net cash used in operating activities resulted from increases in loss from continuing operations, inventory, other assets and net cash provided by discontinued operations, offset by increases in depreciation and amortization expense, other current assets, accounts payable and accrued expenses and other current liabilities.

We have used a total of $1,274,910 in operating activities since inception on May 8, 2009.

| 12 |

Investing Activities

During the fiscal year ended June 30, 2013 we received $14,203 whereas we used $ 519,746 to purchase land use rights, property and equipment in investing activities for the fiscal year ended June 30, 2012. From inception on May 8, 2009 through June 30, 2013, we used $505,543 in investing activities. The increase in investing activities resulted from decreases in fixed assets purchased and land use rights offset by advanced prepayments.

Financing Activities

During the fiscal year ended June 30, 2013, we received proceeds from notes payable - related parties of $157,691 capital contribution by noncontrolling interest of $312,830, advances from related parties and affiliated company of $333,527 and repayment to shareholders of $Nil. As a result, we had net cash provided by financing activities of $804,048.

During the fiscal year ended June 30, 2012, we received proceeds from notes payable - related parties of $350,000 and on July 25, 2011, we completed a private placement of common stock for gross proceeds of $482,750 (or net proceeds of $465,506 after expenses of the offering). We repaid $95,358 to shareholders who advanced to our company to pay its expenses. As a result, we had net cash provided by financing activities of $804,048.

Our net cash provided by financing activities since inception on May 8, 2009 was $1,766,651.

Plan of Operations

In May 2011, we commenced limited operations under our current business model of identifying one or more businesses to merge with or acquire. As described above, in August 2011, we entered into a technology license and technology transfer agreement, under which we licensed the rights to develop, manufacture, market, sell and import products which incorporate or rely upon certain “Triops” technologies and processes in Taiwan, the People’s Republic of China, the United States, Japan and Korea. We began our initial operations using this license in August 2011.

On May 16, 2012, we entered into a joint venture agreement with Mr. Yuan-Hao Chang, a shareholder of our company, under which we intend to develop, own and operate an agricultural business in China, PRC. We intend to rely on Mr. Chang’s experience and knowledge in organic fertilizers and farming to plant and grow various fruits in China, and to harvest and sell the produced crops and goods for a profit. We commenced initial operations in July 2012.

In November 2012, we ceased our limited business operations and disposed the assets in Taiwan where we had entered into a technology licensing and transfer agreement to obtain the rights to develop, manufacture, market, sell and import products which incorporate or rely upon certain “Triops” technologies and processes in Taiwan, the People’s Republic of China, the United States, Japan and Korea.

We will evaluate our performance over the next twelve months of operations as we attempt to emerge from the development stage. We have a limited operating budget and must maintain tight expense controls. However, we will need to obtain additional financing to effectively implement our business plan. If we do not obtain additional financing, we will continue to operate on a reduced budget until such time as more capital can be raised or we may be forced to curtail or discontinue operations. In addition, we are actively pursuing a new business opportunity that would require additional funding over the next twelve months. There can be no assurance that we will be able to raise additional capital, on terms favorable to us or at all.

We will require additional funds to fund our budgeted expenses over the next 12 months. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares. There is still no assurance that we will be able to maintain operations at a level sufficient for an investor to obtain a return on his investment in our common stock. Further, we may continue to be unprofitable. We need to raise additional funds in the immediate future in order to proceed with our budgeted expenses.

| 13 |

Specifically, we estimate our operating expenses and working capital requirements for the next 12 months to be as follows:

| Description | Estimated Completion Date |

Estimated Expenses ($) |

| Consulting fees | 12 months | 60,000 |

| Professional fees | 12 months | 95,000 |

| Salaries and benefits | 12 months | 250,000 |

| Other general and administrative expenses | 12 months | 350,000 |

| Total | 755,000 |

Critical Accounting Policies

Basis of Presentation

Our company has prepared the accompanying consolidated financial statements in conformity with accounting principles generally accepted in the United States of America.

The consolidated financial statements include the accounts of our company and our subsidiaries. Significant inter-company transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Discontinued Operations

In November 2012, our company ceased our Taiwan’s business operations. The Consolidated Financial Statements have been recast to present the Taiwan’s business operation as discontinued operations as described in “Note 12 - Discontinued Operations.” Unless noted otherwise, discussion in the Notes to Consolidated Financial Statements pertain to continuing operations.

Reclassification

Certain amounts in the prior period financial statements have been reclassified to conform to the current period presentation. These reclassifications had no effect on reported net income or losses.

Cash and Cash Equivalents

Cash and cash equivalents are all highly liquid instruments purchased with a maturity of three months or less to the extent the funds are not being held for investment purposes.

Concentrations of Credit Risk

Our company's operations are carried out in China. Accordingly, our company's business, financial condition and results of operations may be influenced by the political, economic and legal environment in China, and by the general state of the China's economy. Our company's operations in China are subject to specific considerations and significant risks not typically associated with companies in North America. Our company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

| 14 |

Financial instruments which potentially subject our company to concentrations of credit risk consist principally of cash. All of our company’s cash is maintained with state-owned banks within China of which no deposits are covered by insurance. Our company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts.

Revenue Recognition

Our company is a development stage company as such has realized no product and or directly related expenses.

Our company entered into a joint venture agreement to develop, own and operate an agricultural business in China, PRC. Our company does not expect to generate any significant revenues over the next twelve months.

Inventory

Our company recognizes all direct and indirect costs of growing crops in accordance to ASC 905-330-25 "Agriculture Inventory Recognition". ASC 905-330-25 requires all direct and indirect costs of growing crops to accumulate as inventory until the time of harvest. Some crop costs such as soil preparation, which are incurred before planting are deferred and allocated until harvest. Growing crops consist of crop land lease, crops for growing crops, seeds and seeding plants costs, and production fees paid to growers. Inventories are stated at the lower of cost or market determined on a weighted average basis.

Fixed Assets

Fixed assets are recorded at cost and are depreciated or amortized using the straight-line method over the estimated useful lives of the assets:

| Machinery and Equipment | 10 years | |

| Electronic Equipment | 3 years | |

| Office Furniture and Others | 5 years |

Land Use Rights

Land use rights are recorded at cost and amortized over the shorter of the estimated useful life or the expected useful life of the land use rights for thirty-four years and six months.

Appropriation to Statutory Reserve

Pursuant to the laws applicable to the China, PRC, entities must make appropriations from after-tax profit to the non-distributable “statutory surplus reserve fund”. Subject to certain cumulative limits, the “statutory surplus reserve fund” requires annual appropriations of 10% of after-tax profits until the aggregated appropriations reach 50% of the registered capital (as determined under accounting principles generally accepted in the PRC (“PRC GAAP”) at each year-end). For foreign invested enterprises and joint ventures in China, PRC, annual appropriations should be made to the “reserve fund”. For foreign invested enterprises, the annual appropriation for the “reserve fund” cannot be less than 10% of after-tax profits until the aggregated appropriations reach 50% of the registered capital (as determined under PRC GAAP at each year-end). Our company did not make any appropriations to the reserve funds mentioned above due to lack of profits after tax in PRC since commencement of operations.

Advertising Costs

Our company’s policy regarding advertising is to expense advertising when incurred.

| 15 |

Income Taxes

Our company provides for income taxes under ASC 740, “Accounting for Income Taxes.” ASC 740 requires the use of an asset and liability approach in accounting for income taxes. Deferred tax assets and liabilities are recorded based on the differences between the financial statement and tax bases of assets and liabilities and the tax rates in effect when these differences are expected to reverse.

Impairment of Long-Lived Assets

Our company continually monitors events and changes in circumstances that could indicate carrying amounts of long-lived assets may not be recoverable. When such events or changes in circumstances are present, our company assesses the recoverability of long-lived assets by determining whether the carrying value of such assets will be recovered through undiscounted expected future cash flows. If the total of the future cash flows is less than the carrying amount of those assets, our company recognizes an impairment loss based on the excess of the carrying amount over the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or the fair value less costs to sell.

Stock-Based Compensation

Our company records stock-based compensation in accordance with ASC 718 (formerly SFAS No. 123R, “Share Based Payments”), using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. Equity instruments issued to employees and the cost of the services received as consideration are measured and recognized based on the fair value of the equity instruments issued.

Fair Value of Financial Instruments

The standard for “Disclosures about Fair Value of Financial Instruments,” defines financial instruments and requires fair value disclosures of those financial instruments. Our company adopts the standard “Fair Value Measurements,” which defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. Current assets and current liabilities qualified as financial instruments and management believes their carrying amounts are a reasonable estimate of fair value because of the short period of time between the origination of such instruments and their expected realization and if applicable, their current interest rate is equivalent to interest rates currently available. The three levels are defined as follows:

| • | Level 1 ─ inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. | |

| • | Level 2 ─ inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. | |

| • | Level 3 ─ inputs to the valuation methodology are unobservable and significant to the fair value. |

As of the balance sheet date, the estimated fair values of the financial instruments were not materially different from their carrying values as presented due to the short maturities of these instruments and that the interest rates on the borrowings approximate those that would have been available for loans of similar remaining maturity and risk profile at respective period-ends. Determining which category an asset or liability falls within the hierarchy requires significant judgment. Our company evaluates the hierarchy disclosures each quarter.

Segment Reporting and Geographic Information

Our company reports operations under one business segments-Agriculture.

| 16 |

Geographic Information as of June 30, 2013 and for the year ended June 30, 2013 and 2012 as follows:

| United States of America | Hong Kong, PRC | China, PRC | ||||||||||

| Revenues | $ | — | $ | — | $ | — | ||||||

| Expenses | (204,454 | ) | (233 | ) | (229,585 | ) | ||||||

| Net Income/(Loss) | $ | (204,454 | ) | $ | (233 | ) | $ | (229,585 | ) | |||

| Assets | $ | 350,899 | $ | 610,400 | $ | 827,463 | ||||||

| Liabilities | 513,866 | 300,719 | 119,463 | |||||||||

| Net Assets | $ | (162,967 | ) | $ | 309,681 | $ | 708,000 | |||||

Foreign Currency Translation

The functional currency of UAN Power operations in United States is U.S. Dollar (“USD”).

The functional currency of UAN Power’s discontinued operations in Taiwan is New Taiwan Dollar (“TWD”).

The functional currency of UAN Lee’s operations in Hong Kong is Hong Kong Dollar (“HKD”).

The functional currency of UAN Sheng’s operations in China, PRC is Chinese Yuan Renminbi (“RMB”).

Transactions denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the date of the transactions. Exchange gains or losses on transactions are included in earnings.

The financial statements of our company are translated into U.S. dollars in accordance with the standard, “Foreign Currency Translation,” codified in ASC 830, using rates of exchange at the end of the period for assets and liabilities, and average rates of exchange for the period for revenues, costs, and expenses and historical rates for equity. Translation adjustments resulting from the process of translating the local currency combining financial statements into U.S. dollars are included in determining comprehensive income.

At June 30, 2013, the cumulative translation adjustment was $23,352. For the year ended June 30, 2013 and 2012, net other comprehensive income (loss) was $5,008 and $(1,268), respectively.

The exchange rates used to translate TWD amounts into USD at (1USD=TWD) as follows:

| Balance Sheet Date Rate | Average Rate | |||||||

| June 30, 2012 | 29.91 | 29.68 | ||||||

| June 30, 2013 | 29.93 | 28.88 | ||||||

The exchange rates used to translate HKD amounts into USD at (1USD=HKD) as follows:

| Balance Sheet Date Rate | Average Rate | |||||||

| June 30, 2012 | — | — | ||||||

| June 30, 2013 | 7.76 | 7.76 | ||||||

The exchange rates used to translate RMB amounts into USD at (1USD=RMB) as follows:

| Balance Sheet Date Rate | Average Rate | |||||||

| June 30, 2012 | — | — | ||||||

| June 30, 2013 | 6.17 | 6.28 | ||||||

Comprehensive Income

Our company adopted FASB Accounting Standards Codification 220, “Comprehensive Income,” which establishes standards for reporting and presentation of comprehensive income (loss) and its components in a full set of general-purpose financial statements. Our company has chosen to report comprehensive income (loss) in the statements of income and comprehensive income. Comprehensive income (loss) is comprised of net income and all changes to stockholders’ equity except those due to investments by owners and distributions to owners.

Basic (Loss) per Common Share

Basic (loss) per share is calculated by dividing our company’s net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing our company’s net income available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. There are no such common stock equivalents outstanding as of June 30, 2013 and 2012, respectively; however, if present, a separate computation of diluted loss per share would not have been presented, as these common stock equivalents would have been anti-dilutive due to our company’s net loss.

| For the Year ended | ||||||||

| June 30, 2013 | June 30, 2012 | |||||||

| Net Loss attributable to Uan Power Corp. | ||||||||

| Continuing operations | $ | (356,212 | ) | $ | (200,974 | ) | ||

| Discontinued operations | $ | (136,110 | ) | $ | (51,416 | ) | ||

| Weighted Average Shares, basic and diluted | 78,273,000 | 75,107,426 | ||||||

| Earnings (Loss) per share | ||||||||

| Continuing operations | $ | (0.005 | ) | $ | (0.003 | ) | ||

| Discontinued operations | $ | (0.002 | ) | $ | (0.001 | ) | ||

Recently Issued Accounting Pronouncements

In July 2013, the FASB issued ASU 2013-11, “Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists.” This standard requires that an unrecognized tax benefits, or a portion of an unrecognized tax benefit be presented on a reduction to a deferred tax asset for an NOL carryforward, a similar tax loss, or a tax credit carryforward with certain exceptions to this rule. If certain exception condition exists, an entity should present an unrecognized tax benefit in the financial statements as a liability and should not net the unrecognized tax benefit with a deferred tax asset. This standard is effective for fiscal years and interim periods within those years beginning after December 15, 2013. Our company does not expect the adoption of the new provisions to have a material impact on our financial condition or results of operations.

| 17 |

In March 2013, the FASB issued ASU No. 2013-05, Foreign Currency Matters. This standard provides additional guidance with respect to the reclassification into income of the cumulative translation adjustment (CTA) recorded in accumulated other comprehensive income associated with a foreign entity of a parent company. The ASU differentiates between transactions occurring within a foreign entity and transactions/events affecting an investment in a foreign entity. For transactions within a foreign entity, the full CTA associated with the foreign entity would be reclassified into income only when the sale of a subsidiary or group of net assets within the foreign entity represents the substantially complete liquidation of that foreign entity. For transactions/events affecting an investment in a foreign entity (for example, control or ownership of shares in a foreign entity), the full CTA associated with the foreign entity would be reclassified into income only if the parent no longer has a controlling interest in that foreign entity as a result of the transaction/event. In addition, acquisitions of a foreign entity completed in stages will trigger release of the CTA associated with an equity method investment in that entity at the point a controlling interest in the foreign entity is obtained. This ASU is effective prospectively beginning January 1, 2014, with early adoption permitted. This ASU would impact our company’s consolidated results of operations and financial condition only in the instance of an event/transaction as described above.

In February 2013, the FASB issued ASU No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income. Under this standard, an entity is required to provide information about the amounts reclassified out of accumulated other comprehensive income (“AOCI”) by component. In addition, an entity is required to present, either on the face of the financial statements or in the notes, significant amounts reclassified out of AOCI by the respective line items of net income, but only if the amount reclassified is required to be reclassified in its entirety in the same reporting period. For amounts that are not required to be reclassified in their entirety to net income, an entity is required to cross-reference to other disclosures that provide additional details about those amounts. ASU 2013-02 does not change the current requirements for reporting net income or other comprehensive income in the financial statements. For our company, this ASU is effective beginning January 1, 2013, and interim periods within those annual periods. The adoption of this standard is not expected to have an impact on our company’s financial results or disclosures.

In July 2012, the FASB issued ASU No. 2012-02, Testing Indefinite-Lived Intangible Assets for Impairment. Under this standard, entities testing long-lived intangible assets for impairment now have an option of performing a qualitative assessment to determine whether further impairment testing is necessary. If an entity determines, on the basis of qualitative factors, that the fair value of the indefinite-lived intangible asset is more-likely-than-not less than the carrying amount, the existing quantitative impairment test is required. Otherwise, no further impairment testing is required. For our company, this ASU is effective beginning January 1, 2013, with early adoption permitted under certain conditions. The adoption of this standard is not expected to have a material impact on our company’s consolidated results of operations or financial condition.

Our company believes that there were no other accounting standards recently issued that had or are expected to have a material impact on our financial position or results of operations.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| Item 8. | Financial Statements and Supplementary Data |

| 18 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

UAN Power Corp. fka Gulf Shores Investments, Inc.

(A Development Stage Company)

We have audited the accompanying balance sheets of UAN Power Corp. as of June 30, 2013 and 2012, and the related statements of operations, comprehensive income (loss), stockholders’ equity (deficit), and cash flows for each of the years in the two-year period ended June 30, 2013, and for the period from May 8, 2009 (date of inception) to June 30, 2013. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of UAN Power Corp. as of June 30, 2013 and 2012, and the results of operations and cash flows for each the years in the two-year ended June 30, 2013, and for the period from May 8, 2009 (date of inception) to June 30, 2013 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has incurred accumulated deficits of $969,037 as of June 30, 2013. The Company incurred a net loss of $570,381 and $252,390 for the years ended June 30, 2013 and 2012, respectively. These factors raise substantial doubt about its ability to continue as a going concern. Management’s plans concerning this matter are also described in Note 3. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Yichien Yeh, CPA

Yichien Yeh, CPA

Oakland Gardens, New York

October 14, 2013

| 19 |

Uan Power Corp. and Subsidiaries

fka Gulf Shores Investments, Inc.

(A Development Stage Company)

Consolidated Balance Sheets

| June 30, 2013 | June 30, 2012 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and equivalents | $ | 18,316 | $ | 41,501 | ||||

| Inventory | 500,145 | — | ||||||

| Advanced prepayments | — | 319,896 | ||||||

| Other current assets | 3,911 | 7,099 | ||||||

| Current assets from discontinued operations | 274 | 46,764 | ||||||

| Total Current Assets | 522,646 | 415,260 | ||||||

| Fixed assets, net | 194,552 | — | ||||||

| Land use rights, net | 109,702 | — | ||||||

| Other assets | 14,537 | — | ||||||

| Other assets from discontinued operations | — | 155,065 | ||||||

| TOTAL ASSETS | $ | 841,437 | $ | 570,325 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued expenses | $ | 53,128 | $ | 24,830 | ||||

| Amounts due to related parties | 333,816 | 20,289 | ||||||

| Due to affiliated company | 20,000 | — | ||||||

| Other current liabilities | 19,412 | 1,167 | ||||||

| Current liabilities from discontinued operations | — | 14,107 | ||||||

| Total Current Liabilities | 426,356 | 60,393 | ||||||

| Notes payable to shareholders | 507,691 | 350,000 | ||||||

| Other liabilities from discontinued operations | — | — | ||||||

| Total Liabilities | 934,047 | 410,393 | ||||||

| Commitments & contingencies | — | — | ||||||

| Stockholders' Equity (Deficit) | ||||||||

| Uan Power Corp. Stockholders' Equity (Deficit) | ||||||||

| Preferred stock, $0.00001 par value, 20,000,000 shares authorized, 0 shares issued and outstanding | — | — | ||||||

| Common stock, $0.00001 par value, 250,000,000 shares authorized, 78,273,000 shares issued and outstanding at June 30, 2013 and 2012, respectively. | 783 | 783 | ||||||

| Additional paid-in capital | 610,906 | 610,906 | ||||||

| Accumulated other comprehensive income | 23,352 | 24,958 | ||||||

| Deficit accumulated during the development stage | (969,037 | ) | (476,715 | ) | ||||

| Total Uan Power Corp. Stockholders' Equity (Deficit) | (333,996 | ) | 159,932 | |||||

| 241,386 | — | |||||||

| Total Stockholders' Equity (Deficit) | (92,610 | ) | 159,932 | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | $ | 841,437 | $ | 570,325 | ||||

The accompanying notes are an integral part of these financial statements

| 20 |

Uan Power Corp. and Subsidiaries

fka Gulf Shores Investments, Inc.

(A Development Stage Company)

Consolidated Statements of Operations

| For the Year | For the Year | From Inception | ||||||||||

| Ended | Ended | May 8, 2009 to | ||||||||||

| June 30, 2013 | June 30, 2012 | June 30, 2013 | ||||||||||

| Revenues | $ | — | $ | — | — | |||||||

| Cost of Sales | — | — | — | |||||||||

| Gross Margin | — | — | — | |||||||||

| Operating Expenses | ||||||||||||

| Professional & Consulting Fees - Related Party | 52,950 | 41,500 | 154,350 | |||||||||

| Professional Fees | 88,694 | 130,318 | 358,517 | |||||||||

| General and administrative expenses | 284,071 | 27,989 | 336,981 | |||||||||

| Total Operating Expenses | 425,715 | 199,808 | 849,848 | |||||||||

| Loss from Operation | (425,715 | ) | (199,808 | ) | (849,848 | ) | ||||||

| Other Expenses | ||||||||||||

| Interest Expense | (17,556 | ) | (1,167 | ) | (18,723 | ) | ||||||

| Other Income | 7,517 | — | 7,517 | |||||||||

| Exchange Gain (Loss) | (6,483 | ) | — | (6,483 | ) | |||||||

| Government Subsidy | 7,966 | — | 7,966 | |||||||||

| Total other expenses | (8,556 | ) | (1,167 | ) | (9,723 | ) | ||||||

| Loss from continuing operations before income tax | (434,271 | ) | (200,974 | ) | (859,571 | ) | ||||||

| Provision for income tax | — | — | — | |||||||||

| Net Loss from continuing operations | (434,271 | ) | (200,974 | ) | (859,571 | ) | ||||||

| Loss from discontinued operations, net of tax | (136,110 | ) | (51,416 | ) | (187,526 | ) | ||||||

| Net Loss | (570,381 | ) | (252,390 | ) | (1,047,096 | ) | ||||||

| Less: Net loss attributable to non-controlling interest | (78,059 | ) | — | (78,059 | ) | |||||||

| Net loss attributable to Uan Power Corp. | $ | (492,322 | ) | $ | (252,390 | ) | $ | (969,037 | ) | |||

| Amounts attributable to Uan Power Corp. | ||||||||||||

| Net loss from continuing operations | $ | (356,212 | ) | $ | (200,974 | ) | $ | (781,512 | ) | |||

| Loss from discontinued operations | (136,110 | ) | (51,416 | ) | (187,526 | ) | ||||||

| Loss attributable to non-controlling interest, discontinued operations | — | — | — | |||||||||

| Net loss from discontinued operations | (136,110 | ) | (51,416 | ) | (187,526 | ) | ||||||

| Net loss attributable to Uan Power Corp. | $ | (492,322 | ) | $ | (252,390 | ) | $ | (969,037 | ) | |||

| Weighted Average Number of Common Shares Outstanding, basic and diluted | 78,273,000 | 75,107,426 | ||||||||||

| Net loss per share attributable to Uan Power Corp. | ||||||||||||

| Continuing Operations, basic and diluted | $ | (0.005 | ) | $ | (0.003 | ) | ||||||

| Discontinued Operations, basic and diluted | $ | (0.002 | ) | $ | (0.001 | ) | ||||||

| Total | $ | (0.006 | ) | $ | (0.003 | ) | ||||||

The accompanying notes are an integral part of these financial statements

| 21 |

Uan Power Corp. and Subsidiaries

fka Gulf Shores Investments, Inc.

(A Development Stage Company)

Consolidated Statements of Comprehensive Income (Loss)

| For the Year | For the Year | From Inception | ||||||||||

| Ended | Ended | May 8, 2009 to | ||||||||||

| June 30, 2013 | June 30, 2012 | June 30, 2013 | ||||||||||

| Net Loss | $ | (570,381 | ) | $ | (252,390 | ) | $ | (1,047,096 | ) | |||

| Other Comprehensive Loss, net of tax | ||||||||||||

| Cumulative Translation Adjustment | 5,008 | (1,268 | ) | 29,966 | ||||||||

| Total Other Comprehensive Loss, net of tax | 5,008 | (1,268 | ) | 29,966 | ||||||||

| Comprehensive Loss | (565,373 | ) | (253,658 | ) | (1,017,130 | ) | ||||||

| Less: Comprehensive Loss attributable to Non-controlling Interest | (71,444 | ) | — | (71,444 | ) | |||||||

| Comprehensive Loss attributable to Uan Power Corp. | $ | (493,928 | ) | $ | (253,658 | ) | $ | (945,685 | ) | |||

The accompanying notes are an integral part of these financial statements

| 22 |

Uan Power Corp. and Subsidiaries

fka Gulf Shores Investments, Inc.

(A Development Stage Company)

Consolidated Statements of Stockholders' Equity (Deficit)

From May 8, 2009 (Inception) to June 30, 2013

| Uan Power Corp. Shareholders' | |||||||||||||||||||||||||||||||

| Deficit | |||||||||||||||||||||||||||||||

| Accumulated | Accumulated | ||||||||||||||||||||||||||||||

| Stock | Additional | During | Other | ||||||||||||||||||||||||||||

| Common Stock | Subscription | Paid-In | Development | Comprehensive | Non-controlling | ||||||||||||||||||||||||||

| Shares | Amount | Receivable | Capital | Stage | Income (Loss) | Interest | Total | ||||||||||||||||||||||||

| Balance, May 8, 2009 - Inception | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

| Issuance of common stock on May 8, 2009 for cash at $0.0000033 per share | 60,000,000 | 600 | (400 | ) | 200 | ||||||||||||||||||||||||||

| Stock Subscription Receivable | (200 | ) | (200 | ) | |||||||||||||||||||||||||||

| Issuance of common stock on May 19, 2009 for cash at $0.00333 per share | 12,000,000 | 120 | 39,880 | 40,000 | |||||||||||||||||||||||||||

| Net Loss for the period from inception to June 30, 2009 | (38,846 | ) | (38,846 | ) | |||||||||||||||||||||||||||

| Balance, June 30, 2009 | 72,000,000 | $ | 720 | $ | (200 | ) | $ | 39,480 | $ | (38,846 | ) | $ | — | $ | — | $ | 1,154 | ||||||||||||||

| Issuance of common stock on July 1, 2009 in exchange for legal services at $0.00333 per share | 75,000 | 1 | 249 | 250 | |||||||||||||||||||||||||||

| Issuance of common stock during September 2009 for cash at $0.00333 per share | 198,000 | 2 | 658 | 660 | |||||||||||||||||||||||||||

| Collection of stock subscription receivable on September 23, 2009 | 200 | 200 | |||||||||||||||||||||||||||||

| Issuance of common stock on December 1, 2009 for cash at a price of $0.00333 per share | 6,000,000 | 60 | 19,940 | 20,000 | |||||||||||||||||||||||||||

| Net Loss for the period from July 1, 2009 to June 30, 2010 | (60,065 | ) | (60,065 | ) | |||||||||||||||||||||||||||

| Balance, June 30, 2010 | 78,273,000 | $ | 783 | $ | — | $ | 60,327 | $ | (98,911 | ) | $ | — | $ | — | $ | (37,801 | ) | ||||||||||||||

| Loan forgiveness - Related Parties on March 31, 2011 | 51,625 | 51,625 | |||||||||||||||||||||||||||||

| Cancellation of Shares on May 23, 2011 | (48,275,000 | ) | (483 | ) | 483 | — | |||||||||||||||||||||||||

| Net Loss for the period from July 1, 2010 to June 30, 2011 | (125,414 | ) | (125,414 | ) | |||||||||||||||||||||||||||

| Balance, June 30, 2011 | 29,998,000 | $ | 300 | $ | — | $ | 112,435 | $ | (224,325 | ) | $ | — | $ | — | $ | (111,590 | ) | ||||||||||||||

| Issuance of common stock on July 25, 2011, net of costs, for cash at a price of $.01 per share | 48,275,000 | 483 | 465,023 | 465,506 | |||||||||||||||||||||||||||

| Loan forgiveness - Related Parties on March 31, 2011 | 33,448 | 33,448 | |||||||||||||||||||||||||||||

| Net Loss for the period from July 1, 2011 to June 30, 2012 | (252,390 | ) | (252,390 | ) | |||||||||||||||||||||||||||

| Foreign currency translation | 24,958 | 24,958 | |||||||||||||||||||||||||||||

| Balance, June 30, 2012 | 78,273,000 | $ | 783 | $ | — | $ | 610,906 | $ | (476,715 | ) | $ | 24,958 | $ | — | $ | 159,932 | |||||||||||||||

| Capital contribution | 312,830 | 312,830 | |||||||||||||||||||||||||||||

| Net Loss for the period from July 1, 2012 to June 30, 2013 | (492,322 | ) | (78,059 | ) | (570,381 | ) | |||||||||||||||||||||||||

| Foreign currency translation | (1,606 | ) | 6,615 | 5,009 | |||||||||||||||||||||||||||

| Balance, June 30, 2013 | 78,273,000 | $ | 783 | $ | — | $ | 610,906 | $ | (969,037 | ) | $ | 23,352 | $ | 241,386 | $ | (92,610 | ) | ||||||||||||||

The accompanying notes are an integral part of these financial statements

| 23 |

Uan Power Corp. and Subsidiaries

fka Gulf Shores Investments, Inc.

(A Development Stage Company)

Consolidated Statements of Cash Flows

| For the Year | For the Year | From Inception | ||||||||||

| Ended | Ended | May 8, 2009 to | ||||||||||

| June 30, 2013 | June 30, 2012 | June 30, 2013 | ||||||||||

| OPERATING ACTIVITIES | ||||||||||||

| Net loss including non-controlling interest | $ | (570,381 | ) | $ | (252,390 | ) | $ | (1,047,096 | ) | |||

| Less: Loss from discontinued operations | (136,110 | ) | (51,416 | ) | (187,526 | ) | ||||||

| Loss from continuing operations | (434,271 | ) | (200,974 | ) | (859,570 | ) | ||||||

| Adjustments to reconcile net loss attributable Uan Power Corp. to net cash provided by or used in operating activities: | ||||||||||||

| Depreciation and amortization expense | 6,257 | — | 6,257 | |||||||||

| Common stock issued for legal services | — | — | 250 | |||||||||

| Expenses paid by related party on the Company's behalf | — | — | 19,125 | |||||||||

| Changes in assets and liabilities | ||||||||||||

| Inventory | (500,145 | ) | — | (500,145 | ) | |||||||

| Other current assets | 3,188 | (7,099 | ) | (3,911 | ) | |||||||

| Other assets | (14,537 | ) | 12,500 | (14,537 | ) | |||||||

| Accounts payable and accrued expenses | 28,298 | 16,787 | 53,128 | |||||||||

| Other current liabilities | 18,245 | 1,167 | 19,412 | |||||||||

| Net cash used in operating activities of continued operations | (892,965 | ) | (177,619 | ) | (1,279,991 | ) | ||||||