Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - PAN AMERICAN GOLDFIELDS LTD | exh31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - PAN AMERICAN GOLDFIELDS LTD | exh32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - PAN AMERICAN GOLDFIELDS LTD | exh31_2.htm |

| EX-32.2 - EXHIBIT 32.2 - PAN AMERICAN GOLDFIELDS LTD | exh32_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended August 31, 2013

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____ to _____.

Commission file number 000-23561

PAN AMERICAN GOLDFIELDS LTD.

(Exact name of small business issuer as specified in its charter)

|

Delaware

|

84-1431797

|

||

|

(State or other jurisdiction of incorporation)

|

(IRS Employer Identification Number)

|

||

|

1100 – 36 Toronto Street

Toronto, ON

|

M5C 2C5

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

||

Registrant’s telephone number, including area code: (416) 848-7744

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Non-accelerated filer o

|

Accelerated filer o

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No þ

As of October 11, 2013, the registrant had 100,340,026 shares of common stock issued and outstanding.

1

|

PART I — FINANCIAL INFORMATION

|

|||||

|

Item 1.

|

Condensed Unaudited Financial Statements

|

3

|

|||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

21

|

|||

|

Item 3.

|

Quantitative and Qualitative Disclosure about Market Risk

|

30

|

|||

|

Item 4.

|

Controls and Procedures

|

30

|

|||

|

PART II — OTHER INFORMATION

|

|||||

|

Item 1.

|

Legal Proceedings

|

31

|

|||

|

Item 1A.

|

Risk Factors

|

31

|

|||

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

31

|

|||

|

Item 3.

|

Defaults Upon Senior Securities

|

31

|

|||

|

Item 4.

|

Mine Safety Disclosures

|

31

|

|||

|

Item 5.

|

Other Information

|

31

|

|||

|

Item 6.

|

Exhibits.

|

31

|

|||

2

ITEM 1. FINANCIAL STATEMENTS

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Expressed in U.S. Dollars)

AUGUST 31, 2013

3

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Consolidated Balance Sheets

(Expressed in U.S. Dollars)

|

August 31

2013

|

February 28

2013

|

|||||||

|

(Unaudited)

|

(Audited)

|

|||||||

| $ | $ | |||||||

|

Assets

|

||||||||

|

Current

|

||||||||

|

Cash and cash equivalents

|

187,345 | 176,538 | ||||||

|

Accounts receivable

|

493,471 | 189,149 | ||||||

|

Prepaid expenses

|

1,721 | 25,663 | ||||||

|

Real estate held for sale

|

640,000 | 640,000 | ||||||

| 1,322,537 | 1,031,350 | |||||||

|

Equipment (note 4)

|

20,470 | 25,033 | ||||||

|

Total assets

|

1,343,007 | 1,056,383 | ||||||

|

Liabilities

|

||||||||

|

Current

|

||||||||

|

Accounts payable and accrued liabilities

|

1,347,560 | 976,934 | ||||||

|

Loans payable (note 7)

|

- | 10,867 | ||||||

|

Total liabilities

|

1,347,560 | 987,801 | ||||||

|

Stockholders’ equity (deficiency)

|

||||||||

|

Capital stock

|

||||||||

|

Preferred stock

|

||||||||

|

Authorized: 20,000,000 shares, $0.01 par value (note 8)

|

||||||||

|

Issued: nil

|

||||||||

|

Common stock

|

||||||||

|

Authorized: 200,000,000 shares, $0.01 par value

|

||||||||

|

Issued: 100,340,026 (February 28, 2013 – 94,507,801) (note 9)

|

1,003,400 | 945,078 | ||||||

|

Additional paid-in capital

|

52,903,781 | 52,567,111 | ||||||

|

Stock subscriptions

|

299,904 | 299,904 | ||||||

|

Accumulated deficit from prior operations

|

(2,003,427 | ) | (2,003,427 | ) | ||||

|

Accumulated deficit during the exploration stage

|

(52,416,037 | ) | (51,962,796 | ) | ||||

|

Accumulated other comprehensive income

|

207,826 | 222,712 | ||||||

|

Total stockholders’ equity (deficiency)

|

(4,553 | ) | 68,582 | |||||

|

Total liabilities and stockholders’ equity (deficiency)

|

1,343,007 | 1,056,383 | ||||||

Going-concern (note 3)

Commitments (notes 6 and 11)

The accompanying notes are an integral part of these consolidated financial statements.

4

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Consolidated Statements of Operations and Comprehensive Income (Loss)

(Expressed in U.S. Dollars)

(Unaudited)

|

Three Months Ended August 31

|

Six Months Ended August 31

|

Period From

March 1, 2004

(Inception of

Exploration

Stage) to

August 31

|

||||||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

2013

|

||||||||||||||||

|

Net sales

|

$ | 1,379,760 | $ | 1,958,376 | $ | 3,228,446 | $ | 3,011,730 | $ | 11,872,741 | ||||||||||

|

Cost of goods sold

|

990,521 | 601,636 | 1,703,005 | 925,238 | 5,269,595 | |||||||||||||||

|

Gross margin

|

389,239 | 1,356,740 | 1,525,441 | 2,086,492 | 6,603,146 | |||||||||||||||

|

Expenses

|

||||||||||||||||||||

|

General and administrative

|

452,157 | 854,579 | 1,554,966 | 1,680,294 | 28,284,603 | |||||||||||||||

|

Mineral exploration (note 6)

|

216,901 | 364,935 | 504,876 | 1,009,875 | 12,255,127 | |||||||||||||||

|

Impairment of mineral property costs

|

90,000 | 150,000 | 180,000 | 310,000 | 18,930,059 | |||||||||||||||

|

Operating loss

|

(369,819 | ) | (12,774 | ) | (714,401 | ) | (913,677 | ) | (52,866,643 | ) | ||||||||||

|

Other income (expenses)

|

||||||||||||||||||||

|

Deposit on equipment written off

|

- | - | - | - | (25,300 | ) | ||||||||||||||

|

Real estate impairment

|

- | - | - | - | (60,000 | ) | ||||||||||||||

|

Foreign exchange (loss)

|

3,023 | 13,985 | (11,251 | ) | (3,948 | ) | (603,221 | ) | ||||||||||||

|

Interest

|

(773 | ) | (821 | ) | (7,429 | ) | (7,314 | ) | (5,375,375 | ) | ||||||||||

|

Other income

|

138,710 | 26,916 | 319,908 | 268,972 | 1,260,905 | |||||||||||||||

|

Gain on disposal of assets

|

- | - | - | - | 15,130 | |||||||||||||||

|

Gain (loss) on sale of assets

|

- | (452 | ) | - | 31,691 | 4,400,065 | ||||||||||||||

|

Gain (loss) on settlement of debt

|

- | (158,120 | ) | (40,068 | ) | (208,736 | ) | 838,402 | ||||||||||||

|

Net loss

|

(228,859 | ) | (131,266 | ) | (453,241 | ) | (833,012 | ) | (52,416,037 | ) | ||||||||||

|

Other comprehensive income (loss)

|

||||||||||||||||||||

|

Foreign exchange translation adjustment

|

$ | (9,896 | ) | $ | 17,358 | $ | (14,886 | ) | $ | (24,516 | ) | $ | 207,826 | |||||||

|

Total comprehensive loss

|

$ | (238,755 | ) | $ | (113,908 | ) | $ | (468,127 | ) | $ | (857,528 | ) | $ | (52,208,211 | ) | |||||

|

Total loss per share – basic and diluted

|

$ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.01 | ) | ||||||||

|

Weighted average number of shares of common stock – basic and diluted

|

99,381,260 | 81,183,606 | 97,324,965 | 76,311,595 | ||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

5

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Consolidated Statements of Cash Flows

(Expressed in U.S. Dollars)

(Unaudited)

|

Six Months Ended August 31

|

Period from

March 1, 2004

(Inception of

Exploration Stage)

to August 31

|

|||||||||||

|

2013

|

2012

|

2013

|

||||||||||

|

Operating activities

|

||||||||||||

|

Net loss

|

$ | (453,241 | ) | $ | (833,012 | ) | $ | (52,416,037 | ) | |||

|

Adjustments to reconcile net (loss) to net cash flows:

|

||||||||||||

|

Write off of note receivable

|

- | - | 57,500 | |||||||||

|

Impairment of mineral property costs

|

- | - | 14,421,668 | |||||||||

|

Real estate impairment

|

- | - | 60,000 | |||||||||

|

Issuance of shares for consulting services

|

- | - | 510,590 | |||||||||

|

Issuance of shares for interest costs

|

- | - | 82,500 | |||||||||

|

Discount on convertible debenture

|

- | - | 569,549 | |||||||||

|

Deposit on equipment written off

|

- | - | 25,300 | |||||||||

|

Gain on disposal of assets

|

- | - | (15,130 | ) | ||||||||

|

Gain (loss) on sale of assets

|

- | 31,691 | (4,357,748 | ) | ||||||||

|

Non-cash component of loss (gain) on settlement of debt

|

40,068 | 208,736 | (880,217 | ) | ||||||||

|

Beneficial conversion feature

|

- | - | 4,081,091 | |||||||||

|

Stock-based compensation

|

94,460 | 348,000 | 13,031,046 | |||||||||

|

Amortization

|

3,782 | 8,960 | 362,820 | |||||||||

|

Net change in operating assets and liabilities:

|

||||||||||||

|

Prepaid expense

|

23,920 | 46,229 | (3,134 | ) | ||||||||

|

Accounts receivable

|

(325,644 | ) | (933,270 | ) | (310,303 | ) | ||||||

|

Inventory

|

- | 64,202 | 64,202 | |||||||||

|

Customer deposits

|

- | - | (194,809 | ) | ||||||||

|

Notes payable

|

- | - | 109,337 | |||||||||

|

Accounts payable and accrued liabilities

|

391,908 | 80,037 | 7,561,716 | |||||||||

|

Cash used in operating activities

|

(224,747 | ) | (978,427 | ) | (17,240,059 | ) | ||||||

|

Investing activities

|

||||||||||||

|

Sale of equipment

|

- | 49,650 | 82,966 | |||||||||

|

Purchase of property and equipment

|

- | (584 | ) | (604,201 | ) | |||||||

|

Cash used in investing activities

|

- | 49,066 | (521,235 | ) | ||||||||

|

Financing activities

|

||||||||||||

|

Proceeds from loans payable

|

- | - | 348,867 | |||||||||

|

Proceeds from notes payable

|

- | - | 3,162,196 | |||||||||

|

Proceeds from convertible debentures

|

- | - | 7,462,500 | |||||||||

|

Proceeds from exercise of options

|

- | - | 78,000 | |||||||||

|

Proceeds from exercise of warrants

|

- | - | 3,144,377 | |||||||||

|

Repayment of loans payable

|

(10,867 | ) | (12,887 | ) | (341,986 | ) | ||||||

|

Repayment of notes payable

|

- | - | (586,620 | ) | ||||||||

|

Repayment of convertible debentures

|

- | - | (2,051,047 | ) | ||||||||

|

Stock subscriptions (net)

|

240,000 | 1,008,600 | 3,896,862 | |||||||||

|

Issuance of common stock (net)

|

- | - | 2,756,994 | |||||||||

|

Cash provided by financing activities

|

229,133 | 995,713 | 17,870,143 | |||||||||

|

Net change in cash

|

4,386 | 66,352 | 108,849 | |||||||||

|

Effect of foreign currency translation on cash

|

6,421 | (20,659 | ) | 56,419 | ||||||||

|

Cash and cash equivalents, beginning

|

176,538 | 117,892 | 22,077 | |||||||||

|

Cash and cash equivalents, ending

|

$ | 187,345 | $ | 163,585 | $ | 187,345 | ||||||

Supplemental cash flow information (note 13)

The accompanying notes are an integral part of these consolidated financial statements.

6

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

|

1.

|

BASIS OF PRESENTATION

|

Pan American Goldfields Ltd. (formerly Mexoro Minerals, Ltd and Sunburst Acquisitions IV, Inc.) ("Panam" or the “Company”) was incorporated in the state of Delaware on March 23, 2010 and on July 2, 2010 changed its name to Pan American Goldfields Ltd. pursuant to an agreement and plan of merger between the Company and Mexoro Minerals Ltd. The Company was formed to seek out and acquire business opportunities. Between 1997 and 2003, the Company was engaged in two business acquisitions and one business opportunity, none of which generated a significant profit or created sustainable business. All were sold or discontinued. The Company had previously been pursuing various business opportunities and, effective March 1, 2004, the Company changed its operations to mineral exploration. Currently, the main focus of the Company’s operations is in Mexico.

On May 25, 2004, the Company completed a “Share Exchange Agreement” with Sierra Minerals and Mining, Inc. (“Sierra Minerals”), a Nevada corporation, which caused Sierra Minerals to become a wholly-owned subsidiary of the Company. Sierra Minerals held certain rights to properties in Mexico that the Company now owns or has an option to acquire. Through Sierra Minerals, the Company entered into a joint venture agreement with Minera Rio Tinto, S.A. de C.V. (“MRT”), a private company duly incorporated pursuant to the laws of Mexico. In August 2005, the Company cancelled the joint venture agreement in order to directly pursue mineral exploration opportunities through a wholly-owned Mexican subsidiary, Sunburst Mining de Mexico S.A. de C.V. (“Sunburst de Mexico”). On August 25, 2005, the Company, Sunburst de Mexico and MRT entered into agreements providing Sunburst de Mexico the right to explore and exploit certain properties in Mexico. In December 2005, the Company and Sunburst de Mexico entered into a new agreement with MRT (the “New Agreement”) (note 6). On January 20, 2006, Sierra Minerals was dissolved.

On February 12, 2009, the Company entered into a joint venture through a definitive agreement for development of its Cieneguita project with MRT. The purpose of the joint venture is to put the Cieneguita property into production. Pursuant to the agreement, MRT was to provide the necessary working capital to begin and maintain mining operations at Cieneguita, which are estimated to be $3,000,000. MRT planned to spend 100% of the money to earn 74% of the net cash flow from production (notes 5 and 6). The Company was expected to receive 20% of the net cash flows from production.

In September 2011, the Company executed an amended and restated development agreement for the restructure of its Cieneguita joint venture related to the Cieneguita project. Under the restructured joint venture agreement the Company was to receive 20% of the net operating profits after royalties for material processed through a small-scale pilot operation and mined from the first 15 meters depth of the Cieneguita deposit until December 31, 2012. For all other material processed from the property, the Company's interest is 80% and MRT is reduced to a 20% working interest, subject to certain dilution provisions (note 6).

In September, 2012, the Company entered into a second amended and restated development agreement (“Second Amended and Restated Development Agreement”) with MRT related to the mineral exploration, production and development of the Company’s Cieneguita project. Under the Second Amended and Restated Development Agreement, the Company’s share of net cash flow from the pilot project operated by MRT on the Cieneguita project increases from 20% to 29% beginning retroactive to March 1, 2012 through December 31, 2012. Beginning January 1, 2013 through December 31, 2013, the Company’s share of net cash flow from the pilot project increases to 35%. At all times, the Company retains its 80% ownership interest in the entire Cieneguita project. This agreement eliminates the additional fees previously payable by MRT for minerals mined below the first 15 meters.

The Second Amended and Restated Development Agreement extended the date of the pilot project from December 31, 2012 to December 31, 2013. MRT may terminate the pilot project by providing the Company with 90 days advanced written notice, and the Company may terminate the pilot project upon an uncured breach of the Second Amended and Restated Development Agreement by MRT.

7

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

|

2.

|

SIGNIFICANT ACCOUNTING POLICIES

|

|

(a)

|

Recent accounting pronouncements

|

|

(i)

|

On June 16, 2011, the FASB issued Accounting Standards Update (“ASU”) 2011-05, which revises the manner in which entities present comprehensive income in their financial statements. The new guidance removes the presentation options in ASC 220 and requires entities to report components of comprehensive income in either (1) a continuous statement of comprehensive income or (2) two separate but consecutive statements. The ASU does not change the items that must be reported in other comprehensive income. The amendments are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. The Company does not expect the provisions of ASU 2011-05 to have a material effect on the financial position, results of operations or cash flows of the Company, as the Company currently presents a continuous statement of operations and comprehensive income (loss).

|

|

(ii)

|

On May 12, 2011, the FASB issued ASU 2011-04. The ASU is the result of joint efforts by the FASB and IASB to develop a single, converged fair value framework. Thus, there are few differences between the ASU and its international counterpart, IFRS 13. This ASU is largely consistent with existing fair value measurement principles in U.S. GAAP; however it expands ASC 820’s existing disclosure requirements for fair value measurements and makes other amendments. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Company does not expect the provisions of ASU 2011-05 to have a material effect on the financial position, results of operations or cash flows of the Company.

|

|

(iii)

|

In May 2010, the FASB issued ASU 2010-19, Foreign Currency (Topic 830): Foreign Currency Issues: Multiple Foreign Currency Exchange Rates. The amendments in this update are effective as of the announcement date of March 18, 2010. Implementation of ASU 2010-19 did not have a material effect on the financial position, results of operations or cash flows of the Company.

|

|

(iv)

|

In April 2010, the FASB issued ASU 2010-17, Revenue Recognition-Milestone Method (Topic 605): Milestone Method of Revenue Recognition. The amendments in this update are effective on a prospective basis for milestones achieved in fiscal years, and interim periods within those years, beginning on or after June 15, 2010. Early adoption is permitted. If a vendor elects early adoption and the period of adoption is not the beginning of the entity’s fiscal year, the entity should apply the amendments retrospectively from the beginning of the year of adoption. Implementation of ASU 2010-17 did not have a material effect on the financial position, results of operations or cash flows of the Company.

|

8

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

|

3.

|

GOING CONCERN

|

The accompanying financial statements have been prepared on a going concern basis. The Company has a history of operating losses and will need to raise additional capital to fund its planned operations. As at August 31, 2013, the Company had a cumulative loss, during its exploration period, of $52,416,037 (February 28, 2013 - $51,962,796). These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

The Company intends to reduce its cumulative loss through the attainment of profitable operations from its investment in Mexican mining venture (note 6). In addition, the Company has conducted private placements of common stock and convertible debt (note 9), which have generated a portion of the initial cash requirements for its planned mining ventures (note 6).

In April 2013, the Company’s Canadian bank accounts were frozen due to a garnishing order for a judgement against the Company by a vendor in the amount of $120,000 plus interest. The Company has accrued the amounts due to this vendor at August 31, 2013.

In March 2013, the Company completed a private placement of 2,000,000 shares at $0.12 per share for total gross proceeds of $240,000 in cash (note 6).

In July 2012, the Company completed a private placement of 17,500,000 shares at $0.12 per share for total gross proceeds of $1,050,000 in cash and an additional $1,050,000 of real property in Argentina.

In May 2012, the Company converted subscription proceeds of $45,000 and issued 300,000 shares of common stock in a private placement. The subscribers to the subscription proceeds have agreed to purchase one unit for each $0.20 of subscription proceeds. Each unit consists of one share of the Company’s common stock and one warrant each exercisable at $0.30, which expires in two years.

In February 2012, the Company completed a private placement of 4,500,000 units at $0.20 per unit for total gross proceeds of $900,000. Each unit consisted of one share of common stock and one warrant to purchase one share of common stock, each exercisable at $0.30, expiring in two years from the closing date.

In June 2011, the Company completed a private placement of 1,500,000 units at $0.20 per unit, for total proceeds of $300,000. Each unit consisted of one share of common stock and one warrant to purchase one share of common stock, each exercisable at $0.30, expiring in two years from the closing date.

In March 2011, the Company completed a private placement of 6,560,000 units at $0.20 per unit, for total proceeds of $1,312,000. Each unit consisted of one share of common stock and one warrant to purchase one share of common stock. Each warrant is exercisable for one share of common stock at an exercise price of $0.30 per share for a period of two years from the closing date.

In July 2009, the Company signed a definitive agreement to sell its Guazapares project located in southwest Chihuahua, Mexico to Paramount Gold de Mexico, SA de C.V., the Mexican subsidiary of Paramount Gold and Silver Corp. (“Paramount”) for a total consideration of up to $5,300,000. The purchase price was to be paid in two stages. The first payment of $3,700,000 was released from escrow in February 2010, as the transfer of the 12 claims to Paramount was completed. An additional payment of $1,600,000 would have been due if, within 36 months following execution of the letter of agreement (July 10, 2009), either (i) Paramount Gold de Mexico SA de C.V. had been sold by Paramount, either through a stock sale or a sale of substantially all of its assets, or (ii) Paramount’s San Miguel project would have been put into commercial production. As of July 10, 2012, none of these two events occurred.

9

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

|

4.

|

EQUIPMENT

|

| August 31, 2013 |

February 28

2013

|

|||||||||||||||

|

Cost

|

Accumulated

Depreciation

|

Net Book

|

Net Book

|

|||||||||||||

|

Value

|

Value

|

|||||||||||||||

| $ | $ | $ | $ | |||||||||||||

|

Software

|

7,631 | 2,476 | 5,155 | 5,557 | ||||||||||||

|

Machinery

|

14,092 | 7,746 | 6,346 | 7,329 | ||||||||||||

|

Vehicles

|

74,497 | 71,686 | 2,811 | 4,676 | ||||||||||||

|

Computers

|

13,455 | 12,425 | 1,030 | 1,318 | ||||||||||||

|

Office equipment

|

15,836 | 10,708 | 5,128 | 6,153 | ||||||||||||

| 125,511 | 105,041 | 20,470 | 25,033 | |||||||||||||

|

5.

|

JOINT VENTURE WITH MRT

|

On February 12, 2009, the Company entered into a joint venture through a definitive agreement for development of its Cieneguita project with MRT. The purpose of the joint venture was to put Cieneguita property into production. As per the agreement, MRT was to provide the necessary working capital to begin and maintain mining operations estimated to be $3,000,000. MRT was to spend 100% of the funds in exchange for a 75% interest in the net cash flow from production. The agreement was amended in December 2009 for MRT to earn a 74% interest in the net cash flow from production (note 6).

In September 2011, the Company executed an amended and restated development agreement for the restructure of its Cieneguita joint venture related to the Cieneguita project. Under the restructured joint venture agreement the Company was to receive 20% of the net operating profits after royalties for material processed through a small-scale pilot operation and mined from the first 15 meters depth of the Cieneguita deposit until December 31, 2012. For all other material processed from the property, the Company's interest was 80% and MRT was reduced to a 20% working interest, subject to certain dilution provisions (note 6).

The agreement limited the mining of the mineralized material that is available from the surface to a depth of 15 meters or approximately 10% of the mineralized material found as of the date of the definitive agreement. The Company incurs no obligations to the joint venture’s creditors as the operations and working capital requirements are controlled by MRT and as such, the Company has concluded that it is not the primary beneficiary of the joint venture. Accordingly, the Company’s share of income and expenses are reflected in these financial statements under the proportionate consolidation method.

In September, 2012, the Company entered into a Second Amended and Restated Development Agreement with MRT related to the mineral exploration, production and development of the Company’s Cieneguita Project. Under the Second Amended and Restated Development Agreement, the Company’s share of net cash flow from the pilot project operated by MRT on the Cieneguita project increases from 20% to 29% beginning retroactive to March 1, 2012 through December 31, 2012. Beginning January 1, 2013 through December 31, 2013, the Company’s share of net cash flow from the pilot project increases to 35%. At all times, the Company retains its 80% ownership interest in the entire Cieneguita project. This agreement eliminates the additional fees previously payable by MRT for minerals mined below the first 15 meters.

The Second Amended and Restated Development Agreement extended the date of the pilot project from December 31, 2012 to December 31, 2013. MRT may terminate the pilot project by providing the Company with 90 days advanced written notice, and the Company may terminate the pilot project upon an uncured breach of the Second Amended and Restated Development Agreement by MRT.

The Company’s proportionate share of revenues was $3,228,446 and proportionate share of the net profit was $1,150,155 for the six months ended August 31, 2013. The Company’s proportionate share of accounts receivable of the joint venture was $457,715, at August 31, 2013. The joint venture did not have any other assets or liabilities at August 31, 2013.

10

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

|

6.

|

MINERAL PROPERTIES

|

The Company incurred exploration expenses as follows in the six months ended August 31, 2013:

|

Cieneguita

|

Total

|

|||||||

| $ | $ | |||||||

|

Geological, geochemical, geophyics

|

2,006 | 2,006 | ||||||

|

Land use permits

|

6,241 | 6,241 | ||||||

|

Travel

|

7,722 | 7,722 | ||||||

|

Consulting

|

370,174 | 370,174 | ||||||

|

Equipment

|

114,896 | 114,896 | ||||||

|

General

|

3,837 | 3,837 | ||||||

| 504,876 | 504,876 | |||||||

The Company incurred exploration expenses as follows in the six months ended August 31, 2012:

|

Cieneguita

|

Cerro Delta

|

New Projects

|

Total

|

|||||||||||||

| $ | $ | $ | $ | |||||||||||||

|

Drilling and sampling

|

- | 13,910 | 3,854 | 17,764 | ||||||||||||

|

Field work preparations

|

- | 369,204 | - | 369,204 | ||||||||||||

|

Land use permits

|

8,604 | - | - | 8,604 | ||||||||||||

|

Travel

|

5,948 | - | - | 5,948 | ||||||||||||

|

Consulting

|

454,195 | 7,265 | - | 461,460 | ||||||||||||

|

Equipment

|

88,801 | - | - | 88,801 | ||||||||||||

|

General

|

6,543 | 892 | 50,659 | 58,094 | ||||||||||||

| 564,091 | 391,271 | 54,513 | 1,009,875 | |||||||||||||

Since May 2004, the Company has held interests in gold exploration properties in Mexico.

In August 2005, the Company formed its wholly owned subsidiary, Sunburst de Mexico, which allowed the Company to take title to the properties in the name of Sunburst de Mexico. On August 25, 2005, the Company entered into property agreements with MRT, which provided Sunburst de Mexico options to purchase the mineral concessions of the Cieneguita and Guazapares properties and the right of refusal on three Encino Gordo properties. The Company also entered into a development and sale agreement, in October 2006, with Minera Emilio S.A. de C.V. for the mineral concessions of the Sahuayacan property.

In August 2005, the parties also entered into an operator’s agreement, that gave MRT the sole and exclusive right and authority to manage the Cieneguita property, and a share option agreement which granted MRT the exclusive option to acquire up to 100% of all outstanding shares of Sunburst de Mexico if the Company did not comply with the terms of the property agreements. The operator’s agreement and share option agreement were subsequently cancelled when the Company and Sunburst de Mexico entered into a new contract with MRT as described below under “Encino Gordo”.

In February 2009, the Company entered into an exploration agreement with MRT, which was amended in December 2009, then in September 2011 and finally in September 2012.

11

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

6. MINERAL PROPERTIES (continued)

The material provisions of the property agreements are as follows:

Cieneguita

MRT assigned to Sunburst de Mexico, with the permission of the Cieneguita property’s owner, Corporativo Minero, S.A. de C.V. (“Corporativo Minero”), all of MRT’s rights and obligations acquired under a previous agreement (the Cieneguita option agreement), including the exclusive option to acquire the Cieneguita property for a price of $2,000,000. Prior to assigning the Cieneguita property to the Company, MRT had paid $350,000 to Corporativo Minero. As the Cieneguita property was not in production by May 6, 2006, Sunburst de Mexico was required to pay $120,000 to Corporativo Minero to extend the contract. Corporativo Minero agreed to reduce the obligation to $60,000, of which $10,000 was paid in April 2006 and the balance paid on May 6, 2006. The Company made this payment to Corporativo Minero and the contract was extended.

The Company had the obligation to pay a further $120,000 per year for the next 13 years and the balance of the payments in the 14th year, until the total amount of $2,000,000 was paid. The Company renegotiated the payment due May 6, 2007, to $60,000 payable on November 6, 2007, which was paid, and the balance of $60,000 was paid on December 20, 2007. The Company paid $60,000 on May 12, 2008, of the $120,000 due on May 6, 2008, and the balance was paid in June 2008. The Company paid $30,000 each for a total of $120,000 on May 22, 2009, June 26, 2009, September 4, 2009 and November 20, 2009. In 2010, the Cieneguita project was put into production under the development agreement as described above and the payment terms were changed based on the following formula:

The Company must pay the Cieneguita owners $20 per ounce of gold produced from the Cieneguita property to the total of $2,000,000 due. In the event that the price of gold is above $400 per ounce, the property payments payable to the Cieneguita owners from production will be increased by $0.10 for each dollar increment over $400 per ounce. The total payment of $2,000,000 does not change with fluctuations in the price of gold. Non-payment of any portion of the $2,000,000 total payment will constitute a default. In such case, the Cieneguita owners will retain ownership of the concessions, but the Company will not incur any additional default penalty.

In September 2011, the Company, MRT and Corporativo Minero entered into a new agreement, where Corporativo Minero was entitled to a monthly payment of $30,000, to be paid from the net cash flows from production at Cieneguita until the completion of the first 15 meters of production or December 31, 2012, whichever occurs first.

In September 2012, the Company entered into a Second Amended and Restated Development Agreement with MRT whereby the Company’s share of net cash flow from the pilot project operated by MRT increases from 20% to 29% beginning retroactively from March 1, 2012 to December 31, 2012. From January 1, 2013 to December 31, 2013, this amount increases to 35%.

Based on production at Cieneguita, the joint venture paid $180,000 during the six months ended August 31, 2013 (February 28, 2013 - $330,000) to the Cieneguita owners. As of August 31, 2013, Corporativo Minero has been paid a total of $1,687,241 for the Cieneguita property. The Company is not in default on its payments for the Cieneguita property.

12

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

6. MINERAL PROPERTIES (continued)

On February 12, 2009, the Company entered into a definitive agreement for development of the Cieneguita project with MRT. The definitive agreement covered project financing of up to $9,000,000. The major points of the agreement were as follows:

|

(i)

|

MRT and/or its investors will subscribe for $1,000,000 of a secured convertible debenture at 8% interest (payable in stock or cash). The debenture was convertible into units at $0.60 per unit. Each unit comprised two common shares and one warrant. Each warrant is exercisable at $0.50 per share for a period of three years. The placement will be used for continued development of the Company’s properties and general working capital.

|

|

(ii)

|

MRT is to provide the necessary working capital to begin and maintain mining operations estimated to be $3,000,000 used for the purpose of putting the Cieneguita property into production. MRT will spend 100% of the money to earn 75% of the net cash flow from production. The agreement will limit the mining to the mineralized material that is available from surface to a depth of 15 meters or approximately 10% of the mineralized material found to date.

|

|

(iii)

|

MRT will spend up to $5,000,000 to take the Cieneguita property through the feasibility stage. In doing so, MRT will earn a 60% interest in the Company’s rights to the property. After the expenditure of the $5,000,000 all costs will be shared on a ratio of 60% to MRT and 40% to the Company. If the Company elects not to pay its portion of costs after the $5,000,000 has been spent, the Company’s position shall revert to a 25% carried interest on the property.

|

To generate funding for the Company’s continued operations, the Company issued $1,500,000 of convertible debentures in March 2009, of which an aggregate of $880,000 was issued to Mario Ayub, a former director of the Company, and his affiliated entity, MRT. Pursuant to the terms of the convertible debentures, the holders irrevocably converted the debentures into a 10% ownership interest in the Cieneguita project and a 10% interest in the net cash flow from First Phase Production.

In December 2009, Mario Ayub and MRT agreed to resell an aggregate 4% ownership interest in the Cieneguita project back to the Company, along with 4% of the net cash flow from First Phase Production, in return for $550,000. In a private transaction not involving the Company, the other holders contributed their remaining 6% ownership interest in the Cieneguita project to a newly formed entity, Marje Minerals SA (“Marje Minerals”).

In December 2009, the Company amended the development agreement and its agreements with the debenture holders. According to the amended development agreement, the ownership interest in the Cieneguita project and the net cash flows from the First Phase Production were held by the Company, MRT and Marje Minerals as follows:

|

Holder

|

Ownership

Percentage

|

Net Cash Flow

Interest From

First Phase

Production

|

Net Cash Flow

Interest Following

First Phase

Production

|

|||||||||

|

MRT

|

54 | % (1) | 74 | % | 54 | % (1) | ||||||

|

Marje Minerals

|

6 | % | 6 | % | 6 | % | ||||||

|

Panam

|

40 | % | 20 | % | 40 | % | ||||||

(1) Was to be earned by MRT by spending $4,000,000 to take the Cieneguita project through the feasibility stage.

Any additional costs for the First Phase Production and the feasibility study for the Cieneguita project, after MRT invested $8,000,000, would have been shared by the Company, MRT and Marje Minerals on a pro-rata basis based on their respective ownership percentages in the Cieneguita project.

13

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

6. MINERAL PROPERTIES (continued)

The major terms of the amended development agreement with MRT and Marje Minerals were as follows:

|

(i)

|

MRT purchased $1,000,000 of secured convertible debentures at 8% interest (payable in stock or cash). The proceeds from this investment were used for continued development and exploration of the Cieneguita project and general working capital. On November 5, 2009, MRT exercised its conversion rights on the debenture and MRT was issued 3,333,333 common shares and a warrant to purchase 1,666,667 shares of common stock at an exercise price of $0.50 per share.

|

|

(ii)

|

MRT agreed to provide the necessary working capital to begin and maintain mining operations, estimated to be $3,000,000, to put the first phase of the Cieneguita project into production. In exchange for these funds, the Company assigned MRT an interest to 74% of the net cash flow from First Phase Production. The agreement limits the mining during First Phase Production to the mineralized material that is available from the surface to a depth of 15 meters.

|

|

(iii)

|

MRT committed to spend up to $4,000,000 to take the Cieneguita project through the feasibility stage. In doing so, the Company assigned MRT a 54% interest in its rights to the Cieneguita project. After the expenditure of the $4,000,000, all costs will be shared on a pro rata ownership basis (i.e. 54% to MRT, 40% to the Company and 6% to Marje Minerals). If any party cannot pay its portion of the costs after the $4,000,000 has been spent, then their ownership position in the Cieneguita project will be reduced by 1% for every $100,000 invested by the other owners. The Company’s ownership interest in the Cieneguita project, however, cannot be reduced below 25%. In addition, the Company has the right to cover Marje Minerals’ pro rata portion of costs if they cannot pay their portion of the costs. In return, the Company will receive 1% of Marje Minerals’ ownership position in the Cieneguita project for every $100,000 the Company invests on their behalf.

|

|

(iv)

|

The MRT agreement was contingent on the Company repaying its debenture to Paramount. In March 2009, the Company repaid $1,000,000, or approximately two-thirds of the debt, and Paramount released a security interest it had on the Cieneguita project. In October 2009, the Company repaid the remaining amount of the debt and Paramount released its security interests on the Sahuayacan, Guazapares and Encino Gordo properties.

|

In September 2011, the Company executed a new amended and restated development agreement with MRT and Marje Minerals, for the restructure of its Cieneguita joint venture. Under the restructured joint venture agreement the Company receives 20% of the net operating profits after royalties for material processed through a small-scale pilot operation and mined from the first 15 meters depth of the Cieneguita deposit until December 31, 2012. For all other material processed from the property, the Company's interest is 80% and MRT is reduced to a 20% working interest, subject to certain dilution provisions. The Company also bought back 6% interest in Cieneguita from Marje Minerals in exchange for 3,333,333 common shares of the Company.

Under the agreement, the parties agreed to restructure their respective ownership interests in the Cieneguita project as follows:

|

Holder

|

Ownership

Percentage

|

Net Cash Flow

Interest From

First Phase

Production

|

Net Cash Flow

Interest Following

First Phase

Production

|

|||||||||

|

MRT

|

20 | % | 74 | % | 20 | % | ||||||

|

Marje Minerals

|

0 | % | 6 | % | 0 | % | ||||||

|

Panam

|

80 | % | 20 | % | 80 | % | ||||||

14

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

6. MINERAL PROPERTIES (continued)

The Company and MRT shall be responsible for the cost of a feasibility study on a pro rata basis based on their respective amended ownership percentages of the Cieneguita project.

Marje Minerals will also assume approximately $490,000 in debt of the Company in consideration for receiving half of all monthly net cash flows that the Company is entitled from operations on the first 15 meters, if any, until the sooner of December 31, 2012 or until Marje Minerals receives $490,000 from these cash flows.

In September, 2012, the Company entered into a Second Amended and Restated Development Agreement with MRT related to the mineral exploration, production and development of the Company’s Cieneguita Project. Under the Second Amended and Restated Development Agreement, the Company’s share of net cash flow from the pilot project operated by MRT on the Cieneguita project increases from 20% to 29% beginning retroactive to March 1, 2012 through December 31, 2012. Beginning January 1, 2013 through December 31, 2013, the Company’s share of net cash flow from the pilot project increases to 35%. At all times, the Company retains its 80% ownership interest in the entire Cieneguita project. This agreement eliminates the additional fees previously payable by MRT for minerals mined below the first 15 meters.

The Second Amended and Restated Development Agreement extended the date of the pilot project from December 31, 2012 to December 31, 2013. MRT may terminate the pilot project by providing the Company with 90 days advanced written notice, and the Company may terminate the pilot project upon an uncured breach of the Second Amended and Restated Development Agreement by MRT.

In connection with the revised development agreement, MRT also purchased 2,000,000 shares of the Company’s common stock at a price of $0.12 per share for net proceeds of $240,000 pursuant to the Company’s private placement subscription agreement. The Company will issue the shares to MRT in reliance on exemptions from registration pursuant to Section 4(2) under the Securities Act of 1933, as amended, and Rule 506 promulgated thereunder.

Encino Gordo

On December 8, 2005, the Company and Sunburst de Mexico entered into a “New Agreement” with MRT to exercise their option under the sale and purchase of the mining concessions agreement, dated August 18, 2005, to obtain two mining concessions in the Encino Gordo region. The New Agreement also provided the Company the option to obtain three additional concessions in the Encino Gordo region.

The following were additional material terms of the New Agreement:

|

(a)

|

The share option agreement with MRT was cancelled;

|

|

(b)

|

The Company granted MRT the option to buy all of the outstanding shares of Sunburst de Mexico for $100 if the Company failed to transfer $1,500,000 to Sunburst de Mexico by April 30, 2006. On April 6, 2006, MRT agreed to waive its option to purchase the shares of Sunburst de Mexico and also waived the Company’s obligation to transfer $1,500,000 to Sunburst de Mexico. The property agreements were modified to change the NSR to a maximum of 2.5% for all properties covered by the agreements. The property agreements contained NSRs ranging from 0.5% to 7%;

|

|

(c)

|

The Company agreed to issue 2,000,000 shares of the Company’s common stock to MRT within four months of the date of signing of the New Agreement. These shares were issued to MRT and its assignee at the market value of $1.05 per share on February 23, 2006, and $2,100,000 was charged to operations for the year ended February 28, 2006. This issuance fulfilled the Company’s payment obligations under the previous property agreements;

|

|

(d)

|

The Company agreed to issue 1,000,000 additional shares of the Company’s common stock to MRT if and when the Cieneguita property is put into production and reaches 85% of production capacity over a 90-day period, as defined in the New Agreement; and

|

|

(e)

|

The operator’s agreement with MRT was cancelled.

|

15

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

6. MINERAL PROPERTIES (continued)

Sunburst de Mexico purchased two of the Encino Gordo concessions from MRT for a price of 1,000 pesos (approximately US$100), and MRT assigned to Sunburst de Mexico a first right of refusal to acquire three additional Encino Gordo concessions. The total payments to acquire 100% of these three additional concessions were as follows: $10,000 on June 30, 2006 (paid); $25,000 on December 31, 2006 (paid), $50,000 on December 31, 2007 ($20,000 of this payment was made on January 3, 2008 and the balance was paid on February 29, 2008) and $75,000 on December 31, 2008 (the payment was not made and the Company was in default). In August 2009, the Company decided to surrender the Encino Gordo 2 mining concession eliminating any future concession payments on these properties.

In May 2012, the Company transferred its interest in concessions at the Encino Gordo project located in the Barranca region of Chihuahua State in Mexico, which included two concessions owned by the Company and two additional concessions the Company had the option to acquire, to MRT. In connection with the transfer, MRT paid $100,000 cash, waived $200,000 in payments the Company owed to MRT in connection with the Encino Gordo Project and agreed to assume all of the Company’s obligations related to the transferred concessions.

Cerro Delta

In February 2011, the Company management entered into an agreement with Compania Minera Alto Rio Salado S.A., a private Argentine entity, for the acquisition of the 15,000-hectare Cerro Delta project in northwest La Rioja Province, Argentina. Under the terms of the agreement, the Company must pay $150,000 upon signing (paid), and $200,000 on the first anniversary (paid), $500,000 on the second anniversary, $750,000 on the third anniversary, $1.2 million on the fourth anniversary, and $2.2 million on the fifth anniversary of the signing, with a final option payment of $5 million to purchase a 100% interest in the project payable on the sixth anniversary of the signing. The vendor was to retain a 1% NSR.

In December 2012, due to the significantly deteriorating political and working environment in Argentina and the difficulty to fund Maricunga belt projects, the Company froze all spending in Argentina. In January 2013, the Company cancelled the contract with Compania Minera Alto Rio Salado S.A. to acquire the Cerro Delta project.

|

7.

|

LOANS PAYABLE

|

As at August 31, 2013, there were loans payable in the amount of $nil (February 28, 2013 - $10,867), which are all current. The loans were repayable in monthly instalments of $nil (February 28, 2013 – $3,702), including interest of 7.50% per annum.

|

8.

|

PREFERRED STOCK

|

The Company is authorized to issue 20,000,000 shares of preferred stock. The Company’s board of directors is authorized to divide the preferred stock into series, and with respect to each series, to determine the preferences and rights and qualifications, limitations or restrictions thereof, including the dividend rights, conversion rights, voting rights, redemption rights and terms, liquidation preferences, sinking fund provisions, and the number of shares constituting the series and the designations of such series. The board of directors could, without stockholder approval, issue preferred stock with voting and other rights that could adversely affect the voting rights of the holders of common stock, which issuance could have certain anti-takeover effects. There were no shares of preferred stock issued or outstanding at August 31, 2013 or August 31, 2012.

16

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

|

9.

|

COMMON STOCK

|

In June 2013, the Company converted $60,533 of debt owed to certain directors for directors’ fee into 289,775 common shares.

In June 2013, the Company issued 3,500,000 common shares in exchange for 10,000,000 warrants to certain directors and an officer under a settlement agreement.

In June 2013, the Company issued 42,450 common shares to a consultant pursuant to a consulting agreement.

In March 2013, the Company completed a $240,000 private placement offering, whereby the Company issued 2,000,000 shares of its common stock at a subscription price of $0.12 per share.

In January 2013, the Company issued 500,000 common shares to a consultant pursuant to a consulting agreement. The shares were valued at the time of issuance at $0.13 per share.

In November 2012, the Company issued 250,000 common shares to a consultant pursuant to a consulting agreement. The shares were valued at the time of issuance at $0.12 per share.

In September 2012, the Company issued 500,000 common shares to a consultant pursuant to a consulting agreement. The shares were valued at the time of issuance at $0.13 per share.

In September 2012, the Company issued the remaining 2,166,666 common shares relating to the acquisition of 6% of ownership interest in the Cieneguita project.

In November 2012, the Company issued 250,000 common shares to a consultant pursuant to a consulting agreement. The shares were valued at the time of issuance at $0.12 per share.

In July 2012, the Company converted outstanding fees in the amount of $71,900 owed to the Company’s directors into shares of the Company’s common stock, at a conversion price of $0.10 per share.

In July 2012, the Company completed a $2.1 million private placement offering, whereby the Company issued 17,500,000 shares of its common stock at a subscription price of $0.12 per share. Of the aggregate purchase price, $1,050,000 was paid in cash and $1,050,000 was paid through the transfer of real property in Argentina. The Company intends to liquidate this property as soon as practical. In conjunction with the offering, the Company paid a finder’s fee of $84,000 and 700,000 shares of common stock.

In June 2012, the Company issued 194,444 common shares pursuant to a debt settlement agreement to settle $20,000 of debt. The shares were valued at the time of issuance at $0.10 per share.

In May 2012, the Company converted subscription proceeds of $45,000 and issued 300,000 shares of common stock in a private placement. The subscribers to the subscription proceeds have agreed to purchase one unit for each $0.20 of subscription proceeds. Each unit consists of one share of the Company’s common stock and two warrants each exercisable at $0.20 and $0.30, which expire in two years. In July 2012, the Company paid a finder’s fee of $2,400 related to the private placement.

In April 2012, the Company issued 235,294 common shares pursuant to a debt settlement agreement to settle $40,000 of debt. The shares were valued at the time of issuance at $0.17 per share.

In April 2012, the Company issued 250,000 common shares to a consultant pursuant to a consulting agreement. The shares were valued at the time of issuance at $0.18 per share.

|

10.

|

STOCK COMPENSATION PROGRAM

|

On March 18, 2009, the board of directors approved the granting of stock options according to the 2009 Nonqualified Stock Option Plan (“2009 Option Plan”) whereby the board is authorized to grant to employees and other related persons stock options to purchase an aggregate of up to 6,000,000 shares of the Company's common stock. Subject to the adoption of the 2009 Option Plan, the options were granted and vest, pursuant to the terms of the 2009 Option Plan, in six equal instalments, with the first instalment vesting at the date of grant, and the balance vesting over 2.5 years, every six months.

In the six months ended August 31, 2013, the Company awarded nil options to purchase common shares (August 31, 2012 – nil) and recorded stock-based compensation expense for the vesting options of $49,400 (August 31, 2012 - $102,200). The following weighted average assumptions were used for the Black-Scholes option-pricing model to value stock options granted in 2013 and 2012:

17

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

10. STOCK COMPENSATION PROGRAM (continued)

|

2013

|

2012

|

|||||||

|

Expected volatility

|

- | - | ||||||

|

Weighted-average volatility

|

- | - | ||||||

|

Expected dividend rate

|

- | - | ||||||

|

Expected life of options in years

|

- | - | ||||||

|

Risk-free rate

|

- | - | ||||||

There were no capitalized stock-based compensation costs at August 31, 2013 or August 31, 2012.

The summary of option activity under the 2009 Option Plan as of August 31, 2013, and changes during the period then ended, is presented below:

|

Weighted

|

Number of

|

Weighted-

|

Aggregate

|

|||||||||||||

|

Average

|

Shares

|

Average

|

Intrinsic

|

|||||||||||||

|

Exercise

|

Remaining

|

Value

|

||||||||||||||

|

Price

|

Contractual

|

|||||||||||||||

|

Options

|

$ | Term | ||||||||||||||

|

Balance at March 1, 2013

|

0.29 | 4,961,669 | ||||||||||||||

|

Options granted

|

- | - | ||||||||||||||

|

Options exercised

|

- | - | ||||||||||||||

|

Options cancelled/forfeited

|

0.26 | (2,166,669 | ) | |||||||||||||

|

Balance at August 31, 2013

|

0.31 | 2,795,000 | 6.19 | - | ||||||||||||

|

Exercisable at August 31, 2013

|

0.31 | 2,611,668 | 6.09 | - | ||||||||||||

The weighted-average grant-date fair value of options granted during the six months ended August 31, 2013 and August 31, 2012 is $nil and $nil, respectively.

A summary of the status of the Company’s non-vested options as of August 31, 2013, and changes during the six months ended August 31, 2013, is presented below:

|

Weighted-average

|

||||||||

|

Grant-Date

|

||||||||

|

Non-vested options

|

Shares

|

Fair Value

|

||||||

| $ | ||||||||

|

Non-vested at February 28, 2013

|

533,332 | 0.25 | ||||||

|

Granted

|

- | - | ||||||

|

Vested

|

(183,332 | ) | 0.27 | |||||

|

Cancelled/forfeited

|

(166,668 | ) | 0.26 | |||||

|

Non-vested at August 31, 2013

|

183,332 | 0.27 | ||||||

As of August 31, 2013, there was an estimated $49,100 of total unrecognized compensation cost related to non-vested share-based compensation arrangements granted under the 2009 nonqualified stock option plan. That cost is expected to be recognized over a weighted-average period of approximately 0.13 years.

18

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

|

11.

|

WARRANTS

|

As at August 31, 2013, the Company had a total of 7,900,000 warrants (February 28, 2013 – 29,160,000) outstanding to purchase common stock. Each warrant entitles the holder to purchase one share of the Company’s common stock. The Company has reserved 7,900,000 shares of common stock in the event that these warrants are exercised.

During the six months ended August 31, 2013, the Company received $nil from warrants exercised.

The following table summarizes the continuity of the Company’s share purchase warrants:

|

Number of

Warrants

|

Weighted Average

Exercise Price

|

|||||||

|

Balance, February 29, 2012

|

32,011,733 | $ | 0.35 | |||||

|

Issued

|

2,100,000 | 0.26 | ||||||

|

Cancelled/expired

|

(4,951,733 | ) | 0.68 | |||||

|

Exercised

|

- | - | ||||||

|

Balance, February 28, 2013

|

29,160,000 | $ | 0.29 | |||||

|

Issued

|

300,000 | 0.30 | ||||||

|

Cancelled/expired

|

(21,560,000 | ) | 0.29 | |||||

|

Exercised

|

- | - | ||||||

|

August 31, 2013

|

7,900,000 | $ | 0.30 | |||||

As at August 31, 2013, the following share purchase warrants were outstanding:

|

Number of

Warrants

|

Exercise Price

|

Expiry Date

|

||||||

| $ | ||||||||

| 600,000 | 0.20 |

May 15, 2014

|

||||||

| 300,000 | 0.30 |

March 13, 2015

|

||||||

| 4,400,000 | 0.30 |

December 30, 2013

|

||||||

| 1,000,000 | 0.30 |

December 29, 2016

|

||||||

| 500,000 | 0.30 |

February 20, 2014

|

||||||

| 100,000 | 0.30 |

February 28, 2014

|

||||||

| 500,000 | 0.30 |

August 28, 2014

|

||||||

| 500,000 | 0.30 |

December 31, 2015

|

||||||

| 7,900,000 | ||||||||

19

PAN AMERICAN GOLDFIELDS LTD.

(An Exploration Stage Company)

Notes to the Consolidated Financial Statements

(Unaudited) (Expressed in U.S. Dollars)

Six Months Ended August 31, 2013

|

12.

|

RELATED PARTY TRANSACTIONS

|

For the six months ended August 31, 2013, the Company paid or accrued management and directors’ fee of $133,966 (August 31, 2012 - $245,000) to certain officers and directors.

The Company also paid consulting fees of $35,989 (August 31, 2012 - $19,500) to a director of the Company.

As at August 31, 2013, accounts payable of $12,959 (August 31, 2012 - $209,820) was owing to directors and officers of the Company.

All related party transactions are in the normal course of business at the exchange amount agreed to by each party.

|

13.

|

SUPPLEMENTAL CASH FLOW INFORMATION

|

|

Six months

ended

August 31,

2013

|

Six months

ended

August 31,

2012

|

Period From

Inception of

Exploration

Stage (March 1,

2004) to

August 31, 2013

|

||||||||||

| $ | $ | $ | ||||||||||

|

Interest paid

|

- | - | 310,053 | |||||||||

|

Common stock issued on conversion of debt

|

60,533 | 131,900 | 4,514,084 | |||||||||

|

Common stock issued on settlement of notes payable

|

- | - | 3,908,812 | |||||||||

|

Common stock issued for interest costs

|

- | - | 82,500 | |||||||||

|

Common stock issued for financing costs

|

- | 84,000 | 229,000 | |||||||||

|

Common stock issued for mineral property costs

|

- | - | 1,206,667 | |||||||||

|

Common stock issued for bonuses

|

- | - | 512,750 | |||||||||

|

Shares issued for services

|

7,726 | 45,000 | 1,087,816 | |||||||||

20

ITEM 2.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Form 10-Q, including statements in the following discussion which are not statements of historical fact, constitute "forward-looking statements". These statements, which may be identified by words such as “plans”, “intends”, "anticipates", “hopes”, “seeks”, “will”, "believes", "estimates", "should", "expects" and similar expressions include our expectations and objectives regarding our present and future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in such forward-looking statements. Numerous factors and future events could cause us to change such plans and objectives or fail to successfully implement such plans or achieve such objectives, or cause such present and future operations to fail to produce revenues, income or profits. Such risks and uncertainties include those set forth under this Item 2, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in this Form 10-Q and in our Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”). These forward-looking statements represent beliefs and assumptions only as of the date of this report. We undertake no obligation to update the forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information. No statements contained in the following discussion should be construed as a guarantee or assurance of future performance or future results. We advise you to carefully review the reports and documents we file from time to time with the SEC, particularly our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K. As used in this management’s discussion and analysis, the terms “Pan American”, the “Company”, “we”, “us”, and “our” mean Pan American Goldfields Ltd.

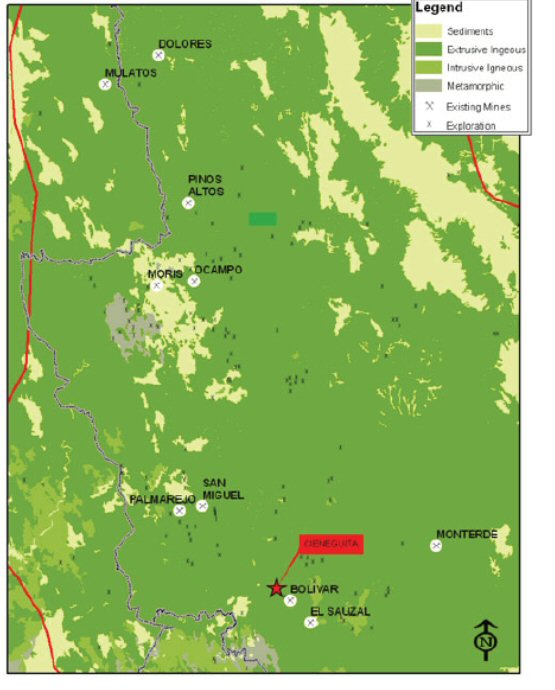

Overview

We are an exploration stage company focused on mineral exploration activities in Mexico through our wholly owned Mexican subsidiary, Sunburst Mining de Mexico, S.A. de C.V., (“Sunburst”). We are currently engaged in the exploration and development of one gold and silver project, named the Cieneguita Project, which is made up of several mining concessions. The Cieneguita Project is located in the Sierra Madre region of the State of Chihuahua, Mexico.

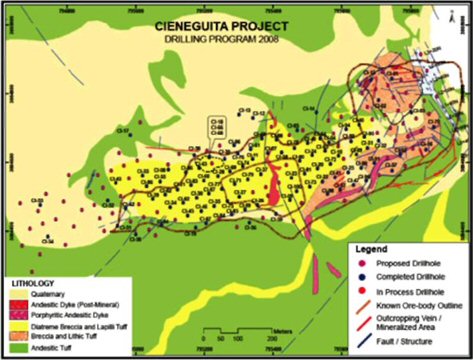

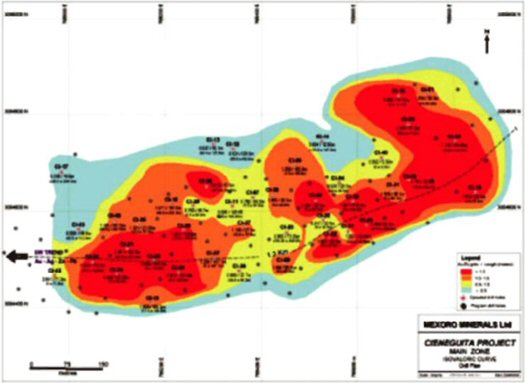

To help support our exploration activities, in February 2009 we entered into a joint venture agreement with Minera Rio Tinto, S.A. de C.V. (“MRT”), a mining operator in Chihuahua, Mexico (the “Joint Venture Agreement”). Under the Joint Venture Agreement, we authorized MRT to commence a small scale milling operation at our Cieneguita Project (the “pilot project” or “pilot operation”). MRT commenced the pilot operation in March 2010 after the construction of systems and initial plant facilities for crushing and gravity and flotation circuits were complete and adequate water supplies established. Operations have since been expanded from one to two 12-hour shifts per day with a processing rate up to 750 tonnes per day. The terms of the Joint Venture Agreement (as amended) with MRT are discussed in detail below.

Our financial condition has improved substantially since late 2009. At the time, the Company’s working capital deficiency was approximately $4.7 million and the Company received no revenues from its operations. Because of lack of capital, the Company faced having its interests in the Cieneguita Project reduced from 40% to 25%.

Since then, the Company’s position has improved dramatically. The Company now receives 35% of net cash flow from pilot operations at the Cieneguita Project, which were 100% financed by MRT under the Joint Venture Agreement, and it retains at all times an 80% ownership interest in the Cieneguita Project. In addition, the Company has substantially reduced the nearly $5 million in debt it had incurred as of 2009, and has achieved positive working capital.

In September 2011, because MRT experienced delays in achieving a steady state of production at the pilot project and was unable to complete a feasibility study for the Cieneguita Project within the prescribed time by the initial terms of the Joint Venture Agreement, we were able to renegotiate the terms of the Joint Venture Agreement to increase the Company’s cash flow from the pilot project and its percentage ownership of the overall Cieneguita Project. We assumed the responsibility to complete a preliminary economic assessment for the Cieneguita Project, and the parties agreed to fund the future feasibility study for the Cieneguita Project on a pro-rata basis according to their respective ownership percentages.

In September 2012, the Company negotiated a second amendment to the Joint Venture Agreement with MRT, as discussed in more detail below. In the second amendment to the Joint Venture Agreement, we were further able to increase cash flow to the Company from the pilot project at the Cieneguita Project, on a retroactive basis to March 2012. The second amendment to the Joint Venture Agreement also increased our ownership interests in the Cieneguita Project, as well as removed the depth limitations for the pilot project, giving MRT more incentive to implement project efficiencies and increase the production rate of the pilot project. Now, due to the second amendment of the Joint Venture Agreement, we are not wholly dependent on the equity markets for funding the Company’s development, a strategy that has turned out to be prescient given the current market conditions.

As a result of our efforts and strategy, the Company has received revenues from MRT on a regular monthly basis to support the Company's activities since late 2011.

21

Recent Developments

Change in Management

Effective July 3, 2013, Mr. Emilio Alvarez was appointed to serve as Chief Executive Officer of the Company. Effective September 20, 2013, Mr. Daniel Crandall was appointed to serve as the Chief Financial Officer of the Company.

Change in Board of Directors

As previously disclosed in its Current Report on Form 8-K filed with the Securities and Exchange Commission on June 21, 2013, pursuant to an Order Setting Meeting Date and Quorum Rule, which the Delaware Court of Chancery entered on March 1, 2013 (the “Order”), the Company held its annual meeting of stockholders on June 17, 2013 (the “Annual Meeting”). On March 19, 2013, Emilio Alvarez, a stockholder associated with Vortex Capital Ltd. (“Vortex”), subsequently submitted a Stockholder Notice (the “Notice”) of his intention to nominate five individuals (the “Vortex Nominees”) at the Annual Meeting. Mr. Alvarez and Vortex solicited proxies on behalf of the Vortex Nominees in advance of the Annual Meeting. At the Annual Meeting, the Company questioned the Notice’s compliance with one of the Company’s Bylaw requirements for stockholder nominations and took the position at the meeting that the Notice did not comply with such Bylaw requirement and that the Vortex Nominees were excluded from consideration at the Annual Meeting. Vortex disputed the Company’s position and took the position that Mr. Alvarez submitted a valid Notice and asserted the nomination of the Vortex Nominees was valid and sufficient.

Following the Annual Meeting, the Company and Vortex entered into discussions to resolve the dispute and avoid litigation and, as a result, entered into a settlement agreement (the “Settlement Agreement”), which was to become effective following formal approval by the Board of Directors. Among other things, the Settlement Agreement provided that the following persons, all of whom are Vortex Nominees, would serve as directors and hold office for the terms designated, (i) Laurent Deydier to hold office until the 2014 Annual Meeting, (ii) Balbir Bindra and William R. Majcher to hold office until the 2015 Annual Meeting, and (iii) Emilio Alvarez and Bruno Le Barber to hold office until the 2016 Annual Meeting. In addition, pursuant to the terms of the Settlement Agreement, Ricardo Ernesto Marcos Touche has been appointed to hold office until the 2014 Annual Meeting. Accordingly, there is one vacancy in the class of directors holding office until the 2015 Annual Meeting. The Settlement Agreement additionally provides for mutual releases by the Company, Vortex, the Vortex Nominees and the departing members of the Board.

Additionally, pursuant to the terms of the Settlement Agreement, Messrs. Neil Maedel, Hernan Celorrio, George Young, Randy Buchamer and Gary Parkison agreed that they were no longer members of the Board of Directors of the Company (the “Board”) and each of Messrs. Maedel, Celorrio, Young, Buchamer and Parkison entered into an option and warrant exchange and share issuance agreement (the “Share Issuance Agreements”), pursuant to which they exchanged warrants issued in connection with Board service for shares of the Company’s common stock. Pursuant to each of their respective Share Issuance Agreements, Mr. Maedel exchanged warrants to purchase 6,000,000 shares of the Company’s common stock for the issuance of 2,100,000 shares of the Company’s common stock and Messrs. Celorrio, Young, Buchamer and Parkison each exchanged a warrant to purchase 1,000,000 shares of common stock for the issuance of 350,000 shares of the Company’s common stock. The shares issued in exchange for the warrants, were issued pursuant to Section 3(a)(9) and Section 4(2) of the Securities Act of 1933, as amended. Mr. Maedel also entered into a consulting agreement with the Company for a consulting fee of $5,000 per month for a term ending December 31, 2013, to provide transition services as requested by the Company.

Project Developments Joint Venture Agreement

In September 2011, because MRT experienced delays in achieving a steady state of production at the pilot project and was unable to complete a feasibility study for the Cieneguita Project within the prescribed time by the initial terms of the Joint Venture Agreement, we were able to renegotiate the terms of the Joint Venture Agreement to increase the Company’s cash flow from the pilot project and its percentage ownership of the overall Cieneguita Project. We assumed responsibility to complete a preliminary economic assessment for the Cieneguita Project, and the parties agreed to fund the future feasibility study for the Cieneguita Project on a pro-rata basis according to their respective ownership percentages.

In September 2012, we entered into the second amendment of the Joint Venture Agreement with MRT. The parties agreed to the following provisions pursuant to the second amendment of the Joint Venture Agreement:

|

·

|

Our share of net cash flow from the pilot project operated by MRT on the Cieneguita Project increased from 20% to 29% beginning retroactive to March 1, 2012 through December 31, 2012. Beginning January 1, 2013 through December 31, 2013, our share of net cash flow from the project increases to 35%. After December 31, 2013, we receive 80% of the net cash flow. At all times, the Company retains its 80% ownership interest in the entire Cieneguita project.

|

22

|

·

|

Additional fees previously payable by MRT for minerals processed below the first 15 meters have been eliminated.

|

|

·

|

MRT, which is the exclusive operator, must provide us financial information related to the calculation of net cash flow within 30 days of the end of each month and will pay a minimum US $150,000 to us within the first 10 days of each month as a good faith advance against the previous month’s net cash flow. The balance of monies owed (if any) to us for the previous quarter is to be paid within 45 days from the end of each fiscal quarter.

|

|

·

|