Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WYNN RESORTS LTD | d611541d8k.htm |

| EX-99.2 - EX-99.2 - WYNN RESORTS LTD | d611541dex992.htm |

Exhibit 99.1

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

This announcement is for informational purposes only and is not an offer to sell or the solicitation of an offer to buy securities in the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Neither this announcement nor anything herein forms the basis for any contract or commitment whatsoever. Neither this announcement nor any copy hereof may be taken into or distributed in the United States. The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration. No public offer of securities is to be made by the Company in the United States.

[Graphic Appears Here]

(incorporated in the Cayman Islands with limited liability)

(Stock Code: 1128)

ISSUE OF US$600 MILLION 5.250% SENIOR NOTES DUE 2021 AND DISCLOSURE PURSUANT TO RULE 13.18 OF THE LISTING RULES

The Company is pleased to announce that on 10 October 2013 (Las Vegas time), the Company entered into the Purchase Agreement with J.P. Morgan Securities LLC, Deutsche Bank AG, Singapore Branch, BOCI Asia Limited, BNP Paribas Securities Corp., DBS Bank Ltd., Industrial and Commercial Bank of China (Asia) Limited, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Scotia Capital (USA) Inc. in connection with the issue of US$600 million 5.250% senior notes due 2021.

The net proceeds from the offering of the Notes will be approximately US$591.5 million after deducting the discounts and commissions of the Initial Purchasers and estimated offering expenses payable by the Company. The Company intends to use the net proceeds from the offering for working capital requirements and general corporate purposes.

The Company proposes to seek a listing of the Notes on the Stock Exchange and has received an eligibility letter from the Stock Exchange for the listing of the Notes. Admission of the Notes to the Stock Exchange and quotation of any Notes on the Stock Exchange is not to be taken as an indication of the merits of the Company or the Notes.

* For identification purposes only.

1

Although none of the Company’s controlling shareholders (as defined in the Listing Rules), including WRL, are parties to the Purchase Agreement or the Indenture, the Indenture will contain a change of control provision that would, if triggered, give rise to a right in favor of the holders of the Notes to require the Company to repurchase the Notes. Certain circumstances that will constitute a change of control are described in this announcement. The disclosure relating to the right in favor of the holders of the Notes to require the Company to repurchase the Notes is made pursuant to Rule 13.18 of the Listing Rules.

As the conditions precedent to completion of the Purchase Agreement may or may not be satisfied and the Purchase Agreement may be terminated upon the occurrence of certain events, shareholders of the Company and prospective investors are advised to exercise caution when dealing in the securities of the Company.

The Company conducted an offering of the Notes to Professional Investors on 10 October 2013 (Las Vegas time). J.P. Morgan Securities LLC and Deutsche Bank AG, Singapore Branch acted as the Joint Global Coordinators and Joint Book-Running Managers and BOCI Asia Limited acted as the Asian Lead Coordinator and Bookrunner of the offering of the Notes. The Company is pleased to announce that on 10 October 2013 (Las Vegas time), the Company entered into the Purchase Agreement with J.P. Morgan Securities LLC, Deutsche Bank AG, Singapore Branch, BOCI Asia Limited, BNP Paribas Securities Corp., DBS Bank Ltd., Industrial and Commercial Bank of China (Asia) Limited, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Scotia Capital (USA) Inc. in connection with the Notes Issue.

THE PURCHASE AGREEMENT

Date : 10 October 2013

Parties : (1) the Company; and

| (2) |

|

the Initial Purchasers. |

The Notes have not been and will not be registered under the Securities Act, and may be offered and sold only to qualified institutional buyers in reliance on Rule 144A under the Securities Act and outside the United States to non-U.S. persons (as defined in Regulation S under the Securities Act) in compliance with Regulation S under the Securities Act or to professional investors as defined in Part 1 of Schedule 1 to the SFO (including those prescribed by rules made under Section 397 of the SFO), and in accordance with any other applicable laws. None of the Notes will be offered to the public in Hong Kong and none of the Notes will be placed to any Connected Person of the Company.

| 2 |

|

Principal terms of the Notes

Issuer : the Company

Aggregate principal amount : US$600 million

Offering price : 100% of the principal amount of the Notes

Issue date : 16 October 2013

Interest rate : 5.250% per annum payable semi-annually in arrears on 15

April and 15 October of each year. Interest will accrue from

16 October 2013

Maturity date : 15 October 2021, unless earlier redeemed in accordance with

the terms thereof

First interest payment due date : 15 April 2014

Ranking of the Notes

The Notes will be general unsecured obligations of the Company and will (1) rank equally in right of payment with all of the Company’s existing and future senior unsecured indebtedness, (2) rank senior to all of the Company’s future subordinated indebtedness, if any, (3) be effectively subordinated to all of the Company’s future secured indebtedness to the extent of the value of the assets securing such debt, and (4) be structurally subordinated to all existing and future obligations of the Company’s subsidiaries, including the Wynn Macau Credit Facilities. As of 30 June 2013, we had secured long-term debt of HK$5,839.5 million (US$752.9 million) under the Wynn Macau Credit Facilities, and we may incur additional secured and/or unsecured indebtedness and other obligations in the future.

Events of default

The events of default under the Notes include, among others:

(1) default for 30 days in the payment when due of interest on the Notes;

(2) default in the payment when due (at maturity, upon redemption, repurchase or otherwise) of the principal of, or premium, if any, on the Notes;

(3) failure by the Company to comply with any payment obligations relating to the repurchase by the Company of the Notes at the option of the holders of the Notes upon certain change in control events as described in the Indenture;

(4) failure by the Company to comply with the covenants relating to merger, consolidation or sale of assets;

(5) failure by the Company for 60 days after receipt of written notice from the Trustee or the holders of at least 25% in aggregate principal amount of the Notes then outstanding voting as a single class to comply with any of the other obligations in the Indenture not identified in clauses (1), (2), (3) or (4) above;

3

(6) default under any mortgage, indenture or instrument under which there may be issued or by which there may be secured or evidenced any Indebtedness for money borrowed by the Company or any of its subsidiaries (or the payment of which is guaranteed by the Company or any of its subsidiaries), whether such indebtedness or guarantee existed on the date of the Indenture, or is created after the date of the Indenture, if that default results in the acceleration of such Indebtedness prior to its express maturity, and, in each case, the principal amount of any such Indebtedness, together with the principal amount of any other such Indebtedness the maturity of which has been so accelerated, aggregates US$50.0 million (or the equivalent thereof) or more, if such acceleration is not annulled within 30 days after written notice as provided in the Indenture;

(7) failure by the Company or any Significant Subsidiary to pay final non-appealable judgments rendered against the Company or any Significant Subsidiary aggregating in excess of US$50.0 million (or the equivalent thereof), which judgments are not paid, bonded, discharged or stayed for a period of 60 days; or

(8) certain events of bankruptcy or insolvency described in the Indenture.

In the case of an event of default arising from certain events of bankruptcy or insolvency, all outstanding Notes will become due and payable immediately without further action or notice. If any other event of default occurs and is continuing, the Trustee or the holders of at least 25% in aggregate principal amount of the Notes then outstanding may declare all the Notes to be due and payable immediately.

Covenants

The Notes and the Indenture will limit the Company’s ability and the ability of certain subsidiaries of the Company to, among other things:

(1) effect a consolidation or merger;

(2) sell, assign, transfer, convey or otherwise dispose of all or substantially all of its properties or assets (but for the avoidance of doubt, a pledge of an asset or property shall not be considered as a sale, assignment, transfer, conveyance or disposal of such asset or property); and

(3) lease all or substantially all of its properties or assets to any other person or entity.

4

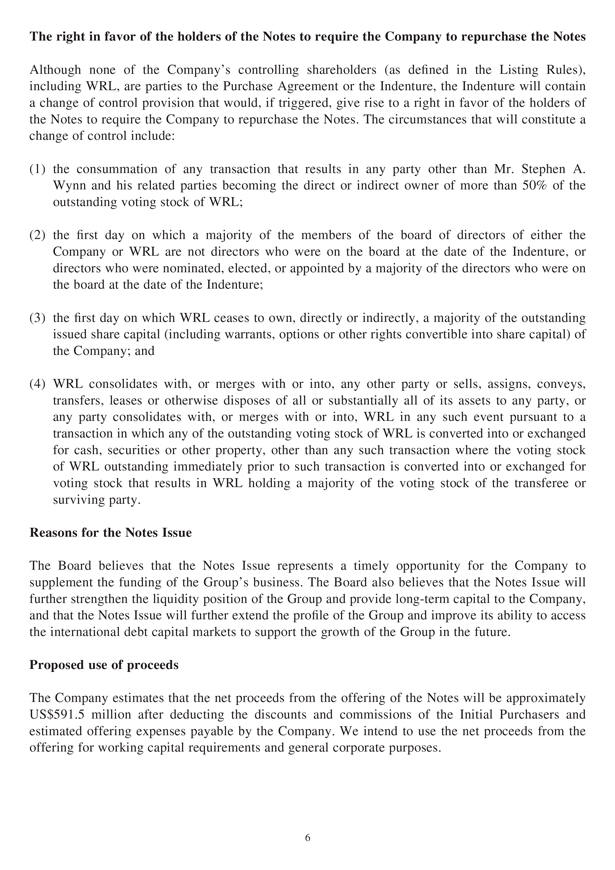

Redemption

Optional Redemption

At any time, the Company may at its option redeem the Notes, in whole or in part prior to their stated maturity.

Period Redemption Price

on or before equal to the greater of: (a) 100% of the principal amount of the Notes

14 October 2016 to be redeemed; or (b) a “make-whole” amount as determined by an

independent investment banker in accordance with the terms of the

Indenture, and in either case, plus accrued and unpaid interest to the date

of redemption on the Notes to be redeemed.

on or after at the prices indicated below (expressed as a percentage of the principal

15 October 2016 amount), plus accrued and unpaid interest, if any, to the date of

redemption on the Notes to be redeemed:

On or after Price

15 October 2016 103.938%

15 October 2017 102.625%

15 October 2018 101.313%

15 October 2019 and thereafter 100.000%

Gaming Redemption

Subject to certain conditions, if any Gaming Authority requires a holder or beneficial owner of Notes to be licensed, qualified or found suitable under any applicable Gaming Law and the holder or beneficial owner fails to apply or become licensed or qualified within the required time period or is found to be unsuitable by any Gaming Authority, the Company will have the right to require the holder or beneficial owner to dispose of its Notes or redeem the Notes at a redemption price equal to the price required by applicable law or by order of any Gaming Authority or the lesser of the principal amount of the Notes and the price that the holder or beneficial owner paid for the Notes, in either case, together with accrued and unpaid interest on the Notes.

Redemption for Tax Reasons

Subject to certain exceptions, the Company may redeem the Notes, as a whole but not in part, at a redemption price equal to 100% of the principal amount thereof, together with accrued and unpaid interest, if any, to the date fixed by the Company for redemption, if the Company would become obligated to pay certain additional amounts as a result of certain changes in specifid tax laws or certain other circumstances.

5

The right in favor of the holders of the Notes to require the Company to repurchase the Notes

Although none of the Company’s controlling shareholders (as defined in the Listing Rules), including WRL, are parties to the Purchase Agreement or the Indenture, the Indenture will contain a change of control provision that would, if triggered, give rise to a right in favor of the holders of the Notes to require the Company to repurchase the Notes. The circumstances that will constitute a change of control include:

(1) the consummation of any transaction that results in any party other than Mr. Stephen A. Wynn and his related parties becoming the direct or indirect owner of more than 50% of the outstanding voting stock of WRL;

(2) the first day on which a majority of the members of the board of directors of either the Company or WRL are not directors who were on the board at the date of the Indenture, or directors who were nominated, elected, or appointed by a majority of the directors who were on the board at the date of the Indenture;

(3) the first day on which WRL ceases to own, directly or indirectly, a majority of the outstanding issued share capital (including warrants, options or other rights convertible into share capital) of the Company; and

(4) WRL consolidates with, or merges with or into, any other party or sells, assigns, conveys, transfers, leases or otherwise disposes of all or substantially all of its assets to any party, or any party consolidates with, or merges with or into, WRL in any such event pursuant to a transaction in which any of the outstanding voting stock of WRL is converted into or exchanged for cash, securities or other property, other than any such transaction where the voting stock of WRL outstanding immediately prior to such transaction is converted into or exchanged for voting stock that results in WRL holding a majority of the voting stock of the transferee or surviving party.

Reasons for the Notes Issue

The Board believes that the Notes Issue represents a timely opportunity for the Company to supplement the funding of the Group’s business. The Board also believes that the Notes Issue will further strengthen the liquidity position of the Group and provide long-term capital to the Company, and that the Notes Issue will further extend the profile of the Group and improve its ability to access the international debt capital markets to support the growth of the Group in the future.

Proposed use of proceeds

The Company estimates that the net proceeds from the offering of the Notes will be approximately US$591.5 million after deducting the discounts and commissions of the Initial Purchasers and estimated offering expenses payable by the Company. We intend to use the net proceeds from the offering for working capital requirements and general corporate purposes.

6

Listing

The Company proposes to seek a listing of the Notes on the Stock Exchange and has received an eligibility letter from the Stock Exchange for the listing of the Notes. Admission of the Notes to the Stock Exchange and quotation of any Notes on the Stock Exchange is not to be taken as an indication of the merits of the Company or the Notes.

Ratings

The Notes are expected to receive a rating of Ba2 by Moody’s Investors Service, Inc. and BB by Standard & Poor’s Rating Services, a division of the McGraw Hill Companies, Inc. A security rating is not a recommendation to buy, sell or hold securities and may be subject to suspension, reduction or withdrawal at any time by the assigning rating agency.

ABOUT THE COMPANY

The Company, through WRM, is a developer, owner and operator of destination casino resorts in Macau. WRM holds one of the six concessions or subconcessions authorizing it to own and operate casinos in Macau, and currently owns and operates “Wynn Macau” and “Encore”. The Group is also constructing an integrated luxury resort in the Cotai area of Macau containing a casino, luxury hotel and other facilities and attractions including a spa, restaurants, retail stores, a convention and business center and entertainment venues. The Cotai resort is anticipated to open in the first half of 2016.

GENERAL

The disclosure relating to the right in favor of the holders of the Notes to require the Company to repurchase the Notes is made pursuant to Rule 13.18 of the Listing Rules. In accordance with the requirements pursuant to Rule 13.21 of the Listing Rules, we will include appropriate disclosure in subsequent interim and annual reports for so long as the above-described right in favor of the holders of the Notes continues to exist under the Indenture.

As the conditions precedent to completion of the Purchase Agreement may or may not be satisfied and the Purchase Agreement may be terminated upon the occurrence of certain events, shareholders of the Company and prospective investors are advised to exercise caution when dealing in the securities of the Company.

| 7 |

|

DEFINITIONS

In this announcement, unless otherwise indicated in the context, the following expressions have the meanings set out below:

“Asian Lead Coordinator and : BOCI Asia Limited

Bookrunner”

“Board” : board of directors of the Company

“Company” : Wynn Macau, Limited, a company incorporated in the Cayman

Islands on 4 September 2009 as an exempted company with

limited liability

“Connected Person” : has the meaning ascribed to it under the Listing Rules

“Gaming Authority” : any agency, authority, board, bureau, commission, department,

office or instrumentality of any nature whatsoever of any

national or foreign government, any state, province or city

or other political subdivision or otherwise, whether on the

date of the Indenture or thereafter in existence, including the

Government of Macau, the Nevada Gaming Commission, the

Nevada State Gaming Board and any other applicable gaming

regulatory authority or agency, in each case, with authority

to regulate the sale or distribution of liquor or any gaming

operation (or proposed gaming operation) owned, managed or

operated by WRL, the Company or the Group

“Gaming Law” : the gaming laws, rules, regulations or ordinances of any

jurisdiction or jurisdictions to which WRL or the Group, is, or

may be, at any time subject

“Group” or “we” : the Company and its subsidiaries, or any of them, and the

businesses carried on by such subsidiaries

“HK$” : Hong Kong dollars, the lawful currency of Hong Kong

“Hong Kong” : the Hong Kong Special Administrative Region of the People’s

Republic of China

“Indenture” : the agreement between the Company and the Trustee, that

specifies the terms of the Notes including the interest rate of

the Notes and maturity date

“Initial Purchasers” : J.P. Morgan Securities LLC, Deutsche Bank AG, Singapore

Branch, BOCI Asia Limited, BNP Paribas Securities Corp.,

DBS Bank Ltd., Industrial and Commercial Bank of China

(Asia) Limited, Merrill Lynch, Pierce, Fenner & Smith

Incorporated and Scotia Capital (USA) Inc., each of whom is

an independent third party and not a Connected Person of the

Company

8

“Joint Global Coordinators : J.P. Morgan Securities LLC and Deutsche Bank AG, Singapore

and Joint Book-Running Branch

Managers”

“Listing Rules” : the Rules Governing the Listing of Securities on The Stock

Exchange of Hong Kong Limited, as amended from time to

time

“Macau” : the Macau Special Administrative Region of the People’s

Republic of China

“Notes Issue” : the issue of the Notes by the Company

“Notes” : the US$600 million 5.250% senior notes due 2021

“Professional Investors” : (1) qualified institutional buyers within the meaning of Rule

144A under the Securities Act, (2) non-U.S. persons outside

the United States as defined under Regulation S under the

Securities Act, (3) for persons in Hong Kong, professional

investors as defined in Part 1 of Schedule 1 to the SFO

(including those prescribed by rules made under Section 397 of

the SFO) and/or (4) for persons outside Hong Kong, a person

to whom securities may be sold in accordance with a relevant

exemption from public offer regulations in that jurisdiction

“Purchase Agreement” : the agreement dated 10 October 2013 entered into between the

Initial Purchasers and the Company in relation to the issuance

of the Notes

“Securities Act” : the United States Securities Act of 1933, as amended

“SFO” : the Securities and Futures Ordinance (Chapters 571 of the

Laws of Hong Kong)

“Significant Subsidiary” : any subsidiary that (1) contributed at least 10% of the Group’s

total consolidated income from continuing operations before

income taxes and extraordinary items for the most recently

ended fiscal year of the Company or (2) owns at least 10%

of the total assets of the Group as of the last day of the most

recently ended fiscal year of the Company

“Stock Exchange” : The Stock Exchange of Hong Kong Limited

“Trustee” : Deutsche Bank Trust Company Americas

“United States” : the United States of America

“US$” : United States dollars, the lawful currency of the United States

“WRM” : Wynn Resorts (Macau) S.A.

9

“Wynn Macau Credit : the HK$7.4 billion (US$950 million) senior secured credit

Facilities” facility and HK$12.1 billion (US$1.55 billion) senior revolving

credit facility secured by, among other things, substantially all

of the assets of the Company’s subsidiary, WRM, entered into

by WRM on 31 July 2012 and upsized on 30 July 2013

“WRL” : Wynn Resorts, Limited, a company incorporated under the

laws of the State of Nevada, United States and the Company’s

controlling shareholder (as defined in the Listing Rules)

By Order of the Board

Wynn Macau, Limited

Stephen A. Wynn

Chairman

Hong Kong, 11 October 2013

As at the date of this announcement, the Board comprises Stephen A. Wynn, Ian Michael Coughlan and Linda Chen (as Executive Directors); Allan Zeman and Matthew O. Maddox (as Non-Executive Directors); and Nicholas Sallnow-Smith, Bruce Rockowitz and Jeffrey Kin-fung Lam (as Independent Non-Executive Directors).

10