Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - METHES ENERGIES INTERNATIONAL LTD | Financial_Report.xls |

| EX-32.2 - CERTIFICATION PURSUANT - METHES ENERGIES INTERNATIONAL LTD | meil_ex322.htm |

| EX-31.1 - CERTIFICATION - METHES ENERGIES INTERNATIONAL LTD | meil_ex311.htm |

| EX-32.1 - CERTIFICATION PURSUANT - METHES ENERGIES INTERNATIONAL LTD | meil_ex321.htm |

| EX-31.2 - CERTIFICATION - METHES ENERGIES INTERNATIONAL LTD | meil_ex312.htm |

| 10-Q - QUARTERLY REPORT - METHES ENERGIES INTERNATIONAL LTD | meil_10q.htm |

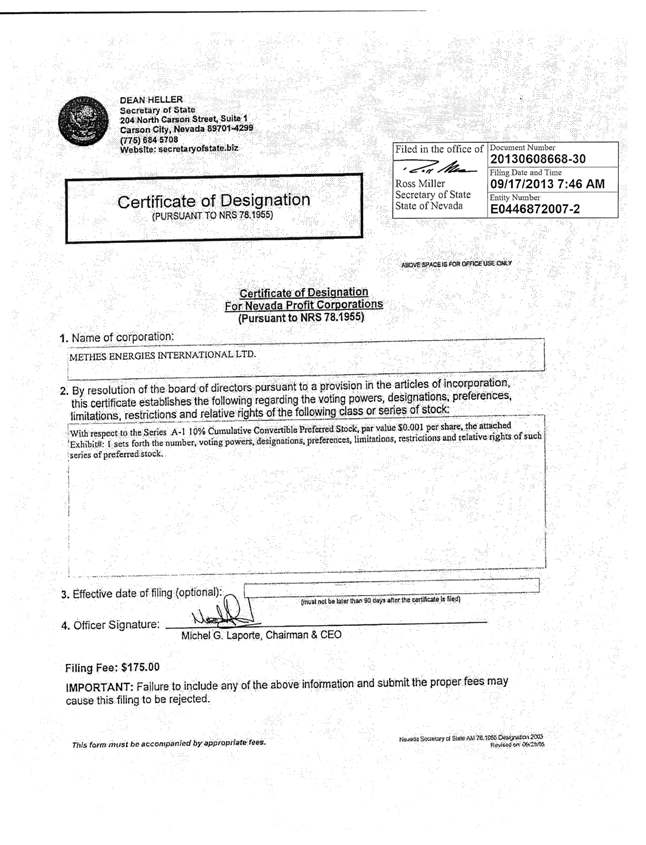

EXHIBIT 3.1

Exhibit#: 1

CERTIFICATE OF DESIGNATION,

of

SERIES A-1 10% CUMULATIVE CONVERTIBLE PREFERRED STOCK

of

METHES ENERGIES INTERNATIONAL LTD.

(Pursuant to Section 78.1955 of the Nevada Revised Statutes)

Methes Energies International Ltd. a corporation organized and existing under the laws of the State of Nevada (the “Company”), hereby certifies that the Company’s Board of Directors, pursuant to authority of the Board of Directors as required by Section 78.1955 of the Nevada Revised Statutes (“NRS”), and in accordance with the provisions of its certificate of incorporation and bylaws, each as amended through the date hereof, has and hereby authorizes a series of the Company’s previously authorized Preferred Stock, par value $0.001 per share (the “Preferred Stock”), and hereby states the designation and number of shares, and fixes the relative rights, preferences, privileges, powers and restrictions thereof, as follows:

1. Designation and Amount; Ranking.

(a) The designation of this series of, which consists of 138,654 shares of Preferred Stock, is the “Series A-1 10% Cumulative Convertible Preferred Stock” (the “Series A-1 Preferred Stock”). Such number of shares of Series A-1 Preferred Stock may be decreased by resolution of the Board of Directors; provided that no decrease shall reduce the number of shares of Series A-1 Preferred Stock to a number less than that of the shares of Series A-1 Preferred Stock then outstanding.

(b) The Series A-1 Preferred Stock will, with respect to dividend rights or rights upon the liquidation, winding-up or dissolution of the Company, rank (i) senior to all Junior Stock, (ii) on a parity with all other Parity Stock and (iii) junior to all Senior Stock.

2. Certain Definitions.

For purposes of this Certificate, in addition to the other terms defined herein, the following terms shall have the meanings ascribed to such terms below:

“Accrued Dividends” means, with respect to any share of Series A Preferred Stock, as of any date, the accrued and unpaid dividends on such share from and including the most recent Dividend Payment Date (or the Issue Date, if such date is prior to the first Dividend Payment Date) to, but not including, such date.

2

“Accumulated Dividends” shall mean, with respect to any share of Series A Preferred Stock, as of any date, the aggregate accumulated and unpaid dividends on such share from the Issue Date until the most recent Dividend Payment Date on or prior to such date. There shall be no Accumulated Dividends with respect to any share of Series A Preferred Stock prior to the first Dividend Payment Date.

“Board of Directors” or “Board” means the Company’s Board of Directors or, with respect to any action to be taken by the Board of Directors, any committee of the Board of Directors duly authorized to take such action.

“Business Day” means any day, other than a Saturday or Sunday or a day on which banking institutions in the State of Nevada are authorized or obligated by law, regulation or executive order to close.

“Common Stock” means the Company’s common stock, par value $0.001 per share.

“Company” has the meaning ascribed to that term in the introductory paragraph of this Certificate.

“Conversion Price” means $2.25, subject to adjustment as set forth in Section 4(g).

“Dividend Payment Date” means January 15 and July 15 of each year, commencing January 15, 2014.

“Dividend Payment Rate” means the VWAP for the 10 Trading Days immediately prior to the applicable Dividend Payment Date.

“Dividend Record Date” means January 1 and July 1of each year commencing January 1, 2014.

“Holder” or “holder” means a holder of record of the Series A Preferred Stock.

“Issue Date” means the original date of issuance of shares of Series A Preferred Stock by the Company.

“Junior Stock” means all classes of Common Stock of the Company and each other class of capital stock or series of Preferred Stock established after the Issue Date by the Board of Directors, the terms of which do not expressly provide that such class or series ranks senior to or on parity with the Series A Preferred Stock as to dividend rights or rights upon the liquidation, winding-up or dissolution of the Company.

“Liquidation Preference” means, with respect to each share of the Series A-1 Preferred Stock., $2.25.

“Majority Holders” means the holders of a majority of the then outstanding shares of Series A Preferred Stock.

3

“Mandatory Conversion Event” means the Trading Day which occurs immediately following the Trading Day on which the VWAP for the Common Stock has been at least $6.50 per share (as adjusted in the manner provided in Section 4(g)(i)) for the 5 (five) Trading Days immediately preceding such day.

“Parity Stock” means the Series A Preferred Stock and any class of capital stock or series of Preferred Stock established after the Issue Date by the Board of Directors, the terms of which expressly provide that such class or series will rank on parity with the Series A Preferred Stock as to dividend rights or rights upon the liquidation, winding-up or dissolution of the Company; provided the consent of the Majority Holders has been obtained with respect to such ranking in accordance with Section 8.

“Person” shall mean any individual, corporation, general partnership, limited partnership, limited liability partnership, limited liability company, joint venture, association, trust, limited liability company, unincorporated organization or government or any agency or political subdivision thereof.

“Senior Stock” means each class of capital stock or series of Preferred Stock established after the Issue Date by the Board of Directors, the terms of which expressly provide that such class or series will rank senior to the Series A Preferred Stock as to dividend rights or rights upon the liquidation, winding-up or dissolution of the Company; provided the consent of the Majority Holders has been obtained with respect to such ranking in accordance with Section 8.

“Series A Preferred Stock” means this series of Preferred Stock and any series of Preferred Stock hereafter designated as Series A-2 10% Cumulative Convertible Preferred Stock, Series A-3 10% Cumulative Convertible Preferred Stock or Series A-4 10% Cumulative Convertible Preferred Stock.

“Stated Value” means, with respect to each share of the Series A-1 Preferred Stock., $2.25.

“Trading Day” means a day on which the Common Stock is traded on a Trading Market.

“Trading Market” means the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question including, but not limited to, the Nasdaq Capital Market, the New York Stock Exchange, the OTC Bulletin Board, or the Pink Sheets.

“VWAP” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date) on the primary Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg Financial L.P. (based on a Trading Day from 9:30 a.m. EST to 4:02 p.m. Eastern Time) using the VAP function; or (b) if the Common Stock is not then listed or quoted on the Trading Market and if prices for the Common Stock are then reported in the “Pink Sheets” published by the Pink Sheets, LLC (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported.

4

3. Dividends.

(a) Holders of shares of the outstanding Series A Preferred Stock shall be entitled, when, as and if declared by the Board of Directors out of funds of the Company legally available therefor, to receive cumulative annual dividends on each share of Series A Preferred Stock at the annual rate (the “Dividend Rate”) of ten (10%) of the Stated Value, payable annually in arrears. Dividends payable for each full dividend period shall be payable in arrears on each Dividend Payment Date (commencing January 15, 2014) for the six-month period ending immediately prior to such Dividend Payment Date, to the holders of record of Series A Preferred Stock at the close of business on the Dividend Record Date applicable to such Dividend Payment Date. Such dividends shall be cumulative from the most recent date as to which dividends shall have been paid or, if no dividends have been paid, from the Issue Date (whether or not in any dividend period or periods there shall be funds of the Company legally available for the payment of such dividends) and shall accrue on a day-to-day basis, whether or not earned or declared, from and after the Issue Date. Dividends payable for any partial dividend period shall be computed on the basis of days elapsed over a 360-day year consisting of twelve 30-day months. Accumulated Dividends shall not bear interest.

(b) The Company may elect to pay any dividend in Common Shares. The decision whether to pay a dividend hereunder in shares of Common Stock or cash shall be at the discretion of the Company. Should the Company elect to pay a dividend in shares of Common Stock, it shall be paid in shares of Common Stock valued at the Dividend Payment Rate, with any resulting fractional shares to be rounded up or down to the nearest whole share.

(c) No dividend will be declared or paid upon, or any sum set apart for the payment of dividends upon, any outstanding share of the Series A Preferred Stock with respect to any dividend period unless all dividends for all preceding dividend periods have been declared and paid or declared and a sufficient sum set apart for the payment of such dividend, upon all outstanding shares of Series A Preferred Stock.

(d) No dividends or other distributions (other than a dividend or distribution payable solely in shares of Parity Stock or Junior Stock, in the case of Parity Stock, or Junior Stock, in the case of Junior Stock, and other than cash paid in lieu of fractional shares) may be declared, made or paid, or set apart for payment upon, any Parity Stock or Junior Stock, nor may any Parity Stock or Junior Stock be redeemed, purchased or otherwise acquired for any consideration (or any money paid to or made available for a sinking fund for the redemption of any Parity Stock or Junior Stock) by or on behalf of the Company (except by conversion into or exchange for shares of Parity Stock or Junior Stock, in the case of Parity Stock, or Junior Stock, in the case of Junior Stock)), unless full Accumulated Dividends shall have been or contemporaneously are declared and paid, or are declared and a sum sufficient for the payment thereof is set apart for such payment, on the Series A Preferred Stock and any Parity Stock for all dividend payment periods terminating on or prior to the date of such declaration, payment, redemption, purchase or acquisition. Notwithstanding the foregoing, if full dividends have not been paid on the Series A Preferred Stock and any Parity Stock, dividends may be declared and paid on the Series A Preferred Stock and such Parity Stock so long as the dividends are declared and paid pro rata so that the amounts of dividends declared per share on the Series A Preferred Stock and such Parity Stock will in all cases bear to each other the same ratio that accumulated and unpaid dividends per share on the shares of Series A Preferred Stock and such other Parity Stock bear to each other.

5

(e) Holders of shares of Series A Preferred Stock shall not be entitled to any dividends on the Series A Preferred Stock, whether payable in cash, property or stock, in excess of full cumulative dividends. No interest, or sum of money in lieu of interest, shall be payable in respect of any dividend payment or payments on the Series A Preferred Stock which may be in arrears.

(f) Holders of shares of Series A Preferred Stock at the close of business on a Dividend Record Date will be entitled to receive the dividend payment on those shares on the corresponding Dividend Payment Date, notwithstanding the subsequent conversion thereof or the Company’s default in payment of the dividend due on that Dividend Payment Date. However, shares of Series A Preferred Stock surrendered for conversion during the period between the close of business on any Dividend Record Date and the close of business on the Business Day immediately preceding the applicable Dividend Payment Date must be accompanied by payment of an amount equal to the dividend payable on the shares on that Dividend Payment Date. A holder of shares of Series A Preferred Stock on a Dividend Record Date who (or whose transferee) tenders any shares for voluntary conversion on the corresponding Dividend Payment Date will receive the dividend payable by the Company on the Series A Preferred Stock on that date, and the converting holder need not include payment in the amount of such dividend upon surrender of shares of Series A Preferred Stock for conversion. Except as provided above with respect to a voluntary conversion pursuant to Section 4, the Company shall make no payment or allowance for unpaid dividends, whether or not in arrears, on converted shares or for dividends on the shares of Common Stock issued upon conversion.

4. Conversion.

(a) Each holder of Series A Preferred Stock shall have the right, at its option, exercisable at any time and from time to time from the Issue Date to convert, subject to the terms and provisions of this Section 4, any or all of such holder’s shares of Series A Preferred Stock and any Accumulated Dividends thereon into shares of Common Stock. In such case, the shares of Series A Preferred Stock and Accumulated Dividends shall be converted into a whole number of fully paid and nonassessable shares of Common Stock as is equal, subject to Section 4(g), for each share of Series A Preferred Stock to the quotient of (i) the Stated Value plus the amount, if any, of Accumulated Dividends divided by (ii) the Conversion Price then in effect, as adjusted for any resulting fractional share of Common Stock in accordance with Section 4(f). The Conversion Price for the Series A-1 Preferred Stock initially shall be $2.25 per share, subject to adjustment as set forth in Section 4(g).

(b) The conversion right of a holder of Series A Preferred Stock shall be exercised by the holder by the surrender to the Company of the certificates representing shares of Series A Preferred Stock (“Preferred Stock Certificates”) to be converted at any time during usual business hours at the Company’s principal place of business or the offices of its agent for such purpose, including any transfer agent for the Common Stock appointed by the Company (“Transfer Agent”), as the Company may designate to the holders of the Series A Preferred Stock (“Conversion Agent”), accompanied by written notice to the Company in the form of Exhibit A that the holder elects to convert all or a portion of the shares of Series A Preferred Stock represented by such certificate and specifying the name or names (with address) in which a certificate or certificates for shares of Common Stock are to be issued (“Conversion Notice”) and (if required by the Company or its Conversion Agent) by a written instrument or instruments of transfer in form reasonably satisfactory to the Company or its Conversion Agent duly executed by the holder or its duly authorized legal representative. If the last day for the exercise of the conversion right shall not be a Business Day, then such conversion right may be exercised on the next preceding Business Day.

6

(c) Immediately prior to the close of business on the date of receipt by the Company or its Conversion Agent of a Conversion Notice (“Conversion Date”), the converting holder of Series A Preferred Stock shall be deemed to be the holder of record of Common Stock issuable upon conversion of such holder’s Series A Preferred Stock and Accumulated Dividends thereon, notwithstanding that the share register of the Company shall then be closed or that certificates representing such Common Stock shall not then be actually delivered to such holder. On any Conversion Date, all rights with respect to the shares of Series A Preferred Stock and Accumulated Dividends thereon so converted, including the rights, if any, to receive notices, will terminate, except only the rights of holders thereof to (i) receive certificates for the number of whole shares of Common Stock into which such shares of Series A Preferred Stock and Accumulated Dividends have been converted and (ii) exercise the rights to which they are entitled as holders of Common Stock.

(d) Upon the surrender of the Preferred Stock Certificates accompanied by a Conversion Notice, the Company or its Conversion Agent shall, no later than the fifth (5th) Business Day following the Conversion Date (or, in the case of lost, stolen or destroyed certificates, after provision of indemnity pursuant to Section 9(b), issue and deliver (i.e., deposit with a nationally recognized overnight courier service postage prepaid) to the holder and/or its nominee(s) (x) certificate(s) representing the number of shares of the Common Stock issuable upon conversion of the shares of the Series A Preferred Stock being converted and (y) if applicable, a certificate representing the number of shares of the Series A Preferred Stock not being converted. Notwithstanding the foregoing, in no event shall the Company be required to (i) effect a conversion of shares of Series A Preferred Stock into less than 100 shares of the Common Stock, unless such conversion would result in the conversion of all shares of the Series A Preferred Stock then held by such holder; and (ii) issue shares of the Common Stock upon a conversion unless either the Preferred Stock Certificates are delivered to the Company as provided above, or the holder notifies the Company that such Preferred Stock Certificates have been lost, stolen or destroyed and delivers the documentation to the Company required by Section 9(b).

(e) The issuance or delivery of certificates for Common Stock upon the conversion of shares of Series A Preferred Stock shall be made without charge to the converting holder of shares of Series A Preferred Stock for such certificates or for any tax in respect of the issuance or delivery of such certificates or the securities represented thereby, and such certificates shall be issued or delivered as provided in Section 4(d); provided, however, that the Company shall not be required to pay any tax which may be payable in respect of any transfer involved in the issuance and delivery of any such certificate in a name other than that of the holder of the shares of Series A Preferred Stock converted, and the Company shall not be required to issue or deliver such certificate unless or until the Person or Persons requesting the issuance or delivery thereof shall have paid to the Company the amount of such tax or shall have established to the reasonable satisfaction of the Company that such tax has been paid.

(f) No fractional share of the Common Stock shall be issued upon conversion of shares of the Series A Preferred Stock. If, as a result of a holder converting all of the holder's shares of the Series A Preferred Stock, a fractional share would otherwise result, such fractional share shall instead be rounded up or down to the nearest whole share. If, as a result of a holder converting only part of the holder's shares of the Series A Preferred Stock, a fractional share would otherwise result, such fractional share shall be disregarded and the holder shall receive the lower number of full shares; provided, however, that such fractional share shall be taken into consideration when the holder converts the holder's remaining shares of the Series A Preferred Stock.

(g) The Conversion Price shall be subject to adjustment as follows:

(i) In case the Company shall at any time or from time to time: (A) pay a dividend (or other distribution) payable in shares of Common Stock on any class of capital stock (which, for purposes of this Section 4(g)(i) shall include, without limitation, any dividends or distributions in the form of options, warrants or other rights to acquire capital stock) of the Company (other than the issuance of shares of Common Stock in connection with the conversion of Series A Preferred Stock); (B) subdivide the outstanding shares of Common Stock into a larger number of shares; (C) combine the outstanding shares of Common Stock into a smaller number of shares; (D) issue any shares of its capital stock in a reclassification of the Common Stock; or (E) pay a dividend or make a distribution to all holders of shares of Common Stock (other than a dividend or distribution pursuant to a stockholder rights plan, “poison pill” or similar arrangement and excluding dividends payable on the Series A Preferred Stock) then, and in each such case, the Conversion Price in effect immediately prior to such event shall be adjusted (and any other appropriate actions shall be taken by the Company) so that the holder of any share of Series A Preferred Stock thereafter surrendered for conversion shall be entitled to receive the number of shares of Common Stock that such holder would have owned or would have been entitled to receive upon or by reason of any of the events described above, had such share of Series A Preferred Stock been converted into shares of Common Stock immediately prior to the occurrence of such event. An adjustment made pursuant to this Section 7(c)(i) shall become effective retroactively (x) in the case of any such dividend or distribution, to the day immediately following the close of business on the record date for the determination of holders of Common Stock entitled to receive such dividend or distribution or (y) in the case of any such subdivision, combination or reclassification, to the close of business on the day upon which such corporate action becomes effective.

7

(ii) In the event of any reclassification of outstanding shares of Common Stock (other than a change in par value, or from par value to no par value, or from no par value to par value), or in the event of any consolidation or merger of the Company with or into another Person or any merger of another Person with or into the Company (other than a consolidation or merger in which the Company is the resulting or surviving Person and which does not result in any reclassification or change of outstanding Common Stock), (any of the foregoing, a “Transaction”), each share of Series A Preferred Stock then outstanding shall become convertible at any time, at the option of the holder thereof, only into the kind and amount of securities (of the Company or another issuer), cash and other property receivable upon such Transaction by a holder of the number of shares of Common Stock into which such share of Series A Preferred Stock could have been converted immediately prior to such Transaction, after giving effect to any adjustment event. In any such case, appropriate provisions (in form and substance reasonably satisfactory to the Majority Holders) shall be made with respect to the rights and interests of the holders of the Series A Preferred Stock to the end that the economic value of the shares of the Series A Preferred Stock is in no way diminished by such Transaction and that the provisions hereof (including, without limitation, in the case of any such consolidation or merger in which the successor entity is not the Company, an immediate adjustment to the Conversion Price so that the Conversion Price immediately after such Transaction reflects the same relative value as compared to the value of the surviving entity's common stock that existed between the Conversion Price and the value of the Common Stock immediately prior to such Transaction) shall thereafter be applicable, as nearly as may be practicable in relation to any shares of stock or securities thereafter deliverable upon the conversion thereof. The Company shall not effect any merger or consolidation unless the resulting successor (if not the Company) assumes by written instrument (in form and substance reasonable satisfactory to the Majority Holders) the obligations of this Certificate of Designations. The above provisions shall apply regardless of whether or not there would have been a sufficient number of shares of the Common Stock authorized and available for issuance upon conversion of the shares of the Series A Preferred Stock outstanding as of the date of such Transaction, and shall similarly apply to successive Transactions. The provisions of this Section 4(g)(ii) shall be the sole right of holders of Series A Preferred Stock in connection with any Transaction and such holders shall have no separate vote thereon.

(iii) Upon the occurrence of each adjustment or readjustment of the Conversion Price pursuant to Section 4(g) amounting to a more than one percent (1%) change in such Conversion Price, or any change in the number or type of stock, securities and/or other property issuable upon conversion of Series A Preferred Stock, the Company, at its expense, shall promptly compute such adjustment or readjustment or change and prepare and furnish to each holder of Series A Preferred Stock a certificate setting forth such adjustment or readjustment or change and showing in detail the facts upon which such adjustment or readjustment or change is based. Any lesser adjustment of the Conversion Price shall be carried forward and shall be made at the time of and together with the next subsequent adjustment, if any, which, together with any adjustment or adjustments so carried forward, shall amount to an increase or decrease of at least 1% of such Conversion Price.

(iv) If, at any time after the Issue Date, the Company takes any action affecting the Common Stock that would be covered by Section 4(g), but for the manner in which such action is taken or structured, which would in any way diminish the value of the Series A Preferred Stock, then the Conversion Price shall be adjusted in such manner as the Board of Directors shall in good faith determine to be equitable under the circumstances.

8

(h) If the Company shall take a record of the holders of its Common Stock for the purpose of entitling them to receive a dividend or other distribution, and shall thereafter (and before the dividend or distribution has been paid or delivered to stockholders) legally abandon its plan to pay or deliver such dividend or distribution, then thereafter no adjustment in the Conversion Price then in effect shall be required by reason of the taking of such record.

(i) The Company shall at all times reserve and keep available for issuance upon the conversion of the Series A Preferred Stock such number of its authorized but unissued shares of Common Stock as will from time to time be sufficient to permit the conversion of all outstanding shares of Series A Preferred Stock, and shall take all action required to increase the authorized number of shares of Common Stock if at any time there shall be insufficient unissued shares of Common Stock to permit such reservation or to permit the conversion of all outstanding shares of Series A Preferred Stock.

5. Mandatory Conversion.

(a) Upon the occurrence of a Mandatory Conversion Event, the outstanding shares of Series A Preferred Stock and all Accumulated Dividends thereon shall automatically be converted into that number of whole shares of Common Stock for each share of Series A Preferred Stock as is equal to the quotient of (i) the Stated Value plus all Accumulated Dividends divided by (ii) the Conversion Price then in effect, with any resulting fractional shares of Common Stock to be settled in accordance with Section 4(f).

(b) The Company shall, not later than five (5) Business Days after the occurrence of the Mandatory Conversion Event, mail a notice to each of the then holders of Series A Preferred Stock describing the Mandatory Conversion Event and requesting that the holder surrender the Preferred Stock Certificate or Certificates representing shares of Series A Preferred Stock then held by them at its then principal office or at the office of the Conversion Agent, if any. As promptly as practicable after surrender of the Preferred Stock Certificate or Certificates pursuant to such notice, the Company shall issue and deliver to a holder or, on his or its written order, a permitted transferee, a certificate or certificates for the number of full shares of the Common Stock issuable as if it were an voluntary conversion, adjusted, as provided in Section 4(f) for any fractional share.

(c) Effective upon the occurrence of a Mandatory Conversion Event, all rights of a holder of the Series A Preferred Stock as such a holder, shall terminate, except the right to receive shares of the Common Stock upon conversion of such holder’s shares Series A Preferred Stock and the Accumulated Dividends thereon, and, thereafter, the holder shall be deemed to be a holder of Common Stock for the number of shares as to which the holder's shares of the Series A Preferred Stock and Accumulated Dividends are convertible pursuant to this Section 4.

9

6. Liquidation Rights.

(a) In the event of (i) any liquidation, winding-up or dissolution of the Company, whether voluntary of involuntary, or (ii) the sale, conveyance, exchange or transfer (for cash, shares of stock, securities or other consideration) of all or substantially all the assets or business of the Company, other than in connection with the liquidation, winding-up or dissolution of the Company(each of the events in clauses (i) and (ii), a “Liquidation Event”), each holder of shares of Series A Preferred Stock shall be entitled to receive and to be paid out of the assets of the Company available for distribution to its stockholders the Liquidation Preference plus Accumulated Dividends and Accrued Dividends thereon in preference to the holders of, and before any payment or distribution is made on, any Junior Stock, including, without limitation, on any Common Stock. The merger or consolidation of the Company into or with any other Person shall not be deemed to be a liquidation, winding-up or dissolution, voluntary or involuntary, for the purposes of this Section 6 and the sole right of the a holder of a holder of Series A Preferred Stock shall be to exercise such holder’s conversion rights in accordance with Section 4.

(b) After the payment to the holders of the shares of Series A Preferred Stock of the full preferential amounts provided for in Section 6(a), the holders of Series A Preferred Stock as such shall have no right or claim to any of the remaining assets of the Company.

(c) In the event the assets of the Company available for distribution to the holders of shares of Series A Preferred Stock upon any liquidation, winding-up or dissolution of the Company, whether voluntary or involuntary, shall be insufficient to pay in full all amounts to which such holders are entitled pursuant to Section 6(a), no such distribution shall be made on account of any shares of Parity Stock upon such liquidation, dissolution or winding-up unless proportionate distributable amounts shall be paid on account of the shares of Series A Preferred Stock, ratably, in proportion to the full distributable amounts for which holders of all Series A Preferred Stock and of any Parity Stock are entitled upon such liquidation, winding-up or dissolution.

7. Voting Rights.

The holders of shares of Series A Preferred Stock shall have the following voting rights:

(a) Except as otherwise expressly provided elsewhere in this Certificate or as otherwise required by the NRS, (i) each holder of the Series A Preferred Stock shall be entitled to vote on all matters submitted to a vote of the stockholders of the Company and shall be entitled to that number of votes equal to the largest number of whole shares of the Common Stock into which such holder's shares of Series A Preferred Stock could be converted pursuant to the provisions of Section 4 hereof at the record date for the determination of stockholders entitled to vote on such matters or, if no such record date is established, at the date such vote is taken or any written consent of stockholders is solicited, and (ii) except as otherwise provided herein, the holders of shares of the Series A Preferred Stock and the Common Stock shall vote together (or tender written consents in lieu of a vote) as a single class on all matters submitted for a vote or consent to the stockholders of the Company.

10

(b) The Company shall provide each holder of Series A Preferred Stock with prior notification of any meeting of the stockholders (and copies of proxy materials and other information sent to holders of the Common Stock) at least 20 days prior to the date of the meeting or other formal action of shareholders (or 20 days prior to the consummation of the transaction or event if a transaction or fundamental corporate event is to be voted upon, whichever is earlier, but in no event earlier than public announcement of such proposed transaction). Mailing of the proxy or consent solicitation material to the holders of the Series A Preferred Stock simultaneously with the mailing of such material to the holders of the Common Stock shall be deemed in complete satisfaction of the Company 's notification obligation hereunder.

(c) To the extent that under the NRS the vote of the holders of the Series A Preferred Stock, voting separately as a class or series, as applicable, is required to authorize a given action of the Company, the affirmative vote or consent of the Majority Holders (except as otherwise may be required under the NRS) shall constitute the approval of such action by the class.

(d) If in connection with any Liquidation Event, the holders of the Series A Preferred Stock are entitled to vote to approve such Liquidation Event as a class, then the holders of such Series A Preferred Stock shall agree to vote their shares in favor of the Liquidation Event, conditioned on the receipt by all holders of Series A Preferred Stock of the full preferential amounts provided for in Section 6(a) hereof.

8. Protective Provisions.

So long as any shares of the Series A Preferred Stock are outstanding, the Company shall not without first obtaining the approval (by vote or written consent) of the Majority Holders:

(a) alter or change the rights, preferences or privileges of, the Series A Preferred Stock, whether through merger, sale, consolidation or otherwise;

(b) alter or change the rights, preferences or privileges of any capital stock of the Company so as to affect adversely the Series A Preferred Stock, whether through merger, sale, consolidation or otherwise;

(c) create any Senior Stock;

(d) issue any shares of Senior Stock;

(e) redeem or repurchase, or declare or pay any cash dividend, distribution or interest on, any Junior Stock, except pursuant to this Certificate or for repurchases pursuant to an equity incentive plan approved by the Board of Directors in good faith;

Notwithstanding the foregoing, no change pursuant to this Section 8 shall be effective to the extent that, by its terms, it applies to less than all of the holders of shares of Series A Preferred Stock then outstanding.

11

9. Miscellaneous.

(a) If any shares of Series A Preferred Stock are converted pursuant to Section 4 hereof, the shares so converted shall be canceled, shall return to the status of authorized, but unissued shares of Preferred Stock of no designated series, and shall not be issuable by the Company as shares of the Series A Preferred Stock.

(b) Upon receipt by the Company of (i) evidence of the loss, theft, destruction or mutilation of any Preferred Stock Certificate(s) and (ii) (y) in the case of loss, theft or destruction, of indemnity (without any bond or other security) reasonably satisfactory to the Company, or (z) in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Company shall execute and deliver new Preferred Stock Certificate(s) of like tenor and date. However, the Company shall not be obligated to reissue such lost or stolen Preferred Stock Certificate(s) if the holder contemporaneously requests the Company to convert such Series A Preferred Stock or in the event of a Mandatory Conversion Event.

(c) Upon submission of a Conversion Notice by a holder of Series A Preferred Stock, (i) the shares covered thereby (other than the shares, if any, which cannot be issued because their issuance would exceed such holder's allocated portion of the Common Stock reserved for issuance upon exercise of such holder’s conversion rights) shall be deemed converted into shares of the Common Stock and (ii) the holder's rights as a holder of such converted shares of the Series A Preferred Stock shall terminate, excepting only the right to receive certificates for such shares of the Common Stock and to any remedies provided herein or otherwise available at law or in equity to such holder because of a failure by the Company to comply with the terms of this Certificate. Notwithstanding the foregoing, if a holder has not received certificates for all shares of the Common Stock prior to the sixth (6th ) Business Day after the Conversion Date with respect to a conversion of the Series A Preferred Stock for any reason, then (unless the holder otherwise elects to retain its status as a holder of the Common Stock by so notifying the Company within five (5) Business Days after the expiration of such six (6)-Business-Day period, the holder shall regain the rights of a holder of the Series A Preferred Stock with respect to such unconverted shares of the Series A Preferred Stock and the Company shall, as soon as practicable, return such unconverted shares to the holder. In all cases, the holder shall retain all of its rights and remedies for the Company's failure to convert shares of the Series A Preferred Stock.

(d) Subject to applicable law and the legend, if any, on the Preferred Stock Certificate(s) to be transferred, the Series A Preferred Stock may be transferred at any time and from time to time by the holder thereof.

(e) The remedies provided in this Certificate shall be cumulative and in addition to all other remedies available under this Certificate of Designations, at law or in equity (including a decree of specific performance and/or other injunctive relief), and nothing herein shall limit a holder's right to pursue actual damages for any failure by the Company to comply with the terms of this Certificate. The Company acknowledges that a breach by it of its obligations under this Certificate will cause irreparable harm to the holders of the Series A Preferred Stock and that the remedy at law for any such breach may be inadequate. The Company agrees, in the event of any such breach or threatened breach, that the holders of Series A Preferred Stock shall be entitled, in addition to all other available remedies, to an injunction restraining any breach, without the necessity of showing economic loss and without any bond or other security being required.

(f) Notwithstanding any provision in this Certificate to the contrary, any provision contained herein and any right of the holders of Series A Preferred Stock granted hereunder may be waived as to all shares of Series A Preferred Stock (and the holders thereof) upon the written consent of the Majority Holders, unless a higher percentage is required by applicable law, in which case the written consent of the holders of not less than such higher percentage of shares of Series A Preferred Stock shall be required.

(g) Any notices required or permitted to be given under the terms hereof shall be sent by certified or registered mail (return receipt requested) or delivered personally, by nationally recognized overnight carrier or by confirmed facsimile transmission, and shall be effective three (3) days after being placed in the mail, if mailed, or upon receipt or refusal of receipt, if delivered personally or by nationally recognized overnight carrier or confirmed facsimile transmission, in each case addressed to a party. With respect to any notice to a holder of shares of Series A Preferred Stock required to be provided hereunder, except as otherwise expressly provide in this Certificate, neither failure to mail such notice, nor any defect therein or in the mailing thereof, to any particular holder shall affect the sufficiency of the notice or the validity of the proceedings referred to in such notice with respect to the other holders or affect the legality or validity of any distribution, rights, reclassification, consolidation, merger, conveyance, transfer, dissolution, liquidation or winding-up, or the vote upon any such action. Any notice which was mailed in the manner herein provided shall be conclusively presumed to have been duly given whether or not the holder receives the notice. All notice periods referred to herein shall commence on the effective date of the mailing of the applicable notice.

12

EXHIBIT A

NOTICE OF CONVERSION

(To be Executed by the Registered Holder in Order to Convert Series A Preferred Stock)

The undersigned hereby irrevocably elects to convert shares of Series A-1 10% Cumulative Convertible Preferred Stock (“Series A-1 Preferred Stock”), represented by Stock Certificate No(s). (the “Preferred Stock Certificates”), into shares of common stock (“Common Stock”) of Methes Energies International Ltd. (the “Company”) according to the conditions of the Certificate of Designation of Series A-1 10% Cumulative Convertible Preferred Stock, as of the date written below. If certificates for shares of Common Stock are to be issued in the name of a person other than the undersigned, the undersigned will pay all transfer taxes payable with respect thereto. No fee will be charged to the holder for any conversion, except for such transfer taxes, if any. Each Preferred Stock Certificate accompanies this Conversion Notice (or evidence of loss, theft or destruction thereof).

The undersigned hereby requests that the Company issue and deliver to the undersigned or its designee or designees physical certificates representing such shares of Common Stock. In the event of a partial conversion, please reissue a new Preferred Stock Certificate for the number of shares of Series A Preferred Stock which shall not have been converted.

The undersigned acknowledges and agrees that all offers and sales by the undersigned of the securities issuable to the undersigned upon conversion of the Series A Preferred Stock have been or will be made only pursuant to an effective registration of the transfer of the Common Stock under the Securities Act of 1933, as amended (the “Act”) or an available exemption from registration under the Act.

|

Date of Conversion:

|

||||||||

|

Applicable Conversion Price:

|

||||||||

|

Signature:

|

||||||||

|

Name:

|

||||||||

|

Address:

|

||||||||

13