Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT232 - Vortex Blockchain Technologies Inc. | exhibit232.htm |

As filed with the Securities and Exchange Commission on October 9, 2013

Registration No. 333-189414

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933UA GRANITE CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

|

3281

(Primary Standard Industrial Classification Number)

|

80-0899451

(IRS Employer Identification Number)

|

10 Bogdan Khmelnitsky Street, # 13A

Kyiv, Ukraine 01030

+380 636419991

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Business Filings Incorporated

311 S. Division Street

Carson City, Nevada 89703

Tel: (800) 981-7183

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Facsimile No.: (206) 260-0111

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective registration statement filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective registration statement filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class

|

Proposed Maximum

|

Proposed Maximum

|

||||||||||||||

|

of Securities

|

Amount to Be

|

Offering Price

|

Aggregate

|

Amount of

|

||||||||||||

|

to be Registered

|

Registered(1)

|

per Share

|

Offering Price

|

Registration Fee

|

||||||||||||

|

Common Stock, par value $0.00001 per share

|

2,500,000

|

(2)

|

$

|

0.04

|

(2)

|

$

|

100,000

|

$

|

13.64

|

|||||||

|

TOTAL

|

2,500,000

|

$

|

0.04

|

$

|

100,000

|

13.64

|

||||||||||

(1) In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) The registration fee for securities to be offered by the Registrant is based on an estimate of the proposed maximum aggregate offering price of the securities, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(a).

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be amended. The Registrant may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

- ii -

PRELIMINARY PROSPECTUS

UA GRANITE CORPORATION

2,500,000 SHARES OF COMMON STOCK

This prospectus relates to the offer and sale of a maximum of 2,500,000 shares (the “Maximum Offering”) of common stock, $0.00001 par value, by UA Granite Corporation Inc., a Nevada company (“we”, “us”, “our”, “UA Granite”, “Company” or similar terms). There is no minimum for this offering. The offering will commence promptly on the date upon which this prospectus is declared effective by the Securities and Exchange Commission (“SEC”) and will continue for 16 months. We will pay all expenses incurred in this offering. We are an “emerging growth company” under applicable SEC rules and will be subject to reduced public company reporting requirements.

The offering of the 2,500,000 shares is a “best efforts” offering, which means that our sole officer and director will use his best efforts to sell the shares and there is no commitment by any person to purchase any shares. The shares will be offered at a fixed price of $0.04 per share for the duration of the offering. There is no minimum number of shares required to be sold to close the offering. Proceeds from the sale of the shares will be used to fund the initial stages of our business development. We have not made any arrangements to place funds received from share subscriptions in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our immediate use.

|

Offering Price

Per Share

|

Commissions

|

Proceeds to

Company

Before Expenses

if 25% of the shares are sold

|

Proceeds to

Company

Before Expenses

if 50% of the shares are sold

|

Proceeds to

Company

Before Expenses

if 75% of the shares are sold

|

Proceeds to

Company

Before Expenses

if 100% of the shares are sold

|

|

|

Common Stock

|

$0.04

|

Not Applicable

|

$25,000

|

$50,000

|

$75,000

|

$100,000

|

|

Totals

|

$0.04

|

Not Applicable

|

$25,0000

|

$50,000

|

$75,000

|

$100,000

|

This is a direct participation offering since we are offering the stock directly to the public without the participation of an underwriter. Our officer and sole director will be solely responsible for selling shares under this offering and no commission will be paid on any sales.

Prior to this offering, there has been no public market for our common stock and we have not applied for the listing or quotation of our common stock on any public market. We have arbitrarily determined the offering price of $0.04 per share in relation to this offering. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. After the effective date of the registration statement, we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our shares of stock. There is no assurance that an active trading market for our shares will develop or will be sustained if developed.

We are a “shell company” within the meaning of Rule 405, promulgated pursuant to Securities Act, because we have nominal assets and nominal operations. Because we are a shell company, the Rule 144 safe harbor is not available for the resale of any restricted securities issued by us in any subsequent unregistered offering. This will likely make it more difficult for us to attract additional capital through subsequent unregistered offerings because purchasers of securities in such unregistered offerings will not be able to resell their securities in reliance on Rule 144, a safe harbor on which holders of restricted securities usually rely to resell securities.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Our business is subject to many risks and an investment in our shares of common stock will also involve a high degree of risk. You should carefully consider the factors described under the heading “risk factors” beginning on page 5 before investing in our shares of common stock. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is _______________, 2013.

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

|

Page

|

||

|

3

|

||

|

6

|

||

|

6

|

||

|

8

|

||

|

11

|

||

|

12

|

||

|

12

|

||

|

13

|

||

|

15

|

||

|

16

|

||

|

23

|

||

|

23

|

||

|

24

|

||

|

28

|

||

|

30

|

||

|

31

|

||

|

32

|

||

|

32

|

||

|

32

|

||

| Interests of name experts and counsel | 32 | |

|

32

|

||

|

33

|

Please read this prospectus carefully. It describes our business, our financial condition and results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on information contained in this prospectus. We have not authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

Until ____________, 2013 (90 business days after the effective date of this prospectus) all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

- 2 -

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

As used in this prospectus, references to the “Company,” “we,” “our”, “us” or “UA Granite” refer to UA Granite Corporation unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

Our Company

UA Granite Corporation was incorporated on February 14, 2013, under the laws of the State of Nevada, for the purpose of the development of web portals to market and distribute cut granite products from Ukraine. To implement our plan of operations we require a minimum funding of $82,693 for the next twelve months. In the event we do not raise sufficient capital to implement its planned operations, your entire investment could be lost.

We are a development stage company that has not realized any revenues to date, and our accumulated deficit as of June 30, 2013 is $3,006. To date we have raised an aggregate of $50 through a private placement of 5,000,000 shares of common stock to our sole officer and director, who has also loaned us $5,123. Proceeds from the private placement were used for working capital. Our independent auditor has issued an audit opinion for our Company which includes a statement expressing substantial doubt as to our ability to continue as a going concern. The Company’s principal offices are located at 10 Bogdan Khmelnitsky Street, # 13A, Kyiv, Ukraine 01030. Our telephone number is +380 636419991.

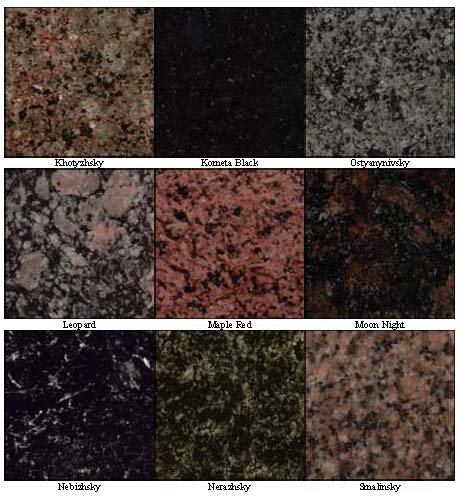

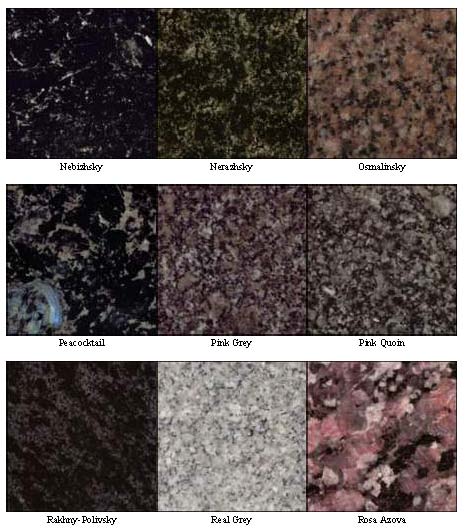

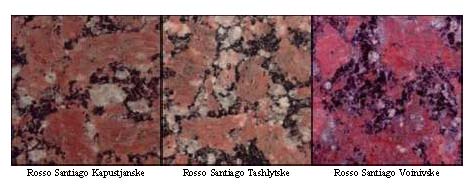

We are in the early stages of developing our plan to distribute granite products in forms including but not limited to countertops, chopped (or split) stone blocks, stone blocks with absolute sawn finish and with chopped-sawn (split and sawn) finish for road surface, kerbstones (border stones), stairs and paving tiles with different kinds of surfaces (chopped, sawn, polished and flamed), decorative tiles with surface like “Rock” and many other kinds of products made from natural granite of Ukrainian deposits. We currently have no revenues, no operating history, and no orders to purchase granite products. Our plan of operations over the 12 month period following successful completion of our offering is to develop and establish our granite products distribution business by establishing our office, developing our website, attempting to enter into supply agreements with prospective retailers of granite products, engage in advertising and marketing activities and hire a sales person (See “Business of the Company” and “Plan of Operations”). We currently have commercial granite products available, but do not expect to be selling such granite products until approximately 12 months following the completion of this offering. Our product availability is derived from our supply agreement with LLC Ukr Stone, a third-party granite supplier.

The rationale of our sole officer and director to make the Company become a public company is based on his subjective belief that potential investors are more inclined to invest in the Company if the Company is subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which provides investors with updated material information about the Company and the ability of the Company’s investors to resell securities through the facilities of the securities markets, assuming the Company finds a market maker in order to have its shares of common stock quoted on the OTC Bulletin Board or the OTCQX tier of the OTC Markets. Our sole officer and director believes that the disadvantages of becoming a public company are the continuing reporting costs of being a reporting issuer under the Exchange Act and reluctance of persons qualified to serve as directors of the Company because of a director’s exposure to possible legal claims.

- 3 -

We plan to raise the additional funding for our twelve month business plan by way of private debt or equity financing, but have not commenced any activities to raise such funds. We cannot provide any assurance that we will be able to raise sufficient funds to proceed with our twelve month business plan.

Because we are a shell company, the Rule 144 safe harbor is not available for the resale of any restricted securities issued by us in any subsequent unregistered offering. This will likely make it more difficult for us to attract additional capital through subsequent unregistered offerings because purchasers of securities in such unregistered offerings will not be able to resell their securities in reliance on Rule 144, a safe harbor on which holders of restricted securities usually rely to resell securities.

From inception until the date of this filing we have had limited operating activities, primarily consisting of the incorporation of our company, the initial equity funding by our officer and sole director, developing our website, and entering into a supply contract with LLC Ukr Stone. We received our initial funding of a loan of $5,123 from our sole officer and director, Myroslav Tsapaliuk, who also purchased 5,000,000 shares of our common stock for $50.

Our financial statements from inception from inception on February 14, 2013, through June 30, 2013, report no revenues and a net loss of $3,006. Our independent auditor has issued an audit opinion for our Company which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

Myroslav Tsapaliuk, our sole officer and director, did not agree to serve as an officer or director of the Company at due to a plan, agreement or understanding that he would solicit, participate in, or facilitate the sale of the enterprise to (or a business combination with) a third party which desires to obtain or become a public reporting entity, and Mr. Tsapaliuk confirms that he has no such intention. No proceeds raised in the offering will be used towards any such business combination.

As of the date of this prospectus, there is no public trading market for our common stock and no assurance that a trading market for our securities will ever develop.

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “RISK FACTORS--RISKS RELATED TO THIS OFFERING AND OUR COMMON STOCK - WE ARE AN `EMERGING GROWTH COMPANY’ AND WE CANNOT BE CERTAIN IF THE REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS” on page 6 of this prospectus.

This is a direct participation offering since we are offering the stock directly to the public without the participation of an underwriter. Sole officer and director will be solely responsible for selling shares under this offering and no commission will be paid on any sales.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to be eligible for trading on the Over-the-Counter Bulletin Board. We do not yet have a market maker who has agreed to file such quotation service or that any market for our stock will develop.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Under U.S. federal securities legislation, our common stock will be “penny stock”. Penny stock is any equity that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

- 4 -

THE OFFERING

|

Securities offered:

|

2,500,000 shares of our common stock, par value $0.00001 per share.

|

|

Offering price:

|

$0.04

|

|

Duration of offering:

|

The 2,500,000 shares of common stock are being offered for a period of 16 months.

|

|

Net proceeds to us:

|

$100,000, assuming the maximum number of shares sold. For further information on the Use of Proceeds, see page 14.

|

|

Market for the common stock:

|

There is no public market for our shares. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to eligible for trading on the Over The Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application.

There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

|

|

Shares outstanding prior to

offering:

|

5,000,000

|

|

Shares outstanding after offering:

|

7,500,000

|

|

Risk Factors:

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 6.

|

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the period from February 14, 2013 (Inception) to March 31, 2013, and our unaudited financial statements at June 30, 2013. Our working capital deficit as at March 31, 2013, and May 29, 2013, was $2,857.

|

March 31, 2013 ($)

|

||||

|

Financial Summary (Audited)

|

||||

|

Cash and Deposits

|

4,982

|

|||

|

Total Assets

|

4,982

|

|||

|

Total Liabilities

|

7,123

|

|||

|

Total Stockholder’s Equity (Deficit)

|

(2,141

|

) | ||

|

Accumulated

From

February 14, 2013

|

||||

|

(Inception) to

March 31, 2013 ($)

|

||||

|

Statement of Operations

|

||||

|

Total Expenses

|

2,191

|

|||

|

Net Loss for the Period

|

(2,191

|

) | ||

|

Net Loss per Share

|

0.00

|

|||

|

June 30, 2013 ($)

|

||||

|

Financial Summary (Unaudited)

|

||||

|

Cash and Deposits

|

4,266

|

|||

|

Total Assets

|

4,266

|

|||

|

Total Liabilities

|

7,123

|

|||

|

Total Stockholder’s Equity (Deficit)

|

(2,857

|

) | ||

|

Accumulated

From

February 14, 2013

|

||||

|

(Inception) to

June 30, 2013 ($)

|

||||

|

Statement of Operations

|

||||

|

Total Expenses

|

3,006

|

|||

|

Net Loss for the Period

|

(3,006

|

) | ||

|

Net Loss per Share

|

0.00

|

|||

- 5 -

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

Because our auditors have issued a going concern opinion, there is substantial uncertainty we will continue operations in which case you could lose your investment.

In their report dated June 18, 2013, our independent registered public accounting firm, M&K CPAS, stated that our financial statements for the year ended March 31, 2013, were prepared assuming the company will continue as a going concern. This means that there is substantial doubt that we can continue as an ongoing business. For the period from inception (February 14, 2013) to June 30, 2013, we incurred a net loss of $3,006. We will need to generate significant revenue in order to achieve profitability and we may never become profitable. The going concern paragraph in the independent auditor’s report emphasizes the uncertainty related to our business as well as the level of risk associated with an investment in our common stock. We intend to use the net proceeds from this offering to develop our business operations. To implement our plan of operations we require a minimum funding of $ 82,693 for the next twelve months.

The Company may not raise the $82,693 needed to implement its plan of operation and your entire investment could be lost.

The Company is making its offering of 2,500,000 shares of common stock on a best-efforts basis in an attempt to raise $82,693 to implement its plan of operation and there is no minimum amount of proceeds the Company may receive. In the event the company does not raise $82,693 to implement its plan of operations, your entire investment will be lost.

We have a very limited history of operations and accordingly there is no track record that would provide a basis for assessing our ability to conduct successful commercial activities. We may not be successful in carrying out our business objectives.

We were incorporated on February 14, 2013 and to date, have been involved primarily in organizational activities and obtaining financing. Accordingly we have no track record of successful business activities, strategic decision making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful as a development stage company which sells cut-stone granite products. As of our quarter ended June 30, 2013, we had an accumulated deficit of $3,006. Internet-based retail companies selling products of third parties often fail to achieve or maintain successful operations, even in favorable market conditions. There is a substantial risk that we will not be successful in our exploration activities, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

We depend to a significant extent on certain key personnel, the loss of any of whom may materially and adversely affect our company.

We depend entirely on Myroslav Tsapaliuk, our sole officer and director, for all of our operations. The loss of Mr. Tsapaliuk would have a substantial negative effect on our company and may cause our business to fail. Mr. Tsapaliuk has not been compensated for his services since our incorporation, and it is highly unlikely that he will receive any compensation unless and until we generate substantial revenues. There is intense competition for skilled personnel and there can be no assurance that we will be able to attract and retain qualified personnel on acceptable terms. The loss of Mr. Tsapaliuk’s services could prevent us from completing the development of our plan of operation and our business. In the event of the loss of services of such personnel, no assurance can be given that we will be able to obtain the services of adequate replacement personnel.

We do not have any employment agreements or maintain key person life insurance policies on sole officer and director. We do not anticipate entering into employment agreements with them or acquiring key man insurance in the foreseeable future.

We have limited business, sales and marketing experience in our industry.

We have not completed the development of our product and have yet to generate revenues. While we have plans for marketing and selling our granite products, there can be no assurance that such efforts will be successful. There can be no assurance that our proposed plan to model to sell granite products will gain wide acceptance in its target market or that we will be able to effectively market our services and third-party granite items. Additionally, we are a newly-formed, development stage company with no prior experience in our industry. We are entirely dependent on the services of our sole President, Myroslav Tsapaliuk, to build our customer base. Our company has no prior experience which it can rely upon in order to garner its first prospective customers to use our prospective website to sell granite products. Prospective customers will be less likely to purchase granite products through our website than a competitor’s because we have no prior experience in our industry.

We may not be able to compete effectively against our competitors.

We expect to face strong competition from well-established companies and small independent companies like our self that may result in price reductions and decreased demand for granite products being sold through our website. We will be at a competitive disadvantage in obtaining the facilities, employees, financing and other resources required to provide web portals desired by third party granite and cut stone sellers and cut granite products demanded by prospective customers. Our opportunity to obtain customers may be limited by our financial resources and other assets. We expect to be less able than our larger competitors to cope with generally increasing costs and expenses of doing business.

- 6 -

Current management’s lack of experience in and with the sale of cut granite means that it is difficult to assess, or make judgments about, our potential success.

Our sole officer and director has no prior experience with or ever been employed in a job involving the marketing and distribution of cut granite. Additionally, our sole officer and director do not have a college or university degrees, or other educational background in a field related to operating a business which sells granite. With no direct training in the Internet retailing business, our sole officer and director may not be fully aware of many of the specific requirements related to operating a website for third party sellers of granite products through the Internet. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to our officer and sole director’s future possible mistakes, lack of sophistication, judgment or experience in operating a website for third party sellers of cut granite products to sell cur granite products through the Internet.

Since all of our shares of common stock are owned by our sole officer and director, our other stockholders may not be able to influence control of the company or decision making by management of the company, and as such, sole officer and director may have a conflict of interest with the minority shareholders at some time in the future.

Our sole officer and director beneficially owns 100% of our outstanding common stock. The interests of our may not be, at all times, the same as that of our other shareholders. Our officer and directors are not simply passive investors but are also executive officers of the Company, and as such their interests as executives may, at times be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon our director exercising, in a manner fair to all of our shareholders, her fiduciary duties as officer or as member of the Company’s board of directors. Also, sole officer and director will have the ability to control the outcome of most corporate actions requiring shareholder approval, including the sale of all or substantially all of our assets and amendments to our Articles of Incorporation. This concentration of ownership may also have the effect of delaying, deferring or preventing a change of control of us, which may be disadvantageous to minority shareholders.

Because we are a shell company, it will likely be difficult for us to obtain additional financing by way of private offerings of our securities.

We are a “shell company” within the meaning of Rule 405, promulgated pursuant to Securities Act, because we have nominal assets and nominal operations. Accordingly, the holders of securities purchased in private offerings of our securities we make to investors will not be able to rely on the safe harbor from being deemed an underwriter under SEC Rule 144 in order to resell their securities. This will likely make it more difficult for us to attract additional capital through subsequent unregistered offerings because purchasers of securities in such unregistered offerings will not be able to resell their securities in reliance on Rule 144, a safe harbor on which holders of restricted securities usually rely to resell securities.

We intend to become subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended, which will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs will negatively affect our ability to earn a profit.

Following the effective date of the registration statement in which this prospectus is included, we will be required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 and the rules and regulations thereunder. In order to comply with such requirements, our independent registered auditors will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. Factors such as the number and type of transactions that we engage in and the complexity of our reports cannot accurately be determined at this time and may have a major negative effect on the cost and amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit.

However, for as long as we remain an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year (A) following the fifth anniversary of our first sale of common equity securities pursuant to an effective registration statement, (B) in which we have total annual gross revenue of at least $1.0 billion, or (C) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, and (ii) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Rule 12b-2 of the Securities Exchange Act of 1934, as amended, defines a “smaller reporting company” as an issuer that is not an investment company, an asset-backed issuer), or a majority-owned subsidiary of a parent that is not a smaller reporting company and that:

|

·

|

Had a public float of less than $ 75 million as of the last business day of its most recently completed second fiscal quarter, computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity; or

|

|

·

|

In the case of an initial registration statement under the Securities Act or Exchange Act for shares of its common equity, had a public float of less than $75 million as of a date within 30 days of the date of the filing of the registration statement, computed by multiplying the aggregate worldwide number of such shares held by non-affiliates before the registration plus, in the case of a Securities Act registration statement, the number of such shares included in the registration statement by the estimated public offering price of the shares; or

|

|

·

|

In the case of an issuer whose public float as calculated under paragraph (1) or (2) of this definition was zero, had annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available.

|

- 7 -

After, and if ever, we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with those requirements applicable to companies that are not “emerging growth companies,” including Section 404 of the Sarbanes-Oxley Act.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under the Jumpstart Our Business Startups Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

Since our sole officer and director has the ability to be employed by or consult for other companies, their other activities could slow down our operations.

Our sole officer and director is not required to work exclusively for us and do not devote all of his time to our operations. Therefore, it is possible that a conflict of interest with regard to his time may arise based on his employment by other companies. His other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that Myroslav Tsapaliuk, our President, will devote between 10 and 20 hours per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch if our operations increase. We do not have any written procedures in place to address conflicts of interest that may arise between our business and the business activities of our sole officer and director.

We have no employment or compensation agreements with our sole officer and director, and as such he may have little incentive to devote time and energy to the operation of the Company.

Our sole officer and director is not subject to any employment or compensation agreement with the Company. Therefore, it is possible that our sole officer and director may decide to focus his respective efforts on other projects or companies which have a higher economic benefit to either one or both of them. Currently, he is not obligated to spend any time at all on Company business and could opt to leave the Company for other opportunities or focus on other business which could negatively impact the Company’s ability to succeed. We do not have any expectation that our sole officer and director will enter into an employment or compensation agreement with the Company in the foreseeable future and the loss of him would be highly detrimental to our ability to conduct ongoing operations.

The lack of public company experience of our management team could adversely impact our ability to comply with the reporting requirements of U.S. securities laws.

Our sole officer and director lack public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Our sole officer and director has never been responsible for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934 which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

We are selling our offering of 2,500,000 shares of common stock without an underwriter and may be unable to sell any shares.

Our offering of 2,500,000 shares is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell our shares through our sole officer and director, who will receive no commissions. He will offer the shares to friends, family members, and business associates, however, there is no guarantee that they will be able to sell any of the shares. Unless he is successful in selling all of our shares and we receive the proceeds from this offering, we may have to seek alternative financing to implement our business plan.

- 8 -

Because there is no minimum proceeds the Company can receive from its offering of 2,500,000 shares, the Company may not raise sufficient capital to implement its planned business and your entire investment could be lost

The Company is making its offering of 2,500,000 shares of common stock on a best-efforts basis and there is no minimum amount of proceeds the Company may receive. Funds raised under this offering will not be held in trust or in any escrow account and all funds raised regardless of the amount will be available to the Company. In the event the company does not raise sufficient capital to implement its planned operations, your entire investment could be lost.

There is no liquidity and no established public market for our common stock and we may not be successful at obtaining a quotation on a recognized quotation service. In such event it may be difficult to sell your shares.

There is presently no public market in our shares. There can be no assurance that we will be successful at developing a public market or in having our common stock quoted on a quotation facility such as the OTC Bulletin Board. There are risks associated with obtaining a quotation, including that broker dealers will not be willing to make a market in our shares, or to request that our shares be quoted on a quotation service. In addition, even if a quotation is obtained, the OTC Bulletin Board and similar quotation services are often characterized by low trading volumes, and price volatility, which may make it difficult for an investor to sell our common stock on acceptable terms. If trades in our common stock are not quoted on a quotation facility, it may be very difficult for an investor to find a buyer for their shares in our Company.

Our common stock is subject to the “penny stock” rules of the sec and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities legislation, our common stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We may, in the future, issue additional common stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 75,000,000 shares of common stock. As of the date of this prospectus, the Company had 5,000,000 shares of common stock outstanding. Accordingly, we may issue up to an additional 70,000,000 shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

There is no current trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to have an application filed for admission to quotation of our securities on the OTC Bulletin Board after this prospectus is declared effective by the SEC. If for any reason our common stock is not quoted on the OTC Bulletin Board or a public trading market does not otherwise develop, purchasers of the shares may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and none may do so.

We intend to become subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended, which will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs will negatively affect our ability to earn a profit.

Following the effective date of the registration statement in which this prospectus is included, we will be required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 and the rules and regulations thereunder. In order to comply with such requirements, our independent registered auditors will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. Although we believe that the approximately $10,000 we have estimated for these costs should be sufficient for the 12 month period following the completion of our offering, the costs charged by these professionals for such services may vary significantly. Factors such as the number and type of transactions that we engage in and the complexity of our reports cannot accurately be determined at this time and may have a major negative affect on the cost and amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit.

- 9 -

However, for as long as we remain an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an “emerging growth company.” We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that you become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

After, and if ever, we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with those requirements applicable to companies that are not “emerging growth companies,” including Section 404 of the Sarbanes-Oxley Act.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under the Jumpstart Our Business Startups Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus.

Secondary trading in common stock sold in this offering will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

The Company does not intend to seek registration or qualification of its shares of common stock the subject of this offering in any State or territory of the United States. Aside from a “secondary trading” exemption, other exemptions under state law and the laws of US territories may be available to purchasers of the shares of common stock sold in this offering.

Anti-takeover effects of certain provisions of Nevada state law hinder a potential takeover of our company.

Though not now, in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors:

(i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

- 10 -

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder’s shares.

Nevada’s control share law may have the effect of discouraging takeovers of the corporation.

In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and “interested stockholders” for three years after the “interested stockholder” first becomes an “interested stockholder,” unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquiror to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of our company from doing so if it cannot obtain the approval of our board of directors.

Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares when desired.

Our public offering of 2,500,000 shares is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.04. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by the Company. There is no assurance that we will raise the full $100,000 as anticipated.

|

25% of

|

50% of

|

75% of

|

100% of

|

|||||||||||||

|

shares sold

|

shares sold

|

shares sold

|

shares sold

|

|||||||||||||

|

Gross Proceeds from this Offering(1):

|

$

|

25,000

|

$

|

50,000

|

$

|

75,000

|

$

|

100,000

|

||||||||

|

Legal and Accounting fees

|

$

|

7,000

|

$

|

10,000

|

$

|

10,000

|

$

|

10,000

|

||||||||

|

Website development and testing

|

$

|

693

|

$

|

3,000

|

$

|

6,000

|

$

|

8,000

|

||||||||

|

Marketing (2)

|

$

|

-0-

|

$

|

20,000

|

$

|

30,000

|

$

|

36,000

|

||||||||

|

Establishing an office

|

$

|

-0-

|

$

|

-0-

|

$

|

4,000

|

$

|

6,000

|

||||||||

|

Samples and shipping

|

$

|

-0-

|

$

|

-0-

|

$

|

5,000

|

$

|

10,000

|

||||||||

|

Salaries/commissions

|

$

|

-0-

|

$

|

-0-

|

$

|

2,693

|

$

|

12,693

|

||||||||

|

Offering Expenses (3)

|

7,693

|

32,693

|

57,693

|

82,693

|

||||||||||||

|

Proceeds After Offering Expenses

|

$

|

17,307

|

$

|

17,307

|

$

|

17,307

|

$

|

17,307

|

||||||||

|

(1)

|

Expenditures for the 12 months following the completion of this offering. The expenditures are categorized by significant area of activity.

|

|

(2)

(3)

|

Includes travel costs to trade shows and exhibits.

Estimated costs of this offering of approximately $17,307 consists of $10,000 of legal fees, $5,000 of accounting and auditing fees, $800 of transfer agent fees, $500 of printing fees, 1,000 of miscellaneous costs, and approximately $7.00 for the SEC registration fee for this offering.

|

Please see a detailed description of the use of proceeds in the “Plan of Operation” section of this prospectus.

- 11 -

The offering price of the 2,500,000 shares being offered has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our cash on hand and the amount of money we would need to implement our business plan. Accordingly, the offering price should not be considered an indication of the actual value of the securities.

The price of our offering of 2,500,000 shares is fixed at $0.04 per share. This price is significantly higher than the $0.00001 price per share paid by Myroslav Tsapaliuk, our President and a Director, for the 5,000,000 shares of common stock he purchased on February 14, 2013.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders. The following tables compare the differences of your investment in our shares with the investment of our existing stockholders.

As of June 30, 2013, the net tangible book value of our shares of common stock was $(2,857) or $(0.0005714) per share based upon 5,000,000 shares outstanding.

Existing Stockholders if all of the Shares are Sold

|

Price per share

|

$

|

0.04

|

||

|

Net tangible book value per share before offering

|

$

|

(0.0005

|

) | |

|

Potential gain to existing shareholders before offering expenses

|

$

|

100,000

|

||

| Potential gain to existing shareholdersnet of offering expenses | 82,693 | |||

|

Net tangible book value per share after offering

|

$

|

0.01

|

||

|

Increase to present stockholders in net tangible book value per share after offering

|

$

|

0.03

|

||

|

Capital contributions

|

$

|

50

|

||

|

Number of shares outstanding before the offering

|

5,000,000

|

|||

|

Number of shares after offering held by existing stockholders

|

5,000,000

|

|||

|

Percentage of ownership after offering

|

66.6

|

%

|

Purchasers of Shares in this Offering if all Shares Sold

|

Price per share

|

$

|

0.04

|

||

|

Dilution per share

|

$

|

0.03

|

||

|

Capital contributions

|

$

|

100,000

|

||

| Net proceeds after offering expenses | 82,693 | |||

|

Percentage of capital contributions

|

99.9

|

%

|

||

|

Number of shares after offering held by public investors

|

2,500,000

|

|||

|

Percentage of ownership after offering

|

33.3

|

%

|

- 12 -

Purchasers of Shares in this Offering if 75% of Shares Sold

|

Price per share

|

$

|

0.04

|

||

|

Dilution per share

|

$

|

0.033

|

||

|

Capital contributions

|

$

|

75,000

|

||

| Net proceeds after offering expenses | 57,693 | |||

|

Percentage of capital contributions

|

99.9

|

%

|

||

|

Number of shares after offering held by public investors

|

1,875,000

|

|||

|

Percentage of ownership after offering

|

27.7

|

%

|

Purchasers of Shares in this Offering if 50% of Shares Sold

|

Price per share

|

$

|

0.04

|

||

|

Dilution per share

|

$

|

0.036

|

||

|

Capital contributions

|

$

|

50,000

|

||

| Net proceeds after offering expenses | 32,693 | |||

|

Percentage of capital contributions

|

99.9

|

%

|

||

|

Number of shares after offering held by public investors

|

1,250,000

|

|||

|

Percentage of ownership after offering

|

20.0

|

%

|

Purchasers of Shares in this Offering if 25% of Shares Sold

|

Price per share

|

$

|

0.04

|

||

|

Dilution per share

|

$

|

0.039

|

||

|

Capital contributions

|

$

|

25,000

|

||

| Net proceeds after offering expenses | 7,693 | |||

|

Percentage of capital contributions

|

99.8

|

%

|

||

|

Number of shares after offering held by public investors

|

625,000

|

|||

|

Percentage of ownership after offering

|

11.1

|

%

|

GENERAL

There is no established public trading market for our common stock. Our authorized capital stock consists of 75,000,000 shares of common stock, with $0.00001 par value per share. As of September 4, 2013, there were 5,000,000 shares of our common stock issued and outstanding that were held by one stockholder of record, and no shares of preferred stock issued and outstanding.

COMMON STOCK

The following is a summary of the material rights and restrictions associated with our common stock. This description does not purport to be a complete description of all of the rights of our stockholders and is subject to, and qualified in its entirety by, the provisions of our most current Articles of Incorporation and Bylaws, which are included as exhibits to this Registration Statement.

- 13 -

The holders of our common stock currently have (i) equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Director of the Company; (ii) are entitled to share ratably in all of the assets of the Company available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of the Company (iii) do not have pre-emptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (iv) are entitled to one non-cumulative vote per share on all matters on which stock holders may vote.

Our Bylaws provide that on all other matters, except as otherwise required by Nevada law or the Articles of Incorporation, a majority of the votes cast at a meeting of the stockholders shall be necessary to authorize any corporate action to be taken by vote of the stockholders. We do not have any preferred stock authorized in our Articles of Incorporation, and we have no warrants, options or other convertible securities issued or outstanding.

NEVADA ANTI-TAKEOVER LAWS

The Nevada Business Corporation Law contains a provision governing “Acquisition of Controlling Interest.” This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to the acquired shares, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights in whole or in part. The control share acquisition act provides that a person or entity acquires “control shares” whenever it acquires shares that, but for the operation of the control share acquisition act, would bring its voting power within any of the following three ranges: (1) 20 to 33 1/3%, (2) 33 1/3 to 50%, or (3) more than 50%. A “control share acquisition” is generally defined as the direct or indirect acquisition of either ownership or voting power associated with issued and outstanding control shares. The stockholders or board of directors of a corporation may elect to exempt the stock of the corporation from the provisions of the control share acquisition act through adoption of a provision to that effect in the Articles of Incorporation or Bylaws of the corporation. Our Articles of Incorporation and Bylaws do not exempt our common stock from the control share acquisition act. The control share acquisition act is applicable only to shares of “Issuing Corporations” as defined by the act. An Issuing Corporation is a Nevada corporation, which; (1) has 200 or more stockholders, with at least 100 of such stockholders being both stockholders of record and residents of Nevada; and (2) does business in Nevada directly or through an affiliated corporation.

At this time, we do not have 100 stockholders of record resident of Nevada. Therefore, the provisions of the control share acquisition act do not apply to acquisitions of our shares and will not until such time as these requirements have been met. At such time as they may apply to us, the provisions of the control share acquisition act may discourage companies or persons interested in acquiring a significant interest in or control of the Company, regardless of whether such acquisition may be in the interest of our stockholders.