Attached files

| file | filename |

|---|---|

| EX-2.1 - FORM OF SHARE EXCHANGE AGREEMENT - TAP RESOURCES, INC. | tapp_ex21.htm |

| EX-10.3 - MINERAL RIGHTS PARTNERSHIP AGREEMENT - TAP RESOURCES, INC. | tapp_ex103.htm |

| EX-3.2.1 - BYLAWS OF THE REGISTRANT - TAP RESOURCES, INC. | tapp_ex321.htm |

| EX-3.1.1 - ARTICLES OF INCORPORATION - TAP RESOURCES, INC. | tapp_ex311.htm |

| EX-23.3 - CONSENT OF DENNIS LAPOINT - TAP RESOURCES, INC. | tapp_ex233.htm |

| EX-21.1 - SUBSIDIARIES OF TAP RESOURCES, INC - TAP RESOURCES, INC. | tapp_ex211.htm |

| EX-23.2 - CONSENT OF DE JOYA GRIFFITH & COMPANY, LLC - TAP RESOURCES, INC. | tapp_ex232.htm |

| EX-10.2 - MINERAL RIGHTS PARTNERSHIP AGREEMENT - TAP RESOURCES, INC. | tapp_ex102.htm |

| EXCEL - IDEA: XBRL DOCUMENT - TAP RESOURCES, INC. | Financial_Report.xls |

Registration No. 333-185102

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

TAP RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1000

|

20-5886006

|

||

|

(State or Other Jurisdiction of

|

(Primary Standard Industrial

|

(IRS Employer

|

||

|

Incorporation or Organization)

|

Classification Number)

|

Identification Number)

|

Freonstraat 29

Parimaribo

Republic of Suriname

Tel: +597 883-6954

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

State Agent and Transfer Syndicate, Inc.

112 North Curry Street

Carson City, Nevada 89703

(800) 253-1013

(Address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

4216 NE 70th Street

Seattle, Washington 98115

Telephone No.: (206) 522-2256

Facsimile No.: (206) 260-0111

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

|

(Do not check if a smaller reporting company)

|

|||

CALCULATION OF REGISTRATION FEE

|

Title of Each Class

|

Proposed Maximum

|

Proposed Maximum

|

||||||||||||||

|

of Securities

|

Amount to Be

|

Offering Price

|

Aggregate

|

Amount of

|

||||||||||||

|

to be Registered

|

Registered (1)

|

per Share

|

Offering Price

|

Registration Fee

|

||||||||||||

|

Common Stock, $0.001 per share

|

40,000,000

|

(2)

|

$

|

0.05

|

(3)

|

$

|

2,000,000

|

$

|

272.80

|

|||||||

|

TOTAL

|

40,000,000

|

$

|

-

|

$

|

2,000,000

|

$ |

272.80

|

|||||||||

(1) In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) Represents shares of the Registrant’s common stock being registered for resale that have been issued to the selling stockholders named in this registration statement.

(3) Estimated pursuant to Rule 457(c) of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee, based on the average of the high and low prices reported on the OTC Bulletin Board on October 25, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

ii

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION DATED OCTOBER 8, 2013

TAP RESOURCES, INC.

40,000,000 SHARES OF COMMON STOCK

This prospectus relates to the resale by certain selling stockholders of Tap Resources, Inc. of up to 40,000,000 shares of common stock held by selling stockholders named in this prospectus. We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

Our common stock is quoted on the OTC Bulletin Board maintained by the Financial Industry Regulatory Authority, Inc. under the symbol “TAPP.” The last closing price for our common stock was $0.51 per share, as reported on the OTC Bulletin Board , on April 29, 2013 .

Any participating broker-dealers and any selling stockholders who are affiliates of broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions or discounts given to any such broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling stockholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their common stock.

Our business is subject to many risks and an investment in our shares of common stock will also involve a high degree of risk. You should carefully consider the factors described under the heading “risk factors” beginning on page 6 before investing in our shares of common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the Securities and Exchange Commission. The selling stockholders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is _______________, 2013.

1

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

|

Page

|

||||

|

Prospectus Summary

|

3

|

|||

|

Risk Factors

|

6

|

|||

|

Risk Factors Relating to Our Company

|

6

|

|||

|

Risk Factors Relating to Our Common Stock

|

12

|

|||

|

Use of Proceeds

|

15

|

|||

|

Determination of Offering Price

|

15

|

|||

|

Selling Stockholders

|

15

|

|||

|

Plan of Distribution

|

17

|

|||

|

Description of Business

|

19

|

|||

|

Our Executive Offices

|

29

|

|||

|

Legal Proceedings

|

29

|

|||

|

Market for Common Equity and Related Stockholder Matters

|

29

|

|||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

30

|

|||

|

Directors, Executive Officers, Promoters and Control Persons

|

36

|

|||

|

Executive Compensation

|

38

|

|||

|

Security Ownership of Certain Beneficial Owners and Management

|

38

|

|||

|

Certain Relationships and Related Transactions

|

39 | |||

|

Disclosure of Commission Position on Indemnification for Securities Act Liabilities

|

39

|

|||

|

Where You Can Find More Information

|

39

|

|||

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

39

|

|||

|

Financial Statements

|

F-1

|

|||

Until _____, 2013 (90 business days after the effective date of this prospectus) all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

2

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things: the volatility of minerals prices, the possibility that exploration efforts will not yield economically recoverable quantities of minerals, accidents and other risks associated with mineral exploration and development operations, the risk that the Company will encounter unanticipated geological factors, the Company’s need for and ability to obtain additional financing, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration and development plans, other factors over which we have little or no control.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

PROSPECTUS SUMMARY

As used in this prospectus, references to the “Company,” “we,” “our”, “us” or “Tap Resources” refer to Tap Resources, Inc. unless the context otherwise indicated.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

OUR COMPANY

Tap Resources, Inc. was incorporated on November 1, 2006, under the laws of the State of Nevada, for the purpose of conducting mineral exploration activities. We are an exploration stage company, with a mining exploration project (the “Marowijne Project”) in the Republic of Suriname that has not realized any revenues to date, and our accumulated net loss as of May 31, 2013 is $24,126.

On September 12, 2012, the Company entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with selling stockholders named in this prospectus, pursuant to which the Company offered and sold an aggregate of 90,000,000 shares of common stock to all the stockholders of Infinity Resources, Inc., a Nevada corporation (“Infinity”), on a pro rata basis based upon their respective beneficial ownership interest in Infinity Resources, as consideration for all of the issued and outstanding shares of common stock of Infinity held by all the stockholders of Infinity.

As a result of the consummation of the Share Exchange Agreement (i) Infinity became a wholly-owned subsidiary of the Company, and the mineral exploration business of Infinity is now the primary business of the Company, and (ii) the stockholders of Infinity immediately prior to the consummation of the Share Exchange Agreement now hold approximately 99.6% of the shares of common stock of the Company.

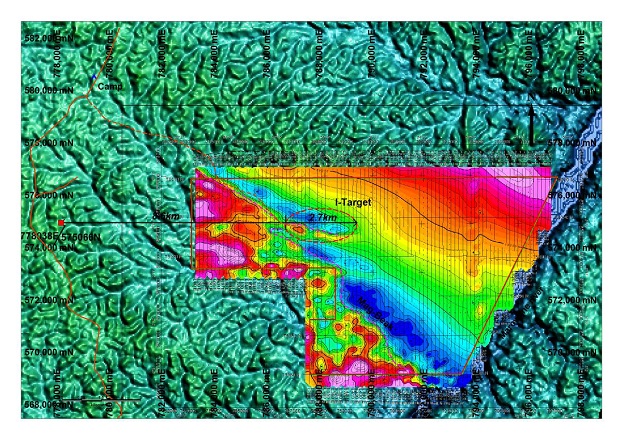

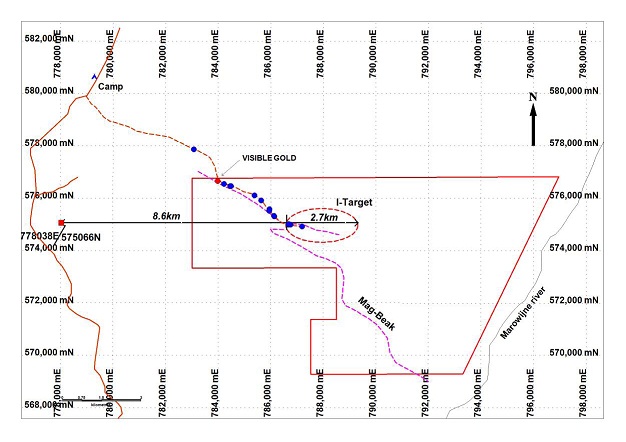

Our current cash of $969 will not be sufficient to operate our company for any period of time from the date of this prospectus or complete the second phase or third phase of our planned exploration program on the Marowijne Project. None of our officers or our director have ever visited the Marowijne Property. Phase 1 and only part of Phase 2 of our exploration program have been completed. In Phase 1 of our plan of operation, we hired a registered geologist and began preliminary N.I. 43-101 exploration. This work was performed primarily between January 2012 and August 2012, at a cost of approximately $104,128 and was paid for by a shareholder of the Company. Phase 2 of our plan of operation was to retain Contract Terraquest Ltd, and hire local contractors for ground work. This work was completed preformed between August 2012 and October 2012, at a cost of approximately $65,871 and was paid for by a shareholder of the Company. The next goals in Phase 2 will be to find a reasonable drill target. We estimate spending an additional $210,000 to complete Phase 2. Phase 3 of our plan of operation will be to diamond drill test on the Marowijne Property. We expect this phase to cost approximately $500,000. We will require additional funding to proceed with phase 3 work on the claim; we have no current plans on how to raise the additional funding. We have not commenced work on Phase 3 of our exploration program, which we expect to cost approximately $1,000,000 to complete.

We are an exploration stage company formed for the purposes of acquiring, exploring, and if warranted and feasible, developing natural resource property. We have raised an aggregate of $31,200 through private placements of our securities. Proceeds from these placements were used to acquire a mineral property and for working capital.

3

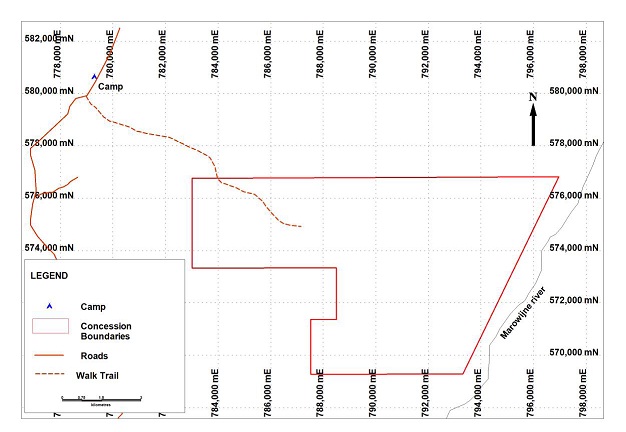

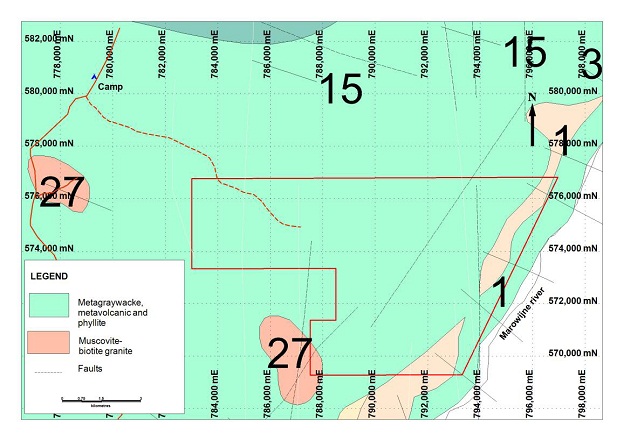

The concession of the Marowijne Property, located in Suriname, consists of approximately 7,008 hectares located west and adjacent to the Marowijne River, and north to the concession of Surgold-Newmont. From Paramaribo, access to the concessions is by truck or bus using the asphalt road all the way towards Moengo City. At this point, an all weathered laterite dirt road better known as the Patamacca road leads south wards all the way to Snesie Kondre. The entrance point however is located at one and a half hour from Moengoe at the Patamacca main road at around 47 kilometers distance. We have had a qualified consulting geologist prepare a geological evaluation report on the claim. We intend to conduct exploratory activities on the claim and if feasible, develop the claim.

Neither Andrew Aird, our President and Chief Executive officer and a director, nor Ron McIntyre our Secretary, agreed to serve as an officer or director of the Company at least in part due to a plan, agreement or understanding that he and she, respectively, would solicit, participate in, or facilitate the sale of the enterprise to (or a business combination with) a third party looking to obtain or become a public reporting entity, and each of Mr. Aird and Mr. McIntyre also confirms that he and she, respectively, has no such present intention.

The Company’s principal offices are located at Freonstraat 29, Parimaribo, Republic of Suriname.

|

Securities offered:

|

The selling stockholders are offering hereby up to 40,000,000 shares of common stock.

|

|

|

Offering price:

|

The selling stockholders will offer and sell their shares of common stock at a price of $0.05 per share on the OTC Bulletin Board, or at prevailing market prices or privately negotiated prices.

|

|

|

Shares outstanding prior to offering:

|

90,280,920

|

|

|

Shares outstanding after offering:

|

90,280,920

|

|

|

Market for the shares of common stock:

|

Our common stock is quoted on the OTC Bulletin Board under the symbol “TAPP.”. There is no active trading market for our common stock, and there is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

|

|

|

Use of proceeds:

|

We will not receive any proceeds from the sale of shares by the selling stockholders

|

4

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the fiscal year ended November 30, 2012, and our unaudited financial statements for the six months ended May 31, 2013. Our working capital as at May 31, 2013 was ($143,244).

|

November 30, 2012

($)

|

||||

|

Financial Summary (Audited)

|

||||

|

Cash and Deposits

|

969

|

|||

|

Total Assets

|

969

|

|||

|

Total Liabilities

|

128,647

|

|||

|

Total Stockholder’s Deficit

|

(127,678)

|

|||

|

Accumulated From

April 27, 2012

|

||||

|

|

(Inception) to November 30, 2012 ($)

|

|||

|

Statement of Operations

|

||||

|

Total Expenses

|

8,560

|

|||

|

Net Loss for the Period

|

8,560

|

|||

|

Net Loss per Share

|

-

|

|||

|

May 31, 2013

($)

|

||||

|

Financial Summary (Unaudited)

|

||||

|

Cash and Deposits

|

969

|

|||

|

Total Assets

|

969

|

|||

|

Total Liabilities

|

144,213

|

|||

|

Total Stockholder’s Deficit

|

(143,244)

|

|||

|

Accumulated From

April 27, 2012

|

||||

|

|

(Inception) to

May 31,

2013 ($)

|

|||

|

Statement of Operations

|

||||

|

Total Expenses

|

24,126

|

|||

|

Net Loss for the Period

|

24,126

|

|||

|

Net Loss per Share

|

-

|

|||

5

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our financial statements for the year ended November 30, 2012 were prepared assuming that we will continue our operations as a going concern. We were incorporated on November 1, 2006 and do not have a history of earnings. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

We will require additional funds which we plan to raise through the private sale of our common stock, which requires favorable market conditions and interest in our activities by investors. If we are not be able to sell our common stock, funding will not be available for continued operations, and our business will fail.

We anticipate that our current cash of $969 will not be sufficient to complete the second phase or third phase of our planned exploration program on the Marowijne mining claim. Phase 1 and only part of Phase 2 of our exploration program have been completed. We estimate spending an additional $210,000 to complete Phase 2. We have not commenced work on Phase 3 of our exploration program, which we expect to cost approximately $1,000,000 to complete. Subsequent exploration activities will require additional funding. Our only present means of funding is through the sale of our common stock. The sale of common stock requires favorable market conditions for exploration companies like ours, as well as specific interest in our stock, neither of which may exist if and when additional funding is required by us. If we are unable to raise additional funds in the future, our business will fail.

We have a very limited history of operations and accordingly there is no track record that would provide a basis for assessing our ability to conduct successful mineral exploration activities. We may not be successful in carrying out our business objectives.

We were incorporated on November 1, 2006 and to date, have been involved primarily in organizational activities, obtaining financing and acquiring an interest in the claims. Accordingly we have no track record of successful exploration activities, strategic decision making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful as a junior resource exploration company. Junior exploration companies often fail to achieve or maintain successful operations, even in favorable market conditions. There is a substantial risk that we will not be successful in our exploration activities, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

Due to the speculative nature of mineral property exploration, there is substantial risk that no commercially viable mineral deposits will be found on our Marowijne Property or other mineral properties that we acquire.

In order for us to even commence mining operations we face a number of challenges which include finding qualified professionals to conduct our exploration program, obtaining adequate financing to continue our exploration program, locating a viable mineral body, partnering with a senior mining company, obtaining mining permits, and ultimately selling minerals in order to generate revenue. Moreover, exploration for commercially viable mineral deposits is highly speculative in nature and involves substantial risk that no viable mineral deposits will be located on any of our present or future mineral properties. There is a substantial risk that the exploration program that we will conduct on the Claim may not result in the discovery of any significant mineralization, and therefore no commercial viable mineral deposit. There are numerous geological features that we may encounter that would limit our ability to locate mineralization or that could interfere with our exploration programs as planned, resulting in unsuccessful exploration efforts. In such a case, we may incur significant costs associated with an exploration program, without any benefit. This would likely result in a decrease in the value of our common stock.

We have not independently verified the mineral reserves on the Marowijne Property, nor have we personally visited the Marowijne Property, and we have relied solely on the representations and advice of our expert advisors.

No members of management of the Company have personally visited the Marowijne Property. We have relied on the expert advice of Dr. Dennis LaPoint, a professional geologist and one of his colleagues, Eriaan Wirosono, who is not a professional geologist but has conducted a site visit to the Marowijne Property. Because we have not independently verified that there are mineral reserves, there may be no commercially viable mineral reserves located on the Marowijne Property. Assuming there are mineralized materials or mineral reserves that can be proved or proven at some time in the future, there can be no assurance that the Marowijne Property does not contain physical or geological defects that could pose obstacles to our exploration plans that a site visit would have revealed.

6

Due to the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or may elect not to insure. We currently have no such insurance nor do we expect to obtain such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all our assets and cease operations, resulting in the loss of your entire investment.

Our activities are subject to governmental regulations which may subject us to penalties for failure to comply, may limit our ability to conduct exploration activities and could cause us to delay or abandon our project.

Various regulatory requirements affect the current and future activities of the Company, including exploration activities on our lode claim. Exploration activities require permits from various federal, provincial and local governmental authorities and are subject to laws and regulations governing, among other things, prospecting, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, and others which currently or in the future may have a substantial adverse impact on the Company. Exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company to obtain permits from various governmental agencies.

Licensing and permitting requirements are subject to changes in laws and regulations in various operating circumstances. There can be no assurance that the Company will be able to obtain or maintain all necessary licenses and/or permits it may require for its activities or that such permits will be will be obtainable on reasonable terms or on a timely basis or that such laws and regulations will not have an adverse effect on any project which we might undertake. If the Company is unable to obtain the necessary licenses or permits for our exploration activities, we might have to change or abandon our planned exploration for such non-permitted properties and/or to seek other joint venture arrangements. In such event, the Company might be forced to sell or abandon its property interests.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing exploration activities to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining activities may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Any change in or amendments to current laws, regulations and permits governing activities of mineral exploration companies, or more stringent implementation thereof, could require increases in exploration expenditures, or require delays in exploration or abandonment of new mineral properties. The cost of compliance with changes in governmental regulations has a potential to increase the Company’s expenses.

Because the Company is subject to compliance with environmental regulation, the cost of our exploration program may increase.

Our operations may be subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain exploration and mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

7

The market price for precious metals is based on numerous factors outside of our control. There is a risk that the market price for precious metals will significantly decrease, which will make it difficult for us to fund further mineral exploration activities, and would decrease the probability that any significant mineralization that we locate can be economically extracted.

Numerous factors beyond our control may affect the marketability of minerals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital and you may lose your entire investment in this offering.

Current management’s lack of experience in and/or with mining and, in particular, mineral exploration activity, means that it is difficult to assess, or make judgments about, our potential success.

Our officers and directors do not have any prior experience with and have never been employed in the mining industry. Additionally, our officers and directors have no college or university degree, or other educational background, in mining or geology or in a field related to mining. More specifically, our officers and directors lack technical training and experience with exploring for, starting, and/or operating a mine. With no direct training or experience in these areas, our officer and director may not be fully aware of many of the specific requirements related to mineral exploration, let alone the overall mining industry as a whole. For example, management and our directors’ decisions and choices may fail to take into account standard engineering and other managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to our officers’ and directors’ future possible mistakes, lack of sophistication, judgment or experience in this particular industry. As a result, if we do obtain the funding or other means to implement a bona fide mineral exploration program, such program will likely have to be implemented and carried out by joint venturers, partners or independent contractors who would have the requisite mineral exploration experience and know-how that we currently lack.

Since our officers and directors have the ability to be employed by or consult for other companies, their other activities could slow down our operations.

Our officers and directors are not required to work exclusively for us and do not devote all of their time to our operations. Therefore, it is possible that a conflict of interest with regard to their time may arise based on their employment by other companies. Their other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that each of our officers and directors will devote between 5 and 10 hours per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed. We do not have any written procedures in place to address conflicts of interest that may arise between our business and the business activities of our directors.

Since the majority of our shares of common stock are owned by one person, Richard Alexander, our other stockholders may not be able to influence control of the Company or decision making by management of the company, and as such, Mr. Alexander may have a conflict of interest with the minority shareholders at some time in the future.

Richard Alexander beneficially owns 55.4% of our issued and outstanding shares of common stock, and will beneficially own 51.3% of our issued and outstanding shares of common stock assuming the sale of all the shares in this offering. The interests of Mr. Alexander may not be, at all times, the same as that of our other shareholders. Mr. Alexander is not simply a passive investor but is also the controlling shareholder the Company, and as such his interests may, at times be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon Mr. Alexander exercising, in a manner fair to all of our shareholders, his fiduciary duties as the majority shareholder of the Company. Also, Mr. Alexander will have the ability to control the outcome of most corporate actions requiring shareholder approval, including the sale of all or substantially all of our assets and amendments to our Articles of Incorporation. This concentration of ownership may also have the effect of delaying, deferring or preventing a change of control of us, which may be disadvantageous to minority shareholders.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The selling shareholders are offering up to 40,000,000 shares of our common stock through this prospectus. Our common stock is presently quoted on the OTC Bulletin Board . No active trading market presently exists for our common stock, but should a market develop, shares sold at a price below the current market price at which the common stock is quoted will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent 44.3 % of the shares of common stock outstanding as of the date of this prospectus.

8

Since our executive officers and directors, are not residents of the United States, it may be difficult to enforce any liabilities against them.

Shareholders may have difficulty enforcing any claims against us because certain of our officers and directors reside outside the United States. If a shareholder desired to sue our officers and directors, shareholders would have to serve a summons and complaint. Even if personal service is accomplished and a judgment is entered against that person, the shareholder would then have to locate the assets of that person, and register the judgment in the foreign jurisdiction where the assets are located.

Lack of additional working capital may cause curtailment of any expansion plans while raising of capital through sale of equity securities would dilute existing shareholders’ percentage of ownership.

Our available capital resources will not be adequate to fund our working capital requirements based upon our present level of operations beyond December 31, 2013. A shortage of capital would affect our ability to fund our working capital requirements. If we require additional capital, funds may not be available on acceptable terms, if at all. In addition, if we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could dilute existing shareholders. If funds are not available, we could be placed in the position of having to cease all operations.

We do not presently have a traditional credit facility with a financial institution. This absence may adversely affect our operations

We do not presently have a traditional credit facility with a financial institution. The absence of a traditional credit facility with a financial institution could adversely impact our operations. If adequate funds are not otherwise available, we may be required to delay, scale back or eliminate portions of our operations and product development efforts. Without such credit facilities, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our inability to successfully achieve sales could adversely affect our financial condition.

We may not be able to successfully achieve sales in order to cover our operating expenses and achieve sustainable profitability. Without such critical mass of sales, the Company could be forced to cease operations.

Our success is substantially dependent on general economic conditions and business trends, a downturn of which could adversely affect our operations.

The success of our operations depends to a significant extent upon a number of factors relating to business spending. These factors include economic conditions, activity in the financial markets, general business conditions, personnel cost, inflation, interest rates and taxation. Our business is affected by the general condition and economic stability of our customers and their continued willingness to work with us in the future. An overall decline in the demand for minerals could cause a reduction in our prospective sales and the Company could face a situation where it never achieves a critical mass of sales and thereby be forced to cease operations.

Changes in generally accepted accounting principles could have an adverse effect on our business financial condition, cash flows, revenue and results of operations.

We are subject to changes in and interpretations of financial accounting matters that govern the measurement of our performance. Based on our reading and interpretations of relevant guidance, principles or concepts issued by, among other authorities, the American Institute of Certified Public Accountants, the Financial Accounting Standards Board, and the United States Securities and Exchange Commission, our management believes that our current contract terms and business arrangements have been properly reported. However, there continue to be issued interpretations and guidance for applying the relevant standards to a wide range of contract terms and business arrangements that are prevalent in the industries in which we operate. Future interpretations or changes by the regulators of existing accounting standards or changes in our business practices could result in future changes in our revenue recognition and/or other accounting policies and practices that could have a material adverse effect on our business, financial condition, cash flows, revenue and results of operations.

9

We will need to increase the size of our organization, and may experience difficulties in managing growth.

We are a small company with no full-time employees. We expect to experience a period of significant expansion in headcount, facilities, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate managers. Our future financial performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

We do not have adequate insurance coverage.

At this time, we do not have adequate insurance coverage and therefore have the risk of loss or damages to our business and assets. We may face liability upon the occurrence of any event which could result in any loss or damages being assessed against the Company. Moreover, any insurance we may ultimately acquire may not be adequate to cover any loss or liability we may incur.

We are subject to numerous laws and regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to extensive federal, state and local laws and regulations relating to the financial markets. Future laws or regulations, any adverse change in the interpretation of existing laws and regulations or our failure to comply with existing legal requirements may result in substantial penalties and harm to our business, results of operations and financial condition. We may be required to make large and unanticipated capital expenditures to comply with governmental regulations. Our operations could be significantly delayed or curtailed and our cost of operations could significantly increase as a result of regulatory requirements or restrictions. We are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the Nasdaq Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors' independence, audit committee oversight, and the adoption of a code of ethics. We have not yet adopted any of these corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

The imprecision of mineral deposit estimates may prove any resource calculations that we make to be unreliable.

Mineral deposit estimates and related databases are expressions of judgment based on knowledge, mining experience, and analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. By their nature, mineral deposit estimates are imprecise and depend upon statistical inferences, which may ultimately prove unreliable. Mineral deposit estimates included here, if any, have not been adjusted in consideration of these risks and, therefore, we cannot be sure that any mineral deposit estimate will ultimately be reclassified as reserves. If our exploration program locates a mineral deposit, such deposits may never be classified as reserves.

10

We are sensitive to fluctuations in the price of gold, silver and other metals which is beyond our control. The price of precious metals is volatile and price changes are beyond our control.

The price of gold and other precious metals can fluctuate. The prices of gold and other precious metals have been and will continue to be affected by numerous factors beyond our control. Factors that affect the price of gold and other precious metals include the demand from consumers for products that use such metals, economic conditions, over supply from secondary sources and costs of production. Price volatility and downward price pressure, which can lead to lower prices, could have a material adverse effect on the costs or the viability of our projects.

Mineral exploration and prospecting is highly competitive and a speculative business and we may not be successful in seeking available opportunities.

The process of mineral exploration and prospecting is a highly competitive and speculative business. In seeking available opportunities, we will compete with a number of other companies, including established, multi-national companies that have more experience and resources than us. We compete with other exploration companies looking for gold and copper deposits. Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire projects of value, which, ultimately, become productive. However, while we compete with other exploration companies, there is no competition for the exploration or removal of minerals from our claims.

Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects. The historical trend toward stricter environmental regulation may continue, and, as such, represents an unknown factor in our planning processes.

All mining is regulated by the government agencies at the federal level of government in the Republic of Suriname. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to obtaining licenses and permits from government agencies before the commencement of mining activities. An environmental impact study that must be obtained on each property in order to obtain governmental approval to mine on the properties is also a part of the overall operating costs of a mining company.

The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project. Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects.

Mining and exploration activities are subject to extensive regulation by the Republic of Suriname. Future changes in governments, regulations and policies, could adversely affect our results of operations for a particular period and our long-term business prospects.

Mining and exploration activities are subject to extensive regulation by the Republic of Suriname. Such regulation relates to production, development, exploration, exports, taxes and royalties, labor standards, occupational health, waste disposal, protection and remediation of the environment, mine and mill reclamation, mine and mill safety, toxic substances and other matters. Compliance with such laws and regulations has increased the costs of exploring, drilling, developing, constructing and operating mines and other facilities. Furthermore, future changes in governments, regulations and policies could adversely affect our results of operations in a particular period and our long-term business prospects.

The development of mines and related facilities is contingent upon governmental approvals, which are complex and time consuming to obtain and which, depending upon the location of the project, involve various governmental agencies. The duration and success of such approvals are subject to many variables outside our control.

11

The majority of our business is focused on providing services in a foreign country which could change its laws or policies such that we cannot conduct business in the Republic of Suriname, resulting in a nearly complete or complete loss of your investment.

Our operations are conducted in the Republic of Suriname, a developing country that has a history of political instability. There is no guarantee that the Republic of Suriname will not change its laws or policies to reverse policy choices in the past, with the result that our business operations are terminated or expropriated. Our business depends on contracts with the Republic of Suriname government and its agencies that are subject to interpretation in accordance with the laws, public policies and courts of the Republic of Suriname. Any change in law or policy that adversely impacts our relations with the Republic of Suriname government, our permits, licenses and consents to conduct our business in the Republic of Suriname or the continuation of our contracts with the Republic of Suriname government agencies would have a material adverse effect on ability to conduct business.

Transportation difficulties and weather interruptions may affect and delay proposed mining operations and impact our proposed business.

Our mining properties are accessible by road. The climate in the area is hot and dry in the summer but is subject to heavy rain in the winter months, which could at times hamper accessibility depending on the winter season precipitation levels. As a result, our exploration and mining plans could be delayed for several months each year.

Supplies needed for exploration may not always be available. If we are unable to secure exploration supplies we may have to delay our anticipated business operations.

Competition and unforeseen limited sources of supplies needed for our proposed exploration work could result in occasional spot shortages of supplies of certain products, equipment or materials. There is no guarantee we will be able to obtain certain products, equipment and/or materials as and when needed, without interruption, or on favorable terms. Such delays could affect our anticipated business operations and increase our expenses.

RISKS RELATING TO OUR COMMON STOCK

Though our common stock is quoted on the OTC Bulletin Board, there is no liquidity and no established public market for our common stock, which means that it will be difficult to sell your shares.

Our common stock is quoted on the OTC Bulletin Board under the symbol “TAPP.” There is, however, presently no public market in our shares. There can be no assurance that a market for our common stock will develop on the OTC Bulletin Board. The OTC Bulletin Board is a significantly more limited market than established trading markets such as the New York Stock Exchange or NASDAQ. Broker dealers may not be willing to make a market in our shares. In addition, the OTC Bulletin Board and similar quotation services are often characterized by low trading volumes, and price volatility, which may make it difficult for an investor to sell our common stock on acceptable terms. If trades in our common stock are not quoted on a quotation facility, it may be very difficult for an investor to find a buyer for their shares in our Company.

12

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities legislation, our common stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We will need to increase the size of our organization, and may experience difficulties in managing growth.

We are a small company with two part-time employees. We expect to experience a period of significant expansion in headcount, facilities, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate managers. Our future financial performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We have offered and sold our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information provided by investors themselves.

If any prior offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

13

We incur costs associated with SEC reporting compliance, which may significantly affect our financial condition.

The Company is a “reporting issuer” under the Securities Exchange Act of 1934, as amended. Therefore, we incur certain costs of compliance with applicable SEC reporting rules and regulations including, but not limited to attorneys fees, accounting and auditing fees, other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately $25,000 per year. On balance, the Company determined that the incurrence of such costs and expenses was preferable to the Company being in a position where it had very limited access to additional capital funding.

We may, in the future, issue additional shares of common stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation, as amended, authorize the issuance of 200,000,000 shares of common stock. As of the date of this prospectus the Company had 90,280,920 shares of common stock outstanding. Accordingly, we may issue up to an additional 109,719,080 shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

There is no current established trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. While our shares of common stock are quoted on the OTC Bulletin Board, an established trading market does not exist, and purchasers of the shares may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and none may do so.

Anti-takeover effects of certain provisions of Nevada state law hinder a potential takeover of the Company.

Though not now, we may be or in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors:

(i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

14

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder’s shares.

Nevada’s control share law may have the effect of discouraging takeovers of the corporation.

In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and “interested stockholders” for three years after the “interested stockholder” first becomes an “interested stockholder,” unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquiror to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of Tap Resources from doing so if it cannot obtain the approval of our board of directors.

Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares when desired.

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders. We will not receive any of the proceeds from the sale of the shares of common stock being offered for sale by the selling stockholders.

DETERMINATION OF THE OFFERING PRICE

The selling stockholders will determine at what price they may sell the offered shares, and such sales may be made at prevailing market prices or at privately negotiated prices.

SELLING STOCKHOLDERS

The following table sets forth the shares beneficially owned, as of the date of this prospectus by the selling stockholders prior to the offering contemplated by this prospectus, the number of shares each selling security holder is offering by this prospectus and the number of shares which each would own beneficially if all such offered shares are sold.

Beneficial ownership is determined in accordance with Securities and Exchange Commission rules. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

15

The percentages below are calculated based on 90,280,920 shares of our common stock issued and outstanding as of as of the date of this prospectus. We do not have any outstanding options, warrants or other securities exercisable for or convertible into shares of our common stock

|

Total

Number of

|

||||||||||||||||

|

Shares to be

Offered for

|

Total Shares

|

Percentage of

|

||||||||||||||

|

Shares

Owned

|

the

Security

|

Owned After

the

|

Shares owned

After

|

|||||||||||||

|

Name of

|

Before

|

Holder’s

|

Offering is

|

the Offering is

|

||||||||||||

|

Selling Shareholder

|

the Offering

|

Account

|

Complete

|

Complete

|

||||||||||||

|

Checkmate Ventures Inc. (1)

|

4,450,000

|

3,636,364

|

813,636

|

*

|

||||||||||||

|

Rowett Capital AG (2)

|

3,875,000

|

3,636,364

|

238,636

|

*

|

||||||||||||

|

Tarbert AG (3)

|

3,767,000

|

3,636,364

|

130,636

|

*

|

||||||||||||

|

Kincardine Corp. (4)

|

3,850,000

|

3,636,364

|

213,636

|

*

|

||||||||||||

|

Lochhouse SA (5)

|

3,950,000

|

3,636,364

|

313,636

|

*

|

||||||||||||

|

Coral Capital Ltd. (6)

|

4,400,000

|

3,636,364

|

763,636

|

*

|

||||||||||||

|

Caribe Management Ltd. (7)

|

4,200,000

|

3,636,364

|

563,636

|

*

|

||||||||||||

|

Dolphin Management Ltd. (8)

|

3,650,000

|

3,636,363

|

13,637

|

*

|

||||||||||||

|

Anthony Domenic Pizzacalla (9)

|

3,825,000

|

3,636,363

|

188,637

|

*

|

||||||||||||

|

Pamela Mary Hutchinson (9)

|

4,033,000

|

3,636,363

|

396,637

|

*

|

||||||||||||

|

Richard Alexander

|

50,000,000

|

3,636,363

|

46,363,637

|

51.3%

|

||||||||||||

|

Total

|

90,000,000

|

40,000,000

|

50,000,000

|

55.3%

|

||||||||||||

________

*less than 1%.

(1) Voting or investment control held by Ian Dawson.

(2) Voting or investment control held by Kenneth Ciopolo.

(3) Voting or investment control held by Anthony Killarney.

(4) Voting or investment control held by Genevieve Yolanda Perrill.

(5) Voting or investment control held by Roger Knox.

(6) Voting or investment control held by ____________.

(7) Voting or investment control held by ____________.

(8) Voting or investment control held by ____________.

(9) Anthony Domenic Pizzacalla and Pamela Mary Hutchinson are husband and wife. Each of Anthony Domenic Pizzacalla and Pamela Mary Hutchinson disclaim beneficial ownership of the shares held by the other.

None of the selling shareholders has a relationship with us other than as a shareholder, has ever been one of our officers or directors, or is a broker-dealer registered under the Securities Exchange Act, as amended, or an affiliate of such a broker-dealer.

We may require the selling stockholders to suspend the sales of the securities offered by this prospectus upon the occurrence of any event that makes any statement in this prospectus, or the related registration statement, untrue in any material respect, or that requires the changing of the statements in these documents in order to make statements in those documents not misleading. We will file a post-effective amendment to the registration statement to reflect any such material changes to this prospectus.

16

PLAN OF DISTRIBUTION

As of the date of this prospectus, our shares of common stock are quoted on the OTC Bulletin Board. The selling stockholders and any of their pledgees, donees, transferees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or quoted or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholders may use any one or more of the following methods when selling shares:

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits investors;

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

·

|

privately negotiated transactions;

|

|

·

|

to cover short sales made after the date that this registration statement is declared effective by the SEC;

|

|

·

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

·

|

a combination of any such methods of sale; and

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The selling stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved.

The selling stockholders may from time to time pledge or grant a security interest in some or all of the shares owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell shares of common stock from time to time under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

Upon the Company being notified in writing by a selling stockholder that any material arrangement has been entered into with a broker-dealer for the sale of common stock through a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer, a supplement to this prospectus will be filed, if required, pursuant to Rule 424(b) under the Securities Act, disclosing (i) the name of each such selling stockholder and of the participating broker-dealer(s), (ii) the number of shares involved, (iii) the price at which such the shares of common stock were sold, (iv) the commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable, (v) that such broker-dealer(s) did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus, and (vi) other facts material to the transaction. In addition, upon the Company being notified in writing by a selling stockholder that a donee or pledgee intends to sell more than 500 shares of common stock, a supplement to this prospectus will be filed if then required in accordance with applicable securities law.

The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

17

The selling stockholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, that can be attributed to the sale of securities will be paid by the selling stockholder and/or the purchasers. Each selling stockholder has represented and warranted to the Company that it acquired the securities subject to this registration statement in the ordinary course of such selling stockholder’s business and, at the time of its purchase of such securities such selling stockholder had no agreements or understandings, directly or indirectly, with any person to distribute any such securities.

The Company has advised each selling stockholder that it may not use shares registered on this registration statement to cover short sales of common stock made prior to the date on which this registration statement shall have been declared effective by the SEC. If a selling stockholder uses this prospectus for any sale of the common stock, it will be subject to the prospectus delivery requirements of the Securities Act. The selling stockholders will be responsible to comply with the applicable provisions of the Securities Act and Exchange Act, and the rules and regulations thereunder promulgated, including, without limitation, Regulation M, as applicable to such selling stockholders in connection with resales of their respective shares under this registration statement.

PENNY STOCK RULES

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in “penny stocks” as such term is defined by Rule 15g-9. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The shares offered by this prospectus constitute penny stock under the Securities and Exchange Act. The shares will remain penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in our company will be subject to the penny stock rules.