Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EnergySolutions, Inc. | a13-21934_18k.htm |

Exhibit 99.1

|

|

Lender Presentation October 8, 2013 |

|

|

Forward Looking Statements Disclaimer 2 This presentation contains forward-looking statements that involve substantial risks and uncertainties. You can identify forward-looking statements by words such as anticipate, believe, could, estimate, expect, intend, may, plan, should, will, would or similar words. You should consider these statements carefully because they discuss our plans, targets, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. There may be events in the future that we are not able to predict accurately or control. Our actual results may differ materially from the expectations we describe in our forward looking statements. Factors or events that could cause our actual results to materially differ may emerge from time to time, and it is not possible for us to accurately predict all of them. You should be aware that the occurrence of any such event could have a material adverse effect on our business, results of operation and financial position. Any forward-looking statement made by us in this presentation speaks only as of the date on which we make it. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. |

|

|

Non-GAAP Financial Information 3 EnergySolutions does not, as a matter of course, publicly disclose projections of future revenue, earnings or other financial performance of the type disclosed below. These historical financial data, financial projections and financial forecasts were not prepared with a view toward public disclosure or compliance with published guidelines of the SEC or the American Institute of Certified Public Accountants for preparation and presentation of prospective financial information, the IFRS or U.S. GAAP and do not, and were not intended to, act as public guidance regarding EnergySolutions' future financial performance. Deloitte & Touche LLP, EnergySolutions' independent registered public accounting firm, has not examined or compiled or performed any procedures on any of the historical financial data or financial projections, expressed any conclusion or provided any form of assurance with respect to the historical financial data or financial projections and, accordingly, assumes no responsibility for them. The inclusion of this information in this presentation should not be regarded as an indication that EnergySolutions or any recipient of this information considered, now considers or will consider this information to be necessarily predictive of future results. EnergySolutions does not intend to update or otherwise revise the historical financial data or financial projections to correct any errors existing in such historical financial data or financial projections when made, to reflect circumstances existing after the date when made or to reflect the occurrence of future events even in the event that any or all of the assumptions underlying the historical financial data or financial projections are shown to be in error. Although presented with numerical specificity, the financial projections and forecasts included in this presentation are based on numerous estimates, assumptions and judgments (in addition to those described above) that may not be realized and are inherently subject to significant business, economic and competitive uncertainties and contingencies related to factors, such as the profitability of the Zion project and related project cost management and nuclear decommissioning trust fund investment earnings performance; our inability to find a partner for the Zion project and access related restricted cash; our ability to obtain and comply with federal, state and local government permits and approvals; the politically sensitive environment in which we operate, the risks associated with radioactive materials and the public perception of those risks; the effects of environmental, health and safety laws and regulations governing, among other things, discharges to air and water, the handling, storage and disposal of hazardous or radioactive materials and wastes, the remediation of contamination associated with releases of hazardous substances and human health and safety; the availability and allocation of government funds to performance of existing government contracts in our industry and any future government contracts; our deferred tax assets for net operating loss carry-forwards and research and development tax credits; the continued operation of, and adequate capacity at, our Clive, Utah disposal facility; factors associated with our international operations; our ongoing business relationships with significant government and commercial customers; our license stewardship arrangement with Exelon; our ability to obtain the financial support, including letters of credit and bonding, necessary for us to win certain types of new work; industry performance; general business, economic, market and financial conditions; and the other factors listed in this presentation under the section entitled "Forward Looking Statements Disclaimer," which are difficult to predict and most of which are beyond the control of EnergySolutions. These or other factors may cause the financial projections or the underlying assumptions and estimates to be inaccurate. Since the financial projections cover multiple years, such information by its nature becomes less reliable with each successive year. The financial projections also do not take into account any circumstances or events occurring after the date they were prepared. The inclusion of the financial projections and forecasts in this presentation shall not be deemed an admission or representation by EnergySolutions that such information is material. The inclusion of the projections should not be regarded as an indication that EnergySolutions considered or now considers them to be a reliable prediction of future results and you should not rely on them as such. Accordingly, there can be no assurance that the financial projections will be realized, and actual results may vary materially from those reflected in the projections. You should read the section entitled "Forward Looking Statements Disclaimer" for additional information regarding the risks inherent in forward-looking information such as the financial projections. Certain of the historical financial data and financial projections set forth herein may be considered non-U.S. GAAP financial measures. Non-U.S. GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP, and non-U.S. GAAP financial measures as used by EnergySolutions may not be comparable to similarly titled amounts used by other companies. |

|

|

Introduction Pramod Raju, Vice President Tyler Reeder, Partner David Lockwood, CEO Greg Wood, CFO 4 |

|

|

Agenda I. Amendment Overview & II. Timeline Business Update III. Progress Review IV. Financial Overview 5 |

|

|

I. Amendment Overview & Timeline 6 Pramod Raju |

|

|

Amendment Terms 7 Amendment Extend the requirement to reduce the aggregate amount of Term Loans and Senior Notes outstanding to $675 million by October 21st (“Original Debt Cap Date”) to 270 days after the Original Debt Cap Date (“New Debt Cap Date”) Provided to Consenting Lenders 25 bps consent fee payable on the Amendment Effective Date A 50 bps increase in the Applicable Margin for the Term Loan B and Revolver starting at the Amendment Effective Date through the earlier of (i) six months from the Amendment Effective Date and (ii) the reduction of the aggregate amount of Term Loans and Senior Notes to $675 million If after six months the aggregate amount of Term Loans and Senior Notes has not been reduced to $675MM, an additional 25 bps increase in the Applicable Margin for the Term Loan B and Revolver through the earlier (i) of three months and (ii) the reduction of the aggregate amount of Term Loans and Senior Notes to $675 million |

|

|

Amendment Timeline 8 October 2013 S M T W T F S 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Date Key Event 10/07 Announce amendment and lender call via Intralinks 10/08 Lender Call 10/11 Signatures from consenting lenders due 10/17 Amendment effective date Amendment Event Holidays |

|

|

II. Business Update 9 Tyler Reeder |

|

|

Business Update On May 24, 2013, EnergySolutions (“ES” or the “Company”) was acquired by affiliates of Energy Capital Partners II, LP (“Energy Capital” or “ECP”) for $4.15 per share, representing a $1.2 billion enterprise value One of the largest equity investments for ECP, a private equity firm with approximately $8 billion under management Since acquisition close, EnergySolutions has had solid financial performance consistent with expectations Overall investment thesis evolving much better than expected, evidenced by multiple announced closures of operating nuclear plants Meaningful improvement in cash flow driven by core business fundamentals, cost reductions and improved working capital management $70 million deleveraging from ECP funding and Company cash flow, including a release of $21 million of restricted cash Represents 0.7x of debt reduction within 150 days of Energy Capital ownership EnergySolutions is currently required to delever its balance sheet to $675 million (the “Debt Cap”) within 150 days of closing (October 21, 2013) pursuant to the terms of the amended term loan facility Current debt balance of $740 million, down from $810 million at closing ES seeks an amendment from term loan lenders to extend the date by which the Debt Cap must be satisfied by 270 days ES views the current debt paydown timing per the Debt Cap requirement as a sub-optimal use of capital given the: Significant recent deleveraging of the business and further deleveraging expected over the next nine months through the release of restricted cash and strong cash flow generation Equity capital may be used by ES for attractive acquisitions, which would further enhance the Company’s credit profile 10 |

|

|

Key Credit Highlights 11 Global Market Leader Global leader in nuclear services with integrated capabilities throughout nuclear lifecycle creates strong, persistent barriers to entry Over 80% share in U.S. LLRW disposal and 95% of commercial Class A LLRW Highly differentiated decommissioning experience Equity infusion, debt reduction and long-term support from ECP creates meaningful financial flexibility, improved customer optics and enhanced cash flow Reduced interest expense Business requires longstanding track-record, regulatory licenses and significant capital Large installed base of nuclear reactors and significant committed spend on legacy government nuclear sites Acceleration of decommissioning activity globally following tragic Fukushima incident in 2011 Clive is a unique, non-replicable disposal asset with over 30 years of available capacity Differentiated processing and logistics assets underpin integrated service capabilities Valuable portfolio of nuclear processing products and technology Stable and visible revenue stream through diversified customer base and long-term contracts Approximately 85% of revenue from cost reimbursable, cost-plus or unit-rate contracts Modest capital expenditure requirements and excellent working capital management Strong Position in Compelling End Markets Non-Replicable Asset Base Sustainable Cash Flow Generation De-Risked Financial Model Diversification across products, end markets, geographies and customers ensures financial stability Diversified, sustainable base revenue stream complemented by high-growth ancillary growth initiatives Balanced revenue and profit generation across end markets and large, globally diversified customer base Highly Diversified |

|

|

III. Progress Review 12 David Lockwood |

|

|

Progress Against Key Strategic Initiatives Deleverage – continued improvement Streamlined corporate structure Improve LP&D asset utilization Positioned to pursue increased decommissioning activity Successfully decommission and de-risk Zion project Strong performance in Europe Cost reduction initiative completed 13 1 2 3 4 5 6 7 Confidential |

|

|

Capitalization Overview 14 Energy Capital’s acquisition of EnergySolutions closed on 5/24/2013 $21MM of restricted cash has been released to retire debt 0.7x reduction in Total Debt / Adj. EBITDA leverage since acquisition close 2 Notes 9/30/2013 debt levels pro forma for additional $15MM pay down in early October Adjusted EBITDA includes equity-based compensation expense and, non-cash accretion expense, plus or minus nuclear decommissioning trust fund gains or losses net of management fees, changes in ARO cost estimates, restructuring costs and one-time settlements and other non-recurring charges 3/31/2013 LTM Adj. EBITDA of $145MM; 9/30/2013PF LTM Adj. EBITDA of $151MM 1 1 2 CHECK 1 Capitalization Overview ($ in millions) 3/31/2013 9/30/2013PF (1) Unrestricted Cash 90 50 Restricted Cash 316 295 Revolver - - Term Loan B 510 440 Senior Notes 300 300 Total Debt 810 740 Total Shareholder's Equity 283 415 Total Capitalization 1,093 1,155 Leverage Metrics (2) (3) Total Debt / Adj. EBITDA 5.6x 4.9x (Total Debt - Unrest. Cash) / Adj. EBITDA 5.0x 4.6x (Total Debt - Total Cash) / Adj. EBITDA 2.8x 2.6x |

|

|

Deleverage – Continued Improvement 15 15 1 9/30/2013 debt levels pro forma for additional $15MM pay down in early October 8.6% debt paydown since acquisition to 9/30/2013PF 0.7x Total Debt / Adj. EBITDA leverage reduction since acquisition to 9/30/2013PF $21MM of restricted cash released since acquisition 3/31/2013A Notes 3/31/2013 LTM Adj. EBITDA of $145 million; 9/30/2013PF LTM Adj. EBITDA of $151 million Total Cash = Unrestricted Cash + Restricted Cash ($ in millions) Restricted Cash Unrestricted Cash Total Debt 9/30/2013PF 5.6x 5.0x 2.8x 4.9x 4.6x 2.6x Total Debt / Adj. EBITDA (1) (Total Debt – Unrest. Cash) / Adj. EBITDA (1) (Total Debt – Total Cash) / Adj. EBITDA (1) (2) |

|

|

Streamlined Corporate Structure 16 Includes U.S. Government projects and global decontamination and decommissioning services Government business is largely DoE clean-up projects Projects include Hanford Site, Los Alamos National Lab, Salt Waste Processing Facility Large international services business highlighted by U.K. Magnox contract Canada project pipeline Decommissioning of Exelon’s Zion nuclear plant in Illinois Attractive position to serve Japan, Germany, France, Belgium and China in various capacities Anchored by Clive disposal asset in Utah Largest commercial radioactive waste disposal facility in the U.S. Other segments include: Bear Creek (TN) – nation’s largest licensed commercial processing facility for low level radioactive waste (“LLRW”) SempraSafe JV to convert Class B&C resins into stable waste suitable for disposal at Clive and other LLRW facilities Logistics (Hittman) Barnwell (SC) disposal site in South Carolina Focus on Class A (low-level) waste disposal and processing Growing business serving nuclear utilities Includes water treatment technology critical to Fukushima clean-up Other products/services include: Chemical and process engineering Dry fuel storage services Transport of medical isotopes Nuclear engineering and radiological safety Vitrification 2 Restructuring the Company into three distinct business lines enables management to identify, evaluate and oversee strategic initiatives in more efficient manner |

|

|

Improving LP&D Asset Utilization LP&D business is characterized by fixed costs with margin expansion potential driven by volume and/or price increases; priorities include: Safety Environmental stewardship Streamlining cost structure Consistent volume and revenue flows driven by strong base of life-of-plant and long-term government and commercial contracts - Consistent historical annual processing and disposal volumes - Innovative technologies for radioactive material volume reduction including smelting, incineration and compaction up to 200 to 1 volume reduction ES has 30+ years of remaining disposal capacity (approximately 87 million ft3) - Sufficient capacity to store all LLRW from all operating and shuttered nuclear plants in the U.S. - Opportunities to better integrate LP&D offerings Core asset to pursue waste disposal revenue growth from new sources, geographies and customers SempraSafe JV is a patented process that effectively blends high radioactivity resins for disposal at Clive 17 Confidential |

|

|

Positioned to Pursue Increased Decommissioning Activity Retired, Announced and At High-Risk Plants Plant MW State Owner Status Year Three Mile Island II 906 PA Exelon Retired 1979 San Onofre Unit 3 1,080 CA SCE Retired 2013 San Onofre Unit 2 1,070 CA SCE Retired 2013 Crystal River 860 FL Progress Retired 2013 Kewaunee 566 WI Dominion Retired 2013 Vt. Yankee 620 VT Entergy Announced 2014 Oyster Creek 636 NJ Exelon Announced 2019 Clinton 1,078 IL Exelon At High-Risk N/A Davis-Besse 894 OH FirstEnergy At High-Risk N/A Fitzpatrick 855 NY Entergy At High-Risk N/A Ft. Calhoun 484 NE OPPD At High-Risk N/A Ginna 610 NY CENG At High-Risk N/A Indian Point Unit 2 1,006 NY Entergy At High-Risk 2013 Millstone 2,103 CT Dominion At High-Risk N/A Nine Mile Point 1,773 NY CENG At High-Risk N/A Palisades 793 MI Entergy At High-Risk N/A Pilgrim 685 MA Entergy At High-Risk N/A Total 16,019 Confidential Recent Street/ Industry Commentary “As some (nuclear) plants are closing, it’s clear that waste management is becoming an increasingly important issue” - Allison Macfarlane, NRC Chairman, September 2013 “The (nuclear) sector faces twin challenges of regulatory mandated investments and a low power price environment as a result of cheap natural gas.” - UBS, January 2013 “…the challenge of upward cost inflation/weak plant profitability will likely put pressure on smaller, more marginal plants that could weigh on nuclear’s market share” - Credit Suisse, February 2013 “By July, 2013 the U.S. was already guaranteed to have the largest amount of early-retired capacity in a single year in the history of the U.S. commercial nuclear sector and the lowest load factor in over a decade.” - Mark Cooper, Institute for Energy and the Environment, July 2013 “The recent retirements are the first since 1998. Decisions to retire the units involved concerns over maintenance and repair costs and declining profitability.” - EIA, July 2013 “Including the Vermont Yankee nuclear plant, New England expects to see more than 1,369 MW of generation retired between 2013 and 2016.” - EIA, September 2013 |

|

|

Positioned to Pursue Increased Decommissioning Activity (cont’d) D&D Strategy Update ES is well recognized as the global leader in reactor decommissioning as a result of the Company's extensive experience at Magnox and Zion Due to its asset base, ES can also mitigate the largest unknown decommissioning cost: disposal of LLRW Utilities and governmental agencies are asking for ES’ advice and counsel as they begin to plan future decommissionings Evaluating strategic opportunities to pursue future D&D projects 19 4 |

|

|

Zion: On Schedule, Continue to De-Risk 5 Project remains on target to meet critical milestones with exemplary operational performance to-date June 2020 anticipated project completion date In Year 3 of a 10-year project Project is on schedule, management expects 5-10% profit margins including waste disposal to Clive Success of project to-date is facilitating the development of additional D&D disposal opportunities worldwide Remaining critical path work streams include reactor vessel segmentation, completion of ISFSI construction and spent fuel transfer, all of which will likely be completed within the next 24 months Seeking opportunities to unlock restricted cash supporting Zion letter of credit 20 |

|

|

Magnox: Partnering with Bechtel for re-bid of Magnox contract to decommission 10 U.K. sites Re-bid process underway, award expected early 2014 and potential transition late 2014 or early 2015 Visible revenue stream Talented employee pool in a resource-constrained industry Reactor operation experience expands the scope of future project opportunities EnergySolutions assumes limited liability exposure related to Magnox projects Ownership of Magnox reactors and nuclear-related liabilities remain with the NDA, and employee-related costs are reimbursed Cost-plus contract structure NDA contracts provide significant value to EnergySolutions: Base fee + incentive fee Visible revenue stream Talented employee pool in a resource-constrained industry Reactor operation experience expands the scope of future project opportunities EnergySolutions is also actively pursuing other European opportunities U.K. Belgium France May seek to team with large EPC companies on certain projects Strong Performance in Europe 6 21 |

|

|

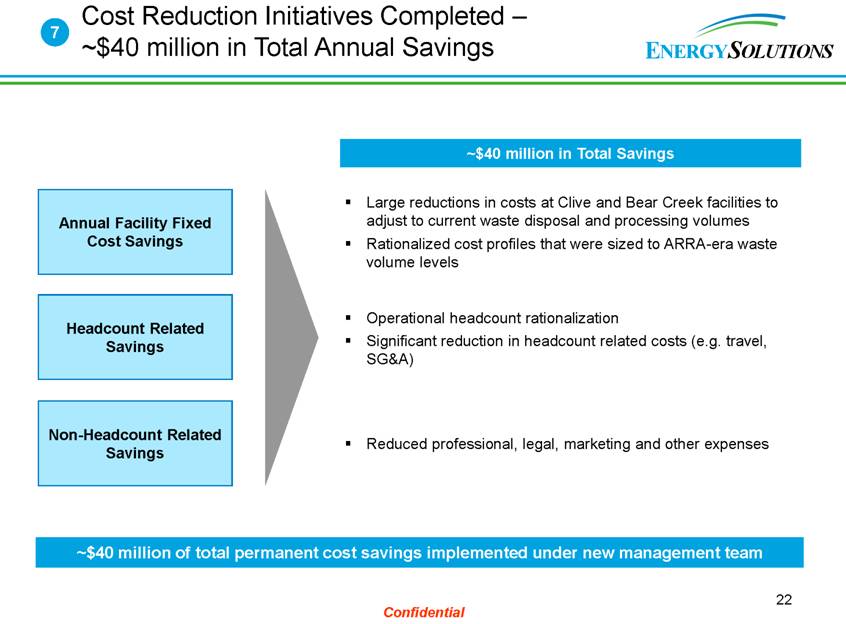

22 Cost Reduction Initiatives Completed – ~$40 million in Total Annual Savings 7 Headcount Related Savings Operational headcount rationalization Significant reduction in headcount related costs (e.g. travel, SG&A) Large reductions in costs at Clive and Bear Creek facilities to adjust to current waste disposal and processing volumes Rationalized cost profiles that were sized to ARRA-era waste volume levels Reduced professional, legal, marketing and other expenses Non-Headcount Related Savings Annual Facility Fixed Cost Savings ~$40 million in Total Savings ~$40 million of total permanent cost savings implemented under new management team |

|

|

IV. Financial Overview 23 Greg Wood |

|

|

Historical Financial Performance Revenue Adjusted EBITDA (1) ($ in millions) Capex Free Cash Flow (2) ($ in millions) ($ in millions) 24 ($ in millions) Notes Adjusted EBITDA includes equity-based compensation expense and, non-cash accretion expense, plus or minus nuclear decommissioning trust fund gains or losses net of management fees, changes in ARO cost estimates, restructuring costs and one-time settlements and other non-recurring charges Free Cash Flow = Operating Cash Flow - Capex |

|

|

Historical Credit Metrics Leverage Ratio Free Cash Flow (1) / Debt x Adj. EBITDA (2) / Interest (Adj. EBITDA (2) – Capex) / Interest x x 25 % Total Debt / Adj. EBITDA (Total Debt – Total Cash) / Adj. EBITDA Free Cash Flow / Total Debt Free Cash Flow / (Total Debt – Total Cash) Notes Free Cash Flow = Operating Cash Flow - Capex Adjusted EBITDA includes equity-based compensation expense and, non-cash accretion expense, plus or minus nuclear decommissioning trust fund gains or losses net of management fees, changes in ARO cost estimates, restructuring costs and one-time settlements and other non-recurring charges 9/30/2013 debt levels pro forma for additional $15MM pay down post effective amendment A LTM 9/30/13PF (3) |