Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - Blue Capital Reinsurance Holdings Ltd. | s000078x3_ex21-1.htm |

| EX-10.7 - EXHIBIT 10-7 - Blue Capital Reinsurance Holdings Ltd. | s000078x3_ex10-7.htm |

| EX-23.1 - EXHIBIT 23.1 - Blue Capital Reinsurance Holdings Ltd. | s000078x3_ex23-1.htm |

As filed with the U.S. Securities and Exchange Commission on October 7, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BLUE CAPITAL REINSURANCE HOLDINGS LTD.

(Exact name of registrant as specified in its charter)

| Bermuda (State or other jurisdiction of incorporation or organization) |

6331 (Primary Standard Industrial Classification Code Number) |

98-1120002 (I.R.S. Employer Identification Number) |

94 Pitts Bay Road

Pembroke HM 08, Bermuda

P.O. Box 2079

Hamilton, Bermuda, HMHX

(441) 296-5550

(Address, including zip code, and telephone

number,

including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, NY 10011

(212) 590-9070

(Name, address, including zip code, and

telephone number,

including area code, of agent for service)

(Copies of all communications, including communications sent to agent for service)

| Craig F. Arcella Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, NY 10019 (212) 474-1000 |

Jonathan L. Freedman Edward F. Petrosky Sidley Austin LLP 787 Seventh Avenue New York, NY 10019 (212) 839-5300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: £

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer £ | Accelerated filer £ |

Non-accelerated filer R (Do not check if a smaller reporting company)

|

Smaller reporting company £ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed

Maximum Aggregate Offering Price(1)(2) |

Amount

of Registration Fee(3) |

| Common shares, par value $1.00 per share | $100,000,000 | $12,880 |

| (1) | Includes shares to be sold upon full exercise of the underwriters’ option to purchase additional common shares. | |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). | |

| (3) | Calculated pursuant to Rule 457(o) under the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Preliminary Prospectus dated October 7, 2013

PROSPECTUS

Shares

Blue Capital Reinsurance Holdings Ltd.

Common Shares

This is an initial public offering of common shares of Blue Capital Reinsurance Holdings Ltd. We are a newly formed Bermuda reinsurance holding company seeking primarily to offer collateralized reinsurance in the property catastrophe market. Our underwriting decisions and operations will be managed by subsidiaries of Montpelier Re Holdings Ltd. (NYSE: MRH), and we expect to use Montpelier’s reinsurance underwriting expertise and its infrastructure to conduct our business. We are selling shares in this offering. Concurrent with this offering, we are selling shares in a private placement directly to Montpelier Reinsurance Ltd., a wholly owned subsidiary of Montpelier Re Holdings Ltd. We will receive the full proceeds and will not pay any underwriting discounts or commissions with respect to shares that we sell to Montpelier Reinsurance Ltd.

No public market currently exists for our common shares. The estimated initial public offering price is $ per share. We have applied to list our common shares on the New York Stock Exchange and we intend to apply to list our common shares on the Bermuda Stock Exchange under the symbol “BCRH.”

We are an “emerging growth company” under federal securities laws and are subject to reduced public company disclosure standards.

Investing in our common shares involves significant risks. See “Risk Factors” beginning on page 14.

Neither the Securities and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us (before expenses)(2) | $ | $ |

| (1) | Montpelier Re Holdings Ltd., our current sole shareholder, has agreed to reimburse us for the underwriting discounts and commissions in connection with this offering and any exercise of the underwriters’ option to purchase additional shares. |

| (2) | Montpelier Re Holdings Ltd., our current sole shareholder, has agreed to reimburse us for our expenses in connection with this offering in excess of $1 million. |

Montpelier has agreed to pay Deutsche Bank Securities Inc. a structuring fee equal to 1% of the gross proceeds of this offering (including with respect to any of our common shares issued pursuant to the exercise by the underwriters in whole or in part of their option to purchase additional shares but excluding any of our common shares purchased by Montpelier Reinsurance Ltd. in the concurrent private placement) for assistance in structuring our organization and our business. See “Underwriting” for a description of compensation payable to the underwriters in connection with this offering.

We have granted the underwriters the right to purchase for a period of 30 days up to additional common shares at the public offering price, less the underwriting discounts and commissions, for the purpose of covering sales of common shares by the underwriters in excess of the number of shares being offered, if any.

We have applied for and received permission from the Bermuda Monetary Authority under the Bermuda Exchange Control Act 1972 (and its related regulations) for the issue and free transfer of our common shares to and among persons who are non-residents of Bermuda for exchange control purposes as long as our common shares are listed on an appointed stock exchange, which includes the New York Stock Exchange and the Bermuda Stock Exchange. In granting such consent, the Bermuda Monetary Authority accepts no responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

The underwriters expect to deliver our common shares to investors on or about , 2013.

Deutsche Bank Securities

The date of this prospectus is , 2013.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

__________________________

TABLE OF CONTENTS

Montpelier has filed an application for the “Blue Capital” trademark. We will enter into a trademark license agreement with Montpelier providing for the royalty-free license of the “Blue Capital” trademark. All other brands are trademarks of their respective owners. See “Business—Intellectual Property.”

| i |

This summary highlights information contained elsewhere in this prospectus. It may not contain all the information that may be important to you. You should read the entire prospectus carefully, including the section entitled “Risk Factors” and our audited consolidated balance sheet and the related notes included elsewhere in this prospectus, before making an investment decision to purchase our common shares.

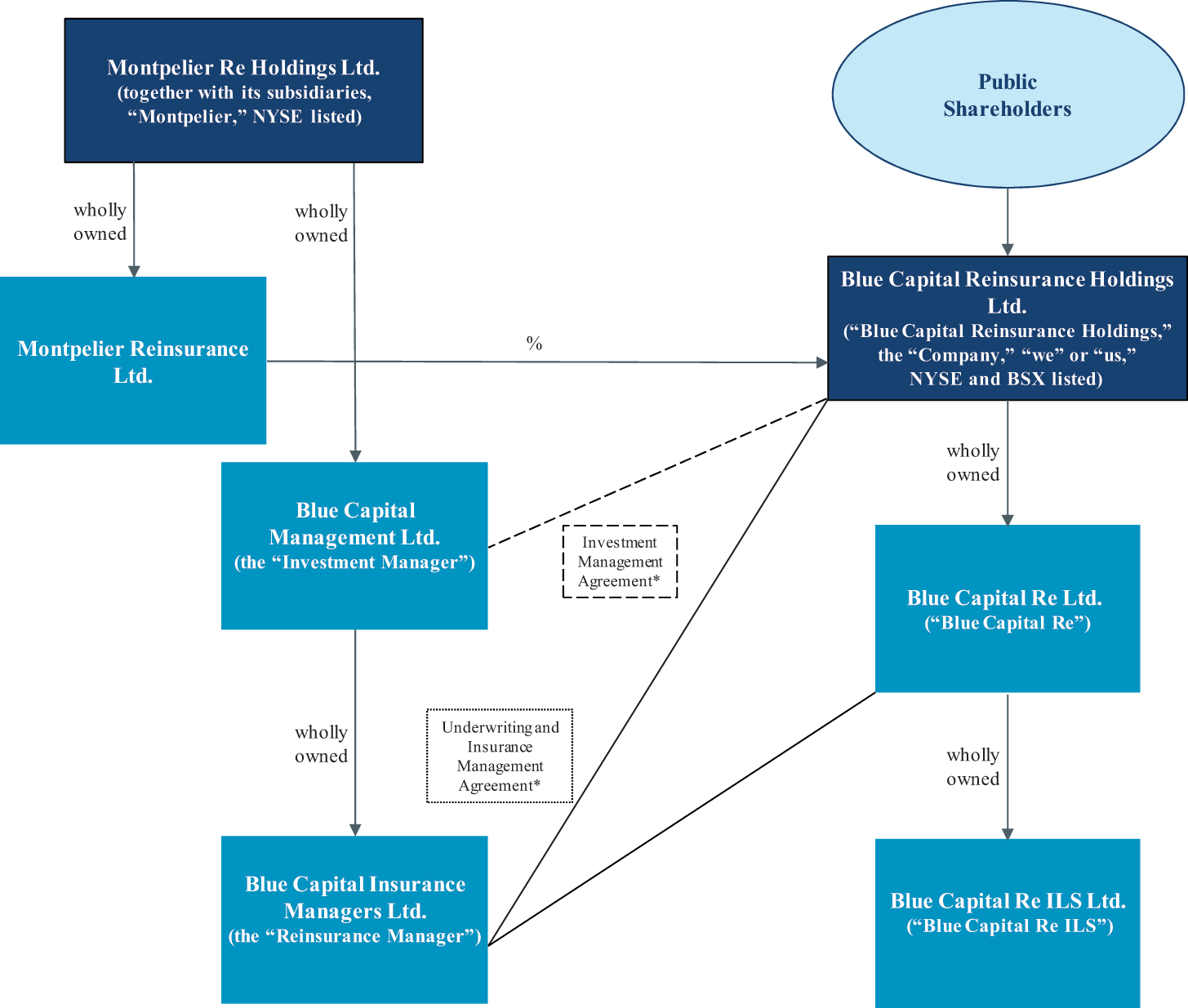

Unless the context suggests otherwise, references in this prospectus to “Blue Capital Reinsurance Holdings,” the “Company,” “we,” “us,” and “our” refer to Blue Capital Reinsurance Holdings Ltd. and its consolidated subsidiaries. References in this prospectus to “Blue Capital Re” refer to Blue Capital Re Ltd., our reinsurance operating company, and references in this prospectus to “Blue Capital Re ILS” refer to Blue Capital Re ILS Ltd., a wholly owned subsidiary of Blue Capital Re. References in this prospectus to “Montpelier” refer to Montpelier Re Holdings Ltd., a publicly traded insurance and reinsurance company that is making a concurrent investment through its wholly owned subsidiary, Montpelier Reinsurance Ltd., in our common shares upon the completion of this offering, and its consolidated subsidiaries. References in this prospectus to the “Investment Manager” refer to Blue Capital Management Ltd., a wholly owned subsidiary of Montpelier Re Holdings Ltd. References in this prospectus to the “Reinsurance Manager” refer to Blue Capital Insurance Managers Ltd., a wholly owned subsidiary of Montpelier Re Holdings Ltd. We refer to the Investment Manager and the Reinsurance Manager collectively as the “Managers.” For certain industry and other terms, investors are referred to the section entitled “Glossary of Industry and Other Terms” beginning on page 122.

Our Company

We are a newly formed Bermuda reinsurance holding company seeking primarily to offer collateralized reinsurance in the property catastrophe market. Our principal objective is to maximize the expected total return for our shareholders, primarily through the payment of dividends, by underwriting a diversified portfolio of short-tail reinsurance contracts and investing in insurance-linked securities with what we believe to be attractive risk and return characteristics. We will seek to provide our shareholders with the opportunity to own an alternative asset class whose returns we believe have historically been largely uncorrelated to those of other asset classes such as global equities, bonds and hedge funds. Subject to the discretion of our board of directors, we currently intend to distribute a minimum of 90% of our Distributable Income, as defined in “Dividend Policy,” in the form of cash dividends to our common shareholders. We intend to make regular quarterly dividend payments, supplemented by a special dividend to meet our dividend payout target for each fiscal year.

Subsidiaries of Montpelier Re Holdings Ltd. (NYSE: MRH) will manage our reinsurance underwriting decisions and will provide us with the services of our Chief Executive Officer and our interim Chief Financial Officer. Montpelier, a leading global provider of property catastrophe and short-tail reinsurance solutions, provides customized and innovative insurance and reinsurance solutions to the global marketplace. As of June 30, 2013, Montpelier had total assets of $3,936 million and total shareholders’ equity of $1,669 million. We intend to leverage Montpelier’s reinsurance underwriting expertise and infrastructure to conduct our business.

Montpelier Reinsurance Ltd., a wholly owned subsidiary of Montpelier, has agreed to purchase common shares through a concurrent private placement upon completion of this offering. Following the completion of this offering and the concurrent private placement, Montpelier will own approximately % of our outstanding shares, or % if the underwriters’ option to purchase additional shares is fully exercised.

Our Competitive Strengths

We believe we have the following competitive strengths:

| • | Access to a Leading Global Reinsurance Provider with an Extensive Infrastructure. We expect to benefit substantially from the Managers’ relationships with Montpelier by accessing and leveraging Montpelier’s management talent, proprietary reinsurance modeling tools, underwriting expertise, proprietary risk management systems, longstanding broker/client relationships and support infrastructure. We believe that the Managers’ affiliations with Montpelier will enable us to build a diversified reinsurance portfolio with an attractive risk-adjusted return potential for our shareholders. In addition, we believe that we will benefit from Montpelier’s scale, experience and reputation. |

| 1 |

| • | Differentiated Approach to Reinsurance Risk Selection. We expect to benefit from the Managers’ risk selection process, which will entail targeting counterparties who can supply us with the full spectrum of information associated with each exposure. Our risk selection process will include using the Managers’ specific knowledge of the insurer and underlying risks, including detailed portfolio data, such as home type, location, building code and date of construction. Additionally, the Managers will analyze the historical loss performance of the insurer, its market position, management’s capabilities and claims mitigation history. The Reinsurance Manager generally acts as a “quoting market” participant, which means that it provides an initial quote to the broker rather than responding to quotes provided by the broker. We believe that this both allows the Reinsurance Manager to be more selective in choosing the reinsurance contracts it presents to us and enhances its relationship with brokers. By contrast, we believe some other reinsurance providers act as price followers and only access exposure at an industry loss level and, accordingly, cannot evaluate specific information related to individual elements of underlying risk or control the underwriting process. |

| • | Access to Reinsurance Products Not Generally Available to Collateralized Reinsurers. We expect to benefit from leveraging our relationship with Montpelier by entering into fronting agreements, enabling us to do business with counterparties who prefer rated reinsurers, and quota share agreements, enabling us to participate proportionally in a diversified risk portfolio, with Montpelier Reinsurance Ltd. in order to gain access to a broader range of reinsurance business than we believe is typically available to most collateralized reinsurers. We believe that these arrangements will enhance the depth of opportunity open to us, increase the diversification of our reinsurance portfolio and provide enhanced expected risk-adjusted returns, particularly compared to most other collateralized reinsurers. |

| • | Experienced Management Team. Our executive officers and Montpelier’s senior managers responsible for the day-to-day oversight of the Managers have significant experience in the reinsurance industry, including the supervision of both traditional reinsurance markets and insurance-linked contracts and instruments. We also expect to benefit from the significant experience of the Investment Manager’s Investment Committee and the Reinsurance Manager’s Underwriting Committee. We also have an experienced board of directors, which includes industry professionals who have an average of more than 25 years of reinsurance experience. We believe that the Managers’ team has demonstrated the ability to generate attractive risk-adjusted returns under varying market conditions and cycles. |

| • | Alignment of Interests Between Our Shareholders and Montpelier. Through Montpelier Reinsurance Ltd.’s purchase of common shares in a concurrent private placement upon completion of this offering, Montpelier will own % of our outstanding common shares, or % if the underwriters fully exercise their option to purchase additional shares. Montpelier has agreed not to sell these shares for a period of 12 months after the completion of this offering without the prior written consent of Deutsche Bank Securities Inc. We believe that Montpelier’s investment in us and our relationship with the Managers will align Montpelier’s interests with those of our shareholders and will create an incentive to maximize returns, while managing risks, for our shareholders. |

Our Strategy

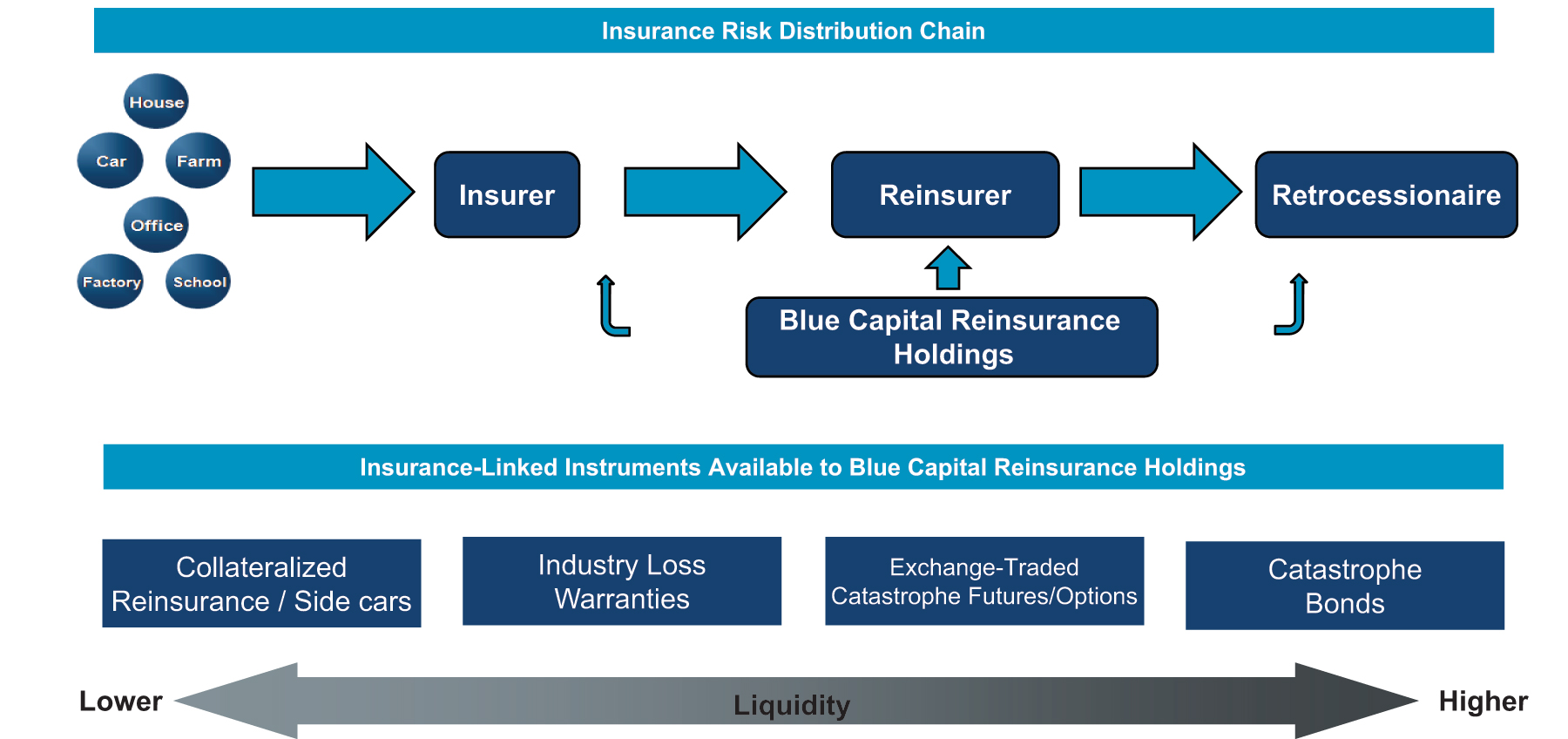

Our business strategy is to build a flexible and diversified portfolio of reinsurance risks to generate underwriting profits and risk-adjusted returns. We will aim to maintain a balanced portfolio of predominantly natural and man-made catastrophe risks by pursuing a broad range of reinsurance instruments, diversified by peril, geography and attachment point. We believe that allocation to traditional reinsurance contracts, either entered into directly or through fronting arrangements, as well as to industry loss warranties, catastrophe bonds and other insurance-linked instruments, will enhance our risk diversification, reduce the volatility of returns and optimize value for our shareholders. The Managers will use Montpelier’s sophisticated risk management techniques to monitor correlation risk, and they will seek to enhance our underwriting returns through careful risk selection using advanced capital allocation methodologies.

We will implement our strategy through our wholly owned subsidiaries Blue Capital Re, a Bermuda exempted company registered as a Class 3A insurer pursuant to the Insurance Act of 1978 as amended (which we refer to as the “Insurance Act”) that will predominantly enter into collateralized reinsurance contracts, and Blue Capital Re ILS, a Bermuda exempted company that will predominantly conduct hedging and other investment activities, including entering into industry loss warranties and purchasing catastrophe bonds.

| 2 |

Our strategy will involve accessing a broad range of reinsurance risks through the following methods:

| • | Third Party Reinsurance, Direct with Cedant or via a Fronting Arrangement. We will focus primarily on providing reinsurance to third-party insurance and reinsurance companies through reinsurance contracts. As a Class 3A insurer with no current intention to become rated, Blue Capital Re must collateralize its obligations under its reinsurance contracts. As an alternative to the collateralized markets, Blue Capital Re may provide reinsurance through fronting arrangements with Montpelier Reinsurance Ltd. or other well capitalized third-party rated reinsurers. These fronting arrangements will provide us with access to reinsurance opportunities with counterparties who would not otherwise be available to us, such as those seeking to do business with a rated reinsurer, although Blue Capital Re would still be required to provide collateral to the fronting reinsurer. |

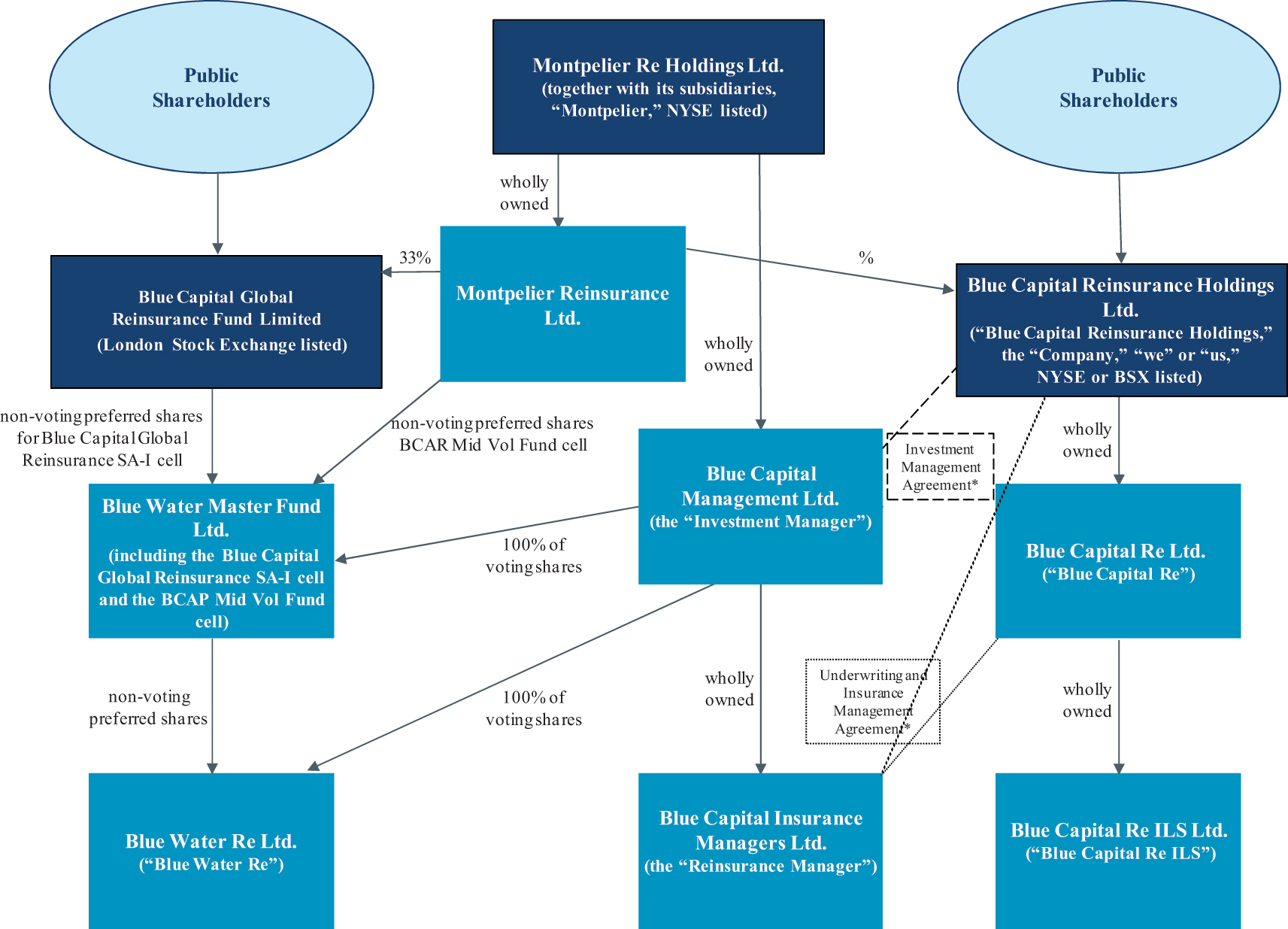

| • | Blue Water Re Retrocession. We will also provide facultative retrocessional reinsurance to Blue Water Re, a Bermuda special purpose insurer that is controlled by Montpelier. Blue Water Re is Montpelier’s market-facing collateralized reinsurer, focusing on providing reinsurance protection to primary insurance companies globally. Blue Water Re underwrites collateralized reinsurance contracts with third-party insurance companies, which transfer all or a portion of the risks and premiums under these insurance companies’ contracts to Blue Water Re. A portion of these risks and premiums will then be allocated to Blue Capital Re through collateralized retrocessional contracts on a facultative basis, under which Blue Capital Re will accept agreed-upon risks in exchange for the corresponding premiums. |

| • | Quota Share Retrocessional Agreements with Montpelier or Other Third-Party Reinsurers. Blue Capital Re may enter into quota share retrocessional agreements with Montpelier Reinsurance Ltd. or other third-party reinsurers, which would allow Blue Capital Re to participate in an agreed percentage of the risks and premiums of certain reinsurance contracts up to a certain amount on a proportional basis. These quota share agreements will provide Blue Capital Re with access to a diversified portfolio of risks on a proportional basis, which would otherwise not likely be available to it through the collateralized markets, although Blue Capital Re would still be required to provide collateral to the reinsurer entering into the quota share agreement. In addition, these quota share agreements will allow us to deploy our capital quickly following the completion of this offering or at other times in the future. |

| • | Industry Loss Warranties and Catastrophe Bonds. We may buy and sell industry loss warranties as a way to access certain risks. We may also purchase catastrophe bonds to access certain risks and to complement or hedge other risks to which we are exposed. |

| • | Other. While our initial focus will be on providing reinsurance against natural property catastrophe risks, our strategy may evolve to the extent that man-made or other non-property catastrophe reinsurance risks (e.g. terrorism reinsurance, workers compensation catastrophe reinsurance) offer more attractive expected risk-adjusted returns or diversification benefits. Blue Capital Re ILS’s portfolio may include over-the-counter or exchange-traded futures or options listed on catastrophe indexes. |

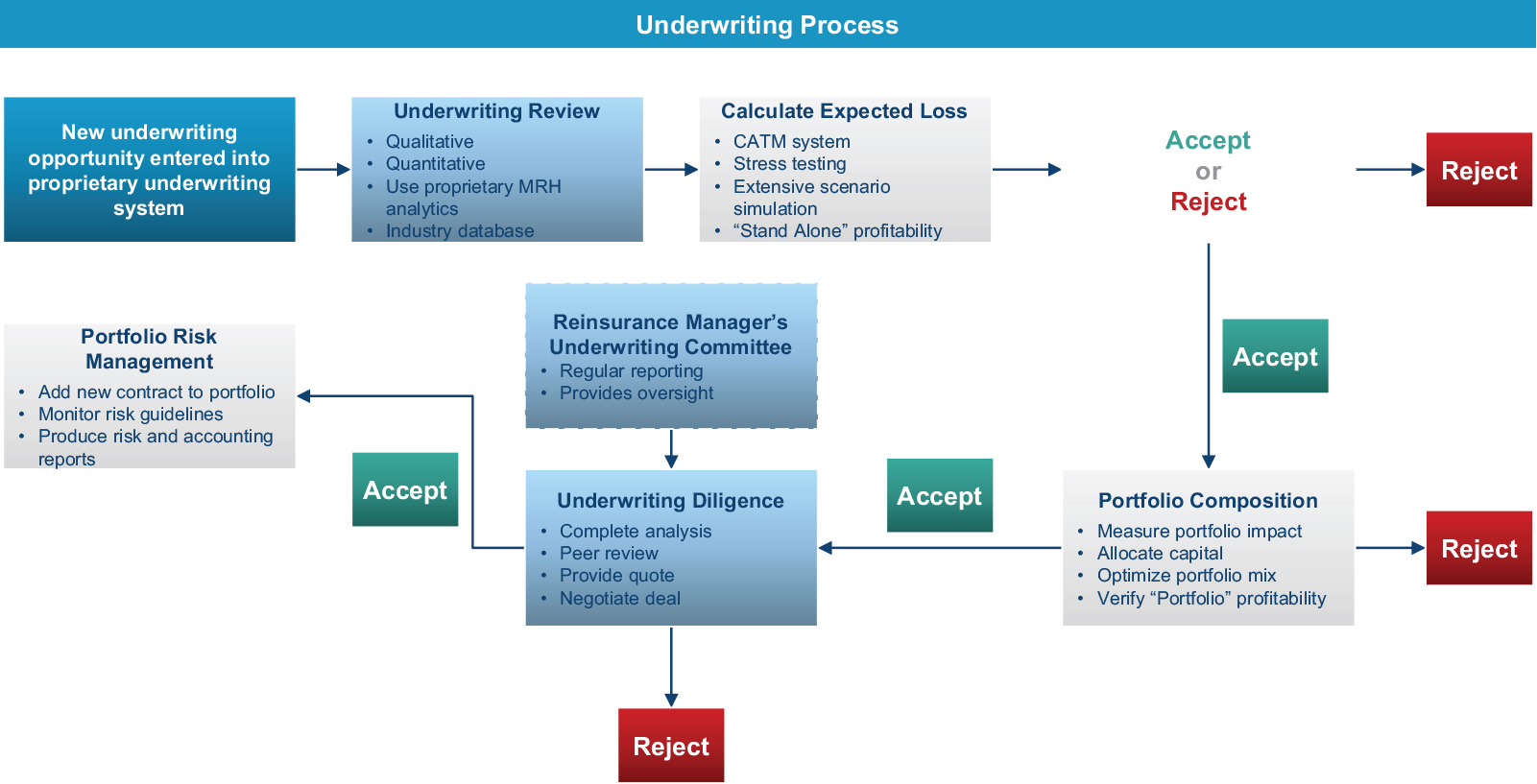

Our Underwriting Guidelines

The Managers have broad discretion, subject to our underwriting guidelines and the oversight of our board of directors and the board of directors of each of our subsidiaries, to execute our underwriting strategy. Our underwriting guidelines are summarized below, but our board of directors may change our underwriting guidelines or our strategy at any time without a vote or approval of our shareholders.

Class of Reinsurance

Our underwriting guidelines have established maximum and minimum thresholds for the amount of each class of reinsurance, as follows:

| • | approximately % to % in indemnity reinsurance; |

| • | approximately % to % in indemnity retrocession; |

| • | approximately % to % in quota share retrocessional agreements; |

| • | approximately % to % in industry loss warranties; |

| 3 |

| • | approximately % to % in catastrophe bonds; and |

| • | approximately % to % in other non-property catastrophe risks. |

We currently expect to deploy at least % of our portfolio in indemnity reinsurance, indemnity retrocession and quota share retrocessional agreements. Taking into account our underwriting guidelines and the targeted allocation described above, we currently estimate that our portfolio will be allocated % - % to traditional reinsurance and % - % to industry loss warranties, catastrophe bonds and non-property catastrophe risks.

Geographic Diversity

We intend to pursue a geographically diversified reinsurance strategy, such that the net maximum aggregate exposure in any one zone will not exceed % of our shareholders’ equity.

Other Limitations

The net probable maximum loss from any one catastrophe loss event at the one in one hundred year return period for any one zone will not exceed % of our shareholders’ equity. A one hundred year return period can also be referred to as the 1.0% occurrence exceedance probability, meaning there is a 1.0% chance in any given year that this level will be exceeded. The net probable maximum loss from any one earthquake loss event at the one in two hundred and fifty year return period for any zone will not exceed % of our shareholders’ equity. A two hundred and fifty year return period can also be referred to as the 0.4% occurrence exceedance probability, meaning there is a 0.4% chance in any given year that this level will be exceeded. For these risks, the net probable maximum loss will be determined by the Reinsurance Manager using various systems, including Montpelier’s proprietary systems and data.

Target Return on Common Equity

Given our underwriting guidelines, and based on (1) our expectations with respect to the portfolio of risks that we intend to construct, (2) our current views with respect to the reinsurance pricing environment, (3) the claims activity we expect to experience using proprietary catastrophe modeling tools and (4) our ongoing corporate expenses, including the fees payable by us to the Managers, we intend to target a return on common equity equal to basis points over the three-month U.S. Treasury yield per annum. We cannot assure you that we will be able to achieve this return on common equity, or any other particular return on common equity.

The Property Reinsurance Market

Our reinsurance activities will focus on property risks. Property reinsurance companies assume, from both insurance companies (known as “ceding companies” or “cedants”) and other reinsurance companies (known as “retrocedants”), as well as other property insurance capital providers, such as government or state-sponsored catastrophe funds, all or a portion of the property insurance or reinsurance risks that the ceding company has underwritten under one or more insurance or reinsurance policies. In return, the reinsurer receives a premium for the risks assumed from the ceding company. When reinsurance companies purchase reinsurance to cover their own risks assumed from ceding companies, this is known as retrocessional reinsurance. Reinsurance or retrocessional reinsurance can benefit a ceding company or retrocedant, as applicable, in various ways, such as by reducing exposure to individual risks and by providing catastrophe protection from larger or multiple losses. Ceding companies and retrocedants can use reinsurance or retrocessional reinsurance to manage their overall risk profile or to create additional underwriting capacity, allowing them to accept larger risks or to write more business than would otherwise be possible, absent an increase in their capital or surplus.

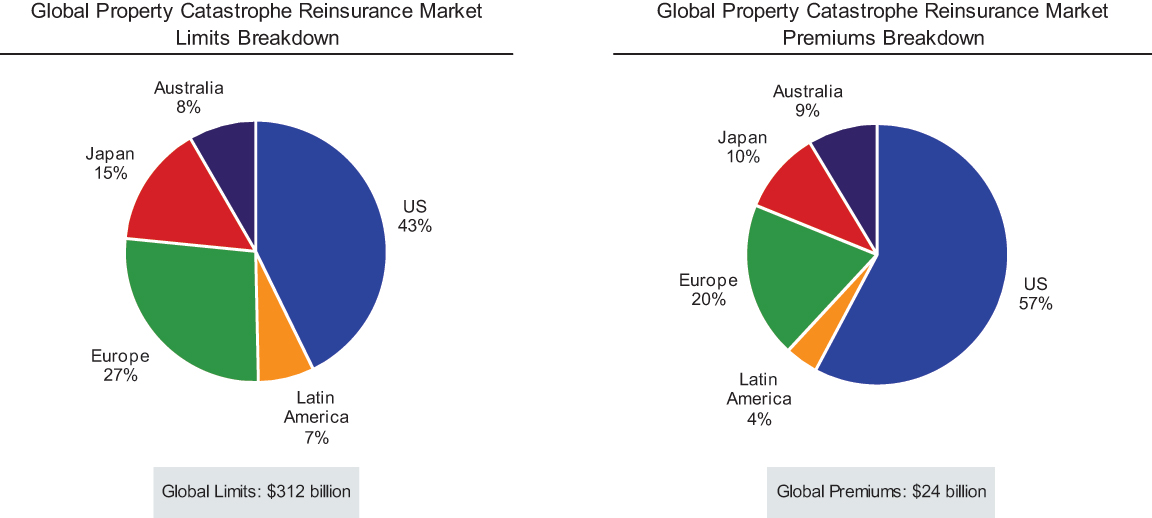

According to Guy Carpenter, the global property catastrophe reinsurance market was estimated to have approximately $312 billion in total aggregate limits (i.e., the maximum amount payable during the policy period to settle any claims made during that policy period) and to generate approximately $24 billion in total annualized premiums, in each case as of and for the 12 months ending March 31, 2013. The United States accounts for approximately 43% of global property catastrophe reinsurance exposures and approximately 57% of premiums.

Insurance and reinsurance companies derive substantially all of their revenues from net earned premiums, net investment income and net gains and losses from investment securities. Premiums represent amounts received from policyholders and ceding companies, and net earned premiums represent the portion of net premiums (gross

| 4 |

premiums less reinsurance purchased from third parties) that are recognized as revenue over the period of time that coverage is provided (e.g., ratably over the life of the policy). In insurance and reinsurance operations, “float” arises when premiums are received before losses and other expenses are paid, an interval that sometimes extends over many years. During that time, the insurer invests the premiums, earns investment income and may generate investment gains and losses. We do not currently expect to derive significant revenue from investing our available cash. Most of our capital will be held in restricted trust accounts as cash or cash equivalent collateral, and our capital that is not deployed will generally be held in the form of cash or cash equivalents until it is deployed.

Concurrent Private Placement

Montpelier Reinsurance Ltd., a wholly owned subsidiary of Montpelier Re Holdings Ltd., has agreed to purchase common shares at a price per share equal to the initial public offering price in a concurrent private placement transaction upon completion of this offering. The purchase price for the shares sold will be paid directly to us at the closing of this offering. We will receive the full proceeds and will not pay any underwriting discounts or commissions with respect to these shares.

Following the completion of this offering and the concurrent private placement, Montpelier will own approximately % of our outstanding shares, or % if the underwriters fully exercise their option to purchase additional shares.

The private placement to Montpelier Reinsurance Ltd. is contingent upon the completion of this offering, and the completion of this offering is contingent upon the completion of the private placement to Montpelier Reinsurance Ltd. In connection with the concurrent private placement, we will grant Montpelier Reinsurance Ltd. the right to nominate two of our five directors (or, if our board consists of more than five directors, no less than 40% of the total board seats at any given time) until the later of the date on which (1) Montpelier sells any of its common shares and (2) Montpelier owns less than % of our common shares. We will also grant Montpelier Reinsurance Ltd. registration rights relating to the common shares it will purchase in the concurrent private placement.

| 5 |

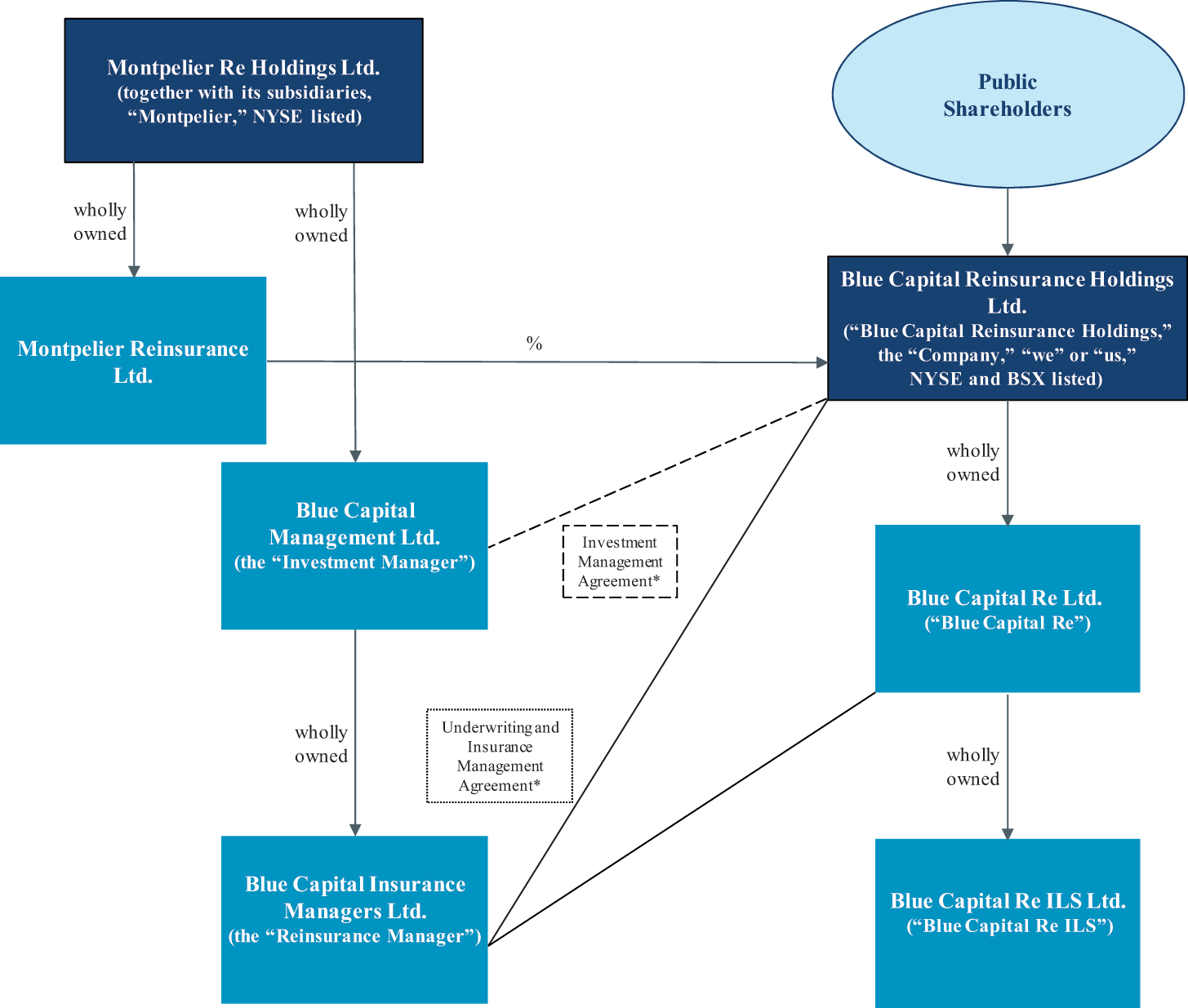

Our Structure

We will conduct our business through our wholly owned subsidiaries Blue Capital Re and Blue Capital Re ILS. We will conduct our reinsurance business through Blue Capital Re, a Class 3A insurer, and we will conduct certain hedging and other investment activity through Blue Capital Re ILS, including entering into industry loss warranties and purchasing catastrophe bonds.

The following chart summarizes our corporate structure and some of our service agreements with Montpelier following the completion of this offering and the concurrent private placement:

| * | In addition to the Investment Management Agreement and the Underwriting and Insurance Management Agreement, the terms of which are summarized below, there are other contracts between us and Montpelier (in particular, various insurance agreements with affiliates of Montpelier). See “Certain Relationships and Related Party Transactions” for more information. |

Our Relationship with the Managers

We will rely on the Managers for services that are essential to the operation of our business. Each of the Managers is a wholly owned subsidiary of Montpelier. The Managers will manage our portfolio and make all of our underwriting and investment decisions, subject to our underwriting guidelines and the oversight of our board of directors and the board of directors of each of our subsidiaries. The Investment Manager will manage our investment portfolio and make all of our investment decisions. The Reinsurance Manager will provide underwriting and claim services to Blue Capital Re, including underwriting decisions, loss control, exposure management and modeling, and statistical, actuarial and administrative support services, and will seek to manage all of our key quantifiable underwriting risks using a combination of Montpelier’s proprietary catastrophe pricing and risk management system (which we refer to as “CATM”), various third-party vendor models and its underwriting judgment.

The Managers each currently manage other accounts with focuses that overlap with our strategy, and each expects to continue to do so in the future. Neither of the Managers is restricted in any way from sponsoring or accepting business or capital from new clients, insurance companies, funds or other accounts, including businesses that are similar to, or that overlap with, our business. Therefore, the Managers’ time and attention may be divided between us and other businesses.

| 6 |

Investment Management Agreement

Blue Capital Reinsurance Holdings will enter into an Investment Management Agreement with the Investment Manager upon completion of this offering (which we refer to as the “Investment Management Agreement”). Pursuant to the terms of the Investment Management Agreement, the Investment Manager will provide us with investment management and other services. The Investment Manager will have full discretionary authority to manage our assets, the majority of which will initially be cash or cash equivalents, subject to our underwriting guidelines, the terms of the Investment Management Agreement and the oversight of our board of directors.

Underwriting and Insurance Management Agreement

Blue Capital Reinsurance Holdings, Blue Capital Re and the Reinsurance Manager will enter into an Underwriting and Insurance Management Agreement upon completion of this offering (which we refer to as the “Underwriting and Insurance Management Agreement”). Pursuant to the Underwriting and Insurance Management Agreement, the Reinsurance Manager will provide underwriting, risk management, claims management, ceded retrocession agreements management, and actuarial and accounting services to Blue Capital Re. The Reinsurance Manager will have full discretionary authority to manage the underwriting decisions of Blue Capital Re, subject to our underwriting guidelines, the terms of the Underwriting and Insurance Management Agreement and the oversight of our board of directors and of the board of directors of Blue Capital Re.

Administrative Services Agreement

Blue Capital Reinsurance Holdings will enter into a Administrative Services Agreement with the Investment Manager upon completion of this offering (which we refer to as the “Administrative Services Agreement”). Pursuant to the terms of the Administrative Services Agreement, the Investment Manager will provide us with support services, including the services of our Chief Executive Officer, Mr. William Pollett, and our interim Chief Financial Officer, Mr. Michael S. Paquette, as well as finance and accounting, claims management and policy wording, modeling software licenses, office space, information technology, human resources and legal and administrative support. The Investment Manager has the right to sub-contract the provision of these services (other than the services of our Chief Executive Officer and of our interim Chief Financial Officer) to a third party.

The following table summarizes the fees payable to our Managers pursuant to the Investment Management Agreement, the Underwriting and Insurance Management Agreement and the Administrative Services Agreement and certain other terms of these agreements:

|

Fee |

Summary Description |

| Management Fee | The Investment Manager will be entitled to a management fee (which we refer to as the “Management Fee”) of % of our average total shareholders’ equity per annum, calculated and payable in arrears in cash each calendar quarter (or part thereof) that the Investment Management Agreement is in effect. For purposes of calculating the Management Fee, our total shareholders’ equity means: (1) the net proceeds from all issuances of our equity securities since inception (allocated on a pro rata daily basis for such issuances during the fiscal quarter of any such issuance), plus (2) our retained earnings as of the end of the most recently completed calendar quarter (without taking into account any non-cash compensation expense incurred in current or prior periods), minus (3) any amount that we may have paid to repurchase our common shares on a cumulative basis since inception. It also excludes (x) any unrealized gains and losses and other non-cash items that have impacted shareholders’ equity as reported in our financial statements prepared in accordance with GAAP (other than unrealized gains and losses and other non-cash items relating to insurance-linked instruments) and (y) one-time events pursuant to changes in GAAP after discussions between the Investment Manager and our independent directors and approval by both a majority of our |

| 7 |

|

Fee |

Summary Description |

| independent directors and the Investment Manager for all such adjustments. As a result, our shareholders’ equity, for purposes of calculating the Management Fee, could be greater or less than the amount of shareholders’ equity shown on our financial statements. | |

| Performance Fee | Our Reinsurance Manager will be entitled to a performance fee (which we refer to as the “Performance Fee”) calculated and payable in arrears in cash each fiscal quarter (or part thereof) that the Underwriting and Insurance Management Agreement is in effect in an amount, not less than zero, equal to the product of (1) % and (2) the difference between (A) our pre-tax, pre-Performance Fee Distributable Income for the then current quarter and (B) a hurdle amount calculated as the product of (i) the weighted average of the issue price per common share pursuant to each of our public or private offerings of common shares since our inception multiplied by the weighted average number of all common shares outstanding (including any restricted share units, any restricted common shares and other common shares underlying awards granted under our equity incentive plans), as further reduced by the amount, if any, by which our inception-to-date dividends to common shareholders exceeds our inception-to-date GAAP net income available to common shareholders, and (ii) %; provided, however, that the foregoing Performance Fee is subject to a rolling three-year high water mark (except that for periods prior to the completion of the three-year period following this offering, the high water mark calculation will be done over the inception-to-date period). |

| Term | We generally may not terminate either the Investment Management Agreement, the Underwriting and Insurance Management Agreement or the Administrative Services Agreement for five years after the completion of this offering, whether or not the Managers’ performance results are satisfactory. These agreements each renew automatically on the fifth anniversary of the completion of this offering, and upon every third anniversary thereafter, unless terminated in accordance with their terms. During the term of these agreements, we may not enter into any other investment management, underwriting and insurance management or services agreement. |

| Termination Fee | Upon any termination or non-renewal of either of the Investment Management Agreement or the Underwriting and Insurance Management Agreement (other than for a material breach by, or the insolvency of, the applicable Manager), we will pay a one-time termination fee to either the Investment Manager or the Reinsurance Manager, as applicable, equal to % of our GAAP shareholders’ equity, calculated as of the most recently completed fiscal quarter prior to the date of termination. |

| Expense Reimbursement | Under the terms of the Investment Management Agreement and the Underwriting and Insurance Management Agreement, we will reimburse the Managers for various fees, expenses and other costs in connection with the services provided under the terms of these agreements. The only fees payable under the terms of the Administrative Services Agreement are to reimburse the Investment Manager for various fees, expenses and other costs in connection with the services provided under the terms of this agreement, including the services of our Chief Executive Officer and our interim Chief Financial Officer, modeling software licenses and finance, legal and administrative support. |

| 8 |

Conflicts of Interest

There may be conflicts of interest that arise out of our relationship with Montpelier and the Managers. Our Chief Executive Officer, who is also one of our directors, our interim Chief Financial Officer and our Chairman are also employees of Montpelier. In addition, each of the Managers is wholly owned by Montpelier. As a result, our officers, two of our initial directors, the Investment Manager or the Reinsurance Manager may have conflicts between their duties to us and their duties to, and interests in, Montpelier or other parties.

As part of our business model and strategy, we will rely on affiliates of Montpelier for access to certain segments of the reinsurance market. In particular, we may enter into retrocessional, quota share or other agreements in which Montpelier or its affiliates have an interest and we may enter into fronting arrangements with Montpelier Reinsurance Ltd. Although these transactions may present conflicts of interest, we nonetheless may pursue and consummate these transactions.

Our business overlaps with portions of Montpelier’s business. In addition to managing some of Montpelier’s accounts, each of the Managers manages other accounts that may compete with us, including other accounts affiliated with Montpelier. The Managers make available to us opportunities to enter into reinsurance contracts and insurance-linked instruments and make investments that they determine are appropriate for us in accordance with their allocation policies and our underwriting guidelines. Neither of the Managers has any duty to allocate any or all such opportunities to us. We expect that the Managers will primarily allocate any overlapping opportunities on a proportional basis.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (which we refer to as the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (which we refer to as the “JOBS Act”). As a result, we are eligible to take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies. These exemptions include:

| • | reduced disclosure about our executive compensation arrangements and no requirement to include a compensation discussion and analysis; |

| • | no requirement to hold nonbinding advisory shareholder votes on executive compensation or golden parachute arrangements; |

| • | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (which we refer to as “Sarbanes-Oxley”); and |

| • | the ability to use an extended transition period for complying with new or revised accounting standards. |

We intend to take advantage of some, but not all, of the exemptions available to emerging growth companies until such time that we are no longer an emerging growth company. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you invest.

We are irrevocably electing not to take advantage of the extended transition period afforded by the JOBS Act for the implementation of new or revised accounting standards and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies.

Following this offering, we will continue to be an emerging growth company until the earliest to occur of (1) the last day of the fiscal year during which we had total annual gross revenues of at least $1 billion (as indexed for inflation), (2) the last day of the fiscal year following the fifth anniversary of the date of our initial public offering under this prospectus, (3) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt and (4) the date on which we are deemed to be a “large accelerated filer,” as defined under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”).

| 9 |

Our Offices

Our office is located at 94 Pitts Bay Road, Pembroke HM 08, Bermuda, and our phone number is (441) 296-5550. Our website can be found at , the contents of which are not a part, and shall not be deemed to be a part, of this prospectus.

Risk Factors

Investing in our common shares involves a high degree of risk. These risks are discussed in more detail in “Risk Factors” beginning on page 14, and you should carefully consider these risks before making a decision to invest in our common shares. The following is a summary of some of the principal risks we believe we face:

| • | the lack of any operating history that you can use to evaluate our business; |

| • | our dependence on service providers, including the Managers, to perform substantially all of our executive, administrative and other functions that are essential to the operation of our business; |

| • | our lack of an established reputation in the reinsurance industry; |

| • | our substantial exposure to losses arising from unpredictable natural disasters and other catastrophic events; |

| • | cyclicality in the reinsurance industry, which may lead to periods with excess underwriting capacity and unfavorable pricing; |

| • | the inherent uncertainties of establishing reserves for loss and loss adjustment expenses; |

| • | our ability to raise additional capital in the future; |

| • | our ability to release capital from existing obligations to redeploy annually; |

| • | intense competition within the reinsurance industry; |

| • | the broad discretion exercised by our Managers in pursuing our strategy, portfolio execution, risk management and other support services; |

| • | the limited operating history of the Managers that you can use to evaluate their performance; |

| • | conflicts of interest that could result from our relationships and potential overlaps in business with Montpelier and its affiliates, including the Managers, which could result in decisions that are not in the best interests of our shareholders; |

| • | declarations and payments of dividends may be impacted by catastrophic or other loss activity; |

| • | our dependence as a holding company upon dividends and distributions from our subsidiaries, and the regulatory restrictions on the payment of those dividends and distributions; |

| • | regulation that may restrict our ability to operate and may restrict the ability of other reinsurers with which we do business to operate; |

| • | counterparty risk resulting from our investments in swap contracts, other derivative contracts, private insurance-linked instruments and non-fully collateralized reinsurance-linked contracts; |

| • | the possibility that we may become an investment company under U.S. federal securities law, which may cause us to fundamentally restructure our business or potentially to cease operations; and |

| • | the possibility that we are or may become a “passive foreign investment company,” in which case a U.S. holder of our common shares would be subject to disadvantageous rules under U.S. federal income tax laws. |

| 10 |

The Offering

| Common shares we are offering | shares |

| Common shares we are selling to Montpelier Reinsurance Ltd. in the concurrent private placement | shares |

| Common shares to be issued and outstanding after this offering |

shares |

| Overallotment option | We have granted the underwriters an option, for a period of 30 days, to purchase up to additional common shares on the same terms and conditions as set forth on the front cover of this prospectus to cover sales of common shares by the underwriters that exceed the number of shares being offered, if any. |

| Use of proceeds | We expect to use the net proceeds from this offering for general corporate purposes to implement our business strategy. In particular, we will use the net proceeds to, among other things, provide fully collateralized reinsurance and engage in hedging and investment activities in connection with providing such reinsurance. See “Business—Our Strategy” and “Business—Our Underwriting Guidelines” for a more detailed description of our business and our underwriting guidelines. See “Use of Proceeds” for more information. |

| Dividend policy | Our principal objective is to maximize the total return for our shareholders, primarily through the payment of dividends. We currently intend to distribute to our common shareholders, in the form of cash dividends, a minimum of 90% of our GAAP net income available to common shareholders excluding any non-cash compensation expense, unrealized gains and losses and other non-cash items recorded in net income for the period (which we refer to as “Distributable Income”). We currently intend to make distributions through regular quarterly dividend payments that may be supplemented by a special dividend. Although our net income (if any) will vary from year to year, we expect that in most years the sum of our regular quarterly dividend payments will be less than 90% of our Distributable Income. If this is the case, we intend to declare a special dividend in the following year to distribute an amount that, taken together with the prior fiscal year’s quarterly dividends, will be at least 90% of our Distributable Income for the prior fiscal year. The declaration and payment of a special dividend, if any, may not occur until a significant period of time after the completion of our fiscal year. We currently expect the first quarterly dividend will be paid after completion of the first quarter of 2014, subject to the discretion of our board of directors. The amount of any dividends we pay will be subject to the requirements of the Insurance Act and the Bermuda Companies Act of 1981, as amended (which we refer to as the “Companies Act”), our |

| 11 |

| net income, retained earnings, collateral requirements, cash flows, contractual arrangements and capital requirements and to the discretion of our board of directors. See “Dividend Policy” for more information. | |

| Risk factors | You should read the section entitled “Risk Factors” beginning on page 14 for a discussion of some of the risks and uncertainties you should carefully consider before deciding to invest in our common shares. |

| NYSE symbol | “BCRH” |

Except as otherwise indicated, all information in this prospectus:

| • | assumes an initial public offering price of $ per share, the price set forth on the front cover page of this prospectus; |

| • | excludes common shares reserved for future issuance under the Blue Capital Reinsurance Holdings Ltd. 2013 Long-Term Incentive Plan, which became effective on September 27, 2013; and |

| • | assumes no exercise by the underwriters of their option to purchase an additional shares to cover sales of common shares by the underwriters that exceed the number of shares being offered, if any. |

| 12 |

MARKET AND INDUSTRY DATA AND FORECASTS

Certain market and industry data included in this prospectus has been obtained from third-party sources that we believe to be reliable. In particular, we refer to market data provided by Guy Carpenter, a leading global reinsurance intermediary. The market data from Guy Carpenter contained in this prospectus was not prepared by Guy Carpenter on our behalf. Other market estimates are calculated by using independent industry publications, government publications and third-party forecasts in conjunction with our assumptions about our markets. We have not independently verified this third-party information. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, this data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Special Note Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus.

| 13 |

This offering and investing in our common shares involve a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, before deciding to invest in our common shares. The occurrence of any of the following risks could materially and adversely affect our business, financial condition, liquidity, results of operations or prospects. In that event, the market price of our common shares could decline and you could lose all or part of your investment.

Risks Related to Our Business and Industry

We have no operating history that you can use to evaluate our business, and we may not be able to operate our business successfully.

We are a newly established Bermuda exempted company and have no operating history. Accordingly, there are no meaningful historical financial statements or other operating or financial data with which you can evaluate us or our business. We cannot assure you that following this offering we will be able to operate our business successfully or implement our operating policies and strategies.

We currently do not have any employees of our own, and we depend (and will continue to depend) on service providers to perform substantially all of our executive, administrative and other functions, and termination of any of these relationships may materially disrupt our business.

We currently do not have any employees of our own. Our Chief Executive Officer and our interim Chief Financial Officer are employees of Montpelier and their services are provided to us through an Administrative Services Agreement (see “Certain Relationships and Related Party Transactions—Service Agreements with Montpelier—Administrative Services Agreement” for more information about the Administrative Services Agreement). Our Chief Executive Officer, Mr. William Pollett, also serves as Senior Vice President and Chief Corporate Development and Strategy Officer and Treasurer of Montpelier and is the President and Chief Executive Officer of the Investment Manager and the Reinsurance Manager and, therefore, will not dedicate all of his time to running our business and is not required to dedicate any specific amount of time to running our business. As a result of Mr. Pollett’s other obligations, Mr. Pollett will not be able to dedicate as much time to running our business as would a typical Chief Executive Officer, and Mr. Pollett may face conflicts of interest that may make it difficult for him to operate our business.

Our interim Chief Financial Officer, Mr. Michael S. Paquette, also serves as the Chief Financial Officer and is an Executive Vice President of Montpelier, and is only serving as our Chief Financial Officer on an interim basis until a permanent replacement is identified. Until we hire a permanent replacement for our interim Chief Financial Officer, our interim Chief Financial Officer will not dedicate all of his time to running our business. We intend to hire a permanent Chief Financial Officer within 24 months following the completion of this offering, but we cannot assure you that we will find a permanent Chief Financial Officer with the requisite skill and experience necessary for our business to be successful in a timely manner or at all.

Even after we hire a permanent Chief Financial Officer, who is the only employee we currently intend to hire, we will rely on service providers to perform many of our executive, administrative and other functions. In particular, an affiliate of Montpelier will provide accounting, legal, administrative and other services that are integral to our day-to-day operations. Failure by any service provider, whether or not an affiliate of Montpelier, to carry out its obligations to us in accordance with the terms of its agreement or to perform its obligations to us as a result of insolvency, bankruptcy or other causes could make it difficult, or in some cases impossible, for us to operate our business. In addition, the termination of any of these service relationships or any delay in appointing or finding a suitable replacement provider (if one exists) could make it difficult for us to operate our business.

Our Chief Executive Officer, our interim Chief Financial Officer and the officers of the Managers will continue to be compensated by Montpelier.

Our Chief Executive Officer, our interim Chief Financial Officer and the officers of the Managers are employees of Montpelier and will continue to be compensated by Montpelier, including through membership in Montpelier’s incentive compensation plans. As a result, they may, consciously or unconsciously, favor Montpelier in dealings among us, Montpelier and the Managers.

| 14 |

Reputation is an important factor in the reinsurance industry, and our lack of an established reputation may make it difficult for us to attract or retain clients.

Reputation is a very important factor in the reinsurance industry, and competition for clients is, in part, based on reputation. Although our reinsurance policies will be fully collateralized and we may benefit from the reputation and experience of Montpelier, as well as the Managers, we are a newly formed reinsurance company and do not yet have an established reputation in the reinsurance industry. Our lack of an established reputation may make it difficult for us to attract or retain clients. While some counterparties may prefer to enter into reinsurance contracts with a rated reinsurer, we do not currently intend to obtain financial strength ratings. We do not own the “Blue Capital” trademark, but we will enter into a trademark license agreement with Montpelier providing for the license of the “Blue Capital” trademark to us. We will consequently be unable to prevent any damage to our reputation that may occur as a result of the activities of Montpelier and others. Furthermore, in the event that any of the Investment Management Agreement, the Underwriting and Insurance Management Agreement or the Administrative Services Agreement is terminated, or the trademark license agreement is otherwise terminated, we may be unable to use the “Blue Capital” trademark.

We will have substantial exposure to losses arising from unpredictable natural disasters and other catastrophic events. Claims from these events could reduce our earnings and cause substantial volatility in our results of operations.

We will have substantial exposure to losses arising from unpredictable natural disasters and other catastrophic events, such as hurricanes, windstorms, earthquakes, floods, fires, explosions and terrorism. In recent years, we believe that the frequency of major weather-related catastrophes has increased and changes in climate conditions, primarily global temperatures and expected sea levels, may serve to further increase the severity, and possibly the frequency, of natural disasters and other catastrophic events. The occurrence of an unusually severe catastrophe could cause us to incur severe losses that impair a significant portion of our capital. As a fully collateralized reinsurer, any sudden and substantial calls upon our collateral resources may prevent us from being able to enter into future collateralized reinsurance contracts.

The extent of losses from catastrophes is a function of the frequency of loss events, the total amount of insured exposure in the area affected by each event and the severity of the events. Increases in the value of insured property, the effects of inflation and changes in cyclical weather patterns may increase the severity of claims from catastrophic events in the future. Claims from catastrophic events could materially reduce our earnings and cash flows, cause substantial volatility in our results of operations and cash flows for any fiscal period or materially impact our financial condition. Our ability to enter into additional reinsurance contracts or to make additional investments could also be impacted as a result of corresponding reductions in our capital.

The Managers will seek to manage some of our key quantifiable risks using a combination of Montpelier’s proprietary catastrophe pricing and risk management system (which we refer to as “CATM”), various third-party vendor models and their underwriting judgment. The models that the Managers will use will help them to control risk accumulation, to inform our management and the Managers and to improve our risk/return profile; however, these models may prove to be inaccurate and may understate our exposures. The Managers will focus on tracking exposed contract limits, estimating the potential impact of a single catastrophe event, and simulating our annual performance to reflect our aggregate underwriting and investment risk. We cannot assure you that any of these techniques, including the use of CATM or other modeling techniques, will be successful in managing our risks. Accordingly, if the Managers’ assumptions are incorrect, the losses that we might incur from an actual catastrophe could be significantly higher than the Managers’ expectation of losses generated from modeled catastrophe scenarios and, as a result, our business could be materially and adversely affected.

Our risk management is based on estimates and judgments that are subject to significant uncertainties.

Our approach to risk management, and our estimates of the net impact from single event losses, rely on subjective variables that entail significant uncertainties. For example, in our reinsurance contracts, the effectiveness of our reinsurance contract zonal limits in managing risk depends largely on the degree to which an actual event is confined to the zone in question and on our ability to determine the actual location of the risks insured. Moreover, in the reinsurance contracts we write, the definition of a single occurrence may differ from policy to policy, and the legal interpretation of a policy’s various terms and conditions following a catastrophic event may be different from that which we envisioned at its inception.

| 15 |

In addition, our risk management involves a substantial number of subjective variables, factors and uncertainties. Small changes in assumptions, which depend heavily on the Managers’ and our judgment, can have a significant impact on the modeled outputs. Although we believe that these probabilistic measures provide a meaningful indicator of the relative riskiness of certain events and changes to our business over time, these measures do not predict our actual exposure to, nor guarantee our successful management of, future losses that could have a material adverse effect on our financial condition and results of operations.

Our board of directors has approved broad underwriting guidelines for the Managers and neither our board of directors nor our management will approve each decision made by the Managers.

The Managers are authorized to follow broad guidelines in pursuing our strategy, portfolio execution, risk management and other support services. Our board of directors will periodically review our guidelines and our portfolio and asset management decisions. They will not, however, review or approve all proposed investment decisions or underwriting decisions. In addition, in conducting periodic reviews, our management and board of directors will rely primarily on information provided to them by the Managers. The Managers have great latitude within the guidelines to determine the types of investments and underwriting decisions they will make on our behalf. Poor decisions by either of the Managers could have a material adverse effect on our business.

We may change our underwriting guidelines or our strategy without shareholder approval.

Our board of directors has the authority to change our underwriting guidelines or our strategy without notice to our shareholders and without shareholder approval. As a result, we may make fundamental changes to our operations without shareholder approval, which could result in our pursuing a strategy or implementing underwriting guidelines that may be materially different from the strategy or underwriting guidelines described in the section titled “Business” or elsewhere in this prospectus.

We will rely on the Managers for services that are essential to the operation of our business, and the loss of either or both of the Managers would make it difficult to operate our business.

The Investment Manager will manage our investment portfolio and make all of our investment decisions, subject to our underwriting guidelines and the oversight of our board of directors and the board of directors of each of our subsidiaries. Because we have no full-time employees, we will not be able to manage our investment portfolio without the benefit of the services of the Investment Manager, which has significant discretion as to the management of our investment portfolio.

The Reinsurance Manager will provide underwriting services to Blue Capital Re, including underwriting decisions, loss control, exposure management and modeling and statistical, claims, actuarial and administrative support services. Because it will not have any full-time employees, Blue Capital Re will not be able to implement its underwriting strategy without the benefit of these services, and the Reinsurance Manager will have significant discretion as to Blue Capital Re’s underwriting practices, within the broad scope of our underwriting guidelines and the oversight of our board of directors and the board of directors of each of our subsidiaries. Blue Capital Re will also be dependent on the Reinsurance Manager to accurately price the risks underwritten on its behalf pursuant to the Underwriting and Insurance Management Agreement in order to meet its targeted rates of return (see “Certain Relationships and Related Party Transactions—Service Agreements with Montpelier—Underwriting and Insurance Management Agreement” for more information about the Underwriting and Insurance Management Agreement).

In the event that these services were to cease to be available from the Managers, we would be required to replace either or both Managers with third parties or to hire employees. In addition, the performance of the Managers depends heavily on the experience and availability of a limited number of individuals, all of whom, through Montpelier’s ownership of the Managers, are affiliated with Montpelier. Any loss of these individuals, for example, to death, incapacity, termination or resignation, could adversely affect the performance of the affected Manager. We cannot assure you that we could find a suitable replacement for either or both of the Managers quickly or at all, and any replacement may increase our expenses. The loss of either or both of the Managers could materially impair our ability to successfully operate our business.

We are dependent on Montpelier and if Montpelier were to experience difficulties, we could be materially adversely affected.

Since the Managers are both affiliates of Montpelier, and our Chief Executive Officer and interim Chief Financial Officer are both employees of Montpelier, if Montpelier’s business were to experience difficulties, the

| 16 |

attention and time of Montpelier’s management would likely be directed to dealing with those difficulties. In these circumstances, there may not be sufficient management attention to our business, and our operations could suffer. In addition, in that event it is also possible that ceding companies would be reluctant to do business with Montpelier, and therefore us, which could have a material adverse effect on our business. It may be difficult, costly or time-consuming to replace the Managers or the other services Montpelier will provide (see “Certain Relationships and Related Party Transactions—Service Agreements with Montpelier” for more information about our contractual arrangements with Montpelier).

We compete with the Managers’ other accounts for access to their services.

Each of the Managers currently manages multiple accounts with focuses that may overlap to a greater or lesser extent with our strategy, and each of the Managers expects to continue to do so in the future. Neither of the Managers is restricted in any way from sponsoring or accepting business or capital from new clients, insurance companies, funds or other accounts, including businesses that are similar to, or that overlap with, our business. Therefore, we compete with other sources of capital for access to the time and attention of the Managers. For the same reasons, the personnel of the Managers will dedicate a substantial portion of their time and attention to managing third-party assets.

We compete with Montpelier accounts, accounts affiliated with Montpelier and third parties for underwriting opportunities and other opportunities.

Many, if not most, of our targeted underwriting and other opportunities are also opportunities targeted to a greater or lesser extent by Montpelier, affiliates of Montpelier and other accounts of the Managers. Neither of the Managers has any duty to allocate any or all such opportunities to us. The Managers will make available to us opportunities to enter into reinsurance transactions, purchase insurance-linked instruments and make investments that they determine are appropriate for us in accordance with their allocation policies and our underwriting guidelines. The Managers have significant discretion as to our investment and underwriting practices, subject to our underwriting guidelines and the oversight of our board of directors. We expect that the Managers will primarily allocate any overlapping opportunities on a proportional basis.

With respect to the renewal of policies that are in place for the benefit of other accounts managed by the Managers at the time we initially deploy the proceeds of this offering, the Managers will likely allocate renewal of any such policy to the account or accounts that existed prior to this offering (up to the amount of the original exposure of that policy and subject to capital and other limits applicable to those accounts that may exist at the time of renewal). As a result, we will not, at the time we initially deploy the proceeds of this offering, benefit from renewal opportunities to the same extent as other accounts presently managed by the Managers, and these renewal opportunities may benefit from the historical performance and reserve experience derived from the original policy. The opportunities in which our assets are initially deployed may therefore, as a whole, present greater risk than those allocated to other accounts presently managed by the Managers. See “Certain Relationships and Related Party Transactions—Insurance Agreements with Montpelier—Overlapping Business with Montpelier” for a discussion of how opportunities are allocated between Blue Capital Re, Blue Capital Global Reinsurance Fund Limited and other Montpelier accounts.

There may be conflicts of interest that result from our relationships with Montpelier and the Managers, which could result in decisions that are not in the best interests of our shareholders.

There may be conflicts of interest that arise out of our relationship with Montpelier and the Managers. One of our directors is a director of Blue Capital Global Reinsurance Fund Limited, a mutual fund company listed in the United Kingdom that has a business strategy some aspects of which are similar to ours. Our Chief Executive Officer and interim Chief Financial Officer are also employees of Montpelier. In addition, the Managers are both wholly owned by Montpelier. As a result, our officers, our directors, the Investment Manager or the Reinsurance Manager may have conflicts between their duties to us and their duties to, and interests in, Montpelier or other parties.

We may enter into retrocessional or other agreements in which Montpelier or its affiliates have an interest and we may acquire investments in which Montpelier or its affiliates have an interest. Although these transactions may present conflicts of interest, we nonetheless may pursue and consummate these transactions.

| 17 |

In deciding whether to issue debt or equity securities, we will rely in part on recommendations made to us by the Managers. Because the Managers earn fees that are closely related to the total amount of our capital, the Managers may have an incentive to recommend that we issue debt or equity securities.

The officers and employees of the Managers will devote as much time to us as the Managers deem appropriate. However, these officers and employees may have conflicts in allocating their time and services among us, Montpelier, affiliates of Montpelier and other accounts. During turbulent conditions in the reinsurance industry or other times when we will need focused support and assistance from the Managers, Montpelier and entities affiliated with Montpelier will likewise require greater focus and attention, placing the Managers’ time and resources in high demand. In this situation, we may not receive the support and assistance we require or would otherwise receive if we were completely internally managed or if the Managers did not act as managers for other entities. Although we believe the Managers have established appropriate procedures to manage any actual or potential conflicts of interest, these procedures do not provide assurance that such conflicts will be avoided.

Each of the Managers has limited operating history that you can use to evaluate their performance.

The Investment Manager and the Reinsurance Manager began their current operations in 2011 and 2012, respectively, and, as a result, each has a limited performance history that you can use to evaluate them. Although the Managers are operated by Montpelier and individuals with experience in the property catastrophe reinsurance market will make investment and underwriting decisions on our behalf, we cannot assure you that the Managers will generate results similar to the results generated by Montpelier in the past, or that the Managers will be able to make investments or underwriting decisions similar to those made by Montpelier. For example, the Managers may not gain access to transactions in which more established entities are able to participate. Accordingly, the Managers, and therefore we, may not perform in the manner you expect.

As a Bermuda company, we may be unable to attract and retain our employees.

Our Chief Executive Officer is employed in Bermuda, and any future employees may be employed in Bermuda. We also rely on services from other Bermuda companies, including the Managers. It may be difficult to attract and retain experienced personnel in Bermuda, particularly if we are unable to secure Bermuda work permits for our personnel or if the Managers’ personnel are unable to secure Bermuda work permits. In addition, Bermuda is currently a highly competitive location for qualified staff, especially in the reinsurance and insurance industry, making it harder to attract and retain employees. As our success depends on our ability to hire and retain personnel, any future difficulties in hiring or retaining personnel in Bermuda or elsewhere could adversely affect our business.

The reinsurance business has historically been cyclical, and we expect to experience periods with excess underwriting capacity and unfavorable pricing, which could adversely affect our business.

Historically, the reinsurance industry has been cyclical, and reinsurers have experienced significant fluctuations in operating results due to competition, frequency of occurrence or severity of catastrophic events, levels of underwriting capacity, underwriting results of primary insurers, general economic conditions and other factors. The supply of reinsurance is related to prevailing prices, the level of insured losses and the level of industry surplus which, in turn, may fluctuate, including in response to changes in rates of return on investments being earned in the reinsurance industry.

The reinsurance industry has historically been characterized by periods of strong price competition, also known as a “soft market,” due to excessive underwriting capacity, as well as periods of more favorable pricing, also known as a “hard market,” due to limited underwriting capacity. Increased capacity, frequently as a result of favorable pricing, is often provided by new entrants or by the commitment of additional capital by existing reinsurers. The industry’s capacity to write business diminishes as losses are incurred and the industry’s capital is depleted. As the industry’s capacity decreases, a hard market begins, which ultimately attracts additional capacity.

The supply of available reinsurance capital has increased over the past several years and may increase further, either as a result of capital provided by new entrants or of the commitment of additional capital by existing insurers or reinsurers. In addition, alternative products, such as the collateralized reinsurance contracts we will write and the other insurance-linked instruments that we may invest in, may also provide increased

| 18 |

capacity. Continued increases in the supply of reinsurance may have consequences for us and for the reinsurance industry generally, including fewer contracts written, lower premium rates, increased expenses for customer acquisition and retention and less favorable policy terms and conditions.