Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - American Realty Capital Trust IV, Inc. | v356845_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - American Realty Capital Trust IV, Inc. | v356845_ex2-1.htm |

| EX-99.2 - EXHIBIT 99.2 - American Realty Capital Trust IV, Inc. | v356845_ex99-2.htm |

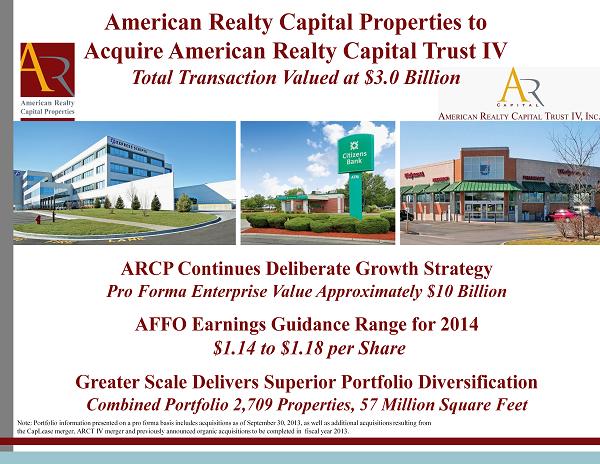

February 2013 ARCP Continues Deliberate Growth Strategy Pro Forma Enterprise Value Approximately $10 Billion AFFO Earnings Guidance Range for 2014 $1.14 to $1.18 per Share Greater Scale Delivers Superior Portfolio Diversification Combined Portfolio 2,709 Properties, 57 Million Square Feet American Realty Capital Properties to Acquire American Realty Capital Trust IV Total Transaction Valued at $ 3.0 Billion Note: Portfolio information presented on a pro forma basis includes acquisitions as of September 30, 2013, as well as additional ac qui sitions resulting from the CapLease merger, ARCT IV merger and

previously announced organic acquisitions to be completed in fiscal year 2013.

2 Additional Information about the Proposed Transaction and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, American Realty Capital Properties, Inc. ("ARCP") expects to prepare and file with the SEC a registration statement on Form S - 4 and American Realty Capital Trust IV, Inc. ("ARCT IV") expects to prepare and file with the SEC a proxy statement and other documents with respect to ARCP’s proposed acquisition of ARCT IV. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND REGISTRATION STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors may obtain free copies of the registration statement, the proxy statement and other relevant documents filed by ARCP and ARCT IV with the SEC (if and when they become available) through the website maintained by the SEC at www.sec.gov . Copies of the documents filed by ARCP and ARCT IV with the SEC are also available free of charge on ARCP’s website at www.arcpreit.com , and copies of the documents filed by ARCT IV with the SEC are available free of charge on ARCT IV’s website at www.arct - 4.com . ARCP, ARCT IV and AR Capital, LLC and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from ARCT IV’s stockholders in respect of the proposed transaction. Information regarding ARCP’s directors and executive officers can be found in ARCP’s definitive proxy statement filed with the SEC on April 30, 2013. Information regarding ARCT IV’s directors and executive officers can be found in the ARCT IV’s definitive proxy statement filed with the SEC on April 30, 2013. Additional information regarding the interests of such potential participants will be included in the joint proxy statement and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available . These documents are available free of charge on the SEC’s website and from ARCP and ARCT IV, as applicable, using the sources indicated above.

3 Forward - Looking Statements Information set forth herein contains “forward - looking statements” (as defined in Section 21E of the Securities Exchange Act of 1934, as amended), which reflect ARCP’s and ARCT IV’s expectations regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the merger agreement will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions and other statements that are not historical facts. The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the inability to complete the proposed merger due to the failure to obtain stockholder approval for the merger and related proxy proposals or the failure to satisfy other conditions to completion of the merger; unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated; the inability to retain key personnel; continuation or deterioration of current market conditions; future regulatory or legislative actions that could adversely affect the companies; the business plans of the tenants of the respective parties; the outcome of any legal proceedings relating to the merger or the merger agreement; and risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all. Additional factors that may affect future results are contained in ARCP’s and ARCT IV’s filings with the SEC, which are available at the SEC’s website at www.sec.gov . ARCP and ARCT IV disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise.

4 Summary of Material Merger Terms Consideration: Total Consideration is $30.43, paid as follows: Cash : $9.00, equates to 30% of the total nominal consideration ARCP Common Stock : 0.5190 of ARCP common stock, which equates to 22% of the total nominal consideration (1) - $0.94 per share annualized dividend, currently yielding 7.2% based on market close on October 4, 2013, payable monthly - Receiving ARCP currency at an attractive valuation relative to its peer group - Registered, freely tradable and listed on NASDAQ - Full liquidity; no lock - up ARCP Preferred Stock : 0.5937 shares of new preferred stock of ARCP with a liquidation preference of $25.00, which equates to 48% of the total nominal consideration (1) - $1.675 per share annualized dividend or 6.7% fixed annualized coupon, payable monthly - Senior to common stock - Registered, freely tradable and listed on NASDAQ - Full liquidity; no lock - up Financial Impact: • Common Dividend : ARCP common dividend increases $0.03 from $0.91 to $0.94 per shar e upon the earlier to close of ARCT IV and CapLease, Inc. (“LSE”) • Preferred Dividend: ARCP annualized preferred dividend of 6.7% (senior to common dividend) • Liquidity: Immediate full liquidity for ARCT IV stockholder (no lock - up) • Operating Costs : Reduced G&A costs • Trading Benefits: Eliminates current overhang on ARCP common stock Timing: • Stockholder Vote : Majority approval of ARCT IV stockholders required; no vote required for ARCP stockholders • Closing: Expected within 60 to 90 days (Q4), subject to SEC review (1) Based on ARCP stock price of $12.70 at market close on October 4, 2013. Fixed per share exchange ratio of 0.5190 for ARC P c ommon stock and 0.5937 for a notional amount of ARCP preferred stock . Liquidation preference/referenced value may not represent current market value .

5 Summary of Material Merger Terms Liquidity Registered, freely tradable and listed on NASDAQ Lock - Up None ARCP Preferred Par Value Liquidation preference of $25.00; not callable for 5 years ARCT IV Stockholder Election No; stockholders will receive a combination of cash, common stock and preferred stock ARCT IV Proxy/Vote Yes ARCP Proxy/Vote No Greater cash component | Freely tradable securities mix (1) Based on ARCP stock price of $12.70 at market close on October 4, 2013. Fixed per share exchange ratio of 0.5190 for ARCP co mmo n stock and 0.5937 for ARCP preferred stock . Liquidation preference/referenced value may not represent current market value. (2) Subject to floor of $30.62. (3) Based on original exchange ratio of 2.05 multiplied by 75% allocation. Consideration Type Referenced Value Exchange Ratio Implied Nominal Per Share Allocated Value 25% Cash N/A N/A $7.50 75% Common Stock (2) $14.94 1.5375 (3) $22.97 $ 30.47 Consideration Type Referenced Value Exchange Ratio (1) Implied Nominal Per Share Allocated Value (1) 30% Cash N/A N/A $9.00 22% Common Stock (1) $12.70 (1) 0.5190 $6.59 48% Preferred Stock (1) $25.00 (1) 0.5937 $ 14.84 $ 30.43 Revised Consideration Original Consideration

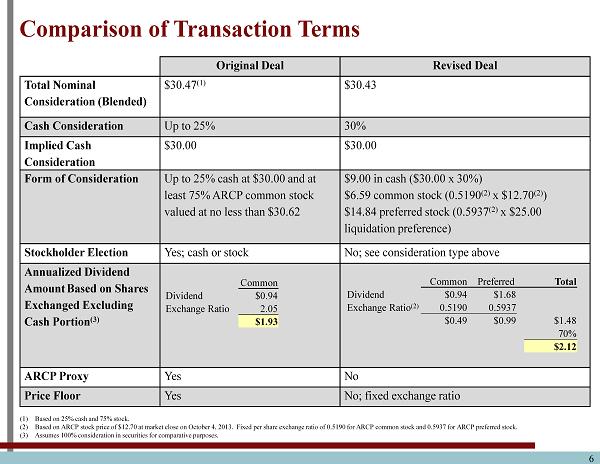

6 Comparison of Transaction Terms Original Deal Revised Deal Total Nominal Consideration (Blended) $30.47 (1) $30.43 Cash Consideration Up to 25% 30% Implied Cash Consideration $30.00 $30.00 Form of Consideration Up to 25% cash at $30.00 and at least 75% ARCP common stock valued at no less than $30.62 $9.00 in cash ($30.00 x 30%) $6.59 common stock (0.5190 (2) x $12.70 (2) ) $14.84 preferred stock ( 0.5937 (2) x $25.00 liquidation preference) Stockholder Election Yes; cash or stock No; see consideration type above Annualized Dividend Amount Based on Shares Exchanged Excluding Cash Portion (3) ARCP Proxy Yes No Price Floor Yes No; fixed exchange ratio (1) Based on 25% cash and 75% stock. (2) Based on ARCP stock price of $12.70 at market close on October 4, 2013. Fixed per share exchange ratio of 0.5190 for ARCP co mmo n stock and 0.5937 for ARCP preferred stock. (3) Assumes 100% consideration in securities for comparative purposes. Common Dividend $0.94 Exchange Ratio 2.05 $1.93 Common Preferred Total Dividend $0.94 $1.68 Exchange Ratio (2) 0.5190 0.5937 $0.49 $0.99 $1.48 70% $2.12

7 ARCT IV Stockholder Benefits • Substantial Share Premium : 22% premium to original offering price on a nominal basis (1) • Greater cash component and a freely tradable securities mix • Cash Consideration : 30% cash consideration of $30.00 (equates to $9.00 per share) to ARCT IV stockholders; an increase from original 25% cash consideration • Dividend Increase : A combination of ARCP common stock and ARCP preferred stock annualized dividend payment of $1.48, payable monthly. Excluding cash portion, annualized dividend increases by $0.47 per share from $1.65 to $2.12 (2 ) , or 28%. • Liquidity : Immediate liquidity for ARCT IV stockholders (no lock - up) • Greater Deal Certainty : No vote required for ARCP stockholders allows greater deal certainty for ARCT IV stockholders • Valuation: Receiving ARCP currency at an attractive valuation relative to its peer group • Stronger Enterprise : ARCT IV becomes part of a larger, more diversified portfolio in a liquid investment with a leading publicly traded net lease REIT • Operating Costs: Reduced G&A costs for ARCT IV stockholders (1) Based on ARCP stock price of $12.70 at market close on October 4, 2013. Fixed per share exchange ratio of 0.5190 for ARCP co mmo n stock and 0.5937 for ARCP preferred stock. (2) Assumes 100% consideration in securities.

8 ARCP Preferred Equity Terms Preferred Equity Type “Perpetual Preferred” Liquidity Registered, freely tradable and listed on NASDAQ Coupon per Annum Fixed annualized 6.70%, payable monthly Options “No Call” for 5 years from closing, thereafter “Callable” by ARCP at “Par Value” of $25.00 Priority Senior to common stock; pari passu with existing preferred securities Conversion “Non - Convertible” Perpetual Preferred No maturity date; will receive dividends indefinitely No Call ARCP cannot repurchase the preferred securities from stockholders for 5 years Callable After 5 years, ARCP has the right to repurchase the preferred shares at par Par Value The specified price at which ARCP can repurchase the preferred shares Non - Convertible The preferred shares cannot be converted into ARCP common stock Definitions:

9 Common Stock vs. Preferred Stock ARCP Preferred Stock ARCP Common Stock Lock - Up No No Exposure to Market Volatility Less More Potential for Growth Less More Reliability of Investment Income More Less Price Volatility Less More Annualized Yield 6.7% 7.2% (1) Liquidity Registered, freely tradable and listed on NASDAQ Registered, freely tradable and listed on NASDAQ ARCT IV stockholders will be receiving a combination of 30% cash, 22% ARCP common stock and 48% ARCP preferred stock (1) Debt Preferred Common Priority Risk Less More (1) Based on ARCP stock price of $12.70 at market close on October 4, 2013. Fixed per share exchange ratio of 0.5190 for ARC P c ommon stock and 0.5937 for ARCP preferred stock.

• Unique Strategy: Unlike any competitor, ARCP acquires both long - duration and mid - duration leases • Stable Income Plus Growth: ARCP offers a well - diversified net lease portfolio with high credit quality tenants, long - weighted and mid - weighted average lease terms and growth potential • Significant Size and Scale: 2 nd largest listed net lease REIT with an enterprise value of over $10 billion • Access to public capital markets and numerous index inclusions to support growth • Able to lower cost of capital with an expected investment grade rating • Larger REITs tend to deliver stronger performance, trade at better multiples • Financial Flexibility: Low borrowing costs, significant liquidity to fund accretive growth and well - laddered debt maturities • Materially Lower Operating Costs: ARCP has a more efficient cost structure, having eliminated acquisition and financing fees, reduced management fees and benefiting from economies of scale • Expert Management Team: Experienced, expert management team that assembled and managed the real estate portfolio (1) 10 ARCP Overview (1) Portfolio information presented on a pro forma basis includes acquisitions as of September 30, 2013, as well as additiona l acquisitions resulting from the CapLease merger, ARCT IV merger and previously announced organic acquisitions to be completed in fiscal year 2013.

11 Notable Recent ARCP Activity ARCP has utilized its low cost of capital to thoughtfully and deliberately increase its scale, diversify its portfolio and grow projected AFFO per share Event Date Pro Forma Property Portfolio Enterprise Value (1) ($M) New Year's Day 2013 01/01/13 148 $ 309 ARCT III Merger 02/28/13 692 $ 3,000 LSE Merger (anticipated to close in October’13) 05/28/13 793 (2) $ 6,000 MSCI RMZ Inclusion 05/31/13 793 (2) $ 6,000 GE Portfolio Acquisition 05/31/13 1,240 (2) $ 6,000 ARCT IV Merger (anticipated to close in Q4’13 ) (As amended on 10/07/2013) 2,709 (3) $ 10,000 (1) Approximation ( 2 ) Pro forma basis at the time of the announced transaction on July 2, 2013 (Amended 10/6/13). (3) Portfolio information presented on a pro forma basis includes acquisitions as of September 30, 2013, as well as additional ac qui sitions resulting from the CapLease merger, ARCT IV merger and previously announced organic acquisitions to be completed in fiscal year 2013.

12 ARCP S tockholder Benefits • AFFO Accretion : Based on 2014E AFFO guidance of $1.14 to $ 1.18 • Dividend Increase : Annualized dividend increases from $0.91 to $0.94 per share • AFFO payout ratio decreases to 80% • Increased Size: At year end 2013, ARCP will have an enterprise value of over $10 billion • ARCP will compare favorably to the largest and most seasoned listed net lease companies • Diversification Improves: Portfolio diversification increases by every relevant metric • Income Stability Maintained: ARCP’s income stability maintained: • Top 10 Tenant concentration improves to approximately 28% • 51% of pro forma annualized rents come from investment grade tenants • G&A Synergies: Approximately $8 million saved through reduction in management fees (75 bps at ARCT IV compared to 40 bps at ARCP) Note: Portfolio information presented on a pro forma basis includes acquisitions as of September 30, 2013, as well as additional ac qui sitions resulting from the CapLease merger, ARCT IV merger and previously announced organic acquisitions to be completed in fiscal year 2013.

13 7 th Increase in ARCP’s Annualized Dividend (1) (1) Effective with the earlier to close of the proposed transaction and ARCP’s merger with LSE. (2) Dividends based on dividend rate at the end of each period. $0.875 $0.875 $0.880 $0.885 $0.890 $0.895 $0.900 $0.910 $0.940 $0.840 $0.860 $0.880 $0.900 $0.920 $0.940 $0.960 Q'3 2011 Q'4 2011 Q'1 2012 Q'2 2012 Q'3 2012 Q'4 2012 Q'1 2013 Q'2 2013 ARCP Post Merger Per Share Historical Annualized Dividend (2) While distributions continue to increase, AFFO payout ratio to 80 %, providing additional room for future dividend growth

14 Tenant % of NOI Rating (1) Dollar General 4.5% BBB - Citizens Bank 3.7% A FedEx Ground 3.3% BBB Aon Corporation 2.8% BBB + AT&T 2.7% A - Walgreen Co. 2.6% BBB GSA 2.5% AA + Goodyear Tire & Rubber 2.5% BB - CVS Caremark 2.2% BBB + Family Dollar 1.5% BBB - 28.3% 91.2% Top 10 Tenants = 91% Investment Grade Note : Portfolio information presented on a pro forma basis includes acquisitions as of September 30, 2013, as well as additional ac qui sitions resulting from the CapLease merger, ARCT IV merger and previously announced organic acquisitions to be completed in fiscal year 2013. (1) Includes investment grade tenants affiliated with investment grade entities as determined by a major independent rating agency. For p urp oses of this presentation, we have attributed the ratings of the affiliated parent company to the tenant. Pro Forma ARCP Top 10 Tenant Concentration of 28% Note: Portfolio metrics based on a pro forma basis at the time of the announced transaction.

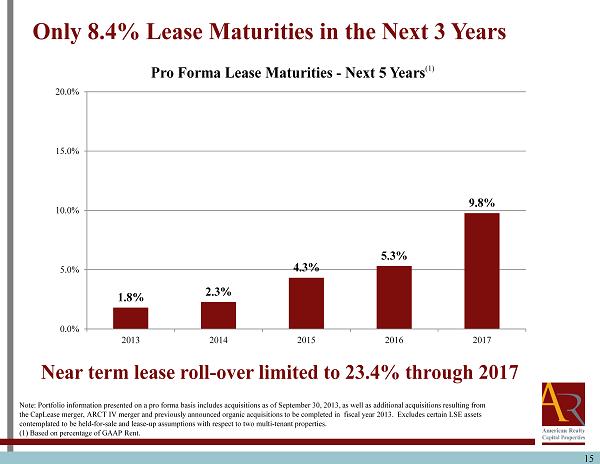

15 15 Note: Portfolio information presented on a pro forma basis includes acquisitions as of September 30, 2013, as well as additional ac qui sitions resulting from the CapLease merger, ARCT IV merger and previously announced organic acquisitions to be completed in fiscal year 2013. Excludes certain LSE assets contemplated to be held - for - sale and lease - up assumptions with respect to two multi - tenant properties. (1) Based on percentage of GAAP Rent. Only 8.4% Lease Maturities in the Next 3 Years Near term lease roll - over limited to 23.4% through 2017 1.8% 2.3% 4.3% 5.3% 9.8% 0.0% 5.0% 10.0% 15.0% 20.0% 2013 2014 2015 2016 2017 Pro Forma Lease Maturities - Next 5 Years (1)

16 ARCP’s Proven Management Team Demonstrated value creation, deep knowledge of the portfolio and superior public company and capital markets experience with over $15 billion of real estate acquisitions in the last decade Supported by a team of over 100 professionals Asset Management Property Management Accounting Legal Human Resources Capital Markets Originations Underwriting Due Diligence Financing Investor Relations Brian S. Block Chief Financial Officer • Chief Financial Officer of ARCP’s manager (ARC Properties Advisors ) • Former Chief Financial Officer, ARCT • Former Chief Accounting Officer, American Financial Realty Trust (NYSE: AFR) • Former public accounting experience (Ernst & Young and Arthur Andersen) Nicholas S. Schorsch Chairman & CEO • CEO of ARCP’s manager (ARC Properties Advisors) • Former Chairman & CEO of ARCT (NASDAQ: ARCT) (acquired by Realty Income in January 2013) • Former CEO of American Financial Realty Trust (NYSE: AFR) • Two - Time Ernst & Young Entrepreneur of the Year Michael Weil President • President of ARCP’s manager (ARC Properties Advisors) • CEO of Realty Capital Securities, LLC • Former Senior VP, Sales & Leasing of American Financial Realty Trust (NYSE: AFR) Brian D. Jones Chief Operating Officer • Former Chief Financial Officer, ARCT • Previously real estate investment banker at Robert W. Baird, Morgan Stanley, UBS and PaineWebber • Previously real estate tax manager Coopers & Lybrand

17 American Realty Capital Properties to Become Self - Managed ARCP announced that its board of directors determined that it’s in the best interests of ARCP and its stockholders to become self - managed following the pending closings of the previously announced acquisitions. Due to the rapid growth of ARCP’s asset and revenue base over the past year through a mix of individual property acquisitions and strategic portfolio and corporate purchases , ARCP believes that once the proposed acquisitions are completed, it will have achieved a size where costs related to a self - administered structure will be lower than those attributable to an externally advised arrangement, thereby ensuring that these annual costs remain among the lowest in its peer group. ARCP will have a dedicated team of senior professionals entirely accountable to ARCP and whose compensation is expected to be linked in large part to the performance of ARCP.

18 Unique Investment Strategy Long Term Leases Strong Credit Quality Tenants and National Brands, Stable Income, Outsized Growth Potential Single Tenant, Net Lease Corporate, Investment Grade Tenant Focus Main & Main/Essential Locations High Occupancy High Credit Quality Market Rents At Market Below Market Replacement Cost At Below Lease Terms Over 10 Years Below 10 Years Current Income Stable High Lease Rollover Maturity Low Moderate Rent Growth Contractual Strong Growth Potential ▪ Combine high credit quality tenants offering stable income plus growth ▪ Extract growth potential from renewal/releasing below market leases ▪ Target acquisition mix of 70% long - duration and 30% mid - duration leases ▪ Maintain blended lease duration of 10 to 12 years “Vintage” Leases Investment Characteristics

19 Acquisition Capabilities; 50 Dedicated Professionals 2 Capital Markets Continuous Deal Flow Through: Tenant, Developer and Broker Relationsh ips 20 Acquisitions Professionals 7 Due Diligence Members Certainty, Speed and Seamless Execution 6 Closing Team 8 Counsel Independent Specialized Expertise 7 Investment Banking Team Consistent & Efficient Sourcing, Underwriting, Financing and Closing • Deal Sourcing • Real Estate, Financial and Credit Risk Analysis • Property Underwriting • Capital Markets Advise and Access • Legal Due Diligence, Documentation, Closing • Transaction Management Integrated Team Efficiency Note: Includes services provided to ARCP by ARC entities

20 Asset and Property Management Team Capabilities: 32 Dedicated Professionals Asset Management • 19 Team Members • Leasing, Dispositions and Lease Modifications • Property Projections and Portfolio Valuations • Tenant Relationships • Insurance, Tax and Title Management Property Management • 13 Team Members • Operating and Cost Budgeting • Property Inspections and Repairs • Lease Administration and Property Recordkeeping • Manage day - to - day individual property requirements Drive exemplary asset performance through leasing and disposition activities Note: Includes services provided to ARCP by ARC entities

21 ARCP’s Management Structure Brings Significant Benefits to S tockholders Scale, Experience and Expertise Generate Better Execution at Lower Cost • Largest U.S. buyer of net lease real estate • Vertically integrated team of 100 real estate professionals • Efficient operational, legal and administrative support • Strong, consistent track record in net lease space • Lower fees and expenses • Performance based management compensation

22 ARCP’s G&A is less than half of the REIT industry average Among the Lowest G&A Expenses in the REIT Industry Source: SNL Financial 2.7% 2.4% 1.7% 1.4% 1.2% 1.2% 1.0% 1.0% 0.9% 0.9% 0.9% 0.8% 0.7% 0.6% 0.5% 0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% G&A as % of Gross Asset Value ARCP (3bp) (40bps)

23 Combined Company Offers S tockholders Significant Benefits • Favorable Cost of Capital: Near all - time low interest rates provide favorable acquisition environment • Liquidity and Access to Capital: Increases enterprise value and provides immediate common stock liquidity, access to capital and financial flexibility • Quality of Income: Maintains focus on income quality: well - located properties tenanted by corporate credits and strong operators • Portfolio Diversification/Earnings Stability: Increases portfolio diversification substantially, providing greater earnings stability • Focus on Essential Goods and Services: Enhances exposure to target industries, focus on essential consumer goods and services • Increased Scale : Increases portfolio scale, creating greater acquisition flexibility • Extension of Investment Strategy: Single tenant properties in “Main & Main” locations Merger reaffirms investment strategy, creates earnings accretion and outsized growth opportunities, preserves capital investment and provides greater portfolio diversification

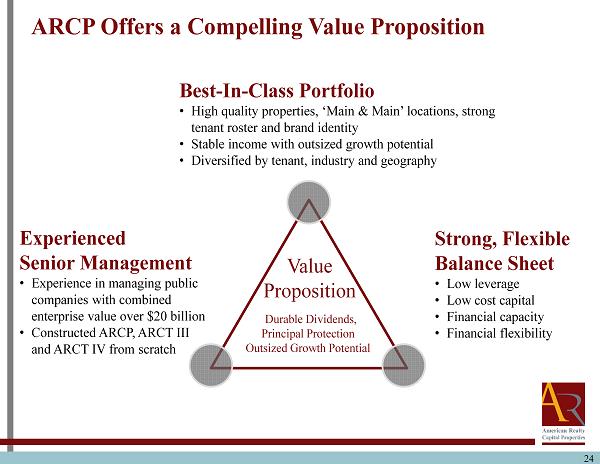

24 ARCP Offers a Compelling Value Proposition Experienced Senior Management • Experience in managing public companies with combined enterprise value over $20 billion • Constructed ARCP, ARCT III and ARCT IV from scratch Best - In - Class Portfolio • High quality properties, ‘Main & Main’ locations, strong tenant roster and brand identity • Stable income with outsized growth potential • Diversified by tenant, industry and geography Value Proposition Durable Dividends, Principal Protection Outsized Growth Potential Strong, Flexible Balance Sheet • Low leverage • Low cost capital • Financial capacity • Financial flexibility

25 Funds from Operations and Adjusted Funds from Operations ARCP and ARCT IV consider funds from operations (“FFO”) and AFFO, which is FFO as adjusted to exclude acquisition - related fees and expenses, amortization of above - market lease assets and liabilities, amortization of deferred financing costs, straight - line rent, non - cash mark - to - market adjustments, amortization of restricted stock, non - cash compensation and gains and losses useful indicators of the performance of a real estate investment trust (“REIT”). Because FFO calculations exclude such factors as depreciation and amortization of real estate assets and gains or losses from sales of operating real estate assets (which can va ry among owners of identical assets in similar conditions based on historical cost accounting and useful - life estimates), they faci litate comparisons of operating performance between periods and between other REITs in our peer group. Accounting for real estate assets in accordance with generally accepted accounting principles (“GAAP”) implicitly assumes that the value of real estate ass ets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many ind ust ry investors and analysts have considered the presentation of operating results for real estate companies that use historical co st accounting to be insufficient by themselves. FFO and AFFO are not in accordance with, or a substitute for, measures prepared in accordance with GAAP, and may be different from non - GAAP measures used by other companies. In addition, FFO and AFFO are not based on any comprehensive set of accounting rules or principles. Non - GAAP measures, such as FFO and AFFO, have limitations in that they do not reflect all of the amounts associated with ARCP’s and ARCT IV's results of operations that would be reflected in measures determined in accordance with GAAP. These measures should only be used to evaluate ARCP's and ARCT IV’s performance in conjunction with corresponding GAAP measures. Additionally, ARCP and ARCT IV believe that AFFO, by excluding acquisition - related fees and expenses, amortization of above - market lease assets and liabilities, amortization of deferred financing costs, straight - line rent, non - cash mark - to - market adjustments, amortization of restricted stock, non - cash compensation and gains and losses, provides information consistent with management's analysis of the operating performance of the properties. By providing AFFO, ARCP and ARCT IV believe it is presenting useful information that assists investors and analysts to better assess the sustainability of our operating perfor man ce. Further, ARCP and ARCT IV believe AFFO is useful in comparing the sustainability of their operating performance with the sustainability of the operating performance of other real estate companies, including exchange - traded and non - traded REITs. As a result, ARCP and ARCT IV believe that the use of FFO and AFFO, together with the required GAAP presentations, provide a more complete understanding of our performance relative to our peers and a more informed and appropriate basis on which to make decisions involving operating, financing and investing activities.