Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - VANTAGESOUTH BANCSHARES, INC. | d572682dex231.htm |

| EX-23.2 - EX-23.2 - VANTAGESOUTH BANCSHARES, INC. | d572682dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on October 2, 2013

Registration No. 333-190731

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VANTAGESOUTH BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 6022 | 45-2915089 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3600 Glenwood Avenue

Suite 300

Raleigh, North Carolina 27612

(919) 659-9000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Scott M. Custer

Chief Executive Officer

VantageSouth Bancshares, Inc.

3600 Glenwood Avenue, Suite 300

Raleigh, North Carolina 27612

(919) 659-9000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications to:

| Betty O. Temple, Esq. Sudhir N. Shenoy, Esq. Womble Carlyle Sandridge & Rice, LLP 550 South Main Street Suite 400 Greenville, South Carolina 29601 (864) 255-5400 |

Todd H. Eveson, Esq. Alexander M. Donaldson, Esq. Jonathan A. Greene, Esq. Wyrick Robbins Yates & Ponton LLP 4101 Lake Boone Trail, Suite 300 Raleigh, North Carolina 27607 (919) 781-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Unit |

Proposed Maximum Offering Price (1)(2) |

Amount of Registration Fee (3) | ||||

| Fixed/Floating Rate Perpetual Non-Cumulative Preferred Stock, no par value per share |

$57,500,000 | $7,843 | ||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) | $6,820 was paid with the filing of the Registration Statement with the Commission on August 20, 2013. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 2, 2013

PRELIMINARY PROSPECTUS

2,000,000 Shares of Fixed/Floating Rate Perpetual Non-Cumulative Preferred Stock

$[—] Per Share

We are offering 2,000,000 shares of our fixed/floating rate perpetual non-cumulative preferred stock, with a liquidation preference of $25 per share (the “Preferred Stock”). The underwriters have an option to purchase 300,000 additional shares of Preferred Stock in this offering. We intend to pay dividends on the Preferred Stock, when, as, and if declared by our board of directors or a duly authorized committee thereof. From the date of issuance to, but excluding, [—], we intend to pay dividends, when, as, and if declared by our board of directors or such committee at a rate of [—]% per annum, payable on a non-cumulative basis quarterly, in arrears, on [—], [—], [—] and [—] of each year beginning on [—] and ending on [—]. From and including [—], we intend to pay dividends, when, as, and if declared by our board of directors or such committee at a floating rate equal to three-month LIBOR plus a spread of [—]% per annum, payable quarterly, in arrears, on [—], [—], [—] and [—] of each year, beginning on [—].

If our board of directors or a duly authorized committee of the board has not declared a dividend on the Preferred Stock before the dividend payment date for any dividend period, such dividend shall not be cumulative and shall not accrue or be payable for such dividend period, and we will have no obligation to pay dividends for such dividend period, whether or not dividends on the Preferred Stock are declared for any future dividend period.

We may redeem shares of the Preferred Stock (i) on any dividend payment date on or after [—], in whole or in part, from time to time or (ii) prior to [—], in whole, but not in part, upon the occurrence of a “regulatory capital treatment event,” as described herein, in each case at a redemption price equal to $25 per share, plus any declared and unpaid dividends on the shares of Preferred Stock called for redemption. The Preferred Stock will not have any voting rights, except as described under “Description of the Preferred Stock—Voting Rights” below.

Application has been made to list the Preferred Stock on the NYSE MKT, LLC (the “NYSE MKT”) under the symbol “VSB PR.” If the application is approved, trading of the Preferred Stock is expected to commence within a 30-day period after the original issuance date of the Preferred Stock. Our common stock is listed on the NYSE MKT under the symbol “VSB.”

The shares of Preferred Stock will be capital stock of VantageSouth Bancshares, Inc. and will not be equivalent to savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and will not be insured or guaranteed by the FDIC or any other governmental agency or instrumentality.

Investing in the Preferred Stock involves risks. See “Risk Factors” beginning on page 18 to read about factors you should consider before buying the Preferred Stock.

Neither the Securities and Exchange Commission (“SEC”) nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price (1) |

$ | [ | —] | $ | [ | —] | ||

| Underwriting discounts and commissions |

$ | [ | —] | $ | [ | —] | ||

| Proceeds to us, before expenses (2) |

$ | [ | —] | $ | [ | —] | ||

| (1) | The public offering price does not include dividends, if any, that may be declared. Dividends, if declared, will be calculated from the date of original issuance, which is expected to be [—], 2013. |

| (2) | Estimated expenses for the offering are approximately $[—]. |

The underwriters expect to deliver the Preferred Stock in book-entry form only through the facilities of The Depository Trust Company (“DTC”) against payment in New York, New York on or about [—], 2013.

Prospectus dated [—], 2013.

Table of Contents

Table of Contents

| ii | ||||

| ii | ||||

| 1 | ||||

| 18 | ||||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| 46 | ||||

| 55 | ||||

| 60 | ||||

| 62 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 67 | ||||

i

Table of Contents

You should rely only on the information contained or incorporated by reference in this prospectus. We have not, and the underwriters have not, authorized any person to provide you with different or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the documents incorporated by reference is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since such dates.

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus to “VSB,” “we,” “us,” “our,” the “Company,” or similar references, mean VantageSouth Bancshares, Inc. and its subsidiaries on a consolidated basis. References to “VantageSouth Bank” or the “Bank” mean our wholly-owned banking subsidiary.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information set forth in this prospectus and the information it incorporates by reference may contain various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which statements represent our judgment concerning the future and are subject to business, economic and other risks and uncertainties, both known and unknown, that could cause our actual operating results and financial position to differ materially from the forward-looking statements. Such forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “estimate,” “believe,” or “continue,” or the negative thereof or other variations thereof or comparable terminology.

We caution that any such forward-looking statements are further qualified by important factors that could cause our actual operating results to differ materially from those in the forward-looking statements, including without limitation:

| • | deterioration in the financial condition of borrowers resulting in significant increases in loan losses and provisions for those losses; |

| • | changes in loan underwriting, credit review or loss reserve policies associated with economic conditions, examination conclusions, or regulatory developments; |

| • | the failure of assumptions underlying the establishment of reserves for possible loan losses; |

| • | changes in accounting principles, policies, and guidelines applicable to bank holding companies and banking; |

| • | changes in political and economic conditions, including continuing political and economic effects of the global economic downturn and other major developments, including the ongoing war on terrorism, continued tensions in the Middle East, and the economic challenges facing the European Union and other developed countries; |

| • | changes in financial market conditions, either internationally, nationally or locally in areas in which we conduct our operations, including, without limitation, reduced rates of business formation and growth, commercial and residential real estate development, and real estate prices; |

| • | our ability to comply with any requirements imposed on VSB or the Bank by our respective regulators, and the potential negative consequences that may result; |

| • | the impact of heightened regulatory scrutiny of financial products aimed at consumers, led by the Consumer Financial Protection Bureau (“CFPB”); |

ii

Table of Contents

| • | fluctuations in markets for equity, fixed-income, commercial paper and other securities, which could affect availability, market liquidity levels, and pricing; |

| • | governmental monetary and fiscal policies, including the effects of the Federal Reserve’s “Quantitative Easing” program, as well as other legislative and regulatory changes; |

| • | effective on January 1, 2015 and subject to certain transition periods, changes in minimum capital requirements, adjustments to prompt corrective action thresholds, increased quality of regulatory capital, revised risk-weighting of certain assets, and implementation of a “capital conservation buffer,” included in the final rule promulgated by the Federal Reserve on July 2, 2013, to implement the so-called “Basel III” accords; |

| • | the risks of changes in interest rates or an extended period of record-low interest rates on the level and composition of deposits, loan demand and the values of loan collateral, securities and interest sensitive assets and liabilities; |

| • | the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market area and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone and the internet; |

| • | the effect of any mergers, acquisitions or other transactions, to which we or our subsidiary bank may from time to time be a party, including, without limitation, our ability to successfully integrate any businesses that we acquire; and |

| • | the risk factors described under the heading “Risk Factors” in this prospectus and in the documents incorporated herein by reference. |

Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date such forward-looking statements are made.

You should read carefully this prospectus, together with the information incorporated herein by reference as described under the heading “Where You Can Find More Information,” completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify all of our forward-looking statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

iii

Table of Contents

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus and does not contain all the information that you need to consider in making your investment decision. You should carefully read this entire prospectus, as well as the information to which we refer you and the information incorporated by reference herein, before deciding whether to invest in the Preferred Stock. You should pay special attention to the “Risk Factors” section of this prospectus and the documents incorporated by reference herein and therein to determine whether an investment in the Preferred Stock is appropriate for you.

The Company

VantageSouth Bancshares, Inc. (hereinafter referred to as the “Company” or “VSB”), is a bank holding company incorporated under the laws of Delaware in 2011. On July 22, 2013, after receiving stockholder approval, we changed the Company’s name from Crescent Financial Bancshares, Inc. to VantageSouth Bancshares, Inc., and transferred the listing of our common stock from the NASDAQ Stock Market, LLC to the NYSE MKT.

The Company conducts its business operations primarily through its commercial bank subsidiary, VantageSouth Bank (formerly known as Crescent State Bank). Our principal executive office is located at 3600 Glenwood Avenue, Suite 300, Raleigh, North Carolina 27612 and our telephone number is (919) 659-9000. VSB is a subsidiary of Piedmont Community Bank Holdings, Inc. (“Piedmont”), a registered bank holding company. At June 30, 2013, we had assets of $2 billion, deposits of $1.65 billion and stockholders’ equity of $230 million.

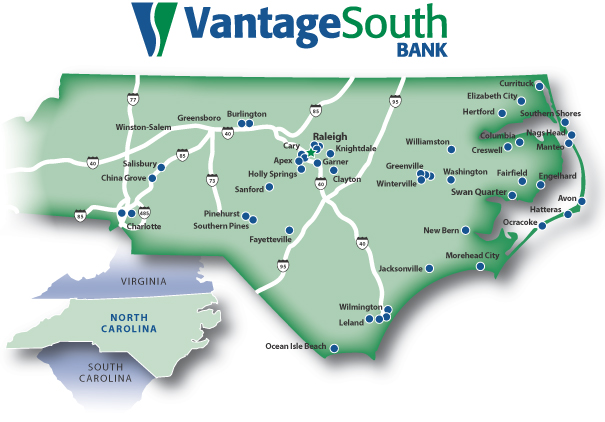

VantageSouth Bank (the “Bank”) was incorporated in 1998 as a North Carolina-chartered commercial bank. The Bank serves central North Carolina to the coast with 46 full-service branch offices located in Apex, Avon, Burlington (2), Cary (2), China Grove, Clayton, Columbia, Creswell, Currituck, Engelhard, Fairfield, Fayetteville, Garner, Greenville (3), Hatteras, Hertford, Holly Springs, Jacksonville, Knightdale, Leland, Manteo, Morehead City, Nags Head, New Bern, Ocean Isle Beach, Ocracoke, Pinehurst, Raleigh (3), Salisbury, Sanford, Southern Pines, Southern Shores, Swan Quarter, Washington, Williamston, Wilmington (4), and Winterville, North Carolina.

The Bank is a community bank focused on being the bank of choice for businesses, business owners, and professionals in its markets. The Bank aims to accomplish this by creating mutually beneficial and robust relationships with its customers and positively impacting its communities. In addition to offering standard banking products and services, the Bank seeks to build relationships with its customers by understanding their personal and business challenges and goals, and providing tangible solutions. The Bank offers a broad range of banking services, including checking and savings accounts, individual retirement accounts, certificates of deposit, money market accounts, commercial, consumer and personal loans, mortgage banking services, U.S. Small Business Administration (“SBA”) loans, builder finance, agricultural finance and other associated financial services. These banking services are offered through the Bank’s branch network and certain services are offered through its online banking and mobile banking platforms.

As a bank holding company, we are subject to the supervision of the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”). We are required to file with the Federal Reserve reports and other information regarding our business operations and the business operations of our subsidiaries. As a North Carolina-chartered bank, the Bank is subject to primary supervision, periodic examination and regulation by the Office of the North Carolina Commissioner of Banks (the “NCCOB”), and by the FDIC as its primary federal regulator.

1

Table of Contents

Additional information about us is included in our filings with the SEC, which are incorporated by reference into this prospectus. See “Where You Can Find More Information” and “Incorporation of Certain Documents By Reference” in this prospectus.

Our History

Piedmont Established

Piedmont was established in 2009 for the purpose of building a community banking franchise in the North Carolina, South Carolina, and Virginia markets. Piedmont was co-founded by J. Adam Abram and Steven J. Lerner. Piedmont received approval to become a bank holding company on January 20, 2010 through its acquisition of VantageSouth Bank (“Legacy VantageSouth”).

Piedmont Acquisition of Legacy VantageSouth

Legacy VantageSouth was organized and incorporated under the laws of the State of North Carolina and commenced operations in 2006. Piedmont recapitalized Legacy VantageSouth on February 19, 2010. Prior to its merger with Crescent State Bank on November 30, 2012, Legacy VantageSouth was headquartered in Burlington, North Carolina. Legacy VantageSouth initially sold 1,768,794 shares of its newly issued Series A Convertible Perpetual Preferred Stock (the “Series A Stock”) to Piedmont for an aggregate price of $7.7 million, or $4.35 per share. The Series A Stock was convertible at any time on a one-for-one basis into shares of Legacy VantageSouth’s common stock, which totaled approximately 62 percent of its outstanding common stock at the date of Piedmont’s investment (as adjusted for the assumed conversion of the Series A Stock). The investment in Legacy VantageSouth gave Piedmont voting control over a majority of Legacy VantageSouth’s outstanding common stock and the ability to control the election of Legacy VantageSouth’s board of directors.

Piedmont Acquisition of Community Bank of Rowan and Merger of Community Bank of Rowan into Legacy VantageSouth

On April 19, 2011, Piedmont acquired Community Bank of Rowan, a North Carolina-chartered bank (“Rowan”). Piedmont purchased all 813,083 shares of Rowan’s common stock for an aggregate purchase price of $9.5 million. Immediately following the acquisition, Piedmont purchased an additional 569,158 shares of newly issued Rowan common stock for an aggregate price of $7.0 million. Since Piedmont owned 100 percent of Rowan following its acquisition, purchase accounting fair value adjustments were pushed down to Rowan’s financial statements at that date. In addition, Legacy VantageSouth and Rowan became commonly controlled by Piedmont beginning on the date of Piedmont’s acquisition of Rowan.

On February 1, 2012, a transaction was completed whereby Piedmont purchased the remaining non-controlling interests in Legacy VantageSouth and simultaneously merged Rowan into Legacy VantageSouth. Piedmont purchased all remaining shares of Legacy VantageSouth common stock from non-controlling stockholders for an aggregate purchase price of $4.8 million, or $4.35 per share. Following this transaction, Piedmont wholly owned the combined Legacy VantageSouth (except for certain shares, known as directors’ qualifying shares, required to be owned by members of the board of directors of Legacy VantageSouth pursuant to North Carolina banking laws then in effect). Because Piedmont purchased the remaining non-controlling common stock of Legacy VantageSouth with this transaction, push-down accounting was applied to Legacy VantageSouth so that the basis reported in Legacy VantageSouth’s financial statements from that date forward reflected Piedmont’s basis in Legacy VantageSouth. The merger of Rowan into Legacy VantageSouth was a merger of commonly controlled companies and was accounted for in a manner similar to a pooling of interests transaction.

2

Table of Contents

Piedmont Acquisition of Crescent Financial Bancshares, Inc.

Crescent Financial Corporation was a North Carolina business corporation and the bank holding company for Crescent State Bank, a North Carolina chartered bank incorporated in 1998 and headquartered in Cary, North Carolina. Crescent State Bank operated fifteen full-service branches in central North Carolina and Wilmington, North Carolina. On February 23, 2011, Crescent Financial Corporation and Crescent State Bank entered into an investment agreement with Piedmont, pursuant to which Piedmont agreed to purchase 18,750,000 newly issued shares of common stock of Crescent Financial Corporation for $75.0 million in cash, or $4.00 per share. Piedmont also agreed to commence a tender offer to purchase up to 6,442,105 shares of Crescent Financial Corporation’s then-outstanding common stock at a price of $4.75 per share (the “Tender Offer”). On November 15, 2011, Crescent Financial Corporation reincorporated as a Delaware corporation through a merger of Crescent Financial Corporation with and into Crescent Financial Bancshares, Inc. (“Crescent Financial”), a newly formed Delaware corporation and wholly owned subsidiary of Crescent Financial Corporation. Crescent Financial was the surviving entity after the reincorporation merger. On November 18, 2011, Crescent Financial completed the issuance and sale to Piedmont of 18,750,000 shares of its common stock. Piedmont also purchased 6,128,423 shares of Crescent Financial common stock on December 22, 2011, pursuant to the Tender Offer. As a result of Piedmont’s investment and the Tender Offer, Piedmont acquired approximately 88% of the outstanding common stock of Crescent Financial.

Crescent Financial’s financial condition and results of operations were significantly impacted by Piedmont’s investment. Because of the level of Piedmont’s ownership and control following the controlling investment, push-down accounting was applied. Accordingly, Crescent Financial’s assets, liabilities and non-controlling interests were adjusted to estimated fair value at the acquisition date, and the allowance for loan losses was eliminated.

Merger of Legacy VantageSouth into Crescent Financial and Change in Reporting Entity

On November 30, 2012, Crescent Financial completed the merger of Legacy VantageSouth into Crescent State Bank in a share exchange. All outstanding Legacy VantageSouth shares of common stock were converted into Crescent Financial’s shares at a 5.3278 exchange ratio for a total transaction value of $35.0 million. At the time of merger, Piedmont owned all outstanding shares of Legacy VantageSouth except for directors’ qualifying shares. Piedmont owned approximately 90 percent of the Company’s outstanding common stock following the merger. The Company re-branded its wholly-owned banking subsidiary as “VantageSouth Bank” immediately following the merger.

The merger of Legacy VantageSouth into Crescent State Bank was a merger of commonly controlled companies and was accounted for in a manner similar to a pooling of interests transaction. Thus, the Company’s financial statements have been retrospectively adjusted to combine the financial statement balances of Crescent Financial and Legacy VantageSouth beginning on November 18, 2011, the date the two companies became commonly controlled by Piedmont. In addition, periods prior to the date of common control in this document reflect only Legacy VantageSouth’s historical balances since it was the first company acquired by Piedmont, which resulted in a change in reporting entity.

Merger with ECB Bancorp, Inc.

On April 1, 2013, the Company completed the merger of ECB Bancorp, Inc. (“ECB”), a bank holding company headquartered in Engelhard, North Carolina, with and into the Company, and the merger of ECB’s subsidiary bank, The East Carolina Bank, with and into the Bank. Under the terms of the merger agreement, shareholders of ECB received 3.55 shares of the Company’s common stock for each share of ECB common stock. The aggregate merger consideration consisted of 10,312,186 shares of the Company’s

3

Table of Contents

common stock. Based upon the market price of the Company’s common stock at merger, the transaction value was $40.6 million. Following the ECB merger, Piedmont owned approximately 70% of the Company’s outstanding common stock. The East Carolina Bank had twenty-five branch offices in eastern North Carolina stretching from the Virginia to South Carolina state lines east of Interstate 95. The East Carolina Bank offered a full range of financial services, including community banking, mortgage and agricultural banking.

Our Markets

Management views the Company’s target market area for both organic and acquisition growth as the Interstate 85 growth corridor, which has been identified by demographers as a key U.S. “mega region” for the next 40 years. This corridor includes areas in North Carolina, South Carolina and Virginia. North Carolina has been the number one state in the U.S. for corporate relocations in eight out of the last nine years according to Site Selection magazine. North Carolina’s population of 9.8 million is projected by the U.S. Census Bureau to grow by 3.0 million people, or 31%, by 2030. North Carolina is currently the tenth largest state in the U.S. and is projected to be the seventh largest state by 2030.

The Company’s franchise is concentrated in North Carolina’s top metropolitan statistical areas (“MSAs”). Half of our deposit base is located in North Carolina’s top ten MSAs with projected growth well in excess of national averages for the next five years. The Raleigh-Cary, North Carolina MSA, which is the heart of the Company’s footprint and includes 28.2% of our deposits, is the fifth fastest growing MSA in the U.S. with projected population growth of 12.9% from 2012 to 2017. Raleigh is the state capital and is geographically positioned in the center of the state. Intersected by I-40 and adjacent to I-85 and I-95, Raleigh’s strategic location has contributed greatly to its growth and commercial appeal. Raleigh is located in the “Triangle” area of North Carolina (the “Triangle”), which also includes Durham, Chapel Hill, and the Research Triangle Park. The Triangle is a well-diversified market with a mixture of businesses, universities, large medical institutions and state/local government offices providing for a stable local economy. The University of North Carolina, Duke University and North Carolina State University are all located in the Triangle and the Research Triangle Park is home to more than 170 global companies, including IBM, GlaxoSmithKline, Syngenta, RTI International, Credit Suisse, and Cisco, that foster a culture of scientific advancement and competitive excellence. In March 2013, Forbes magazine reported that the population for the Raleigh MSA has expanded 47.8% since 2000, tops among the nation’s 52 metropolitan areas that have a population of more than 1 million. This growth is primarily driven by the education, technology, healthcare and state government sectors. In February 2013, The National Federation of Independent Businesses placed Raleigh second on its list of best cities in which to start a business.

The Company’s other top-growth MSAs in North Carolina are Wilmington, Greenville, Burlington, and Southern Pines-Pinehurst, which represent 26.5% of its deposit franchise and have a weighted average projected population growth of 7.9% for the next five years. The Company continues to expand into other high-growth MSAs. The Company recently expanded into the Fayetteville, NC and Jacksonville, NC MSAs with weighted average population projected growth of 9.4% for the next five years. Fayetteville and Jacksonville are home to Fort Bragg and Camp Lejeune, respectively. Fort Bragg is the largest global Army installation with 10% of the Army’s active forces and Camp Lejeune is the largest Marine Corps base on the East Coast.

4

Table of Contents

Our Experienced Executive Management Team and Highly Qualified Board of Directors

Our executive management team consists of five seasoned banking professionals who have over 125 years of combined experience with an average of over 25 years experience each in the financial services industry. Scott M. Custer has served as a director and Chief Executive Officer of Piedmont since 2010 and a director and Chief Executive Officer of VSB and the Bank since November 2011. Before joining Piedmont, he served as Chairman and Chief Executive Officer of RBC Bank (USA), a position he held since 2004. We believe that our executive officers’ experience and local market knowledge are valuable assets in turbulent economic times, and will enable them to guide the Company successfully in the future.

In addition to our seasoned executive management team, our board of directors consists of highly qualified and respected members of the communities that we serve, and many of them own businesses in their local communities. Our executive management team and members of our board of directors own a significant amount of our stock, as described below:

| Name |

Title |

Years Experience |

Prior Experience |

VSB Ownership % (1) |

||||||||||

| Employer |

Position |

|||||||||||||

| Adam Abram |

Chairman of the Board | 30 | Franklin Holdings | Chairman | 5.0 | % | ||||||||

| James River Group | Chief Executive Officer | |||||||||||||

| Scott Custer |

Chief Executive Officer | 31 | RBC Bank | Chief Executive Officer | 1.8 | % | ||||||||

| RBC Centura | President | |||||||||||||

| Lee Roberts |

Chief Operating Officer | 19 | Morgan Stanley | Executive Director | 0.7 | % | ||||||||

| Chief Risk Officer |

Business Unit COO | |||||||||||||

| Steve Jones |

Bank President | 19 | RBC Bank | President—Carolinas | 0.6 | % | ||||||||

| Terry Earley |

Chief Financial Officer | 30 | RBC Bank | Chief Financial Officer | 0.5 | % | ||||||||

| Chief Operating Officer | ||||||||||||||

| Board & Executives |

50.0 | % | ||||||||||||

| (1) | This includes both beneficial ownership of VSB common stock and Piedmont common stock based upon “beneficial ownership” concepts described in the rules issued under the Exchange Act. VSB ownership including fully diluted Piedmont ownership is calculated by multiplying each beneficial owner’s fully diluted ownership percentage of Piedmont by the 32,242,726 shares of VSB stock which Piedmont owns. |

5

Table of Contents

Recent Developments

Highlights of Second Quarter of 2013

| • | Net income was $3.7 million in the second quarter of 2013 compared to a net loss of $806,000 in the first quarter of 2013 and net income of $338,000 in the second quarter of 2012. |

| • | Operating earnings, which excludes securities gains, a one-time acquisition gain, and merger and conversion costs, were $2.8 million in the second quarter of 2013 compared to a loss of $422,000 in the first quarter of 2013 and earnings of $360,000 in the second quarter of 2012. |

| • | The Company completed the merger and system conversion of ECB in the second quarter of 2013. The ECB merger generated a one-time gain of $8.2 million in the second quarter of 2013, while merger and system conversion costs totaled $12.0 million in the second quarter of 2013 compared to $1.6 million in the first quarter of 2013 and $6,000 in the second quarter of 2012. |

| • | Annualized net loan growth was approximately 24 percent in the second quarter of 2013, excluding acquired ECB loans, which was driven by loan originations of $154.2 million. |

| • | Net interest margin expanded to 4.67 percent in the second quarter of 2013 from 4.24 percent in the first quarter of 2013 and 4.33 percent in the second quarter of 2012. |

| • | Operating non-interest income, which excludes a one-time acquisition gain, increased to $4.9 million in the second quarter of 2013 as the Company continued to expand its government guaranteed lending and mortgage businesses and acquired a merchant banking platform and expanded its deposit-related fee income base through the ECB merger. |

| • | Asset quality continued to improve as nonperforming assets decreased to 1.33 percent of total assets as of June 30, 2013 from 1.48 percent of total assets as of March 31, 2013 and 1.71 percent of total assets as of December 31, 2012. |

| • | Operating efficiency, which represents operating expenses to total operating revenues, improved to 75.9 percent in the second quarter of 2013 from 82.5 percent in the first quarter of 2013 and 82.8 percent in the second quarter of 2012. |

Reconciliation of Non-GAAP Financial Measures

Statements included in “Highlights of Second Quarter of 2013” above include non-GAAP financial measures and should be read along with the table below which provides a reconciliation of non-GAAP financial measures to GAAP financial measures. Our management uses non-GAAP financial measures, including: (i) net operating earnings (loss), (ii) operating non-interest income, and (iii) operating efficiency ratio, in its analysis of the Company’s performance. Net operating earnings (loss) excludes the following from net income (loss): securities gains, a one-time acquisition gain, merger and conversion costs, and the income tax effect of adjustments. Operating non-interest income excludes a one-time acquisition gain from non-interest income. The operating efficiency ratio excludes a one-time acquisition gain and merger and conversion costs from the efficiency ratio.

6

Table of Contents

Our management believes that non-GAAP financial measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and you should consider the Company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non-GAAP financial measures have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of the Company’s results or financial condition as reported under GAAP.

| Three Months Ended | ||||||||||||

| (Dollars in thousands) | June 30, 2013 |

March 31, 2013 |

June 30, 2012 |

|||||||||

| Reconciliation of GAAP to Non-GAAP |

||||||||||||

| OPERATING EARNINGS |

||||||||||||

| Net income (loss) (GAAP) |

$ | 3,700 | $ | (806 | ) | $ | 338 | |||||

| Securities (gains) losses |

(123 | ) | (1,092 | ) | 27 | |||||||

| Gain on acquisition |

(8,241 | ) | — | — | ||||||||

| Merger and conversion costs |

11,961 | 1,601 | 6 | |||||||||

| Income tax effect of adjustments |

(4,484 | ) | (125 | ) | (11 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net operating earnings (loss) (Non-GAAP) |

$ | 2,813 | $ | (422 | ) | $ | 360 | |||||

|

|

|

|

|

|

|

|||||||

| OPERATING NON-INTEREST INCOME |

||||||||||||

| Non-interest income (GAAP) |

$ | 13,096 | $ | 3,462 | $ | 2,390 | ||||||

| Gain on acquisition |

(8,241 | ) | — | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Operating non-interest income (Non-GAAP) |

$ | 4,855 | $ | 3,462 | $ | 2,390 | ||||||

|

|

|

|

|

|

|

|||||||

| OPERATING EFFICIENCY RATIO |

||||||||||||

| Efficiency ratio (GAAP) |

92.89 | % | 94.49 | % | 82.89 | % | ||||||

| Effect to adjust for gain on acquisition |

30.28 | % | — | % | — | % | ||||||

| Effect to adjust for merger and conversion costs |

(47.31 | )% | (11.94 | )% | (0.04 | )% | ||||||

|

|

|

|

|

|

|

|||||||

| Operating efficiency ratio (Non-GAAP) |

75.86 | % | 82.55 | % | 82.85 | % | ||||||

|

|

|

|

|

|

|

|||||||

Offering of Subordinated Notes

On August 12, 2013 and August 14, 2013, we entered into Subordinated Note Purchase Agreements with twelve accredited investors pursuant to which we issued an aggregate of $38,050,000 of subordinated notes (the “Notes”) to the accredited investors. The Notes have a term of ten years and a maturity date of August 12, 2023. The Notes bear interest, payable on the 1st of January and July of each year, commencing January 1, 2014, at a fixed interest rate of 7.625% per year.

We chose to conduct this offering of the Preferred Stock rather than raise additional capital through the offering of additional Notes because we expect the Preferred Stock to qualify as tier 1 capital to the Company, while the Notes would not qualify as tier 1 capital.

The Notes are not convertible into common stock or preferred stock, and the Notes are not callable by the Company or subject to prepayment at the option of the holders. If certain events of default occur, including bankruptcy of the Company, the holder of a Note may declare the principal amount of the Note to be due and immediately payable. The Notes are unsecured, subordinated obligations of the Company and rank junior in right of payment to our senior indebtedness and to our obligations to our general creditors. The Notes rank senior to the Preferred Stock.

7

Table of Contents

The Notes are intended to qualify as tier 2 capital for regulatory purposes. We have contributed $32 million of the net proceeds from the sale of the Notes to the Bank.

The Notes were offered and sold in reliance on the exemptions from registration provided by Section 4(2) of the Securities Act and Rule 506 of Regulation D thereunder. Accordingly, the Notes were offered and sold exclusively to persons who are “accredited investors” within the meaning of Rule 501(a) of Regulation D.

The Offering

The following summary contains basic information about the Preferred Stock offered hereby and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the Preferred Stock, you should read the section of this prospectus entitled “Description of the Preferred Stock” beginning on page [—].

| Securities offered hereby |

2,000,000 shares of our Fixed/Floating Rate Perpetual Non-Cumulative Preferred Stock, with a liquidation preference of $25 per share (the “Preferred Stock”). |

| Option to purchase additional shares |

The underwriters will have an option to purchase 300,000 additional shares of Preferred Stock in this offering. |

| Further issuances |

We reserve the right to re-open this series of Preferred Stock and issue additional shares of the Preferred Stock either through public or private sales at any time and from time to time. The additional shares would form a single series with the Preferred Stock offered by this prospectus. |

| Public offering price |

$[—] per share. |

| Dividends |

We intend to pay dividends on the Preferred Stock, when, as, and if declared by our board of directors or a duly authorized committee thereof. From the date of issuance to, but excluding, [—], we intend to pay dividends, when, as, and if declared by our board of directors or such committee at a rate of [—]% per annum, payable on a non-cumulative basis quarterly, in arrears, on [—], [—], [—] and [—] of each year beginning on [—] and ending on [—]. From and including [—], we intend to pay dividends, when, as, and if declared by our board of directors or such committee at a floating rate equal to three-month LIBOR plus a spread of [—]% per annum, payable quarterly, in arrears (each such rate, a “dividend rate”). |

| Dividends on the Preferred Stock will not be cumulative. Accordingly, if our board of directors or a duly authorized committee thereof has not declared a dividend on the Preferred Stock before the dividend payment date for any dividend period, such dividend will not be cumulative and shall cease to accrue and be payable, and we will have no obligation to pay dividends accrued for such dividend period, whether or not dividends on the Preferred Stock are declared for any future dividend period. |

8

Table of Contents

Our ability to declare and pay dividends is limited by applicable regulatory restrictions, including the regulations and guidelines of the Federal Reserve Board applicable to bank holding companies.

In addition, because we are a bank holding company, our ability to pay dividends on, and redeem at our option, the Preferred Stock will be highly dependent upon the receipt of dividends, fees and other amounts from the Bank, which, in turn, will be highly dependent upon the Bank’s historical and projected results of operations, liquidity, cash flows and financial condition, as well as various legal and regulatory prohibitions and other restrictions on the ability of the Bank to pay dividends, extend credit or otherwise transfer funds to the Company. Our right to participate in any distribution of assets of any of our subsidiaries upon their respective liquidation or reorganization will be subject to the prior claims of the creditors (including any depositors) and preferred equity holders of the applicable subsidiary, except to the extent that we are a creditor, and are recognized as a creditor, of such subsidiary. Accordingly, the holders of the Preferred Stock will be structurally subordinated to all existing and future obligations and preferred equity of our subsidiaries. We currently have no plans to issue any such debt or equity.

| During any dividend period in which the Preferred Stock is outstanding, unless, in each case, the full dividends for the then-current dividend period on all outstanding shares of Preferred Stock have been declared and paid or declared and a sum sufficient for the payment thereof has been set aside: |

| • | no dividend will be declared or paid or set aside for payment and no distribution will be declared or made or set aside for payment on any junior stock, other than: |

| • | a dividend payable solely in junior stock and cash in lieu of fractional shares in connection with such dividend; or |

| • | any dividend in connection with the implementation of a shareholders’ rights plan, or the redemption or repurchase of any rights under any such plan; |

| • | no shares of junior stock shall be repurchased, redeemed or otherwise acquired for consideration by us, directly or indirectly (nor shall any monies be paid to or made available for a sinking fund for the redemption of any such securities by us) other than: |

| • | as a result of a reclassification of junior stock for or into other junior stock; |

| • | the exchange or conversion of one share of junior stock for or into another share of junior stock; |

| • | through the use of the proceeds of a substantially contemporaneous sale of other shares of junior stock; |

9

Table of Contents

| • | purchases, redemptions or other acquisitions of shares of junior stock in connection with any employment contract, benefit plan or other similar arrangement with or for the benefit of employees, officers, directors or consultants; |

| • | purchases of shares of junior stock pursuant to a contractually binding requirement to buy junior stock existing prior to the preceding dividend period, including under a contractually binding stock repurchase plan; or |

| • | the purchase of fractional interests in shares of junior stock pursuant to the conversion or exchange provisions of such stock or the security being converted or exchanged; and |

| • | no shares of parity stock shall be repurchased, redeemed or otherwise acquired for consideration by us otherwise than pursuant to pro rata offers to purchase all, or a pro rata portion, of the Preferred Stock and such parity stock other than: |

| • | as a result of a reclassification of parity stock for or into other parity stock; |

| • | the exchange or conversion of one share of parity stock for or into another share of parity stock; |

| • | through the use of the proceeds of a substantially contemporaneous sale of other shares of parity stock; |

| • | purchases, redemptions or other acquisitions of shares of parity stock in connection with any employment contract, benefit plan or other similar arrangement with or for the benefit of employees, officers, directors or consultants; |

| • | purchases of shares of parity stock pursuant to a contractually binding requirement to buy parity stock existing prior to the preceding dividend period, including under a contractually binding stock repurchase plan; |

| • | the purchase of fractional interests in shares of parity stock pursuant to the conversion or exchange provisions of such stock or the security being converted or exchanged; or |

| • | the redemption of the TARP Preferred Stock as described in “Use of Proceeds.” |

When dividends are not paid in full upon the shares of Preferred Stock and any parity stock, all dividends declared upon shares of Preferred Stock and any parity stock will be declared on a proportional basis so that the amount of dividends declared per share will bear to each other the same ratio that accrued dividends for the then-current dividend period per share on the Preferred Stock, and accrued dividends, including any accumulations, on any parity stock, bear to each other.

10

Table of Contents

| Dividend payment dates |

Dividends on the Preferred Stock will be payable when, as and if declared by our board of directors or a duly authorized committee thereof on the [—] day of [—], [—], [—] and [—] of each year, commencing on [—]. If any date on which dividends would otherwise be paid is not a business day, then the dividend payment date will be the next succeeding business day and no additional dividends will accrue in respect of any payment made on the next succeeding business day. |

| No maturity |

The Preferred Stock will be perpetual and will have no maturity date. |

| Redemption |

We may redeem shares of the Preferred Stock (i) on any dividend payment date on or after [—], in whole or in part, from time to time or (ii) prior to [—], in whole, but not in part, upon the occurrence of a “regulatory capital treatment event,” as described below under “Description of the Preferred Stock—Redemption—Optional Redemption,” in each case at a redemption price equal to $25 per share, plus any declared and unpaid dividends on the shares of Preferred Stock called for redemption. |

| Any redemption of the Preferred Stock is subject to our receipt of any required prior approval by the Federal Reserve Board (including any successor bank regulatory authority that may become our appropriate federal banking agency) and to the satisfaction of any conditions set forth in the capital guidelines or regulations of the Federal Reserve Board or successor bank regulatory authority applicable to a redemption of the Preferred Stock. |

| The holders of the Preferred Stock will not have the right to require a redemption. |

| Ranking |

The Preferred Stock will rank, as to the payment of dividends and distribution of assets upon our liquidation, dissolution or winding-up: |

| • | senior to our common stock and to any other class or series we may issue in the future ranking junior to the Preferred Stock; |

| • | equal to the Fixed Rate Cumulative Perpetual Preferred Stock, Series A (the “Series A Preferred Stock”) and the Fixed Rate Cumulative Perpetual Preferred Stock, Series B (the “Series B Preferred Stock”, and referred to collectively in this prospectus with the Series A Preferred Stock as the “TARP Preferred Stock”), and to any series of preferred stock we may issue in the future ranking equal to the Preferred Stock; and |

| • | junior to any series of preferred stock we may issue in the future ranking senior to the Preferred Stock and to all of our existing and future debt obligations, including the Notes. |

11

Table of Contents

| Liquidation rights |

In the event we liquidate, dissolve or wind-up our business and affairs, either voluntarily or involuntarily, holders of the Preferred Stock will be entitled to receive liquidating distributions of $25 per share, plus any declared and unpaid dividends, before we make any distribution of assets to the holders of our common stock or any other class or series of shares ranking junior to the Preferred Stock, and subject to the rights of the holders of any class or series of securities ranking senior to or on parity with the Preferred Stock upon liquidation and the rights of our depositors and other creditors with respect to the distribution of assets. If we fail to pay in full all amounts payable with respect to the Preferred Stock and any stock having the same rank upon liquidation, dissolution or winding-up as the Preferred Stock, the holders of the Preferred Stock and such other parity stock will share in any distribution of assets in proportion to the full respective liquidating distribution to which they are entitled. After the holders of the Preferred Stock and such other parity stock are paid in full, they will have no right or claim to any of our remaining assets. |

| Neither the sale, conveyance, exchange or transfer (for cash, shares of stock, securities or other consideration) of all or substantially all of our property or business nor a merger or consolidation by us with or into any other entity will be considered a dissolution, liquidation or winding-up of our business or affairs. |

| Voting rights |

Holders of the Preferred Stock will not have voting rights, except with respect to authorizing or increasing senior stock, certain changes in terms of the Preferred Stock, the election of two directors in connection with certain dividend non-payments and as otherwise required by applicable law. |

| Preemptive and conversion rights |

Holders of the Preferred Stock will not have any preemptive or conversion rights. |

| Capital treatment |

The Preferred Stock is expected to qualify as tier 1 capital to the Company. |

| Listing |

Application has been made to list the Preferred Stock on the NYSE MKT under the symbol “VSB PR.” If the application is approved, trading of the Preferred Stock on the NYSE MKT is expected to commence within a 30-day period after the original issuance date of the Preferred Stock. |

| Risk factors |

See “Risk Factors” and other information included or incorporated by reference in this prospectus for a discussion of factors you should consider carefully before making a decision to invest in the Preferred Stock. |

12

Table of Contents

| Tax consequences |

The material U.S. federal income tax consequences of purchasing, owning and disposing of the Preferred Stock are described in “Material U.S. Federal Income Tax Considerations.” You should consult your tax advisor with respect to the U.S. federal income tax consequences of owning the Preferred Stock in light of your own particular situation and with respect to any tax consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. |

| Use of proceeds after expenses |

We expect to receive net proceeds from this offering of approximately $[—], after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

We intend to use the net proceeds of this offering to redeem the outstanding shares of our TARP Preferred Stock for an aggregate price of $42.8 million and to repurchase from the United States Department of Treasury (the “Treasury”) warrants to purchase an aggregate of 1,348,398.2 shares of our common stock which currently have a book value of approximately $1.5 million (the “Treasury Warrants”), and to use any remainder for general corporate purposes.

| Calculation Agent |

VantageSouth Bank |

| Transfer agent, paying agent and registrar |

Registrar and Transfer Company |

13

Table of Contents

Selected Financial Data

The table below sets forth a summary of our historical financial and other information for the periods presented. We derived the financial information as of and for each of the years in the five-year period ended December 31, 2012 from our audited consolidated financial statements incorporated by reference in this prospectus. We derived the financial information as of and for the six-month periods ended June 30, 2013 and 2012 from our unaudited consolidated financial statements incorporated by reference in this prospectus. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results of operations for the unaudited periods have been made. The selected operating data presented below for the six months ended June 30, 2013 are not necessarily indicative of the full year’s operations.

The selected consolidated historical financial information should be read in conjunction with:

| • | Our audited consolidated financial statements as of December 31, 2012 and 2011 and for the years ended December 31, 2012, 2011 and 2010 and our unaudited consolidated financial statements as of June 30, 2013 and for the three- and six-month periods ended June 30, 2013 and 2012 and related notes incorporated by reference in this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Annual Report on Form 10-K for the year ended December 31, 2012 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2013, which are incorporated by reference in this prospectus; and |

| • | The section entitled “Risk Factors” in this prospectus. |

The Company’s financial data was significantly impacted by Piedmont’s acquisitions of Rowan and Crescent Financial in 2011, two common control mergers in 2012, push-down accounting that was applied to Legacy VantageSouth’s financial statements in February 2012, and our merger with ECB in April 2013. Financial data for 2011 and 2012 has been retrospectively adjusted to combine results of operations for all companies from the time they became commonly controlled by Piedmont. Predecessor financial data prior to the periods the companies became under common control reflects historical financial data for Legacy VantageSouth only since it was the first company acquired by Piedmont.

14

Table of Contents

| Successor Company | Predecessor Company | |||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) |

As of and for the Six Months Ended June 30, |

As of and for the period from February 1 to June 30, |

February 1 to December 31, |

January 1 to January 31, |

As of and for the Year Ended December 31, | |||||||||||||||||||||||||||||

| 2013 | 2012 | 2012 | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||

| Summary of Operations |

||||||||||||||||||||||||||||||||||

| Interest income |

$ | 33,930 | $ | 19,884 | $ | 43,519 | $ | 4,206 | $ | 14,334 | $ | 4,319 | $ | 4,945 | $ | 5,025 | ||||||||||||||||||

| Interest expense |

3,558 | 2,975 | 6,170 | 633 | 2,778 | 1,181 | 1,909 | 2,784 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net interest income |

30,372 | 16,909 | 37,349 | 3,573 | 11,556 | 3,138 | 3,036 | 2,241 | ||||||||||||||||||||||||||

| Provision for loan losses |

3,432 | 2,915 | 5,159 | 195 | 880 | 3,172 | 1,792 | 1,050 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net interest income (loss) after the provision for loan losses |

26,940 | 13,994 | 32,190 | 3,378 | 10,676 | (34 | ) | 1,244 | 1,191 | |||||||||||||||||||||||||

| Non-interest income |

16,558 | 3,862 | 11,327 | 657 | 1,716 | (824 | ) | 280 | 364 | |||||||||||||||||||||||||

| Non-interest expense |

43,807 | 17,716 | 43,210 | 3,236 | 11,236 | 3,953 | 3,066 | 2,935 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income (loss) before income taxes |

(309 | ) | 140 | 307 | 799 | 1,156 | (4,811 | ) | (1,542 | ) | (1,380 | ) | ||||||||||||||||||||||

| Income tax expense (benefit) |

(3,203 | ) | (255 | ) | (3,486 | ) | 270 | 188 | — | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income (loss) |

2,894 | 395 | 3,793 | 529 | 968 | (4,811 | ) | (1,542 | ) | (1,380 | ) | |||||||||||||||||||||||

| Dividends and accretion on preferred stock |

1,074 | 611 | 1,346 | 122 | 182 | — | — | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income (loss) attributable to common stockholders |

$ | 1,820 | $ | (216 | ) | $ | 2,447 | $ | 407 | $ | 786 | $ | (4,811 | ) | $ | (1,542 | ) | $ | (1,380 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Per Common Share |

||||||||||||||||||||||||||||||||||

| Net income (loss), basic |

$ | 0.04 | $ | (0.01 | ) | $ | 0.07 | $ | 0.01 | $ | 0.07 | $ | (0.77 | ) | $ | (0.27 | ) | $ | (0.24 | ) | ||||||||||||||

| Net income (loss), diluted |

$ | 0.04 | $ | (0.01 | ) | $ | 0.07 | $ | 0.01 | $ | 0.07 | $ | (0.77 | ) | $ | (0.27 | ) | $ | (0.24 | ) | ||||||||||||||

| Book value |

$ | 4.07 | $ | 4.07 | $ | 4.18 | NA | $ | 4.08 | $ | 0.72 | $ | 1.09 | $ | 1.32 | |||||||||||||||||||

| Tangible book value |

$ | 3.36 | $ | 3.26 | $ | 3.37 | NA | $ | 3.27 | $ | 0.72 | $ | 1.09 | $ | 1.32 | |||||||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||||||||||||||||

| Basic |

40,865,433 | 35,721,316 | 35,724,513 | 35,511,770 | 10,858,223 | 6,241,901 | 5,732,356 | 5,732,356 | ||||||||||||||||||||||||||

| Diluted |

40,883,775 | 35,721,316 | 35,796,731 | 35,534,050 | 10,916,115 | 6,241,901 | 5,732,356 | 5,732,356 | ||||||||||||||||||||||||||

| Common shares outstanding |

46,038,808 | 35,749,689 | 35,754,247 | 35,549,785 | 35,566,535 | 11,831,770 | 5,732,356 | 5,732,356 | ||||||||||||||||||||||||||

| Balance Sheet Data |

||||||||||||||||||||||||||||||||||

| Total assets |

$ | 2,009,420 | $ | 1,067,829 | $ | 1,085,225 | NA | $ | 1,087,621 | $ | 81,140 | $ | 94,766 | $ | 94,997 | |||||||||||||||||||

| Cash and cash equivalents |

87,808 | 70,128 | 50,463 | NA | 46,472 | 2,722 | 10,475 | 2,630 | ||||||||||||||||||||||||||

| Investment securities (1) |

376,736 | 173,887 | 136,491 | NA | 170,004 | 10,454 | 6,731 | 10,483 | ||||||||||||||||||||||||||

| Loans (2) |

1,345,371 | 704,229 | 779,855 | NA | 740,303 | 63,402 | 73,535 | 77,996 | ||||||||||||||||||||||||||

| Allowance for loan losses |

6,425 | 3,043 | 3,998 | NA | 2,131 | 1,880 | 1,964 | 1,174 | ||||||||||||||||||||||||||

| Deposits |

1,654,699 | 866,610 | 873,222 | NA | 886,244 | 63,766 | 78,620 | 77,559 | ||||||||||||||||||||||||||

| Stockholders’ equity |

229,873 | 169,881 | 173,941 | NA | 169,509 | 8,564 | 6,262 | 7,595 | ||||||||||||||||||||||||||

15

Table of Contents

| Successor Company | Predecessor Company | |||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) |

As of and for the Six Months Ended June 30, |

As of and for the period from February 1 to June 30, |

February 1 to December 31, |

January 1 to January 31, |

As of and for the Year Ended December 31, | |||||||||||||||||||||||||||||

| 2013 | 2012 | 2012 | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||

| Selected Performance Ratios |

||||||||||||||||||||||||||||||||||

| Return on average assets |

0.38 | % | 0.09 | % | 0.39 | % | 0.58 | % | 0.32 | % | (5.41 | )% | (1.61 | )% | (1.58 | )% | ||||||||||||||||||

| Return on average stockholders’ equity |

2.84 | % | 0.56 | % | 2.41 | % | 3.67 | % | 2.56 | % | (42.49 | )% | (20.69 | )% | (16.62 | )% | ||||||||||||||||||

| Net interest margin |

4.53 | % | 4.36 | % | 4.40 | % | 4.55 | % | 4.19 | % | 3.78 | % | 3.38 | % | 2.73 | % | ||||||||||||||||||

| Efficiency ratio (3) |

93.35 | % | 85.29 | % | 88.77 | % | 76.50 | % | 84.66 | % | 101.96 | % | 92.46 | % | 112.67 | % | ||||||||||||||||||

| Asset Quality Ratio |

||||||||||||||||||||||||||||||||||

| Net charge-offs to average loans |

0.19 | % | 0.39 | % | 0.37 | % | — | % | 0.31 | % | 4.77 | % | 1.28 | % | 0.65 | % | ||||||||||||||||||

| Allowance for loan losses to loans |

0.49 | % | 0.44 | % | 0.52 | % | NA | 0.29 | % | 2.98 | % | 2.67 | % | 1.50 | % | |||||||||||||||||||

| Nonperforming loans to loans |

1.14 | % | 2.58 | % | 2.44 | % | NA | 5.09 | % | 0.71 | % | 8.46 | % | 2.23 | % | |||||||||||||||||||

| Nonperforming assets to total assets |

1.33 | % | 2.41 | % | 1.71 | % | NA | 3.44 | % | 1.65 | % | 8.07 | % | 3.13 | % | |||||||||||||||||||

| Capital Ratios |

||||||||||||||||||||||||||||||||||

| Tangible common equity to tangible assets |

7.83 | % | 11.21 | % | 11.42 | % | NA | 10.99 | % | 10.55 | % | 6.61 | % | 7.99 | % | |||||||||||||||||||

| Total risk-based capital (Bank) (4) |

11.11 | % | 12.49 | % | 14.96 | % | NA | 11.85 | % | 14.65 | % | 9.18 | % | 10.48 | % | |||||||||||||||||||

| Tier 1 risk-based capital (Bank) (4) |

10.22 | % | 12.02 | % | 13.66 | % | NA | 10.59 | % | 13.38 | % | 7.91 | % | 9.23 | % | |||||||||||||||||||

| Tier 1 leverage (Bank) (4) |

8.26 | % | 9.41 | % | 11.45 | % | NA | 8.49 | % | 10.47 | % | 6.29 | % | 7.31 | % | |||||||||||||||||||

| (1) | Investment securities include available-for-sale and held-to-maturity securities. |

| (2) | Loans include loans held for sale. |

| (3) | Efficiency ratio is non-interest expense divided by the sum of net interest income and non-interest income. |

| (4) | Regulatory capital ratios reflect the Bank’s capital ratios. Predecessor periods reflect regulatory capital ratios of Legacy VantageSouth only, which was the predecessor company due to the change in reporting entity. |

16

Table of Contents

Ratio of Earnings to Combined Fixed Charges and Preferred Stock Dividends

The following table sets forth our ratio of earnings to combined fixed charges and preferred stock dividends for the periods indicated. The ratio of earnings to combined fixed charges and preferred stock dividends is calculated in accordance with SEC requirements and computed by dividing earnings by fixed charges and preferred stock dividends. For purposes of calculating the ratios of earnings to combined fixed charges and preferred stock dividends, earnings consists of income before income taxes plus fixed charges. Fixed charges excluding interest on deposits consist of interest on short-term and long-term debt, interest related to capitalized leases and capitalized interest and one-third of rent expense, which approximates the interest component of that expense. Fixed charges including interest on deposits consist of the foregoing items plus interest on deposits. The preferred stock dividends amount consists solely of the amounts due on our TARP Preferred Stock, and is on a gross basis to represent the pre-tax income equivalent assuming an estimated tax rate of 38.5%.

Historical Ratios:

| Successor Company | Predecessor Company | |||||||||||||||||

| For the six months ended June 30, |

For the period from February 1 to June 30, |

For the period from February 1 to December 31, |

For the period from January 1 to January 31, |

For the year ended December 31, | ||||||||||||||

| 2013 | 2012 | 2012 | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||

| Excluding interest on deposits | (a) | (a) | (a) | 2.65 | 1.76 | (a) | (a) | (a) | ||||||||||

| Including interest on deposits | (a) | (a) | (a) | 1.67 | 1.27 | (a) | (a) | (a) | ||||||||||

| (a) | Ratio is less than one, therefore, earnings are inadequate to cover fixed charges. The dollar amount of the deficiency for the affected periods is presented below. The amount is the same whether including or excluding interest on deposits. |

| Successor Company | Predecessor Company | |||||||||||||||||||||||||||||||||

| For the

six months ended June 30, |

For the period from February 1 to June 30, |

For the period from February 1 to December 31, |

For the period from January 1 to January 31, |

For the year ended December 31, | ||||||||||||||||||||||||||||||

| 2013 | 2012 | 2012 | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||||||||||||||

| Coverage deficiency | $ | (2,057 | ) | $ | (854 | ) | $ | (1,884 | ) | $ | — | $ | — | $ | (4,811 | ) | $ | (1,542 | ) | $ | (1,380 | ) | ||||||||||||

Pro Forma Ratios:

| Six months ended June 30, (1) |

Year ended December 31, | |||

|

|

| |||

| 2013 | 2012 | |||

| Excluding interest on deposits |

[—] | [—] | ||

| Including interest on deposits |

[—] | [—] |

| (1) | Pro forma ratios reflect the issuance of $38.05 million of the Notes and $50 million of the Preferred Stock as well as the redemption of the TARP Preferred Stock and the repurchase of the Treasury Warrants. The Notes have a fixed interest rate of 7.625% per year with annual interest payments totaling $2.9 million. |

17

Table of Contents

An investment in the Preferred Stock involves certain risks. You should carefully consider the risks described below and the risk factors included in our Annual Report on Form 10-K for the year ended December 31, 2012, as well as the other information included or incorporated by reference in this prospectus, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our Preferred Stock could decline due to any of these risks, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus.

Risks Related to Our Business

Our financial information reflects the application of the acquisition method of accounting. Any change in the assumptions used in such methodology could have an adverse effect on our results of operations.

As a result of Piedmont’s and VSB’s bank and bank holding company acquisitions, our financial results are heavily influenced by the application of the acquisition method of accounting. The acquisition method of accounting requires management to make assumptions regarding the assets purchased and liabilities assumed to determine their fair value. In addition, the balances of nonperforming assets were significantly reduced by the adjustments to fair value recorded in conjunction with Piedmont’s and VSB’s acquisitions. If our fair value assumptions are incorrect or the regulatory agencies to whom we report require us to change or modify our assumptions, such change or modification could have a material adverse effect on our financial condition or results of operations or our previously reported results, as well as the value of, and our ability to declare and pay dividends on, the Preferred Stock.

We may experience increased delinquencies and credit losses, which could have a material adverse effect on our capital, financial condition, and results of operations.

Like other lenders, we face the risk that our customers will not repay their loans. A customer’s failure to repay us is usually preceded by missed monthly payments. In some instances, however, a customer may declare bankruptcy prior to missing payments, and, following a borrower filing bankruptcy, a lender’s recovery of the credit extended is often limited. Since many of our loans are secured by collateral, we may attempt to seize the collateral when and if customers default on their loans. However, the value of the collateral may not equal the amount of the unpaid loan, and we may be unsuccessful in recovering the remaining balance from our customers. The resolution of non-performing assets, including the initiation of foreclosure proceedings, requires significant commitments of time from management and our directors, which can be detrimental to the performance of their other responsibilities, and will expose us to additional legal costs and potential delays. Elevated levels of loan delinquencies and bankruptcies in our market area generally and among our customers specifically can be precursors of future charge-offs and may require us to increase our allowance for loan and lease losses (“ALLL”). Higher charge-off rates, delays in the foreclosure process or in obtaining judgments against defaulting borrowers and an increase in our ALLL may hurt our overall financial performance if we are unable to increase revenue to compensate for these losses and may also increase our cost of funds, and could materially adversely affect the value of, and our ability to declare and pay dividends on, the Preferred Stock.

The effects of the economic downturn on the performance of financial institutions in our geographic area, actions taken by our competitors to address the continuing economic downturn, and the public perception of and confidence in the economy generally, and the banking industry specifically, could negatively impact our performance and operations.

All financial institutions are subject to similar risks resulting from a weakened economy, such as increased charge-offs and levels of past due loans and nonperforming assets. As troubled institutions in our market area

18

Table of Contents

continue to recognize and dispose of problem assets, the already substantial inventory of residential homes and lots will increase and may negatively affect home values and increase the time it takes us or our borrowers to sell existing inventory. The perception that troubled banking institutions (and smaller banking institutions that are not “in trouble”) are risky institutions for purposes of regulatory compliance or safeguarding deposits may cause depositors nonetheless to move their funds to larger institutions. If our depositors should move their funds based on events at other financial institutions, our operating results would suffer.

Our loan portfolio mix, which has loans secured by real estate, could result in increased credit risk in a challenging economy.

Our loan portfolio is concentrated in commercial real estate and commercial business loans. These types of loans generally are viewed as having more risk of default than residential real estate loans or certain other types of loans or investments. In fact, the FDIC has issued pronouncements alerting banks of its concern about heavy loan concentrations in certain types of commercial real estate loans, including acquisition, construction and development loans, and also by geographic segment. Because our loan portfolio contains commercial real estate and commercial business loans with relatively large balances, the deterioration of one or a few of these loans may cause a significant increase in our non-performing loans. An increase in non-performing loans could result in a loss of earnings from these loans, an increase in the provision for loan losses, or an increase in loan charge-offs, any of which could have a material adverse impact on our results of operations and financial condition.

The current economic environment and any deterioration or downturn in the economies or real estate values in the markets we serve could have a material adverse effect on both borrowers’ ability to repay their loans and the value of the real property securing such loans. Our ability to recover on defaulted loans would then be diminished, and we would be more likely to suffer losses on defaulted loans. Any of these developments could materially adversely affect our business, financial condition, results of operations and prospects, as well as the value of, and our ability to declare and pay dividends on, the Preferred Stock.

The fair value of our investment securities can fluctuate due to factors outside of our control.

As of June 30, 2013, the fair value of our investment securities portfolio was approximately $377 million. Factors beyond our control can significantly influence the fair value of securities in our portfolio and can cause potential adverse changes to the fair value of these securities. These factors include, but are not limited to, rating agency actions in respect of the securities, defaults by the issuer or with respect to the underlying securities, monetary tapering actions by the Federal Reserve, and changes in market interest rates and continued instability in the capital markets. Any of these factors, among others, could cause other-than-temporary impairments and realized and/or unrealized losses in future periods and declines in other comprehensive income, which could materially and adversely affect our business, results of operations, financial condition and prospects, as well as the value of, and our ability to declare and pay dividends on, the Preferred Stock. The process for determining whether impairment of a security is other-than-temporary usually requires complex, subjective judgments about the future financial performance and liquidity of the issuer and any collateral underlying the security in order to assess the probability of receiving all contractual principal and interest payments on the security.

If our allowance for loan losses is not sufficient to cover actual loan losses, our earnings could decrease.