Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNIVERSITY GENERAL HEALTH SYSTEM, INC. | d606653d8k.htm |

Exhibit 99.1

| INVESTOR PRESENTATION October 2013 1 |

| Forward Looking Statements 2 The information in this presentation includes certain forward-looking statements that are based upon assumptions that in the future may prove not to have been accurate and are subject to significant risks and uncertainties, including statements to the future financial performance of the Company. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it can give no assurance that such expectations or any of its forward-looking statements will prove to be correct. Factors that could cause results to differ include, but are not limited to, successful execution of growth strategies, product development and acceptance, the impact of competitive services and pricing, general economic conditions, and other risks and uncertainties described in the Company's periodic filings with Securities and Exchange Commission. |

| UGHS Business Overview 3 University General Health System, Inc. (UGHS): We are a Regional Healthcare System |

| 4 The Basics of Healthcare |

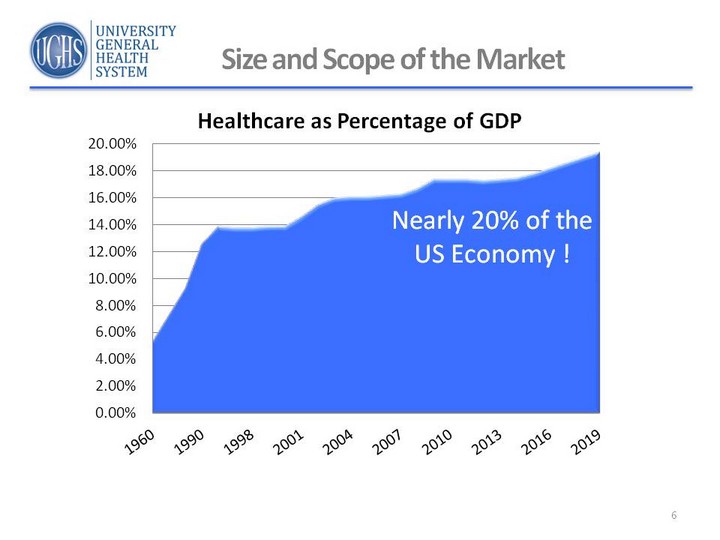

| Healthcare - a Great Opportunity 5 (CHART) Industry - Virtually Recession Resistant U.S. spends more per capita worldwide Fastest growing Segment of Economy (will increase 34.5% by 2020) Very Complex and Regulated Constantly undergoing Reform |

| 6 (CHART) Size and Scope of the Market Healthcare as Percentage of GDP |

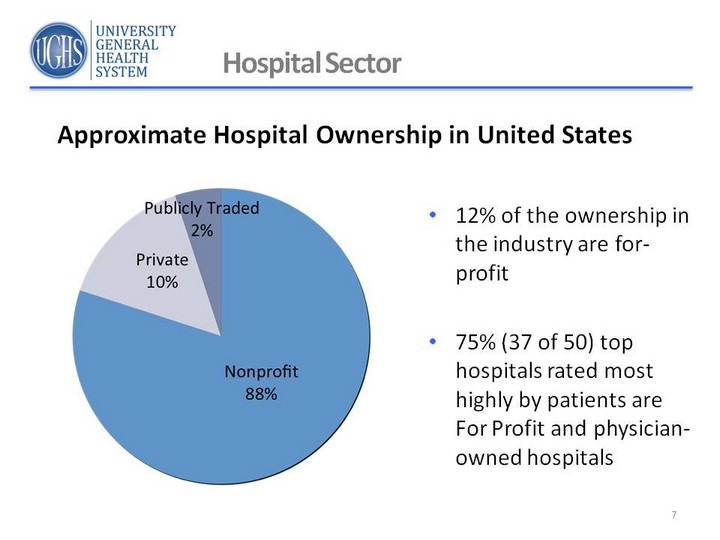

| Hospital Sector 7 12% of the ownership in the industry are for- profit 75% (37 of 50) top hospitals rated most highly by patients are For Profit and physician- owned hospitals Approximate Hospital Ownership in United States |

| Physicians (American Medical Association) Hospitals (American Hospital Association) Third Party Payers (Insurance, Medicare/Medicaid) "All Compete for the Patient and the Payment !" 3 Major Players in Healthcare |

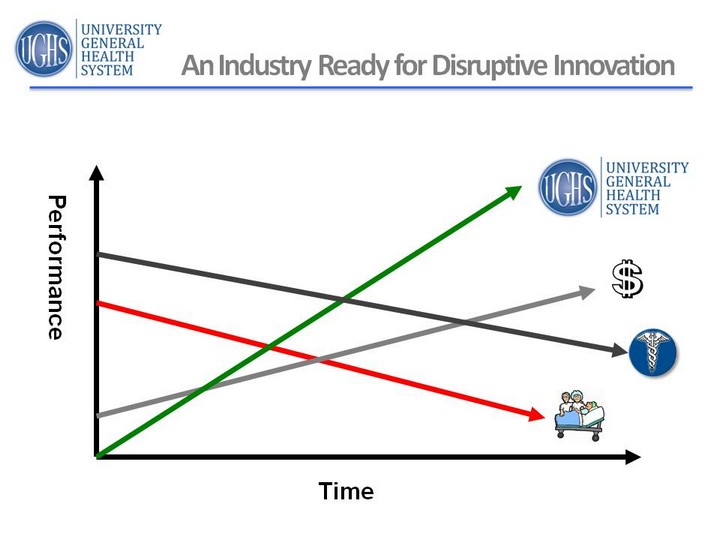

| Time Performance An Industry Ready for Disruptive Innovation |

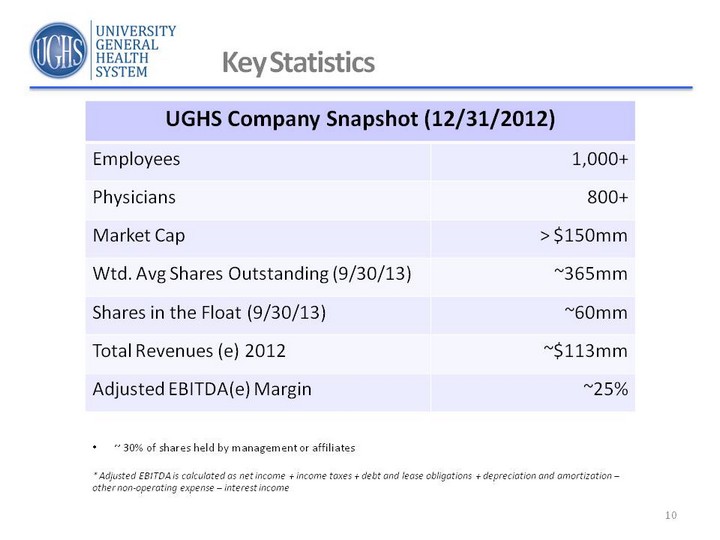

| 10 Key Statistics UGHS Company Snapshot (12/31/2012) UGHS Company Snapshot (12/31/2012) Employees 1,000+ Physicians 800+ Market Cap > $150mm Wtd. Avg Shares Outstanding (9/30/13) ~365mm Shares in the Float (9/30/13) ~60mm Total Revenues (e) 2012 ~$113mm Adjusted EBITDA(e) Margin ~25% ~ 30% of shares held by management or affiliates * Adjusted EBITDA is calculated as net income + income taxes + debt and lease obligations + depreciation and amortization - other non-operating expense - interest income |

| Core Business Philosophy 11 General Acute Care Hospital Size - 50 to 150 Beds Physician-Centric Efficient/Lean Management Lower Capital Cost/Bed Lower Operating Cost/Bed Consistent Higher EBITDA Margins than Industry Higher Occupancy than Competition |

| 12 Execution of the Strategy |

| Experienced Leadership 13 Our senior management team has diverse experience in healthcare management and are leaders with proven success, and over 200 years of experience |

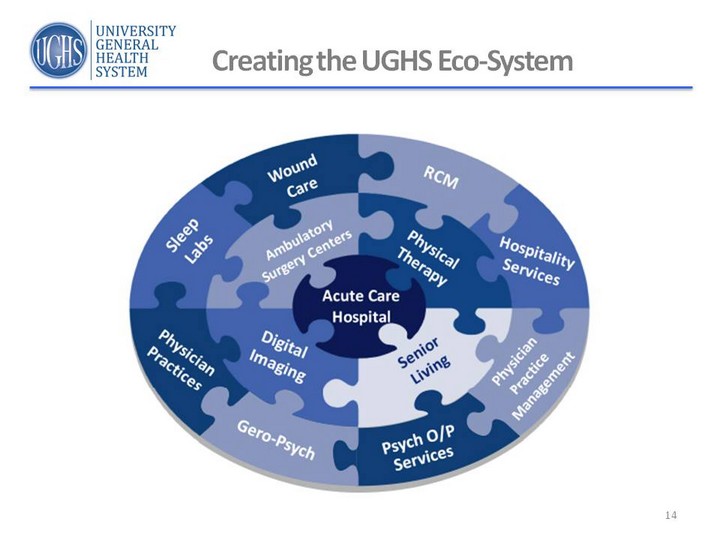

| 14 Creating the UGHS Eco-System |

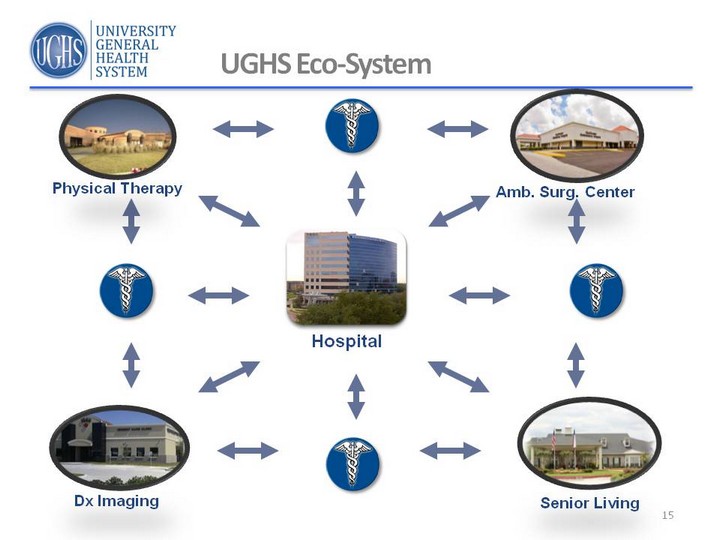

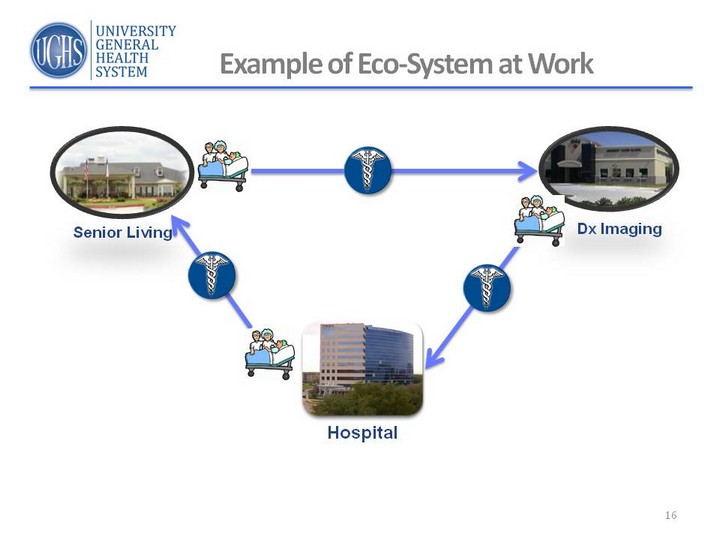

| UGHS Eco-System 15 Hospital Senior Living Dx Imaging Amb. Surg. Center Physical Therapy |

| 16 Senior Living Hospital Dx Imaging Example of Eco-System at Work |

| 17 UGHS Eco-System Outcome Patient has seamless spell of illness - ONE SYSTEM Multiple Physicians Benefit from Care Third Party Payer Reduces Cost of Care Generated Revenue Throughout Treatment |

| 18 Building Shareholder Equity |

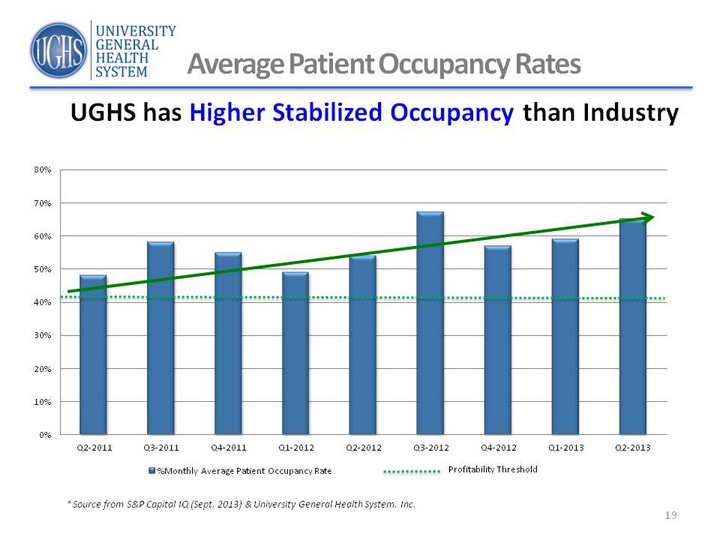

| (CHART) Average Patient Occupancy Rates 19 UGHS has Higher Stabilized Occupancy than Industry Profitability Threshold * Source from S&P Capital IQ (Sept, 2013) & University General Health System, Inc. |

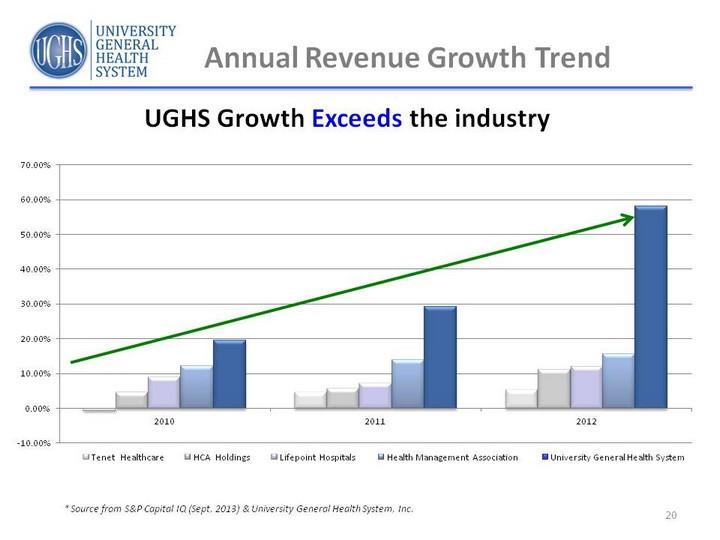

| Annual Revenue Growth Trend 20 (CHART) UGHS Growth Exceeds the industry * Source from S&P Capital IQ (Sept, 2013) & University General Health System, Inc. (CHART) |

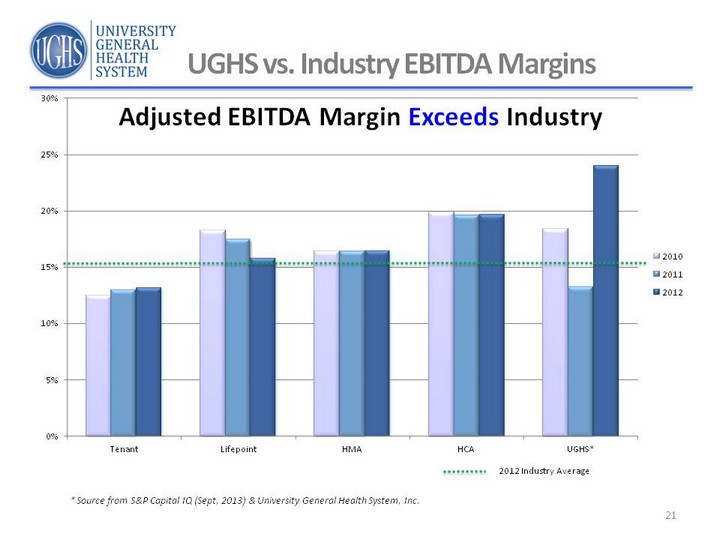

| UGHS vs. Industry EBITDA Margins 21 2012 Industry Average Adjusted EBITDA Margin Exceeds Industry * Source from S&P Capital IQ (Sept, 2013) & University General Health System, Inc. (CHART) |

| 22 Summary |

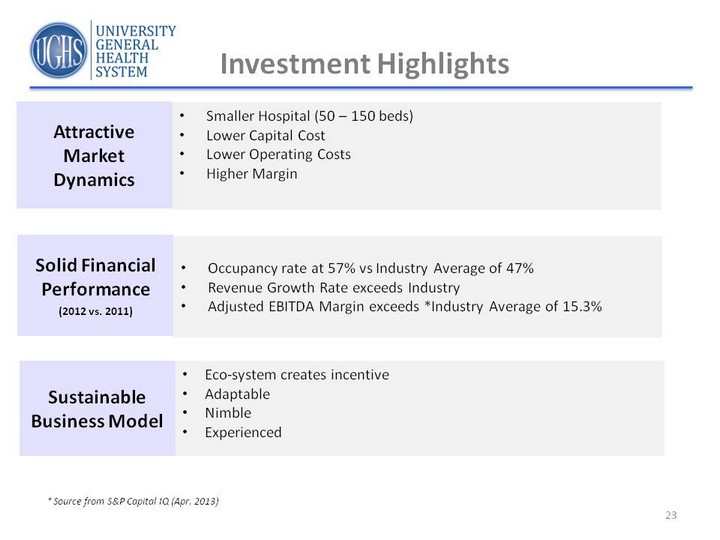

| Investment Highlights 23 Attractive Market Dynamics Smaller Hospital (50 - 150 beds) Lower Capital Cost Lower Operating Costs Higher Margin Solid Financial Performance (2012 vs. 2011) Occupancy rate at 57% vs Industry Average of 47% Revenue Growth Rate exceeds Industry Adjusted EBITDA Margin exceeds *Industry Average of 15.3% Sustainable Business Model Eco-system creates incentive Adaptable Nimble Experienced * Source from S&P Capital IQ (Apr, 2013) |

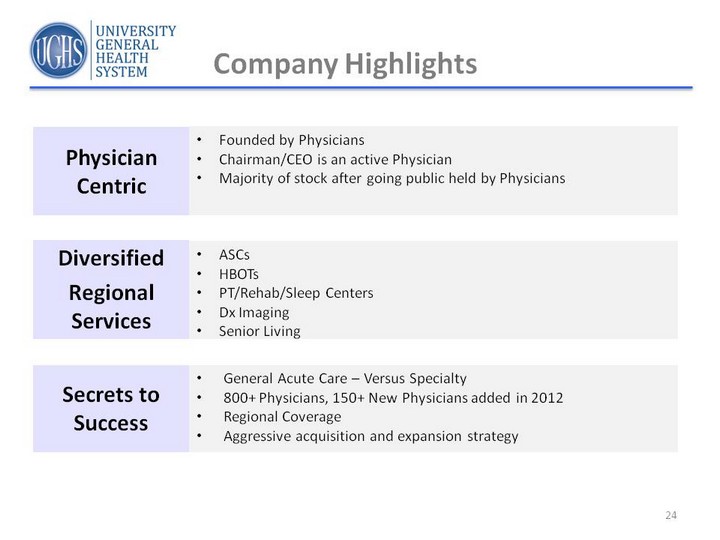

| Company Highlights 24 Physician Centric Founded by Physicians Chairman/CEO is an active Physician Majority of stock after going public held by Physicians Diversified Regional Services ASCs HBOTs PT/Rehab/Sleep Centers Dx Imaging Senior Living Secrets to Success General Acute Care - Versus Specialty 800+ Physicians, 150+ New Physicians added in 2012 Regional Coverage Aggressive acquisition and expansion strategy |

| 25 Discussion |

| Contact Us Donald W. Sapaugh President 713-375-7557 dsapaugh@ughs.net R. Jerry Falkner, CFA RJ Falkner & Company, Inc., Investor Relations (800) 377-9893 info@rjfalkner.com Forward Looking Statements The information in this presentation includes certain forward-looking statements that are based upon assumptions that in the future may prove not to have been accurate and are subject to significant risks and uncertainties, including statements to the future financial performance of the Company. Although the Company believes that the expectations reflected in the forward- looking statements are reasonable, it can give no assurance that such expectations or any of its forward-looking statements will prove to be correct. Factors that could cause results to differ include, but are not limited to, successful execution of growth strategies, product development and acceptance, the impact of competitive services and pricing, general economic conditions, and other risks and uncertainties described in the Company's periodic filings with Securities and Exchange Commission. 26 |