Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RCS Capital Corp | v356374_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - RCS Capital Corp | v356374_ex99-2.htm |

| EX-99.3 - EXHIBIT 99.3 - RCS Capital Corp | v356374_ex99-3.htm |

Exhibit 99.1

1 RCS Capital Investor Presentation October 1, 2013

• Information set forth herein contains “forward - looking statements” (as defined in Section 21E of the Exchange Act), which reflect RCS Capital Corporation’s (“RCAP”) expectations regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the purchase of the Hatteras Funds Group will be consummated, plans for the operations of RCAP and the Hatteras Funds Group post - closing, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to RCAP and the Hatteras Funds Group post - closing, including regarding future dividends and market valuations, and other statements that are not historical facts. • The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the ability to obtain requisite approvals for the purchase of the Hatteras Funds Group , including, among other things, regulatory approval of certain changes in control of the Hatteras Funds Group’s FINRA - regulated broker - dealer businesses; market volatility; unexpected costs or unexpected liabilities that may arise from the purchase of the Hatteras Funds Group , whether or not consummated; the inability to retain key personnel; the deterioration of market conditions; and future regulatory or legislative actions that could adversely affect the parties to the purchase agreement relating to the purchase of the Hatteras Funds Group . Additional factors that may affect future results are contained in RCAP’s filings with the Securities and Exchange Commission (“SEC”), which are available at the SEC’s website at www.sec.gov. RCAP disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise. 2 Cautionary Note Regarding Forward - Looking Statements

American Realty Capital 3 Executive Summary Transaction Overview » RCAP has agreed to acquire 100 % of the assets of the Hatteras g roup of companies (“Hatteras” or “Hatteras Funds Group ”), which act as sponsor, investment adviser to and distributor for the Hatteras Funds, a leading alternative fund complex . » Summary transaction terms : ▪ $ 30 million cash at closing ▪ $ 10 million deferred cash payable over the subsequent 3 years ▪ Earn out payments in 2016 and 2018 based on 1 . 5 x pre - tax net income » Hatteras has a proven record in the development and distribution of liquid alternative funds ▪ $ 2 billion of assets under management at June 30 , 2013 ▪ Six funds with established performance track records » Hatteras would become RCAP’s 5 th primary line of business, complementing the existing direct investment distribution, banking, transaction management services and transfer agent businesses » Hatteras generates recurring fee revenue on assets under management in the Hatteras Funds, adding a new revenue generation element to the RCAP platform » Addition of established liquid alternatives fund company adds significant growth area for RCAP

American Realty Capital 4 » Founded in 2003 , Hatteras Funds Group have been leaders in the development of alternative investment funds for retail investors » Hatteras Funds provide retail investors access to experienced investment managers and styles used by the largest institutions through liquid and qualified funds » Individual Hatteras Funds offerings represent a suite of innovative products designed to help financial advisors allocate to alternatives in a more liquid format than hedge funds and other investment vehicles . Executive Summary Hatteras Overview » Current offerings include : I. Mutual Funds with Daily Liquidity ▪ Alpha Hedged Strategies Fund ▪ Long/Short Equity Fund ▪ Long/Short Debt Fund ▪ Managed Futures Strategies Fund ▪ Hedged Strategies Fund II. Interval Funds (for qualified investors) ▪ Core Alternatives Fund

Projected Growth of Liquid Alternative Funds 5

American Realty Capital 6 Hatteras Alternative Mutual Funds AUM Future mutual fund sales will drive overall AUM growth $ in Millions $670 (6 month annualized)

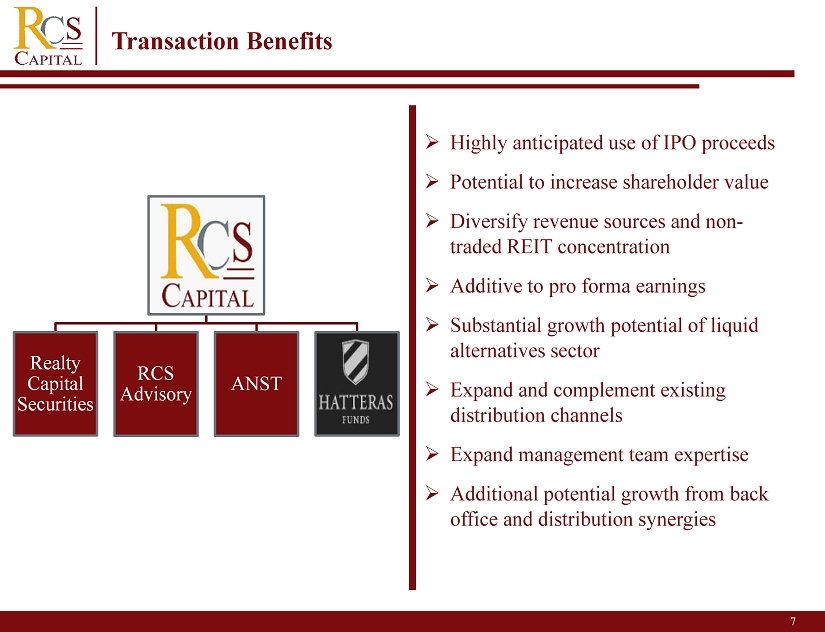

7 Transaction Benefits Realty Capital Securities RCS Advisory ANST » Highly anticipated use of IPO proceeds » Potential to increase shareholder value » Diversify revenue sources and non - traded REIT concentration » Additive to pro forma earnings » Substantial growth potential of liquid alternatives sector » Expand and complement existing distribution channels » Expand management team expertise » Additional potential growth from back office and distribution synergies

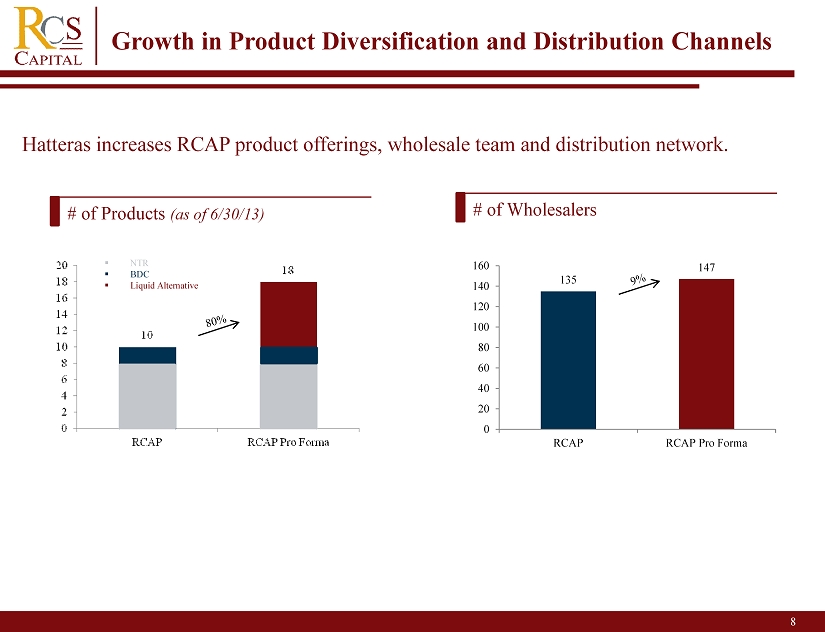

American Realty Capital 8 Growth in Product Diversification and Distribution Channels # of Products (as of 6/30/13) # of Wholesalers 135 147 0 20 40 60 80 100 120 140 160 RCAP RCAP Pro Forma Hatteras increases RCAP product offerings, wholesale team and distribution network. ▪ NTR ▪ BDC ▪ Liquid Alternative

American Realty Capital 9 Hatteras Distribution Partners National Broker Dealers Registered Investment Advisors Regional Broker Dealers Independent Broker Dealers

American Realty Capital 10 Summary of Key Transaction Terms • RCAP to acquire 100% of the assets of Hatteras Funds Group Transaction • The acquisition will be funded using IPO proceeds Capital • Hatteras Funds Group builds on the RCAP alternative investment story, focused on products with lower correlation to the broader market • Common focus on providing retail investors with access to institutional quality investment managers and styles • Significant Growth in the market for liquid alternative investment products since 2008 driven by broader market volatility and cross - market correlation • Combination will provide advisors with a single course for an array of unique alternative investments Synergy Opportunities • David B. Perkins, CEO • Robert L. Worthington, President • J. Michael Fields, COO • R. Lance Baker, CFO • Michael J. Hutten, President of Distribution • Jessica Sherburne, Director of Marketing Management • Subject to customary regulatory approvals and Hatteras Funds shareholder approval Approvals

American Realty Capital R. Lance Baker, CFA, CPA – Chief Financial Officer, Executive Management Team Member » Responsible for all financial and accounting functions of the Hatteras operating entities as well as the Treasurer for the Hatteras registered fund of funds products » Prior Controller and Vice President of Fund Administration and Portfolio Accounting at Smith Breeden Associates and employed at BDO Seidman » Received BS in Business Administration and MA from the Kenan - Flagler Business School at the University of North Carolina » Earned designation as a Chartered Financial Analyst (CFA) and is a licensed Certified Public Accountant (CPA) within the State of No rth Carolina 11 Leadership Team Biographies David B. Perkins, CAIA – Chief Executive Officer, Chairman, Executive Management Team » Member of the investment committees for several Hatteras Funds » Previously Co - Founder and Managing Partner of CapFinancial Partners, LLC » More than two decades of experience in investment management consulting and institutional and private client relations » Received a BA from the University of North Carolina at Charlotte and earned designation as a Chartered Alternatives Investment Analyst (CAIA ) Robert L. Worthington, CFA – President, Executive Management Team Member » Oversees the investment and portfolio management teams of Hatteras Funds » Prior Managing Director at JPMorgan Asset Management; President of Undiscovered Managers, LLC, and Principal and Senior Vice Presid ent of the Burridge Group » Held corporate finance positions at Mellon Bank, Nikko Securities, Bankers Trust, and Westpac Banking for first ten years of career » Received MBA from the University of Pittsburgh and a BA from the University of Wisconsin. Earned designation as a Chartered Financial Analyst (CFA ) J. Michael Fields, CAIA – Chief Operating Officer, Executive Management Team Member » Manages client service, fund accounting, compliance, and integration as well as SEC and Board level communications » Previously employed by an institutional consulting firm and Morgan Stanley » Received MBA from the University of Central Florida and a BA from the University of Florida. Earned designation as a Chartered Alternatives Investment Analyst (CAIA ) Michael J. Hutten – President of Distribution, Executive Management Team Member » Manages sales and distribution initiatives, marketing efforts, and national account relationships » Prior Executive Director for the western U.S. where he focused on business development and client relationships, serving Inve stm ent Consultants, RIAS and Broker/Dealers » Nearly two decades of alternative investment industry experience » Received BA in Business Economics from the University of California Santa Barbara Jessica T. Sherburne – Director of Marketing, Executive Management Team Member » Responsible for creating and managing the firms brand, communications and website » Prior Director of Marketing for First Eagle Funds » Received BS with a double major in Math and Physics from Trinity College » Attended the Eisenbeg School of Management at the University of Massachusetts to earn her Master of Business Administration degree

American Realty Capital 12 Liquidity & Distribution Statistics As of August 31, 2013. Assets Under Management = $2.0 Billion By Fund Type By Distribution Channel RIA 35% Wirehouse 35% Regional BD 20% IBD 5% Other 5% Alternative Mutual Funds is fastest growing product Wirehouses and RIAs account for 70% of distribution Hatteras Core Alternatives Fund (Quarterly) 54% Hatteras Alternative Mutual Funds (Daily) 44% Hatteras Global Private Equity Funds (>1 Year) 2%