Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Natfresh Beverages Corp. | f231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 5

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NATFRESH BEVERAGES CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 2080 | 72-1621978 |

| (State or jurisdiction of incorporation | Primary Standard Industrial | IRS Employer |

2800 Post Oak Boulevard, Suite 4100

Houston, Texas 77056

Telephone: (832) 390-2235 Facsimile: (832) 390-2350

(Address and telephone number of principal executive offices)

Incsmart.biz, Inc.

4421 Edward Avenue

Las Vegas, Nevada 89108

Telephone: (702) 403-8432

(Name, address and telephone number of agent for service)

with a copy to:

Dean Law Corp.

601 Union Street, Suite 4200

Seattle, Washington 98101

Telephone: (206) 274-4598 Facsimile: (206) 493-2777

| Approximate date of proposed sale to the public: | as soon as practicable after the effective date of this Registration Statement. |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company: in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer|__| Accelerated filer |__|

Non-accelerated filer |__| Smaller reporting company | X |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

| TITLE OF EACH |

| PROPOSED | PROPOSED |

|

| Common Stock | 11,947,741 | $0.65 per share | $7,766,031.65 | $1,059.29 |

| Common Stock | 6,200,000 (2) | $0.65 per share | $4,030,000.00 | $549.69 |

| TOTAL | 18,147,741 | $0.65 per share | $11,796,031.65 | $1,608.98 |

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 under the Securities Act.

(2) Being sold in a Direct Public Offering.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| 2 |

SUBJECT TO COMPLETION, Dated September____, 2013

NATFRESH BEVERAGES CORP.

18,147,741 SHARES

COMMON STOCK

The selling shareholders named in this prospectus are offering 11,947,741 shares of common stock at a price of $0.65 per share for net proceeds of $7,766,032, and we are offering 6,200,000 shares of common stock at a price of $0.65 per share for net proceeds of $3,165,000. The 6,200,000 shares are being offered on our own account by a self-underwritten, best-efforts offering, through this prospectus for a period of one hundred and eighty (180) days from the effective date of this prospectus, unless extended by our board of directors for an additional 90 days. Our sole officer and director Mr. Oliver Lin will sell our shares and intends to rely on Section 201(c) of the JOBS Act to conduct the offering. There is no guarantee that we will receive any proceeds from the direct public offering.

We are an emerging growth company. Our common stock is presently not traded on any market or securities exchange.

----------------

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. See section entitled "Risk Factors" on pages 7 to 10 of this prospectus.

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and have elected to comply with certain reduced public company reporting requirements for future filings. Investing in our common stock involves a high degree of risk and should only be purchased by those who can afford to lose their entire investment.

The selling shareholders will sell our shares at a fixed price of $0.65. The offering price has been arbitrarily determined by us and does not necessarily bear any relationship to assets, earnings, book value or any other objective criteria of value.

There is no assurance of when, if ever, our stock will be listed on an exchange. We are offering up to 6,200,000 shares of our common stock in a direct public offering, on a self-underwritten, best efforts basis, which means that our officer and director will attempt to sell the shares, without any involvement of underwriters or broker-dealers. This prospectus will permit our sole officer and director to sell the shares directly to the public, with no commission or other remuneration payable to them for any shares that they may sell. Our sole officer and director will rely on Section 201(c) of the JOBS Act to conduct the offering. For more information, see the section of this prospectus entitled "Plan of Distribution”. The shares will be offered at a fixed price of $0.65 per share for a period of one hundred and eighty (180) days from the effective date of this prospectus, unless extended by our board of directors for an additional 90 days.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

----------------

The Date of This Prospectus Is: September ___, 2013

| 3 |

|

| PAGE |

| Summary | 5 |

| Risk Factors | 7 |

| Forward-Looking Statements | 11 |

| Use of Proceeds | 11 |

| Determination of Offering Price | 12 |

| Dilution | 12 |

| Selling Shareholders | 14 |

| Plan of Distribution | 15 |

| Description of Securities | 17 |

| Interest of Named Experts and Counsel | 18 |

| Description of Business | 18 |

| Legal Proceedings | 37 |

| Market for Common Equity and Related Stockholder Matters | 37 |

| Plan of Operations | 38 |

| Changes in and Disagreements with Accountants | 40 |

| Available Information | 40 |

| Directors, Executive Officers, Promoters and Control Persons | 40 |

| Executive Compensation | 41 |

| Security Ownership of Certain Beneficial Owners and Management | 42 |

| Certain Relationships and Related Transactions | 42 |

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities | 42 |

| Financial Statements | 43 |

| 4 |

Summary

Prospective investors are urged to read this prospectus in its entirety.

We are a development stage company. From inception to August 31, 2012, we have not yet earned revenues from the sale of our products. We have minimal assets, and have incurred losses since inception.

We are a start-up company and our main focus will be to import, distribute and export of bottled pure natural artesian water and importation of natural spring water for manufacturing. In addition, through our wholly owned subsidiary company in Singapore, NATfresh Productions (S) Pte Ltd (“NPSPL”), we intend to import and distribute drinking water and beverages as well as to set up a factory to process and bottle natural spring water. We intend to use natural spring water for the production of drinking water, instant tea as well as microbrewery operations for the production of both shandy and lager beer. We intend to market, promote, and distribute our goods in the Republic of Singapore and for export to neighboring country, Malaysia. We own the following brands and trademarks in Singapore: NATfresh![]() , Tani Premium, Tani Magic and TaniNZ Premium.

, Tani Premium, Tani Magic and TaniNZ Premium.

We have not yet earned revenues, we have achieved significant losses since inception, and we have had only limited operations and have been issued a going concern opinion by our auditors.

As of May 29, 2013, we have total cash on hand of $1,132,883 in our bank accounts. We may need to raise additional funds through public or private debt or sale of equity to achieve our current business strategy. The financing we need may not be available when required. Although financing maybe available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences or other terms. Our inability to obtain financing will inhibit to implement our development strategy, which could require us to diminish or suspend our operations and possibly cease our operations.

We were incorporated on June 18, 2012 under the laws of the state of Nevada. Our principal office is located at 2800 Post Oak Boulevard, Suite 4100, Houston, Texas 77056. Our telephone number is (832) 390-2235 and our fax number is (832) 390-2350.

| 5 |

The Offering: Securities Being Offered Up to 18,147,741 shares of common stock. Offering Price Terms of the Offering The selling shareholders will determine when and how they will sell the common stock offered in this prospectus. In addition, we are offering up to 6,200,000 shares of our common stock in a direct public offering, on a self-underwritten, best efforts basis, which means that our officer and director will attempt to sell the shares, without any involvement of underwriters or broker-dealers. Termination of the Offering The offering will conclude when all of the 18,147,741 shares of common stock that are being offered by us in the direct public offering and the selling shareholders have been sold, or we decide at any time to terminate the registration of the shares at our sole discretion. In any event, both the direct and selling shareholder offering shall be terminated no later than one hundred and eighty (180) days from the effective date of this prospectus, unless extended by our board of directors for an additional 90 days. Securities Issued And to be Issued 1,156,460,641 shares of our common stock are issued and outstanding as of the date of this prospectus. 11,947,741 shares of common stock to be sold under this prospectus will be Use of Proceeds We will not receive any proceeds from the sale of the common stock by the selling shareholders. However, we will receive proceeds from the shares of our common stock that we sell pursuant to our Direct Public Offering. See “Use of Proceeds.” Market for the common stock

We, through the direct public offering and the selling shareholders will sell our shares at a fixed price $0.65 per share throughout the duration of our continuous offering. The offering price has been arbitrarily determined by us and does not necessarily bear any relationship to assets, earnings, book value or any other objective criteria of value. We determined the offering price by considering, among other factors, a business valuation that was conducted by our management. There is no assurance of when, if ever, our stock will be listed on the OTCBB or another exchange.

sold by existing shareholders. In addition, we are offering up to 6,200,000 in a direct public offering. There has been no market for our securities. Our common stock is not traded on any exchange

or on the Over-the-Counter market. After the effective date of the registration statement

relating to this prospectus, we hope to have a market maker file an application with FINRA for

our common stock to become eligible for quotation on the Over-the-Counter Bulletin Board.

We do not yet have a market maker who has agreed to file such application. There is no

assurance that a trading market will develop or, if developed, that it will be sustained.

Consequently, a purchaser of our common stock may find it difficult to resell the securities

offered herein should the purchaser desire to do so.

| 6 |

Summary Financial Information (unaudited)

The following financial information summarizes the more complete historical financial information at the end of this prospectus.

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

Our business plan calls for ongoing expenses in connection with the importation and distribution of our natural spring water. We have not yet generated revenues from our inception to May 31, 2013.

While at May 31, 2013, we had cash on hand of $1,115,323 and accumulated $1,338,752 in general and administrative expenses for the nine months ended May 31, 2013. Our current monthly burn rate is $148,440. At this rate we will be able to sustain operations for approximately 7 months and we anticipate that additional funding will be needed for general administrative expenses and marketing costs. In addition, we require approximately $4,000,000 over the next 12 months to begin our operations.

In order to expand our business operations, we anticipate that we will have to raise additional funding. If we are not able to raise the capital necessary to fund our business expansion objectives, we may have to delay the implementation of our business plan.

We do not currently have any arrangements for financing. Obtaining additional funding will be subject to a number of factors, including general market conditions, investor acceptance of our business plan and initial results from our business operations. These factors may impact the timing, amount, terms or conditions of additional financing available to us. The most likely source of future funds available to us is through the sale of additional shares of common stock or advances from our sole director.

7

BECAUSE OUR AUDITORS HAVE ISSUED A GOING CONCERN OPINION, THERE IS SUBSTANTIAL UNCERTAINTY THAT WE WILL CONTINUE OPERATIONS IN WHICH CASE YOU

COULD LOSE YOUR INVESTMENT.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from

the uncertainty about our ability to continue in business. As such we may have to cease operations and you could lose your investment.

THERE IS NO MINIMUM OFFERING AND THEREFORE YOUR INVESTMENT MAY BE USED EVEN THOUGH SUCH INVESTMENT WILL NOT SATISFY OUR CAPITAL REQUIREMENTS

TO COMPLETE ANY PROJECT.

Our director has not specified a minimum offering amount and there in no escrow account in operation. Because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill our objectives or proceed with our operations due to a lack of interest in this offering. If this were to occur, we might be forced to curtail or abandon our operations with a loss to investors who purchase stock under this Prospectus. There is no guarantee that we will receive any proceeds from the direct offering. The selling shareholders are also offering shares of our common stock, which may make it difficult for us to raise proceeds from our direct offering.

If Yi Lung Lin, our sole officer and director, should resign or die, we will not have a chief executive officer. thIS could result in our operations suspending, AND you

could lose your investment.

We depend on the services of our sole officer and director, Yi Lung Lin, for the future success of our business. The loss of the services of Mr. Lin could have an adverse effect on our business, financial condition and results of operations. If he should resign or die we will not have a chief executive officer. If that should occur, until we find another person to act as our chief executive officer, our operations could be suspended. In that event it is possible you could lose your entire investment. We do not carry any key personnel life insurance policies on Mr. Lin and we do not have a contract for his services.

WE MAY HAVE DIFFICULTY ATTRACTING AND RETAINING SKILLED PERSONNEL. OUR FAILURE TO DO SO COULD CAUSE US TO GO OUT OF BUSINESS.

Our future success will depend in large part on our ability to attract and retain highly skilled management, sales, marketing, and finance and product development personnel. Competition for such personnel is intense, and there can be no assurance that we will be successful in attracting or retaining such personnel. Failure to attract and retain such personnel could have a material adverse effect on our operations and financial condition or cause us to go out of business.

WE WILL NEED SIGNIFICANT CAPITAL REQUIREMENTS TO CARRY OUT OUR BUSINESS PLAN, AND WE WILL NOT BE ABLE TO FURTHER IMPLEMENT OUR BUSINESS STRATEGY UNLESS SUFFICIENT FUNDS ARE RAISED, WHICH COULD CAUSE US TO DISCONTINUE OUR OPERATIONS.

We will require significant expenditures of capital in order to acquire and develop our planned operations. We plan to obtain the necessary funds through private equity offerings. We may not be able to raise sufficient amounts from our planned sources. In addition, if we drastically underestimate the total amount needed to fully implement our business plan, our ability to continue our business will be adversely affected.

Our ability to obtain additional financing is subject to a number of factors, including market conditions, investor acceptance of our business plan, and investor sentiment. These factors may make the timing, amount, terms and conditions of additional financing unattractive or unavailable to us. If we are unable to raise additional financing, we will have to significantly reduce our spending, delay or cancel planned activities or substantially change our current corporate structure. In such an event, we intend to implement expense reduction plans in a timely manner. However, these actions would have material adverse effects on our business, revenues, operating results and prospects, resulting in a possible failure of our business.

WE MAY BE SUSCEPTIBLE TO AN ADVERSE EFFECT ON OUR BUSINESS DUE TO THE CURRENT WORLDWIDE ECONOMIC CRISIS.

Our market and sales results could be greatly impacted by the current worldwide economic crisis, making it difficult to reach sales goals and thus generate significant revenue.

WE HAVE NO EXPERIENCE AS A PUBLIC COMPANY. OUR INABILITY TO SUCCESSFULLY OPERATE AS A PUBLIC COMPANY COULD CAUSE YOU TO LOSE YOUR ENTIRE INVESTMENT.

We have never operated as a public company. We have no experience in complying with the various rules and regulations, which are required of a public company. As a result, we may not be able to operate successfully as a public company, even if our operations are successful. We plan to comply with all of the various rules and regulations, which are required of a public company. However, if we cannot operate successfully as a public company, your investment may be materially adversely affected. Our inability to operate as a public company could be the basis of your losing your entire investment.

8

WE WILL INCUR INCREASED COSTS AS A RESULT OF BEING A PUBLIC COMPANY.

Upon completion of this offering, we will become a public company and expect to incur significant legal, accounting and other expenses that we did not incur as a private company. Moreover, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the Securities and Exchange Commission and the NASDAQ Stock Market, has imposed additional requirements on corporate governance practices of public companies. We expect these new rules and regulations to increase our legal and financial compliance costs and to make some corporate activities more time-consuming and costly, which may have a materially adverse impact on our business.

THE RECENTLY ENACTED JOBS ACT WILL ALLOW US TO POSTPONE THE DATE BY WHICH WE MUST COMPLY WITH SOME OF THE LAWS AND REGULATIONS INTENDED TO PROTECT INVESTORS AND TO REDUCE THE AMOUNT OF INFORMATION WE PROVIDE IN OUR REPORTS FILED WITH THE SEC, WHICH COULD UNDERMINE INVESTOR CONFIDENCE IN OUR COMPANY AND ADVERSELY AFFECT THE MARKET PRICE OF OUR COMMON STOCK.

For so long as we remain an “emerging growth company” as defined in the JOBS Act, we may take advantage of certain exemptions from various requirements that are applicable to public companies that are not “emerging growth companies” including:

- the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that our independent registered public accounting firm provide an attestation report on the effectiveness of our internal control over financial reporting;

- the “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Act and some of the disclosure requirements of the Dodd-Frank Act relating to compensation of its chief executive officer;

- the requirement to provide detailed compensation discussion and analysis in proxy statements and reports filed under the Securities Exchange Act of 1934, and instead provide a reduced level of disclosure concerning executive compensation; and

- any rules that may be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

We may take advantage of these exemptions until we are no longer an “emerging growth company.” We would cease to be an “emerging growth company” upon the earliest of: (i) the first fiscal year following the fifth anniversary of this offering; (ii) the first fiscal year after our annual gross revenues are $1 billion or more; (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities; or (iv) as of the end of any fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year.

Although we are still evaluating the JOBS Act, we currently intend to take advantage of some, but not all, of the reduced regulatory and reporting requirements that will be available to us so long as we qualify as an “emerging growth company.” For example, we have irrevocably elected not to take advantage of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act. Our independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of our internal control over financial reporting so long as we qualify as an “emerging growth company,” which may increase the risk that weaknesses or deficiencies in our internal control over financial reporting go undetected. Likewise, so long as we qualify as an “emerging growth company,” we may elect not to provide you with certain information, including certain financial information and certain information regarding compensation of our executive officers, that we would otherwise have been required to provide in filings we make with the SEC, which may make it more difficult for investors and securities analysts to evaluate our company. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock, and our stock price may be more volatile and may decline.

U.S. INVESTORS MAY EXPERIENCE DIFFICULTIES IN ATTEMPTING TO EFFECT SERVICE OF PROCESS AND TO ENFORCE JUDGMENTS BASED UPON U.S. FEDERAL SECURITIES LAWS AGAINST THE COMPANY AND ITS SOLE NON-U.S. RESIDENT OFFICER AND DIRECTOR AND A U.S. OR FOREIGN PLAINTIFF MAY LACK STANDING OR OTHERWISE BE UNABLE TO BRING A LAWSUIT IN A SINGAPOREAN OR CHINESE COURT, INCLUDING A CASE WHICH IS PREDICATED UPON U.S. SECURITIES LAWS.

Our sole officer and director is not a resident of the United States. Consequently, it may be difficult for investors to effect service of process on Mr. Lin in the United States and to enforce judgments obtained in United States courts against Mr. Lin based on the civil liability provisions of the United States securities laws. Since all our assets are located in Singapore it may be difficult or impossible for U.S. investors to collect a judgment against us. As well, any judgment obtained in the United States against us may not be enforceable in the United States.

In addition, a U.S. or foreign plaintiff may lack standing or otherwise be unable to bring a lawsuit in a Singaporean court, including a case which is predicated upon U.S. securities laws.

OUR SOLE OFFICER AND DIRECTOR HAS OTHER BUSINESS INTERESTS WHICH MAY LIMIT THE AMOUNT OF TIME THEY CAN DEVOTE TO OUR COMPANY AND POTENTIALLY CREATE CONFLICTS OF INTEREST.

Our director has other business interests in that Mr. Lin Yi Lung is also the Managing Director of Access Finance and Securities (NZ) Limited and Access Management Consulting and Marketing Pte Ltd and Chief Executive Officer for Access Equity Capital Management Corp. Access Equity Capital Management Corp is considered an underwriter of this offering. This means that Mr. Lin is unable to work full time for our company and that potential conflicts of interests may arise when Mr. Lin is presented certain business opportunities. These conflicts might eventually lead to business failure. Mr. Lin plans to devote 30 hours a week to our business and to our affairs which may lead to periodic interruptions of business operations if he is unable to devote the amount of time required to our business because of his other business interests. Unforeseen events may cause this amount of time to become even less.

OUR SOLE OFFICER MR. LIN IS IN THE BUSINESS OF PROVIDING CERTAIN CONSULTING AND FINANCIAL SERVICES TO COMPANIES THAT SEEK TO ACCESS THE CAPITAL MARKETS IN THE UNITED STATES AND THIS COULD CREATE POTENTIAL CONFLICTS OF INTERESTS.

Our sole officer Mr. Lin is in the business of providing certain consulting and financial services to companies that seek to access the capital markets in the United States and this could create potential conflicts of interests if he devotes his time helping other companies, rather than furthering our needs.

Mr. Lin provides consulting and financial services through the following entities: Access Management Consulting and Marketing Pte Ltd. and Access Finance and Securities (NZ) Limited.

On July 2, 2012, we entered into an Agreement with Access Finance and Securities (NZ) Limited (the “Advisor”) to provide Manager Consulting Service. In consideration of these services provided by the Advisor, we have agreed to pay a total fee of US$300,000, to be payable in cash of US$250,000 and the balance US$50,000 by way of issuance of our common shares at a price of $0.001 per share.

On July 2, 2012, we entered into an Agreement with Access Management Consulting and Marketing Pte Ltd (the “Consultant”) to provide Prospectus Service. In consideration of these services provided by the Consultant, we have agreed to pay a total fee of US$800,000, to be payable in cash of US$650,000 and the balance US$150,000 by way of issuance of our common shares at a price of $0.001 per share.

OUR SOLE OFFICER AND DIRECTOR MR. LIN AND THE AFS ENTITIES PROVIDE CONSULTING AND FINANCIAL SERVICES TO GENUFOOD ENERGY ENZYMES CORP. (“GENUFOOD”) AND AND MR. LIN IS THE CEO OF GENUFOOD AND IN SEPTEMBER 2012 WE PURCHASED $500,000 IN COMMON STOCK OF GENUFOOD AND THAT GENUFOOD’S ONLY REVENUE TO DATE IS FROM A RELATED PARTY. Our sole officer and director Mr. Lin and the AFS entities provide consulting and financial services to Genufood Energy Enzymes Corp. (“Genufood”) and Mr. Lin is the CEO of Genufood and in September 2012 we purchased $500,000 in common stock of Genufood and that Genufood's only revenue to date is from a related party. This could be viewed as a potential conflict of interest.

The objective purchasing $500,000 of common stock in Genufood is for an investment. The strategy is to seek short term profits through market share price appreciation. This was considered since the $500,000 is unused and free from commitment since we have not commenced full scale operations.

WE ONLY HAVE ONE OFFICER WHO IS ALSO OUR ONLY DIRECTOR WHICH MAY LEAD TO FAULTY CORPORATE GOVERNANCE.

We have only one director who is also our sole executive officer who makes all the decisions regarding corporate governance. This includes their (executive) compensation, accounting overview, related party transactions and so on. They will also have full control over matters that require Board of Directors approval. This may introduce conflicts of interest and prevent the segregation of executive duties from those that require Board of Directors’ approval. This may lead to ineffective disclosure and accounting controls. Non-compliance with laws and regulations may result in fines and penalties. They would have the ability to take any action as they review and approve them. They would exercise control over all matters requiring shareholder approval including significant corporate transactions. We have not implemented various corporate governance measures nor have we adopted any independent committees as we presently do not have any independent directors.

RISKS RELATED TO OUR INDUSTRY

CURRENCY EXCHANGE RATE FLUCTUATIONS MAY INCREASE OUR COSTS.

The exchange rates between the U.S. dollar and non-U.S. currencies in which we conduct our business have and will likely fluctuate in the future. Any appreciation in the value of these non-U.S. currencies would result in higher expenses for our company. We do not have any hedging arrangements to protect against such exchange rate exposures. We plan to operate our business in U.S. and Singapore dollars.

IMPORT/EXPORT REGULATIONS AND TARIFFS MAY CHANGE AND INCREASE OUR COSTS.

We are subject to risks associated with the regulations relating to the export of products. We cannot predict whether the export of our products will be adversely affected by changes in, or enactment of new quotas, duties, taxes or other charges or restrictions imposed by the Asian countries in the future. Any of these factors could have a material adverse effect on our operating costs.

9

RISKS RELATED TO OUR OFFERING

Our shares of common stock are subject to the “penny stock" rules of the Securities and Exchange Commission and the trading market in our securities will be limited, which will make transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in "penny stocks." Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which specifies information about penny stocks and the nature and significance of risks of the penny stock market. A broker-dealer must also provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer, and sales person in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for stock that becomes subject to those penny stock rules. If a trading market for our common stock develops, our common stock will probably become subject to the penny stock rules, and shareholders may have difficulty in selling their shares.

There is no current trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to have a market maker apply for admission to provide quotation of our securities on the Over-the-Counter Bulletin Board after the Registration Statement relating to this prospectus is declared effective by the SEC. We do not yet have a market maker who has agreed to file such application. If for any reason our common stock is not quoted on the Over-the-Counter Bulletin Board or a public trading market does not otherwise develop, purchasers of the share may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and none may do so.

ANY ADDITIONAL FUNDING WE ARRANGE THROUGH THE SALE OF OUR COMMON STOCK WILL RESULT IN DILUTION TO EXISTING SHAREHOLDERS.

We must raise additional capital in order for our business plan to succeed. Most likely our source of additional capital will be through the sale of additional shares of common stock. Such stock issuances will cause stockholders' interests in our company to be diluted. Such dilution will negatively affect the value of investors’ shares.

YOUR PERCENTAGE OWNERSHIP IN US MAY BE DILUTED BY FUTURE ISSUANCES OF CAPITAL STOCK, WHICH COULD REDUCE YOUR INFLUENCE OVER MATTERS ON WHICH STOCKHOLDERS VOTE.

Our Board of Directors has the authority, without action or vote of our stockholders, to issue all or any part of our authorized but unissued shares of common stock, including shares issuable upon the exercise of options or shares that may be issued to satisfy our payment obligations. Issuances of additional common stock would reduce your influence over matters on which our stockholders vote. Kuei Hua Tsai has interest, control and voting rights in Toprise International Investment Limited and with her 49% equity interests our company, she has the ability to exert significant influence over our decisions.

WE DO NOT EXPECT TO PAY DIVIDENDS IN THE FORESEEABLE FUTURE WHICH MAY MAKE IT MORE DIFFICULT FOR YOU TO EARN A RETURN ON YOUR INVESTMENT WITH US.

We have never paid any dividends on our common stock. We do not expect to pay cash dividends on our common stock at any time in the foreseeable future. The future payment of dividends directly depends upon our future earnings, capital requirements, financial requirements and other factors that our board of directors will consider. Since we do not anticipate paying cash dividends on our common stock, return on your investment, if any, will depend solely on an increase, if any, in the market value of our common stock. Therefore, you may have difficulty earning a return on your investment with us.

| 10 |

Forward-Looking Statements

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in the “Risk Factors” section and elsewhere in this prospectus.

Use of Proceeds

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders. However, we may be receiving funds from our direct public offering. We are offering up to 6,200,000 shares in a direct public offering, without the involvement of underwriters or broker-dealers. Our sole officer and director Mr. Oliver Lin will sell our shares and intends to rely on Section 201(c) of the JOBS Act to conduct the offering.

We intend to use our net proceeds from the Offering for the following purposes:

· between $0 and $1,654,329 for the purchase of manufacturing equipment, facilities and office equipment; and

· between $142,500 and $1,510,671 for working capital.

The foregoing represents our best estimate of our allocation of the net proceeds from the Offering based on our current plans and estimates regarding our anticipated expenditures. Actual expenditures may vary from these estimates, and we may find it necessary or advisable to re-allocate our net proceeds within the categories described above or to use portions of our net proceeds for other purposes.

Pending the use of our net proceeds in the manner described above, we may also use our net proceeds for our working capital, place the funds in fixed deposits with banks and financial institutions or use the funds to invest in short-term money market instruments, as our Director may deem appropriate in their absolute discretion.

We estimate that the expenses of the Offering and the application for listing, including the underwriting fees and selling commission, and all other incidental expenses relating to the Offering, will amount to approximately $865,000.

Our direct public offering is being made on a self-underwritten basis - with no minimum and a maximum of $4,030,000. The table below sets forth the use of proceeds if 25%, 50%, 75% or 100% is sold.

|

| 25% | 50% | 75% | 100% |

| Gross Proceeds | $1,007,500 | $2,015,000 | $3,022,500 | $4,030,000 |

| Offering Expenses | $865,000 | $865,000 | $865,000 | $865,000 |

| Net Proceeds | $142,500 | $1,150,000 | $2,157,500 | $3,165,000 |

The proceeds will be used in the order of priority when the securities offered are sold:

|

| 25% | 50% | 75% | 100% |

| Working Capital | $142,500 | $325,000 | $503,171 | $1,510,671 |

| Purchase of manufacturing equipment, facilities and office equipment | $- | $825,000 | $1,654,329 | $1,654,329 |

| Total | $142,500 | $1,150,000 | $2,157,500 | $3,165,000 |

The securities offering and the use of the proceeds shown above are for illustrative purposes only.

| 11 |

Determination of Offering Price

The selling shareholders will sell our shares at fixed price of $0.65 per throughout the duration of our continuous offering. We intend to apply for quotation on the OTCBB, but there is no assurance of when, if ever, our stock will be listed on the OTCBB or another exchange.

We will be selling the shares in our direct public offering at $0.65 per share. There is no established public market for the securities being registered. As a result, the offering price and other terms and conditions relative to our shares have been arbitrarily determined by us and do not necessarily bear any relationship to assets, earnings, book value or any other objective criteria of value. In addition, no investment banker, appraiser or other independent, third party has been consulted concerning the offering price for the shares or the fairness of the price used for the shares. Accordingly, the offering price should not be considered an indication of the actual value of our securities.

In determining the initial public offering price of the shares we considered several factors including the following:

· the risks we face as a business;

· prevailing market conditions, including the history and prospects for the industry in which we compete;

· our future prospects; and

· our capital structure.

The above is an exhaustive list of factors we used to determine our initial public offering price. Taking into consideration a review of the above factors, our management was of the view that $0.65 per share is a fair valuation of our initial public offering price due to our capital structure, strong financial position, our advanced development of our products as well as our unique position within our industries.

Dilution

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders.

The calculations below are based upon 1,156,460,641common shares issued and outstanding and a net tangible book value of $1,999,274or $0.0017per share of common stock as of February 28, 2013.

You will suffer substantial dilution in the purchase price of your stock compared to the net tangible book value per share immediately after the purchase.

The following assumes the sale of 100% of the shares of common stock in this offering. After giving effect to the sale of 6,200,000 shares at an offering price of $0.65 per share of common stock, our net tangible book value as of the closing of this offering would increase from $0.0017to $0.0052per share. This represents an immediate increase in the net tangible book value of approximately $0.0035 per share to current shareholders, and immediate dilution of about $0.6448per share to new investors, as illustrated in the following table:

| Public offering price per share of common stock | $ | 0.65 |

| Net tangible book value per share prior to offering | $ | 0.0017 |

| Increase per share attributable to new investors | $ | 0.0035 |

| Net tangible book value per share after offering | $ | 0.0052 |

| Dilution per share to new investors | $ | 0.6448 |

| Percentage dilution | $ | 99.2% |

11

The following assumes the sale of 75% of the shares of common stock in this offering. After giving effect to the sale of 4,650,000 shares at an offering price of $0.65 per share of common stock, our net tangible book value as of the closing of this offering would increase from $0.0017to $0.0043per share. This represents an immediate increase in the net tangible book value of approximately $0.0026 per share to current shareholders, and immediate dilution of about $0.6457per share to new investors, as illustrated in the following table:

| Public offering price per share of common stock | $ | 0.6500 |

| Net tangible book value per share prior to offering | $ | 0.0017 |

| Increase per share attributable to new investors | $ | 0.0026 |

| Net tangible book value per share after offering | $ | 0.0043 |

| Dilution per share to new investors | $ | 0.6457 |

| Percentage dilution | $ | 99.3% |

The following assumes the sale of 50% of the shares of common stock in this offering. After giving effect to the sale of 3,100,000 shares at an offering price of $0.65 per share of common stock, our net tangible book value as of the closing of this offering would increase from $0.0017 to $0.0035 per share. This represents an immediate increase in the net tangible book value of approximately $0.0018 per share to current shareholders, and immediate dilution of about $0.6465 per share to new investors, as illustrated in the following table:

| Public offering price per share of common stock | $ | 0.6500 |

| Net tangible book value per share prior to offering | $ | 0.0017 |

| Increase per share attributable to new investors | $ | 0.0018 |

| Net tangible book value per share after offering | $ | 0.0035 |

| Dilution per share to new investors | $ | 0.6465 |

| Percentage dilution | $ | 99.5% |

| 12 |

The following assumes the sale of 25% of the shares of common stock in this offering. After giving effect to the sale of 1,550,000 shares at an offering price of $0.65 per share of common stock, our net tangible book value as of the closing of this offering would increase from $0.0017to $0.0026per share. This represents an immediate increase in the net tangible book value of approximately $0.0009 per share to current shareholders, and immediate dilution of about $0.6474per share to new investors, as illustrated in the following table:

| Public offering price per share of common stock | $ | 0.6500 |

| Net tangible book value per share prior to offering | $ | 0.0017 |

| Increase per share attributable to new investors | $ | 0.0009 |

| Net tangible book value per share after offering | $ | 0.0026 |

| Dilution per share to new investors | $ | 0.6474 |

| Percentage dilution | $ | 99.6% |

Pursuant to Item 506 of Regulation S-K, t

| Shares Purchased | Total Consideration | ||||||||||

| Number | Percent | Amount | Percent | ||||||||

| Existing stockholders |

| 1,156,460,641 |

| 99.47% |

|

| $ | 3,310,000 |

| 45.10% | |

| Purchasers in this offering | 6,200,000 | 0.53% | 4,030,000 | 54.90% | |||||||

|

|

|

|

|

| |||||||

| Total |

| 1,162,660,641 |

| 100.00% |

|

| $ | 7,340,000 |

| 100.00% | |

| 13 |

Selling Shareholders

The selling shareholders named in this prospectus are offering all of the 11,947,741 shares of common stock offered through this prospectus, not including our direct public offering. These shares were acquired from us in private placements that were exempt from registration provided under Regulation S of the Securities Act of 1933. Our reliance upon the exemption under Rule 903 of Regulation S of the Securities Act was based on the fact that the sale of the securities was completed in an "offshore transaction,” as defined in Rule 902(h) of Regulation S. We did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities. Each investor was not a US person, as defined in Regulation S, and was not acquiring the securities for the account or benefit of a US person.

The following table provides as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

- the number of shares owned by each prior to this offering;

- the total number of shares that are to be offered for each;

- the total number of shares that will be owned by each upon completion of the offering; and

- the percentage owned by each upon completion of the offering.

| Name Of Selling Shareholder | Shares Owned Prior To This Offering | Total Number Of Shares To Be Offered For Selling Shareholders Account | Total Shares to Be Owned Upon Completion Of This Offering | Percentage of Shares owned Upon Completion of This Offering |

| Access Finance and Securities (NZ) Limited (2)(7) | 50,000,000 | 500,000 | 49,500,000 | 4.28% |

| Access Management Consulting and Marketing Pte Ltd. (3)(7) | 150,000,000 | 1,500,000 | 148,500,000 | 12.84% |

| Access Equity Capital Management Corp. (4)(7) | 10,000,000 | 100,000 | 9,900,000 | (1) |

| Kuei Hua Tsai | 70,000,000 | 700,000 | 69,300,000 | 5.99% |

| Huei Ling Wang (5) | 50,000,000 | 500,000 | 49,500,000 | 4.28% |

| En Chen Pai | 16,040,000 | 160,400 | 15,879,600 | 1.37% |

| Hsi Chuen Pai | 10,000,000 | 100,000 | 9,900,000 | (1) |

| Toprise International Investment Ltd. (6) | 500,000,000 | 5,000,000 | 495,000,000 | 42.80% |

| Chia Wan Lu | 22,350,000 | 223,500 | 22,126,500 | 1.91% |

| Li Tzu Wang | 20,120,000 | 201,200 | 19,918,800 | 1.72% |

| Pi Lin Chen | 20,780,000 | 207,800 | 20,572,200 | 1.78% |

| Shu Li Lai | 22,340,000 | 223,400 | 22,116,600 | 1.91% |

| Jui Chen Lee | 20,240,000 | 202,400 | 20,037,600 | 1.73% |

| Kuan Chen Li | 21,720,000 | 217,200 | 21,502,800 | 1.86% |

| Hsin Li Chiu | 15,000,000 | 150,000 | 14,850,000 | 1.28% |

| Hsuan Wen Yeh | 15,000,000 | 150,000 | 14,850,000 | 1.28% |

| Yu Tzu Chan | 15,000,000 | 150,000 | 14,850,000 | 1.28% |

| Kuan Lin Yeh | 12,000,000 | 120,000 | 11,880,000 | 1.03% |

| Chi Cheng Yeh | 12,000,000 | 120,000 | 11,880,000 | 1.03% |

| Shu Chin Yeh | 10,000,000 | 100,000 | 9,900,000 | (1) |

| Cheng Yu Lee | 10,000,000 | 100,000 | 9,900,000 | (1) |

| Wan Lien Li | 10,000,000 | 100,000 | 9,900,000 | (1) |

| Mei Chih Chen | 6,910,000 | 69,100 | 6,840,900 | (1) |

| Yin Chen Huang | 6,100,000 | 61,000 | 6,039,000 | (1) |

| Jung Chia Hsu | 6,000,000 | 60,000 | 5,940,000 | (1) |

| Yueh Mei Wang | 5,600,000 | 56,000 | 5,544,000 | (1) |

| Wen Chung Huang | 5,200,000 | 52,000 | 5,148,000 | (1) |

| Pi Chen Hsu | 5,200,000 | 52,000 | 5,148,000 | (1) |

| Pao Tsai Lin Wang | 5,200,000 | 52,000 | 5,148,000 | (1) |

| Miao Ju Chien | 5,000,000 | 50,000 | 4,950,000 | (1) |

| Chin Hsiu, Lin Su | 5,000,000 | 50,000 | 4,950,000 | (1) |

| Su Chuan Wang | 3,200,000 | 32,000 | 3,168,000 | (1) |

| Hsiao Ling Yeh | 3,027,000 | 30,270 | 2,996,730 | (1) |

| Pei Ling Yeh | 2,003,000 | 20,030 | 1,982,970 | (1) |

| Mei Pi Chang | 2,150,000 | 21,500 | 2,128,500 | (1) |

| Ching Tieh Chang | 2,030,000 | 20,300 | 2,009,700 | (1) |

| Cheng Ying Lee | 2,000,000 | 20,000 | 1,980,000 | (1) |

| Shu Chiung Lee | 2,000,000 | 20,000 | 1,980,000 | (1) |

| Kun Wang Lin | 2,000,000 | 20,000 | 1,980,000 | (1) |

| Mei Chi Liao | 2,000,000 | 20,000 | 1,980,000 | (1) |

| Po Jen Chen | 1,200,000 | 12,000 | 1,188,000 | (1) |

| Mei Lan Hsieh | 1,000,000 | 10,000 | 990,000 | (1) |

| Yung Shan Hsu | 400,000 | 40,000 | 360,000 | (1) |

| Yu Han Huang | 230,000 | 23,000 | 207,000 | (1) |

| Hui Cheng Hsu Lin | 100,000 | 10,000 | 90,000 | (1) |

| Shu Heng Hsu | 66,666 | 66,666 | Nil | Nil |

| Ching Ming Hsu | 50,000 | 50,000 | Nil | Nil |

| Hui Mei Lee | 40,000 | 40,000 | Nil | Nil |

| Tsuan Chih Hsieh | 33,333 | 33,333 | Nil | Nil |

| Fang Ju Lin | 28,571 | 28,571 | Nil | Nil |

| Shih Chuan Huang | 25,000 | 25,000 | Nil | Nil |

| Chieh Ching Lee | 22,222 | 22,222 | Nil | Nil |

| Chung Shou Wu | 20,000 | 20,000 | Nil | Nil |

| Ming Kan Huang | 18,182 | 18,182 | Nil | Nil |

| Li Wen Liu | 16,667 | 16,667 | Nil | Nil |

| Total | 1,156,460,641 | 11,947,741 | 1,144,512,900 |

|

(2) Yi Lung Lin has voting and investment control over shares held by Access Finance and Securities (NZ) Limited.

(3) Yi Lung Lin has voting and investment control over shares held by Access Management Consulting and Marketing Pte Ltd

(4) Yi Lung Lin has voting and investment control over shares held by Access Equity Capital Management Corp.

(5) Huei Ling Wang is the wife of our President Yi Lung Lin.

(6) Kuei Hua Tsai has voting and investment control over shares held by Toprise International Investment Ltd.

(7) Underwriter of our offering.

| 14 |

Other than disclosed above, none of the selling shareholders:

- has had a material relationship with us other than as a shareholder at any time within the past three years;

- has ever been one of our officers or directors;

- is a broker-dealer; or broker-dealer's affiliate.

In addition, we are offering up to 6,200,000 shares of common stock on a direct public offering, without any involvement of underwriters or broker-dealers, no minimum. The offering price is $0.65 per share or prevailing market prices. All of the shares covered by this prospectus are being offered for a period not to exceed 180 days, unless extended by our Board of Directors for an additional 90 days.

Plan of Distribution

We are offering up to 6,200,000 shares of our common stock in a direct public offering, on a self-underwritten, best efforts basis, which means that our sole officer and director will attempt to sell the shares, without any involvement of underwriters or broker-dealers. This prospectus will permit our officer and director to sell the shares directly to the public, with no commission or other remuneration payable to them for any shares that they may sell. Our sole officer and director will rely on Section 201(c) of the JOBS Act to conduct the offering. The shares will be offered at a fixed price of $0.65 per share for a period of one hundred and eighty (180) days from the effective date of this prospectus, unless extended by our board of directors for an additional 90 days.

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions. There are no arrangements, agreements or understandings with respect to the sale of these securities.

The selling shareholders will sell our shares at a fixed price of $0.65 per share. The offering price has been arbitrarily determined by us and does not necessarily bear any relationship to assets, earnings, book value or any other objective criteria of value. There is no assurance of when, if ever, our stock will be listed on an exchange or quotation system. The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144, when eligible.

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144, when eligible.

If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above. If these shares being registered for resale are transferred from the named selling shareholders and the new shareholders wish to rely on the prospectus to resell these shares, then we must first file a prospectus supplement naming these individuals as selling shareholders and providing the information required concerning the identity of each selling shareholder and he or her relationship to us. There is no agreement or understanding between the selling shareholders and any partners with respect to the distribution of the shares being registered for resale pursuant to this registration statement.

We can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

| 15 |

The selling shareholders must comply with the requirements of the Securities Act and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1. Not engage in any stabilization activities in connection with our common stock

2. Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

3. Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities Exchange Act.

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which:

- contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

- contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements;

- contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price;

- contains a toll-free telephone number for inquiries on disciplinary actions;

- defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

- contains such other information and is in such form (including language, type, size, and format) as the Commission shall require by rule or regulation;

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with:

- bid and offer quotations for the penny stock;

- the compensation of the broker-dealer and its salesperson in the transaction;

- the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

- monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

In addition, we are offering up to 6,200,000 shares of common stock on a direct public offering, without any involvement of underwriters or broker-dealers, no minimum. The offering price is $0.65 per share or prevailing market prices. The shares are being offered for a period not to exceed 180 days, unless extended by our Board of Directors for an additional 90 days.

| 16 |

Description of Securities

General

Our authorized capital stock consists of 2,000,000,000 shares of common stock at a par value of $0.001 per share.

Common Stock

As of February 28, 2013, there were 1,156,460,641 shares of our common stock issued and outstanding that were held by 50 stockholders of record.

Holders of our common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of our common stock representing a majority of the voting power of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our articles of incorporation.

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

We do not have an authorized class of preferred stock.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

| 17 |

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, an interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Dean Law Corp. has provided an opinion on the validity of our common stock.

The financial statements included in this prospectus have been audited by M&K CPAS, PLLC to the extent and for the periods set forth in their report appearing elsewhere in this document and in the registration statement filed with the SEC, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

Description of Business

General

We were incorporated in the State of Nevada on June 18, 2012.

We are a start-up company and our main focus will be to import, distribute and export bottled pure natural artesian water and importation of natural spring water for manufacturing. In addition, through our wholly owned subsidiary company in Singapore, NATfresh Productions (S) Pte Ltd (“NPSPL”), we intend to import and distribute drinking water and beverages as well as to set up a factory to process and bottle our natural spring water. We do not have yet had a bottling plant in Singapore and there is no guarantee that we will secure such a facility. We also intend to use our natural spring water for the production of drinking water, instant tea and microbrewery operations for the production of shandy and lager beer. We intend to market, promote, and distribute our goods in the Republic of Singapore as well as to its neighboring country, Malaysia. We own the following trademarks: NATfresh, Tani Premium, Tani Magic and TaniNZ Premium.

Our Business Model

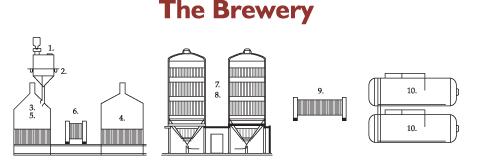

Our business model has two main aspects, to import, distribute and export bottled pure natural artesian water and to import natural spring water for the manufacturing of drinking water, instant tea and for microbrewery operations. The importation of bottled pure natural artesian water is done under contract manufacturing under our private label – TaniNZ Premium as shown in the chart below. The importation of natural spring water will be implemented when our factory in Singapore is available. In the meantime, our subsidiary company in Singapore, NATfresh Productions (S) Pte Ltd (NPSPL) will commence to trade in the distribution of drinking water and beverages as shown in the chart below.

The Company (“NATfresh”)

Business Activities of NATfresh

Stage 1 Stage 2 Stage 2

Contract Manufacturing Import Natural Spring Water Supply of Natural Spring Water

Pure Natural Artesian Water to NPSPL for Manufacturing

- TaniNZ Premium

500ml & 1,500ml

Business Activities of NPSPL

Stage 1 Stage 2 Stage 2 Stage 3

Sole Agent for Bottling of Manufacturing Microbrewery

Ayala’s Herbal Water Natural Spring Instant Tea with operations for

- Distribution in Water – the Natural Spring production of

Singapore and Tani Premium Water- shandy and lager

Export 600ml & 1,500ml Tani Magic instant beer using Natural

tea 600ml Spring Water-

Distribution of Nats Shandy

TaniNZ Premium Nats5 Bitter

in Singapore Nats5 Premium

Our model involves scrutinizing every single aspect of our business to maximize the use of our pure natural artesian water and natural spring water for innovative quality drinking water and beverages. Our business model is designed to maintain a technological high quality approach without compromising high essential costs, thus our disciplined approach to executing this model has given us the ability to serve the needs of the general public with innovative and quality beverages. Our objective is to maximize profitability by developing new beverages from natural spring water. Our disciplined approach will allow us to offer new quality beverages with competitive prices on a consistent and sustainable basis to the consumer, thus improving our profitability once we commence operations.

We have on May 17, 2013 entered into a contract manufacturing arrangement with Deep Waters Trust, New Zealand to supply bottled pure natural artesian water under our own private label – TaniNZ Premium for distribution in Singapore and export to other countries. The key provisions of the agreement are as follows:

1. Section 3.2 gives Deep Waters Trust to supply us TaniNZ Premium for a minimum period of two years unless a six-month written notice is given to terminate the Agreement.

2. Section 6.2 specified that title will not pass until full payment is made. We are deemed to be trustee of the Products and the sales proceeds.

3. Section 7.4 (a) requires the Supplier to maintain and mange a certified HACCP (Codex) Food Safety Programme at all times during the continuous in force of the contract.

4. Section 7.4 (b) requires the Supplier to arrange for the Products to be tested and to provide such test reports on request.

5. Section 9.4 requires both parties to secure comprehensive general liability insurance (including contractual liability and with product liability covering the Products) in an amount not less than NZD1, 000,000 in the aggregate and NZD1, 000,000 per occurrence.

6. The termination provisions are set out as per Section 10.

We have on April 8, 2013 entered into a Distributor Agreement for distribution of Herbal Water with Herbal Water Inc. in nine countries, namely Singapore, Malaysia, Indonesia, Taiwan, Hong Kong, Macau, Thailand, Sri Lanka and The Philippines.

The key provisions of the agreement are as follows:

1. Section 1(a) grants the territorial rights to us for nine countries namely Singapore, Malaysia, Indonesia, Taiwan, Hong Kong, Macau, Thailand, Sri Lanka and The Philippines.

2. Section 1(b) permits the Supplier to discontinue making the Products available in the defined territories by giving us six-month advance written notice.

3. Section 2 (iv) binds the Supplier in supplying the Products to us to comply with all Federal, State or local laws and regulations in all material respects.

4. Section 6(C) requires both parties to secure comprehensive general liability insurance (including contractual liability and with product liability coverage respecting the Products) in an amount of not less than USD3,000,000 in the aggregate and USD1,000,000 per occurrence. (Insurance disclosure)

5. Section 7(a) specifies the term of the Distributorship Agreement is 60 months subject to an automatic every 12-month renewal.

Our Markets and Growth Opportunities

Our primary target market is Singapore. Singapore has a population of 5,183,700 people as per the statistics shown below. The Singapore Government has called for an increase in population due to growth substantiality and the aging population in Singapore. The Singapore government is providing incentives for singles to get married and also for married women to have more children (Source: Child Development Co-Savings Act (CHAPTER 38A), Part II, 3. (1)).

| 18 |

SINGAPORE POPULATIONS STATISTICS

| tems | Date of Latest | Most Recent Period | % Change1 | Previous Period | % Change2 | |

| Population | ||||||

| Total Population | '000 | 2011 | 5,183.7 | 2.1 | 5,076.7 | 1.8 |

| Singapore Residents | '000 | 2011 | 3,789.3 | 0.5 | 3,771.7 | 1.0 |

| Singapore Citizens | '000 | 2011 | 3,257.2 | 0.8 | 3,230.7 | 0.9 |

| Singapore Permanent | '000 | 2011 | 532.0 | -1.7 | 541.0 | 1.5 |

Source: Singapore Department of Statistics

Singapore had an annual average of 10 million tourists and at the current rate of growth, tourism is expected to increase. This is a stable and developed tourism industry as shown below:

INTERNATIONAL VISITORS TO SINGAPORE (COUNTRY BASIS)

| Year | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 (Jan to Sept) | ||||||

| Countries | No. | % | No. | % | No. | % | No. | % | No. | % | No. | % |

| Indonesia | 1,921,000 | 19.7 | 1,962,000 | 19.1 | 1,765,000 | 17.4 | 1,745,000 | 18.0 | 2,305,000 | 19.8 | 1,925,000 | 19.6 |

| China | 1,037,000 | 10.6 | 1,114,000 | 10.8 | 1,079,000 | 10.7 | 937,000 | 9.7 | 1,171,000 | 10.1 | 1,230,000 | 12.5 |

| Australia | 692,000 | 7.1 | 768,000 | 7.5 | 833,000 | 8.2 | 830,000 | 8.6 | 880,000 | 7.6 | 717,000 | 7.3 |

| India | 659,000 | 6.8 | 749,000 | 7.3 | 778,000 | 7.7 | 726,000 | 7.5 | 829,000 | 7.1 | 641,000 | 6.5 |

| Malaysia | 634,000 | 6.5 | 646,000 | 6.3 | 647,000 | 6.4 | 764,000 | 7.9 | 1,037,000 | 8.9 | 817,000 | 8.3 |

| Japan | 594,000 | 6.1 | 594,000 | 5.8 | 571,000 | 5.6 | 490,000 | 5.1 | 529,000 | 4.5 | 475,000 | 4.8 |

| UK | 488,000 | 5.0 | 496,000 | 4.8 | 493,000 | 4.9 | 470,000 | 4.9 | 462,000 | 4.0 | 330,000 | 3.4 |

| South Korea | 455,000 | 4.7 | 464,000 | 4.5 | 423,000 | 4.2 | 314,000 | 3.2 | 361,000 | 3.1 | 319,000 | 3.2 |

| USA | 400,000 | 4.1 | 419,000 | 4.1 | 397,000 | 3.9 | 371,000 | 3.8 | 417,000 | 3.6 | 331,000 | 3.4 |

| Philippines | 386,000 | 4.0 | 409,000 | 4.0 | 419,000 | 4.1 | 432,000 | 4.5 | 544,000 | 4.7 | 505,000 | 5.1 |

| Thailand | 356,000 | 3.7 | 353,000 | 3.4 | 334,000 | 3.3 | 318,000 | 3.3 | 430,000 | 3.7 | 351,000 | 3.6 |

| Hong Kong | 291,000 | 3.0 | 302,000 | 2.9 | 278,000 | 2.7 | 294,000 | 3.0 | 388,000 | 3.3 | 366,000 | 3.7 |

| Singapore | 219,000 | 2.2 | 208,000 | 2.0 | 239,000 | 2.4 | 157,000 | 1.6 | 191,000 | 1.6 | 190,000 | 1.9 |

| Vietnam | 165,000 | 1.7 | 203,000 | 2.0 | 176,000 | 1.7 | 265,000 | 2.7 | 323,000 | 2.8 | 259,000 | 2.6 |

| Germany | 161,000 | 1.7 | 165,000 | 1.6 | 175,000 | 1.7 | 184,000 | 1.9 | 209,000 | 1.8 | 157,000 | 1.6 |

| Total Visitors Arrival in SG | 9,748,207 | 100 | 10,283,615 | 100 | 10,115,638 | 100 | 9,681,259 | 100 | 11,638,663 | 100 | 9,841,445 | 100 |

Source: Singapore Department of Statistics

Water consumption is a MUST for every human being for health reasons. Therefore, water is required by some 6.2 million people daily, but Singapore has no self-made water. However, recently, the Singapore Government has started reclaiming water through a NEWater process, that is, treated wastewater (sewage) to drinking water. The Singapore Government also purchases water from its neighboring country, Malaysia.

| 19 |

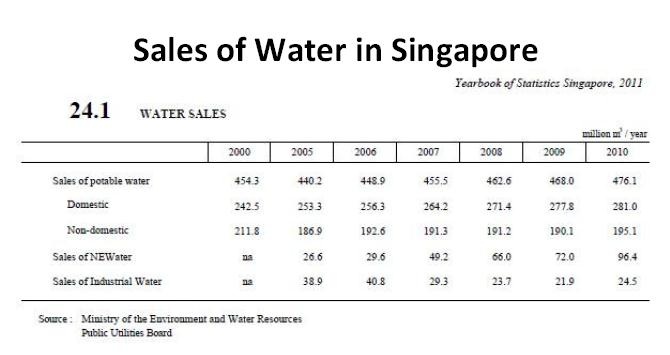

According to the Institute of Medicine/Mayo Clinic, on average of 3 liters of water per day is required for males and an average of 2.2 liters of water per day for females. On an average of 3 liters of water per day per person, Singapore would require a minimum of 18,600,000 liters of water daily or 6,789,000,000 liters of water annually. This is derived by taking 6.2 million people multiply by 3 liters of water per day to give 18,600,000 liters of water needed for daily consumption. Statistic from the Singapore Ministry of the Environment and Water Resources reveals that 471,000,000,000 liters of portable water was sold in year 2010. This recorded an average annual growth consumption rate of 1.1% as shown from the chart below. It is noted that tourists have a high consumption of water and demand many different types of beverages due to the hot tropical climate of Singapore.

While we wait for the Singapore factory to be established, we had on May 17, 2013 entered into a contract manufacturing arrangement with Deep Waters Trust, New Zealand to supply bottled pure natural artesian water under our own private label – TaniNZ Premium for distribution in Singapore and export to other countries. Once our Singapore factory is available with machinery and equipment installed, we would commence to import natural spring water in bulk from Sri Lanka into Singapore for manufacturing of bottled drinking water, Tani Premium and instant tea, Tani Magic for marketing and distribution in the Singapore market under our Stage 2 plan. This may require us to apply for an import permit for the importation of natural spring water in bulk where local regulations require it.

We then intend to introduce the first of its kind – Tani Magic Instant Tea in three flavors: Black Tea, Green Tea, and Rose Tea with a view to break into the Singapore market for betterment of sales revenue. Tani Magic Instant Tea is instant tea from our natural spring water. No hot water is required to make instant tea. This will be our Stage 2 plan. We would then use our natural spring water for the microbrewery operations to produce shandy and lager beer on a Contract Manufacturing (OEM) basis under a private label to interested buyers. Along with, producing shandy and lager beer under our own brand “Nats Shandy”, Nats5 Bitter”, and “Nats5 Premium” for distribution and re-sale to pubs and restaurants in Singapore and to export to our neighboring country, Malaysia. This is our Stage 3 plan.

Strategy and Strengths

Our model involves scrutinizing every single aspect of the business to maximize the use of pure natural artesian water and natural spring water for innovative quality drinking water and beverages without compromising high essential costs. We could achieve this significant objective through the introduction of the following, but we do not possess the financial capabilities at this current time:

| 20 |

* TaniNZ Premium – Pure Natural Artesian Water

We have entered into a contract manufacturing arrangement to supply bottled pure natural artesian water under our own private label – TaniNZ Premium for distribution in Singapore and export to other countries. There is no guarantee that we will begin distribution in Singapore as expected.

TaniNZ Premium pure natural artesian water is from New Zealand, a nuclear-free country. Bottled at source at its purest and low in minerals which give it a soft and smooth taste, TaniNZ Premium has a pH level of 7.8 that helps balance the overall body metabolism and other digestive functions.

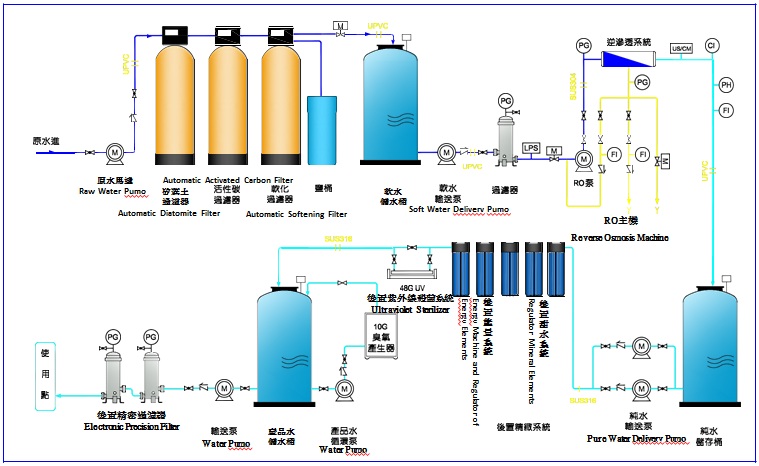

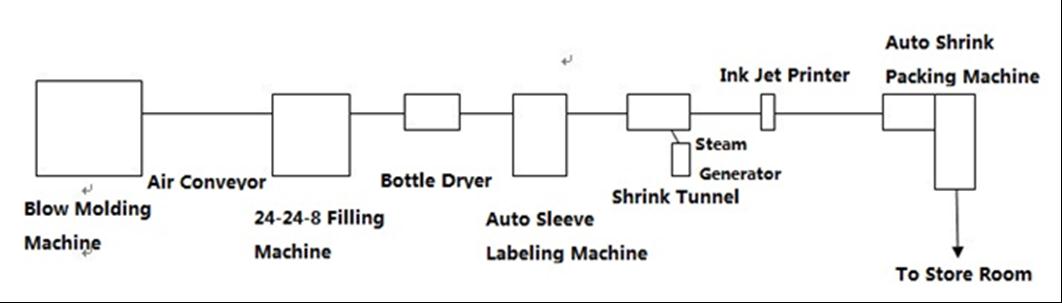

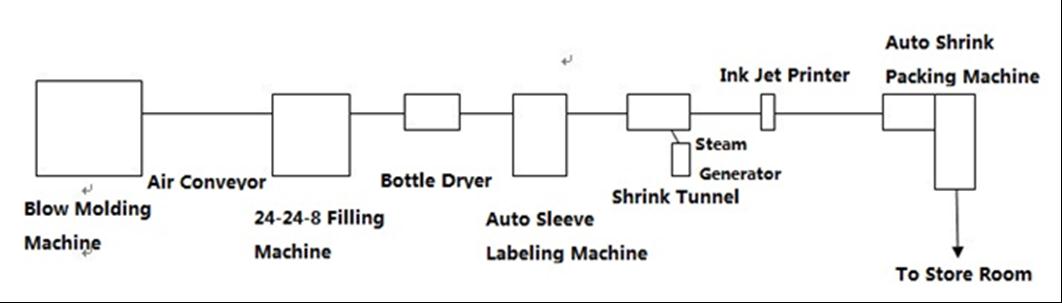

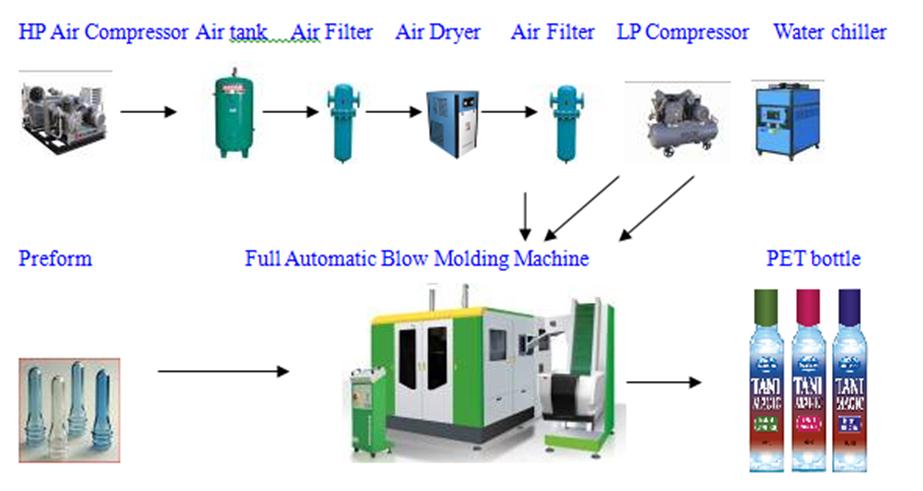

The bottling plant is based in North Canterbury in the South Island of New Zealand which is surrounded by a vast ocean. The rain falling in the Southern Alps, is carried by the winds coming from the South Pole, Antarctica, and is free of pollutants. The raindrops weave their way into underground rivers for their marathon 80-year journey to the confined artesian aquifer, undergoing natural filtration and gaining essential minerals on the way. The plant is located on a 120,000 square meters land on a remote country-side of less than one person per square km. While many artesian wells in the world are being heavily pumped and running dry, it is ensured that its water is not drawn more than it is being recharged at the source.