Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GENTIVA HEALTH SERVICES INC | d601827d8k.htm |

Exhibit 99.1

SELECTED INFORMATION CONTAINED IN

CONFIDENTIAL INFORMATION MEMORANDUM

Confidential

Transaction Overview

On September 18, 2013, Gentiva Health Services, Inc. (“Gentiva” or the “Company”) entered into a definitive agreement to acquire Harden Healthcare Holdings, Inc. (“Harden” or the “Target”) excluding its Long-Term Care segment for approximately $408.8 million (“The Transaction”). The purchase price consists of $355.0 million in cash and approximately $53.8 million in Gentiva common stock.

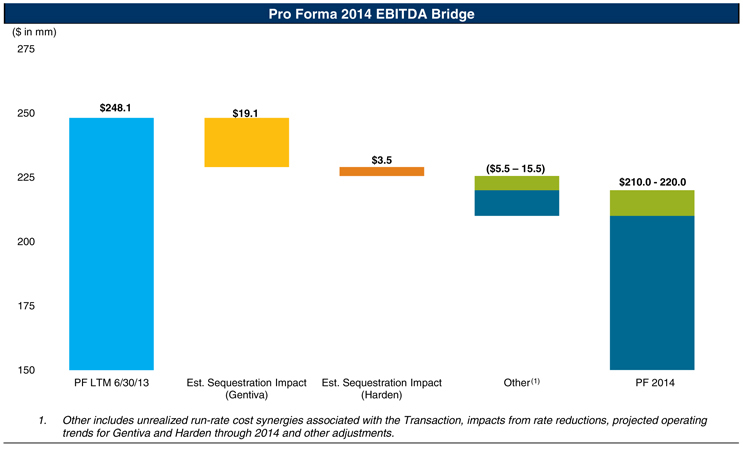

For the twelve months ending June 30, 2013, combined Pro Forma Adjusted EBITDA is $248.1 million including Harden LTM Adjusted EBITDA of $36.9 million (excluding the Long-Term Care segment), $28.0 million of run-rate synergies associated with the Transaction and approximately $5 million of expected Gentiva cost savings associated with an internal corporate restructuring.

The Transaction will be supported by a $200.0 million Senior Unsecured Bridge Facility (the “Bridge Facility”). In conjunction with the proposed acquisition, the Company will also be seeking a refinancing of its existing credit facilities. The expected permanent financing will include:

| • | $955.0 new Senior Secured Credit Facilities |

| • | $100.0 million Revolving Credit Facility, undrawn at close |

| • | $855.0 million Term Loan B Facility |

| • | $53.8 million of new Gentiva equity issued to Harden’s existing shareholders |

| • | $116.0 million of cash |

Pro forma for the Transaction, net senior secured and net total leverage will be 3.2x and 4.5x, respectively, as of June 30, 2013.

In support of the Transaction, Barclays Bank PLC and Bank of America Merrill Lynch have been engaged to act as Joint Lead Arrangers and Joint Bookrunners for the Bridge Facility.

The Transaction is expected to close mid-October 2013, subject to customary closing conditions.

2

Confidential

Sources and Uses

($ in millions)

Pro Forma Capitalization

| ($ in millions) | ||||||||||||

| Pro Forma Capitalization 6/30/2013A |

Status Quo 6/30/2013A |

Adj. | Pro Forma 6/30/2013A |

|||||||||

| Cash |

$ | 185.1 | ($ | 116.0 | ) | $ | 69.2 | |||||

| Revolving Credit Facility |

— | — | — | |||||||||

| Existing Term Loan A due 2015 |

118.8 | (118.8 | ) | — | ||||||||

| Existing Term Loan B due 2016 |

466.4 | (466.4 | ) | — | ||||||||

| New Term Loan B |

— | 855.0 | 855.0 | |||||||||

| Existing Senior Notes due 2018 |

325.0 | — | 325.0 | |||||||||

| Total Debt |

$ | 910.2 | $ | 269.8 | $ | 1,180.0 | ||||||

| Credit Statistics |

||||||||||||

| 6/30/13A Adj. EBITDA |

$ | 178.3 | $ | 69.9 | (1) | $ | 248.1 | |||||

| Secured Debt / EBITDA |

3.3x | 3.4x | ||||||||||

| Net Secured Debt / EBITDA |

2.2x | 3.2x | ||||||||||

| Total Debt / EBITDA |

5.1x | 4.8x | ||||||||||

| Net Total Debt / EBITDA |

4.1x | 4.5x | ||||||||||

| EBITDA / Interest |

2.0x | 2.8x | ||||||||||

| 1. | Includes LTM Adj. EBITDA of $36.9mm for Harden, $28mm of run-rate synergies associated with the Transaction and approximately $5mm of expected Gentiva cost savings associated with an internal corporate restructuring. For additional detail on LTM Adj. EBITDA, please see page 13. |

3

Confidential

Target Overview – Harden Healthcare Holdings, Inc.

Founded in 2001, Harden is a leading provider of a continuum of healthcare services in 13 states. Harden is majority owned by Capstar Partners, LLC, a private investment firm based in Austin, Texas, founded by R. Steven Hicks in 2000. Harden serves over 35,000 patients and operates in four main business segments, which include: Community Care, Home Health, Hospice, and Long-Term Care.

Gentiva’s acquisition of Harden is focused on the Community Care, Home Health, and Hospice business segments. Gentiva will not be acquiring the Long-Term Care segment.

Community Care

Community Care provides support services to patients who have chronic care needs or long-term disabilities that require assistance with routine personal care in the home. Harden’s Community Care services are primarily funded through Medicaid and serve as a low cost alternative to inpatient care.

Home Health

Home Health offers a range of skilled nursing services for home-based patients in a lower cost setting versus facility-based care. Harden’s Home Health services are primarily funded through Medicare Fee-For-Service as well as Medicare Advantage.

Hospice

Hospice provides end-of-life care focused on enhancing the quality of life for patients and their families. Care may occur in private home or community facility settings. The business is almost exclusively Medicare reimbursed.

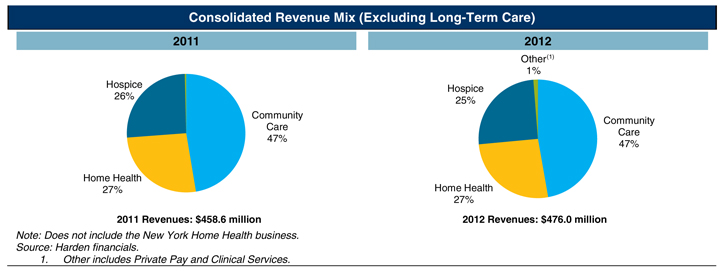

Historical Revenue (Excluding Long-Term Care)

| ($ in mm) |

2011 | 2012 | ||||||

| Home Health |

$ | 121.2 | $ | 125.3 | ||||

| Hospice |

118.4 | 120.1 | ||||||

| Community Care |

217.2 | 224.8 | ||||||

| Other(1) |

1.7 | 5.8 | ||||||

|

|

|

|

|

|||||

| Consolidated Revenue |

$ | 458.6 | $ | 476.0 | ||||

Note: Does not include the New York Home Health business.

Source: Harden financials.

| 1. | Other includes Private Pay and Clinical Services. |

4

Confidential

Leading Player with Geographic Scale and Scope

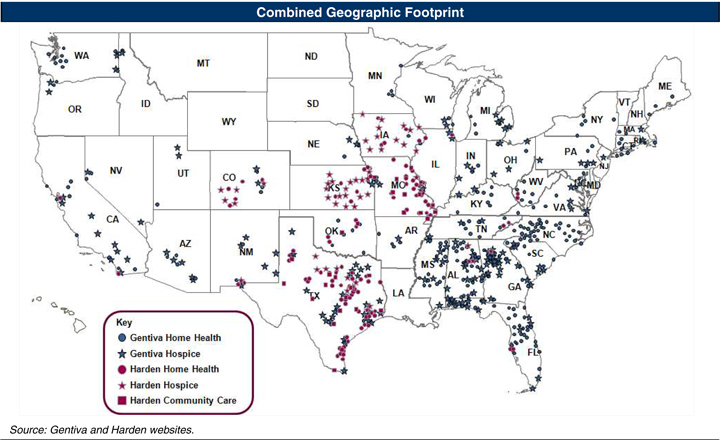

| • | Gentiva is currently the largest Home Health and Hospice provider in the U.S. based on revenue. Harden is also a leading Home Health and Hospice provider and is one of the largest Community Care providers in Texas |

| • | Gentiva’s current geographic footprint will be expanded with significantly increased presence in Texas and increases its existing positions in Missouri, Iowa, Kansas and Colorado. The combined company will have 235 Hospice locations and 319 Home Health locations across 40 states (including 42 overlapping locations) significantly increasing its scale and reach to customers across the country |

| • | The geographic footprint of each company complements each other very well, which should facilitate a smooth transition. There are 12 overlapping Home Health states and 7 overlapping Hospice states resulting in 42 overlapping locations providing the opportunity for meaningful cost savings. Geographic diversity also helps to mitigate the risk associated with competitor landscape in any one market and adverse regulatory changes related to Medicaid reimbursement in any one state |

| • | Gentiva will be able to leverage its increased scale, diverse business lines and addition of the Community Care business to generate revenue synergies. In addition, Gentiva also expects $28 million of cost savings from the elimination of expenses related to overlapping personnel, corporate overhead, consolidation of IT systems and other cost saving initiatives. The Company expects to achieve approximately $17 million in year 1 and the remainder in year 2. The cost savings can be broken out into 3 distinct categories listed below: |

| • | $16 million of corporate synergies derived from eliminating overlapping corporate costs |

| • | $8 million of regional synergies associated with divisional level costs and other general and administrative expenses |

| • | $4 million of branch synergies driven by 42 overlapping branch locations |

5

Confidential

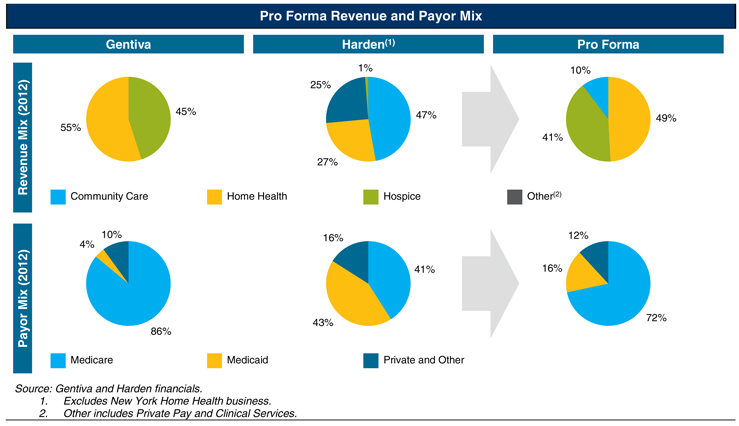

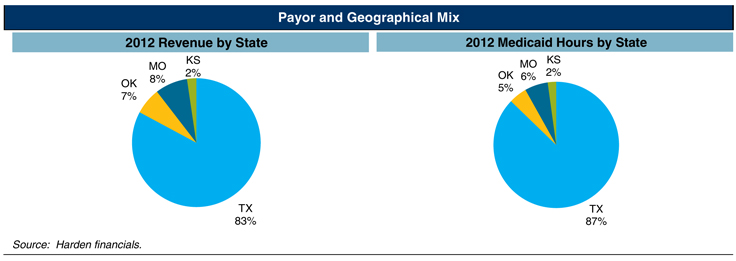

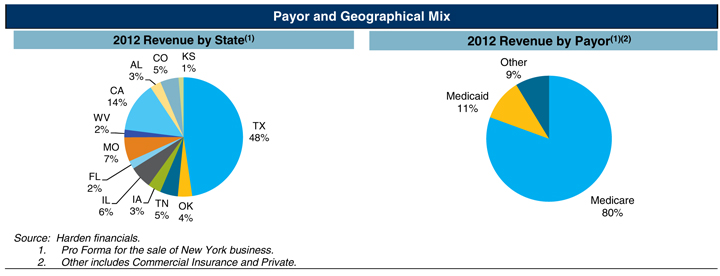

Diversification Across Service Lines and Payors

| • | The Company will lower its dependence on federal reimbursement programs by increasing contribution from Texas Medicaid, which has more stable reimbursement rates versus Medicare. Today, Gentiva’s revenue payor mix is largely Medicare (86%) with 10% Private and Other and 4% Medicaid while Harden’s payor mix has continued to diversify over the last 2 years (59% non-Medicare in 2012 compared to 54% in 2010). Pro forma for the combined company, Medicare exposure would be reduced from 86% to 72% based on 2012 full-year results |

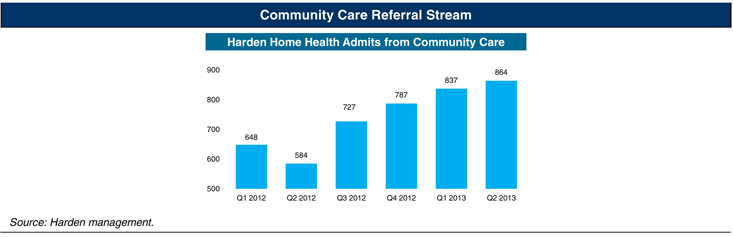

| • | Gentiva will add a new business line, Community Care, to its current operations, thus expanding the Company’s offering across the pre- and post-acute care continuum. Community Care provides a strong and growing stream of referrals to the Home Health and Hospice divisions. Harden’s current operations demonstrate the potential growth of the Community Care referral stream as Home Health admits from its Community Care business grew nearly 33.3% from Q1 2012 to Q2 2013 in locations where Harden offered both services. Currently, Harden’s Community Care business is mostly concentrated in Texas, but Gentiva can leverage its scale and existing operations to potentially expand Community Care into other states and further increase the referral potential. Additionally, the national market for Community Care services is expected to grow in the high single digits due to the aging population and increased state level focus on keeping patients out of higher cost settings |

6

Confidential

Target Overview – Harden Healthcare Holdings, Inc.

Harden is a leading provider of a continuum of healthcare services in 13 states. Harden is comprised of four major, diverse business segments with different drivers of performance, which include: Community Care, Home Health, Hospice, and Long-Term Care. Gentiva will not be acquiring the Long-Term Care segment.

Despite the difficult reimbursement environment and effects of the recession, Harden has continued to grow its core businesses through its strong patient relationships, growth in key markets including Texas and prudent acquisition strategy. Excluding its Long-Term Care business, Harden’s 2012 consolidated revenue was approximately $476.0 million.

| Home Health |

• 8,600 total home health patients

• 59 locations

• 12 states |

Harden’s acquisition strategy focused on the Home Health and Hospice segments, generally on smaller tuck-in targets with high synergy potential. Harden also completed larger scale acquisitions including Girling Healthcare in 2007, which significantly expanded the Home Health footprint and Voyager HospiceCare in 2010 to further expand the Hospice division. Additionally, Harden opened 3 Hospice de novos and 3 Private Pay de novos in 2012. | ||

| Community Care | • 22,500 Medicaid home health patients

|

Harden Integrated Care (“HIC”) platform is an innovative solution to capitalize on existing business lines and maximize the value of the post-acute care continuum. This strategy is aimed at building clusters of services whereby a combination or all of its post-acute care services are offered in order to build long-term relationships. These long-term relationships are often initially formed when a patient enters Community Care and allow Harden to retain patients as they move across the settings of post-acute care. Gentiva believes that it can better execute and leverage the HIC platform to further expand its Home Health and Hospice divisions through the referral stream from Community Care. | ||

| • 34 locations

|

||||

| • 4 states |

||||

| Hospice

|

• 2,100 patients

• 67 locations

• 7 states |

|||

Source: Harden management.

7

Confidential

Community Care

Community Care segment provides support services to patients who have chronic care needs or long-term disabilities that require assistance with routine personal care in the home. Harden has 34 locations in 4 states with Texas being the largest. The ongoing shift from Medicaid Fee-For-Service to Managed Medicaid as well as the 2014 Medicaid expansion under PPACA pose significant opportunities for the segment. Community Care offers significant cost advantages as opposed to traditional facility-based care, which creates a compelling selling point in the current healthcare environment focused on using low-cost, high quality care. Furthermore, the ability to remain and receive care in the home is attractive to patients.

Smaller competitors include Texas Home Health, Jordan Health Services (Texas) and HCI (Oklahoma).

8

Confidential

Home Health

Home Health offers a range of skilled nursing services for home-based patients in a lower cost setting. Individual care plans range from the management of complex diseases to physical, occupational and speech therapy and personal care services. Harden’s Home Health services are primarily funded through Medicare Fee-For-Service with an increasing importance of Medicare Advantage. The Home Health segment serves 8,600 patients across 59 locations in 12 states.

9

Confidential

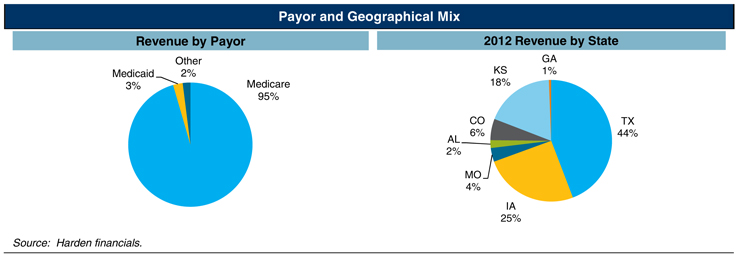

Hospice

Hospice provides end-of-life care focused on enhancing the quality of life for patients and their families. Hospice care teams may consist of consulting physicians, skilled nurses, Home Health aides, pastoral caregivers, social work services and more. Care may occur in private home or community facility settings. The business is almost exclusively Medicare reimbursed. The Hospice segment serves 2,100 patients across 67 locations in 7 states.

Harden’s historical growth in Hospice was spurred by its acquisition of Voyager, which occurred in 2010 and fully contributed to revenues in 2011.

10

Confidential

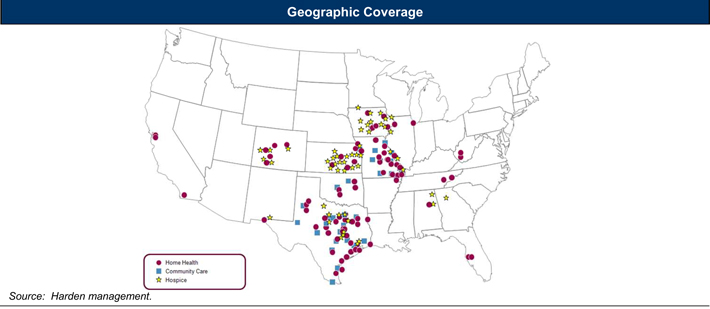

Geographic Coverage

Harden’s geographic footprint is focused on the central and southern US with locations in 13 states across its four business segments. Harden serves over 35,000 patients.

| • | Community Care – 22,500 patients, 34 locations in 4 states |

| • | Home Health – 8,600 patients, 59 locations in 12 states |

| • | Hospice – 2,100 patients, 67 locations in 7 states |

Competitive Position

Harden has a similar competitor landscape as Gentiva for its Home Health and Hospice segments.

Community Care

The homecare industry is highly competitive, fragmented and market specific. Each local market has its own competitive profile and no single competitor has significant market share across any market. Competition consists of Home Health providers, private caregivers, and larger publicly held companies such as Addus HealthCare, privately held homecare organizations, community-based organizations, managed care organizations and self-directed care programs. In addition, certain governmental payors contract for services with independent providers such that relationships with these payors are not exclusive. There is continual competition from new entrants into the homecare markets.

Employees

Harden has 9,000 full-time and 24,000 part-time employees, none of which are represented by unions.

11

Confidential

Community Care Industry

Overview

Community Care provides non-skilled home and community based services to the elderly and other adult infirm who need long-term care and assistance with activities of daily living (ADL), essential, routine tasks of life such as bathing, dressing, eating, cleaning, etc. The Kaiser Commission report on Medicaid and the uninsured dated December 2011 estimated total Medicaid expenditures for home and community based services in 2008 to be over $45 billion annually. Home and community based services is the fastest growing segment within this overall homecare market, which includes home and community based services, Home Health and Hospice services, with the program expenditures nearly doubling from $28 billion in 2003 to $45 billion in 2008, representing a compounded annual growth rate, or CAGR, of 10%.

Reimbursement

Community Care services are reimbursed through Medicaid. As such, the reimbursement environments vary greatly state by state. The major driver of cost and volume trends is the continued shift from Medicaid Fee-for-Service to Managed Medicaid as states transfer the management of their Medicaid populations to managed care companies such as Molina, Centene and others. In the Managed Medicaid environment the Company expects pricing to decrease as providers give up margin for significantly increased volumes, while payors focus more on cost effective settings of care. Community Care received a reimbursement increase in Oklahoma for Case Management and PAS effective November 1, 2012.

Texas Medicaid (~83% of Harden’s Community Care revenue)

Effective September 1, 2013, the State of Texas is implementing a $0.28 rate increase for PHC Non-Priority services ($10.41 to $10.69). This increase will also be applied to Harden’s Managed Care contracts. Partially offsetting this increase, the State of Texas is requiring a minimum wage of $7.50/hour (up from $7.25) for personal care attendants providing services in the PHC program starting September, 1, 2013. Beginning September 1, 2014, the required minimum base wage is $7.86.

Attempts to expand Medicaid coverage in Texas, including legislation during a special session of the state legislature in May, have so far failed due to political headwinds. However political analysts believe Texas will expand coverage.

Medicaid Managed Care reimbursement increases, which provide an indirect benefit to Harden, went into effect June 1, 2013:

| • | Medicaid STAR (acute care): +2.6% |

| • | Medicaid STAR+PLUS (long-term care): +0.8% |

| • | CHIP (children’s health): +1.8% |

12

Confidential

Gentiva LTM 6/30/2013 Adjusted EBITDA

| ($ in millions) | LTM 6/30/2013 |

|||

| Consolidated Net Loss |

($ | 189.2 | ) | |

| Consolidated Interest Charges |

90.2 | |||

| Provision for Income Taxes |

4.6 | |||

| Depreciation and Amortization |

21.4 | |||

| Non-recurring Charges or Losses Related to Litigation Settlement(1) |

9.3 | |||

| Gain on Sale of Assets |

(2.6 | ) | ||

| Losses Related to Closure of Certain Facilities and Branches |

1.1 | |||

| Asset Write-Downs or Impairments |

243.5 | |||

|

|

|

|||

| Total Adj. EBITDA |

$ | 178.3 | ||

| 1. | Excludes litigation expense related to Odyssey Healthcare existing on the closing date of Gentiva’s existing Senior Secured Credit Facilities (8/17/2010). |

Harden LTM 6/30/2013 Adjusted EBITDA (Excluding Long-Term Care)

| ($ in millions) | LTM 6/30/2013 |

|||

| Consolidated Net Loss |

($ | 27.2 | ) | |

| Interest Expense |

32.1 | |||

| Income Taxes |

3.2 | |||

| Depreciation |

12.2 | |||

| Amortization |

0.4 | |||

| Long-Term Care |

(1.1 | ) | ||

| Impairment Charges |

16.7 | |||

| Legal Expenses |

0.5 | |||

| Severance Expenses |

0.8 | |||

| Restructuring and M&A Expenses |

2.0 | |||

| De Novo Related Expenses |

2.3 | |||

| Out of Period Management Adjustments |

(0.4 | ) | ||

| Hospice PPD for DME and Pharmacy Expenses |

(0.9 | ) | ||

| Health Insurance Expenses |

(1.8 | ) | ||

| Compensation Related Expenses |

(0.4 | ) | ||

| Discontinued Operations Expenses |

(0.6 | ) | ||

| Other(1) |

(1.1 | ) | ||

|

|

|

|||

| Total Adj. EBITDA |

$ | 36.9 | ||

| 1. | Other includes expenses related to Home Health bad debts, payroll tax penalty and accounting diligence related adjustments. |

13

Confidential

14