Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - PROTHENA CORP PUBLIC LTD CO | d591137dex231.htm |

| EX-23.2 - EX-23.2 - PROTHENA CORP PUBLIC LTD CO | d591137dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 17, 2013.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Prothena Corporation plc

(Exact name of Registrant as specified in its charter)

| Ireland |

2834 | 43-1256213 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

650 Gateway Boulevard

South San Francisco, CA 94080

(650) 837-8550

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Dale B. Schenk

Chief Executive Officer

Prothena Corporation plc

650 Gateway Boulevard

South San Francisco, CA 94080

(650) 837-8550

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Alan C. Mendelson, Esq. Robert W. Phillips, Esq. Latham & Watkins LLP 140 Scott Drive Menlo Park, CA 94025 Telephone: (650) 328-4600 Facsimile: (650) 463-2600 |

Mark B. Weeks, Esq. John T. McKenna, Esq. Cooley LLP 3175 Hanover Street Palo Alto, CA 94304 Telephone: (650) 843-5000 Facsimile: (650) 849-7400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of securities to be registered | Amount to be registered (1) |

Proposed maximum offering price per share |

Proposed offering price (2) |

Amount of registration fee | ||||

| Ordinary Shares, par value $0.01 per share |

5,750,000 shares | $20.02 | $115,115,000 | $15,702 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes ordinary shares that the underwriters have the option to subscribe for from the Registrant, if any. |

| (2) | Estimated solely for the purpose of computing the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended (the “Securities Act”). In accordance with Rule 457(c) of the Securities Act, the price shown is the average of the high and low prices for the Registrant’s ordinary shares on September 13, 2013, as reported on The NASDAQ Global Market. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling shareholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Prospectus dated September 17, 2013

5,000,000 Shares

Ordinary Shares

Prothena Corporation plc is offering 3,500,000 of its ordinary shares. The selling shareholder identified in this prospectus is offering 1,500,000 ordinary shares. We will not receive any of the proceeds from the sale of the ordinary shares offered by the selling shareholder.

Our ordinary shares are listed on The NASDAQ Global Market under the symbol “PRTA.” On September 16, 2013, the last reported sale price of our ordinary shares on The NASDAQ Global Market was $20.10 per ordinary share.

We are an “emerging growth company” as that term is defined under the federal securities laws of the United States and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings.

Investing in our ordinary shares involves risks that are described in the “Risk Factors” section beginning on page 11 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount (1) |

$ | $ | ||||||

| Proceeds, before expenses, to Prothena Corporation plc |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholder |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

We have granted to the underwriters the right to subscribe for up to 750,000 additional ordinary shares at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares to investors on or about , 2013.

| BofA Merrill Lynch | Credit Suisse | RBC Capital Markets |

| Wedbush PacGrow Life Sciences | Roth Capital Partners |

The date of this prospectus is , 2013.

Table of Contents

| Page |

||||

| 1 | ||||

| 11 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

48 | |||

| 57 | ||||

| 71 | ||||

| 79 | ||||

| 89 | ||||

| 96 | ||||

| 99 | ||||

| 112 | ||||

| Material United States Federal Income Tax Consequences to U.S. Holders |

114 | |||

| Certain Irish Tax Consequences Relating to the Holding of Our Ordinary Shares |

119 | |||

| 121 | ||||

| 128 | ||||

| 128 | ||||

| 128 | ||||

| F-1 | ||||

Neither we, the selling shareholder nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling shareholder and the underwriters are offering to sell ordinary shares and seeking offers to buy ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of our ordinary shares.

Prothena and our logo are our trademarks and are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus appear without the ™ symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

For investors outside the United States: Neither we nor any of the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who have come into possession of this prospectus in a jurisdiction outside the United States are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

Table of Contents

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all of the information you should consider before buying our ordinary shares. Therefore, you should read the entire prospectus carefully, especially the “Risk Factors” section beginning on page 11 and our consolidated financial statements (which we refer to as our “Financial Statements”) and the related notes appearing at the end of this prospectus, before deciding to invest in our ordinary shares. In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” or “Prothena,” refer to Prothena Corporation plc.

Overview

We are a clinical stage biotechnology company focused on the discovery, development and commercialization of novel antibodies for the treatment of a broad range of diseases that involve protein misfolding or cell adhesion. We focus on the discovery, development and commercialization of therapeutic monoclonal antibodies directed specifically to disease causing proteins. Our antibody-based product candidates target a broad range of potential indications including AL and AA forms of amyloidosis (NEOD001), Parkinson’s disease and other synucleinopathies (PRX002) and inflammatory diseases and cancers (PRX003). We initiated a Phase 1 clinical trial for NEOD001, with the first patient dosing in April 2013. The Phase 1 clinical trial of NEOD001 is evaluating its safety and tolerability in AL amyloidosis patients. We also plan to initiate Phase 1 clinical trials for PRX002 and PRX003 in 2014 and 2015, respectively. Our strategy is to identify antibody candidates for clinical development by applying our extensive expertise in generating novel therapeutic antibodies and working with collaborators having expertise in specific animal models of disease.

We are a public limited company formed under the laws of Ireland. We separated from Elan Corporation, plc, or Elan, on December 20, 2012 and our ordinary shares began trading on The NASDAQ Global Market under the symbol “PRTA” on December 21, 2012.

Our Approach

We focus on the discovery, development and commercialization of therapeutic monoclonal antibodies directed specifically to disease causing proteins. These product candidates target a broad range of potential indications including AL (primary) and AA (secondary) forms of amyloidosis, Parkinson’s disease and other synucleinopathies, and novel cell adhesion targets involved in inflammatory diseases and cancers. Our strategy is to apply our extensive expertise in generating novel therapeutic antibodies and work with collaborators having expertise in specific animal models of disease, to identify antibody candidates for clinical development.

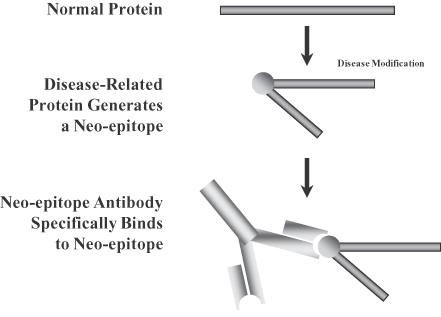

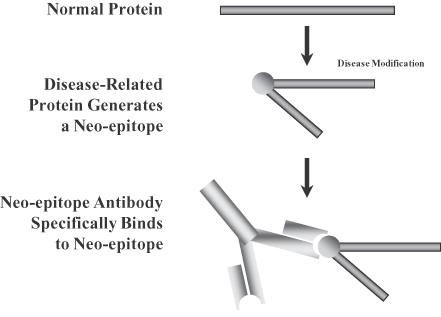

An epitope is the molecular target recognized by an antibody. A neo-epitope is a site on a protein that becomes accessible only after modification, such as from cleavage or by misfolding into an abnormal shape. The neo-epitopes we target may occur as part of a disease-associated pathological process. For some of our products we are developing novel, specific monoclonal antibodies against neo-epitope targets for the potential treatment of patients having a disease associated with the neo-epitope.

1

Table of Contents

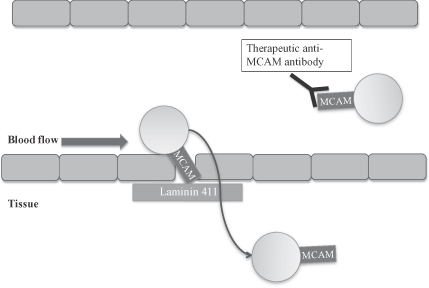

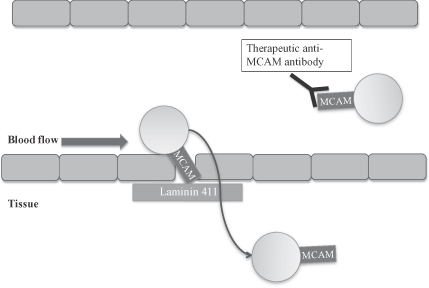

Targeting Neo-epitopes of Misfolded Proteins Associated with Disease

In addition to antibodies directed to neo-epitope targets, we are developing antibodies directed to other targets. For example, we have generated antibodies against novel cell adhesion targets expressed on certain pathogenic Th17 immune cells and tumor cells. One specific cell adhesion protein, called melanoma cell adhesion molecule, or MCAM, interacts with another protein called laminin near blood vessel walls which allows circulating tumor cells and a critical subset of T cells to leave the bloodstream and enter into tissues, sometimes initiating pathogenic processes that result in disease. Antibodies that interfere with the cell adhesion process may be useful for treating a range of inflammatory diseases and cancers.

Targeting Cell Adhesion Involved in Disease Processes

2

Table of Contents

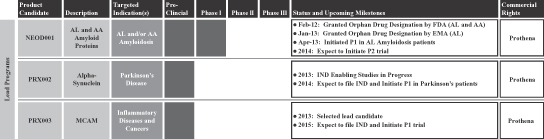

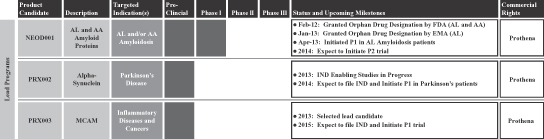

Research and Development Pipeline

Our research and development pipeline includes three lead therapeutic antibody programs that we intend to advance: NEOD001 for the potential treatment of AL and AA amyloidosis; PRX002 for the potential treatment of Parkinson’s disease; and PRX003 for the potential treatment of inflammatory diseases and cancers.

The following table summarizes the status and anticipated upcoming milestones of our research and development pipeline for lead programs:

Our Lead Programs

NEOD001 for Amyloidosis

Systemic amyloidoses are a complex group of diseases caused by tissue deposition of misfolded proteins that result in progressive organ damage. The most common type, AL amyloidosis or primary amyloidosis, involves a hematological disorder caused by plasma cells that produce misfolded AL protein resulting in deposits of abnormal AL protein (amyloid), in the tissues and organs of individuals with AL amyloidosis. Although little data are available on amyloidosis populations, AL amyloidosis is a rare disorder with an estimated incidence of 8.9 in 1,000,000 patient years. 1,200 to 3,200 new cases of AL amyloidosis are reported each year in the United States. The etiology of AL amyloidosis remains poorly understood.

Current treatments of patients with AL amyloidosis are organ transplant or treatments aimed at reducing or eliminating the bone marrow disorder, i.e. the plasma cells that are responsible for producing the AL protein, thereby limiting production of amyloid. There are no currently approved treatments for AL amyloidosis and no treatments that directly target potentially toxic forms of the AL protein. We believe that there are approximately 15,000 patients in the United States and Europe suffering from AL amyloidosis.

A different form of systemic amyloidosis, AA amyloidosis or secondary amyloidosis, occurs as a result of other illnesses, such as chronic inflammatory diseases (for example, rheumatoid arthritis and ankylosing spondylitis) or chronic infections (for example, tuberculosis or osteomyelitis). In secondary amyloidosis, the depositing amyloid protein is amyloid A protein. Amyloid A protein is a cleaved fragment from the acute phase protein serum amyloid A that is produced in abundance by the liver as a result of chronic inflammation. The treatment of secondary amyloidosis is directed at treating the underlying illness, typically with broad acting anti-inflammatory agents such as tumor necrosis factor, or TNF, inhibitors. We believe that there are approximately 8,000 patients in the United States and Europe suffering from AA amyloidosis.

NEOD001 is a monoclonal antibody that specifically targets the amyloid that accumulates in both AL and AA forms of amyloidosis. The antibody was designed to not react with normal serum amyloid A and only with the aberrant cleaved form of the protein (amyloid A). Preclinical data has demonstrated survival benefits

3

Table of Contents

and selectivity of NEOD001 for amyloid deposits in a mouse model of AA amyloidosis. This approach has the potential to be a first-in-class agent for this orphan disease with a significant unmet medical need. NEOD001 was granted orphan drug designation for the treatment of AL and AA amyloidosis by the FDA in 2012 and for the treatment of AL amyloidosis by the European Medicines Agency in 2013. An Investigational New Drug application, or IND, for NEOD001 in systemic amyloidosis (AL and AA forms of amyloidosis) was filed and accepted by the FDA in 2012. We have initiated a Phase 1 clinical trial for NEOD001 with the first patient dosed in April 2013. The primary objective of the Phase 1 clinical trial is evaluating the safety and tolerability of NEOD001 in AL Amyloidosis patients and determining a recommended dose for testing in Phase 2 trials. The secondary and exploratory objective of the Phase 1 clinical trial includes assessments of pharmacokinetics and immunogenicity of NEOD001 and hematologic and organ response. We anticipate initiating a Phase 2 trial of NEOD001 in 2014 assuming a Phase 2 recommended dose is identified prior to that date.

PRX002 for Parkinson’s Disease

Alpha-synuclein is a protein that is a prominent component of Lewy bodies and neurites which are pathological hallmarks of Parkinson’s disease, dementia with Lewy bodies, multiple system atrophy and certain other neurological disorders, collectively known as synucleinopathies. While the normal function of synuclein is not well understood, the protein normally occurs in an unstructured soluble form. In synucleinopathies, the synuclein protein can misfold and aggregate to form insoluble fibrils that contribute to the pathology of the disease.

There is genetic evidence for a causal role of synuclein in Parkinson’s disease. In rare cases of familial forms of Parkinson’s disease, there are mutations in the synuclein gene, or duplication and triplications of the gene that may cause synuclein protein to form amyloid-like fibrils that contribute to the disease. There is also increasing evidence that pathogenic forms of synuclein can be propagated and transmitted from neuron to neuron. Recent studies in cellular and animal models suggest that the spread of synuclein-associated neurodegeneration can be disrupted by targeting the pathogenic synuclein. Parkinson’s disease is a degenerative disorder of the central nervous system. Current treatments for Parkinson’s disease are effective at managing the early motor symptoms of the disease, mainly through the use of levodopa and dopamine agonists. As the disease progresses and dopaminergic neurons continue to be lost, these drugs eventually become ineffective at treating the symptoms. The goal of our approach is to slow down the progressive neurodegenerative consequences of disease, a current unmet need.

We have generated proprietary antibodies targeting alpha-synuclein that may slow or reduce the neurodegeneration associated with synuclein misfolding and/or transmission. We have tested the efficacy of these antibodies in various cellular and animal models of synuclein-related disease. In a transgenic mouse model of Parkinson’s disease, passive immunization with 9E4, a murine version of PRX002, reduced the appearance of synuclein pathology, protected synapses and improved performance by the mice in behavioral testing. The humanized antibody product candidate PRX002 has advanced into manufacturing and preclinical safety testing. We anticipate filing an IND and initiating a Phase 1 trial of PRX002 for Parkinson’s disease in 2014.

PRX003 for Inflammatory Diseases and Cancers

We are developing PRX003, a monoclonal antibody targeting MCAM for the potential treatment of inflammatory diseases and cancers.

MCAM is a cell adhesion molecule that allows certain cells travelling in the blood stream to leave the circulation and enter tissues. For example, MCAM is expressed on pathogenic Th-17 expressing immune cells that underlie inflammatory diseases and on tumor cells involved in metastatic cancer. MCAM functions like VELCRO™ hook-and-loop fasteners, allowing these cells to stick to the blood vessel wall and migrate into tissues to initiate their pathogenic process.

4

Table of Contents

Our research in the area of cell adhesion has uncovered unique insights into MCAM function, allowing us to develop specific and novel antibodies that may block MCAM’s VELCRO-like function as potential therapeutics to prevent disease causing cells from spreading into tissue.

Anti-MCAM antibodies may be useful for treating a variety of inflammatory diseases such as rheumatoid arthritis, psoriasis, psoriatic arthritis, multiple sclerosis, sarcoidosis and Behcet’s disease. Inflammatory disease arises from an inappropriate immune response of the body against substances and tissues normally present in the body. In other words, the immune system mistakes some part of the body as a pathogen and attacks its own cells. A substantial portion of the population suffers from these diseases, which are often chronic, debilitating, and life-threatening. There are more than eighty illnesses caused by autoimmunity. Current treatment for many types of inflammatory diseases typically entails the use of broad acting immunosuppressive agents that weaken the body’s ability to fight infection. Only 3 to 5% of CD4+ T-cells in the circulation express MCAM, yet these cells appear to be disproportionately involved in the propagation of inflammatory diseases. Hence, anti-MCAM based therapy may provide a more specific way to target the disease-causing immune cells while not interfering with normal function of the majority of the immune system.

MCAM antibodies may also be useful for treating cancers, including melanoma. Melanoma is a malignant tumor of melanocytes, a potentially dangerous form of skin cancer. It was estimated that doctors in the United States would diagnose about 76,250 new cases of melanoma in 2012, with approximately 9,000 melanoma-related deaths that are usually related to metastatic spread of the tumors. Normal melanocytes do not express MCAM, but expression is turned on and continues to increase as the cells become more malignant. Treatment with anti-MCAM antibodies may help patients with melanoma by inhibiting the growth and spread of the tumor.

We have generated monoclonal antibodies that selectively block MCAM-mediated cell adhesion and have been shown to delay relapse and severity of relapse in a mouse model of multiple sclerosis known as experimental autoimmune encephalomyelitis. Our antibodies are currently being tested in animal models of inflammatory diseases and cancers. Based on early results from these studies, we have identified a lead clinical candidate, PRX003. We have advanced this antibody into manufacturing and intend to advance this antibody into preclinical safety testing. We anticipate that we will file an IND and initiate a Phase 1 trial of PRX003 in late 2015.

Our Discovery Programs

Our pipeline also includes several late discovery stage programs for which we are testing efficacy of antibodies in preclinical models of disease. We are also generating additional novel antibodies against other targets involved in protein misfolding and cell adhesion for characterization in vivo and in vitro. If promising, we expect that these antibodies will advance to preclinical development.

Our Strategy

Our goal is to be a leading biotechnology company focused on discovery, development and commercialization of novel antibodies for the treatment of a broad range of diseases that involve protein misfolding or cell adhesion. Key elements of our strategy to achieve this goal are to:

| • | Continue to discover antibodies directed against novel targets involved in protein misfolding and cell adhesion; |

| • | Quickly translate our research discoveries into clinical development; |

| • | Establish early clinical proof of concept with our therapeutic antibodies; |

5

Table of Contents

| • | Strategically collaborate or out-license select programs; |

| • | Highly leverage external talent and resources; |

| • | Collaborate with scientific and clinical experts in disease areas of interest; and |

| • | Evaluate commercialization strategies on a product-by-product basis in order to maximize the value of each of our product candidates or future potential products. |

Risks and Uncertainties Relating to Our Business

We are a clinical stage biotechnology company and our business and ability to execute our business strategy is subject to numerous risks and uncertainties that you should be aware of before making an investment decision. These risks and uncertainties are described more fully in the sections titled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” in this prospectus. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” and “Special Note Regarding Forward-Looking Statements” in deciding whether to invest in our ordinary shares. Among these important risks and uncertainties that could adversely affect our results of operations and business condition are the following:

| • | We have not generated any significant third party external revenue to date, and we anticipate that we will incur losses for the foreseeable future and we may never achieve or sustain profitability; |

| • | We will require additional capital to fund our operations, and if we are unable to obtain such capital, we will be unable to successfully develop and commercialize drug candidates; |

| • | Our success is largely dependent on the success of our research and development programs, which are at an early stage. Our drug candidates are still in early stages of development and we have only one drug candidate in its first Phase 1 clinical trials. We may not be able to successfully discover, develop, obtain regulatory approval for or commercialize any drug candidates; |

| • | Even if any of our drug candidates receives regulatory approval, if such approved product does not achieve broad market acceptance, the revenues that we generate from sales of the product will be limited; |

| • | The markets for our drug candidates are subject to intense competition. If we are unable to compete effectively, our drug candidates may be rendered noncompetitive or obsolete; |

| • | If clinical trials of our drug candidates are prolonged, delayed, suspended or terminated, we may be unable to commercialize our drug candidates on a timely basis, which would require us to incur additional costs and delay our receipt of any revenue from potential product sales; |

| • | We rely on third parties to conduct our clinical trials, and those third parties may not perform satisfactorily, including failing to meet established deadlines for the completion of any such clinical trials; |

| • | The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our drug candidates, our business will be substantially harmed; |

| • | Even if our drug candidates receive regulatory approval in the United States, we may never receive approval or commercialize our products outside of the United States; |

6

Table of Contents

| • | We depend on third-party suppliers for key raw materials used in our manufacturing processes, and the loss of these third-party suppliers or their inability to supply us with adequate raw materials could harm our business; |

| • | If we are unable to adequately protect or enforce the intellectual property relating to our drug candidates our ability to successfully commercialize our drug candidates will be harmed; and |

| • | Other factors identified elsewhere in this prospectus, including those set forth under “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” |

Corporate Information

We were formed under the laws of Ireland as a private limited company under the name “Neotope Corporation Limited” on September 26, 2012. We subsequently re-registered as a public limited company and changed our name to “Neotope Corporation plc.” On November 1, 2012, our shareholders resolved to change our name to “Prothena Corporation plc,” and this was approved by the Irish Registrar of Companies on November 7, 2012.

Our business consists of a substantial portion of Elan’s former drug discovery business platform, including Neotope Biosciences Limited and its wholly owned subsidiaries Onclave Therapeutics Limited and Prothena Biosciences Inc (which for the period prior to separation and distribution we refer to herein as the “Prothena Business”). Prior to December 21, 2012, the Prothena Business operated as part of Elan and not as a separate stand-alone entity. After the separation from Elan, and the related distribution of our ordinary shares to Elan’s shareholders (which we refer to as the “Separation and Distribution”), our ordinary shares began trading on The NASDAQ Global Market under the symbol “PRTA” on December 21, 2012.

Our principal executive offices are located at 650 Gateway Boulevard, South San Francisco, California 94080, and our telephone number is (650) 837-8550. We also maintain offices in Dublin, Ireland. Our website address is http://www.prothena.com. The information contained in, or that can be accessed through, our website is not part of this prospectus.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These include, but are not limited to, (i) reduced obligations with respect to the disclosure of selected financial data in registration statements filed with the Securities and Exchange Commission (including the registration statement on Form S-1 of which this information statement is a part), (ii) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, (iii) an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and (iv) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and the requirement to obtain shareholder approval of any golden parachute payments not previously approved.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, or Securities Act, for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for private companies. Section 107 of the JOBS Act provides that we can elect to opt out of the extended transition period at any time and that election is irrevocable.

7

Table of Contents

THE OFFERING

| Issuer |

Prothena Corporation plc |

Ordinary shares offered:

| by us |

3,500,000 ordinary shares (or 4,250,000 ordinary shares if the underwriters exercise in full their option to subscribe for additional shares) |

| by the selling shareholder |

1,500,000 ordinary shares |

| Ordinary shares to be outstanding after the offering |

21,179,182 ordinary shares (or 21,929,182 shares if the underwriters exercise in full their option to subscribe for additional shares) |

| Use of proceeds |

We intend to use substantially all of the net proceeds from this offering to conduct clinical trials and the balance for working capital and general corporate purposes, including research and development. We will not receive any proceeds from the sale of ordinary shares by the selling shareholder. See “Use of Proceeds” on page 42 for a more complete description of the intended use of proceeds from this offering. |

| Risk factors |

See “Risk Factors” beginning on page 11 and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our ordinary shares. |

| Symbol on The NASDAQ Global Market |

“PRTA” |

The number of ordinary shares to be outstanding after this offering is based on 17,679,182 ordinary shares outstanding as of June 30, 2013, and excludes the following:

| • | 1,835,500 ordinary shares issuable upon the exercise of outstanding options as of June 30, 2013 having a weighted-average exercise price of $6.57 per share; and |

| • | 814,500 ordinary shares reserved for issuance pursuant to future awards under our 2012 Long Term Incentive Plan. |

Unless otherwise indicated, all information in this prospectus assumes:

| • | no exercise of options outstanding as of June 30, 2013; and |

| • | no exercise of the underwriters’ option to subscribe for additional ordinary shares from us. |

8

Table of Contents

SUMMARY FINANCIAL DATA

The following tables set forth a summary of our historical financial data as of, and for the period ended on, the dates indicated. The Consolidated Statement of Operations data for the years ended December 31, 2012, 2011 and 2010 and the Consolidated Balance Sheet data as of December 31, 2012 and 2011 are derived from our audited Financial Statements included elsewhere in this prospectus. The Consolidated Balance Sheet data as of December 31, 2010 are derived from our audited Financial Statements not included in this prospectus. The Consolidated Statement of Operations data for the six months ended June 30, 2013 and 2012 and Consolidated Balance Sheet data as of June 30, 2013 have been derived from our unaudited Financial Statements appearing elsewhere in this prospectus. You should read this data together with our audited and unaudited Financial Statements and related notes appearing elsewhere in this prospectus and the information under the captions “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results, and results for the six months ended June 30, 2013 are not necessarily indicative of results to be expected for the full year ending December 31, 2013.

Our historical results of operations presented below may not be reflective of our financial position, results of operations and cash flows had we operated as a stand-alone public company during all periods presented. Prior to December 21, 2012, the Prothena Business operated as part of Elan and not as a separate stand-alone entity. Our Combined Financial Statements prior to December 21, 2012 have been prepared on a “carve-out” basis from the consolidated financial statements of Elan to represent our financial position and performance as if we had existed on a stand-alone basis during each of the fiscal years presented in the Consolidated Financial Statements. Central support costs have been allocated to us for the purposes of preparing the Consolidated Financial Statements based on our estimated usage of the resources. Our estimated usage of the central support resources was determined by estimating our portion of the most appropriate driver for each category of central support costs such as headcount or labor hours, depending on the nature of the costs. We believe that such allocations have been made on a reasonable basis, but may not necessarily be indicative of all of the costs that would have been incurred if we had operated on a standalone basis.

| Years Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||

| 2012 | 2011 | 2010 | 2013 | 2012 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||

| Revenues—related party |

$ | 2,658 | $ | 507 | $ | 1,243 | $ | 338 | $ | 1,139 | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

34,139 | 24,172 | 9,787 | 14,104 | 16,776 | |||||||||||||||

| General and administrative |

9,929 | 5,579 | 3,618 | 6,393 | 4,885 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

44,068 | 29,751 | 13,405 | 20,497 | 21,661 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(41,410 | ) | (29,244 | ) | (12,162 | ) | (20,159 | ) | (20,522 | ) | ||||||||||

| Interest income, net |

5 | — | — | 36 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income taxes |

(41,405 | ) | (29,244 | ) | (12,162 | ) | (20,123 | ) | (20,522 | ) | ||||||||||

| Provision for income taxes |

6 | 426 | 320 | 130 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (41,411 | ) | $ | (29,670 | ) | $ | (12,482 | ) | $ | (20,253 | ) | $ | (20,522 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic and diluted net loss per share (1) |

$ | (2.84 | ) | $ | (2.05 | ) | $ | (0.86 | ) | $ | (1.15 | ) | $ | (1.42 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Shares used to compute basic and diluted net loss per share |

14,593 | 14,497 | 14,497 | 17,679 | 14,497 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

9

Table of Contents

| December 31, | June

30, 2013 |

|||||||||||||||

| 2012 | 2011 | 2010 | ||||||||||||||

| (in thousands) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||

| Cash and cash equivalents (1) |

$ | 124,860 | $ | — | $ | — | $ | 112,507 | ||||||||

| Total assets |

129,283 | 3,618 | 3,278 | 117,930 | ||||||||||||

| Other non-current liabilities |

1,055 | 1,650 | 1,384 | 1,618 | ||||||||||||

| Total liabilities |

2,799 | 10,054 | 3,249 | 10,701 | ||||||||||||

| Shareholders’ and parent company equity |

126,484 | (6,436 | ) | (30 | ) | 107,229 | ||||||||||

| (1) | Prior to the Separation and Distribution completed on December 20, 2012, the Prothena Business operated as part of Elan and not as a separate stand-alone entity. As a result, Prothena did not have any ordinary shares outstanding and cash and cash equivalents prior to December 20, 2012. The calculation of basic and diluted net loss per share assumes that the 14,496,929 ordinary shares issued to Elan shareholders in connection with the separation from Elan have been outstanding for all periods presented and that the 3,182,253 ordinary shares subscribed for by a wholly owned subsidiary of Elan upon separation have been outstanding since December 20, 2012. |

10

Table of Contents

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our Financial Statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our ordinary shares. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our ordinary shares could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Relating to Our Financial Position, Our Need for Additional Capital and Our Business

We have not generated any significant third party external revenue to date, and we anticipate that we will incur losses for the foreseeable future and we may never achieve or sustain profitability.

We may not generate the cash that is necessary to finance our operations in the foreseeable future. We have not generated any significant third party external revenues to date. We have incurred losses of $41.4 million, $29.7 million and $12.5 million for the years ended December 31, 2012, 2011 and 2010, respectively, and $20.3 million for the six months ended June 30, 2013. We expect to continue to incur substantial losses for the foreseeable future as we:

| • | conduct our Phase 1 clinical trial for NEOD001 and initiate additional clinical trials, if supported by the results of the Phase 1 trial; |

| • | complete preclinical development of other product candidates and initiate clinical trials, if supported by positive preclinical data; and |

| • | pursue our early stage research and seek to identify additional drug candidates and potentially acquire rights from third parties to drug candidates through licenses, acquisitions or other means. |

We must generate significant revenue to achieve and sustain profitability. Even if we succeed in discovering, developing and commercializing one or more drug candidates, we may not be able to generate sufficient revenue and we may never be able to achieve or sustain profitability.

We will require additional capital to fund our operations, and if we are unable to obtain such capital, we will be unable to successfully develop and commercialize drug candidates.

As of June 30, 2013, we had cash and cash equivalents of $112.5 million. Although we believe, based on our current business plans, that our existing cash and cash equivalents will be sufficient to meet our obligations for at least the next twelve months, we anticipate that we will require additional capital in the future in order to continue the research and development of our drug candidates. Our future capital requirements will depend on many factors that are currently unknown to us, including, without limitation:

| • | the timing of initiation, progress, results and costs of our clinical trials, including our Phase 1 clinical trial for NEOD001; |

| • | the results of our research and preclinical studies; |

| • | the costs of clinical manufacturing and of establishing commercial manufacturing arrangements; |

| • | the costs of preparing, filing, and prosecuting patent applications and maintaining, enforcing, and defending intellectual property-related claims; |

11

Table of Contents

| • | our ability to establish research collaborations, strategic collaborations, licensing or other arrangements; |

| • | the costs to satisfy our obligations under potential future collaborations; and |

| • | the timing, receipt, and amount of revenues or royalties, if any, from any approved drug candidates. |

We have based our expectations relating to liquidity and capital resources on assumptions that may prove to be wrong, and we could use our available capital resources sooner than we currently expect. Because of the numerous risks and uncertainties associated with the development and commercialization of our product candidates, we are unable to estimate the amounts of increased capital outlays and operating expenses associated with completing the development of our current product candidates.

We are not able to provide specific estimates of the timelines or total costs to complete the ongoing Phase 1 clinical trial for NEOD001 that we initiated in April 2013. In the pharmaceutical industry, the research and development process is lengthy and involves a high degree of risk and uncertainty. This process is conducted in various stages and, during each stage, there is a substantial risk that product candidates in our research and development pipeline will experience difficulties, delays or failures. This makes it difficult to estimate the total costs to complete this ongoing Phase 1 clinical trial or any future clinical trials for NEOD001, or any potential future drug candidates, and to estimate the anticipated completion date with any degree of accuracy, and raises concerns that attempts to provide estimates of timing may be misleading by implying a greater degree of certainty than actually exists.

In order to develop and obtain regulatory approval for our product candidates we will need to raise substantial additional funds. We expect to raise any such additional funds through public or private equity or debt financings, collaborative agreements with corporate partners or other arrangements. We cannot assure you that additional funds will be available when we need them on terms that are acceptable to us, or at all. General market conditions may make it very difficult for us to seek financing from the capital markets. If we raise additional funds by issuing equity securities, substantial dilution to existing shareholders would result. If we raise additional funds by incurring debt financing, the terms of the debt may involve significant cash payment obligations as well as covenants and specific financial ratios that may restrict our ability to operate our business. We may be required to relinquish rights to our technologies or drug candidates or grant licenses on terms that are not favorable to us in order to raise additional funds through strategic alliances, joint ventures or licensing arrangements.

If adequate funds are not available on a timely basis, we may be required to:

| • | terminate or delay clinical trials or other development for one or more of our drug candidates; |

| • | delay arrangements for activities that may be necessary to commercialize our drug candidates; |

| • | curtail or eliminate our drug research and development programs that are designed to identify new drug candidates; or |

| • | cease operations. |

In addition, if we do not meet our payment obligations to third parties as they come due, we may be subject to litigation claims. Even if we are successful in defending against these claims, litigation could result in substantial costs and distract management, and may have unfavorable results that could further adversely impact our financial condition.

Our future success depends on our ability to retain our chief executive officer and to attract, retain and motivate qualified personnel.

We are highly dependent on Dr. Dale Schenk, our President and Chief Executive Officer. We expect that we will continue to pay our key executives less cash compensation than what they were paid by Elan. There

12

Table of Contents

can be no assurance that we will be able to retain Dr. Schenk or any of our key executives. The loss of the services of Dr. Schenk or any other person on which we become highly dependent might impede the achievement of our research and development objectives. Recruiting and retaining qualified scientific personnel will also be critical to our success. We may not be able to attract and retain these personnel on acceptable terms given the competition among numerous pharmaceutical and biotechnology companies for similar personnel. We also experience competition for the hiring of scientific personnel from universities and research institutions.

Our collaborators, prospective collaborators and suppliers may need assurances that our financial resources and stability on a stand-alone basis are sufficient to satisfy their requirements for doing or continuing to do business with us.

Some of our collaborators, prospective collaborators and suppliers may need assurances that our financial resources and stability on a stand-alone basis are sufficient to satisfy their requirements for doing or continuing to do business with us. If our collaborators, prospective collaborators or suppliers are not satisfied with our financial resources and stability, it could have a material adverse effect on our ability to develop our drug candidates, enter into licenses or other agreements and on our business, financial condition or results of operations.

Risks Related to the Discovery, Development and Regulatory Approval of Drug Candidates

Our success is largely dependent on the success of our research and development programs, which are at an early stage. Our drug candidates are still in early stages of development and we have only one drug candidate in its first Phase 1 clinical trials. We may not be able to successfully discover, develop, obtain regulatory approval for or commercialize any drug candidates.

The success of our business depends substantially upon our ability to discover, develop, obtain regulatory approval for and commercialize our drug candidates successfully. Our research and development programs are prone to the significant and likely risks of failure inherent in drug development. We intend to continue to invest most of our time and financial resources in our research and development programs. Although we have initiated one Phase 1 clinical trial for NEOD001, there is no assurance that this clinical trial will support further development of this drug candidate. In addition, we currently do not, and may never, have any other drug candidates in clinical trials, and we have not identified drug candidates for many of our research programs.

Before obtaining regulatory approvals for the commercial sale of any drug candidate for a target indication, we must demonstrate with substantial evidence gathered in well-controlled clinical trials, and, with respect to approval in the United States, to the satisfaction of the United States Food and Drug Administration, or FDA, or, with respect to approval in other countries, similar regulatory authorities in those countries, that the drug candidate is safe and effective for use for that target indication. Satisfaction of these and other regulatory requirements is costly, time consuming, uncertain, and subject to unanticipated delays. Despite our efforts, our drug candidates may not:

| • | offer improvement over existing, comparable products; |

| • | be proven safe and effective in clinical trials; or |

| • | meet applicable regulatory standards. |

Positive results in preclinical studies of a drug candidate may not be predictive of similar results in humans during clinical trials, and promising results from early clinical trials of a drug candidate may not be replicated in later clinical trials. Interim results of a clinical trial do not necessarily predict final results. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials even after achieving promising results in early-stage development. Accordingly, the

13

Table of Contents

results from completed preclinical studies and clinical trials for our drug candidates may not be predictive of the results we may obtain in later stage trials or studies. Our preclinical studies or clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional preclinical studies or clinical trials, or to discontinue clinical trials altogether.

Furthermore, we have not marketed, distributed or sold any products. Our success will, in addition to the factors discussed above, depend on the successful commercialization of our drug candidates, which may require:

| • | obtaining and maintaining commercial manufacturing arrangements with third-party manufacturers; |

| • | collaborating with pharmaceutical companies or contract sales organizations to market and sell any approved drug; or |

| • | acceptance of any approved drug in the medical community and by patients and third-party payors. |

Many of these factors are beyond our control. We do not expect any of our drug candidates to be commercially available for several years and some or all may never become commercially available. Accordingly, we may never generate revenues through the sale of products.

If clinical trials of our drug candidates are prolonged, delayed, suspended or terminated, we may be unable to commercialize our drug candidates on a timely basis, which would require us to incur additional costs and delay our receipt of any revenue from potential product sales.

We cannot predict whether we will encounter problems with our Phase 1 clinical trial for NEOD001 or any future clinical trials that will cause us or any regulatory authority to delay or suspend those clinical trials or delay the analysis of data derived from them. For example, our current Phase 1 NEOD001 clinical trial targets patients with amyoloidosis, an orphan population with a relatively small pool of patients who may be eligible, accessible and interested in participating in clinical trials. A number of events, including any of the following, could delay the completion of our planned clinical trials and negatively impact our ability to obtain regulatory approval for, and to market and sell, a particular drug candidate:

| • | conditions imposed on us by the FDA or any foreign regulatory authority regarding the scope or design of our clinical trials; |

| • | delays in obtaining, or our inability to obtain, required approvals from institutional review boards, or IRBs, or other reviewing entities at clinical sites selected for participation in our clinical trials; |

| • | insufficient supply or deficient quality of our drug candidates or other materials necessary to conduct our clinical trials; |

| • | delays in obtaining regulatory agency agreement for the conduct of our clinical trials; |

| • | lower than anticipated enrollment and retention rate of subjects in clinical trials for a variety of reasons, including size of patient population, nature of trial protocol, the availability of approved effective treatments for the relevant disease and competition from other clinical trial programs for similar indications; |

| • | serious and unexpected drug-related side effects experienced by patients in clinical trials; or |

| • | failure of our third-party contractors to meet their contractual obligations to us in a timely manner. |

14

Table of Contents

Clinical trials may also be delayed or terminated as a result of ambiguous or negative interim results. In addition, a clinical trial may be suspended or terminated by us, the FDA, the IRBs at the sites where the IRBs are overseeing a trial, or a data safety monitoring board, or DSMB, overseeing the clinical trial at issue, or other regulatory authorities due to a number of factors, including:

| • | failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols; |

| • | inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities resulting in the imposition of a clinical hold; |

| • | varying interpretation of data by the FDA or similar foreign regulatory authorities; |

| • | failure to achieve primary or secondary endpoints or other failure to demonstrate efficacy; |

| • | unforeseen safety issues; or |

| • | lack of adequate funding to continue the clinical trial. |

Additionally, changes in regulatory requirements and guidance may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to IRBs for reexamination, which may impact the cost, timing or successful completion of a clinical trial.

We do not know whether our clinical trials will be conducted as planned, will need to be restructured or will be completed on schedule, if at all. Delays in our clinical trials will result in increased development costs for our drug candidates. In addition, if we experience delays in the completion of, or if we terminate, any of our clinical trials, the commercial prospects for our drug candidates may be harmed and our ability to generate product revenues will be jeopardized. Furthermore, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of a drug candidate.

The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our drug candidates, our business will be substantially harmed.

The time required to obtain approval by the FDA and comparable foreign authorities is inherently unpredictable but typically takes many years following the commencement of clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities. In addition, approval policies, regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a drug candidate’s clinical development and may vary among jurisdictions. We have not obtained regulatory approval for any drug candidate and it is possible that none of our existing drug candidates or any drug candidates we may seek to develop in the future will ever obtain regulatory approval.

Our drug candidates could fail to receive regulatory approval for many reasons, including the following:

| • | the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of our clinical trials; |

| • | we may be unable to demonstrate to the satisfaction of the FDA or comparable foreign regulatory authorities that a drug candidate is safe and effective for its proposed indication; |

15

Table of Contents

| • | the results of clinical trials may not meet the level of statistical significance required by the FDA or comparable foreign regulatory authorities for approval; |

| • | we may be unable to demonstrate that a drug candidate’s clinical and other benefits outweigh its safety risks; |

| • | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| • | the data collected from clinical trials of our drug candidates may not be sufficient to support the submission of a Biologics License Application, or BLA, or other submission or to obtain regulatory approval in the United States or elsewhere; |

| • | the FDA or comparable foreign regulatory authorities may fail to approve the manufacturing processes or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; or |

| • | the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval. |

This lengthy approval process as well as the unpredictability of future clinical trial results may result in our failing to obtain regulatory approval to market our drug candidates, which would significantly harm our business, results of operations and prospects. In addition, even if we were to obtain approval, regulatory authorities may approve any of our drug candidates for fewer or more limited indications than we request, may not approve the price we intend to charge for our products, may grant approval contingent on the performance of costly post-marketing clinical trials, or may approve a drug candidate with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that drug candidate. Any of the foregoing scenarios could materially harm the commercial prospects for our drug candidates.

Even if our drug candidates receive regulatory approval in the United States, we may never receive approval or commercialize our products outside of the United States.

In order to market any products outside of the United States, we must establish and comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy. Approval procedures vary among countries and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval process in other countries may include all of the risks detailed above regarding FDA approval in the United States as well as other risks. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in others. Failure to obtain regulatory approval in other countries or any delay or setback in obtaining such approval would impair our ability to develop foreign markets for our drug candidates.

Both before and after marketing approval, our drug candidates are subject to ongoing regulatory requirements and continued regulatory review, and if we fail to comply with these continuing requirements, we could be subject to a variety of sanctions and the sale of any approved products could be suspended.

Both before and after regulatory approval to market a particular drug candidate, the manufacturing, labeling, packaging, adverse event reporting, storage, advertising, promotion, distribution and record keeping related to the product are subject to extensive, ongoing regulatory requirements. These requirements include submissions of safety and other post-marketing information and reports, registration, as well as continued

16

Table of Contents

compliance with current good manufacturing practice, or cGMP, requirements and current good clinical practice, or cGCP, requirements for any clinical trials that we conduct post-approval. Any regulatory approvals that we receive for our drug candidates may also be subject to limitations on the approved indicated uses for which the product may be marketed or to the conditions of approval, or contain requirements for potentially costly post-marketing testing, including Phase IV clinical trials, and surveillance to monitor the safety and efficacy of the drug candidate. Later discovery of previously unknown problems with a product, including adverse events of unanticipated severity or frequency, or with our third-party manufacturers or manufacturing processes, or failure to comply with the regulatory requirements of the FDA and other applicable U.S. and foreign regulatory authorities could subject us to administrative or judicially imposed sanctions, including:

| • | restrictions on the marketing of our products or their manufacturing processes; |

| • | warning letters; |

| • | civil or criminal penalties; |

| • | fines; |

| • | injunctions; |

| • | product seizures or detentions; |

| • | import or export bans; |

| • | voluntary or mandatory product recalls and related publicity requirements; |

| • | suspension or withdrawal of regulatory approvals; |

| • | total or partial suspension of production; and |

| • | refusal to approve pending applications for marketing approval of new products or supplements to approved applications. |

The FDA’s policies may change and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our drug candidates. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any marketing approval that we may have obtained, which would adversely affect our business, prospects and ability to achieve or sustain profitability.

If side effects are identified during the time our drug candidates are in development or after they are approved and on the market, we may choose to or be required to perform lengthy additional clinical trials, discontinue development of the affected drug candidate, change the labeling of any such products, or withdraw any such products from the market, any of which would hinder or preclude our ability to generate revenues.

Undesirable side effects caused by our drug candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in a more restrictive label or the delay or denial of regulatory approval by the FDA or other comparable foreign authorities. The drug-related side effects could affect patient recruitment or the ability of enrolled patients to complete the trial or result in potential product liability claims. Any of these occurrences may harm our business, financial condition and prospects significantly. Even if any of our drug candidates receives marketing approval, as greater numbers of patients use a drug

17

Table of Contents

following its approval, an increase in the incidence of side effects or the incidence of other post-approval problems that were not seen or anticipated during pre-approval clinical trials could result in a number of potentially significant negative consequences, including:

| • | regulatory authorities may withdraw their approval of the product; |

| • | regulatory authorities may require the addition of labeling statements, such as warnings or contraindications; |

| • | we may be required to change the way the product is administered, conduct additional clinical trials or change the labeling of the product; |

| • | we could be sued and held liable for harm caused to patients; and |

| • | our reputation may suffer. |

Any of these events could substantially increase the costs and expenses of developing, commercializing and marketing any such drug candidates or could harm or prevent sales of any approved products.

We deal with hazardous materials and must comply with environmental laws and regulations, which can be expensive and restrict how we do business.

Some of our research and development activities involve the controlled storage, use, and disposal of hazardous materials. We are subject to federal, state, and local laws and regulations governing the use, manufacture, storage, handling, and disposal of these hazardous materials. Although we believe that our safety procedures for the handling and disposing of these materials comply with the standards prescribed by these laws and regulations, we cannot eliminate the risk of accidental contamination or injury from these materials. In the event of an accident, state or federal authorities may curtail our use of these materials, and we could be liable for any civil damages that result, which may exceed our financial resources and may seriously harm our business. Because we believe that our laboratory and materials handling policies and practices sufficiently mitigate the likelihood of materials liability or third-party claims, we currently carry no insurance covering such claims. An accident could damage, or force us to shut down, our operations.

Risks Related to the Commercialization of Our Drug Candidates

Even if any of our drug candidates receives regulatory approval, if such approved product does not achieve broad market acceptance, the revenues that we generate from sales of the product will be limited.

Even if any drug candidates we may develop or acquire in the future obtain regulatory approval, they may not gain broad market acceptance among physicians, healthcare payors, patients and the medical community. The degree of market acceptance for any approved drug candidate will depend on a number of factors, including:

| • | the indication and label for the product and the timing of introduction of competitive products; |

| • | demonstration of clinical safety and efficacy compared to other products; |

| • | prevalence and severity of adverse side effects; |

| • | availability of reimbursement from managed care plans and other third-party payors; |

| • | convenience and ease of administration; |

18

Table of Contents

| • | cost-effectiveness; |

| • | other potential advantages of alternative treatment methods; and |

| • | the effectiveness of marketing and distribution support of the product. |

Consequently, even if we discover, develop and commercialize a product, the product may fail to achieve broad market acceptance and we may not be able to generate significant revenue from the product.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell an approved product, we may be unable to generate product revenue.

We do not currently have an organization for the sales, marketing and distribution of pharmaceutical products. In order to market any products that may be approved by the FDA, we must build our sales, marketing, managerial and other non-technical capabilities or make arrangements with third parties to perform these services. If we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, we may not be able to generate product revenue and may not become profitable.

If government and third-party payors fail to provide coverage and adequate reimbursement rates for any of our drug candidates that receive regulatory approval, our revenue and prospects for profitability will be harmed.

In both domestic and foreign markets, our sales of any future products will depend in part upon the availability of reimbursement from third-party payors. Such third-party payors include government health programs such as Medicare, managed care providers, private health insurers, and other organizations. There is significant uncertainty related to the third-party coverage and reimbursement of newly approved drugs. Coverage and reimbursement may not be available for any drug that we or our collaborators commercialize and, even if these are available, the level of reimbursement may not be satisfactory. Third-party payors often rely upon Medicare coverage policy and payment limitations in setting their own reimbursement policies. Third-party payors are also increasingly attempting to contain healthcare costs by demanding price discounts or rebates and limiting both coverage and the amounts that they will pay for new drugs, and, as a result, they may not cover or provide adequate payment for our drug candidates. We might need to conduct post-marketing studies in order to demonstrate the cost-effectiveness of any future products to such payors’ satisfaction. Such studies might require us to commit a significant amount of management time and financial and other resources. Our future products might not ultimately be considered cost-effective. Adequate third-party reimbursement might not be available to enable us to maintain price levels sufficient to realize an appropriate return on investment in product development. If coverage and adequate reimbursement are not available or reimbursement is available only to limited levels, we or our collaborators may not be able to successfully commercialize any product candidates for which marketing approval is obtained.

The regulations that govern marketing approvals, pricing, coverage and reimbursement for new drugs vary widely from country to country. Current and future legislation may significantly change the approval requirements in ways that could involve additional costs and cause delays in obtaining approvals. Some countries require approval of the sale price of a drug before it can be marketed. In many countries, the pricing review period begins after marketing or licensing approval is granted. In some foreign markets, prescription pharmaceutical pricing remains subject to continuing governmental control even after initial approval is granted. As a result, we or our collaborators might obtain marketing approval for a drug in a particular country, but then be subject to price regulations that delay commercial launch of the drug, possibly for lengthy time periods, and negatively impact our ability to generate revenue from the sale of the drug in that country. Adverse pricing limitations may hinder our ability to recoup our investment in one or more drug candidates, even if our drug candidates obtain marketing approval.

19

Table of Contents

U.S. and foreign governments continue to propose and pass legislation designed to reduce the cost of healthcare. In the United States, we expect that there will continue to be federal and state proposals to implement similar governmental controls. In addition, recent changes in the Medicare program and increasing emphasis on managed care in the United States will continue to put pressure on pharmaceutical product pricing. For example, in 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, collectively, the Healthcare Reform Law, was enacted. The Healthcare Reform Law substantially changes the way healthcare is financed by both governmental and private insurers and significantly affects the pharmaceutical industry. Among the provisions of the Healthcare Reform Law of importance to the pharmaceutical industry are the following:

| • | an annual, nondeductible fee on any entity that manufactures or imports certain branded prescription drugs and biologic agents, apportioned among these entities according to their market share in certain government healthcare programs; |

| • | an increase in the minimum rebates a manufacturer must pay under the Medicaid Drug Rebate Program to 23.1% and 13.0% of the average manufacturer price for branded and generic drugs, respectively; |

| • | expansion of healthcare fraud and abuse laws, including the False Claims Act and the Anti-Kickback Statute, new government investigative powers and enhanced penalties for non-compliance; |

| • | a new Medicare Part D coverage gap discount program, under which manufacturers must agree to offer 50 percent point-of-sale discounts off negotiated prices of applicable brand drugs to eligible beneficiaries during their coverage gap period, as a condition for the manufacturer’s outpatient drugs to be covered under Medicare Part D; |

| • | extension of manufacturers’ Medicaid rebate liability to covered drugs dispensed to individuals who are enrolled in Medicaid managed care organizations; |

| • | expansion of eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to additional individuals and by adding new mandatory eligibility categories for certain individuals with income at or below 133% of the federal poverty level beginning in 2014, thereby potentially increasing a manufacturer’s Medicaid rebate liability; |

| • | a licensure framework for follow-on biologic products; |

| • | expansion of the entities eligible for discounts under the Public Health Service pharmaceutical pricing program; |

| • | new requirements under the federal Open Payments program and its implementing regulations; |

| • | a new requirement to annually report drug samples that manufacturers and distributors provide to physicians; and |

| • | a new Patient-Centered Outcomes Research Institute to oversee, identify priorities in, and conduct comparative clinical effectiveness research, along with funding for such research. |

In addition, other legislative changes have been proposed and adopted since the Healthcare Reform Law was enacted. These changes include aggregate reductions to Medicare payments to providers of up to 2% per fiscal year, starting in 2013. On March 1, 2013, the President signed an executive order implementing the 2% Medicare payment reductions, and on April 1, 2013, these reductions went into effect. In January 2013, President

20

Table of Contents

Obama signed into law the American Taxpayer Relief Act of 2012, which, among other things, reduced Medicare payments to several types of providers and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. These new laws may result in additional reductions in Medicare and other healthcare funding, which could have a material adverse effect on customers for our drugs, if approved, and, accordingly, our financial operations.

We expect that the Healthcare Reform Law, as well as other healthcare reform measures that may be adopted in the future, may result in more rigorous coverage criteria and in additional downward pressure on the price that we receive for any approved drug. Legislation and regulations affecting the pricing of pharmaceuticals might change before our drug candidates are approved for marketing. Any reduction in reimbursement from Medicare or other government healthcare programs may result in a similar reduction in payments from private payors. The implementation of cost containment measures or other healthcare reforms may prevent us from being able to generate revenue, attain profitability or commercialize our drugs.