Attached files

| file | filename |

|---|---|

| 8-K - PEDEVCO CORP | pedevco8k091113.htm |

| EX-99.2 - PEDEVCO CORP | ex99-2.htm |

| EX-10.1 - PEDEVCO CORP | ex10-1.htm |

EXHIBIT 99.1

PACIFIC ENERGY DEVELOPMENT NYSE MKT: PED Company Presentation September 16, 2013

Cautionary Statement

This presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward looking statements are based on our current expectations about our company, our properties, our estimates of required capital expenditures and our industry. You can identify these forward looking statements when you see us using words such as "expect”, "will", "anticipate," "indicate," "estimate," "believes," "plans" and other similar expressions. It is important to note that any such forward looking statements are not guarantees of future performance and involve a number of risks and uncertainties. Actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statement include: the preliminary nature of well data, including permeability and gas content, and commercial viability of the wells; risk and uncertainties associated with exploration, development and production of oil and gas; drilling and production risks; our lack of operating history; limited and potentially inadequate cash resources; expropriation and other risks associated with foreign operations; matters affecting the oil and gas industry generally; lack of oil and gas field goods and services; environmental risks; changes in laws or regulations affecting our operations, as well as other risks described in PEDEVCO Corp.’s public filings with the U.S. Securities and Exchange Commission (the “SEC”). We undertake no obligation to publicly update any forward looking statements for any reason, even if new information becomes available or other events occur in the future. We caution you not to place undue reliance on those statements.

Definition of Technical Terms: Certain technical terms used in this presentation associated with descriptions of the potential for oil and gas properties are not consistent with “Proved Reserves” as defined by the SEC.

Note to Investors: This presentation contains information about adjacent properties on which we have no right to explore. Investors are cautioned that petroleum deposits on adjacent properties are not necessarily indicative of such deposits on our properties. This document is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted.

Summary

Overview A dynamic, emerging energy company focusing on high-growth, early cash flow energy projects, including shale oil and gas, in the U.S. and Asia. Focus Shale and conventional oil and gas in the U.S. and Asia Strategic Partner MIE Holdings Corporation (HK: 1555) – one of the largest independent upstream oil companies in China Ticker NYSE MKT: PED Shares 22.5 M total shares (27.1 M fully diluted, 19% owned by officers and directors) Company Reserve Engineers Ryder Scott Co. LP Experience Management team with global experience led by President and CEO Frank C. Ingriselli, previous President of Texaco International Operations. Technical and operating team with prior experience with Shell, Chevron, Exxon, Rosetta Resources and others. Have been key players in the booming shale developments in the U.S. and have participated in 500+ different horizontal shale well operations.

Corporate History

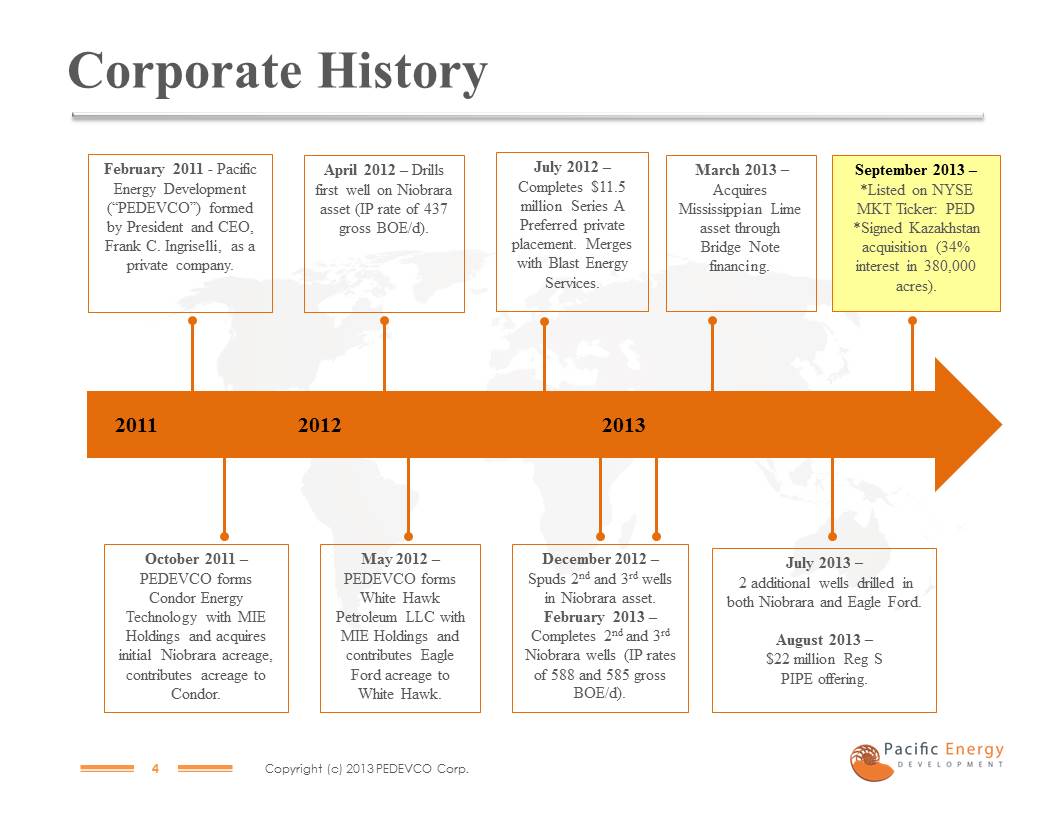

February 2011 - Pacific Energy Development (“PEDEVCO”) formed by President and CEO, Frank C. Ingriselli, as a private company. October 2011 – PEDEVCO forms Condor Energy Technology with MIE Holdings and acquires initial Niobrara acreage, contributes acreage to Condor. April 2012 – Drills first well on Niobrara asset (IP rate of 437 gross BOE/d). May 2012 – PEDEVCO forms White Hawk Petroleum LLC with MIE Holdings and contributes Eagle Ford acreage to White Hawk. July 2012 – Completes $11.5 million Series A Preferred private placement. Merges with Blast Energy Services. December 2012 – Spuds 2nd and 3rd wells in Niobrara asset. February 2013 – Completes 2nd and 3rd Niobrara wells (IP rates of 588 and 585 gross BOE/d). March 2013 – Acquires Mississippian Lime asset through Bridge Note financing. July 2013 – 2 additional wells drilled in both Niobrara and Eagle Ford. August 2013 –$22 million Reg S PIPE offering. September 2013 –*Listed on NYSE MKT Ticker: PED *Signed Kazakhstan acquisition (34% interest in 380,000 acres).

Corporate Highlights Proven Management and Operations Team • Strong industry relationships • Developed over 500 horizontal shale wells • 4Q/2012 - Fastest spud to TD in Niobrara • Well costs significantly below AFE Assets Across Prolific Proven Oil Regions United States: • Niobrara • Mississippian • Eagle Ford International: • Kazakhstan, Pre-Caspian Basin Disciplined Growth Strategy • Focus on liquids plays in proven shales • Optimize economics of existing and future assets • Leverage strategic partnerships for funding domestic and international opportunities Strong Strategic Partners • MIE Holdings (HK: 1555) - one of the largest independent upstream oil companies in China • World class shale development expertise • Access to funding, expertise and opportunities

Management Team Frank Ingriselli • President, CEO Past President of Texaco International Operations • Past President of Texaco Technology Ventures • Past founder and CEO of Pacific Asia Petroleum, Inc. • Past CEO of Timan Pechora Company Led team that established the first successful Chinese oil contract by a foreign entity Y.M. Shum • Chief Technology Officer Held senior management positions in E&P at Texaco • Lead first foreign offshore oil discovery in China • Led largest enhanced oil recovery in history for Texaco • Head of Texaco in Beijing for almost a decade • PhD, Brown University Michael Peterson • CFO, EVPPast Chairman and CEO of Solargen Energy, Inc. • Past Interim CEO and Director of Blast Energy Services • Founder and Managing Partner - Pascal Management • Past Managing Partner, Co-founder and Director of Venture Investing - American International Partners • First Vice President, Merrill Lynch Vice President, Goldman Sachs Gregory Rozenfeld • Development & Operations Officer Division Manager, Project Evaluation, M&A – Lukoil-Overseas, Moscow, Russia • VP Upstream & Special Projects – Sidan, Moscow • Project Manager, International Asset Management, Texaco Power and Gasification Division, U.S. • VP, Texaco International Operations, Inc. Clark Moore • EVP & General Counsel Past Lead in-house Corporate Counsel and Secretary at Pacific Asia Petroleum, Inc. • Former Attorney at the law firms of Venture Law Group and Heller Ehrman LLP J. D. degree with distinction from Stanford Law School Jamie Tseng • SVP & MD 30 years of financial management and operations experience in U.S., China and Taiwan • Former VP & founding partner at CAMAC Energy Inc. • CFO at General Energy Technologies Inc. • CFO at Multa Communications Corporation

Technical/Operating Experts Pacific Energy Technical Services Sean Fitzgerald • VP of Business Development Former Lead Business Development Engineer at Rosetta Resources & Lead Reservoir Engineer at Shell • Led over $350M in completed acquisition including the Mid-Continental, Gulf Coast, Gulf Coast Shelf, West Coast, and Rockies BS Petroleum Engineering from the University of Texas at Austin; licensed petroleum engineer in Texas Michael Rozenfeld • VP of Geosciences Former Lead Reservoir Engineer and Petrophysicist at Rosetta Resources and at Shell • Proven record of success in leasing, planning, and drilling vertical and horizontal wells in conventional, tight gas, and shale plays • BS Petroleum Engineering from the University of Texas at Austin; licensed petroleum engineer in Texas Kristopher Johnson • VP of Operations Former Asset and Operations Engineer at Citation Oil and Gas • Led the development of various multi-well exploration drilling programs at Citation • Proven record in large oil and gas properties management, capital projects implementation and acquisition opportunity development BS Petroleum Engineering from the University of Texas at Austin; licensed petroleum engineer in Texas Cindy Welch • Manager, Geosciences Geoscientist with over 10 years of experience at Chevron and other majors • Extensive expertise in carbonate depositional systems, sequence stratigraphy, petrophysics, and waterflood analysis. • Drilled over 100 horizontal and vertical wells in multiple reservoirs in the Permian Basin, Oklahoma and Monterey shale • MS in Geology and a BS in Geophysics from Texas Tech University Hakim Benhammou • Manager, Exploration & Production Reservoir production specialist. Has optimized & improved thousands of producing oil & gas wells • Instrumental in drilling and completing Bone Springs horizontals and recompletions years before the play was on the map • International experience in Morocco and Spain, drilling company’s first international wells in logistically challenging desert environments BS Petroleum Engineering from the University of Texas at Austin Richard Wilde • Manager, Operations Lead operator; has overseen the drilling of over 400 horizontal wells (4.4 Million FT) • Managed drilling rig scheduling of up to 25 rigs in his previous career at XTO in partnership with Exxon • Optimized 175 wells resulting in a 300% increase in production while reducing drilling costs by 50% • Reduced drill times from 25 days to 10 days while increasing laterals lengths by thousands of feet • BS Petroleum Engineering from the University of Texas at Austin

Board of Directors Frank Ingriselli • President, CEO President and CEO of Pacific Energy Development (NYSE MKT: PED) • Founder and former President and CEO of Pacific Asia Petroleum • President of Texaco International • President of Texaco Technology Ventures • CEO of Timan Pechora Company • Led team that established the first successful Chinese oil contract by a foreign entity David C. Crikelair • Director Over 40 years experience in corporate finance, banking, capital markets and financial reporting in the energy industry • Managing Partner, FrontStreet Partners, LLC • Vice President, Treasurer, and Head of Alternate Energy, Texaco Inc. • CFO, Equilon Enterprises, LLC – largest downstream company in the United States • Director, Caltex Petroleum Corporation • MBA, Corporate Finance from NYU Elizabeth P. Smith • Director Over 30 years experience in corporate compliance, investor relations, and law in the energy industry • Vice President-Investor Relations and Shareholder Services, Texaco Inc. • Corporate Compliance Officer, Texaco Inc. • Former member and past President of Investor Relations Association and the Petroleum Investor Relations Institute • JD from Georgetown University Law Center

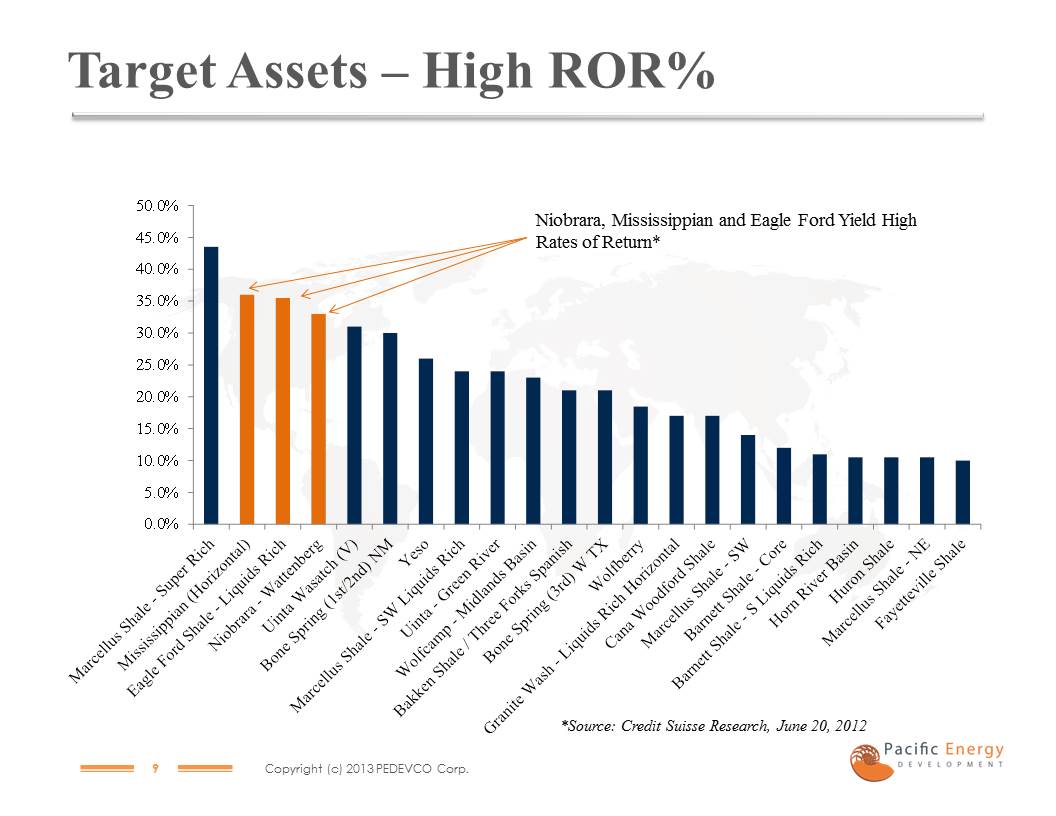

Target Assets – High ROR%

Current Assets United States – Shale Oil

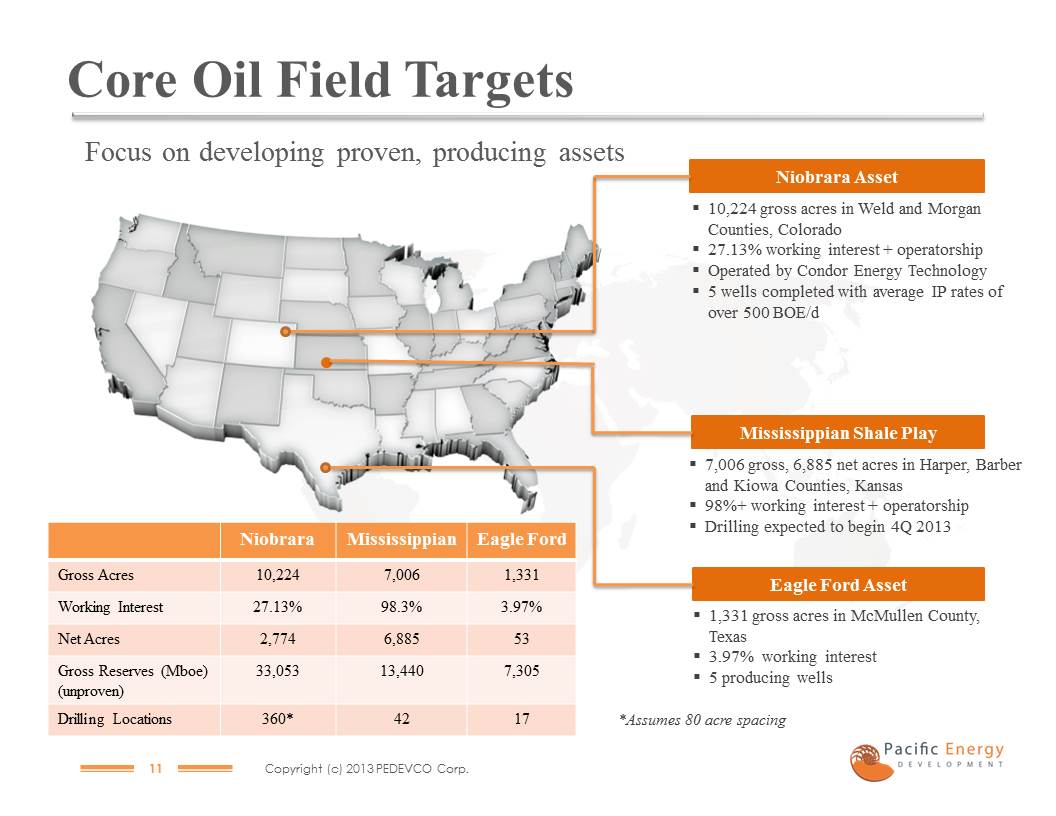

Core Oil Field Targets Focus on developing proven, producing assets Niobrara Asset § 10,224 gross acres in Weld and Morgan Counties, Colorado § 27.13% working interest + operatorship § Operated by Condor Energy Technology § 5 wells completed with average IP rates of over 500 BOE/d Mississippian Shale Play § 7,006 gross, 6,885 net acres in Harper, Barber and Kiowa Counties, Kansas § 98%+ working interest + operatorship § Drilling expected to begin 4Q 2013 Eagle Ford Asset § 1,331 gross acres in McMullen County, Texas § 3.97% working interest § 5 producing wells Niobrara Mississippian Eagle Ford Gross Acres 10,224 7,006 1,331 Working Interest 27.13% 98.3% 3.97% Net Acres 2,774 6,885 53 Gross Reserves (Mboe) (unproven) 33,053 13,440 7,305 Drilling Locations 360* 42 17 *Assumes 80 acre spacing

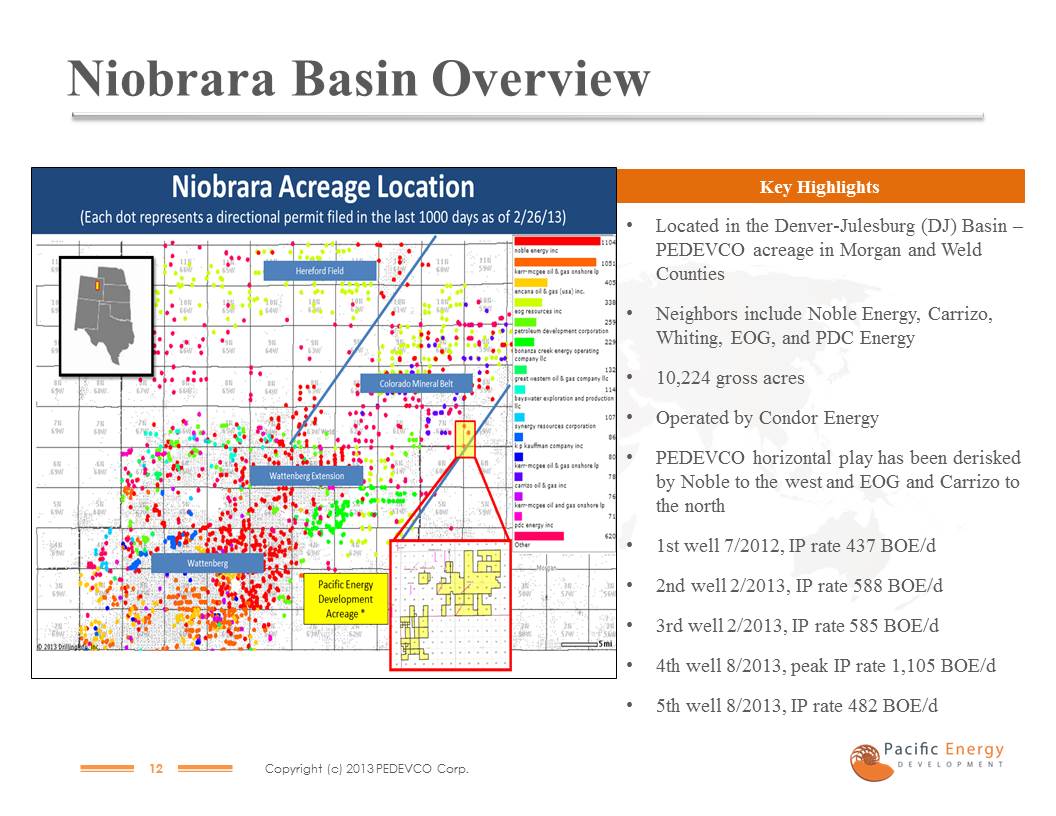

Niobrara Basin Overview Key Highlights • Located in the Denver-Julesburg (DJ) Basin – PEDEVCO acreage in Morgan and Weld Counties • Neighbors include Noble Energy, Carrizo, Whiting, EOG, and PDC Energy • 10,224 gross acres • Operated by Condor Energy • PEDEVCO horizontal play has been derisked by Noble to the west and EOG and Carrizo to the north • 1st well 7/2012, IP rate 437 BOE/d • 2nd well 2/2013, IP rate 588 BOE/d • 3rd well 2/2013, IP rate 585 BOE/d • 4th well 8/2013, peak IP rate 1,105 BOE/d • 5th well 8/2013, IP rate 482 BOE/d

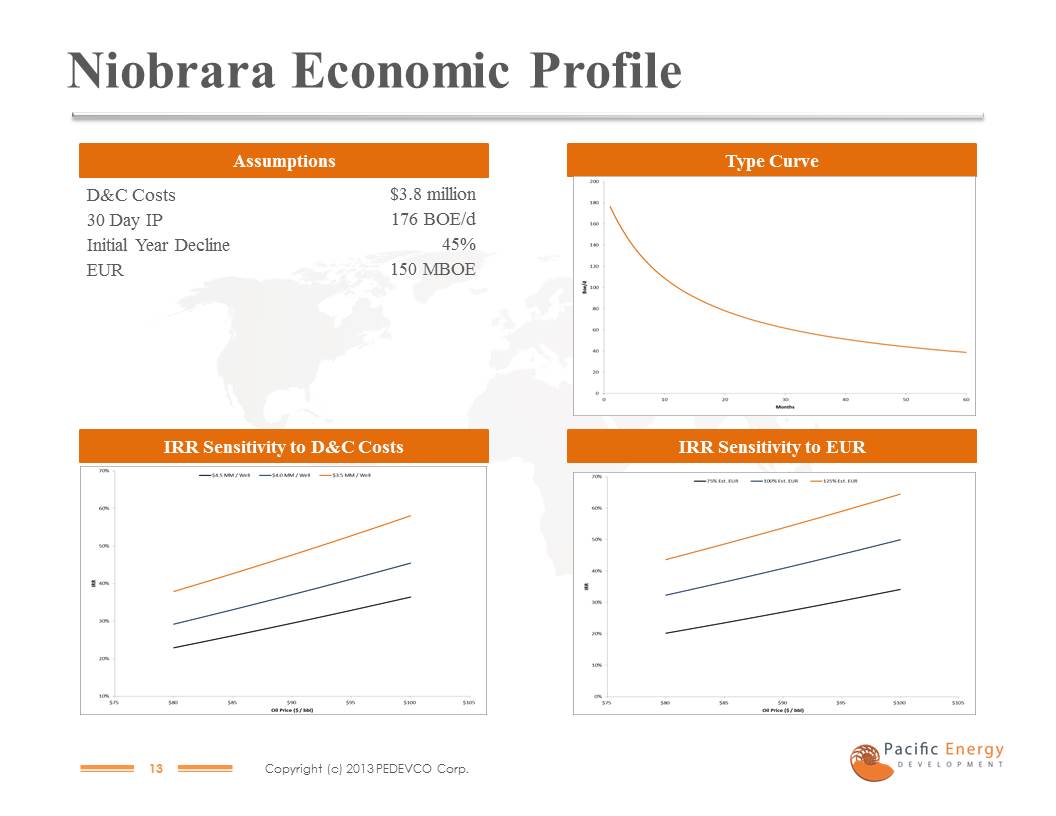

Niobrara Economic Profile Assumptions D&C Costs 30 Day IP Initial Year Decline EUR $3.8 million 176 BOE/d 45% 150 MBOE IRR Sensitivity to D&C Costs Type Curve IRR Sensitivity to EUR

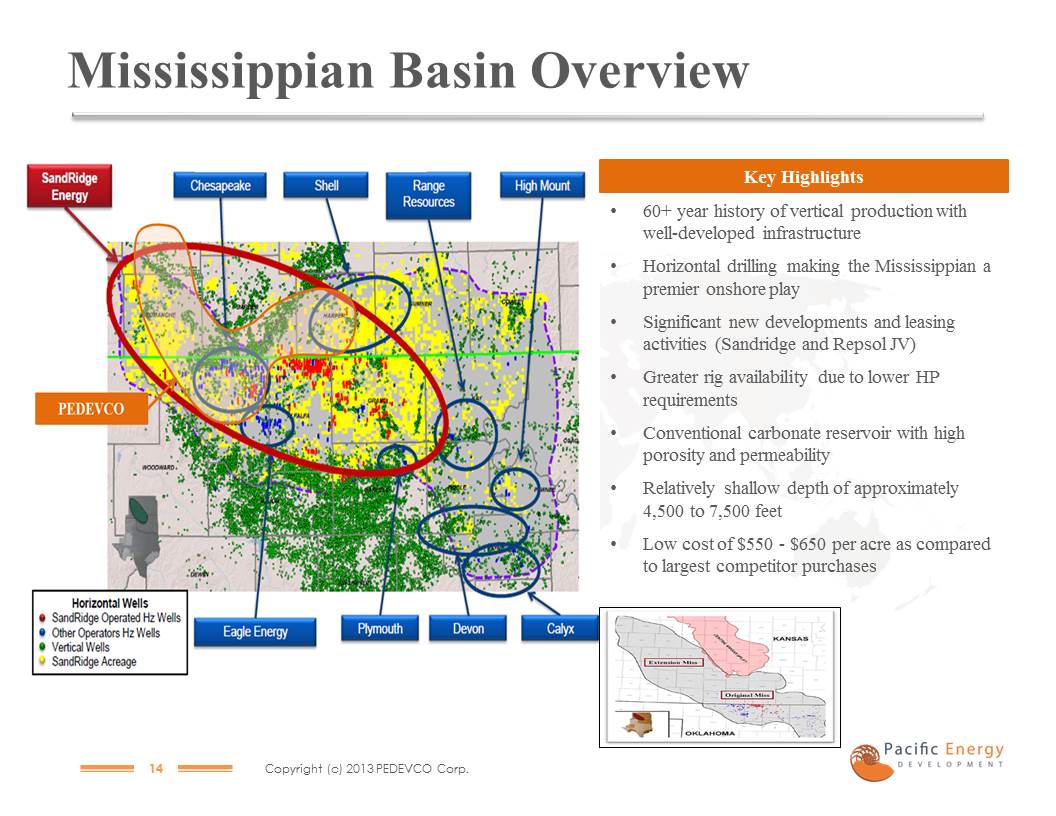

Mississippian Basin Overview Key Highlights • 60+ year history of vertical production with well-developed infrastructure • Horizontal drilling making the Mississippian a premier onshore play • Significant new developments and leasing activities (Sandridge and Repsol JV) • Greater rig availability due to lower HP requirements • Conventional carbonate reservoir with high porosity and permeability • Relatively shallow depth of approximately 4,500 to 7,500 feet • Low cost of $550 - $650 per acre as compared to largest competitor purchases

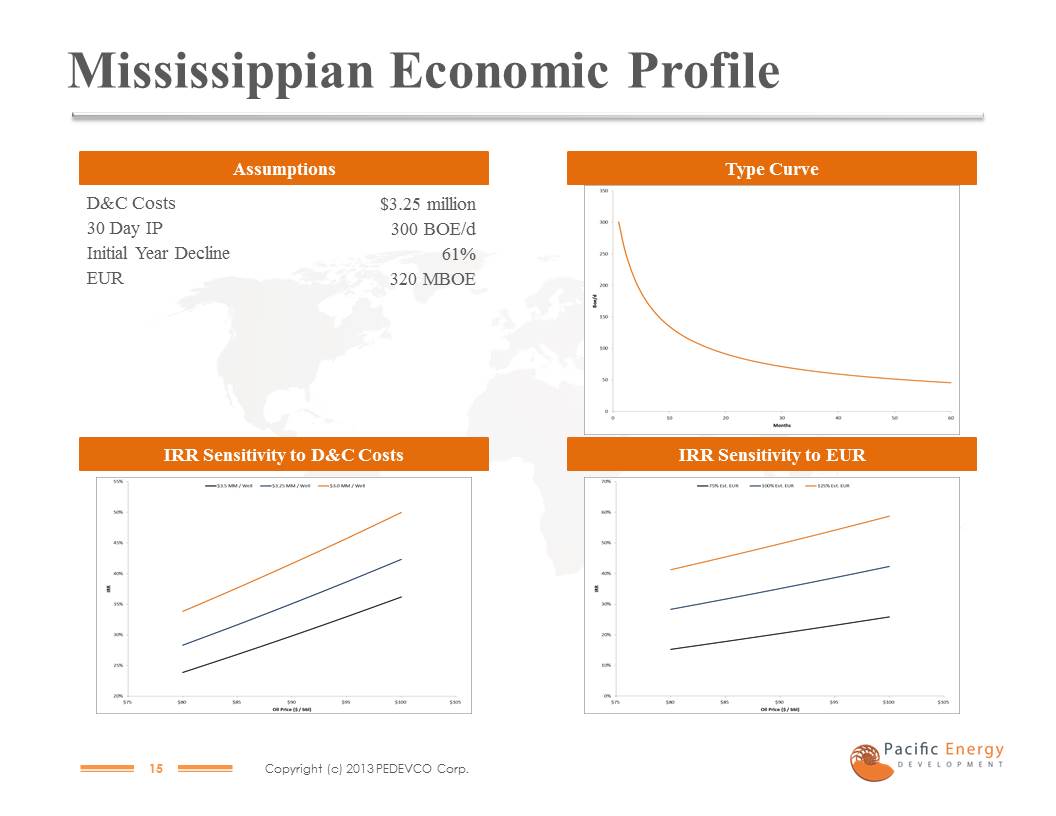

Mississippian Economic Profile Assumptions D&C Costs 30 Day IP Initial Year Decline EUR $3.25 million 300 BOE/d 61% 320 MBOE IRR Sensitivity to D&C Costs Type Curve IRR Sensitivity to EUR

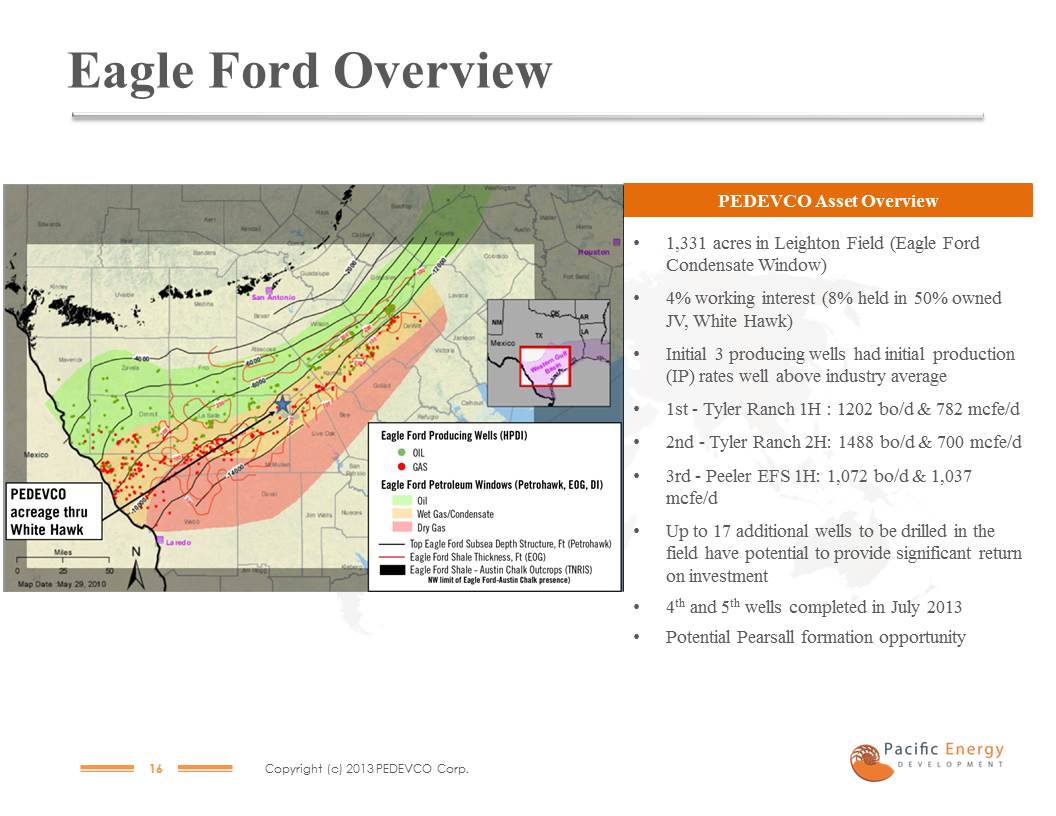

Eagle Ford Overview PEDEVCO Asset Overview • 1,331 acres in Leighton Field (Eagle Ford Condensate Window) • 4% working interest (8% held in 50% owned JV, White Hawk) • Initial 3 producing wells had initial production (IP) rates well above industry average • 1st - Tyler Ranch 1H : 1202 bo/d & 782 mcfe/d • 2nd - Tyler Ranch 2H: 1488 bo/d & 700 mcfe/d • 3rd - Peeler EFS 1H: 1,072 bo/d & 1,037 mcfe/d • Up to 17 additional wells to be drilled in the field have potential to provide significant return on investment • 4th and 5th wells completed in July 2013 • Potential Pearsall formation opportunity

Significant Potential Net Reserves • PEDEVCO’s current Niobrara, Eagle Ford and Mississippian assets could hold net unrisked reserve potential of 34 MMboe, stemming from only one primary reservoir in each asset and using 80 acre spacing in the Niobrara and 160 acre spacing in the Mississippian assets. • The upside potential is even greater when considering that 40 acre spacing has been proven in the Niobrara and the Niobrara and Eagle Ford acreage have numerous other opportunities up and down the stratigraphic column. • Potential Net Reserves

International Acquisition Kazakhstan – Oil and Gas

Kazakhstan – 2nd Largest Oil Producer • World’s 2nd largest oil reserves and 2nd largest oil production. • Long history of industry development, foreign investment and established infrastructure and service sector. • Politically stable with attractive fiscal terms under concession (royalty / tax). • Broad presence of international majors. • Existing pipelines to China, Russia and Europe. • Significant ventures: Chevron marked 20 years of partnership in Kazakhstan, with total investments of over $70 billion. CNPC acquired PetroKazakhstan for $4.18 billion in 2005. CNPC acquired Kazakh oil company for 3.3 billion 2009. PetroChina paid $1.4 Billion for Kazakh Oil stake 2009. CNPC to buy 8.3% s stake in Kashagan Field for $5 billion (July 2013).

PED Acquisition • Entered into agreement to acquire 34% of Aral which holds a 100% operated working interest in a 380,000 acre contract area in the North Block located in the Pre-Caspian Basin (closing subject to several conditions including government approval). • Production license expires in 2035. • The contract area includes the producing and developing areas of the East Zhagabulak field, and the exploration areas of Baktygaryn, Itassai, Kodzhasy, and West Kodzhasy fields. • 5 producing wells in 2012: approximately 87,000 BOE. • 3 producing wells in 2013: approximately 383BOE per day while Aral reworking and retesting wells. • Expect to close in September 2014.

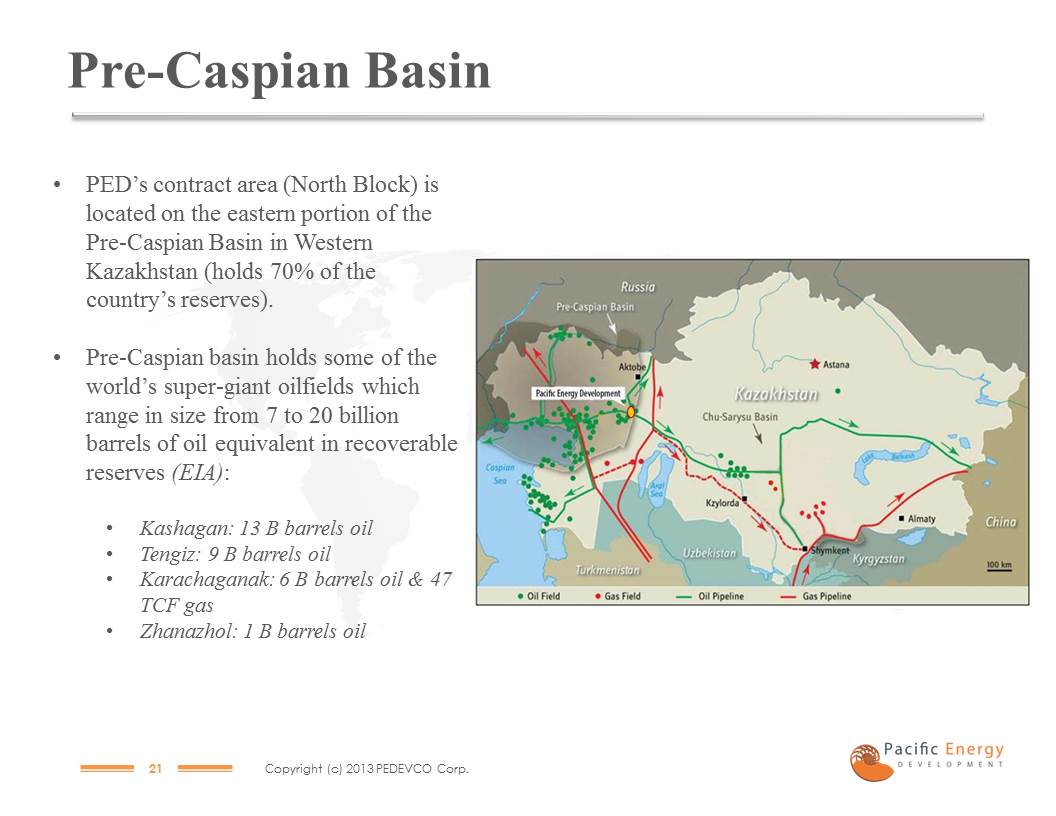

Pre-Caspian Basin • PED’s contract area (North Block) is located on the eastern portion of the Pre-Caspian Basin in Western Kazakhstan (holds 70% of the country’s reserves). • Pre-Caspian basin holds some of the world’s super-giant oilfields which range in size from 7 to 20 billion barrels of oil equivalent in recoverable reserves (EIA): • Kashagan: 13 B barrels oil • Tengiz: 9 B barrels oil • Karachaganak: 6 B barrels oil & 47 TCF gas • Zhanazhol: 1 B barrels oil

PED Contract Area Surrounded by Major Production North Block is located in the eastern portion of the Pre-Caspian Basin, an active exploration area with presence of major oil and gas companies.

Pipeline of Opportunities • Opportunities to expand in our core areas: – Down-spacing of well spacing: • 80 to 40 acres/well in Niobrara • 160 to 80 acres/well in Mississippian – Additional formations in Niobrara and Eagle Ford: • Niobrara C & Greenhorn • Pearsall • Evaluating producing China oil acquisition opportunities. • Strong continued deal flow driven through management’s global relations in the energy industry and partnership with MIE. • Focus on low risk assets that have ability to provide early cash flow - same strategy as used in current asset acquisitions.

Contact Information Corporate Headquarters 4125 Blackhawk Plaza Circle, Suite 201 Danville, CA 94506 Tel: 1 (855) PEDEVCO (925) 271 9314 Corporate website: www.PacificEnergyDevelopment.com Investor Relations Contacts: Liviakis Financial Communications john@liviakis.com +1-415-389-4670 CCG Investor Relations Inc. Crocker Coulson, President +1-646-213-1915 (New York) crocker.coulson@ccgir.com www.ccgir.com