Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ENTERPRISE GROUP INC | d595674d8k.htm |

Forward Looking Statement

3

EXHIBIT 99

Certain of the matters discussed in this report constitute

“forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements are subject to risks and uncertainties, which

could cause actual results to differ materially from those anticipated.

Such statements are based on management’s beliefs as well as

assumptions made by and information currently available to management.

When used herein, the words “anticipate,” “intend,”

“estimate,” “believe,” “expect,”

“plan,” “should,” “hypothetical,” “potential,” “forecast,

“project,” variations of such words and similar expressions are

intended to identify forward-looking statements. Factors that may

cause actual results to differ are often presented with the

forward-looking statements themselves. Other factors that could

cause actual results to differ materially from those contemplated in any

forward- looking statements made by us herein are discussed in Item

1. Financial Statements— Note 9. Commitments and Contingent

Liabilities, Item 2. Management’s Discussion and Analysis of

Financial Condition and Results of Operations, and other factors

discussed in filings we make with the United States Securities and Exchange

Commission (SEC). These factors include, but are not limited to:

• adverse changes in the demand for or the price of the capacity and

energy that we sell into wholesale electricity

markets, • adverse changes in energy industry law, policies and regulation,

including market structures and a potential

shift away from competitive markets toward subsidized

market mechanisms, transmission planning and cost allocation rules, including

rules regarding how transmission is planned and who is

permitted to build transmission in the future, and

reliability standards, • any inability of our transmission and distribution businesses to obtain

adequate and timely rate relief and regulatory

approvals from federal and state regulators, • changes in federal and state environmental regulations that could

increase our costs or limit our operations,

• changes in nuclear regulation and/or general developments in the nuclear

power industry, including various impacts from any

accidents or incidents experienced at our facilities

or by others in the industry, that could limit operations of our nuclear

generating units,

• actions or activities at one of our nuclear units located on a

multi-unit site that might adversely affect our

ability to continue to operate that unit or other units

located at the same site,

• any inability to balance our energy obligations, available supply and

risks,

• any deterioration in our credit quality or the credit quality of our

counterparties, including in our leveraged

leases, • availability of capital and credit at commercially reasonable terms and

conditions and our ability to meet cash needs,

• changes in the cost of, or interruption in the supply of, fuel and

other commodities necessary to the operation of our

generating units, • delays in receipt of necessary permits and approvals for our

construction and development activities,

• delays or unforeseen cost escalations in our construction and

development activities,

• any inability to achieve, or continue to sustain, our expected levels

of operating performance,

• any equipment failures, accidents, severe weather events or other

incidents that impact our ability to provide safe

and reliable service to our customers, and any

inability to sufficiently obtain coverage or recover proceeds of insurance on

such matters,

• increases in competition in energy supply markets as well as

competition for certain rate-based

transmission projects, • any inability to realize anticipated tax benefits or retain tax

credits, • challenges associated with recruitment and/or retention of a qualified

workforce, • adverse performance of our decommissioning and defined benefit plan

trust fund investments and changes in funding

requirements, and • changes in technology and customer usage

patterns.

All of the forward-looking statements made in this report are qualified by

these cautionary statements and we cannot assure you that the results

or developments anticipated by management will be realized or even if

realized, will have the expected consequences to, or effects on, us or

our business prospects, financial condition or results of operations.

Readers are cautioned not to place undue reliance on these

forward-looking statements in making any investment decision.

Forward-looking statements made in this report apply only as of the

date of this report. While we may elect to update forward-looking

statements from time to time, we specifically disclaim any obligation

to do so, even if internal estimates change, unless otherwise required

by applicable securities laws. The forward-looking statements

contained in this report are intended to qualify for the safe harbor

provisions of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as

amended.

|

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Income from Continuing

Operations/Net Income reported in accordance with accounting principles

generally accepted in the United States (GAAP). Operating Earnings

is a non- GAAP financial measure that differs from Net Income because

it excludes gains or losses associated with Nuclear Decommissioning

Trust (NDT), Mark-to-Market (MTM) accounting, and other material

one-time items. PSEG presents Operating Earnings because

management believes that it is appropriate for investors to consider

results excluding these items in addition to the results reported in

accordance with GAAP. PSEG believes that the non-GAAP financial

measure of Operating Earnings provides a consistent and comparable

measure of performance of its businesses to help shareholders understand

performance trends. This information is not

intended to be viewed as an alternative to GAAP

information. Slides A and B at the end of this presentation include a list of

items excluded from Income from Continuing Operations/Net Income to

reconcile to Operating Earnings, with a reference to that slide included

on each of the slides where the non-GAAP information appears.

4 |

PSEG meeting the market’s challenges

with our strong platform of assets

PSEG Energy

Holdings positioned

to pursue attractive

renewable

generation and

develop new

business

opportunities

Assets $1.5B

Operating Earnings $64M

Renewable

Investments

PSE&G positioned

to meet NJ’s

energy policy and

economic growth

objectives with an

investment program

exceeding $10 billion

through 2017

Assets $19.2B

Operating Earnings $528M

Electric & Gas Delivery

and Transmission

PSEG Power’s

low-cost, base

load and load

following fleet is

geographically well

positioned and

environmentally

responsible

Assets $11.0B

Operating Earnings $644M

Regional

Wholesale Energy

*

7

ASSETS

AND

OPERATING

EARNINGS

ARE

FOR

THE

YEAR

ENDED

12/31/2012.

ENERGY

HOLDINGS

INCLUDES

PARENT.

SEE

SLIDE A

FOR

ITEMS

EXCLUDED

FROM

INCOME

FROM

CONTINUING

OPERATIONS/NET

INCOME

TO RECONCILE

TO

OPERATING

EARNINGS.

. |

61 local NJ towns and 5 counties

support

•

61 municipalities and five counties (Bergen, Hudson, Mercer,

Passaic and Somerset) have approved resolutions in support of

Energy Strong, PSE&G’s infrastructure proposal to improve and

fortify its electric and gas distribution systems

•

The Energy Strong proposal is currently being evaluated by the

NJ Board of Public Utilities

•

Public hearings are scheduled for September and October 2013

13 |

Where we’re going …

PSE&G operating earnings

are forecast to grow at double digit rate through

2015

•

O&M Growth per year

•

PSE&G Rate Base

Transmission

E&G Distribution

EMP

•

EFORd Rate -

CCGT

•

Nuclear Generation

•

Holdings Solar Investment

•

LIPA Earnings

PSEG Focus

($ millions, except as noted)

•

•

$12,600

•

$5,000

4

•

$6,900

5

•

$700

5

•

1.4%

•

30.4TWh

•

$290

•

$12-$15

2015E

•

0.8%

•

$9,000

•

$2,500

•

$5,900

•

$600

•

1.7%

•

29.8TWh

•

$240

•

$0

2012

•

2.4%

•

$6,800

•

$866

•

$5,900

•

$0

•

1.6%

•

29.3TWh

•

$0

•

$0

2008

(1)

Planned compound annual growth rate 2008-2012.

(2)

Actual compound annual growth rate 2008-2012.

(3) Two-year compound annual growth rate from 2013.

(4) Includes additional Transmission hardening.

(5) Includes proposed filings: EE4A, SL3, S4Ae, and ES programs.

E = ESTIMATE.

.

2.2%

(planned

)

(actual )

(forecast )

1

2

3

15 |

PSEG First Half 2013 -

Highlights

Maintaining 2013 operating earnings guidance of $2.25 -

$2.50 per share

Strong earnings: First half 2013 earnings of $1.33 per share vs. $1.28

in year-ago period Power benefitting from higher capacity prices

and asset location PSE&G seeing results from increased investment

in transmission O&M under control {Continuing control of O&M

supporting results} Capital investment on schedule

PSE&G received approval to invest $446 million in extensions of Solar 4

All and Solar Loan programs PSE&G’s existing $3.4 billion

Transmission investment program remains on schedule Hearings scheduled

for Energy Strong, PSE&G’s $2.6 billion, 5-year capital infrastructure program

Financial position remains strong

S&P

credit

rating

upgrade

across

Enterprise,

Power

and

PSE&G

Debt represented 41% of capital at June 30, 2013

Dividend

increased

1.4%

to

$1.44

per

share,

the

9

increase

in

the

last

ten

years

Full year 2013 operating earnings expected to be at the upper end of

guidance, assuming normal weather and unit operations

17

th |

2013 Operating Earnings

*

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING OPERATIONS/NET

INCOME TO RECONCILE TO OPERATING EARNINGS; ALL PERIODS REFLECT TEXAS IN

DISCONTINUED OPERATIONS. E=ESTIMATE.

Investment in the

regulated business

has changed the

earnings mix

Our 2009-2013

investment focus has

brought us to a 50/50

mix for 2013

PSE&G’s 2013-2017

Energy Strong Program

and ongoing transmission

investments will support

continued growth in

PSE&G’s earnings

Percent of Operating Earnings Contribution by Subsidiary

PSE&G

Power

Other

$2.74

$2.44

$2.25 -$2.50E

$3.09

$3.12

18

20%

27%

38%

43%

50%

76%

69%

61%

52%

47%

2009

2010

2011

2012

2013E |

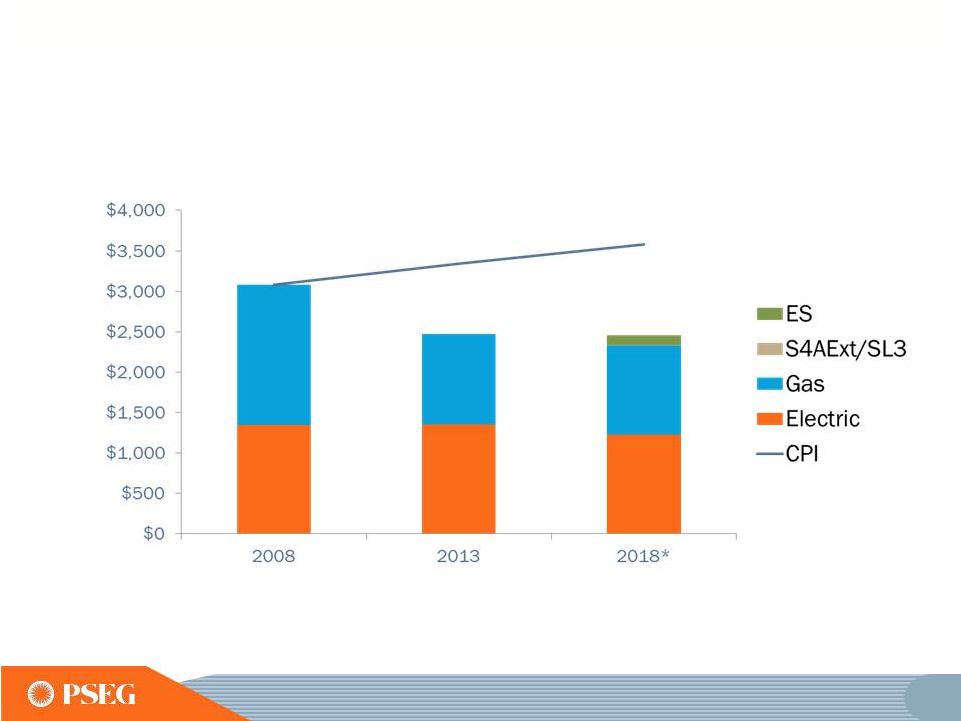

Lower commodity costs and expiration of

certain transition charges are expected to offset the impact to

customer bills

*FOR THE TYPICAL COMBINED ELECTRIC & GAS RESIDENTIAL CUSTOMER, 2018 BGS

(INCLUDING TRANSMISSION) / BGSS, AS WELL AS SBC, WNC, RAC AND DISTRIBUTION RATES HELD CONSTANT AS OF THE ES FILING DATE (FEB-2013). RATES RELATED TO

ELECTRIC RESTRUCTURING: SECURITIZATION (STC), NON-UTILITY GENERATION

CHARGE (NGC), & TRANSITIONAL ENERGY FACILITIES ASSESSMENT (TEFA), ARE REDUCED TO ZERO BY 2018. THE RGGI RECOVERY CHARGE (RRC), SOLAR PILOT RECOVERY

CHARGE (SPRC), AND CAPITAL ECONOMIC STIMULUS INFRASTRUCTURE INVESTMENT PROGRAM

(CIP I) AND THE CIP EXTENSION (CIP II) BILL IMPACTS ARE INCLUDED IN THEIR RESPECTIVE GAS & ELECTRIC BARS AND FORECASTED BASED UPON MAR-2013

ESTIMATES. THE BILL IMPACTS FOR ES PROGRAM BASED UPON THE PROPOSED FILING

AND S4AEXT/SL3 IMPACTS ARE BASED UPON THE BPU APPROVED PROGRAM.

.

Typical Residential Annual Bill

44 |

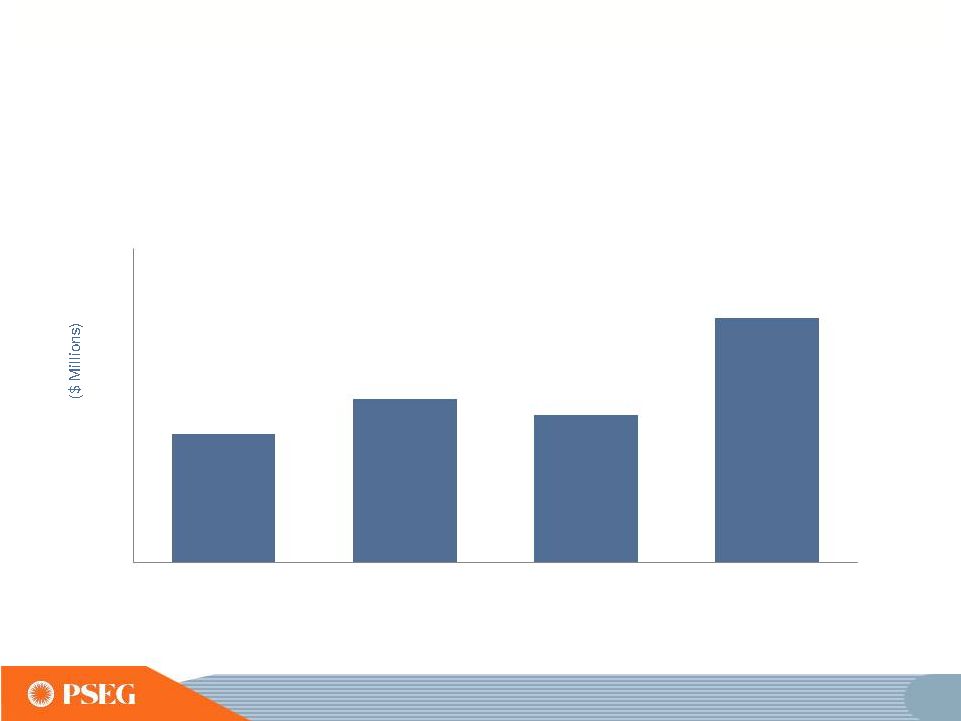

PSE&G’s 2013 operating earnings

benefiting from transmission growth and cost containment

initiatives

E= ESTIMATE

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING OPERATIONS/NET

INCOME TO RECONCILE TO OPERATING EARNINGS.

$528

2012

2013 Guidance

PSE&G Operating Earnings*

($ Millions)

$580

-

$635E

45 |

PSEG Energy Holdings

These projects should produce steady results for PSEG

PSEG Solar Source EBITDA

E

E = ESTIMATE.

…

A STABLE, LOW-RISK PORTFOLIO

53

0

3

6

9

12

15

2010

2011

2012

2013 |

•

Lower cost supplies of shale

gas have been beneficial to

both PSE&G customers and

PSEG Power

•

Over 50% of our available

pipeline capacity can access

market area supplies of shale

gas

•

Power’s generating units sit in

close proximity to the Marcellus

fairway

•

Power buys approximately

350BCF/year of gas

•

Availability of a robust gas

portfolio of storage and pipeline

capacity benefits PSE&G

customers and Power’s

generating assets

Albany

PSEG’s locational advantage

and gas basis

New York

Shale Supply

0.6 BCF/D

Storage

0.9 BCF/D

Gulf Coast Supply

0.7 BCF/D

80 |

Reserve margins in PJM declining with retirements

Generation Deactivation Notifications

Source: PJM TEAC, 8/8/2013

•

PJM Pending Deactivation Requests of

13,340 MW as of August 13, 2013

•

Approximately 5,000 MW of additional

owner announced retirements in PJM

through next auction

Forecast Reserve Margin (PJM June 2013)

•

PJM forecasts a declining Reserve Margin

through 2017

82

0%

5%

10%

15%

20%

25%

30%

6/1/2013

6/1/2014

6/1/2015

6/1/2016

6/1/2017

Reserve Requirement

Existing + Expected New Generation |

Maintaining 2013 operating earnings guidance

PSEG Operating Earnings

$ Millions (except EPS)

2013E

PSEG Power

$535 -

$600

PSE&G

$580 -

$635

PSEG Energy Holdings/Parent

$25 -

$35

Operating Earnings*

$1,140 -

$1,270

2013 Earnings Guidance

$2.25

-

$2.50

E = ESTIMATE

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING OPERATIONS/NET

INCOME TO RECONCILE TO OPERATING EARNINGS.

Based on our performance year-to-date, we expect full year

operating earnings to be at the upper end of guidance,

assuming normal weather and unit operations

87 |

Our capital investment options can result in as

much as $5.4B of utility growth investment through 2015

PSE&G

Growth

~$4.2B

PSE&G

Maintenance

Power

& Other

Potential Opportunities

Approved Programs

2013 –

2015E Capital Investment

~$6.3B

~$6.5B

~$7.5B

New

Transmission

~$0.2B

New

Distribution

~$1B

PSE&G

Growth

$5.4B

DATA AS OF JUNE 30, 2013.

E = ESTIMATE

90 |

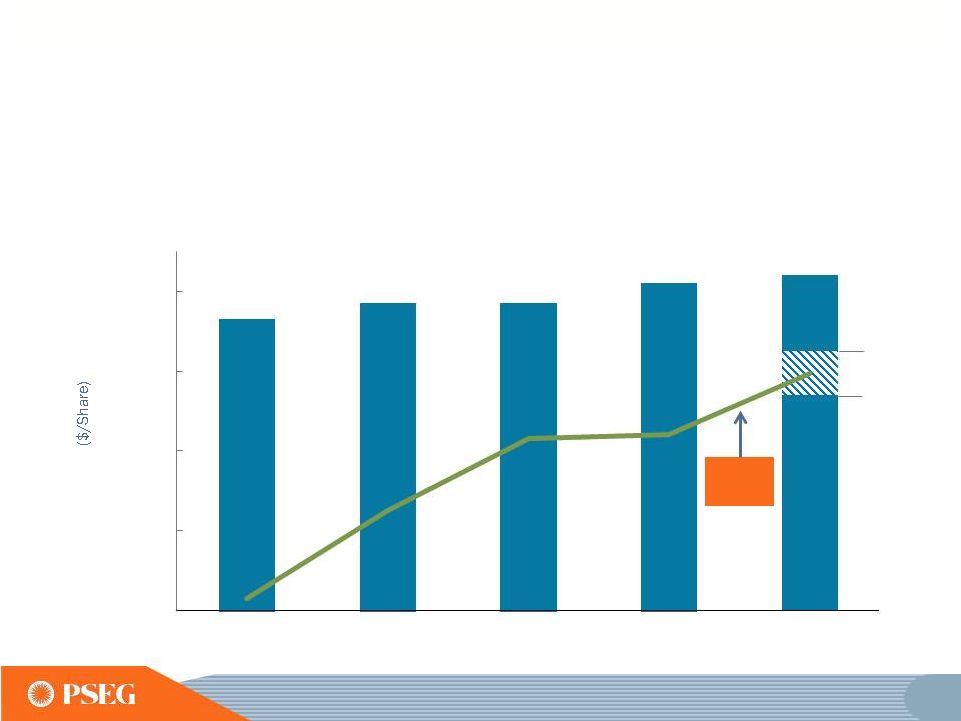

Opportunity for modest and sustainable

dividend increases consistent with stable regulated growth

and cash generation outlook at PSEG Power

PSE&G

EPS

$1.25

$1.14

$1.42

Annual Dividend Per Share

E = ESTIMATE

99

$1.33

$1.37

$1.37

$1.44

$0.60

$0.80

$1.00

$1.20

$1.40

2009

2010

2011

2012

2013E |

PSEG Summary

•

Maintaining

2013

operating

earnings

guidance

of

$2.25

-

$2.50

per share --

based on financial results to date, we expect operating

earnings for the full year to be at the upper end of our guidance range

assuming normal weather and unit operations

•

Double digit operating earnings growth at PSE&G starting in 2013,

and continuing through 2015 driven by transmission investments

and approved programs

•

Power’s continued focus on operational excellence, market expertise

and financial strength reduces risk in low price environment

•

Strong Balance Sheet and Cash Flow support full capital program

without the need for equity

•

Long history of returning cash to the shareholder through the

common dividend, with opportunity for future growth

100 |

The full requirements BGS rate recognizes the

forward PJM capacity market price

114

Capacity Price per RPM Auction for PSEG Zone

Capacity Price per BGS Tranche

2013-2014

250

$

Three Year Average ($/MW-day)

$195

2014-2015

170

$

MW

per Tranche (varies by EDC) 108

2015-2016

166

$

Days per Year

365

195

$

7,712,637

$

MWh per Tranche

Energy MW per Tranche (varies by EDC)

108

Hours per Year

8,760

Load Factor (varies by EDC)

~37%

MWh per Tranche, approx.

350,000

Capacity Cost per MWh

22

$

Three Year Average ($/MW-day)

Capacity Cost per Tranche |

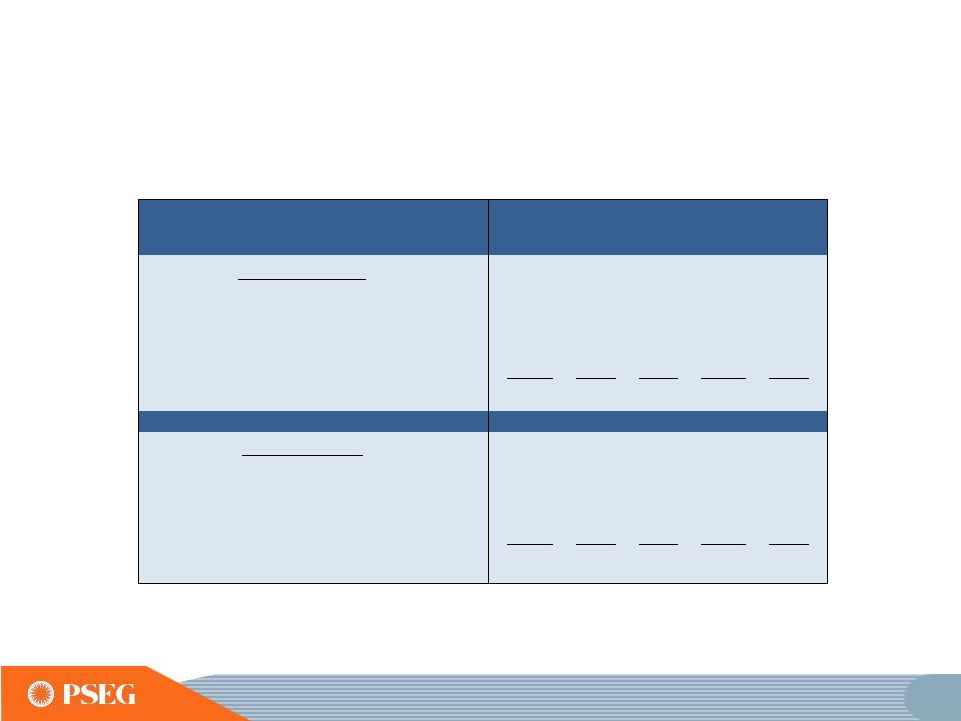

Items Excluded from Income from Continuing

Operations/Net Income to Reconcile to Operating Earnings

2012

2011

2010

2009

2008

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

52

$

50

$

46

$

9

$

(71)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

(10)

107

(1)

(11)

14

Lease Transaction Activity (Energy Holdings)

36

(173)

-

29

(490)

Storm O&M (PSEG Power)

(39)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

(72)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

34

-

-

(13)

Total Pro-forma adjustments

39

$

18

$

(27)

$

27

$

(560)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

508

Per Share Impact (Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.10

$

0.10

$

0.09

$

0.02

$

(0.14)

$

Gain (Loss) on MTM (PSEG Power)

(0.02)

0.21

-

(0.02)

0.03

Lease Transaction Activity (Energy Holdings)

0.07

(0.34)

-

0.05

(0.96)

Storm O&M (PSEG Power)

(0.08)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

(0.14)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

0.06

-

-

(0.03)

Total Pro-forma adjustments

0.07

$

0.03

$

(0.05)

$

0.05

$

(1.10)

$

For the Year Ended

December 31,

(Unaudited)

Pro-forma Adjustments, net of tax

A

PLEASE SEE PAGE 4 FOR AN EXPLANATION OF PSEG’S USE OF OPERATING

EARNINGS AS A NON-GAAP FINANCIAL MEASURE AND HOW IT DIFFERS FROM

INCOME FROM CONTINUING OPERATIONS/NET INCOME. |

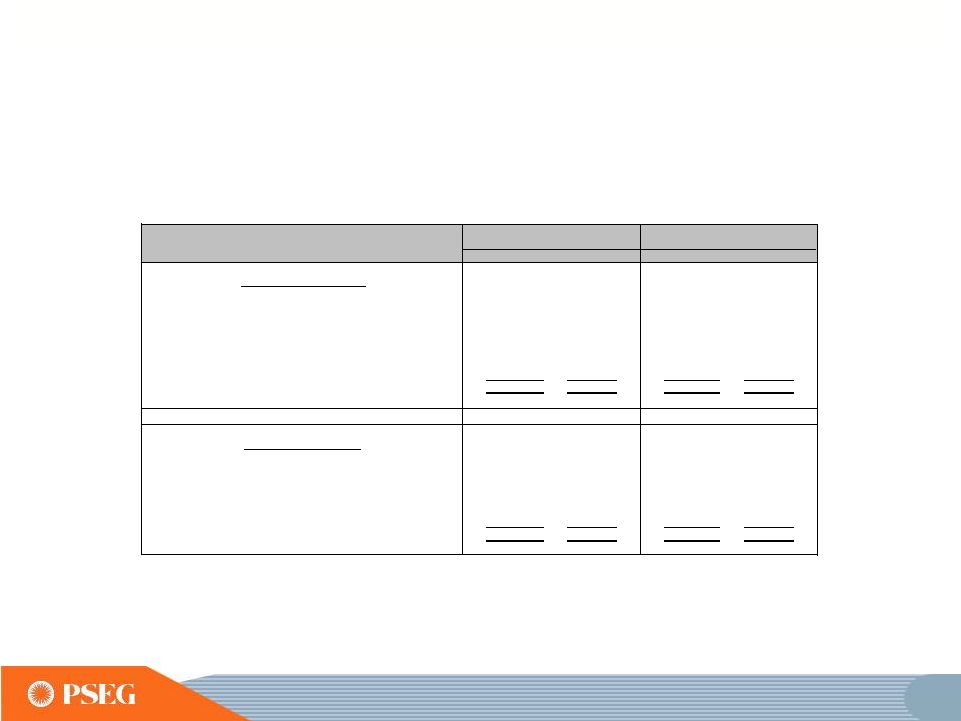

Items Excluded from Income from Continuing

Operations/Net Income to Reconcile to Operating Earnings

B

PLEASE SEE PAGE 4 FOR AN EXPLANATION OF PSEG’S USE OF OPERATING

EARNINGS AS A NON-GAAP FINANCIAL MEASURE AND HOW IT DIFFERS FROM

INCOME FROM CONTINUING OPERATIONS/NET INCOME. 2013

2012

2013

2012

Earnings

Impact

($

Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

8

$

4

$

17

$

9

$

Gain (Loss) on Mark-to-Market (MTM)

(a)

(PSEG Power)

80

(10)

(25)

42

Lease Related Activity (PSEG Energy Holdings)

-

2

-

6

Storm O&M, (PSEG Power)

2

-

(15)

-

Total Pro-forma adjustments

90

$

(4)

$

(23)

$

57

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

Per

Share

Impact

(Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.02

$

0.01

$

0.04

$

0.02

$

Gain (Loss) on MTM

(a)

(PSEG Power)

0.16

(0.02)

(0.05)

0.08

Lease Related Activity (PSEG Energy Holdings)

-

-

-

0.01

Storm O&M, (PSEG Power)

-

-

(0.03)

-

Total Pro-forma adjustments

0.18

$

(0.01)

$

(0.04)

$

0.11

$

(a) Includes the financial impact from positions with forward delivery months.

Three Months Ended

Six Months Ended

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling Items Excluded from Income from Continuing Operations/Net Income to Compute Operating

Earnings (Unaudited)

June 30,

June 30,

Pro-forma Adjustments, net of tax |