Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sorrento Therapeutics, Inc. | d595928d8k.htm |

| EX-2.1 - EX-2.1 - Sorrento Therapeutics, Inc. | d595928dex21.htm |

| EX-99.2 - EX-99.2 - Sorrento Therapeutics, Inc. | d595928dex992.htm |

| EX-99.1 - EX-99.1 - Sorrento Therapeutics, Inc. | d595928dex991.htm |

September 2013

Exhibit

99.3

Sorrento Therapeutics, Inc.

Next-Generation

Cancer Therapeutics |

2

This presentation contains "forward-looking statements" as that term is

defined under the Private Securities Litigation Reform Act of 1995 (PSLRA),

including statements regarding expectations, beliefs or intentions regarding

our business, technologies and products strategies or prospects. Actual

results may differ from those projected due to a number of risks and

uncertainties, including, but not limited to, the possibility that some or all of

the pending matters and transactions being considered by the Company may not

proceed as contemplated, and by

all other matters specified in Company's filings with the Securities and Exchange

Commission, as well as risks inherent in funding, developing and obtaining

regulatory approvals of new, commercially-viable and competitive

products and product candidates. These statements are made based upon

current expectations that are subject to risk and uncertainty and information

available to the Company as of the date of this presentation. The company does not

undertake to update forward-looking statements in this presentation to

reflect actual results, changes in assumptions or changes in other factors

affecting such forward-looking information. Assumptions and other

information that could cause results to differ from those set forth in the

forward-looking information can be found in the Company's filings with the

Securities and Exchange Commission, including its most recent periodic

report. We intend that all forward- looking statements be subject to the

safe-harbor provisions of the PSLRA. Safe Harbor Statement

OTCQB: SRNE |

Positioned to Become Oncology Leader

Cynviloq™

G-MAB

®

ADC/AfDC

Phase 3

Immuno-

therapy

mAb

candidates

Targeted

therapeutics |

4

Sorrento’s Next-Generation Cancer Therapeutics

TUMOR

G-MAB

®

•

High-diversity human Ab library

•

10+ lead mAb programs, including

•

FTO and no stacking royalties

ADC

•

G-MAB

®

targets toxin to cancer cell

•

Programs include VEGFR2, c-Met

Cynviloq™

•

Bioequivalence (BE)

pathway for approval

•

Efficacy demonstrated

•

US and EU rights

•

G-MAB

®

targets approved oncolytics to the tumor

•

Effective against inherently target-heterogeneous tumors

Next-generation

Abraxane

®

PD-L1, PD-1, and CCR2 |

5

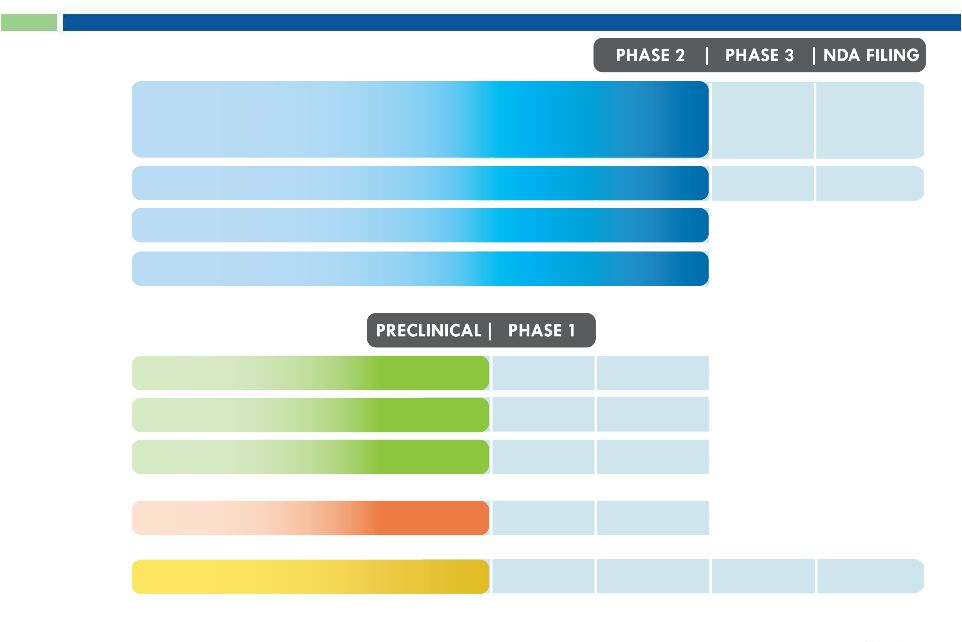

Pipeline

INDICATION

INDICATION > TARGET

G-MAB

®

ADC

AfDC

Cynviloq™

Oncology > PD-L1, PD-1, CXCR5

Inflammation > CCR2,

PD-L1, CXCR3

Infectious Disease > MRSA, C.diff

Oncology > VEGFR2,

c-Met, CXCR5, EGFR

Oncology > PD-L1, VEGFR2, c-Met

H1 2015

H2 2015

Metastatic Breast Cancer

Non-Small Cell Lung Cancer

Bladder Cancer (sNDA)

Ovarian Cancer (sNDA)

BE Trial

Q4 2013

Q4 2014 /

Q1 2015

505(b)(2) Pathway

}

Pancreatic Cancer (BE* or sNDA)

* Abraxane

®

orphan drug status (FDA approved: September 2013)

Multiple

Strategic

Partnership

Opportunities

5 |

Seasoned Management Team

6

Henry Ji, Ph.D.

President, CEO & Director

•

Inventor of G-MAB

®

Technology

•

President & CEO of Stratagene Genomics

•

VP of CombiMatrix and Stratagene

Vuong Trieu, Ph.D.

Chief Scientific Officer

•

Founder and CEO of IgDraSol

•

Co-inventor of IP covering Abraxane

®

•

Instrumental

in

the

approval

of

Abraxane

®

•

Celgene acquired Abraxis Biosciences for > $3 billion

George Uy

Chief Commercial Officer

•

CCO of IgDraSol

•

Directed the launches of Abraxane

®

, Xeloda

®

& Fusilev

®

•

Built commercial infrastructures and organizations in startup

companies

Richard Vincent

CFO and Director

•

$430M sale of Elevation to Sunovion-Dainippon

•

Meritage Pharma option agreement with ViroPharma ($90M

upfront + milestones)

•

$310M sale of Verus asthma program to AstraZeneca

•

Elan: various acquisitions and divestitures with aggregate values

in excess of $300M |

Oncology Franchise

Cynviloq™

Phase 3

7 |

8

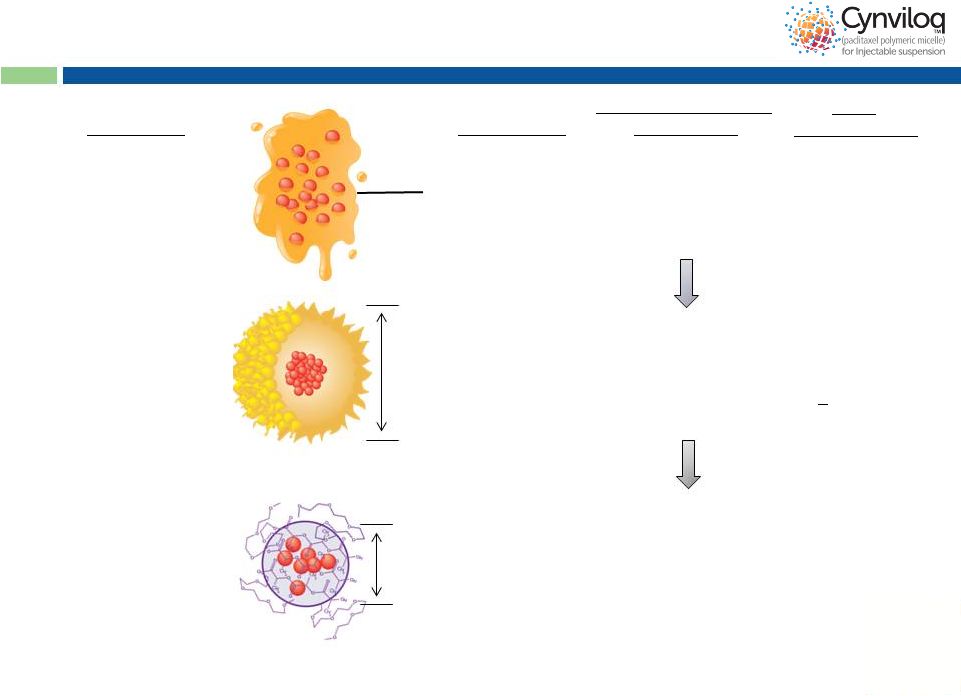

Cynviloq™

is the 3 Generation

Paclitaxel Therapy

Mean size

~25 nm

Cynviloq™

paclitaxel

polymeric micelle

Chemical

polymer:

Poly-lactide and

polyethylene glycol

diblock copolymer

3

>300 mg/m

(up to 435 mg/m )

Abraxane

®

nab-

Mean size

130 nm

Biological

polymer:

Donor-derived human

serum albumin (HSA)

2

260 mg/m

Taxol

®

paclitaxel

Cremophor EL

excipient:

Polyoxyethylated

castor oil

Formulation

Generation

1

175 mg/m

Maximum Tolerated

Dose (MTD)

Peak

Product

Sales

~ $1.6B (WW in 2000)

$430M

(2012, mostly MBC)

Est. >$1.7B* (US)

30-50% Abraxane

sales conversion +

new indications

(BC, OC etc)

*Analyst projection for MBC+NSCLC+PC

2

2

2

2

®

rd

nd

st

rd

paclitaxel |

9

Why Cynviloq™?

1.

Abraxane sold to Celgene for > $3 billion

2.

Efficacy demonstrated in Phase 2 and Phase 3 studies

•

Phase 2 studies affirmed clinical activity in MBC, NSCLC, PC,

ovarian cancer (OC) and bladder cancer (BC)

•

Interim data from Phase 3 study in MBC patients shows activity comparable to

Abraxane

®

•

Approved and marketed in S. Korea and other countries

3.

FDA concurred that available data supports pursuing the 505(b)(2)

bioequivalence (BE) regulatory submission pathway

4.

Single BE study in MBC patients may be sufficient for approval for

both NSCLC and MBC indications with Abraxane

label

5.

Potential to expand Cynviloq™

label and increase market size

6.

US and EU Rights

7.

Multiple unique advantages over Abraxane

®

®

® |

10

Cynviloq™

has Unique Advantages

vs. Abraxane

®

Cynviloq™

Abraxane

®

Taxol

®

Cynviloq™

Advantage

>300

260

175

Potential for

higher efficacy

Rapid reconstitution:

no foaming concerns

Convenience for busy

practices and pharmacies

No donor-derived human

serum albumin (HSA)

No viral / prion concerns

Convenient storage

conditions

No requirement for

controlled temp storage

No microbial growth

Chemical polymer

Cremophor-free

Reduced side effects

Dosing

q3w

q3w* &

weekly**

q3w & weekly

Exploits PK advantage

@ higher dose

* MBC; ** NSCLC & PC

Maximum Tolerated Dose

(mg/m

²

) |

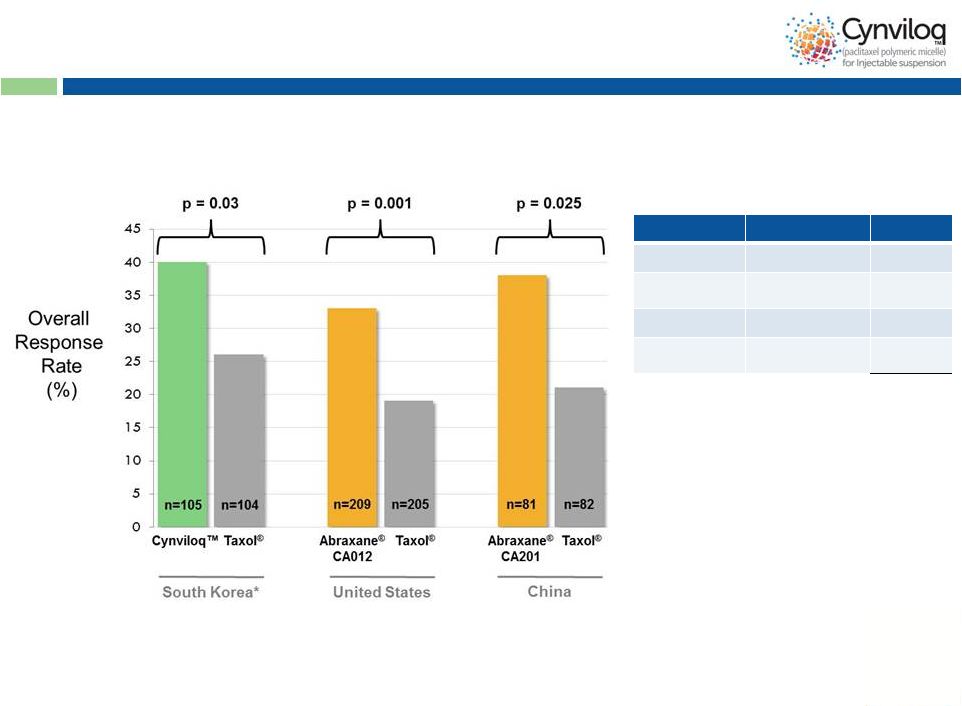

11

Cynviloq™

is Efficacious

Stage

Trial

Patients

Phase 1

MTD

80

Phase 2

MBC, NSCLC,

PC, OC, BC

259

Phase 3

MBC

105

Post Market

(Safety)

MBC, NSCLC

502

Total

946

Phase 3 study in

MBC Summary of

Clinical Exposures

11

US

approval

for

Abraxane

®

in

MBC

and

NSCLC

for

non-inferiority

against

Taxol

®

based

on

ORR

-

*

No obvious ethnic differences seen between ORR in trials

Interim data from trial; OS and PFS analyses ongoing

|

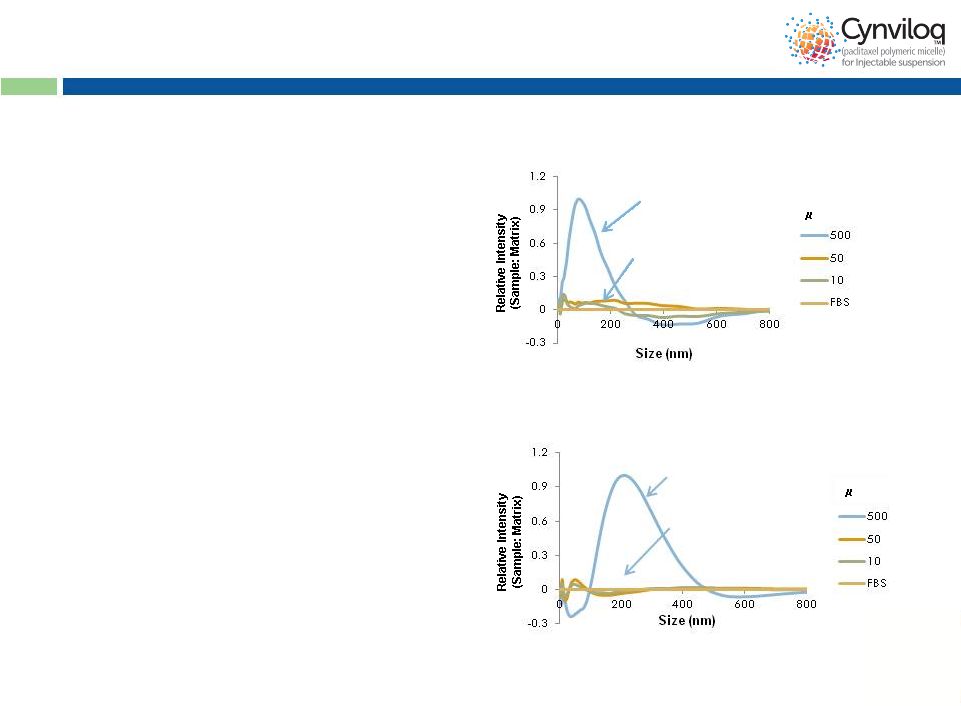

12

Common Mechanism Of Action

* Data on file

FBS = fetal bovine serum

•

Free paclitaxel exploits the

albumin-transport pathway

to preferentially accumulate

in tumor tissues

Intact nanoparticle

(in the vial)

Disintegration

upon dilution

(in blood)

Cynviloq™

Intact nanoparticle

(in the vial)

Disintegration

upon dilution

(in blood)

Abraxane

®

•

Cynviloq™

and Abraxane

®

nanoparticles disintegrate

rapidly in the bloodstream to

release free paclitaxel

g/mL

g/mL |

13

Simulated PK Parameters Supportive of BE:

Cynviloq™

vs.

Abraxane

Note: Internal calculations done as 95% CI

Per FDA requirement, ratio T/R (Cmax and AUCinf) must be within 80-125%

(90% confidence interval, or CI)

Comparison of mean non-compartmental pharmacokinetic parameters of

Cynviloq™

(T) and Abraxane

®

(R) @ 260 mg/m

2

with 30 min infusion time:

Cmax

(ng/mL)

Ratio

Cmax(T)/Cmax(R)

AUCinf

(ng*h/mL)

Ratio

AUCinf(T)/AUCinf(R)

Cynviloq

TM

(Simulated PK)

19486

99.6%

22198

109.2%

Abraxane

®

(Actual PK)*

19556

20324

®

Cynviloq™

data on file

*

Gardner et al, 2008 |

14

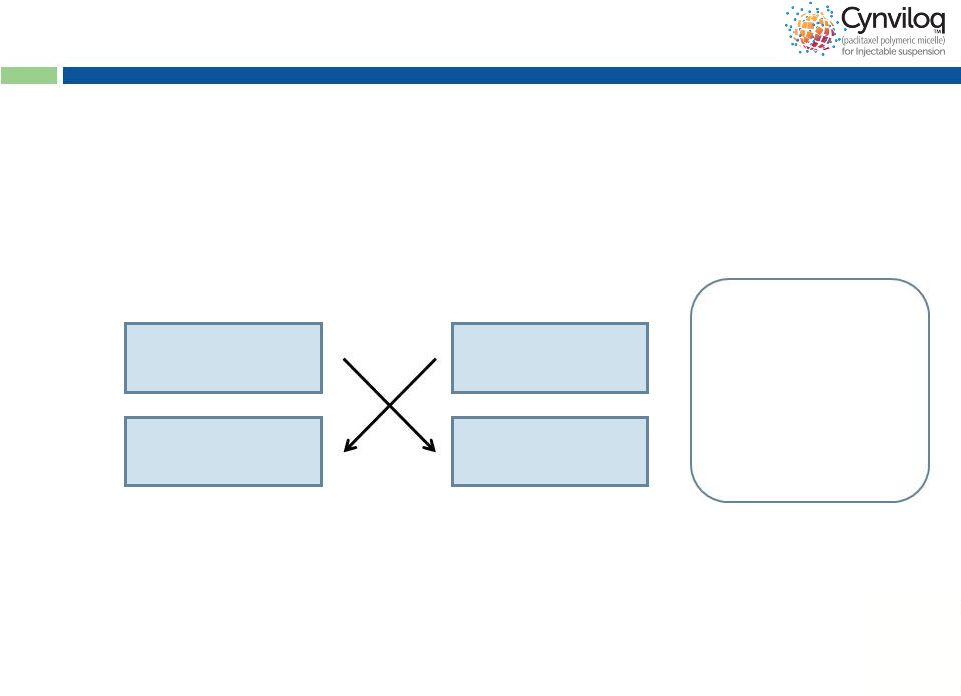

505(b)(2) Bioequivalence Dev’t Pathway

•

EOP2 meeting (July 2013): FDA concurrence on 505(b)2 BE as

appropriate regulatory submission pathway

•

Bioequivalence registration study in MBC (Q4 2013)

-

12 months of duration (including patient recruitment)

-

Trial cost less than $5M

•

NDA filing (Q4 2014 / Q1 2015), Approval (Q4 2015 / Q1 2016)

-

MBC and NSCLC and future (PC and MM) Abraxane

®

indications

•

Product launch for MBC and NSCLC (Q4 2015 / Q1 2016)

Abraxane

®

(50 patients)

Cynviloq™

(50 patients)

Cynviloq™

Abraxane

®

Cycle 1

Cycle 2

•

Dose 260 mg/m

•

30 min infusion time

•

3 weeks then cross

over for 3 weeks

•

Endpoint is AUC and

Cmax

2

(90% CI) |

15

Potential to Expand Label Indications –

For

Example:

2

Line

Bladder

Cancer

Cynviloq™

Phase 2 (Korea)*

260-300 mg/m

q3w

n=34

#

Best Supportive Care

Phase 2 (Japan) **/ Phase 3 (EU)***

n=23** / n=108***

Overall Response

Rate (ORR)

21%

-

/ 0%***

Progression Free

Survival

2.7 M

-

/ 1.5 M***

Overall Survival

6.5 M

2.3 M** / 4.3 M***

*

Invest

New

Drugs

(2012)

30:1984–1990

# advanced urothelial carcinoma patients refractory to gemcitabine and

cisplatin ** AUA-

San Diego May 4th-8 ; *** JCO (2009): 4454-61

Summary:

•

High

unmet

need

with

no

FDA

approved

2

nd

line

drug

•

Generally well-tolerated and demonstrated clinical ORR

•

Phase

3-ready

for

development

as

2

nd

line

chemotherapy

in

patients

refractory to platinum-based therapy

nd

th

2 |

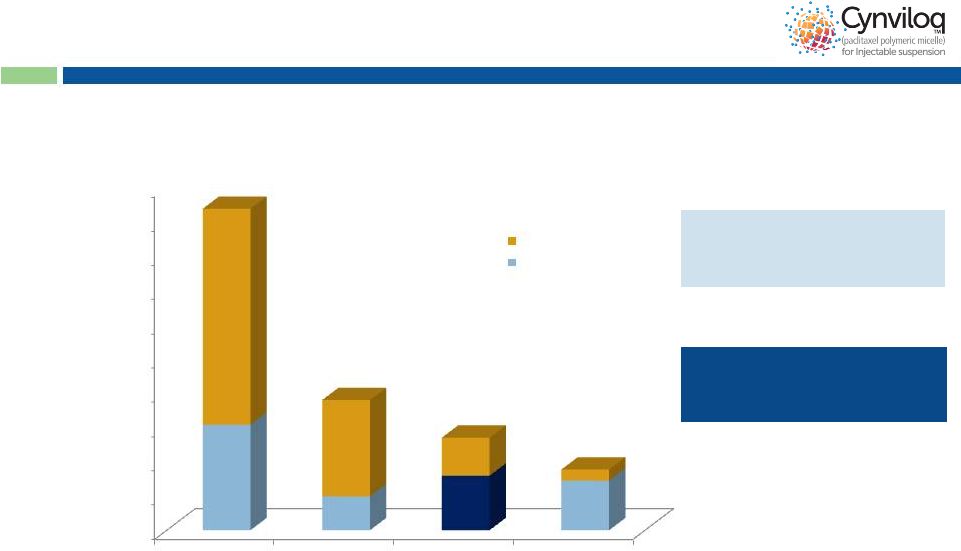

16

~55,000 patients with paclitaxel

as 1

st

line therapy in MBC,

NSCLC & OC

15,903 PC patients eligible for

treatment with Abraxane

®

+

Gemcitabine combination

Cynviloq™

Market Opportunity

Note: In PC, the blue portion represents

# pts treated with gem-based Rx in 2012 #

of

Patients

Treated

in

1

st

Line

(US

Only)

(2012)

Sources: US information, SEER Annual Cancer Review 1975-2006; US Census;

Mattson Jack; UHC and Medicare Claims; IntrinsiQ; Synovate Tandem. WHO

mortality database 2008 http://www.who.int/whosis/whosis/. World Population Prospects. The 2008 Revision. UN Population

Division 2009. http://esa.un.org/unpp/. Roche-Genentech Clinical, Patient Chart

Audits. Total patient numbers represent treatable population. 1

Line

patient

estimates

from

IntrinsiQ

2012

Monthly

LOT

Diag

Combo.

~70,000

patients

treated

with

paclitaxel-based

regimen

in

1

st

line

NSCLC

n = 93,800

MBC

n = 38,000

PC

n = 27,000

OC

n = 17,700

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

Other regimens

PAC+ treated

-

30,766

9,880

15,903

14,479

st

16 |

Therapeutic Antibody Engine |

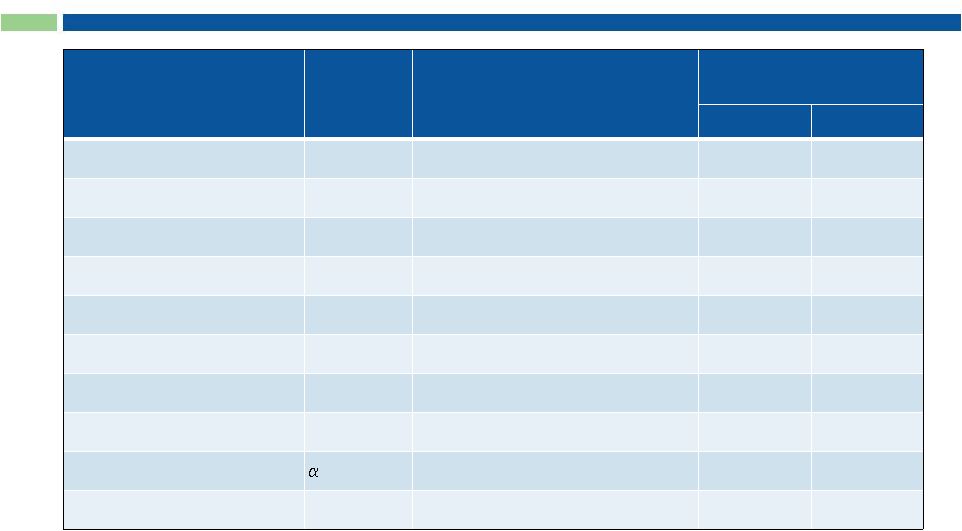

18

Top 10 Selling Therapeutic Antibodies (> $50B)

mAb

Target

Companies

2012 Sales

(US$ billions)*

US

Global

Humira (Adalimumab)

TNF

Abbott; Esai

4.4

9.3

Enbrel (Etanercept)

TNF

Amgen; Pfizer; Takeda

4.0

8.0

Rituxan (Rituximab)

CD20

Roche

3.3

7.0

Remicade (Infliximab)

TNF

J&J; Merck; Mitsubishi Tanabe

3.6

6.6

Herceptin (Trastuzumab)

HER2

Roche

1.7

6.2

Avastin (Bevacizumab)

VEGF

Roche

2.6

6.1

Lucentis (Ranibizumab)

VEGF

Novartis; Roche

1.6

4.0

Erbitux (Cetuximab)

EGFR

BMS; Merck-Serono

0.7

1.8

Tysabri (Natalizumab)

4 integrin

Biogen Idec

0.9

1.6

Xolair (Omalizumab)

IgE

Novartis; Roche

0.7

1.3

*Data Monitor

|

G-MAB

®

Library

Difficult Targets:

Small Molecules

Low molecular weight antigens

(< 2,500 Da; “haptens”)

Validated and/or Hot

Targets:

Medium-sized antigens

Soluble protein ligands

or cell surface receptors

Most Difficult Targets:

Large Complex Molecules

G protein-coupled receptors

(GPCRs)

Size of Target Antigen

•

Proprietary amplification

-

RNA amplification for variable

domains

•

Very high diversity:

V

H

: 7.1 x 10

7

•

Issued and pending patents

on G-MAB

®

library and

individual mAbs

•

Freedom-to-Operate (FTO)

•

No Stacking Royalties

V

L

: 2.9 x 10

8

Combined: 2.1 x 10

16 |

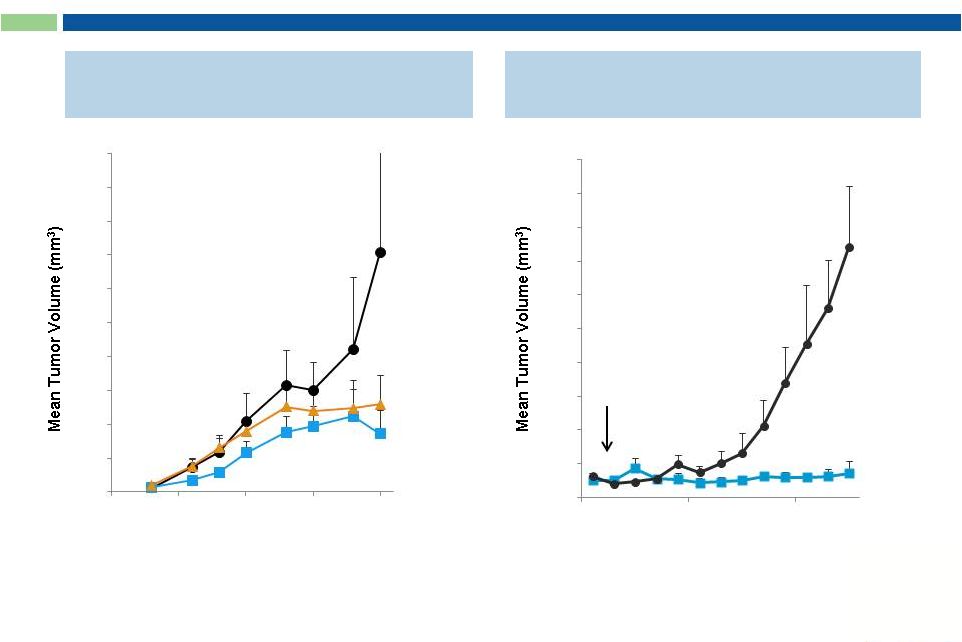

20

Anti-PD-L1 mAbs Exhibit Potent Activity

In Vitro and In Vivo

In Vitro*

In Vivo**

* mAbs @ 0.05 mg/mL

** xenograft model using H1975 human NSCLC cells; % inhibition relative to control

mAb treatment *** p<0.05, mean tumor volumes are significantly reduced in

STI-A1010 group versus control groups as determined by Mann-Whitney u-test

Day

Competitor mAb

Sorrento mAb |

21

“Naked”

Anti-Cancer mAbs Exert Potent

Anti-Tumor Activity In Vivo

Anti VEGFR2 mAb*

Anti c-Met mAb**

treatment

initiated

Days After Tumor Inoculation

Sorrento mAb

PBS

* xenograft model –

human carcinoma cells A431

** xenograft model –

human glioblastoma cells U118

Days After Tumor Inoculation

Sorrento mAb

Anti-VEGF mAb

PBS

0

200

400

600

800

1000

1200

1400

1600

1800

2000

5

10

15

20

25

0

100

200

300

400

500

600

700

800

900

1000

7

14

21

28

35 |

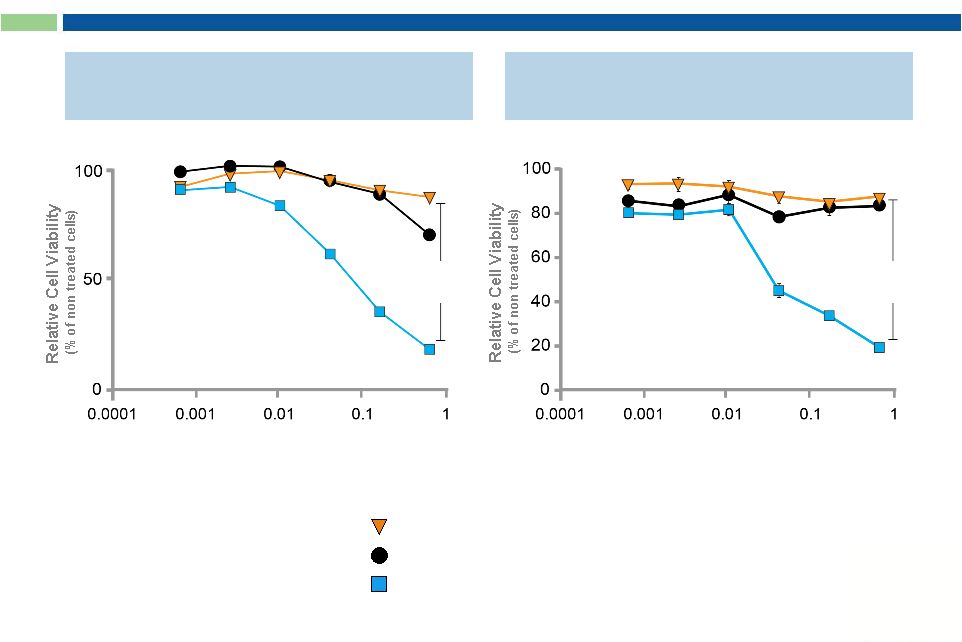

22

Anti-c-Met ADC**

IgG Concentration (nM)

Sorrento ADCs Possess Enhanced Cytotoxic Activity

Compared to “Naked”

mAbs

Leading Competitor mAb

Sorrento mAb + Toxin

Toxin Control

Anti-VEGFR2 ADC*

IgG Concentration (nM)

p value

< 0.0001

p value

< 0.0001

* Human Vascular Endothelial Cells (HUVECs)

** against Human A549 NSCLC Cells |

23

Targeted Drug Formulation Platform

ADC/AfDC

Targeted

Therapeutics |

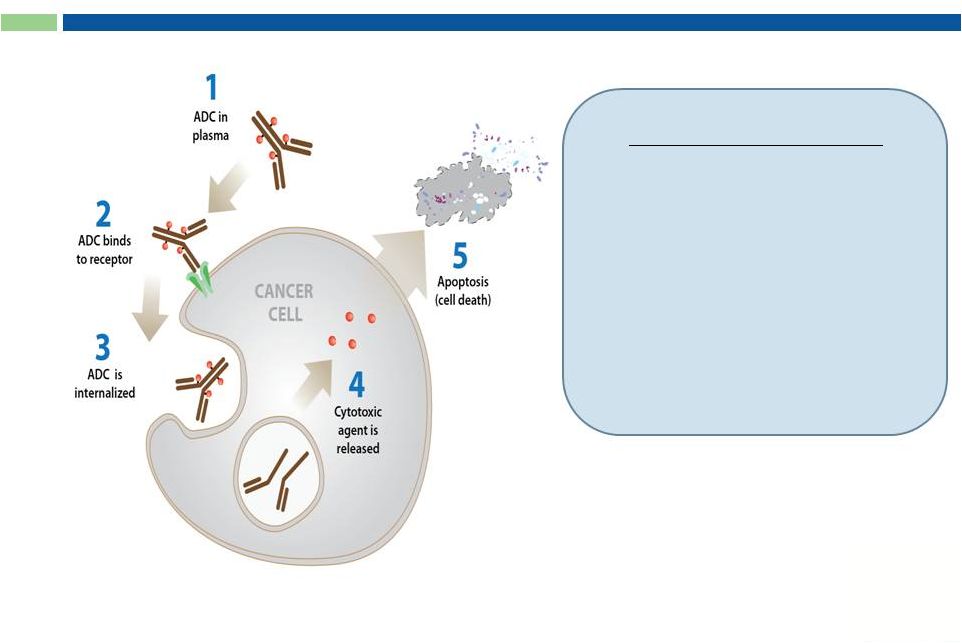

24

Antibody Drug Conjugates (ADC)

Key Components:

1.

Target-specific internalizing

antibody

2.

Potent cytotoxic prodrugs

3.

Linker and conjugation

chemistries

Drug released in CANCER CELL |

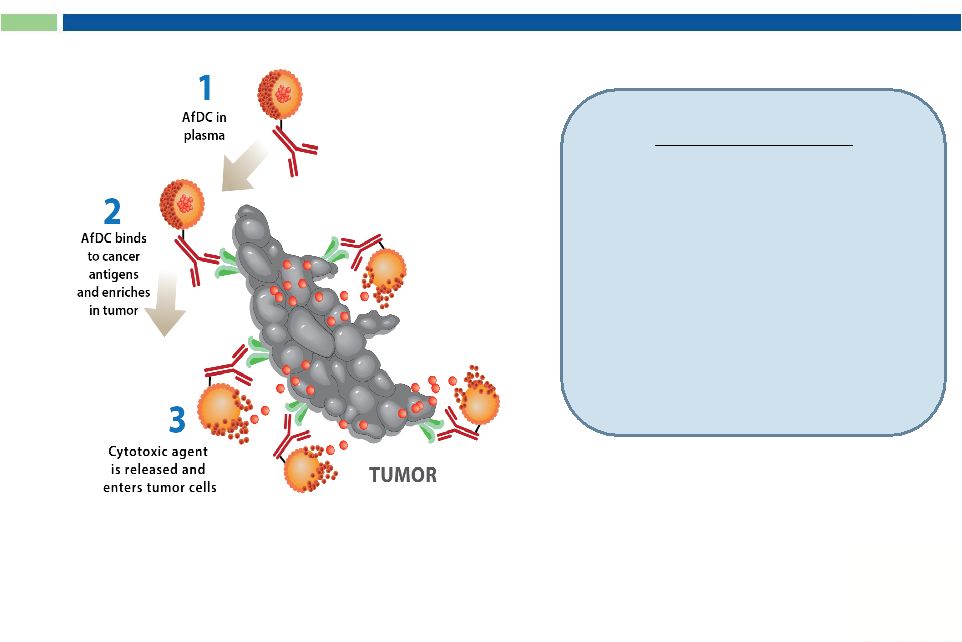

25

Key Features:

1.

2.

3.

Drug released in TUMOR

Antibody formulated Drug Conjugates (AfDC)

Approved oncolytic drug

with known safety profile

No internalization required

Flexibility in combining

mAbs and drugs |

26

G-MAB

®

, ADC and AfDC Pipeline

G-MAB

®

Antibody

ONCOLOGY

PD-L1

INFLAMMATION

ONCOLOGY /

INFLAMMATION

(GPCR)

INFECTIOUS

DISEASE

PD-1

VEGFR2-ADC

EGFR

PD-L1

RAGE

CGRP

CCR2

CXCR3

CXCR5

MRSA

(STI-A100X)

(STI-A110X)

(STI-A020X)

(STI-B010X)

(STI-B120X)

(STI-B150X)

(STI-B020X)

(STI-A120X)

(STI-B030X)

(STI-C020X)

(STI-A0168)

H1 2015

H2 2015

c-Met

(STI-A060X)

ADC/AfDC

ADC

ADC

PD-L1

(STI-A100X)

AfDC

CCR2

(STI-B020X)

ADC

ADC/AfDC

H2 2015

Multiple

Strategic

Partnership

Opportunities |

Positioned to Become Oncology Leader

Cynviloq™

Phase 3

G-MAB

®

Immuno-

therapy

mAb

candidates

ADC/AfDC

Targeted

therapeutics |

28

Small Molecule Oncology Drug, Antibody Library

and ADC Company Valuations

Company

Small Molecule

Oncology Drug

Antibody

Platform

Targeted

Drug Delivery

Mkt Cap*

Sorrento: SRNE

NSCLC, MBC

(Ph3/Registration Trial)

Antibody

Library

ADC/

AfDC

$150M

Puma:

PBYI

MBC (Phase 3)

~$1.6B

Clovis:

CLVS

NSCLC, MBC (Phase 1)

~$2.0B

MorphoSys:

MOR.DE

Antibody

Library

~$1.6B

CAT:

Acquired (2006)

Antibody

Library

~$1.4B

Domantis:

Acquired (2007)

Antibody

Library

~$450M

Seattle Genetics:

SGEN

ADC

~$5.0B

ImmunoGen:

IMGN

ADC

~$1.6B

* based on publicly-available information (09/04/13)

|

Sorrento Therapeutics

Next-Generation

Cancer Therapeutics

Contact:

Henry Ji

President and CEO

hji@sorrentotherapeutics.com

(858) 668-6923 |