Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PARKWAY PROPERTIES INC | d596850d8k.htm |

Investor

Presentation Acquisition of Thomas Properties Group, Inc.

September

2013

Exhibit 99.1 |

2

Forward-Looking Statements

Certain statements contained in this presentation, including those that express a belief, expectation

or intention, as well as those that are not statements of historical fact, are

forward-looking statements within the meaning of the federal securities laws and as such are based

upon the Company’s current beliefs as to the outcome and timing of future events. There can be no

assurance that actual future developments affecting the Company will be those anticipated by

the Company. Examples of forward-looking statements include projected capital resources,

projected profitability and portfolio performance, estimates of market rental rates, projected capital

improvements, expected sources of financing, expectations as to the timing of closing of acquisitions,

dispositions, or other transactions, the expected operating performance of anticipated

near-term acquisitions and descriptions relating to these expectations, including without

limitation, the anticipated net operating income yield. We caution investors that any forward-looking statements presented in this

presentation are based on management’s beliefs and assumptions made by, and information currently

available to, management. When used, the words “anticipate,” “believe,”

“expect,” “intend,” “may,” “might,” “plan,” “estimate,” “project,” “should,” “will,” “result” and similar

expressions that do not relate solely to historical matters are intended to identify

forward-looking statements. You can also identify forward-looking statements by

discussions of strategy, plans or intentions. Forward-looking statements involve risks and uncertainties

(some of which are beyond the Company’s control) and are subject to change based upon various

factors, including but not limited to the following risks and uncertainties: changes in

the real estate industry and in performance of the financial markets; the demand for and market

acceptance of our properties for rental purposes; the amount and growth of our expenses; tenant financial difficulties and general

economic conditions, including interest rates, as well as economic conditions in those areas where we

own properties; risks associated with joint venture partners; the risks associated with the

ownership and development of real property; the failure to acquire or sell properties as and

when anticipated; termination or non-renewal of property management contracts; the bankruptcy or insolvency of

companies for which Parkway provides property management services or the sale of these properties; the

outcome of claims and litigation involving or affecting the Company; the ability to satisfy

conditions necessary to close pending transactions; our failure to maintain our status as real

estate investment trust, or REIT; and other risks and uncertainties detailed from time to time in the

Company’s SEC filings. Should one or more of these risks or uncertainties occur, or should

underlying assumptions prove incorrect, the Company’s business, financial condition,

liquidity, cash flows and results could differ materially from those expressed in any forward-

looking statement. While forward-looking statements reflect our good faith beliefs, they are not

guarantees of future performance. Any forward-looking statements speak only as of the date

on which it is made. New risks and uncertainties arise over time, and it is not possible for us

to predict the occurrence of those matters or the manner in which they may affect us. We disclaim any obligation to

publicly update or revise any forward-looking statement to reflect changes in underlying

assumptions or factors, of new information, data or methods, future events or other changes.

Accordingly, investors should use caution in relying on past forward-looking statements,

which were based on results and trends at the time they were made, to anticipate future results or

trends. |

3

Additional Information

In connection with the proposed transaction, the Parkway Properties Inc. expects to file with the SEC

a registration statement on Form S-4 that will include a joint proxy statement of Parkway

and Thomas Properties that also constitutes a prospectus of Parkway, which joint proxy statement will

be mailed or otherwise disseminated to Parkway and Thomas Properties shareholders when it becomes

available. Parkway and Thomas Properties also plan to file other relevant documents with

the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME

AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the

joint proxy statement/prospectus (if and when it becomes available) and other relevant documents

filed by Parkway and Thomas Properties with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by the companies will be available free of charge on their websites at

www.pky.com

and www.tpgre.com

or by contacting Investor Relations at the companies (for Parkway at (407) 650-0593 and for

Thomas Properties at (213) 613-1900). Parkway and Thomas

Properties and their respective directors and executive officers may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. You can find information about Parkway’s

executive officers and directors in Parkway’s definitive proxy statement filed with the SEC

on April 4, 2013 in connection with its 2013 annual meeting of shareholders. You can find information about

Thomas Properties’ executive officers and directors in Thomas Properties’ definitive proxy

statement filed with the SEC on April 30, 2013 in connection with its 2013 annual meeting of

shareholders. Additional information regarding the interests of such potential participants will be

included in the joint proxy statement/prospectus and other relevant documents filed with the SEC if

and when they become available. You may obtain free copies of these documents from Parkway

or Thomas Properties using the sources indicated above.

This document shall not constitute an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as amended. |

4

Table of Contents

Situation / Transaction Overview

5

Asset & Market Overviews

19

Appendix

26

San Felipe Plaza

Houston, TX

Frost Tower

Houston, TX

One Congress Plaza

Austin, TX |

Situation / Transaction Overview

Houston, TX

Galleria Submarket

Austin, TX

Downtown CBD |

6

Strategic Plan Overview

Strategic Objective

Increase cash flow and unlock embedded value within

existing portfolio

Realize leasing and operational efficiencies and gain local

advantage

Create long-term value for shareholders as the leading

owner of high-quality assets in higher growth submarkets

in the Sunbelt

Maintain a conservative balance sheet with sufficient

flexibility for growth

Tactics

•

Efficiently exit non-core markets

•

Reinvest funds over time in quality assets in higher-growth

submarkets

•

Pursue primarily wholly owned investments and select joint ventures

when appropriate

•

Achieve critical mass in target submarkets

•

Maintain highly experienced local leadership

•

New asset level ownership plans given new investment strategy

•

Customized leasing strategies by submarket

•

More judicious prioritization of capital expenditures

•

Focus on high-quality, differentiated assets

•

Maintain between 5.5x to 6.5x net debt to EBITDA over long term

•

Focus on debt composition and maintain quality unencumbered pool

•

Use credit facility as short-term financing source

Since the new management team was put in place in the fourth quarter of 2011, Parkway

has executed on its strategic plan |

7

Key Achievements

New

Management

Team / TPG

Sponsorship

Enhanced

Operational

Results

Fortified

Balance Sheet

and Cash Flow

•

New management team with proven value creation expertise and strong regional

management platform took over in December 2011

•

~$275 million total equity investment by TPG, a leading global private investment

firm, which holds a 34% ownership interest in the Company

pre-transaction and 25% post-transaction •

Substantial operational improvement throughout 2012 and through 2Q 2013

–

Occupancy increased over 475 basis points to 89.9%

–

Average in-place rents increased from $22.65 to $24.13 per square foot

–

FAD / FFO ratio significantly improved

–

Announced

over

1.0

million

SF

of

leasing

from

April

through

July

2013

•

Parkway has maintained a strong and conservative balance sheet as it has continued

to grow •

All

leverage

and

coverage

metrics

have

improved,

and

Parkway

has

raised

$839

million

of

capital

–

Raised $594 million in private and public equity in 2012 and 2013 YTD

–

Closed $125 million and $120 million unsecured term loans

•

Amended

its

credit

facility

to

extend

term,

increase

the

size

of

the

accordion

and

lower

fees

•

Reduced overall cost of capital by redeeming 8.0% preferred equity

•

Improved operating cash flow performance, which resulted in a 100% increase in

dividend Strategy &

Portfolio

Transformation

•

Portfolio repositioning substantially completed and acquisition pipeline remains

strong •

Exited majority of non-core assets and completed sale of Fund I

portfolio •

Purchased or under contract to purchase over $1.6 billion of high-quality

assets since January 2011 |

8

Strategic Rationale for Transaction

High Quality

Portfolio

Increased Scale

and Market

Dominance

Limited

Integration Risk

•

Premier, Class A office properties with difficult to replicate locations and

amenities •

Located in target submarkets of desirable, high-growth markets

•

Core and core-plus properties with creditworthy and diverse tenant base

•

Significant upside potential through lease-up due to in-place portfolio

occupancy of 90% •

Increases PKY’s total portfolio square feet by approximately 39%

•

More than doubles the size and improves the quality of PKY’s Houston

portfolio •

Achieves PKY’s stated strategy of expanding into Austin

•

Critical mass gained in targeted, high-growth submarkets

•

Overlapping markets with strong regional leadership already in-place

•

Significant potential cost savings with minimal increase to PKY’s existing

G&A expense •

No changes to PKY’s current management team

PKY’

s Stated

Investment Strategy

Attractive

Asset Pricing

•

Early stages of recovery in the real estate cycle

•

Core and core-plus investments with room for occupancy and rental rate

growth •

Significant embedded rent growth via below-market rents

•

Pricing below replacement cost

•

Leverage remains conservative post transaction with sufficient flexibility for

growth •

Projected

Net

Debt

to

EBITDA

of

6.5x

and

Net

Debt

to

TEV

of

46.4%

post

transaction

•

Expect portfolio to naturally de-lever as EBITDA increases from announced

leasing •

Expect to continue to recycle certain PKY assets

1.

Based on PKY closing stock price of $16.37 as of September 4, 2013.

Pro Forma

Balance Sheet

Strategic Rationale is Consistent with and Exemplifies PKY’s

Stated Investment Strategy

Create Long-Term

Value as the

Leading Owner of

Quality Assets in

Higher Growth

Submarkets in the

Sunbelt

Achieve Critical

Mass in Target

Submarkets

Conservative

Balance Sheet with

Flexibility for

Growth

1 |

9

Transaction Overview

Transaction

Summary

•

Parkway Properties, Inc. (“PKY”) to acquire Thomas Properties Group, Inc.

(NYSE:TPGI or “TPGI”)

•

100% stock merger

•

Fixed exchange ratio

–

0.3822 shares / units of PKY per TPGI common share / unit

•

Implied offer price of $6.26 per TPGI share

–

9.8% premium to TPGI closing price of $5.70 on September 4, 2013

Board of

Directors

•

PKY’s Board of Directors will be expanded from 9 to 10 members

•

James

A.

Thomas

will

be

named

Chairman

of

the

Board

of

Directors

of

PKY

Transaction

Value

•

$381 million aggregate offer value to TPGI shareholders

•

$1.235 billion implied transaction value

•

$1.034 billion implied transaction value (pro forma for planned asset sales in

conjunction with the closing of the transaction)

Ownership

•

~75% PKY shareholders

•

~25% TPGI shareholders

Shareholder

Vote / Closing

•

Transaction will require majority approval by both PKY and TPGI shareholders

•

Anticipated closing: December 2013 |

10

Key Elements of the Transaction

TPGI / CalSTRS

Joint Venture

Liquidation

•

TPGI

/

CalSTRS

joint

venture

to

be

liquidated

in

advance

of

closing

of

transaction

1

–

City National Plaza (Los Angeles) distributed to CalSTRS

–

San Felipe Plaza and CityWestPlace (Houston Assets) distributed to TPGI

Bridge

Financing to

TPGI

•

PKY to provide up to $80 million bridge loan to TPGI

–

Used to fund portion of TPGI’s $163 million equity contribution in connection

with the TPGI / CalSTRS joint venture liquidation

Planned

Sales of TPGI

Assets

•

One

&

Two

Commerce

Square

(Philadelphia)

and

Four

Points

Centre

(Austin)

2

expected

to

be

sold to Brandywine Realty Trust (Brandywine) concurrently with the closing of the

transaction •

Three TPGI Northern Virginia properties under special servicer oversight expected

to be sold prior to or shortly after closing

1.

As announced on July 31, 2013. See slide 27 for more details related to the TPGI /

CalSTRS joint venture liquidation. 2.

Includes property and adjacent land parcel.

Key Steps

1. Bridge Financing

2. Joint Venture Liquidation

3. TPGI Acquisition

4. Asset Sales

•

PKY provides up to $80 mm

bridge loan to TPGI

•

Funded through PKY revolving

credit facility

•

TPGI funds equity contribution

for the liquidation of the TPGI /

CalSTRS JV

•

Houston Assets distributed to

TPGI

•

City National Plaza distributed

to CalSTRS

•

PKY acquires TPGI

•

Anticipated timing: Dec. 2013

•

At or near closing:

•

One & Two Commerce Square

sold to Brandywine

•

Four Points Centre

²

sold to

Brandywine

•

Northern VA properties sold or

liquidated |

1.

Based on 100% ownership.

11

TPGI Operating Properties

Pre and Post Transaction

Denotes properties part of the TPGI / CalSTRS JV Liquidation

Existing TPGI Properties

Properties Acquired by PKY

Rentable

TPGI

Rentable

PKY

Sq. Ft.

Occupancy

Existing

Sq. Ft.

Occupancy

Pro Forma

Property

Location

(000's)

(1)

at 6/30/13

(1)

Ownership

Property

(000's)

(1)

at 6/30/13

(1)

Ownership

1.

CityWestPlace

Houston

1,473

99%

25%

1.

CityWestPlace

1,473

99%

100%

2.

San Felipe Plaza

Houston

980

87%

25%

2.

San Felipe Plaza

980

87%

100%

3.

Frost Bank Tower

Austin

535

95%

33%

3.

Frost Bank Tower

535

95%

33%

4.

One Congress Plaza

Austin

518

84%

33%

4.

One Congress Plaza

518

84%

33%

5.

One American Center

Austin

504

76%

33%

5.

One American Center

504

76%

33%

6.

300 West 6th Street

Austin

454

90%

33%

6.

300 West 6th Street

454

90%

33%

7.

San Jacinto Center

Austin

410

81%

33%

7.

San Jacinto Center

410

81%

33%

8.

One Commerce Square

Philadelphia

943

88%

75%

One Commerce Square

9.

Two Commerce Square

Philadelphia

953

87%

75%

Two Commerce Square

10.

Four Points Centre

Austin

192

99%

100%

Four Points Centre

11.

City National Plaza

Los Angeles

2,496

88%

8%

City National Plaza

Distributed to CalSTRS

12.

Fair Oaks Plaza

Northern VA

180

N/A

25%

Fair Oaks Plaza

13.

Reflections I

Northern VA

124

N/A

25%

Reflections I

14.

Reflections II

Northern VA

64

N/A

25%

Reflections II

Existing TPGI Properties

9,827

89%

Properties Acquired by PKY

4,875

90%

Expected to be sold in conjunction with closing

of transaction

Expected to be sold in the near term |

12

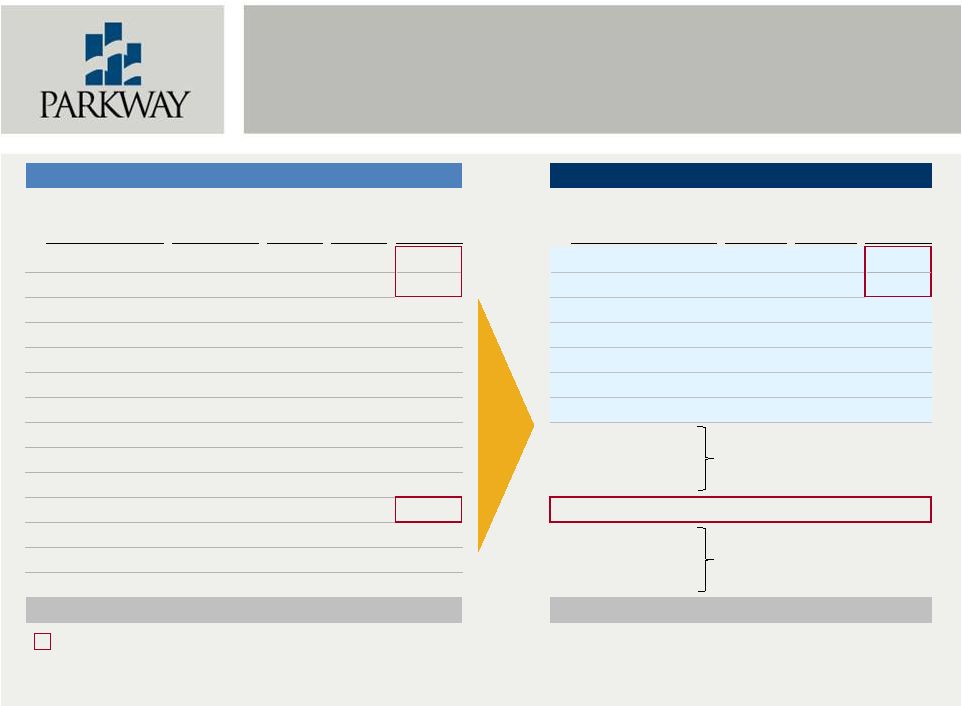

Transaction Value / Economics

Transaction Value

Transaction Value

Before

Expected

After

Asset Sales

¹

Asset Sales

³

Asset Sales

PKY Stock Price (as of 9/4/13)

$16.37

$16.37

Exchange Ratio

0.3822x

0.3822x

Offer Price per TPGI Share

$6.26

$6.26

Premium to TPGI Closing Price (on 9/4/2013)

9.8%

9.8%

TPGI Shares Outstanding

60.9

60.9

Offer Value

$381

$381

Assumed TPGI Debt

$731

2

($201)

$530

Bridge Loan for Houston Assets

75

2

75

Less: Cash & Cash Equivalents

(28)

2

(95)

(123)

Net Debt

$777

$481

TPGI Total Enterprise Value (TEV) at Offer Price

$1,159

$863

Add-Back: Cash & Cash Equivalents

28

95

123

Estimated Transaction Costs

48

48

Transaction Value

$1,235

$1,034

Value of Operating Real Estate

$866

Estimated 2014E FFO per Share Accretion

$0.13 -

$0.18

Estimated Annual Recurring G&A Increase

~$1.5 -

2.0 million

Estimated 2014E Cash NOI Cap Rate

6.0%

Estimated 2014E GAAP NOI Cap Rate

8.1%

Note: $ in millions, except per share amounts.

1.

Pro forma for the three Northern Virginia properties under special servicer oversight that are expected

to be sold prior to or shortly after closing.

2.

Pro forma for TPGI’s planned liquidation of TPGI / CalSTRS joint venture, announced on July 31,

2013. 3.

Adjustments for the planned sale of One Commerce Square and Two Commerce Square (Philadelphia, PA) and

Four Points Centre (property and land parcel in Austin, TX) concurrent with the

transaction.

|

Note: $ in millions, except per share amounts.

1.

Estimated TPGI debt outstanding at December 31, 2013, shown at TPGI’s pro rata

share of ownership. 2.

Expected net proceeds from the sale of One Commerce Square, Two Commerce Square and

Four Points Centre (property and land) in connection with the anticipated closing of this transaction.

3.

Bridge financing provided by PKY to TPGI to fund a portion of TPGI’s required

equity contribution in connection with the announced liquidation of the TPGI / CalSTRS joint venture.

13

Transaction Financing:

Sources & Uses

Sources

Uses

$ in millions

% of Total

$ in millions

% of Total

PKY Shares Issued to TPGI Shareholders

$381

37%

Stock Consideration to TPGI Shareholders

$381

37%

Assumed TPGI Debt

¹

530

51%

Assumed TPGI Debt

¹

530

51%

Net Proceeds from Planned Asset Sales

²

95

9%

Bridge Loan

³

75

7%

TPGI Cash & Cash Equivalents

28

3%

Estimated Transaction Costs

48

5%

Total Sources

$1,034

100%

Total Uses

$1,034

100% |

14

Pro Forma PKY Capitalization

Bridge Loan to TPGI

$75.0

Estimated Transaction Costs

48.3

Total Potential Line of Credit Draw

$123.3

Less: Net Proceeds from Asset Sales

(95.1)

Less: TPGI Cash & Equivalents

(28.2)

Net Line of Credit Draw

$0.0

PKY Capitalization

$ in millions, except per share amounts

TPGI Acquisition

PKY

Incremental

Post TPGI

Asset

New

PKY

Acquisition

Financing

Acquisition

Sales

PKY

PKY Stock Price (as of 9/4/13)

$16.37

$16.37

$16.37

$16.37

Shares Outstanding

69.7

23.3

93.0

93.0

Equity Market Capitalization

$1,140.5

$381.3

$1,521.8

$1,521.8

Debt

Secured Debt -

Wholly Owned

$452.6

$344.3

$797.0

($200.8)

$596.1

Secured Debt -

Consolidated Joint Venture

88.1

177.6

265.7

265.7

Unsecured Term Loans

245.0

245.0

245.0

Revolving Credit Facility

17.5

95.1

112.6

(95.1)

17.5

Draw to Fund Bridge Loan to TPGI

75.0

(75.0)

0.0

0.0

Share of Unconsolidated Joint Venture Debt

0.0

208.7

208.7

208.7

Total Debt

$803.3

$805.5

$20.1

$1,628.9

$1,333.0

-

Cash & Cash Equivalents

(16.2)

(28.2)

28.2

(16.2)

(16.2)

Net Debt

$787.0

$1,612.7

$1,316.7

TEV

$1,927.5

$3,134.5

$2,838.5

Net Debt / TEV

40.8%

51.4%

46.4%

Net Debt / EBITDA

6.1x

7.1x

6.5x

1

3

4

2

Pro forma for acquisition / disposition activity announced after June 30, 2013.

PKY debt is shown at share and as of June 30, 2013. TPGI debt is based on estimated debt balance at

December 31, 2013.

Bridge financing funded through PKY’s revolving credit facility to partially fund TPGI’s

equity contribution in connection with TPGI / CalSTRS joint venture liquidation.

Adjustments for the planned sale of Commerce Square (Philadelphia, PA) and Four Points

Centre (property and land parcel in Austin, TX) concurrent with the transaction. 1.

2.

3.

4. |

$255

$33

$110

$69

$291

$18

$125

$120

$236

$31

$27

$3

$15

$255

$412

$261

$96

$294

$100

$200

$300

$400

$500

2013

2014

2015

2016

2017

2018

2019

Thereafter

$33

$69

$198

$18

$125

$120

$28

$31

$27

$3

$15

$137

$203

$151

$96

$201

$100

$200

$300

$400

$500

2013

2014

2015

2016

2017

2018

2019

Thereafter

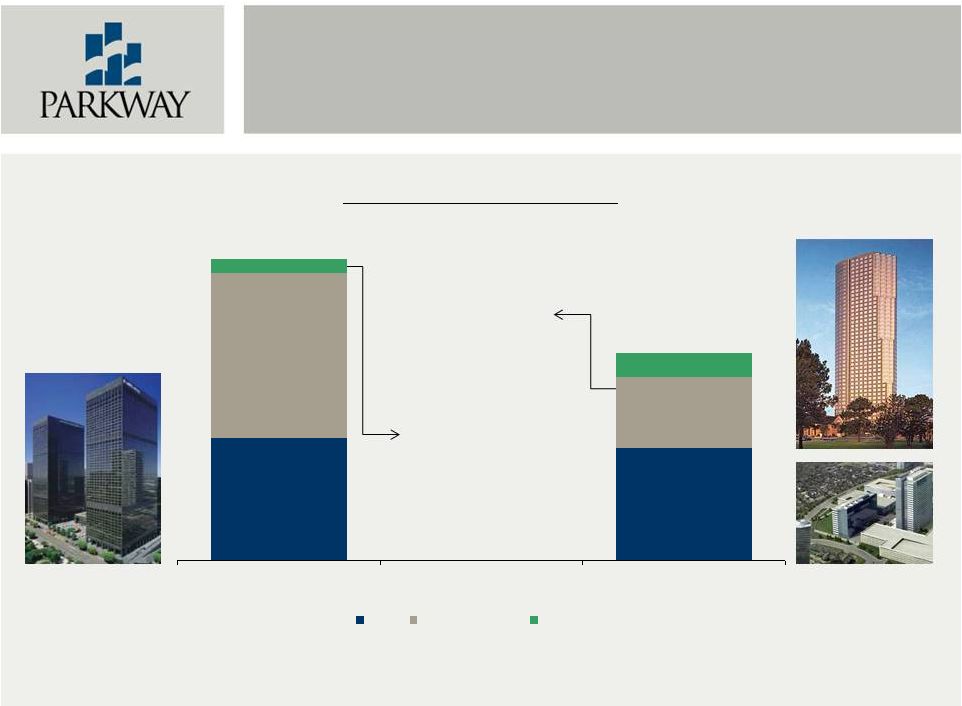

15

Debt Maturity Schedule

PKY (As of 6/30/13)

PRO FORMA PKY

Note: $ in millions.

1.

Pro forma for announced sales of Waterstone, Meridian, and Bank of America Plaza and

for the pending acquisition of Lincoln Place. 2.

Includes

100%

of

debt

on

San

Felipe

Plaza

and

CityWestPlace

(Houston,

TX

assets)

and

debt

related

to

TPGI

/

CalSTRS

Austin

joint

venture

assets.

Secured (Wholly Owned)

Revolving Credit Facility

Secured (JV)

Term Loan

Total Debt (At Share):

$803mm

Total Debt (At Share):

$1,333mm

1

2 |

16

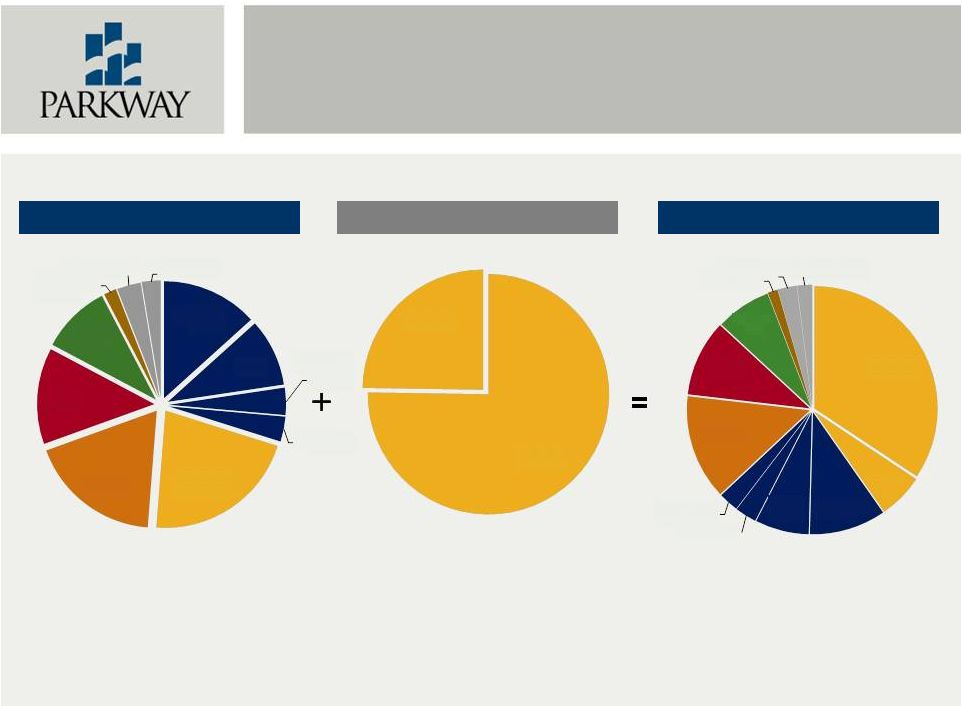

Increased Exposure to Desirable

Markets and CBD / Infill Locations

PKY

1

PRO FORMA PKY

TPGI

2

Jacksonville

13%

Tampa

9%

Orlando

4%

South Florida

4%

Houston

21%

Charlotte

18%

Atlanta

13%

Phoenix

10%

Philadelphia

2%

Memphis

3%

Jackson

3%

Houston

75%

Austin

25%

Houston

34%

Austin

6%

Jacksonville

10%

Tampa

7%

Orlando

3%

South Florida

3%

Charlotte

14%

Atlanta

10%

Phoenix

7%

Philadelphia

1%

Memphis

2%

Jackson

2%

Note: Based on sq. ft. (at pro rata share of PKY, TPGI and the combined company).

1.

Pro forma for announced sale of three properties for $53 million (Waterstone, Meridian, and Bank of

America Plaza) and for pending acquisition of Lincoln Place for $66 million.

2.

Only reflects properties to be retained by combined company. |

17

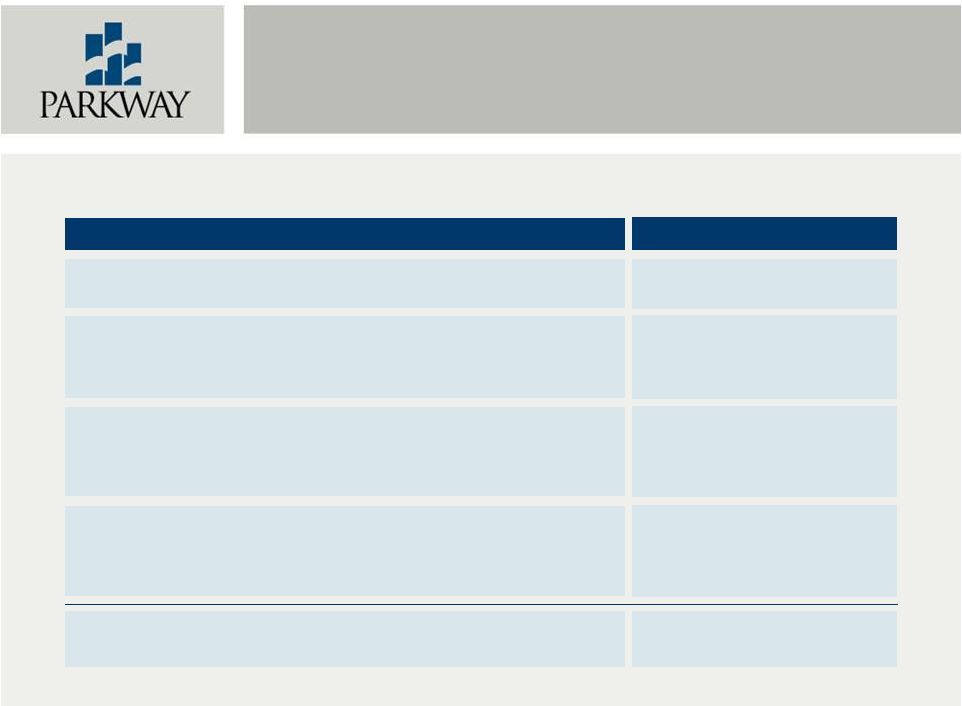

Broader and More Diversified

Tenant Base

=

Note: Shaded rows represent new PKY tenants.

1.

Excludes One Commerce Square and Two Commerce Square (Philadelphia), Four Points

Centre (Austin), and City National Plaza (Los Angeles) per TPGI / CalSTRS liquidation and

transaction with Brandywine.

2.

Based on pro rata share of PKY, TPGI and the combined company square feet.

PKY

TPGI

(1)

PRO FORMA PKY

% of Total

% of Total

% of Total

Tenant

Sq. Ft.

(2)

Tenant

Sq. Ft.

(2)

Tenant

Sq. Ft.

(2)

1.

Bank of America

6.8%

1.

BMC Software

23.4%

1.

Bank of America

5.5%

2.

Raymond James & Associates

2.7%

2.

Halliburton

18.2%

2.

BMC Software

4.7%

3.

Nabors Industries

2.3%

3.

ENSCO

8.5%

3.

Halliburton

3.7%

4.

US Airways

2.3%

4.

Statoil

6.2%

4.

Raymond James & Associates

2.8%

5.

Blue Cross Blue Shield

2.1%

5.

Ion Geophysical

4.7%

5.

Nabors Industries

1.9%

6.

JPMorgan Chase Bank

2.0%

6.

Houston Series of Lockton Cos

3.4%

6.

US Airways

1.9%

7.

Hearst Communications

1.9%

7.

Aker Solutions

3.1%

7.

ENSCO

1.7%

8.

K & L Gates

1.6%

8.

Raymond James & Associates

3.1%

8.

Blue Cross Blue Shield

1.7%

9.

Schlumberger

1.6%

9.

Petrobras

2.5%

9.

JPMorgan Chase Bank

1.6%

10.

NASCAR Media Group

1.5%

10.

Alliant Insurance Services

1.8%

10.

Hearst Communications

1.5%

11.

Chiquita Brands

1.4%

11.

The Hanover Company

1.7%

11.

K & L Gates

1.3%

12.

Honeywell

1.4%

12.

Pannell Kerr Forster of Texas, P.C.

1.6%

12.

Schlumberger

1.3%

13.

Forman Perry Watkins

1.3%

13.

Wood Mackenzie, Inc.

1.4%

13.

Statoil

1.2%

14.

General Services Administration

1.3%

14.

Hoover Slovacek, L.L.P.

1.3%

14.

NASCAR Media Group

1.2%

15.

Southwestern Energy

1.2%

15.

Brown McCarroll

1.2%

15.

Chiquita Brands

1.1%

PKY Top 15 Tenants

31.6%

TPGI Top 15 Tenants

(1)

82.2%

Pro Forma Top 15 Tenants

33.0% |

18

Potential Value Creation

Houston

Austin

TPGI Acquisition

Total Square Footage (At 100% / At Share)

4.9 million

/

3.3 million

Implied Value of Operating Real Estate

$866 million

Price per Square Foot

$266

Occupancy

1

90%

Estimated 2014E Cash NOI Cap Rate

6.0%

Estimated 2014E GAAP NOI Cap Rate

8.1%

Note: Amounts shown are based on PKY’s pro forma pro rata share unless otherwise noted.

1.

Based on 100% ownership and as of 6/30/13. 2.

Based on triple net rates for available spaces in the respective properties as of 9/2/2013, per CoStar

Group.

San Felipe Plaza

CityWestPlace

Square Footage (At 100% / At Share)

1.0 million / 1.0 million

1.5 million / 1.5 million

Price per Square Foot

$246

$250

Occupancy¹

87%

99%

In-Place Rents per Square Foot

$20.94 PSF

$20.20 PSF

Blended Market / Asking Rates

²

$25.00 PSF

$29.00 PSF

Above / (Below) Market

(16%)

(30%)

Total Portfolio

Square Footage (At 100% / At Share)

2.4 million / 0.8 million

Price per Square Foot

$313

Occupancy¹

85%

In-Place Rents

$22.14 PSF

Blended Market / Asking Rates

²

$28.58 PSF

Above / (Below) Market

(23%) |

19

Acquired Other Assets

Other Acquired Asset

Remaining Condominiums at Murano

•

41 of 302 units remain unsold as of June 30, 2013

•

Value estimated at net book value as of June 30, 2013

Entitled Land Parcel at CityWestPlace

•

9.9 acres with 500,000 square feet of entitlements

•

Value estimated at approximately $25 per buildable foot

Cash and Cash Equivalents on TPGI’s Balance Sheet

Continuing Fee Income on TPGI / Austin Joint Venture

•

Fee income estimated to be between $1.8 and $2.3 million annually

•

Value estimated at present value of fee income

Estimated Value ($ in millions))

31.6

12.5

$28.2

7.2

In addition to the Operating Real Estate assets of TPGI, PKY will acquire a number of

other tangible assets of TPGI

TOTAL ESTIMATED VALUE OF NET OTHER ASSETS ACQUIRED

$79.5

1. Estimated pro forma cash balance at closing.

2. Present value based on 5-year fee income projection as of 1/1/14 at a

10% discount rate. 2

1 |

Asset & Market Overviews |

21

High-Quality Office Properties in

Desirable Markets

TPGI Assets To Be Acquired by PKY

Frost Bank Tower

Austin, TX

One Congress Plaza

Austin, TX

San Jacinto Center

Austin, TX

300

West

6

Street

Austin, TX

One American Center

Austin, TX

San Felipe Plaza

Houston, TX

CityWestPlace

Houston, TX

th |

22

Houston Market

Houston Office Statistics

•

First major metro area in the U.S. to regain all jobs lost

during the recession (290,000 since Dec. 2009)

•

Overall Class A office vacancy of 6.9%

•

YTD net absorption in excess of 1.6 million SF

•

Galleria submarket Class A vacancy of 7.3%

•

Significant rental rate momentum. Class A

rate growth year-over-year exceeds 12%

•

Westchase submarket Class A vacancy of 2.5%

•

Vacancy compression of 760 bps since 1Q12

•

CityWestPlace represents ~25% of the Class A

office inventory in the submarket

•

PKY is a significant owner / operator of Class A office

space in its targeted submarkets in Houston

Galleria –

Class A

Westchase –

Class A

Sources: BLS.gov and CBRE.

CBRE Galleria submarket data is for combined Galleria/West Loop submarket.

All data as of 2Q13 unless otherwise noted. |

23

Houston Portfolio

San Felipe Plaza

CityWestPlace

•

Four building, Class A corporate campus located in the

Westchase submarket of Houston

•

Numerous attractive amenities including three cafes, two

fitness centers and basketball courts on campus

•

The campus was constructed for BMC Software in 1998

•

Assets currently operate as a unique multi-tenant corporate

campus environment

•

46-story, Class A office tower located in the

Galleria submarket of Houston

•

Second tallest building outside of the CBD

•

LEED EB Gold certified

•

Well located with surrounding high-end

residential and Galleria amenities

San Felipe Plaza

San Felipe Plaza

San Felipe Plaza

CityWestPlace 1

305,828 SF

CityWestPlace 2

443,551 SF

CityWestPlace 3

205,348 SF

CityWestPlace 4

518,293 SF |

24

Houston Portfolio (cont’d)

San Felipe Plaza

CityWestPlace

Market

Houston

Houston

Submarket

Galleria

Westchase

RSF

980,472

1,473,020

Year Built (Renovated)

1984 (1996)

1998-2001

Occupancy (6/30/2013)

86.5%

99.0%

Pro Forma Ownership

100.0%

100.0%

Investment Highlights

•

Premier, Class A office properties with distinctive

designs and features

•

Located in desirable, high-growth Galleria and

Westchase submarkets

•

Value-add potential:

•

Lease-up of San Felipe Plaza vacant space

•

Embedded growth opportunity with in-place

rents lower than market rents at both

properties

•

Leased to a diverse array of high-quality tenants

•

Immediately upgrades the quality of PKY’s

Houston portfolio

•

Houston office demand continues to grow at a

rapid pace, absorbing over 1.5mm SF YTD

•

Assets will be wholly-owned by PKY at closing

San Felipe Plaza

CityWestPlace |

25

Austin Market

Source: CBRE and Rosen Consulting Group.

Austin Office Statistics

•

Austin MSA has been one of the fastest growing

regions in the United States

•

Job growth of 3.9% year-over-year

•

Population expected to reach 2.1mm by 2017

•

Overall Austin had strong rental rate growth over the

past year due to limited new supply and increasing

demand

•

YTD net absorption of 464,000 SF

•

CBD average Class A rental rates have grown

9% year-over-year

•

Downtown office demand driven by growing

technology hub, expanding government sector and

increased residential expansion

CBD –

Class A

Frost Bank

Tower

San Jacinto

Tower

One American

Center |

26

Austin Portfolio

Frost Bank

Tower

300 West 6th Street

San Jacinto

Center

One Congress

Plaza

One American

Center

Submarket

CBD

CBD

CBD

CBD

CBD

RSF

535,078

454,225

410,248

518,385

503,951

Year Built (Renovated)

2003

2001

1987

1987

1984 (1992)

Occupancy (6/30/2013)

94.8%

89.9%

81.2%

83.5%

75.9%

Pro Forma Ownership

33.3%

33.3%

33.3%

33.3%

33.3%

Investment Highlights

•

Five Class A, Trophy assets comprising 2.4mm RSF

•

Represents ~40% of Class A office inventory

in CBD

•

Centrally located in thriving downtown Austin CBD

•

Positive embedded growth opportunities with in-

place rents lower than market rents

•

All five assets are LEED EB Gold certified

•

Portfolio overall occupancy of 85% provides

significant upside potential through lease-up

•

Anchored by a diverse, stable tenant base including

legal, financial services, insurance firms and

technology companies such as Facebook

•

Achieves PKY’s stated strategy of expanding into

Austin market with portfolio of high-quality assets

1.

Owned as part of the TPGI / CalSTRS Austin joint venture.

2.

Source: CBRE.

2

1 |

Appendix |

28

TPGI / CalSTRS

Joint Venture Liquidation

Purchase of CalSTRS Equity

in San Felipe Plaza and CityWestPlace:

~$205 million

Less:

TPGI’s

Equity in City National Plaza:

~$41 million

Less: Trans. Fees of ~$1mm

Equals

~$163 million

TPGI Net Equity Contribution

$351mm

$323mm

$474mm

$205mm

$41mm

$68mm

$865mm

$596mm

City National Plaza (Los Angeles)

San Felipe Plaza and

CityWestPlace (Houston)

Debt

CalSTRS Equity

TPGI Equity |

29

Austin CBD Map

300 West 6 St

One American Center

Frost Bank Tower

One Congress Plaza

San Jacinto Center

th |

30

Houston Map

Galleria

Westchase

CityWest Place

San Felipe Plaza |

Parkway Properties, Inc.

390 North Orange Avenue

Suite 2400

Orlando, FL 32801

(407) 650-0593

www.pky.com |