Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT231 - Gulfstream Capital Corp | exhibit231.htm |

| EX-5.1 - EXHIBIT51 - Gulfstream Capital Corp | exhibit51.htm |

| EX-23.3 - EXHIBIT233 - Gulfstream Capital Corp | exhibit233.htm |

As filed with the Securities and Exchange Commission on September 11, 2013

Registration No. 333-188694

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

(Amendment No. 1)

(Amendment No. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Gulfstream Capital Corporation

(Exact name of registrant as specified in its charter)

|

Nevada

|

1000

|

39-2078090

|

||

|

(State or other jurisdiction of incorporation)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification Number)

|

Wildunger Strasse 1B, Suite 62

Frankfurt, Germany 60487

+ 496957801945

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Harry Hohenstein

Wildunger Strasse 1B, Suite 62

Frankfurt, Germany 60487

+496957801945

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

|

Gregg E. Jaclin, Esq.

Anslow + Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, New Jersey 07726

Tel: (732) 409-1212

Fax: (732) 577-1188

|

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

Calculation of Registration Fee

|

Title of Each Class Of

Securities to be Registered

|

Amount to be

Registered

|

Proposed

Maximum

Offering

Price per

Share (1)

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration

Fee (2)

|

||||||||||||

|

Common stock, par value $0.00001 per share

|

1,000,000

|

$

|

0.04

|

$

|

40,000

|

$

|

5.46

|

|||||||||

(1) The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price.

(2) Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

TABLE OF CONTENTS

|

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

|

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION ON September 11, 2013

|

1,000,000 shares of common stock

Gulfstream Capital Corporation

Gulfstream Capital Corporation (“Gulfstream”, “we”, “us”, or the “Company”) is offering for sale a maximum of 1,000,000 shares of its common stock, par value $0.00001 per share (the “Shares”), at a fixed price of $0.04 per Share. There is no minimum number of shares that must be sold by us for the offering to close, and therefore we may receive no proceeds or very minimal proceeds from the offering. As such, potential investors may end up obtaining shares in a company that may not receive enough proceeds from the offering to begin operations or where there may be no market for our shares.

We will retain the proceeds from the sale of any of the offered shares that are sold. The offering is being conducted on a self-underwritten, best efforts basis, which means our directors and officers, Harry Hohenstein and Liliia Berezhna, will be responsible for the sale of the shares. This prospectus will permit our officers and directors to sell the shares directly to the public, with no commission or other remuneration payable to them for any shares they may sell. The Company may not sell the Shares to the public until this registration statement is declared effective by the Securities and Exchange Commission (the “SEC”). The intended methods of communication include, without limitations, telephone and personal contact. For more information, see the section of this prospectus entitled “Plan of Distribution.”

We have not made any arrangements to place funds received from share subscriptions in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our use. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. If a creditor sues us and obtains a judgment against us, the creditor could garnish the bank account and take possession of the subscriptions. As such, it is possible that a creditor could attach your subscription which could preclude or delay the return of money to you. If that happens, you will lose your investment and your funds will be used to pay creditors.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Below is a summary of proceeds, before and after calculating aggregate offering costs, which we may receive from the sale of the shares in the Offering:

|

Offering Price

|

Expenses

|

Proceeds to Us

|

||||||||||

|

Per Share – Gross Proceeds

|

$

|

0.04

|

$

|

0.005

|

$

|

0.035

|

||||||

|

Total – Gross Proceeds

|

$

|

40,000

|

$

|

14,702

|

$

|

25,298

|

||||||

The offering will terminate upon the earlier to occur of: (i) the date the Company, in its discretion, elects to terminate, (ii) the sale of all 1,000,000 Shares being offered, or (iii) 270 days after this registration statement is declared effective by the SEC.

Prior to the filing of this registration statement, there has been no public trading market for the common stock or any other class of securities of the Company and the Shares are not presently traded on any market or securities exchange.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 3 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is ____________, 2013

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY

|

1

|

|||

|

RISK FACTORS

|

2

|

|||

|

FORWARD-LOOKING STATEMENTS

|

8 | |||

|

USE OF PROCEEDS

|

8 | |||

|

DETERMINATION OF OFFERING PRICE

|

10 | |||

|

DILUTION

|

10 | |||

|

MARKET FOR OUR SECURITIES AND RELATED SHAREHOLDER MATTERS

|

11 | |||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND PLAN OF OPERATIONS

|

12 | |||

|

OUR BUSINESS

|

15 | |||

|

MANAGEMENT

|

28 | |||

|

EXECUTIVE COMPENSATION

|

29 | |||

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

31 | |||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

31 | |||

|

DESCRIPTION OF CAPITAL STOCK

|

31 | |||

|

PLAN OF DISTRIBUTION

|

32 | |||

|

LEGAL MATTERS

|

34 | |||

|

EXPERTS

|

34 | |||

|

ADDITIONAL INFORMATION

|

34 | |||

|

INDEX TO FINANCIAL STATEMENTS

|

35

|

Please read this prospectus carefully. It describes our business, our financial condition and results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on information contained in this prospectus. We have not authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

Through and including ______________ (the 90th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This obligation is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. You should read the entire prospectus, including “Risk Factors” and the consolidated financial statements and the related notes before making an investment decision.

“We,” “us,” “our company,” “our,” “Gulfstream” and the “Company” refer to Gulfstream Capital Corporation, but do not include the shareholders of Gulfstream Capital Corporation.

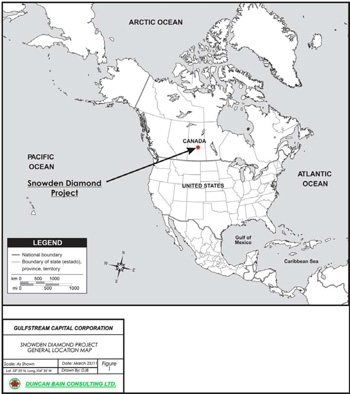

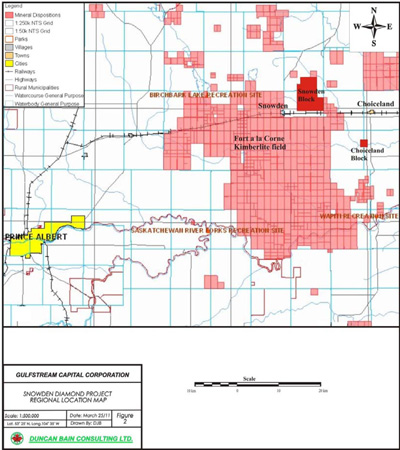

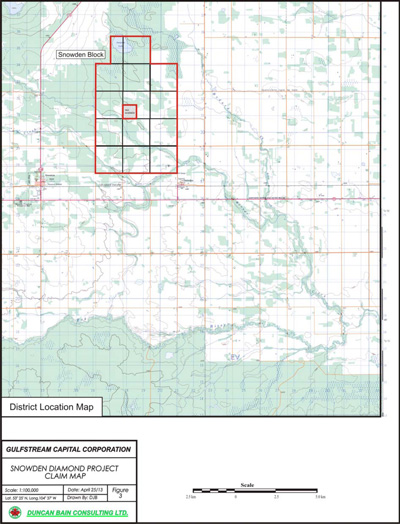

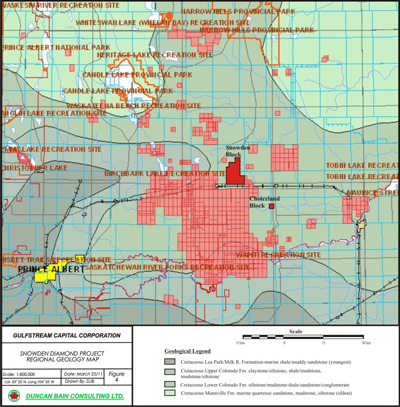

Business Overview

We were incorporated under the laws of the State of Nevada on December 29, 2010. We are an exploration-stage company engaged in exploration in Saskatchewan Province, Canada, for commercially recoverable metal-bearing mineral deposits, such as diamond bearing kimberlite bodies. We have not yet identified any proven or probable mineral reserves, and only limited exploration activity has so far been undertaken, primarily by governmental bodies in Saskatchewan Province. Provided that we successfully identify commercializable mineral deposits, we intend to engage in a joint venture or partnership with a larger, more established mining operator to commence mining, processing and distributing the mineral deposits.

Currently we have no operations, have been issued a going concern opinion and rely upon the sale of our securities and loans from our sole officer and director to fund operations. Even if we sell the maximum number of securities offered by this prospectus, we will likely need from this require additional offerings from time to time to complete our exploration of the property. If we are unable to complete financing, we will have to find alternative sources, which may include private placements of securities, debt or loans from our officers or others. If we raise 50% of the funds through sales of the securities offered hereby, we will be able to only commence the initial phase of exploration. It is unlikely that we will be able to make our exploration commercially viable if we are unable to continue exploration.

We believe we will need to raise a minimum of $40,000 from this offering in order to remove uncertainties surrounding our ability to continue as a going concern. We cannot guarantee that we will be able to raise enough money through this offering to stay in business. Whatever money we do raise, will be applied to the items set forth in the Use of Proceeds section of this prospectus. If we do not raise all of the money we need from this offering to complete our exploration of the property, we will have to find alternative sources of capital, like a second public offering, a private placement of securities, or loans from our officers or others. At the present time, we have not made any arrangements to raise additional cash, other than through this offering. If we need additional cash and can't raise it we will either have to suspend operations until we do raise the cash, or cease operations entirely. If we raise the maximum amount of money from this offering, it will last a year. If we raise less than the maximum amount, we do not believe the money will last a year. Even if all shares are sold in this offering we may not have sufficient available cash in order to maintain operations during the next twelve months without the need for additional funds.

We are in the very early exploration stage and need the proceeds from this offering to start exploration. Our exploration program is explained in greater detail in the “business section” of this prospectus.

Our chairman, CEO, and sole current shareholder, Mr. Harry Hohenstein has advanced monies to the Company to assist with expenses arising from this offering. Mr. Hohenstein is currently owed $11,000 as a result of a loan to the Company on a non-interest bearing loan; the repayment of which is on a demand basis and without specific terms for repayment. No interest will be paid to him although interest may be required to be imputed for tax and financial reporting purposes. For more information on the priority and amount of his repayment please view the section of this Prospectus entitled “Use of Proceeds.”

Risk Factors

Our ability to successfully operate our business and achieve our goals and strategies is subject to numerous risks as discussed in the section titled “Risk Factors,” beginning on page 3.

Corporate Information

The address of our principal executive office is at Wildunger Strasse 1B, Suite 62 , Frankfurt, Germany 60487, and our telephone number is +496957801945, our website is www.gulfstreamcapitalcorp.com

Implications of Being an Emerging Growth Company

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

|

•

|

A requirement to have only two years of audited financial statements and only two years of related MD&A;

|

|

•

|

Exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002;

|

|

•

|

Reduced disclosure about the emerging growth company’s executive compensation arrangements; and

|

|

•

|

No non-binding advisory votes on executive compensation or golden parachute arrangements.

|

We have already taken advantage of these reduced reporting burdens in this prospectus, which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

1

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. We have elected to use the extended transition period provided above and therefore our financial statements may not be comparable to companies that comply with public company effective dates.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

For more details regarding this exemption, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies.”

The Offering

This prospectus relates to the sale of 1,000,000 shares of common stock, par value of $0.00001.

As of May 17, 2013 we had 5,000,000 shares of common stock issued and outstanding. The number of shares registered under this prospectus would represent approximately between 16.67% of the total common stock outstanding, based on the amount of shares sold.

|

Securities being offered

|

1,000,000 shares of common stock, par value $0.00001.

|

|

Offering price per share

|

$0.04

|

|

Offering period

|

Our shares are being offered for a period not to exceed 270 days.

|

|

Net proceeds to us

|

Approximately $25,298.

|

|

Use of proceeds

|

We will use the proceeds to pay for offering expenses, the implementation of our business plan, and for working capital.

|

|

Terms of the Offering

|

The Company’s directors and officers will sell the common stock upon effectiveness of this registration statement.

|

|

Number of shares outstanding before the offering

|

5,000,000

|

|

Number of shares outstanding after the offering is completely sold

|

6,000,000, assuming sale of all shares.

|

|

Risk Factors

|

You should read the section titled “Risk Factors” beginning on page 3 as well as other cautionary statements throughout this prospectus before investing in any shares offered hereunder.

|

Selected Financial Data

The following selected financial data have been derived from the Company’s financial statements which have been audited by M&K CPAS, PLLC, an independent registered public accounting firm.

The summary financial data as of January 31, 2013 are derived from our financial statements, which are included elsewhere in this prospectus. The following data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Prospectus and the Financial Statements and notes thereto included in this Prospectus.

As shown in the accompanying financial statements, the Company has suffered a loss from operations to date. It has experienced a loss of $24,607 since inception and has a negative working capital. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

Financial Summary Information

Because this is only a financial summary, it does not contain all the financial information that may be important to you. It should be read in conjunction with the financial statements and related notes presented in this section.

|

As of

January 31, 2013

(audited)

|

As of

January 31, 2012

(audited)

|

|||||||

|

Balance Sheet

|

||||||||

|

Total Assets

|

$

|

-

|

-

|

|||||

|

Total Liabilities

|

$

|

11,000

|

6,000

|

|||||

|

Stockholders’ Deficit

|

$

|

(11,000

|

)

|

(6,000

|

)

|

|||

|

December 29, 2010

(Inception) to

January 31, 2013

(audited)

|

||||

|

Income Statement

|

||||

|

Revenue

|

$

|

-

|

||

|

Total Expenses

|

$

|

24,607

|

||

2

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

We anticipate losses for the foreseeable future and our auditors note that there is substantial doubt as to whether we can continue as a going concern.

Our auditors have noted that our ability to become a going concern is dependent on our continued ability to obtain additional financing. We have not achieved profitability and expect to continue to incur net losses since inception. Our plan of operation is limited to finding diamond-bearing kimberlite pipes. As such we have no plans for revenue generation. Accordingly, you should not expect any revenues from operations. We have no plans or funds for diamonds extraction. Accordingly, we will not generate any revenues as a result of your investment.

Our financial statements have been prepared on a going concern basis, which implies we will continue to meet our obligations and continue its operations for the next fiscal year. Realization value may be substantially different from carrying values as shown and our financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern. As at January 31, 2013 the Company had a working capital deficiency, had not generated revenues and has accumulated losses of $24,607 since inception. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding our ability to continue as a going concern.

Our plan of operation is limited to finding diamond-bearing kimberlite pipes. As such we have no plans for revenue generation. Accordingly, you should not expect any revenues from operations.

Our plan of operation and the funds we raise from this offering will be used for exploration of the property to determine if there are diamond-bearing kimberlite pipes on the property beneath the surface. Exploration work is designed to determine whether the Snowden Diamond Project block contains diamond-bearing kimberlite and exploration does not contemplate extraction of the diamonds. We have no plans or funds for diamonds extraction. Accordingly, we will not generate any revenues as a result of your investment.

Because the probability of an individual prospect ever having reserves is extremely remote any funds spent on exploration will probably be lost.

The probability of an individual prospect ever having reserves is extremely remote. In all probability the property does not contain any reserves. As such, any funds spent on exploration will probably be lost which result in a loss of your investment.

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease operations.

We were incorporated in December 2010 and we have not started our proposed business operations or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our net loss since inception is $24,607. To achieve and maintain profitability and positive cash flow we are dependent upon:

|

·

|

our ability to locate a profitable mineral property

|

|

·

|

our ability to generate revenues

|

|

·

|

our ability to reduce exploration costs.

|

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our mineral properties. As a result, we will require future financing and we may not generate revenues in the future. Failure to generate revenues may cause us to suspend or cease operations.

3

In the event that we fail to pay advance royalty payments to Duncan Bain for the rights to mining claims, the mining claims will revert back to Duncan Bain.

Our only potential revenue stream at the present time are our mining Claims owned by Duncan Bain (the “Vendor”) and leased to the Company. We must pay to the Vendor advance royalty payments on an annual basis of $25,000 per year commencing thirty-six (36) months and forty-eight (48) months from April 7, 2011. We must pay to the Vendor advance royalty payments on an annual basis of $50,000 per year commencing sixty (60) months from the April 7, 2011 and continuing until commercial production is obtained. In the event that we do not pay the advance royalty payments to the Vendor for any two (2) consecutive years all of our rights in and to the Claims shall revert back to the Vendor within 30 days of the date of the second defaulted advance royalty payment.

Because our management does not have technical training or experience in exploring for, starting, and operating an exploration program, we will have to hire qualified personnel. If we can't locate qualified personnel, we may have to suspend or cease operations which will result in the loss of your investment.

Because our management is inexperienced with exploring for, starting, and operating an exploration program, we will have to hire qualified persons to perform surveying, exploration, and excavation of the property. Our management has no direct training or experience in these areas and as a result may not be fully aware of many of the specific requirements related to working within the industry. Management's decisions and choices may not take into account standard engineering or managerial approaches, mineral exploration companies commonly use. Consequently our operations, earnings and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry. As a result we may have to suspend or cease operations which will result in the loss of your investment.

Because we are small and do not have much capital, we may have to limit our exploration activity which may result in a loss of your investment.

Because we are small and do not have much capital, we must limit our exploration activity. As such we may not be able to complete an exploration program that is as thorough as we would like. In that event, an existing ore body may go undiscovered. Without finding a diamond-bearing kimberlite, we cannot generate revenues and you will lose your investment.

Weather interruptions in the province of Saskatchewan may affect and delay our proposed exploration operations and as a result, there may be delays in generating revenues.

Our proposed exploration work can only be performed approximately five to six months out of the year. This is because rain and snow cause the roads leading to our claims to be impassible during six to seven months of the year. When roads are impassible, we are unable to conduct exploration operations on the property which will delay the generation of possible revenues by us.

|

1.

|

Our officers and directors Harry Hohenstein and Liliia Berezhna have other outside business activities. They will only be devoting 10% of his/her time, or four hours per week to our operations. As a result, our operations may be sporadic which may result in periodic interruptions or suspensions of exploration.

|

|

2.

|

Our officers and directors Harry Hohenstein and Liliia Berezhna have not visited the claims. Therefore we are relying entirely upon the assessments of unaffiliated third parties and we will have little or no recourse against them if the representations turn out to be untrue.

|

If our officers and directors should resign or die without having found replacements, our operations will be suspended or will cease. If that should occur, you could lose your entire investment.

We have two officers and directors. We are entirely dependent upon them to conduct our operations. If they should resign or die, there will be no one to run us. Further, we do not have key man insurance. If that should occur, until we find other person(s) to run us, our operations will be suspended or cease entirely. In that event it is possible you could lose your entire investment.

Because our directors and officers will own 83.3% of our total outstanding common stock, they will retain control of us and will be able to decide who will be directors and you may not be able to elect any directors which could decrease the price and marketability of our shares.

If all 1,000,000 shares of common stock in this offering are sold, Harry Hohenstein and Liliia Berezhna will own 83.3% of the total outstanding common stock; Harry Hohenstein and Liliia Berezhna will be able to elect all of our directors and control our operations, which could decrease the price and marketability of our shares.

Our directors and officers are lack of formal training in financial accounting and management, in the future, there may not be effective disclosure and accounting controls to comply with applicable laws and regulations which could result in fines, penalties and assessments against us.

Harry Hohenstein and Liliia Berezhna are lack of formal training in financial accounting and management; however, they are responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes Oxley Act of 2002. When the disclosure and accounting controls referred to above are implemented, they will be responsible for the administration of them. Should they not have sufficient experience, they may be incapable of creating and implementing the controls which may cause us to be subject to sanctions and fines by the Securities and Exchange Commission, which ultimately could cause you to lose your investment.

4

Because our officers and directors do not have prior experience in financial accounting and the preparation of reports under the Securities Exchange Act of 1934, we may have to hire individuals which could result in additional expenses which could have a material adverse effect on our business, results of operations and financial condition.

Because our officers and directors do not have prior experience in financial accounting and the preparation of reports under the Securities Act of 1934, we may have to hire additional experienced personnel to assist us with the preparation thereof. The hiring of additional experienced personnel will result in additional expenses which could have a material adverse effect on our business, results of operations and financial condition.

We may incur significant costs to be a public company to ensure compliance with U.S corporate governance and accounting requirements and we may not be able to absorb such costs.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations. Based on our management’s reasonable estimates, we anticipate that our cost of being a public company, including legal, audit costs, printing, filing fees and other costs will be between $10,000 and $15,000 per year.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $75 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $75 million.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

We will incur increased costs and demands upon management as a result of complying with the laws and regulations that affect public companies, which could materially adversely affect our results of operations, financial condition, business and prospects.

After we become a public company and particularly after we cease to be an “emerging growth company,” we will incur significant legal, accounting and other expenses that we did not incur as a private company, including costs associated with public company reporting and corporate governance requirements. These requirements include compliance with Section 404 and other provisions of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, as well as rules implemented by the SEC. In addition, our management team will also have to adapt to the requirements of being a public company. We expect that compliance with these rules and regulations will substantially increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

The increased costs associated with operating as a public company will decrease our net income or increase our net loss, and may require us to reduce costs in other areas of our business or increase the prices of our products or services. Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our results of operations, financial condition, business and prospects.

However, for as long as we remain an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We may take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

5

We will remain an “emerging growth company” for up to five years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any July 31 before that time, we would cease to be an “emerging growth company” as of the following year end, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an “emerging growth company” immediately.

If we become a public company, we also expect that it may be more difficult and expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as our executive officers.

We will not be required to comply with certain provisions of the Sarbanes-Oxley Act for as long as we remain an “emerging growth company.”

We are not currently required to comply with the SEC rules that implement Sections 302 and 404 of the Sarbanes-Oxley Act, and are therefore not required to make a formal assessment of the effectiveness of our internal controls over financial reporting for that purpose. Upon becoming a public company, we will be required to comply with certain of these rules, which will require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our internal control over financial reporting. Though we will be required to disclose changes made in our internal control procedures on a quarterly basis, we will not be required to make our first annual assessment of our internal control over financial reporting pursuant to Section 404 until the year following our first annual report required to be filed with the SEC.

We will remain an “emerging growth company” for up to five years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any July 31 before that time, we would cease to be an “emerging growth company” as of the following January 31, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an “emerging growth company” immediately.

Our independent registered public accounting firm is not required to formally attest to the effectiveness of our internal control over financial reporting until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an “emerging growth company.” At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An “emerging growth company” can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

6

Risks Related to Our Common Stock

Because we do not have an escrow or trust account for your subscription, if we file for bankruptcy protection, are forced into bankruptcy, or a creditor obtains a judgment against us and attaches the subscription, you will lose your investment.

Investor’s funds will not be placed in a separate bank account. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to bankruptcy laws. If a creditor sues us and obtains a judgment against us, the creditor could garnish the bank account and take possession of the subscriptions.

Declining economic conditions could negatively impact our business.

Our operations are affected by local, national and worldwide economic conditions. Markets in the United States and elsewhere have been experiencing extreme volatility and disruption for more than 12 months, due in part to the financial stresses affecting the liquidity of the banking system and the financial markets generally. In 2009, this volatility and disruption has reached unprecedented levels. The consequences of a potential or prolonged recession may include a lower level of economic activity and uncertainty regarding mineral prices, the costs of operations, the cost of capital and commodity markets. While the ultimate outcome and impact of the current economic conditions cannot be predicted, a lower level of economic activity might result in a decline in energy consumption, which may adversely affect the price and market for diamonds, liquidity and future growth. Instability in the financial markets, as a result of recession or otherwise, also may affect the cost of capital and our ability to raise capital.

Because there is no public trading market for our common stock, you may not be able to resell your stock.

There is currently no public trading market for our common stock. Therefore there is no central place, such as stock exchange or electronic trading system, to resell your shares. If you want to resell your shares, you will have to locate a buyer and negotiate your own sale. Further, resales in the United States may require compliance with some state securities laws. There is no assurance that such compliance can be obtained or maintained. The Company does not presently plan to file with any state securities regulators.

Because the Securities and Exchange Commission imposes additional sales practice requirements on brokers who deal in our shares that are penny stocks, some brokers may be unwilling to trade them. This means that you may have difficulty reselling your shares and this may cause the price of our shares to decline.

Our shares would be classified as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934 and the rules promulgated thereunder which impose additional sales practice requirements on brokers/dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, the broker/dealer must make a special suitability determination and receive from you a written agreement prior to making a sale for you. Because of the imposition of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares. This could prevent you from reselling your shares and may cause the price of our shares to decline.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions.

We have never declared or paid any cash dividends or distributions on our capital stock. And we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

7

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” above.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date of this prospectus. You should read this prospectus and the documents that we reference in this prospectus, or that we filed as exhibits to the registration statement of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF PROCEEDS

Our offering is being made on behalf of the company in a direct public offering, without any involvement of underwriters or broker-dealers, on a best efforts basis. Our chairman, CEO, and current shareholder, Mr. Harry Hohenstein, has advanced monies for the payment of offering expenses which will be reimbursed to him from the gross proceeds of this offering. We will also use net proceeds to repay to Mr. Hohenstein certain loans and advancements previously made. Repayment to Mr. Hohenstein will be the lowest priority compared to the other uses of proceeds. Mr. Hohenstein is presently owed $11,000 plus such amounts as he may advance to cover the offering costs. The loans and advancements are on a demand basis. No interest will be paid to Mr. Hohenstein although interest may be required to be imputed for tax and financial reporting purposes.

Under our agreement with Bain Consulting we are required to make advanced royalty payments at the rate of $25,000 per year beginning April 23, 2016. To the extent that we lack the funds to meet this obligation, Mr. Hohenstein and Ms. Berezhna have agreed to advance monies on behalf of the company. There can be no assurance that Mr. Hohenstein and Ms. Berezhna will be able to do so and failure to meet this obligation could result in a default under the April 23, 2013 agreement. While the agreement does not specify remedies for default, Mr. Bain would have all of the remedies allowable under Canadian law and investors could expect to lose their entire investment.

Our offering is being made in a direct public offering, without any involvement of underwriters or broker-dealers, on a best efforts basis. The table below sets forth the use of proceeds if 1,000,000 common shares of the offering are sold at $0.04 per share.

|

1,000,000

|

||||

|

Gross proceeds

|

$

|

40,000

|

||

|

Offering expenses

|

$

|

14,702

|

||

|

Net proceeds

|

$

|

25,298

|

The net proceeds will be used as follows:

|

Consulting Services

|

$

|

1,000

|

||

|

Preliminary review of assessment work

|

$

|

500

|

||

|

Mobilization/demobilization of crew

|

$

|

500

|

||

|

Pace and compass/GPS lines, estimated 10 line km

|

$

|

1,500

|

||

|

Detailed magnetometer survey, 20 line km

|

$

|

2,000

|

||

|

Base station and instrument rental

|

$

|

1,000

|

||

|

Consumables – flagging, pickets, etc.

|

$

|

100

|

||

|

Accommodation/meals, 3 men

|

$

|

400

|

||

|

Drafting and report

|

$

|

1,500

|

||

|

Contingencies

|

$

|

500

|

||

|

Telephone

|

$

|

100

|

||

|

Mail

|

$

|

30

|

||

|

Stationary

|

$

|

50

|

||

|

Accounting and Legal

|

$

|

3,000

|

||

|

SEC filing

|

$

|

250

|

||

|

Repayment of loan and Advances

|

$

|

11,000

|

||

|

Other expenses

|

$

|

1,868

|

||

|

TOTAL

|

$

|

25,298

|

8

If 75% are sold:

|

Gross proceeds

|

$

|

30,000

|

||

|

Offering expenses

|

$

|

14,702

|

||

|

Net proceeds

|

$

|

15,298

|

|

The net proceeds will be used as follows:

|

||||

|

Consulting Services

|

$

|

750

|

||

|

Preliminary review of assessment work

|

$

|

375

|

||

|

Mobilization/demobilization of crew

|

$

|

375

|

||

|

Pace and compass/GPS lines, estimated 20 line km

|

$

|

1,125

|

||

|

Detailed magnetometer survey, 25 line km

|

$

|

1,500

|

||

|

Base station and instrument rental

|

$

|

750

|

||

|

Consumables – flagging, pickets, etc.

|

$

|

75

|

||

|

Accommodation/meals, 2 men

|

$

|

300

|

||

|

Drafting and report

|

$

|

400

|

||

|

Contingencies

|

$

|

230

|

||

|

Telephone

|

$

|

88

|

||

|

Mail

|

$

|

30

|

||

|

Stationary

|

$

|

50

|

||

|

Accounting and Legal

|

$

|

2,750

|

||

|

SEC filing

|

$

|

100

|

||

|

Repayment of loan and Advances

|

$

|

5,500

|

||

|

Other expenses

|

$

|

900

|

||

|

TOTAL

|

$

|

15,298

|

If 50% are sold:

|

Gross proceeds

|

$

|

20,000

|

||

|

Offering expenses

|

$

|

14,702

|

||

|

Net proceeds

|

$

|

5,298

|

|

The net proceeds will be used as follows:

|

||||

|

Consulting Services

|

$

|

0

|

||

|

Preliminary review of assessment work

|

$

|

500

|

||

|

Mobilization/demobilization of crew

|

$

|

500

|

||

|

Pace and compass/GPS lines, estimated 20 line km

|

$

|

1,000

|

||

|

Detailed magnetometer survey, 25 line km

|

$

|

1,000

|

||

|

Base station and instrument rental

|

$

|

700

|

||

|

Consumables – flagging, pickets, etc.

|

$

|

50

|

||

|

Accommodation/meals, 3 men

|

$

|

200

|

||

|

Drafting and report

|

$

|

200

|

||

|

Contingencies

|

$

|

200

|

||

|

Telephone

|

$

|

25

|

||

|

Mail

|

$

|

25

|

||

|

Stationary

|

$

|

50

|

||

|

Accounting and Legal

|

$

|

748

|

||

|

SEC filing

|

$

|

100

|

||

|

Repayment of loan and Advances

|

$

|

0

|

||

|

Other expenses

|

$

|

0

|

||

|

TOTAL

|

$

|

5,298

|

9

If 25% are sold:

|

Gross proceeds

|

$

|

10,000

|

||

|

Offering expenses

|

$

|

14,702

|

||

|

Net proceeds

|

$

|

(4,702)

|

Offering expenses consist of: (1) legal services, (2) accounting fees, (3) fees due to the transfer agent, (4) printing expenses and (5) filing fees.

The Company has allocated a maximum of $1,000 of the offering proceeds to be used for consulting services to offset the costs of retaining a professional geological consultant payable at the management’s request. At this time, the board intends to spend no greater than $1,000 of the offering proceeds towards such consulting fees.

While we currently intend to use the proceeds of this offering substantially in the manner set forth above, we reserve the right to reassess and reassign such use if, in the judgment of our board of directors, such changes are necessary or advisable. The above amounts and priorities for the use of proceeds represent management's estimates based upon current conditions.

DETERMINATION OF OFFERING PRICE

The price of the shares we are offering was arbitrarily determined in order for us to raise up to $40,000. The offering price bears no relationship to our assets, earnings, book value or other criteria of value. Among the factors we considered were:

|

•

|

our lack of operating history;

|

|

|

•

|

the proceeds to be raised by the offering;

|

|

|

•

|

the amount of capital to be contributed by purchasers of this offering in proportion to the amount of stock to be retained by our existing stockholder; and,

|

|

|

•

|

our relative cash requirements.

|

DILUTION

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Following this offering, even if all shares are sold, the net tangible book offering will be 0.00. Dilution arises mainly as a result of our arbitrary determination of the offering price of our shares being offered. Dilution of the value of our shares you purchase is also a result of the lower book value of our shares held by our existing stockholders.

As of July 31, 2013, the net tangible book value of our shares of common stock was a deficit of (0.002) or approximately ($0.00) per share based upon 5,000,000 shares outstanding.

10

If 100% of the shares are sold:

Upon completion of this offering, in the event all of our shares are sold, the pro forma net tangible book value of the 6,000,000 shares to be outstanding will be $27,025 or approximately $0.00 per share. The net tangible book value of our shares held by our existing stockholder will be increased by $0.04 per share without any additional investment on his part. You will incur an immediate dilution from $0.04 per share to $0.00 per share.

After completion of this offering, if 1,000,000 shares are sold, you will own 20% of the total number of outstanding shares for which you will have made a cash investment of $40,000, or $0.04 per share. Our existing stockholders will own 80% of the total number of outstanding shares for which he has made cash contributions totaling $50.00 or approximately $0.00001 per share.

The following table compares the differences of your investment in our shares with the investment of our existing stockholder.

|

Dilution

|

100 | % | 75 | % | 50 | % | 25 | % | ||||||||

|

Price per share

|

$ | 0.04 | 0.04 | 0.04 | 0.04 | |||||||||||

|

Net tangible book value per share before offering

|

$ | 0 | 0 | 0 | 0 | |||||||||||

|

Potential gain to existing shareholder

|

$ | 40,000 | 30,000 | 20,000 | 10,000 | |||||||||||

|

Net tangible book value per share after offering

|

$ | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||

|

Increase to present stockholder in net tangible book value per share after offering

|

$ | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||

|

Capital contributions by Prior Investor

|

$ | 50 | 50 | 50 | 50 | |||||||||||

|

Number of shares outstanding before the offering

|

5,000,000 | 5,000,000 | 5,000,000 | 5,000,000 | ||||||||||||

|

Number of shares after offering assuming the sale of the maximum number of shares

|

6,000,000 | 5,750,000 | 5,500,000 | 5,250,000 | ||||||||||||

|

Price per share

|

$ | 0.04 | 0.04 | 0.04 | 0.04 | |||||||||||

|

Dilution per share

|

$ | 0.04 | 0.04 | 0.04 | 0.04 | |||||||||||

|

Capital contributions

|

$ | 40,000 | 30,000 | 20,000 | 50,000 | |||||||||||

|

Number of shares after offering held by public investors

|

1,000,000 | 750,000 | 500,000 | 250,000 | ||||||||||||

|

Percentage of capital contributions by existing shareholder

|

0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

|

Percentage of ownership after offering

|

17 | 13 | 9 | 5 |

MARKET FOR OUR SECURITIES AND RELATED SHAREHOLDER MATTERS

There is presently no established public trading market for our shares of common stock. We plan to apply for trading of our common stock on the OTC Bulletin Board upon the effectiveness of the registration statement of which this prospectus forms apart. However, we can provide no assurance that our shares of common stock will be traded on the Bulletin Board or, if traded, that a public market will materialize.

Holders

As of May 17, 2013, we had 2 shareholders of our common stock.

Dividends

Since inception we have not paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future. Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Securities Authorized for Issuance under Equity Compensation Plans

We presently do not have any equity based or other long-term incentive programs. In the future, we may adopt and establish an equity-based or other long-term incentive plan if it is in the best interest of the Company and our shareholders to do so.

11

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The information and financial data discussed below is derived from our audited financial statements for the years ended January 31, 2013 and 2012. The audited financial statements were prepared and presented in accordance with generally accepted accounting principles in the United States. The information and financial data discussed below is only a summary and should be read in conjunction with the related notes contained elsewhere in this prospectus. The financial statements contained elsewhere in this prospectus fully represent our financial condition and operations; however, they are not indicative of our future performance.

Overview

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business operations.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues. Our only other source for cash at this time is investments by others in Gulfstream Capital Corporation. We must raise cash to implement our project and stay in business. Even if we raise the maximum amount of money in this offering, we do not know how long the money will last, however, we do believe it will last twelve months. It depends upon the amount of exploration we conduct and the cost thereof. We won't know that information until we begin exploring our property. We will not begin exploration of our property until we raise money from this offering. We believe we will need to raise a minimum of $40,000 from this offering in order to remove uncertainties surrounding our ability to continue as a going concern.

To meet our need for cash we are attempting to raise money from this offering. We cannot guarantee that we will be able to raise enough money through this offering to stay in business. Whatever money we do raise, will be applied to the items set forth in the Use of Proceeds section of this prospectus. If we do not raise all of the money we need from this offering to complete our exploration of the property, we will have to find alternative sources, like a second public offering, a private placement of securities, or loans from our officers or others.

At the present time, we have not made any arrangements to raise additional cash, other than through this offering. If we need additional cash and can't raise it we will either have to suspend operations until we do raise the cash, or cease operations entirely. If we raise the maximum amount of money from this offering, it will last a year. If we raise less than the maximum amount, we do not believe the money will last a year. If we raise less than the maximum amount and we need more money we will have to revert obtaining additional money as described in this paragraph. Other than as described in this paragraph, we have no other financing plans.

As of January 31, 2013, our financial statements reflected no assets and $11,000 in liabilities. Even if all shares are sold in this offering we may not have sufficient available cash in order to maintain operations during the next twelve months without the need for additional funds. Under our agreement with Bain Consulting we are required to make advanced royalty payments at the rate of $25,000 per year beginning April 23, 2016. To the extent that we lack the funds to meet this obligation, Mr. Hohenstein and Ms. Berezhna have agreed to advance monies on behalf of the company. There can be no assurance that Mr. Hohenstein and Ms. Berezhna will be able to do so and failure to meet this obligation could result in a default under the April 2013 agreement. While the agreement does not specify remedies for default, Mr. Bain would have all of the remedies allowable under Canadian law and investors could expect to lose their entire investment.

Exploration expenditures consist of fees to be paid for consulting services connected with exploration, the cost of rock sampling (the collection of a series of small chips over a measured distance, which is then submitted for a chemical analysis, usually to determine the metallic content over the sampled interval, a pre-determined location(s) on the property), and cost of analyzing these samples. Since we recently leased the properties, we have not begun exploration.

We cannot be more specific about the application of proceeds for exploration, because we do not know what we will find. If we attempted to be too specific, every time an event occurred that would change our allocation, we would have to amend this registration statement. We believe that the process of amending the registration statement would take an inordinate amount of time and not be in your best interest in that we would have to spend money for legal fees which could then not be spent on exploration.

We have allocated a range of money for exploration. That is because we do not know how much will ultimately be needed for exploration. If our initial exploration proves positive results, we will expand the exploration activities to include reverse circulation drilling. This is a less expensive form of drilling that does not allow for the recovery of a tube or core of rock. The material is brought up from depth as a series of small chips of rock that are then bagged and sent in for analysis. This is a quicker and cheaper method of drilling, but does not necessarily give one as much information about the underlying rocks. If warranted, core drilling would follow this stage.

12

If we discover significant quantities of mineralized material, we will begin technical and economic feasibility studies to determine if we have reserves. Only if we have reserves will we consider developing the property.

If, through early stage exploration, we find mineralized material and it is feasible to expand the exploration program, we will attempt to raise additional money through a subsequent private placement, public offering or through loans. If we do not raise all of the money we need, we will have to find alternative sources of funding, like a public offering, a private placement of securities, or loans.

We have discussed this matter with our officers and directors, however, our officers and directors are unwilling to make any commitment to loan us any significant amounts of money at this time. At the present time, we have not made any arrangements to raise additional cash. If we need additional cash and cannot raise it we will either have to suspend operations until we do raise the cash, or cease operations entirely.

We will be conducting research in the form of exploration of the properties. Our exploration program is explained in as much detail as possible in the business section of this prospectus. We are not going to buy or sell any plant or significant equipment during the next twelve months. We will not buy any additional equipment until we have located a body of minerals and we have determined they are economical to extract from the land.

We intend to interest other companies in the properties should we discover mineralized materials or we may elect to develop the properties ourselves.

If we are unable to complete any phase of exploration because we do not have enough money, we will cease operations until we raise more money. If we cannot or do not raise more money, we will cease operations. If we cease operations, we do not know what we will do and we don’t have any plans to do anything.

We do not intend to hire additional employees at this time. Any work that would be conducted on a property that we may secure will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

Plan of Operation - Milestones

During the next twelve months we plan to spend funds from our working capital balance as follows:

|

(1)

|

Costs related to legal fees for the preparation and of the subsequent Form S-1 registration statement with the SEC.

|

|

|

(2)

|

Costs related to trenching and surface sampling.

|

|

(3)

|

Costs related to analyzing mineral claims.

|

|

|

(4)

|

Costs for accounting and auditing services.

|

|

(5)

|

Salaries to be paid to officers of the corporation.

|

|

(6)

|

Costs for accounting and auditing services.

|

13

|

Based on positive results such as magnetic highs from the Phase 1 work a Phase 2 program would be initiated to provide additional information.

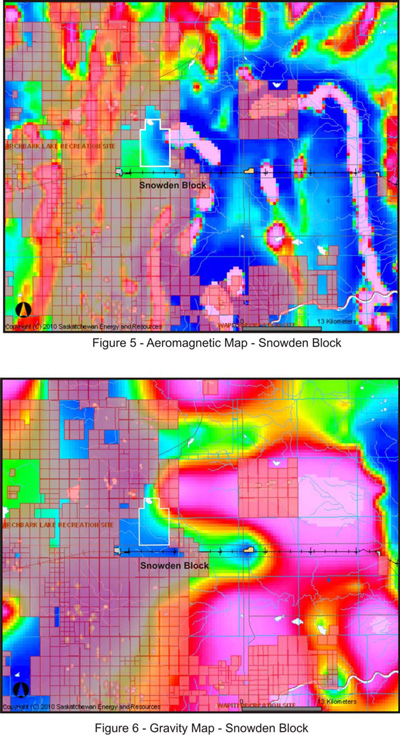

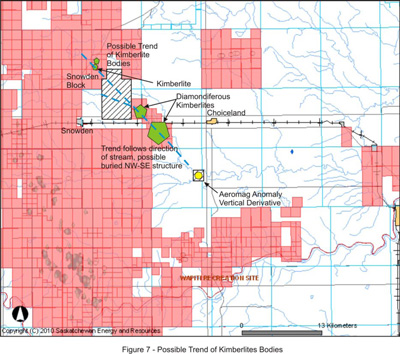

PHASE 2

This Phase 2 program would consist of gravity survey totaling 15 line kilometers to cover the most promising parts of the claim covered by the Phase 1 magnetometer survey. The estimated cost of the Phase 2 program is $30,000USD.

PHASE 3.

Upon the completion of Phases 1 and 2, and based on positive results, a diamond drill program would be initiated on targets generated by the first two phases of work. This would consist of approximately 600 m of drilling . The estimated cost of the Phase 3 program is $150,000USD.

To meet our need for cash we are attempting to raise money from this offering. We cannot guarantee that we will be able to raise enough money through this offering to stay in business and complete all 3 Phases of our planned exploration program. Whatever money we do raise, will be applied to the items set forth in the Use of Proceeds section of this prospectus. In the event that the proceeds raised are insufficient to start exploring, we will attempt to raise additional money through a subsequent private placement, public offering or through loans. If we do not raise all of the money we need from this offering to complete our exploration of the property, we will have to find alternative sources, like a second public offering, a private placement of securities, or loans from our officers or others. At the present time, we have not made any arrangements to raise additional cash, other than through this offering. If we need additional cash and can't raise it we will either have to suspend operations until we do raise the cash, or cease operations entirely. Other than as described in this paragraph, we have no other financing plans.

|

Limited Operating History; Need for Additional Capital