Attached files

| file | filename |

|---|---|

| EX-4.8 - EXHIBIT 4.8 - FORM OF UNDERWRITER WARRANT - PIONEER POWER SOLUTIONS, INC. | v354317_ex4-8.htm |

| EX-5.1 - EXHIBIT 5.1 - FORM OF OPINION OF HAYNES AND BOONE, LLP - PIONEER POWER SOLUTIONS, INC. | v354317_ex5-1.htm |

| EX-1.1 - EXHIBIT 1.1 - FORM OF UNDERWRITING AGREEMENT - PIONEER POWER SOLUTIONS, INC. | v354317_ex1-1.htm |

| EX-23.1 - EXHIBIT 23.1 - CONSENT OF RICHTER LLP - PIONEER POWER SOLUTIONS, INC. | v354317_ex23-1.htm |

As filed with the Securities and Exchange Commission on September 10, 2013.

SEC File No. 333- 190302

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PIONEER POWER SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3612 | 27-1347616 |

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

400 Kelby Street, 9th Floor

Fort Lee, New Jersey 07024

(212) 867-0700

(Address, including zip code, and telephone

number,

including area code, of registrant’s principal executive offices)

Nathan J. Mazurek

Chief Executive Officer

Pioneer Power Solutions, Inc.

400 Kelby Street, 9th Floor

Fort Lee, New Jersey 07024

(212) 867-0700

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

|

Rick A. Werner, Esq. Haynes and Boone, LLP 30 Rockefeller Plaza, 26th Floor New York, New York 10112 Tel. (212) 659-7300 Fax (212) 884-8234 |

Robert L. Frome, Esq. Kenneth A. Schlesinger, Esq. Olshan Frome Wolosky LLP Park Avenue Tower 65 East 55th Street New York, NY 10022 Tel. (212) 451-2300 Fax (212) 451-2222 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

| (Do not check if a smaller reporting company) |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 10, 2013

1,000,000 Shares

Pioneer Power Solutions, Inc.

Common Stock

$ per share

We are offering 1,000,000 shares of our common stock. Our common stock is quoted on the OTCQB under the symbol “PPSI.” On September 9, 2013, the last reported sale price of our common stock was $7.00 per share.

We have applied to list our shares of common stock for quotation on the Nasdaq Capital Market under the symbol “PPSI.”

We anticipate that the offering price per share of our common stock will be between $7.00 and $8.00.

Investing in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus before making a decision to purchase our common stock.

| Per Share | Total | ||

| Public offering price | $ | $ | |

| Underwriting discount (1) | $ | $ | |

| Proceeds, before expenses, to Pioneer Power Solutions, Inc. | $ | $ |

| (1) | See “Underwriting” beginning on page 66 for disclosure regarding compensation payable to the underwriters by us. |

We have granted the underwriters an option to purchase up to 150,000 additional shares of common stock from us at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares against payment in New York, New York on , 2013.

The date of this prospectus is , 2013

Sole Book-Running Manager

Roth Capital Partners

Co-Manager

Monarch Capital Group

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Industry and Market Data

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

Prospectus Artwork

The photograph on the inside back cover of this prospectus is published pursuant to a license available at creativecommons.org/licenses/by/2.0/deed.en

| i |

This summary highlights information contained in other parts of this prospectus. Because it is a summary, it does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should read the entire prospectus carefully, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

When used herein, unless the context requires otherwise, references to the “Company,” “Pioneer,” “we,” “our” and “us” refer to Pioneer Power Solutions, Inc., and, where appropriate, its consolidated subsidiaries.

The Company

Overview

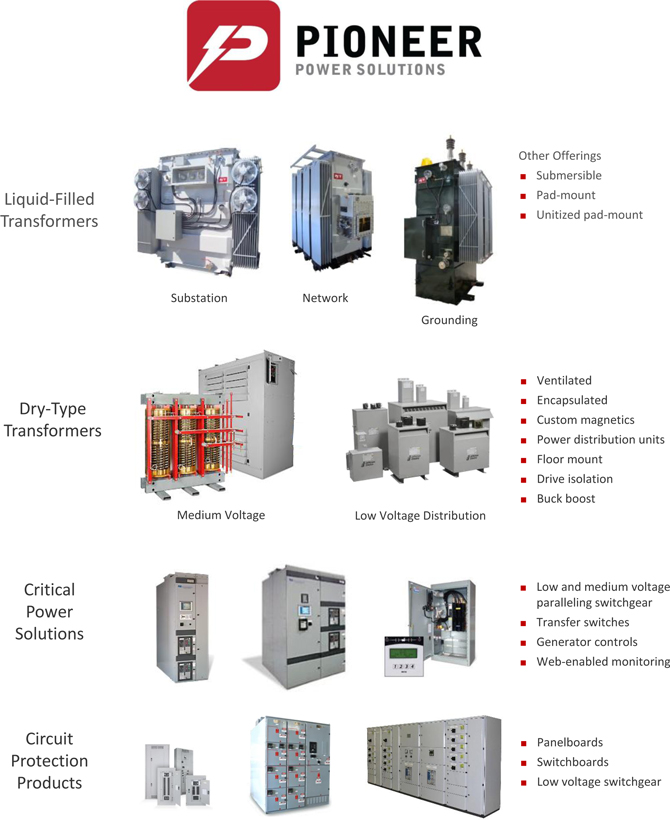

We manufacture specialty electrical transmission and distribution equipment and provide a broad range of custom-engineered and general purpose solutions for applications in the utility, industrial and commercial markets. Our product lines include a wide range of liquid-filled and dry-type power, distribution and specialty electrical transformers, which are magnetic products used in the control and conditioning of electrical current for critical processes. Through an acquisition in March 2013, we expanded our product range to include certain classes of low and medium voltage switchgear and control systems. Generally, this equipment is used to distribute, monitor and control the flow of electricity, while isolating and protecting critical equipment such as transformers, motors and other machinery. We believe demand for our products will continue to increase based on the aging and overburdened power grid in North America, increasing use of on-site distributed generation and renewables and rapid expansion in critical power needs. We are headquartered in Fort Lee, New Jersey and operate from eight additional locations in the U.S., Canada and Mexico for manufacturing, centralized distribution, engineering, sales and administration.

Our largest customers are primarily located in North America and include many recognized national and regional utilities, industrial companies and engineering, procurement and construction (EPC) firms. In 2012, our two largest customers were Hydro-Quebec Utility Company and Siemens Industry, Inc., both of which have been customers of ours for more than 10 years. In addition, we sell our products to hundreds of electrical distributors served by our direct sales force, independent sales representatives and by our network of 14 independently-operated stocking locations throughout the U.S. We intend to grow our business through acquisitions and internal product development by increasing the scope of highly-engineered solutions we offer our customers for their electrical applications.

Recent Acquisitions

On March 6, 2013, our wholly-owned subsidiary, Pioneer Critical Power Inc., acquired Power Systems Solutions, Inc., a Minneapolis-based provider of paralleling switchgear, transfer switches and engine generator control systems. Common applications for these products are to ensure reliable backup power at critical locations, such as data centers and hospitals, and to operate power generation sources at remote operations not connected to the power grid. We intend to make significant new investments in this area of our electrical business, increasing our penetration into the growing markets for emergency backup power and distributed generation products.

On August 19, 2013, our wholly-owned subsidiary Pioneer Custom Electrical Products Corp., or Pioneer CEP, hired all the employees and acquired all the machinery and equipment, certain inventory assets and all of the intellectual property of Pico Electrical Equipment, Inc. and Pico Metal Products, Inc. Pioneer CEP is a manufacturer of electrical switchboards, panelboards and custom electrical enclosures operating from a 40,000 square foot facility in the Los Angeles metropolitan area. This acquisition reflects the implementation of our strategy to expand our product offerings and become a larger and more value-added supplier to our customers.

Financial Results and Guidance

In the year ended December 31, 2012, our revenue and earnings from continuing operations per share grew to $84.0 million and $0.54, respectively, as compared to revenue of $68.8 million and earnings from continuing operations per share of $0.42 in the year ended December 31, 2011. As of June 30, 2013, our order backlog was $24.4 million, up from $23.6 million as of December 31, 2012.

On September 10, 2013, we updated our previously-issued revenue guidance and increased our earnings guidance to take into account our mid-year results and to reflect the Pioneer CEP acquisition completed in August 2013. We expect that our revenue will increase to between $89 and $95 million in the year ending December 31, 2013, of which we expect $2 to $3 million to be comprised of revenue from the Pioneer Critical Power Inc. and Pioneer CEP business units we established during 2013. We expect that that our non-GAAP net earnings per diluted share will be between $0.80 and $0.86, before giving effect to this offering. Including additional shares to be outstanding after this offering, and our anticipated use of the net proceeds, we expect that our non-GAAP net earnings per diluted share will be between $0.76 and $0.82 for the year ending December 31, 2013. For an explanation of non-GAAP net earnings per diluted share, a reconciliation of GAAP net earnings to non-GAAP net earnings and a description of how management uses non-GAAP measures, please see page 30 of this prospectus. With respect to factors that could impact our expected operating results, please see “Cautionary Note Regarding Forward-Looking Statements” beginning on page 23 of this prospectus.

| 1 |

Key Trends in Our Industry

We believe that we are well positioned to capitalize on projected expenditures for power transmission and distribution related infrastructure in the North American electric grid and on capital investment by commercial and industrial companies in on-site generation assets to power their own operations. We expect to benefit from the following industry trends:

| · | Aging and Overburdened North American Power Grid — The aging and overburdened North American power grid is expected to require significant capital expenditures to upgrade the existing infrastructure over the next several years to maintain adequate levels of reliability and efficiency. According to the North American Electric Reliability Corp. (NERC), Level 5 Transmission Load Relief (TLR) events, which are triggered when power outages are imminent or in progress, grew at a 27% compounded annual growth rate from 2002 to 2012. These events demonstrate the current power grid’s inadequate capacity to accommodate all requests for reliable power. Significant capital investment will be required to relieve congestion, meet growing demand, achieve targets for efficiency, emissions and use of renewable sources and to replace components of the U.S. power grid operating at, near or past their planned service lives. |

| · | Increasing Long-Term Demand for Electricity and Reliable Power — The Department of Energy’s Energy Information Administration, or EIA, forecasts that total electricity use in the U.S. will increase by approximately 28% from 2011 to 2040. This increase is driven by anticipated population growth, economic expansion, increasing dependence on computing power throughout the economy and the increased use of electrical devices in the home. In order to meet growing demand for electricity in North America, substantial investment in increased electrical grid capacity and efficiency will be required, as well as the addition of specialized equipment to help ensure the reliability and quality of electricity for critical applications. In response to these challenges, there is an increasing trend among commercial and industrial companies to invest in on-site power sources, both for standby purposes in the event of a catastrophic power outage, or to reduce the amount of electricity they draw from the utility grid during peak periods. |

| · | Growth in Critical Power Applications and the Data Center Market — The number of mission-critical facilities, sites where a power disturbance or outage could cause failure of business operations, safety concerns or regulatory non-compliance, continues to grow exponentially worldwide. In the U.S., the single largest driver for demand in critical power applications is the data center market, followed by the health care industry. The amount of information managed by data centers is expected to grow by a factor of 50 over the next decade, according to General Electric, fueling increasing needs for data storage (for corporate data, content delivery, social networking, handheld devices, online retail and gaming) and the information technology evolution (cloud computing and outsourced hosting). The 2012 DatacenterDynamics Industry Census projects that global investment in data centers will increase 14.5% in 2013 to $120 billion. Much of this growth will be for spending in the electrical sector, including switchgear, uninterruptible power supplies and generators, systems that typically represent over 40% of data center development cost. Coinciding with demand for mission-critical facilities is the need for efficient, reliable primary power to support their essential applications, and for backup generator plants in case the utility feed becomes unavailable. Electricity is the highest operating cost of a data center, a factor supporting investment in on-site alternative energy systems to reduce base load and peak-demand utility costs. These systems require paralleling switchgear, such as we provide, operated by hardware embedded with sophisticated programming and logic to synchronize multiple power sources reliably and efficiently. |

| 2 |

| · | Greater Adoption of Renewable Power Sources — Many North American federal, state, provincial, and local governments have enacted or are considering legislation and regulations aimed at increasing energy efficiency and encouraging expansion of renewable energy generation. In particular, 29 states and the District of Columbia have adopted mandatory renewable portfolio standards, or RPS, which require utilities to supply a specified percentage of their electricity from renewable sources. In the long term, the EIA forecasts that renewable energy generation capacity additions will account for 32% of overall growth in electricity generation from 2011 to 2040. We believe these factors will drive investment growth in infrastructure to transport and integrate electricity from various sources within the transmission and distribution grid, as well as increased spending on products we manufacture for the on-site conversion and distribution of power from wind, solar and non-renewable energy plants. |

Competitive Strengths

We believe that we are well positioned for significant growth in the niche markets within the electrical transmission and distribution equipment industry in which we compete. Our competitive strengths include:

| · | Focus on Attractive Niche Markets — We focus on niche markets in the utility, industrial and commercial sectors of the electrical transmission and distribution industry that we believe are underserved by our larger competitors and have either attractive growth or profitability characteristics. Our key target markets include utility distribution, oil and gas, mining, data centers and renewable energy. Our customers in these and other markets often require equipment with specific electrical and mechanical attributes that we design and manufacture for them on an engineered-to-order basis in low quantity production runs. Most orders are time-sensitive, as other critical work is frequently being scheduled against the delivery and installation of our equipment, or because our equipment is a key sub-component of an original equipment manufacturer’s product offering to its customers. Competition in the markets we serve is very fragmented and conditioned by a number and combination of factors including application complexity, the capability to provide the range and specifications of equipment required, the diverse categories of end users, technological standards and time frames for quotation and delivery demanded by customers. |

| · | Recurring and Balanced Customer Base — We believe that our established, long-standing customer relationships provide us with a stable and recurring revenue base. We sold our products to approximately 1,900 individual customers in 2012 and our 20 largest customers represented 66% of our consolidated revenue. Approximately 89% of our revenue in 2012 originated from customers that ordered from us in 2011. We believe this customer continuity is a direct result of our uncompromising commitment to service, as evidenced by our high supplier scorecard ratings with several of our largest customers. In addition, we have developed a number of designs specifically for our customers and we have found that they are typically reluctant to switch suppliers once a favorable service track record has been established, even in cases where orders for our products are routinely released for competitive bidding. We believe that the historical growth of our product range, end-markets and revenues is due in large part to close relationships with our customers. Our strong customer relationships enable us to often anticipate our customers’ needs and collaborate with our customers to identify new, often highly-engineered applications. |

| · | Integration and Enhancement of Acquisitions — Our management team has a long track record of acquiring companies, including four businesses since 2010, and business combinations have been integral to our growth in revenue and earnings over the past three years. These recent acquisitions have and should provide us with new products and services, additional sales channels and markets, manufacturing facilities, technical expertise, purchasing economies and administrative efficiencies. We believe that our management’s ability to identify and integrate acquisitions will allow us to implement our growth plans and compete more effectively in the markets we serve. |

| · | Experienced Management Team — Our management team has extensive experience in the electrical equipment and components industry. Our senior management team includes seasoned professionals with industry, finance, transaction and operational experience that averages over 20 years per person. The prior companies owned and operated by our chief executive officer, Nathan J. Mazurek, have been focused on transformer, switchgear, circuit breaker and film capacitor products. Mr. Mazurek and his team have developed an extensive network of relationships with domestic and international companies in the electrical equipment and components industry. |

| 3 |

Growth Strategy

We believe that we have a diverse product portfolio, proven capabilities to provide customized equipment solutions and a strong presence in several key markets. We intend to grow organically and through strategic acquisitions, capitalizing on our existing competitive strengths to maximize stockholder value. The key elements of our growth strategy are:

| · | Expand Our Product and Service Offerings — We intend to expand our product and service offerings to both existing and new customers, through internal development and by acquiring new businesses. We are focused on products and end-markets that we expect should benefit from the repair and replacement cycle of an aging electric grid, rising electricity demand, the transition to renewable energy sources and investment in on-site power generation assets for backup, prime power and peak-shaving applications. In anticipation of increased volumes, we initiated expansion projects at three of our manufacturing plants in the last five years. In 2013, we established our critical power business unit to focus on opportunities in the data center market and our Pioneer CEP business unit to deepen our relationships with electrical distributors. Also in 2013, we established a new corporate sales group to market the full breadth of our product portfolio, design, engineering and manufacturing capabilities, particularly to EPC firms and large commercial contractors. We expect to continually evaluate opportunities to expand organically or through acquisitions to broaden our relationships with existing and new customers. |

| · | Focus on Operating Efficiencies — We intend to continue to efficiently manage and invest in our assets and operations. We have introduced new products from companies we acquired into our existing sales channels in order to maximize the productivity of our salespersons and distribution network. We have demonstrated our ability to integrate new production facilities into our existing operations, while maintaining or improving profitability, and intend to examine joint purchasing and production capabilities between our companies to further improve our operating results. We are focused on improving product mix, enhancing our supply chain management, optimizing the use of our available capacity and continuing to manage project costs efficiently throughout their lifecycle. For example, in 2013 we began deployment of a new ERP system and performance management information platform which we believe will support improved productivity in all business process areas and connect all of our operations, enabling us to do business internally and externally with substantially improved efficiency. |

| · | Pursue Targeted Strategic Acquisitions — We intend to accelerate our growth through a disciplined acquisition strategy to broaden and augment our product and service offerings, technical expertise, customers, end-markets and sales channels. Our strategy is to capitalize on potential market opportunities and operating efficiencies created by each business combination, thereby enhancing the performance of companies we acquire, as well as our pre-existing business operations. Our acquisitions of Jefferson Electric, Inc., Bemag Transformer Inc., Power Systems Solutions, Inc. and Pico Electrical Equipment, Inc. are four examples of our implementation of this strategy. The electrical transmission and distribution equipment market is very fragmented with a large number of potential acquisition candidates that focus on highly-specialized applications, select end-markets or more regionally defined market areas. We favor candidates that have competencies and business characteristics similar to our own, and those that we expect will benefit from some of the major trends affecting our industry. We intend to continually evaluate acquisition targets. |

Risks Associated with Our Business

Our ability to operate our business and achieve our goals and strategies is subject to numerous risks as discussed more fully in the section titled “Risk Factors,” including, without limitation:

| 4 |

| · | General economic conditions and their effect on demand for electrical equipment, particularly in the commercial construction market, but also in the power generation, industrial production, data center, oil and gas, marine and infrastructure industries. |

| · | The effects of fluctuations in sales on our business, revenues, expenses, net income, earnings per share, margins, profitability, cash flow, liquidity, financial condition and results of operations. |

| · | Many of our competitors are better established and have significantly greater resources, and may subsidize their competitive offerings with other products and services, which may make it difficult for us to attract and retain customers. |

| · | We depend on Hydro-Quebec Utility Company and Siemens Industry, Inc. for a large portion of our business, and any change in the level of orders from Hydro-Quebec Utility Company or Siemens Industry, Inc. could have a significant impact on our results of operations. |

| · | The potential loss or departure of key personnel, including Nathan J. Mazurek, our chairman, president and chief executive officer. |

| · | Our ability to expand our business through strategic acquisitions. |

| · | Our ability to integrate acquisitions and related businesses. |

| · | Our ability to generate internal growth, maintain market acceptance of our existing products and gain acceptance for our new products. |

| · | Unanticipated increases in raw material prices or disruptions in supply could increase production costs and adversely affect our profitability. |

| · | Restrictive loan covenants or our ability to repay or refinance debt under our credit facilities could limit our future financing options and liquidity position and may limit our ability to grow our business. |

| · | Our ability to realize revenue reported in our backlog. |

| · | Operating margin risk due to competitive pricing and operating efficiencies, supply chain risk, material, labor or overhead cost increases, interest rate risk and commodity risk. |

| · | Strikes or labor disputes with our employees may adversely affect our ability to conduct our business. |

| · | A majority of our revenue and a significant portion of our expenditures are derived or spent in Canadian dollars. However, we report our financial condition and results of operations in U.S. dollars. As a result, fluctuations between the U.S. dollar and the Canadian dollar will impact the amount of our revenues and earnings. |

| · | The impact of geopolitical activity on the economy, changes in government regulations such as income taxes, climate control initiatives, the timing or strength of an economic recovery in our markets and our ability to access capital markets. |

| · | Our chairman controls a majority of our combined voting power, and may have, or may develop in the future, interests that may diverge from yours. |

| · | Future sales of large blocks of our common stock may adversely impact our stock price. |

| · | The liquidity and trading volume of our common stock. |

Any of the above risks as well as others discussed herein could materially and negatively affect our business, financial condition and operating results. Investing in our common stock involves a high degree of risk. You should carefully consider the information set forth in “Risk Factors” and other information in this prospectus before making a decision to invest in our common stock.

Mr. Mazurek’s Voting Rights and Our Status as a Controlled Company

Mr. Mazurek, who after this offering will control approximately 67% of the voting power of our outstanding capital stock through his ownership interest in the general partner of Provident Pioneer Partners, L.P., will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors, as well as the overall management and direction of our company.

| 5 |

Because Mr. Mazurek controls a majority of our outstanding voting power, we are a “controlled company” under the corporate governance rules for NASDAQ-listed companies. Therefore, we are not required to have a majority of our board of directors be independent, nor are we required to have a compensation committee or an independent nominating function. In light of our status as a controlled company, our board of directors has determined not to have a majority of independent directors or an independent nominating or compensation function and to have the full board of directors be directly responsible for compensation matters and for nominating members of our board.

Corporate and Other Information

Our principal executive offices are located at 400 Kelby Street, 9th Floor, Fort Lee, New Jersey, 07024. Our telephone number is (212) 867-0700. Our website address is http://www.pioneerpowersolutions.com. Information on or accessed through our website is not incorporated into this prospectus and is not a part of this prospectus.

| 6 |

| The Offering | |

| Common stock offered by us: | 1,000,000 shares

|

| Common stock outstanding prior to the offering: | 5,907,255 shares

|

| Common stock outstanding after this offering: | 6,907,255 shares

|

Offering price:

|

$7.00 to $8.00 per share (estimate) |

| Over-allotment option to be offered by us: | 150,000 shares

|

| Use of proceeds: | We estimate that our net proceeds from the sale of shares of our common stock will be approximately $6.6 million, assuming that the public offering price will be $7.50 per share, the midpoint of the range set forth on the cover page of this prospectus.

We intend to use the proceeds of this offering to pay down our outstanding borrowings under our U.S. revolving credit line with Bank of Montreal, Chicago Branch. We intend to use the remaining net proceeds, if any, and the resulting additional availability under our revolving credit line, to fund acquisitions, working capital and other general corporate purposes. See “Use of Proceeds” beginning on page 25 of this prospectus.

|

| OTCQB symbol: | PPSI

|

Proposed Nasdaq Capital Market symbol:

|

PPSI |

| Risk factors: | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus. |

The number of shares of common stock outstanding after this offering excludes:

| · | 640,000 shares of common stock issuable upon the exercise of warrants with a weighted average exercise price of $14.00 per share; | |

| · | 40,000 shares of common stock issuable upon the exercise of warrants to be issued to the underwriters as underwriter compensation in this offering at an exercise price equal to the public offering price of our common stock hereunder; |

| · | 246,400 shares of common stock issuable upon the exercise of currently outstanding options with a weighted average exercise price of $9.89 per share; and |

| · | 453,600 shares of common stock available for future issuance under our 2011 Long-Term Incentive Plan. |

Unless otherwise stated, all information contained in this prospectus assumes no exercise of the over-allotment option granted to the underwriters.

| 7 |

Summary Consolidated Financial Information

(in thousands, except per share data)

The following summary consolidated financial data should be read in conjunction with the consolidated financial statements and the related notes thereto and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. We derived the statement of operations data for the years ended December 31, 2011 and 2012, and balance sheet data as of December 31, 2011 and 2012 from the audited financial statements in this prospectus. Those financial statements were audited by Richter LLP, an independent registered public accounting firm. We derived the statement of operations data for the year ended December 31, 2010 and the balance sheet data as of December 31, 2010 from the financial statements audited by Richter LLP that are not included in this prospectus. We derived the statement of operations data for the six months ended June 30, 2013 and 2012 and the balance sheet data at June 30, 2013 from the unaudited financial statements in this prospectus. We believe that the unaudited, non-GAAP historical financial statement information contains all adjustments needed to present fairly the information included in those statements, and that the adjustments made consist only of normal recurring adjustments.

| Years Ended | Six Months Ended | |||||||||||||||||||||||

| December 31, | June 30, | |||||||||||||||||||||||

| 2010 | 2011 | 2012 | 2012 | 2013 | ||||||||||||||||||||

| Statement of Operations Data: | ||||||||||||||||||||||||

| Revenues | $ | 47,236 | $ | 68,790 | $ | 83,960 | $ | 42,137 | $ | 44,546 | ||||||||||||||

| Cost of goods sold | 35,637 | 52,813 | 65,020 | 32,783 | 33,885 | |||||||||||||||||||

| Gross profit | 11,599 | 15,977 | 18,940 | 9,354 | 10,661 | |||||||||||||||||||

| Operating expenses | ||||||||||||||||||||||||

| Selling, general and administrative | 7,635 | 11,070 | 13,181 | 6,551 | 7,052 | |||||||||||||||||||

| Foreign exchange (gain) loss | (133 | ) | 197 | (188 | ) | (86 | ) | 47 | ||||||||||||||||

| Total operating expenses | 7,502 | 11,267 | 12,993 | 6,465 | 7,099 | |||||||||||||||||||

| Operating income | 4,096 | 4,710 | 5,947 | 2,889 | 3,562 | |||||||||||||||||||

| Interest expense | 182 | 646 | 933 | 443 | 368 | |||||||||||||||||||

| Other expense | 353 | 820 | 92 | 30 | 167 | |||||||||||||||||||

| Earnings from continuing operations before income taxes | 3,561 | 3,244 | 4,922 | 2,416 | 3,027 | |||||||||||||||||||

| Provision for income taxes | 327 | 773 | 1,733 | 697 | 852 | |||||||||||||||||||

| Earnings from continuing operations | 3,234 | 2,471 | 3,189 | 1,719 | 2,175 | |||||||||||||||||||

| Loss from discontinued operations, net of income taxes | (288 | ) | (2,531 | ) | (199 | ) | (161 | ) | - | |||||||||||||||

| Net earnings (loss) | $ | 2,946 | $ | (60 | ) | $ | 2,990 | $ | 1,558 | $ | 2,175 | |||||||||||||

| Earnings from continuing operations per diluted share | $ | 0.55 | $ | 0.42 | $ | 0.54 | $ | 0.29 | $ | 0.37 | ||||||||||||||

| Weighted average diluted common shares outstanding | 5,931 | 5,949 | 5,913 | 5,907 | 5,922 | |||||||||||||||||||

| Other Data: | ||||||||||||||||||||||||

| Non-GAAP net earnings | $ | 2,945 | $ | 3,307 | $ | 4,121 | $ | 1,940 | $ | 2,495 | ||||||||||||||

| Non-GAAP net earnings per diluted common share | 0.50 | 0.56 | 0.70 | 0.33 | 0.42 | |||||||||||||||||||

| Adjusted EBITDA (Non-GAAP measure) | 5,251 | 6,050 | 7,753 | 3,751 | 4,392 | |||||||||||||||||||

| Acquisition of subsidiaries and related assets | 832 | 7,830 | - | - | 655 | |||||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||||||

| Cash and cash equivalents | $ | 516 | $ | 1,398 | $ | 467 | $ | 150 | $ | 822 | ||||||||||||||

| Working capital | 2,558 | 4,244 | 6,883 | 4,718 | 5,775 | |||||||||||||||||||

| Total assets | 32,103 | 48,838 | 52,178 | 52,198 | 52,873 | |||||||||||||||||||

| Total debt | 6,080 | 17,885 | 17,130 | 18,352 | 16,953 | |||||||||||||||||||

| Total liabilities | 17,011 | 34,070 | 34,263 | 35,851 | 33,118 | |||||||||||||||||||

| Total shareholders’ equity | 15,092 | 14,768 | 17,915 | 16,347 | 19,755 | |||||||||||||||||||

| 8 |

Use of Non-GAAP Financial Measures

We have presented non-GAAP measures such as non-GAAP net earnings and Adjusted EBITDA because many of our investors use these non-GAAP measures to monitor our performance. These non-GAAP measures should not be considered as an alternative to GAAP measures as an indicator of our operating performance.

Non-GAAP net earnings is defined by us as net earnings before amortization of acquisition-related intangibles, stock-based compensation, non-recurring acquisition costs and reorganization expense, impairments, other unusual gains or charges and any tax effects related to these items. We define Adjusted EBITDA as net earnings before interest, income tax expense, depreciation and amortization, non-cash compensation and non-recurring acquisition costs and reorganization expenses and other non-recurring or non-cash items.

Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flow that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. The non-GAAP measures included below, however, should be considered in addition to, and not as a substitute for or superior to, operating income, cash flows, or other measures of financial performance prepared in accordance with GAAP. A reconciliation of non-GAAP to GAAP financial measures is set forth in the table below.

Reconciliation of GAAP Measures to Non-GAAP Measures

(In thousands, except per share data)

| Years Ended | Six Months Ended | |||||||||||||||||||

| December 31, | June 30, | |||||||||||||||||||

| 2010 | 2011 | 2012 | 2012 | 2013 | ||||||||||||||||

| Non-GAAP Net Earnings and Diluted EPS: | ||||||||||||||||||||

| Earnings per share from continuing operations (GAAP measure) | $ | 0.55 | $ | 0.42 | $ | 0.54 | $ | 0.29 | $ | 0.37 | ||||||||||

| Earnings from continuing operations (GAAP measure) | $ | 3,234 | $ | 2,471 | $ | 3,189 | $ | 1,719 | $ | 2,175 | ||||||||||

| Amortization of acquisition intangibles | 144 | 252 | 285 | 143 | 142 | |||||||||||||||

| Stock-based compensation expense | 161 | 254 | 270 | 133 | 108 | |||||||||||||||

| Stock and warrant issuance expense for services | 232 | - | - | - | - | |||||||||||||||

| Non-recurring acquisition and reorganization costs | 353 | 334 | 55 | 32 | 169 | |||||||||||||||

| (Gain) on sale of assets | - | - | (8 | ) | (2 | ) | (2 | ) | ||||||||||||

| Withdrawn financing transaction costs | - | 487 | 45 | - | - | |||||||||||||||

| Non-recurring tax (recoveries) non-cash charges, net | (831 | ) | (26 | ) | 411 | - | - | |||||||||||||

| Tax effects | (347 | ) | (464 | ) | (126 | ) | (85 | ) | (97 | ) | ||||||||||

| Non-GAAP net earnings | $ | 2,945 | $ | 3,307 | $ | 4,121 | $ | 1,940 | $ | 2,495 | ||||||||||

| Non-GAAP net earnings per diluted share | $ | 0.50 | $ | 0.56 | $ | 0.70 | $ | 0.33 | $ | 0.42 | ||||||||||

| Weighted average diluted shares outstanding | 5,931 | 5,949 | 5,913 | 5,907 | 5,922 | |||||||||||||||

| Reconciliation to Adjusted EBITDA: | ||||||||||||||||||||

| Earnings from continuing operations (GAAP measure) | $ | 3,234 | $ | 2,471 | $ | 3,189 | $ | 1,719 | $ | 2,175 | ||||||||||

| Interest expense | 182 | 646 | 933 | 443 | 368 | |||||||||||||||

| Provision for income taxes | 327 | 773 | 1,733 | 697 | 852 | |||||||||||||||

| Depreciation and amortization | 763 | 1,086 | 1,536 | 730 | 722 | |||||||||||||||

| Non-recurring acquisition and reorganization costs | 353 | 334 | 55 | 32 | 169 | |||||||||||||||

| (Gain) on sale of assets | - | - | (8 | ) | (2 | ) | (2 | ) | ||||||||||||

| Withdrawn financing transaction costs | - | 487 | 45 | - | - | |||||||||||||||

| EBITDA | 4,859 | 5,797 | 7,483 | 3,618 | 4,284 | |||||||||||||||

| Adjustments to EBITDA: | ||||||||||||||||||||

| Stock-based compensation expense | 161 | 254 | 270 | 133 | 108 | |||||||||||||||

| Stock and warrant issuance expense for services | 232 | - | - | - | - | |||||||||||||||

| Adjusted EBITDA (Non-GAAP measure) | $ | 5,251 | $ | 6,050 | $ | 7,753 | $ | 3,751 | $ | 4,392 | ||||||||||

Note: Amounts may not foot due to rounding

| 9 |

Investing in our common stock involves a high degree of risk. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this prospectus. Additional risks and uncertainties that we are unaware of may become important factors that affect us. If any of the following events occur, our business, financial conditions and operating results may be materially and adversely affected. In that event, the trading price of our common stock may decline, and you could lose all or part of your investment.

Risks Relating to Our Business and Industry

We are vulnerable to economic downturns in the commercial construction market, which may reduce the demand for some of our products and adversely affect our sales, earnings, cash flow or financial condition.

Portions of our business, in particular those of Jefferson Electric, Inc. and Bemag Transformer Inc., involve sales of our products in connection with commercial and industrial construction. Our sales to this sector are affected by the levels of discretionary business spending. During economic downturns in this sector, the levels of business discretionary spending may decrease. This decrease in spending will likely reduce the demand for some of our products and may adversely affect our sales, earnings, cash flow or financial condition.

The commercial and industrial building and maintenance sectors began to experience a significant decline in 2008. The downturn in these segments contributed to a decline in the demand for our standard distribution transformer products and adversely affected Jefferson Electric, Inc.’s sales and earnings in 2008 through 2010. We cannot predict the timing, duration or severity of another such downturn in these segments which may adversely impact sales, earnings and cash flow.

Our operating results may vary significantly from quarter to quarter, which makes our operating results difficult to predict and can cause our operating results in any particular period to be less than comparable quarters and expectations from time to time.

Our quarterly results may fluctuate significantly from quarter to quarter due to a variety of factors, many of which are outside our control and have the potential to materially and adversely affect our results. Factors that affect our operating results include the following:

| · | the size, timing and terms of sales and orders, especially large customer orders; |

| · | variations caused by customers delaying, deferring or canceling purchase orders or making smaller purchases than expected; |

| · | the timing and volume of work under new agreements; |

| · | the spending patterns of customers; |

| · | customer orders received; |

| · | a change in the mix of our products having different margins; |

| · | a change in the mix of our customers, contracts and business; |

| · | increases in design and manufacturing costs; |

| · | the length of our sales cycles; |

| · | the rates at which customers renew their contracts with us; |

| · | changes in pricing by us or our competitors, or the need to provide discounts to win business; |

| · | a change in the demand or production of our products caused by severe weather conditions; |

| · | our ability to control costs, including operating expenses; |

| · | losses experienced in our operations not otherwise covered by insurance; |

| · | the ability and willingness of customers to pay amounts owed to us; |

| · | the timing of significant investments in the growth of our business, as the revenue and profit we hope to generate from those expenses may lag behind the timing of expenditures; |

| · | costs related to the acquisition and integration of companies or assets; |

| · | general economic trends, including changes in equipment spending or national or geopolitical events such as economic crises, wars or incidents of terrorism; and |

| 10 |

| · | future accounting pronouncements and changes in accounting policies. |

Accordingly, our operating results in any particular quarter may not be indicative of the results that you can expect for any other quarter or for an entire year.

Our industry is highly competitive.

The electrical transmission and distribution equipment industry is highly competitive. Principal competitors in our markets include ABB Ltd., Carte International, Inc., Eaton Corporation plc, Emerson Electric Company, General Electric Company, Hammond Power Solutions Inc., Howard Industries, Inc., Partner Technologies, Inc., Russelectric, Inc. and Schneider Electric SA. Many of these competitors, as well as other companies in the broader electrical equipment manufacturing and service industry where we expect to compete, are significantly larger and have substantially greater resources than we do and are able to achieve greater economies of scale and lower cost structures than us and may, therefore, be able to provide their products and services to customers at lower prices than we are able to. Moreover, our competitors could develop the expertise, experience and resources to offer products that are superior in both price and quality to our products. While we seek to compete by providing more customized, highly-engineered products, there are few technical or other barriers to prevent much larger companies in our industry from putting more emphasis on this same strategy. Similarly, we cannot be certain that we will be able to market our business effectively in the face of competition or to maintain or enhance our competitive position within our industry, maintain our customer base at current levels or increase our customer base. Our inability to manage our business in light of the competitive forces we face could have a material adverse effect on our results of operations.

Because we currently derive a significant portion of our revenues from two customers, any decrease in orders from these customers could have an adverse effect on our business, financial condition and operating results.

We depend on Hydro-Quebec Utility Company and Siemens Industry, Inc. for a large portion of our business, and any change in the level of orders from Hydro-Quebec Utility Company or Siemens Industry, Inc., has, in the past, had a significant impact on our results of operations. In particular, Hydro-Quebec Utility Company represented approximately 19% and 21% of our net sales in the years ended December 31, 2012 and 2011, respectively. In addition, Siemens Industry, Inc. accounted for 12% and 11% of our net sales in the years ended December 31, 2012 and 2011, respectively. Our long term supply agreements with Hydro-Quebec Utility Company had an initial term expiring in April 2012, and two one-year extension options, the second of which was exercised by Hydro-Quebec Utility Company and which extended our contracts through April 2014. We therefore cannot assure you that Hydro-Quebec Utility Company will continue to purchase transformers from us in quantities consistent with the past or at all. In addition, our pricing agreement with Siemens Industry, Inc. does not obligate Siemens Industry, Inc. to purchase transformers from us in quantities consistent with the past or at all. If either of these customers was to significantly cancel, delay or reduce the amount of business it does with us for any reason, there would be a material adverse effect on our business, financial condition and operating results.

The departure or loss of key personnel could disrupt our business.

We depend heavily on the continued efforts of Nathan J. Mazurek, our principal executive officer, and on other senior officers who are responsible for the day-to-day management of our operations. In addition, we rely on our current electrical and mechanical design engineers, along with trained coil winders, many of whom are important to our operations and would be difficult to replace. We cannot be certain that any of these individuals will continue in their respective capacities for any particular period of time. The departure or loss of key personnel, or the inability to hire and retain qualified employees, could negatively impact our ability to manage our business.

| 11 |

We may not be able to expand our business through strategic acquisitions, which could decrease our profitability.

A key element of our strategy is to pursue strategic acquisitions that either expand or complement our business in order to increase revenue and earnings. We may not be able to identify additional attractive acquisition candidates on terms favorable to us or in a timely manner. We may require additional debt or equity financing for future acquisitions, which may not be available on terms favorable to us, if at all. Moreover, we may not be able to integrate any acquired businesses into our business or to operate any acquired businesses profitably. Recently acquired businesses (such as Power Systems Solutions, Inc. and Pioneer CEP) may operate at lower profit margins, which could negatively impact our results of operations. Each of these factors may contribute to our inability to grow our business through strategic acquisitions, which could ultimately result in increased costs without a corresponding increase in revenues, causing decreased profitability.

Any acquisitions that we complete may not perform as planned and could disrupt our business and harm our financial condition and operations.

In an effort to effectively compete in the specialty electrical equipment manufacturing and service businesses, where increasing competition and industry consolidation prevail, we will seek to acquire complementary businesses in the future. In the event of any future acquisitions, we could:

| · | issue additional securities that would dilute our current stockholders’ percentage ownership or provide the purchasers of the additional securities with certain preferences over those of common stockholders, such as dividend or liquidation preferences; |

| · | incur debt and assume liabilities; and |

| · | incur large and immediate write-offs of intangible assets, accounts receivable or other assets. |

These events could result in significant expenses and decreased revenue, which could adversely affect the market price of our common stock.

In addition, integrating product acquisitions and completing any future acquisitions involve numerous operational and financial risks. These risks include difficulty in assimilating acquired operations, diversion of management’s attention and the potential loss of key employees or customers of acquired operations. Furthermore, companies acquired by us may not generate financial results consistent with our management’s plans at the time of acquisition. To this end, through transactions completed in June and August 2010, we acquired substantially all the assets and the capital stock of AAER Inc. to form Pioneer Wind Energy Systems Inc., a business that sought to provide project integration solutions, including equipment sales, procurement, after-sales services and financing to community wind and industrial customers. In September 2011, following weak domestic wind energy market conditions, combined with our inability to establish an arrangement, on commercially acceptable terms, with a qualified third party to provide outsourced parts procurement and assembly services, we decided to discontinue this business. On a cumulative basis, from formation through to the discontinuation of Pioneer Wind Energy Systems Inc., our results from operations were impacted by a cumulative net loss of $3.0 million.

If we do not conduct an adequate due diligence investigation of a target business that we acquire, we may be required subsequently to take write downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and our stock price, which could cause you to lose some or all of your investment.

As part of our acquisition strategy, we will need to conduct a due diligence investigation of one or more target businesses. Intensive due diligence is time consuming and expensive due to the operations, accounting, finance and legal professionals who must be involved in the due diligence process. We may have limited time to conduct such due diligence. Even if we conduct extensive due diligence on a target business that we acquire, we cannot assure you that this diligence will uncover all material issues relating to a particular target business, or that factors outside of the target business and outside of our control will not later arise. If our diligence fails to identify issues specific to a target business or the environment in which the target business operates, we may be forced to write-down or write-off assets, restructure our operations, or incur impairment or other charges that could result in us reporting losses. Even though these charges may be non-cash items and not have an immediate impact on our liquidity, the fact that we report charges of this nature could contribute to negative market perceptions about us or our common stock. In addition, charges of this nature may cause us to violate net worth or other covenants that we may be subject to under our credit facilities.

| 12 |

Our revenue may be adversely affected by fluctuations in currency exchange rates.

A majority of our revenue and a significant portion of our expenditures are derived or spent in Canadian dollars. However, we report our financial condition and results of operations in U.S. dollars. As a result, fluctuations between the U.S. dollar and the Canadian dollar will impact the amount of our revenues and earnings. For example, if the Canadian dollar appreciates relative to the U.S. dollar, the fluctuation will result in a positive impact on the revenues that we report. However, if the Canadian dollar depreciates relative to the U.S. dollar, there will be a negative impact on the revenues we report due to such fluctuation. It is possible that the impact of currency fluctuations will result in a decrease in reported sales even though we have experienced an increase in sales when reported in the Canadian dollar. Conversely, the impact of currency fluctuations may result in an increase in reported sales despite declining sales when reported in the Canadian dollar. The exchange rate from the U.S. dollar to the Canadian dollar has fluctuated substantially in the past and may continue to do so in the future. Though we may choose to hedge our exposure to foreign currency exchange rate changes in the future, there is no guarantee such hedging, if undertaken, will be successful.

We may be unable to generate internal growth.

Our ability to generate internal growth will be affected by, among other factors, our ability to attract new customers, increases or decreases in the number or size of orders received from existing customers, hiring and retaining skilled employees and increasing volume utilizing our existing facilities. Many of the factors affecting our ability to generate internal growth may be beyond our control, and we cannot be certain that our strategies will be implemented with positive results or that we will be able to generate cash flow sufficient to fund our operations and to support internal growth. If we do not achieve internal growth, our results of operations will suffer and we will likely not be able to expand our operations or grow our business.

Fluctuations in the price and supply of raw materials used to manufacture our products may reduce our profits.

Our raw material costs represented approximately 64% and 60% of our revenues for the years ended December 31, 2012 and 2011, respectively. The principal raw materials purchased by us are electrical core steel, copper wire, aluminum strip and insulating materials including transformer oil. We also purchase certain electrical components from a variety of suppliers including bushings, switches, fuses and protectors. These raw materials and components are available from, and supplied by, numerous sources at competitive prices, although there are more limited sources of supply for electrical core steel and transformer oil. Unanticipated increases in raw material prices or disruptions in supply could increase production costs and adversely affect our profitability. We cannot provide any assurances that we will not experience difficulties sourcing our raw materials in the future.

Our Bemag Transformer Inc. subsidiary currently derives a significant portion of its revenues from three electrical distributor groups; any decrease in orders from these distributors could have an adverse effect on Bemag Transformer Inc.’s financial condition and operating results.

Bemag Transformer Inc. depends on three electrical distributor groups for a large portion of its business, and any change in the level of orders from these distributors, has, in the past, had a significant impact on Bemag Transformer Inc.’s results of operations. Collectively, purchases from these distributor groups represented approximately 50% of Bemag Transformer Inc.’s sales in 2012 and approximately 9% of our sales on a consolidated basis. We expect aggregate sales to these distributor groups to continue to represent less than 10% of our consolidated sales in 2013. Our Bemag Transformer Inc. subsidiary has pricing and rebate agreements with these distributor groups that are negotiated annually and, if the pricing and rebate agreements are modified or not renewed in future periods or are less favorable than those offered by competitors, we cannot assure you that these distributor groups will continue to purchase transformers from us in quantities consistent with the past or at all. If any of these distributor groups were to influence our customers to cancel, significantly delay or reduce the amount of business they do with Bemag Transformer Inc., there could be a material adverse effect on our business, financial condition and operating results. Moreover, although Bemag Transformer Inc. has agreements for the sale of its products through these three distributor groups, these agreements do not obligate the groups to distribute transformers from Bemag Transformer Inc. in quantities consistent with the past or at all. If any of these distributor groups were to become insolvent, our business, financial condition and operating results could also be materially adversely affected.

| 13 |

We have, and expect to continue to have, credit facilities with restrictive loan covenants that may impact our ability to operate our business and to pursue our business strategies, and our failure to comply with these covenants could result in an acceleration of our indebtedness.

While we expect to use the proceeds from this offering to pay down our outstanding borrowings under our revolving credit line with the Bank of Montreal, Chicago Branch, we expect to rely on our credit facilities for a significant portion of the working capital to operate our business and execute our strategy. These credit facilities contain certain covenants that restrict our ability to, among other things:

| · | undergo a change in control; |

| · | incur new indebtedness or other obligations, subject to certain exceptions; |

| · | pay cash dividends; |

| · | create or incur new liens, subject to certain exceptions; |

| · | make new acquisitions or investments in other entities, subject to certain exceptions; |

| · | wind up, liquidate or dissolve our affairs; |

| · | change the nature of our core business; |

| · | alter our capital structure in a manner that would be materially adverse to our lenders; and |

| · | make investments or advancements to affiliated or related companies. |

The majority of the liquidity derived from our credit facilities is based on availability determined by a borrowing base. Specifically, the availability of credit is dependent upon eligible receivables, inventory and certain liens. We may not be able to maintain adequate levels of eligible assets to support our required liquidity.

In addition, our credit facilities require us to meet certain financial ratios, including a total leverage ratio, a funded debt to total capitalization ratio and a fixed charge coverage ratio and, in the case of our Canadian domiciled subsidiaries, maintenance of a minimum fixed charge coverage ratio, a maximum funded debt to EBITDA ratio and a maximum total debt to capitalization ratio. Our ability to meet these financial provisions may be affected by events beyond our control. If, as or when required, we are unable to repay, refinance or restructure our indebtedness under, or amend the covenants contained in, our credit facilities, our lenders could institute foreclosure proceedings against the assets securing borrowings under those facilities, which would harm our business, financial condition and results of operations.

The indebtedness under our credit facilities with Bank of Montreal is secured by substantially all of our consolidated assets. As a result of these security interests, such assets would only be available to satisfy claims of our general creditors or to holders of our equity securities if we were to become insolvent to the extent the value of such assets exceeded the amount of our indebtedness and other obligations. In addition, the existence of these security interests may adversely affect our financial flexibility.

Indebtedness under our credit facilities with Bank of Montreal is secured by a lien on substantially all of our assets. Accordingly, if an event of default were to occur under our credit facilities, Bank of Montreal would have a prior right to our assets, to the exclusion of our general creditors in the event of our bankruptcy, insolvency, liquidation, or reorganization. In that event, our assets would first be used to repay in full all indebtedness and other obligations secured by them (including all amounts outstanding under our senior secured credit agreement), resulting in all or a portion of our assets being unavailable to satisfy the claims of our unsecured indebtedness. Only after satisfying the claims of our unsecured creditors and our subsidiaries’ unsecured creditors would any amount be available for our equity holders. The pledge of these assets and other restrictions may limit our flexibility in raising capital for other purposes. Because substantially all of our assets are pledged under these financing arrangements, our ability to incur additional secured indebtedness or to sell or dispose of assets to raise capital may be impaired, which could have an adverse effect on our financial flexibility.

We may not be able to fully realize the revenue value reported in our backlog.

We routinely have a backlog of work to be completed on contracts representing a significant portion of our annual sales. As of June 30, 2013, our order backlog was $24.4 million. Orders included in our backlog are represented by customer purchase orders and contracts that we believe to be firm. Backlog develops as a result of new business taken, which represents the revenue value of new customer orders received by us during a given period. Backlog consists of customer orders that either (1) have not yet been started or (2) are in progress and are not yet completed. In the latter case, the revenue value reported in backlog is the remaining value associated with work that has not yet been completed. From time to time, customer orders are canceled that appeared to have a high certainty of going forward at the time they were recorded as new business taken. In the event of a customer order cancellation, we may be reimbursed for certain costs but typically have no contractual right to most of the revenue reflected in our backlog. In addition to us being unable to recover certain direct costs, canceled customer orders may also result in additional unrecoverable costs due to the resulting underutilization of our assets.

We are subject to pricing pressure from our larger customers.

We face significant pricing pressures in all of our business segments from our larger customers, including Hydro-Quebec Utility Company and Siemens Industry, Inc. Because of their purchasing size, our larger customers can influence market participants to compete on price terms. Such customers also use their buying power to negotiate lower prices. If we are not able to offset pricing reductions resulting from these pressures by improved operating efficiencies and reduced expenditures, those price reductions may have an adverse impact on our financial results.

| 14 |

Deterioration in the credit quality of several major customers could have a material adverse effect on our operating results and financial condition.

A significant asset included in our working capital is accounts receivable from customers. If customers responsible for a significant amount of accounts receivable become insolvent or are otherwise unable to pay for products and services, or become unwilling or unable to make payments in a timely manner, our operating results and financial condition could be adversely affected. A significant deterioration in the economy could have an adverse effect on the servicing of these accounts receivable, which could result in longer payment cycles, increased collection costs and defaults in excess of management’s expectations. Deterioration in the credit quality of Hydro-Quebec Utility Company, Siemens Industry, Inc. or of any other major customers could have a material adverse effect on our operating results and financial condition.

We rely on third parties for key elements of our business whose operations are outside our control.

We rely on arrangements with third party shippers and carriers such as independent shipping companies for timely delivery of our products to our customers. As a result, we may be subject to carrier disruptions and increased costs due to factors that are beyond our control, including labor strikes, inclement weather, natural disasters and rapidly increasing fuel costs. If the services of any of these third parties become unsatisfactory, we may experience delays in meeting our customers’ product demands and we may not be able to find a suitable replacement on a timely basis or on commercially reasonable terms. Any failure to deliver products to our customers in a timely and accurate manner may damage our reputation and could cause us to lose customers.

We also utilize third party distributors and manufacturer’s representatives to sell, install and service certain of our products. While we are selective in whom we choose to represent us, it is difficult for us to ensure that our distributors and manufacturer’s representatives consistently act in accordance with the standards we set for them. To the extent any of our end-customers have negative experiences with any of our distributors or manufacturer’s representatives, it could reflect poorly on us and damage our reputation, thereby negatively impacting our financial results.

We may face impairment charges if economic environments in which our business operates and key economic and business assumptions substantially change.

Assessment of the potential impairment of property, plant and equipment, goodwill and other identifiable intangible assets is an integral part of our normal ongoing review of operations. Testing for potential impairment of long-lived assets is dependent on numerous assumptions and reflects our best estimates at a particular point in time, which may vary from testing date to testing date. The economic environments in which our businesses operate and key economic and business assumptions with respect to projected product selling prices and materials costs, market growth and inflation rates, can significantly affect the outcome of impairment tests. Estimates based on these assumptions may differ significantly from actual results. Changes in factors and assumptions used in assessing potential impairments can have a significant impact on both the existence and magnitude of impairments, as well as the time at which such impairments are recognized. Future changes in the economic environment and the economic outlook for the assets being evaluated could also result in additional impairment charges. Any significant asset impairments would adversely impact our financial results.

Our business requires skilled labor, and we may be unable to attract and retain qualified employees.

Our ability to maintain our productivity and profitability will be limited by our ability to employ, train and retain skilled personnel necessary to meet our requirements. We may experience shortages of qualified personnel. We cannot be certain that we will be able to maintain an adequate skilled labor force necessary to operate efficiently and to support our growth strategy or that our labor expenses will not increase as a result of a shortage in the supply of skilled personnel. Labor shortages, increased labor costs or loss of our most skilled workers could impair our ability to deliver on time to our customers (thereby creating a risk that we lose our customers to competition) and would inhibit our ability to maintain our business or grow our revenues, and may adversely impact our profitability.

| 15 |

Our business operations are dependent upon our ability to engage in successful collective bargaining with our unionized workforce.

Approximately 69% of our workforce is unionized. Our current collective bargaining agreements with our unionized workforces in Canada expire in May 2015, in the case of Pioneer Transformers Ltd., and in the case of Bemag Transformer Inc., expired in March 2013. We are in the process of negotiating a new collective bargaining agreement with our unionized workforce at Bemag Transformer Inc. which may take several months to complete. There can be no assurance we will be successful in this effort. We have similar labor agreements with our unionized workforce in Santa Fe springs, California and in Reynosa, Mexico that have indefinite terms, and are subject to annual review and negotiation of key provisions. If we are unable to renew our collective bargaining agreements, or if additional segments of our workforce become unionized, we may be subject to work interruptions or stoppages. Strikes or labor disputes with our employees may adversely affect our ability to conduct our business.

Deploying a new enterprise resource planning system could interfere with our business or operations and could adversely impact our financial position, results of operations and cash flows.

We are in the process of deploying a new enterprise resource planning, or ERP, system. This project requires significant investment of capital and human resources, the re-engineering of many processes of our business and the attention of many employees who would otherwise be focused on other aspects of our business. Any disruptions, delays or deficiencies in the design and integration of the new ERP system could result in potentially much higher costs than we had anticipated and could adversely affect our ability to develop and commercialize products, provide services, fulfill contractual obligations, file reports with the Securities Exchange Commission in a timely manner and/or otherwise operate our business, or otherwise impact our controls environment. Any of these consequences could have an adverse effect on our results of operations and financial condition.

We are subject to the risks of owning real property.

We own real property, including the land and buildings at two of our manufacturing locations. The ownership of real property subjects us to risks, including: the possibility of environmental contamination and the costs associated with fixing any environmental problems and the risk of damages resulting from such contamination; adverse changes in the value of the property due to interest rate changes, changes in the neighborhood in which the property is located or other factors; ongoing maintenance expenses and costs of improvements; the possible need for structural improvements in order to comply with zoning, seismic, disability act or other requirements; and possible disputes with neighboring owners or others.

Our risk management activities may leave us exposed to unidentified or unanticipated risks.

Although we maintain insurance policies for our business, these policies contain deductibles and limits of coverage. We estimate our liabilities for known claims and unpaid claims and expenses based on information available as well as projections for claims incurred but not reported. However, insurance liabilities are difficult to estimate due to various factors and we may be unable to effectively anticipate or measure potential risks to our company. If we suffer unexpected or uncovered losses, any of our insurance policies or programs are terminated for any reason or are not effective in mitigating our risks, we may incur losses that are not covered by our insurance policies or that exceed our accruals or that exceed our coverage limits and could adversely impact our consolidated results of operations, cash flows and financial position.

Regulatory, environmental, monetary and other governmental policies could have a material adverse effect on our profitability.

We are subject to international, federal, provincial, state and local laws and regulations governing environmental matters, including emissions to air, discharge to waters and the generation and handling of waste. We are also subject to laws relating to occupational health and safety. The operation of manufacturing plants involves a high level of susceptibility in these areas, and there is no assurance that we will not incur material environmental or occupational health and safety liabilities in the future. Moreover, expectations of remediation expenses could be affected by, and potentially significant expenditures could be required to comply with, environmental regulations and health and safety laws that may be adopted or imposed in the future. Future remediation technology advances could adversely impact expectations of remediation expenses.

| 16 |

Future litigation could impact our financial results and condition.

Our business, results of operations and financial condition could be affected by significant future litigation or claims adverse to us. Types of potential litigation cases include product liability, contract, employment-related, labor relations, personal injury or property damage, intellectual property, stockholder claims and claims arising from any injury or damage to persons, property or the environment from hazardous substances used, generated or disposed of in the conduct of our business.

Our international operations subject us to additional risks, which risks and costs may differ in each country in which we do business and may cause our profitability to decline.

Most of our products are manufactured at our facilities in Canada and Mexico, and we depend on a number of suppliers for raw materials and component parts that are located outside of the U.S., including Asia and Western Europe. We generate a significant portion of our revenue from our operations in Canada and currently derive most of our revenue in the U.S. from products we manufacture in Mexico. Our international operations are subject to a variety of risks that we do not face in the U.S., and that we may face only to a limited degree in Canada, including:

| · | building and managing highly experienced foreign workforces and overseeing and ensuring the performance of foreign subcontractors; |

| · | increased travel, infrastructure and legal and compliance costs associated with multiple international locations; |

| · | additional withholding taxes or other taxes on our foreign income, and tariffs or other restrictions on foreign trade or investment; |

| · | imposition of, or unexpected adverse changes in, foreign laws or regulatory requirements, many of which differ from those in the U.S.; |